Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Gas Natural Inc. | d348818d8k.htm |

Exhibit 99.1

Exhibit 99.1

AGA Financial Forum

May 7, 2012

Kevin J. Degenstein

President & COO

Thomas J. Smith

Vice President • CFO & Director

Safe Harbor Statement

These slides contain (and the accompanying oral discussion will contain) “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including but not limited to the Company’s continued ability to make dividend payments, the company’s ability to implement its business plan, the company’s ability to consummate its pending acquisitions and to successfully integrate the operations of the acquired companies; fluctuating energy commodity prices, the possibility that regulators may not permit the company to pass through all of its increased costs to its customers, changes in the utility regulatory environment, wholesale and retail competition, weather conditions, litigation risks, risks associated with contracts accounted for as derivatives, and other factors disclosed in the Company’s periodic reports filed with the Securities and Exchange Commission. Consequently such forward looking statements should be regarded as the Company’s current plans, estimates and beliefs. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

| 2 |

|

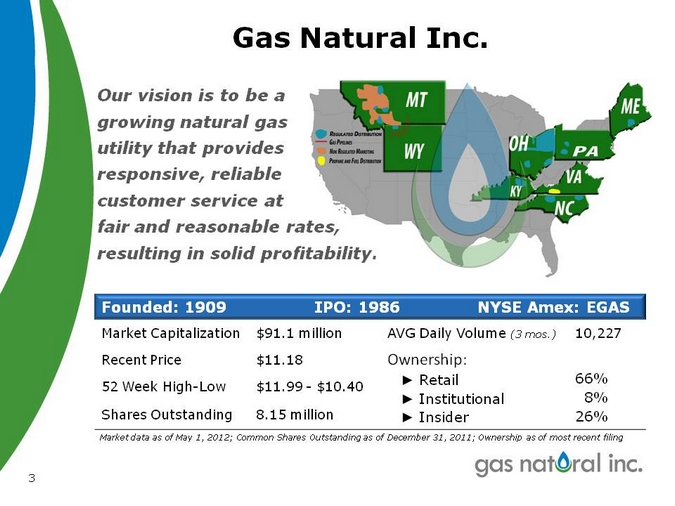

Gas Natural Inc.

Our vision is to be a growing natural gas utility that provides responsive, reliable customer service at fair and reasonable rates, resulting in solid profitability.

Founded: 1909 IPO: 1986 NYSE Amex: EGAS

Market Capitalization $91.1 million AVG Daily Volume (3 mos.) 10,227

Recent Price $11.18 Ownership:

Retail 66%

52 Week High-Low $11.99—$10.40

Institutional 8% Shares Outstanding 8.15 million Insider 26%

Market data as of May 1, 2012; Common Shares Outstanding as of December 31, 2011; Ownership as of most recent filing

| 3 |

|

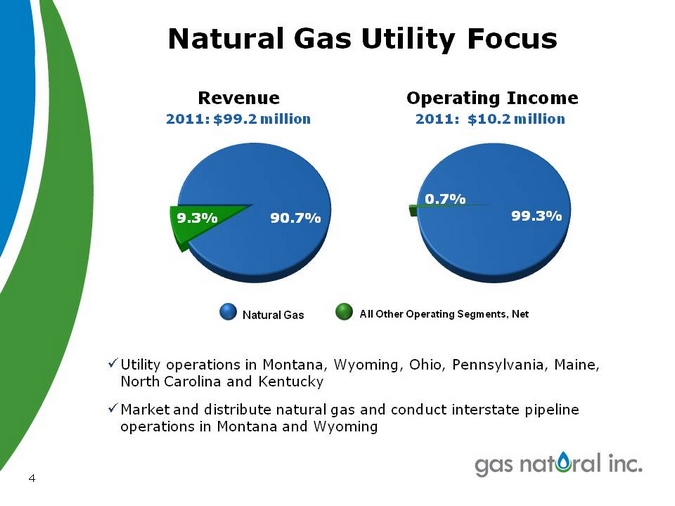

Natural Gas Utility Focus

Revenue Operating Income

2011: $99.2 million 2011: $10.2 million

0.7%

9.3% 90.7% 99.3%

Natural Gas All Other Operating Segments, Net

9Utility operations in Montana, Wyoming, Ohio, Pennsylvania, Maine, North Carolina and Kentucky

