Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED MAY 11, 2018 - IT TECH PACKAGING, INC. | f10q0318ex99-1_orientpaper.htm |

| EX-32.2 - CERTIFICATION - IT TECH PACKAGING, INC. | f10q0318ex32-2_orientpaper.htm |

| EX-32.1 - CERTIFICATION - IT TECH PACKAGING, INC. | f10q0318ex32-1_orientpaper.htm |

| EX-31.2 - CERTIFICATION - IT TECH PACKAGING, INC. | f10q0318ex31-2_orientpaper.htm |

| EX-31.1 - CERTIFICATION - IT TECH PACKAGING, INC. | f10q0318ex31-1_orientpaper.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2018

or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission file number: 001-34577

| ORIENT PAPER, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 20-4158835 | |

(State or other jurisdiction of incorporation or organization) |

(IRS Employer identification No.) |

Science Park, Juli Rd, Xushui District, Baoding City Hebei Province, The People’s Republic of China 072550 |

| (Address of principal executive offices and Zip Code) |

| 011 - (86) 312-8698215 |

| (Registrant’s telephone number, including area code) |

| (Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ☐ No ☒

As of May 14, 2018, there were 21,450,316 shares of the registrant’s common stock, par value $0.001, outstanding.

TABLE OF CONTENTS

| Part I. - FINANCIAL INFORMATION | 1 | ||

| Item 1. Financial Statements | 1 | ||

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 23 | ||

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | 36 | ||

| Item 4. Controls and Procedures | 36 | ||

| Part II. - OTHER INFORMATION | 37 | ||

| Item 1. Legal Proceedings | 37 | ||

| Item 1A. Risk Factors | 37 | ||

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | 37 | ||

| Item 3. Defaults Upon Senior Securities | 37 | ||

| Item 4. Mine Safety Disclosures | 37 | ||

| Item 5. Other Information | 37 | ||

| Item 6. Exhibits | 37 | ||

| SIGNATURES | 38 |

i

PART I - FINANCIAL INFORMATION

| Item 1. | Financial Statements |

ORIENT PAPER, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF MARCH 31, 2018 AND DECEMBER 31, 2017

(Unaudited)

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and bank balances | $ | 740,309 | $ | 2,895,790 | ||||

| Restricted cash | 3,975,764 | 6,121,637 | ||||||

| Accounts receivable (net of allowance for doubtful accounts of $16,699 and $37,626 as of March 31, 2018 and December 31, 2017, respectively) | 818,255 | 1,843,682 | ||||||

| Inventories | 9,009,448 | 8,474,165 | ||||||

| Prepayments and other current assets | 3,246,169 | 651,523 | ||||||

| Total current assets | 17,789,945 | 19,986,797 | ||||||

| Property, plant, and equipment, net | 193,753,101 | 189,388,709 | ||||||

| Value-added tax recoverable | 3,138,164 | 3,041,416 | ||||||

| Deferred tax asset non-current | 7,371,246 | 6,572,559 | ||||||

| Total Assets | $ | 222,052,456 | $ | 218,989,481 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Short-term bank loans | $ | 13,040,505 | $ | 7,192,923 | ||||

| Current portion of long-term loans from credit union | 6,615,671 | 6,366,502 | ||||||

| Accounts payable | 308,880 | 422,705 | ||||||

| Notes payable | 3,975,764 | 6,121,637 | ||||||

| Due to a related party | 102,498 | 60,378 | ||||||

| Accrued payroll and employee benefits | 307,472 | 231,247 | ||||||

| Other payables and accrued liabilities | 939,233 | 836,337 | ||||||

| Income taxes payable | 546,127 | 525,804 | ||||||

| Total current liabilities | 25,836,150 | 21,757,533 | ||||||

| Loans from credit union | 1,240,438 | 1,193,719 | ||||||

| Loans from a related party | 6,361,222 | 10,712,865 | ||||||

| Total liabilities (including amounts of the consolidated VIE without recourse to the Company of $30,913,599 and $31,235,520 as of March 31, 2018 and December 31, 2017, respectively) | 33,437,810 | 33,664,117 | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders’ Equity | ||||||||

| Common stock, 500,000,000 shares authorized, $0.001 par value per share, 21,450,316 shares issued and outstanding as of March 31, 2018 and December 31, 2017, respectively | 21,450 | 21,450 | ||||||

| Additional paid-in capital | 50,635,243 | 50,635,243 | ||||||

| Statutory earnings reserve | 6,080,574 | 6,080,574 | ||||||

| Accumulated other comprehensive income | 12,844,357 | 5,468,799 | ||||||

| Retained earnings | 119,033,022 | 123,119,298 | ||||||

| Total stockholders’ equity | 188,614,646 | 185,325,364 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 222,052,456 | $ | 218,989,481 | ||||

See accompanying notes to condensed consolidated financial statements.

1

ORIENT PAPER, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

FOR THE THREE MONTHS ENDED MARCH 31, 2018 AND 2017

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2018 | 2017 | |||||||

| Revenues | $ | 1,888,194 | $ | 25,289,659 | ||||

| Cost of sales | (2,583,502 | ) | (19,635,739 | ) | ||||

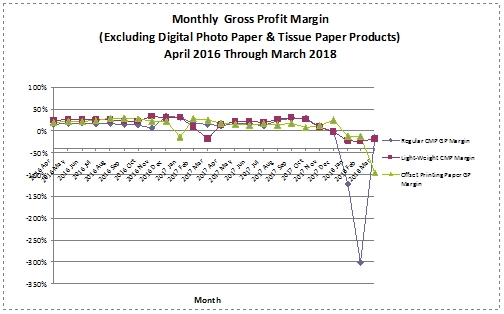

| Gross (Loss) Profit | (695,308 | ) | 5,653,920 | |||||

| Selling, general and administrative expenses | (3,813,794 | ) | (2,782,342 | ) | ||||

| Loss from disposal of property, plant and equipment | (10,376 | ) | - | |||||

| (Loss) Income from Operations | (4,519,478 | ) | 2,871,578 | |||||

| Other Income (Expense): | ||||||||

| Interest income | 44,763 | 17,945 | ||||||

| Subsidy income | 253,281 | 40,712 | ||||||

| Interest expense | (403,811 | ) | (679,084 | ) | ||||

| (Loss) Income before Income Taxes | (4,625,245 | ) | 2,251,151 | |||||

| Provision for Income Taxes | 538,969 | (543,282 | ) | |||||

| Net (Loss) Income | (4,086,276 | ) | 1,707,869 | |||||

| Other Comprehensive Income | ||||||||

| Foreign currency translation adjustment | 7,375,558 | 956,292 | ||||||

| Total Comprehensive Income | $ | 3,289,282 | $ | 2,664,161 | ||||

| (Losses) Earnings Per Share: | ||||||||

| Basic and Diluted (Losses) Earnings per Share | $ | (0.19 | ) | $ | 0.08 | |||

| Outstanding – Basic and Diluted | 21,450,316 | 21,450,316 | ||||||

See accompanying notes to condensed consolidated financial statements.

2

ORIENT PAPER, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2018 AND 2017

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2018 | 2017 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net income | $ | (4,086,276 | ) | $ | 1,707,869 | |||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 3,730,585 | 3,615,359 | ||||||

| Loss from disposal of property, plant and equipment | 10,376 | - | ||||||

| Allowance for bad debts | (22,297 | ) | (16,112 | ) | ||||

| Share-based compensation expenses | - | - | ||||||

| Deferred tax | (538,969 | ) | (578,139 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 1,114,843 | 805,599 | ||||||

| Prepayments and other current assets | (2,535,170 | ) | (3,939,630 | ) | ||||

| Inventories | (202,692 | ) | (2,358,426 | ) | ||||

| Accounts payable | (129,770 | ) | (69,194 | ) | ||||

| Advance from customers | - | (29,079 | ) | |||||

| Notes payable | (2,374,507 | ) | 3,634,936 | |||||

| Due to a related party | 39,575 | 36,349 | ||||||

| Accrued payroll and employee benefits | 66,867 | 127,180 | ||||||

| Other payables and accrued liabilities | 69,841 | (1,228,505 | ) | |||||

| Income taxes payable | - | (345,594 | ) | |||||

| Net Cash (Used in) Provided by Operating Activities | (4,857,594 | ) | 1,362,613 | |||||

