Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

333-126751

(Commission File Number)

Lazard Group LLC

(Exact name of registrant as specified in its Charter)

| Delaware | 51-0278097 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 30 Rockefeller Plaza New York, NY | 10020 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (212) 632-6000

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2012, none of the Registrant’s common membership interests were held by non-affiliates. As of June 30, 2012, LAZ-MD Holdings LLC held 6,570,078 common memberships interests of the Registrant, representing approximately 5.1% of the Registrant’s then outstanding common membership interests. As of January 31, 2013, LAZ-MD Holdings LLC held 1,549,667 common membership interests, or 1.2% of the Registrant’s then outstanding common membership interests. If LAZ-MD Holdings LLC is not deemed an “affiliate” of the Registrant, then as of June 30, 2012 there would have been 6,570,078 outstanding common membership interests of the Registrant held by non-affiliates, with a market value of $170,756,327 (assuming each common membership interest has a value equivalent to one share of Lazard Ltd Class A common stock and based on a closing price per share of $25.99 of Lazard Ltd Class A common stock on June 29, 2012).

As of January 31, 2013, in addition to profit participation interests, there were 129,766,090 common membership interests and two managing member interests outstanding.

Table of Contents

EXPLANATORY NOTE

The registrant is filing this Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) to its Annual Report on Form 10-K for the year ended December 31, 2012, as filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2012 (the “Form 10-K”), for the sole purpose of adding certain information required by the item of Form 10-K referenced below. This Form 10-K/A does not modify or update the disclosures and information contained in the Form 10-K in any way other than as described in this Explanatory Note. Accordingly, this Form 10-K/A must be read in conjunction with the Form 10-K and the registrant’s other filings made with the SEC subsequent to the filing of the Form 10-K.

Item and Description:

| Item 11. | Executive Compensation |

The registrant is hereby amending and replacing in its entirety Item 11 in the Form 10-K to include such omitted information.

2

Table of Contents

| PART III |

||||||

| Item 11 |

Executive Compensation | 4 | ||||

| 42 | ||||||

3

Table of Contents

| Item 11. | Executive Compensation |

Compensation Discussion and Analysis

Executive Summary

The Compensation Committee of Lazard Ltd’s Board of Directors, or the Compensation Committee, which is comprised entirely of independent directors, determined the 2012 compensation of our named executive officers, or NEOs: Kenneth M. Jacobs, Chairman and Chief Executive Officer, or CEO; Ashish Bhutani, Chief Executive Officer of Lazard Asset Management; Matthieu Bucaille, Chief Financial Officer; Scott D. Hoffman, General Counsel; and Alexander F. Stern, Chief Operating Officer.

2012 Business Performance Highlights

As further discussed under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” above, our Company performed well in 2012 and delivered strong results compared to 2011, despite difficult financial markets. We made substantial progress toward a variety of the strategic goals that we announced in April 2012, some of which are reflected in the table below. We believe that our compensation philosophy and discipline contributed to our strong performance.

The Compensation Committee focused on the following selected financial information regarding Lazard Ltd in evaluating the performance of our NEOs and setting their incentive compensation—that is, all compensation beyond their base salary—for 2012.

Lazard Ltd

Selected Consolidated Financial Metrics

($ in millions)

| 2012 | 2011 | |||||||

| Operating Revenue (1) |

$ | 1,971 | $ | 1,884 | ||||

| % Growth |

5 | % | ||||||

| Awarded Compensation (1) |

1,171 | 1,169 | ||||||

| % of Operating Revenue |

59.4 | % | 62.0 | % | ||||

| % Growth |

0 | % | ||||||

| Adjusted Non-Compensation (1) |

421 | 400 | ||||||

| % of Operating Revenue |

21 | % | 21 | % | ||||

| Operating Margin (based on Awarded Compensation) (2) |

19 | % | 17 | % | ||||

| % Growth |

12 | % | ||||||

| Return of Capital (3) |

540 | 375 | ||||||

| Total Shareholder Return (1-Year) (4) |

19 | % | (32 | %) | ||||

Endnotes to this Compensation Discussion and Analysis are located on page 27.

4

Table of Contents

Selected 2012 Business Performance Highlights

| • | Lazard Ltd’s 2012 operating revenue of $1,971 million was near the record level set in 2007 (a strong year for the financial services industry generally) and up 5% from 2011. |

| • | Our Financial Advisory business’s operating revenue in 2012 was $1,049 million, up 6% from 2011. 2012 operating revenue for the M&A and Other Advisory divisions of our Financial Advisory business was $793 million, up 13% from 2011, notwithstanding a 14% decrease in global completed M&A transactions during the same period. We maintained our position as the leading global independent financial advisory firm, and we reinforced our position as a leader in providing cross-border M&A, restructuring, capital structure and sovereign advisory services to clients around the globe. |

| • | Our Asset Management business’s operating revenue in 2012 was $882 million, effectively matching the record set in 2011, and assets under management as of December 31, 2012 reached a record of $167 billion, up 18% from year-end 2011. We enhanced our reputation as a world-class asset manager, predominantly serving institutional clients around the globe through a diverse offering of investment platforms and myriad geographic locations. |

| • | Notwithstanding Lazard Ltd’s 5% increase in operating revenue during 2012, Lazard Ltd’s 2012 awarded compensation and benefits expense, or awarded compensation, remained essentially level with 2011. Lazard Ltd’s 2012 ratio of awarded compensation to operating revenue, or the awarded compensation ratio, was 59.4%, compared to 62.0% for 2011. |

| • | We advanced the cost saving initiatives that we announced in October 2012, which we expect to result in improved profitability with minimal impact on revenue growth through approximately $125 million in annual savings from our existing cost base. We expect to realize at least two-thirds of the expense savings in 2013, and we expect the full impact of the expense savings to be realized in 2014. We expect pre-tax implementation expenses to range between $110 million and $130 million, primarily relating to compensation expense. We incurred $103 million of these expenses in the fourth quarter of 2012. |

| • | In addition, Lazard Ltd paid $140 million in dividends on Lazard Ltd’s Class A common stock, or Class A common stock, and repurchased 12.8 million shares of Class A common stock for $355 million during 2012, at an average price of $27.66 per share. These share repurchases more than offset the dilutive effect of equity awards granted in February 2012. |

5

Table of Contents

2012 Compensation Highlights

| • | Notwithstanding Lazard Ltd’s 5% increase in operating revenue during 2012, 2012 awarded compensation remained essentially level with 2011, and total 2012 awarded compensation for our NEOs was 5% lower than 2011. |

| • | 77% to 92% of each NEO’s 2012 awarded compensation was paid in the form of performance-based compensation. As further discussed under “Compensation for Each of Our NEOs in 2012” below, the Compensation Committee granted this compensation after evaluating each NEO’s performance in light of Lazard Ltd’s financial results, including progress toward key strategic objectives set in early 2012 involving operating revenue, awarded compensation, operating margin, cost savings and return of capital. |

| • | At least 50% of each NEO’s 2012 awarded compensation was paid in the form of long-term incentive compensation. |

| • | Approximately 60% of 2012 awarded compensation for Mr. Jacobs was paid in the form of performance-based restricted stock units, or PRSUs, which vest 33% two years, and 67% three years, after the grant date based on both the achievement of long-term performance goals and satisfaction of service conditions. PRSUs replaced restricted stock units, or RSUs, which are similar to PRSUs but are only subject to service conditions, as the vehicle for providing Mr. Jacobs with long-term incentive compensation for 2012. |

| • | Approximately 45% of 2012 awarded compensation for each of Messrs. Bucaille, Hoffman and Stern was paid in the form of PRSUs. An additional 9%, 9% and 14% of 2012 awarded compensation for Messrs. Bucaille, Hoffman and Stern, respectively, was paid in the form of restricted stock units, or RSUs, which share the same vesting schedule as PRSUs and are subject to forfeiture through the applicable vesting date. The ultimate value of the RSUs will directly depend upon the long-term performance of our Class A common stock. |

| • | Approximately 33% of 2012 awarded compensation for Mr. Bhutani was paid in the form of PRSUs. An additional 17% of 2012 awarded compensation for Mr. Bhutani was paid in the form of Lazard Fund Interests, or LFIs, which share the same vesting schedule as PRSUs and are subject to forfeiture through the applicable vesting date. The ultimate value of the LFIs will directly depend upon the long-term performance of the underlying investment funds managed by our Asset Management business. |

| • | We entered into an amended retention agreement with our CEO in October 2012 that eliminated the excise tax gross-up provision and reduced the change in control severance to which he was previously entitled. |

| • | We also entered into amended retention agreements with our other NEOs in March 2013 that eliminated their excise tax gross-up provisions (except for Mr. Bhutani, who entered into his retention agreement in August 2011, after we committed not to enter into any new retention agreements that provide for excise tax gross-ups, and accordingly, did not have such a provision) and reduced the change in control severance to which they were previously entitled. |

