Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - E TRADE FINANCIAL CORP | d262458d8k.htm |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

E*TRADE Financial Corporation

KBW Securities Brokerage & Market Structure Conference

Matthew Audette

Chief Financial Officer

November 30, 2011

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Exhibit 99.1 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Notice to Investors

Safe Harbor Statement

This presentation contains certain projections or other forward-looking

statements regarding future events or the future performance of the

Company. Various factors, including risks and uncertainties referred to in the

10Ks, 10Qs and other reports E*TRADE Financial Corporation periodically

files with the SEC, could cause our actual results to differ materially from

those indicated by our projections or other forward-looking statements.

This presentation also contains disclosure of non-GAAP financial

measures. A reconciliation of these financial measures to the most directly

comparable GAAP financial measures can be found on the investor relations

site at https://investor.etrade.com.

Forward-Looking Statements

The statements contained in this presentation that are forward looking are

based on current expectations that are subject to a number of uncertainties

and risks, and actual results may differ materially. Further information about

these risks and uncertainties can be found in the Company’s annual,

quarterly and current reports on Form 10-K, Form 10-Q and Form

8-K previously filed by E*TRADE Financial Corporation with the SEC

(including information under the caption “Risk Factors”). Any

forward-looking statement included in this release speaks only as of the

date of this communication; the Company disclaims any obligation to update

any information. 2 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Summary of recent strategic review process

3

•

•

Focus on maximizing shareholder value

Focus on maximizing shareholder value

•

•

Comprehensive process conducted from Aug through Nov 2011

Comprehensive process conducted from Aug through Nov 2011

•

A period which experienced a significant negative shift in

macroeconomic dynamics and market sentiment

•

•

Broad range of alternatives contemplated

Broad range of alternatives contemplated

•

From

execution

of

current

strategy

deleverage

/de-risk

Bank

sell Bank

to sale of Company

•

•

Unanimous conclusion of entire Board to continue execution of

Unanimous conclusion of entire Board to continue execution of

current strategy

current strategy

•

Consistent with the recommendation of financial advisors

•

All measures support substantially higher valuation of ETFC

through execution of current plan, than current market would likely

provide in an acquisition scenario

•

•

No sales process initiated

No sales process initiated

•

Conclusion

supported

by

evaluation

of

likely

candidates,

ability

to

pay,

synergies, financing and market considerations |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Summary of recent strategic review process

Provides time to work through credit & interest rate

environment, to realize normalized earnings and

valuation

Opportunity to realize value from strategic

initiatives

Regulatory

restrictions

on

efficient

use

of

capital

Ongoing credit exposure in legacy portfolio

Outcome of exhaustive review

Advantages and Disadvantages of contemplated alternatives

4

Considered in connection with a variety of

Bank deleveraging / de-risking strategies

Crystallizes downside

credit scenario, today

Regulatory and market

concerns regarding

deposit transfer pricing

Current environment

impacting strategic

interest and valuation

Crystallizes downside

credit scenario, today

Limited value for

strategic initiatives

Current environment

impacting strategic

interest and valuation

Potential for “pure play”

broker valuation / capital

structure

Eliminate exposure to

downside credit

scenarios

Realize synergy value

Eliminate exposure to

downside credit

scenarios |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Strategic focus

Improve market position in retail brokerage

Improve market position in retail brokerage

•

Accelerate growth of our customer franchise

•

Continue to enhance the customer experience, improve satisfaction and

retention Accelerate growth of institutional businesses

Accelerate growth of institutional businesses

•

Corporate services group

•

Market making operations

Enhance position in long term investor segment

Enhance position in long term investor segment

•

Expand brand reach for awareness and preference

•

Grow customer share of wallet

Strengthen overall financial and franchise position

Strengthen overall financial and franchise position

•

Strengthen balance sheet and income statement

•

Mitigate credit losses on legacy loan portfolio & enhance risk profile

•

Focus on increasing shareholder value through efficient distribution of

capital 5

•

Strategic partnerships

Optimize value of bank franchise

Optimize value of bank franchise

•

Maximize value of customer deposits

•

Develop strategy to more fully serve the financial needs of our 2.8M brokerage

customers |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Strengthen overall financial position