| Cash Flows from Investing Activities: | ||||||||

| Purchases of property, plant and equipment | (707,162 | ) | (5,258,905 | ) | ||||

| Net Cash Used in Investing Activities | (707,162 | ) | (5,258,905 | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Proceeds from related party loans | 4,749,015 | - | ||||||

| Repayments of related party loans | (9,498,029 | ) | - | |||||

| Proceeds from short term bank loans | 9,972,931 | 9,887,026 | ||||||

| Repayment of bank loans | (4,432,414 | ) | - | |||||

| Payment of capital lease obligation | - | (63,613 | ) | |||||

| Net Cash Provided by Financing Activities | 791,503 | 9,823,413 | ||||||

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | 471,899 | 23,654 | ||||||

| Net (Decrease) Increase in Cash and Cash Equivalents | (4,301,354 | ) | 5,950,775 | |||||

| Cash, Cash Equivalents and Restricted Cash - Beginning of Period | 9,017,427 | 4,494,964 | ||||||

| Cash, Cash Equivalents and Restricted Cash - End of Period | $ | 4,716,073 | $ | 10,445,739 | ||||

| Supplemental Disclosure of Cash Flow Information: | ||||||||

| Cash paid for interest, net of capitalized interest cost | $ | 787,353 | $ | 713,199 | ||||

| Cash paid for income taxes | $ | - | $ | 1,467,016 | ||||

| Cash and bank balances | 740,309 | 4,648,049 | ||||||

| Restricted cash | 3,975,764 | 5,797,690 | ||||||

| Total cash, cash equivalents and restricted cash shown in the statement of cash flows | 4,716,073 | 10,445,739 | ||||||

See accompanying notes to condensed consolidated financial statements.

3

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(1) Organization and Business Background

Orient Paper, Inc. was incorporated in the State of Nevada on December 9, 2005, under the name “Carlateral, Inc.” Through the steps described immediately below, we became the holding company for Hebei Baoding Orient Paper Milling Company Limited (“Orient Paper HB”), a producer and distributor of paper products in China, on October 29, 2007, and effective December 21, 2007, we changed our name to “Orient Paper, Inc.” to more accurately describe our business.

On October 29, 2007, pursuant to an agreement and plan of merger (the “Merger Agreement”), the Company acquired Dongfang Zhiye Holding Limited (“Dongfang Holding”), a corporation formed on November 13, 2006 under the laws of the British Virgin Islands, and issued the shareholders of Dongfang Holding an aggregate of 7,450,497 (as adjusted for a four-for-one reverse stock split effected in November 2009) shares of our common stock, which shares were distributed pro-rata to the shareholders of Dongfang Holding in accordance with their respective ownership interests in Dongfang Holding. At the time of the Merger Agreement, Dongfang Holding owned all of the issued and outstanding stock and ownership of Orient Paper HB and such shares of Orient Paper HB were held in trust with Zhenyong Liu, Xiaodong Liu and Shuangxi Zhao, for Mr. Liu, Mr. Liu and Mr. Zhao (the original shareholders of Orient Paper HB) to exercise control over the disposition of Dongfang Holding’s shares in Orient Paper HB on Dongfang Holding’s behalf until Dongfang Holding successfully completed the change in registration of Orient Paper HB’s capital with the relevant PRC Administration of Industry and Commerce as the 100% owner of Orient Paper HB’s shares. As a result of the merger transaction, Dongfang Holding became a wholly owned subsidiary of the Company, and Dongfang Holding’s wholly owned subsidiary, Orient Paper HB, became an indirectly owned subsidiary of the Company.

Dongfang Holding, as the 100% owner of Orient Paper HB, was unable to complete the registration of Orient Paper HB’s capital under its name within the proper time limits set forth under PRC law. In connection with the consummation of the restructuring transactions described below, Dongfang Holding directed the trustees to return the shares of Orient Paper HB to their original shareholders, and the original Orient Paper HB shareholders entered into certain agreements with Baoding Shengde Paper Co., Ltd. (“Orient Paper Shengde”) to transfer the control of Orient Paper HB over to Orient Paper Shengde.

On June 24, 2009, the Company consummated a number of restructuring transactions pursuant to which it acquired all of the issued and outstanding shares of Shengde Holdings Inc, a Nevada corporation. Shengde Holdings Inc was incorporated in the State of Nevada on February 25, 2009. On June 1, 2009, Shengde Holdings Inc incorporated Orient Paper Shengde, a limited liability company organized under the laws of the PRC. Because Orient Paper Shengde is a wholly-owned subsidiary of Shengde Holdings Inc, it is regarded as a wholly foreign-owned entity under PRC law.

4

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

To ensure proper compliance of the Company’s control over the ownership and operations of Orient Paper HB with certain PRC regulations, on June 24, 2009, the Company entered into a series of contractual agreements (the “Contractual Agreements”) with Orient Paper HB and Orient Paper HB Equity Owners via the Company’s wholly owned subsidiary Shengde Holdings Inc (“Shengde Holdings”) a Nevada corporation and Baoding Shengde Paper Co., Ltd. (“Orient Paper Shengde”), a wholly foreign-owned enterprise in the PRC with an original registered capital of $10,000,000 (subsequently increased to $60,000,000 in June 2010). Orient Paper Shengde is mainly engaged in production and distribution of digital photo paper and is 100% owned by Shengde Holdings. Prior to February 10, 2010, the Contractual Agreements included (i) Exclusive Technical Service and Business Consulting Agreement, which generally provides that Orient Paper Shengde shall provide exclusive technical, business and management consulting services to Orient Paper HB, in exchange for service fees including a fee equivalent to 80% of Orient Paper HB’s total annual net profits; (ii) Loan Agreement, which provides that Orient Paper Shengde will make a loan in the aggregate principal amount of $10,000,000 to Orient Paper HB Equity Owners in exchange for each such shareholder agreeing to contribute all of its proceeds from the loan to the registered capital of Orient Paper HB; (iii) Call Option Agreement, which generally provides, among other things, that Orient Paper HB Equity Owners irrevocably grant to Orient Paper Shengde an option to purchase all or part of each owner’s equity interest in Orient Paper HB. The exercise price for the options shall be RMB1 which Orient Paper Shengde should pay to each of Orient Paper HB Equity Owner for all their equity interests in Orient Paper HB; (iv) Share Pledge Agreement, which provides that Orient Paper HB Equity Owners will pledge all of their equity interests in Orient Paper HB to Orient Paper Shengde as security for their obligations under the other agreements described in this section. Specifically, Orient Paper Shengde is entitled to dispose of the pledged equity interests in the event that Orient Paper HB Equity Owners breach their obligations under the Loan Agreement or Orient Paper HB fails to pay the service fees to Orient Paper Shengde pursuant to the Exclusive Technical Service and Business Consulting Agreement; and (v) Proxy Agreement, which provides that Orient Paper HB Equity Owners shall irrevocably entrust a designee of Orient Paper Shengde with such shareholder’s voting rights and the right to represent such shareholder to exercise such owner’s rights at any equity owners’ meeting of Orient Paper HB or with respect to any equity owner action to be taken in accordance with the laws and Orient Paper HB’s Articles of Association. The terms of the agreement are binding on the parties for as long as Orient Paper HB Equity Owners continue to hold any equity interest in Orient Paper HB. An Orient Paper HB Equity Owner will cease to be a party to the agreement once it transfers its equity interests with the prior approval of Orient Paper Shengde. As the Company had controlled Orient Paper HB since July 16, 2007 through Dongfang Holding and the trust until June 24, 2009, and continues to control Orient Paper HB through Orient Paper Shengde and the Contractual Agreements, the execution of the Contractual Agreements is considered as a business combination under common control.

On February 10, 2010, Orient Paper Shengde and the Orient Paper HB Equity Owners entered into a Termination of Loan Agreement to terminate the above-mentioned $10,000,000 Loan Agreement. Because of the Company’s decision to fund future business expansions through Orient Paper Shengde instead of Orient Paper HB, the $10,000,000 loan contemplated was never made prior to the point of termination. The parties believe the termination of the Loan Agreement does not in itself compromise the effective control of the Company over Orient Paper HB and its businesses in the PRC.