6

Table of Contents

As exemplified by our compensation practices in 2012, we remain committed to our long-term goal of limiting increases in our compensation expense, so that our compensation expense grows at a rate that is less than the rate of our revenue growth. We have maintained control on compensation costs and applied a consistent compensation deferral policy for our NEOs and employees, which advances our goals of retaining and attracting talented individuals, paying for performance and managing our compensation costs over time. Lazard Ltd achieved an awarded compensation ratio of 59.4% for 2012, down from 62.0% in 2011. Lazard Ltd’s ratio of adjusted compensation and benefits expense, or adjusted compensation, to operating revenue was 61.8% for 2012, compared to 62.0% for 2011. For a description of how we calculate the awarded compensation ratio and the adjusted compensation ratio, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Consolidated Results of Operations”.

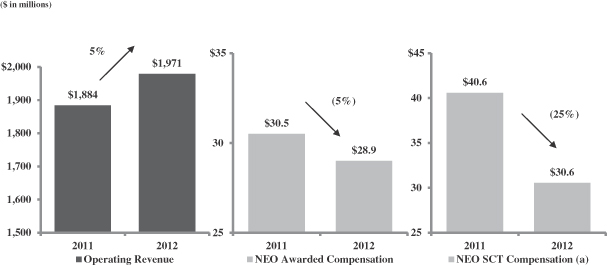

We also applied our firm-wide discipline on compensation expense to our NEOs. As illustrated in the chart below, the total 2012 awarded compensation for our NEOs was 5% lower than 2011, notwithstanding our financial and other achievements described above.

2012 Lazard Ltd Operating Revenue vs. NEO Compensation

| (a) | NEO SCT Compensation refers to total compensation as reported in the table under “Summary Compensation Table” below. |

7

Table of Contents

2012 Shareholder Advisory Vote Regarding Executive Compensation

Improving our Compensation Programs

| • | In April 2012, Lazard Ltd’s shareholders provided an advisory vote in favor of NEO compensation for 2011, but only by a slim majority. |

| • | Lazard Ltd discussed our compensation programs with many of Lazard Ltd’s shareholders since the distribution of Lazard Ltd’s March 2012 proxy statement in order to better understand their views regarding our compensation programs. |

| • | Lazard Ltd’s shareholders spoke in April 2012, and the Compensation Committee and NEOs listened. The Compensation Committee has reassessed and tailored our compensation programs accordingly. |

| • | Notwithstanding our financial and other achievements in 2012, including Lazard Ltd’s 5% increase in our operating revenue during 2012, the Compensation Committee approved a 2012 awarded compensation ratio for Lazard Ltd of 59.4%, a 2.6 percentage point decrease from the 2011 awarded compensation ratio. Awarded compensation for our NEOs in 2012 fell by 5%, in spite of our financial and other achievements. |

| • | We simplified our long-term incentive plan by streamlining payout metrics for performance-based awards, updating the scoring ranges and reference points and increasing the portion of pay tied directly to the achievement of long-term performance goals. |

| • | The Compensation Committee, in consultation with its independent compensation consultant, updated the primary peer group used for compensation comparison purposes and excluded certain companies with which we compete for financial service professionals, but that substantially exceed our revenues and market capitalization. The Compensation Committee considered these excluded companies, but as a reference group to provide a broader perspective on competitive pay levels and practices. |

| • | Lazard Ltd adopted stock ownership guidelines for our NEOs, which require our CEO and the other NEOs to own shares (including restricted Class A common stock and RSUs) equal to, in the case of our CEO, six times his base salary, and in the case of each other NEO, three times his base salary. Each NEO has five years to attain the required ownership levels. All of our NEOs currently exceed the required ownership levels. In addition, our directors receive a majority of their compensation in the form of DSUs that remain invested in Lazard Ltd until they leave the Board. |

| • | Lazard Ltd adopted a compensation clawback policy for our NEOs. Pursuant to the clawback policy, if Lazard Ltd’s Board of Directors determines that any bonus, incentive payment, equity award or other compensation awarded to or received by an NEO was based on any financial results or operating metrics that were achieved as a result of that NEO’s intentional fraudulent or illegal conduct, we will seek to recover from the officer such compensation (in whole or in part) as Lazard Ltd’s Board of Directors deems appropriate under the circumstances and as permitted by law. |

| • | Lazard Ltd adopted “double-trigger” vesting for NEO long-term incentive awards. Any such awards granted in 2013 (which relate to 2012 performance) and later will not immediately accelerate upon a change in control, but instead will require both a change in control and another customary event to vest. |

| • | We put in place new retention agreements for each of our NEOs, which eliminated excise tax gross-up provisions, decreased the change in control severance for our NEOs, and made a variety of other adjustments based on feedback from Lazard Ltd’s shareholders, evolving best practices and our commitment to excellence in compensation governance. |

| • | The Compensation Committee enhanced the structure of its NEO evaluation and compensation decision-making process, increasing its focus on Lazard Ltd’s financial results and progress regarding key strategic metrics in determining the amount of incentive compensation awarded to our NEOs. |

| • | We also implemented a variety of corporate governance improvements. Among other matters, we increased the proportion of independent members of our Board of Directors (one of whom is our Lead Director) to 80%. |

8

Table of Contents

Our Compensation Philosophy and Objectives

We Strive to Retain and Attract Talented Individuals. Our people are our most important asset. It is imperative to continue to retain, attract and motivate executives and professionals of the highest quality and effectiveness, especially given the uneven economic recovery worldwide and the current regulatory environment.

| • | We prudently invest in human capital. Our compensation programs focus on retaining and attracting proven senior professionals who have strong client relationships, valuable industry expertise and demonstrated money management skills, and who understand the needs of our business and culture. The Compensation Committee is committed to awarding these individuals levels of compensation that are commensurate with the value that they bring to the Company. |

| • | Our compensation programs help to effectively retain our human capital. We believe our overall levels of compensation, as well as the structure of our long-term incentive awards, have helped us successfully retain and motivate our NEOs and other key personnel. We believe our compensation policy has been effective in recent years, enabling us to retain and attract key personnel and resulting in low voluntary attrition. |

We Pay for Performance. We firmly believe that pay should be tied to performance. Superior performance enhances shareholder value and is a fundamental objective of our compensation programs.

