Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Evolve Transition Infrastructure LP | d452670d8k.htm |

Constellation Energy Partners LLC

Annual Meeting Company Overview

December 14, 2012

Exhibit 99.1 |

2

Forward-looking Statements Disclaimer

This presentation contains forward–looking statements that are subject to a number

of risks and uncertainties, many of which are beyond our control, which may

include statements about: the volatility of realized oil and natural gas prices; the conditions of the

capital markets, inflation, interest rates, availability of a credit facility to

support business requirements, liquidity, and general economic and political

conditions; the discovery, estimation, development and replacement of oil and natural gas reserves; our business,

financial, and operational strategy; our drilling locations; technology; our cash flow,

liquidity and financial position; the ability to extend

or

refinance

our

reserve-based

credit

facility;

the

level

of

our

borrowing

base

under

our

reserve-based

credit

facility;

the

resumption or amount of our cash distributions; our hedging program and our derivative

positions; our production volumes; our lease operating

expenses,

general

and

administrative

costs

and

finding

and

development

costs;

the

availability

of

drilling

and

production

equipment, labor and other services; our future operating results; our prospect

development and property acquisitions; the marketing of oil and natural gas;

competition in the oil and natural gas industry; the impact of the current global credit and economic environment;

the

impact

of

weather

and

the

occurrence

of

natural

disasters

such

as

fires,

floods,

hurricanes,

tornados,

earthquakes,

snow

and

ice

storms and other catastrophic events and natural disasters; governmental regulation,

including environmental regulation, and taxation of the oil and natural gas

industry; developments in oil-producing and natural gas producing countries; lack of support from a sponsor or a

change in sponsor; and our strategic plans, objectives, expectations, forecasts,

budgets, estimates and intentions for future operations. In

some

cases,

forward–looking

statements

can

be

identified

by

terminology

such

as

“may,”

“could,”

“should,”

“expect,”

“plan,”

“project,”

“intend,”

“anticipate,”

“believe,”

“estimate,”

“predict,”

“potential,”

“pursue,”

“target,”

“continue,”

the negative of such

terms or other comparable terminology.

The forward–looking statements contained in this presentation are largely based on

our expectations, which reflect estimates and assumptions made by our

management. These estimates and assumptions reflect our best judgment based on currently known market

conditions

and

other

factors.

Although

we

believe

such

estimates

and

assumptions

to

be

reasonable,

they

are

inherently

uncertain

and

involve a number of risks and uncertainties that are beyond our control. In addition,

management’s assumptions about future events may prove to be

inaccurate. Management cautions all readers that the forward–looking statements contained in this presentation are not

guarantees of future performance, and we cannot assure any reader that such statements

will be realized or the forward–looking events and circumstances will

occur. Actual results may differ materially from those anticipated or implied in the forward–looking statements

due

to

factors

listed

in

the

“Risk

Factors”

section

in

our

SEC

filings

and

elsewhere

in

those

filings.

All

forward–looking

statements

speak

only as of the date of this presentation. We do not intend to publicly update or revise

any forward–looking statements as a result of new information, future

events or otherwise. These cautionary statements qualify all forward-looking statements attributable to us or