9Market and distribute natural gas and conduct interstate pipeline operations in Montana and Wyoming

| 4 |

|

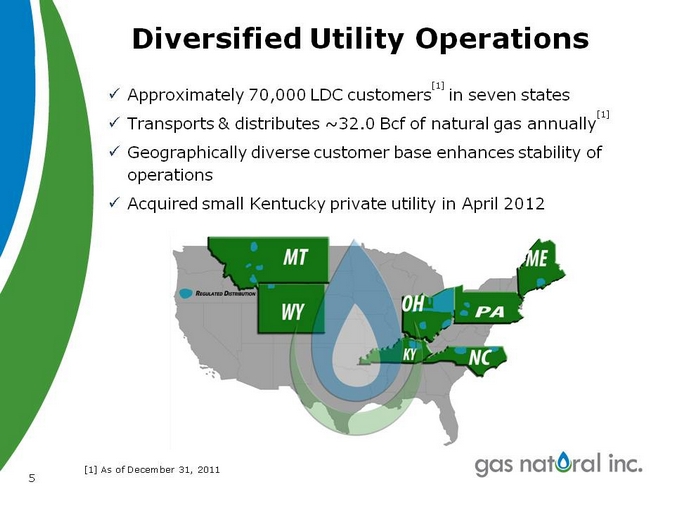

Diversified Utility Operations

Approximately 70,000 LDC customers[1] in seven states

Transports & distributes ~32.0 Bcf of natural gas annually[1]

Geographically diverse customer base enhances stability of operations

Acquired small Kentucky private utility in April 2012

[1] As of December 31, 2011

5

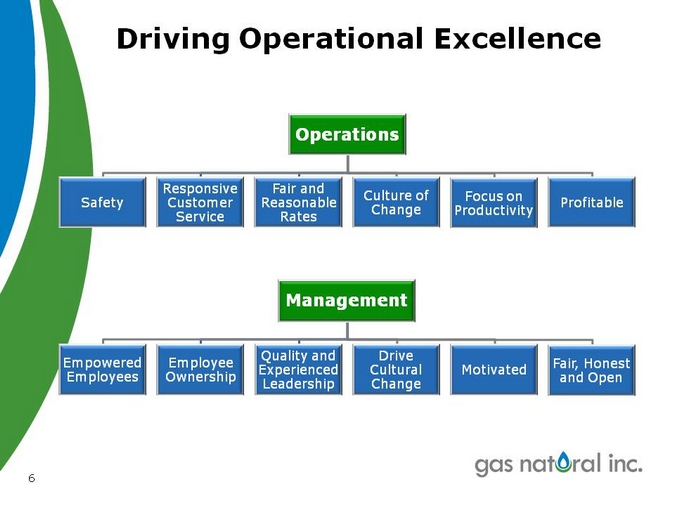

Driving Operational Excellence

Operations

Responsive Fair and

Culture of Focus on

Safety Customer Reasonable Profitable Change Productivity Service Rates

Management

Quality and Drive

Empowered Employee Fair, Honest Experienced Cultural Motivated Employees Ownership and Open Leadership Change

