Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - E TRADE FINANCIAL CORP | etfc-20180331xex321.htm |

| EX-31.2 - EXHIBIT 31.2 - E TRADE FINANCIAL CORP | etfc-20180331xex312.htm |

| EX-31.1 - EXHIBIT 31.1 - E TRADE FINANCIAL CORP | etfc-20180331xex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2018

Commission File Number 1-11921

E TRADE Financial Corporation

TRADE Financial Corporation

TRADE Financial Corporation

TRADE Financial Corporation(Exact Name of Registrant as Specified in its Charter)

Delaware | 94-2844166 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

11 Times Square, 32nd Floor, New York, New York 10036

(Address of principal executive offices and Zip Code)

(646) 521-4300

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer | ¨ | |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |

Emerging growth company ¨ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

As of April 30, 2018, there were 263,909,776 shares of common stock outstanding.

E*TRADE FINANCIAL CORPORATION

FORM 10-Q QUARTERLY REPORT

For the Quarter Ended March 31, 2018

TABLE OF CONTENTS

PART I | FINANCIAL INFORMATION | |

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Part II | OTHER INFORMATION | |

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5 | ||

Item 6. | ||

E*TRADE Q1 2018 10-Q | Page i

Unless otherwise indicated, references to "the Company," "we," "us," "our," "E*TRADE" and "E*TRADE Financial" mean E*TRADE Financial Corporation and its subsidiaries, and references to the parent company mean E*TRADE Financial Corporation but not its subsidiaries.

E*TRADE, E*TRADE Financial, E*TRADE Bank, the Converging Arrows logo, OptionsHouse and Equity Edge Online are registered trademarks of E*TRADE Financial Corporation in the United States and in other countries. All other trademarks are the property of their respective owners.

E*TRADE Q1 2018 10-Q | Page ii

PART I

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. These statements discuss, among other things:

• | our future plans, objectives, outlook, strategies, expectations and intentions relating to our business and future financial and operating results and the assumptions that underlie these matters and include statements regarding our proposed transaction with Capital One and its benefits and timing, |

• | our capital plan initiatives and expected balance sheet size, |

• | the payment of dividends from our subsidiaries to our parent company, |

• | the management of our legacy mortgage and consumer loan portfolio, |

• | our ability to utilize deferred tax assets, the expected implementation and applicability of government regulation and our ability to comply with these regulations, |

• | our ability to maintain required regulatory capital ratios, |

• | continued repurchases of our common stock, payment of dividends on our preferred stock, |

• | our ability to meet upcoming debt obligations, |

• | the integration and related restructuring costs of past and any future acquisitions, |

• | the expected outcome of existing or new litigation, |

• | our ability to execute our business plans and manage risk, |

• | the potential decline of fees and service charges, |

• | future sources of revenue, expense and liquidity, and |

• | any other statement that is not historical in nature. |

These statements may be identified by the use of words such as "assume," "expect," "believe," "may," "will," "should," "anticipate," "intend," "plan," "estimate," "continue" and similar expressions.

We caution that actual results could differ materially from those discussed in these forward-looking statements. Important factors that could contribute to our actual results differing materially from any forward-looking statements include, but are not limited to:

• | the closing of the proposed transaction with Capital One Financial Corporation may not occur or may be delayed and that the actual aggregate consideration paid in connection with the proposed transaction is still subject to final determination, |

• | changes in business, economic or political condition, |

• | performance, volume and volatility in the equity and capital markets, |

• | changes in interest rates or interest rate volatility, |

• | customer demand for financial products and services, |

• | our ability to continue to compete effectively and respond to aggressive price competition within our industry, |

• | cyber security threats, potential system disruptions and other security breaches or incidents, |

• | our ability to participate in consolidation opportunities in our industry, to complete consolidation transactions and to realize synergies or implement integration plans, |

• | our ability to service our corporate debt and, if necessary, to raise additional capital, |

• | changes in government regulation or actions by our regulators, including those that may result from the implementation and enforcement of regulatory reform legislation, |

• | our ability to move capital to our parent company from our subsidiaries, |

E*TRADE Q1 2018 10-Q | Page 1

• | adverse developments in litigation, |

• | our ability to manage our balance sheet growth, and |

• | the timing, duration and costs associated with our stock repurchase program. |

By their nature forward-looking statements are not guarantees of future performance or results and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. Actual future results may vary materially from expectations expressed or implied in this report or any of our prior communications. Investors should also consider the risks and uncertainties described elsewhere in this report, including under Part II. Item 1A. Risk Factors and Part I. Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part I. Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2017, filed with the Securities and Exchange Commission (SEC), which are incorporated herein by reference. The forward-looking statements contained in this report reflect our expectations only as of the date of this report. Investors should not place undue reliance on forward-looking statements, as we do not undertake to update or revise forward-looking statements, except as required by law.

E*TRADE Q1 2018 10-Q | Page 2

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A)

The following discussion should be read in conjunction with the consolidated financial statements and the related notes that appear elsewhere in this document and with the Annual Report on Form 10-K for the year ended December 31, 2017.

OVERVIEW |

Company Overview

E*TRADE is a financial services company that provides online brokerage and related products and services primarily to individual retail investors. Our business is organized into three product areas: Trading, Investing and Corporate Services. Additionally, we offer banking and cash management capabilities, including deposit accounts insured by the Federal Deposit Insurance Corporation (FDIC), which are fully integrated into customer brokerage accounts.

Our mission is to enhance the financial independence of traders and investors through a powerful digital offering and professional guidance. Our vision is to be the #1 digital broker and advisor to traders and investors, known for ease of use and the completeness of our offering.

We operate directly and through several subsidiaries, many of which are overseen by governmental and self-regulatory organizations. Our most important subsidiaries are described below:

• | E*TRADE Securities LLC (E*TRADE Securities) is a registered broker-dealer that clears and settles customer securities transactions. |

• | E*TRADE Bank is a federally chartered savings bank that provides FDIC insurance on qualifying amounts of customer deposits and provides other banking and cash management capabilities. |

• | E*TRADE Savings Bank, a subsidiary of E*TRADE Bank, is a federally chartered savings bank that provides FDIC insurance on qualifying amounts of customer deposits, and now also provides custody solutions to Registered Investment Advisers (RIAs) as the acquisition of Trust Company of America (TCA) was completed in April 2018. |

• | E*TRADE Financial Corporate Services is a provider of software and services for managing equity compensation plans to our corporate clients. The Corporate Services channel is an important driver of brokerage account and asset growth. |

• | E*TRADE Futures LLC (E*TRADE Futures) is a registered non-clearing Futures Commission Merchant (FCM) that provides clearing and settlement services for customer futures transactions. |

• | E*TRADE Capital Management, LLC (E*TRADE Capital Management) is a registered investment adviser that provides investment advisory services for our customers. |

E*TRADE Q1 2018 10-Q | Page 3

Strategy

Our business strategy is centered on two key objectives: accelerating the growth of our core brokerage business to improve market share, and generating robust earnings growth and healthy returns on capital to deliver long-term value for our shareholders.

Accelerate Growth of Core Brokerage Business

• | Enhance overall customer experience |

We are focused on delivering cutting-edge trading solutions while improving our market position in investing products. Through these offerings, we aim to continue growing our customer base while deepening engagement with our existing customers.

• | Capitalize on value of corporate services channel |

Our corporate services channel is a strategically important driver of brokerage account and asset growth. We leverage our industry-leading position in corporate stock plan administration to improve client acquisition and engage with plan participants to bolster awareness of our full suite of offerings.

Generate Robust Earnings Growth and Healthy Returns on Capital

• | Utilize balance sheet to enhance returns |

We utilize our bank structure to effectively monetize brokerage relationships by investing stable, low-cost deposits primarily in agency mortgage-backed securities. Meanwhile, we continue to manage down the size and risk associated with our legacy mortgage and consumer loan portfolio.

• | Put capital to work for shareholders |

As we continue to deliver on our capital plan initiatives, we are focused on generating and effectively deploying excess capital, including through our share repurchase program, for the benefit of our shareholders.

Financial Performance

Our net revenue is generated primarily from net interest income, commissions and fees and service charges. Net interest income is largely impacted by the size of our balance sheet, our balance sheet mix, and average yields on our assets and liabilities. Net interest income is driven primarily from interest earned on investment securities and margin receivables, less interest incurred on interest-bearing liabilities, including deposits, customer payables, corporate debt and other borrowings. Net interest income is also earned on our legacy mortgage and consumer loan portfolio which we expect to continue to run off in future periods. Commissions revenue is generated by customer trades and is largely impacted by trade volume and commission rates. Fees and service charges revenue is mainly impacted by order flow revenue, fees earned on off-balance sheet customer cash and other assets, mutual fund service fees and advisor management fees. Our net revenue is offset by non-interest expenses, the largest of which are compensation and benefits and advertising and market development.

E*TRADE Q1 2018 10-Q | Page 4

Significant Events in the First Quarter of 2018

Announced acquisition of brokerage accounts from Capital One

In January 2018, we announced an agreement to acquire approximately one million retail brokerage accounts with $18 billion in customer assets from Capital One for a cash purchase price of up to $170 million. We intend to fund this transaction with existing cash. The acquisition is expected to close by the third quarter of 2018, subject to customary closing conditions and regulatory approvals.

