Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - McEwen Mining Inc. | a2197255zex-32.htm |

| EX-21 - EX-21 - McEwen Mining Inc. | a2197255zex-21.htm |

| EX-31.2 - EX-31.2 - McEwen Mining Inc. | a2197255zex-31_2.htm |

| EX-23.1 - EX-23.1 - McEwen Mining Inc. | a2197255zex-23_1.htm |

| EX-31.1 - EX-31.1 - McEwen Mining Inc. | a2197255zex-31_1.htm |

| EX-23.2 - EX-23.2 - McEwen Mining Inc. | a2197255zex-23_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2009 |

||

o |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 001-33190

US GOLD CORPORATION

(Name of registrant as specified in its charter)

| Colorado (State or other jurisdiction of incorporation or organization) |

84-0796160 (I.R.S. Employer Identification No.) |

|

99 George Street, 3rd Floor, Toronto, Ontario Canada (Address of principal executive offices) |

M5A 2N4 (Zip Code) |

(866) 441-0690

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, no par value | NYSE Amex | |

|---|---|---|

| Title of each class | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2009 (the last business day of the registrant's second fiscal quarter), the aggregate market value of the registrant's voting and non-voting common equity held by non-affiliates of the registrant was $254,186,661 based on the closing price of $2.64 per share as reported on the NYSE Amex. There were 115,662,588 shares of common stock outstanding (and 6,235,265 exchangeable shares exchangeable into US Gold Corporation common stock on a one-for-one basis) on March 10, 2010.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Proxy Statement for the 2010 Annual Meeting of Shareholders are incorporated into Part III, Items 10 through 14 of this report.

Descriptions of agreements or other documents in this report are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein by reference as exhibits. Please see the Exhibit Index at the end of this report for a complete list of those exhibits.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Please see the note under "ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS," for a description of special factors potentially affecting forward-looking statements included in this report.

History and Organization

US Gold Corporation ("US Gold," "we," "us," or the "Company") is engaged in the exploration for gold, silver, and other valuable minerals. Our core assets are our interests in several large exploration properties in the State of Nevada and our properties in Sinaloa State, Mexico. We were organized under the laws of the State of Colorado on July 24, 1979 under the name Silver State Mining Corporation. On June 21, 1988, we changed our name to U.S. Gold Corporation and on March 16, 2007, we changed our name to US Gold Corporation. We are currently in the exploration stage and have not generated revenue from operations since 1990.

In June 2007, we completed three simultaneous acquisitions ("Acquisitions"), significantly increasing our land position in Nevada and adding our Mexican properties as well as a property in the State of Utah. The three companies acquired were: Nevada Pacific Gold Ltd. ("Nevada Pacific"), Tone Resources Ltd. ("Tone") and White Knight Resources Ltd. ("White Knight"), which we refer to as the Acquired Companies. Presently, we hold interests in approximately 260 square miles in the United States, which we refer to as the U.S. and approximately 1,395 square miles in Mexico. We own our properties and operate through various consolidated subsidiaries, each of which is owned entirely, directly or indirectly, by us. References in this report to our company may include one or more of our subsidiaries as the context requires.

Segment Information

Our operating segments include Nevada and Mexico. See Note 14 to the Consolidated Financial Statements for information relating to our operating segments.

Overview of Business and Properties

Our objective is to increase the value of our shares through the exploration, discovery, development, and extraction of gold, silver and other valuable minerals. We generally conduct our business as sole operator, but we may enter into arrangements with other companies through joint venture or similar agreements in an effort to achieve our strategic objectives.

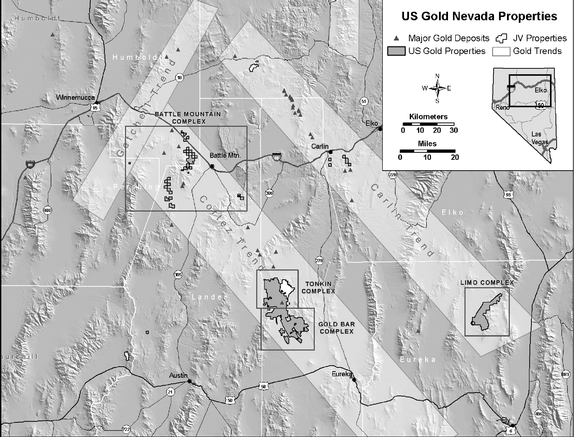

A majority of our Nevada properties, including our Tonkin and Gold Bar properties, are located along the Cortez Trend, in north central Nevada. We also own property, including our Limo property, on the Carlin Trend, which is located east of the Cortez Trend. Our Tonkin property produced gold for a limited period of time from shallow deposits from 1988 to 1990. From early 1991 to early 2005, we had a series of joint venture partners that conducted exploration activities at the Tonkin property. In 2005, the last of these joint venture relationships was terminated, returning to us 100% of the Tonkin property. In 2006, we commenced comprehensive exploration of our Tonkin property in an effort to identify additional mineralized material. In 2007, after the completion of the Acquisitions, we began a comprehensive evaluation of the major land areas acquired in Nevada and identified numerous drilling targets at our Tonkin, Gold Bar, and Limo properties. In 2008 and 2009, we continued to drill various targets on these properties, as well as expand the quantity of known mineralized material at the Gold Bar property in updated technical reports. In 2009, we also developed targets for future drilling on our Battle Mountain Complex properties which are located at the north end of the Cortez trend.

