Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | d348203d8k.htm |

| EX-99.1 - PRESS RELEASE DATED MAY 8, 2012 - BROADRIDGE FINANCIAL SOLUTIONS, INC. | d348203dex991.htm |

©

2012 Broadridge Financial Solutions, Inc.

Broadridge and the Broadridge logo are registered trademarks of Broadridge

Financial Solutions, Inc. May 8, 2012

Earnings Webcast & Conference Call

Third Quarter Fiscal Year 2012

Exhibit 99.2 |

1

Forward-Looking Statements This presentation

and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Statements that are not historical in nature, and which may be identified by the use of words

like “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar

meaning, are forward-looking statements. In particular, information appearing in the

“Fiscal Year 2012 Financial Guidance” section and statements about our future

financial performance are forward-looking statements. These statements are based on management’s expectations

and assumptions and are subject to risks and uncertainties that may cause actual results to differ

materially from those expressed. These risks and uncertainties include those risk factors

discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year

ended June 30, 2011 (the “2011 Annual Report”), as they may be updated in any future reports

filed with the Securities and Exchange Commission. All forward-looking statements

speak only as of the date of this presentation and are expressly qualified in their entirety by reference

to the factors discussed in the 2011 Annual Report. These risks include: the success of

Broadridge in retaining and selling additional services to its existing clients and in

obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those

clients, and the continued use by such clients of Broadridge’s sevices with favorable pricing

terms; changes in laws and regulations affecting the investor communication services provided

by Broadridge; declines in participation and activity in the securities markets; overall market and

economic conditions and their impact on the securities markets; any material breach of Broadridge

security affecting its clients’ customer information; the failure of Broadridge’s

outsourced data center services provider to provide the anticipated levels of service; any significant

slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s

services; Broadridge’s failure to keep pace with changes in technology and demands of its

clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures;

and competitive conditions. Broadridge disclaims any obligation to update or revise

forward-looking statements that may be made to reflect events or circumstances that arise

after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

Non-GAAP Financial Measures In certain

circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”) and should

be viewed in addition to, and not as a substitute for, the Company’s reported results. Net

earnings, diluted earnings per share and pre-tax earnings margins excluding the Penson

Impairment charges and the IBM Migration costs, and free cash flow are Non-GAAP measures. These

measures are adjusted to exclude costs to be incurred in connection with the Penson Impairment charges

and the IBM Migration costs as Broadridge believes this information helps investors understand

the effect of the Penson Impairment charges and the IBM Migration costs on reported results and

provides a better representation of our actual performance. Free cash flow is a Non-GAAP measure and is defined as cash

flow from operating activities, less capital expenditures and purchases of intangibles.

Management believes such Non-GAAP measures provide investors with a more complete

understanding of Broadridge’s underlying operational results. These Non-GAAP measures are indicators that

management uses to provide additional meaningful comparisons between current results and prior

reported results, and as a basis for planning and forecasting for future periods.

Accompanying this release is a reconciliation of Non-GAAP measures to the comparable GAAP measures.

Pre-Spin Financial Information

Financial information presented for periods prior to the March 30, 2007 spin-off of Broadridge

from Automatic Data Processing, Inc. (“ADP”) represents the operations of the

brokerage services business which were operated as part of ADP. Broadridge’s financial results for periods

before the spin-off from ADP may not be indicative of our future performance and do not

necessarily reflect what our results would have been had Broadridge operated as a separate,

stand-alone entity during the periods presented, including changes in our operations and capitalization as a

result of the spin-off from ADP. Use of

Material Contained Herein The information contained in this presentation is being provided for your convenience and information

only. This information is accurate as of the date of its initial presentation. If

you plan to use this information for any purpose, verification of its continued accuracy is your responsibility.

Broadridge assumes no duty to update or revise the information contained in this presentation.

You may reproduce information contained in this presentation provided you do not alter, edit,

or delete any of the content and provided you identify the source of the information as Broadridge

Financial Solutions, Inc., which owns the copyright.

Broadridge and the Broadridge logo are registered trademarks of Broadridge Financial Solutions, Inc. |

2

Today’s Agenda

Opening Remarks and Other

Rich Daly, CEO

Key Topics

Third Quarter and YTD FY 2012

Dan Sheldon, CFO

Highlights and Segment Results

Summary

Rich Daly, CEO

Q&A

Rich Daly, CEO

Dan Sheldon, CFO

Closing Remarks

Rich Daly, CEO |

3

Opening Remarks

Key Topics:

