Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Education Realty Trust, Inc. | edr-form8xkforinvestorpres.htm |

Ole Miss Development Capital Markets Update February 2013 The District on 5th at the University of Arizona

• EdR is Second-Largest Company in Industry − 43 wholly owned communities with 25,000 beds − 24 managed communities with over 12,000 beds (1) − 11 active development projects: 2013 deliveries - $190 million (2) 2014 deliveries - $198 million (2) • Excellent Capital Structure • Creating Value through Growth Opportunities − ONE PlanSM on-campus developments − ONE PlanSM on-campus developments at the University of Kentucky − Off-campus developments − Extensive pipeline for acquisitions − Growth in net operating income from existing portfolio − Third-party development and management services • Robust Environment for Industry Growth • 2012 Core FFO per share/unit of $0.47 − 9% increase over 2011 • 2013 Core FFO per share/unit Guidance of $0.53 to $0.57 − 17% increase over 2012 at the mid-point Irish Row, Notre Dame A Leader in Collegiate Housing 1 (1) Includes 1 joint venture community also managed by the Company. (2) Project development costs represent the Company’s portion of the project costs for joint ventures and includes only company-owned projects. GrandMarc at Westberry Place, Texas Christian University

Reasonable Near-term Supply of New Product • Decreased state appropriations limit ability for many universities to update their aging and obsolete on-campus housing • On-campus housing capacity as a percentage of undergraduate enrollment decreased Demand for Collegiate Housing • Increasing Enrollment – estimated at 1% annually through 2019 (1) − Echo Boom generation − Increasing percentage of high school graduates choosing to attend college − College students are taking longer to graduate − Surging student population stress on-campus housing capabilities of universities (2) • Tight state and college budgets drive need for public private partnerships to replace, fund and own on-campus housing 2 Supply/Demand Dynamics Support Net Operating Income Growth (1) National Center for Education Statistics report titled “The Condition of Education 2011.” (2) National Multi Housing Council White Paper, May 2012 Strong Industry Environment

