Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PENN VIRGINIA CORP | d515707d8k.htm |

| EX-99.1 - EX-99.1 - PENN VIRGINIA CORP | d515707dex991.htm |

| EX-99.2 - EX-99.2 - PENN VIRGINIA CORP | d515707dex992.htm |

$400MM Eagle

Ford Shale Acquisition Investor Presentation

April 3, 2013

NYSE: PVA

Exhibit

99.3 |

1

Forward-Looking Statements Certain

statements contained herein that are not descriptions of historical facts are “forward-looking” statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Because such statements include risks, uncertainties and contingencies,

actual results may differ materially from those expressed or implied by such forward-looking statements. These risks, uncertainties and

contingencies include, but are not limited to, the following: the volatility of commodity

prices for oil, natural gas liquids and natural gas; our ability to develop, explore

for, acquire and replace oil and gas reserves and sustain production; our ability to generate profits or achieve targeted reserves in our development and

exploratory drilling and well operations; any impairments, write-downs or write-offs

of our reserves or assets; the projected demand for and supply of oil, natural gas

liquids and natural gas; reductions in the borrowing base under our revolving credit facility; our ability to contract for drilling rigs, supplies and

services at reasonable costs; our ability to obtain adequate pipeline transportation capacity

for our oil and gas production at reasonable cost and to sell the production at, or at

reasonable discounts to, market prices; the uncertainties inherent in projecting future rates of production for our wells and the extent to

which actual production differs from estimated proved oil and gas reserves; drilling and

operating risks; our ability to compete effectively against other independent and major

oil and natural gas companies; our ability to successfully monetize select assets and repay our debt; leasehold terms expiring before

production can be established; environmental liabilities that are not covered by an effective

indemnity or insurance; the timing of receipt of necessary regulatory permits; the

effect of commodity and financial derivative arrangements; our ability to maintain adequate financial liquidity and to access adequate

levels of capital on reasonable terms; the occurrence of unusual weather or operating

conditions, including force majeure events; our ability to retain or attract senior

management and key technical employees; counterparty risk related to their ability to meet their future obligations; changes in governmental

regulations or enforcement practices, especially with respect to environmental, health and

safety matters; uncertainties relating to general domestic and international economic

and political conditions; and other risks set forth in our filings with the Securities and Exchange Commission (SEC).

Additional information concerning these and other factors can be found in our press releases

and public periodic filings with the SEC. Many of the factors that will determine

our future results are beyond the ability of management to control or predict. Readers should not place undue reliance on forward-looking

statements, which reflect management’s views only as of the date hereof. We

undertake no obligation to revise or update any forward-looking statements, or to

make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Oil and Gas

Reserves

Effective January 1, 2010, the SEC permits oil and gas companies, in their filings with the

SEC, to disclose not only “proved” reserves, but also “probable”

reserves and “possible” reserves. As noted above, statements of reserves are

only estimates and may not correspond to the ultimate quantities of oil and gas

recovered. Any reserve estimates provided in this presentation that are not specifically

designated as being estimates of proved reserves may include estimated reserves not

necessarily calculated in accordance with, or contemplated by, the SEC’s latest reserve reporting guidelines. Investors are urged to consider closely

the disclosure in PVA’s Annual Report on Form 10-K for the fiscal year ended December

31, 2011, which is available from PVA at Four Radnor Corporate Center, Suite 200,

Radnor, PA 19087 (Attn: Investor Relations). You can also obtain this report from the SEC by calling 1-800-SEC-0330 or from the SEC’s website at

www.sec.gov.

Definitions

Proved reserves are those quantities of oil and gas which, by analysis of

geosciences and engineering data, can be estimated with reasonable certainty to be

economically producible from a given date forward, from known reservoirs, and under existing

economic conditions, operating methods and government regulation before the time at

which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of

whether the estimate is a deterministic estimate or probabilistic estimate. Probable

reserves are those additional reserves that are less certain to be recovered than

proved reserves, but which are as likely than not to be recoverable (there should be at least a 50% probability that the quantities actually recovered will

equal or exceed the proved plus probable reserve estimates). Possible reserves are those

additional reserves that are less certain to be recoverable than probable reserves

(there should be at least a 10% probability that the total quantities actually recovered will equal or exceed the proved plus probable plus

possible reserve estimates). “3P” reserves refer to the sum of proved,

probable and possible reserves. Estimated ultimate recovery (EUR) is the sum of reserves

remaining as of a given date and cumulative production as of that date.

Forward-Looking Statements, Oil and Gas Reserves and Definitions

|

Transformational

Acquisition in the

Eagle Ford Shale

•

Penn Virginia is acquiring Eagle Ford Shale assets from Magnum Hunter for approximately $400

million

•

Assets are adjacent to PVA’s current Eagle Ford position in Gonzales and Lavaca Counties

•

40,565 (19,037 net) acres in Gonzales and Lavaca counties

•

46 (22.1 net) producing wells and drilling inventory of 345 (169

net) locations

(1)

•

Approximately 3,173 BOEPD –

February 2013

•

Approximately 5,500 BOEPD –

2013E (final eight months)

•

12.0 MMBoe of proved reserves (37% PD / 96% Liquids)

(2)