persons acting on our behalf. |

3

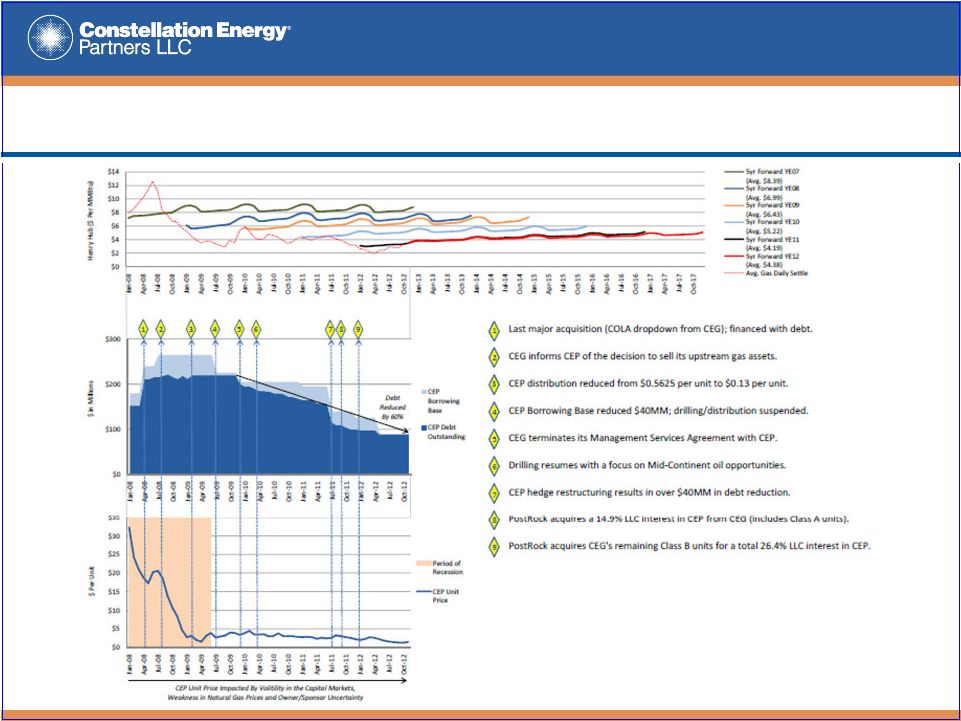

CEP’s Operating Environment

3 |

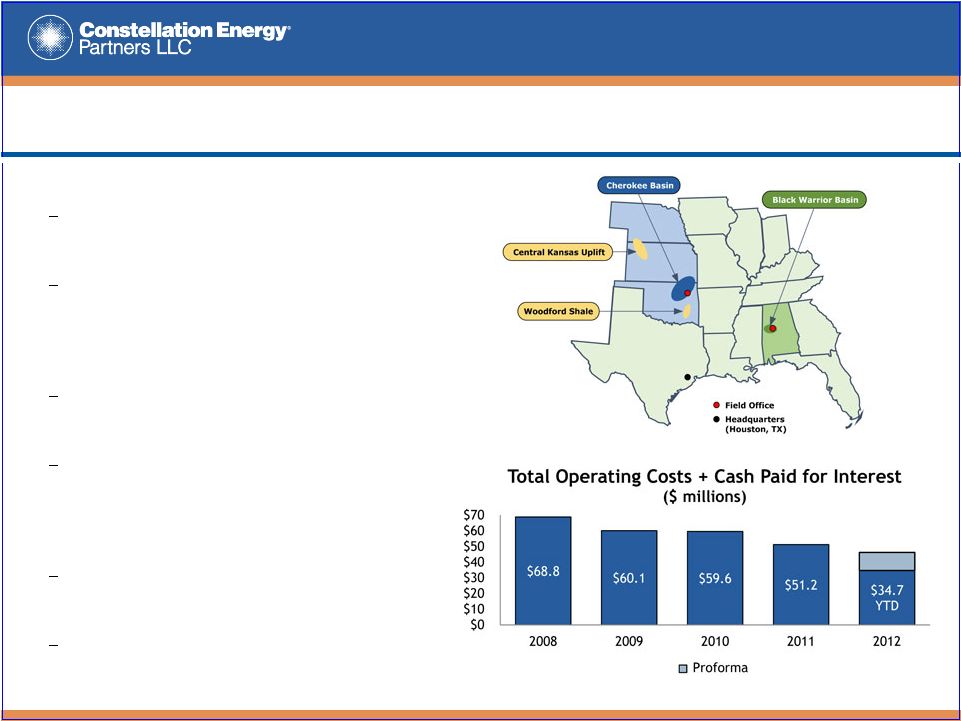

4

CEP’s Strategic Focus, 2008-Present

•

Integrate asset acquisitions

Substantial focus in 2008 due to the

2007 acquisition of operated assets in

the Cherokee Basin

Non-operated assets added in Mar-08

(Woodford Shale) and Dec-10 (Central

Kansas Uplift)

•

Manage CEG transition

Efforts initiated by CEP in 2008 as a

result of CEG’s decision to sell its

upstream natural gas assets

Substantial focus for CEP in 2009

leading up to CEG’s termination of the

Master Services Agreement in Dec-09

•

Achieve cost reductions

CEP’s continuing focus on controllable

costs (LOE, G&A, and interest) has

achieved results

Our goal is to further reduce structural

G&A costs by 25% |

5

CEP’s Strategic Focus, 2008 to Present

(con’t)

