Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - E TRADE FINANCIAL CORP | dex311.htm |

| EX-32.1 - EXHIBIT 32.1 - E TRADE FINANCIAL CORP | dex321.htm |

| EX-31.2 - EXHIBIT 31.2 - E TRADE FINANCIAL CORP | dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended September 30, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-11921

E*TRADE Financial Corporation

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 94-2844166 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

135 East 57th Street, New York, New York 10022

(Address of Principal Executive Offices and Zip Code)

(646) 521-4300

(Registrant’s Telephone Number, including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x |

Accelerated filer ¨ | |||

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

As of November 2, 2009, there were 1,865,498,830 shares of common stock outstanding.

Table of Contents

E*TRADE FINANCIAL CORPORATION

FORM 10-Q QUARTERLY REPORT

For the Quarter Ended September 30, 2009

Unless otherwise indicated, references to “the Company,” “We,” “Us,” “Our” and “E*TRADE” mean E*TRADE Financial Corporation or its subsidiaries.

E*TRADE, E*TRADE Financial, E*TRADE Bank, Equity Edge, OptionsLink and the Converging Arrows logo are registered trademarks of E*TRADE Financial Corporation in the United States and in other countries.

2

Table of Contents

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

This information is set forth immediately following Item 3, “Quantitative and Qualitative Disclosures about Market Risk.”

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the consolidated financial statements and the related notes that appear elsewhere in this document.

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements involving risks and uncertainties. These statements relate to our future plans, objectives, expectations and intentions. These statements may be identified by the use of words such as “expect,” “may,” “anticipate,” “intend,” “plan” and similar expressions. Our actual results could differ materially from those discussed in these forward-looking statements, and we caution that we do not undertake to update these statements. Factors that could contribute to our actual results differing from any forward-looking statements include those discussed under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this report. The cautionary statements made in this report should be read as being applicable to all forward-looking statements wherever they appear in this report. Important factors that may cause actual results to differ materially from any forward-looking statements are set forth in our 2008 Form 10-K filed with the Securities and Exchange Commission (“SEC”) under the heading “Risk Factors,” as well as the factors set forth in or incorporated by reference in this report under Part II, Item 1A “Risk Factors”.

We further caution that there may be risks associated with owning our securities other than those discussed in such filings.

GLOSSARY OF TERMS

In analyzing and discussing our business, we utilize certain metrics, ratios and other terms that are defined in the “Glossary of Terms,” which is located at the end of Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Strategy

Our core business is our trading and investing customer franchise. Our strategy is designed to profitably grow this business by focusing on several key factors. These key factors include development of innovative online brokerage products and services, a concerted effort to deliver superior customer service, creative and cost-effective marketing and sales, and expense discipline. In addition, we have and continue to invest significantly for long-term growth so that we remain competitive among the largest online brokers. We believe our focus on these key factors will lead to continued growth in our core business.

In addition to focusing on our customer franchise, our strategy includes an intense focus on addressing the balance sheet issues caused by the mortgage crisis. We are focused primarily on improving our capital structure as well as mitigating the credit losses inherent in our loan portfolio. We believe the recapitalization transactions executed in the second and third quarters of 2009 significantly improve our capital structure and better position the Company for future growth in the online brokerage business.

3

Table of Contents

Key Factors Affecting Financial Performance

Our financial performance is affected by a number of factors outside of our control, including:

| • | customer demand for financial products and services; |

| • | the weakness or strength of the residential real estate and credit markets; |

| • | the performance, volume and volatility of the equity and capital markets; |

| • | customer perception of the financial strength of our franchise; |

| • | market demand and liquidity in the secondary market for mortgage loans and securities; and |

| • | market demand and liquidity in the wholesale borrowings market, including securities sold under agreements to repurchase. |

In addition to the items noted above, our success in the future will depend upon, among other things:

| • | continuing our success in the acquisition, growth and retention of brokerage customers; |

| • | our ability to assess and manage credit risk; |

| • | our ability to generate capital sufficient to meet our operating needs, particularly at a level sufficient to offset loan losses; |

| • | our ability to assess and manage interest rate risk; and |

| • | disciplined expense control and improved operational efficiency. |

Management monitors a number of metrics in evaluating the Company’s performance. The most significant of these are shown in the table and discussed in the text below:

| As of or For the Three Months Ended September 30, |

Variance | As of or For the Nine Months Ended September 30, |

Variance | |||||||||||||||||||

| 2009 | 2008 | 2009 vs. 2008 | 2009 | 2008 | 2009 vs. 2008 | |||||||||||||||||

| Customer Activity Metrics: |

||||||||||||||||||||||

| Daily average revenue trades |

196,413 | 183,691 | 7 | % | 204,143 | 178,814 | 14 | % | ||||||||||||||

| Average commission per trade |

$ | 11.50 | $ | 11.10 | 4 | % | $ | 11.05 | $ | 11.07 | (0 | )% | ||||||||||

| End of period brokerage accounts |

2,729,137 | 2,520,102 | 8 | % | 2,729,137 | 2,520,102 | 8 | % | ||||||||||||||

| Customer assets (dollars in billions) |

$ | 148.7 | $ | 142.2 | 5 | % | $ | 148.7 | $ | 142.2 | 5 | % | ||||||||||

| Net new customer assets (dollars in billions)(1) |

$ | (0.2 | ) | $ | 0.8 | * | $ | 4.2 | $ | 2.0 | * | |||||||||||

| Brokerage related cash (dollars in billions) |

$ | 20.3 | $ | 17.7 | 15 | % | $ | 20.3 | $ | 17.7 | 15 | % | ||||||||||

| Other customer cash and deposits (dollars in billions) |

14.2 | 15.7 | (10 | )% | 14.2 | 15.7 | (10 | )% | ||||||||||||||

| Customer cash and deposits (dollars in billions) |

$ | 34.5 | $ | 33.4 | 3 | % | $ | 34.5 | $ | 33.4 | 3 | % | ||||||||||

| Company Financial Metrics: |

||||||||||||||||||||||

| Corporate cash (dollars in millions) |

$ | 501.1 | $ | 665.6 | (25 | )% | $ | 501.1 | $ | 665.6 | (25 | )% | ||||||||||

| E*TRADE Bank excess risk-based capital (dollars in millions) |

$ | 985.4 | $ | 523.9 | 88 | % | $ | 985.4 | $ | 523.9 | 88 | % | ||||||||||

| Allowance for loan losses (dollars in millions) |

$ | 1,214.5 | $ | 874.2 | 39 | % | $ | 1,214.5 | $ | 874.2 | 39 | % | ||||||||||

| Allowance for loan losses as a % of nonperforming loans |

82.37 | % | 109.45 | % | (27.08 | )% | 82.37 | % | 109.45 | % | (27.08 | )% | ||||||||||

| Enterprise net interest spread (basis points) |

282 | 263 | 7 | % | 269 | 261 | 3 | % | ||||||||||||||

| Enterprise interest-earning assets (average in billions) |

$ | 44.3 | $ | 46.6 | (5 | )% | $ | 44.7 | $ | 47.7 | (6 | )% | ||||||||||

| * | Percentage not meaningful |

| (1) | For the nine months ended September 30, 2008, net new customer assets were $2.9 billion excluding the sale of Retirement Advisors of America (“RAA”). |

4

Table of Contents

Customer Activity Metrics

| • | Daily average revenue trades (“DARTs”) are the predominant driver of commissions revenue from our customers. |

| • | Average commission per trade is an indicator of changes in our customer mix, product mix and/or product pricing. As a result, this metric is impacted by both the mix between our domestic and international businesses and the mix between active traders, mass affluent and main street customers. |

| • | End of period brokerage accounts are an indicator of our ability to attract and retain trading and investing customers. |

| • | Changes in customer assets are an indicator of the value of our relationship with the customer. An increase in customer assets generally indicates that the use of our products and services by existing and new customers is expanding. Changes in this metric are also driven by changes in the valuations of our customers’ underlying securities, which declined substantially towards the end of 2008 and into 2009. |

| • | Net new customer assets are total inflows to all new and existing customer accounts less total outflows from all closed and existing customer accounts and are a general indicator of the use of our products and services by existing and new customers. |

| • | Customer cash and deposits, particularly our brokerage related cash, are an indicator of a deepening engagement with our customers and are a key driver of net operating interest income. |

