Attached files

| file | filename |

|---|---|

| 8-K - RUTH'S HOSPITALITY GROUP, INC. 8-K - Ruths Hospitality Group, Inc. | a50412259.htm |

EXHIBIT 99.1

Investor UpdateSeptember 2012

Disclaimer This communication contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may”, “will”, “expect,” “intend,” “indicate,” “anticipate,” “believe,” “forecast,” “estimate,” “plan,“ “guidance,” “outlook,” “could, “ “should,” “continue” and similar terms used in connection with statements regarding the outlook of Ruth’s Hospitality Group, Inc., (the “Company”, “Ruth’s Chris Steak House”, “Mitchell’s Fish Market”, “Ruth’s Hospitality” or any subsidiary or division of Ruth’s Hospitality Group). Such statements include, but are not limited to, statements about the Company’s: expected financial performance and operations, expected costs, the competitive environment, future financing plans and needs, overall economic condition and its business plans, objectives, expectations and intentions. Other forward-looking statements that do not relate solely to historical facts include, without limitation, statements that discuss the possible future effects of current known trends or uncertainties or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed or assured. Such statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties that could cause the Company’s actual results and financial position to differ materially from the Company’s expectations. Such risks and uncertainties include, but are not limited to, the following: market volatility, risks from food safety or food-borne illness, the impact of negative publicity surrounding our restaurants or the consumption of beef or seafood, the impact on revenues of shifts in customers tastes, our ability to compete with other restaurant concepts who may have greater financial, marketing and other resources, supply shortages, increased food, beverage, labor or other costs, significant disruptions in the supply of food and beverages by our suppliers, labor shortages or increases in labor costs/benefits, federal/state/local regulations, operational shortcomings of our franchisees that may be affect or reputation and brand, reduced royalty revenues from our franchisees, litigation, restrictions from our senior credit agreement that may restrict our ability to operate our business and pursue other business strategies, a potential impairment in the carrying value of our goodwill or other intangible assets, economic downturns and the impact on consumer spending habits, failure or weakness of our internal controls, and other risks and uncertainties listed from time to time in the Company’s reports to the Securities and Exchange Commission. There may be other factors not identified above of which the Company is not currently aware that may affect matters discussed in the forward-looking statements, and may also cause actual results to differ materially from those discussed. All forward-looking statements are based on information currently available to the Company. Except as may be required by applicable law, Ruth’s Hospitality Group assumes no obligation to publicly update or revise any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting such estimates. Additional factors that may affect the future results of the Company are set forth in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the period ended December 25, 2011, or as supplemented in the Company’s subsequently filed periodic reports, which are available at www.sec.gov and at www.rhgi.com.

Leading restaurant company focused on upscale dining Iconic upscale steak house brand celebrating 47 years as segment leader Consistently recognized and awarded for high quality food, special occasion dining, and customer service Nation’s Restaurant News - #1 Consumer Picks Survey across all segments National footprint with growing international presence Upscale casual seafood restaurant founded in 1998 Creative offerings with high flavor profile Natural complement to Steak House business Well positioned to take advantage of growth in seafood consumption

Strong Investment Highlights Proven business model for over 47 years Stable franchise base generates steady and profitable revenue stream Consistent traffic and revenue growth Improved capital structure Disciplined use of capital Focused on growing equity share of enterprise value Positioned for future growth opportunities Through both franchise and company-owned locations