Completed Trust Company of America acquisition

On April 9, 2018, we completed the acquisition of TCA for a cash purchase price of $275 million. The acquisition is expected to benefit the Company as the RIA portion of our industry is growing and the Company expects to leverage the E*TRADE brand to accelerate growth. The Company also expects this acquisition to help bolster the Company's ability to retain customers in need of specialized customer service engagement. For additional information, see Note 15—Subsequent Event.

Repurchased 2.7 million shares of our common stock

We continued to execute on our share repurchase program, under which the Board of Directors has authorized the repurchase of up to $1 billion of shares of our common stock. During the three months ended March 31, 2018, the Company repurchased 2.7 million shares of common stock at an average price of $52.12 for a total of $140 million. As of March 31, 2018, we have repurchased 11.2 million shares of common stock at an average price of $44.91 for a total of $502 million since we began repurchasing shares under this authorization in the third quarter of 2017. As of March 31, 2018, $498 million remained available for additional repurchases. As of April 30, 2018, we have subsequently repurchased an additional 0.9 million shares of common stock at an average price of $60.01.

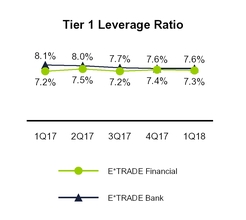

Tier 1 leverage ratio threshold reduced for E*TRADE Bank

Beginning January 2018, E*TRADE Bank's Tier 1 leverage ratio threshold was reduced to 7.0% from the previous threshold of 7.5%.

E*TRADE Q1 2018 10-Q | Page 5

Key Performance Metrics

Management monitors a number of customer activity and company metrics to evaluate the Company’s performance. The most significant of these are displayed below along with the percentage variance for the three months ended March 31, 2018 from the same period in 2017.

Customer Activity Metrics:

E*TRADE Q1 2018 10-Q | Page 6

E*TRADE Q1 2018 10-Q | Page 7

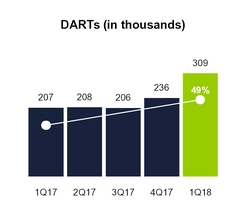

Daily Average Revenue Trades (DARTs) is the predominant driver of commissions revenue from our customers. DARTs were 309,469 and 207,221 for the three months ended March 31, 2018 and 2017, respectively.

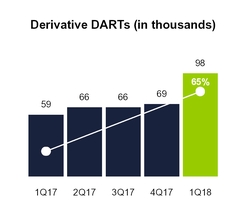

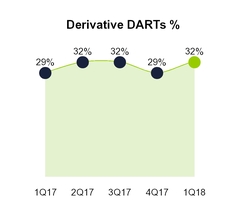

Derivative DARTs, a key driver of commissions revenue, is the daily average number of options and futures trades, and Derivative DARTs percentage is the mix of options and futures as a component of total DARTs. Derivative DARTs were 97,658 and 59,078 for the three months ended March 31, 2018 and 2017, respectively, and Derivative DARTs represented 32% and 29%, respectively, of total DARTs.

Average commission per trade is an indicator of changes in our customer mix, product mix and/or product pricing. Average commission per trade was $7.27 and $9.87 for the three months ended March 31, 2018 and 2017, respectively. Average commission per trade for the three months ended March 31, 2018 was impacted by our reduced commission rates for equity and options trades effective March 13, 2017, which were as follows:

• | Stock, options and ETF trade commissions reduced to $6.95 from $9.99 |

• | For active traders, commissions reduced to $4.95 from $7.99 and options charges reduced to $0.50 per contract from $0.75; trades required for active trader tier reduced to 30 per quarter from 150 |

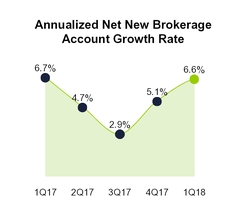

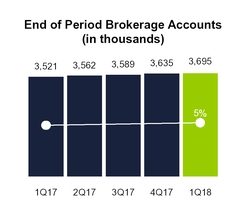

End of period brokerage accounts and net new brokerage accounts are indicators of our ability to attract and retain brokerage customers. End of period brokerage accounts were 3.7 million and 3.5 million at March 31, 2018 and 2017, respectively. Net new brokerage accounts were 59,685 and 58,215 for the three months ended March 31, 2018 and 2017, respectively. During the three months ended March 31, 2018 and 2017, our annualized net new brokerage account growth rate was 6.6% and 6.7%, respectively.

Customer margin balances represents credit extended to customers to finance their purchases of securities by borrowing against securities they own and is a key driver of net interest income. Customer margin balances were $10.5 billion and $7.3 billion at March 31, 2018 and 2017, respectively.

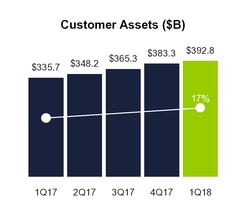

Customer assets is an indicator of the value of our relationship with the customer. An increase generally indicates that the use of our products and services by existing and new customers is expanding. Changes in this metric are also driven by changes in the valuations of our customers' underlying securities. Customer assets were $392.8 billion and $335.7 billion at March 31, 2018 and 2017, respectively.

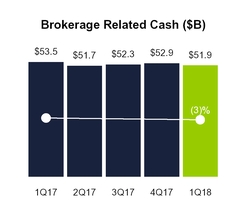

Brokerage related cash is an indicator of the level of engagement with our brokerage customers and is a key driver of net interest income as well as fees and service charges revenue, which includes fees earned on customer cash held by third parties. Brokerage related cash was $51.9 billion and $53.5 billion at March 31, 2018 and 2017, respectively.

E*TRADE Q1 2018 10-Q | Page 8

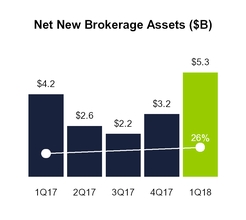

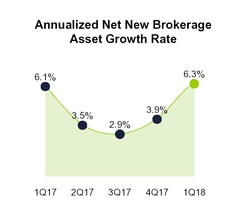

Net new brokerage assets is total inflows to new and existing brokerage accounts less total outflows from closed and existing brokerage accounts. The net new brokerage assets metric is a general indicator of the use of our products and services by new and existing brokerage customers. Net new brokerage assets were $5.3 billion and $4.2 billion for the three months ended March 31, 2018 and 2017, respectively. During the three months ended March 31, 2018 and 2017, our annualized net new brokerage asset growth rate was 6.3% and 6.1%, respectively.

Managed products represents customer assets in our Core Portfolio, Blend Portfolio, Dedicated Portfolio and Fixed Income Portfolios. Managed products are a driver of fees and service charges revenue. Managed products were $5.6 billion and $4.3 billion at March 31, 2018 and 2017, respectively.

Company Metrics:

E*TRADE Q1 2018 10-Q | Page 9

Operating margin is the percentage of net revenue that results in income before income taxes and is an indicator of the Company's profitability. Operating margin was 47% and 41% for the three months ended March 31, 2018 and 2017, respectively.

Adjusted operating margin is a non-GAAP measure that provides useful information about our ongoing operating performance by excluding the provision (benefit) for loan losses and losses on early extinguishment of debt, which are not viewed as key factors governing our investment in the business and are excluded by management when evaluating operating margin performance. Adjusted operating margin was 44% and 38% for the three months ended March 31, 2018 and 2017, respectively. See MD&A—Earnings Overview for a reconciliation of adjusted operating margin to operating margin.

Corporate cash, a non-GAAP measure, is a component of cash and equivalents and represents the primary source of capital above and beyond the capital deployed in our regulated subsidiaries. Cash and equivalents was $498 million and $998 million at March 31, 2018 and 2017, respectively, while corporate cash was $439 million and $417 million for the same periods. See MD&A—Liquidity and Capital Resources for a reconciliation of corporate cash to cash and equivalents.

Tier 1 leverage ratio is an indicator of capital adequacy for E*TRADE Financial and E*TRADE Bank. Tier 1 leverage ratio is Tier 1 capital divided by adjusted average assets for leverage capital purposes. E*TRADE Financial's Tier 1 leverage ratio was 7.3% and 7.2% at March 31, 2018 and 2017, respectively. E*TRADE Bank's Tier 1 leverage ratio was 7.6% and 8.1% at March 31, 2018 and 2017, respectively. See MD&A—Liquidity and Capital Resources for additional information, including the calculation of regulatory capital ratios.

E*TRADE Q1 2018 10-Q | Page 10

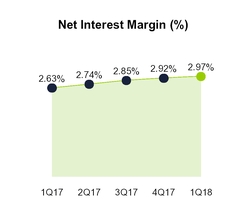

Interest-earning assets, along with net interest margin, is an indicator of our ability to generate net interest income. Average interest-earning assets were $59.8 billion and $48.7 billion for the three months ended March 31, 2018 and 2017, respectively.