Company Financial Metrics

| • | Corporate cash is an indicator of the liquidity at the parent company. It is also a source of cash that can be deployed in our regulated subsidiaries. |

| • | E*TRADE Bank excess risk-based capital is the excess capital that E*TRADE Bank has compared to the regulatory minimum well-capitalized threshold and is an indicator of E*TRADE Bank’s ability to absorb future loan losses. |

| • | Allowance for loan losses is an estimate of the losses inherent in our loan portfolio as of the balance sheet date and is typically equal to the expected charge-offs in our loan portfolio over the next twelve months as well as the estimated charge-offs, including economic concessions to borrowers, over the estimated remaining life of loans modified in troubled debt restructurings. |

| • | Allowance for loan losses as a percentage of nonperforming loans is a general indicator of the adequacy of our allowance for loan losses. Changes in this ratio are also driven by changes in the mix of our loan portfolio. |

| • | Enterprise net interest spread is a broad indicator of our ability to generate net operating interest income. |

| • | Enterprise interest-earning assets, in conjunction with our enterprise net interest spread, are indicators of our ability to generate net operating interest income. |

Significant Events in the Third Quarter of 2009

Completion of Our Previously Announced $1.7 Billion Debt Exchange

| • | We obtained shareholder approval for and completed an offer to exchange $1.7 billion aggregate principal amount of our corporate debt, including $1.3 billion principal amount of our 12 1/2% springing lien notes due 2017 (“12 1/2% Notes”) and $0.4 billion principal amount of our 8% Senior Notes due 2011 (“8% Notes”), for an equal principal amount of newly-issued non-interest-bearing convertible debentures (“Debt Exchange”); |

| • | As a result of the Debt Exchange, we reduced our annual corporate interest payments from approximately $360 million to approximately $160 million and eliminated any substantial debt maturities until 2013; and |

5

Table of Contents

| • | The completion of the Debt Exchange resulted in a pre-tax non-cash charge of $968.3 million ($772.9 million after tax) and an increase of $707.5 million to additional paid-in capital. The net effect of the exchange to shareholders’ equity was a reduction of $65.4 million. For further details regarding this charge, see Note 1—Organization, Basis of Presentation and Summary of Significant Accounting Policies and Note 9—Corporate Debt of Item 1. Consolidated Financial Statements (Unaudited). |

Conversions of the Newly-Issued Convertible Debentures into Equity

| • | The newly-issued non-interest-bearing convertible debentures are convertible into shares of our common stock at any time at the election of the holder; and |

| • | As of September 30, 2009, $592.3 million principal amount, or 34%, of the convertible debentures had been converted into 572.2 million shares of our common stock(1). |

Launched and Completed an At the Market Common Stock Offering

| • | We raised $150 million in gross proceeds ($147 million in net proceeds) from our common stock offering that was launched and completed in September 2009 (the “At the Market Offering”) in which a total of 80.2 million shares of common stock were issued; and |

| • | The completion of the At the Market Offering brings our total cash equity raised during the second and third quarters of 2009 to $765 million of gross proceeds ($733.2 million in net proceeds). |

Summary Financial Results

Income Statement Highlights for the Three and Nine Months Ended September 30, 2009 (dollars in millions, except per share amounts)

| Three Months Ended September 30, |

Variance | Nine Months Ended September 30, |

Variance | |||||||||||||||||||

| 2009 | 2008 | 2009 vs. 2008 | 2009 | 2008 | 2009 vs. 2008 | |||||||||||||||||

| Net operating interest income |

$ | 321.4 | $ | 324.8 | (1 | )% | $ | 939.6 | $ | 993.9 | (5 | )% | ||||||||||

| Commissions |

$ | 144.5 | $ | 129.5 | 12 | % | $ | 424.2 | $ | 374.0 | 13 | % | ||||||||||

| Fees and service charges |

$ | 50.4 | $ | 49.6 | 2 | % | $ | 145.0 | $ | 155.5 | (7 | )% | ||||||||||

| Principal transactions |

$ | 24.9 | $ | 20.7 | 20 | % | $ | 65.2 | $ | 59.5 | 10 | % | ||||||||||

| Gains (losses) on loans and securities, net |

$ | 42.0 | $ | (141.9 | ) | * | $ | 150.4 | $ | (122.4 | ) | * | ||||||||||

| Net impairment |

$ | (19.2 | ) | $ | (17.9 | ) | * | $ | (67.7 | ) | $ | (61.6 | ) | * | ||||||||

| Other revenues |

$ | 11.4 | $ | 13.0 | (12 | )% | $ | 36.7 | $ | 40.3 | (9 | )% | ||||||||||

| Total net revenue |

$ | 575.3 | $ | 377.7 | 52 | % | $ | 1,693.6 | $ | 1,439.2 | 18 | % | ||||||||||

| Provision for loan losses |

$ | 347.2 | $ | 517.8 | (33 | )% | $ | 1,205.7 | $ | 1,070.8 | 13 | % | ||||||||||

| Total operating expense |

$ | 301.7 | $ | 295.9 | 2 | % | $ | 924.9 | $ | 968.8 | (5 | )% | ||||||||||

| Operating margin |

$ | (73.6 | ) | $ | (436.0 | ) | * | $ | (437.1 | ) | $ | (600.4 | ) | * | ||||||||

| Net loss from continuing operations |

$ | (831.7 | ) | $ | (320.8 | ) | * | $ | (1,207.6 | ) | $ | (533.2 | ) | * | ||||||||

| Less: net loss on the Debt Exchange |

(772.9 | ) | — | * | (772.9 | ) | — | * | ||||||||||||||

| Net loss from continuing operations excluding the Debt Exchange(2) |

$ | (58.8 | ) | $ | (320.8 | ) | * | $ | (434.7 | ) | $ | (533.2 | ) | * | ||||||||

| Diluted net loss per share from continuing operations |

$ | (0.66 | ) | $ | (0.60 | ) | * | $ | (1.45 | ) | $ | (1.07 | ) | * | ||||||||

| Less: diluted net loss per share on the Debt Exchange |

(0.61 | ) | — | * | (0.93 | ) | — | * | ||||||||||||||

| Diluted net loss per share from continuing operations excluding the Debt Exchange(2) |

$ | (0.05 | ) | $ | (0.60 | ) | * | $ | (0.52 | ) | $ | (1.07 | ) | * | ||||||||

| * | Percentage not meaningful |

| (1) | As of October 26, 2009, a total of $688.2 million of the convertible debentures had been converted into 664.9 million shares of common equity. |

| (2) | Net loss excluding the non-cash charge on the Debt Exchange represents net loss plus the non-cash charge on the Debt Exchange, net of tax and is a non-GAAP measure. Loss per share excluding the non-cash charge on the Debt Exchange represents net loss plus the non-cash charge on the Debt Exchange, net of tax, divided by diluted shares and is a non-GAAP measure. Management believes that excluding the non-cash charge associated with the Debt Exchange from net loss and loss per share provides a useful additional measure of the Company’s ongoing operating performance because the charge is not directly related to our performance and is non-recurring. The reconciliation of these non-GAAP measures is provided in the table above. |

6

Table of Contents

During the third quarter of 2009, our brokerage business continued to perform very well, increasing the level of income generated in the trading and investing segment as well as achieving record levels of brokerage accounts. This strong performance was more than offset by the provision for loan losses reported in our balance sheet management segment. Although we expect our provision for loan losses to continue at historically high levels in future periods, the level of provision for loan losses in the third quarter of 2009 represents the fourth consecutive quarter in which the provision for loan losses has declined when compared to the prior quarter. While we cannot state with certainty that this trend will continue, we believe it is a positive indicator that our loan portfolio may be stabilizing.

We also continued to make significant progress during the third quarter of 2009 on our comprehensive plan to strengthen the Company’s capital structure. We obtained shareholder approval for and completed an offer to exchange $1.7 billion aggregate principal amount of our corporate debt, including $1.3 billion principal amount of the 12 1/2% Notes and $0.4 billion principal amount of the 8% Notes, for an equal principal amount of newly-issued non-interest-bearing convertible debentures. The Debt Exchange resulted in a $968.3 million pre-tax non-cash loss on extinguishment of debt and an increase to additional paid-in capital of $707.5 million during the third quarter of 2009. The net effect of the Debt Exchange to shareholders’ equity was a reduction of $65.4 million(1). As a result of the completion of this exchange, we reduced our annual corporate interest payments from approximately $360 million to approximately $160 million and eliminated any substantial debt maturities until 2013.

In addition to the Debt Exchange, we successfully raised an additional $147.0 million in net proceeds from our At the Market Offering. The completion of this offering brings our total cash equity raised during the second and third quarters of 2009 to $765 million of gross proceeds (net proceeds of $733.2 million).