An agreement was also entered into among Orient Paper Shengde, Orient Paper HB and the Orient Paper HB Equity Owners on December 31, 2010, reiterating that Orient Paper Shengde is entitled to 100% of the distributable profit of Orient Paper HB, pursuant to the above mentioned Contractual Agreements. In addition, Orient Paper HB and the Orient Paper HB Equity Owners shall not declare any of Orient Paper HB’s unappropriated earnings as dividend, including the unappropriated earnings of Orient Paper HB from its establishment to 2010 and thereafter.

Orient Paper has no direct equity interest in Orient Paper HB. However, through the Contractual Agreements described above Orient Paper is found to be the primary beneficiary (the “Primary Beneficiary”) of Orient Paper HB and is deemed to have the effective control over Orient Paper HB’s activities that most significantly affect its economic performance, resulting in Orient Paper HB being treated as a controlled variable interest entity of Orient Paper in accordance with Topic 810 - Consolidation of the Accounting Standards Codification (the “ASC”) issued by the Financial Accounting Standard Board (the “FASB”). The revenue generated from Orient Paper HB for the three months ended March 31, 2018 and 2017 was accounted for 100%, of the Company’s total revenue for the same periods. Orient Paper HB also accounted for 87.95% and 87.96% of the total assets of the Company as of March 31, 2018 and December 31, 2017, respectively.

5

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

As of March 31, 2018 and December 31, 2017, details of the Company’s subsidiaries and variable interest entities are as follows:

| Date of Incorporation | Place of Incorporation or | Percentage of | ||||||||

| Name | or Establishment | Establishment | Ownership | Principal Activity | ||||||

| Subsidiary: | ||||||||||

| Dongfang Holding | November 13, 2006 | BVI | 100 | % | Inactive investment holding | |||||

| Shengde Holdings | February 25, 2009 | State of Nevada | 100 | % | Investment holding | |||||

| Orient Paper Shengde | June 1, 2009 | PRC | 100 | % | Paper production and distribution | |||||

| Variable interest entity (“VIE”): | ||||||||||

| Orient Paper HB | March 10, 1996 | PRC | Control | * | Paper production and distribution | |||||

* Orient Paper HB is treated as a 100% controlled variable interest entity of the Company.

However, uncertainties in the PRC legal system could cause the Company’s current ownership structure to be found to be in violation of any existing and/or future PRC laws or regulations and could limit the Company’s ability, through its subsidiary, to enforce its rights under these contractual arrangements. Furthermore, shareholders of the VIE may have interests that are different than those of the Company, which could potentially increase the risk that they would seek to act contrary to the terms of the aforementioned agreements.

In addition, if the current structure or any of the contractual arrangements were found to be in violation of any existing or future PRC law, the Company may be subject to penalties, which may include, but not be limited to, the cancellation or revocation of the Company’s business and operating licenses, being required to restructure the Company’s operations or being required to discontinue the Company’s operating activities. The imposition of any of these or other penalties may result in a material and adverse effect on the Company’s ability to conduct its operations. In such case, the Company may not be able to operate or control the VIE, which may result in deconsolidation of the VIE. The Company believes the possibility that it will no longer be able to control and consolidate its VIE will occur as a result of the aforementioned risks and uncertainties is remote.

6

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The Company has aggregated the financial information of Orient Paper HB in the table below. The aggregate carrying value of Orient Paper HB’s assets and liabilities (after elimination of intercompany transactions and balances) in the Company’s condensed consolidated balance sheets as of March 31, 2018 and December 31, 2017 are as follows:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and bank balances | $ | 566,627 | $ | 2,681,942 | ||||

| Restricted cash | 3,975,764 | 6,121,637 | ||||||

| Accounts receivable | 818,255 | 1,843,682 | ||||||

| Inventories | 8,965,604 | 8,431,972 | ||||||

| Prepayments and other current assets | 3,241,210 | 646,598 | ||||||

| Total current assets | 17,567,460 | 19,725,831 | ||||||

| Property, plant, and equipment, net | 171,880,357 | 167,727,768 | ||||||

| Deferred tax asset non-current | 5,844,337 | 5,167,288 | ||||||

| Total Assets | $ | 195,292,154 | $ | 192,620,887 | ||||

| LIABILITIES | ||||||||

| Current Liabilities | ||||||||

| Short-term bank loans | $ | 13,040,505 | $ | 7,192,923 | ||||

| Current portion of long-term loans from credit union | 5,343,426 | 5,142,175 | ||||||

| Accounts payable | 308,880 | 422,705 | ||||||

| Notes payable | 3,975,764 | 6,121,637 | ||||||

| Due to a related party | 102,498 | 60,378 | ||||||

| Accrued payroll and employee benefits | 302,414 | 227,163 | ||||||

| Other payables and accrued liabilities | 939,198 | 836,309 | ||||||

| Income taxes payable | 539,692 | 519,365 | ||||||

| Total current liabilities | 24,552,377 | 20,522,655 | ||||||

| Loans from a related party | 6,361,222 | 10,712,865 | ||||||

| Total liabilities | $ | 30,913,599 | $ | 31,235,520 | ||||

The Company and its consolidated subsidiaries are not required to provide financial support to the VIE, and no creditor (or beneficial interest holders) of the VIE have recourse to the assets of Company unless the Company separately agrees to be subject to such claims. There are no terms in any agreements or arrangements, implicit or explicit, which require the Company or its subsidiaries to provide financial support to the VIE. However, if the VIE does require financial support, the Company or its subsidiaries may, at its option and subject to statutory limits and restrictions, provide financial support to the VIE.

7

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(2) Basis of Presentation and Significant Accounting Policies

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”) for reporting on Form 10-Q. Accordingly, certain information and notes required by the United States of America generally accepted accounting principles (“GAAP”) for annual financial statements are not included herein. These interim statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Annual Report on Form 10-K for the year ended December 31, 2017 of Orient Paper, Inc. a Nevada corporation, and its subsidiaries and variable interest entity (which we sometimes refer to collectively as “Orient Paper”, “we”, “us” or “our”).

Principles of Consolidation

Our unaudited condensed consolidated financial statements reflect all adjustments, which are, in the opinion of management, necessary for a fair presentation of our financial position and results of operations. Such adjustments are of a normal recurring nature, unless otherwise noted. The balance sheet as of March 31, 2018 and the results of operations for the three months ended March 31, 2018 are not necessarily indicative of the results to be expected for any future period.

Our unaudited condensed consolidated financial statements are prepared in accordance with GAAP. These accounting principles require us to make certain estimates, judgments and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. We believe that the estimates, judgments and assumptions are reasonable, based on information available at the time they are made. Actual results could differ materially from those estimates.

Valuation of long-lived asset

The Company reviews the carrying value of long-lived assets to be held and used when events and circumstances warrants such a review. The carrying value of a long-lived asset is considered impaired when the anticipated undiscounted cash flow from such asset is separately identifiable and is less than its carrying value. In that event, a loss is recognized based on the amount by which the carrying value exceeds the fair market value of the long-lived asset and intangible assets. Fair market value is determined primarily using the anticipated cash flows discounted at a rate commensurate with the risk involved. Losses on long-lived assets and intangible assets to be disposed are determined in a similar manner, except that fair market values are reduced for the cost to dispose.

Fair Value Measurements

The Company has adopted ASC Topic 820, Fair Value Measurements and Disclosures, which defines fair value, establishes a framework for measuring fair value in GAAP, and expands disclosures about fair value measurements. It does not require any new fair value measurements, but provides guidance on how to measure fair value by providing a fair value hierarchy used to classify the source of the information. It establishes a three-level valuation hierarchy of valuation techniques based on observable and unobservable inputs, which may be used to measure fair value and include the following:

Level 1 - Quoted prices in active markets for identical assets or liabilities.

Level 2 - Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 - Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

8

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Classification within the hierarchy is determined based on the lowest level of input that is significant to the fair value measurement.

The Company estimates the fair value of financial instruments using the available market information and valuation methods. Considerable judgment is required in estimating fair value. Accordingly, the estimates of fair value may not be indicative of the amounts that the Company could realize in a current market exchange. As of March 31, 2018 and December 31, 2017, the carrying value of the Company’s short term financial instruments, such as cash and cash equivalents, accounts receivable, accounts and notes payable, short-term bank loans, balance due to a related party and obligation under capital lease, approximate at their fair values because of the short maturity of these instruments; while loans from credit union and loans from a related party approximate at their fair value as the interest rates thereon are close to the market rates of interest published by the People’s Bank of China.