| • | Most of the compensation we pay is based on performance. Compensation for each of our NEOs, managing directors and other senior professionals is viewed on a total compensation basis and then subdivided into two primary categories: base salary and incentive compensation. Our annual performance-based incentive compensation awards generally include cash bonuses, deferred cash awards, PRSUs, RSUs and LFIs. |

| • | Performance-based incentive compensation is the principal component of our compensation strategy. We have tailored our compensation programs so that incentive compensation can be highly variable from year to year. Incentive compensation is awarded based on Lazard Ltd’s financial results in the immediately preceding fiscal year, as well as each individual’s contribution to those results and to the Company’s development, including business unit performance. We also consider competitive compensation practices in the financial services industry. |

| • | We grant long-term awards with multi-year vesting horizons and value that fluctuates with performance. The RSUs, PRSUs, restricted shares of Class A common stock, or restricted stock, and LFIs awarded to our NEOs and employees align the interests of our NEOs and employees with the interests of our equityholders—and link the value of these awards to performance—as the value that each individual realizes upon vesting depends, for restricted stock, RSUs and PRSUs, on the long-term performance of Class A common stock and our business, respectively, and, for LFIs, on the performance of investment funds managed by our Asset Management business. It also helps to retain our NEOs and employees, giving shareholders the stability of highly productive, experienced management and employees who help to perpetuate our strong firm culture. |

| • | We grant at-risk, performance-based long-term incentive awards. As disclosed in Lazard Ltd’s 2012 proxy statement, in 2012, the Compensation Committee instituted a new long-term incentive program, the LTIP program, under which it planned to grant at-risk performance-based awards based on three-year forward-looking performance metrics to establish another link between the payout of long-term incentive awards and the performance of our business. In March 2013, in consultation with the Compensation Committee’s independent compensation consultant, the Compensation Committee improved the LTIP program to, among other things, simplify the previously announced performance metrics applicable to awards and update the scoring ranges and references by which these metrics are evaluated. At that time, the Compensation Committee determined to utilize PRSUs for purposes of award grants. The PRSUs subject 60% of the total compensation awarded to Mr. Jacobs for 2012, 45% of the total compensation awarded to each of Messrs. Bucaille, Hoffman and Stern for 2012, and |

9

Table of Contents

| 33% of the total compensation awarded to Mr. Bhutani for 2012 (in each case based on the PRSUs vesting at the target level), to full risk of loss in the event of failure to achieve applicable performance goals. The PRSUs vest 33% two years, and 67% three years, after the date of grant and pay out based on the achievement of three-year forward-looking performance criteria relating to Lazard Ltd’s Volatility Adjusted Revenue Growth Ratio, Capital Return Ratio and Operational Leverage Ratio—which align directly with Lazard Ltd’s long-term strategy of driving shareholder returns—in addition to satisfaction of the applicable service conditions. |

We are Committed to Compensation Governance and Independence. The Compensation Committee, which determines and implements our compensation philosophy, is committed to ensuring that our compensation programs conform to our pay-for-performance paradigm.

| • | Lazard Ltd maintains an independent Compensation Committee. The Compensation Committee is comprised solely of independent directors. In October 2012, Lazard Ltd’s Board of Directors appointed a new independent chairman of the Compensation Committee. |

| • | The Compensation Committee continually reassesses our compensation programs. The Compensation Committee monitors the effectiveness of our compensation programs throughout the year and performs an annual reassessment of the programs in the first quarter of each year in connection with year-end compensation decisions. |

| • | The Compensation Committee engages an independent compensation consultant. In October 2012, the Compensation Committee directly and independently engaged Compensation Advisory Partners, or CAP, an independent compensation consulting firm, to assist it with compensation analyses, including through the use of compensation data of certain of our competitors. CAP performs no work for the Company other than advising the Compensation Committee with respect to compensation matters. The Compensation Committee has concluded that none of CAP’s work to date has raised any conflicts of interest. Before the Compensation Committee engaged CAP, Hay Group, Inc., or Hay Group, served as the Compensation Committee’s independent compensation consultant. During 2012, Hay Group performed no work for the Company other than advising the Compensation Committee with respect to compensation matters. Hay Group’s services to the Compensation Committee ended in October 2012 prior to most of the material compensation decisions for 2012. We believe Hay Group’s work did not raise any conflicts of interest. |

| • | Lazard Ltd conducts an annual shareholder advisory vote regarding executive compensation. We value the views of Lazard Ltd’s shareholders regarding many topics, including compensation for our NEOs. The shareholders asked Lazard Ltd to annually solicit their feedback on our compensation programs, and Lazard Ltd now holds an annual advisory vote regarding executive compensation. As demonstrated by our actions, the Compensation Committee strongly considers the results of the vote, as well as related feedback provided by shareholders, as part of its annual assessment of our compensation programs. Lazard Ltd encourages its shareholders to engage with us in constructive dialogue regarding our compensation programs. |

| • | Lazard Ltd has an anti-hedging policy, and has adopted stock ownership guidelines and a clawback policy. Lazard Ltd has an anti-hedging policy applicable to our NEOs and, as described above under “2012 Shareholder Advisory Vote Regarding Executive Compensation”, recently adopted stock ownership guidelines and a clawback policy, both of which are applicable to our NEOs. |

10

Table of Contents

Executive Compensation Practices

What We Do

| ü | Pay for Performance. We tie pay to performance. Almost all of the compensation we pay to our NEOs is not guaranteed. We review financial results and goals for the Company, as well as individual achievement, in determining NEO compensation. We grant performance-based equity awards, including awards based on transparent, objective, three-year forward-looking payout metrics. |

| ü | Apply Multi-Year Vesting to Equity Awards. The PRSUs, RSUs and LFIs granted to our NEOs for 2012 vest 33% two years, and 67% three years, after the grant date. |

| ü | Utilize Stock Ownership Guidelines. Lazard Ltd has adopted clear stock ownership guidelines, which all of our NEOs exceed. In addition, our directors receive a majority of their annual compensation in the form of deferred stock units, or DSUs, which are not settled, and therefore remain invested in the Company, until the director leaves our Board of Directors. |

| ü | Employ Clawback and Anti-Hedging Policies. Lazard Ltd has compensation clawback and anti-hedging policies applicable to our NEOs. |

| ü | Apply Reasonable Post-Employment / Change in Control Provisions. We have reduced the severance payable following a change in control under all NEO retention agreements. |

| ü | Apply Double-Trigger Vesting. RSUs, PRSUs and LFIs granted to our NEOs for 2012 compensation and thereafter will not automatically vest upon a change in control. |

| ü | Have a Lead Director and a High Number of Independent Directors. 80% of the members of our Board of Directors are independent. In addition, our Board of Directors has a Lead Director position that balances the combined Chairman and CEO position. Our current Lead Director is an independent member of the Board of Directors. |

| ü | Retain an Independent Compensation Consultant. The Compensation Committee consults with CAP, its independent compensation consultant, in connection with our compensation programs generally and NEO compensation specifically. |

| ü | Mitigate Undue Risk. We do not believe that our compensation programs create risks that are reasonably likely to have a material adverse effect on the Company. |

| ü | Offset Equity Award Dilution. We monitor the potentially dilutive impact of the equity component of our compensation programs and seek to offset that impact by repurchasing shares of Class A common stock. |

What We Don’t Do

| X | No Excise Tax Gross-Ups Upon Change in Control. We have eliminated excise tax gross-ups in connection with change in control payments from all NEO retention agreements. |

| X | No Guaranteed Bonuses. We do not provide guaranteed bonuses to any of our NEOs. Other than base salaries, none of our NEOs’ compensation for 2012 was guaranteed. Instead, all of their compensation was at risk based on performance. |

| X | No Hedging Transactions or Short Sales. We do not permit our NEOs to enter into hedging transactions or short sales in respect of Class A common stock. |

11

Table of Contents

Design of Our Compensation Programs—Base Salary

Base Salary. Base salaries are intended to reflect the experience, skill and knowledge of our NEOs, managing directors and other senior professionals in their particular roles and responsibilities, while retaining the flexibility to appropriately compensate for fluctuations in performance, both of the Company and the individual.

| • | Base salaries are approved by the Compensation Committee. Base salaries for our NEOs and any subsequent adjustments thereto are reviewed and approved by the Compensation Committee annually, after consultation with the independent compensation consultant. During 2012, each of our NEOs was a party to a retention agreement with the Company that provided for a minimum annual base salary during the term of those agreements. Each of the amended retention agreements we entered into in 2012 and 2013 retained the salary levels paid to each NEO during 2012. See “Amended NEO Retention Agreements” and “Retention Agreements with our NEOs” below. |

| • | Base salaries are the only component of NEO compensation that is not tied to performance. As further described below under “Design of our Compensation Programs—Performance-Based Incentive Compensation”, all other forms of compensation that we pay to our NEOs are linked to performance. |

| • | Base salaries represent a small proportion of total NEO compensation. As described below under “Compensation for Each of Our NEOs in 2012”, most of the compensation that we pay to our NEOs is performance-based compensation. |

Design of Our Compensation Programs—Performance-Based Incentive Compensation

Cash Bonuses. Except for base salaries, all cash compensation opportunity is based on a combination of Company and individual performance. Accordingly, the cash compensation paid to our NEOs and employees as a group has fluctuated from year to year, reflecting changes in the Company’s performance and financial results, as well as individual performance.