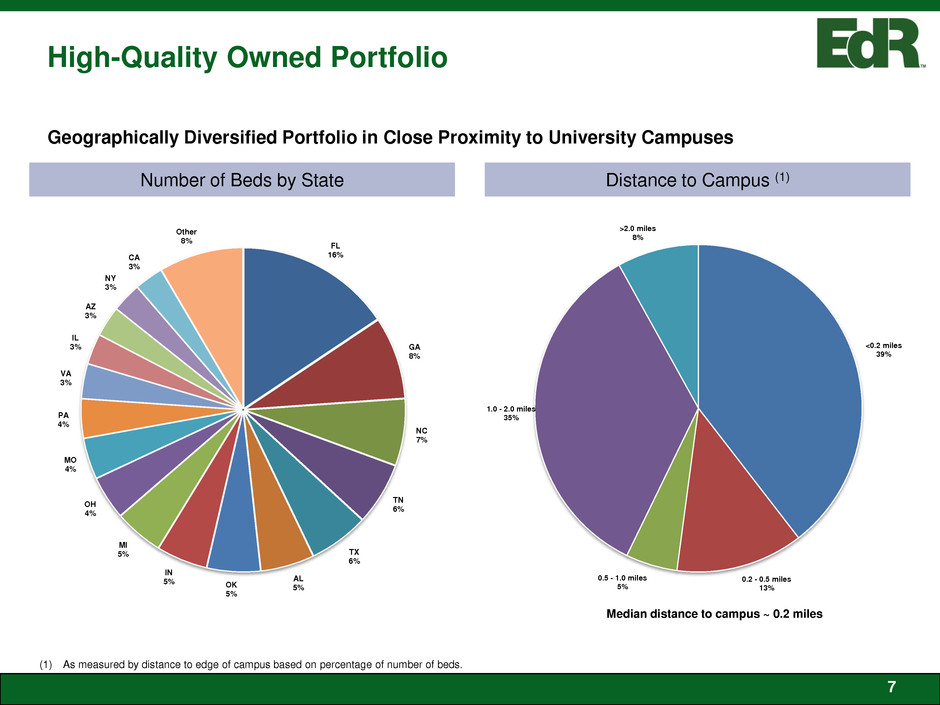

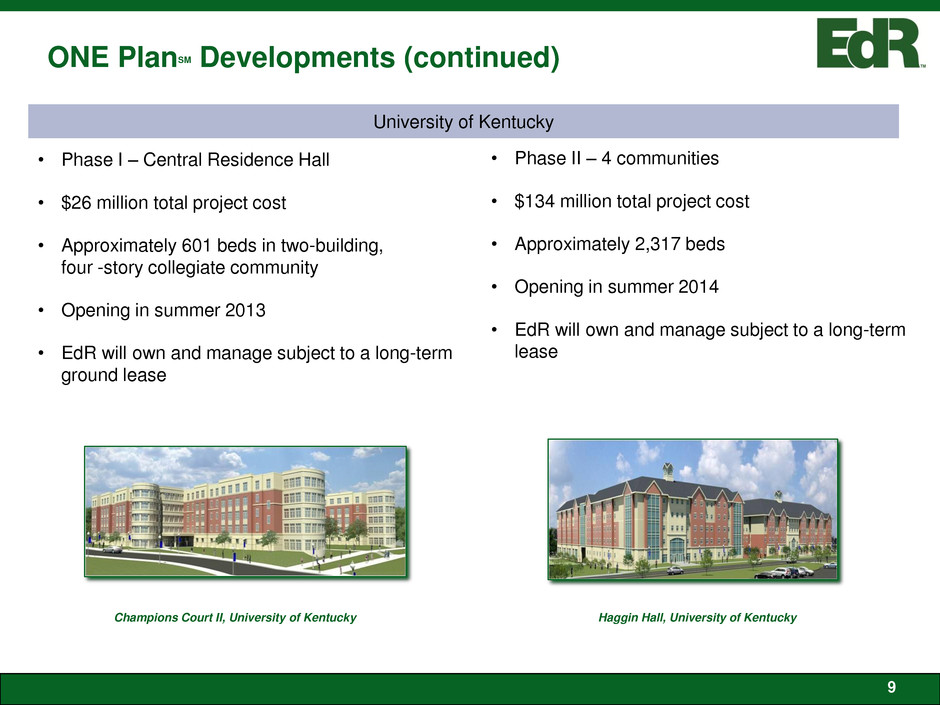

Investment Strategy 1. High-Quality Owned Portfolio • Over the last three years, purchased $500 million of assets, developed $91 million of owned assets and sold $195 million of assets. Improved portfolio metrics include: • Median distance to campus - 0.2 miles • Average distance to campus – 0.6 miles • Average rental rate – $571 • Average enrollment of university served – 26,318 • 11 active owned-developments with aggregate development costs of $388 million (1) on or adjacent to the University of Connecticut, Arizona State University – Phoenix, University of Colorado, University of Kentucky, University of Texas at Austin, University of Mississippi, and the University of Minnesota • Multi-phase project with University of Kentucky to revitalize its on-campus housing. − Replaces 6,000 existing beds and expands such to 9,000 beds over the next 5 to 7 years − Total estimated cost of approximately $550 million − EdR will own and manage the new communities under its ONE PlanSM − Nearly 3,000 beds currently under development (Phase I with 601 beds to open Summer 2013; Phase II including 4 communities with 2,317 beds to open Summer 2014) 3 (1) Project development costs represent the Company’s portion of the project costs for joint ventures and includes only company-owned projects.