The Company does not have any assets and liabilities measured at fair value on a recurring basis as of March 31, 2018 and December 31, 2017.

Non-Recurring Fair Value Measurements

The Company reviews long-lived assets for impairment annually or more frequently if events or changes in circumstances indicate the possibility of impairment. For the continuing operations, long-lived assets are measured at fair value on a nonrecurring basis when there is an indicator of impairment, and they are recorded at fair value only when impairment is recognized. For discontinued operations, long-lived assets are measured at the lower of carrying amount or fair value less cost to sell. The fair value of these assets were determined using models with significant unobservable inputs which were classified as Level 3 inputs, primarily the discounted future cash flow.

Share-Based Compensation

The Company uses the fair value recognition provision of ASC Topic 718, Compensation-Stock Compensation, which requires the Company to expense the cost of employee services received in exchange for an award of equity instruments based on the grant date fair value of such instruments over the vesting period.

The Company also applies the provisions of ASC Topic 505-50, Equity Based Payments to Non-Employees to account for stock-based compensation awards issued to non-employees for services. Such awards for services are recorded at either the fair value of the consideration received or the fair value of the instruments issued in exchange for such services, whichever is more reliably measurable.

Liquidity and Going Concern

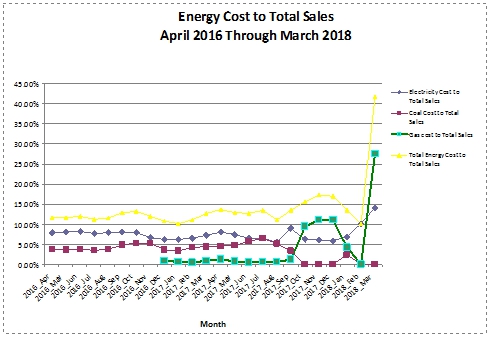

As of March 31, 2018 the Company had current assets of $17,789,945 and current liabilities of $25,836,150 (including amounts due to related parties of $785,648), resulting in a working capital deficit of approximately $8,046,205; as of December 31, 2017, the Company had current assets of $19,986,797 and current liabilities of $21,757,533 (including amounts due to related parties of $$609,062), resulting in a working capital deficit of approximately $1,770,736. In late January, 2018, the Company temporarily suspended its production due to a government-mandated restriction on the natural gas supply. The company resumed production on March 14, 2018. As a result, the net income and net cash generated from operating activities in the first quarter ended March 31, 2018 was a loss and net cash-out. As the production resumed, the management expects that, there will be sufficient and continuous cash-in from sales in coming months and the working capital condition as of March 31, 2018 will be substantially improved.

(3) Restricted Cash

Restricted cash of $3,975,764 as of March 31, 2018 was presented for the cash deposited at the Bank of Cangzhou for purpose of securing the bank acceptance notes from the bank (see Note (9)). The restriction will be lifted upon the maturity of the notes payable on January 10, 2019.

Restricted cash of $6,121,637 as of December 31, 2017 was presented for the cash deposited at the Bank of Cangzhou for purpose of securing the bank acceptance notes from the bank (see Note (9)). The restriction was lifted upon the maturity of the notes payable on January 5, 2018.

9

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(4) Inventories

Raw materials inventory includes mainly recycled paper and coal. Finished goods include mainly products of corrugating medium paper, offset printing paper and tissue paper products. Inventories consisted of the following as of March 31, 2018 and December 31, 2017:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Raw Materials | ||||||||

| Recycled paper board | $ | 5,294,406 | $ | 6,337,374 | ||||

| Recycled white scrap paper | 846,463 | 862,734 | ||||||

| Recycled scrap binding margin | 87,467 | - | ||||||

| Coal & gas | 51,964 | 71,674 | ||||||

| Base paper and other raw materials | 217,684 | 216,655 | ||||||

| 6,497,984 | 7,488,437 | |||||||

| Finished Goods | 2,511,464 | 985,728 | ||||||

| Totals | $ | 9,009,448 | $ | 8,474,165 | ||||

(5) Prepayments and other current assets

Prepayments and other current assets consisted of the following as of March 31, 2018 and December 31, 2017:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Prepaid land lease | $ | 333,964 | $ | 459,123 | ||||

| Prepayment for purchase of materials | 2,871,244 | 183,649 | ||||||

| Others | 40,961 | 8,751 | ||||||

| $ | 3,246,169 | $ | 651,523 | |||||

(6) Property, plant and equipment, net

As of March 31, 2018 and December 31, 2017, property, plant and equipment consisted of the following:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Property, Plant, and Equipment: | ||||||||

| Land use rights | $ | 12,968,241 | $ | 12,479,814 | ||||

| Building and improvements | 102,736,091 | 98,866,703 | ||||||

| Machinery and equipment | 123,474,514 | 118,670,578 | ||||||

| Vehicles | 616,484 | 593,265 | ||||||

| Construction in progress | 38,023,949 | 36,077,498 | ||||||

| Totals | 277,819,279 | 266,687,858 | ||||||

| Less: accumulated depreciation and amortization | (84,066,178 | ) | (77,299,149 | ) | ||||

| Property, Plant and Equipment, net | $ | 193,753,101 | $ | 189,388,709 | ||||

As of March 31, 2018 and December 31, 2017, land use rights represented two parcel of state-owned lands located in Xushui County of Hebei Province in China, with lease terms of 50 years expiring from 2061 to 2066.

10

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Construction in progress mainly represents payments for the new 15,000 tonnes per year tissue paper manufacturing equipment PM8, the tissue paper workshops and general infrastructure and administrative facilities in the Wei County Industrial Park. The tissue paper development project at the Wei County Industrial Park is expected to be completed in 2018. For the three months ended March 31, 2018 and 2017, the amount of interest capitalized is $nil and $5,164, respectively.

As of March 31, 2018 and December 31, 2017, certain property, plant and equipment of Orient Paper HB with net values of $7,782,238 and $7,963,285, respectively, have been pledged pursuant to a long-term loan from credit union of Orient Paper HB. Land use right of Orient Paper HB with net values of $6,651,641 and $6,437,419 as of March 31, 2018 and December 31, 2017 were pledged for the bank loan from Bank of Industrial & Commercial Bank of China. In addition, plant and equipment of Orient Paper Shengde with net values of $15,440,870 and $nil as of March 31, 2018 and December 31, 2017, respectively, and another land use right with net value of $5,279,211 and $nil as of March 31, 2018 and December 31, 2017 were pledged for the bank loan from Bank of Cangzhou. See “Short-term bank loans ” under Note (7), Loans Payable, for details of the transaction and asset collaterals.

Depreciation and amortization of property, plant and equipment was $3,730,585 and $3,615,359 for the three months ended March 31, 2018 and 2017, respectively.

(7) Loans Payable

Short-term bank loans

| March 31, | December 31, | ||||||||||

| 2018 | 2017 | ||||||||||

| Industrial and Commercial Bank of China (“ICBC”) Loan 1 | (a) | $ | - | $ | 4,285,145 | ||||||

| ICBC Loan 2 | (b) | 3,021,580 | 2,907,778 | ||||||||

| Bank of Cangzhou | (c) | 5,566,070 | - | ||||||||

| ICBC Loan 3 | (d) | 4,452,855 | - | ||||||||

| Total short-term bank loans | $ | 13,040,505 | $ | 7,192,923 | |||||||

| (a) | On January 10, 2017, the Company entered into a working capital loan agreement with the ICBC, with a balance of $4,285,145 as of December 31, 2017. The working capital loan was guaranteed by Hebei Tengsheng with its land use right pledged as collateral for the benefit of the bank. The loan bears a fixed interest rate of 4.5675% per annum. The loan was due and repaid on January 8, 2018. |

| (b) | On October 18, 2017, the Company entered into a working capital loan agreement with the ICBC, with a balance of $3,021,580 and $2,907,778 as of March 31, 2018 and December 31, 2017, respectively. The working capital loan is secured by the Company’s land use right as collateral for the benefit of the bank. The loan bears a fixed interest rate of 4.945% per annum. The loan will be due on October 12, 2018. |

| (c) | On January 2, 2018, the Company entered into a working capital loan agreement with the Bank of Cangzhou. The loan was withdrawn on January 4, 2018, with a balance of $5,566,070 as of March 31, 2018. The loan bears a fixed interest rate of 6.09% per annum. The working capital loan is secured by the Company’s land use right and guaranteed by the Company’s CEO and Orient Paper Shengde with its production equipment as collateral for the benefit of the bank. The loan will be due on January 3, 2019. |

| (d) | On February 6, 2018, the Company entered into a working capital loan agreement with the ICBC, with a balance of $4,452,855 as of March 31, 2018. The working capital loan was guaranteed by Hebei Tengsheng with its land use right pledged as collateral for the benefit of the bank. The loan bears a fixed interest rate of 5.4% per annum. The loan will be due on February 9, 2019. |

11

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

As of March 31, 2018, there were guaranteed short-term borrowings of $13,040,505 and unsecured bank loans of $nil. As of December 31, 2017, there were guaranteed short-term borrowings of $7,192,923 and unsecured bank loans of $nil.