Net interest margin is a measure of the net yield on our average interest-earning assets. Net interest margin is calculated for a given period by dividing the annualized sum of net interest income by average interest-earning assets. Net interest margin was 2.97% and 2.63% for the three months ended March 31, 2018 and 2017, respectively.

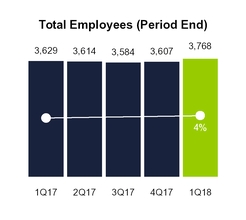

Total employees were 3,768 and 3,629 at March 31, 2018 and 2017, respectively.

Regulatory Developments

In April 2016, the US Department of Labor (DOL) published its final Conflicts of Interest Rule- Retirement Investment Advice regulations under the Employee Retirement Income Security Act of 1974 and the Internal Revenue Code of 1986 (Fiduciary Rule). Certain aspects of the Fiduciary Rule became applicable in June 2017. The Fiduciary Rule generally subjects particular persons, such as broker-dealers and other financial advisers providing investment advice to individual retirement accounts and other qualified retirement plans and accounts, to fiduciary duties and additional regulatory restrictions for a wider range of customer interactions. The DOL extended the transition period for the remaining aspects of the Fiduciary Rule, currently scheduled to take effect on July 1, 2019. On March 5, 2018, the Fifth Circuit Court of Appeals vacated the Fiduciary Rule in its entirety. If the decision is not reviewed or appealed, the Fiduciary Rule will be nullified as if it had not been adopted.

E*TRADE Q1 2018 10-Q | Page 11

EARNINGS OVERVIEW |

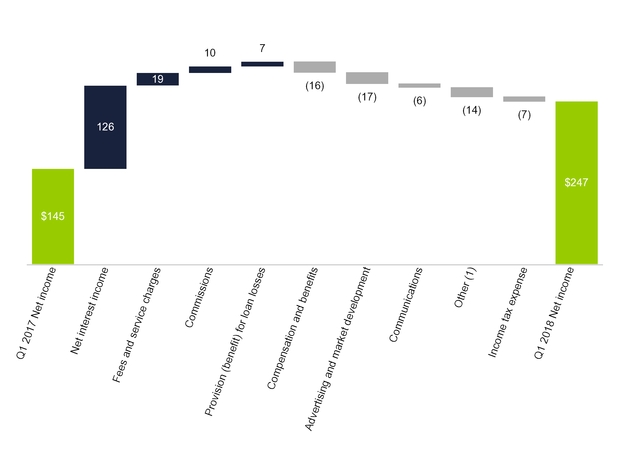

We generated net income of $247 million on total net revenue of $708 million for the three months ended March 31, 2018. The following chart presents a reconciliation of net income for the three months ended March 31, 2017 to net income for the three months ended March 31, 2018 (dollars in millions):

(1) | Includes clearing and servicing, professional services, occupancy and equipment, depreciation and amortization, FDIC insurance premiums, amortization of other intangibles, restructuring and acquisition-related activities and other non-interest expenses. |

E*TRADE Q1 2018 10-Q | Page 12

The following table presents significant components of the consolidated statement of income (dollars in millions except per share amounts):

Three Months Ended March 31, | Variance | |||||||||||||

2018 vs. 2017 | ||||||||||||||

2018 | 2017 | Amount | % | |||||||||||

Net interest income | $ | 445 | $ | 319 | $ | 126 | 39 | % | ||||||

Total non-interest income | 263 | 234 | 29 | 12 | % | |||||||||

Total net revenue | 708 | 553 | 155 | 28 | % | |||||||||

Provision (benefit) for loan losses | (21 | ) | (14 | ) | (7 | ) | 50 | % | ||||||

Total non-interest expense | 395 | 342 | 53 | 15 | % | |||||||||

Income before income tax expense | 334 | 225 | 109 | 48 | % | |||||||||

Income tax expense | 87 | 80 | 7 | 9 | % | |||||||||

Net income | $ | 247 | $ | 145 | $ | 102 | 70 | % | ||||||

Preferred stock dividends | 12 | 13 | (1 | ) | (8 | )% | ||||||||

Net income available to common shareholders | $ | 235 | $ | 132 | $ | 103 | 78 | % | ||||||

Diluted earnings per common share | $ | 0.88 | $ | 0.48 | $ | 0.40 | 83 | % | ||||||

Net income increased 70% to $247 million for the three months ended March 31, 2018 compared to the same period in 2017. Net income available to common shareholders was $235 million for the three months ended March 31, 2018, which reflects $12 million in preferred stock dividends, compared to $132 million, which reflects $13 million in preferred stock dividends, during the same period in 2017. The increase in net income was primarily driven by higher interest income due to a larger average balance sheet and an improvement in net interest margin, as well as higher fees and service charges. A lower effective tax rate resulting from federal tax reform also added to the increase. The increase in net income was partially offset by higher non-interest expense primarily due to increased compensation and benefits and advertising and market development expenses.

Net Revenue

The following table presents the significant components of net revenue (dollars in millions):

Three Months Ended March 31, | Variance | |||||||||||||

2018 vs. 2017 | ||||||||||||||

2018 | 2017 | Amount | % | |||||||||||

Net interest income | $ | 445 | $ | 319 | $ | 126 | 39 | % | ||||||

Commissions | 137 | 127 | 10 | 8 | % | |||||||||

Fees and service charges | 105 | 86 | 19 | 22 | % | |||||||||

Gains on securities and other, net | 10 | 10 | — | — | % | |||||||||

Other revenue | 11 | 11 | — | — | % | |||||||||

Total non-interest income | 263 | 234 | 29 | 12 | % | |||||||||

Total net revenue | $ | 708 | $ | 553 | $ | 155 | 28 | % | ||||||

Net Interest Income

Net interest income increased 39% to $445 million for the three months ended March 31, 2018, compared to the same period in 2017. Net interest income is earned primarily through investment securities, margin receivables and our legacy mortgage and consumer loan portfolio, offset by funding costs. Our investment grade debt refinancing in the third quarter of 2017 reduced our funding costs and improved our ability to generate net interest income.

E*TRADE Q1 2018 10-Q | Page 13

The following table presents average balance sheet data and interest income and expense data, as well as the related net interest margin, yields and rates (dollars in millions):

Three Months Ended March 31, | |||||||||||||||||||||

2018 | 2017 | ||||||||||||||||||||

Average Balance | Interest Inc./Exp. | Average Yield/ Cost | Average Balance | Interest Inc./Exp. | Average Yield/ Cost | ||||||||||||||||

Cash and equivalents | $ | 803 | $ | 3 | 1.42 | % | $ | 1,345 | $ | 2 | 0.64 | % | |||||||||

Cash required to be segregated under federal or other regulations | 795 | 3 | 1.62 | % | 1,684 | 3 | 0.71 | % | |||||||||||||

Investment securities(1) | 45,194 | 290 | 2.57 | % | 34,117 | 205 | 2.41 | % | |||||||||||||

Margin receivables | 9,466 | 103 | 4.41 | % | 6,781 | 66 | 3.93 | % | |||||||||||||

Loans(2) | 2,629 | 33 | 5.07 | % | 3,608 | 43 | 4.77 | % | |||||||||||||

Broker-related receivables and other | 950 | 4 | 1.55 | % | 1,119 | — | 0.12 | % | |||||||||||||

Subtotal interest-earning assets | 59,837 | 436 | 2.92 | % | 48,654 | 319 | 2.63 | % | |||||||||||||

Other interest revenue(3) | — | 32 | — | 22 | |||||||||||||||||

Total interest-earning assets | 59,837 | 468 | 3.14 | % | 48,654 | 341 | 2.81 | % | |||||||||||||

Total non-interest-earning assets | 4,787 | 5,252 | |||||||||||||||||||

Total assets | $ | 64,624 | $ | 53,906 | |||||||||||||||||

Deposits | $ | 43,178 | $ | 2 | 0.02 | % | $ | 34,869 | $ | 1 | 0.01 | % | |||||||||

Customer payables | 9,556 | 1 | 0.06 | % | 8,686 | 1 | 0.06 | % | |||||||||||||

Broker-related payables and other | 1,566 | 1 | 0.20 | % | 1,160 | — | 0.00 | % | |||||||||||||

Other borrowings | 932 | 7 | 3.12 | % | 492 | 5 | 3.85 | % | |||||||||||||

Corporate debt | 991 | 9 | 3.62 | % | 994 | 14 | 5.39 | % | |||||||||||||

Subtotal interest-bearing liabilities | 56,223 | 20 | 0.14 | % | 46,201 | 21 | 0.18 | % | |||||||||||||

Other interest expense(4) | — | 3 | — | 1 | |||||||||||||||||

Total interest-bearing liabilities | 56,223 | 23 | 0.17 | % | 46,201 | 22 | 0.19 | % | |||||||||||||

Total non-interest-bearing liabilities | 1,329 | 1,402 | |||||||||||||||||||

Total liabilities | 57,552 | 47,603 | |||||||||||||||||||

Total shareholders' equity | 7,072 | 6,303 | |||||||||||||||||||

Total liabilities and shareholders' equity | $ | 64,624 | $ | 53,906 | |||||||||||||||||

Excess interest earning assets over interest bearing liabilities/net interest income/net interest margin | $ | 3,614 | $ | 445 | 2.97 | % | $ | 2,453 | $ | 319 | 2.63 | % | |||||||||

(1) | For the three months ended March 31, 2018, includes a $3 million net loss related to fair value hedging adjustments, previously referred to as hedge ineffectiveness. Hedge ineffectiveness for the prior periods continues to be reflected within the gains on securities and other, net line item. See Note 7- Derivative Instruments and Hedging Activities for additional information. |

(2) | Nonaccrual loans are included in the average loan balances. Interest payments received on nonaccrual loans are recognized on a cash basis in interest income until it is doubtful that full payment will be collected, at which point payments are applied to principal. |

(3) | Represents interest income on securities loaned. |

(4) | Represents interest expense on securities borrowed. |

Average interest-earning assets increased 23% to $59.8 billion for the three months ended March 31, 2018 compared to the same period in 2017. The fluctuation in interest-earning assets is generally driven by changes in interest-bearing liabilities, primarily deposits and customer payables. Average interest-bearing liabilities increased 22% to $56.2 billion for the three months ended March 31, 2018 compared to the same period in 2017. The increase was primarily due to higher deposits as a result of transferring customer cash held by third parties to our balance sheet.