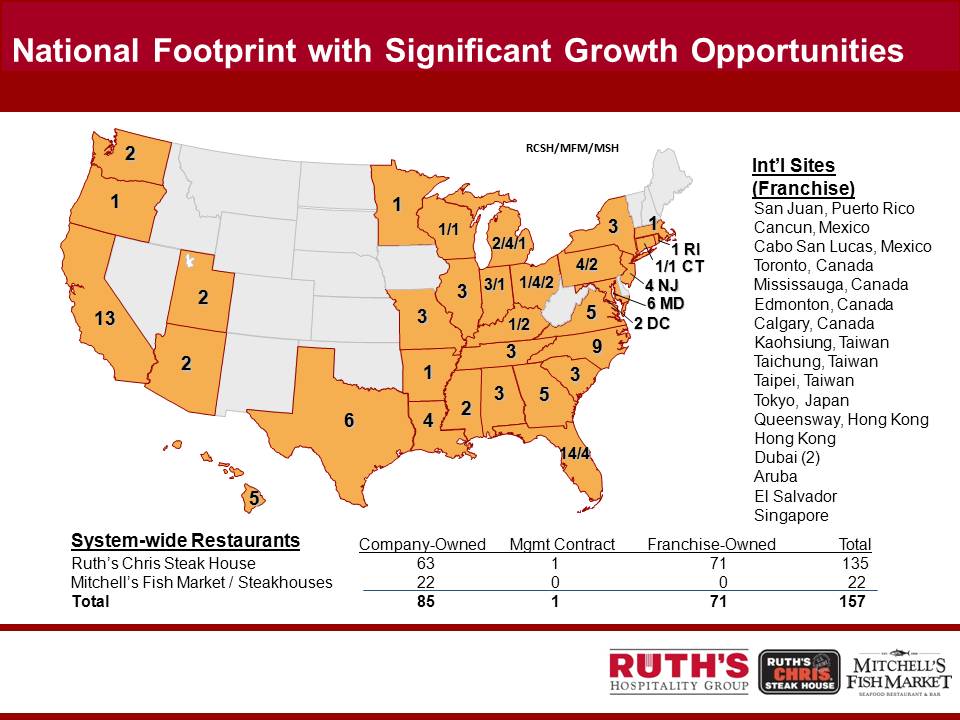

National Footprint with Significant Growth Opportunities Int’l Sites (Franchise) San Juan, Puerto Rico Cancun, Mexico Cabo San Lucas, Mexico Toronto, Canada Mississauga, Canada Edmonton, Canada Calgary, Canada Kaohsiung, Taiwan Taichung, Taiwan Taipei, Taiwan Tokyo, Japan Queensway, Hong Kong Hong Kong Dubai (2) Aruba El Salvador Singapore System-wide RestaurantsRuth’s Chris Steak House Mitchell’s Fish Market / Steakhouses Total Company-Owned Mgmt Contract Franchise-Owned Total 63 1 71 135 22 0 85 157 RCSH/MFM/MSH

The Story of Ruth's Chris Founded in 1965 from one location with the purchase of Chris Steak House in New Orleans by Ruth Fertel Today a world class, segment leading brand with broad consumer acceptance

The Secret Behind the Sizzle Comfortable, elegant and classically American

The Secret Behind the Sizzle Highest food quality Prepared to exacting standards

The Secret Behind the Sizzle Passionate Hospitality

The Secret Behind the Sizzle Uncompromising Service

Some of the Rewards from the Sizzle We want to thank you because without you we wouldn't be #1 with our guests.