Investment Strategy (continued) 2. Competitive Advantage – On Campus Owned Developments • Limited competition: • 50 years experience developing and managing on campus • Syracuse, University of Texas and Kentucky owned assets • Public Company Transparency • Size • Low Debt Metrics 3. Other Competitive Advantages • Access to construction financing with low costs • Low cost of capital • Proprietary Leasing/Marketing System (“PILOT”) 4

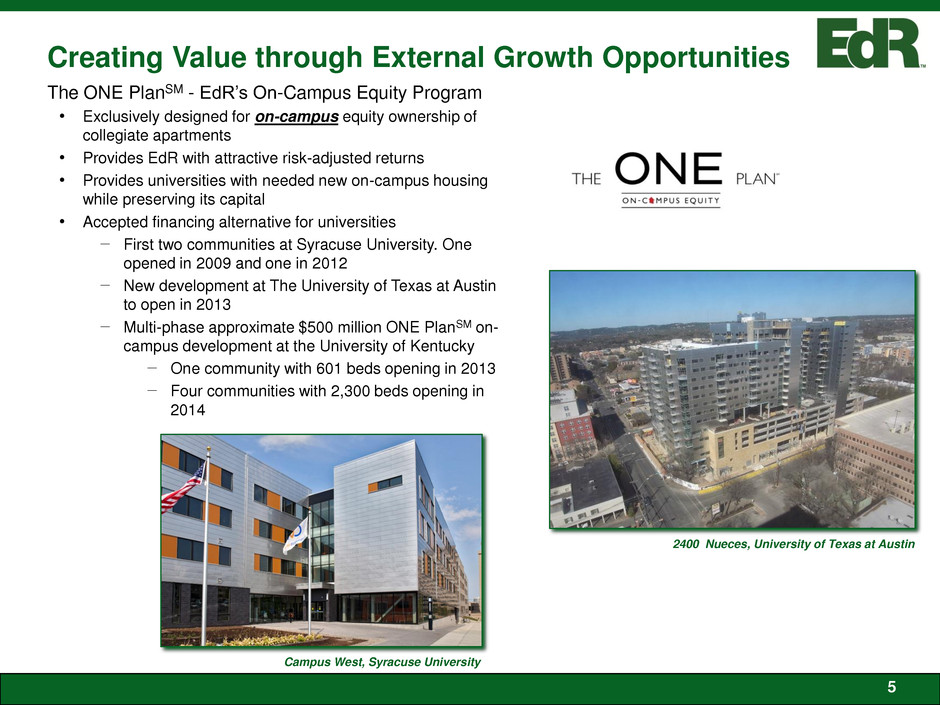

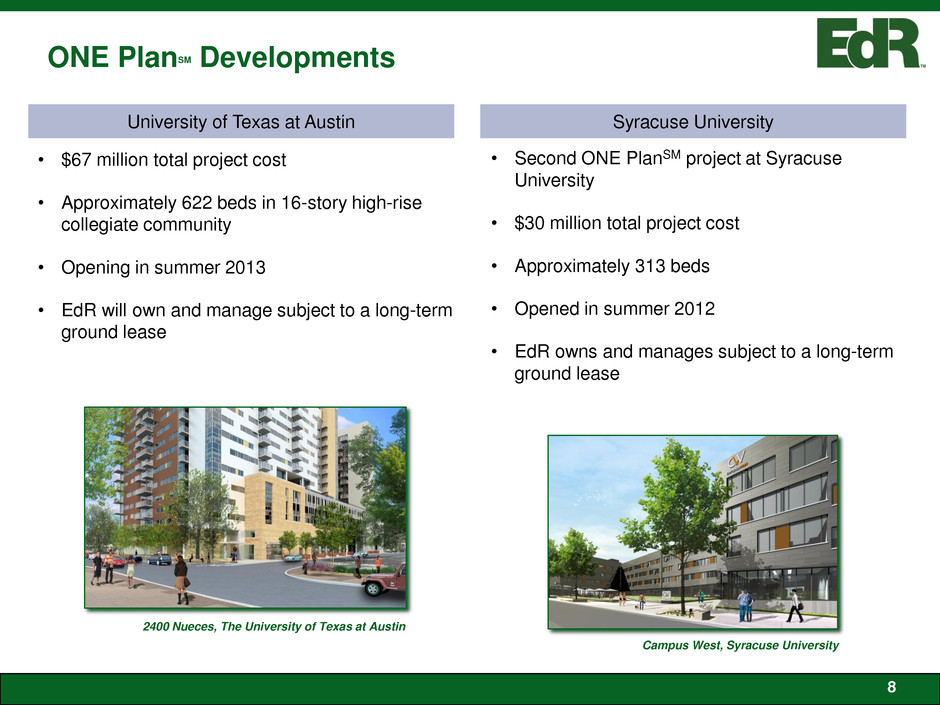

Creating Value through External Growth Opportunities Campus West, Syracuse University 5 The ONE PlanSM - EdR’s On-Campus Equity Program • Exclusively designed for on-campus equity ownership of collegiate apartments • Provides EdR with attractive risk-adjusted returns • Provides universities with needed new on-campus housing while preserving its capital • Accepted financing alternative for universities − First two communities