Net interest margin increased 34 basis points to 2.97% for the three months ended March 31, 2018 compared to the same period in 2017. Net interest margin is driven by the mix of asset and liability average balances and the interest rates earned or paid on those balances. The increase during the three months ended March 31, 2018 compared to 2017 is due to higher interest rates earned on increased margin receivables and investment securities balances, increased securities lending activities and lower corporate

E*TRADE Q1 2018 10-Q | Page 14

debt service cost, partially offset by the continued run-off of our higher yielding legacy mortgage and consumer loan portfolio.

Commissions

Commissions revenue increased 8% to $137 million for the three months ended March 31, 2018 compared to the same period in 2017. The main factors that affect commissions revenue are DARTs, average commission per trade and the number of trading days.

DARTs volume increased 49% to 309,469 for the three months ended March 31, 2018, compared to the same period in 2017, mainly driven by continued improved market sentiment along with the higher volatility of the equity markets. Derivative DARTs volume increased 65% to 97,658 for the three months ended March 31, 2018 compared to the same period in 2017. Derivative DARTs represented 32% and 29% of trading volume for the three months ended March 31, 2018 and 2017, respectively.

Average commission per trade decreased 26% to $7.27 for the three months ended March 31, 2018 compared to the same period in 2017. Average commission per trade is impacted by customer mix and differing commission rates on various trade types (e.g. equities, derivatives, stock plan and mutual funds). Average commission per trade for the three months ended March 31, 2018 was impacted by reduced commission rates implemented in March 2017 as well as increased trading activity from certain customers, qualifying them for lower active trader commission pricing.

Fees and Service Charges

The following table presents the significant components of fees and service charges (dollars in millions):

Three Months Ended March 31, | Variance | |||||||||||||

2018 vs. 2017 | ||||||||||||||

2018 | 2017 | Amount | % | |||||||||||

Order flow revenue | $ | 47 | $ | 31 | $ | 16 | 52 | % | ||||||

Money market funds and sweep deposits revenue(1) | 17 | 22 | (5 | ) | (23 | )% | ||||||||

Mutual fund service fees | 11 | 9 | 2 | 22 | % | |||||||||

Advisor management fees | 11 | 8 | 3 | 38 | % | |||||||||

Foreign exchange revenue | 8 | 8 | — | — | % | |||||||||

Reorganization fees | 3 | 3 | — | — | % | |||||||||

Other fees and service charges | 8 | 5 | 3 | 60 | % | |||||||||

Total fees and service charges | $ | 105 | $ | 86 | $ | 19 | 22 | % | ||||||

(1) | Includes revenue earned on average customer cash held by third parties based on the federal funds rate or LIBOR plus a negotiated spread or other contractual arrangements with the third party institutions. |

Fees and service charges increased 22% to $105 million for the three months ended March 31, 2018 compared to the same period in 2017 primarily driven by increased order flow revenue due to higher trade volume and improved rates. This increase was partially offset by decreased money market funds and sweep deposits revenue driven by lower customer cash balances held by third parties due to transferring cash onto our balance sheet. The impact of the lower balances was partially offset by a higher gross yield of 135 basis points for the three months ended March 31, 2018 as compared to approximately 60 basis points in 2017.

E*TRADE Q1 2018 10-Q | Page 15

Gains on Securities and Other, Net

The following table presents the significant components of gains on securities and other, net (dollars in millions):

Three Months Ended March 31, | Variance | |||||||||||||

2018 vs. 2017 | ||||||||||||||

2018 | 2017 | Amount | % | |||||||||||

Gains on available-for-sale securities | $ | 11 | $ | 8 | $ | 3 | 38 | % | ||||||

Equity method investment income (loss) and other(1) | (1 | ) | 2 | (3 | ) | (150 | )% | |||||||

Gains on securities and other, net | $ | 10 | $ | 10 | $ | — | — | % | ||||||

(1) | Includes a loss of $1 million on hedge ineffectiveness for the three months ended March 31, 2017. Beginning January 1, 2018, fair value hedging adjustments are recognized within net interest income. See Note 1—Organization, basis of presentation and summary of significant accounting policies for additional information. |

Provision (Benefit) for Loan Losses

We recognized a benefit for loan losses of $21 million and $14 million for the three months ended March 31, 2018 and 2017, respectively. The timing and magnitude of the provision (benefit) for loan losses is affected by many factors that could result in variability. These benefits reflected better than expected performance of our portfolio as well as recoveries in excess of prior expectations, including recoveries of previous charge-offs that were not included in our loss estimates. For additional information on management's estimate of the allowance for loan losses, see Note 6—Loans Receivable, Net.

Non-Interest Expense

The following table presents the significant components of non-interest expense (dollars in millions):

Three Months Ended March 31, | Variance | |||||||||||||

2018 vs. 2017 | ||||||||||||||

2018 | 2017 | Amount | % | |||||||||||

Compensation and benefits | $ | 152 | $ | 136 | $ | 16 | 12 | % | ||||||

Advertising and market development | 60 | 43 | 17 | 40 | % | |||||||||

Clearing and servicing | 36 | 32 | 4 | 13 | % | |||||||||

Professional services | 22 | 22 | — | — | % | |||||||||

Occupancy and equipment | 30 | 27 | 3 | 11 | % | |||||||||

Communications | 31 | 25 | 6 | 24 | % | |||||||||

Depreciation and amortization | 22 | 20 | 2 | 10 | % | |||||||||

FDIC insurance premiums | 9 | 8 | 1 | 13 | % | |||||||||

Amortization of other intangibles | 10 | 9 | 1 | 11 | % | |||||||||

Restructuring and acquisition-related activities | — | 4 | (4 | ) | (100 | )% | ||||||||

Other non-interest expenses | 23 | 16 | 7 | 44 | % | |||||||||

Total non-interest expense | $ | 395 | $ | 342 | $ | 53 | 15 | % | ||||||

Compensation and Benefits

Compensation and benefits expense increased 12% to $152 million for the three months ended March 31, 2018 compared to the same period in 2017. The expense increase was primarily driven by a 4% increase in headcount to support the growth in our business along with higher payroll taxes and incentive compensation related to strong company performance.

E*TRADE Q1 2018 10-Q | Page 16

Advertising and Market Development

Advertising and market development expense increased 40% to $60 million for the three months ended March 31, 2018 compared to the same period in 2017. This planned increase was primarily due to higher media and brand production spend resulting from our increased focus on accelerating the growth of our business by increasing engagement across new and existing customers.

Communications

Communications expense increased 24% to $31 million for the three months ended March 31, 2018 compared to the same period in 2017. The increase was driven primarily by increased market data fees resulting from higher trading activity and the impact of higher rates for professional users.

Other Non-Interest Expenses

Other non-interest expenses increased 44% to $23 million for the three months ended March 31, 2018 compared to the same period in 2017. The increase was primarily driven by $5 million in losses related to margin lending activity and futures transactions due to high market volatility experienced in early February 2018.

Operating Margin

Operating margin was 47% for the three months ended March 31, 2018, compared to 41% for the same period in 2017. Adjusted operating margin, a non-GAAP measure, was 44% for the three months ended March 31, 2018 compared to 38% for the same period in 2017.

Adjusted operating margin is a non-GAAP measure calculated by dividing adjusted income before income tax expense by total net revenue. Adjusted income before income tax expense excludes provision (benefit) for loan losses. The following table presents a reconciliation of adjusted income before income tax expense and adjusted operating margin, non-GAAP measures, to the most directly comparable GAAP measures (dollars in millions):

Three Months Ended March 31, | |||||||||||

2018 | 2017 | ||||||||||

Amount | Operating Margin % | Amount | Operating Margin % | ||||||||

Income before income tax expense / operating margin | $ | 334 | 47% | $ | 225 | 41% | |||||

Provision (benefit) for loan losses | (21 | ) | (14 | ) | |||||||

Adjusted income before income tax expense / adjusted operating margin | $ | 313 | 44% | $ | 211 | 38% | |||||

Income Tax Expense

Income tax expense was $87 million and $80 million for the three months ended March 31, 2018 and 2017, respectively. The effective tax rate was 26% and 36% for the same periods. The lower effective rate of 26% for the three months ended March 31, 2018 includes the impact of federal tax reform, which resulted in a lower federal tax rate beginning January 1, 2018.