Attractive

Transaction

Valuation

•

Transaction Value / Production ($ / BOEPD –

February 2013) = ~$126,000

•

Transaction Value / Production ($ / BOEPD –

2013E) = ~$73,000

•

Transaction Value / Proved Reserves ($ / BOE) = ~$33.00

•

Transaction Value / 2013E EBITDAX ($93 million over 7.5 months, annualized) = ~2.7x

Committed

Transaction

Financing

•

The transaction is not subject to any financing contingency

•

$250 million senior unsecured bridge facility is available

•

$40 million common equity (at its option, PVA can issue 10 million shares to MHR @

$4/share) •

We intend to issue $400MM of senior unsecured notes in a private

placement

Closing Timeline

•

April 2

nd

–

PSA signed

•

April 2

nd

–

Acquisition announced

•

April 3

rd

–

Commence private placement

•

Week of April 8

th

–

Price notes placement

•

By mid-May 2013 –

Close acquisition

Transaction Overview

(1)

Inventory includes seven MHR/Hunt wells that are in the process of completion or waiting on

completion. (2)

As of December 31, 2012 per March 28, 2013 reserve report prepared by Cawley, Gillespie &

Associates. 2 |

•

Transformational acquisition which increases our footprint in the volatile oil window core of

the Eagle Ford Shale play

•

With 82,995 gross (54,057 net) highly contiguous acres, our pro forma position will be

significant with attractive leverage on a per share basis

•

MHR’s acreage is adjacent to our current leasehold position and has geologic and reserve

characteristics that are very comparable to our existing Eagle Ford Shale assets

•

Enhances production growth, with 2013E production (7.5 months) of approximately 5,500

BOEPD, representing a 34% increase (23% increase in BOEPD on a full-year basis)

•

Increases

drilling

inventory

in

the

Eagle

Ford

Shale

to

640

(420

net)

locations

•

Attractive drilling economics with PV-10 breakeven WTI prices of between $47 and $57 per

barrel (with and without current LLS uplift)

•

Accretive to 2013 and 2014 cash flow per share and net asset value

•

Increases proved reserve asset base by 11% by adding 12.0 MMBoe (96% liquids / 37% PD),

increases Eagle Ford Shale proved reserve base by 46%

•

Increases our ability to achieve operational efficiencies of scale

Strategic Rationale

3 |

4

•

Purchase price of approximately $400 million

for 19,037 highly contiguous net acres in

Gonzales and Lavaca Counties

•

Year-end 2012 SEC proved reserves of 12.0

MMBoe

(1)

–

Oil = 90% of proved reserves

–

37% proved developed

•

Year-end

2012

SEC

PV-10

of

$241

million

(1)

–

PD PV-10 of $156 million

•

Year-end reserves include 44 proved

developed locations and 51 locations booked

as PUDs

(1)