Financial Highlights

Closed Sales Performance |

4

Financial Highlights

Solid revenue growth

Revenues were up 4% for the quarter

•

Recurring revenues were up 9%

–

Approximately 50% organic and 50% from acquisitions

•

Event-driven revenues down slightly for the quarter

Year-to-date revenues were up 8%

•

Recurring revenues were up 13%

Non-GAAP diluted earnings per share (EPS) were up

Third quarter Non-GAAP diluted EPS of $0.28 were up 12%

•

Primarily due to increased revenues and cost containment

Year-to-date Non-GAAP diluted EPS of $0.55 were up 25%

Penson

Conversion completed in January 2012, processing completely on Broadridge

platform Impairment charge on Penson note receivable

Restructuring efforts continue

Full year guidance

Reaffirming Non-GAAP diluted EPS of $1.50 to $1.60

Revenue growth range now 7% to 8% |

5

Closed Sales Performance

Year-to-date recurring revenue closed sales were $79M vs

$72M in the prior year

ICS recurring revenue closed sales year-to-date were $44M

SPS recurring revenue closed sales year-to-date were

$35M

Pipeline remains strong across existing and new products

Reaffirming our full year recurring revenue closed sales

guidance of $110M to $150M |

6

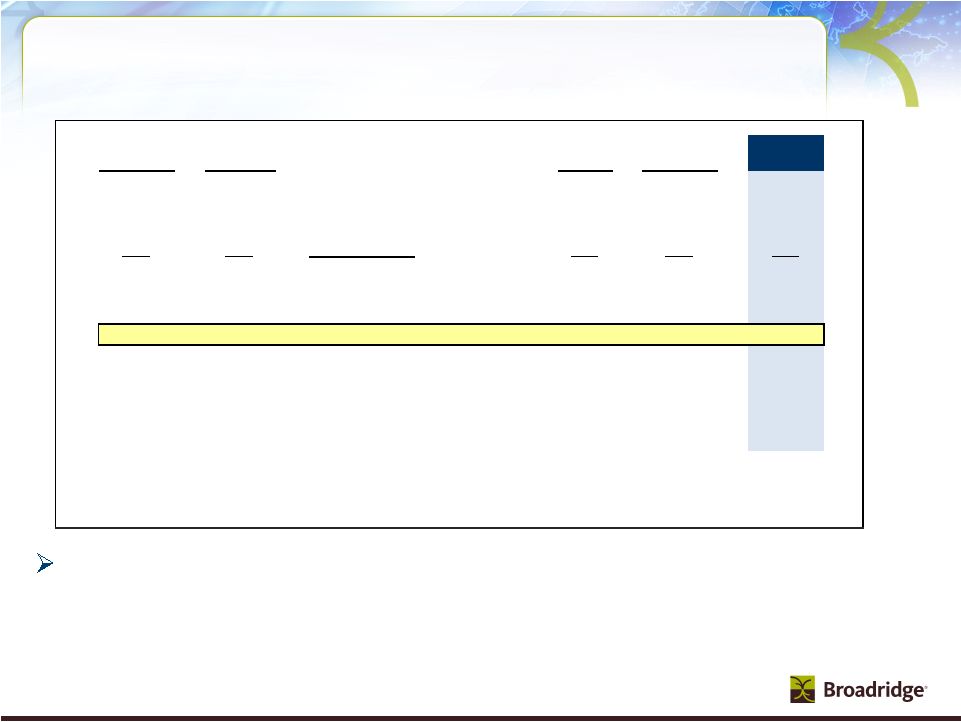

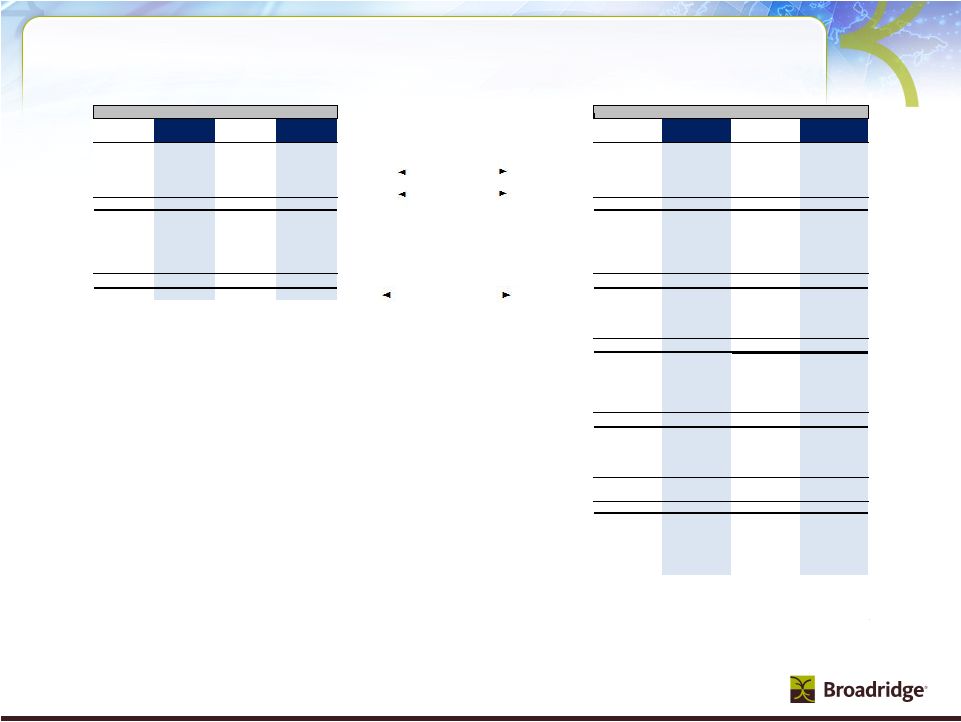

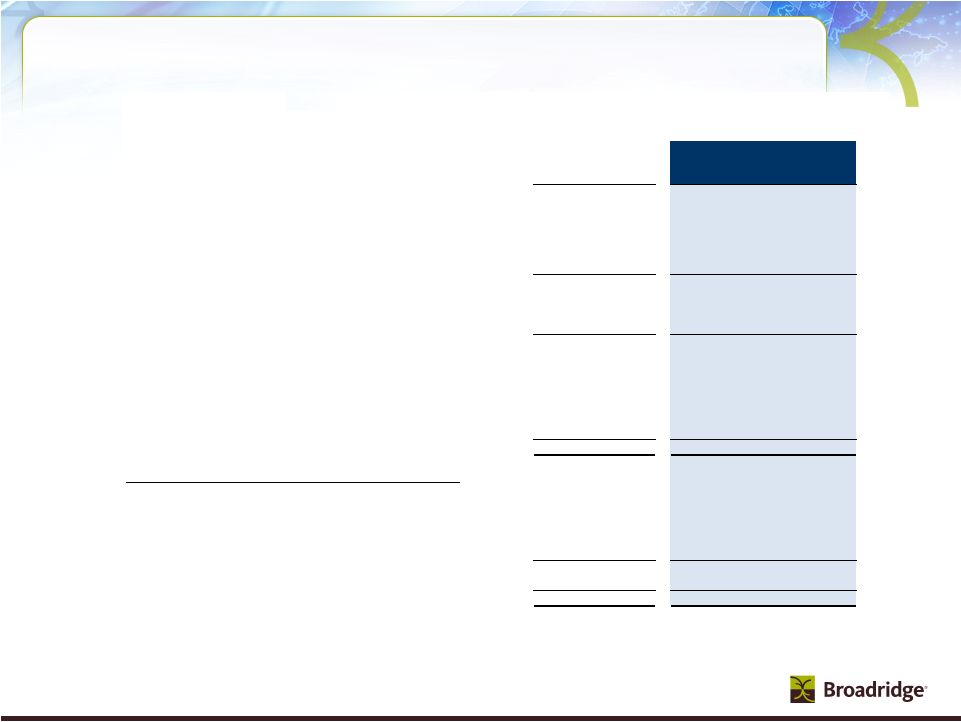

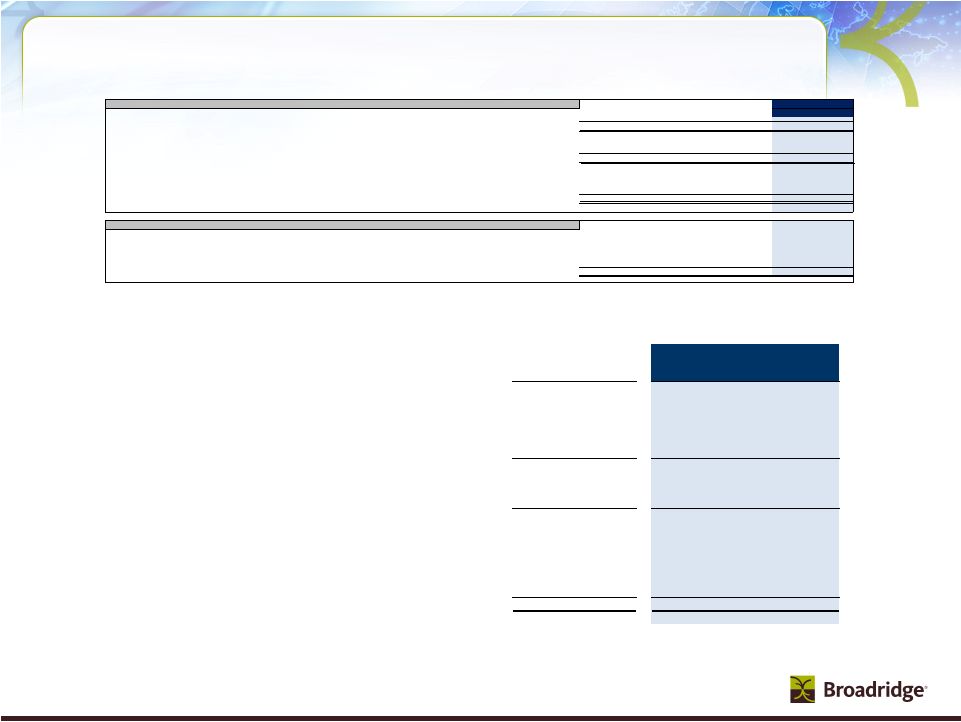

Revenue Growth Drivers, EBIT and Free Cash Flow

Free cash flow excluding IBM Migration costs of ~$73M and Penson’s conversion

costs of ~$20M are expected to increase FY12 range from $136-188M to

~$230-280M (Recurring)

Closed Sales

EBIT Margin

(Non-GAAP)

Historical CAGR

Actual

3Q

3Q YTD

Forecast

(FY05-FY10)

FY11

FY12

FY12

FY12

6%

(2)%

Total Revenue Growth

4%

8%

7-8%

4%

3%

3%

3%

4%

(2)%

(1)%

Client Losses

(1)%

(1)%

(1)%

2%

2%

Net New Business

2%

2%

3%

3%

1%

Internal Growth

(a)

1%

2%

1%

0%

4%

Acquisitions

3%

4%

3%

5%

7%

Total Recurring

6%

8%

7%

1%

(6)%

Event-Driven

(b)

