Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Evolve Transition Infrastructure LP | d498238d8k.htm |

| EX-99.1 - EX-99.1 - Evolve Transition Infrastructure LP | d498238dex991.htm |

Constellation Energy Partners LLC

Fourth Quarter and Full Year 2012

Earnings Presentation

March 5, 2013

Exhibit 99.2 |

2

Forward-looking Statements Disclaimer

This presentation contains forward–looking statements that are subject to a number

of risks and uncertainties, many of which are beyond our control, which may

include statements about: the volatility of realized oil and natural gas prices; the conditions of the

capital markets, inflation, interest rates, availability of a credit facility to

support business requirements, liquidity, and general economic and political

conditions; the discovery, estimation, development and replacement of oil and natural gas reserves; our

business, financial, and operational strategy; our drilling locations; technology; our

cash flow, liquidity and financial position; the ability to extend or refinance

our reserve-based credit facility; the level of our borrowing base under our reserve-based credit facility;

the resumption or amount of our cash distributions; our hedging program and our

derivative positions; our production volumes; our lease operating expenses,

general and administrative costs and finding and development costs; the availability of drilling and

production equipment, labor and other services; our future operating results; our

prospect development and property acquisitions; the marketing of oil and natural

gas; competition in the oil and natural gas industry; the impact of the current global credit and economic

environment; the impact of weather and the occurrence of natural disasters such as

fires, floods, hurricanes, tornados, earthquakes, snow and ice storms and other

catastrophic events and natural disasters; governmental regulation, including environmental regulation,

and taxation of the oil and natural gas industry or publicly traded partnerships;

developments in oil-producing and natural gas producing countries; lack of

support from a sponsor; and our strategic plans, objectives, expectations, forecasts, budgets, estimates

and intentions for future operations. In some cases, forward–looking

statements can be identified by terminology such as “may,”

“could,” “should,” “expect,” “plan,”

“project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,”

“target,” “continue,” the negative of such terms or other

comparable terminology.

The forward–looking statements contained in this presentation are largely based on

our expectations, which reflect estimates and assumptions made by our

management. These estimates and assumptions reflect our best judgment based on currently known market

conditions and other factors. Although we believe such estimates and assumptions to be

reasonable, they are inherently uncertain and involve a number of risks and

uncertainties that are beyond our control. In addition, management’s assumptions about future events

may prove to be inaccurate. Management cautions all readers that the

forward–looking statements contained in this presentation are not

guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward–looking

events and circumstances will occur. Actual results may differ materially from

those anticipated or implied in the forward–looking statements due to

factors listed in the “Risk Factors” section in our SEC filings and elsewhere in those filings. All forward–looking

statements speak only as of the date of this presentation. We do not intend to publicly

update or revise any forward–looking statements as a result of new

information, future events or otherwise. These cautionary statements qualify all forward-looking

statements attributable to us or persons acting on our behalf.

