Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - IT TECH PACKAGING, INC. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - IT TECH PACKAGING, INC. | v310918_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - IT TECH PACKAGING, INC. | v310918_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - IT TECH PACKAGING, INC. | v310918_ex32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - IT TECH PACKAGING, INC. | v310918_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2012

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission file number: 001-34577

ORIENT PAPER, INC.

| (Exact name of small business issuer as specified in its charter) |

| Nevada | 20-4158835 | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer identification No.) |

Science Park, Juli Rd, Xushui County, Baoding City

Hebei Province, The People’s Republic of China 072550

(Address of principal executive offices)

011 - (86) 312-8698215

(Registrant’s telephone number, including area code)

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes £ No x

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Check whether the registrant filed all documents and reports required to be filed by Section l2, 13 or 15(d) of the Exchange Act after the distribution of securities under a plan confirmed by a court. Yes £ No £

APPLICABLE ONLY TO CORPORATE ISSUERS:

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: 18,459,775 shares of common stock, $.001 par value, were outstanding as of May 9, 2012.

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| Item 1. | Financial Statements. | 3 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operation. | 17 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk. | 31 |

| Item 4. | Controls and Procedures. | 31 |

| PART II | ||

| Item 1. | Legal Proceedings. | 31 |

| Item 1A. | Risk Factors. | 32 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 32 |

| Item 3. | Defaults Upon Senior Securities. | 32 |

| Item 4. | Mine Safety Disclosures. | 32 |

| Item 5. | Other Information. | 32 |

| Item 6. | Exhibits. | 33 |

| SIGNATURES | 35 | |

| 2 |

PART I – FINANCIAL INFORMATION

Item 1 Financial Statements

ORIENT PAPER, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF MARCH 31, 2012 AND DECEMBER 31, 2011

(Unaudited)

| March 31, | December 31, | |||||||

| 2012 | 2011 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 5,626,620 | $ | 4,165,446 | ||||

| Accounts receivable (net of allowance for doubtful accounts of $73,491 and $76,752 as of March 31, 2012 and December 31, 2011, respectively) | 3,748,005 | 3,820,696 | ||||||

| Inventories | 7,897,958 | 10,007,928 | ||||||

| Prepayments and other current assets | 4,648,076 | 5,071,215 | ||||||

| Total current assets | 21,920,659 | 23,065,285 | ||||||

| Prepayment on property, plant and equipment | 7,280,209 | 7,241,472 | ||||||

| Property, plant, and equipment, net | 120,667,946 | 114,651,107 | ||||||

| Total Assets | $ | 149,868,814 | $ | 144,957,864 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current Liabilities | ||||||||

| Short-term bank loans | $ | 2,769,645 | $ | 2,833,619 | ||||

| Loan from related parties | 2,311,611 | 2,499,312 | ||||||

| Accounts payable | 99,397 | 2,766,554 | ||||||

| Accrued payroll and employee benefits | 260,000 | 308,290 | ||||||

| Other payables and accrued liabilities | 2,003,114 | 1,589,541 | ||||||

| Income taxes payable | 3,449,060 | 1,744,253 | ||||||

| Total current liabilities | 10,892,827 | 11,741,569 | ||||||

| Loans from credit union | 5,721,295 | 5,690,852 | ||||||

| Total liabilities | 16,614,122 | 17,432,421 | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders' Equity | ||||||||

| Common stock, 500,000,000 shares authorized, $0.001 par value per share, 18,459,775 and 18,350,191 shares issued and outstanding as of March 31, 2012 and December 31, 2011, respectively | 18,460 | 18,350 | ||||||

| Additional paid-in capital | 46,135,975 | 45,758,020 | ||||||

| Statutory earnings reserve | 5,863,442 | 5,863,442 | ||||||

| Accumulated other comprehensive income | 12,112,060 | 11,442,567 | ||||||

| Retained earnings | 69,124,755 | 64,443,064 | ||||||

| Total stockholders' equity | 133,254,692 | 127,525,443 | ||||||

| Total Liabilities and Stockholders' Equity | $ | 149,868,814 | $ | 144,957,864 | ||||

See accompanying notes to condensed consolidated financial statements.

| 3 |

ORIENT PAPER, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

FOR THE THREE MONTHS ENDED MARCH 31, 2012 AND 2011

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2012 | 2011 | |||||||

| Revenues | $ | 34,408,999 | $ | 33,225,219 | ||||

| Cost of sales | (26,655,827 | ) | (25,453,511 | ) | ||||

| Gross Profit | 7,753,172 | 7,771,708 | ||||||

| Selling, general and administrative expenses | (1,044,672 | ) | (860,286 | ) | ||||

| Loss from disposal of property, plant and equipment | - | (68,561 | ) | |||||

| Income from Operations | 6,708,500 | 6,842,861 | ||||||

| Other Income (Expense): | ||||||||

| Interest income | 4,716 | 11,146 | ||||||

| Interest expense | (204,874 | ) | (130,066 | ) | ||||

| Income before Income Taxes | 6,508,342 | 6,723,941 | ||||||

| Provision for Income Taxes | (1,826,651 | ) | (1,871,017 | ) | ||||

| Net Income | 4,681,691 | 4,852,924 | ||||||

| Other Comprehensive Income: | ||||||||

| Foreign currency translation adjustment | 669,493 | 663,498 | ||||||

| Total Comprehensive Income | $ | 5,351,184 | $ | 5,516,422 | ||||

| Earnings Per Share: | ||||||||

| Basic and Fully Diluted Earnings per Share | $ | 0.25 | $ | 0.26 | ||||

| Weighted Average Number of Shares | ||||||||

| Outstanding – Basic and Fully Diluted | 18,447,733 | 18,346,722 | ||||||

See accompanying notes to condensed consolidated financial statements.

| 4 |

ORIENT PAPER, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2012 AND 2011

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2012 | 2011 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net income | $ | 4,681,691 | $ | 4,852,924 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 1,959,302 | 1,084,944 | ||||||

| Loss from disposition of property, plant and equipment | - | 68,561 | ||||||

| (Recovery from)/allowance for bad debts | (3,677 | ) | 24,398 | |||||

| Stock-based expense for service received | 378,065 | 30,369 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts and notes receivable | 96,949 | (910,294 | ) | |||||

| Prepayments and other current assets | 450,454 | (4,619 | ) | |||||

| Inventories | 2,166,832 | 1,993,995 | ||||||

| Accounts payable | (2,686,080 | ) | 384,203 | |||||

| Accrued payroll and employee benefits | (49,556 | ) | 704 | |||||

| Other payables and accrued liabilities | 656,543 | (545,567 | ) | |||||

| Income taxes payable | 1,698,083 | 1,611,172 | ||||||

| Net Cash Provided by Operating Activities | 9,348,606 | 8,590,790 | ||||||

| Cash Flows from Investing Activities: | ||||||||

| Prepayment/deposit for purchase of property, plant and equipment | (2,452,130 | ) | - | |||||

| Purchases of property, plant and equipment | (5,169,530 | ) | (5,843,476 | ) | ||||

| Proceeds from disposal of property, plant and equipment | - | 736 | ||||||

| Net Cash Used in Investing Activities | (7,621,660 | ) | (5,842,740 | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Repayment of related party loans | (200,000 | ) | - | |||||

| Proceeds from bank loans | 1,981,359 | 1,494,825 | ||||||

| Repayments of bank loans | (2,060,614 | ) | (3,988,223 | ) | ||||

| Net Cash Used in Financing Activities | (279,255 | ) | (2,493,398 | ) | ||||

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | 13,483 | 75,234 | ||||||

| Net Increase in Cash and Cash Equivalents | 1,461,174 | 329,886 | ||||||

| Cash and Cash Equivalents - Beginning of Period | 4,165,446 | 11,348,108 | ||||||

| Cash and Cash Equivalents - End of Period | $ | 5,626,620 | $ | 11,677,994 | ||||

| Supplemental Disclosure of Cash Flow Information: | ||||||||

| Cash paid for interest | $ | 171,015 | $ | 187,538 | ||||

| Cash paid for income taxes | $ | 128,568 | $ | 259,845 | ||||

| Supplemental Disclosure of significant non-cash transactions: | ||||||||

| Disposal of property, plant and equipment in lieu of payment for construction cost of a new plant | - | 243,479 | ||||||

| Issuance of warrants for consultancy services | - | 79,521 | ||||||

| Issuance of 109,584 shares of common stock to directors and officers | 378,065 | - | ||||||

See accompanying notes to condensed consolidated financial statements.

| 5 |

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(1) Organization and Business Background

Orient Paper, Inc. (“Orient Paper” or “the Company”) was incorporated under the laws of the State of Nevada on December 9, 2005, under the name of Carlateral, Inc. Carlateral, Inc. started its business by providing financing services specializing in subprime title loans, secured primarily using automobiles (and also boats, recreational vehicles, machinery, and other equipment) as collateral.

