Attached files

| file | filename |

|---|---|

| 8-K - 8-K - McEwen Mining Inc. | a11-28715_18k.htm |

Exhibit 99.1

|

|

|

October 27, 2011 |

NEWS RELEASE

NEW GOLD-SILVER DISCOVERY AT THE EL GALLO COMPLEX

TORONTO, ONTARIO (October 27, 2011) US GOLD CORPORATION (NYSE: UXG) (TSX: UXG) is pleased to announce that exploration drilling within the El Gallo Complex, located in Sinaloa State, Mexico, has intersected significant gold and silver mineralization at the San Dimas prospect. To date, results have been received from 7 holes. Highlights are shown below, with remaining results contained in Table 1. An additional 7 holes have been completed and assays are pending.

Exploration Drill Hole Highlights

SDX-02: 1.61 gpt gold, 81 gpt silver over 18.5 meters (3.23 gpt gold eq. over 18.5 meters*)

Including: 4.73 gpt gold, 292.1gpt silver over 3.9 meters (10.57 gpt gold eq. over 3.9 meters)

Starting 40 meters below surface

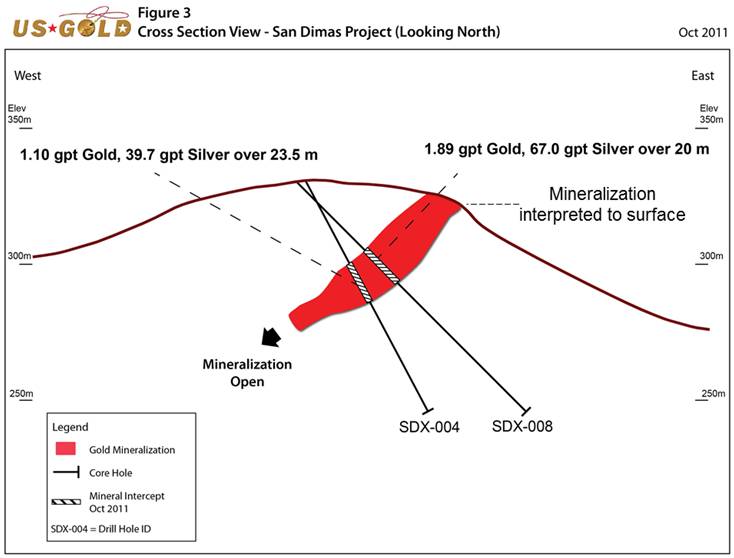

SDX-04: 1.10 gpt gold, 39.7 gpt silver over 23.5 meters (1.89 gpt gold eq. over 23.5 meters)

Including: 8.71 gpt gold, 285.6 gpt silver over 1.4 meters (14.42 gpt gold eq. over 1.4 meters)

Starting 25 meters below surface

SDX-08: 1.89 gpt gold, 67.0 gpt silver over 20.0 meters (3.23 gpt gold eq. over 20.0 meters)

Including: 3.14 gpt gold, 110.4 gpt silver over 9.3 meters (5.35 gpt gold eq. over 9.3 meters)

Starting 31 meters below surface

*Gold:Silver ratio = 1:50

“The first series of holes from San Dimas has returned significant near surface intersections of gold and silver mineralization. In addition, the discovery is close to US Gold’s planned production facilities, increasing San Dimas’ possible economic significance,” stated Rob McEwen, Chairman and CEO.