| 6 |

|

Growth Strategy

Focus on cost controls and efficiency

Build rate base around core operations

Bolt-on acquisition strategy

create critical mass: add rate base near existing utility operations

New market acquisition strategy

target areas with low saturation rates for natural gas

Major acquisitions

provide step change to operational efficiencies and customer counts

| 7 |

|

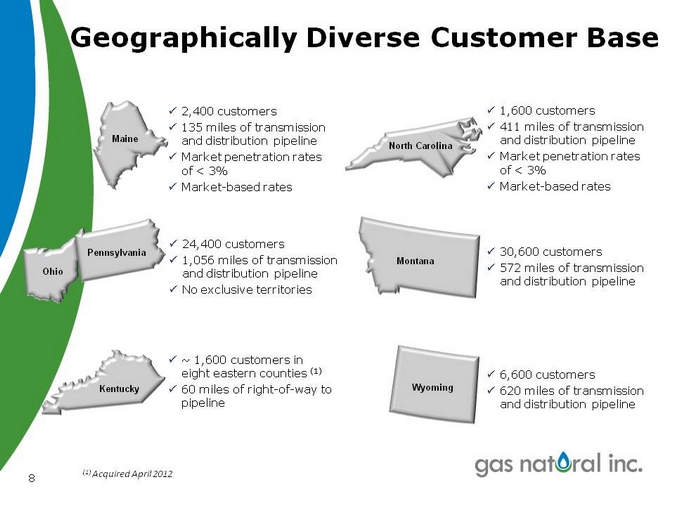

Geographically Diverse Customer Base

Maine

| (1) |

|

Acquired April 2012 |

| 8 |

|

2,400 customers

135 miles of transmission and distribution pipeline

Market penetration rates of < 3% Market-based rates

Pennsylvania

24,400 customers

1,056 miles of transmission and distribution pipeline

No exclusive territories

North Carolina

1,600 customers

411 miles of transmission and distribution pipeline Market penetration rates of < 3% Market-based rates

Montana

30,600 customers 572 miles of transmission and distribution pipeline

[Graphic Appears Here]

~ 1,600 customers in eight eastern counties (1)