Hebei Baoding Orient Paper Milling Company Limited (“HBOP”) was incorporated on March 10, 1996, under the laws of the People’s Republic of China (“PRC”). HBOP is mainly engaged in the production and distribution of paper products such as corrugating medium paper, offset paper and writing paper. HBOP also has capability to produce other paper and packaging-related products, such as plastic paper and craft paper. HBOP uses recycled paper as its primary raw material.

Dongfang Zhiye Holding Limited (“Dongfang Holding”) was formed on November 13, 2006, under the laws of the British Virgin Islands, and is an investment holding company. As such, Dongfang Holding does not generate any financial or operating transactions. On July 16, 2007, Dongfang Holding entered into an agreement to acquire the equity ownership of HBOP and placed all the equity interest in trust with Mr. Zhenyong Liu, Mr. Xiaodong Liu, and Mr. Shuangxi Zhao (the original equity owners of HBOP, each, an “HBOP Equity Owner” and collectively, “HBOP Equity Owners”), pursuant to a trust agreement executed on the same date. Under the terms of the trust agreement, the HBOP Equity Owners would exercise control over the disposition of Dongfang Holding’s shares in HBOP on Dongfang Holding’s behalf until Dongfang Holding successfully completed the change in registration of HBOP’s capital with the relevant PRC Administration of Industry and Commerce as the 100% owner of HBOP’s equity interest. In connection with the consummation of the restructuring transactions on June 24, 2009 as described below, Dongfang Holding directed its trustee to return its equity ownership in HBOP to the HBOP Equity Owners.

On October 29, 2007, Orient Paper entered into an Agreement and Plan of Merger (“Merger Agreement”) with (i) Orient Paper wholly owned subsidiary, CARZ Merger Sub, Inc., (ii) Dongfang Holding, and (iii) all shareholders of Dongfang Holding (Zhenyong Liu, Xiaodong Liu, Chen Li, Ning Liu, Jie Liu, Shenzhen Huayin Guaranty & Investment Company Limited, Top Good International Limited, Total Giant Group Limited, Total Shine Group Limited, Victory High Investment Limited, Think Big Trading Limited, Huge Step Enterprises Limited, and Sure Believe Enterprise Limited).

Pursuant to the Merger Agreement, Dongfang Holding merged with CARZ Merger Sub, Inc. via a share exchange, with Dongfang Holding as the surviving entity. In exchange for their shares in Dongfang Holding, the Dongfang Holding shareholders received an aggregate of 7,450,497 newly-issued shares of Orient Paper’s common stock, $0.001 par value, which were distributed pro ratably among the Dongfang Holding shareholders in accordance with their respective ownership interests in Dongfang Holding.

As a result of the merger transaction, Dongfang Holding became a wholly-owned subsidiary of Orient Paper, which, in turn, has the controlling right on Dongfang Holding’s operating company, HBOP, pursuant to the terms of the trust agreement. HBOP, the entity through which the Company operates its business currently has no subsidiaries, either wholly- or partially-owned.

Prior to the completion of the reverse merger, Orient Paper only had limited operations (since its incorporation on December 9, 2005). On December 21, 2007, the name of the Company was changed from Carlateral, Inc. to Orient Paper, Inc. in order to better reflect the current business plan subsequent to the reverse merger. Accordingly, the reverse merge has been recorded as a recapitalization of Orient Paper.

| 6 |

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

To ensure proper compliance of the Company’s control over the ownership and operations of HBOP with certain PRC regulations, on June 24, 2009, the Company entered into a series of contractual agreements (the “Contractual Agreements”) with HBOP and HBOP Equity Owners via the Company’s wholly owned subsidiary Shengde Holdings, Inc. (“Shengde Holdings”) a Nevada corporation and Baoding Shengde Paper Co., Ltd. (“Baoding Shengde”), a wholly foreign-owned enterprise in the PRC with an original registered capital of $10,000,000 (subsequently increased to $60,000,000 in June 2010). Baoding Shengde is mainly engaged in production and distribution of digital photo paper and is 100% owned by Shengde Holdings. Prior to February 10, 2010, the Contractual Agreements included (i) Exclusive Technical Service and Business Consulting Agreement, which generally provides that Baoding Shengde shall provide exclusive technical, business and management consulting services to HBOP, in exchange for service fees including a fee equivalent to 80% of HBOP’s total annual net profits; (ii) Loan Agreement, which provides that Baoding Shengde will make a loan in the aggregate principal amount of $10,000,000 to HBOP Equity Owners in exchange for each such shareholder agreeing to contribute all of its proceeds from the loan to the registered capital of HBOP; (iii) Call Option Agreement, which generally provides, among other things, that HBOP Equity Owners irrevocably grant to Baoding Shengde an option to purchase all or part of each owner’s equity interest in HBOP. The exercise price for the options shall be RMB1 which Baoding Shengde should pay to each of HBOP Equity Owner for all their equity interests in HBOP; (iv) Share Pledge Agreement, which provides that HBOP Equity Owners will pledge all of their equity interests in HBOP to Baoding Shengde as security for their obligations under the other agreements described in this section. Specifically, Baoding Shengde is entitled to dispose of the pledged equity interests in the event that HBOP Equity Owners breach their obligations under the Loan Agreement or HBOP fails to pay the service fees to Baoding Shengde pursuant to the Exclusive Technical Service and Business Consulting Agreement; and (v) Proxy Agreement, which provides that HBOP Equity Owners shall irrevocably entrust a designee of Baoding Shengde with such shareholder’s voting rights and the right to represent such shareholder to exercise such owner’s rights at any equity owners’ meeting of HBOP or with respect to any equity owner action to be taken in accordance with the laws and HBOP’s Articles of Association. The terms of the agreement are binding on the parties for as long as HBOP Equity Owners continue to hold any equity interest in HBOP. An HBOP Equity Owner will cease to be a party to the agreement once it transfers its equity interests with the prior approval of Baoding Shengde. As the Company had controlled HBOP since July 16, 2007 through Dongfang Holding and the trust until June 24, 2009, and continues to control HBOP through Baoding Shengde and the Contractual Agreements, the execution of the Contractual Agreements is considered as a business combination under common control.

On February 10, 2010, Baoding Shengde and the HBOP Equity Owners entered into a Termination of Loan Agreement to terminate the above $10,000,000 Loan Agreement. Because of the Company’s decision to fund future business expansions through Baoding Shengde instead of HBOP, the $10,000,000 loan contemplated was never made prior to the point of termination. The parties believe the termination of the Loan Agreement does not in itself compromise the effective control of the Company over HBOP and its businesses in the PRC.

An agreement was also entered into among Baoding Shengde, HBOP and the HBOP Equity Owners on December 31, 2010, reiterating that Baoding Shengde is entitled to 100% of the distributable profit of HBOP, pursuant to the above mentioned Contractual Agreements. In addition, HBOP and the HBOP Equity Owners shall not declare any of HBOP’s unappropriated earnings as dividend, including the unappropriated earnings of HBOP from its establishment to 2010 and thereafter.

Orient Paper has no direct equity interest in HBOP. However, through the Contractual Agreements described above Orient Paper is found to be the primary beneficiary of HBOP and is deemed to have the effective control over HBOP’s activities that most significantly affect its economic performance, resulting in HBOP being treated as a controlled variable interest entity of Orient Paper in accordance with Topic 810- Consolidation of the Accounting Standards Codification (the “ASC”) issued by the Financial Accounting Standard Board (the “FASB”). The revenue of the Company generated from HBOP for the quarter ended March 31, 2012 and 2011 were 95.4% and 93.5%, respectively. HBOP also accounted for 69.6% and 68.2% of the total assets of the Company as at March 31, 2012 and December 31, 2011, respectively.

| 7 |

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

As of March 31, 2012 and December 31, 2011, details of the Company’s subsidiaries and variable interest entities are as follows:

| Place of | |||||||||

| Date of Incorporation | Incorporation or | Percentage of | |||||||

| Name | or Establishment | Establishment | Ownership | Principal Activity | |||||

| Subsidiary: | |||||||||

| Dongfang Holding | November 13, 2006 | BVI | 100 | % | Inactive investment holding | ||||

| Shengde Holdings | February 25, 2009 | State of Nevada | 100 | % | Investment holding | ||||

| Baoding Shengde | June 1, 2009 | PRC | 100 | % | Paper Production and distribution | ||||

| Variable interest entity: | |||||||||

| HBOP | March 10, 1996 | PRC | Control | * | Paper Production and distribution |

* HBOP is treated as a 100% controlled variable interest entity of the Company

(2) Basis of Presentation and Significant Accounting Policies

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”) for reporting on Form 10-Q. Accordingly, certain information and notes required by the United States of America generally accepted accounting principles (“GAAP”) for annual financial statements are not included herein. These interim statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Annual Report on Form 10-K for the year ended December 31, 2011 of Orient Paper, Inc. a Nevada corporation, and its subsidiaries and variable interest entity (which we sometimes refer to collectively as “Orient Paper”, “we”, “us” or “our”).