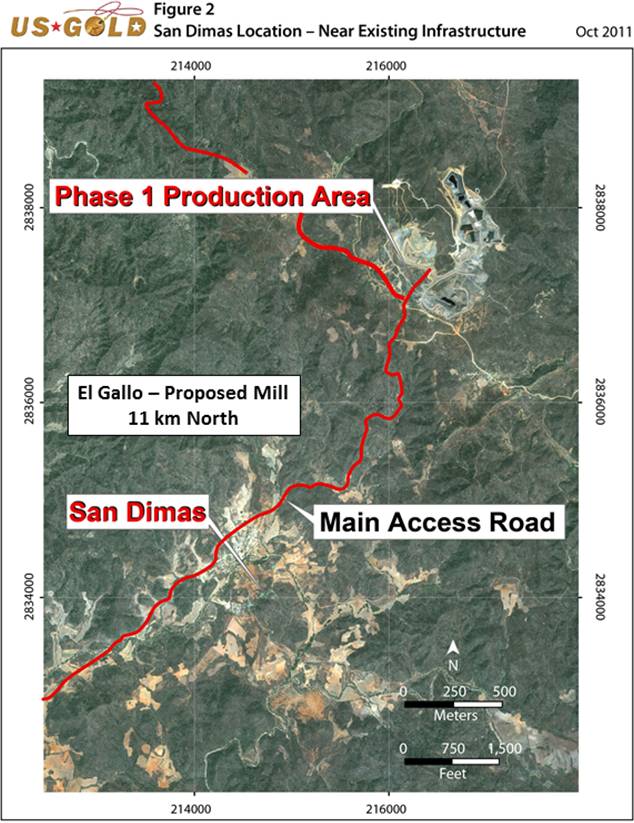

US Gold believes the results are important for several reasons: 1) the gold grades and widths are comparable to the zones that will be mined during Phase 1. In addition, the silver grades are considerably higher, 2) the prospect is near infrastructure, located 11 km from the proposed mill site at El Gallo. It is located immediately south of the main access road (Fig. 1 & 2) and, 3) the mineralization is shallow and amenable to open pit mining.

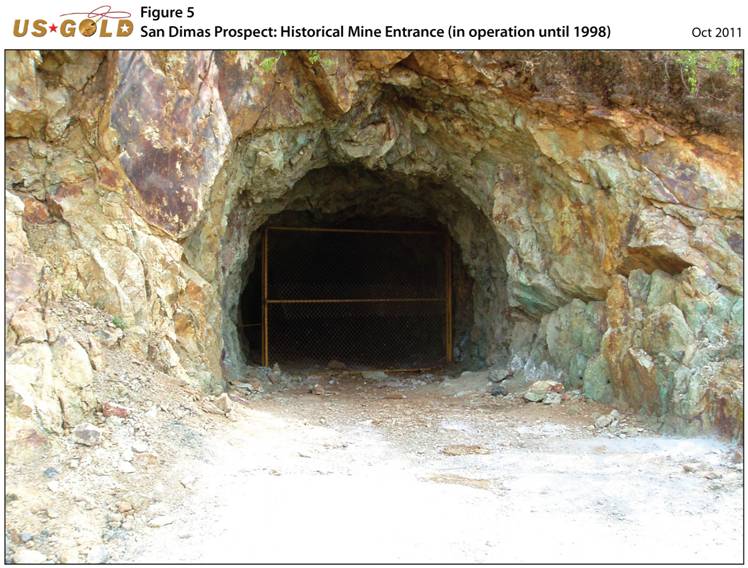

The San Dimas prospect is a former producing property that operated on a small scale until 1998 (Fig. 4 & 5). Excellent potential remains within the immediate area for additional targets. An extensive reconnaissance exploration program, consisting of percussion drilling, an airborne magnetic survey, soil sampling and detailed prospecting and sampling is being undertaken south of San Dimas.

One core drill is currently operating at San Dimas in order to extend the known mineralization. A series of metallurgical tests are being planned to determine the optimum process method.

PHASE 1 MINING SCHEDULED FOR Q2 2012

Phase 1 mining at the El Gallo Complex is expected to commence during the second quarter 2012. The El Gallo Complex includes the El Gallo and Palmarito silver deposits and the Magistral gold deposits, which are all located within a 13 km (8 mile) radius. Phase 1 will focus on the permitted gold deposits and is expected to produce 30,000 ounces of gold per year after initial ramp up. Capital costs have been estimated at $15 million and the projected cash flow will help fund Phase 2, which is forecasted to produce an additional 5 million ounces of silver per year, beginning in 2014. Readers should note that mineral resources that are not classified as mineral reserves do not have demonstrated economic viability.

COMMENTARY ON ARGENTINIAN DECREE

US Gold has learned that yesterday the government of Argentina announced a change to a 2004 decree which had previously exempted the mining industry from a requirement to repatriate revenues from exports. As further information becomes available, we will evaluate what impact this may have on the combined US Gold/Minera Andes entity (McEwen Mining). US Gold will keep its shareholders apprised as more information becomes available.

ABOUT US GOLD (www.usgold.com)

US Gold’s objective is to qualify for inclusion in the S&P 500 by 2015. US Gold explores for gold and silver in the Americas and is advancing its El Gallo Complex in Mexico and its Gold Bar Project in Nevada towards production. US Gold’s shares are listed on the NYSE and the TSX under the symbol UXG, trading 2.5 million shares daily during the past twelve months. US Gold’s shares are included in S&P/TSX and Russell indices and Van Eck’s Junior Gold Miners ETF. Rob McEwen, Chairman and CEO, owns 20% of the shares of US Gold. On June 14, 2011 the Company announced that Mr. McEwen proposed to combine the Company with Minera Andes to create a high growth, low-cost, mid-tier silver producer operating in the Americas. Each Minera Andes shareholder would receive 0.45 of a US Gold share for every Minera Andes share held.