Restricted Stock Unit Awards. RSUs are contractual rights to receive shares of Class A common stock upon vesting. The RSUs granted to our NEOs in 2013 (which relate to 2012 performance) vest 33% two years, and 67% three years, after the date of grant, subject to the executive’s continued service with the Company. With respect to 2012, neither Mr. Jacobs nor Mr. Bhutani received any RSUs, and 9%, 9% and 14% of the awarded compensation for Messrs. Bucaille, Hoffman and Stern, respectively, was comprised of RSUs.

| • | RSUs are performance-based awards that enhance shareholder value. We believe RSU awards enhance shareholder value by aligning the long-term interests of our NEOs, managing directors and senior professionals with those of Lazard Ltd’s shareholders. Because the amount an individual realizes upon the vesting of RSUs directly depends on the value of Class A common stock at that time, each individual who receives an RSU becomes, economically, a long-term shareholder of Lazard Ltd, with interests aligned with the interests of other shareholders. In this way, the performance of our Company over time directly affects the value of our RSU awards—which can fluctuate in value over time and could have very low value upon vesting in the event of poor Company performance. |

| • | RSUs help retain key employees. RSUs also serve as an important retention mechanism by subjecting a significant portion of each recipient’s compensation to forfeiture if he or she leaves the firm prior to the vesting date. Our NEOs each own considerable interests in Lazard Ltd through previous grants of RSUs and restricted stock. As a result, we believe our NEOs have a demonstrable and significant interest in remaining with the Company and increasing shareholder value over the long term. For additional information about the RSUs and shares of Class A common stock held by each of our NEOs, see “Outstanding Equity Awards at 2012 Fiscal Year-End” below. |

| • | Vesting requirements and other restrictions regarding RSU awards. RSU awards are typically made in early February following Lazard Ltd’s year-end earnings release. This year, RSUs were granted to each of our NEOs (other than Messrs. Jacobs and Bhutani) on March 12, 2013. The number of RSUs actually granted to an NEO was determined in the same way that the number was derived for all of our |

12

Table of Contents

| employees, by dividing the dollar amount allocated to be granted to the NEO as an RSU award by the average closing price of Class A common stock on the NYSE on the five trading days ending on February 13, 2013 (i.e., $36.95). The RSUs granted on March 12, 2013 will vest 33% on March 2, 2015 and 67% on March 1, 2016. Unlike awards granted in 2012 and earlier, the RSUs granted to our NEOs will not automatically vest in the event of a change in control, but rather will require a subsequent qualifying termination in order to be eligible for accelerated vesting. In exchange for their RSU awards, all recipients, including our NEOs, agreed to restrictions on their ability to compete with the Company or to solicit our clients and employees, which protect the Company’s intellectual and human capital. |

Lazard Fund Interest Awards. In February 2011, in order to more closely align the compensation and performance of our employees in the Asset Management business with the interests of our equityholders, the Company adopted LFIs as a new form of long-term incentive compensation. In February 2012, the Company gave all of our managing directors and other senior professionals (with the exception of our NEOs) the option to participate in the LFI program as part of their incentive compensation for 2012. As the CEO of Lazard Asset Management, the Compensation Committee determined that Mr. Bhutani’s participation in the LFI program for 2012 would be mandatory (with respect to 2012, LFIs comprised 17% of his awarded compensation), and the Compensation Committee did not permit Messrs. Jacobs, Bucaille, Hoffman and Stern to participate in the LFI program.

| • | LFIs are performance-based awards that enhance shareholder value. LFIs represent actual or notional interests in certain investment funds managed by LAM or LFG and, accordingly, should enable eligible employees to directly benefit from the performance of such funds. Recipients of LFIs are awarded a dollar value, which is invested (or deemed invested) in specified investment funds as directed by the recipient and held in a restricted brokerage account for the benefit of the recipient. The value that each recipient realizes upon vesting depends on the performance of the applicable investment funds managed by our Asset Management business. In this way, the performance of our Asset Management business over time directly affects the value of our LFI awards—which also can fluctuate in value over time and could have very low value upon vesting in the event of poor fund performance. Given that our Asset Management business contributes approximately half of our annual operating revenue, which in turn directly benefits our equityholders, we believe that LFIs align the interests of recipients with the interests of our equityholders. |

| • | LFIs help retain key employees. Like RSUs, LFIs also serve as an important retention mechanism by subjecting a significant portion of each recipient’s compensation to forfeiture if he or she leaves the firm prior to the vesting date. |

| • | Vesting requirements and other restrictions regarding LFI awards. LFI award agreements generally contain the same vesting, change-in-control, restrictive covenant and forfeiture provisions as RSU award agreements (including, for LFIs awarded to Mr. Bhutani in 2013 and later, the “double-trigger” vesting provisions described above in connection with a change in control). In the event that the investment funds in which the LFIs are invested distribute earnings, such earnings are automatically re-invested in additional LFIs. These distributions will have the same restrictions as the underlying LFIs to which they relate. Mr. Bhutani was granted LFIs on March 12, 2013 that will vest 33% on March 2, 2015 and 67% on March 1, 2016. |

PRSU Awards. The Compensation Committee adopted the LTIP program at the beginning of 2012 to establish another link between the payout of long-term incentive awards and the performance of our business, as well as to place a portion of pay at risk based on three-year forward-looking financial metrics and our performance relative to the performance of our peers. As discussed above and based in part upon recommendations from Lazard Ltd’s shareholders, in March 2013, the Compensation Committee improved the LTIP program in order to, among other things, simplify the previously-announced performance metrics, update the scoring and reference ranges applicable to awards, and utilize PRSUs for purposes of award grants. PRSUs

13

Table of Contents

are restricted stock units that are subject to both performance-based and service-based vesting conditions. In addition, the Compensation Committee determined that Mr. Bhutani would participate in the program along with the other NEOs.

