Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VISTEON CORP | d467912d8k.htm |

Delivering Value

Deutsche Bank Global Auto Industry Conference

January 15, 2013

Exhibit 99.1

Halla Visteon Climate Control

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses |

Page 2

This

presentation

contains

"forward-looking

statements"

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995. Forward-looking statements are not guarantees of future results and

conditions but rather are subject to various factors, risks and

uncertainties that could cause our actual results to differ materially from those expressed in these forward-

looking statements, including, but not limited to,

Caution should be taken not to place undue reliance on our forward-looking

statements, which represent our view only as of the

date

of

this

presentation,

and

which

we

assume

no

obligation

to

update.

our ability to satisfy future capital and liquidity requirements; including our

ability to access the credit and capital markets at the times and in the

amounts needed and on terms acceptable to us; our ability to comply with financial

and other covenants in our credit agreements; and the continuation of acceptable

supplier payment terms; our ability to satisfy pension and other

post-employment benefit obligations; our ability to access funds

generated by foreign subsidiaries and joint ventures on a timely and cost-effective basis;

our ability to execute on our transformational plans and cost-reduction

initiatives in the amounts and on the timing contemplated;

conditions within the automotive industry, including (i) the automotive vehicle

production volumes and schedules of our customers, (ii) the financial

condition of our customers or suppliers and the effects of any restructuring or

reorganization plans that may be undertaken by our customers or suppliers or work

stoppages at our customers or suppliers, and (iii) possible disruptions in

the supply of commodities to us or our customers due to financial distress,

work stoppages, natural disasters or civil unrest;

new business wins and re-wins do not represent firm orders or firm commitments

from customers, but are based on various assumptions, including the timing

and duration of product launches, vehicle production levels, customer price

reductions and currency exchange rates;

general

economic

conditions,

including

changes

in

interest

rates

and

fuel

prices;

the

timing

and

expenses

related

to

internal restructurings, employee reductions, acquisitions or dispositions and the

effect of pension and other post- employment benefit obligations;

increases in raw material and energy costs and our ability to offset or recover

these costs, increases in our warranty, product liability and recall costs

or the outcome of legal or regulatory proceedings to which we are or may become a

party; and

those factors identified in our filings with the SEC (including our Annual Report

on Form 10-K for the fiscal year ended December 31, 2011).

Forward-Looking Information |

Page 3

Because not all companies use identical calculations, Adjusted EBITDA, Adjusted EPS

and Free Cash Flow used throughout this presentation may not be comparable

to other similarly titled measures of other companies.

In order to provide the forward-looking non-GAAP financial measures for

full-year 2012 and 2013, the Company is providing reconciliations to the

most directly comparable GAAP financial measures in the Appendix of this

presentation. The provision of these comparable GAAP financial

measures is not intended to indicate that the Company is explicitly or

implicitly providing projections on those GAAP financial measures, and actual

results for such measures are likely to vary from those presented. The

reconciliations include all information reasonably available to the Company

at the date of this presentation and the adjustments that management can

reasonably predict. Use of Non-GAAP Financial Information

|

Page 4

Today We Will …

Present Visteon at a glance

Review 2012 key accomplishments

Provide update on Halla Visteon Climate Control (HVCC)

transaction progress

Offer additional Yanfeng Visteon insight

Discuss 2012 performance

Announce 2013 full-year guidance |

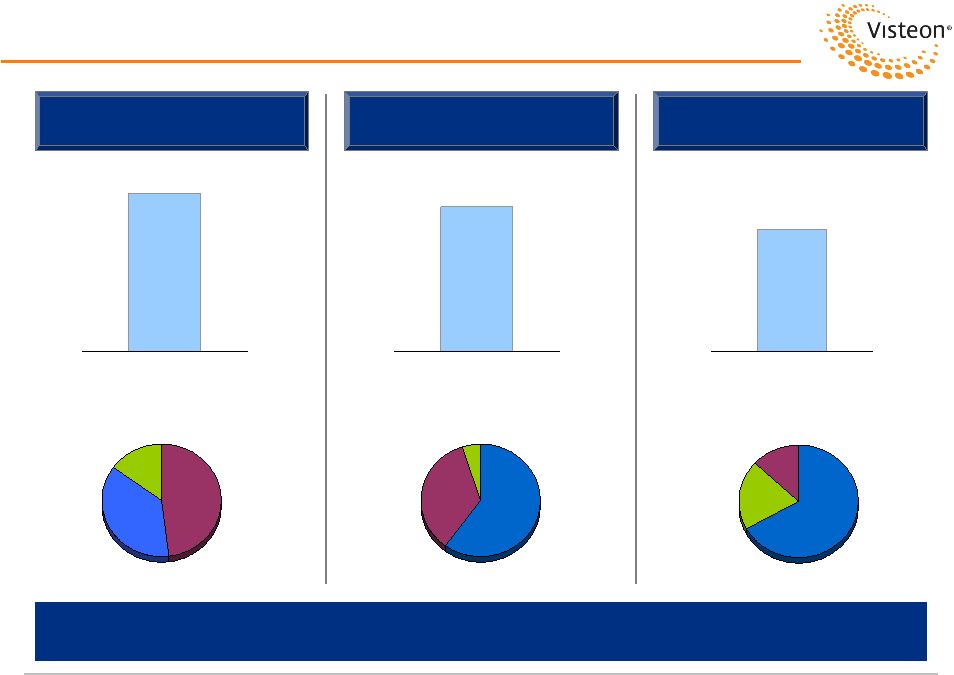

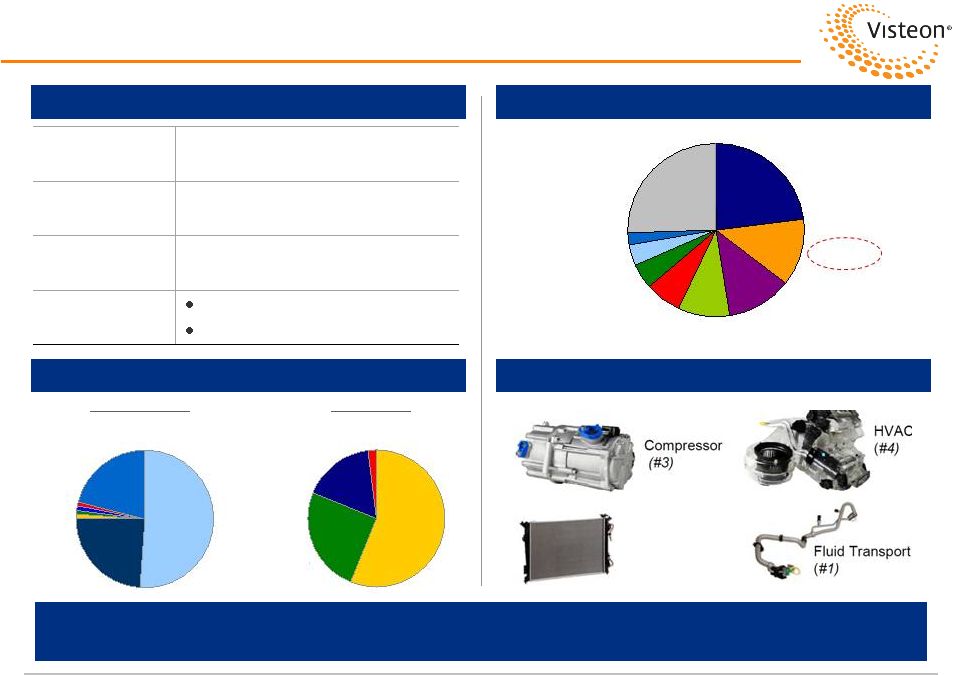

Overview

Key Businesses

Global auto supplier of

climate, electronics and

interiors products

Worldwide manufacturing /

engineering footprint with

emphasis on low-cost regions

172 facilities in 28 countries

including non-consolidated

joint ventures

(1)

Strategically positioned to

capitalize on emerging-

market growth

2012 estimated sales:

$6.8 billion consolidated

$15.4 billion including JVs

(1)

$4.3 Billion

Climate

HVAC Systems

Powertrain Cooling

EV & Hybrid Battery Cooling

Compressors

Fluid Transport

Interiors

Cockpit Modules

Instrument Panels

Consoles

Door Trim

Electronics

Audio and Infotainment

Information and Controls

Vehicle Electronics

Visteon in Summary

$1.2 Billion

$1.4 Billion

2012E Sales

Page 5

Yanfeng Visteon

Interiors

Electronics

Seating

Exteriors

Safety

$7.1 Billion

Non-Consolidated

(1) Includes all non-consolidated joint ventures. For Yanfeng Visteon

sales, includes full year of Yanfeng seating sales as well as full year of Yanfeng Exterior and Safety sales. |