at Syracuse University. One opened in 2009 and one in 2012 − New development at The University of Texas at Austin to open in 2013 − Multi-phase approximate $500 million ONE PlanSM on- campus development at the University of Kentucky − One community with 601 beds opening in 2013 − Four communities with 2,300 beds opening in 2014 2400 Nueces, University of Texas at Austin

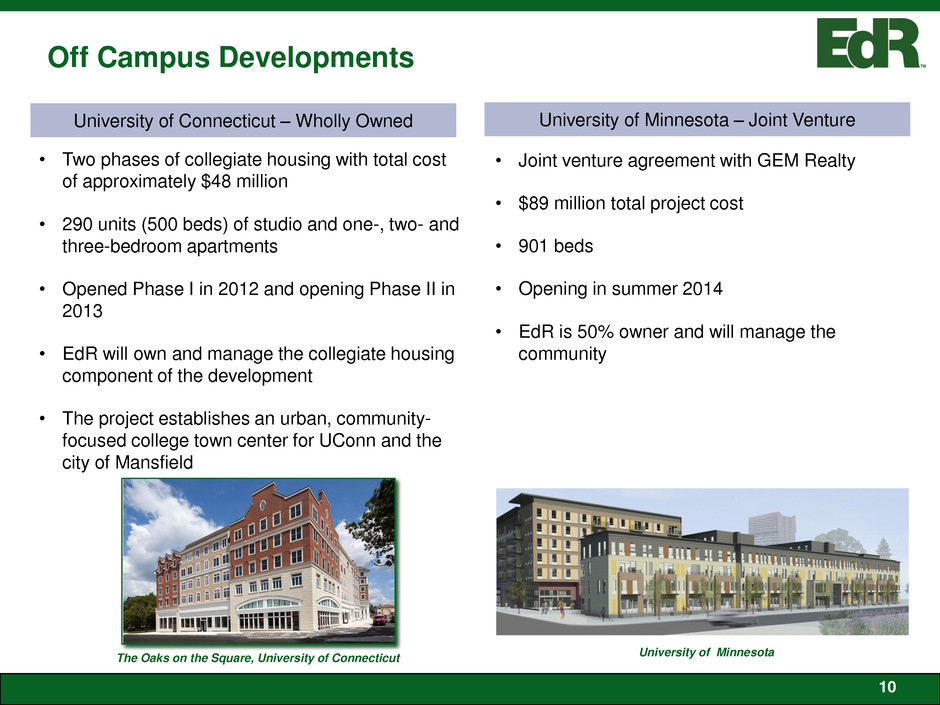

External Growth Opportunities (continued) Off-Campus Developments for Own Account • Sole sourced deals with local developers • Primarily walking distance to campus • Differentiated product for respective markets Potential for Acquisitions • Highly fragmented sector, ownership by small local property owners/operators • Industry contacts and network will provide opportunities • Ability to move quickly versus lesser capitalized buyers • Acquired eight communities in 2011 and seven in 2012 929, Johns Hopkins Medical Center 6