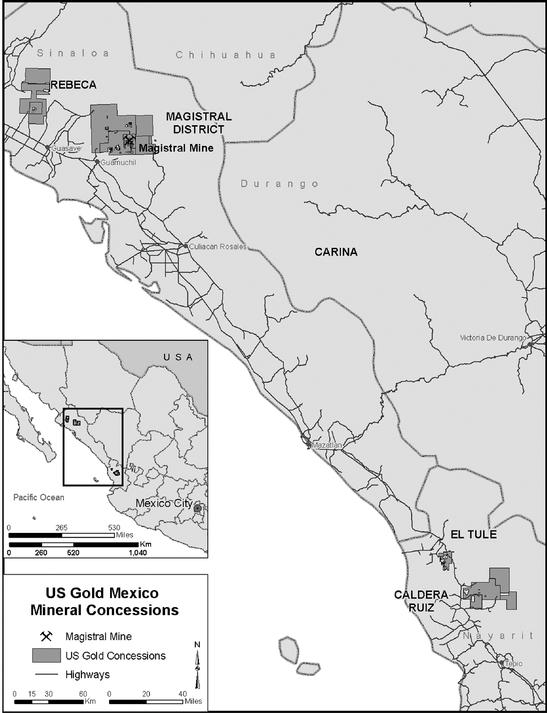

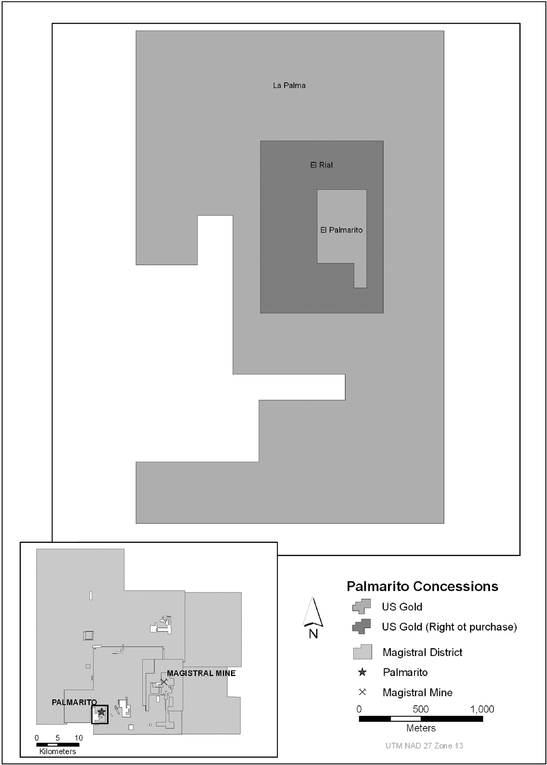

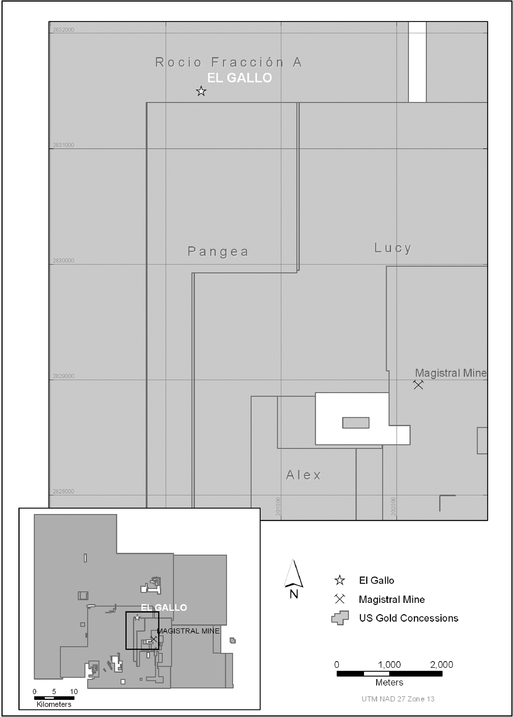

Our primary properties in Mexico include the El Gallo Project, the Magistral Mine Property, and the Palmarito Project, in addition to large amounts of unexplored land. The El Gallo Project, located approximately 4 miles to the northwest of the Magistral Mine, has become the primary focus of our exploration efforts in Mexico. We made the El Gallo silver discovery in the second half of 2008 as a result of a regional exploration program that we were conducting on targets surrounding the Magistral

1

Mine. In 2009, we significantly expanded the known area of mineralized material at El Gallo through drilling and began the permitting process to significantly expand our exploration efforts in 2010. The Magistral Mine Property, located in Sinaloa State, consists of approximately 38 square miles of mineral concessions, plant and equipment. The mine operated and produced approximately 70,000 ounces of gold from 2002 to 2005, before it was placed on care and maintenance status in 2006 due to higher than anticipated operating costs and a lack of operating capital when gold prices were approximately $400 per ounce. Inclusive of the foregoing, we control mineral concessions of approximately 1,395 square miles located in the Mexican states of Sinaloa and Nayarit.

Our principal executive office is located at 99 George Street, 3rd Floor, Toronto, Ontario, Canada M5A 2N4 and our telephone number is (866) 441-0690. We also maintain offices in Elko and Reno, Nevada and Guamuchil, Mexico. Our website is www.usgold.com. We make available our periodic reports and press releases on our web site. Our common stock is listed on the NYSE Amex and on the Toronto Stock Exchange (TSX), each under the symbol "UXG." Our warrants are listed on the TSX under the symbol "UXG.WT".

In this report, opt represents ounces per ton, gpt represents grams per tonne, ft. represents feet, m represents meters, km represents kilometer, and sq. represents square. All of our financial information is reported in U.S. dollars, unless otherwise noted.

Developments During 2009

During 2009, we continued our multi-year exploration and evaluation program at our Nevada properties and significantly increased our focus on our Mexican properties subsequent to the El Gallo discovery in 2008. Total exploration costs for the year were $8.2 million with $4.8 million spent in Nevada and $3.4 million spent in Mexico, compared to $10.8 million in 2008 with $5 million and $5.8 million for Nevada and Mexico respectively.

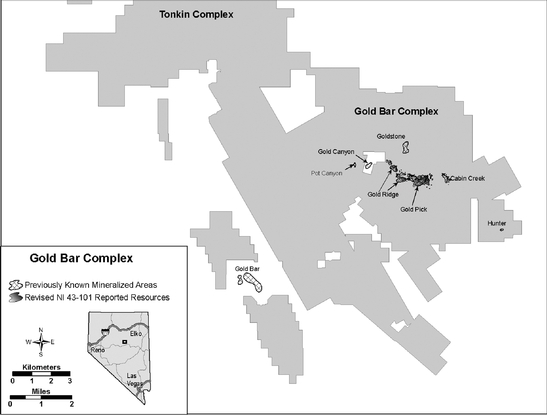

Exploration targets drilled in Nevada during the year included a number of targets on the Tonkin and Gold Bar properties, each on the Cortez Trend, and targets at the Limo property on the Carlin Trend. Also, we completed an update of the estimate of mineralized material for the Gold Bar properties prepared in compliance with the Canadian Institute of Mining, Metallurgy and Petroleum referred to in Canadian National Instrument 43-101, commonly known as NI 43-101 and an initial NI 43-101 compliant mineralized material estimate at the Limo properties.

Mexico exploration efforts during the first half of 2009 focused on expanding the size of the El Gallo project. Primary exploration activities consisted of core and conventional rotary drilling and geochemical surface sampling. Our focus at El Gallo during the second half of the year was on completion of environmental studies and the permitting process to drill on a significantly expanded area around the initial discovery. Applications for two key permits were submitted to local authorities in July 2009. The permit for a Land Use Change was subsequently approved on November 27, 2009 and the second permit relating to an Environmental Impact Study was approved on December 15, 2009. While the environmental and permitting work was being completed, we continued to carry out prospecting activities in the El Gallo/Magistral region and also initiated planning for an extensive drill program at El Gallo in anticipation of the permits being received. Renewed drilling began in January 2010. During 2009, we also completed the first phase of metallurgical testing at El Gallo and initiated the second phase of such testing, including tests to help determine the viability of using a heap leach recovery process. Results are expected to be released during the second quarter of 2010.

As the Company is now focusing on the most prospective properties from the Acquisitions, in 2009 we began the process of rationalizing the lowest priority exploration areas by allowing those claims to lapse as they come due. Accordingly, we recorded a write-off of long lived assets for 2009 of $16.6 million of which $15.8 million related to our Nevada mineral property interests. The remainder of the write-off was due to an impairment charge recorded for mobile mining equipment in Mexico.

2

In order to fund our continued exploration programs, we successfully completed a public offering pursuant to a registration statement filed with U.S. securities regulators and a prospectus filed with Canadian securities regulators. In May 2009, we issued 25.15 million shares of common stock at a price of $2.00 per share (before the underwriters' commissions and expenses). This provided the Company with net cash of $46.3 million and we ended 2009 with working capital of $42.5 million.

Competitive Business Conditions

We compete with many companies in the mining industry, including large, established mining companies with substantial capabilities, personnel, and financial resources. There is a limited supply of desirable mineral lands available for claim-staking, lease, or acquisition in the U.S., Mexico, and other areas where we may conduct exploration activities. We may be at a competitive disadvantage in acquiring mineral properties, since we compete with these individuals and companies, many of which have greater financial resources and larger technical staffs than we do. From time to time, specific properties or areas which would otherwise be attractive to us for exploration or acquisition may be unavailable due to their previous acquisition by other companies or our lack of financial resources.

Competition in the industry is not limited to the acquisition of mineral properties, but also extends to the technical expertise to find, advance, and operate such properties; the labor to operate the properties; and the capital for the purpose of funding such exploration and development. Many competitors not only explore for and mine precious metals, but conduct refining and marketing operations on a world-wide basis. Such competition may result in our company being unable not only to acquire desired properties, but to recruit or retain qualified employees or to acquire the capital necessary to fund our operation and advance our properties. Our inability to compete with other companies for these resources would have a material adverse effect on our results of operation, financial condition and cash flows.

General Government Regulations

United States

Mining in the State of Nevada is subject to federal, state and local law. Three types of laws are of particular importance to our U.S. mineral properties: those affecting land ownership and mining rights; those regulating mining operations; and those dealing with the environment.