Balance Sheet Highlights (dollars in millions)

| September 30, 2009 |

December 31, 2008 |

Variance | |||||||||

| 2009 vs. 2008 | |||||||||||

| Total assets |

$ | 48,487.0 | $ | 48,538.2 | (0 | )% | |||||

| Less: Goodwill and other intangibles, net |

(2,316.2 | ) | (2,324.5 | ) | (0 | )% | |||||

| Add: Deferred tax liability related to goodwill |

158.1 | 127.7 | 24 | % | |||||||

| Tangible assets(2) |

$ | 46,328.9 | $ | 46,341.4 | (0 | )% | |||||

| Loans, net |

$ | 20,260.0 | $ | 24,451.9 | (17 | )% | |||||

| Corporate debt(3) |

|||||||||||

| Interest-bearing |

$ | 1,537.0 | $ | 3,150.4 | (51 | )% | |||||

| Non-interest-bearing |

$ | 1,149.6 | $ | — | * | ||||||

| Shareholders’ equity |

$ | 3,645.9 | $ | 2,591.5 | 41 | % | |||||

| Less: Goodwill and other intangibles, net |

(2,316.2 | ) | (2,324.5 | ) | (0 | )% | |||||

| Add: Deferred tax liability related to goodwill |

158.1 | 127.7 | 24 | % | |||||||

| Tangible common equity(4) |

$ | 1,487.8 | $ | 394.7 | 277 | % | |||||

| Tangible common equity to tangible assets(5) |

3.21 | % | 0.85 | % | 2.36 | % | |||||

| * | Percentage not meaningful |

| (1) | For further details regarding the loss on extinguishment of debt, see “Earnings Overview” in Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Note 1—Organization, Basis of Presentation and Summary of Significant Accounting Policies and Note 9—Corporate Debt of Item 1. Consolidated Financial Statements (Unaudited). |

| (2) | Tangible assets is calculated as total assets less goodwill, net of related deferred tax liability and intangible assets and is a non-GAAP measure. Management believes that tangible assets is a measure of the Company’s capital strength and is additional useful information that supplements the regulatory capital ratios of E*TRADE Bank. |

| (3) | The corporate debt balances represent the amount of principal outstanding. |

| (4) | Tangible common equity is calculated as shareholders’ equity less goodwill, net of related deferred tax liability and intangible assets and is a non-GAAP measure. Management believes that tangible common equity is a measure of the Company’s capital strength and is additional useful information that supplements the regulatory capital ratios of E*TRADE Bank. |

| (5) | Tangible common equity to tangible assets is calculated as shareholders’ equity less goodwill, net of related deferred tax liability and intangible assets divided by total assets less goodwill, net of related deferred tax liability and intangible assets and is a non-GAAP measure. Management believes that tangible common equity to tangible assets is a measure of the Company’s capital strength and is additional useful information that supplements the regulatory capital ratios of E*TRADE Bank. |

7

Table of Contents

During the third quarter of 2009, we exchanged $1.7 billion principal amount of our interest-bearing debt for an equal principal amount of non-interest-bearing convertible debentures. Subsequent to the Debt Exchange, $592.3 million debentures were converted into 572.2 million shares of common stock during the quarter ended September 30, 2009. The considerable increase in tangible common equity during the period was a result of the common stock issued in connection with our equity offerings and the debt conversions that occurred in the third quarter of 2009.

We incurred a net loss of $831.7 million and $1.2 billion for the three and nine months ended September 30, 2009, respectively. The net loss for the three and nine months ended September 30, 2009 was due principally to the Debt Exchange that resulted in a non-cash loss of $772.9 million (pre-tax loss of $968.3 million) on early extinguishment of debt during the third quarter of 2009. Our brokerage business continued to perform very well, resulting in trading and investing segment income of $202.5 million and $502.8 million for the three and nine months ended September 30, 2009, respectively. However, the provision for loan losses in our balance sheet management segment more than offset this strong performance, resulting in an overall segment loss of $276.1 million and $939.8 million for the three and nine months ended September 30, 2009, respectively.

On April 1, 2009, we adopted the amended guidance for the recognition of other-than-temporary impairment (“OTTI”) for debt securities as well as the presentation of OTTI on the consolidated financial statements. As a result of the adoption, we recognized a $20.2 million after-tax increase to beginning retained earnings and a corresponding offset in accumulated other comprehensive loss on our consolidated balance sheet. This adjustment represents the after-tax difference between the impairment reported in prior periods for securities on our balance sheet as of April 1, 2009 and the level of impairment that would have been recorded on these same securities under the new accounting guidance. Additionally, in accordance with the new guidance, we changed the presentation of the consolidated statement of loss to state “Net impairment” as a separate line item, as well as the credit and noncredit components of net impairment. Prior to this new presentation, OTTI was included in the “Gains (losses) on loans and securities, net” line item on the consolidated statement of loss.

During the third quarter of 2009, we added a new operating expense line item to the consolidated statement of loss for Federal Deposit Insurance Corporation (“FDIC”) insurance premiums. During the nine months ended September 30, 2009, these expenses increased to a level at which we believe a separate line item on the consolidated statement of loss is appropriate. FDIC insurance premium expenses were previously presented in the “Other operating expenses” line item.

We report corporate interest income and corporate interest expense separately from operating interest income and operating interest expense. We believe reporting these two items separately provides a clearer picture of the financial performance of our operations than would a presentation that combined these two items. Our operating interest income and operating interest expense is generated from the operations of the Company. Our corporate debt, which is the primary source of our corporate interest expense, has been issued primarily in connection with our transaction with Citadel Investment Group LLC and its affiliates (“Citadel”) in 2007 and past acquisitions, such as Harrisdirect and BrownCo.

Similarly, we report gains (losses) on sales of investments, net separately from gains (losses) on loans and securities, net. We believe reporting these two items separately provides a clearer picture of the financial performance of our operations than would a presentation that combined these two items. Gains (losses) on loans and securities, net are the result of activities in our operations, namely our balance sheet management segment. Gains (losses) on sales of investments, net relate to historical equity investments of the Company at the corporate level and are not related to the ongoing business of our operating subsidiaries.

8

Table of Contents

The following sections describe in detail the changes in key operating factors and other changes and events that have affected our consolidated revenue, provision for loan losses, operating expense, other income (expense) and income tax benefit.

Revenue

The components of net revenue and the resulting variances are as follows (dollars in thousands):

| Three Months Ended September 30, |

Variance | Nine Months Ended September 30, |

Variance | |||||||||||||||||||||||||||

| 2009 vs. 2008 | 2009 vs. 2008 | |||||||||||||||||||||||||||||

| 2009 | 2008 | Amount | % | 2009 | 2008 | Amount | % | |||||||||||||||||||||||

| Revenue: |

||||||||||||||||||||||||||||||

| Net operating interest income |

$ | 321,378 | $ | 324,774 | $ | (3,396 | ) | (1 | )% | $ | 939,630 | $ | 993,909 | $ | (54,279 | ) | (5 | )% | ||||||||||||

| Commissions |

144,533 | 129,513 | 15,020 | 12 | % | 424,222 | 374,003 | 50,219 | 13 | % | ||||||||||||||||||||

| Fees and service charges |

50,373 | 49,612 | 761 | 2 | % | 145,022 | 155,515 | (10,493 | ) | (7 | )% | |||||||||||||||||||

| Principal transactions |

24,888 | 20,664 | 4,224 | 20 | % | 65,223 | 59,546 | 5,677 | 10 | % | ||||||||||||||||||||

| Gains (losses) on loans and securities, net |

41,979 | (141,915 | ) | 183,894 | * | 150,439 | (122,434 | ) | 272,873 | * | ||||||||||||||||||||

| Net impairment |

(19,229 | ) | (17,884 | ) | (1,345 | ) | * | (67,683 | ) | (61,639 | ) | (6,044 | ) | * | ||||||||||||||||

| Other revenues |

11,405 | 12,968 | (1,563 | ) | (12 | )% | 36,723 | 40,263 | (3,540 | ) | (9 | )% | ||||||||||||||||||

| Total non-interest income |

253,949 | 52,958 | 200,991 | 380 | % | 753,946 | 445,254 | 308,692 | 69 | % | ||||||||||||||||||||

| Total net revenue |

$ | 575,327 | $ | 377,732 | $ | 197,595 | 52 | % | $ | 1,693,576 | $ | 1,439,163 | $ | 254,413 | 18 | % | ||||||||||||||

| * | Percentage not meaningful |

Total net revenue increased 52% to $575.3 million and 18% to $1.7 billion for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. This was driven by our gains (losses) on loans and securities, net, which increased from net losses of $141.9 million to net gains of $42.0 million and from net losses of $122.4 million to net gains of $150.4 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. Commission revenue also increased 12% to $144.5 million and 13% to $424.2 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008.