•

Expands existing footprint and acreage is largely

adjacent to existing position

•

Acquired assets add up to 345 gross (169

net) locations

Greater scale with ~54,000 net acres

in the Eagle Ford and substantial growth in oil production revenue

Transformational Acquisition

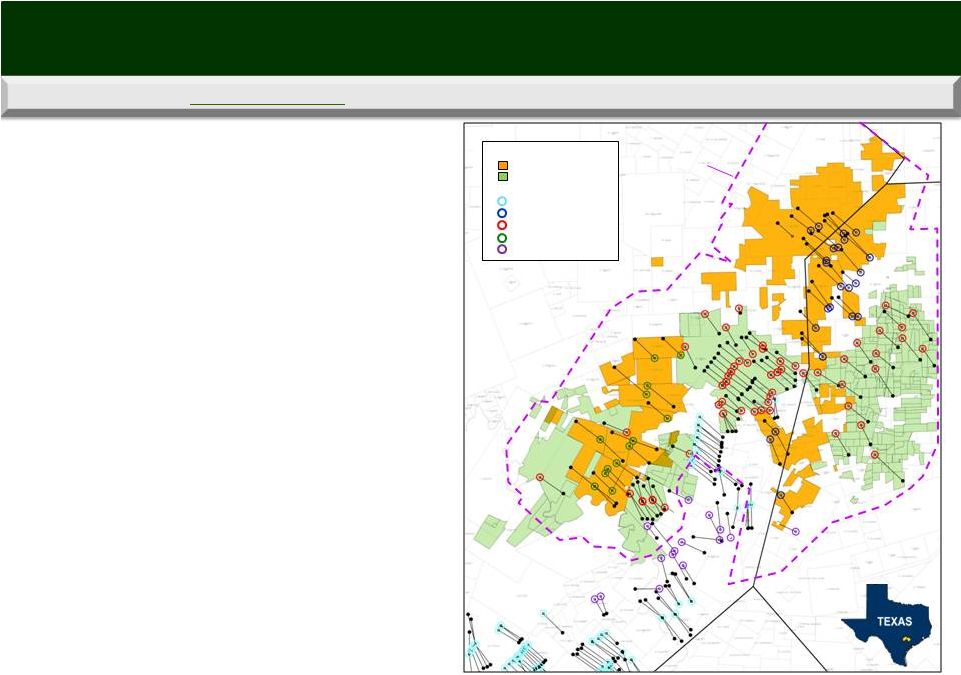

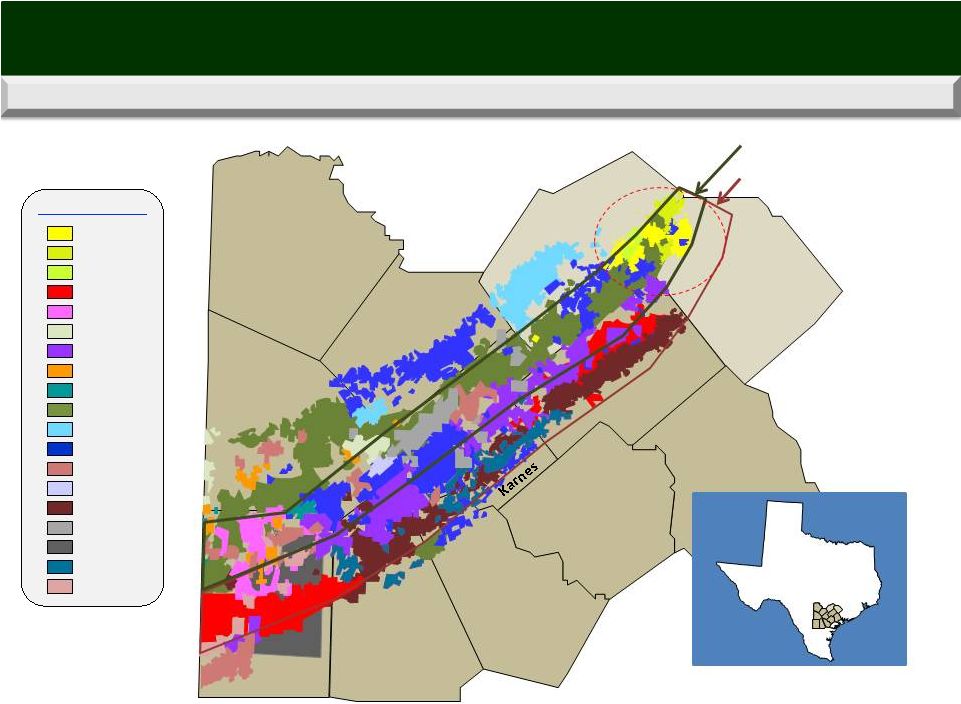

MRO

MHR

PVA

HUNT

EOG

EOG

PVA

Gonzales

Lavaca

DeWitt

3D Seismic

(1)

As of December 31, 2012 per March 28, 2013 reserve report prepared by Cawley, Gillespie &

Associates. ACREAGE

EAGLE HUNTER

PVA

OPERATOR

EOG

MAGNUM HUNTER

PVA

HUNT

MARATHON |

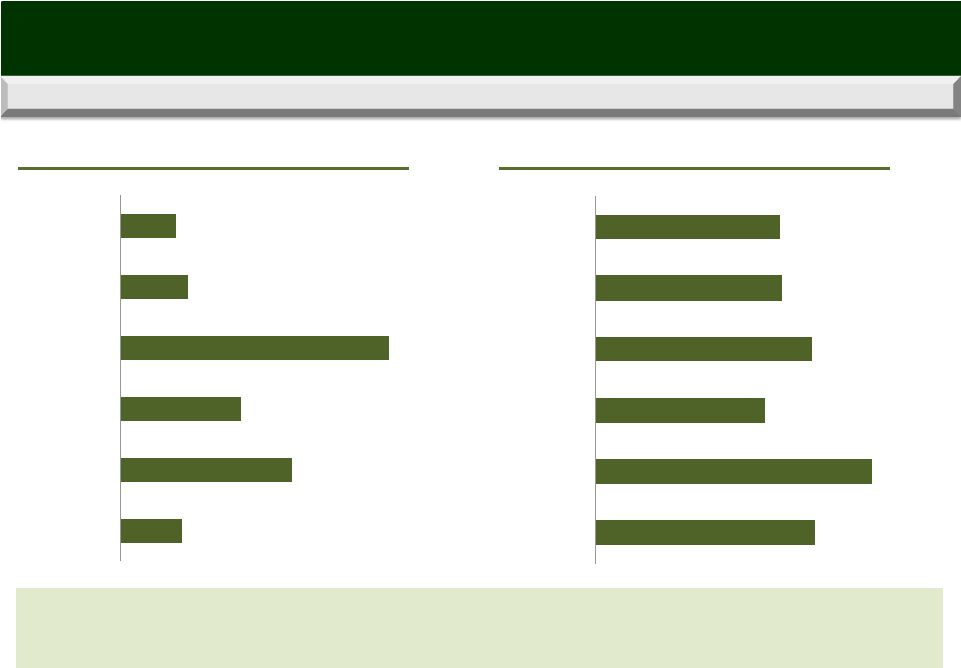

5

10%

28%

44%

11%

9%

20%

Net Acres

Net Inventory

February 2013

Daily Production

Total Proved Oil

Reserves

Total Proved

Reserves

Proved

Developed

Reserves

54%

68%

53%

46%

45%

42%

Net Acres

Net Inventory

February 2013

Daily Production

Total Proved Oil

Reserves

Total Proved

Reserves

Proved

Developed

Reserves

Acquisition Impacts to PVA’s Asset Profile

Transformational Acquisition (cont.)

Growth in Key Corporate Metrics as a Result of Acquisition

Growth in Key Eagle Ford Metrics as a Result of Acquisition

Note: Reserves as of 12/31/2012 . All other figures current unless otherwise stated.