Principles of Consolidation

Our unaudited condensed consolidated financial statements reflect all adjustments, which are, in the opinion of management, necessary for a fair presentation of our financial position and results of operations. Such adjustments are of a normal recurring nature, unless otherwise noted. The balance sheet as of March 31, 2012 and the results of operations for the three months ended March 31, 2012 are not necessarily indicative of the results to be expected for any future period.

Our unaudited condensed consolidated financial statements are prepared in accordance with GAAP. These accounting principles require us to make certain estimates, judgments and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. We believe that the estimates, judgments and assumptions are reasonable, based on information available at the time they are made. Actual results could differ materially from those estimates.

| 8 |

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(3) Inventories

Raw materials inventory includes mainly recycled paper and coal. Finished goods include mainly products of offset printing paper and corrugating medium paper. Inventories consisted of the following as of March 31, 2012 and December 31, 2011:

| March 31, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Raw Materials | ||||||||

| Recycled paper board | $ | 4,018,776 | $ | 5,645,449 | ||||

| Pulp | 13,791 | 13,718 | ||||||

| Recycled printed paper | 513,264 | 589,165 | ||||||

| Recycled white scrap paper | 1,558,462 | 1,918,545 | ||||||

| Coal | 508,049 | 661,891 | ||||||

| Base paper and other raw materials | 300,720 | 149,306 | ||||||

| 6,913,062 | 8,978,074 | |||||||

| Finished Goods | 984,896 | 1,029,854 | ||||||

| Totals | $ | 7,897,958 | $ | 10,007,928 | ||||

(4) Prepayment and other current assets

Prepayment and other current assets consisted of the following as of March 31, 2012 and December 31, 2011:

| March 31, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Prepaid annual fees | $ | 27,500 | $ | 18,125 | ||||

| Recoverable VAT | 4,320,321 | 4,776,962 | ||||||

| Prepaid insurance | - | 61,357 | ||||||

| Prepayment for purchase of materials | 295,480 | 206,930 | ||||||

| Others | 4,775 | 7,841 | ||||||

| $ | 4,648,076 | $ | 5,071,215 | |||||

(5) Prepayment on property, plant and equipment

As of March 31, 2012 and December 31, 2011, prepayment on property, plant and equipment consisted of $7,280,209 and $7,241,472, respectively in respect of prepaid land use right.

(6) Property, plant and equipment

As of March 31, 2012 and December 31, 2011, property, plant and equipment consisted of the following:

| March 31, 2012 | December 31, 2011 | |||||||

| Property, Plant, and Equipment: | ||||||||

| Land use rights | $ | 2,371,481 | $ | 2,358,862 | ||||

| Building and improvements | 20,386,902 | 11,145,342 | ||||||

| Machinery and equipment | 121,412,865 | 122,844,563 | ||||||

| Vehicles | 400,893 | 233,217 | ||||||

| Construction in progress | 2,448,366 | 2,335,579 | ||||||

| 147,020,507 | 138,917,563 | |||||||

| Less accumulated depreciation and amortization | (26,352,561 | ) | (24,266,456 | ) | ||||

| Property, Plant and Equipment, net | $ | 120,667,946 | $ | 114,651,107 | ||||

Land use right represents state-owned land located in Baoding, Hebei province in China with lease terms of 50 years expiring in 2053.

| 9 |

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Construction in progress mainly represents payments for the staff dormitory and canteen under construction.

Property, plant and equipment with net values of $10,352,907 and $10,646,244 have been pledged for long-term loans from credit union of HBOP as of March 31, 2012 and December 31, 2011, respectively. Depreciation and amortization of property, plant and equipment was $1,959,302 and $1,084,944 for the quarter ended March 31, 2012 and 2011, respectively.

(7) Loans Payable

Short-term bank loans

| March 31, 2012 | December 31, 2011 | |||||||||||

| Industrial & Commercial Bank of China | (a) | $ | - | $ | 2,046,503 | |||||||

| Industrial & Commercial Bank of China | (b) | 791,327 | 787,116 | |||||||||

| Industrial & Commercial Bank of China | (c) | 1,978,318 | - | |||||||||

| Total short-term bank loans | $ | 2,769,645 | $ | 2,833,619 | ||||||||

| (a) | On March 16, 2011, the Company obtained from the Industrial & Commercial Bank of China an accounts receivable factoring facility with a maximum credit limit of $2,046,503 as of December 31, 2011. Under the factoring agreement, the bank has recourse against the Company if the receivables, which remain in the Company’s books at all times, are not fully collected. The term of the factoring facility expired on February 27, 2012 and carried an interest rate of 6.4236% per annum, which is 106% of the prime rate for the loan set forth by the People’s Bank of China at the time of funding. The Company paid off the balance of the factoring facility on February 24, 2012. |

| (b) | On August 18, 2011, the Company obtained from the Industrial & Commercial Bank of China a new accounts receivable factoring facility with a maximum credit limit of $791,327 as of March 31, 2012. Under the factoring agreement, the bank has recourse against the Company if the receivables, which remain in the Company’s books at all times, are not fully collected. The term of the factoring facility expires on August 15, 2012 and carries an interest rate of 8.528% per annum. |

| (c) | On March 13, 2012, the Company obtained from the Industrial & Commercial Bank of China another accounts receivable factoring facility with a maximum credit limit of $1,978,318 as of March 31, 2012. Under the factoring agreement, the bank has recourse against the Company if the receivables, which remain in the Company’s books at all times, are not fully collected. The term of the factoring facility will expire on January 4, 2013 and carried an interest rate of 8.856% per annum as of March 31, 2012, or 3.5% plus the prime rate for the loan set forth by the People’s Bank of China at the time of funding. |

As of March 31, 2012 and December 31, 2011, short-term borrowings were $2,769,645 and $2,833,619, respectively. No unsecured bank loans. The factoring facility was secured by the Company’s accounts receivable in the amount of $3,974,879 and $3,956,948 as of March 31, 2012 and December 31, 2011, respectively.

As of March 31, 2012 and December 31, 2011, the Company had no unutilized credit facility with the banks. The average short-term borrowing rates for the three months ended March 31, 2012 and 2011 were approximately 7.49% and 5.42%, respectively.

Long-term loans from credit union

As of March 31, 2012 and December 31, 2011, loan payable to Rural Credit Union of Xushui County (formerly Rural Credit Cooperative of Xushui County) amounted to $5,721,295 and $5,690,852. On March 31, 2011, the Company entered into a three-year term loan agreement with the Rural Credit Union of Xushui County for an amount that is $1,558,915 as of March 31, 2012 and $1,550,619 as of December 31, 2011. The loan is guaranteed by an independent third party. Interest payment is due quarterly and bears the rate of 0.72% per month.

On June 10, 2011, the Company entered into a new term loan agreement with the Xushui County Rural Credit Union for an amount that is $4,162,380 as of March 31, 2012 and $4,140,233 as of December 31, 2011. The new loan is secured by its manufacturing equipment of $10,352,907 and $10,646,244 as of March 31, 2012 and December 31, 2011, respectively and will mature on June 9, 2013. Interest payment is due quarterly and bears the rate of 0.72% per month.

| 10 |

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Total interest expenses for the short-term bank loans and long-term loans for the three months ended March 31, 2012 and 2011 were $171,015 and $67,686, respectively.

Future maturities of short term and long term loans payable were as follows as of March 31, 2012:

| March 31, | Amount | |||||

| 2013 | $ | 2,769,645 | ||||

| 2014 | 5,721,295 | |||||

| $ | 8,490,940 | |||||

(8) Related Party Transactions

Mr. Zhenyong Liu is the director, principal stockholder and chief executive officer of the Company. He loaned money to HBOP for working capital purposes over a period of time. On August 31, 2009, Orient Paper, HBOP, and Mr. Liu entered into a tri-party Debt Assignment and Assumption Agreement, under which Orient Paper agreed to assume the loan of $4,000,000 due from HBOP to Mr. Liu. Concurrently, Orient Paper issued 1,204,341 shares of restricted common stock to Mr. Liu at the market price of $3.32132 per share. As of March 31, 2012 and December 31, 2011, net amount due to Mr. Liu were $2,311,611 and $2,299,312, respectively.

The loan of Mr. Liu is interest bearing and the interest rate is equal to the rate established by the People’s Bank of China, which was 5.85% and 5.85% per annum, respectively as of March 31, 2012 and December 31, 2011. The term is for 3 years and starts from January 1, 2010 and is due December 31, 2012.

On August 1 and August 5, 2008, two members of the Board of Directors of HBOP loaned money to the Company for working capital purposes. The amounts owed bore interest equals the rate established by the People’s Bank of China and are due on July 31 and August 4, 2011, respectively. The Company paid off the loan balance to both directors of HBOP by August 4, 2011. The interest rate was 5.85% per annum before the payoff in year 2011.