E*TRADE Q1 2018 10-Q | Page 17

BALANCE SHEET OVERVIEW |

The following table presents the significant components of the consolidated balance sheet (dollars in millions):

Variance | ||||||||||||||

March 31, | December 31, | 2018 vs. 2017 | ||||||||||||

2018 | 2017 | Amount | % | |||||||||||

Assets: | ||||||||||||||

Cash and equivalents | $ | 498 | $ | 931 | $ | (433 | ) | (47 | )% | |||||

Segregated cash | 472 | 872 | (400 | ) | (46 | )% | ||||||||

Investment securities(1) | 45,492 | 44,518 | 974 | 2 | % | |||||||||

Margin receivables | 10,515 | 9,071 | 1,444 | 16 | % | |||||||||

Loans receivable, net | 2,506 | 2,654 | (148 | ) | (6 | )% | ||||||||

Receivables from brokers, dealers and clearing organizations | 735 | 1,178 | (443 | ) | (38 | )% | ||||||||

Goodwill and other intangibles, net | 2,645 | 2,654 | (9 | ) | — | % | ||||||||

Other(2) | 1,324 | 1,487 | (163 | ) | (11 | )% | ||||||||

Total assets | $ | 64,187 | $ | 63,365 | $ | 822 | 1 | % | ||||||

Liabilities and shareholders’ equity: | ||||||||||||||

Deposits | $ | 42,902 | $ | 42,742 | $ | 160 | — | % | ||||||

Customer payables | 8,947 | 9,449 | (502 | ) | (5 | )% | ||||||||

Payables to brokers, dealers and clearing organizations | 2,892 | 1,542 | 1,350 | 88 | % | |||||||||

Other borrowings | 910 | 910 | — | — | % | |||||||||

Corporate debt | 992 | 991 | 1 | — | % | |||||||||

Other liabilities | 655 | 800 | (145 | ) | (18 | )% | ||||||||

Total liabilities | 57,298 | 56,434 | 864 | 2 | % | |||||||||

Shareholders’ equity | 6,889 | 6,931 | (42 | ) | (1 | )% | ||||||||

Total liabilities and shareholders’ equity | $ | 64,187 | $ | 63,365 | $ | 822 | 1 | % | ||||||

(1) | Includes balance sheet line items available-for-sale and held-to-maturity securities. |

(2) | Includes balance sheet line items property and equipment, net and other assets. Other assets includes deferred tax assets, net due to a presentation change beginning January 1, 2018. See Note 1—Organization, Basis of Presentation and Summary of Significant Accounting Policies for additional information. |

Cash and Equivalents

Cash and equivalents decreased 47% to $498 million during the three months ended March 31, 2018 and includes corporate cash, a non-GAAP measure, of $439 million as of March 31, 2018. Cash and equivalents will fluctuate based on a variety of factors, including, among other drivers, liquidity needs at the parent, customer activity at our regulated subsidiaries, and the timing of investments at E*TRADE Bank. For additional information on our use of cash and equivalents, including corporate cash, see MD&A—Liquidity and Capital Resources and the consolidated statement of cash flows.

E*TRADE Q1 2018 10-Q | Page 18

Segregated Cash

Cash required to be segregated under federal or other regulations decreased 46% to $472 million during the three months ended March 31, 2018. The level of segregated cash is driven largely by customer payables and securities lending balances we hold as liabilities compared with the amount of margin receivables and securities borrowed balances we hold as assets. The excess represents customer cash that we are required by our regulators to segregate for the exclusive benefit of our brokerage customers. At March 31, 2018 and December 31, 2017, $750 million and $800 million, respectively, of reverse repurchase agreements between E*TRADE Securities and E*TRADE Bank, representing investments that were segregated under federal or other regulations by E*TRADE Securities, were eliminated in consolidation.

Investment Securities

The following table presents the significant components of available-for-sale and held-to-maturity securities (dollars in millions):

Variance | ||||||||||||||

March 31, | December 31, | 2018 vs. 2017 | ||||||||||||

2018 | 2017 | Amount | % | |||||||||||

Available-for-sale securities: | ||||||||||||||

Debt securities: | ||||||||||||||

Agency mortgage-backed securities | $ | 23,418 | $ | 19,195 | $ | 4,223 | 22 | % | ||||||

Other debt securities | 1,417 | 1,477 | (60 | ) | (4 | )% | ||||||||

Total debt securities | 24,835 | 20,672 | 4,163 | 20 | % | |||||||||

Publicly traded equity securities(1) | — | 7 | (7 | ) | (100 | )% | ||||||||

Total available-for-sale securities | $ | 24,835 | $ | 20,679 | $ | 4,156 | 20 | % | ||||||

Held-to-maturity securities: | ||||||||||||||

Agency mortgage-backed securities | $ | 17,482 | $ | 20,502 | $ | (3,020 | ) | (15 | )% | |||||

Other debt securities | 3,175 | 3,337 | (162 | ) | (5 | )% | ||||||||

Total held-to-maturity securities | $ | 20,657 | $ | 23,839 | $ | (3,182 | ) | (13 | )% | |||||

Total investment securities | $ | 45,492 | $ | 44,518 | $ | 974 | 2 | % | ||||||

(1) | Consists of investments in a mutual fund related to the Community Reinvestment Act. At March 31, 2018, these equity securities are included in other assets on the consolidated balance sheet as a result of the adoption of amended accounting guidance related to the classification and measurement of financial instruments. See Note 1—Organization, Basis of Presentation and Summary of Significant Accounting Policies for additional information. |

Securities represented 71% and 70% of total assets at March 31, 2018 and December 31, 2017, respectively. We classify debt securities as available-for-sale or held-to-maturity based on our investment strategy and management’s assessment of our intent and ability to hold the debt securities until maturity. The following portfolio transfers occurred during the three months ended March 31, 2018:

• | Securities with a carrying value of $4.7 billion and related unrealized pre-tax gain of $7 million were transferred from held-to-maturity securities to available-for-sale securities during the three months ended March 31, 2018, as part of a one-time transition election for early adopting the new derivatives and hedge accounting guidance. |

• | Securities with a fair value of $1.2 billion were transferred from available-for-sale to held-to-maturity during the three months ended March 31, 2018 pursuant to an evaluation of our investment strategy and an assessment by management about our intent and ability to hold those particular securities until maturity. |

E*TRADE Q1 2018 10-Q | Page 19

See Note 1—Organization, Basis of Presentation and Summary of Significant Accounting Policies, Note 5—Available-for-Sale and Held-to-Maturity Securities and Note 11—Shareholders' Equity for additional information.

Margin Receivables

Margin receivables increased 16% to $10.5 billion during the three months ended March 31, 2018. We believe recent market appreciation of customer assets provided additional capacity which, coupled with market sentiment, drove the increase in margin receivables.

Loans Receivable, Net

The following table presents the significant components of loans receivable, net (dollars in millions):

Variance | ||||||||||||||

March 31, | December 31, | 2018 vs. 2017 | ||||||||||||

2018 | 2017 | Amount | % | |||||||||||

One- to four-family | $ | 1,339 | $ | 1,432 | $ | (93 | ) | (6 | )% | |||||

Home equity | 1,026 | 1,097 | (71 | ) | (6 | )% | ||||||||

Consumer and other(1) | 189 | 188 | 1 | 1 | % | |||||||||

Total loans receivable | 2,554 | 2,717 | (163 | ) | (6 | )% | ||||||||

Unamortized premiums, net | 10 | 11 | (1 | ) | (9 | )% | ||||||||

Subtotal | 2,564 | 2,728 | (164 | ) | (6 | )% | ||||||||

Less: Allowance for loan losses | 58 | 74 | (16 | ) | (22 | )% | ||||||||

Total loans receivable, net | $ | 2,506 | $ | 2,654 | $ | (148 | ) | (6 | )% | |||||

(1) | In 2017 we introduced E*TRADE Line of Credit, a securities-based lending product, where customers can borrow up to 50% of the market value of securities pledged as collateral. The drawn amount and unused credit line amount totaled $29 million and $81 million, respectively, as of March 31, 2018 and $12 million and $35 million, respectively, as of December 31, 2017. |

Loans receivable, net decreased 6% to $2.5 billion during the three months ended March 31, 2018. We expect the remaining legacy mortgage and consumer loan portfolio to continue its run-off for the foreseeable future. As our portfolio has seasoned and substantially all interest-only loans have converted to amortizing, we continue to assess underlying performance, the economic environment, and the value of the portfolio in the marketplace. While it is our intention to hold these loans, if the markets improve our strategy could change. For additional information on management's estimate of the allowance for loan losses, see Note 6—Loans Receivable, Net.