2012

Achievements Announced and implemented strategic plan to create value for

stakeholders Initiated $100 million restructuring program to further reduce

fixed-cost structure, right-size operations and address

underperforming assets Completed several value-creating strategic and

financial actions Closed

Cadiz

plant

in

Spain

Sold Grace Lake Corporate Center

Divested Lighting operations

Sold R-TEK Interiors joint venture

Announced transaction to combine Visteon Climate w/ Halla

Concluded lump-sum pension buyout offer, used $301 million

in pension assets to reduce PBO by $411 million

Redeemed $50 million of bonds

Repurchased $50 million of stock

Visteon Continues to Lay the Groundwork for Shareholder Value Enhancement

Page 6

February

April

August

August

September

December

December

November |

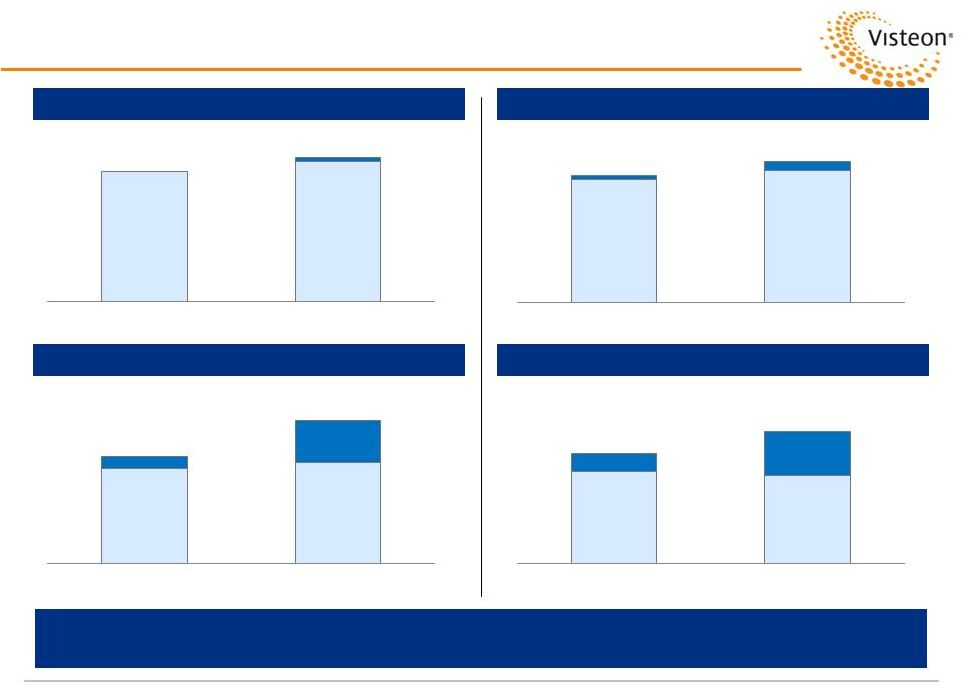

Page 7

2012 New Business Wins

(Dollars in Millions)

$450

2012

($210)

2012

$750

2012

During

2012,

Visteon

was

Awarded

Approximately

$1

Billion

of

Net

New

Business,

Which Will Launch During the Next Five Years

Incremental New

Business Wins

Re-Wins

Lost Business

Climate

60%

Interiors

5%

Electronics

35%

Climate

67%

Electronics

13%

Interiors

20%

Electronics

48%

Interiors

15%

Climate

37% |

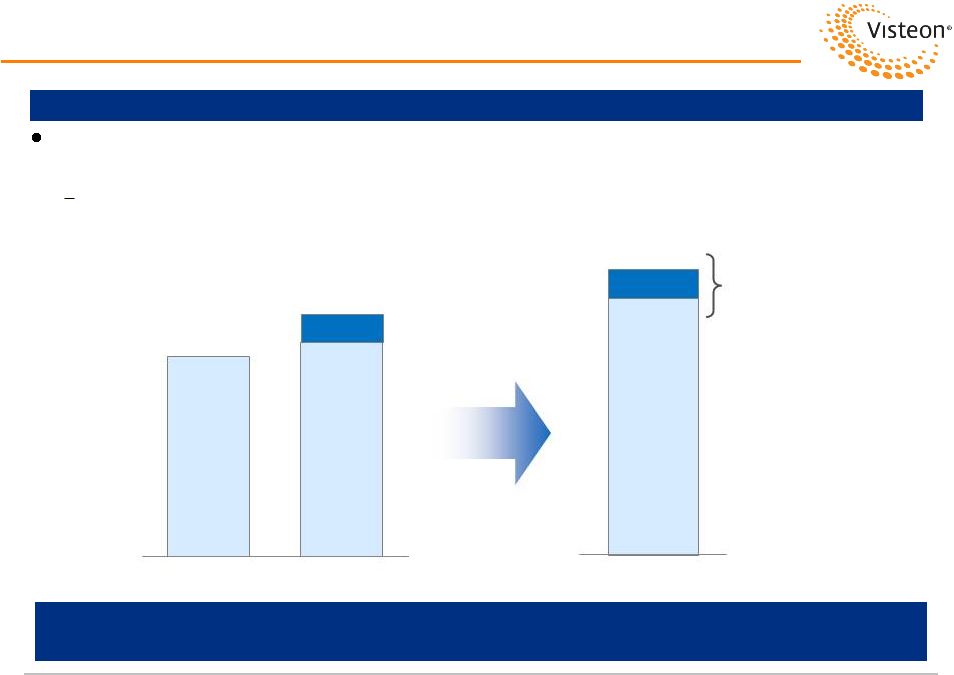

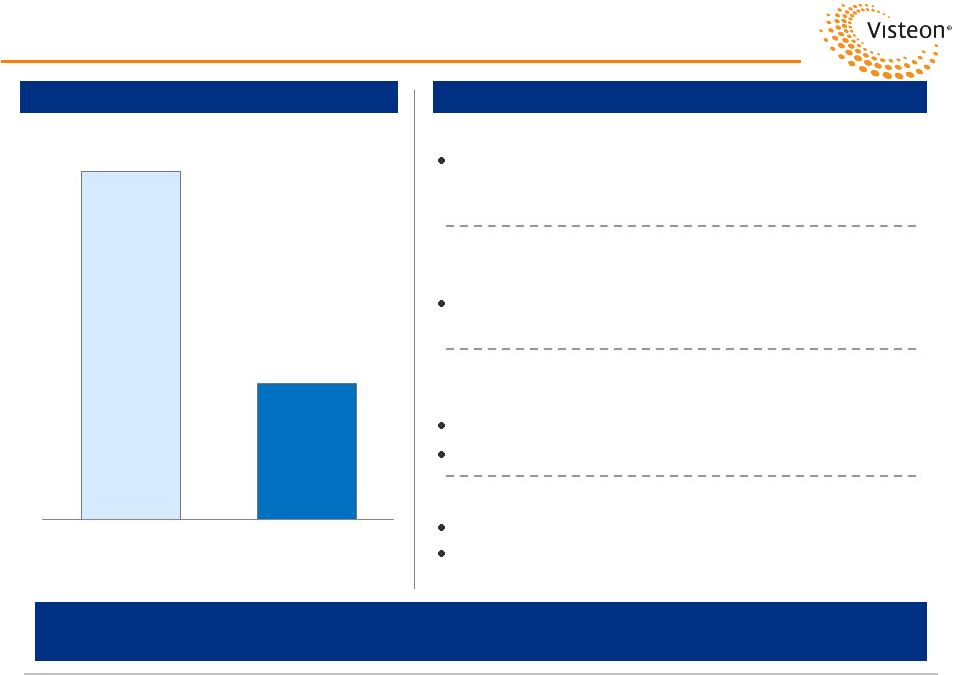

Backlog Fuels Visteon Future Growth

Visteon’s $800 Million Net Backlog Will Launch During the Next Three

Years and is Forecasted to Drive Sales Growth to $8.2 Billion by 2015

Page 8

$6.8B

$7.4B

$8.2B

Base

Including

Volume,

Currency,

Pricing

Net Backlog

Visteon Sales and Net Backlog

Addt’l Net

Backlog

Net backlog:

incremental new business net of lost business that will launch

during the next three years

Base

Including

Volume,

Currency,

Pricing

$0.8B

Total Net

Backlog

2015E Sales

2012E Sales

2013E Sales

0.4

0.4

Incremental new business includes 2012 wins as well as wins recognized in previous

years |

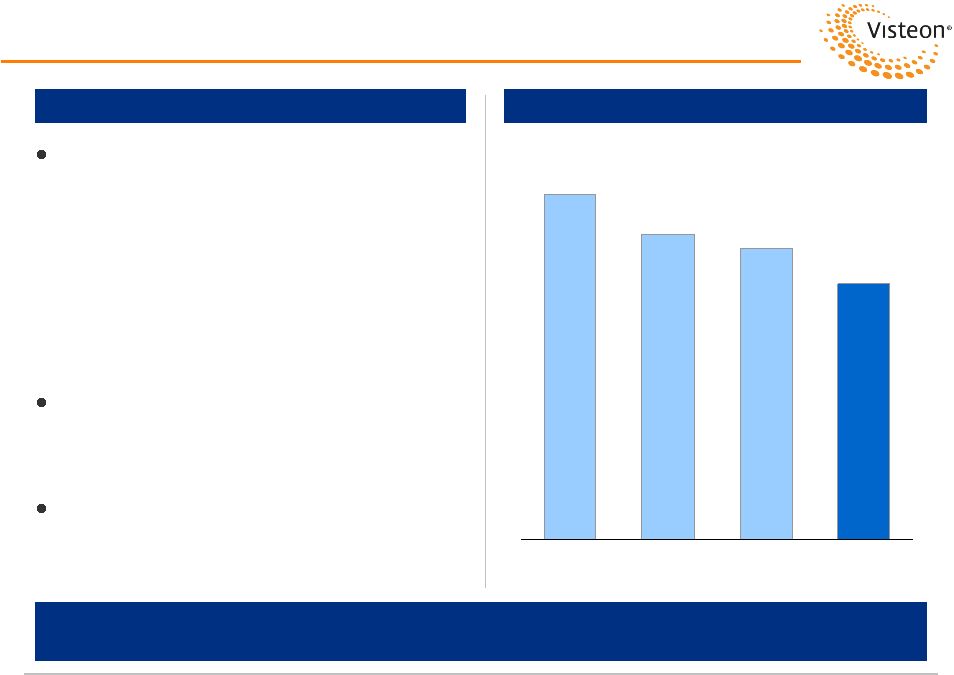

Fixed-Cost and SG&A Actions –

An Update

Initiative Underway to Reduce 2013 Fixed Costs and SG&A Expense to $410

Million Page 9

Visteon announced during its third

quarter 2012 earnings call a focused

plan to further reduce SG&A and other

fixed costs

–

“Other fixed costs”

include

information technology costs and

other costs of goods sold supporting

engineering staff

Achieved savings in 2012 and expect

an additional $20 million in efficiencies,

net of unfavorable currency in 2013

Savings will drive year-over-year SG&A

improvement in 2013 and 2014

$485

$430

$410

2011

2012E

2013E

Goal

(Dollars in Millions)