60 miles of right-of-way to pipeline

Wyoming

6,600 customers

620 miles of transmission and distribution pipeline

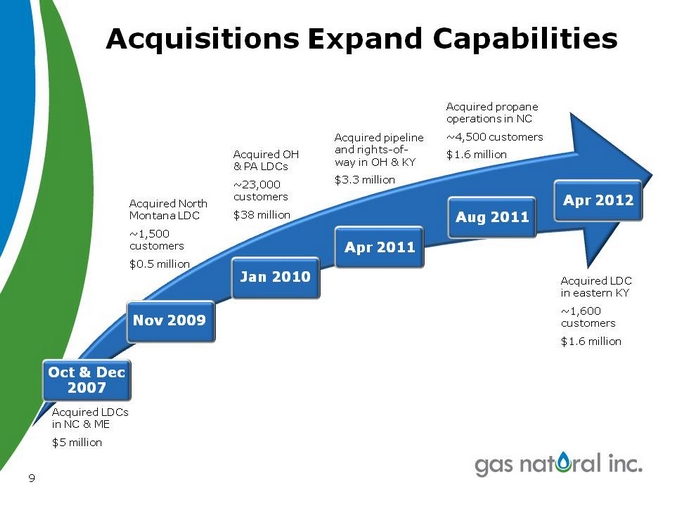

Acquisitions Expand Capabilities

Acquired propane operations in NC

Acquired pipeline ~4,500 customers Acquired OH and rights-of- $1.6 million

& PA LDCs way in OH & KY

~23,000 $3.3 million customers Apr 2012 Acquired North

Montana LDC $38 million Aug 2011

~1,500 customers Apr 2011

$0.5 million Jan 2010

Acquired LDC in eastern KY ~1,600 Nov 2009 customers

$1.6 million

9

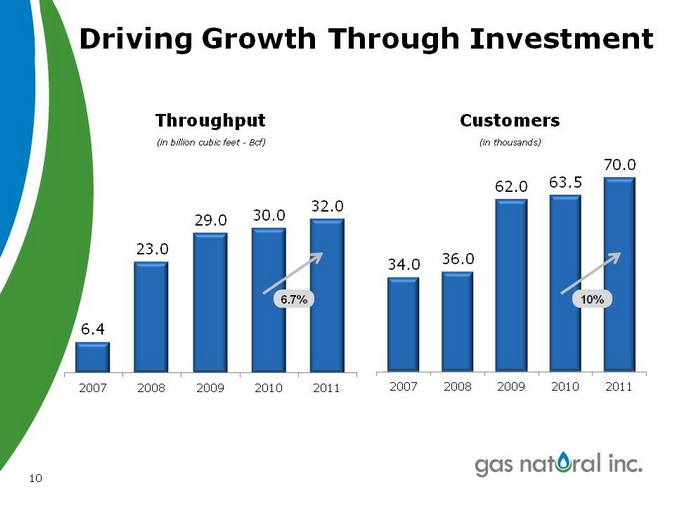

Driving Growth Through Investment

Throughput Customers

(in billion cubic feet—Bcf) (in thousands)

70.0

62.0 63.5

32.0

29.0 30.0

23.0

34.0 36.0

6.7% 10%

6.4

2007 2008 2009 2010 2011 2007 2008 2009 2010 2011

10

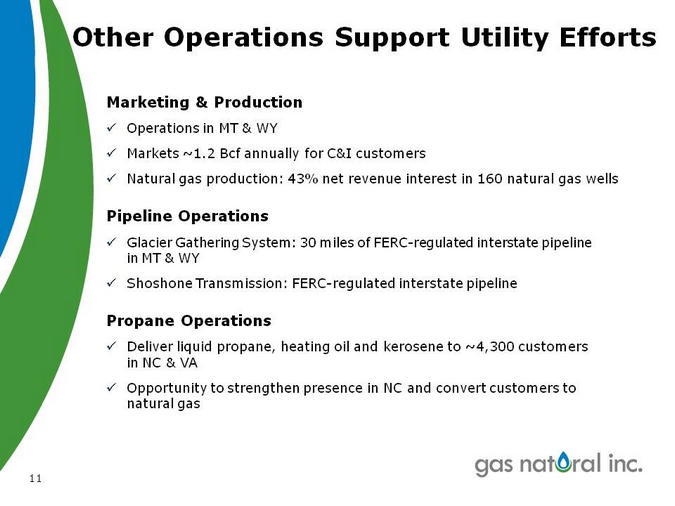

Other Operations Support Utility Efforts

Marketing & Production

operations in MT & WY

markets ~1.2 Bcf annually for C&I customers

Natural gas production: 43% net revenue interest in 160 natural gas wells

Pipeline Operations

Glacier Gathering System: 30 miles of FERC-regulated interstate pipeline in MT & WY

Shoshone transmission: FERC-regulated interstate pipeline

Propane Operations

deliver liquid propane, heating oil and kerosene to ~4,300 customers in NC & VA

opportunity to strengthen presence in NC and convert customers to natural gas

11

Financial Highlights

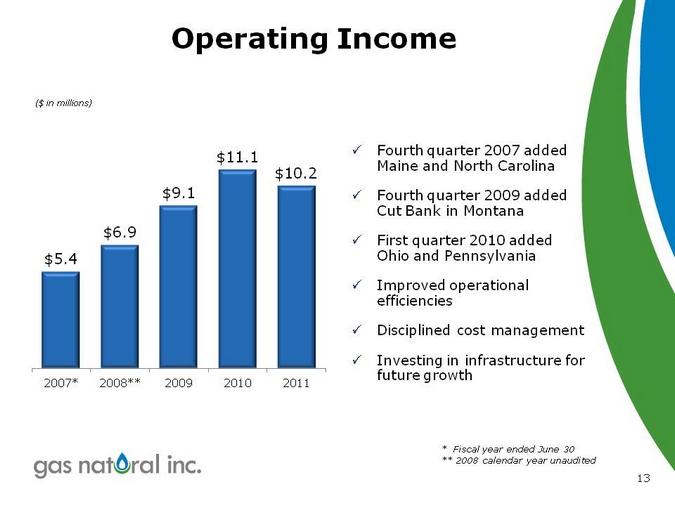

Operating Income

Fiscal year ended June 30

2008 calendar year unaudited

13

($ in millions)