| • | PRSU awards subject the NEOs to risk of total loss of a critical component of annual compensation. PRSU awards supplement our existing risk-based long-term incentive compensation programs by subjecting a substantial proportion of the total compensation payable to each of the NEOs for a given year (approximately 60% of the 2012 awarded compensation for our CEO and 33%-45% of the 2012 awarded compensation for our other NEOs) to full risk of loss based upon the long-term financial performance of our business, measured against objective, pre-established performance goals. |

| • | PRSU awards involve a transparent payout mechanism. PRSU awards advance our goal of implementing transparent compensation practices. The performance metrics that must be satisfied in order for PRSUs to vest are tied to factors that we consider to be critical measures of our success and our ability to return value to our equityholders. Importantly, the financial information that is used in measuring the Company’s and an NEO’s performance with respect to these metrics is readily available, including through Lazard Ltd’s annual earnings releases. PRSUs allow our equityholders to know, in advance, how this substantial component of compensation for the NEOs will be measured and paid. |

| • | Payouts under PRSU awards are based on objective financial metrics. The number of shares of Class A common stock that a recipient will realize upon vesting of a PRSU award will be calculated by reference to financial metrics that were chosen because they are indicative of the Company’s overall performance, rather than individual performance, both on an absolute and a relative basis. These metrics rely on criteria such as revenue growth, returns to Lazard Ltd’s shareholders and operating leverage. At the measurement times, each of the metrics is assigned a score based on our performance. Such scores are generally weighted evenly over the performance period, with the ultimate level of payout for the awards determined by reference to the weighted numeric score. PRSU awards look to pre-established metrics of Lazard Ltd’s performance and link payout directly to scores awarded for such metrics. |

| • | Payouts under PRSU awards will depend on long-term financial performance and could be equal to zero. The target number of shares of Class A common stock subject to each PRSU is one. Based on the achievement of performance criteria, as confirmed by the Compensation Committee, the number of shares of Class A common stock that may be received in connection with each PRSU will range from zero to three times the target number. PRSUs for the 2012 compensation cycle relate to Lazard Ltd’s performance over the three-year period beginning on January 1, 2012 and ending on December 31, 2014. Unless threshold performance levels are satisfied during this period, all such PRSUs will be forfeited, and the NEOs will not be entitled to any payments with respect to such awards. |

| • | Payouts under PRSU awards are determined, in part, by reference to the performance of our peers. As further discussed below, one of the three financial metrics used to calculate payouts under PRSU awards includes a relative measure. By including this measure, the Compensation Committee intended that our performance be judged against what our competitor companies were able to accomplish under the same general market conditions during the performance period. |

| • | PRSU awards also include service-based and other vesting criteria. In addition to the applicable performance criteria, PRSU award agreements generally contain the same vesting, change-in-control, restrictive covenant and forfeiture provisions as RSU and LFI award agreements with our NEOs, including “double-trigger” vesting provisions, with certain variations to reflect the impact of a termination of employment or a change in control on performance conditions. The target number of shares of Class A common stock that are subject to the PRSUs that were granted for the 2012 compensation cycle was determined using the same methodology and price that were used in connection with RSUs that were granted for the 2012 compensation cycle. |

14

Table of Contents

| • | PRSUs advance our pay-for-performance paradigm. By coupling the potential value of the PRSUs with our degree of financial success, we believe we have created another strong link between value realized by our equityholders and value to the NEOs. Each NEO knows—at the beginning of a fiscal year—that the year is a component of a three-year, forward-looking PRSU performance measurement period and that his compensation under PRSU awards will be determined in part based on the Company’s performance during that fiscal year. Each NEO is updated at least annually on our progress. |

PRSU Financial Metrics and Scoring. The Compensation Committee determined that three financial ratios are the most appropriate and, taken together, comprehensive financial metrics for purposes of PRSU awards: Lazard Ltd’s Volatility Adjusted Revenue Growth Ratio, or VARGR, Capital Return Ratio, or CRR, and Operational Leverage Ratio, or OLR, each of which is described in further detail below. Collectively, the VARGR, CRR and OLR metrics align directly with our long-term strategy of driving equityholder returns through high-quality revenue and earnings growth, focusing on reducing volatility, increasing operating leverage and returning capital to our equityholders. These performance metrics also reflect, among other things, the manner in which the Compensation Committee measures the success that the NEOs can achieve in executing our long-term strategy and managing our business for the benefit of our equityholders. An explanation of the importance of each financial ratio is set forth below.

15

Table of Contents

| • | VARGR: Volatility Adjusted Revenue Growth Ratio. We seek to generate stable, high-quality revenue growth, and we believe that our equityholders value such revenue growth. Our innovative business model incorporates balanced growth initiatives and a diversity of businesses, including operations that are countercyclical, which we believe ultimately produces less volatile revenues. We believe that the VARGR performance metric aligns directly with our objective of achieving revenue growth while simultaneously limiting volatility in order to promote consistent, high-quality revenue growth over time. And, as described in more detail below, we evaluate this metric against the members of a relevant peer group. |

Explanation of the VARGR Metric

Relative Performance Measure

| Step 1: | We establish Lazard Ltd’s annual operating revenue growth rate for each fiscal year within the three-year performance period. We adjust this growth rate for debt valuation adjustment, and for certain acquisitions that may have occurred during the period, in each case, if applicable, as these items can substantially affect reported revenues and can reduce comparability among us and our peers. We then combine each of these operating revenue growth rates into a single compound operating revenue growth rate for the entire performance period. |

| Step 2: | We divide the compound annual operating revenue growth rate established in Step 1 by the historical volatility of Lazard Ltd’s compound annual operating revenue growth rate (i.e., the standard deviation in Lazard Ltd’s compound annual operating revenue growth rate over the preceding ten-year period). This normalizes the operating revenue growth rate and reduces the disproportionate impact of any nonrecurring events that may have occurred in a given year. Ultimately, this enhances operating revenue growth rate comparability among us and our peers. The value we obtain is the VARGR. |

| Step 3: | We determine our peers’ VARGRs, in each case using the most appropriate revenue statistic and applying Steps 1-2 above. Given their mix of businesses, the peer group for PRSUs granted in connection with 2012 compensation is: AllianceBernstein, Bank of America Merrill Lynch, BlackRock, Citigroup, Credit Suisse, Deutsche Bank, Evercore, Goldman Sachs, Greenhill, JP Morgan, Legg Mason, Morgan Stanley, Schroders and UBS. We selected this peer group, which is different than the peer group used for comparative compensation analyses described under “Compensation for Each of Our NEOs in 2012”, because we feel that this peer group more accurately reflects the companies with which we actively compete in the financial services industry (without regard to their relative size, which is relevant to compensation, but not relevant to their indicative growth rates). |

| Step 4: | We determine the VARGR score based on the VARGR ranking relative to the VARGRs of our peers. The VARGR scoring table is below. |

| Lazard VARGR Percentile Rank |

VARGR Score | |||

| Lazard Rank < 20% |

0.00 | |||

| Lazard Rank = 20% |

0.25 | |||

| Lazard Rank = 40% |

0.75 | |||

| Lazard Rank = 60% |

1.25 | |||

| Lazard Rank > 80% |

3.00 | |||

| If the VARGR ranking is between levels set forth in the table above, we will interpolate the VARGR score based on the scores provided for the closest levels. |

16

Table of Contents

| • | CRR: Capital Return Ratio. We endeavor to return capital to our equityholders, including by paying dividends, repurchasing equity and minimizing the need for additional capital in our business. We believe that our equityholders value our success in returning capital to them, and that the CRR performance metric aligns directly with our objective of returning capital. |