Acquisition Significantly Increases PVA’s Eagle Ford Position and Overall Scale in the

Eagle Ford |

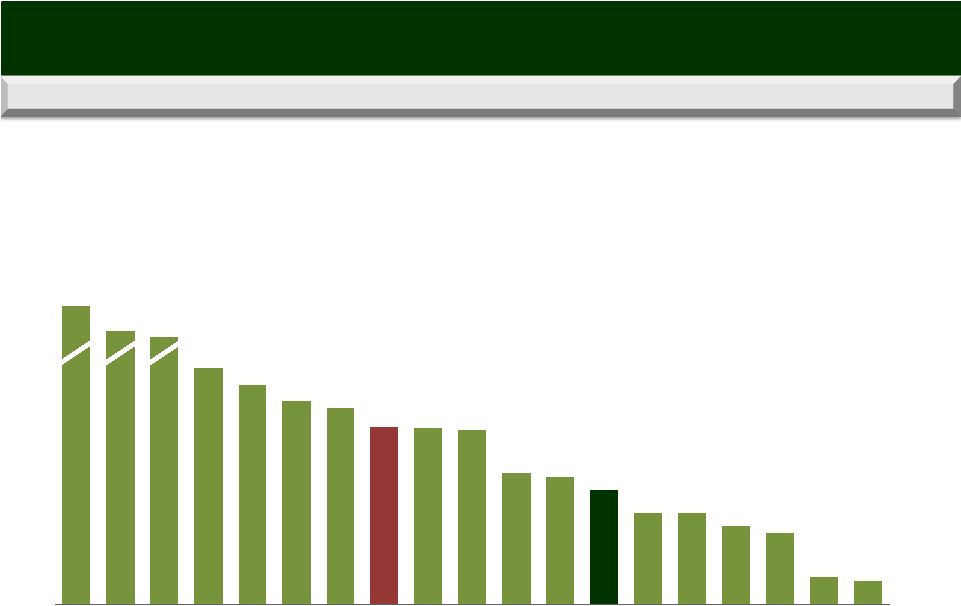

6

Expanded Eagle Ford Acreage Position

72

67

62

60

54

54

53

40

39

35

28

28

24

22

9

7

0

10

20

30

40

50

60

70

80

90

BHP

SN

PXD

ZAZA

ROSE

COG

PXP

PVA PF

SFY

CRZO

FST

GDP

PVA

CRK

MTDR

HK

Aurora

CXPO

AXAS

Source: Company investor presentations and SEC filings.

341

138

118

(Net acreage in thousands)

•

Net acreage by operator across entire Eagle Ford play

•

Operators’

disclosed acreage includes leaseholds outside volatile oil window

•

Approximately all of PVA’s leasehold is in the volatile oil window

|

Note:

Some operators off map.

(1)

Based on latest company presentations, as well as industry publications. Some industry

publication information may be out of date. PVA

MHR

Hunt

BHP

CHK

COG

COP

CRK

CRZO

EOG

FST

MRO

MUR

NFX

PXD

PXP

SFY

STO

TLM

EFS Operators

Eagle Ford Shale Operators

Eastern Volatile Oil Windows

(1)

7

Victoria

Goliad

Bee

Live Oak

McMullen

Wilson

Atascosa

Bexar

San Antonio

Texas

Volatile Oil

Condensate

Rich Gas

Gonzales

Lavaca

DeWitt |

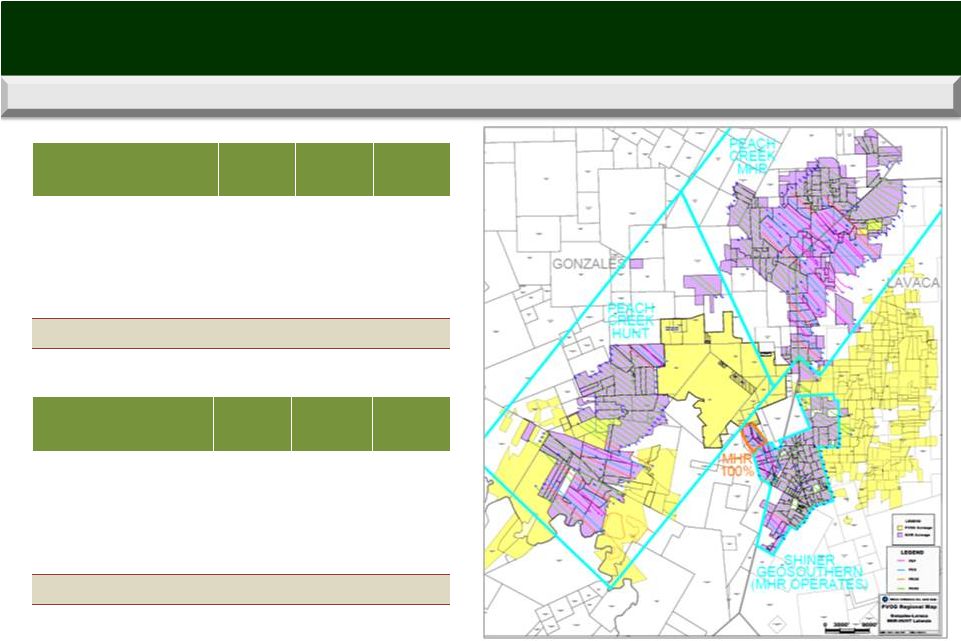

•

82,995 gross ( 54,057 net) acres in Gonzales and Lavaca

Counties, TX

(1)

