Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - E TRADE FINANCIAL CORP | d309105d8k.htm |

E*TRADE

Financial Corporation Raymond

James

33

Annual

Institutional

Investors

Conference

Matthew Audette

Chief Financial Officer

March 6, 2012

©

2012 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Exhibit 99.1

rd |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

2

Notice to investors

Safe Harbor Statement

This presentation contains certain projections or other forward-looking statements

regarding future events or the future performance of the Company. Various factors,

including risks and uncertainties referred to in the 10Ks, 10Qs and other reports

E*TRADE Financial Corporation periodically files with the SEC, could cause our actual

results to differ materially from those indicated by our projections or other

forward- looking statements. This presentation also contains disclosure of

non-GAAP financial measures. A reconciliation of these financial measures to the

most directly comparable GAAP financial measures can be found on the investor relations

site at https://investor.etrade.com. Forward-Looking

Statements The statements contained in this presentation that are forward looking are

based on current expectations that are subject to a number of uncertainties and risks,

and actual results may differ materially. Further information about these risks and

uncertainties can be found in the Company’s annual, quarterly and current reports

on Form 10-K, Form 10- Q and Form 8-K previously filed by E*TRADE Financial

Corporation with the SEC (including information under the caption “Risk

Factors”). Any forward-looking statement included in this release speaks only

as of the date of this communication; the Company disclaims any obligation to update

any information. |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

3

•

Strategic partnerships

Strategic focus

Strengthen overall financial and franchise position

•

Strengthen balance sheet and income statement

•

Mitigate credit losses on legacy loan portfolio & enhance risk profile

•

Focus on increasing shareholder value through efficient distribution of capital

Improve market position in retail brokerage

•

Accelerate growth of our customer franchise

•

Continue to enhance the customer experience, improve satisfaction and retention

Enhance position in investing & retirement

•

Expand brand position for awareness and preference

•

Grow customer share of wallet

Continue to evolve bank franchise

•

Continue to maximize value of customer deposits

•

Develop strategy to more fully serve the financial needs of our 2.8M brokerage

customers Accelerate growth of complementary brokerage businesses

•

Corporate services group

•

Market making operations |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

4

(1)

Strengthen overall financial position

Ongoing improvement in net income

$627

($1,442)

($809)

($525)

($28)

$157

($1,500)

($1,000)

($500)

$0

$500

$1,000

FY 2006

FY 2007

FY 2008

FY 2009

FY 2010

FY 2011 |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

5

Strengthen overall financial position

Pre-tax income:

Defined path to improved earnings through current strategy

Long-term

impact to

current

strategy

(1)

Spread should improve to 300bps

with normalized rate environment

Should reduce to $0 as legacy portfolio runs off

Servicing costs should reduce to $0 as legacy portfolio runs off

FDIC should reduce by 50% as risk profile improves

Should reduce to $0 as capital is efficiently deployed

($ M)

2011

Net interest income

Commissions

Other

Net revenues

Provision

Expenses

Operating income

Interest & other

Pre-tax income

$1,220

$436

$380

$2,037

($441)

($1,235)

$361

($176)

$185

$1,309

Long-term impact

to current strategy

$436

$380

$2,126

$0

($1,110)

$1,016

$0

$1,016

$0.9B

$(2.2)B

$(1.3)B

$(0.9)B

$0.0B

$0.2B

$1.0B

$1.0

$0.8

$0.6

$1.0

$0.9

$0.8

$1.0

($3.5)

($2.5)

($1.5)

($0.5)

$0.5

$1.5

2006

2007

2008

2009

2010

2011

Earnings before interest, taxes and credit costs

Provision / credit costs

Interest & other expense |

6

Earnings

Earnings

Provision

Provision

Loan portfolio

runoff

Loan portfolio

runoff

DTA

DTA

other

Margin

Margin

Uses

Sources

Uses

Sources

Strengthen overall financial position

Improve capital structure

as of 12/31/11

Bank

Parent

Well-

capitalized

threshold

Total capital to

risk-weighted

assets

(2)

17.3%

12.7%

10.0%

Tier 1 capital to

risk-weighted

assets

(2)

16.0%

11.4%

6.0%

Tier 1 leverage

(2)

7.8%

5.7%

5.0%

Tier 1 common

(3)

16.0%

9.4%

7.0%

Tier 1

Risk-based

$0.41B generated

$0.23B

generated

$-

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

2008

2009

2010

2011

($B)