Net Operating Interest Income

Net operating interest income decreased 1% to $321.4 million and 5% to $939.6 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. Net operating interest income is earned primarily through holding credit balances, which include margin, real estate and consumer loans, and by holding customer cash and deposits, which are a low cost source of funding. The slight decrease in net operating interest income was due primarily to a decrease in our average interest earning assets of $2.3 billion and $3.0 billion for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008, which was mostly offset by a decrease in the yields paid on our deposits for both the three and nine months ended September 30, 2009.

9

Table of Contents

The following table presents enterprise average balance sheet data and enterprise income and expense data for our operations, as well as the related net interest spread, yields and rates and has been prepared on the basis required by the SEC’s Industry Guide 3, “Statistical Disclosure by Bank Holding Companies” (dollars in thousands):

| Three Months Ended September 30, | ||||||||||||||||||

| 2009 | 2008 | |||||||||||||||||

| Average Balance |

Operating Interest Inc./Exp. |

Average Yield/ Cost |

Average Balance |

Operating Interest Inc./Exp. |

Average Yield/ Cost |

|||||||||||||

| Enterprise interest-earning assets: |

||||||||||||||||||

| Loans(1) |

$ | 22,527,378 | $ | 276,846 | 4.92 | % | $ | 26,928,190 | $ | 379,195 | 5.63 | % | ||||||

| Margin receivables |

3,197,894 | 37,832 | 4.69 | % | 6,420,090 | 72,291 | 4.48 | % | ||||||||||

| Available-for-sale mortgage-backed securities |

9,584,503 | 99,518 | 4.15 | % | 9,494,421 | 108,511 | 4.57 | % | ||||||||||

| Available-for-sale investment securities |

761,969 | 6,078 | 3.19 | % | 131,332 | 2,140 | 6.52 | % | ||||||||||

| Trading securities |

14,870 | 680 | 18.30 | % | 272,677 | 3,211 | 4.71 | % | ||||||||||

| Cash and cash equivalents(2) |

7,511,328 | 4,894 | 0.26 | % | 2,630,478 | 17,850 | 2.70 | % | ||||||||||

| Stock borrow and other |

689,693 | 11,085 | 6.38 | % | 741,127 | 14,531 | 7.80 | % | ||||||||||

| Total enterprise interest-earning assets |

44,287,635 | 436,933 | 3.94 | % | 46,618,315 | 597,729 | 5.12 | % | ||||||||||

| Non-operating interest-earning assets(3) |

3,941,934 | 4,694,410 | ||||||||||||||||

| Total assets |

$ | 48,229,569 | $ | 51,312,725 | ||||||||||||||

| Enterprise interest-bearing liabilities: |

||||||||||||||||||

| Retail deposits |

$ | 26,329,314 | 35,487 | 0.53 | % | $ | 26,151,874 | 136,148 | 2.07 | % | ||||||||

| Brokered certificates of deposit |

138,513 | 1,833 | 5.25 | % | 883,289 | 10,984 | 4.95 | % | ||||||||||

| Customer payables |

5,070,584 | 2,127 | 0.17 | % | 4,368,391 | 7,444 | 0.68 | % | ||||||||||

| Repurchase agreements and other borrowings |

6,901,475 | 48,527 | 2.75 | % | 7,581,472 | 71,648 | 3.70 | % | ||||||||||

| Federal Home Loan Bank (“FHLB”) advances |

2,559,578 | 30,150 | 4.61 | % | 4,166,643 | 50,062 | 4.70 | % | ||||||||||

| Stock loan and other |

571,406 | 517 | 0.36 | % | 1,055,662 | 2,848 | 1.07 | % | ||||||||||

| Total enterprise interest-bearing liabilities |

41,570,870 | 118,641 | 1.12 | % | 44,207,331 | 279,134 | 2.49 | % | ||||||||||

| Non-operating interest-bearing liabilities(4) |

3,637,656 | 4,550,263 | ||||||||||||||||

| Total liabilities |

45,208,526 | 48,757,594 | ||||||||||||||||

| Total shareholders’ equity |

3,021,043 | 2,555,131 | ||||||||||||||||

| Total liabilities and shareholders’ equity |

$ | 48,229,569 | $ | 51,312,725 | ||||||||||||||

| Excess of enterprise interest-earning assets over enterprise interest-bearing liabilities/Enterprise net interest income/Spread |

$ | 2,716,765 | $ | 318,292 | 2.82 | % | $ | 2,410,984 | $ | 318,595 | 2.63 | % | ||||||

| Enterprise net interest margin (net yield on enterprise interest-earning assets) |

2.87 | % | 2.73 | % | ||||||||||||||

| Ratio of enterprise interest-earning assets to enterprise interest-bearing liabilities |

106.54 | % | 105.45 | % | ||||||||||||||

| Return on average: |

||||||||||||||||||

| Total assets |

(6.90 | )% | (0.39 | )% | ||||||||||||||

| Total shareholders’ equity |

(110.12 | )% | (7.90 | )% | ||||||||||||||

| Average equity to average total assets |

6.26 | % | 4.98 | % | ||||||||||||||

Reconciliation from enterprise net interest income to net operating interest income (dollars in thousands):

| Three Months Ended September 30, |

||||||||

| 2009 | 2008 | |||||||

| Enterprise net interest income(5) |

$ | 318,292 | $ | 318,595 | ||||

| Taxable equivalent interest adjustment |

(333 | ) | (1,526 | ) | ||||

| Customer cash held by third parties and other(6) |

3,419 | 7,705 | ||||||

| Net operating interest income |

$ | 321,378 | $ | 324,774 | ||||

| (1) | Loans represent the gross loan balances including premium/discount but excluding the allowance for loan losses. Nonaccrual loans are included in the respective average loan balances. Income on such nonaccrual loans is recognized on a cash basis. |

| (2) | Includes segregated cash and investment balances. |

| (3) | Non-operating interest-earning assets consist of property and equipment, net, goodwill, other intangibles, net, other assets that do not generate operating interest income. Some of these assets generate corporate interest income. |

| (4) | Non-operating interest-bearing liabilities consist of corporate debt, accounts payable, accrued and other liabilities that do not generate operating interest expense. Some of these liabilities generate corporate interest expense. |

| (5) | Enterprise net interest income is taxable equivalent basis net operating interest income excluding corporate interest income and corporate interest expense and interest earned on customer cash held by third parties. Management believes this non-GAAP measure is useful to analysts and investors as it is a measure of the net interest income generated by our operations. |

| (6) | Includes interest earned on average customer assets of $3.0 billion and $3.3 billion for the three months ended September 30, 2009 and 2008, respectively, held by parties outside E*TRADE Financial, including third party money market funds and sweep deposit accounts at unaffiliated financial institutions. |

10

Table of Contents

| Nine Months Ended September 30, | ||||||||||||||||||

| 2009 | 2008 | |||||||||||||||||

| Average Balance |

Operating Interest Inc./Exp. |

Average Yield/ Cost |

Average Balance |

Operating Interest Inc./Exp. |

Average Yield/ Cost |

|||||||||||||

| Enterprise interest-earning assets: |

||||||||||||||||||

| Loans(1) |

$ | 23,824,135 | $ | 882,683 | 4.94 | % | $ | 28,354,314 | $ | 1,232,872 | 5.80 | % | ||||||

| Margin receivables |

2,907,877 | 96,181 | 4.42 | % | 6,633,365 | 238,610 | 4.80 | % | ||||||||||

| Available-for-sale mortgage-backed securities |

10,845,173 | 352,790 | 4.34 | % | 9,141,068 | 317,170 | 4.63 | % | ||||||||||

| Available-for-sale investment securities |

382,902 | 11,374 | 3.96 | % | 144,550 | 7,123 | 6.57 | % | ||||||||||

| Trading securities |

24,590 | 1,851 | 10.04 | % | 457,320 | 23,070 | 6.73 | % | ||||||||||

| Cash and cash equivalents(2) |

6,092,829 | 15,354 | 0.34 | % | 2,155,474 | 49,460 | 3.07 | % | ||||||||||

| Stock borrow and other |

654,323 | 40,804 | 8.34 | % | 814,133 | 46,698 | 7.66 | % | ||||||||||

| Total enterprise interest-earning assets |

44,731,829 | 1,401,037 | 4.18 | % | 47,700,224 | 1,915,003 | 5.35 | % | ||||||||||