5

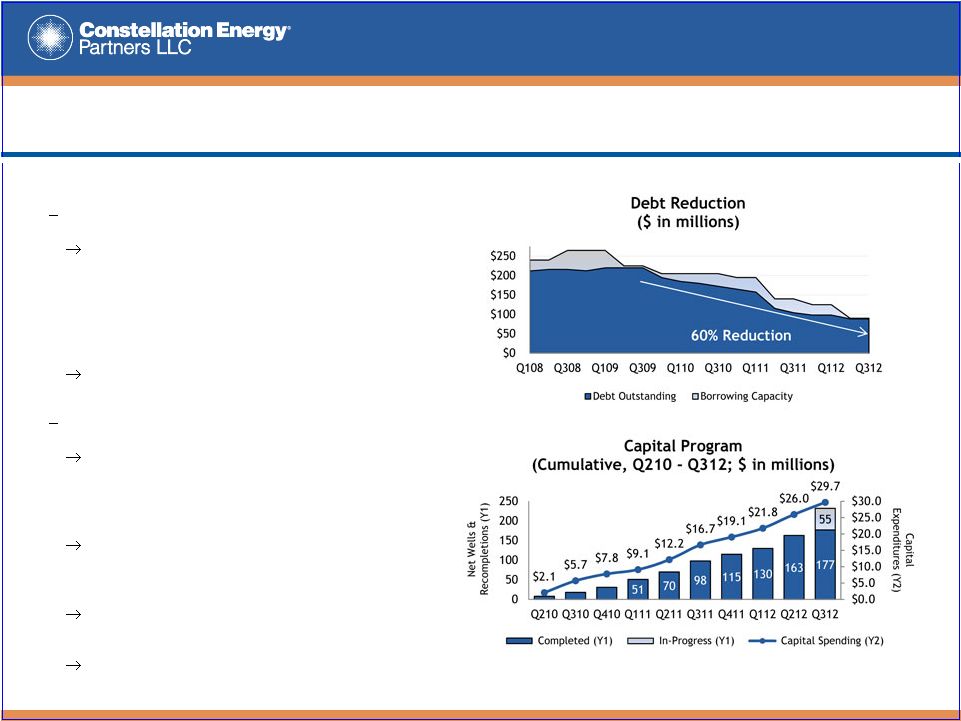

•

Use cash flow from operations to

Reduce debt levels:

Function of (1) borrowing base pressure in

an environment characterized by weak

natural gas prices and (2) structural issues

that tend to limit CEP’s ability to tap capital

markets for preferred or mezzanine

financing

Debt outstanding has been reduced by 60%

since Q309

Invest in capital efficient projects

CEP’s drilling efforts were suspended in mid-

2009, when declining gas prices and

uncertainty in the capital markets lead to a

$40MM reduction in our borrowing base

Since drilling resumed in Q210, the company

has invested $29.7 million to complete 177

net wells and recompletions

At the end of Q312, an additional 55 net

wells and recompletions were in progress

Our capital program targets oil opportunities

with rates of return that exceed 20% |

6

CEP’s Strategic Focus, 2008 to Present

(con’t)