Ongoing improvement in net income

6

(1) |

Strengthen overall financial position

7

Defined path to improved earnings through current strategy

Should reduce to $0 as capital is efficiently deployed

Should reduce to $0 as legacy portfolio runs off

Spread should improve to 300bps

with normalized rate environment

Servicing costs should reduce to $0 as legacy portfolio runs off

FDIC should reduce by 50% as risk profile improves

Net interest income

$1,236

$1,297

Commissions

$450

$450

Other

$394

$394

Net revenues

$2,080

$2,141

Provision

($512)

$0

Expenses

($1,235)

($1,113)

Operating income

$333

$1,028

Interest & other

($174)

$0

Pre-tax income

$159

$1,028

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

($ M)

Last 12 months

Long-term impact

to current strategy |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Strengthen overall financial position

Improve capital structure

as of 9/30/11

Bank

Parent

Well-

capitalized

threshold

Bank excess

to well-

capitalized

Total capital to

risk-weighted assets

(2)

17.2%

12.5%

10.0%

$1.5B

Tier 1 capital to

risk-weighted assets

(2)

16.0%

11.2%

6.0%

$2.1B

Tier 1 leverage

(2)

8.1%

5.7%

5.0%

$1.3B

Tier 1 common

(3)

--

9.3%

7.0%

--

Bank excess capital / Parent debt

Bank capital generation (last 4 quarters)

8

On average, each $1B of loan portfolio run-off

generates:

$100M of risk-based capital

$60M of Tier 1 capital

Since 2008, Bank has grown excess risk-based

capital by $0.8B, and excess Tier 1 capital by $0.7B

Company is focused on increasing franchise value

and risk profile through efficient distribution of capital

as soon as feasible |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Strengthen overall financial position

Deferred tax asset

9 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Strengthen overall financial position

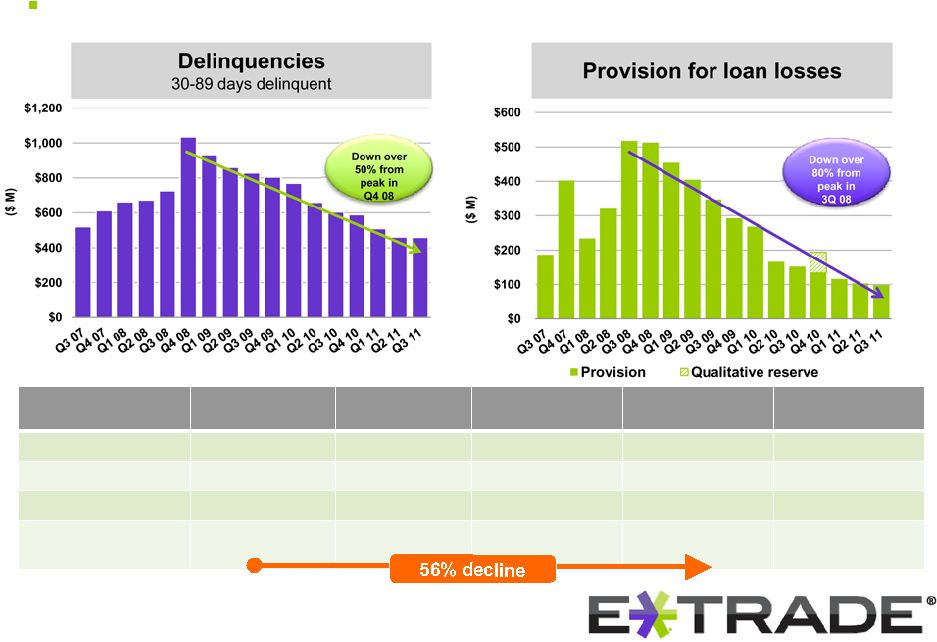

Mitigate credit losses on legacy loan portfolio

($ B)

