Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - U S PHYSICAL THERAPY INC /NV | d333609d8k.htm |

Exhibit 99.1

Dear U.S. Physical Therapy Shareholder:

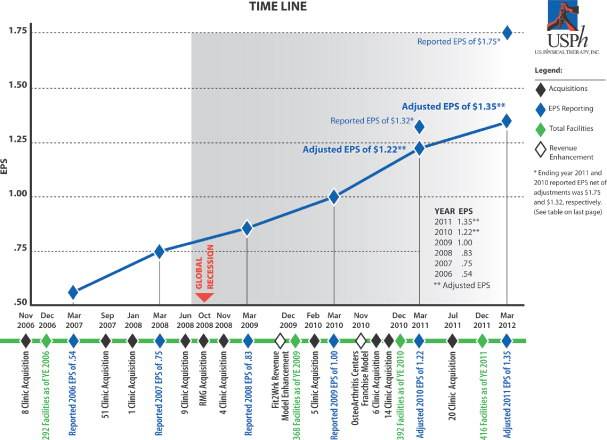

Over the past few years the macro economic environment has been exceedingly challenging with high single digit unemployment and significantly higher “under-employment”. In spite of this difficult operating environment, USPH has produced some of the best earnings in the history of our Company with an average compounded adjusted earning’s growth over the past five years of 20%. Additionally, we produced continuous positive earning’s growth, year after year, in spite of the recession. I am really proud of our entire team’s effort and resolve which in 2011 produced another record earning’s year for our shareholders!

During this period, when many companies were cutting programs and people, we further expanded our 42 state facility network, organically as well as through acquisition. In addition, we added key brands and programs such as our Fit2WRK industrial solution’s program and our growing OsteoArthritis Centers of America business. Further, while many companies were trimming their sales force, we were adding to our already sizeable sales group while we continued to invest in additional training and marketing resources. These additions and enhancements, coupled with the persistent drive to make a meaningful difference in the lives of our patients, have not only contributed to a strong year in 2011 but have helped to further position us for continued success in the future.

Some of our 2011 accomplishments include:

Successfully integrated 3 acquisitions - two of which came to us at year’s end 2010 and the third, a terrific partnership with 20 locations, was acquired in July of 2011.

We enjoyed solid organic expansion as well, opening 21 de novo locations during the course of the year.

Visits grew 12.3% and importantly and excitingly we were able to produce a strong finish to the year which propelled us into positive same store visit territory for 2011.

Adjusted EBITDA increased 15.3% to $35.2 million compared to the 2010 period. (See table on last page for a reconciliation of Adjusted EBITDA).

We deployed over $30 million in acquisition related capital and another $4.7 million for USPH share repurchases during the year.

Do to the continued strength of our cash flow, we initiated the first regular quarterly dividend to shareholders in the company’s history. The dividend rate was recently increased by 12.5%.

For a “visual overview” of key events over the past few years we have provided the time line on the following page relating to acquisitions, key events, facility count and earning’s milestones.

In 2012 you can count on the same intensity of focus, purpose and execution that you have seen from our team in the past. We hope that as the macro-economic environment improves, coupled with some near term certainty of payment from the federal government, that we will be able to do even more good things. Regardless of the environment, we will remain focused on creating shareholder value through the thoughtful, purposeful creation and maintenance of key relationships, sincere and focused clinical efforts to positively impact our patient’s lives, efficient and effective deployment of capital to produce growth and additional opportunities for expansion and success, and importantly we will continue to work to do all of this with honesty and integrity.

As always, we appreciate your support, feedback and encouragement, so please don’t hesitate to give us a call (especially if it’s related to the encouragement theme). Thank you very much on behalf of our entire team of dedicated professionals with whom I feel very blessed to work every day.

Sincerely,

Chris Reading, PT

President and CEO

| * | The following tables reconcile Adjusted Net Income Attributable to Common Shareholders (“Adjusted Net Income”) and Adjusted EBITDA to comparable generally accepted accounting principles (“GAAP”) measurements. Adjusted Net Income equals net income attributable to common shareholders (“Net Income”) less the after-tax effect of the 2011 gain on purchase price settlement, the 2010 gain on sale of a five clinic joint venture and the 2010 positive adjustment to the income tax provision, all of which are described in the Company’s Form 10K filed with the SEC on March 9, 2012. Adjusted EBITDA equals Net Income before interest, taxes, depreciation and amortization and equity compensation expense and above mentioned adjustments use to arrive at Adjusted Net Income. Management believes providing these non-GAAP financial measurements to investors are useful information for comparing the Company’s period-to-period results. |

| Adjusted Net Income and Adjusted EBITDA are not measures of financial performance under GAAP. Items excluded from both measures are significant components in understanding and assessing financial performance. Both measures should not be considered in isolation or as an alternative to, or substitute for, Net Income or net income including noncontrolling interests data presented in the consolidated financial statements as indicators of financial performance. Because both measures are not measurements determined in accordance with GAAP and are thus susceptible to varying calculations, these measurements may not be comparable to other similarly titled measures of other companies. |

|

ADJUSTED NET INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS |

Year Ended | |||||||

| December 31, | ||||||||

| 2011 | 2010 | |||||||

| (In thousands, except per share data) | ||||||||

| Net income attributable to common shareholders |

$ | 20,974 | $ | 15,645 | ||||

| Gain on purchase price settlement of $5,434 less tax effect of $629 |

(4,805) | - | ||||||

| Positive adjustment in income tax provision |

- | (814) | ||||||

| Gain on the sale of a five clinic joint venture of $578 less tax effect of $227 |

- | (351) | ||||||

|

|

|

|

|

|||||

| Adjusted net income attributable to common shareholders |

$ | 16,169 | $ | 14,480 | ||||

|

|

|

|

|

|||||

| Diluted shares used in computation |

11,977 | 11,870 | ||||||

| Adjusted net income attributable to common shareholders per diluted share |

$ | 1.35 | $ | 1.22 | ||||

| ADJUSTED EBITDA |

Year Ended |

|||||||

| December 31, | ||||||||

| 2011 | 2010 | |||||||

| (In thousands) | ||||||||

| Net income including noncontrolling interests |

$ | 29,783 | $ | 24,700 | ||||

| Gain on purchase price settlement of $5,434 less tax effect of $629 |

(4,805) | - | ||||||

| Positive adjustment in income tax provision |

- | (814) | ||||||

| Gain on the sale of a five clinic joint venture of $578 less tax effect of $227 |

- | (351) | ||||||

| Depreciation and amortization |

5,449 | 5,667 | ||||||

| Interest expense, net of interest income |

486 | 229 | ||||||

| Noncontrolling interests |

(8,809) | (9,005) | ||||||

| Equity-based awards compensation expense |

2,032 | 1,292 | ||||||

| Provision for income taxes |

11,097 | 8,840 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 35,233 | $ | 30,558 | ||||

|

|

|

|

|

|||||