Attached files

| file | filename |

|---|---|

| 8-K - 8-K - McEwen Mining Inc. | a13-9094_18k.htm |

Exhibit 99.1

Los Azules Copper Project Exploration Drilling Update

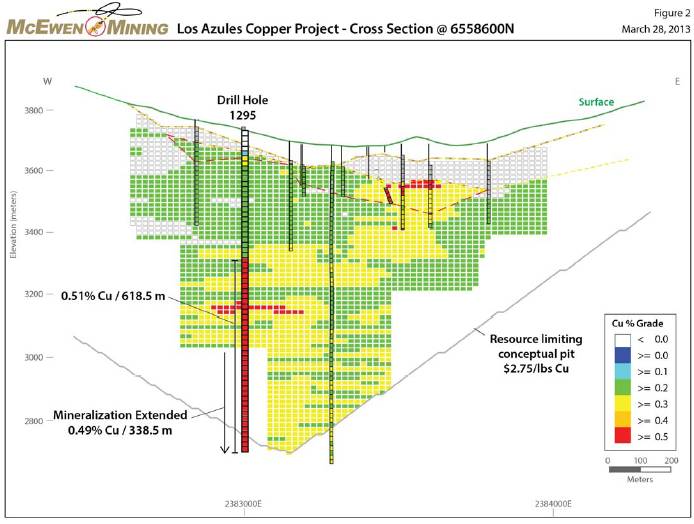

TORONTO, ONTARIO — (March 28, 2013) - McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce assay results for nine new core holes from the Los Azules copper project in San Juan Province, Argentina. Most importantly, drilling continues to intersect significant intercepts of high to medium grade copper mineralization over long intervals west of the original deposit. In addition, the mineralization has been successfully extended at depth.

Exploration Highlights

· Drilling west of the resource has intersected high-grade copper mineralization in Hole 12114, returning 0.70% copper over 150 meters. This hole was located on the periphery of the resource and continues to extend what is becoming an important new parallel trend.

· Hole 1297, which was drilled on the western edge of the resource, returned 0.50% copper over 414 meters, including 1.07% over 54 meters. In addition to Hole 12114, this hole helps demonstrate that there is excellent potential to increase the size of the resource.

· Drilling below the previously known resource successfully extended the depth of the mineralization by over 300 meters in Hole 1295, returning 0.49% copper over 338.5 meters. This result was part of a longer intercept that went through two known zones of mineralization. The overall intercept from this hole was 0.51% copper over 618.5 meters.

· The Company will incorporate these drill results plus an additional 3 holes not yet released into an updated resource estimate that is expected to be available by the end of May.

“These results continue to illustrate the growth potential of this world class copper asset. Los Azules is both large and high-grade, which makes it unique among the world’s undeveloped projects,” stated Rob McEwen, Chief Owner.

Table 1. Los Azules Exploration Highlights

|

|

|

From |

|

To |

|

Thickness |

|

Copper Grade |

|

|

Hole |

|

(m) |

|

(m) |

|

(m) |

|

(%) |

|

|

1295 |

|

426 |

|

1044.5 |

|

618.5 |

|

0.51 |

|

|

including |

|

580 |

|

618 |

|

38 |

|

1.07 |

|

|

including |

|

720 |

|

744 |

|

24 |

|

1.16 |

|

|

including |

|

970 |

|

1044.5 |

|

74.5 |

|

0.61 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1297 |

|

276 |

|

690 |

|

414 |

|

0.50 |

|

|

including |

|

436 |

|

490 |

|

54 |

|

1.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

12114 |

|

224 |

|

374 |

|

150 |

|

0.70 |

|

This season was the first time that exploration had drilled below 700 meters. The discovery of deeper mineralization at the project has significantly expanded the potential to grow the resource. Drilling this season has continued to focus on

![]()

expanding the resource with 15,800 meters completed to date. The drill results in this news release, plus 3 additional holes not yet finalized, will be incorporated into a new resource estimate that will be released by the end of May. This updated resource would form the basis of a new Preliminary Economic Assessment (PEA), which is due by the end of the third quarter 2013. Los Azules is one of the largest, highest grade copper-porphyry deposits not owned by a major base metal company.