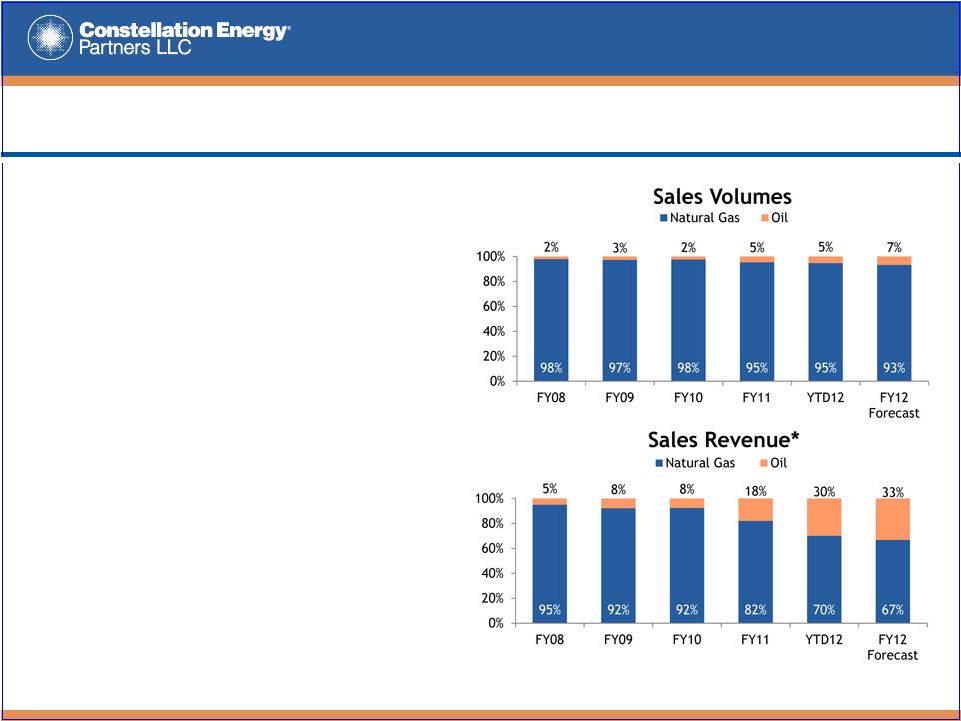

•

Pursue organic growth opportunities

–

Our focus on oil opportunities in our Mid-

Continent asset base has shown progress

and forms the basis of our near-term

drilling and capital plan

–

Were natural gas prices to recover, we’re

well positioned to capitalize on the gas

resource potential in our Mid-Continent

asset base, which we believe is substantial

–

We believe there are advantages to

consolidation in the Cherokee Basin

–

CEP is uniquely positioned to capitalize on

these consolidation opportunities due to

our scale, the nature of our asset base

(including the Osage Concession), and

existing infrastructure

–

Our Q312 market price of $1.27/unit

compares

to

an

$8.98/unit

net

asset

value

**

–

We continue to look for merger and

acquisition opportunities that accelerate

growth and enhance unitholder value

*

Excludes hedge settlements, gains (losses) on mark-to-market activities, and

other revenue **

Additional detail can be found on slide 6 of CEP’s Third Quarter Earnings

Presentation dated November 9, 2012 |

Appendix |

8

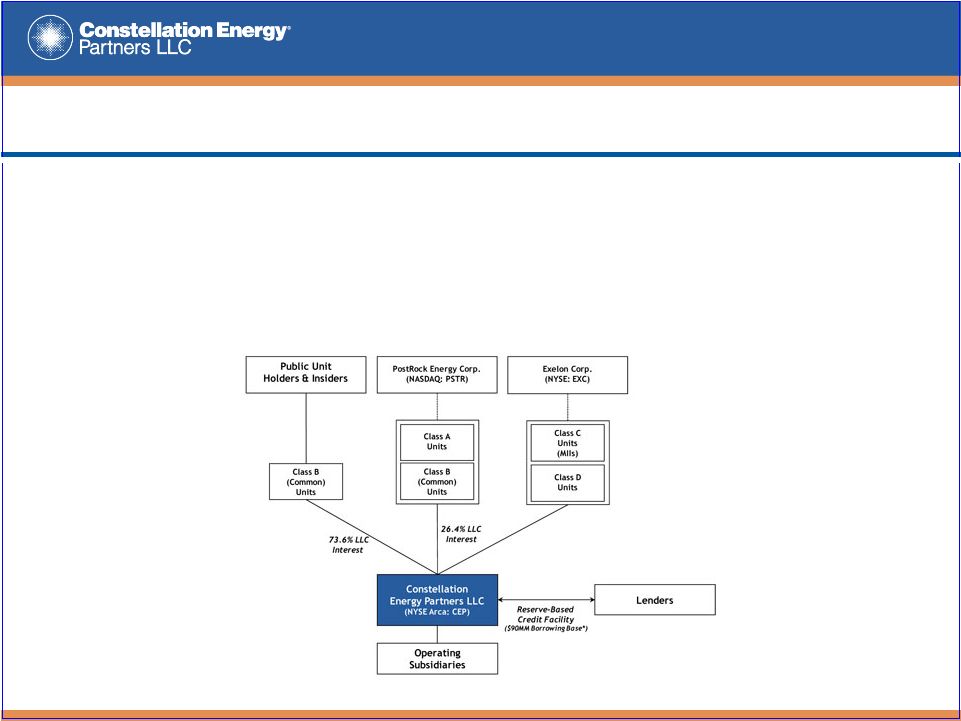

CEP Ownership

*

* As of October 25, 2012

•

As a result of two transactions executed in 2011, our largest unitholder is

PostRock Energy Corporation (“PostRock”), which indirectly owns a 26.4% LLC

interest (including our Class A units)

•

Exelon Corp. indirectly owns all of our Class D units and the MIIs

•

Insider holdings total 6.1% of our outstanding common (or Class B) units

|