Fixed-Cost and SG&A Reduction Plan

Fixed-Costs and SG&A Spend

(1)

$340-$380

(1) Adjusted to exclude Lighting. |

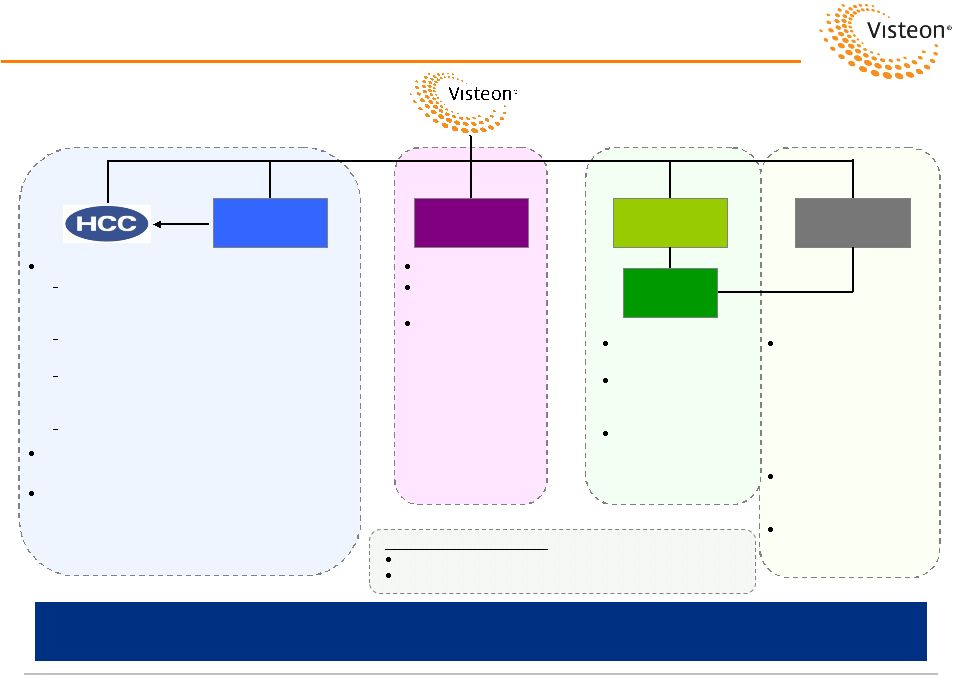

Page 10

Visteon’s Strategic Plan –

The Value of Optionality

Visteon

Climate

Yanfeng

Visteon

70%

100%

50%

100%

100%

Visteon

Interiors

Visteon

Electronics

Contribute Visteon Climate to HCC for cash

Establishes “Halla Visteon Climate Control”

(HVCC) as single consolidated climate entity

with leadership of all global climate operations

Consolidation of these two operations into one

has been a major customer request

Headquartered in Korea with global customer

presence and Korean leadership supported by

international management team

Visteon remains equity holder (70%) in HVCC

Transfer limited SG&A and operating resources to

make business globally self-capable

Target transaction completion during Q1 2013

Remains non-core

Continue to pursue

options

Interiors will be

exited at a time

when value

objectives are met

#5 global market

position

Significant integration

and technology

synergies with YFVE

Focused on

optimizing global

scale and ownership

YFV

Electronics

60%

40%

YFV and affiliated

Yanfeng Visteon

Electronics represent a

dynamic marriage of

global presence with

Asian-centric power,

low-cost operations and

technological prowess

Core YFV business is

Interiors, which is non-

core to Visteon

Uncover value for

Visteon shareholders

Comprehensive Plan to Create Value for Customers and Shareholders

Corporate Right-sizing

Minimal footprint

Staff

businesses

with

lean

and

only

“necessary”

support |

Halla Visteon Climate Control

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses

Halla Visteon Climate Control (HVCC)

A Value-Creating Joint Venture

Deutsche Bank Global Auto Industry Conference

January 15, 2013 |

Page 12

HVCC Transaction Update

Pro forma entity name changed to “Halla Visteon Climate Control”

Visteon to contribute majority of Visteon Climate business to Halla for cash

(small portion of business retained by Visteon)

Definitive agreement signed on January 11, 2013

$410 million gross proceeds to Visteon, financed by conservative

mix of

cash and debt at Halla

Estimated $353 million proceeds after purchase price adjustments

(i.e.

pension, debt, cash), taxes and fees

Accretive to Halla shareholders on EPS and EBITDA multiple basis

Diligence, negotiations and signing completed in less than 100 days after

announcement

Closing on track to be completed during first quarter 2013

Transition / integration work progressing

Proceeding as Expected |

A

Valuable Organization Expected HVCC Financial Profile

Page 13

Overview

2012E

Climate

Global

Market

Share

(2)

Hyundai /

Kia

51%

Chrysler 1%

Suzuki 1%

VW 1%

Mazda1%

2012E

Sales

(1)

$4.1 Billion

2012E EBITDA

Margin

(1)

9.0%

Headcount

13,350

Mfg Facilities

Consolidated

26

Unconsolidated

6

By Customer

By Region

2012E Sales Breakdown

Key

Products

and

Market

Positions

(2)

HVCC

13%

Denso

23%

Valeo

12%

Delphi

7%

Behr

10%

Calsonic 5%

Other

24%

Modine 2%

Sanden 4%

Powertrain and EV /

Hybrid Cooling

(#4)

AP

56%

EU

25%

NA

17%

SA

2%

Other

21%

Ford

24%

(1)

HVCC represents total Climate segment estimated results minus those Climate operations that will be

retained. EBITDA margin excludes equity income and non-controlling interests. (2)

IHS unconsolidated unit share.

|

Page 14

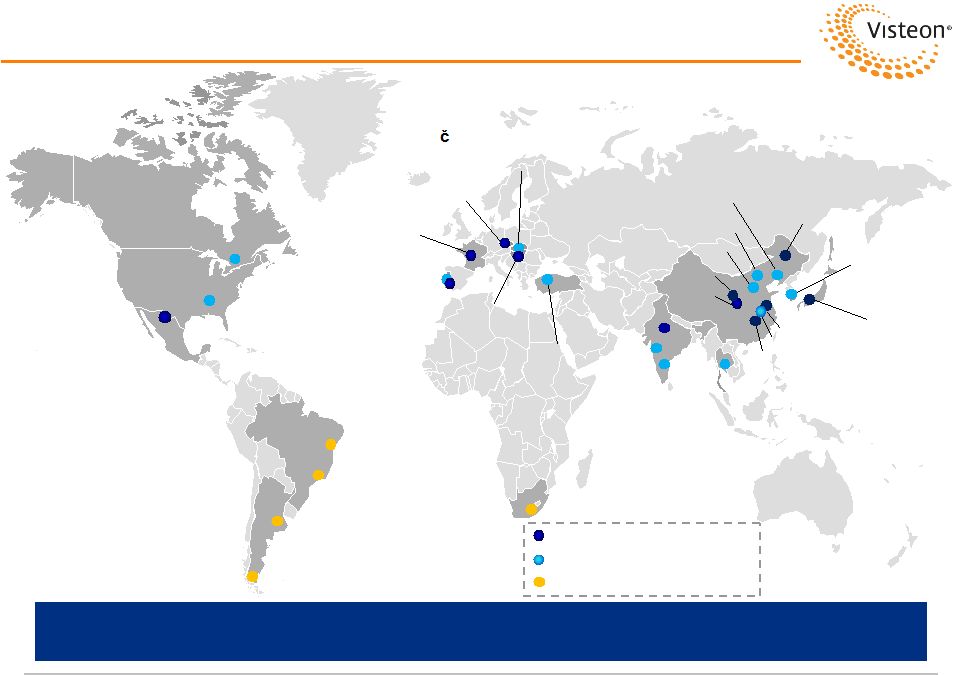

The HVCC Manufacturing Footprint

Visteon in HVCC Perimeter

Halla

Visteon Transition Facilities

Low-Cost, Global Manufacturing Footprint Focused in Asia –

32 Manufacturing Sites Globally, Including Affiliates

Juarez (3 Plants)