|

3

Updates

•

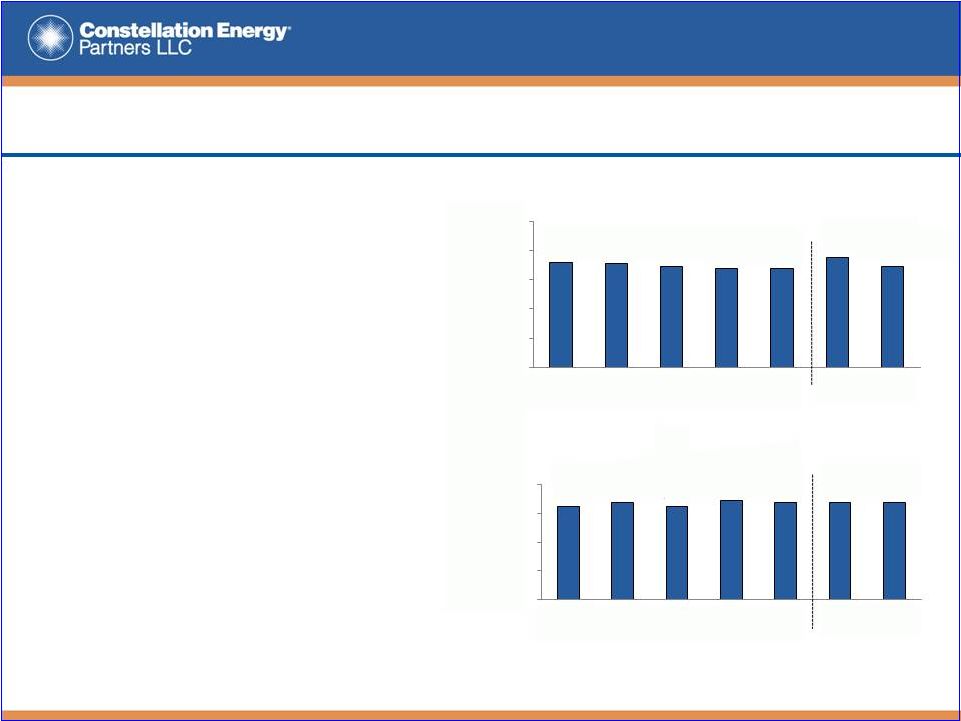

Q412 operating performance:

–

Average daily net production of 33.9 MMcfe

includes average daily net oil production of

approximately 396 Bbl, which is up 45% vs.

Q312

–

Operating cost of $3.38 per Mcfe, which is

down 2% vs. Q312

–

Resulted in $6.6 million in Adjusted EBITDA,

which is up 18% vs. Q312, for Adjusted

EBITDA of $24.5 million in 2012

•

Completed 38 net wells and

recompletions in Q412 resulting in

100 net wells and recompletions in

2012 with 18 additional net wells and

recompletions in progress at year-end

•

Capital

spending

of

$5.4

million

in

Q412 resulted in total capital spending

of $15.9 million in 2012

(1)

See Appendix

(1)

(2)

(2)

35.8

35.5

34.5

34.0

33.9

37.5

34.5

0.0

10.0

20.0

30.0

40.0

50.0

Q411

Q112

Q212

Q312

Q412

FY11

FY12

Average Daily Net Production

(MMcfe per day)

$3.26

$3.40

$3.24

$3.44

$3.38

$3.37

$3.37

$-

$1.00

$2.00

$3.00

$4.00

Q411

Q112

Q212

Q312

Q412

FY11

FY12

Operating Cost

($ per Mcfe)

Includes lease operating expenses, production taxes, general and administrative

expenses; excludes exploration costs and unit-based compensation program

expenses, which are non-cash items

|

4

Robinson’s Bend Sale

•

Closed the sale of Robinson’s Bend

Field assets on February 28, 2013

–

Sale encompassed all of CEP’s assets in

the Black Warrior Basin

–

Under the terms of the agreement, a base

sale price of $63.0 million resulted in

$58.9 million in proceeds received at

closing

–

Allowing for estimated sales-related cost

impacts, net sales proceeds were

approximately $55.3 million

–

CEP used net sales proceeds to reduce

debt by $50.0 million

–

CEP is now $34.0 million drawn on a

borrowing base of $37.5 million (net debt

of approximately $21.9 million)

–

Since Q309, CEP has reduced debt

outstanding by $186.0 million or 85%

–

Decreased leverage allows CEP to remain

focused on the oil opportunities in our

Mid-Continent asset base

$ in millions

Amount

Sales Price (Dec. 1, 2012 Effective Date)

$63.0

NORM Deduction

-2.6

Adjustment for Dec. 1, 2012 Effective Date

-0.4

Escrowed Funds (NORM/NPDES)

-1.1

Proceeds Received at Closing

$58.9

Sales Commission

-0.9

Transaction Costs (Legal, Opinions, etc.)

-0.6

Swap Liquidation

-2.1

Net Sales Proceeds

$55.3

Debt Reduction

-50.0

Cash Retained at Closing

$5.3

Cash on Hand Prior to Closing

6.8

Proforma Cash on Hand at Closing

$12.1

Debt Outstanding at Closing

$34.0

Debt Outstanding (-) Proforma Cash on Hand at Closing

$21.9 |

5

Our Continuing Focus on Oil Opportunities

•

Our

capital

program

has

been

focused

on

the

oil

potential

we

see

in

our

existing asset base and our most capital efficient recompletion opportunities

•

As a result of this focus, oil continues to be an increasingly important part of

our production mix

•

Drilling efforts are focused in the Pennsylvanian aged horizon with the

Burgess, Bartlesville, Red Fork and Skinner sandstones as primary targets

•

In 2013, we forecast capital spending of between $19.0 million and $21.0

million and anticipate that oil will account for about 15% of our production mix

(~ 548

Bbl/day)

and

about

50%

of

our

sales

revenue

*

*

Excludes hedge settlements, gains (losses) on mark-to-market activities, and

other revenue **

FY2013 Forecast oil production is based on the mid-point of CEP’s 2013

production forecast |

6

Q412 Financial Results

19

(1)