The average short-term borrowing rates for the three months ended March 31, 2018 and 2017 were approximately 5.57% and 5.28%, respectively.

Long-term loans from credit union

As of March 31, 2018 and December 31, 2017, loans payable to Rural Credit Union of Xushui County, amounted to $7,856,109 and $7,560,221, respectively.

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Rural Credit Union of Xushui County Loan 1 | $ | 1,367,663 | $ | 1,316,152 | ||||

| Rural Credit Union of Xushui County Loan 2 | 3,975,763 | 3,826,022 | ||||||

| Rural Credit Union of Xushui County Loan 3 | 2,512,683 | 2,418,047 | ||||||

| Total | 7,856,109 | 7,560,221 | ||||||

| Less: Current portion of long-term loans from credit union | (6,615,671 | ) | (6,366,502 | ) | ||||

| Long-term loans from credit union | $ | 1,240,438 | $ | 1,193,719 | ||||

As of Mar 31, 2018, the Company’s long-term debt repayments for the next five years were as follows:

| Fiscal year | Amount | |||

| Remainder of 2018 | $ | 6,615,671 | ||

| 2019 | 1,240,438 | |||

| 2020 | - | |||

| 2021 | - | |||

| 2022 | - | |||

| 2023 | - | |||

| Total | 7,856,109 |

On April 16, 2014, the Company entered into a loan agreement with the Rural Credit Union of Xushui County for a term of 5 years, which is payable in various installments from June 21, 2014 to November 18, 2018. The loan is guaranteed by an independent third party. Interest payment is due quarterly and bears the rate of 0.72% per month. In August 2015, after giving the required notice to the Rural Credit Union of Xushui County in accordance with the terms on the agreement, the Company prepaid a portion of the loan in an amount of $198,788, of which $71,564 was paid ahead of its original repayment schedule. As of March 31, 2018 and December 31, 2017, total outstanding loan balance was $1,367,663 and $1,316,152, respectively, which is presented as current liabilities in the consolidated balance sheet.

On July 15, 2013, the Company entered into a loan agreement with the Rural Credit Union of Xushui County for a term of 5 years, which is due and payable in various installments from December 21, 2013 to July 26, 2018. The loan is secured by certain of the Company’s manufacturing equipment with net book value of $7,782,238 and $7,963,285 as of March 31, 2018 and December 31, 2017, respectively. Interest payment is due quarterly and bears a fixed rate of 0.72% per month. In August 2015, after giving the required notice to the Rural Credit Union of Xushui County in accordance with the terms on the agreement, the Company prepaid a portion of the loan in an amount of $206,740, of which $47,709 was paid ahead of its original repayment schedule. As of March 31, 2018 and December 31, 2017, the total outstanding loan balance was $3,975,763 and $3,826,022, respectively, which is presented as current liabilities in the consolidated balance sheet.

On April 20, 2017, the Company entered into a loan agreement with the Rural Credit Union of Xushui County for a term of 2 years, which is due and payable in various installments from August 26, 2017 to April 19, 2019. The loan is guaranteed by Hebei Tengsheng with its land use right pledged as collateral for the benefit of the bank. Interest payment is due quarterly and bears a fixed rate of 0.6% per month. As of March 31, 2018 and December 31, 2017, the total outstanding loan balance was $2,512,683 and $2,418,047, respectively. Out of the total outstanding loan balance, current portion amounted were $1,272,245 and $1,224,328 as of March 31, 2018 and December 31, 2017, respectively, which are presented as current liabilities in the consolidated balance sheet and the remaining balance of $1,240,438 and $1,193,719 are presented as non-current liabilities in the consolidated balance sheet as of March 31, 2018 and December 31, 2017, respectively.

Total interest expenses for the short-term bank loans and long-term loans for the three months ended March 31, 2018 and 2017 were $291,339 and $262,779, respectively.

12

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(8) Related Party Transactions

The Company’s CEO has loaned money to Orient Paper HB for working capital purposes over a period of time. On January 1, 2013, Orient Paper HB and Mr. Zhenyong Liu renewed the three-year term loan previously entered on January 1, 2010, and extended the maturity date further to December 31, 2015. On December 31, 2015, the Company paid off the loan of $2,249,279, together with interest of $391,374 for the period from 2013 to 2015. Approximately $407,649 and $392,296 of interest were outstanding to Mr. Zhenyong Liu, which were recorded in other payables and accrued liabilities as part of the current liabilities in the consolidated balance sheet as of March 31, 2018 and December 31, 2017, respectively.

On December 10, 2014, Mr. Zhenyong Liu provided a loan to the Company, amounted to $9,541,833 to Orient Paper HB for working capital purpose with an interest rate of 4.35% per annum, which was based on the primary lending rate of People’s Bank of China. The unsecured loan was provided on December 10, 2014, and would be originally due on December 10, 2017. During the year of 2016, the Company repaid $6,012,416 to Mr. Zhenyong Liu, together with interest of $288,596. In February 2018, the company repaid $3,166,010 to Mr. Zhenyong Liu. As of March 31, 2018 and December 31, 2017, the outstanding loan balance was $nil and $3,060,818, respectively and the accrued interest was $69,616 and $45,912, respectively, which was recorded in other payables and accrued liabilities as part of the current liabilities in the consolidated balance sheet.

On March 1, 2015, the Company entered an agreement with Mr. Zhenyong Liu which allows Orient Paper HB to borrow from the CEO an amount up to $19,083,666 (RMB120,000,000) for working capital purposes. The advances or funding under the agreement are due three years from the date each amount is funded. The loan is unsecured and carries an annual interest rate set on the basis of the primary lending rate of the People’s Bank of China at the time of the borrowing. On July 13, 2015, an unsecured amount of $4,324,636 was drawn from the facility. On October 14, 2016 an unsecured amount of $2,883,091 was drawn from the facility. In February 2018, the company repaid $1,583,005 to Mr. Zhenyong Liu. The loan would be originally due on July 12, 2018. Mr. Zhenyong Liu agreed to extend the loan for additional 3 years and the remaining balance will be due on July 12, 2021. As of March 31, 2018 and December 31, 2017, the outstanding loan balance were $6,361,222 and $7,652,047, respectively, and the accrued interest was $205,885 and $110,476, respectively, which was recorded in other payables and accrued liabilities as part of the current liabilities in the consolidated balance sheet.

As of March 31, 2018 and December 31, 2017, total amount of loans due to Mr. Zhenyong Liu were $6,361,222 and $10,712,865, respectively. The interest expense incurred for such related party loans are $112,472 and $110,684 for the three months ended March 31, 2018 and 2017, respectively. The accrued interest owe to the CEO was approximately $683,150 and $548,684, as of March 31, 2018 and December 31, 2017, respectively, which was recorded in other payables and accrued liabilities.

During the three months ended March 31, 2018 and 2017, the Company borrowed $nil from shareholders.

Lease of Headquarters Compound Real Properties from a Related Party

On August 7, 2013, the Company’s Audit Committee and the Board of Directors approved the sale of the land use right of the Headquarters Compound (the “LUR”), the office building and essentially all industrial-use buildings in the Headquarters Compound (the “Industrial Buildings”), and three employee dormitory buildings located within the Headquarters Compound (the “Dormitories”) to Hebei Fangsheng for cash prices of approximately $2.77 million, $1.15 million, and $4.31 million, respectively. Sales of the LUR and the Industrial Buildings were completed in year 2013.

In connection with the sale of the Industrial Buildings, Hebei Fangsheng agreed to lease the Industrial Buildings back to the Company for its original use for a term of up to three years, with an annual rental payment of approximately $158,300 (RMB1,000,000). The lease agreement expired in August 2016. On August 9, 2016, the Company paid off the rental for the first lease agreement and entered into a supplementary agreement with Hebei Fangsheng, who agreed to extend the lease term for another two years, with the same rental payment as original lease agreement.