Loan balance

9/30/07

(4)

Paydowns

(5)

Charge-offs

Loan balance

9/30/11

(4)

(4)

Average age

1-4 Family loans

$17

($9)

($1)

$7

5.2 yrs

Home equity

$12

($3)

($3)

$6

5.5 yrs

Consumer

$3

($2)

($0)

$1

7.6 yrs

TOTAL

$32

($14)

($4)

$14

10 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Strengthen overall financial position

Mitigate credit losses on legacy loan portfolio

Loan modifications (TDRs)

Other loss mitigation

Increasing the use of

servicers that specialize in

troubled assets:

$2.3B, or ~20% of portfolio with

higher quality servicers, with an

additional $1B of loans in the

pipeline

Accelerating the liquidation of

properties in foreclosure through

short sales

$311M of net recoveries from

originators to date (including

$43M in 4Q 2011)

Payment

reduction:

targeting 50% reduction in

borrower payments

Incremental reserving:

Allowance increases to life of

loan from 12 mo loss assumption

for loans that are modified

Improvement to performance

as program evolves:

avg re-delinquency at 12mo:

•

1-4 Family: 28%

•

Home equity: 42%

11 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Favorable mix shift in assets from legacy loans into high quality

margin loans and securities (i.e., government-backed agencies)

Optimize value of bank franchise

Average agency securities

and cash & other

Average loans and

margin receivables

12 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

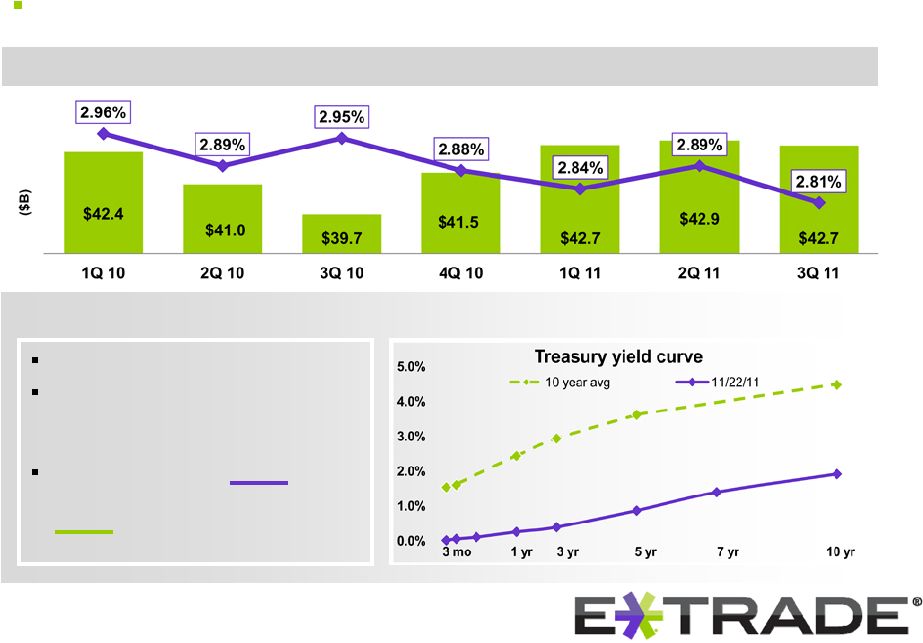

Interest rates are at historic lows

Expect meaningful spread

compression if the current rate

environment persists

Spread could go to 2.50% if

current rate environment persists;

3.00% is more indicative of long-

term spread.