The interest expenses incurred for above related party loans are $33,859 and $62,380 for the three months ended March 31, 2012 and 2011.

On November 30, 2011, the Company borrowed $200,000 from a shareholder to pay for various expenses incurred in the U.S. The amount is repayable on demand with interest free. The Company repaid the entire balance on January 4, 2012.

(9) Other payables and accrued liabilities

Other payables and accrued liabilities consist of the following:

| March 31, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Accrued electricity | $ | 329,306 | $ | 314,598 | ||||

| Accrued professional fees | 48,000 | 58,000 | ||||||

| Value-added tax payable | 626,620 | - | ||||||

| Accrued interest | 304,266 | 269,019 | ||||||

| Payable for purchase of equipment | 625,390 | 936,908 | ||||||

| Others | 69,532 | 11,016 | ||||||

| Totals | $ | 2,003,114 | $ | 1,589,541 | ||||

| 11 |

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(10) Common Stock

Issuance of common stock pursuant to the 2011 Incentive Stock Plan

On January 12, 2012, the Company issued shares of 109,584 out of the 2011 Incentive Stock Plan of Orient Paper Inc. (the “2011 ISP”) to certain of its directors and officers when the stock was at $3.45 per share, as compensation for their services in the past years. Total fair value of the stock was calculated at $378,065 as of the date of issuance. The 2011 ISP was approved by the shareholders of the Company in August 2011 and sets aside 375,000 shares of the Company’s common stock for the purpose of compensating services provided by the employees, directors and other service providers. See Note (13), Stock Incentive Plan, for more details of the 2011 ISP.

(11) Earnings Per Share

For the three months ended March 31, 2012 and 2011, basic and diluted net income per share are calculated as follows:

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2012 | 2011 | |||||||

| Basic income per share | ||||||||

| Net Income for the period – numerator | $ | 4,681,691 | $ | 4,852,924 | ||||

| Weighted average common stock outstanding – denominator | 18,447,733 | 18,346,722 | ||||||

| Net income per share | $ | 0.25 | $ | 0.26 | ||||

| Diluted income per share | ||||||||

| Net Income for the period – numerator | $ | 4,681,691 | $ | 4,852,924 | ||||

| Weighted average common stock outstanding - denominator | 18,447,733 | 18,346,722 | ||||||

| Effect of dilution | - | - | ||||||

| Warrant | - | - | ||||||

| Weighted average common stock outstanding - denominator | 18,447,733 | 18,346,722 | ||||||

| Diluted income per share | $ | 0.25 | $ | 0.26 | ||||

(12) Income Taxes

United States

Orient Paper and Shengde Holdings are incorporated in the State of Nevada and are subject to the U.S. federal tax and state statutory tax rates up to 34% and 0%, respectively.

PRC

HBOP and Baoding Shengde are PRC operating companies and are subject to PRC Enterprise Income Tax. Pursuant to the PRC New Enterprise Income Tax Law, Enterprise Income Tax is generally imposed at a statutory rate of 25%.

The provision for income taxes for the three months ended March 31, 2012 and 2011 were as follows:

| Three Months Ended March 31, | ||||||||

| 2012 | 2011 | |||||||

| Provision for Income Taxes | ||||||||

| Current Tax Provision – PRC | $ | 1,826,651 | $ | 1,871,017 | ||||

| 12 |

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

During the three months ended March 31, 2012 and 2011, the effective income tax rate was estimated by the Company to be 28.1% and 27.8%, respectively.

The Company has adopted ASC Topic 740-10-05, Income Taxes, related to uncertain income tax positions. To date, the adoption of this interpretation has not impacted the Company’s financial position, results of operations, or cash flows. The Company performed self-assessment and the Company’s liability for income taxes includes the liability for unrecognized tax benefits, interest and penalties which relate to tax years still subject to review by taxing authorities. Audit periods remain open for review until the statute of limitations has passed, which in the PRC is usually 5 years. The completion of review or the expiration of the statute of limitations for a given audit period could result in an adjustment to the Company’s liability for income taxes. Any such adjustment could be material to the Company’s results of operations for any given quarterly or annual period based, in part, upon the results of operations for the given period. As of March 31, 2012 and December 31, 2011, management considered that the Company had no uncertain tax positions affecting its consolidated financial position and results of operations or cash flows, and will continue to evaluate for any uncertain position in future. There are no estimated interest costs and penalties provided in the Company’s condensed consolidated financial statements for the three months ended March 31, 2012 and 2011, respectively. The Company’s tax positions related to open tax years are subject to examination by the relevant tax authorities and the major one is the China Tax Authority.

(13) Stock Incentive Plan

On August 28, 2011, the Company’s Annual General Meeting approved the 2011 Incentive Stock Plan (the “2011 ISP”) as previously adopted by the Board of Directors on July 5, 2011. Under the 2011 ISP, the Company may grant an aggregate of 375,000 shares of the Company’s common stock to the Company’s directors, officers, employees or consultants. Specifically, the Board and/or the Compensation Committee have authority to (a) grant, in its discretion, Incentive Stock Options or Non-statutory Options, Stock Awards or Restricted Stock Purchase Offers; (b) determine in good faith the fair market value of the stock covered by any grant; (c) determine which eligible persons shall receive grants and the number of shares, restrictions, terms and conditions to be included in such grants; and (d) make all other determinations necessary or advisable for the 2011 ISP's administration. No stock or option was issued under the 2011 ISP until January 12, 2012, when the Compensation Committee granted 109,584 shares of restricted common stock to certain officers and directors of the Company.

(14) Commitments and Contingencies

Operating Lease

Orient Paper leases 32.95 acres of land from a local government through a real estate lease with a 30-year term, which expires on December 31, 2031. The lease requires an annual rental payment of approximately $18,992(RMB 120,000). This operating lease is renewable at the end of the 30-year term. The rental expenses for the three months ended March 31, 2012 and 2011 were $ 4,755 and $4,553, respectively.

Future minimum lease payments are as follows:

| March 31, | Amount | |||

| 2013 | $ | 18,992 | ||

| 2014 | 18,992 | |||

| 2015 | 18,992 | |||

| 2016 | 18,992 | |||

| 2017 | 18,992 | |||

| Thereafter | 280,130 | |||

| Total operating lease payments | $ | 375,090 | ||

Capital commitment

The Company has signed several contracts for constructing staff hostel and purchase of equipment. The outstanding commitments are $4,069,003 and $4,860,965 as of March 31, 2012 and December 31, 2011. The Company expects to pay off all the balances by the end of 2012.

| 13 |

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Pending Litigation

On August 6, 2010, a stockholder class action lawsuit was filed in the U.S. District Court for the Central District of California against the Company, certain current and former officers and directors of the Company, and Roth Capital Partners, LLP. The complaint in the lawsuit, Mark Henning, et al. v. Orient Paper et al., CV-10-5887 RSWL (AJWx), alleges, among other claims, that the Company issued materially false and misleading statements and omitted to state material facts that rendered its affirmative statements misleading as they related to the Company’s financial performance, business prospects, and financial condition, and that the defendants failed to prevent such statements from being issued or corrected. The complaint seeks, among other relief, compensatory damages, attorneys' fees and experts’ fees. Plaintiffs purport to sue on behalf of themselves and a class consisting of the Company’s stockholders (other than the defendants and their affiliates). The plaintiffs filed an amended complaint on January 28, 2011, and the Company filed a motion to dismiss with the court on March 14, 2011. On July 20, 2011 the court denied the Company’s motion to dismiss, thus allowing the litigation to proceed to discovery. Nevertheless, at this stage of the proceedings, management cannot opine that a favorable outcome for the Company is probable or that an unfavorable outcome to the Company is remote. While certain legal defense costs may be later reimbursed by the Company’s insurance carrier, no reasonable estimate of any impact of the outcome of the litigation or related legal fees on the financial statements can be made as of the date of this statement.

On April 1, 2011 the Company was served a summon for a complaint filed by Tribank Capital Investments, Inc. (“Tribank”) on March 30, 2011 in the Superior Court of the State of California for the County of Los Angeles against the Company and its Chairman and CEO Mr. Zhenyong Liu (the “Tribank Matter”). By filing the complaint, Tribank alleges, among other claims, that the Company breached the Non-Circumvention Agreement dated October 29, 2008 between the Company and Tribank (the “Agreement”), and that the Company was unjustly enriched as a result of breaching the Agreement. The complaint seeks, among other relief, compensatory damages and plaintiff’s counsel’s fees. On April 29, 2011 the Company filed a Notice of Removal to remove the jurisdiction of the case from the state court of California to the Federal District Court for the District of Central California and filed a motion to dismiss the lawsuit on May 6, 2011. On July 18, 2011, United States District Court Judge Manual Real granted Orient Paper motion to dismiss the complaint in its entirety, finding that venue is improper because the contract that forms the basis of the parties' relationship contains a valid and enforceable forum selection clause providing that the Hong Kong Special Administrative Region of China is the exclusive forum for resolution of disputes. Tribank subsequently filed a notice of appeal with the court on August 5, 2011. The Company continues to believe that the complaint has no merit and intends to vigorously defend the lawsuit. While certain legal defense costs may be later reimbursed by the Company’s insurance carrier, no reasonable estimate of any impact of the outcome of the litigation or related legal fees on the financial statements can be made as of date of this statement.