A table of assay results is provided below in Table 2. A drill hole location map and cross sections of the Los Azules resource are provided below in Figures 1 to 4, respectively.

About the Los Azules Copper Project

Los Azules is a large copper porphyry system located in western San Juan Province within a belt of porphyry copper deposits that straddles the Chilean/Argentine border. This belt contains some of the world’s largest copper deposits, including Codelco’s El Teniente and Andina mines, Anglo American’s Los Bronces mine, Antofagasta PLC’s Los Pelambres mine and Xstrata’s El Pachón project, among others.

The mineral resources for Los Azules were calculated in January 2013 and are summarized in the table below with a cut-off grade of 0.35% copper.

|

Mineral Resource |

|

Tonnes |

|

Copper |

|

Contained Copper |

|

Gold |

|

Silver |

|

|

Indicated |

|

310 |

|

0.65 |

|

4.45 |

|

0.07 |

|

1.8 |

|

|

Inferred |

|

1,302 |

|

0.49 |

|

13.95 |

|

0.06 |

|

2.0 |

|

About McEwen Mining (www.mcewenmining.com)

The goal of McEwen Mining is to qualify for inclusion in the S&P 500 by 2015 by creating a high growth gold producer focused in the Americas. McEwen Mining’s principal assets consist of the San José mine in Santa Cruz, Argentina (49% interest); the El Gallo complex in Sinaloa, Mexico; the Gold Bar project in Nevada, US; the Los Azules project in San Juan, Argentina and a large portfolio of exploration properties in Argentina, Mexico and Nevada.

McEwen Mining has 296,024,859 shares issued and outstanding. Rob McEwen, Chairman, President and Chief Owner, owns 25% of the shares of the Company (assuming all outstanding Exchangeable Shares are exchanged for an equivalent amount of Common Shares). As of December 31, 2012, McEwen Mining had cash and liquid assets of approximately US$79 million and is debt free.

Technical Information

James K. Duff, Senior Consultant to the Company and a Registered Member in good standing of the Society for Mining, Metallurgy and Exploration, who is a Qualified Person as defined by National Instrument 43-101 (“NI 43-101”) has reviewed and approved the technical contents of this news release. Bruce Davis, PhD, FAusIMM, who is a Qualified Person as defined by NI 43-101 and responsible for the quality control for the assaying of the Los Azules drill core has reviewed the assay quality control information. All samples were collected in accordance with industry standards. Split drill core samples were submitted to Alex Stewart International laboratory in Mendoza, Argentina for fire assay and ICP analysis. Accuracy of results is verified through the systematic inclusion of standards, blanks and duplicate samples.

For additional information about the Los Azules project see the Technical Report titled “Los Azules Porphyry Copper Project, San Juan Province, Argentina” dated August 1, 2012, with an effective date of June 15, 2012, prepared by D. Ernest Winkler, P.Eng, Robert Sim, P.Geo, Bruce Davis, PhD, FAusIMM and James K. Duff, P.Geo, all of whom are qualified persons and all of whom are independent of McEwen Mining, each as defined by NI 43-101. The foregoing report is available under the Corporation’s profile on SEDAR (www.sedar.com).

The mineral resource estimate referenced in this news release was prepared in January 2013 by Robert Sim, P.Geo. and Bruce Davis, PhD, FAusIMM, each a qualified person and independent of McEwen Mining, each as defined by NI 43-101

and first disclosed in the Corporation’s news release dated February 5, 2013 titled “McEwen Mining Continues to Expand Los Azules’ Large, High-Grade, Mineral Resource.