Technical Information

This news release has been viewed and approved by John Read, CPG, US Gold’s consulting geologist, who is a Qualified Person as defined by National Instrument 43-101 and is responsible for program design and quality control of exploration undertaken by the Company at its Mexican exploration properties.

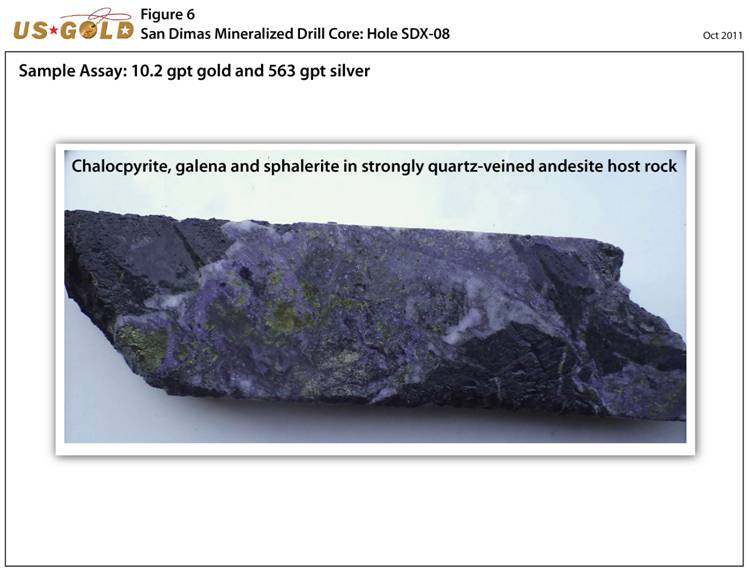

Samples from the core drilling were split on-site at the Company’s El Gallo Complex. One quarter to one half of the split drill core is shipped to ALS Chemex for sample preparation and analysis by 4-acid digestion with ICP determination for silver and fire assay for gold. Samples returning greater than 1500 ppm silver or 10 ppm gold were re-analyzed using gravimetric fire assay. Standards and blanks were inserted every 20 samples.

All holes were drilled with HQ bits and reduced to NTW where required. Samples were taken based on lithologic and/or mineralized intervals and vary in length. The true width of the mineral zone has not been determined.

For additional information about the El Gallo Complex see the “Preliminary Economic Assessment for the El Gallo District, Sinaloa State Mexico” dated February 11, 2011 and prepared by Paul Gates, PE, Richard Addison, PE, Aaron McMahon, PG of Pincock Allen & Holt of Denver, Colorado (“El Gallo PEA”). All three individuals are Qualified Persons as defined by NI 43-101 and are independent of US Gold Corporation as defined in Section 1.4 of NI 43-101 and Section 3.5 of Companion Policy 43-101CP. Mr. McMahon verified the mineral resource data contained in the El Gallo PEA by conducting a site visit, which included verifying drill hole locations and survey data, reviewing sampling handling, data collection procedures, partial audit of the assay database, review of the QA/QC data and analysis of core recovery and drill logs and their relations to assay values. The El Gallo PEA is available on SEDAR (www.sedar.com).

Cautionary Note to US Investors

US Gold (including in its preparation of the El Gallo PEA) prepares its resource estimates in accordance with standards of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in Canadian National Instrument 43-101 (NI 43-101). These standards are different from the standards generally permitted in reports filed with the SEC. Under NI 43-101, US Gold reports measured, indicated and inferred resources, measurements which are generally not permitted in filings made with the SEC. The estimation of measured resources and indicated resources involve greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that any part of measured or indicated resources will ever be converted into economically mineable reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources.

Canadian regulations permit the disclosure of resources in terms of “contained ounces”; however, the SEC only permits issuers to report “mineralized material” in tonnage and grade without reference to contained ounces. Under U.S. regulations the tonnage and grade described herein under the “measured” and “indicated” categories would be characterized as mineralized material. The disclosure herein is being made by US Gold to provide a means of comparing its project to those of other companies in the mining industry, many of which are Canadian and report pursuant to NI 43-101, and to comply with applicable disclosure requirements. U.S. investors should be aware that the issuer has no “reserves” as defined by Guide 7 and are cautioned not to assume that any part or all of the potential target mineral resources will ever be confirmed or converted into Guide 7 compliant “reserves”.