Deposits

The following table presents the significant components of deposits (dollars in millions):

Variance | ||||||||||||||

March 31, | December 31, | 2018 vs. 2017 | ||||||||||||

2018 | 2017 | Amount | % | |||||||||||

Sweep deposits | $ | 37,927 | $ | 37,734 | $ | 193 | 1 | % | ||||||

Savings deposits | 2,797 | 2,912 | (115 | ) | (4 | )% | ||||||||

Other deposits | 2,178 | 2,096 | 82 | 4 | % | |||||||||

Total deposits | $ | 42,902 | $ | 42,742 | $ | 160 | — | % | ||||||

Deposits represented 75% and 76% of total liabilities at March 31, 2018 and December 31, 2017, respectively. At March 31, 2018, 90% of our customer deposits were covered by FDIC insurance.

E*TRADE Q1 2018 10-Q | Page 20

Brokerage Related Cash

The majority of the deposits balance, specifically sweep deposits, is included in brokerage related cash, which is reported as a customer activity metric. The following table presents the significant components of total brokerage related cash (dollars in millions):

Variance | ||||||||||||||

March 31, | December 31, | 2018 vs. 2017 | ||||||||||||

2018 | 2017 | Amount | % | |||||||||||

Brokerage customer cash held on balance sheet: | ||||||||||||||

Sweep deposits | $ | 37,927 | $ | 37,734 | $ | 193 | 1 | % | ||||||

Customer payables | 8,947 | 9,449 | (502 | ) | (5 | )% | ||||||||

Subtotal | 46,874 | 47,183 | (309 | ) | (1 | )% | ||||||||

Customer cash held by third parties: | ||||||||||||||

Sweep deposits | 3,444 | 4,724 | (1,280 | ) | (27 | )% | ||||||||

Money market funds and other | 1,561 | 1,016 | 545 | 54 | % | |||||||||

Subtotal | 5,005 | 5,740 | (735 | ) | (13 | )% | ||||||||

Total brokerage related cash | $ | 51,879 | $ | 52,923 | $ | (1,044 | ) | (2 | )% | |||||

We offer an extended insurance sweep deposit account (ESDA) program to our brokerage customers. The ESDA program utilizes our bank subsidiaries, in combination with additional third party program banks, to allow customers the ability to have aggregate deposits they hold in the ESDA program insured up to $1,250,000 for each category of legal ownership. As of March 31, 2018, 99% of sweep deposits were in the ESDA program. Sweep deposits on balance sheet are held at bank subsidiaries and are included in the deposits line item on our consolidated balance sheet.

Customer cash held by third parties is maintained at unaffiliated financial institutions. Customer cash held by third parties is not reflected on our consolidated balance sheet and is not immediately available for liquidity purposes.

E*TRADE Q1 2018 10-Q | Page 21

Receivables from and Payables to Brokers, Dealers and Clearing Organizations

The following table presents the significant components of receivables from and payables to brokers, dealers and clearing organizations (dollars in millions):

Variance | ||||||||||||||

March 31, | December 31, | 2018 vs. 2017 | ||||||||||||

2018 | 2017 | Amount | % | |||||||||||

Receivables: | ||||||||||||||

Securities borrowed | $ | 193 | $ | 740 | $ | (547 | ) | (74 | )% | |||||

Receivables from clearing organizations | 491 | 376 | 115 | 31 | % | |||||||||

Other | 51 | 62 | (11 | ) | (18 | )% | ||||||||

Total | $ | 735 | $ | 1,178 | $ | (443 | ) | (38 | )% | |||||

Payables: | ||||||||||||||

Securities loaned | $ | 2,840 | $ | 1,373 | $ | 1,467 | 107 | % | ||||||

Payables to clearing organizations | 9 | 123 | (114 | ) | (93 | )% | ||||||||

Other | 43 | 46 | (3 | ) | (7 | )% | ||||||||

Total | $ | 2,892 | $ | 1,542 | $ | 1,350 | 88 | % | ||||||

Securities borrowed decreased 74% to $193 million during the three months ended March 31, 2018. The decrease was driven by a lower demand for securities to cover customer short positions during the period.

Securities loaned increased 107% to $2.8 billion during the three months ended March 31, 2018. The increase was driven by funding requirements at E*TRADE Securities, primarily to support increased margin lending activity. For additional information on E*TRADE Securities liquidity, see MD&A—Liquidity and Capital Resources.

E*TRADE Q1 2018 10-Q | Page 22

LIQUIDITY AND CAPITAL RESOURCES |

We have established liquidity and capital policies to support the successful execution of our business strategy, while maintaining ongoing and sufficient liquidity through the business cycle. We believe liquidity is of critical importance to the Company and especially important for E*TRADE Bank and E*TRADE Securities. The objective of our policies is to ensure that we can meet our corporate, banking and broker-dealer liquidity needs under both normal operating conditions and under periods of stress in the financial markets.

Liquidity

Our corporate liquidity needs are primarily driven by capital needs at E*TRADE Bank and E*TRADE Securities as well as by the interest due on our corporate debt and the amount of dividend payments on our preferred stock. Our banking and brokerage subsidiaries' liquidity needs are driven primarily by the level and volatility of our customer activity. Management maintains a set of liquidity sources and monitors certain business trends and market metrics closely in an effort to ensure we have sufficient liquidity. Potential loans by E*TRADE Bank to the parent company and the parent company's other non-bank subsidiaries are subject to various quantitative, arm’s length, collateralization, capital and other requirements.

As a result of the Company's balance sheet growth, we became subject to the modified liquidity coverage ratio (LCR) requirement beginning April 1, 2018. The modified LCR rule requires us to hold at least 70% of our projected net cash outflows over a 30-day period in high-quality liquid assets. The Company believes the LCR is an important measure of liquidity and has been managing against it in preparation for the applicability of these requirements.

Parent Company Liquidity

The parent company's primary source of liquidity is corporate cash. Corporate cash, a non-GAAP measure, is a component of cash and equivalents; see the consolidated statement of cash flows for information on cash and equivalents activity. We define corporate cash as cash held at the parent company and subsidiaries, excluding bank, broker-dealer, and FCM subsidiaries that require regulatory approval or notification prior to the payment of certain dividends to the parent company.

We believe corporate cash is a useful measure of the parent company’s liquidity as it is the primary source of capital above and beyond the capital deployed in our regulated subsidiaries. Corporate cash can fluctuate in any given quarter and is impacted primarily by the following:

• | Dividends from and investments in subsidiaries |

• | Non-cumulative preferred stock dividends |

• | Share repurchases |

• | Debt service costs |

• | Acquisitions and other investments |

• | Reimbursements from subsidiaries for the use of the parent company's deferred tax assets |

• | Parent company overhead less reimbursements through cost sharing arrangements with subsidiaries |

E*TRADE Q1 2018 10-Q | Page 23

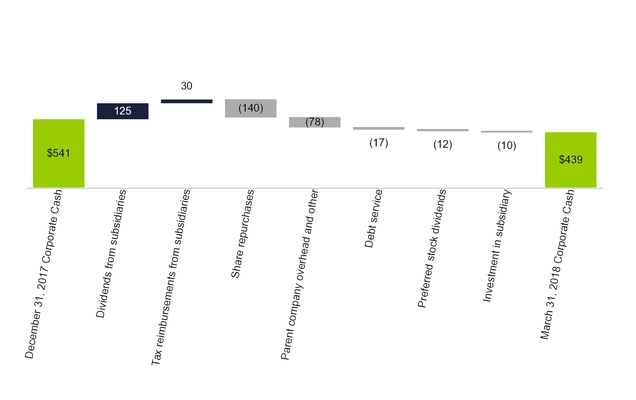

The following chart provides a roll forward of corporate cash at December 31, 2017 to corporate cash at March 31, 2018 (dollars in millions):

The following table presents a reconciliation of consolidated cash and equivalents to corporate cash, a non-GAAP measure (dollars in millions):

March 31, | December 31, | March 31, | |||||||||

2018 | 2017 | 2017 | |||||||||

Consolidated cash and equivalents | $ | 498 | $ | 931 | $ | 998 | |||||

Less: Cash at regulated subsidiaries(1) | (59 | ) | (390 | ) | (581 | ) | |||||

Corporate cash | $ | 439 | $ | 541 | $ | 417 | |||||

(1) | Reported net of corporate cash on deposit at E*TRADE Bank that is eliminated in consolidation. |

Corporate cash decreased $102 million to $439 million during the three months ended March 31, 2018 primarily due to the following:

• | $140 million used for share repurchases |

• | $78 million used primarily for parent company overhead less reimbursements from subsidiaries under cost sharing arrangements |

• | $125 million received in dividends from E*TRADE Securities |

Corporate cash is monitored as part of our liquidity risk management and our current corporate cash target is $250 million. This target covers approximately 18 months of parent company fixed costs, which includes preferred stock dividends, debt service and other overhead costs. The Company maintains $300 million of additional liquidity through an unsecured committed revolving credit facility. The parent has the ability to borrow against the credit facility for working capital and general corporate purposes. At March 31, 2018, there was no outstanding balance under this credit facility. For additional information about our liquidity risk management

E*TRADE Q1 2018 10-Q | Page 24

approach see Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations of our Annual Report on Form 10-K for the year ended December 31, 2017.