| Non-operating interest-earning assets(3) |

3,850,848 | 5,218,220 | ||||||||||||||||

| Total assets |

$ | 48,582,677 | $ | 52,918,444 | ||||||||||||||

| Enterprise interest-bearing liabilities: |

||||||||||||||||||

| Retail deposits |

$ | 26,588,811 | 179,557 | 0.90 | % | $ | 25,871,958 | 445,210 | 2.30 | % | ||||||||

| Brokered certificates of deposit |

214,926 | 8,293 | 5.16 | % | 1,081,185 | 40,337 | 4.98 | % | ||||||||||

| Customer payables |

4,455,148 | 7,027 | 0.21 | % | 4,422,244 | 25,303 | 0.76 | % | ||||||||||

| Repurchase agreements and other borrowings |

7,303,376 | 170,209 | 3.07 | % | 7,678,211 | 235,212 | 4.02 | % | ||||||||||

| FHLB advances |

3,101,768 | 105,506 | 4.49 | % | 4,920,804 | 172,473 | 4.61 | % | ||||||||||

| Stock loan and other |

499,183 | 1,893 | 0.51 | % | 1,291,261 | 16,742 | 1.73 | % | ||||||||||

| Total enterprise interest-bearing liabilities |

42,163,212 | 472,485 | 1.49 | % | 45,265,663 | 935,277 | 2.74 | % | ||||||||||

| Non-operating interest-bearing liabilities(4) |

3,689,948 | 4,937,795 | ||||||||||||||||

| Total liabilities |

45,853,160 | 50,203,458 | ||||||||||||||||

| Total shareholders’ equity |

2,729,517 | 2,714,986 | ||||||||||||||||

| Total liabilities and shareholders’ equity |

$ | 48,582,677 | $ | 52,918,444 | ||||||||||||||

| Excess of enterprise interest-earning assets over enterprise interest-bearing liabilities/Enterprise net interest income/Spread |

$ | 2,568,617 | $ | 928,552 | 2.69 | % | $ | 2,434,561 | $ | 979,726 | 2.61 | % | ||||||

| Enterprise net interest margin (net yield on enterprise interest-earning assets) |

2.77 | % | 2.74 | % | ||||||||||||||

| Ratio of enterprise interest-earning assets to enterprise interest-bearing liabilities |

106.09 | % | 105.38 | % | ||||||||||||||

| Return on average: |

||||||||||||||||||

| Total assets |

(3.31 | )% | (0.60 | )% | ||||||||||||||

| Total shareholders’ equity |

(58.99 | )% | (11.60 | )% | ||||||||||||||

| Average equity to average total assets |

5.62 | % | 5.13 | % | ||||||||||||||

Reconciliation from enterprise net interest income to net operating interest income (dollars in thousands):

| Nine Months Ended September 30, |

||||||||

| 2009 | 2008 | |||||||

| Enterprise net interest income(5) |

$ | 928,552 | $ | 979,726 | ||||

| Taxable equivalent interest adjustment |

(1,763 | ) | (8,429 | ) | ||||

| Customer cash held by third parties and other(6) |

12,841 | 22,612 | ||||||

| Net operating interest income |

$ | 939,630 | $ | 993,909 | ||||

| (1) | Loans represent the gross loan balances including premium/discount but excluding the allowance for loan losses. Nonaccrual loans are included in the respective average loan balances. Income on such nonaccrual loans is recognized on a cash basis. |

| (2) | Includes segregated cash and investment balances. |

| (3) | Non-operating interest-earning assets consist of property and equipment, net, goodwill, other intangibles, net, other assets that do not generate operating interest income. Some of these assets generate corporate interest income. |

| (4) | Non-operating interest-bearing liabilities consist of corporate debt, accounts payable, accrued and other liabilities that do not generate operating interest expense. Some of these liabilities generate corporate interest expense. |

| (5) | Enterprise net interest income is taxable equivalent basis net operating interest income excluding corporate interest income and corporate interest expense and interest earned on customer cash held by third parties. Management believes this non-GAAP measure is useful to analysts and investors as it is a measure of the net interest income generated by our operations. |

| (6) | Includes interest earned on average customer assets of $2.9 billion and $3.3 billion for the nine months ended September 30, 2009 and 2008, respectively, held by parties outside E*TRADE Financial, including third party money market funds and sweep deposit accounts at unaffiliated financial institutions. |

11

Table of Contents

Average enterprise interest-earning assets decreased 5% to $44.3 billion and 6% to $44.7 billion for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. This decrease was primarily a result of the decrease in our loans, net portfolio and our margin receivables, partially offset by an increase in cash and equivalents. Average loans, net decreased 16% to $22.5 billion and 16% to $23.8 billion for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. For the foreseeable future, we plan to allow our loan portfolio to pay down. Average margin receivables decreased 50% to $3.2 billion and 56% to $2.9 billion for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. We believe this decrease was due to customers deleveraging and reducing their risk exposure given the substantial volatility in the financial markets. These decreases were offset by an increase in average cash and cash equivalents. Average cash and cash equivalents increased 186% to $7.5 billion and 183% to $6.1 billion for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008.

Average enterprise interest-bearing liabilities decreased 6% to $41.6 billion and 7% to $42.2 billion for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. The decrease in average enterprise interest-bearing liabilities was primarily due to a decrease in FHLB advances, brokered certificates of deposit and stock loan and other. Average FHLB advances decreased 39% to $2.6 billion and 37% to $3.1 billion for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. Brokered certificates of deposit decreased 84% to $0.1 billion and 80% to $0.2 billion for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. Average stock loan and other decreased 46% to $0.6 billion and 61% to $0.5 billion for the three and nine months ended September 30, 2009, compared to the same periods in 2008. While our average retail deposits increased by $0.2 billion and $0.7 billion for the three and nine months ended September 30, 2009, respectively, when compared to the same periods in 2008, we expect the non-sweep deposit balances to decrease over the remainder of 2009.

Enterprise net interest spread increased by 19 basis points to 2.82% and 8 basis points to 2.69% for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. This increase was largely driven by a decrease in the yields paid on our deposits and lower wholesale borrowing costs, partially offset by a decrease in higher yielding enterprise interest-earning assets.

Commissions

Commissions revenue increased 12% to $144.5 million and 13% to $424.2 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. The main factors that affect our commissions revenue are DARTs, average commission per trade and the number of trading days during the period. Average commission per trade is impacted by both trade types and the mix between our domestic and international businesses. Each business has a different pricing structure, unique to its customer base and local market practices and, as a result, a change in the relative number of executed trades in these businesses impacts average commission per trade. Each business also has different trade types (e.g. equities, options, fixed income, exchange-traded funds, contract for difference and mutual funds) that can have different commission rates. Accordingly, changes in the mix of trade types within either of these businesses may impact average commission per trade.

DARTs increased 7% to 196,413 and 14% to 204,143 for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. Our U.S. DART volume increased 8% and 16% for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008, driven entirely by organic growth. Option-related DARTs as a percentage of our total U.S. DARTs represented 12% and 16% of U.S. trading volume for the nine months ended September 30, 2009 and 2008, respectively. Exchange-traded funds-related DARTs as a percentage of our total U.S. DARTs represented 14% and 9% of U.S. trading volume for the nine months ended September 30, 2009 and 2008, respectively.

12

Table of Contents

Average commission per trade increased 4% to $11.50 and decreased slightly to $11.05 for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. The increase in the average commission per trade for the third quarter was due primarily to the product and customer mix when compared to same period in 2008. The slight decrease in the average commission per trade for the nine months ended September 30, 2009, was primarily a function of international product mix and the impact of foreign currency exchange as a result of the strengthening U.S. dollar, partially offset by an improvement in domestic product and customer mix, compared to the same period in 2008.

Fees and Service Charges

Fees and service charges increased 2% to $50.4 million and decreased 7% to $145.0 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. The increase in the third quarter of 2009 was primarily due to an increase in order flow revenue which was partially offset by a decrease in account service fees, compared to the same period in 2008. For the nine months ended September 30, 2009, the decline was driven by a decrease in account service fee and advisory management fee revenue, which was partially offset by an increase in order flow revenue, compared to the same period in 2008. The decrease in advisory management fees was primarily due to our sale of RAA in the second quarter of 2008. Declines in foreign currency margin revenue, fixed income product revenue and mutual fund fees also contributed to the decrease in fees and service charges.

Principal Transactions

Principal transactions increased 20% to $24.9 million and 10% to $65.2 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. Our principal transactions revenue is influenced by overall trading volumes, the number of stocks for which we act as a market-maker, the trading volumes of those specific stocks and the performance of our proprietary trading activities. The increase in principal transactions revenue was driven by an increase in the volume of equity shares that were traded, which was partially offset by a decrease in our average revenue earned per share traded for the three and nine months ended September 30, 2009, respectively.