Cautionary Note to U.S. Investors

McEwen Mining reports its resource estimates in accordance with standards of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in Canadian National Instrument 43-101 (NI 43-101). These standards are different from the standards generally permitted in reports filed with the SEC. Under NI 43-101, McEwen Mining reports measured, indicated and inferred resources, measurements which are generally not permitted in filings made with the SEC. According to Canadian NI 43-101 criteria, the estimation of measured resources and indicated resources involve greater uncertainty as to their economic feasibility than the estimation of proven and probable reserves. Under SEC Industry Guide 7 criteria, measured, indicated and inferred resources are considered Mineralized Material. The SEC considers that in addition to greater uncertainty as to the economic feasibility of Mineralized Material compared to proven and probable reserves, there is also greater uncertainty as to the existence of Mineralized Material. U.S. investors are cautioned not to assume that measured or indicated resources will be converted into economically mineable reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources.

Caution Concerning Forward-Looking Statements

This press release contains certain forward-looking statements and information, including “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this press release, McEwen Mining Inc.’s (the “Company”) estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic, political and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, risks related to the cost of transferring or otherwise allocating funds between operating jurisdictions, factors associated with fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, risks associated with the construction and permitting of mining operations and commencement of production and the projected costs thereof, risks related to litigation, property title, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012 and other filings with the Securities and Exchange Commission, under the caption “Risk Factors”, for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by management of McEwen Mining Inc.

|

For further information contact: |

|

|

|

|

|

|

|

Jenya Meshcheryakova Investor Relations Tel: (647) 258-0395 ext 410 Toll Free: (866) 441-0690 Fax: (647) 258-0408

Facebook: facebook.com/mcewenrob |

|

Mailing Address 181 Bay Street Suite 4750 Toronto, ON M5J 2T3 PO box 792 E-mail: info@mcewenmining.com |

|

Twitter: twitter.com/mcewenmining Store: mcewenmining.com/store |

|

|

Table 2 — Summary of Drill Hole Results

|

|

|

Hole |

|

Northing |

|

Easting |

|

Dip |

|

From |

|

To |

|

Thickness |

|

Cu |

|

Zone |

|

|

1) |

|

1290 |

|

6559000 |

|

2383750 |

|

90° |

|

0 |

|

61 |

|

61 |

|

— |

|

Overburden |

|

|

|

|

|

|

|

|

|

|

|

|

61 |

|

142 |

|

81 |

|

0.02 |

|

Leached oxide cap |

|

|

|

|

|

|

|

|

|

|

|

|

142 |

|

152 |

|

10 |

|

0.06 |

|

Mixed oxide |

|

|

|

|

|

|

|

|

|

|

|

|

152 |

|

366 |

|

214 |

|

0.24 |

|

Partially enriched with weak chalcopyrite and chalcocite Includes 30m at 0.41% Cu from 288m to 318m |

|

|

|

|

|

|

|

|

|

|

|

|

366 |

|

757.5 |

|

389.5 |

|

0.13 |

|

Weak primary with chalcopyrite |

|

|

|

|

|

|

|

|

|

|

|

|

Step-out hole completed to target depth. Average core recovery was 93%. |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2) |

|

1293 |

|

6559621 |

|

2383360 |

|

90° |

|

0 |

|

61 |

|

61 |

|

— |

|

Overburden |

|

|

|

|

|

|

|

|

|

|

|

|

61 |

|

74.5 |

|

13.5 |

|

— |

|

Caving – no sample |

|

|

|

|

|

|

|

|

|

|

|

|

74.5 |

|

106 |

|

31.5 |

|

0.18 |

|

Partially enriched with weak chalcopyrite and chalcocite |

|

|

|

|

|

|

|

|

|

|

|

|

Infill hole lost before reaching target depth. Average core recovery was 50%. |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3) |