13

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(9) Notes payable

As of March 31, 2018, the Company had bank acceptance notes of $3,975,764 from the Bank of Cangzhou to one of its major suppliers for settling purchase of raw materials. The acceptance notes are used to essentially extend the payment of accounts payable and are issued under the banking facilities obtained from the bank as well as the restricted bank deposit of $3,975,764 in the bank as mentioned in Note (3). The bank acceptance notes from the bank bore interest rate at nil% per annum and 0.05% of notes amount as handling charge. The acceptance notes will become due and payable on January 10, 2019.

As of December 31, 2017, the Company had bank acceptance notes of $6,121,637 from the Bank of Cangzhou to one of its major suppliers for settling purchase of raw materials. The acceptance notes are used to essentially extend the payment of accounts payable and are issued under the banking facilities obtained from bank as well as the restricted bank deposit of $6,121,637 in the bank as mentioned in Note (3). The bank acceptance notes from the bank bore interest rate at nil% per annum and 0.05% of notes amount as handling charge. The acceptance notes were due and paid off in January 2018.

(10) Other payables and accrued liabilities

Other payables and accrued liabilities consist of the following:

| March 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Accrued electricity | $ | 161,799 | $ | 2,862 | ||||

| Value-added tax payable | 28,271 | 196,395 | ||||||

| Accrued interest to a related party | 683,150 | 548,684 | ||||||

| Payable for purchase of equipment | 51,526 | 49,585 | ||||||

| Accrued commission to salesmen | 2,119 | 16,992 | ||||||

| Others | 12,368 | 21,819 | ||||||

| Totals | $ | 939,233 | $ | 836,337 | ||||

(11) Common Stock

Issuance of common stock to investors

On August 27, 2014, the Company issued 1,562,500 shares of our common stock and warrants to purchase up to 781,250 shares of our common stock (the “Offering”). Each share of common stock and accompanying warrant was sold at a price of $1.60. Please refer to Note (12), Stock Warrants, for details.

Issuance of common stock pursuant to the 2012 Incentive Stock Plan and 2015 Omnibus Equity Incentive

On January 12, 2016, the Company granted an aggregate of 1,133,916 shares of common stock under its compensatory incentive plans to nine officers, directors and employees of and a consultant when the stock was at $1.25 per share, as compensation for their services in the past years, of which 168,416 shares of common stock were granted under the 2012 Incentive Stock Plan and 965,500 shares were granted under the 2015 Omnibus Equity Incentive. Please see Note (15), Stock Incentive Plans for more details. Total fair value of the stock was calculated at $1,417,395 as of the date of grant.

14

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(12) Stock warrants

On August 27, 2014, the Company issued 1,562,500 shares of our common stock and warrants to purchase up to 781,250 shares of our common stock. The warrants have an exercise price of $1.70 per share. These warrants are exercisable immediately upon issuance on September 3, 2014 and have a term of exercise equal to five years from the date of issuance till September 2, 2019. The fair value of these shares amounted to $780,000, is classified as equity at the date of issuance.

The fair value of the warrants issued was estimated by using the Binominal pricing model with the following assumptions:

| Terms of warrants | 5 years | |||

| Expected volatility | 72.0 | |||

| Risk-free interest rate | 1.69 | |||

| Expected dividend yield | 0.81 | |||

In connection with the Offering, the Company issued warrants to its placement agent of this Offering, which can purchase an aggregate of up to 2.50% of the aggregate number of shares of common stock sold in the Offering, i.e. 39,062 shares. These warrants have substantially the same terms as the warrants issued to purchaser in the Offering, except that the exercise price is $2.00 per share and the expiration date is from September 3, 2014 to June 26, 2019. The fair value of these shares amounted to $35,191, is classified in the equity at the date of issuance to net off the proceeds from the issuance of the shares and warrants.

The fair value of the warrants issued was estimated by using the Binominal pricing model with the following assumptions:

| Terms of warrants | 4.81 years | |||

| Expected volatility | 69.8 | |||

| Risk-free interest rate | 1.62 | |||

| Expected dividend yield | 0.81 |

The Company applied judgment in estimating key assumptions in determining the fair value of the warrants on the date of issuance. The Company used historical data to estimate stock volatilities and expected dividend yield. The risk-free rates are consistent with the terms of the warrants and are based on the United States Treasury yield curve in effect at the time of issuance.

A summary of stock warrant activities is as below:

Three Months Ended March 31, 2018 | ||||||||

| Number | Weight average exercise price | |||||||

| Outstanding and exercisable at beginning of the period | 820,312 | $ | 1.71 | |||||

| Issued during the period | - | - | ||||||

| Exercised during the period | - | - | ||||||

| Cancelled or expired during the period | - | - | ||||||

| Outstanding and exercisable at end of the period | 820,312 | $ | 1.71 | |||||

| Range of exercise price | $1.70 to $2.00 | |||||||

15

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

No warrants were issued, exercised, cancelled or expired during the three months ended March 31, 2018. As of March 31, 2018, the aggregated intrinsic value of warrants outstanding and exercisable was $nil.

No warrants were issued, exercised, cancelled or expired during the three months ended March 31, 2017. As of December 31, 2017, the aggregated intrinsic value of warrants outstanding and exercisable was $nil.

(13) Earnings Per Share

For the three months ended March 31, 2018 and 2017, basic and diluted net income per share are calculated as follows:

Three Months Ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| Basic (loss) income per share | ||||||||

| Net (loss) income for the period - numerator | $ | (4,086,276 | ) | $ | 1,707,869 | |||

| Weighted average common stock outstanding - denominator | 21,450,316 | 21,450,316 | ||||||

| Net (loss) income per share | $ | -0.19 | $ | 0.08 | ||||

| Diluted income per share | ||||||||

| Net income for the period- numerator | $ | (4,086,276 | ) | $ | 1,707,869 | |||

| Weighted average common stock outstanding - denominator | 21,450,316 | 21,450,316 | ||||||

| Effect of dilution | - | - | ||||||

| Weighted average common stock outstanding - denominator | 21,450,316 | 21,450,316 | ||||||

| Diluted (loss) income per share | $ | -0.19 | $ | 0.08 | ||||

For the three months ended March 31, 2018 and 2017, 820,312 warrants shares were excluded from the calculations of dilutive net income per share as their effects would have been anti-dilutive since the average share price was lower than the warrants exercise price. For the three months ended March 31, 2018, there were no securities with dilutive effect issued and outstanding.

16

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(14) Income Taxes

United States

Orient Paper and Shengde Holdings are incorporated in the State of Nevada and are subject to the U.S. federal tax and state statutory tax rates up to 34% and 0%, respectively. On December 22, 2017, the U.S. enacted the Tax Cuts and Jobs Act (the “2017 TCJAAct”), which significantly changed U.S. tax law. The Act 2017 TCJA lowered the Company’s U.S. statutory federal income tax rate from the highest rate of 35% to 21% effective January 1, 2018, while also imposing a deemed repatriation tax on deferred foreign income which requires companies to pay a one-time transition tax on previously unremitted earnings of non-U.S. subsidiaries that were previously tax deferred and creates new taxes on certain foreign sourced earnings. The SEC staff issued Staff Accounting Bulletin (SAB) 118, which provides guidance on accounting for enactment effects of the 2017 TCJA. SAB 118 provides a measurement period of up to one year from the 2017 TCJA’s enactment date for companies to complete their accounting under ASC 740. In accordance with SAB 118, to the extent that a company’s accounting for certain income tax effects of the 2017 TCJA is incomplete but it is able to determine a reasonable estimate, it must record a provisional estimate in its financial statements. If a company cannot determine a provisional estimate to be included in its financial statements, it should continue to apply ASC 740 on the basis of the provisions of the tax laws that were in effect immediately before the enactment of the 2017 TCJA.