$5.4

$6.9

$9.1

$11.1

$10.2

2007* 2008** 2009 2010 2011

Fourth quarter 2007 added Maine and North Carolina

Fourth quarter 2009 added Cut Bank in Montana

First quarter 2010 added Ohio and Pennsylvania

Improved operational efficiencies Disciplined cost management

Investing in infrastructure for future growth

* Fiscal year ended June 30

** 2008 calendar year unaudited

13

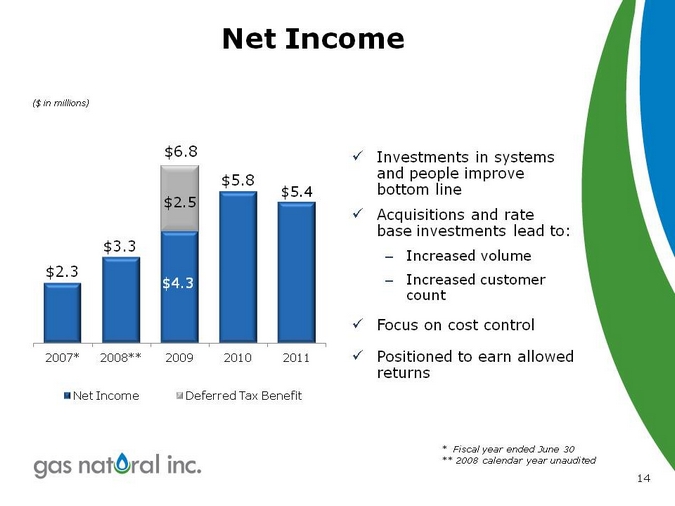

Net Income

($ in millions)

$6.8

$5.8

$2.5 $5.4

$3.3

$2.3

$4.3

2007* 2008** 2009 2010 2011

Net Income Deferred Tax Benefit

Investments in systems

and people improve

bottom line

Acquisitions and rate

base investments lead to:

–

Increased volume

–

Increased customer count

Focus on cost control

Positioned to earn allowed

returns

Fiscal year ended June 30

2008 calendar year unaudited

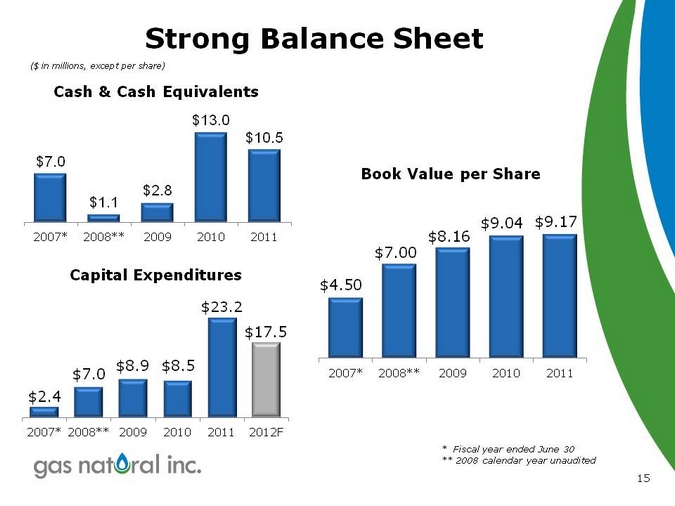

Strong Balance Sheet

($ in millions, except per share)