(15) Segment Reporting

Since March 10, 2010, Baoding Shengde started its operations and thereafter the Company manages its operations through two business operating segments: HBOP, which produces printing paper and corrugating medium paper, and Baoding Shengde, which produces digital photo paper. They are managed separately because each business requires different technology and marketing strategies.

The Company evaluates performance of its operating segments based on net income. Administrative functions such as finance, treasury, and information systems are centralized. However, where applicable, portions of the administrative function expenses are allocated between the operating segments based on gross revenue generated. The operating segments do share facilities in Xushui County, Baoding City, Hebei, China. All sales were sold to customers located in the PRC.

| 14 |

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Summarized financial information for the two reportable segments for the three months ended March 31, 2012 and 2011 is as follows:

| Three Months Ended March 31, 2012 | ||||||||||||||||||||

| HBOP | Baoding Shengde | Not Attributable to Segments | Elimination of Inter-segment | Enterprise-wide, consolidated | ||||||||||||||||

| Revenues | $ | 32,832,860 | $ | 1,576,139 | $ | - | $ | - | $ | 34,408,999 | ||||||||||

| Gross Profit | 7,348,894 | 404,278 | - | - | 7,753,172 | |||||||||||||||

| Depreciation and amortization | 1,722,300 | 237,002 | - | - | 1,959,302 | |||||||||||||||

| Interest income | 2,686 | 1,994 | 36 | - | 4,716 | |||||||||||||||

| Interest expense | 204,874 | - | - | - | 204,874 | |||||||||||||||

| Income tax expense | 1,732,811 | 93,840 | - | - | 1,826,651 | |||||||||||||||

| Net Income (Loss) | 4,892,129 | 279,754 | (479,097 | ) | (11,095 | ) | 4,681,691 | |||||||||||||

| Total Assets | 113,624,700 | 45,878,586 | 28,456 | (9,662,928 | ) | 149,868,814 | ||||||||||||||

Three Months Ended March 31, 2011 | ||||||||||||||||||||

| HBOP | Baoding Shengde | Not Attributable to Segments | Elimination of Inter-segment | Enterprise-wide, consolidated | ||||||||||||||||

| Revenues | $ | 31,067,920 | $ | 2,157,299 | $ | - | $ | - | $ | 33,225,219 | ||||||||||

| Gross Profit | 6,979,613 | 792,095 | - | - | 7,771,708 | |||||||||||||||

| Depreciation and amortization | 860,536 | 224,408 | - | - | 1,084,944 | |||||||||||||||

| Interest income | 2,668 | 8,435 | 43 | - | 11,146 | |||||||||||||||

| Interest expense | 130,066 | - | - | - | 130,066 | |||||||||||||||

| Income tax expense | 1,678,309 | 192,708 | - | - | 1,871,017 | |||||||||||||||

| Net Income (Loss) | 4,864,842 | 586,558 | (598,476 | ) | - | 4,852,924 | ||||||||||||||

| Year Ended December 31, 2011 | ||||||||||||||||||||

| HBOP | Baoding Shengde | Not Attributable to Segments | Elimination of Inter-segment | Enterprise-wide, Consolidated | ||||||||||||||||

| Total Assets | $ | 111,305,277 | $ | 46,180,744 | $ | 224,868 | $ | (12,753,025 | ) | $ | 144,957,864 | |||||||||

(16) Concentration of Major Suppliers

For the three months ended March 31, 2012, the Company had two major suppliers which primarily accounted for 75% and 15% of the total purchases.

For the three months ended March 31, 2011, the Company had two major suppliers accounted for 59% and 15% of the total purchases.

(17) Concentration of Credit Risk

Financial instruments for which the Company is potentially subject to concentration of credit risk consist principally of cash. The Company places its temporary cash investments in reputable financial institutions in the PRC and the United States. Although it is generally understood that the PRC central government stands behind all of the banks in China in the event of bank failure, there is no deposit insurance system in China that is similar to the protection provided by the Federal Deposit Insurance Corporation (FDIC) of the United States. The Company’s U.S. bank accounts are all fully covered by the FDIC insurance as of March 31, 2012 and December 31, 2011, respectively.

| 15 |

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(18) Risks and Uncertainties

Orient Paper is subject to substantial risks from, among other things, intense competition associated with the industry in general, other risks associated with financing, liquidity requirements, rapidly changing customer requirements, foreign currency exchange rates, and operating in the PRC under its various laws and restrictions.

(19) Recent Accounting Pronouncements

In December 2011, the FASB issued ASU 2011-11 - Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities, which requires entities to disclose both gross and net information about both instruments and transactions eligible for offset in the statement of financial position and instruments and transactions subject to an agreement similar to a master netting agreement. The objective of the disclosure is to facilitate comparison between those entities that prepare their financial statements on the basis of U.S. GAAP and those entities that prepare their financial statements on the basis of International Financial Reporting Standards ("IFRS"). This ASU is effective for fiscal years, and interim periods within those years, beginning on or after January 1, 2013. Retrospective presentation for all comparative periods presented is required. The Company’s adoption of ASU 2011-11 is not expected to have material impact on its consolidated financial statements.

| 16 |

Item 2 Management’s Discussion and Analysis of Financial Condition and Results of Operation

Cautionary Notice Regarding Forward-Looking Statements

The following discussion of the financial condition and results of operation of the Company for the three months ended March 31, 2012 and 2011 should be read in conjunction with the selected financial data, the financial statements, and the notes to those statements that are included elsewhere in this Quarterly Report. Some of the information contained in this discussion and analysis or set forth elsewhere in this Report, including information with respect to our plans and strategy for our business and related financing, includes forward-looking statements that involve risks and uncertainties.

In this quarterly report, references to “Orient Paper,” “ONP,” “the Company,” “we,” “our,” “us,” and the Company’s variable interest entity, “HBOP,” refer to Orient Paper, Inc.

We make certain forward-looking statements in this report, including information with respect to our plans and strategy for our business and related financing and include forward-looking statements that involve risks and uncertainties. Statements concerning our future operations, prospects, strategies, financial condition, future economic performance (including growth and earnings), demand for our services, and other statements of our plans, beliefs, or expectations, including the statements contained under the captions “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” as well as captions elsewhere in this document, are forward-looking statements. In some cases these statements are identifiable through the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can”, “could,” “may,” “should,” “will,” “would,” and similar expressions. We intend such forward-looking statements to be covered by the safe harbor provisions contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and in Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The forward-looking statements we make are not guarantees of future performance and are subject to various assumptions, risks, and other factors that could cause actual results to differ materially from those suggested by these forward-looking statements. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. Indeed, it is likely that some of our assumptions will prove to be incorrect. Our actual results and financial position will vary from those projected or implied in the forward-looking statements and the variances may be material. You are cautioned not to place undue reliance on such forward-looking statements. These risks and uncertainties, together with the other risks described from time to time in reports and documents that we file with the SEC should be considered in evaluating forward-looking statements.

In evaluating these forward-looking statements, you should consider various factors, including the following: (a) those risks and uncertainties related to general economic conditions, (b) whether we are able to manage our planned growth efficiently and operate profitable operations, (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations, (d) whether we are able to successfully fulfill our primary requirements for cash. Please refer to the section entitled “Liquidity and Capital Resources” contained in this Report for additional discussion. Please also refer to our other filings with the Securities and Exchange Commission. We assume no obligation to update forward-looking statements, except as otherwise required under the applicable federal securities laws.