•

Operator

of

46,452

(32,410

net)

acres

in

Gonzales

-

70%

WI

•

Operator

of

23,203

(15,148

net)

acres

in

Lavaca

-

65%

WI(1)

•

Non-operator

of

13,340

(6,499

net)

acres

in

Gonzales

-

49%

WI

•

Avg. IP/30-day rates of 1,066/676 Boe/d

•

Gonzales

type

curve

EUR

of

400

MBoe

(2)

•

Lavaca

type

curve

EUR

of

500

MBoe

(2)

•

Proved reserves of 38.2 MMBoe at year-end 2012, consisting of

82% oil, 10% NGLs and 8% gas

•

Proved PV-10 at YE12 of $933 MM ($784MM of PD value)

•

117 (82.0 net) wells producing

•

Objective is to lower PVA well costs by at least 10-15% in 2013

•

Up to 640 (420 net) remaining drilling locations

•

Initial positive down-spacing tests of 3-well pad in Gonzales

County and 2 closely spaced MHR wells in Lavaca County

•

Includes over 300 infill locations

•

Rigs, infrastructure in place

•

Dedicated rigs and frac crew

•

Gas gathering and processing in place

•

Receiving premium LLS base pricing

(1)

Net acreage in Lavaca County is expected to increase due to non-consents by our partner on

initial wells in 17 drilling units. (2)

Based on 1/29/13 operational release, YE12 SEC reserve report prepared by Wright & Co. and

YE12 SEC reserve report prepared by Cawley, Gillespie & Associates. Premier Shale Oil

& Liquids Play Sizeable Position in a Successful Portion of the Eastern Oil Window of

the Eagle Ford Shale PVA’s Pro Forma Eagle Ford Shale Position

Gonzales

Lavaca

DeWitt

PVA Pro Forma

BHP Billiton

ConocoPhillips

EOG

Forest

Nearby Operators

Marathon

Pioneer

Plains

Statoil

8 |

Prospect

Area Gross

Acres

Net Acres

Average

Royalty

Peach Creek (MHR)

19,722

9,166

20%

Peach Creek (Hunt JV)

13,340

6,499

20%

Shiner (GeoSouthern JV)

4,674

2,119

20%

Shiner

2,829

1,253

20%

Total / Average

40,565

19,037

20%

Prospect Area

Producing

Wells

Gross Non-

Producing

Locations

Net Non-

Producing

Locations

Peach Creek (MHR)

27

149

73.1

Peach Creek (Hunt JV)

15

121

60.5

Shiner (GeoSouthern JV)

3

72

32.6

Shiner

1

3

3.0

Total

46

345

169.3

Total of 345 (169 net) locations across 40,565 (19,037 net) acres in Gonzales and Lavaca

Counties Acquired Asset in Detail

9 |

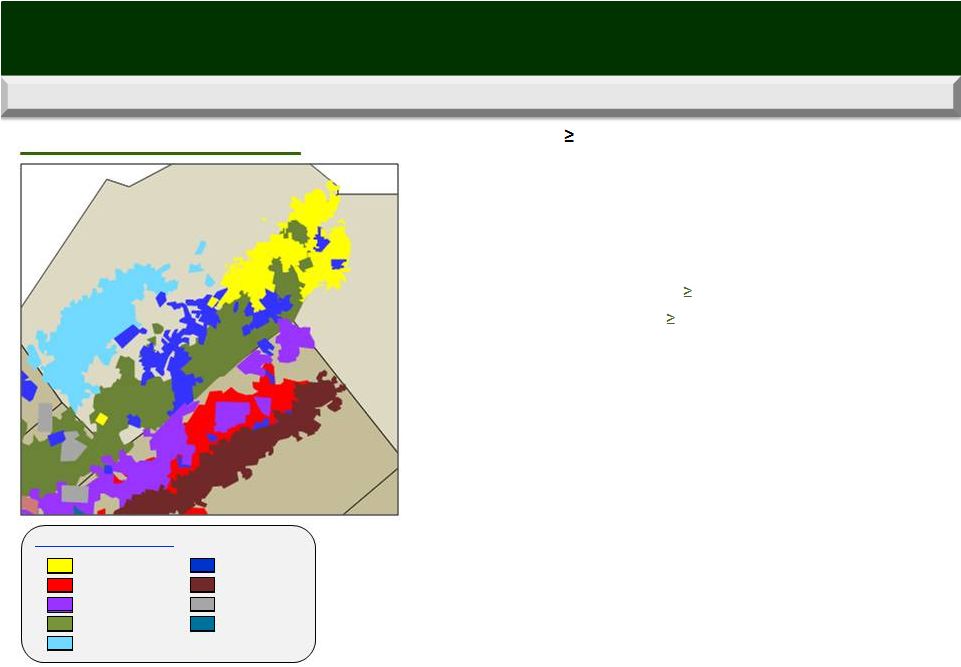

PVA vs. MHR

Eagle Ford Assets 10

•

Located in Gonzalez and Lavaca

Counties

•

Total of 42,430 gross (35,020 net) acres

primarily in the volatile oil window

•

Existing assets provide a multi-year

inventory of up to 295 (251 net)

additional locations

•

Successful down-spacing tests add

potential locations to inventory

•

Recent successful wells in the southern and

eastern portions of our Lavaca acreage

have further “de-risked”

inventory

•

Also located in Gonzalez and Lavaca

Counties and largely adjacent to PVA’s

existing leaseholds

•

Total of 40,565 gross (19,037 net) acres

•

Expands our multi-year inventory with

the addition of up to 345 (169 net)

additional undrilled locations

•

Peach Creek area in Gonzales and Lavaca

Cos. has a total of 270 (133 net) locations

•

Shiner area in Lavaca Co. has a total of 75

(36 net) locations

Pro Forma Eagle Ford Shale

PVA EXISTING

MHR ASSETS TO BE ACQUIRED |

Area

Producing

Wells

Remaining

Locations

Total Well

Locations

Gross

Acreage

Net

Acreage

(1)