(1)%

(1)%

0%

0%

(4)%

Distribution

(c)

(1)%

1%

0-1%

0%

1%

FX/Other

0%

0%

0%

13.1%

11.1%

8.0%

13.6-14.1%

(a) Internal Growth includes SPS Equity & Fixed Income Trades, ICS Equity &

Mutual Fund Stock Record Growth, Transaction Reporting and Time & Materials

(b) Event-Driven includes ICS Proxy Contest/Specials, Mutual Fund Proxy and

Marketing Communications Fulfillment (c) Distribution includes

pass-through fees from Matrix |

7

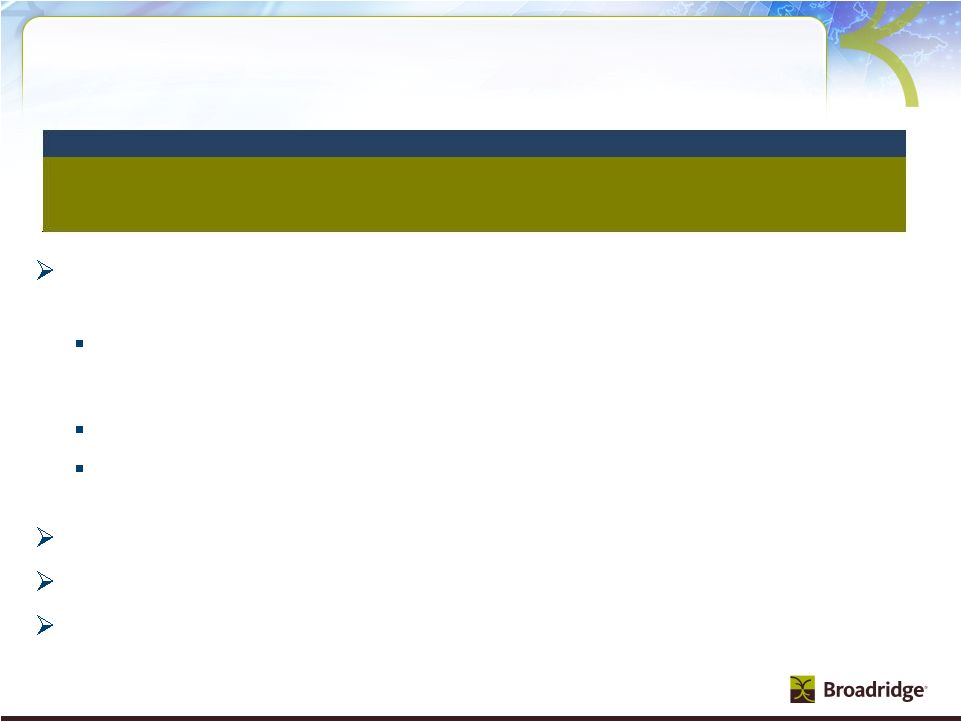

Penson –

Impairment Analysis

Note

Receivable

-

full

principal

amount

of

~$21M

charge

in

Q3 –

Balance $0M (cancellation due to Penson restructuring)

Long-Term

Investments

(Penson

Stock)

-

~$11M

charge

YTD –

Balance ~$2M (Other-than-temporary impairment/mark-to-

market)