Land Ownership and Mining Rights. The Tonkin Springs property is situated on lands owned by the United States (Federal Lands). On Federal Lands, mining rights are governed by the General Mining Law of 1872 (General Mining Law) as amended, 30 U.S.C. §§ 21-161 (various sections), which allows the location of mining claims on certain Federal Lands upon the discovery of a valuable mineral deposit and proper compliance with claim location requirements. A valid mining claim provides the holder with the right to conduct mining operations for the removal of locatable minerals, subject to compliance with the General Mining Law and Nevada state law governing the staking and registration of mining claims, as well as compliance with various federal, state and local operating and environmental laws, regulations and ordinances. As the owner or lessee of the unpatented mining claims, we have the right to conduct mining operations on the lands subject to the prior procurement of required operating permits and approvals, compliance with the terms and conditions of any applicable mining lease, and compliance with applicable federal, state, and local laws, regulations and ordinances.

Mining Operations. The exploration of mining properties and development and operation of mines is governed by both federal and state laws. The Tonkin Springs property is administered by the United States Department of the Interior, Bureau of Land Management, which we refer to as the BLM. In general, the federal laws that govern mining claim location and maintenance and mining operations on Federal Lands, including the Tonkin Springs property, are administered by the BLM. Additional federal

3

laws, such as those governing the purchase, transport or storage of explosives, and those governing mine safety and health, also apply.

The State of Nevada likewise requires various permits and approvals before mining operations can begin, although the state and federal regulatory agencies usually cooperate to minimize duplication of permitting efforts. Among other things, a detailed reclamation plan must be prepared and approved, with bonding in the amount of projected reclamation costs. The bond is used to ensure that proper reclamation takes place, and the bond will not be released until that time. The Nevada Department of Environmental Protection, which we refer to as the NDEP, is the state agency that administers the reclamation permits, mine permits and related closure plans on our Nevada property. Local jurisdictions (such as Eureka County) may also impose permitting requirements (such as conditional use permits or zoning approvals).

Environmental Law: The development, operation, closure, and reclamation of mining projects in the United States requires numerous notifications, permits, authorizations, and public agency decisions. Compliance with environmental and related laws and regulations requires us to obtain permits issued by regulatory agencies, and to file various reports and keep records of our operations. Certain of these permits require periodic renewal or review of their conditions and may be subject to a public review process during which opposition to our proposed operations may be encountered. We are currently operating under various permits for activities connected to mineral exploration, reclamation, and environmental considerations. Unless and until a mineral resource is proved, it is unlikely our operations will move beyond the exploration stage. If in the future we decide to proceed beyond exploration, there will be numerous notifications, permit applications, and other decisions to be addressed at that time.

Mexico

Mining Regulations

Exploration and exploitation of minerals in Mexico may be carried out through Mexican companies incorporated under Mexican law by means of obtaining mining concessions. Mining concessions are granted by the Mexican government for a period of fifty years from the date of their recording in the Public Registry of Mining and are renewable for a further period of fifty years upon application within five years of the expiration of such concession in accordance with the Mining Law and its Regulations. Failure to do so prior to expiration of the term of the exploration concession will result in termination of the concession.

Mining concessions are subject to annual work requirements and payment of annual surface taxes which are assessed and levied on a semi-annual basis. Such concessions may be transferred or assigned by their holders, but such transfers or assignments must be registered with the Public Registry of Mining in order to be valid against third parties.

The holder of a concession must pay semi-annual duties in January and July of each year on a per hectare basis and in accordance with the amounts provided by the Federal Fees Law.

During the month of May of each year, the concessionaire must file with the General Bureau of Mines, the work assessment reports made on each concession or group of concessions for the preceding calendar year. The Regulations of the Mining Law provides tables containing the minimum investment amounts that must be made on a concession. This amount is updated annually in accordance with the variation of the Consumer Price Index.

Mexican mining law does not require payment of finder's fees or royalties to the government, except for a discovery premium in connection with national mineral reserves, concessions and claims or allotments contracted directly from the Mexican Geological Survey. None of the claims held by any subsidiaries of US Gold are under such a discovery premium regime. However, the PRI, which is the

4

main opposition party in Mexico, with the support of other opposition parties, has introduced in the Chamber of Deputies a 4% mining royalty on production. The opposition parties collectively have a majority in both the Chamber of Deputies and the Senate, with the governing PAN a minority. The opposition numbers are sufficient (over 2/3) to override a Presidential veto in the Chamber but not in the Senate. To date, the Government has been silent on the royalty proposal.

There are no limitations on the total amount of surface covered by mining concessions.

Environmental Law

The Environmental Law in Mexico called the General Law of Ecological Balance and Protection to the Environment ("General Law"), provides for general environmental policies, with specific requirements for certain activities such as exploration set forth in regulations called "Mexican official norms". Responsibility for enforcement of the General Law, the regulations and the Mexican official norms is with the Ministry of Environment and Natural Resources, which regulate all environmental matters with the assistance of Procuraduría Federal de Proteccion al Ambiente (PROFEPA).

The primary laws and regulations used by the State of Sinaloa in order to govern environmental protection for mining and exploration are: the General Law, Forestry Law, Residues Law, as well as their specific regulations on air, water and residues, and the Mexican official norms ("NOM-120"). In order to comply with the environmental regulations, a concessionaire must obtain a series of permits during the exploitation and exploration stage. The time required to obtain the required permits is dependent on a number of factors including the type of vegetation and trees impacted by proposed activities.

Employees

As of March 10, 2010, we had 110 employees including 10 employees based in the U.S., 10 in Canada and 90 in Mexico. All of our employees based in Canada work in an executive or administrative position, while our employees in the U.S. and Mexico include geologists, environmentalists, information technologists, and office administrators. None of our employees are covered by union labor contracts and the Company believes we have good relations with our employees. We also engage independent contractors in connection with the exploration of our properties, such as drillers, geophysicists, geologists, and other technical disciplines.

This report, including Management's Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements that may be affected by several risk factors. The following information summarizes all material risks known to us as of the date of filing this report:

We have incurred substantial losses since our inception in 1979 and may never be profitable. Since our inception in 1979, we have never been profitable and we have not generated revenue from operations since 1990. As of December 31, 2009, our accumulated deficit was approximately $298 million (including a non-cash expense of approximately $52 million related to derivative instrument accounting in the year ended December 31, 2006, a non-cash expense of approximately $107 million related to impairment of the Company's goodwill, all of which was related to the Acquired Companies, in the year ended December 31, 2008, and a non-cash expense of approximately $17 million related to the write-off of long-lived assets in the year ended December 31, 2009). To become profitable, we must identify additional mineralization and establish economic reserves on our properties, and then either develop our properties or locate and enter into agreements with third party operators. It could be years before we receive any revenues from production, if ever. We may suffer significant additional losses in the future and may never be profitable. We do not expect to receive revenue from operations in the foreseeable future, if at all. Even if we do achieve profitability, we may not be able to sustain or

5

increase profitability on a quarterly or annual basis. We expect to incur losses unless and until such time as one or more of our properties enter into commercial production and generate sufficient revenue to fund our continuing operations.

The feasibility of mining any of our properties has not been established, meaning that we have not completed sufficient exploration or other work necessary to determine if it is commercially feasible to develop any of our properties. We are currently an exploration stage company. We have no proven or probable reserves on our properties as defined by U.S. law. A "reserve," as defined by regulation of the Securities and Exchange Commission ("SEC"), is that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. A reserve requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically extracted and produced. We have not carried out any feasibility study with regard to any of our properties. As a result, we currently have no reserves and there are no assurances that we will be able to prove that there are reserves on our properties.