Acres /

Location

(2)

PVA Gonzales

54

190

244

26,239

21,261

108

PVA Lavaca

17

105

122

16,191

13,759

133

Eagle Hunter

46

345

391

40,565

19,037

104

Pro Forma Total

117

640

757

82,995

54,057

110

(% Change)

65%

117%

107%

96%

54%

(1)

Net acreage in Lavaca County is expected to increase due to non-consents by our partner on

initial wells in 17 drilling units. (2)

Represents gross acres per location.

•

Due to both acquisitions and leasing efforts over the past two years, our acreage position is

now

83,000

gross

(~54,000

net)

acres

primarily

in

the

volatile

oil

window

(1)

•

We also have a multi-year inventory of up to 640 (420 net) additional drilling

locations •

Successful

down-spacing

testing

has

added

over

300

potential

infill

locations

to

our

inventory

•

Locations will vary over time in terms of lateral length, frac stages, spacing and

geology •

Recent successful wells in the southern and eastern portions of our Lavaca acreage have

further “de-risked”

our inventory

•

Unitizations with other industry participants and continued leasing are expected to yield

additional locations

11

Significant Eagle Ford Shale Acreage and Drilling Inventory

Combined Position Post Acquisition |

12

Note: Excludes two Marcellus locations.

(1)

Median gross EUR for all PUD locations.

•

Total inventory of up to 1,133 gross undrilled locations (952 horizontal locations)

•

Up to 692 gross horizontal drilling locations in the Eagle Ford and Granite Wash

Pro Forma PVA Has a Healthy Inventory of Drilling Locations

Play

Gross Undrilled

Locations

Average Working

Interest

Gross EUR

(MBoe/Well)

(1)

Existing Eagle Ford (Gonzales)

190

83%

394

Existing Eagle Ford (Lavaca)

105

88%

513

Eagle Hunter

345

48%

357

Granite Wash

52

18%

809

Cotton Valley

78

71%

903

Haynesville

78

77%

869

Cotton Valley (vertical)

181

71%

172

Selma Chalk

104

96%

302

Totals

1,133

Pro Forma Total Company Drilling Inventory

•

Significant

upside

in

inventory

of

“gassy”

locations |

13

2013 Capital Spending Focused on Eagle Ford Drilling

•

Full-year

2013

capital

expenditures

expected

to

be

approximately

$457

million

(1)

•

Four

operated

rigs

with

two

on

existing

PVA

acreage

and

two

rigs

on

operated

MHR

acreage

•

Two non-operated rigs

•

Incremental

capital

spending

of

approximately

$77

million

(1)

•

Six-rig drilling program (currently seven rigs running between PVA, MHR and Hunt)

•

Adjusted EBITDAX expected to increase to between $295 and $350 million, or 25% over previous

guidance •

2013 capital spending is expected to be 92% Eagle Ford

•

Maintenance and new ventures capital for other areas

Pro Forma Capital Expenditures by Area

(1)

Pro Forma Capital Expenditures by Type

(1)

Other

4%

Eagle Ford D&C

87%

Other D&C

4%

Land

5%

Revised 2013 Capital Plan

(1)

Change in mid-points of full-year 2013 guidance, adjusted for acquired Eagle Ford

assets. Other

3%

Pearsall

2%

Existing Eagle

Ford

64%

Acquired Eagle

Ford Assets

28%

Mid-Continent

3% |

14

Sources & Uses / Pro Forma Capitalization

(1)

Seller has agreed to backstop transaction, ultimately in the amount of

$40 million of equity consideration.

(2)

Company estimate based on closing date of May 1, 2013.

(3)

Current borrowing base of $300 million will be adjusted to $287.5

million at closing, pending borrowing base redetermination waiver.

Calculation not inclusive of $2.1 million outstanding on letters

of credit as of December 31, 2012.

(4)

As of March 31, 2013, PVA had cash and cash equivalents of $10.7

million. Subsequently, in connection with entering into the stock

purchase agreement relating to the acquisition, PVA borrowed $5

million under its revolving credit facility and paid a $10 million deposit to

MHR, which will be applied towards the purchase price at the close of

the acquisition.

(5)

Reflects total value of convertible preferred at issuance.

(6)

Current Market Capitalization reflects share price of $3.90 as of April 2,

2013. Acquisition adjustment reflects value of 10 million shares

issued at $4.00 per share.

(7)

As of March 31, 2013, PVA had $38 million outstanding under its

revolving credit facility.

Uses

($ in millions)

Acquisition Consideration

$400

43

Estimated Fees and Expenses

15

Total Uses

$458

Sources

($ in millions)

New Senior Notes

$400

40

Draw on Revolver

18

Total Sources

$458

Pro Forma Capitalization

($ in millions)

12/31/2012

Eagle Ford Acq.