Explanation of the CRR Metric

Absolute Performance Measure

| Step 1: | For each fiscal year during the performance period, we first calculate capital returned to Lazard Ltd’s shareholders, which we define for this purpose as (A) the aggregate value of dividends paid to Lazard Ltd’s shareholders and the aggregate distributions by Lazard Group to its members (other than Lazard Ltd’s subsidiaries, and excluding any tax distributions) during the fiscal year, plus (B) the aggregate amount of funds used for equity (including Lazard Group membership interest) repurchases during the fiscal year, plus (C) the value of Class A common stock withheld for tax purposes during the fiscal year upon vesting of equity-based awards. |

| Step 2: | For the same fiscal year, we calculate Lazard Ltd’s cash flow during the fiscal year, which we define for this purpose as (A) Lazard Ltd’s net income for the fiscal year, calculated in the adjusted manner set forth in its annual earnings release for the fiscal year (primarily to enhance comparability between periods) plus (B) the amortization expense arising from year-end equity-based and LFI awards granted in prior years and recorded during the fiscal year, plus (C) aggregate cash proceeds received from any new equity or debt issuances, other than with respect to an acquisition, minus (D) the value of amounts used to fund investments relating to LFI awards, minus (E) amounts used to reduce outstanding debt. |

| Step 3: | We establish the CRR for the entire three-year performance period by dividing (A) the sum of the amounts obtained in Step 1 for each fiscal year in the performance period by (B) the sum of the amounts obtained in Step 2 for each fiscal year in the performance period. We then determine the CRR score based on the table set forth below. |

| Lazard CRR |

CRR Score | |||

| CRR < 50% |

0.00 | |||

| CRR = 50% |

0.50 | |||

| CRR = 55% |

1.00 | |||

| CRR = 60% |

1.50 | |||

| CRR = 65% |

2.50 | |||

| CRR > 70% |

3.00 | |||

| If the CRR is between levels set forth in the table above, we will interpolate the CRR score based on the scores provided for the closest levels. |

| • | OLR: Operational Leverage Ratio. We are committed to effectively managing the costs of our business, including through our long-term goal of limiting increases in our compensation expense, so that our compensation expense grows at a rate that is less than the rate of our revenue growth. By increasing our operating leverage, we seek to advance our ultimate objective of increasing equityholder returns. We retain this objective even in years where revenue remains flat or declines, in which case we aim to stabilize and reduce our expenses. We believe that the OLR performance metric aligns directly with our objective of increasing our operating leverage through cost discipline and thereby increasing the proportion of our revenue that ultimately benefits our equityholders. We revised the OLR performance metric to provide this equityholder-focused incentive to the NEOs even during periods of revenue decline. |

17

Table of Contents

Explanation of the OLR Metric

Absolute Performance Measure

| Step 1: | We determine Lazard Ltd’s pre-tax earnings growth rate for the entire three-year performance period by reference to the beginning of the first and the end of the last fiscal year during the period, using the customary method for calculating pre-tax earnings, but (i) instead of using compensation expense determined in accordance with GAAP, we use awarded compensation expense for the fiscal year (excluding one-time non-recurring items and the value of off-cycle grants made during the year, which represent new investments in our business) and (ii) we calculate other expenses, including interest expense and non-compensation expense, for the fiscal year in the adjusted manner set forth in Lazard Ltd’s annual earnings release for the fiscal year, rather than in the manner prescribed by GAAP. |

| Step 2: | We establish the OLR for the entire three-year performance period by dividing the growth rate obtained in Step 1 by Lazard Ltd’s operating revenue growth rate over the entire three-year performance period. We then determine the OLR score based on the tables set forth below (depending on whether operating revenue growth is positive or negative over the performance period). |

| Positive Operating Revenue Growth |

Negative Operating Revenue Growth |

|||||||||

| Lazard OLR |

OLR Score | Lazard OLR |

OLR Score | |||||||

| OLR < 100% |

0.00 | OLR > 400% | 0.00 | |||||||

| OLR = 100% |

0.50 | OLR = 400% | 0.50 | |||||||

| OLR = 125% |

1.00 | OLR = 350% | 1.00 | |||||||

| OLR = 150% |

1.50 | OLR = 300% | 1.50 | |||||||

| OLR = 175% |

2.50 | OLR = 250% | 2.50 | |||||||

| OLR > 200% |

3.00 | OLR < 200% | 3.00 | |||||||

If the OLR is between levels set forth in the table above, we will interpolate our OLR score based on the scores provided for the closest levels.

| • | PRSU Scoring. Generally, each of the three performance metrics (VARGR, CRR and OLR) is weighted equally. The determination of the number of PRSUs that may ultimately vest under each award generally will be based on Lazard Ltd’s cumulative performance over the three-year performance period. However, each of the three performance metrics will also be evaluated on an annual basis at the end of each fiscal year during the performance period, and for this purpose, the same scoring ranges and reference points will be used, but the evaluation will be based solely on performance during that fiscal year. If Lazard Ltd achieves a score of at least 1.0 with respect to such fiscal year, as confirmed by the Compensation Committee, then 25% of the total target number of shares of Class A common stock subject to the PRSUs will no longer be at risk based on achievement of the performance criteria. Any such PRSUs will remain subject to the service-based vesting criteria described herein (and the total payout with respect to such PRSUs could increase based on the performance over the performance period). The scoring described above corresponds directly to the level of achievement of performance goals (taking into account any applicable interpolation). For example, the achievement of a score of 1.50 for the cumulative three-year performance period translates into payout of the PRSU award at 1.50 times the target level (subject to achievement of the service-based vesting condition). The Compensation Committee retains full discretion with respect to the interpretation and application of the scoring systems described above. |

18

Table of Contents

| • | Evaluation of Fiscal Year 2012 Performance. After the end of 2012, the Compensation Committee evaluated Lazard Ltd’s performance for 2012 with respect to each of the three performance metrics and determined that Lazard Ltd’s performance exceeded a score of 1.0. Accordingly, 25% of the total target number of shares of Class A common stock subject to the PRSUs awarded to the NEOs for 2012 are not subject to further achievement of performance goals. However, these PRSUs remain subject to the service-based vesting criteria described above. |

Long-Term Incentive Awards Are the Primary Component of Compensation for Our Most Senior Professionals. In January 2013, we applied a progressive formula based on total compensation for all of our NEOs, managing directors and senior professionals. Pursuant to this formula, as a recipient’s total compensation (cash salary, cash bonus and long-term incentive compensation) increases, a greater percentage of his or her total compensation is composed of long-term incentive awards. This formula is based on a sliding scale that effectively begins at 5% for some of our vice presidents and directors and generally reaches 60% (or 50% in our Asset Management business) for our highest paid managing directors.

Amended NEO Retention Agreements

As expressed in early 2012 and in consultation with its independent compensation consultant, the Compensation Committee reviewed the Company’s retention agreements with its NEOs, with a particular focus on how the terms compared to evolving best practices in the market. After review, the Compensation Committee determined that certain provisions in the then-existing agreements, such as excise tax gross-ups and enhanced change in control severance payments, reflected market practice at the time the agreements were executed, but had since become less common. The Compensation Committee determined that these provisions were no longer needed as retention tools and therefore no longer served our Company’s best interests. Consistent with the Company’s compensation philosophy, the Compensation Committee accordingly determined to eliminate or reduce these provisions and make other updates to the NEO retention agreements. These changes, along with others adopted in 2012 and 2013 (e.g., the PRSU program, the compensation clawback policy, the introduction of stock ownership guidelines and the inclusion of “double-trigger” provisions in our NEO award agreements granted in respect of 2012 and later), demonstrate the Compensation Committee’s responsiveness to changes in the market and shareholder feedback.