Includes lease operating expenses, production taxes, general and administrative

expenses and unit-based compensation program expenses (2)

Includes loss (gain) on asset sale and exploration costs

(3)

Includes accretion expense and asset impairments

(4)

2011 results exclude $41.3 million in hedge settlements related to the company’s

Jun-11 hedge restructuring; including these hedge settlements, Adjusted EBITDA was $97.1 million

See Appendix

Q412 vs. Q312

Full Year

($ in 000’s unless noted)

Q412

Q312

2012

2011

Production (MMcfe)

3,119

3,126

12,613

13,679

Oil & Gas Sales

$17,521

$16,653

$68,041

$144,639

Gain (Loss) from Mark-to-Market Activities

(253)

(10,158)

(8,706)

(39,422)

Revenue

$17,268

$6,495

$59,335

$105,217

Operating Expenses

(1)

10,889

11,254

43,977

47,445

Cost of Sales

376

287

1,299

2,188

Other (Income) Expense

(2)

(33)

(21)

(147)

(99)

EBITDA

$6,036

$(5,025)

$14,206

$55,683

DD&A

(3)

81,148

4,604

95,016

25,981

Net Interest Expense

1,143

1,534

5,733

10,116

Net Income (Loss)

$(76,255)

$(11,163)

$(86,543)

$19,586

Adjusted EBITDA

$6,635

$5,639

$24,445

$55,257 |

7

Net Asset Value ($ in millions)

*

Adjusted to reflect the sale of the Robinson’s Bend Field assets, which closed

February 28, 2013 (1)

Estimated by Netherland, Sewell & Associates in a report dated as of the last day

of the quarter shown using SEC reserve guidelines using a five year limit on

PUDs (2)

Based on (a) forward market prices on the last day of the quarter shown and (b) a 10%

discount rate (PV10) (3)

Current assets less current liabilities less the value of current risk management

balance sheet items (4)

Value of probable reserves is: Q412 $40.8 million

(5)

Value of possible reserves is: Q412 $14.5 million

(6)

Price

shown

is

as

of

the

market

close

on

the

last

day

of

trading

for

the

quarter

Quarter Ending:

Q412*

Value of Proved Reserves

(1),(2)

$116.4

+/-

Adjustments for:

Debt

-34.0

Working Capital

(3)

4.4

ARO

-7.7

Value of Hedges in Place

(2)

26.2

= Net Asset Value (NAV) --

Proved Reserves

(1),(2)

$105.3

÷

Units Outstanding

(millions)

24.2

= NAV/Unit --

Proved Reserves

(1),(2)

($/Unit)

$4.35

+ NAV/Unit --

Probable Reserves

(1),(2),(4)

($/Unit)

$1.69

+ NAV/Unit --

Possible Reserves

(1),(2),(5)

($/Unit)

$0.60

= NAV/Unit --

Total Reserves (3P)

(1),(2)

($/Unit)