MEXICO

São Paulo

BRAZIL

Quilmes

ARGENTINA

Belleville

CANADA

Shorter, AL

USA

Port Elizabeth

SOUTH AFRICA

Palmela (2)

PORTUGAL

Charleville

FRANCE

Nový

Ji

in,

Hluk,

Rychvald

CZECH REP

Szekesfehervar

HUNGARY

Ilava

SLOVAKIA

Gebze

TURKEY

Chennai

Bhiwadi

INDIA

Pune

Hiroshima,

Hofu

JAPAN

Rayong

THAILAND

Daejeon,

Pyeongtaek,

Ulsan

S. KOREA

Dalian

CHINA

Chongqing

Beijing

Wuhu

Changchun

Nanjing

Jinan

Chengdu

Nanchang

Rio Grande

Camaçari |

Offer Full Range of Climate Products

Compressors

Powertrain

Cooling

EV &

Hybrid

Battery

Cooling

Fluid

Transport

HVAC

Page 15 |

Key

Technologies Drive Strong Order Book and Awards Page 16

Strong Backlog Drives Sales

Recognized by Our Customers and Industry Experts

HVCC 3-year backlog of $700

million

–

Represents new business,

net of lost business

Strong backlog, higher

volumes and currency

impacts drive 7% forecasted

sales CAGR through 2015

2013E

2014E

2015E

3-Year Backlog

$700 Million |

Page 17

HVCC Positioned to Fuel Growth

Clear #2 global Climate player, with 13% market share

Customer-focused solutions provider with worldwide presence

Leading product and technology portfolio

One of only two “full-line”

suppliers

Low-cost, Asian-centric manufacturing footprint

Strong balance sheet and cash flow profile

$700 million three-year backlog

Gaining share in growing markets

A World-Class Climate Organization |

Halla Visteon Climate Control

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses

Growth in China and Abroad

Deutsche Bank Global Auto Industry Conference

January 15, 2013 |

Page 19

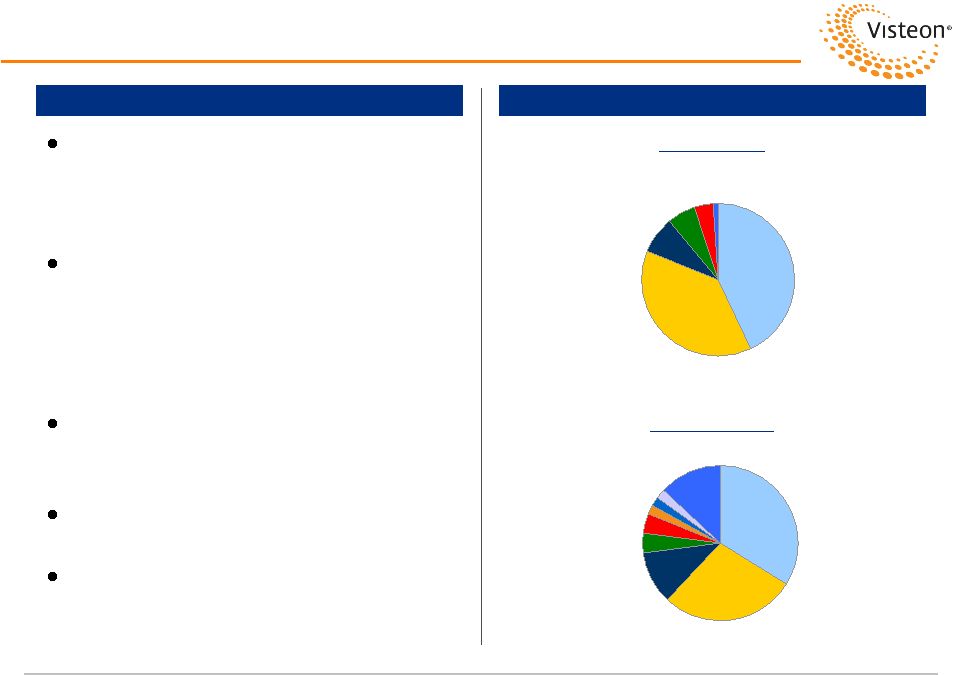

Yanfeng Visteon (YFV) Today

50% / 50% joint venture between

Visteon / HASCO (SAIC)

in China,

established in 1994

One of the largest auto suppliers in

China

with five primary businesses

–

Interiors, electronics, seating,

exteriors and safety

SVW, SGM and SAIC represent

about 65% of sales; export 11%

96 facilities and 29,000 employees

2012E total revenues of $7.1 billion

By Customer

SVW

34%

SGM 28%

SAIC 4%

Export

11%

Other 13%

CAFM 4%

JAC 2%

DF Nissan 2%

DPCA 2%

By Product

Overview

2011 Sales Breakdown

Interiors

43%

Seating

38%

Electronics

8%

Exterior

6%

Safety

4%

Tooling

1% |

Page 20

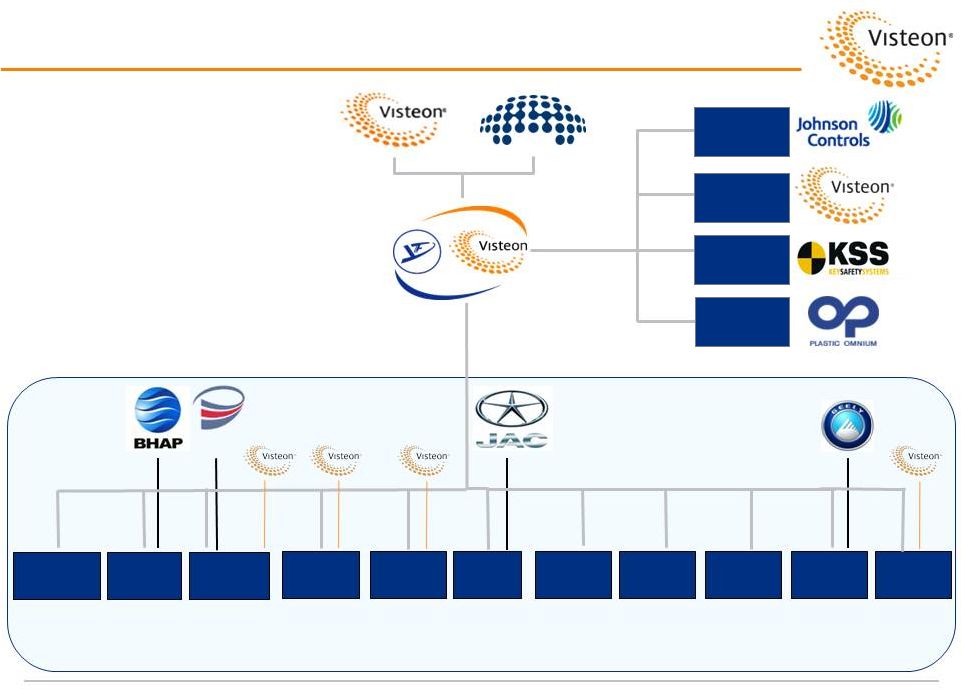

YFV Structure

•

50% / 50% JV between

Visteon and HASCO (SAIC)

YFV

Beijing

2002

YFV

Tooling

2006

Dongfeng

Visteon

2003

YFV

Jinqiao

2004

60%

YFV

Electronics

2002

50%

2004

YF Key

Safety

50%

YFPO

Exterior

2007

YFV

Hefei

2007

YFV

Jiqiang

2008

YFV

Nanjing

2010

YFV

NJ FEM

2010

YFV

Zhejiang

2011

50%

YFJCI

Seating

1997

•

Technology JVs with

international partners

YFV

Chongqing

2001

•

Interior subsidiaries and

JVs with OEMs to expand

outside of Shanghai

YFV

India

2011

DETC

75%

50%

40%

75%

80%

51%

80%

80%

60%

99%

50%

20%

12.5%

25%

50%

50%

50%

Interiors Operations |

Page 21

Five YFV Businesses: Strong Technical Capabilities

Cockpit

Instrument panels

Door panels

Console

Interior System

Driver

information

Entertainment

Controls

Seats

Trim covers

Mechanisms

Foam pads

Seating System

Bumpers

Body trim

Rear closures

Fenders

Exterior System

Steering wheels

Air bags

Seat belts

Safety System

Full-service

supplier (from styling

to production)

System integration

World-class testing

facilities

Globally integrated

technical centers

Safety testing

Acoustic and NVH

testing

Full design / engin.

capability

Advanced application

software

World-class testing

facilities

Structure design

CAE verification

New tech center

under construction

R&D / product

engineering

Crash simulation

Lifecycle testing

850

Engineers

555

Engineers

500

Engineers

330

Engineers

220

Engineers

Electronic System |

Page 22

YFV’s Global Footprint

Extensive Footprint with 96 Facilities and 29,000 Employees

Note: As of October 2012.