Cash & Cash Equivalents

Fiscal year ended June 30

2008 calendar year unaudited

15

$7.0

$1.1

$2.8

$13.0

$10.5

2007* 2008** 2009 2010 2011

Book Value per Share

$4.50

$7.00

$8.16

$9.04

$9.17

2007* 2008** 2009 2010 2011

Capital Expenditures

$2.4

$7.0

$8.9

$8.5

$23.2

$17.5

2007* 2008** 2009 2010 2011 2012F

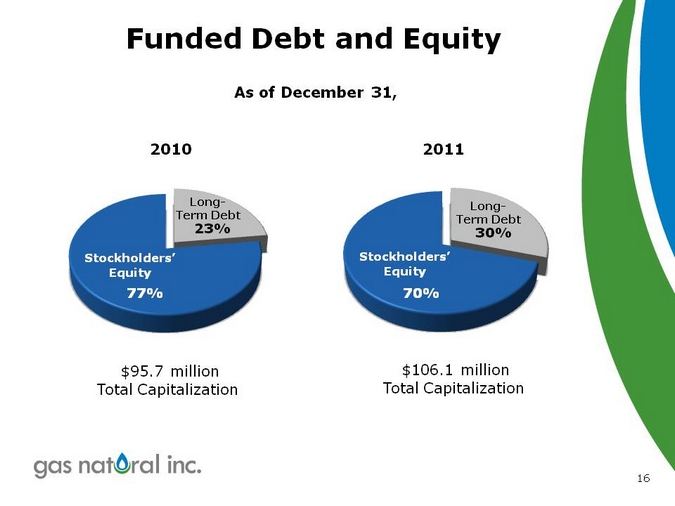

funded debt and equity

as of December 31,

2010

2011

long-term debt 23%

stockholders’ equity 77%

long-term debt 30%

stockholders’ equity 70%

$95.7 million total capitalization

$106.1 million

total capitalization

16

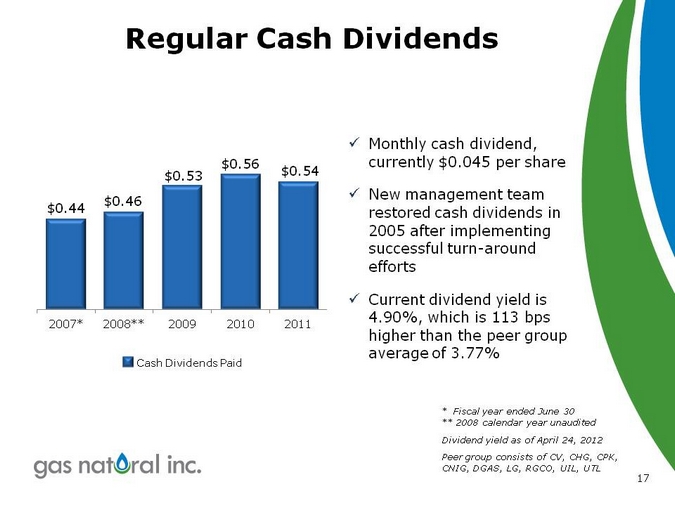

Regular Cash Dividends

$0.56

$0.53 $0.54

$0.46

$0.44

2007* 2008** 2009 2010 2011

Fiscal year ended June 30

2008 calendar year unaudited

Dividend yield as of April 24, 2012

Peer group consists of CV, CHG, CPK, CNIG, DGAS, LG, RGCO, UIL, UTL

17

Monthly cash dividend, currently $0.045 per share New management team restored cash dividends in 2005 after implementing successful turn-around efforts Current dividend yield is 4.90%, which is 113 bps higher than the peer group average of 3.77%

Cash Dividends Paid

Company Highlights

Growth-Oriented Utilities Focused Acquisition Strategy Geographically Diverse Customer Base Experienced Leadership Team

18

AGA Financial Forum

May 7, 2012

Kevin J. Degenstein

President & COO

Thomas J. Smith

Vice President • CFO & Director