E*TRADE Bank Liquidity

E*TRADE Bank, including its subsidiary E*TRADE Savings Bank, relies on bank cash and deposits for liquidity needs. Management believes that within deposits, sweep deposits are of particular importance as they are a stable source of liquidity for E*TRADE Bank. We have the ability to generate liquidity in the form of additional deposits by raising the yield on our customer deposit products. Sweep deposits on our balance sheet as of March 31, 2018 increased $0.2 billion compared to December 31, 2017. We utilize our sweep deposit platform to efficiently manage our balance sheet size.

We may utilize wholesale funding sources for short-term liquidity and contingency funding requirements. Our ability to borrow these funds is dependent upon the continued availability of funding in the wholesale borrowings market. In addition, we can borrow from the Federal Reserve Bank of Richmond's discount window to meet short-term liquidity requirements, although it is not viewed as a primary source of funding. At March 31, 2018, E*TRADE Bank had $5.4 billion and $0.7 billion in additional collateralized borrowing capacity with the FHLB and the Federal Reserve Bank of Richmond, respectively.

E*TRADE Securities Liquidity

E*TRADE Securities relies on customer payables, securities lending, and internal and external lines of credit to provide liquidity and to fund margin lending. At March 31, 2018, E*TRADE Securities' external liquidity lines totaled approximately $1.1 billion and included the following:

• | A 364-day, $450 million senior unsecured committed revolving credit facility with a syndicate of banks, with a maturity date in June 2018 and a commitment fee of 0.35% on unused balances |

• | Secured committed lines of credit with two unaffiliated banks, aggregating to $175 million, with a maturity date in June 2018 and a commitment fee of 0.15% on unused balances |

• | Unsecured uncommitted lines of credit with three unaffiliated banks, aggregating to $125 million, of which $50 million matures in June 2018 and the remaining lines have no maturity date |

• | Secured uncommitted lines of credit with several unaffiliated banks, aggregating to $375 million with no maturity date |

The revolving credit facility contains certain covenants, including maintenance covenants related to E*TRADE Securities' minimum consolidated tangible net worth and regulatory net capital ratio. There were no outstanding balances for any of these lines at March 31, 2018. E*TRADE Securities also maintains lines of credit with the parent company and E*TRADE Bank.

Capital Resources

The Company seeks to manage capital levels in support of our business strategy of generating and effectively deploying capital for the benefit of our shareholders, governed by the Company's risk management framework. For additional information on our bank and brokerage capital requirements, see Note 13—Regulatory Requirements.

E*TRADE Q1 2018 10-Q | Page 25

Bank Capital Requirements

The Dodd-Frank Act requires all companies, including savings and loan holding companies, that directly or indirectly control an insured depository institution, to serve as a source of strength for the institution. There are bank regulatory capital requirements applicable to the Company and E*TRADE Bank, some of which are still subject to phase-in periods, including certain deductions from and adjustments to regulatory capital. Most of these requirements became fully implemented as of January 1, 2018. For additional information on bank regulatory requirements and phase-in periods, see Overview—Regulatory Developments as well as Part I. Item 1. Business—Regulation in our Annual Report on Form 10-K for the year ended December 31, 2017.

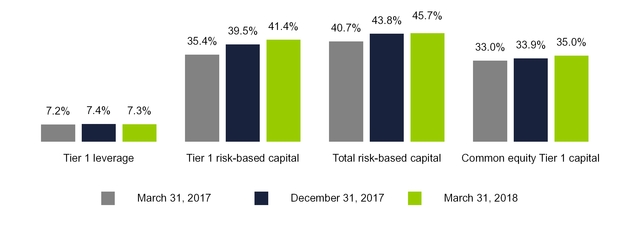

At March 31, 2018, our regulatory capital ratios for E*TRADE Financial were well above the minimum ratios required to be "well capitalized." E*TRADE Financial's current Tier 1 leverage ratio threshold is 6.5%. E*TRADE Financial's capital ratios are as follows:

E*TRADE Q1 2018 10-Q | Page 26

The following table presents the calculation of E*TRADE Financial's capital ratios (dollars in millions):

March 31, 2018 | December 31, 2017 | March 31, 2017 | |||||||||

E*TRADE Financial shareholders’ equity | $ | 6,889 | $ | 6,931 | $ | 6,444 | |||||

Deduct: | |||||||||||

Preferred stock | (689 | ) | (689 | ) | (394 | ) | |||||

E*TRADE Financial Common Equity Tier 1 capital before regulatory adjustments | $ | 6,200 | $ | 6,242 | $ | 6,050 | |||||

Add: | |||||||||||

(Gains) losses in other comprehensive income on available-for-sale debt securities, net of tax | 176 | 26 | 98 | ||||||||

Deduct: | |||||||||||

Goodwill and other intangible assets, net of deferred tax liabilities | (2,219 | ) | (2,191 | ) | (2,058 | ) | |||||

Disallowed deferred tax assets | (353 | ) | (304 | ) | (638 | ) | |||||

E*TRADE Financial Common Equity Tier 1 capital | 3,804 | 3,773 | 3,452 | ||||||||

Add: | |||||||||||

Preferred stock | 689 | 689 | 394 | ||||||||

Deduct: | |||||||||||

Disallowed deferred tax assets | — | (76 | ) | (136 | ) | ||||||

E*TRADE Financial Tier 1 capital | $ | 4,493 | $ | 4,386 | $ | 3,710 | |||||

Add: | |||||||||||

Allowable allowance for loan losses | 58 | 74 | 135 | ||||||||

Non-qualifying capital instruments subject to phase-out (trust preferred securities) | 414 | 414 | 414 | ||||||||

E*TRADE Financial total capital | $ | 4,965 | $ | 4,874 | $ | 4,259 | |||||

E*TRADE Financial average assets for leverage capital purposes | $ | 64,486 | $ | 62,095 | $ | 54,032 | |||||

Deduct: | |||||||||||

Goodwill and other intangible assets, net of deferred tax liabilities | (2,219 | ) | (2,191 | ) | (2,058 | ) | |||||

Disallowed deferred tax assets | (353 | ) | (380 | ) | (774 | ) | |||||

E*TRADE Financial adjusted average assets for leverage capital purposes | $ | 61,914 | $ | 59,524 | $ | 51,200 | |||||

E*TRADE Financial total risk-weighted assets(1) | $ | 10,856 | $ | 11,115 | $ | 10,466 | |||||

E*TRADE Financial Tier 1 leverage ratio (Tier 1 capital / Adjusted average assets for leverage capital purposes) | 7.3 | % | 7.4 | % | 7.2 | % | |||||

E*TRADE Financial Common Equity Tier 1 capital / Total risk-weighted assets(1) | 35.0 | % | 33.9 | % | 33.0 | % | |||||

E*TRADE Financial Tier 1 capital / Total risk-weighted assets | 41.4 | % | 39.5 | % | 35.4 | % | |||||

E*TRADE Financial total capital / Total risk-weighted assets | 45.7 | % | 43.8 | % | 40.7 | % | |||||

(1) | Under the regulatory guidelines for risk-based capital, on-balance sheet assets and credit equivalent amounts of derivatives and off-balance sheet items are assigned to one of several broad risk categories according to the obligor or, if relevant, the guarantor or the nature of any collateral. The aggregate dollar amount in each risk category is then multiplied by the risk weight associated with that category. The resulting weighted values from each of the risk categories are aggregated for determining total risk-weighted assets. |

E*TRADE Q1 2018 10-Q | Page 27

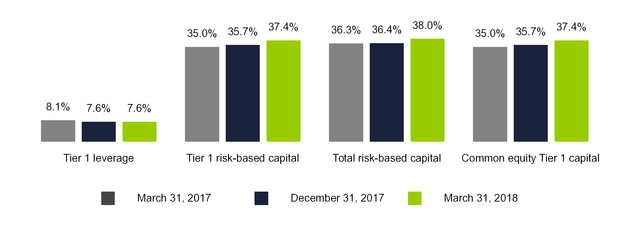

At March 31, 2018, our regulatory capital ratios for E*TRADE Bank were well above the minimum ratios required to be "well capitalized." E*TRADE Bank's current Tier 1 leverage ratio threshold was reduced to 7.0% from 7.5% in January 2018. E*TRADE Bank's capital ratios are as follows:

The following table presents the calculation of E*TRADE Bank's capital ratios (dollars in millions):

March 31, 2018 | December 31, 2017 | March 31, 2017 | |||||||||

E*TRADE Bank shareholder's equity | $ | 3,721 | $ | 3,703 | $ | 3,291 | |||||

Add: | |||||||||||

(Gains) losses in other comprehensive income on available-for-sale debt securities, net of tax | 176 | 26 | 98 | ||||||||

Deduct: | |||||||||||

Goodwill and other intangible assets, net of deferred tax liabilities | (38 | ) | (38 | ) | (38 | ) | |||||

Disallowed deferred tax assets | (66 | ) | (71 | ) | (100 | ) | |||||

E*TRADE Bank Common Equity Tier 1 capital / Tier 1 capital | 3,793 | 3,620 | 3,251 | ||||||||