Gains (Losses) on Loans and Securities, Net

Gains (losses) on loans and securities, net were gains of $42.0 million and $150.4 million for the three and nine months ended September 30, 2009, respectively, as shown in the following table (dollars in thousands):

| Three Months Ended September 30, |

Variance | Nine Months Ended September 30, |

Variance | |||||||||||||||||||||||||||

| 2009 vs. 2008 | 2009 vs. 2008 | |||||||||||||||||||||||||||||

| 2009 | 2008 | Amount | % | 2009 | 2008 | Amount | % | |||||||||||||||||||||||

| Losses on sales of loans, net |

$ | (12,629 | ) | $ | — | $ | (12,629 | ) | * | $ | (12,552 | ) | $ | (783 | ) | $ | (11,769 | ) | * | |||||||||||

| Gains on securities and other investments, net |

48,303 | 5,489 | 42,814 | 780 | % | 157,133 | 17,966 | 139,167 | 775 | % | ||||||||||||||||||||

| Gains (losses) on trading securities, net |

6,174 | (147,777 | ) | 153,951 | * | 5,336 | (142,508 | ) | 147,844 | * | ||||||||||||||||||||

| Hedge ineffectiveness |

131 | 373 | (242 | ) | (65 | )% | 522 | 2,891 | (2,369 | ) | (82 | )% | ||||||||||||||||||

| Gains (losses) on securities, net |

54,608 | (141,915 | ) | 196,523 | * | 162,991 | (121,651 | ) | 284,642 | * | ||||||||||||||||||||

| Gains (losses) on loans and securities, net |

$ | 41,979 | $ | (141,915 | ) | $ | 183,894 | * | $ | 150,439 | $ | (122,434 | ) | $ | 272,873 | * | ||||||||||||||

| * | Percentage not meaningful |

13

Table of Contents

The gains on loans and securities, net for the three and nine months ended September 30, 2009, were due primarily to gains on the sale of certain agency mortgage-backed securities, which were partially offset by net losses on the sales of loans. The losses on the sales of loans were due to the sale of a $0.4 billion pool of home equity loans during the three months ended September 30, 2009. We purchased this particular pool of loans from the originator of the loans in a prior period. This same originator, who continued to service the loans subsequent to our purchase, made an unsolicited offer to repurchase the loans back from us at a price of 98% of the balance of the loan portfolio and we accepted this offer. We believe transactions of this nature are rare and are unlikely to occur again in future periods. The losses on loans and securities, net during the three and nine months ended September 30, 2008 were due to losses on our preferred stock in Federal National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation (“Freddie Mac”).

Net Impairment

In accordance with the OTTI accounting guidance that became effective in the second quarter of 2009, we changed the presentation of the consolidated statement of loss to state “Net impairment” as a separate line item, as well as the credit and noncredit components of net impairment. Prior to this new presentation, OTTI was included in the “Gains (losses) on loans and securities, net” line item on the consolidated statement of loss.

We recognized $19.2 million and $67.7 million of net impairment during the three and nine months ended September 30, 2009, respectively, on certain securities in our non-agency collateralized mortgage obligation (“CMO”) portfolio due to continued deterioration in the expected credit performance of the underlying loans in the securities. The net impairment included gross OTTI of $9.3 million and $227.8 million for the three and nine months ended September 30, 2009. For the three months ended September 30, 2009, net impairment included $9.9 million of previously recognized noncredit OTTI that was reclassified from accumulated other comprehensive loss into earnings. Of the $227.8 million of gross OTTI for the nine months ended September 30, 2009, $160.2 million related to the noncredit portion of OTTI, which was recorded through other comprehensive income (loss).

We had net impairment of $17.9 million and $61.6 million for the three and nine months ended September 30, 2008, which represented the total decline in the fair value of impaired securities in accordance with the OTTI accounting guidance that was in effect prior to April 1, 2009.

Other Revenues

Other revenues decreased 12% to $11.4 million and 9% to $36.7 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. The decrease in other revenue was driven by lower software consulting fees from our Corporate Services business.

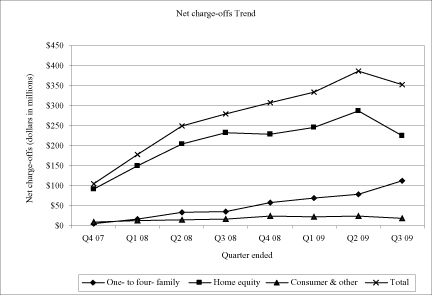

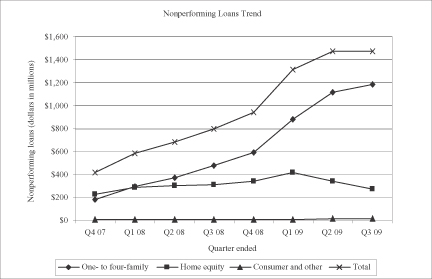

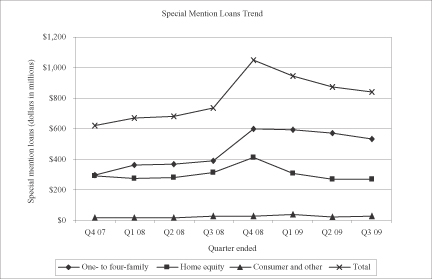

Provision for Loan Losses

Provision for loan losses decreased $170.6 million to $347.2 million and increased $134.9 million to $1.2 billion for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. The provision for loan losses for the three and nine months ended September 30, 2009 was due primarily to the high levels of delinquent loans in our one- to four-family and home equity loan portfolios. We believe the delinquencies in both of these portfolios were caused by several factors, including: home price depreciation in key markets; growing inventories of unsold homes; rising foreclosure rates; significant contraction in the availability of credit; and a general decline in economic growth. In addition, the combined impact of home price depreciation and the reduction of available credit made it increasingly difficult for borrowers to refinance existing loans. Although we expect these factors will cause the provision for loan losses to continue at historically high levels in future periods, the level of provision for loan losses in the third quarter of 2009 represents the fourth consecutive quarter in which the provision for loan losses has declined when compared to the prior quarter. While we cannot state with certainty that this trend will continue, we believe it is a positive indicator that our loan portfolio may be stabilizing.

14

Table of Contents

Operating Expense

The components of operating expense and the resulting variances are as follows (dollars in thousands):

| Three Months Ended September 30, |

Variance | Nine Months Ended September 30, |

Variance | |||||||||||||||||||||||

| 2009 vs. 2008 | 2009 vs. 2008 | |||||||||||||||||||||||||

| 2009 | 2008 | Amount | % | 2009 | 2008 | Amount | % | |||||||||||||||||||

| Operating expense: |

||||||||||||||||||||||||||

| Compensation and benefits |

$ | 97,984 | $ | 83,644 | $ | 14,340 | 17 | % | $ | 272,181 | $ | 302,854 | $ | (30,673 | ) | (10 | )% | |||||||||

| Clearing and servicing |

43,245 | 46,105 | (2,860 | ) | (6 | )% | 129,988 | 137,112 | (7,124 | ) | (5 | )% | ||||||||||||||

| Advertising and market development |

19,438 | 30,381 | (10,943 | ) | (36 | )% | 88,015 | 130,566 | (42,551 | ) | (33 | )% | ||||||||||||||

| FDIC insurance premiums |

19,993 | 7,721 | 12,272 | 159 | % | 74,834 | 24,172 | 50,662 | 210 | % | ||||||||||||||||

| Communications |

20,502 | 23,029 | (2,527 | ) | (11 | )% | 63,065 | 72,623 | (9,558 | ) | (13 | )% | ||||||||||||||

| Professional services |

20,592 | 16,862 | 3,730 | 22 | % | 61,696 | 66,256 | (4,560 | ) | (7 | )% | |||||||||||||||

| Occupancy and equipment |

19,569 | 20,470 | (901 | ) | (4 | )% | 59,082 | 62,666 | (3,584 | ) | (6 | )% | ||||||||||||||

| Depreciation and amortization |

21,149 | 20,569 | 580 | 3 | % | 62,638 | 62,607 | 31 | 0 | % | ||||||||||||||||

| Amortization of other intangibles |

7,433 | 7,937 | (504 | ) | (6 | )% | 22,303 | 27,982 | (5,679 | ) | (20 | )% | ||||||||||||||

| Facility restructuring and other exit activities |

2,497 | 5,526 | (3,029 | ) | (55 | )% | 6,832 | 28,525 | (21,693 | ) | (76 | )% | ||||||||||||||

| Other operating expenses |

29,312 | 33,646 | (4,334 | ) | (13 | )% | 84,290 | 53,403 | 30,887 | 58 | % | |||||||||||||||

| Total operating expense |

$ | 301,714 | $ | 295,890 | $ | 5,824 | 2 | % | $ | 924,924 | $ | 968,766 | $ | (43,842 | ) | (5 | )% | |||||||||

Operating expense increased 2% to $301.7 million and decreased 5% to $924.9 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. The fluctuation was driven by an increase in variable compensation and FDIC insurance premiums during the three months ended September 30, 2009, compared to the three months ended September 30, 2008. The decrease during the nine months ended September 30, 2009, was driven by a decrease in compensation and benefits and advertising and market development, partially offset by an increase in FDIC insurance premiums, compared to the nine months ended September 30, 2008.