The mineralized material identified on our properties does not and may never have demonstrated economic viability. Substantial expenditures are required to establish reserves through drilling and additional study and there is no assurance that reserves will be established. The feasibility of mining on our Tonkin or Magistral properties or any other property has not been, and may never be, established. Whether a mineral deposit can be commercially viable depends upon a number of factors, including the particular attributes of the deposit, including size, grade and proximity to infrastructure; metal prices, which can be highly variable; and government regulations, including environmental and reclamation obligations. If we are unable to establish some or all of our mineralized material as proven or probable reserves in sufficient quantities to justify commercial operations, we may not be able to raise sufficient capital to develop a mine, even if one is warranted. If we are unable to establish such reserves, the market value of our securities may suffer, and you may lose some or all of your investment.

There are significant differences in U.S. and Canadian practices for reporting reserves and resources. Our estimates of mineralized material have been prepared in accordance with standards of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in Canadian National Instrument 43-101, commonly known as NI 43-101. These standards are different from the standards generally permitted to report reserve and other estimates in reports and other materials filed with the SEC. Under NI 43-101, we report measured, indicated and inferred resources, measurements which are generally not permitted in filings made with the SEC. Under SEC rules, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, "inferred resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Canadian regulations permit disclosure of "contained ounces", however, the SEC only permits issuers to report "mineralized material" in tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization contained in our public filings may not be comparable to information made public by other U.S. companies subject only to the U.S. reporting and disclosure requirements of the SEC.

Historical production of gold at our Tonkin or Magistral properties may not be indicative of the potential for future development or revenue. Historical production of gold from our Tonkin property came from relatively shallow deposits, in very limited quantities and for a very limited period of time. We commenced exploration of deeper zones of our Tonkin property in 2006 in an effort to identify additional mineralized material, and recently have identified priority exploration drilling targets on our Tonkin, Gold Bar and Limo properties in Nevada. In Mexico, the Magistral Mine produced gold from 2002 through 2005, but it was shut down in 2006 and is currently held by us on a care and maintenance

6

basis. In recent years, we increased our expenditures for exploration for our Mexico properties in and around the Magistral Mine. However, due to uncertainties associated with exploration, including variations in geology and structure, there is no assurance that our efforts will be successful or that prior drilling results are reflective of additional or economically developable deposits. Investors in our securities should not rely on our historical operations as an indication that we will ever place any of our mining properties into commercial production again.

We will require significant additional capital to continue our exploration activities, and, if warranted, to develop mining operations. Substantial expenditures will be required to determine if proven and probable mineral reserves exist at any of our properties, to develop metallurgical processes to extract metal or to develop the mining and processing facilities and infrastructure at any of our properties or mine sites. We have spent and will be required to continue to expend significant amounts of capital for drilling, geological and geochemical analysis, assaying, and, if warranted, feasibility studies with regard to the results of our exploration. We may not benefit from these investments if we are unable to identify commercially exploitable mineralized material. If we do locate commercially mineable material or decide to put one or more of our properties into production, we may be required to upgrade our processing facility at the Magistral Mine or the Tonkin property or construct new facilities. Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the price of gold and other precious metals. Capital markets worldwide have been adversely affected by substantial losses by financial institutions, in turn caused by investments in asset-backed securities. We may not be successful in obtaining the required financing, or if we can obtain such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration or development and the possible, partial or total loss of our potential interest in certain properties.

The figures for our estimated mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated. Unless otherwise indicated, mineralization figures presented in our filings with securities regulatory authorities including the SEC, press releases and other public statements that may be made from time to time are based upon estimates made by independent geologists and our internal geologists. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material and grades of mineralization on our properties. Until ore is actually mined and processed, mineralized material and grades of mineralization must be considered as estimates only.

These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that:

- •

- these estimates will be accurate;

- •

- mineralization estimates will be accurate; or

- •

- this mineralization can be mined or processed profitably.

Any material changes in mineral estimates and grades of mineralization will affect the economic viability of placing a property into production and such property's return on capital. There can be no assurance that minerals recovered in small scale tests will be recovered in large-scale tests under on-site conditions or in production scale.

The estimates contained in our public filings have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for gold and/or silver may render portions of our mineralization estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability of one or

7

more of our properties. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our results of operations or financial condition.

The integration of any other acquisitions that we may pursue will present significant challenges. The investigation of any other acquisitions, integration of our operations with any other acquisitions we may pursue and the consolidation of those operations will require the dedication of management resources, which will temporarily divert attention from the day-to-day business of the Company. The process of combining the organizations may cause an interruption of, or a loss of momentum in, the activities of any or all of the Company's businesses, which could have an adverse effect on the operating results of the combined company for an indeterminate period of time. The failure to successfully integrate any such acquisitions, to retain key personnel and to successfully manage the challenges presented by the integration process may prevent us from achieving the anticipated potential benefits of any such acquisitions. If we fail to realize the anticipated benefits of any such acquisitions, our results of operations, financial condition and cash flows may be adversely affected.

Fluctuating gold and silver prices could negatively impact our business. The potential for profitability of our gold and silver mining operations and the value of our mining properties are directly related to the market price of gold and silver. The price of gold and silver may also have a significant influence on the market price of our common stock. The market price of gold and silver historically has fluctuated significantly and is affected by numerous factors beyond the control of any mining company. These factors include supply and demand fundamentals, expectations with respect to the rate of inflation, the relative strength of the U.S. dollar and other currencies, interest rates, gold and silver sales and loans by central banks, forward sales by metal producers, accumulation and divestiture by exchange traded Funds, global or regional political, economic or banking crises, and a number of other factors. The market price of silver is also affected by industrial demand. The selection of a property for exploration or development, the determination to construct a mine and place it into production, and the dedication of funds necessary to achieve such purposes are decisions that must be made long before the first revenues, if any, from production will be received. Price fluctuations between the time that such decisions are made and the commencement of production can have a material adverse effect on the economics of a mine.

The volatility in gold and silver prices is illustrated by the following table, which sets forth, for the periods indicated (calendar year), the average annual market prices in U.S. dollars per ounce of gold and silver, based on the daily London P.M. fix.

Average Annual Market Price of Gold and Silver (per oz.)

Mineral

|

2005 | 2006 | 2007 | 2008 | 2009 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Gold |

$ | 445 | $ | 604 | $ | 696 | $ | 872 | $ | 972 | ||||||

Silver |

$ | 7.32 | $ | 11.54 | $ | 13.38 | $ | 14.99 | $ | 14.67 | ||||||

The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. In the event gold and silver prices decline and remain low for prolonged periods of time, we might be unable to develop our properties, which may adversely affect our results of operations, financial performance and cash flows.

Our continuing reclamation obligations at the Tonkin property and other properties could require significant additional expenditures. We are responsible for the reclamation obligations related to disturbances located on all of our properties, including the Tonkin property. We have posted a bond in the amount of the estimated reclamation obligation at the Tonkin project. We are required to submit a mine closure plan to the BLM for the Tonkin property during the fourth quarter of 2010. There is a significant risk that our bonding requirements will increase subsequent to the submission of the closure

8

plan. We have not posted a bond in Mexico, as none is required. There is a risk that any cash bond, even if increased based on the analysis and work performed to update the reclamation obligations, could be inadequate to cover the actual costs of reclamation when carried out. The satisfaction of bonding requirements and continuing reclamation obligations will require a significant amount of capital. There is a risk that we will be unable to fund these additional bonding requirements, and further, that the regulatory authorities may increase reclamation and bonding requirements to such a degree that it would not be commercially reasonable to continue exploration activities, which may adversely affect our results of operations, financial performance and cash flows.

Our ongoing operations and past mining activities are subject to environmental risks, which could expose us to significant liability and delay, suspension or termination of our operations. All phases of our operations are subject to federal, state and local environmental regulation. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for us and our officers, directors and employees. Future changes in environmental regulation, if any, may adversely affect our operations, make our operations prohibitively expensive, or prohibit them altogether. Environmental hazards may exist on our properties that are unknown to us at the present and that have been caused by us, one of the Acquired Companies, or previous owners or operators, or that may have occurred naturally. Mining properties that the Acquired Companies may have transferred may cause us to be liable for remediating any damage that those companies may have caused. The liability could include response costs for removing or remediating the release and damage to natural resources, including ground water, as well as the payment of fines and penalties.