In connection with the Company’s initial analysis of the impact of the enactment of the 2017 TCJA, the Company recorded a net tax expense of approximately $80,000 in the fourth quarter of 2017. For various reasons that are discussed more fully below, including the issuance of additional technical and interpretive guidance, the Company has not completed its accounting for the income tax effects of certain elements of the 2017 TCJA. However, with respect to the following, the Company was able to make reasonable estimates of the 2017 TCJA’s effects and, as such, recorded provisional amounts:

Transition tax: The transition tax is a tax on previously untaxed accumulated and current earnings and profits (E&P) of certain of the Company’s non-U.S. subsidiaries. To determine the amount of the transition tax, the Company must determine, in addition to other factors, the amount of post-1986 E&P of the relevant subsidiaries, as well as the amount of non-U.S. income taxes paid on such earnings. Further, the transition tax is based in part on the amount of those earnings held in cash and other specified assets. The Company was able to make a reasonable estimate of the transition tax and recorded a provisional obligation and additional income tax expense of approximately $80,000 in the fourth quarter of 2017. However, the Company is continuing to gather additional information and will consider additional technical guidance to more precisely compute and account for the amount of the transition tax. This amount may change when the Company finalizes the calculation of post-1986 foreign E&P previously deferred from U.S. federal taxation and finalizes the amounts held in cash or other specified assets. The 2017 TCJA’s transition tax is payable over eight years beginning in 2018. Hence, the Company only provided $6,528 for the year ended 31 December 2017.

PRC

Orient Paper HB and Orient Paper Shengde are PRC operating companies and are subject to PRC Enterprise Income Tax. Pursuant to the PRC New Enterprise Income Tax Law, Enterprise Income Tax is generally imposed at a statutory rate of 25%.

The provisions for income taxes for three months ended March 31, 2018 and 2017 were as follows:

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2018 | 2017 | |||||||

| Provision for Income Taxes | ||||||||

| Current Tax Provision PRC | $ | - | $ | 1,121,421 | ||||

| Deferred Tax Provision PRC | (538,969 | ) | (578,139 | ) | ||||

| Total Provision for Income Taxes | $ | (538,969 | ) | $ | 543,282 | |||

17

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

In addition to the reversible future PRC income tax benefits stemming from the timing differences of items such as recognition of asset disposal gain or loss and asset depreciation, Orient Paper, Inc. was incorporated in the United States and incurred aggregate net operating losses of approximately $nil and $6,710,939 for U.S. income tax purposes for the years ended December 31, 2017 and 2016, respectively. The net operating loss carried forward may be available to reduce future years’ taxable income. These carry forwards would expire, if not utilized, during the period of 2030 through 2035. As of December 31, 2016, management believed that the realization of all the U.S. income tax benefits from these losses, which generally would generate a deferred tax asset if it can be expected to be utilized in the future, appears not more than likely due to the Company’s limited operating history and continuing losses for United States income tax purposes. Accordingly, As of December 31, 2016, the Company provided a 100% valuation allowance on the U.S. deferred tax asset benefit to reduce the total deferred tax asset to the amount realizable for the PRC income tax purposes. Management reviews this valuation allowance periodically and will make adjustments as warranted. A summary of the otherwise deductible (or taxable) deferred tax items is as follows:

| December 31, | ||||||||

| 2017 | 2016 | |||||||

| Deferred tax assets (liabilities) | ||||||||

| Depreciation and amortization of property, plant and equipment | $ | 5,123,762 | $ | 2,766,595 | ||||

| Impairment of property, plant and equipment | 440,080 | 372,514 | ||||||

| Miscellaneous | 712,517 | (21,472 | ) | |||||

| Net operating loss carryover of PRC company | 1,094,887 | 147,204 | ||||||

| Net operating loss carryover for U.S. income tax purposes | - | 2,949,287 | ||||||

| Total deferred tax assets | 7,371,246 | 6,214,128 | ||||||

| Less: Valuation allowance | - | (2,949,287 | ) | |||||

| Total deferred tax assets, net | $ | 7,371,246 | $ | 3,264,841 | ||||

The following table reconciles the statutory rates to the Company’s effective tax rate for:

Three Months Ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| PRC Statutory rate | 25 | % | 25.0 | % | ||||

| Effect of different tax jurisdiction | 0.0 | 0.5 | ||||||

| Effect of expenses not deductible for PRC tax purposes | 13.3 | 0.4 | ||||||

| Change in valuation allowance | 0.0 | (1.8 | ) | |||||

| Effective income tax rate | 11.7 | % | 24.1 | % | ||||

During the three months ended March 31, 2018 and 2017, the effective income tax rate was estimated by the Company to be 11.7% and 24.13%, respectively.

As of December 31, 2017, except for the one-time transition tax under the 2017 TCJA which imposes a U.S. tax liability on all unrepatriated foreign E&Ps, the Company does not believe that its future dividend policy and the available U.S. tax deductions and net operating losses will cause the Company to recognize any other substantial current U.S. federal or state corporate income tax liability in the near future. Nor does it believes that the amount of the repatriation of the VIE’s earnings and profits for purposes of paying dividends will change the Company’s position that its PRC subsidiary Orient Paper Shengde and the VIE, Orient Paper HB are considered or are expected to be indefinitely reinvested offshore to support our future capacity expansion. If these earnings are repatriated to the U.S. resulting in U.S. taxable income in the future, or if it is determined that such earnings are to be remitted in the foreseeable future, additional tax provisions would be required.

18

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The Company has adopted ASC Topic 740-10-05, Income Taxes. To date, the adoption of this interpretation has not impacted the Company’s financial position, results of operations, or cash flows. The Company performed self-assessment and the Company’s liability for income taxes includes the liability for unrecognized tax benefits, interest and penalties which relate to tax years still subject to review by taxing authorities. Audit periods remain open for review until the statute of limitations has passed, which in the PRC is usually 5 years. The completion of review or the expiration of the statute of limitations for a given audit period could result in an adjustment to the Company’s liability for income taxes. Any such adjustment could be material to the Company’s results of operations for any given quarterly or annual period based, in part, upon the results of operations for the given period. As of December 31, 2017 and 2016, management considered that the Company had no uncertain tax positions affecting its consolidated financial position and results of operations or cash flows, and will continue to evaluate for any uncertain position in future. There are no estimated interest costs and penalties provided in the Company’s consolidated financial statements for the years ended December 31, 2017 and 2016, respectively. The Company’s tax positions related to open tax years are subject to examination by the relevant tax authorities and the major one is the China Tax Authority.

(15) Stock Incentive Plans

Issuance of common stock pursuant to the 2011 Incentive Stock Plan and 2012 Incentive Stock Plan

On August 28, 2011, the Company’s Annual General Meeting approved the 2011 Incentive Stock Plan of Orient Paper, Inc. (the “2011 ISP”) as previously adopted by the Board of Directors on July 5, 2011. Under the 2011 ISP, the Company may grant an aggregate of 375,000 shares of the Company’s common stock to the Company’s directors, officers, employees or consultants. No stock or option was issued under the 2011 ISP until January 2, 2012, when the Compensation Committee granted 109,584 shares of restricted common stock to certain officers and directors of the Company when the stock was at $3.45 per share, as compensation for their services in the past years. Total fair value of the stock was calculated at $378,065 as of the date of issuance.

On September 10, 2012, the Company’s Annual General Meeting approved the 2012 Incentive Stock Plan of Orient Paper, Inc. (the “2012 ISP”) as previously adopted by the Board of Directors on July 4, 2012. Under the 2012 ISP, the Company may grant an aggregate of 200,000 shares of the Company’s common stock to the Company’s directors, officers, employees or consultants. Specifically, the Board and/or the Compensation Committee have authority to (a) grant, in its discretion, Incentive Stock Options or Non-statutory Options, Stock Awards or Restricted Stock Purchase Offers; (b) determine in good faith the fair market value of the stock covered by any grant; (c) determine which eligible persons shall receive grants and the number of shares, restrictions, terms and conditions to be included in such grants; and (d) make all other determinations necessary or advisable for the 2012 ISP’s administration. On December 31, 2013, the Compensation Committee granted restricted common shares of 297,000, out of which 265,416 shares were granted under the 2011 ISP and 31,584 shares under the 2012 ISP, to certain officers, directors and employees of the Company when the stock was at $2.66 per share, as compensation for their services in the past years. Total fair value of the stock was calculated at $790,020 as of the date of grant.