Tier 1 capital

Risk-based capital

Parent debt

Bank excess capital / Parent debt

Bank capital generation in 2011

On average, each $1B of loan portfolio run-off generates:

$100M of risk-based capital

$60M of Tier 1 capital

Capital ratios at the Bank have improved significantly:

Tier 1 capital ratio: 7.8% vs 6.3% in 4Q08

Risk-based ratio: 17.3% vs 13.0% in 4Q08

Company is focused on increasing franchise value and risk

profile through efficient distribution of capital as soon as

feasible

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

|

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

7

0.0

1.0

2.0

3.0

4.0

DTA

Pre-tax income shielded

Parent company

Bank

$1.6B

$4.2B

Strengthen overall financial position

Deferred tax asset

Consolidated DTA of $1.6B

($0.5B at parent; $1.1B at Bank)

Potential source of corporate cash in future periods as

subsidiaries reimburse the parent for use of its DTA

Ability to include more in regulatory capital with ongoing

profitability

Approximately 16 years to use; expect to utilize the full

amount

Consolidated DTA = $1.6B; only 16%

is

included in our regulatory capital

excluded from

regulatory

capital

included in

regulatory

capital

excluded from

regulatory

capital

included in

regulatory

capital

$0.25

$1.3

$0.3

$0.8

$ B

$ B

Bank DTA = $1.1B; 24% is included in our

regulatory capital |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

8

Strengthen overall financial position

Mitigate credit losses on legacy loan portfolio

($ B)

Loan balance

12/31/07

(4)

Paydowns

(5)

Charge-offs

Loan balance

12/31/11

(4)

(4)

Average age

1-4 Family loans

$16

($8)

($1)

$7

5.2 yrs

Home equity

$12

($4)

($3)

$5

5.5 yrs

Consumer

$3

($2)

($0)

$1

7.6 yrs

TOTAL

$31

($14)

($4)

$13

Delinquencies

30-89 days delinquent

Provision for loan losses

Down over

50% from

peak in

Q4 08

Down over

75% from

peak in

3Q 08

$0

$200

$400

$600

$800

$1,000

$1,200

$0

$100

$200

$300

$400

$500

$600

Provision

Qualitative reserve

58%

decline |

Strengthen overall

financial position Mitigate credit losses on legacy loan portfolio

1-4 Family TDR portfolio

Home equity TDR portfolio

Loan modifications (TDRs)

Other loss mitigation

Leveraging

servicers that specialize in troubled

assets:

$3B, or ~23% of portfolio with higher quality servicers,

completing the majority of planned transfers

Accelerating the liquidation of properties in

foreclosure through short sales

$335M of recoveries from originators to date

targeting 50% reduction in

borrower payments

Allowance increases to life of

loan from 12 mo loss assumption for loans that are

modified

Improvement to performance as program evolved:

avg re-delinquency at 12mo:

Payment reduction:

Incremental reserving:

0%

20%

40%

60%

80%

0.0

0.2

0.4

0.6

0.8

1.0

1.2

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

TDRs outstanding

Total expected losses

0%

20%

40%

60%

80%

0.0

0.2

0.4

0.6

0.8

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

TDRs outstanding

Total expected losses

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

9

•

1-4 Family: 29%

•

Home equity: 42% |

Improve market

position in retail brokerage Net new brokerage accounts

Net new brokerage assets

(7)

27%

Accelerate growth of our customer base

Annualized brokerage

account attrition

(6)

2010: 54k

2011: 99k

2010: $8.1B

2011: $9.7B

2010: 6.8%

2011: 6.7 %

2

18

7

28

51

25

13

10

0

15

30

45

60

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

15.3%

13.0%

10.0%

10.3%

9.9%

10.7%

10.5%

9.5%

0%

5%

10%

15%

20%

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

$2.2

$2.1

$1.4

$2.4

$3.9

$1.5

$2.6

$1.7

$0.0

$1.3

$2.5

$3.8

$5.0

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

7.3%

6.5%

4.7%

7.3%

10.7%

3.8%

6.8%

5.0%

0%

3%

6%

9%

12%

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Annualized net new

brokerage asset growth

(8)