Symbol

Business System

Facilities

Seating

39

Interiors

33

Exteriors

14

Electronics

7

Safety

2

Tooling

1

Total

96

Michigan, USA

Ruesselsheim, Germany

Kalol, India

Beijing

Changchun

Xuzhou

Shaoxing

Wuhan

Shi‘yan

Guangzhou

Yancheng

Liuzhou

Shanghai

Shenyang

Yantai

Yizheng

Wuhu

Hefei

Nanjing

Taizhou

Nantong

Fuzhou

Chongqing

Chengdu

Baotou

Baoding

Dalian

Zhuzhou

Changsha

Zhengzhou

Cixi

Hangzhou

Dongguan |

Page 23

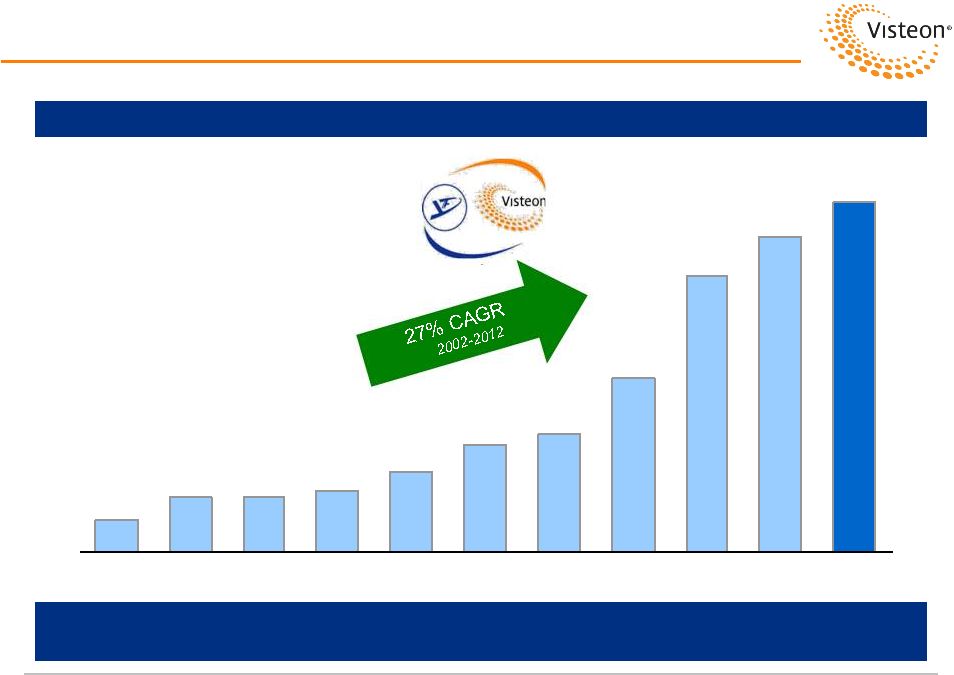

YFV’s Robust Historical Growth

(1) Non-U.S. GAAP figure. Represents People’s Republic of China GAAP

sales. 4.1

6.9

6.9

7.8

10.2

13.7

15.0

22.2

35.5

40.4

44.8

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012E

(RMB in Billions)

YFV Group Total Sales

(1)

27% Sales CAGR Since 2002 |

Page 24

YFV: Well-Positioned in World’s Largest Auto Market

China Passenger Car Sales

Yanfeng Visteon Market Positions in China

(Units in Millions)

11% China Market CAGR

Yanfeng Visteon #1 China Auto Supplier

in Important Segments

Leading Market Positions Will Enable Yanfeng Visteon

to Capitalize on Strong China Market Growth

#1

Seats

Instrument panels

Door panels

Audio

Steering wheels

#2

Bumpers

#3

Clusters

Consoles

Source: IHS Automotive.

13.2

20.1

2012E

2016E |

Page 25

A Solid Outlook

YFV’s 2013 Outlook

Total

Sales

Double-Digit

Growth

Sales expected to increase by $1 billion, driven by:

Double-digit, year-over-year growth in Interiors, Seating, Exterior

and Safety, as well as solid growth for Electronics

Strong domestic sales, partially offset by weakness in exports

Growing SVW, SGM and SAIC sales

EBITDA

Double-Digit

Growth

EBITDA increase reflects:

Higher volumes and launch of significant new business, offset by:

•

Higher engineering costs to support new programs

•

Business mix changes and competitive market pressures

•

Costs related to new plant launches across all businesses

Net

Income

Solid

Growth

Net income reflects strong EBITDA growth, offset by:

Increase in D&A related to spending at several facilities, including 26

new

or

expanded

production

facilities,

that

will

generate

strong

sales

and earnings growth in future years

Increase in interest related to cash needs to fund investments

Higher taxes driven by higher tax rates for certain entities

2013 Outlook |

Page 26

Strategic Initiatives at YFV

Expand domestic footprint to support growth of core customers

Grow customer base with local China OEMs; continued diversification

with select Chinese and Japanese OEMs

Support OEMs’

growth plans in China and abroad via cooperation with

Visteon and other partners

Strengthen technical capability in all business segments; enhance

tooling and equipment as a competitive advantage

Continue focus on development of new employees and YFV culture

Transition to Global Supplier While Strengthening Base Market

|

Halla Visteon Climate Control

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses

Financially Speaking

Deutsche Bank Global Auto Industry Conference

January 15, 2013 |

Page 28

A Strong Capital Structure

9/30/12

6.75% Senior Notes due 2019

$495

Affiliate Debt / Other

100

Total Debt

$595

Cash

920

Net Debt

($325)

Visteon Leverage

Adjusted EBITDA (2012E Guidance Midpoint)

$600

Debt / Adjusted EBITDA

< 1.0x

Net Debt / Adjusted EBITDA

N/M

Visteon Debt and Cash

Visteon Debt Maturity Schedule

No Significant Near-Term Debt Maturities

and Strong Cash Balances and Liquidity

$72

$76

$1

$1

$445

2012

2013

2014

2015

2016+

(Dollars in Millions)

(2)

(1)

(1) Includes Halla debt of $75 million.

(2) Includes Halla cash of $351 million.

Annual

Working

Capital

Facility

Renewals

Includes

$50M Bond

Redemption

in Dec 2012 |

Page 29

2012 Guidance Update

2012

Guidance

Current

Outlook

Commentary

Sales

$6.8 billion

Expect full-year sales to be in line with guidance

Adjusted

EBITDA

$590 -

$610

million

Expect to be at high-end of guidance or slightly

above

Q4 benefitted from the timing of several

commercial claims and engineering recoveries, as

well as SG&A savings

Adjusted

EPS

$2.77 -

$3.14

Expect to be at high-end of guidance

Driven by strong Adjusted EBITDA

Free Cash

Flow

+$25 million

Expect free cash flow to be positive and in line

with guidance

Reflects higher Adjusted EBITDA offset by trade

working capital

On Track to Achieve High-end (or Above) of 2012 Profit Guidance

|

Page 30

2012 Adjusted EBITDA Recast

2012E

2012

Adjusted

EBITDA

Guidance

Midpoint

($590-$610)

$600

Exclude: Lighting and R-TEK

(30)

Exclude: Non-Cash Equity-Based Compensation Expense

+25

Add: Non-Controlling Interest from Climate Transaction

(10)

2012

Adjusted

EBITDA

Recast

Midpoint

($575-$595)

$585

Visteon’s 2012 Recasted Adjusted EBITDA is on the Same Basis as 2013

(Dollars in Millions)

Visteon

has

recasted

2012

estimated

Adjusted

EBITDA

to

be

on

the

same

basis

as

2013 Adjusted EBITDA. Three key adjustments:

Lighting and R-TEK:

entities sold in 2012 and will not be included in 2013

Non-Cash Equity-Based Compensation Expense:

in 2013, this item will be

excluded from Visteon’s Adjusted EBITDA

Non-Controlling

Interest

from

Climate

Transaction:

Visteon

will

incur

additional

non-controlling

interest

in

2013 related

to

Climate

entities

sold

to

Halla

Y/Y Change

in Methodology |

(Units in

Millions) 2012E

2013E

% Growth

North America

Ford

2.8

3.0

6.2%

Hyundai / Kia

0.7

0.7

5.8

All Other

11.7

11.7

(0.1)

Subtotal

15.2

15.4

1.4%

Europe

Ford

1.4

1.3

(7.3%)

PSA

2.0

2.0

(0.2)

Renault / Nissan

2.3

2.2

(4.7)

Hyundai / Kia

0.9

0.9

(1.9)

All Other

12.3

12.3

(0.4)

Subtotal

19.0

18.7

(1.5%)

Asia

Hyundai / Kia

5.4

5.5

1.0%

All Other

35.2

36.3

3.1

Subtotal

40.6

41.8

2.8%

South America

Ford

0.4

0.4

0.3%

All Other

4.0

4.1

3.4

Subtotal

4.3

4.5

4.2%

Other

1.7

2.0

15.1

Total

80.9

82.4

1.9%

Page 31

2013 Volume and Currency Outlook

Source: IHS Automotive, October 2012 forecast. Used in conjunction with customer

data to develop Visteon’s internal volume forecast. (1) Hedges impact

transaction risk; do not impact translation risk. 2013 Production Volumes

2013 Exchange Rates

Visteon Assumptions

2012E

2013E

Exchange

Rates

$ / Euro

$1.28

$1.30

Korean Won / $

1,131

1,055

Effective

Rates

w/

Hedges

(1)

$ / Euro

$1.34

$1.30

Korean Won / $

1,122

1,094

Impact to Visteon

(Dollars in Millions)

Sales

EBITDA

Euro: $0.05 Decrease

($140)

($25)

KRW: 25 Decrease

$30

($12)