Results of Operations

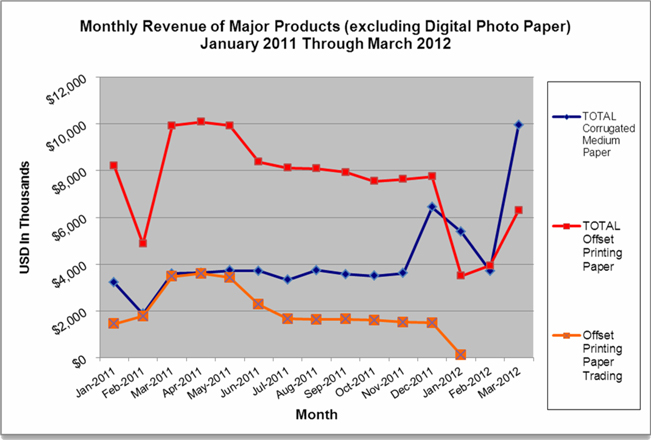

Revenue of Offset Printing Paper and Corrugating Medium Paper

Revenue from sales of offset printing paper and corrugating medium paper for the three months ended March 31, 2012 was $32,832,860, an increase of $1,764,941 or 5.68% from $31,067,919 for the comparable period in 2011. Total paper sold during the three months ended March 31, 2012 amounted to 63,222 tonnes, an increase of 12,379 tonnes or 24.35% from 50,843 tonnes sold in the comparable period in 2011. Starting December 2011, we produce and sell corrugating medium paper from a new paper production line with a designed capacity of 360,000 tonnes/year. The new production line contributed 26,978 tonnes of corrugating medium paper to our total production, or $11,330,214 in gross revenue, during the three months ended March 31, 2012 and provided a significant source of growth for our operations. However, the Company temporarily discontinued the trading of purchased offset printing paper finished goods, as it had been conducting since the third quarter of 2010, in January 2012 because of downward pricing pressure which squeezed the profit margin of the trading activities. The loss of sales revenue from the trading activities partially offset the growth in corrugating medium paper during the first quarter. The changes in revenue dollar amount and in tonnage for the three months ended March 31, 2012 and 2011 are summarized as follows:

| 17 |

| Three Months Ended | Three Months Ended | Changes in | Percentage | |||||||||||||||||||||||||||||

| March 31, 2012 | March 31, 2011 | Changes | ||||||||||||||||||||||||||||||

| Sales Revenue | Qty.(Tonne) | Amount | Qty.(Tonne) | Amount | Qty.(Tonne) | Amount | Qty.(Tonne) | Amount | ||||||||||||||||||||||||

| Corrugating medium Paper | 45,391 | $ | 19,063,302 | 22,152 | $ | 8,522,771 | 23,239 | $ | 10,540,531 | 104.91 | % | 123.67 | % | |||||||||||||||||||

| Offset printing Paper | 17,831 | 13,769,558 | 28,691 | 22,545,148 | (10,860 | ) | (8,775,590 | ) | (37.85 | )% | (38.92 | )% | ||||||||||||||||||||

| Total Corrugating Medium and Offset Printing Paper Sales Revenue | 63,222 | $ | 32,832,860 | 50,843 | $ | 31,067,919 | 12,379 | $ | 1,764,941 | 24.35 | % | 5.68 | % | |||||||||||||||||||

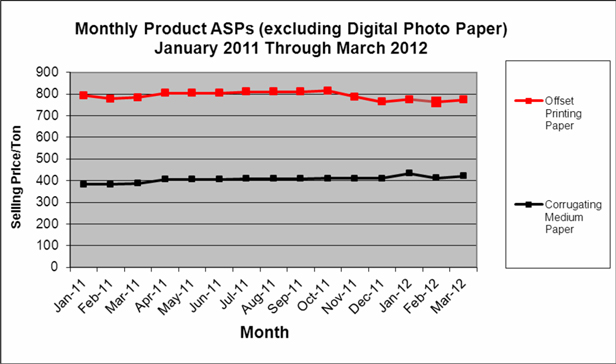

Average Selling Prices (“ASPs”) for our main products for the three months ended March 31, 2012 and 2011 are summarized as follows:

| Corrugating | ||||||||

| Medium Paper | ||||||||

| Offset ASP | ASP | |||||||

| Three months ended March 31, 2011 | $ | 786 | $ | 385 | ||||

| Three months ended March 31, 2012 | $ | 772 | $ | 420 | ||||

| Increase(decrease) from comparable period in the previous year | $ | (14 | ) | $ | 35 | |||

| Increase(decrease) as a percentage | (1.78 | )% | $ | 9.09 | % | |||

Revenue from corrugating medium paper amounted to $19,063,302 (or 58.06% of total offset printing paper and corrugating medium paper revenue) for the three months ended March 31, 2012, representing a $10,540,531 (or 123.67%) increase over the corrugating medium paper revenue of $8,522,711 for the comparable period in 2011. We sold 45,391 tonnes of corrugating medium paper in the three months ended March 31, 2012, representing a 23,239 tonnes (or 104.91%) increase compared with 22,152 tonnes sold in the comparable period in 2011. Within the total corrugating medium paper sold in the three months ended March 31, 2012, 26,978 tonnes were produced from the new production line that we launched in December 2011, compared with nil sold in the comparable period in 2011. ASP for corrugating medium paper rose from $385/tonne in the three months ended March 31, 2011 to $420/tonne in the three months ended March 31, 2012, representing a 9.09% increase over the comparable period. We believe the increase in ASP is primarily attributable to (1) increasing customer demand, and more importantly (2) a regional shortage in paper products supply, caused by mandatory closures of smaller paper manufacturers under government mandates in 2010 and for the most part of 2011. For example, the provincial government of Hebei announced on June 12, 2010 that it was working on closing 64 inefficient paper production lines with 26 local paper mills by the end of the year 2010, accounting for an elimination of annual capacity of approximately 400,000 tonnes in 2010, while the neighboring province of Henan announced that it was closing more than 100 local paper mills with an aggregate capacity of over 2 million tons of paper production. The Ministry of Industry and Information Technology of the People’s Republic of China announced on July 11, 2011 that 8.2 million tons of outdated paper milling capacities located in 599 paper companies across China will be forced to close down in the year 2011 (the “2011 Mandatory Closure”). Of all of the paper mills affected by the 2011 Mandatory Closure, 82 companies with total capacities of 1.07 million tons (or 13% of total closure) are located in the province of Hebei, where many of the old paper mills only have capacities under 50,000 tons. Our neighboring province of Henan saw 1.84 million tonnes capacities (or 22% of total 2011 closure), owned by 84 companies, eliminated before the end of 2011. Many industry commentators believe that the 2011 Mandatory Closure impacted mostly packaging paper, printing paper and household paper supplies in China in 2011 and has driven up selling prices of these products during the second half of 2011 and for most part of year 2011. However, as of March 31, 2012, we expect the ASPs for our corrugating medium paper to remain stabilized.

We started the new 360,000 tonnes/year facility in December 2011. Production quantities for December 2011 and January through March 2012 are 6,571 tonnes, 7,491 tonnes, 5,401 tonnes and 14,085 tonnes, respectively. We estimate that annual production quantity from the new production line would be approximately 150,000 tonnes.

Revenue from offset printing paper amounted to $13,769,558 (or 41.94% of total offset printing paper and corrugating medium paper revenue) for the three months ended March 31, 2012, which represents an $8,775,590 (or 38.92%) decrease over the offset printing paper revenue of $22,545,148 for the comparable period in 2011. We sold 17,831 tonnes of offset printing paper in the three months ended March 31, 2012 compared to 28,691 tonnes of offset printing paper in the comparable period in year 2011, a decrease of 10,860 tonnes or 37.85%. ASP for our offset printing paper decreased from $786/tonne in the first quarter of year 2011 to $772/tonne in the comparable period in 2012, representing a decrease of 1.78%. However, the year-over-year decrease in our offset printing paper ASP in the first quarter would be 6.14% if denominated in the functional currency RMB and calculated exclusive of any currency translation difference. Because of shrinking gross profit margin of the trading activities due to the decrease in offset printing paper ASP, we decided to temporary suspend offset printing paper trading after January 2012. Gross revenue from trading of offset printing paper finished goods is $121,619 for the three months ended March 31, 2012, which represents a decrease of $6,458,502 (or 98.15%) over the $6,580,121 for the comparable period in 2011. Only 157 tonnes of offset printing paper that we purchased from third party suppliers were sold for the three months ended March 31, 2012, compared to 8,390 tonnes sold in the same period in 2011. We have not resumed the trading business as of May 1, 2012, but may start the trading activities again if ASP of offset printing paper improves in the future.

| 18 |

The following is a chart showing the month-by-month ASPs (except for the ASPs of the digital photo paper) for the 15 months ended March 31, 2012:

Monthly sales revenue, including revenue from the sales of purchased paper finished goods and excluding revenue of digital photo paper, for the 15 months ended March 31, 2012, are summarized below. Monthly sales in February of 2012 and 2011 were seasonably lower because of the extended Chinese New Year holiday breaks.