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

10

2010: 12.2%

2011: 10.3% |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

11

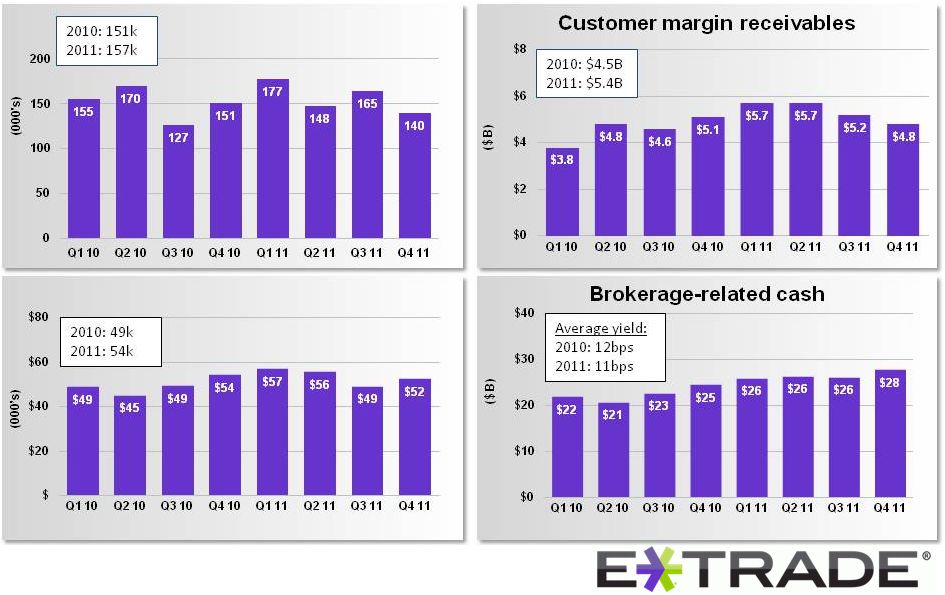

DARTs

Improve market position in retail brokerage

Accelerate growth of our customer base

Avg brokerage assets per account

(9) |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

12

Unique, customizable website experience

One-page investing dashboard

Dynamic content, streamlined experience,

better segmentation

Premiere, fully customizable active trader

platform

Powerful platform for account and market

access anytime, anywhere

Sophisticated options tools and analytics

E*TRADE FX forex platform

Integrated futures (Q2 12)

Upgraded Bond Resource Center

New educational resources –

video, live, web

Expanded Retirement Planning Center

Evolving products & platform

Connecting customers for education, investing ideas

Improve market position in retail brokerage

New Customer Site

New Public Site

E*TRADE Pro

E*TRADE Mobile

Options,

Futures & FX

Investing & planning

resources

E*TRADE

Community |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

13

Market making business

Leveraging world class technologies and superior execution

capabilities

Leading market share in ADRs; growing market share in

National Market Securities

Growing base of external customers, comprising 37+ external

clients

(30%+ y/y growth), and accounting for ~ 50% of market

making revenue

Corporate services group

Build on market leadership with 1,400+ corporate clients,

representing +20% of S&P 500

Foster strategically important channel for new brokerage

accounts, accounting for 25-30% of gross new accounts

1.1 million accounts; $19B in vested and $38B in unvested

options

proceeds retention of 35%+ 3 months post exercise, and 15%+

12 months post exercise

Accelerate growth of complementary brokerage businesses

E*TRADE

#2 Player

#3 Player

6+ other providers

Stock plan administration for public

companies

10%

48%

20%

22%

Principal transactions revenue ($MM) |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

14

Enhance position in investing & retirement

NEW

Public Site

NEW

TV Commercials

NEW

Print & Online

Retooled

marketing

focused

on

investing

&

retirement

to

evolve

the

brand

Financial consultant network

highlights

Grew Financial Consultant headcount by 42% during 2011 and remain committed to this

effort We

estimate

we

have

a

12%

share

of

our

customers’

wallet

(36%

for

active

traders;

10%

for

investors)

(10)

Have identified segments best served by proactive engagement with FCs

—

One year post assignment seeing significant improvement in engagement and retention

|

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

15

Chartered Retirement Planning

Counselors

Kiplinger’s 2011 “Best Of”

Retirement Calculator

Retirement education

8,100+ mutual funds

4,600 no-load/6,900 no

transaction fee

80+ commission -free

70,000+ bonds

Unified Managed Accounts

Managed Investment

Portfolios

Integrated into advertising

Grew headcount by 42%

Increased asset penetration

1year post assignment

Enhance position in investing & retirement

Integrated investing & retirement offering to drive accounts & assets

Services

Products

Financial Consultants

Accounts

& assets

assets

773k retirement account

investment accounts

17% of $172 billion of customer assets

28% of brokerage accounts

(2 years post inception)