$6.64 |

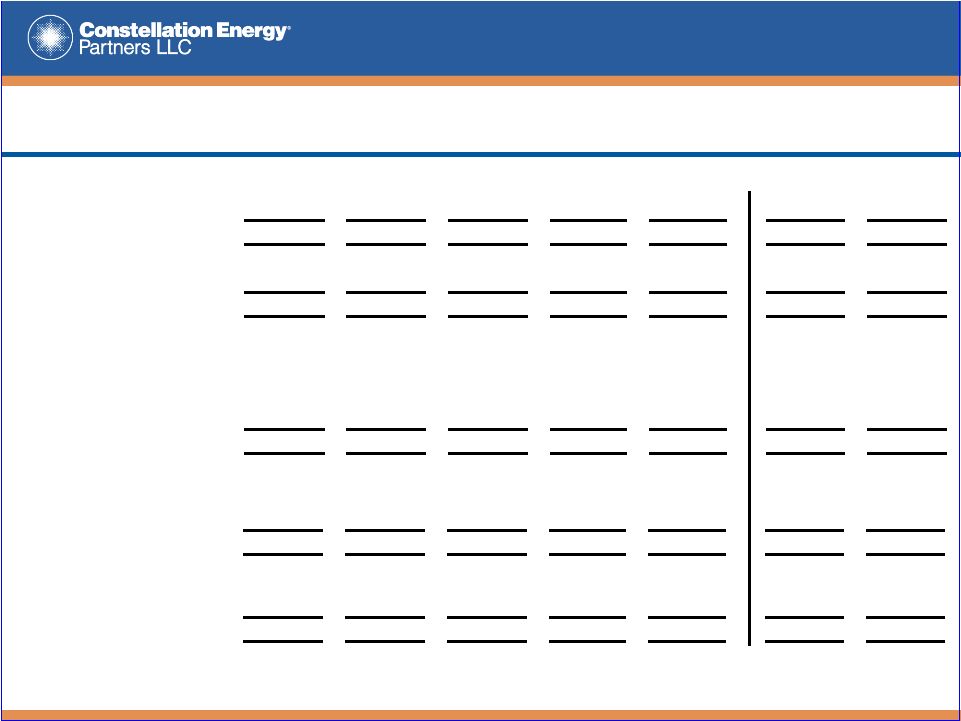

G&A

Cost Reductions •

Changes that will impact our future operating results include:

–

Closure of our Tulsa, OK and Dewey, OK offices (employees relocated to our Skiatook,OK

field office)

–

Headcount reductions (impacts G&A and LOE)

–

Changes in compensation structure for employees and CEP’s board of managers

–

Changes in employee benefits structure

–

In-sourcing of accounting activities related to CEP’s Mid-Continent

assets –

Cancellation of the 2009 board advisory engagement with Tudor, Pickering, Holt & Co.

Securities, Inc.

(1)

Excludes LTIP

(2)

Excludes one-time cost of $0.8 million incurred in connection with headcount

reductions 33% Reduction Since

2010, Our First Full

Year Without a Sponsor

8

$18.6

$15.4

$14.6

$12.4

$0

$10

$20

2010

2011

2012

2013 Forecast

(Midpoint)

General & Administrative Costs

($ millions)

(2)

(1) |

9

2013 Forecast

Forecast Component

2013 Forecast

Total Capital Spending

$19.0MM -

$21.0MM

Total Net Production

7.6 Bcfe –

8.6 Bcfe

Production Mix

Mcfe, Oil / Natural Gas

15% / 85%

Natural Gas

6.5 –

7.3 Bcfe

Oil

190,000 –

210,000 Bbls

Sales Revenue (Excludes Hedges)

Oil / Natural Gas

50% / 50%

NYMEX Hedges

Natural Gas

8.8 Bcfe at $5.59 per Mcfe

Basis Only Hedges

Mid-Con Basis –

Natural Gas

5.2 Bcfe at ($0.39) per Mcfe

WTI Hedges

Oil

147 Mbl at $96.28 per Bbl

Hedges as a % of Natural Gas Production

128%

(At Midpoint)

Hedges as a % of Oil Production

74%

(At Midpoint)

Differentials:

Mid-Con Natural Gas (Basis to NYMEX)

($0.14) per Mcfe

Mid-Con Oil (Marketing)

($2.50) per Bbl

Mid-Con Natural Gas (Gathering)

($0.50) per Mcfe

Operating Costs:

LOE

(1)

$17.0 MM –

$18.2 MM

Production Taxes

$1.6 MM -

$2.4 MM

G&A –

Corporate and Field Level

(2)

$12.8 MM -

$13.6 MM

Total

$31.4 MM -

$34.2 MM

Margin from Third Party Sales/Services

$1.75 MM -

$2.25 MM

Adjusted EBITDA

(3)

$23.0 MM -

$25.0 MM

Interest Expense

$2.0 MM

Maintenance Capital

$21.0 MM

(1)

Excludes exploration costs and unit-based compensation program expenses, which are

non-cash items (2)