We have transferred our interest in several mining properties over past years, some of which are now being operated by third parties. Under applicable U.S. federal and state environmental laws, as prior owner of these properties, we may be liable for remediating any damage that we may have caused. The liability could include response costs for removing or remediating the release and damage to natural resources, including ground water, as well as the payment of fines and penalties.

Failure to comply with applicable environmental laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities, causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions.

Production, if any, at our property will involve the use of hazardous materials. Should these materials leak or otherwise be discharged from their containment systems, we may become subject to liability. We have not purchased insurance for environmental risks including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production, as it is not generally available at a reasonable price.

Our operations are subject to permitting requirements which could require us to delay, suspend or terminate our operations on our mining property. Our operations, including ongoing exploration drilling programs, require permits from the state and federal governments. We may be unable to obtain these permits in a timely manner, on reasonable terms, or at all. Even if we are able to obtain such permits, the time required by the permitting process can be significant. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving these permits, our timetable and business plan for exploration of our properties will be adversely affected, which may in turn adversely affect our results of operations, financial condition and cash flows.

9

Our operations in Mexico are subject to potential changes in political conditions and regulations and crime in that country. Our Magistral Mine and certain other concessions are located in Mexico, and are subject to Mexican federal and state laws and regulations. As a result, our mining investments are subject to the risks normally associated with the conduct of business in foreign countries. In the past, Mexico has been subject to political instability, changes and uncertainties which may cause changes to existing government regulations affecting mineral exploration and mining activities. Civil or political unrest could disrupt our operations at any time. Our Magistral Mine is in a region that is subject to violence in connection with the illegal drug trade. An increase in criminal activity and violent crime, especially in connection with such drug trade, could impact our ability to operate safely in the region or to bring in needed consultants and contractors. Our exploration and mining activities may be adversely affected in varying degrees by changing government regulations relating to the mining industry or shifts in political conditions that could increase the costs related to our activities or maintaining our properties.

Title to mineral properties can be uncertain, and we are at risk of loss of ownership of one or more of our properties. Our ability to explore and operate our properties depends on the validity of title to that property. Our U.S. mineral properties consist of leases of unpatented mining claims, and unpatented mining and millsite claims. Unpatented mining claims provide only possessory title and their validity is often subject to contest by third parties or the federal government, which makes the validity of unpatented mining claims uncertain and generally more risky. These uncertainties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work and possible conflicts with other claims not determinable from public record. Since a substantial portion of all mineral exploration, development and mining in the U.S. now occurs on unpatented mining claims, this uncertainty is inherent in the mining industry. We have not obtained a title opinion on our entire property, with the attendant risk that title to some claims, particularly title to undeveloped property, may be defective. There may be valid challenges to the title to our property which, if successful, could impair development and/or operations.

We remain at risk that the mining claims may be forfeited either to the U.S., or to rival private claimants due to failure to comply with statutory requirements as to location and maintenance of the claims or challenges to whether a discovery of a valuable mineral exists on every claim.

Legislation has been proposed that would significantly affect the mining industry. Periodically, members of the U.S. Congress have introduced bills which would supplant or alter the provisions of the General Mining Law of 1872, which governs the unpatented claims that we control with respect to our U.S. properties. One such amendment has become law and has imposed a moratorium on patenting of mining claims, which reduced the security of title provided by unpatented claims such as those on our U.S. properties. If additional legislation is enacted, it could substantially increase the cost of holding unpatented mining claims by requiring payment of royalties, and could significantly impair our ability to develop mineral estimates on unpatented mining claims. Such bills have proposed, among other things, to make permanent the patent moratorium, to impose a federal royalty on production from unpatented mining claims and to declare certain lands as unsuitable for mining. Although it is impossible to predict at this time what royalties may be imposed in the future, the imposition of such royalties could adversely affect the potential for development of such mining claims, and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our business.

On March 1, 2010, Nevada's State Assembly and Senate passed Assembly Bill No. 6 ("AB6") which sought to balance the state budget by reducing expenditures and increasing certain fees. Among those fee increases was a one-time fee payable in conjunction with the annual filing of an affidavit of the work performed on or improvements made to a mining claim, or an affidavit of the intent to hold a mining claim with a tiered fee structure applied for holders of 11 or more claims. The fee ranges from $70 per claim for holders of 11 to 199 claims up to $195 per mining claim for holders of 1,300 or more

10

claims as of the date of filing. The Company is still reviewing the potential impact of this bill, however, as one of the state's largest claim holders, US Gold and its subsidiaries in the state would have to pay approximately $1.6 million due to this fee on or before June 1, 2011, based on the number of claims held at December 31, 2009. As of March 10, 2010, AB6 has not been signed by the Governor.

In Mexico, the PRI, which is the main opposition political party, with the support of other opposition parties, has introduced in the Chamber of Deputies a 4% mining royalty on production. The opposition parties collectively have a majority in both the Chamber of Deputies and the Senate, with the governing PAN party a minority. The opposition numbers are sufficient (over 2/3) to override a Presidential veto in the Chamber but not in the Senate. To date, the Government has been silent on the royalty proposal.

A significant portion of the lode claims comprising our Tonkin property are subject to a lease in favor of a third party which may expire in 2011 and which provides for a 5% royalty on production. A total of 372 of our mining and millsite claims at the Tonkin property are subject to this lease. The lease requires annual payments of $187,500 or 568.75 ounces of gold, whichever is greater, and payment of a royalty of 5% of the gross sales price of gold or silver from the property before deduction of any expenses from the gross sales price. The term of this lease expires January 1, 2011 and can be extended from year to year, up to a maximum of 99 years, by production from or other activities on the leased claims. This lease covers a portion of the claims in the mine corridor where most of our mineralized material relating to the Tonkin project has been identified. In the event the lease is not extended and/or we are unable to purchase the claims from the owner, we may be forced to forfeit the underlying claims, which in turn may adversely affect our ability to explore and develop the property. If we are successful in identifying sufficient mineralization to warrant placing the property into production, we will be obligated to pay the leaseholder a royalty of 5% of the production. The payment of this royalty, together with other royalties payable to third parties in respect of certain claims, will reduce our potential revenue.

Gain recognized by non-U.S. holders and non-U.S. persons holding any interest in the Company other than solely as a creditor (including, for example, convertible debt) on the sale or other disposition of our securities may be subject to U.S. federal income tax. We believe that we currently are a "United States real property holding corporation" under section 897(c) of the Internal Revenue Code, or USRPHC, and that there is a substantial likelihood that we will continue to be a USRPHC. Generally, securities (other than securities that provide no interest in a corporation other than solely as a creditor) issued by a corporation that has been a USRPHC at any time during the preceding five years (or the non-U.S. holder's holding period for such securities, if shorter) are treated as United States real property interests, or USRPIs, and gain recognized by a non-U.S. holder on the sale or other disposition of securities is subject to regular U.S. federal income tax, as if such gain were effectively connected with the conduct by such holder of a U.S. trade or business. There are, however, certain exceptions pursuant to which our securities may not be treated as USRPIs provided that our common stock is "regularly traded" on an "established securities market." Under one such exception, shares of our common stock will not be treated as USRPIs in the hands of a non-U.S. holder provided that such non-U.S. holder has not owned or been deemed to own (directly or under certain constructive ownership rules) more than 5% of the common stock at any time during the 5-year period ending on the date of the sale or other taxable disposition. Under any exception, classes of our securities other than common stock will not generally be treated as USRPIs in the hands of a non-U.S. holder provided that, on the date such security was acquired by the non-U.S. holder, it had a fair market value not greater than the fair market value on that date of 5% of our common stock (or, under certain circumstances, the value, if lower, of 5% of any other regularly traded class of our stock, which may possibly include the exchangeable shares of our subsidiary, US Gold Canadian Acquisition Corporation ("Canadian Exchange Co.")). If gain recognized by a non-U.S. holder from the sale or other disposition of our common stock or other securities is subject to regular income tax under these rules, the transferee of

11

such common stock or other securities may be required to deduct and withhold a tax equal to 10 percent of the amount realized on the sale or other disposition, unless certain exceptions apply. Any tax withheld may be credited against the U.S. federal income tax owed by the non-U.S. holder for the year in which the sale or other disposition occurs.