Compensation and Benefits

Compensation and benefits increased 17% to $98.0 million and decreased 10% to $272.2 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. The increase for the three months ended September 30, 2009 was due to an increase in variable compensation as a result of our strong trading and investing segment results, compared to the three months ended September 30, 2008. The decrease for the nine months ended September 30, 2009 resulted primarily from lower salary expense due to a reduction in our employee base compared to the nine months ended September 30, 2008.

Advertising and Market Development

Advertising and market development expense decreased 36% to $19.4 million and 33% to $88.0 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. This decrease was due to higher expense in the first half of 2008 that was aimed at restoring customer confidence as well as an overall decline in advertising rates in the three and nine months ended September 30, 2009.

FDIC Insurance Premiums

FDIC insurance premiums increased 159% to $20.0 million and 210% to $74.8 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. The increase was primarily due to an increase in the ongoing FDIC insurance rates as well as an industry wide special assessment of $21.6 million in the second quarter of 2009.

15

Table of Contents

Other Operating Expenses

Other operating expenses decreased 13% to $29.3 million and increased 58% to $84.3 million for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008. The decrease during the three months ended September 30, 2009, was primarily due to a decrease in our fraud related expenses, compared to the same period in 2008. The increase for the nine months ended September 30, 2009, was primarily due to a $23.7 million gain on the sale of our corporate aircraft related assets during the nine months ended September 30, 2008, which reduced other operating expenses during that period.

Other Income (Expense)

Other income (expense) increased to an expense of $1.1 billion and $1.3 billion for the three and nine months ended September 30, 2009, respectively, compared to the same periods in 2008, as shown in the following table (dollars in thousands):

| Three Months Ended September 30, |

Variance | Nine Months Ended September 30, |

Variance | |||||||||||||||||||||||||||

| 2009 vs. 2008 | 2009 vs. 2008 | |||||||||||||||||||||||||||||

| 2009 | 2008 | Amount | % | 2009 | 2008 | Amount | % | |||||||||||||||||||||||

| Other income (expense): |

||||||||||||||||||||||||||||||

| Corporate interest income |

$ | 192 | $ | 1,387 | $ | (1,195 | ) | (86 | )% | $ | 793 | $ | 5,619 | $ | (4,826 | ) | (86 | )% | ||||||||||||

| Corporate interest expense |

(69,035 | ) | (88,772 | ) | 19,737 | (22 | )% | (242,791 | ) | (274,262 | ) | 31,471 | (11 | )% | ||||||||||||||||

| Gains (losses) on sales of investments, net |

— | (213 | ) | 213 | * | (2,025 | ) | 307 | (2,332 | ) | * | |||||||||||||||||||

| Loss on the Debt Exchange |

(968,254 | ) | — | (968,254 | ) | * | (968,254 | ) | — | (968,254 | ) | * | ||||||||||||||||||

| Gains (losses) on extinguishment of FHLB advances and other |

(37,239 | ) | — | (37,239 | ) | * | (50,594 | ) | 10,084 | (60,678 | ) | * | ||||||||||||||||||

| Gains (losses) on early extinguishment of debt |

(1,005,493 | ) | — | (1,005,493 | ) | * | (1,018,848 | ) | 10,084 | (1,028,932 | ) | * | ||||||||||||||||||

| Equity in income (loss) of investments and venture funds |

(3,404 | ) | 21,965 | (25,369 | ) | * | (6,972 | ) | 25,070 | (32,042 | ) | * | ||||||||||||||||||

| Total other income (expense) |

$ | (1,077,740 | ) | $ | (65,633 | ) | $ | (1,012,107 | ) | * | $ | (1,269,843 | ) | $ | (233,182 | ) | $ | (1,036,661 | ) | * | ||||||||||

| * | Percentage not meaningful |

Total other income (expense) for the three and nine months ended September 30, 2009 decreased significantly as a result of the $968.3 million pre-tax non-cash loss on the early extinguishment of debt related to our Debt Exchange. The loss on the Debt Exchange resulted from the de-recognition of the debt that was exchanged and the corresponding recognition of the newly-issued non-interest-bearing convertible debentures at fair value. The loss was composed of two main components: 1) the difference between the fair value of the newly-issued convertible debentures and the face amount of the exchanged debt, which resulted in a $725.0 million premium on the new debt; and 2) the realization of the $243.3 million discount on the debt that was exchanged. The fair value(1) of the newly-issued convertible debentures was greater than the face amount of the debt that was exchanged primarily due to the significant increase in our stock price from June 22, 2009, the date on which the conversion price was established, to August 25, 2009, the date on which the Debt Exchange was consummated. The time delay was due to the required shareholder approval prior to the consummation of the Debt Exchange, which occurred at a special meeting on August 19, 2009. This component of the loss did not significantly impact our shareholders’ equity as it was substantially offset by a simultaneous increase in additional paid-in capital(2). The remaining $243.3 million component of the loss represented an acceleration of

| (1) | For further details on the calculation of the fair value of the non-interest-bearing convertible debentures, see Note 3—Fair Value Disclosures of Item 1. Consolidated Financial Statements (Unaudited). |

| (2) | For further details on the accounting for the Debt Exchange see, Note 1—Organization, Basis of Presentation and Summary of Significant Accounting Policies of Item 1. Consolidated Financial Statements (Unaudited). |

16

Table of Contents

the interest expense that otherwise would have been recorded in future periods. Prior to the consummation of the Debt Exchange, this discount was being accreted into interest expense over the life of the exchanged debt under the effective interest method.

Total other income (expense) also consists of corporate interest expense resulting from our interest-bearing corporate debt. Corporate interest expense decreased 22% to $69.0 million and 11% to $242.8 million for the three and nine months ended September 30, 2009, respectively, primarily due to the reduction in interest-bearing debt in connection with our Debt Exchange. Based on our remaining balance of interest-bearing debt subsequent to the Debt Exchange, we estimate that our annual corporate interest payments in future periods will be approximately $160 million on an annual basis, which is approximately $200 million lower than our estimated annual corporate interest payments prior to the Debt Exchange.

Income Tax Benefit

Income tax benefit was $319.7 million and $499.3 million during the three and nine months ended September 30, 2009, respectively, compared to $180.8 million and $300.4 million, respectively, for the same periods in 2008. Our effective tax rates were (27.8)% and (36.0)% for the three months ended September 30, 2009 and 2008, respectively, and (29.3)% and (36.0)% for the nine months ended September 30, 2009 and 2008, respectively. We expect our overall 2009 effective tax rate to be in the range of 33% to 35%.

Debt Exchange

The effective tax rate on the Debt Exchange of 20% was below our statutory federal tax rate of 35%. This was primarily due to certain components of the loss on the Debt Exchange not being deductible for tax purposes, which are summarized in the following table (dollars in thousands):

| Three Months Ended September 30, 2009 |

||||||||||

| Amount of Loss | Tax Rate | Tax Benefit | ||||||||

| Deductible portion of the loss on the Debt Exchange |

$ | 722,952 | 35 | % | $ | 253,033 | ||||

| Non-deductible portion of the loss on the Debt Exchange |

245,302 | — | % | — | ||||||

| Prior period interest expense on the 12 1/2% Notes not deductible as a result of the Debt Exchange |

N/A | N/A | (57,687 | ) | ||||||

| Total |

$ | 968,254 | 20 | % | $ | 195,346 | ||||

Tax Ownership Change

During the third quarter of 2009, we exchanged $1.7 billion principal amount of our interest-bearing debt for an equal principal amount of non-interest-bearing convertible debentures. Subsequent to the Debt Exchange, $592.3 million debentures were converted into 572.2 million shares of common stock during the quarter ended September 30, 2009. As a result of these conversions, we believe we experienced a tax ownership change during the third quarter of 2009.