Excludes unit-based compensation program expenses, which is a non-cash item;

Includes a one-time cost of $0.8 million incurred in connection with headcount reductions

(3)

We are unable to reconcile our forecast range of Adjusted EBITDA to GAAP net income or

operating income because we do not predict the future impact of adjustments to

net income (loss), such as (gains) losses from mark-to-market activities and

equity investments or asset impairments due to the difficulty of doing so, and we are unable to

address the probable significance of the unavailable reconciliation, in significant

part due to ranges in our forecast impacted by changes in oil and natural gas prices and

reserves which affect certain reconciliation items |

Appendix |

Cherokee Basin

Central Kansas Uplift

Woodford Shale

•

Proved reserves: 130 Bcfe

-

PDP as a % of total proved: 60%

-

Natural gas: 123 Bcfe (95%)

-

Oil: 1,042 MBbl (5%)

•

Net producing wells: 2,310

•

Net acres: over 727,000

•

Average working interest: 100% operated,

50% non-operated

•

Average net revenue interest: 80% operated,

40% non-operated

•

Pricing: ONEOK, Southern Star, CEGT East,

NGP MidCon, PEPL, WTI

•

Proved reserves: ~ 0.2 Bcfe

-

PDP as a % of total proved: 100%

-

Oil: 38 MBbl (100%)

•

Net producing wells: 6

•

Net Acres: approximately 893

•

Non-operated

•

Average working interest: 20%

•

Average net revenue interest: 16%

•

Pricing: WTI

•

Proved reserves: ~ 6 Bcfe

-

PDP as a % of total proved: 100%

-

Natural gas: 6 Bcfe (100%)

•

Net producing wells: 9

•

Net Acres: N/A, wellbores

•

Non-operated

•

Average working interest: 11%

•

Average net revenue interest: 9%

•

Pricing: CEGT East

11

Portfolio Summary

Statistics as of December 31, 2012; excludes assets divested in Q113; reserve values are

estimates based on forward prices on December 31, 2012; numbers may not add due to rounding

Portfolio

Existing Reserves

•

Total: 402 Bcfe

•

Proved reserves, total: 136 Bcfe

•

Proved oil reserves: 1,080 MBbl

•

Proved gas reserves: 129 Bcfe

•

Proved developed as a % of

total proved reserves: 62%

•

Proved R/P ratio: 17 years

•

Probable reserves, total: 119 Bcfe

•

Probable oil reserves: 876 MBbl

•

Probable gas reserves: 114 Bcfe

New Activity

•

Drilling focus: Cherokee Basin oil

opportunities in the Pennsylvanian aged

horizon with the Burgess, Bartlesville, Red

Fork and Skinner sandstones as primary

targets

•

New well costs: $170,000 to $450,000

•

Initial daily production,

new wells: 1 to 40 Bbl

•

Well depths: 700 to 2,700 feet

•

Well spacing: 10 to 160 acres

•

Recompletion costs: $45,000 to $65,000

•

Incremental daily production,

recompletions: 1 to 15 Bbl |

12

Natural Gas Hedge Positions

(1)

(1)

As of March 5, 2013

(2)

NYMEX

(3)

Excludes an offset trade executed on 1,041,814 MMBtu at a fixed price of $3.662; this

trade will settle financially over the course of the year against the fixed price trades shown

NOTE: The company accounts for derivatives using the mark-to-market

accounting method. Fixed Price Swaps

(2)

MMBtu Hedged

Weighted Average Sales Price ($/MMBtu)

BOY 2013

6,187,500

5.75

(3)

2014

6,387,500

5.75

2015

1,839,490

4.30

Basis Swaps

MMBtu Hedged

Weighted Average Sales Price ($/MMBtu)

BOY 2013

3,832,587

0.39

2014

4,443,677

0.39 |

13

Oil Hedge Positions

(1)

Fixed Price Swaps

Bbl Hedged

Weighted Average Sales Price ($/Bbl)

BOY 2013

106,757

$96.31

2014

113,127

$94.02

2015

87,680

$93.53

2016

66,117

$85.50

(1)

As of March 5, 2013

NOTE: The company accounts for derivatives using the mark-to-market

accounting method. |

14

Non-GAAP Financial Measures

Use of Non-GAAP Financial Measures:

EBITDA and Adjusted EBITDA are non-GAAP financial measures that are reconciled to

their most comparable GAAP financial measure under Reconciliation of

Non-GAAP Financial Measures in this presentation. The reconciliations are only intended to be reviewed in

conjunction with the oral presentation to which they relate.