| 19 |

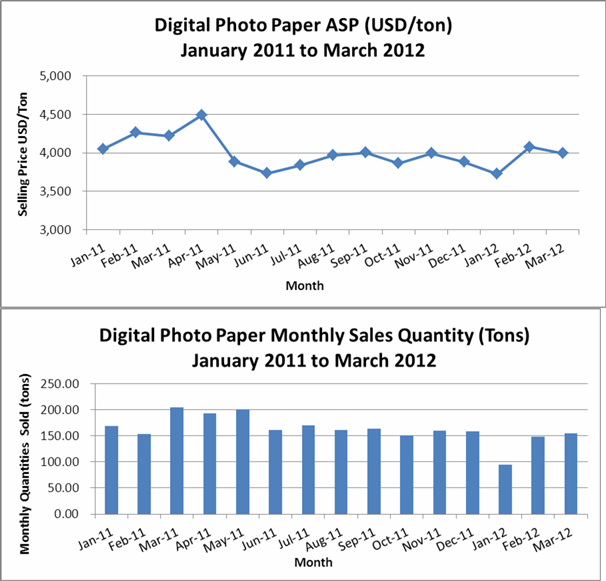

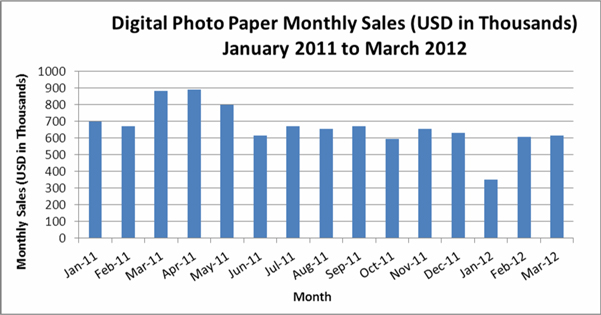

Revenue of Digital Photo Paper

Revenue generated from selling digital photo paper was $1,576,139 (or 4.58% of total consolidated revenue) for the three months ended March 31, 2012, compared with $2,157,300 (or 6.49% of total consolidated revenue) for the three months ended March 31, 2011. Because of a prolonged maintenance break before the Chinese New Year in January 2012, and a temporary slowdown of customer demands in the holiday period, production in the month of January 2012 was substantially lower than normal level. Other than the minor concern over a slowdown of Chinese photo paper export, which may affect the domestic market dynamics, we believe that the fundamentals of our digital photo paper market will remain stable and that production quantity in the second quarter of 2012 should return to normal level.

| Three months Ended | Three months Ended | Percentage | ||||||||||||||||||||||||||||||

| Sales | March 31, 2012 | March 31, 2011 | Change in | Change | ||||||||||||||||||||||||||||

| Revenue | Qty.(Tonne) | Amount | Qty.(Tonne) | Amount | Qty.(Tonne) | Amount | Qty.(Tonne) | Amount | ||||||||||||||||||||||||

| Digital Photo Paper | 398 | $ | 1,576,139 | 527 | $ | 2,157,300 | (129 | ) | $ | (581,161 | ) | (24.48 | )% | (26.94 | )% | |||||||||||||||||

We currently produce glossy and semi-matte photo paper in various weights (from 120g/m2 to 260g/m2). Our ASP of digital photo paper has been relatively steady since the third quarter of year 2011. Digital photo paper products’ monthly ASPs, monthly sales quantity (in tonnes) and monthly sales revenue for the 15 months from January 2011 to March 31, 2012 are summarized as follows:

| 20 |

| 21 |

Cost of Sales

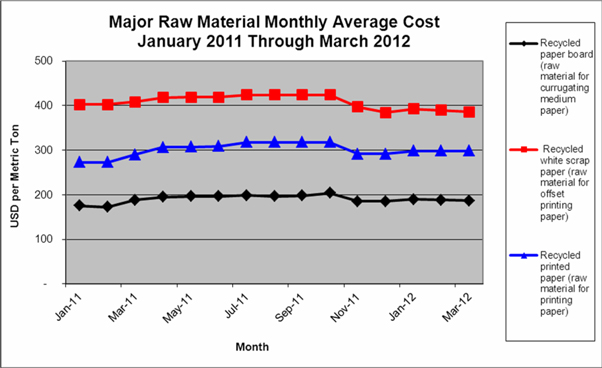

Total cost of sales for corrugating medium and offset printing paper for the three months ended March 31, 2012 was $25,483,966, an increase of $1,395,659 or 5.79% from $24,088,307 for the comparable period in 2011. The slight increase in total cost of sales in the three months ended March 31, 2012 is primarily due to the net increase in sales volume over the same period in 2011. As explained above, total sales revenue (excluding revenue from sales of digital photo paper) grew from $31,067,919 in the first quarter of 2011 to $32,832,860 in the comparable period in year 2012, representing a 5.68% year-over-year increase. During the current quarter ended March 31, 2012, major raw material costs for our corrugating medium and offset printing paper remained relatively lower as opposed to most part of year 2011. Monthly average purchase costs of our major raw materials for the 15 months period from January 2011 to March 2012 are as follows:

Costs for all types of raw materials in the 15-month period ended March 31, 2012 have been generally stable since November 2011, when a major downward waste paper pricing adjustment occurred. For example, our weighted-average unit purchase cost (net of applicable Value Added Tax) of recycled paper board, recycled white scrap paper, and recycled printed paper in the three months ended March 2012 were $188/tonne, $389/tonne, and $298/tonne, respectively, which represent year-over-year increases of 5.48%, negative 3.65%, and 7.16% as compared to what we paid per unit for these raw materials in the same period a year ago. Our production takes advantage entirely of domestic recycled paper (produced mainly from the Beijing-Tianjin metropolitan area, where 40% of publishing companies are located) and do not have to rely on imported recycled paper, which tends to have a more volatile pricing behavior than the domestic recycled paper, it appears that demand for domestic paper in 2012 is slightly weaker than most of the year of 2011. Depending on the regional economic outlook for the rest of year 2012, we believe that the future waste paper raw material costs will be stable or slightly recovering.

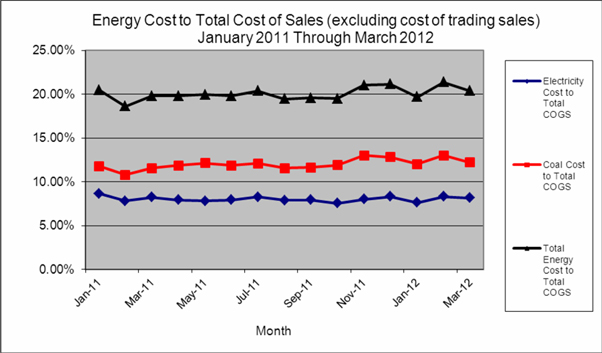

Electricity and coal are the two main energy sources of our paper manufacturing activities. Coal prices have been subject to seasonal fluctuations in China, with peaks often occurring in the winter months. Historically, electricity and coal accounted for approximately 9.98% and 11.63% of our total cost of sales, or approximately 7.74% and 9.03% of total sales, respectively. The monthly energy costs (electricity and coal) as a percentage of total monthly cost of sales of our main paper products for the 15 months ended March 31, 2012 are summarized as follows:

| 22 |

Total cost of sales of digital photo paper amounted to $1,171,861 for the three months ended March 31, 2012, representing a decrease of $193,343, or 14.16%, over the cost of sales of $1,365,204 in the comparable period in year 2011. The decrease is primarily due to the decrease in sales volume explained above.

Gross Profit

Gross profit for corrugating medium paper and offset printing paper for the three months ended March 31, 2012 was $7,348,894, a net increase of $369,282 or 5.29% from $6,979,612 for the comparable period in 2011. The net increase in gross profit of our two major products was primarily attributable to a 5.68% increase in total sales revenue, as well as a 5.79% increase in total cost of sales during the quarter ended March 31, 2012 as opposed to the comparable period in the previous year, as explained above. We generated only $8,258 of gross profit from sales of offset printing paper purchased under the four offset printing paper supply agreements with paper manufacturers in Hebei Province and the neighboring Shandong province in August 2010 during the three months ended March 31, 2012, versus $392,784 for the same period in year 2011.

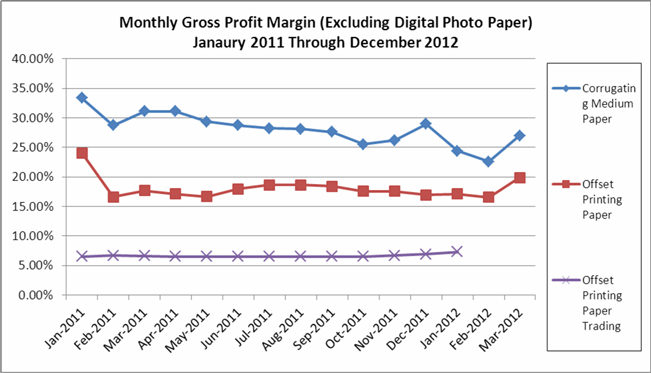

The overall gross profit margin for corrugating medium paper and offset printing paper for the three months ended March 31, 2012 decreased slightly by 0.09%, from 22.47% a year ago to 22.38%.

Gross profit margin for the corrugating medium paper for the three months ended March 31, 2012 was 25.42%, compared to 31.02% for the comparable period a year ago despite a year-over-year increase in product ASP of 9.09%. In the first quarter of 2012 we produced 26,978 tons of corrugating medium paper from the newly installed 360,000 tonnes/year production line, at approximately 30% of annualized design capacity of the new production line. We believe the gross profit margin realized in the run-in period of the new line will continue to be lower than that of the other production line, at least before the run rate is raised to approximately 60% of the design capacity.