We entered into an amended retention agreement with Mr. Jacobs in October 2012, pursuant to which, among other changes, we reduced his change in control severance payment and eliminated his excise tax gross-up following a change in control (instead, Mr. Jacobs will forfeit certain payments to the extent that such forfeiture would place Mr. Jacobs in a more favorable after-tax position, which we refer to as a cutback). On March 14, 2013, we entered into amended retention agreements with our other NEOs that also reduced their change in control severance payments and eliminated any excise tax gross-up provisions (and included cutback provisions). Prior to the amendments, the NEOs were generally entitled to severance payable at three times base salary plus bonus if the qualifying termination occurred on or following a change in control; under the amended retention agreements, severance is payable to the NEOs upon a qualifying termination at two times base salary plus bonus regardless of whether there has been a change in control (except that, for Mr. Bhutani, severance is payable at two times base salary plus bonus in the event such termination is on or following a change in control pursuant to which Lazard Ltd is acquired by an entity that has an asset management business, and one times base salary plus bonus in all other cases). Mr. Bhutani’s prior agreement, which we entered into in August 2011, after we committed not to enter into new retention agreements that provide for excise tax gross-ups, did not include such a provision, and his amended agreement does not either. The amended retention agreements expire on March 31, 2016, except that if there is a change in control, the term will automatically extend for at least two years from the date of such change in control. The compensation and amount and form of any annual bonus payable to each of Messrs. Bhutani, Bucaille, Hoffman and Stern generally remain unchanged from the respective prior agreement. Mr. Jacobs’ compensation generally also remains unchanged, and the amount and form of any annual bonus will be determined by the Compensation Committee after consultation with Mr. Jacobs, except that (subject to changes in applicable law or pay practices) the first $3 million (less the

19

Table of Contents

amount of Mr. Jacobs’ annual salary) of such bonus will be paid in cash. Pursuant to the amended retention agreements, severance payments that are incurred prior to a change in control are conditioned on the NEO timely delivering a valid and irrevocable release of claims in favor of the Company. In addition, a resignation by the NEO for “good reason” will be treated as a termination without “cause” for purposes of such NEO’s then-outstanding PRSUs, RSUs, restricted stock, LFIs and other similar awards. For a further description of the terms of the NEOs’ retention agreements, see “Retention Agreements with Our NEOs—Payments and Benefits Upon Certain Terminations of Service”.

Compensation for Each of Our NEOs in 2012

The Compensation Process. Decisions with regard to incentive compensation are generally made in the first quarter of each year and are based on Company and individual performance in the prior fiscal year.

| • | The Compensation Committee approves NEO compensation. Our CEO, Mr. Jacobs, makes recommendations to the Compensation Committee as to the total compensation package to be paid to our NEOs. The Compensation Committee reviews and approves the total compensation package to be paid to our NEOs, including Mr. Jacobs, and considers Mr. Jacobs’ recommendations in its review. Mr. Jacobs reviewed with the Compensation Committee the performance of each of the other NEOs individually and their overall contribution to the Company in 2012, which was not based on any numerical targets but rather on qualitative issues. Mr. Jacobs does not participate in sessions of the Compensation Committee at which his own compensation is determined; however, he does participate in sessions at which the compensation of the other NEOs is discussed. |

The Compensation Committee Considers a Variety of Available Information. Before any year-end compensation decisions are made, the Compensation Committee reviews information from a variety of available sources.

| • | Business Performance. In evaluating the total compensation packages to be paid to our NEOs, the Compensation Committee considered the factors described under “2012 Business Performance Highlights”, as well as their individual contributions, their desire to advance the implementation of compensation discipline throughout the firm and their desire to personally participate in this initiative. |

| • | Financial Metrics. The Compensation Committee reviewed a variety of metrics relating to the Company’s financial performance in evaluating the total compensation packages to be paid to our NEOs. The Compensation Committee considered Lazard Ltd’s results and progress during 2012 regarding key strategic metrics, including operating revenue, awarded compensation, operating margin, cost savings, and return of capital. The Compensation Committee also considered Lazard Ltd’s TSR, on a standalone basis and relative to a peer group including Affiliated Managers Group Inc., Blackstone Group LP, Eaton Vance Corp., Evercore Partners Inc., Greenhill & Co., Inc., Invesco Ltd, Legg Mason, Inc., Raymond James, T. Rowe Price and Stifel Financial. |

| • | Tally Sheets. The Compensation Committee reviewed a comprehensive tally sheet of all elements of each NEO’s compensation. The tally sheets included information on cash and non-cash compensation for the past three fiscal years (including current and prior year base salaries, annual bonuses, deferred cash awards, restricted stock, RSUs and LFIs, if any), and the value of benefits and other perquisites paid to our NEOs, as well as potential amounts to be delivered under post-employment scenarios. |

| • | Competitive Compensation Considerations. The competition to attract and retain high-performing executives and professionals in the financial services industry is intense, the amount and composition of total compensation paid to our executives must be considered in light of competitive compensation levels. In this regard, for our NEOs, the Compensation Committee reviewed an analysis prepared by CAP regarding compensation levels for 2011 (the most recent year for which comprehensive data for our peers was available) and considered data regarding indicative trends for 2012 for comparable |

20

Table of Contents

| positions at the financial services firms described above under “Financial Metrics”. This comparator group was chosen because we compete in the same marketplace with these companies for highly qualified and talented financial service professionals. CAP noted that while it is difficult to choose a comparator group that provides an ideal comparison for these purposes, this comparator group (which included changes to the comparator group used in 2012) was a positive improvement. |

CAP’s analysis compared the total direct compensation for our NEOs (calculated with respect to 2011 base salary and actual cash bonuses, RSUs awarded in February 2012 for 2011 performance and, in the case of Mr. Bhutani, LFIs awarded in February 2012 for 2011 performance) to the total direct compensation for the appropriate named executive officers in the comparator group described above, or an appropriate subset of that comparator group, calculated based on compensation levels for 2011 (as reported in 2012). CAP constructed a compensation reference range for each of our NEOs based on the comparator data as follows: for Mr. Jacobs, $7 million to $9 million; for Mr. Bhutani, $7 million to $10 million; for Mr. Bucaille, $3 million to $4 million; for Mr. Hoffman, $3 million to $4 million; and for Mr. Stern, $4 million to $7 million. According to CAP’s analysis, the total direct compensation paid to each of our NEOs with respect to 2011 performance was within a reasonable range in light of compensation levels of the comparator group.

While the Compensation Committee considered the level of compensation paid by the firms in the comparator group as a reference point that provided a framework for its compensation decisions, in order to maintain competiveness and flexibility, the Compensation Committee did not target compensation at a particular level relative to the comparator group (or relevant subset of the group). This information was merely one of several data points that the Compensation Committee considered in evaluating compensation for our NEOs.

The Company also noted that aggregate total direct compensation for the named executive officers in the comparator group for 2011 (as reported in 2012) ranged from a 25th percentile amount of approximately $16.8 million to a 75th percentile amount of approximately $34.8 million, and that the Company’s aggregate total direct compensation for the NEOs for 2011 (which consisted of 2011 base salaries and actual cash bonuses, RSUs and LFIs awarded for 2011) was $30.5 million. While information about the percentile rankings of aggregate total direct compensation for the members of the comparator group was presented to the Compensation Committee in prior years, it was not a factor that the Compensation Committee considered when determining compensation.

2012 Base Salaries. We have retention agreements with our NEOs that establish their respective minimum annual base salaries. These amounts were negotiated and were meant to ensure that the Company would have the services of each of the NEOs during the term of their respective agreements. See “Retention Agreements with our NEOs” below. The base salary paid in 2012 to Mr. Jacobs was $900,000 and to each of Mr. Bucaille, Mr. Bhutani, Mr. Hoffman and Mr. Stern was $750,000.

2012 Incentive Compensation

Mr. Jacobs. The Compensation Committee noted that, despite difficult financial markets, the Company performed well in 2012. In evaluating incentive compensation for Mr. Jacobs, the Compensation Committee considered the information regarding Lazard Ltd’s performance described under “2012 Business Performance Highlights” above, as well as his individual accomplishments. The Compensation Committee specifically considered Lazard Ltd’s results and progress regarding key strategic metrics set at the beginning of 2012 involving operating revenue, awarded compensation, operating margin, cost savings and return of capital. The Compensation Committee also considered Lazard Ltd’s TSR, on both a standalone and relative basis.

The Compensation Committee also considered the qualitative goals and objectives established for Mr. Jacobs by the Compensation Committee in early 2012. These goals and objectives provided the Compensation Committee with a comprehensive set of criteria that assisted the Compensation Committee in its evaluation of Mr. Jacobs’ performance in 2012.