Deferred

Client

Conversion

and

Start-up

Costs

-

Balance

~$47M

(anticipate recoverability at this time based upon projected future

cash flows) |

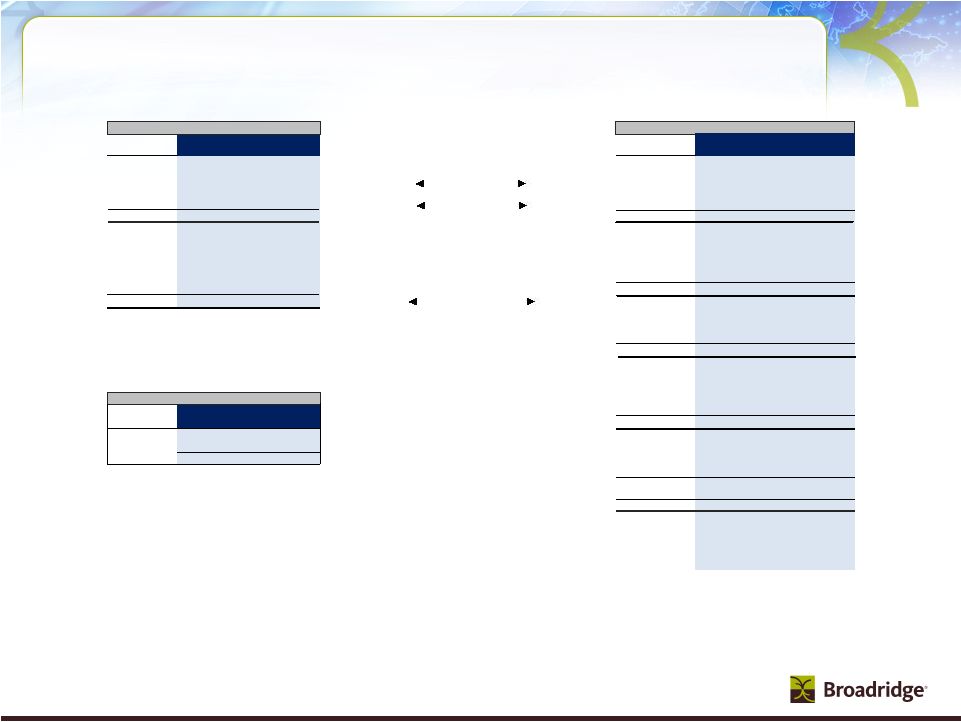

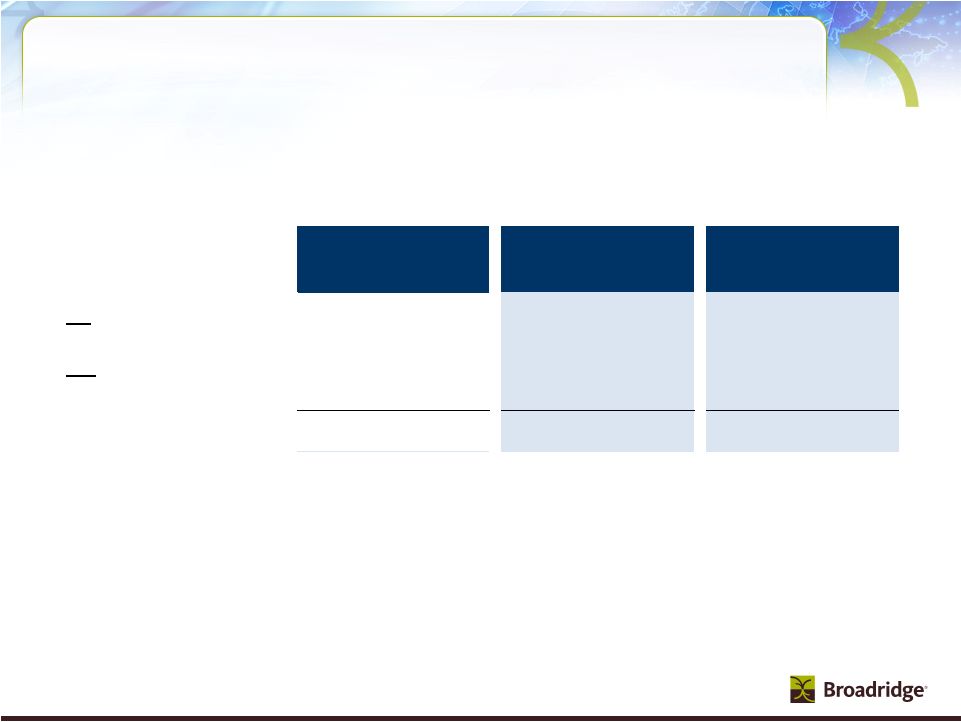

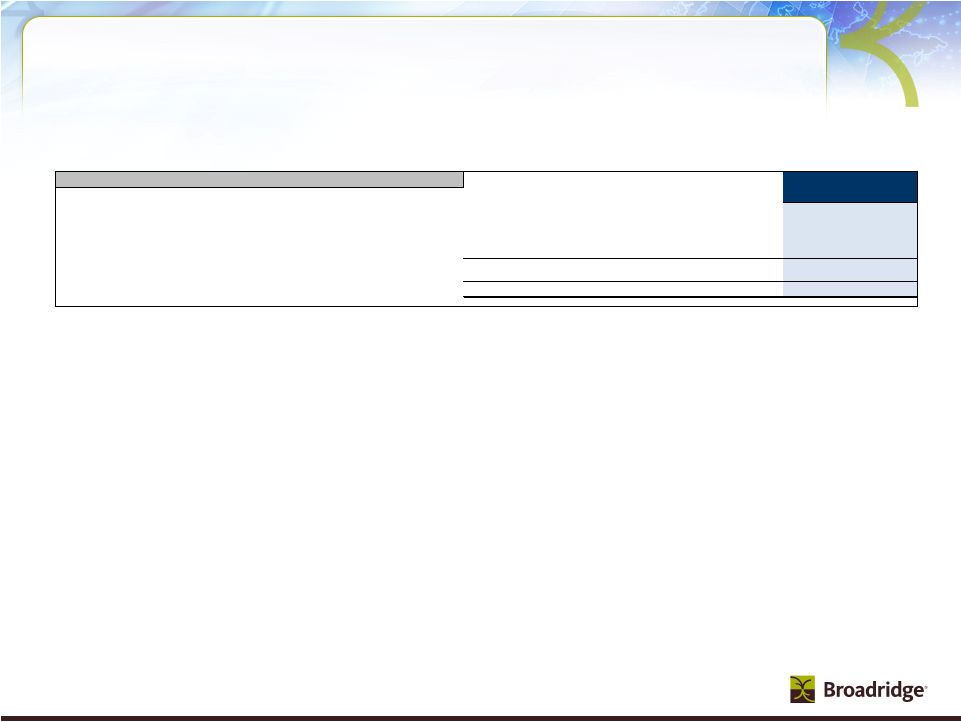

Segment Results

& Forecast – Investor Communication Solutions

Recurring business activities continue to provide momentum and drive

the quarter, YTD, and the expected full year results

Net new business (closed sales less client losses), acquisitions, and internal

growth on track to contribute 12% recurring fee growth and 6 points to

total revenue on a full year basis

Client revenue retention levels at 99% which we

expect to maintain YTD internal growth factors trending in line with

full year expectations (equity position growth +1%, interim position growth

+9%) Event-driven fee revenue outlook slightly behind prior

guidance Change in revenue guidance primarily driven by distribution

mix Higher recurring fee revenue and cost containment initiatives expected to

lead to 90 to 150 bps margin improvement

Revenue/Growth

EBIT/Growth

Margin/Growth

YTD:

Q3:

FY12:

$374M / 1%

$1,004M / 7%

$1,648 to 1,655M / 6%

$37M / 23%

$56M / 43%

$241 to 251M / 13 to 18%

9.9% / 170 bps

5.6% / 150 bps

14.6 to 15.0% / 90 to 150 bps

(Non-GAAP)

(Non-GAAP)

8 |

Segment Results

& Forecast – Securities Processing Solutions

Q3 and YTD revenues up ~10%, split 50/50 between new business and a

combination of acquisitions and the Penson outsourcing agreement

which is

expected to continue for the rest of the year

Closed sales in Q3 of $6M. YTD closed sales are $35M with a full year

forecast of $45- 65M. Upper end of range dependent on closing

larger deals Client revenue retention rate of 99%

Non-trade growth driven by acquisitions

Lower trade volumes

Margins negatively impacted for quarter and YTD by reduction of trade volumes

and integration of Paladyne acquisition

Revenue/Growth

EBIT/Growth

Margin/Growth

YTD:

Q3:

FY12:

$169M / +10%

$489M / +11%

$654 to 660M / +10 to +11%

$25M / (8)%

$73M / +8%

$91 to 97M / +5 to +11%

14.6% / (300) bps

14.9% / (30) bps

13.9 to 14.7% / (80) to +0 bps

(Non-GAAP)

(Non-GAAP)

9 |

Summary

Solid operating results for the quarter and year-to-date

Recurring fee revenue and closed sales results continue to be strong

Event-driven revenues have not returned to historical normal levels

Non-GAAP earnings were up for the quarter and year-to-date

Strong

closed

sales

pipeline,

strong

brand

and

expanding

product

breadth

Anticipate IBM data center migration will be substantially completed by fiscal

year-end

Acquisitions have been successfully integrated

Earnings Guidance

7% to 8% revenue growth

$1.50 to $1.60 Non-GAAP diluted EPS

Expect to provide EPS guidance of $1.80 in FY13 contingent on:

99% client revenue retention

Continuing strong closed sales

Return of event-driven revenues to historical normal levels should generate an

incremental $0.20 EPS in FY13

10 |

Q&A

There are no slides during this portion of the presentation

11 |

Closing Comments

There are no slides during this portion of the presentation

12 |

Appendix

13 |

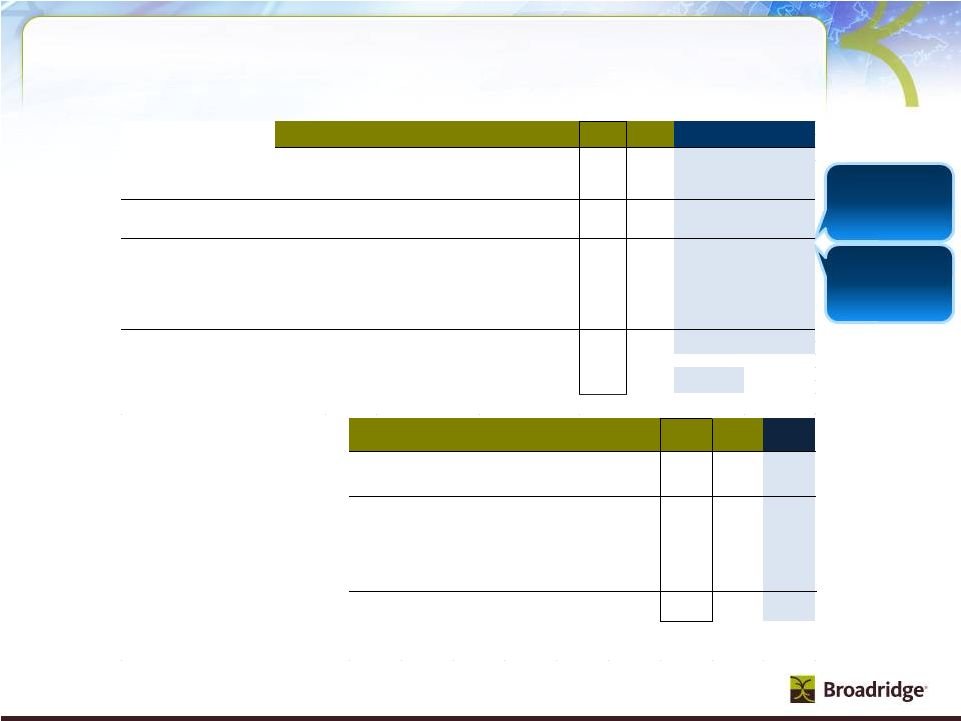

Segment Results

& Forecast – Other & Foreign Exchange (FX)

Corporate

Expenses:

Q3

results

as

expected

Penson Impairment

charges:

Non-cash YTD charges consist of common stock ($11M)

and note receivable ($21M)

Interest,

net:

FY12

reflects

higher

average

debt

balance

and

refinancing

of

our

credit

facilities

YTD

3Q12

3Q12

Low

High

Corporate Expenses

$(5)M

$(18)M

$(28)M

$(32)M

IBM Migration costs

$(6)M

$(13)M

$(33)M

$(33)M

Penson Impairment charges

$(22)M

$(32)M

$(32)M

$(32)M

Interest Expense, net

$(3)M

$(10)M

$(14)M

$(14)M

FX -

P&L -

Revenue

$3M

$10M

$9M

$15M

-

EBIT

$4M

$9M

$10M

$12M

-

Transaction Activity

$(1)M

$(1)M

$(1)M

$(1)M

FY12 Range

14 |

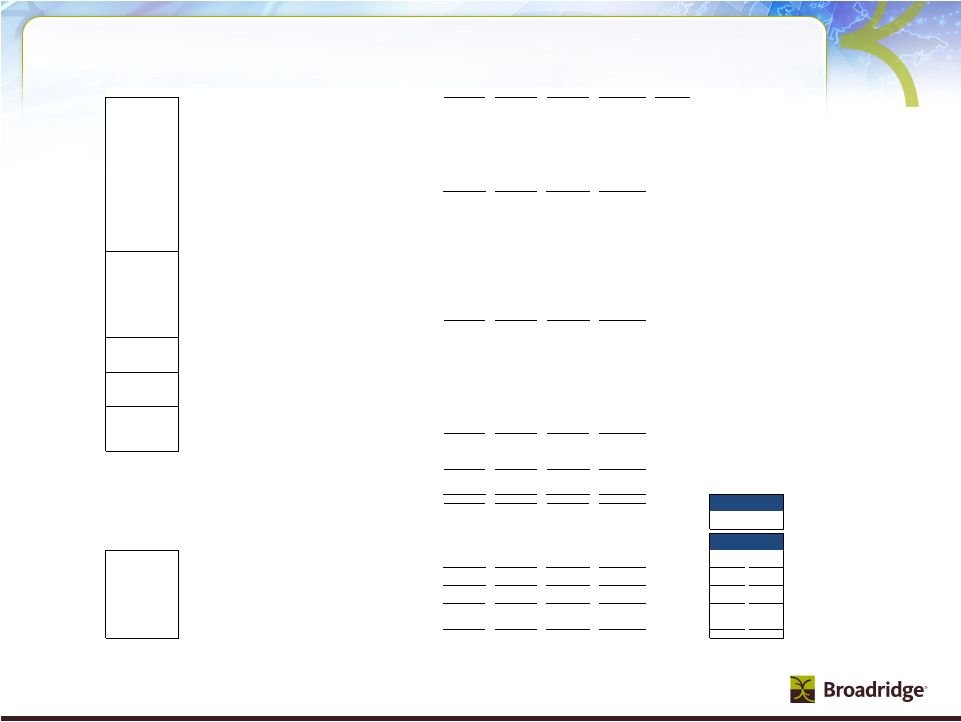

Broadridge 3Q

and YTD from Continuing Operations Revenue

Earnings

FY11

FY12

FY11

FY12

FY11

FY12

FY11

FY12

Q3

Q3

YTD Q3

YTD Q3

($ in millions)

Q3

Q3

YTD Q3

YTD Q3

$369

$374

$942

$1,004

ICS

$30

$37

$39

$56

3%

1%

-11%

7%

Growth % / Margin %

8.2%

9.9%

4.1%

5.6%

$154

$169

$442

$489

SPS

$27

$25

$67

$73

15%

10%

11%

11%

Growth % / Margin %

17.6%

14.6%

15.2%

14.9%

$523

$543

$1,384

$1,493

Total Segments

$57

$62

$106

$129

7%

4%

-5%

8%

Margin %

10.9%

11.4%

7.7%

8.6%

$0

$0

$0

$0

Other

(a)

($7)

($4)

($17)

($17)

$4

$3

$7

$10

FX

(b)

$3

$3

$6

$8

$527

$547

$1,391

$1,503

Total Broadridge (Non-GAAP)

(a)

$53

$60

$95

$120

7%

4%

-5%

8%

Growth % / Margin %

10.1%

11.1%

6.8%

8.0%

Interest & Other

(c)

($2)

($3)

($6)

($10)

Total EBT (Non-GAAP)

(a),(c)

$51

$57

$89

$110

Margin %

9.7%

10.4%

6.4%

7.3%

Income taxes

(a),(c)

($18)

($21)

($32)

($40)

Tax Rate

36.2%

37.2%

36.2%

36.6%

Total Net Earnings (Non-GAAP)

(a),(c)

$33

$36

$57

$70

Margin %

6.2%

6.6%

4.1%

4.7%

IBM Migration costs

$0

($4)

$0

($8)

Penson Impairment charges

(d)

$0

($14)

$0

($20)

Non-GAAP Items (Net of Taxes)

$0

($18)

$0

($28)

Total Net Earnings (GAAP)

$33

$18

$57

$42

Margin %

6.2%

3.3%

4.1%

2.8%

(a)

Diluted Shares

128

128

129

127

Diluted EPS (Non-GAAP)

(a),(c)

$0.25

$0.28

$0.44

$0.55

Diluted EPS (GAAP)

$0.25

$0.14

$0.44

$0.33

(b) Includes impacts of FX P&L and FX Transaction Activity.

(d) Represents

impairment

charges

on

the

Penson

common

stock

and

Penson

note

receivable.

(a) FY12

Q3

excludes

the

IBM

Migration

costs

of

$6M

(after

tax

$4M,

or

$0.03

EPS

impact).

FY12

YTD

Q3

excludes

the

IBM

Migration

costs

of

$13M

(after

tax

$8M,

or

$0.06

EPS

impact).

(c) FY12 Q3 excludes Penson Impairment charges of $23M (after tax $14M, or $0.11

EPS impact). FY12 YTD Q3 excludes Penson Impairment charges of $32M (after tax $21M, or $0.16 EPS impact).

* Guidance does not take into consideration the effect of any future acquisitions,

additional debt and/or share repurchases in excess of the repurchases needed to achieve our 128 million diluted weighted-

average outstanding shares guidance.