High-Quality Owned Portfolio Geographically Diversified Portfolio in Close Proximity to University Campuses 7 Number of Beds by State Distance to Campus (1) (1) As measured by distance to edge of campus based on percentage of number of beds. Median distance to campus ~ 0.2 miles FL 16% GA 8% NC 7% TN 6% TX 6% AL 5% OK 5% IN 5% MI 5% OH 4% MO 4% PA 4% VA 3% IL 3% AZ 3% NY 3% CA 3% Other 8% <0.2 miles 39% 0.2 - 0.5 miles 13% 0.5 - 1.0 miles 5% 1.0 - 2.0 miles 35% >2.0 miles 8%

• $67 million total project cost • Approximately 622 beds in 16-story high-rise collegiate community • Opening in summer 2013 • EdR will own and manage subject to a long-term ground lease ONE PlanSM Developments 8 University of Texas at Austin Syracuse University • Second ONE PlanSM project at Syracuse University • $30 million total project cost • Approximately 313 beds • Opened in summer 2012 • EdR owns and manages subject to a long-term ground lease 2400 Nueces, The University of Texas at Austin Campus West, Syracuse University

• Phase I – Central Residence Hall • $26 million total project cost • Approximately 601 beds in two-building, four -story collegiate community • Opening in summer 2013 • EdR will own and manage subject to a long-term ground lease ONE PlanSM Developments (continued) 9 University of Kentucky • Phase II – 4 communities • $134 million total project cost • Approximately 2,317 beds • Opening in summer 2014 • EdR will own and manage subject to a long-term lease Champions Court II, University of Kentucky Haggin Hall, University of Kentucky

• Two phases of collegiate housing with total cost of approximately $48 million • 290 units (500 beds) of studio and one-, two- and three-bedroom apartments • Opened Phase I in 2012 and opening Phase II in 2013 • EdR will own and manage the collegiate housing component of the development • The project establishes an urban, community- focused college town center for UConn and the city of Mansfield Off Campus Developments The Oaks on the Square, University of Connecticut 10 University of Connecticut – Wholly Owned University of Minnesota – Joint Venture • Joint venture agreement with GEM Realty • $89 million total project cost • 901 beds • Opening in summer 2014 • EdR is 50% owner and will manage the community University of Minnesota

Off Campus Developments 11 University of Mississippi – Joint Venture Arizona State University-Phoenix – Joint Venture • Joint-venture agreement with Concord Eastridge • $52 million total project cost • 609 beds • Opening in summer 2013 • EdR is 91.4% owner and will manage the property • Joint-venture agreement with Landmark • $37 million total project cost • 668 beds • Opening in summer 2013 • EdR is 70% owner and will manage the property The Retreat , University of Mississippi Roosevelt Point, Arizona State University - Phoenix