|

1295 |

|

6558598 |

|

2382993 |

|

90° |

|

0 |

|

67 |

|

67 |

|

— |

|

Overburden |

|

|

|

|

|

|

|

|

|

|

|

|

67 |

|

80 |

|

13 |

|

0.07 |

|

Leached oxide cap |

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

112 |

|

32 |

|

0.31 |

|

Partially enriched with calcocite and chalcopyrite |

|

|

|

|

|

|

|

|

|

|

|

|

112 |

|

140 |

|

28 |

|

0.18 |

|

Primary chalcopyrite |

|

|

|

|

|

|

|

|

|

|

|

|

140 |

|

164 |

|

24 |

|

0.24 |

|

Partially enriched with chalcopyrite and chalcocite |

|

|

|

|

|

|

|

|

|

|

|

|

164 |

|

426 |

|

262 |

|

0.22 |

|

Primary chalcopyrite and bornite |

|

|

|

|

|

|

|

|

|

|

|

|

426 |

|

1044.5 |

|

618.5 |

|

0.51 |

|

Primary chalcopyrite and bornite Includes 38m at 1.07% Cu from 580m to 618m, And 24m of 1.16% Cu from 720m to 744m, And 74.5m of 0.61% Cu from 970m to 1044.5m |

|

|

|

|

|

|

|

|

|

|

|

|

Twin of hole T-01 (drilled in 2010) completed to target depth. Average core recovery was 99%. |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4) |

|

1296 |

|

6558158 |

|

2323223 |

|

90° |

|

0 |

|

60.2 |

|

60.2 |

|

— |

|

Overburden |

|

|

|

|

|

|

|

|

|

|

|

|

60.2 |

|

66.2 |

|

4 |

|

0.03 |

|

Leached oxide cap |

|

|

|

|

|

|

|

|

|

|

|

|

66.2 |

|

72.7 |

|

6.5 |

|

— |

|

Caving – no sample |

|

|

|

|

|

|

|

|

|

|

|

|

72.7 |

|

156 |

|

83.3 |

|

0.25 |

|

Primary chalcopyrite |

|

|

|

|

|

|

|

|

|

|

|

|

156 |

|

244 |

|

88 |

|

0.92 |

|

Primary chalcopyrite and chalcocite |

|

|

|

|

|

|

|

|

|

|

|

|

244 |

|

523.2 |

|

279.2 |

|

0.24 |

|

Primary chalcopyrite and bornite |

|

|

|

|

|

|

|

|

|

|

|

|

Reattempt of hole 12101 lost before reaching target depth. Average core recovery was 86%. |

| ||||||||

|

5) |

|

1297 |

|

6559203 |

|

2382889 |

|

90° |

|

0 |

|

69 |

|

69 |

|

— |

|

Overburden |

|

|

|

|

|

|

|

|

|

|

|

|

69 |

|

72 |

|

3 |

|

0.03 |

|

Mixed oxide |

|

|

|

|

|

|

|

|

|

|

|

|

72 |

|

218 |

|

146 |

|

0.18 |

|

Partially enriched with chalcopyrite and chalcocite |

|

|

|

|

|

|

|

|

|

|

|

|

218 |

|

276 |

|

58 |

|

0.18 |

|

Primary chalcopyrite and bornite |

|

|

|

|

|

|

|

|

|

|

|

|

276 |

|

690 |

|

414 |

|

0.50 |

|

Primary chalcopyrite and bornite Includes 54m at 1.07% Cu from 436m to 490m |

|

|

|

|

|

|

|

|

|

|

|

|

690 |

|

980.8 |

|

290.8 |

|

0.23 |

|

Primary chalcopyrite and bornite |

|

|

|

|

|

|

|

|

|

|

|

|

Step-out hole completed to target depth. Average core recovery was 97%. |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6) |