Add: | |||||||||||

Allowable allowance for loan losses | 58 | 74 | 118 | ||||||||

E*TRADE Bank total capital | $ | 3,851 | $ | 3,694 | $ | 3,369 | |||||

E*TRADE Bank average assets for leverage capital purposes | $ | 50,063 | $ | 47,992 | $ | 40,501 | |||||

Deduct: | |||||||||||

Goodwill and other intangible assets, net of deferred tax liabilities | (38 | ) | (38 | ) | (38 | ) | |||||

Disallowed deferred tax assets | (66 | ) | (71 | ) | (100 | ) | |||||

E*TRADE Bank adjusted average assets for leverage capital purposes | $ | 49,959 | $ | 47,883 | $ | 40,363 | |||||

E*TRADE Bank total risk-weighted assets(1) | $ | 10,133 | $ | 10,147 | $ | 9,280 | |||||

E*TRADE Bank Tier 1 leverage ratio (Tier 1 capital / Adjusted average assets for leverage capital purposes) | 7.6 | % | 7.6 | % | 8.1 | % | |||||

E*TRADE Bank Common Equity Tier 1 capital / Total risk-weighted assets | 37.4 | % | 35.7 | % | 35.0 | % | |||||

E*TRADE Bank Tier 1 capital / Total risk-weighted assets | 37.4 | % | 35.7 | % | 35.0 | % | |||||

E*TRADE Bank total capital / Total risk-weighted assets | 38.0 | % | 36.4 | % | 36.3 | % | |||||

(1) | Under the regulatory guidelines for risk-based capital, on-balance sheet assets and credit equivalent amounts of derivatives and off-balance sheet items are assigned to one of several broad risk categories according to the obligor or, if relevant, the guarantor or the nature of any collateral. The aggregate dollar amount in each risk category is then multiplied by the risk weight associated with that category. The resulting weighted values from each of the risk categories are aggregated for determining total risk-weighted assets. |

E*TRADE Q1 2018 10-Q | Page 28

Broker-Dealer and FCM Capital Requirements

Our broker-dealer and FCM subsidiaries are subject to capital requirements determined by their respective regulators. At March 31, 2018, these subsidiaries met their minimum net capital requirements. We continue to assess our ability to distribute excess net capital to the parent while maintaining adequate capital at the broker-dealer and FCM subsidiaries. E*TRADE Securities paid dividends of $125 million to the parent company during the three months ended March 31, 2018. For additional information on our broker-dealer and FCM capital requirements, see Note 13—Regulatory Requirements.

Off-Balance Sheet Arrangements

We enter into various off-balance sheet arrangements in the ordinary course of business, primarily to meet the needs of our customers and to reduce our own exposure to interest rate risk. These arrangements include firm commitments to extend credit. Additionally, we enter into guarantees and other similar arrangements as part of transactions in the ordinary course of business. For additional information on these arrangements, see Note 14—Commitments, Contingencies and Other Regulatory Matters.

RISK MANAGEMENT |

The identification, mitigation and management of existing and potential risks is critical to effective enterprise risk management. There are certain risks inherent to our industry (e.g. execution of transactions) and certain risks that will surface through the conduct of our business operations. We seek to monitor and manage our significant risk exposures by operating under a set of Board-approved limits and by monitoring certain risk indicators. Our governance framework is designed to comply with applicable requirements and requires regular reporting on metrics and significant risks and exposures to senior management and the Board of Directors.

We face the following key types of risks: credit, liquidity, market, operational, information security, data, strategic, reputational, legal, as well as regulatory and compliance. We have a Board-approved Enterprise Risk Appetite Statement (RAS) that is provided to all employees. The RAS specifies significant risk exposures and addresses the Company's tolerance of those risks, which are described in further detail within Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations of our Annual Report on Form 10-K for the year ended December 31, 2017.

We are also subject to other risks that could affect our business, financial condition, results of operations or cash flows in future periods. For additional information see Part I. Item 1A.— Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2017.

CONCENTRATIONS OF CREDIT RISK |

Credit risk is the risk of loss arising from the inability or failure of a borrower or counterparty to meet its credit obligations. Our mortgage loan portfolio represents our most significant credit risk exposure. See Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations of our Annual Report on Form 10-K for the year ended December 31, 2017 for additional information on our management of credit risk.

One- to Four-Family Interest-Only Loans

One- to four-family loans include loans with a five to ten year interest-only period, followed by an amortizing period ranging from 20 to 25 years. At March 31, 2018, nearly 100% of these loans were amortizing.

E*TRADE Q1 2018 10-Q | Page 29

Home Equity Loans

The home equity loan portfolio consists of home equity installment loans (HEILs) and home equity lines of credit (HELOCs) and is primarily second lien loans on residential real estate properties that have a higher level of credit risk than first lien mortgage loans. HEILs are primarily fixed rate and fixed term, fully amortizing loans that do not offer the option of an interest-only payment. The majority of HELOCs had an interest-only draw period at origination and converted to amortizing loans at the end of the draw period, which typically ranged from five to ten years. At March 31, 2018, nearly 100% of the HELOC portfolio had converted from the interest-only draw period.

Securities

We focus primarily on security type and credit rating to monitor credit risk in our securities portfolios. We consider securities backed by the US government or its agencies to have low credit risk as the long-term debt rating of the US government is AA+ by S&P and Aaa by Moody’s at March 31, 2018. The amortized cost of these securities accounted for over 99% of our total securities portfolio at March 31, 2018. We review the remaining debt securities that were not backed by the US government or its agencies according to their credit ratings from S&P and Moody’s where available. At March 31, 2018, all municipal bonds in our securities portfolio were rated investment grade (defined as a rating equivalent to a Moody’s rating of "Baa3" or higher, or an S&P rating of “BBB-“ or higher).

SUMMARY OF CRITICAL ACCOUNTING POLICIES AND ESTIMATES |

The discussion and analysis of our financial condition and results of operations are based on our consolidated financial statements, which have been prepared in conformity with GAAP. Note 1—Organization, Basis of Presentation and Summary of Significant Accounting Policies in Part II. Item 8. Financial Statements and Supplementary Data in the Company's Annual Report on Form 10-K for the year ended December 31, 2017, contains a summary of our significant accounting policies, many of which require the use of estimates and assumptions that affect the amounts reported in the consolidated financial statements and related notes for the periods presented. We believe that of our significant accounting policies, the following are critical because they are based on estimates and assumptions that require complex and subjective judgments by management: allowance for loan losses; valuation and impairment of goodwill and acquired intangible assets; and estimates of effective tax rates, deferred taxes and valuation allowance. Changes in these estimates or assumptions could materially impact our financial condition and results of operations, and actual results could differ from our estimates. Our critical accounting policies are more fully described in Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Summary of Critical Accounting Policies and Estimates in our Annual Report on Form 10-K for the year ended December 31, 2017.

E*TRADE Q1 2018 10-Q | Page 30

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The following discussion about market risk includes forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements as a result of certain factors, including, but not limited to, those set forth in Part I. Item 1a. Risk Factors in the Annual Report on Form 10-K for the year ended December 31, 2017.

Interest Rate Risk

Our exposure to interest rate risk is related primarily to interest-earning assets and interest-bearing liabilities. Managing interest rate risk is essential to profitability. The primary objective of the management of interest rate risk is to control exposure to interest rates within the Board-approved limits and with limited exposure to earnings volatility resulting from interest rate fluctuations. Our general strategies to manage interest rate risk include balancing variable-rate and fixed-rate assets and liabilities and utilizing derivatives to help manage exposures to changes in interest rates. Exposure to interest rate risk requires management to make complex assumptions regarding maturities, market interest rates and customer behavior. Changes in interest rates, including the following, could impact interest income and expense:

• | Interest-earning assets and interest-bearing liabilities may re-price at different times or by different amounts, creating a mismatch. |

• | The yield curve may steepen, flatten or otherwise change shape, which could affect the spread between short- and long-term rates. Widening or narrowing spreads could impact net interest income. |

• | Market interest rates may influence prepayments, resulting in maturity mismatches. In addition, prepayments could impact yields as premiums and discounts amortize. |

Exposure to interest rate risk is dependent upon the distribution and composition of interest-earning assets, interest-bearing liabilities and derivatives. The differing risk characteristics of each product are managed to mitigate our exposure to interest rate fluctuations. At March 31, 2018, 94% of our total assets were interest-earning assets and we had no securities classified as trading.

At March 31, 2018, 68% of total assets were available-for-sale and held-to-maturity mortgage-backed securities and residential real estate loans. The values of these assets are sensitive to changes in interest rates as well as expected prepayment levels. As interest rates increase, fixed-rate residential mortgages and mortgage-backed securities tend to exhibit lower prepayments. The inverse is true in a falling rate environment.

When real estate loans are prepaid, unamortized premiums and/or discounts are recognized immediately in interest income. Depending on the timing of the prepayment, these adjustments to income would impact anticipated yields. The Company reviews estimates of the impact of changing market rates on prepayments. This information is incorporated into our interest rate risk management strategy.