Challenging rate environment & impact on spread

Optimize value of bank franchise

Maximize value of customer deposits

Average interest earning assets & net interest spread

13 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Improve market position in retail brokerage

Accelerate growth of our customer base

14 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Improve market position in retail brokerage

Accelerate growth of our customer base

15 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Improve market position in retail brokerage

A unique, customizable investor experience (Q1 12)

33,000 users in Beta

Adds dynamic content and streamlines

browser experience

Exclusive program for active traders

Customer-centric marketing campaign

Powerful mobile platform for account

and market access anytime, anywhere

Weekly options, portfolio margin

Futures integrated E*TRADE Pro in 2012

Increasing partner network

Rolling out developer kit

Evolving products & platform

Connecting customers for education, investing

ideas

16 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Increasing sales impact

Refocusing advertising to evolve brand

with focus on long term investors

Testing multiple offers; focused on greater

assets and account quality

Improve market position in retail brokerage

Expanding

sales force

Significantly increase sales network from 2010 through 2012

Recently implemented performance management plan that clearly

measures, targets, and rewards performance

Segmentation and targeting of long-term investors for outreach

Expanding

annuitized revenue

Greater focus on mutual funds and managed investment portfolios

Launched unified managed accounts

Continuous improvements in packaging of diversified investment products

17 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

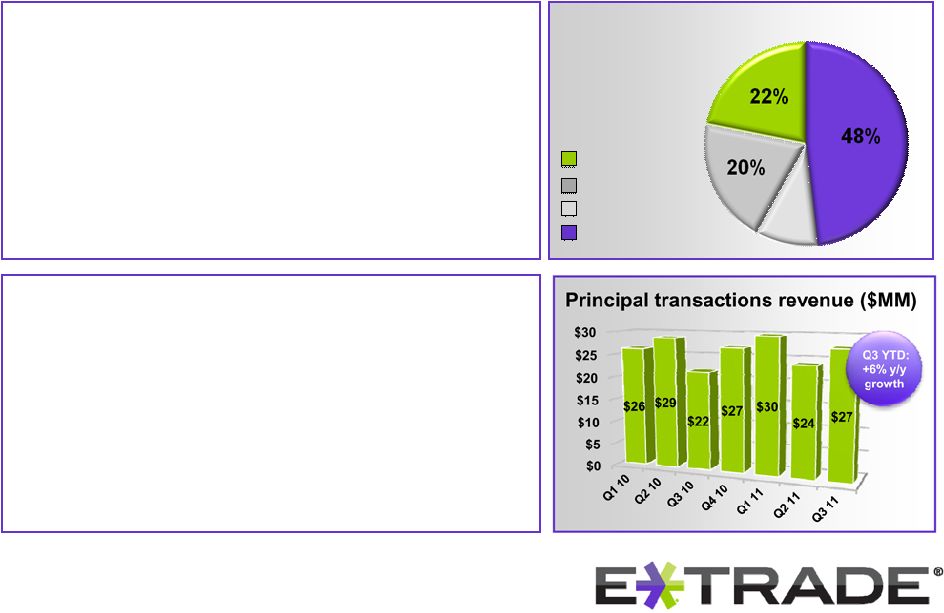

Market making business

•

Leveraging world class technologies and superior

execution capabilities

•

Leading market share in ADRs; growing market share

in National Market Securities

•

Growing base of external customers, comprising 32+

external clients

(20%+ y/y growth), and accounting for

50% of market making revenue

Stock plan administration for public

companies

Corporate services group

Build on market leadership with 1,400+ corporate clients,

representing +20% of S&P 500

•

Foster strategically important channel for new brokerage

accounts, accounting for 25-30% of gross new accounts

•

Increase institutional sales force

•

Healthy pipeline of committed new clients

Accelerate growth of institutional business

E*TRADE

#2 Player

#3 Player

6+ other providers

10%

18 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Segmentation of customers to drive greater share of wallet

Investable assets per

household

(11)

E*TRADE share of

customer wallet

Active Trader

$1,100,000

36%

Investor

$542,000

10%

Total households

(12)

$557,000

12%

Enhance position in long term investor segment

Through segmentation have determined customers best served by proactive engagement

Significant improvement in asset penetration within a year of assigning a

financial consultant Goal is to significantly grow sales network by end of

2012 from 2010 levels Enhance brand reputation as a trusted financial

provider Expand investing and retirement product set, education, resources

and advisory capabilities 19 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Challenges

20 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

21 |

©

2011 E*TRADE Financial Corporation. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

Appendix

22 |