|

12104 |

|

6558803 |

|

2383200 |

|

90° |

|

0 |

|

114 |

|

114 |

|

— |

|

Overburden |

|

|

|

|

|

|

|

|

|

|

|

|

114 |

|

172 |

|

58 |

|

0.18 |

|

Partially enriched with chalcocite and chalcocite |

|

|

|

|

|

|

|

|

|

|

|

|

172 |

|

270 |

|

98 |

|

0.23 |

|

Primary chalcopyrite and bornite |

|

|

|

|

|

|

|

|

|

|

|

|

270 |

|

374 |

|

104 |

|

0.39 |

|

Primary chalcopyrite and bornite |

|

|

|

|

|

|

|

|

|

|

|

|

374 |

|

706.4 |

|

332.4 |

|

0.25 |

|

Primary chalcopyrite and bornite |

|

|

|

|

|

|

|

|

|

|

|

|

Infill hole completed to target depth. Average core recovery was 92%. |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7) |

|

12106 |

|

6559621 |

|

2383360 |

|

90° |

|

0 |

|

79 |

|

79 |

|

— |

|

Overburden |

|

|

|

|

|

|

|

|

|

|

|

|

79 |

|

106 |

|

27 |

|

0.02 |

|

Leached oxide cap |

|

|

|

|

|

|

|

|

|

|

|

|

106 |

|

222 |

|

116 |

|

1.01 |

|

Enriched with chalcocite and chalcopyrite |

|

|

|

|

|

|

|

|

|

|

|

|

222 |

|

428 |

|

206 |

|

0.55 |

|

Partially enriched with chalcopyrite and chalcocite |

|

|

|

|

|

|

|

|

|

|

|

|

428 |

|

496 |

|

68 |

|

1.18 |

|

Partially enriched with chalcopyrite and chalcocite |

|

|

|

|

|

|

|

|

|

|

|

|

496 |

|

866.4 |

|

370.4 |

|

0.30 |

|

Primary chalcopyrite and bornite |

|

|

|

|

|

|

|

|

|

|

|

|

Offset hole 1048 (drilled in 2010) completed to target depth. Average core recovery was 91%. |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8) |

|

12100 |

|

6559046 |

|

2383378 |

|

90° |

|

0 |

|

30 |

|

30 |

|

— |

|

Overburden |

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

104 |

|

74 |

|

0.02 |

|

Leached oxide cap |

|

|

|

|

|

|

|

|

|

|

|

|

104 |

|

136 |

|

32 |

|

0.30 |

|

Mixed oxide |

|

|

|

|

|

|

|

|

|

|

|

|

136 |

|

222 |

|

86 |

|

0.55 |

|

Secondary chalcocite with pyrite |

|

|

|

|

|

|

|

|

|

|

|

|

222 |

|

282 |

|

60 |

|

0.29 |

|

Partially enriched with pyrite. chalcopyrite and chalcocite |

|

|

|

|

|

|

|

|

|

|

|

|

282 |

|

751.3 |

|

469.3 |

|

0.21 |

|

Primary pyrite, chalcopyrite and bornite |

|

|

|

|

|

|

|

|

|

|

|

|

Infill hole completed to target depth. Average core recovery was 97%. |

| ||||||||

|

9) |

|

12114 |

|

6559820 |

|

2382635 |

|

90° |

|

0 |

|

101 |

|

101 |

|

— |

|

Overburden |

|

|

|

|

|

|

|

|

|

|

|

|

101 |

|

138 |

|

37 |

|

0.09 |

|

Mixed oxide |

|

|

|

|

|

|

|

|

|

|

|

|

138 |

|

174 |

|

36 |

|

0.16 |

|

Partially enriched with pyrite and chalcocite |

|

|

|

|

|

|

|

|

|

|

|

|

174 |

|

224 |

|

50 |

|

0.39 |

|

Enriched with chalcocite and chalcopyrite |

|

|

|

|

|

|

|

|

|

|

|

|

224 |

|

374 |

|

150 |

|

0.70 |

|

Enriched with chalcocite and chalcopyrite |

|

|

|

|

|

|

|

|

|

|

|

|

374 |

|

814.5 |

|

440.5 |

|

0.22 |

|

Primary pyrite, chalcopyrite and bornite |

|

|

|

|

|

|

|

|

|

|

|

|

Step-out hole completed to target depth. Average core recovery was 95%. |

| ||||||||