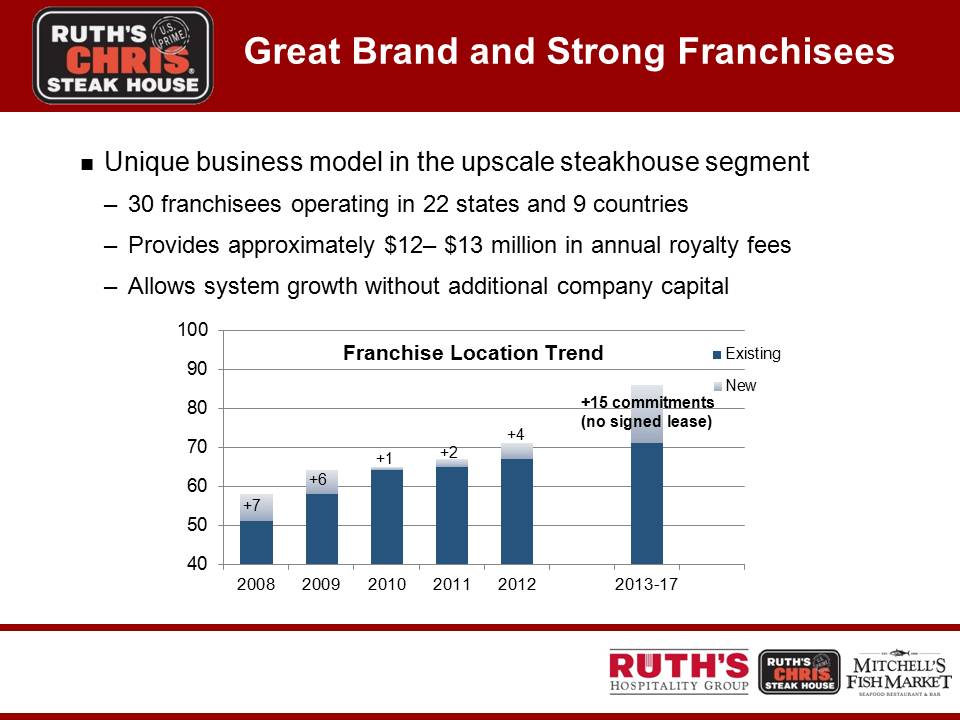

Unique business model in the upscale steakhouse segment 30 franchisees operating in 22 states and 9 countries Provides approximately $12– $13 million in annual royalty fees Allows system growth without additional company capital Great Brand and Strong Franchisees Franchise Location Trend Existing New +15 commitments (no signed lease) 100 90 80 70 60 50 40 2008 2009 2010 2011 2012 2013-17 +7 +6 +1 +2 +4

Grand Rapids, MI – New Franchisee in 2011

Ruth’s Chris Strategic Initiatives Focused on growing revenues across our three core segments through traffic before using price Special Occasion Corporate Business Core Guests/Regular Customers Using product offerings to broaden consumer relevance Ruth’s Classics Happy Hour/Beverage programs Satellite broadcast for meetings Selective use of TV for brand focused communication Re-investing through targeted remodels and relocations

It’s no wonder so many great businesses are led by women. The name may say Chris, but the house was all Ruth’s. With fierce ambition she reigned as First Lady of Steak, setting the bar for food and service. Decades later we continue to honor her same values and make our restaurants a great place for women in business today.

Segment Overview Upscale-casual seafood restaurant founded in 1998 by Cameron Mitchell RestaurantsAcquired by Ruth’s Hospitality in 2008 19 locations in 8 statesAll are company-owned Creative fresh seafood with a high flavor profile

Earning the Right to Grow Profitable and contributing to Ruth’s Hospitality Group earnings New management focused on improving consistency of execution and unit level economics before accelerating growth Leveraging high guest loyalty Consistent high scores for food taste and quality 1/3 of customers are “heavy” users (>8x/yr) which is nearly double that of its peers

Increasing Consumer Awareness High quality, satisfaction, and loyalty scores Mitchell’s trails peers in awareness Applying Ruth’s Chris expertise to increase banquet/corporate dining Marketing initiatives Broaden menu appeal with innovative surf and “turf” offerings Smaller unit base requires enhanced local marketing and increased social media efforts

Even if you don’t spend summer by the sea, you can eat like you do.