2013 Currency Sensitivity Analysis |

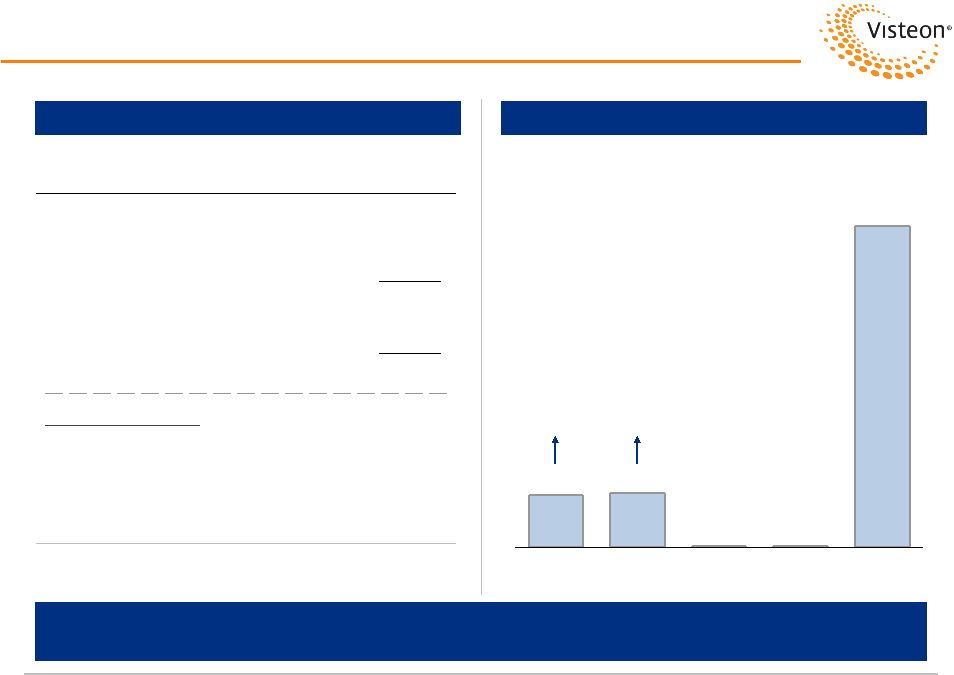

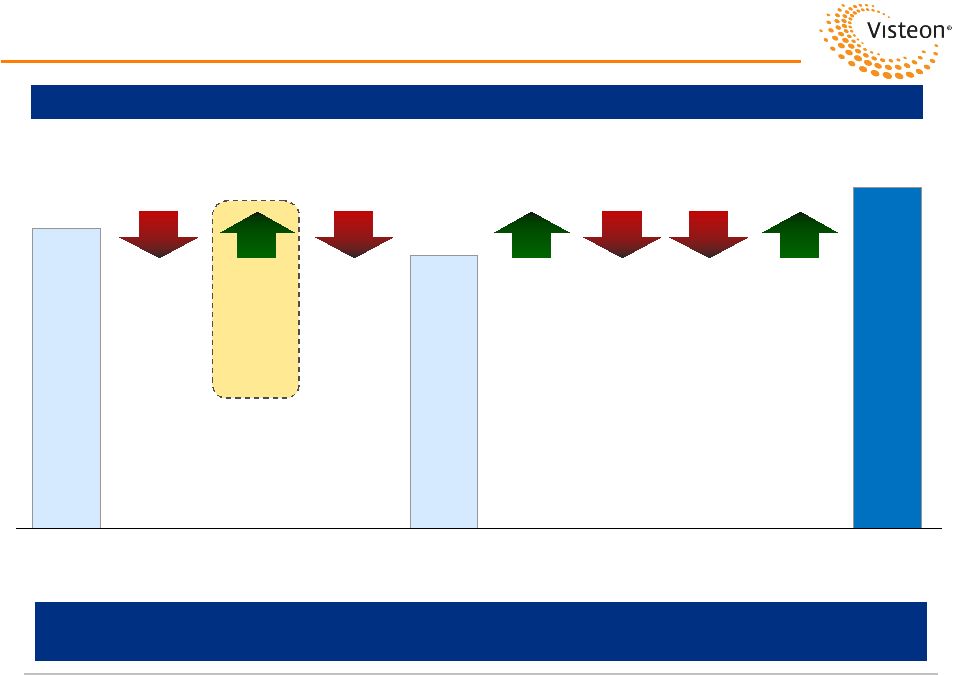

$2.96 -

$4.19

Page 32

2013 Guidance

$6.8B

$7.3B -

$7.5B

$2.77 -

$3.14

$575M -

$595M

$100M -

$150M

$105M -

$125M

$620M -

$660M

Excl. Restructuring and Transaction-Related Cash

(1)

(1) Represents 2012 Adjusted EBITDA Recast. Please see page 42 of

presentation for calculation. Y/Y FX

Impact of

Positive

$125M

Y/Y FX

Impact of

Negative

($15M)

Strong Year-Over-Year Improvement for All Key Financial Metrics

Sales

Adjusted EBITDA

Adjusted EPS

Adjusted Free Cash Flow

2012E

2013E

2012E Recast

2013E

2012E

2013E

2012E

2013E |

Page 33

Value-Creating Uses of Cash

Visteon Will Use Cash Balances to Drive Value for Shareholders Through

Share Repurchases, Restructuring and Operational Improvements

$920M

Visteon Cash

$353M

(1)

(1) Includes Halla cash of $351 million.

2013 Actions to Drive Shareholder Value

Visteon Cash

(9/30/2012)

HVCC Net Proceeds

Upsized total repurchase authorization to $300 million,

to be executed during the next two years (includes $50

million of repurchases in 2012)

$100 million to further reduce fixed-cost structure, right-

size operations and address underperforming assets

Strict focus on Y/Y operating improvements

Increasing 2013 guidance for all key financial metrics

Moving toward Q1 2013 closing of HVCC transaction

Progressing plans to divest Interiors business and

optimize Electronics business

Focus on Value Enhancing Transactions

Drive Fundamental Improvements

Across Our Operations

Focus Restructuring to Address

Cash / Value Draining Areas

Upsize Share Repurchase Program to $300M |

Page 34

Strategic Imperatives

Reduce

Overhead

Focused on achieving lean corporate overhead structure

Plans being finalized and implemented

Divest

Interiors

Non-core business

Sale or alternative strategic placement of consolidated business

Optimize

Electronics

Address Electronics’

strategy and global position

Position business to unlock value of non-consolidated operations

Address

Legacy Issues

Address historically underperforming assets

Negotiate with customers for future sourcing commitments

Committed to Provide Improved Value for Our Customers and Shareholders

Unlock Value

of Yanfeng

Valuable asset with robust growth profile

Improve transparency and grow YFV value to Visteon shareholders

|

Questions and Discussion |

Halla Visteon Climate Control

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses

Appendix

Deutsche Bank Global Auto Industry Conference

January 15, 2013 |

Page 37

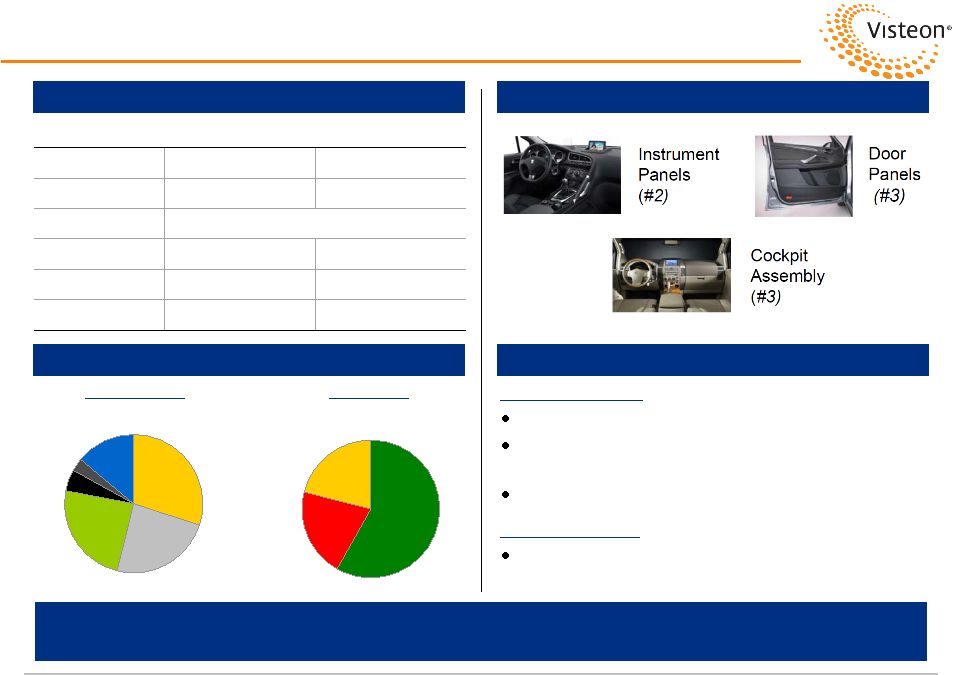

Interiors Product Line

By Customer

By Region

EU

58%

SA

21%

AP

21%

Other

14%

GM

3%

VW

5%

PSA

24%

Ford

24%

Nissan /

Renault

30%

Note: 2012E Consolidated EBITDA excludes equity in affiliates and

non-controlling interests. Business Focus

New leadership in place to drive change

Maintain investment to drive continued long-term

technological offerings for customers

Capitalize on strong positions in Asia

Strategic Focus

Sale or alternative strategic placement of

consolidated business

Currently Evaluating All Strategic Opportunities for Interiors Business

Product Line Overview

Key Products and Market Positions

Go Forward Plan

2012E Consolidated Sales Breakdown

Note: Includes consolidated and non-consolidated entities.