As of September 30, 2009, we have federal net operating losses (“NOLs”) available to carry forward of approximately $1.6 billion. Section 382 of the Internal Revenue Code of 1986, as amended, imposes restrictions on the use of a corporation’s NOLs, certain recognized built-in losses and other carryovers after an “ownership change” occurs. Section 382 rules governing when a change in ownership occurs are complex and subject to interpretation; however, an ownership change generally occurs when there has been a cumulative change in the stock ownership of a corporation by certain “5% shareholders” of more than 50 percentage points over a rolling three-year period.

Section 382 imposes an annual limitation on the amount of post-ownership change taxable income a corporation may offset with pre-ownership change NOLs. In general, the annual limitation is determined by multiplying the value of the corporation’s stock immediately before the ownership change (subject to certain

17

Table of Contents

adjustments) by the applicable long-term tax-exempt rate. Any unused portion of the annual limitation is available for use in future years until such NOLs are scheduled to expire (in general, our NOLs may be carried forward 20 years). In addition, the limitation may, under certain circumstances, be decreased by built-in losses which may be present with respect to assets held at the time of the ownership change that are recognized in the five-year period (one-year for loans) after the ownership change. The use of NOLs arising after the date of an ownership change would not be affected unless a corporation experienced an additional ownership change in a future period.

We believe the tax ownership change will extend the period of time it will take to fully utilize our pre-ownership change NOLs, but will not limit the total amount of pre-ownership change NOLs we can utilize. Our preliminary estimate is that we will be subject to an overall annual limitation on the use of our pre-ownership change NOLs of approximately $111 million; however, this amount is subject to change in future periods as we finalize the tax change of control analysis. Since the statutory carry forward period for our overall pre-ownership change NOLs, which are approximately $1.6 billion, is 20 years (the majority of which expire in 19 years), we believe we will be able to fully utilize these NOLs in future periods.

Our ability to utilize the pre-ownership change NOLs is dependent on our ability to generate sufficient taxable income over the duration of the carry forward periods and will not be impacted by our ability or inability to generate taxable income in an individual year.

Valuation Allowance

During the three and nine months ended September 30, 2009, we did not provide for a valuation allowance against our federal deferred tax assets. We are required to establish a valuation allowance for deferred tax assets and record a charge to income if we determine, based on available evidence at the time the determination is made, that it is more likely than not that some portion or all of the deferred tax assets will not be realized. If we did conclude that a valuation allowance was required, the resulting loss would have a material adverse effect on our results of operations and financial condition.

We did not establish a valuation allowance against our federal deferred tax assets as of September 30, 2009 as we believe that it is more likely than not that all of these assets will be realized. Our evaluation focused on identifying significant, objective evidence that we will be able to realize our deferred tax assets in the future. We reviewed the estimated future taxable income for our trading and investing and balance sheet management segments separately and determined that our net operating losses in 2007 and 2008 were due solely to the credit losses in our balance sheet management segment. We believe these losses were caused by the crisis in the residential real estate and credit markets which significantly impacted our asset-backed securities and home equity loan portfolios in 2007 and continued to generate credit losses in 2008. We estimate that these credit losses will continue in future periods; however, we ceased purchasing asset-backed securities and home equity loans which we believe are the root cause of the majority of these losses. Therefore, while we do expect credit losses to continue in future periods, we do expect these amounts to decline when compared to our credit losses in 2007 and 2008. Our trading and investing segment generated substantial book taxable income for each of the last six years and we estimate that it will continue to generate taxable income in future periods at a level sufficient to generate taxable income for the Company as a whole. We consider this to be significant, objective evidence that we will be able to realize our deferred tax assets in the future.

A key component of our evaluation of the need for a valuation allowance was our level of corporate interest expense, which represents our most significant non-segment related expense. Our estimates of future taxable income included this expense, which reduces the amount of segment income available to utilize our federal deferred tax assets. Therefore, a decrease in this expense in future periods would increase the level of estimated taxable income available to utilize our federal deferred tax assets. As a result of the Debt Exchange, we reduced our annual cash interest payments from approximately $360 million to $160 million. We believe this decline in cash interest payments significantly improves our ability to utilize our federal deferred tax assets in future periods when compared to evaluations in prior periods which did not include this decline in corporate interest payments.

18

Table of Contents

Our analysis of the need for a valuation allowance recognizes that we are in a cumulative book taxable loss position as of the three-year period ended December 31, 2008 and the three and nine months ended September 30, 2009, which is considered significant and objective evidence that we may not be able to realize some portion of our deferred tax assets in the future. However, we believe we are able to rely on our forecasts of future taxable income and overcome the uncertainty created by the cumulative loss position.

The crisis in the residential real estate and credit markets has created significant volatility in our results of operations. This volatility is isolated almost entirely to our balance sheet management segment. Our forecasts for this segment include assumptions regarding our estimate of future expected credit losses, which we believe to be the most variable component of our forecasts of future taxable income. We believe this variability could create a book loss in our overall results for an individual reporting period while not significantly impacting our overall estimate of taxable income over the period in which we expect to realize our deferred tax assets. Conversely, we believe our trading and investing segment will continue to produce a stable stream of income which we believe we can reliably estimate in both individual reporting periods as well as over the period in which we estimate we will realize our deferred tax assets.

In evaluating the need for a valuation allowance, we estimated future taxable income based on management approved forecasts. This process required significant judgment by management about matters that are by nature uncertain. If future events differ significantly from our current forecasts, a valuation allowance may need to be established, which would have a material adverse effect on our results of operations and our financial condition.

19

Table of Contents

Beginning in the first quarter of 2009, we revised our segment financial reporting to reflect the manner in which our chief operating decision maker had begun assessing the Company’s performance and making resource allocation decisions. As a result, we now report our operating results in two segments: 1) “Trading and Investing,” which includes the businesses that were formerly in the “Retail” segment and now includes our market-making business; and 2) “Balance Sheet Management,” which includes the businesses from the former “Institutional” segment, other than the market-making business. Our segment financial information from prior periods has been reclassified in accordance with the new segment financial reporting.

Trading and Investing

The following table summarizes trading and investing financial and key metrics as of and for the three and nine months ended September 30, 2009 and 2008 (dollars in thousands, except for key metrics):

| As of and For the Three Months Ended September 30, |

Variance | As of and For the Nine Months Ended September 30, |

Variance | |||||||||||||||||||||||||||

| 2009 vs. 2008 | 2009 vs. 2008 | |||||||||||||||||||||||||||||

| 2009 | 2008 | Amount | % | 2009 | 2008 | Amount | % | |||||||||||||||||||||||

| Trading and investing segment income: |

||||||||||||||||||||||||||||||

| Net operating interest income |

$ | 206,762 | $ | 217,173 | $ | (10,411 | ) | (5 | )% | $ | 577,337 | $ | 645,374 | $ | (68,037 | ) | (11 | )% | ||||||||||||

| Commissions |

144,533 | 129,459 | 15,074 | 12 | % | 424,222 | 373,252 | 50,970 | 14 | % | ||||||||||||||||||||

| Fees and service charges |

49,723 | 47,908 | 1,815 | 4 | % | 139,788 | 147,296 | (7,508 | ) | (5 | )% | |||||||||||||||||||

| Principal transactions |

24,888 | 20,694 | 4,194 | 20 | % | 65,223 | 59,462 | 5,761 | 10 | % | ||||||||||||||||||||

| Losses on loans and securities, net |

— | (37 | ) | 37 | * | (60 | ) | (21 | ) | (39 | ) | 186 | % | |||||||||||||||||

| Other revenues |

8,466 | 9,316 | (850 | ) | (9 | )% | 26,985 | 29,379 | (2,394 | ) | (8 | )% | ||||||||||||||||||

| Net segment revenue |

434,372 | 424,513 | 9,859 | 2 | % | 1,233,495 | 1,254,742 | (21,247 | ) | (2 | )% | |||||||||||||||||||

| Total segment expense |

231,840 | 248,264 | (16,424 | ) | (7 | )% | 730,718 | 784,282 | (53,564 | ) | (7 | )% | ||||||||||||||||||

| Total trading and investing segment income |

$ | 202,532 | $ | 176,249 | $ | 26,283 | 15 | % | $ | 502,777 | $ | 470,460 | $ | 32,317 | 7 | % | ||||||||||||||

| Key Metrics: |

||||||||||||||||||||||||||||||

| DARTs |

196,413 | 183,691 | 12,722 | 7 | % | 204,143 | 178,814 | 25,329 | 14 | % | ||||||||||||||||||||

| Average commission per trade |