2015 Incentive Plan

On August 29, 2015, the Company’s Annual General Meeting approved the 2015 Omnibus Equity Incentive Plan of Orient Paper, Inc. (the “2015 ISP”) as previously adopted by the Board of Directors on July 10, 2015. Under the 2015 ISP, the Company may grant an aggregate of 1,500,000 shares of the Company’s common stock to the directors, officers, employees and/or consultants of the Company and its subsidiaries. On January 12, 2016, the Compensation Committee granted un-restricted common shares of 1,133,916, of which 168,416 shares were granted under the 2012 ISP and 965,500 shares under the 2015 ISP, to certain officers, directors, employees and a consultant of the Company as compensation for their services in the past years. Total fair value of the stock was calculated at $1,417,395 as of the date of issuance at $1.25 per share.

(16) Commitments and Contingencies

Operating Lease

Orient Paper leases 32.95 acres of land from a local government in Xushui County, Baoding City, Hebei, China through a real estate lease with a 30-year term, which expires on December 31, 2031. The lease requires an annual rental payment of approximately $18,996 (RMB 120,000). This operating lease is renewable at the end of the 30-year term.

On November 27, 2012, Orient Paper entered into a 49.4 acres land lease with an investment company in the Economic Development Zone in Wei County, Hebei Province, China. The lease term of the Wei County land lease commences on the date of the lease and lasts for 15 years. The lease requires an annual rental payment of $569,882 (RMB 3,600,000). The Company is currently building two new tissue paper production lines and future production facilities in the leased Wei County land.

As mentioned in Note (8) Related Party Transactions, in connection with the sale of Industrial Buildings to Hebei Fangsheng, Hebei Fangsheng agrees to lease the Industrial Buildings back to Orient Paper at an annual rental of $158,300 (RMB 1,000,000), for a total term of up to five years.

19

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Future minimum lease payments of all operating leases are as follows:

| March 31, | Amount | |||

| 2019 | 644,604 | |||

| 2020 | 591,594 | |||

| 2021 | 591,594 | |||

| 2022 | 591,594 | |||

| 2023 | 591,594 | |||

| Thereafter | 2,504,730 | |||

| Total operating lease payments | $ | 5,515,710 | ||

Capital commitment

As of March 31, 2018, the Company has signed several contracts for construction of equipment and facilities, including a new tissue paper production line PM8. Total outstanding commitments under these contracts were $11,479,463 and $11,227,896 as of March 31, 2018 and December 31, 2017, respectively. The Company expected to pay off all the balances within 1 year.

Guarantees and Indemnities

The Company agreed with Baoding Huanrun Trading Co. (formerly known as Dongfang Trading Co.), a major supplier of raw materials, to guarantee certain obligations of this third party, and as of March 31, 2018 and December 31, 2017, the Company guaranteed its long-term loan from financial institutions amounting to $8,905,711 (RMB56,000,000) and $8,570,292 (RMB56,000,000) that matured at various times in 2018. If Huanrun Trading Co., were to become insolvent, the Company could be materially adversely affected.

(17) Segment Reporting

Since March 10, 2010, Orient Paper Shengde started its operations and thereafter the Company manages its operations through two business operating segments: Orient Paper HB, which produces offset printing paper and corrugating medium paper, and Orient Paper Shengde, which produces digital photo paper. They are managed separately because each business requires different technology and marketing strategies.

The Company evaluates performance of its operating segments based on net income. Administrative functions such as finance, treasury, and information systems are centralized. However, where applicable, portions of the administrative function expenses are allocated between the operating segments based on gross revenue generated. The operating segments do share facilities in Xushui County, Baoding City, Hebei Province, China. All sales were sold to customers located in the PRC.

Summarized financial information for the two reportable segments is as follows:

| Three Months Ended | ||||||||||||||||||||

| March 31, 2018 | ||||||||||||||||||||

| Orient Paper | Orient Paper | Not Attributable | Elimination | Enterprise-wide, | ||||||||||||||||

| HB | Shengde | to Segments | of Inter-segment | consolidated | ||||||||||||||||

| Revenues | $ | 1,888,194 | $ | - | $ | - | $ | - | $ | 1,888,194 | ||||||||||

| Gross profit | (695,308 | ) | - | - | - | (695,308 | ) | |||||||||||||

| Depreciation and amortization | 3,538,159 | 192,426 | - | - | 3,730,585 | |||||||||||||||

| Loss from disposal of property, plant and equipment | 10,376 | - | - | - | 10,376 | |||||||||||||||

| Interest income | 44,615 | 148 | - | - | 44,763 | |||||||||||||||

| Interest expense | 358,790 | 45,021 | - | - | 403,811 | |||||||||||||||

| Income tax expense(benefit) | (472,636 | ) | (66,333 | ) | - | - | (538,969 | ) | ||||||||||||

| Net income (loss) | (3,550,390 | ) | (198,724 | ) | (337,162 | ) | - | (4,086,276 | ) | |||||||||||

20

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| Three Months Ended | ||||||||||||||||||||

| March 31, 2017 | ||||||||||||||||||||

| Orient Paper | Orient Paper | Not Attributable | Elimination | Enterprise-wide, | ||||||||||||||||

| HB | Shengde | to Segments | of Inter-segment | consolidated | ||||||||||||||||

| Revenues | $ | 25,289,659 | $ | - | $ | - | $ | - | $ | 25,289,659 | ||||||||||

| Gross profit | 5,653,920 | - | - | - | 5,653,920 | |||||||||||||||

| Depreciation and amortization | 3,391,288 | 224,071 | - | - | 3,615,359 | |||||||||||||||

| Loss from disposal of property, plant and equipment | - | - | - | - | - | |||||||||||||||

| Interest income | (17,709 | ) | (236 | ) | - | - | (17,945 | ) | ||||||||||||

| Interest expense | 679,084 | - | - | - | 679,084 | |||||||||||||||

| Income tax expense(benefit) | 687,570 | (144,288 | ) | - | - | 543,282 | ||||||||||||||

| Net income (loss) | 2,022,614 | (97,623 | ) | (217,122 | ) | - | 1,707,869 | |||||||||||||

| As of March 31, 2018 | ||||||||||||||||||

| Orient Paper | Orient Paper | Not Attributable | Elimination of | Enterprise-wide, | ||||||||||||||

| HB | Shengde | to Segments | Inter-segment | consolidated | ||||||||||||||

| Total assets | $ | 195,292,154 | 26,744,370 | 15,932 | - | 222,052,456 | ||||||||||||

| As of December 31, 2017 | ||||||||||||||||||

| Orient Paper | Orient Paper | Not Attributable | Elimination of | Enterprise-wide, | ||||||||||||||

| HB | Shengde | to Segments | Inter-segment | consolidated | ||||||||||||||

| Total assets | $ | 192,620,887 | 26,363,435 | 5,159 | - | 218,989,481 | ||||||||||||

(18) Concentration and Major Customers and Suppliers

For the three months ended March 31, 2018, the Company had two customers contributed over 20% of total sales.

For the three months ended March 31, 2017, the Company had no single customer contributed over 10% of total sales.

For the three months ended March 31, 2018, the Company had three major suppliers accounted for 41%, 20% and 10% of total purchases. For the three months ended March 31, 2017, the Company had three major suppliers accounted for 52%, 16% and 14% of total purchases.

21

ORIENT PAPER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(19) Concentration of Credit Risk

Financial instruments for which the Company is potentially subject to concentration of credit risk consist principally of cash. The Company places its cash in reputable financial institutions in the PRC and the United States. Although it is generally understood that the PRC central government stands behind all of the banks in China in the event of bank failure, there is no deposit insurance system in China that is similar to the protection provided by the Federal Deposit Insurance Corporation (“FDIC”) of the United States as of March 31, 2018 and December 31, 2017. On May 1, 2015, the new “Deposit Insurance Regulations” was effective in the PRC that the maximum protection would be up to RMB500,000 (US$79,515) per depositor per insured financial intuition, including both principal and interest. For the cash placed in financial institutions in the United States, the Company’s U.S. bank accounts are all fully covered by the FDIC insurance as of March 31, 2018 and December 31, 2017, respectively, while for the cash placed in financial institutions in the PRC, the balances exceeding the maximum coverage of RMB500,000 amounted to RMB27,522,952 (US$4,376,990) as of March 31, 2018.

(20) Risks and Uncertainties

Orient Paper is subject to substantial risks from, among other things, intense competition associated with the industry in general, other risks associated with financing, liquidity requirements, rapidly changing customer requirements, foreign currency exchange rates, and operating in the PRC under its various laws and restrictions.

(21) Recent Accounting Pronouncements