SM

$29.5 billion in retirement

$0.7 billion in managed

Every ETF

sold

|

16

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

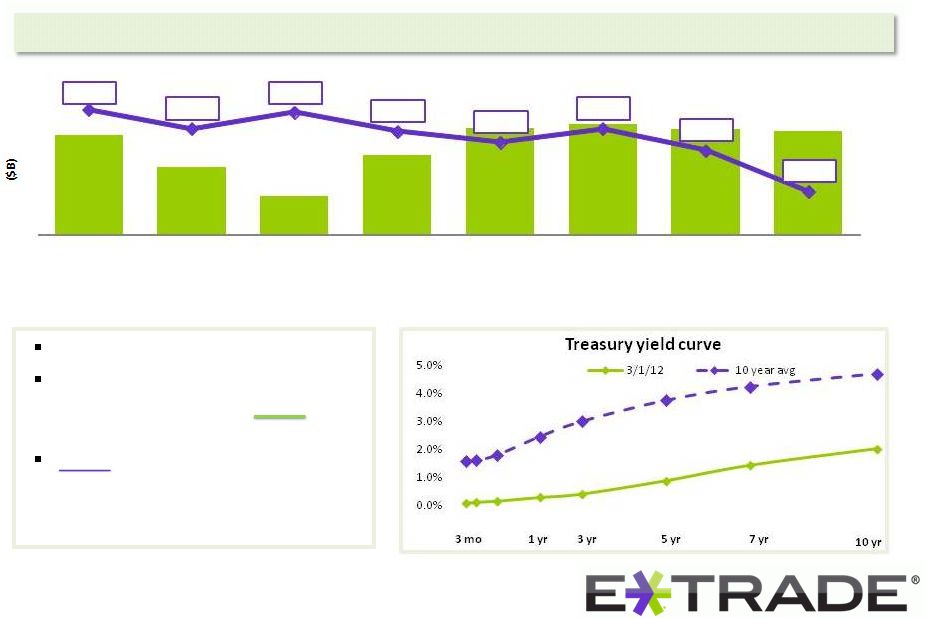

Favorable mix shift in assets from legacy loans into high quality margin loans and securities

(i.e., government-backed agencies)

Continue to evolve bank franchise

$18B

$24B

$40B

$19B

Average loans and

margin receivables

Average agency securities

and cash & other

$31.9

$13.6

$7.7

$4.9

$15.5

$20.5

$2.2

$3.6

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

Q4 07

Q4 11

Q4 07

Q4 11

Loans, net

Margin

receivables

Securities

Cash and other |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

17

Interest rates are at historic lows

In current rate environment: spread

could average less than 2.50% in

2012

3.00% continues to be more

indicative of long-term spread

Challenging rate environment & impact on spread

Continue to evolve bank franchise

Maximize value of customer deposits

$42.4

$41.0

$39.7

$41.5

$42.7

$42.9

$42.7

$42.6

2.96%

2.89%

2.95%

2.88%

2.84%

2.89%

2.81%

2.66%

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

2Q 11

3Q 11

4Q 11

Average interest earning assets & net interest spread |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed without

E*TRADE FINANCIAL Corporation’s written permission.

18

Continue to evolve bank franchise

Visibility into future drivers of net interest spread

and prior

Home equity lines of credit

1-4 family mortgages

•Avg loan size: $66K

•Avg estimated increase at

conversion: $150 -$200

/mo. payment

Average

cost

3-4%

Wholesale

funding obligations will expire

over the next ten years

payment resets by year

I/O to amortizing conversions

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

•83%

of

non-TDR portfolio

is

adjustable for

rate

or

amortization

•$2.2B

has

previously

reset

Loan portfolio continues to run off at

approximately 20% per year

Nearly 70% of 1-4 family loans resetting in 2012

are expected to reset to a lower payment

Hedges on wholesale funding channels require us

to continue issuing short-term debt for next

several years |

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

19

Challenges

Environment

Business model

Prolonged low interest rate

environment

Further deterioration in home prices

Consumer confidence

Regulatory transition

Sustain accelerated growth in

brokerage

Success in investing & retirement

Reposition and capitalize on our

bank franchise

Efficient use of capital |

20

|

©

2012 E*TRADE FINANCIAL Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE FINANCIAL Corporation’s written permission.

21

Appendix |