We cannot assure you that we will have an adequate supply of water to complete desired exploration or development of our mining properties. In accordance with the laws of the State of Nevada, we have obtained permits to drill the water wells that we currently use to service the Tonkin property and we plan to obtain all required permits for drilling water wells to serve other properties we may develop or acquire in the future. However, the amount of water that we are entitled to use from those wells must be determined by the appropriate regulatory authorities. A final determination of these rights is dependent in part on our ability to demonstrate a beneficial use for the amount of water that we intend to use. Unless we are successful in developing the property to a point where we can commence commercial production of gold or other precious metals, we may not be able to demonstrate such beneficial use. Accordingly, there is no assurance that we will have access to the amount of water needed to operate a mine at the property, which may prevent us from generating revenue, and which would adversely affect our financial condition and cash flows.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses that could materially and adversely affect our operations. Exploration for minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Few properties that are explored are ultimately advanced to production. Our current exploration efforts are, and any future development or mining operations we may elect to conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as, but not limited to:

- •

- economically insufficient mineralized material;

- •

- fluctuations in production costs that may make mining uneconomical;

- •

- labor disputes;

- •

- unanticipated variations in grade and other geologic problems;

- •

- environmental hazards;

- •

- water conditions;

- •

- difficult surface or underground conditions;

- •

- industrial accidents;

- •

- metallurgical and other processing problems;

- •

- mechanical and equipment performance problems;

- •

- failure of pit walls or dams;

- •

- unusual or unexpected rock formations;

- •

- personal injury, fire, flooding, cave-ins and landslides; and

- •

- decrease in reserves due to a lower gold price.

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, potential revenues and production dates. We currently have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would

12

incur a writedown of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable.

We do not insure against all risks to which we may be subject in our planned operations. While we currently maintain insurance to insure against general commercial liability claims, we do not maintain insurance to cover all of the potential risks associated with our operations. Certain of our exploration properties such as Gold Bar and Limo have no existing infrastructure for which we insure, and we do not insure our limited physical assets at the Magistral Mine or Tonkin property. For example, we do not have insurance on the mill at our Tonkin property nor the mine assets associated with the Magistral property and we do not have business interruption insurance. We may also be unable to obtain insurance to cover other risks at economically feasible premiums or at all. Insurance coverage may not continue to be available, or may not be adequate to cover liabilities. We might also become subject to liability for environmental, pollution or other hazards associated with mineral exploration and production which may not be insured against, which may exceed the limits of our insurance coverage or which we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could materially adversely affect our financial condition and our ability to fund activities on our property. A significant loss could force us to reduce or terminate our operations.

We depend on a limited number of personnel and the loss of any of these individuals could adversely affect our business. Our company is primarily dependent on two persons, namely our Chairman and Chief Executive Officer, and our Vice President and Chief Financial Officer. Robert R. McEwen, our Chairman and Chief Executive Officer, is responsible for strategic direction and the oversight of our business. Perry Y. Ing, our Vice President and Chief Financial Officer, is responsible for our public reporting and administrative functions. We rely heavily on these individuals for the conduct of our business. The loss of either of these officers would significantly and adversely affect our business. In that event, we would be forced to identify and retain an individual to replace the departed officer. We may not be able to replace one or more of these individuals on terms acceptable to us. We have no life insurance on the life of any officer.

We are required to annually evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 and any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have a material adverse effect on the price of our common stock. Under Section 404 of the Sarbanes-Oxley Act of 2002, we are required to furnish a report by our management on internal control over financial reporting. Such a report must contain, among other matters, an assessment of the effectiveness of our internal control over financial reporting, including a statement as to whether or not our internal control over financial reporting is effective. This assessment must include disclosure of any material weaknesses in our internal control over financial reporting identified by our management. If we are unable to maintain and to assert that our internal control over financial reporting is effective, or if we disclose material weaknesses in our internal control over financial reporting, investors could lose confidence in the accuracy and completeness of our financial reports, which could have a material adverse effect on our stock price.

The acquisition of the Acquired Companies has and may further result in the issuance of a significant amount of additional US Gold common stock which may in turn depress the trading price of our stock or other securities. The acquisition of the Acquired Companies resulted in the issuance of approximately 42,968,830 exchangeable shares of Canadian Exchange Co., each of which is convertible into shares of our common stock on a one-for-one basis. As of December 31, 2009, 15,355,122 exchangeable shares remain outstanding. If all of those exchangeable shares were converted into common stock, it would represent an increase in the outstanding shares of US Gold common stock as of December 31, 2009 of approximately 14%. The conversion of the remaining outstanding exchangeable shares could depress the trading price of our common stock.

13

The exercise of outstanding options and warrants and the future issuances of our common stock will dilute current shareholders and may reduce the market price of our common stock. As of March 10, 2010, we had outstanding options and warrants to purchase a total of 12,203,500 shares of our common stock, which if completely exercised, would dilute existing shareholders' ownership by approximately 10%, assuming all exchangeable shares not held by US Gold or our subsidiaries are exchanged for an equivalent amount of our common stock. Under certain circumstances, our Board of Directors has the authority to authorize the offer and sale of additional securities without the vote of or notice to existing shareholders. Based on the need for additional capital to fund expected growth, it is likely that we will issue additional securities to provide such capital and that such additional issuances may involve a significant number of shares. Issuance of additional securities in the future will dilute the percentage interest of existing shareholders and may reduce the market price of our common stock.

Our stock price may be volatile and as a result you could lose all or part of your investment. In addition to volatility associated with publicly traded securities in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of our common stock:

- •

- changes in the worldwide price for gold and/or silver;

- •

- disappointing results from our exploration or development efforts;

- •

- failure to meet our operating budget;

- •

- decline in demand for our common stock;

- •

- downward revisions in securities analysts' estimates or changes in general market conditions;

- •

- technological innovations by competitors or in competing technologies;

- •

- investor perception of our industry or our prospects; and

- •

- general economic trends.

In addition, stock markets generally have experienced extreme price and volume fluctuations and the market prices of securities generally have been highly volatile. These fluctuations are often unrelated to operating performance of a company and may adversely affect the market price of our common stock. As a result, investors may be unable to resell their shares at a fair price.

A small number of existing shareholders own a significant portion of our common stock, which could limit your ability to influence the outcome of any shareholder vote. Our chairman and chief executive officer, Robert McEwen, beneficially owns approximately 21% of our common stock as of March 10, 2010 (assuming all exchangeable shares not held by US Gold or our subsidiaries are exchanged for an equivalent amount of our common stock). Under our Articles of Incorporation and the laws of the State of Colorado, the vote of a majority of the shares voting at a meeting at which a quorum is present is generally required to approve most shareholder action. As a result, this individual will be able to significantly influence the outcome of shareholder votes for the foreseeable future, including votes concerning the election of directors, amendments to our Articles of Incorporation or proposed mergers, acquisitions or other significant corporate transactions.

We have never paid a dividend on our common stock and we do not anticipate paying one in the foreseeable future. We have not paid a dividend on our common stock to date, and we may not be in a position to pay dividends in the foreseeable future. Our ability to pay dividends will depend on our ability to successfully develop one or more properties and generate revenue from operations. Further, our initial earnings, if any, will likely be retained to finance our growth. Any future dividends will depend upon our earnings, our then-existing financial requirements and other factors, and will be at the discretion of our Board of Directors.