Consolidated

Non-Consolidated

2012E Sales

$1.4 billion

$7.4 billion

2012E EBITDA

~$32 million

N/A

Mkt Position

#2 (12% Share)

Headcount

6,750

24,925

Mfg Facilities

27

90

Equity Income

–

~$140 million |

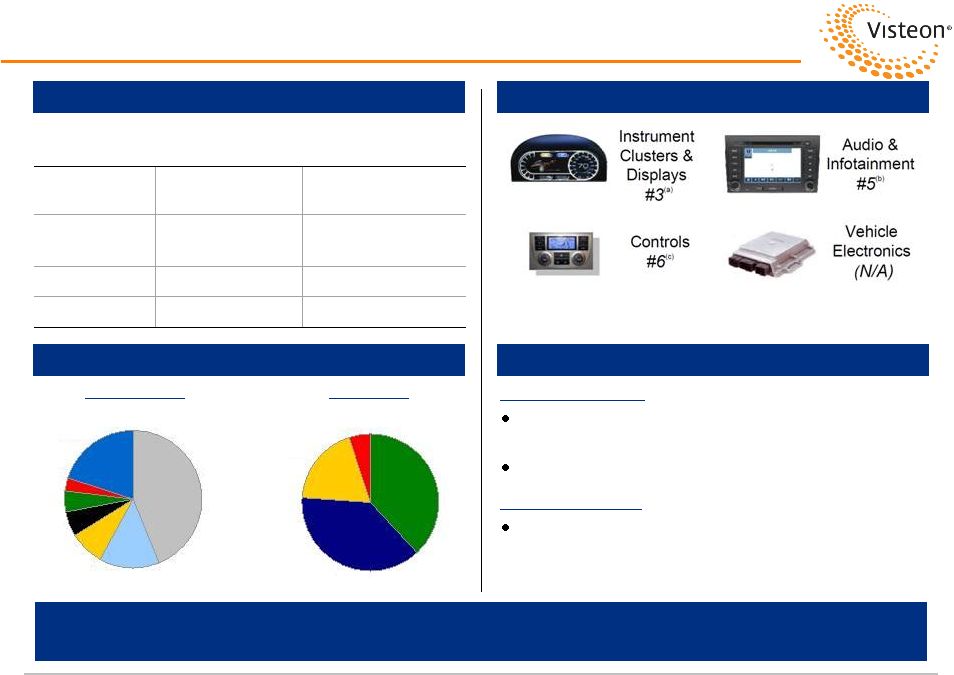

Page 38

Electronics Product Line

Product Line Overview

Key Products and Market Positions

Go Forward Plan

Note: Includes consolidated and non-consolidated entities.

(a)

Instrument Clusters

(b)

OEM Audio Head Units

(c)

Electronic Climate Controls

2012E Consolidated Sales Breakdown

By Customer

By Region

Tier 1 -

Ford

14%

Nissan / Renault

8%

Mazda 6%

JLR 5%

Mitsubishi

3%

Note:

EBITDA margin based on Adjusted EBITDA (excluding equity in affiliates and

non-controlling interests). (1)

Assumes consolidation of all YFVE 50%-plus-owned joint ventures.

Business

Focus

Continue to provide innovative solutions and

technologies for customers

Maintain disciplined investments in business

Strategic

Focus

Optimize global scale and ownership to create

the most value for Visteon customers and

shareholders

Address Electronics’

Strategy and Global Position

Consolidated

Consolidated +

YFVE Consolidation

2012E Sales

EBITDA Margin

$1.2 billion

(~6.0% Margin)

$1.8 billion

(~7.6% Margin)

Global Mkt

Position

#8 (4% Share)

#5 (6% Share)

Headcount

5,900

10,700

Mfg Facilities

9

16

(1)

Ford

44%

Other

20%

EU

38%

AP

19%

SA

5%

NA

38% |

Note:

Discount

rate

for

plan

to

be

fully

funded

on

PBO

basis

is

6.25%.

Page 39

Lump Sum Program Reduced Net PBO Liability by $110 Million

and Significantly Reduced Future Pension Plan Volatility

(Dollars in Millions)

U.S. Pension Funding Status as of December 31, 2012

Preliminary Amounts (Estimated)

PBO

Asset Value

Unfunded

Actual

12/31/2011

Funded

Level

(4.87%

Discount

Rate)

$1,480

$1,151

$329

Interest on PBO

70

Stock Contribution (1/9/2012)

73

Cash Contribution

4

Asset Appreciation and Interest Income

114

Benefit Payments and Admin Expenses

(76)

(76)

12/31/2012 Funded Level (Before Discount Rate Change)

$1,474

$1,266

$208

Discount Rate Change to 3.89%

183

12/31/2012 Funded Level (After Discount Rate Change)

$1,657

$1,266

$391

Lump Sum Program

(411)

(301)

12/31/2012 Funded Level (After Lump Sum Program)

$1,246

$965

$281 |

Page 40

2013 Guidance

2013 Guidance

Product Sales

$7.3 B -

$7.5 B

Adjusted EBITDA

$620 M -

$660 M

Free Cash Flow

Free Cash Flow

(1)

($75) M -

$25 M

Adjusted Free Cash Flow

(ex. Restructuring and Transaction-Related Cash)

$100 M -

$150 M

Adjusted EPS

$2.96 -

$4.19

Other Selected Items:

2013 Guidance

Depreciation and Amortization

$275 M

Interest Payments

$55 M

Cash Taxes

Operating

$120 M -

$140 M

Climate Transaction

$20 M -

$40 M

Restructuring Payments

$75 M -

$125 M

Capital Spending

$250 M

(1)

Free cash flow equal to cash from operating activities, less capital expenditures.

Includes $75-$125 million of restructuring and $50 million in taxes and fees, primarily

related to Halla Visteon Climate Control transaction.

|

Page 41

2013 Adjusted EBITDA Drivers

Adjusted EBITDA Improvement Driven by Higher Volumes

and Administrative Staff Cost Reductions

Adjusted EBITDA

$600M

$640M

2012

Midpoint

2013

Midpoint

$585M

($30M)

Lighting

Disc Ops /

R-TEK

$25M

Equity-

Based

Comp

Expense

Volume

($10M)

NCI

Impact

of HVCC

Transaction

Currency

Net Cost

Performance

Y/Y Change

in Methodology

2012

Re-cast

Other

NCI |

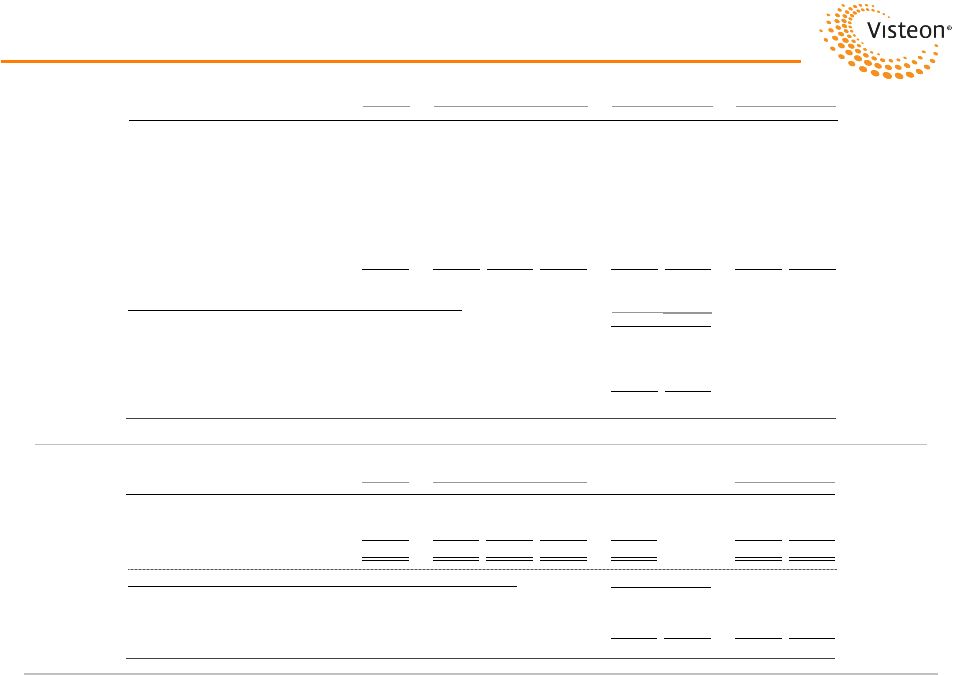

Page 42

Reconciliation of Non-GAAP Financial Information

Adjusted EBITDA

Free Cash Flow

+

+

(1)

(1) Could be impacted by timing of Fixed-Cost Restructuring Plan charges.