15 |

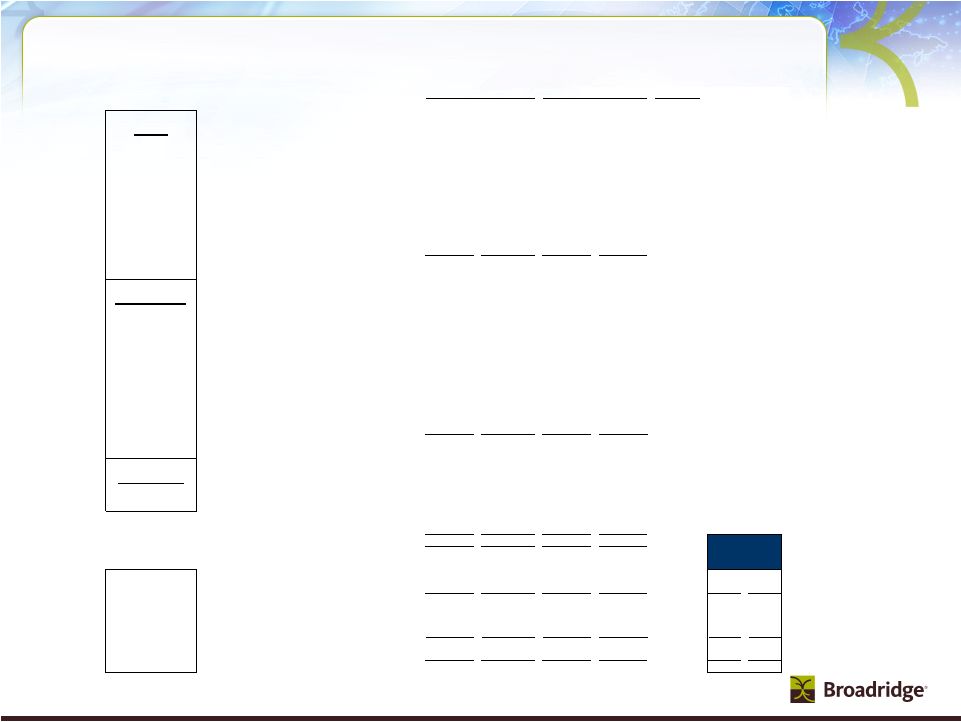

Broadridge FY12

Guidance from Continuing Operations Revenue

FY11

FY12 Range

Actual

Low

High

$1,559

$1,648

$1,655

-7%

6%

6%

$594

$654

$660

11%

10%

11%

$2,153

$2,302

$2,315

-2%

7%

8%

$0

$0

$0

$14

$9

$15

$2,167

$2,311

$2,330

-2%

7%

8%

Recurring Closed Sales

FY12 Range

Segments

Low

High

ICS

$65

$85

SPS

$45

$65

Total

$110

$150

FY11

FY12 Range

Actual

Low

High

$213

$241

$251

13.7%

14.6%

15.2%

$87

$91

$97

14.7%

13.9%

14.7%

$301

$332

$348

14.0%

14.4%

15.0%

($25)

($28)

($32)

$9

$9

$11

$285

$314

$328

13.1%

13.6%

14.1%

($8)

($14)

($14)

$276

$300

$314

12.7%

13.0%

13.5%

($100)

($108)

($110)

36.3%

36.0%

35.0%

$176

$192

$204

8.1%

8.3%

8.8%

($4)

($21)

($21)

-

($21)

($21)

($4)

($42)

($42)

$172

$150

$162

7.9%

6.5%

7.0%

128

128

128

$1.37

$1.50

$1.60

$1.34

$1.18

$1.28

Earnings

($ in millions)

ICS

SPS

Total Segments

Margin %

Margin %

Tax Rate

Margin %

IBM Migration costs

Non-GAAP Items (Net of Taxes)

Total Net Earnings (GAAP)

Margin %

Diluted Shares

Diluted EPS (GAAP)

(a)

(b)

(a)

(c)

(a),(c)

(a),(c)

(a),(c)

(d)

(a),(c)

Other

FX

Interest & Other

Income taxes

Penson Impairment charges

Diluted EPS (Non-GAAP)

Total EBT (Non-GAAP)

Total Net Earnings (Non-GAAP)

(b) Includes impacts of FX P&L and FX Transaction Activity.

(d) Represents

impairment

charges

on

the

Penson

common

stock

and

Penson

note

receivable.

(a) FY11 excludes the IBM Migration costs of $6M, after-tax $4M, or $0.03 EPS

impact. FY12 excludes the IBM Migration costs of $13M (after tax $8M, or

$0.06 EPS impact).

(c) FY12 excludes Penson Impairment charges of $32M (after tax $21M, or $0.16 EPS

impact). * Guidance does not take into consideration the effect of any future

acquisitions, additional debt and/or share repurchases in excess of the repurchases

needed to achieve our 128 million diluted weighted-average outstanding shares

guidance. Growth % / Margin %

Growth % / Margin %

Growth % / Margin %

Total Broadridge (Non-GAAP)

16 |

Cash Flow

– YTD FY12 Results and FY12 Forecast

(a)

Guidance

does

not

take

into

consideration

the

effect

of

any

future

acquisitions,

additional

debt

and/or

share

repurchases

in

excess

of

the

repurchases

needed

to

achieve

our

128

million

diluted

weighted-

average shares outstanding guidance.

(b)

Includes IBM Migration costs of $(21)M and ~$(33)M for YTD Q3FY12 actual and FY12

guidance, respectively. (c)

FY12 range presented in this table includes the impact of ~$(73)M due to IBM

Migration costs. When the IBM Migration costs are excluded from the FY12 range, free cash flow would be ~$210M to ~$260M,

with the mid-point of ~$235M.

Nine Months Ended

March 2012

Low

High

Free Cash Flow

(Non-GAAP)

:

Net earnings from continuing operations (GAAP)

42

$

150

$

162

$

Depreciation and amortization (includes other LT assets)

68

95

100

Stock-based compensation expense

22

31

31

Other

11

17

27

Subtotal

143

293

320

Working capital changes

27

(15)

(15)

Long-term assets and liabilities changes

(b)

(59)

(55)

(45)

Net cash flow provided by continuing operating activities

111

223

260

Cash Flows From Investing Activities

IBM / ITO data center investment

(7)

(15)

(10)

(7)

(7)

(7)

Capital expenditures and software purchases

(25)

(65)

(55)

Free cash flow (Non-GAAP)

(c)

72

$

136

$

188

$

Cash

Flows

From

Other

Investing

and

Financing

Activities

Acquisitions

(72)

(73)

(73)

Stock repurchases net of options proceeds

1

1

1

Proceeds from borrowing net of debt repayments

40

-

-

Dividends paid

(58)

(78)

(78)

Other

(5)

(5)

5

Net change in cash and cash equivalents

(23)

(19)

43

Cash and cash equivalents, at the beginning of year

242

242

242

Cash and cash equivalents, at the end of period

219

$

223

$

285

$

(In millions)

Unaudited

Free Cash Flow (Non-GAAP)

FY12 Range

(a)

17 |

Closed Sales to

Revenue Contribution Recurring Closed Sales to Revenue

($ in millions)

Closed Sales

Revenue Contribution

(a)

Forecast

Forecast

Backlog

(b)

FY12

FY12

ICS

$65-85

~$45-65

~$40-50

~Contribution to revenue growth

~4%

SPS

$45-65

~$30-35

~$80-100

~Contribution to revenue growth

~5%

Total Recurring Closed Sales

$110-150

~$75-100

~$120-150

~Contribution to revenue growth

~4%

(a)

Revenue from current year and prior year Closed Sales.

(b)

Closed Sales that will convert to revenue in future years.

18 |

Revenues and

Closed Sales FY05-FY12 ($ in millions)

FY05-10

Forecast

Event-Driven Fee Revenues

(a)

FY05

FY06

FY07

FY08

FY09

FY10

CAGR

FY11

FY12

Mutual

Fund

Proxy

51

$

61

$

79

$

92

$

55

$

150

$

24%

39

$

27

$

Mutual

Fund

Supplemental

39

$

43

$

51

$

49

$

58

$

48

$

4%

44

$

45

$

Contest/

Specials/

Other

Communications

38

$

49

$

73

$

59

$

67

$

59

$

9%

52

$

52

$

Total Event-Driven Fee Revenues

128

$

153

$

203

$

200

$

180

$

257

$

15%

135

$

124

$

Growth

20%

33%

-1%

-10%

43%

-47%

Recurring Distribution Revenues

(b)

496

$

562

$

593

$

580

$

567

$

564

$

3%

573

$

~$615

Growth

13%

6%

-2%

-2%

-1%

2%

ED Distribution Revenues

(b)

153

$

169

$

228

$

228

$

190

$

217

$

7%

131

$

~$110

Growth

10%

35%

0%

-17%

14%

-39%

Total Distribution Revenues

649

$

730

$

821

$

808

$

757

$

781

$

4%

704

$

~$725

Growth

12%

12%

-2%

-6%

3%

-10%

(a) Includes reclassification of Pre-sale Fulfillment from event-driven revenues to

recurring revenues. (b) Includes reclassification of Pre-sale Fulfillment

related distribution revenues and Matrix pass-through administrative services from event-driven revenues to recurring revenues.