14

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Introduction

Throughout 2009, we continued to hold a 100% interest in the historic Tonkin property and have begun the process of rationalizing the Nevada Pacific, White Knight and Tone properties acquired in 2007. Our total Nevada land position consists of approximately 260 square miles (673 sq. km), of which approximately 199 square miles (515 sq. km) are located on the Cortez Trend. We also continued to hold approximately 1,395 square miles (3,613 sq. km) of mineral rights in Mexico, including the Magistral Gold Mine located in the state of Sinaloa, Mexico.

The following table summarizes the U.S. land position of our company as of December 31, 2009:

Complex Summary

|

Claims | Approx Sq. Miles |

||||||

|---|---|---|---|---|---|---|---|---|

Tonkin Complex |

3,100 | 93.12 | ||||||

Gold Bar Complex |

2,310 | 72.36 | ||||||

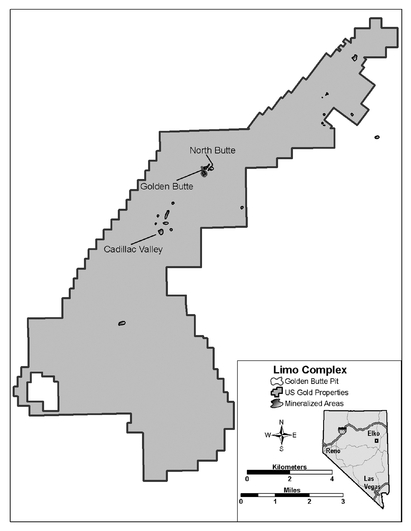

Limo Complex |

1,392 | 44.04 | ||||||

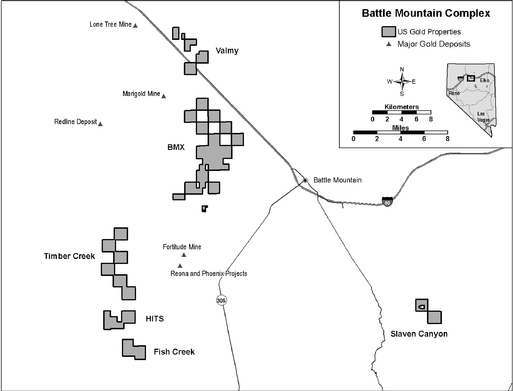

Battle Mountain Complex |

1,118 | 33.72 | ||||||

Other United States Properties |

464 | 16.35 | ||||||

Total |

8,384 | 259.59 | ||||||

The following Nevada trend map and property location map is presented to generally indicate the location of the trends and our properties:

15

For purposes of organizing and describing our exploration efforts in the United States, we have grouped our properties into four complexes, the Tonkin Complex, the Gold Bar Complex, the Limo Complex and the Battle Mountain Complex. Mineral properties outside these areas and where limited exploration work has been performed by us to date are grouped as "Other United States Properties". Certain properties are subject to certain royalty and earn-in rights. Please see the "Other United States Properties" section below for further information.

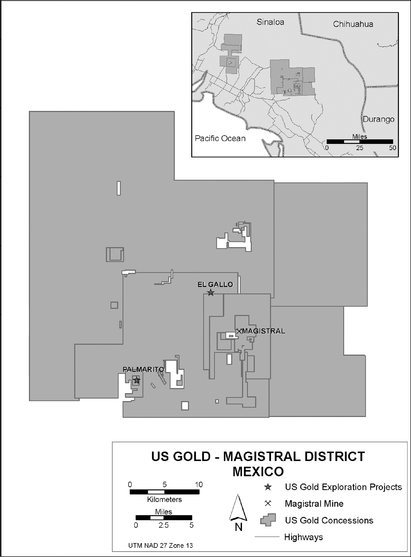

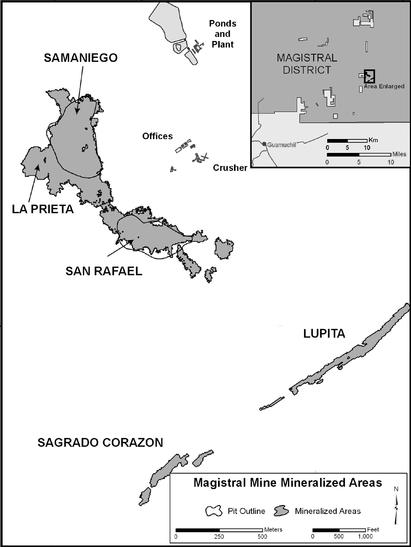

In addition to the above-mentioned U.S. properties, we acquired mineral concessions in Mexico from our acquisition of Nevada Pacific in 2007, including the Magistral Mine. The Magistral Mine is located in northwestern Mexico, within Sinaloa state, Mocorito Municipality, Mexico. In addition to the Magistral Mine complex of approximately 38 sq. miles (98 sq. km), we acquired exploration concessions consisting of approximately 1,513 sq. miles (3,919 sq. km) located in the Mexican states of Sinaloa, Nayarit and Durango. In 2009, we began a closer examination of our Mexico properties and as a result we released our concessions in the state of Durango. In aggregate, we currently own an interest in approximately 1,395 sq. miles (3,613 sq. km) of mineral concessions in Mexico.

16

The following map illustrates the general location of the Magistral Mine and our mineral concessions in Mexico:

17

Tonkin Complex

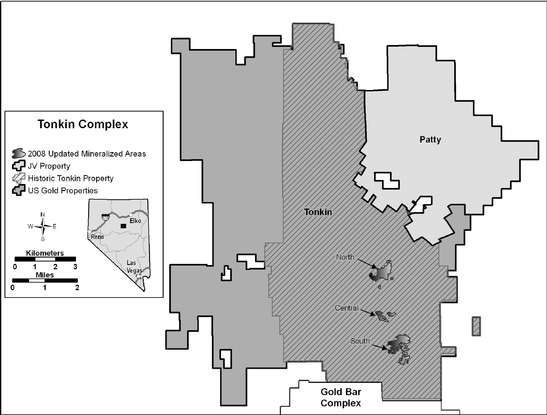

Overview. The Tonkin Complex includes our historic Tonkin property, together with additional properties and interests acquired in 2007. The Tonkin Complex is divided functionally into five areas: the Mine Corridor, Tonkin North, Patty, Keystone, and Tweed. The Tonkin Complex represents our largest holding in the State of Nevada at approximately 93 sq. miles (241 sq. km).

Location. The Tonkin Complex is located on the Cortez Trend, approximately 48 miles (77 km) by road northwest from Eureka, Nevada, 85 miles (137 km) by road southwest from Elko and 245 miles (394 km) by road east from Reno. The nearest commercial airport is located in Elko.

Infrastructure. The Tonkin Complex includes a mine site from operations in the 1980's with several small open pits, stockpile areas, plant and established infrastructure. In 1988 and 1989, an integrated carbon-in-leach bacterial oxidation plant was built. The plant and associated infrastructure was decommissioned and put on care and maintenance in June 1990, but apart from the SAG mill, which has been removed, it is complete and we believe it is in relatively good condition. The existing infrastructure also includes a water supply, water storage and distribution, sewage disposal, trailer park, fuel storage and distribution, grid and emergency power supply and distribution. Electrical power is supplied via existing 64kV power lines and a substation on the property. The power lines and substation are owned and maintained by Sierra Pacific Power Company. Existing facilities include an administration building, truck shop, assay laboratory, mill building, warehouse, and plant maintenance shop.

History. We obtained the first claims which now comprise the Tonkin Complex in 1985. Between 1985 and 1988, we produced approximately 26,000 ounces of gold from the heap leach operation from about 871,000 tons of ore.

In 1988 and 1989, we constructed a mill with the proceeds of a debt financing. In 1989, we processed ore from the "Rooster" deposit, producing 1,753 ounces of gold. In 1990, using bio-oxidation and the carbon-in-leach circuits of the mill, we produced 2,735 additional ounces of gold from approximately 70,000 tons of sulfide ore mined from the property. To date, a total of approximately 30,517 ounces of gold has been produced at the Tonkin property.