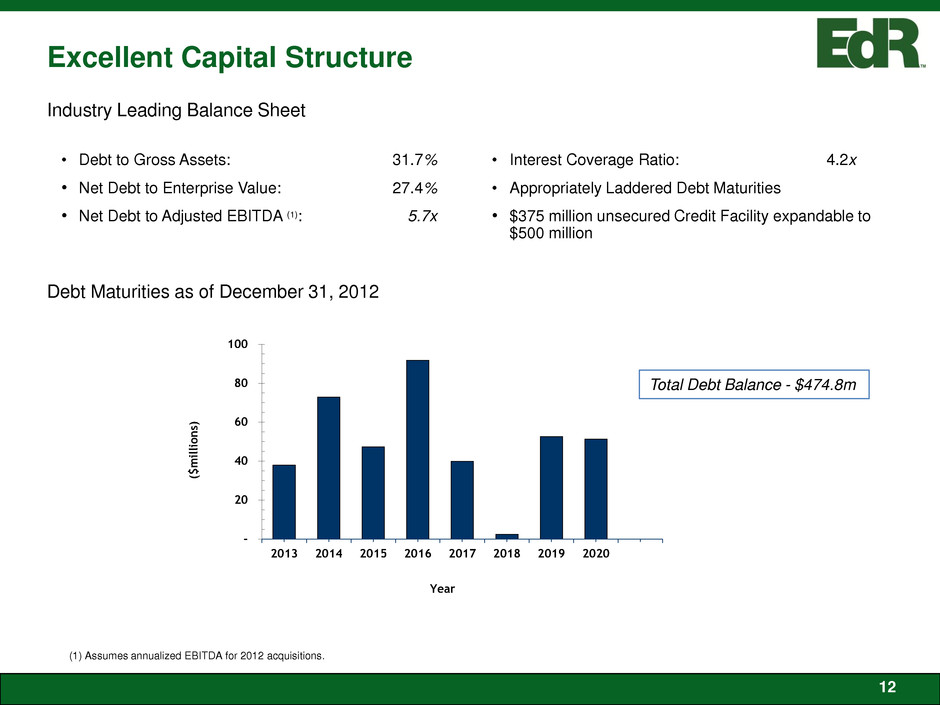

Excellent Capital Structure • Debt to Gross Assets: 31.7% • Net Debt to Enterprise Value: 27.4% • Net Debt to Adjusted EBITDA (1): 5.7x Industry Leading Balance Sheet Debt Maturities as of December 31, 2012 12 • Interest Coverage Ratio: 4.2x • Appropriately Laddered Debt Maturities • $375 million unsecured Credit Facility expandable to $500 million Total Debt Balance - $474.8m (1) Assumes annualized EBITDA for 2012 acquisitions. - 20 40 60 80 100 2013 2014 2015 2016 2017 2018 2019 2020 ($ m il li o n s) Year

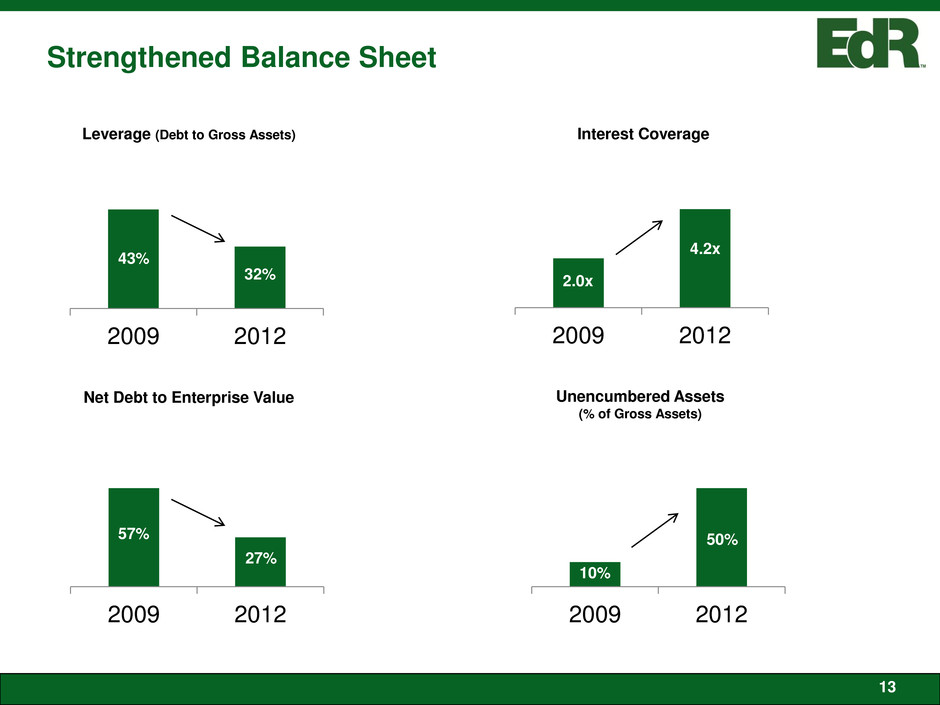

Strengthened Balance Sheet 13 Leverage (Debt to Gross Assets) Interest Coverage Net Debt to Enterprise Value Unencumbered Assets (% of Gross Assets) 2009 2012 2009 2012 2009 2012 2009 2012 43% 32% 57% 27% 2.0x 4.2x 10% 50%