Gross profit margin for the offset printing paper sold was 18.17% for the quarter ended March 31, 2012, compared to 19.23% for the comparable period a year ago. Gross profit margins for the purchased finished good of offset printing paper during the three months ended March 31, 2012 and 2011 were 6.79% and 5.97%, respectively, and were substantially lower than the gross profit margin of offset printing paper that was manufactured internally. Absent other changes, the discontinuance of the trading of purchased finished goods would have an effect of elevating our gross profit margin of total offset printing paper. However, because of the 6.14% decrease in offset printing paper’s year-over-year ASP (measured in our functional currency Chinese RMB and exclusive of any currency translation adjustment) in the first quarter of year 2012, gross profit margin of offset printing paper manufactured internally decreased 6.35% from 24.62% in the first three months ended March 31, 2011 to 18.27% in the comparable period in year 2012.

| 23 |

Monthly Gross Profit Margins on the sales of our corrugating medium and offset printing paper for the 15-month period ending March 31, 2012 are as follows:

Gross profit from the sales of digital photo paper for the three months ended March 31, 2012 amounted to $404,278, or 25.65% as a percentage of total digital photo paper sales, compared to gross profit of $792,095 and gross profit margin of 36.72% for the same period in the previous year. The decline of gross profit margin for the three months ended March 31, 2012 is a result of both lower production quantity (and in terms of quantity sold, 24.48% less than the same period in 2011) and a lower ASP (3.26% lower than the ASP in the previous year). We expect that digital photo paper ASP will recover slightly during the second quarter of 2012 and our production and gross profit margin should return to normal level.

Selling, General and Administrative Expenses

Selling, general and administrative expenses for the three months ended March 31, 2012 were $1,044,672, an increase of $184,386 or 21.43% from $860,286 for the comparable period in 2011. The increase was primarily attributable to the fair value of approximately 109,584 shares of common stock issued to certain of our directors and officers in January 2012 to compensate their services in the past years. The $378,065 share compensation was recorded as a one-time compensation expense during the first quarter of 2012. For the three months ended March 31, 2012, the expenses incurred or accrued for legal and accounting/auditing fees amounted to $54,909 and $253,945, respectively as compared to $201,916 and $263,882, respectively, during the three months ended March 31, 2011. The increased expense from the 2012 share compensation offset the decrease in legal expense, accounting/auditing fees and other various expenses in the first quarter 2012 when compared with the same period a year ago, resulted in the increase of $184,386.

Income from Operations

Operating income for the three months ended March 31, 2012 was $6,708,500, a decrease of $134,361 or 1.96% from $6,842,861 for the comparable period in 2011. In addition to the changes in gross profit and selling, general and administrative expenses as explained above, the difference was also caused by a $68,561 loss from disposal of one vehicle and other plant equipments in the three months ended March 31, 2011. There was no gain or loss from disposal of any business property in the first quarter of year 2012.

| 24 |

Accounts Receivable

Net accounts receivable was $3,748,005 as of March 31, 2012, a slight decrease of $72,691 or 1.90% compared to $3,820,696 as of December 31, 2011. It represents a decrease of $698,101, or 22.89% over the March 31, 2011 balance in the amount of $3,049,904. We usually collect accounts receivable within 30 days of delivery and completion of sales.

Inventory

Inventory of $7,897,958 consists of raw materials (accounting for 87.53% of total value of ending inventory as of March 31, 2012) and finished goods. As of March 31, 2012, the recorded value of our inventory had decreased by $2,109,970, or 21.08%, from $10,007,928 as of December 31, 2011. The largest change came from the inventory item of recycled paperboard, which is the main raw material for the production of our corrugating medium paper and was stated at $4,018,776 as of March 31, 2012. The balance of recycled paperboard at March 31, 2012 was lower than the balance at December 31, 2011 by $1,626,673 but higher than the balance a year ago on March 31, 2011 by $1,217,743. Because of limited space of our raw material stocking ground, we have to make more frequent purchase orders of raw materials from our suppliers as the production of the new corrugating medium paper line ramps up. In March 2012 we made a purchase of recycled paper board approximately every six days, as opposed to approximately every 10 days before year 2011, to keep up with the production of the new 360,000 tonnes/year corrugating medium paper production line. The frequency changes for purchasing of recycled paper board lowered the inventory levels we kept in the prior years.

We decreased the amount of coal stored on hand to $508,049 as of March 31, 2012, as compared to the stock of coal for a total amount of $661,891 as of December 31, 2011. The average price per tonne that we paid for coal in the month of March 2012 was approximately $115/tonne and was lower compared with approximately $125/tonne in December 2011. A summary of changes in major inventory items is as follows:

| March 31, 2012 | December 31, 2011 | $ Change | % Change | |||||||||||||

| Raw Materials | ||||||||||||||||

| Recycled paper board | $ | 4,018,776 | $ | 5,645,449 | $ | (1,626,673 | ) | -28.81 | % | |||||||

| Pulp | 13,791 | 13,718 | 73 | 0.53 | % | |||||||||||

| Recycled printed paper | 513,264 | 589,165 | (75,901 | ) | -12.88 | % | ||||||||||

| Recycled white scrap paper | 1,558,462 | 1,918,545 | (360,083 | ) | -18.77 | % | ||||||||||

| Coal | 508,049 | 661,891 | (153,842 | ) | -23.24 | % | ||||||||||

| Digital photo base paper and other raw materials | 300,720 | 149,306 | 151,414 | 101.41 | % | |||||||||||

| Total Raw Materials | 6,913,062 | 8,978,074 | (2,065,012 | ) | -23.00 | % | ||||||||||

| Finished Goods | 984,896 | 1,029,854 | (44,958 | ) | -4.37 | % | ||||||||||

| Totals | $ | 7,897,958 | $ | 10,007,928 | $ | (2,109,970 | ) | -21.08 | % | |||||||

Accounts Payable

Accounts payable (excluding non-inventory purchase payables and accrued expenses) was $99,397 as of March 31, 2012, a decrease of $2,667,157 or 96.41% from $2,766,554 as of December 31, 2011. All accounts payable as of March 31, 2012 and December 31, 2011 were within the normal payment terms of our suppliers. We made approximately $4,985,200 of accounts payable payments for purchases of raw materials and production supplies to six different vendors in the last three business days of March 2012.

| 25 |

Liquidity and Capital Resources

Overview

As of March 31, 2012 we had net working capital of $11,027,832, a decrease of $295,884 over net working capital of $11,323,716 at December 31, 2011.

The Company finances its daily operations mainly by cash flows generated from its business operations and loans from banking institutions and major shareholders. Major capital expenditures in the year of 2011 and the first quarter of 2012 were primarily financed by cash flows generated from business operations. As of March 31, 2012 we had approximately $4,069,003 in capital expenditure commitments that were mainly related to the remaining unbilled construction cost of a new corrugating medium paper production line, a new power substation, a new 75-tonne boiler and related facilities, and new employee dormitories and will be satisfied by payment of cash within the next 12 months. In addition to the binding contracts that we have entered into, we are considering capital expenditure plans with estimated costs of up to $5 million in the year of 2012 and $10 million in the year of 2013. These plans include building additional offices, cafeteria, and production line worker living quarters over the land across the street that we have recently acquired (see below), and eventually building new production line of tissue paper that has the capacity of producing up to 20,000 tons of tissue paper per year, if we are able to acquire additional adjacent space to carry out the tissue paper expansion plan.

Since the spring of 2010 we have been trying to acquire approximately 667,000 square meters of land that is right across the street from our current facilities and is already approved by the government for our capacity expansion plan. However, since the acquisition process started we have met significant opposition by some local residents over the price that we offered for their land. We have finally completed on April 13, 2012 a partial closing on some 58,566 square meters of land with street frontage with local residents and secured all land use right permits. For the 58,566 square meters, we were refunded approximately $3.1 million of the purchase price on April 2, 2012 from the $7.3 million security deposit that we had paid as of March 31, 2012. Subsequently, we paid another $3.3 million in various compensation, taxes and recording fees to the sellers and the government to close out the acquisition on April 13, 2012. The area we acquired as of April 13, 2012 is not large enough to build major tissue paper production facilities, as we originally planned. However, because we have run out of space to house new employees and management hired since the construction of the 360,000 tonnes per year corrugating medium paper line, we plan to first build new offices and employee living quarters on the 58,566 square meters new land across the street. We estimate that the construction of these buildings may take up one third of the space of the new land. We will carefully evaluate the use of the rest of the new land, including making every effort to acquire more adjacent land in the rest of this year and in 2013 to allow the construction of new tissue paper plant.

The Company currently does not have any plan for equity financing in the next 12 months.

Cash and Cash Equivalents

Our cash and cash equivalents as of March 31, 2012 was $5,626,620, an increase of $1,461,174 from $4,165,446 as of December 31, 2011. The increase in year 2012 was primarily attributable to a number of factors, including the following:

i. Net cash provided by operating activities