EBITDA is defined as net income (loss) adjusted by interest (income) expense, net;

depreciation, depletion and amortization; write-off of deferred financing

fees; asset impairments; and accretion expense. Adjusted EBITDA is defined as EBITDA adjusted by (gain) loss on

sale of assets; exploration costs; (gain) loss from equity investment; unit-based

compensation programs; (gain) loss from mark-to-market activities; and

unrealized (gain) loss on derivatives/hedge ineffectiveness. Although not presented herein, we define Distributable Cash

Flow as Adjusted EBITDA less maintenance capital expenditures and cash interest

expense. Maintenance capital expenditures are capital expenditures

that

we

expect

to

make

on

an

ongoing

basis

to

maintain

our

asset

base

(including

our

undeveloped

leasehold

acreage)

at

a

steady

level

over

the

long

term.

These

expenditures

include

the

drilling

and

completion

of

additional

development

wells

to

offset

the

expected production decline during such period from our producing properties, as well

as additions to our inventory of unproved properties or proved reserves required

to maintain our asset base. These

financial

measures

are

used

as

a

quantitative

standard

by

our

management

and

by

external

users

of

our

financial

statements

such

as investors, research analysts and others to assess the financial performance of our

assets without regard to financing methods, capital structure

or

historical

cost

basis;

the

ability

of

our

assets

to

generate

cash

sufficient

to

pay

interest

costs

and

support

our

indebtedness;

and our operating performance and return on capital as compared to those of other

companies in our industry, without regard to financing or capital

structure. These financial measures are not intended to represent cash flows for the period, nor are they presented

as a substitute for net income, operating income, cash flows from operating activities

or any other measure of financial performance or liquidity presented in

accordance with GAAP. Summary of Non-GAAP Financial Measures:

Non-GAAP Measure

Slide(s) Where Used in

Presentation

Most Comparable GAAP Measure

Slide Containing Reconciliations

Adjusted EBITDA, EBITDA

3, 6

Net Income

15 |

Reconciliation Items

15

(1)

Includes accretion expense and asset impairments

(2)

YTD 2011 results include $41.3 million in hedge settlements related to the

company’s Jun-11 hedge restructuring (3)

Includes lease operating expenses, production taxes, general and administrative

expenses, exploration costs, and unit-based compensation program expenses

Reconciliation of Net Income (Loss)

to Adjusted EBITDA ($ in 000s)

YTD

2012

Q412

Q312

Q212

Q112

YTD

2011

Q411

Net income (loss)

$(86,543)

$(76,255)

$(11,163)

$(5,010)

$5,885

$19,586

$15,127

Interest (income) expense, net

5,733

1,143

1,534

1,437

1,619

10,116

1,186

DD&A

(1)

95,016

81,148

4,604

4,550

4,714

25,981

5,745

EBITDA

$14,206

$6,036

$(5,025)

$977

$12,218

$55,683

$22,058

(Gain) loss on sale of assets

7

7

--

(4)

4

19

(10)

Exploration costs

--

--

--

--

--

131

--

Unit-based compensation programs

1,526

339

506

394

287

1,341

317

(Gain) loss from mark-

to-market activities

(2)

8,706

253

10,158

4,897

(6,602)

39,422

(8,524)

Adjusted EBITDA

$24,445

$6,635

$5,639

$6,264

$5,907

$96,596

$13,841

Operating Expense

to Operating Cost ($/Mcfe)

YTD

2012

Q412

Q312

Q212

Q112

YTD

2011

Q411

Operating expenses

(3)

$3.49

$3.49

$3.60

$3.37

$3.49

$3.48

$3.36

Less:

Exploration costs

--

--

--

--

--

0.01

--

Less:

Unit-based compensation

incl. in operating expense

$0.12

0.11

0.16

0.13

0.09

0.10

0.10

Operating cost

$3.37

$3.38

$3.44

$3.24

$3.40

$3.37

$3.26 |