($ in millions)

FY05-10

Forecast

FY11-12

Recurring Fee Revenues

FY05

FY06

FY07

FY08

FY09

FY10

CAGR

FY11

FY12

Growth Rates

ICS

444

$

513

$

519

$

558

$

583

$

610

$

7%

650

$

$702-705

8%

Growth

16%

1%

8%

4%

5%

7%

SPS

459

$

458

$

509

$

515

$

537

$

513

$

2%

522

$

$545-552

4-6%

Growth

0%

11%

1%

4%

-4%

2%

Segment Recurring Fee Revenues

903

$

971

$

1,028

$

1,073

$

1,120

$

1,123

$

4%

1,172

$

$1,247-1,257

6-7%

Growth

7%

6%

4%

4%

0%

4%

Acquisitions

0

$

18

$

28

$

28

$

33

$

45

$

NM*

141

$

~$210

~50%

Total Recurring Fee Revenues

903

$

988

$

1,056

$

1,101

$

1,153

$

1,168

$

5%

1,313

$

$1,455-1,465

11-12%

9%

7%

4%

5%

1%

12%

Event-Driven

128

$

153

$

203

$

200

$

180

$

257

$

15%

135

$

$124

(8)%

Growth

20%

33%

-1%

-10%

43%

-47%

Distribution

649

$

730

$

821

$

808

$

757

$

781

$

4%

704

$

~$725

~3%

Growth

12%

12%

-2%

-6%

3%

-10%

Other/FX

(25)

$

(19)

$

(12)

$

22

$

(17)

$

4

$

NM*

14

$

~$12

NM*

Total BR Revenues

1,656

$

1,853

$

2,068

$

2,131

$

2,072

$

2,209

$

6%

2,167

$

$2,311-2,330

7-8%

Growth

12%

12%

3%

-3%

7%

-2%

Recurring Closed Sales

77

$

92

$

63

$

82

$

95

$

119

$

9%

113

$

$110-150

Growth

19%

-32%

30%

16%

25%

-5%

*NM= Not Meaningful

(cumulative)

Acquisitions

~5%

Growth Contribution

Organic

~6%

Growth Contribution

19 |

Reconciliation

of Non-GAAP to GAAP Measures (a)

Guidance

does

not

take

into

consideration

the

effect

of

any

future

acquisitions,

additional

debt

and/or

share

repurchases

in

excess

of

the

repurchases

needed

to

achieve

our

128

million

diluted

weighted-

average

shares

outstanding

guidance.

(b)

Includes

IBM

Migration

costs

of

$(21)M

and

~$(33)M

for

YTD

Q3FY12

actual

and

FY12

guidance,

respectively.

(c)

FY12

range

presented

in

this

table

includes

the

impact

of

~$(73)M

due

to

IBM

Migration

costs.

When

the

IBM

Migration

costs

are

excluded

from

the

FY12

range,

free

cash

flow

would

be

~$210M

to

~$260M,

with

the

mid-point

of

~$235M.

Nine Months Ended

March 2012

Low

High

Free Cash Flow

(Non-GAAP)

:

Net earnings from continuing operations (GAAP)

42

$

150

$

162

$

Depreciation and amortization (includes other LT assets)

68

95

100

Stock-based compensation expense

22

31

31

Other

11

17

27

Subtotal

143

293

320

Working capital changes

27

(15)

(15)

Long-term assets and liabilities changes

(b)

(59)

(55)

(45)

Net cash flow provided by continuing operating activities

111

223

260

Cash Flows From Investing Activities

IBM / ITO data center investment

(7)

(15)

(10)

Penson

(7)

(7)

(7)

Capital expenditures and software purchases

(25)

(65)

(55)

Free cash flow (Non-GAAP)

(c)

72

$

136

$

188

$

(In millions)

Unaudited

Free Cash Flow (Non-GAAP)

FY12 Range

(a)

EBIT Reconciliation

3Q11

3Q12

YTD11

YTD12

FY11

FY12 Range

($ in millions)

Actual

Actual

Actual

Actual

Actual

Low

High

EBIT from continuing operations (Non-GAAP / excluding IBM Migration costs)

$53

$60

$94

$120

$285

$314

$328

Margin %

10.1%

11.1%

6.8%

8.0%

13.1%

13.6%

14.1%

Interest & Other

($2)

($3)

($6)

($10)

($8)

($14)

($14)

Total EBT from continuing operations (Non-GAAP / excluding IBM Migration costs

and Penson Impairment charges) $51

$57

$88

$110

$276

$300

$314

Margin %

9.7%

10.4%

6.4%

7.3%

12.7%

13.0%

13.5%

IBM Migration costs

$0

($6)

$0

($13)

($6)

($33)

($33)

Penson Impairment charges

$0

($22)

$0

($32)

$0

($32)

($32)

Total EBT (GAAP)

$51

$29

$88

$66

$270

$235

$249

Margin %

9.7%

5.3%

6.4%

4.4%

12.5%

10.2%

10.7%

EPS Reconciliation

Diluted EPS from continuing operations (Non-GAAP)

$0.25

$0.28

$0.44

$0.55

$1.37

$1.50

$1.60

IBM Migration costs

0.00

(0.03)

0.00

(0.06)

(0.03)

(0.16)

(0.16)

Penson Impairment charges

0.00

(0.11)

0.00

(0.16)

0.00

(0.16)

(0.16)

Diluted EPS from continuing operations (GAAP)

$0.25

$0.14

$0.44

$0.33

$1.34

$1.18

$1.28

20 |

One-time

Items

(For

Informational

Purposes

Only)

One-Time Restructuring and Acquisition Related Costs (a)

3Q11

3Q12

YTD11

YTD12

FY11

FY12 Range

Actual

Actual

Actual

Actual

Actual

Low

High

Deal Costs (b)

($2)

$0

($3)

($2)

($2)

($2)

($2)

Amortization of Intangibles

($5)

($7)

($9)

($18)

($15)

($24)

($24)

Integration Costs

($1)

-

($1)

-

($2)

($3)

($3)

Total One-Time Acquisition Related Costs

($8)

($7)

($13)

($20)

($19)

($29)

($29)

Diluted EPS impact

($0.04)

($0.03)

($0.07)

($0.10)

($0.09)

($0.14)

($0.14)

(a) Although not excluded from our GAAP financial information, management believes these items could be

excluded from the GAAP financials when assessing the overall business performance. (b) Deal Costs

include only costs related to closed transactions. 21

|

ICS Key Segment

Revenue Stats RC= Recurring

ED= Event-Driven

In millions

Fee Revenues

3Q11

3Q12

YTD FY11

YTD FY12

Type

Proxy

Equities

31.1

$

31.7

$

81.2

$

80.1

$

RC

Stock Record Position Growth

0%

4%

-1%

1%

Pieces

25.6

24.5

69.6

66.1

Mutual Funds

12.8

$

5.5

$

30.1

$

19.3

$

ED

Pieces

16.9

6.6

41.0

29.6

Contests/Specials

2.1

$

3.0

$

10.3

$

9.7

$

ED

Pieces

2.1

3.0

10.9

10.7

Total Proxy

46.0

$

40.2

$

121.6

$

109.1

$

Total Pieces

44.6

34.2

121.5

106.5

Notice and Access Opt-in %

61%

69%

57%

66%

Suppression %

52%

58%

50%

56%

Interims

Mutual Funds (Annual/Semi-Annual Reports/Annual Prospectuses)

30.0

$

33.5

$

76.5

$

84.7

$

RC

Position Growth

8%

7%

9%

9%

Pieces

146.4

168.8

386.1

438.1

Mutual Funds (Supplemental Prospectuses) & Other

14.3

$

15.9

$

34.1

$

34.9

$

ED

Pieces

86.4

86.8

198.1

191.2

Total Interims

44.3

$

49.4

$

110.6

$

119.6

$

Total Pieces

232.8

255.7

584.2

629.3

Transaction

Transaction Reporting/Customer Communications

45.4

$

47.7

$

118.0

$

123.9

$

RC

Reporting

Fulfillment

Fulfillment (a)