(2) 2011 and 2012 reconciliation not yet recast for equity-based compensation

expense. (2)

2012 FY Guidance Provided

2011

2012

During Q3 2012 Earnings

2013 FY Guidance

(Dollars in Millions)

Full Year

1st Qtr

2nd Qtr

3rd Qtr

Low-end

High-end

Low-end

High-end

Adjusted EBITDA

$685

$150

$151

$131

$590

$610

$620

$660

Interest expense, net

27

9

6

13

41

41

50

50

Loss on debt extinguishment

24

-

-

4

4

4

-

-

Provision for income taxes

127

27

42

33

140

140

160

120

Depreciation and amortization

295

64

67

64

260

260

275

275

Restructuring and other (income), expense net

11

63

11

(11)

80

80

150

100

Equity investment gain

-

-

(63)

-

(63)

(63)

-

-

Other non-operating costs, net

30

5

2

5

13

13

10

10

Non-cash equity-based compensation expense

-

-

-

-

-

-

20

20

Discontinued operations

91

11

11

8

30

30

-

-

Net Income (loss) attributable to Visteon

$80

($29)

$75

$15

$85

$105

($45)

$85

Reconciliations

to

2012

Adjusted

EBITDA

Recast

(2012

on

Same

Basis

as

2013)

2012 FY Guidance Recast

Low-end

High-end

Adjusted EBITDA

$590

$610

Exclude: Lighting and R-TEK operations

(30)

(30)

Exclude: Non-cash equity-based compensation expense

25

25

Add: Non-controlling interest from Climate transaction

(10)

(10)

Adjusted EBITDA Recast

$575

$595

2012 FY Guidance

2011

2012

Provided During

2013 FY Guidance

(Dollars in Millions)

Full Year

1st Qtr

2nd Qtr

3rd Qtr

Q3 2012 Earnings

Low-end

High-end

Cash from (used by) operating activities

$175

$19

($12)

$156

$255

$175

$275

Less: Capital expenditures

258

53

49

44

230

250

250

Free cash flow

($83)

($34)

($61)

$112

$25

($75)

$25

Reconciliations

to

Adjusted

Free

Cash

Flow

(ex.

Restructuring

and

Transaction-Related

Cash)

Low-end

High-end

Free cash flow

$25

$25

($75)

$25

Exclude: Restructuring cash payments

60

80

125

75

Exclude: Transaction-related cash

20

20

50

50

Adjusted free cash flow (ex. restructuring and transaction-related cash)

$105

$125

$100

$150 |

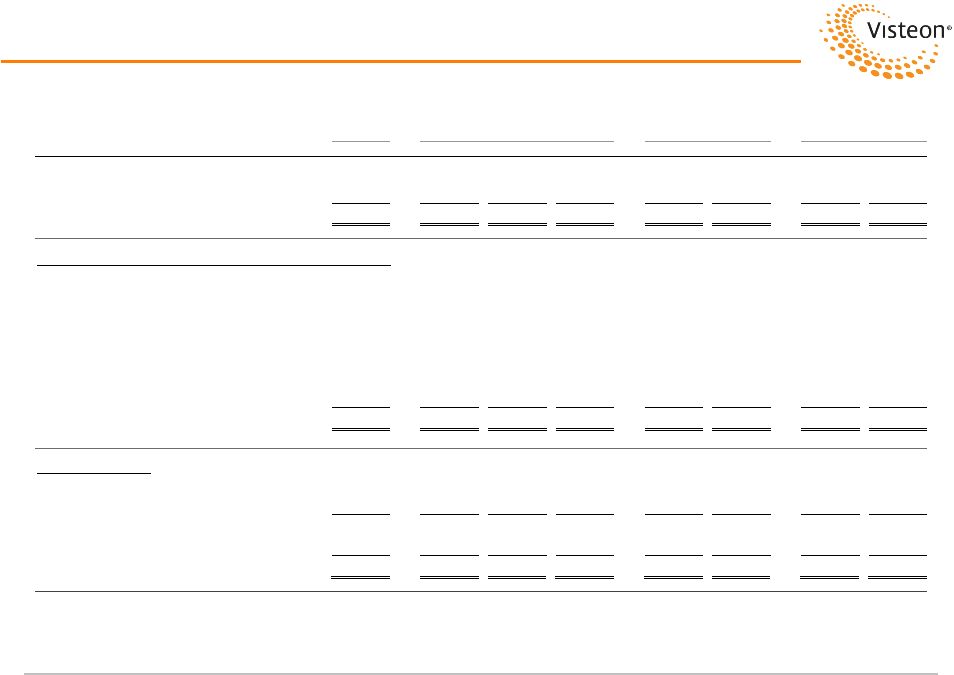

Page 43

Earnings per Share

Adjusted EPS

2012 FY Guidance Provided

2011

2012

During Q3 2012 Earnings

2013 FY Guidance

(Dollars and Shares in Millions)

Full Year

1st Qtr

2nd Qtr

3rd Qtr

Low-end

High-end

Low-end

High-end

Net income (loss) attributable to Visteon

$80

($29)

$75

$15

$85

$105

($45)

$85

Average shares outstanding, diluted

52.0

51.9

53.7

53.8

53.5

53.5

52.3

51.3

Earnings per share

$1.54

($0.56)

$1.40

$0.28

$1.59

$1.96

($0.86)

$1.66

Memo:

Items

Included

in

Net

income

(loss)

attributable

to

Visteon

Restructuring and other income, (expense) net

(11)

(63)

(11)

11

(80)

(80)

(150)

(100)

Equity investment gain

-

-

63

-

63

63

-

-

Taxes related to equity investment gain

-

-

(6)

-

(6)

(6)

-

-

Taxes related to HVCC transaction

-

-

-

-

-

-

(40)

(20)

Other non-operating costs, net

(30)

(5)

(2)

(5)

(13)

(13)

(10)

(10)

Loss on debt extinguishments

(24)

-

-

(4)

(4)

(4)

-

-

Asset impairments and cost related to disc. ops.

(68)

(4)

(12)

(7)

(23)

(23)

-

-

Total

($133)

($72)

$32

($5)

($63)

($63)

($200)

($130)

Memo: Adjusted EPS

Net income (loss) attributable to Visteon

$80

($29)

$75

$15

$85

$105

($45)

$85

Items in net income (loss) attributable to Visteon

(133)

(72)

32

(5)

(63)

(63)

(200)

(130)

Adjusted net income (loss)

$213

$43

$43

$20

$148

$168

$155

$215

Average shares outstanding, diluted

52.0

51.9

53.7

53.8

53.5

53.5

52.3

51.3

Adjusted earnings per share

$4.10

$0.83

$0.80

$0.37

$2.77

$3.14

$2.96

$4.19 |

Page 44

Adjusted EBITDA Reconciliation by Product Group

Disc Ops/

Total

(Dollars in Millions)

Total

Retained

HVCC

Electronics

Interiors

Elims

Visteon

Product Sales

$4,263

$152

$4,111

$1,243

$1,379

($105)

$6,780

Gross Margin

$380

$4

$376

$115

$73

-

$568

Employee Charges / Corp Severance

(1)

-

(1)

(4)

(1)

-

(6)

Adjusted Gross Margin

$381

$4

$377

$119

$74

-

$574

% of Product Sales

8.9%

2.6%

9.2%

9.6%

5.4%

8.5%

SG&A

Product Line Specific and Allocated SG&A

(192)

(8)

(184)

(81)

(74)

(16)

(363)

Employee Charges / Corp Severance

2

-

2

1

1

-

4

Adjusted SG&A

($190)

($8)

($182)

($80)

($73)

($16)

($359)

Adjusted EBITDA

Adjusted Gross Margin

$381

$4

$377

$119

$74

-

$574

Adjusted SG&A

(190)

(8)

(182)

(80)

(73)

(16)

(359)

Exclude D&A

177

3

174

36

31

16

260

Adjusted EBITDA (excl. Equity in Affil., NCI)

$368

($1)

$369

$75

$32

-

$475

% of Product Sales

8.6%

(0.7%)

9.0%

6.0%

2.3%

0.0%

7.0%

Equity in Affiliates

5

-

5

17

141

-

163

Noncontrolling Interests

(62)

-

(62)

(1)

(2)

-

(65)

Discontinued operations

-

-

-

-

-

27

27

Adjusted EBITDA

$311

($1)

$312

$91

$171

$27

$600

Climate

2012 FY PG Guidance Underlying Corporate Guidance Given During Q3 Earnings Call

|

Combined

Electronics

(Dollars in Millions)

Electronics

YFVE

& YFVE

Product Sales

$1,243

$700

$1,783

Gross Margin

$115

$65

$180

Employee Charges / Corp Severance

(4)

-

(4)

Adjusted Gross Margin

$119

$65

$184

% of Product Sales

9.6%

9.3%

10.3%

SG&A

Product Line Specific and Allocated SG&A

(81)

(15)

(96)

Employee Charges / Corp Severance

1

-

1

Adjusted SG&A

($80)

($15)

($95)

Adjusted EBITDA

Adjusted Gross Margin

$119

$65

$184

Adjusted SG&A

(80)

(15)

(95)

Exclude D&A

36

10

46

Adjusted EBITDA (excl. Equity in Affil., NCI)

$75

$60

$135

% of Adjusted Sales

6.0%

8.6%

7.6%

Page 45

Electronics –

Consolidated + YFVE Reconciliation

(1) Includes Visteon / YFVE eliminations.

Note: YFVE estimates only, not purported to be U.S. GAAP.

(1)

2012 FY Electronics Guidance Underlying Corporate Guidance Given During Q3 Earnings Call |

www.visteon.com |