21

Table of Contents

In addition to the factors described above, the Compensation Committee noted the following accomplishments as a result of Mr. Jacobs’ initiative, ongoing leadership and dedication during 2012:

| • | The Company developed a focused and well-received strategic plan; |

| • | Lazard Ltd expanded communications with shareholders and the analyst community, enhancing investor awareness of its business model, strategic objectives and accomplishments; |

| • | The Company announced cost saving initiatives in October 2012 and was implementing them according to plan; and |

| • | The Company continued to successfully retain and attract valuable senior professionals. |

Together with its independent compensation consultant, the Compensation Committee thoroughly reviewed the Company’s past compensation practices and the competitive compensation practices at other firms. The Compensation Committee also considered Mr. Jacobs’ strong desire to implement compensation discipline throughout the firm and his continuing desire to personally participate in this initiative.

Based on its review, the Compensation Committee decided to grant Mr. Jacobs an incentive compensation award of $7.60 million, payable as follows: a PRSU award valued at $5.1 million (based on the achievement of performance goals at the target level) and a $2.5 million cash bonus. The PRSUs awarded to Mr. Jacobs constituted approximately 60% of Mr. Jacobs’ total compensation for 2012. The total performance-based compensation awarded to Mr. Jacobs constituted approximately 89% of his total compensation for 2012.

The following charts show Mr. Jacobs’ mix of fixed versus performance-based compensation, and cash incentive versus long-term incentive compensation, for 2012 (based on the achievement of performance goals with respect to the PRSUs at the target level).

As reflected in the table below, notwithstanding a 5% increase in Lazard Ltd’s annual operating revenue, Mr. Jacobs’ total incentive compensation for 2012 declined by approximately 5% from the level he received for 2011. This decline in Mr. Jacobs’ incentive compensation for 2012 is indicative of the benefits to the Company of maintaining a flexible compensation system that allows the Compensation Committee to adjust the amount payable to our CEO and our other NEOs. Furthermore, by linking 60% of Mr. Jacobs’ compensation for 2012 directly to the future performance of our business through PRSUs, the majority of Mr. Jacobs’ compensation for 2012 will be at risk based on Lazard Ltd’s ability to achieve growth and produce value for shareholders over the next two to three years. Given the combination of base salary, annual cash bonus and PRSUs awarded to Mr. Jacobs for 2012, the Compensation Committee believes it has struck the right balance between paying for performance, on the one hand, and the desire to keep Mr. Jacobs focused on the Company’s overall performance and continued growth and success.

Mr. Bhutani. In evaluating annual incentive compensation for Mr. Bhutani, the Compensation Committee and Mr. Jacobs considered his consistent leadership and high level of performance as the Chief Executive Officer of LAM and the overall success of the Asset Management business in 2012, including the achievements described under “2012 Business Performance Highlights” above. The Compensation Committee and Mr. Jacobs

22

Table of Contents

reviewed Mr. Bhutani’s role in the Company, his positioning on an internal pay equity scale vis-à-vis other managing directors within the Asset Management business, specifically, and the Company, in general, and the competitive compensation practices at the other firms. The Compensation Committee approved the following incentive compensation for Mr. Bhutani for his performance in 2012: Mr. Bhutani received a cash bonus of $3.01 million (a portion of which was paid in December 2012 based on estimates of Company and individual performance), a deferred cash award valued at $940,000, a PRSU award valued at $3.133 million (based on the achievement of performance goals at the target level) and an LFI award valued at $1.567 million. Together, the deferred cash, PRSUs and LFIs awarded to Mr. Bhutani constituted approximately 60% of his total compensation for 2012. The total performance-based compensation awarded to Mr. Bhutani constituted approximately 92% of his total compensation for 2012.

Mr. Stern. In evaluating annual incentive compensation for Mr. Stern, the Compensation Committee and Mr. Jacobs considered several factors, including the various roles that Mr. Stern performs for the Company. The Compensation Committee and Mr. Jacobs considered Mr. Stern’s myriad responsibilities, his performance as Chief Operating Officer and his contribution to the financial strength of the Company. Mr. Stern maintains a balance between his leadership and administrative responsibilities within the firm, while continuing to cultivate important client relationships. Additional factors that the Compensation Committee and Mr. Jacobs considered included Mr. Stern’s successful conceptualization and implementation of the Company’s cost saving initiatives, Mr. Stern’s effective management of managing directors and senior professionals overseeing various business sectors on a global basis, and the competitive compensation practices at other firms. The Compensation Committee approved the following incentive compensation for Mr. Stern for his performance in 2012: Mr. Stern received a cash bonus of $1.118 million, a PRSU award valued at $2.025 million (based on the achievement of performance goals at the target level) and an RSU award valued at $607,500. The PRSUs and RSUs awarded to Mr. Stern constituted approximately 45% and 14%, respectively, and collectively constituted approximately 59%, of Mr. Stern’s total compensation for 2012. The total performance-based compensation awarded to Mr. Stern constituted approximately 83% of his total compensation for 2012.

Messrs. Bucaille and Hoffman. In evaluating incentive compensation for Messrs. Bucaille and Hoffman, the Compensation Committee and Mr. Jacobs considered that each provides significant leadership to the Company in his role as Chief Financial Officer and General Counsel, respectively. Mr. Bucaille has worldwide responsibility for corporate finance and accounting at the Company, while continuing to maintain important client relationships cultivated prior to becoming Chief Financial Officer. Mr. Hoffman has worldwide responsibility for legal and compliance, and also oversees internal audit and global communications.

The Compensation Committee and Mr. Jacobs further considered that both executives have been tasked with primary responsibility for establishing and implementing uniform internal policies within the Company, so that other members of senior management can focus on building the Lazard franchise and cultivating client relationships. With respect to Mr. Bucaille, the Compensation Committee and Mr. Jacobs discussed his contribution to the overall strength of the Company as well as his dedication in connection with his responsibilities as Chief Financial Officer. With respect to Mr. Hoffman, the Compensation Committee and Mr. Jacobs discussed his wide-ranging responsibility for overseeing worldwide legal and compliance operations during a period of continuing legal and regulatory reform, as well as his diverse responsibilities for overseeing internal audit, global communications and legislative and regulatory affairs. Mr. Jacobs noted that Mr. Hoffman was a key contributor to the collective management team, providing leadership, advice and guidance to him, as CEO, and to the Compensation Committee, and Mr. Jacobs further noted that Mr. Hoffman also provides such advice and guidance to the Board of Directors.

Based on Mr. Jacobs’ recommendation, the Compensation Committee approved the following incentive compensation for each of Mr. Bucaille and Mr. Hoffman for their performance in 2012: Mr. Bucaille received a cash bonus of $727,500, a PRSU award valued at $1.44 million (based on the achievement of performance goals at the target level) and an RSU award valued at $282,500; Mr. Hoffman received a cash bonus of $757,500, a PRSU award valued at $1.49 million (based on the achievement of performance goals at the target level) and an

23

Table of Contents

RSU award valued at $307,500. The PRSUs and RSUs awarded to Messrs. Bucaille and Hoffman constituted approximately 54% of their total compensation for 2012. The total performance-based compensation awarded to Messrs. Bucaille and Hoffman constituted approximately 77% of their total compensation for 2012.

The following table shows the base salary and incentive compensation paid to our NEOs for their performance in 2012 in the manner it was considered by the Compensation Committee. This presentation differs from that contained in the Summary Compensation Table for 2012 in the following respects:

| • | by showing the full grant date value of the PRSUs (assuming payout at the target level), RSUs and LFIs granted on March 12, 2013, which related to 2012 performance but are not reflected in the Summary Compensation Table for 2012 because they were granted after the end of our 2012 fiscal year; |

| • | by excluding the full grant date value of the RSUs and LFIs granted on February 10, 2012, which are included in the Summary Compensation Table for 2012, as they related to 2011 performance; |

| • | by excluding the “Change in Pension Value” and “All Other Compensation” columns for each year, because they are not tied to the NEO’s performance for the applicable year; and |