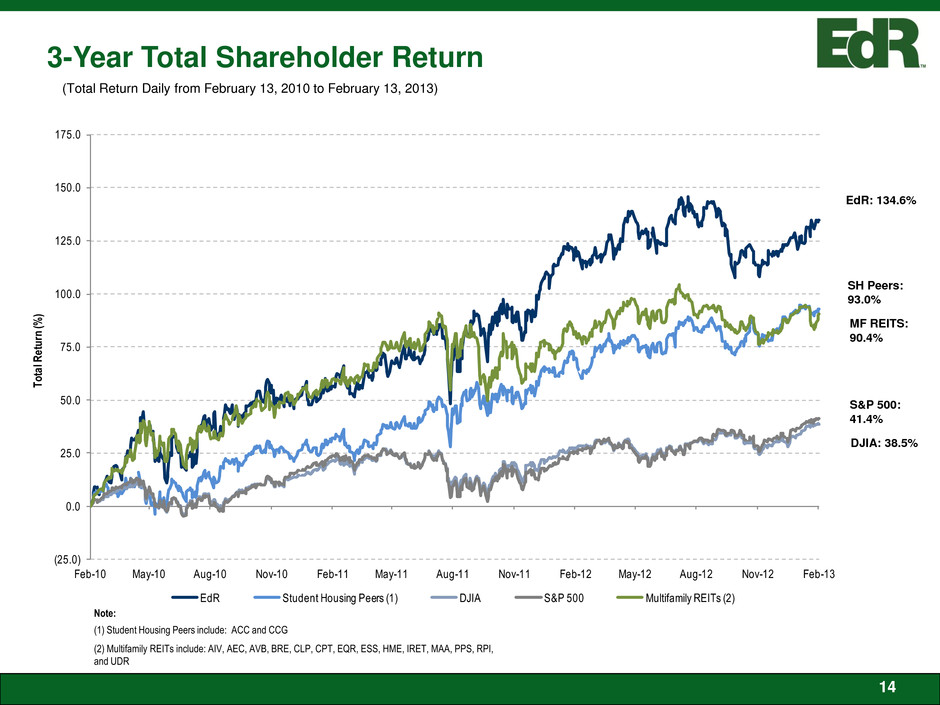

3-Year Total Shareholder Return 14 (25.0) 0.0 25.0 50.0 75.0 100.0 125.0 150.0 175.0 Feb-10 May-10 Aug-10 Nov-10 Feb-11 May-11 Aug-11 Nov-11 Feb-12 May-12 Aug-12 Nov-12 Feb-13 To tal Re tur n ( %) EdR Student Housing Peers (1) DJIA S&P 500 Multifamily REITs (2) EdR: 134.6% SH Peers: 93.0% MF REITS: 90.4% S&P 500: 41.4% DJIA: 38.5% Note: (1) Student Housing Peers include: ACC and CCG (2) Multifamily REITs include: AIV, AEC, AVB, BRE, CLP, CPT, EQR, ESS, HME, IRET, MAA, PPS, RPI, and UDR (Total Return Daily from February 13, 2010 to February 13, 2013)

• High-Quality Portfolio • Favorable Supply and Demand Trends • External Growth Opportunities − ONE PlanSM on-campus development − ONE PlanSM on-campus developments at the University of Kentucky − Off-campus developments − Potential for acquisitions • Internal Growth Opportunities − Continue to improve performance of current portfolio − Capital recycling program • Solid Capital Structure/Meaningful Capacity for Growth Investment Highlights The Province, East Carolina University Campus Village, Michigan State University 15