Financial Overview

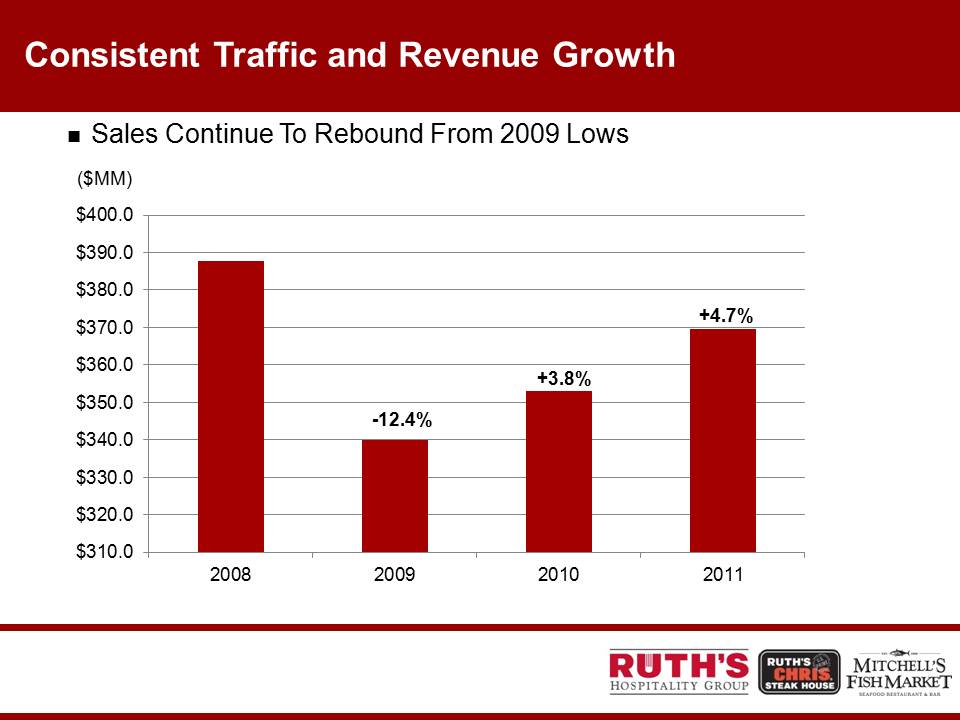

Consistent Traffic and Revenue Growth Sales Continue To Rebound From 2009 Lows ($MM) $400.0 $390.0 $380.0 $370.0 $360.0 $350.0 $340.0 $330.0 $320.0 $310.0 2008 2009 2010 2011 -12.4% +3.8% +4.7%

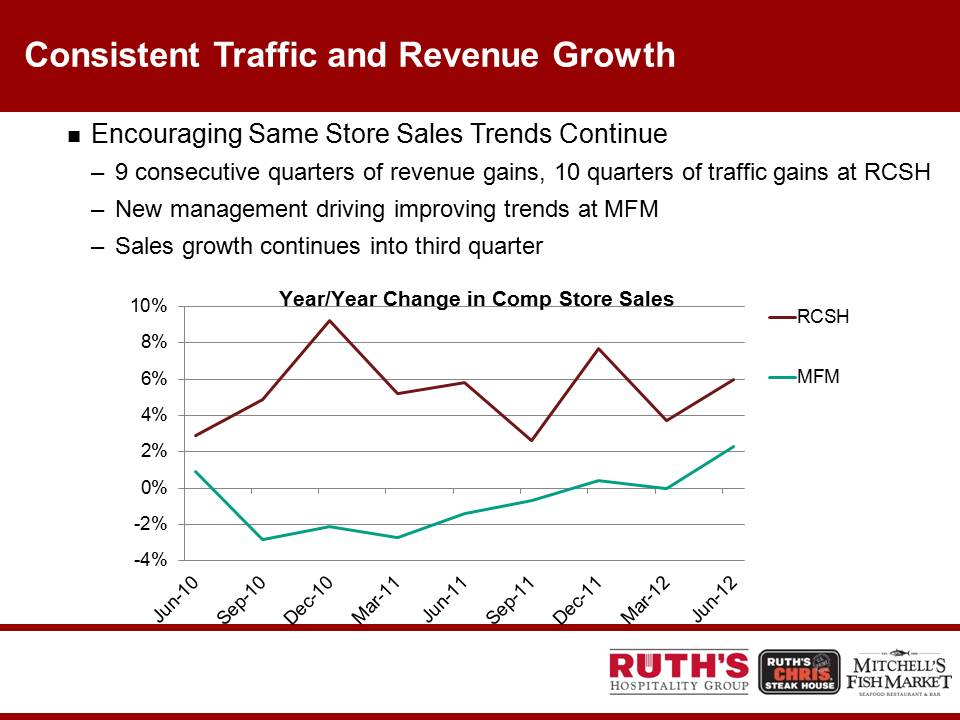

Consistent Traffic and Revenue Growth Encouraging Same Store Sales Trends Continue 9 consecutive quarters of revenue gains, 10 quarters of traffic gains at RCSH New management driving improving trends at MFM Sales growth continues into third quarter Year/Year Change in Comp Store Sales RCSH MFM 10% 8% 6% 4% 2% 0% -2% -4% Jun-10 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Jun-12