Adjustments

PVA Pro Forma

12/31/2012

(4)

$18

--

$18

(3)

-

$18

$18

10.375% Senior Notes due 2016

295

--

295

7.250% Senior Notes due 2019

300

--

300

New Senior Notes

-

400

400

Total Debt

$595

$1,013

(5)

$115

--

$115

(6)

$215

$40

$255

Enterprise Value

$907

--

$1,365

LTM Adjusted EBITDAX

$248

$62

$309

Proved Reserves (MMBoe)

113.5

12.0

125.5

% Oil

22%

90%

28%

% Liquids

40%

96%

45%

% Developed

41%

37%

41%

Q4 2012 Production (MBoe/d)

15.4

2.7

18.2

Proved R/P (Years)

20.1x

12.2x

18.9x

PD R/P (Years)

8.3x

4.4x

7.8x

PT Proved PV-10%

$693

$241

$933

Credit Statistics

Total Debt /

Proved Reserves ($ / Boe)

$5.24

$8.07

PD Reserves ($ / Boe)

12.66

19.72

LTM Adj. EBITDA

2.4x

3.3x

PT Proved PV-10% / Total Debt

1.2x

0.9x

Total Debt / EV

66%

74%

(3)(7)

$300

$269

Pro forma for the acquisition, PVA has

~$269 million of undrawn liquidity on

its

revolving

credit

facility

(3)

Post Closing Adjustments

Equity Issuance

(1)

(2)

Cash and Cash Equivalents

Current Undrawn Facility

Revolving Credit Facility

6% Convertible Preferred

Market Capitalization |

15

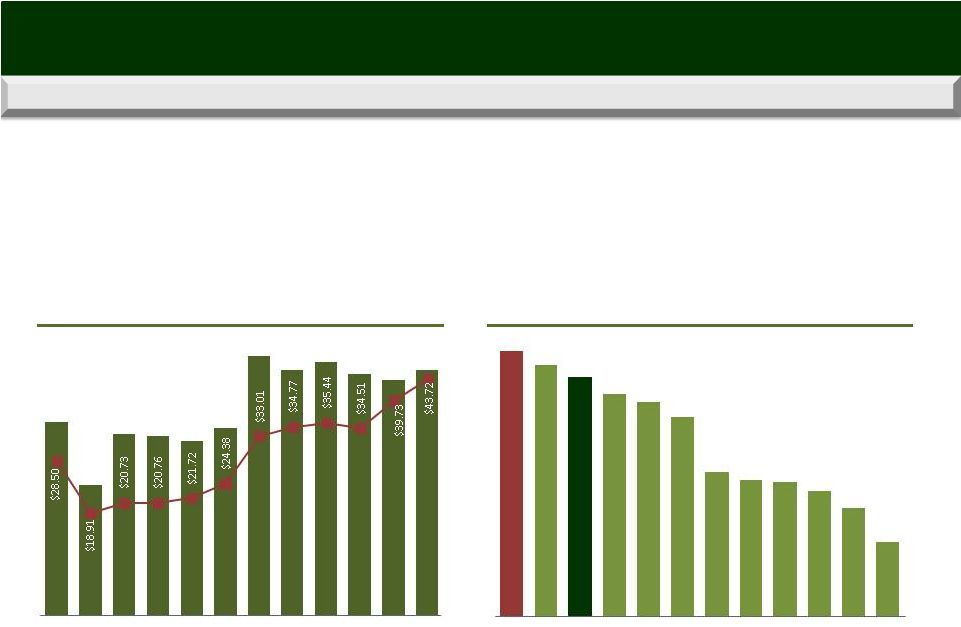

Quarterly Adjusted EBITDAX and EBITDAX Margin ($ / Boe)

Comparative Q4 2012 EBITDAX Margins ($ / Boe)

(2)

•

EBITDAX has increased significantly since mid-2010 when we shifted our strategy to oil and

NGLs •

Cash margin per Boe has also improved significantly due to the increase in oil prices and

declining operating costs per unit

•

Eagle Ford cash margin was $79.00 / Boe in 4Q12

(1)

Source: Company filings.

(1)

Excludes regional and corporate G&A expenses.

(2)

PVA 4Q2012 EBITDAX of $62.3 million per its earnings release. EBITDAX for peers calculated as

total revenues less lease operating expenses, production taxes and cash G&A unless

otherwise disclosed. Inclusive of realized hedge gains or losses. (3)

Pro forma for the Acquisition.

Strong Margins vs. Peers

$48.41

$45.88

$43.72

$40.61

$39.10

$36.48

$26.37

$25.01

$24.54

$22.95

$19.79

$13.56

PVA

PF

GDP

PVA

CWEI

CRZO

FST

PDCE

BBG

CRK

Antero

XCO

KWK

(3)