Since 1990, we have had a series of joint venture partners at the Tonkin property. These partners include Homestake Mining Company, Sudbury Contact Mines Limited, a subsidiary of Agnico-Eagle Mines Limited, and BacTech Mining Corporation. As a group, these companies conducted various types of exploration, including data compilation, geologic mapping, rock, soil and chemical sampling, and drilling, all focused primarily on the development of near-surface oxide and later, sulfide mineralization. For a variety of reasons, some of which are unknown to us, these relationships were terminated, returning 100% ownership of the property to us in 2005. We commenced a comprehensive drilling program in 2006, following an equity financing.

Recent Exploration. The following table summarizes drilling at our Tonkin Complex during 2008 and 2009:

| |

2008 | 2009 | |||||

|---|---|---|---|---|---|---|---|

Total Footage |

6,785 | 4,890 | |||||

Number of Holes |

14 | 3 | |||||

Reverse Circulation drilling (ft.) |

5,235 | 4,890 | |||||

Core drilling (ft.) |

1,550 | 0 | |||||

As noted in the previous table, drilling on the Tonkin Complex for 2009 totaled 4,890 ft. (1,490 m) in three reverse circulation drill holes. Additional exploration efforts at the Complex included geologic mapping and sampling. The objective of the 2009 program at the Tonkin Complex was to explore for feeders to the known mineralization in the North Mine Corridor area, testing new targets adjacent to the known mineralization identified through our three-dimensional modeling completed in 2008.

18

The following graphic depicts the Tonkin Complex:

During 2008, a technical report completed on the Tonkin property concluded that mineralized material totals 35.6 million tons with an average grade of 0.041 oz gold/ton. Mineralized material cutoff grades were 0.018 oz gold/ton for sulfide and 0.012 oz gold/ton for oxide. This report provides a technical summary of the existing exploration and development activities and results, and the mineral potential of the Tonkin property. It was prepared in accordance with the standards on mineral resources of the Canadian Institute of Mining, Metallurgy and Petroleum. As a company listed on the Toronto Stock Exchange, we are required to comply with NI 43-101, which requires the preparation of a technical report and includes estimates of potential mineral resources for further targeted exploration disclosed pursuant to the applicable provisions of NI 43-101. However, U.S. reporting requirements for disclosure of mineral properties are governed by the SEC and included in the SEC's Securities Act Industry Guide 7 entitled "Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations" ("Guide 7"). NI 43-101 and Guide 7 standards are substantially different. For example, the SEC only permits the disclosure of proven or probable reserves, which in turn, requires the preparation of a feasibility study demonstrating the economic and legal feasibility of mining and processing the mineralization. We have not received a feasibility study with regard to our Tonkin property and therefore the Tonkin property has no "reserves" as defined by Guide 7. We cannot be certain that any part of the mineralized material at the Tonkin property will ever be confirmed or converted into Guide 7 compliant "reserves". U.S. investors are cautioned not to assume that all or any part of the mineralized material will ever be confirmed or converted into reserves or that any of the mineralized material can be economically or legally extracted.

The 2009 exploration program at Tonkin was directed by in-house three-dimensional modeling that utilized surface geology, surface geochemistry, drill hole geochemistry, drill hole geology, drill hole and surface structure, and geophysical surveys. The program consisted of three reverse circulation drill holes totaling 4,890 feet (1,490 m) that tested three separate targets in the north area. Although none of these holes intersected ore grade mineralization, two contained weakly anomalous gold mineralization

19

(30-245 ppb) with anomalous pathfinder elements. The significance of this mineralization is currently being evaluated.

Geology. The geology of the Tonkin Complex area is complicated. The primary host for mineralization is the Cambro-Ordovician Hales Formation, which consists of sandy limestones, siltstones, shales, and greenstones in the Mine Corridor area. These rocks are in apparent structural contact with Ordovician rocks of the Vinini Formation, Devonian Slaven Chert, Devonian McColley Canyon Formation and the Devonian Devils Gate Limestone. This assemblage has been intruded locally by Tertiary porphyritic dacite and andesite dikes. All rocks east and west of the Mine Corridor are overlain by Tertiary volcanic rocks. Gold mineralization is found in all of the rock types of the Hales Formation, Slaven Chert, and McColley Canyon Formation, as well as at the contact between internal units. Spotty gold occurs in other units in the Mine Corridor, but it has not been recorded in economic amounts to date.

Patty Project. The Tonkin Complex also includes the Patty Project, in which the Company holds a non-operating minority interest (30%) and where Barrick Gold U.S. Inc. ("Barrick") is manager and holds a 60% interest and the remaining 10% is owned by Chapleau Resources Ltd. The Patty Project is a large property (approximately 18.1 sq. miles) located in the northeast portion of the Tonkin Complex and consists of 544 unpatented mining claims. The 2009 exploration program expenditures totaled approximately $225,777, of which our portion was $67,733. In November 2009, Barrick informed us that it intended to cease management of the exploration program. An amendment to the joint venture agreement would need to be executed should that occur.

In addition to exploration conducted during 2009, we completed the reclamation of certain access roads, and other existing disturbed areas at the Tonkin Complex.

The mineral interests included in the Tonkin Complex are set forth in the following table:

Tonkin Complex Properties

|

Trend/Location | Claims | Approx Sq. Miles |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

US Gold's Historic Tonkin Property |

Cortez | 1,478 | 43.06 | |||||||

Cornerstone |

Cortez | 156 | 4.61 | |||||||

Keystone |

Cortez | 371 | 9.91 | |||||||

Fye Canyon |

Cortez | 345 | 11.03 | |||||||

Pat Canyon |

Cortez | 178 | 5.49 | |||||||

Patty |

Cortez | 544 | 18.12 | |||||||

South Keystone |

Cortez | 28 | 0.90 | |||||||

Total |

3,100 | 93.12 | ||||||||

We generally hold mineral interests in the Tonkin Complex through unpatented mining and mill site claims, leases of unpatented mining claims, and joint venture and other agreements. Unpatented mining claims are held subject to paramount title in the United States. In order to retain these claims, we must pay annual maintenance fees to the BLM, and to the counties within which the claims are located. Rates for these jurisdictions vary and may change over time. Other obligations which must be met include obtaining and maintaining necessary regulatory permits, and lease and option payments to claim owners.

Tonkin North. The 372 claims covering the area of the property known as Tonkin North are owned by unaffiliated parties and held by us under a lease agreement. The term of this lease expires January 1, 2011 and may be extended from year to year, up to a maximum of 99 years, by production from or other activities on the leased claims. We believe that current and past exploration are sufficient to hold the lease and the Company has a significant carry-forward work commitment balance.

20

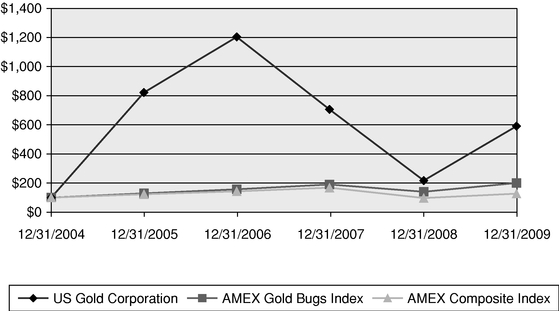

The lease requires payment of an annual advance royalty in the amount of $187,500 or the value of 568.75 ounces of gold, whichever is greater, due in January of each year. The lease also requires payment of production royalties of 5% of the gross sales price of gold or silver but provides for recapture of annual advance royalties previously paid. The existing balance of the advance royalties paid by us, after taking into account the January 2010 payment, is approximately $5.03 million, meaning that we would not be required to pay any production royalties until we produced approximately $101 million of gross revenue from the leased claims. Our interests in other claims included in the Tonkin Complex are subject to royalties ranging from 1% to 2% of any production from those claims.