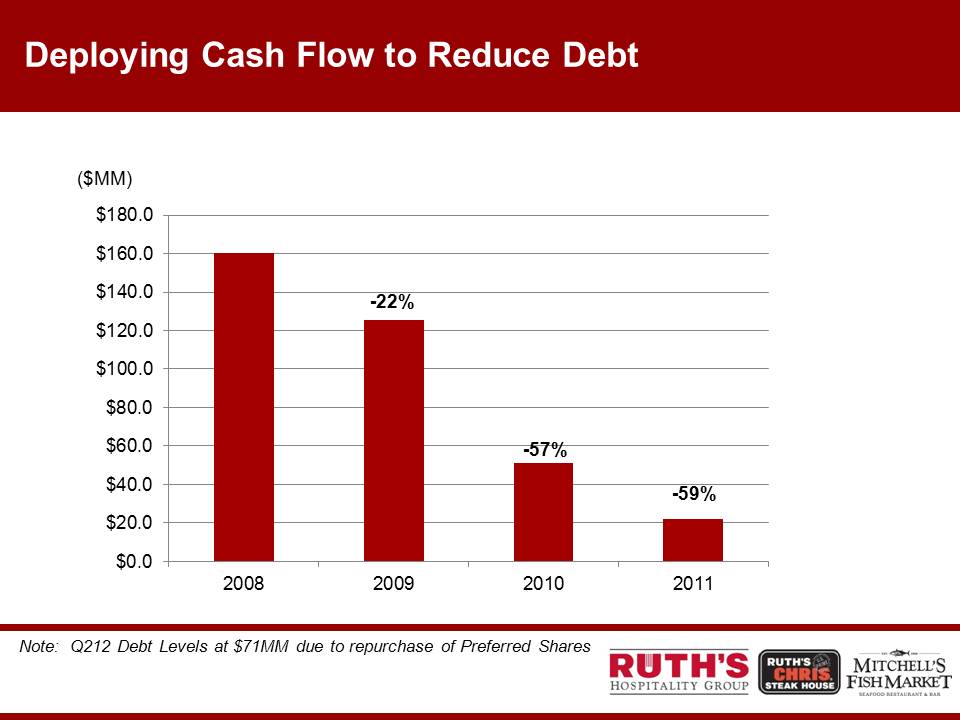

Deploying Cash Flow to Reduce Debt ($MM) -22% -57% -59% Note: Q212 Debt Levels at $71MM due to repurchase of Preferred Shares $180.0 $160.0 $140.0 $120.0 $100.0 $80.0 $60.0 $40.0 $20.0 $0.0 2008 2009 2010 2011

Significant Improvement to Capital Structure in Q1 2012 Redeemed BRS preferred shares for $60.2MM Highly accretive Eliminated $2.5MM annual preferred dividend Reduced diluted share count by 20% Removed “overhang” Financed with recently renegotiated credit facility Incremental interest expense significantly less than dividend obligation

Solid Financial Results in Q2 2012 Total revenues grew 6.2% to $97.7MM Beef cost inflation was 19% EBITDA increased 6% to $12.5MM and improved EBITDA margin Pro forma Net income available to preferred and common shareholders increased 41.4% to $5.8MM and as a percent of sales increased 150bp to 6.0%1 Debt balance at quarter-end was $71MM - up from $22MM at year-end due to BRS transaction Expect to continue to pay down debt in 20121 excludes loss on impairment, restructuring benefit, loss on disposal debt issuance costs and discontinued operations

Investing in the Future Remodel of existing locations In the last two years, over 1/3 of company locations have been remodeled /refreshed Relocation Portland, OR successful relocated in 2011 resulting in initial sales growth of over 40% Houston, TX scheduled to be relocated in 1H 2013 New locations Cherokee, NC opened May 21, 2012 Cincinnati, OH under construction – anticipated Q412 Denver, CO – anticipated Q112 Actively evaluating additional opportunities for 2012-2013

Strategy to Create Shareholder Value Respected Brands High Quality Food Passionate Hospitality Operational Excellence Uncompromising Service Leverage Strong Competitive Positioning Over $65 million in free cash flow generated in last eight quarters Create Significant Financial Flexibility Priorities for Capital Allocation Investing in Growth Investing in new units Remodels/Relocations Investments in other strategic initiatives Returning Capital Paying down debt Additional share repurchases Dividends Multiple Options to Creating Shareholder Value