$49

$33

$46

$45

$44

$48

$66

$62

$64

$61

$60

$62

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12 |

16

Revised for Proposed MHR Acquisition Assuming 5/15/13 Closing Date

Full-Year 2013 Guidance Table

2,775

-

3,075

760

-

890

3,535

-

3,965

730

-

820

55

-

75

785

-

895

13,000

-

13,650

190

-

240

13,190

-

13,890

5,672

-

6,170

847

-

1,005

6,518

-

7,175

15,539

-

16,904

3,681

-

4,370

17,858

-

19,658

59.9%

-

64.9%

95.3%

-

96.8%

64.5%

-

69.4%

$265.0

-

$293.5

$70.0

-

$80.0

$335.0

-

$373.5

21.5

-

24.5

1.5

-

2.0

23.0

-

26.5

43.5

-

45.5

1.0

-

1.5

44.5

-

47.0

$330.0

-

$363.5

$72.5

-

$83.5

$402.5

-

$447.0

$58.18

-

$58.91

$85.63

-

$83.08

$61.75

-

$62.30

86.2%

-

88.0%

97.9%

-

98.8%

88.3%

-

90.0%

$4.60

-

$5.00

$4.65

-

$5.05

$1.70

-

$1.90

$1.45

-

$1.65

6.3%

-

6.9%

6.6%

-

7.1%

$39.5

-

$40.5

$1.8

-

$2.0

$41.3

-

$42.5

3.0

-

4.0

0.2

-

0.3

3.2

-

4.3

2.5

-

2.7

2.5

-

2.7

$42.5

-

$44.5

$4.5

-

$5.0

$47.0

-

$49.5

$28.0

-

$30.0

$18.0

-

$22.0

$46.0

-

$52.0

21.0

-

22.0

21.0

-

24.0

42.0

-

46.0

$36.00

-

$39.00

$36.00

-

$39.00

$234.5

-

$280.0

$60.0

-

$70.0

$294.5

-

$350.0

$310.0

-

$345.0

$80.0

-

$85.0

$390.0

-

$430.0

17.0

-

18.0

(2.5)

-

(2.0)

14.5

-

16.0

5.0

-

7.0

(2.5)

-

(2.0)

2.5

-

5.0

28.0

-

30.0

(3.0)

-

1.0

25.0

-

31.0

$360.0

-

$400.0

$72.0

-

$82.0

$432.0

-

$482.0

Pro Forma

2013 Guidance

Current Full-Year

2013 Guidance

Adjustments for MHR

Acquisition / One Less Rig

(a)

Assumes average benchmark prices of $90.96 per barrel for crude oil and $3.51 per MMBtu for

natural gas, prior to any premium or discount for quality, basin differentials, the impact of hedges

and other adjustments. NGL realized pricing is assumed to be $29.38 per barrel.

Production:

Crude oil (MBbls)

NGLs (MBbls)

Natural gas

(MMcf)

Equivalent production

Percent crude oil and NGLs

Production revenues (a):

Crude oil

NGLs

Natural gas

Total product revenues

Total product revenues ($ per BOE)

Percent crude oil and NGLs

Operating expenses:

Lease operating

($ per BOE)

Adjusted EBITDAX (b)

Capital expenditures:

Drilling and completion

Pipeline, gathering, facilities

Seismic (c)

Lease acquisitions, field projects and other

Total oil and gas capital expenditures

Depreciation, depletion and amortization

($ per BOE)

(b)

Adjusted EBITDAX is not a measure of financial performance under GAAP and should not be

considered as a measure of liquidity or as an alternative to net income.

(c)

Seismic expenditures are also reported as a component of exploration expense and as a

component of net cash provided by operating activities .

(MBOE)

Equivalent

daily

production

(BOEPD)

General and administrative:

Recurring general and administrative

Share-based compensation

Restructuring

Total reported G&A

Exploration:

Total reported exploration

Unproved property amortization

Gathering, processing and trans. cost($ per BOE)

Production and ad valorem taxes

(% of oil and gas revenues) |

17

PVA Proved Reserves

(1)

Oil

(MMBbls)

NGLs

(MMBbls)

Natural Gas

(Bcfe)

Oil Equivalents

(MMBoe)

SEC PV-10

($mm)

Proved Developed

10.5

8.3

169.4

47.0

$627.9

Proved Undeveloped

14.4

12.4

238.1

66.5

64.5

Total Proved Reserves

24.9

20.7

407.5

113.5

$692.5

(1) Prepared by Wright & Company, Inc. based on adjusted product

prices of $102.24 per barrel of oil, $39.48 per barrel of NGLs and $2.47 per Mcf of gas.

(2) Prepared by Cawley, Gillespie & Associates, Inc. for Magnum

Hunter based on average prices of $98.77 per barrel of oil, $2.88 per Mcf of gas and $43.57 per barrel of NGL.

SEC Proved Reserve Disclosure

Acquired Eagle Ford Assets

(2)

Oil

(MMBbls)

NGLs

(MMBbls)

Natural Gas

(Bcfe)

Oil Equivalents

(MMBoe)

SEC PV-10

($mm)

Proved Developed

3.9

0.3

1.1

4.4

$156.0

Proved Undeveloped

6.9

0.4

1.8

7.6

84.7

Total Proved Reserves

10.8

0.7

2.9

12.0

$240.7

Pro Forma Proved Reserves

Oil

(MMBbls)

NGLs

(MMBbls)

Natural Gas

(Bcfe)

Oil Equivalents

(MMBoe)

SEC PV-10

($mm)

Proved Developed

14.4

8.5

170.6

51.4

$784.0

Proved Undeveloped

21.3

12.9

239.9

74.1

149.3

Total Proved Reserves

35.7

21.4

410.5

125.5

$933.2 |

Penn Virginia

Corporation 4 Radnor Corporate Center, Suite 200

Radnor, PA 19087

610-687-8900

www.pennvirginia.com |