28.5

$

31.6

$

85.4

$

94.7

$

RC

Other

Other - Recurring (b)

22.1

$

25.8

$

37.5

$

76.8

$

RC

Communications

Other - Event-Driven (c)

11.3

$

12.1

$

25.6

$

27.7

$

ED

Total Other

33.4

$

37.9

$

63.3

$

104.5

$

Total Fee Revenues

197.6

$

206.8

$

#

499.0

$

551.6

$

Total Distribution Revenues (d)

171.3

$

167.2

$

443.5

$

452.2

$

Total Revenues as reported - GAAP

368.9

$

374.0

$

942.5

$

1,003.8

$

Q3 FY12 Ranges

Low

High

Total RC Fees

157.1

$

170.3

$

398.9

$

460.1

$

801

$

805

$

Total ED Fees

40.5

$

36.5

$

100.1

$

91.5

$

124

$

124

$

Q3 FY12 Ranges

Low

High

Sales

2%

2%

2%

3%

4%

4%

Losses

0%

-1%

0%

-1%

-1%

-1%

Key

Net New Business

2%

1%

2%

2%

3%

3%

Revenue

Internal growth

1%

2%

0%

2%

1%

1%

Drivers

Recurring (Excluding Acquisitions)

3%

3%

2%

4%

4%

4%

Acquisitions

4%

0%

4%

3%

2%

2%

Total Recurring

7%

3%

6%

7%

6%

6%

Event-Driven

-3%

-1%

-9%

-1%

-1%

-1%

Distribution

-1%

-1%

-8%

1%

1%

1%

TOTAL

3%

1%

-11%

7%

6%

6%

(a) Consolidated Pre-sale and Post-sale Fulfillment and reclassified Pre-sale from

event-driven to recurring revenues. (b) Other Recurring Fee Revenue includes Matrix,

NewRiver, StockTrans, Access Data, Forefield and Tax Reporting. (c) Other event-driven

includes 2.4M pieces for 3Q11, 2.0M for 3Q12, 6.9M for FY11 YTD and 5.8M for FY12 YTD, primarily related to corporate actions.

(d) Total Distribution revenues primarily include pass-through revenues related to the physical

mailing of Proxy and Interims, as well as Matrix administrative services. Note: Certain prior

period amounts have been reclassified to conform with current period presentation.

22 |

SPS and

Outsourcing Key Segment Revenue Stats RC= Recurring

ED= Event-Driven

In millions

3Q11

3Q12

YTD FY11

YTD FY12

Type

Equity

Transaction-Based

Equity Trades (a)

40.7

$

36.4

$

109.3

$

108.1

$

RC

Internal Trade Volume

1,120

996

964

975

Internal Trade Growth

14%

-11%

0%

1%

Trade Volume (Average Trades per Day in '000)

1,142

1,005

986

982

Non-Transaction

Other Equity Services

77.0

$

86.3

$

227.5

$

248.7

$

RC

Total Equity

117.7

$

122.8

$

336.8

$

356.8

$

Fixed Income

Transaction-Based

Fixed Income Trades (a)

12.3

$

13.6

$

35.4

$

40.1

$

RC

Internal Trade Volume

267

276

256

270

Internal Trade Growth

20%

3%

20%

6%

Trade Volume (Average Trades per Day in '000

270

299

257

294

Non-Transaction

Other Fixed Income Services

9.3

$

10.8

$

28.1

$

33.5

$

RC

Total Fixed Income

21.6

$

24.4

$

63.5

$

73.7

$

Outsourcing

Outsourcing

14.6

$

22.1

$

41.3

$

58.4

$

RC

# of Clients

11

13

11

13

Total Net Revenue as reported - GAAP

153.9

$

169.3

$

441.7

$

488.8

$

FY12 Ranges

Low

High

Sales

3%

5%

4%

5%

5%

5%

Losses

-2%

-1%

-4%

-1%

-1%

-1%

Key

Net New Business

1%

4%

0%

4%

4%

4%

Revenue

Transaction & Non-transaction

6%

0%

4%

2%

1%

2%

Drivers

Concessions

-1%

-2%

-2%

-1%

-1%

-1%

Internal growth

5%

-2%

2%

1%

0%

1%

Acquisitions

9%

8%

9%

6%

6%

6%

TOTAL

15%

10%

11%

11%

10%

11%

(a) Equities and Fixed Income trade volumes have been adjusted to exclude additional trades processed

under fixed-price contracts and semi-variable step contracts. The revenue related

to these contracts was re-classified from 'Transaction-Based'.

23 |

Refers

primarily

to

information

required

to

be

provided

by

mutual

funds

to

supplement

information

previously

provided

in

an

annual

mutual

fund

prospectus

(e.g.,

change

in

portfolio

managers,

closing

funds

or

class

of

shares

to

investors,

or

restating

or

clarifying

items

in

the

original

prospectus).

The

events

could

occur

at

any

time

throughout

the

year.

Refers to the proxy services we provide in connection with stockholder meetings

held outside of the normal annual meeting cycle and are primarily driven by special events (e.g., mergers

and

acquisitions

in

which

the

company

being

acquired

is

a

public

company and needs to solicit the approval of its stockholders).

Refers

to

communications

provided

by

corporate

issuers

and

investment

companies

to

investors

including

newsletters,

notices, tax information, marketing materials and other information not

required to be distributed by regulation.

Mutual

Funds

(Supplemental

Prospectuses)

–

Refers to the services we provide investment companies in connection with

information they are required by regulation to distribute periodically to

their investors. These reports contain pertinent information such as holdings, fund performance, and other required disclosure.

Refers primarily to the printing and distribution of account statements, trade

confirmations and tax reporting documents to account holders, including electronic delivery and

archival services.

Refers

primarily

to

the

distribution

of

prospectuses,

offering

documents,

and

required

regulatory disclosure information to investors in connection with purchases of

securities.

Refers to the distribution of marketing literature, welcome kits, enrollment kits,

and investor information to prospective investors, existing stockholders and other targeted recipients

on behalf of broker-dealers, mutual fund companies and 401(k)

administrators. Refers to the services we provide in connection with the

distribution of communications material not included in the above definitions such as non-objecting beneficial owner (NOBO) lists, and

corporate actions such as mergers, acquisitions, and tender offer

transactions. Refers

to

the

proxy

services

we

provide

when

a

separate

agenda

is

put

forth

by

one

or

more

stockholders

that

is

in opposition to the proposals presented by management of

the company which is separately distributed and tabulated from the company’s

proxy materials. Refers to the proxy services we provide for funds, classes

or trusts of an investment company. Open-ended mutual funds are not required to have annual

meetings. As a result, mutual fund proxy services provided to open-ended mutual

funds are driven by a "triggering event." These triggering events can be a change in

directors, fee structures, investment restrictions, or mergers of funds.

Refers to the proxy services we provide in connection with annual stockholder

meetings for publicly traded corporate issuers. Annual meetings of public companies include

shares held in "street name" (meaning that they are held of record by

brokers or banks, which in turn hold the shares on behalf of their clients, the ultimate beneficial owners) and shares

held in "registered name" (shares registered directly in the names of their

owners). Equities

–

Mutual

Funds

–

Contests

–

Specials –

Mutual

Funds

(Annual/Semi-Annual

Reports/Annual

Prospectuses)

–

Transaction Reporting

–

Post-Sale

Fulfillment

–

Pre-Sale

Fulfillment

–

Other

–

Other –

Proxy

Interims

Transaction Reporting

Fulfillment

Other

Communications

24

Broadridge ICS Definitions |