Forward Looking Statement

Certain statements contained herein and subsequent oral statements made by and on behalf of the Company may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may be identified by words such as “intends,” “anticipates,” “believes,” “expects” and “hopes” and include, without limitation, statements regarding the Company’s results of exploration, plan of business operations, potential contractual arrangements, receipt of working capital, anticipated revenues and related expenditures. Factors that could cause actual results to differ materially include, among others, those set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010 and other filings with the Securities and Exchange Commission, under the caption “Risk Factors”. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking statements. Except as otherwise required by applicable securities statutes or regulations, the Company disclaims any intent or obligation to update publicly these forward looking statements, whether as a result of new information, future events or otherwise.

|

For further information contact: |

|

|

|

|

|

|

|

Jenya Mescheryakova Investor Relations Tel: (647) 258-0395 Toll Free: (866) 441-0690 Fax: (647) 258-0408 |

|

Mailing Address 181 Bay Street Bay Wellington Tower Suite 4750, P.O. Box 792 Toronto, ON M5J 2T3 E-mail: info@usgold.com |

|

Table 1. Drill Results: Core Holes Assays |

|

October 2011 |

Metric Units

|

Hole # |

|

Gold |

|

Silver |

|

Gold Eq.* |

|

Length |

|

From |

|

Azimuth |

|

Dip |

|

Northing |

|

Easting |

|

San Dimas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-001** |

|

0.51 |

|

46.8 |

|

1.45 |

|

14.3 |

|

9.8 |

|

50° |

|

-50° |

|

214743 |

|

2834001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-002** |

|

1.61 |

|

81.0 |

|

3.23 |

|

18.5 |

|

40.6 |

|

50° |

|

-75° |

|

214771 |

|

2833953 |

|

Including |

|

4.73 |

|

292.1 |

|

10.57 |

|

3.9 |

|

55.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-003** |

|

0.79 |

|

18.5 |

|

1.16 |

|

1.5 |

|

48.8 |

|

50° |

|

-45° |

|

214717 |

|

2833961 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-004 |

|

1.10 |

|

39.7 |

|

1.89 |

|

23.5 |

|

26.7 |

|

50° |

|

-65° |

|

214792 |

|

2833940 |

|

Including |

|

8.71 |

|

285.6 |

|

14.42 |

|

1.4 |

|

32.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-005 |

|

0.77 |

|

7.4 |

|

0.92 |

|

6.9 |

|

34.3 |

|

50° |

|

-60° |

|

214798 |

|

2833909 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-007 |

|

0.42 |

|

13.3 |

|

0.69 |

|

1.0 |

|

13.0 |

|

50° |

|

-55° |

|

214844 |

|

2833831 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-008** |

|

1.89 |

|

67.0 |

|

3.23 |

|

20.0 |

|

31.0 |

|

50° |

|

-45° |

|

214791 |

|

2833940 |

|

Including |

|

3.14 |

|

110.4 |

|

5.35 |

|

9.3 |

|

34.3 |

|

|

|

|

|

|

|

|

* Gold:Silver ratio = 1:50

**SDX-001 includes 3 m of open stope, SDX-002 includes 3 m of open stope, SDX-003 includes 3 m of open stop and SDX-004 includes 2 m of open stope

Imperial Units

|

Hole # |

|

Gold |

|

Silver |

|

Gold Eq.* |

|

Length |

|

From |

|

Azimuth |

|

Dip |

|

Northing |

|

Easting |

|

San Dimas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-001** |

|

0.015 |

|

1.4 |

|

0.042 |

|

46.9 |

|

32.2 |

|

50° |

|

-50° |

|

214743 |

|

2834001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-002** |

|

0.047 |

|

2.4 |

|

0.094 |

|

60.7 |

|

133.2 |

|

50° |

|

-75° |

|

214771 |

|

2833953 |

|

Including |

|

0.138 |

|

8.5 |

|

0.308 |

|

12.8 |

|

181.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-003** |

|

0.023 |

|

0.5 |

|

0.034 |

|

4.9 |

|

160.1 |

|

50° |

|

-45° |

|

214717 |

|

2833961 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-004 |

|

0.032 |

|

1.2 |

|

0.055 |

|

77.1 |

|

87.6 |

|

50° |

|

-65° |

|

214792 |

|

2833940 |

|

Including |

|

0.254 |

|

8.3 |

|

0.421 |

|

4.6 |

|

107.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-005 |

|

0.022 |

|

0.2 |

|

0.027 |

|

22.6 |

|

112.5 |

|

50° |

|

-60° |

|

214798 |

|

2833909 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-007 |

|

0.012 |

|

0.4 |

|

0.020 |

|

3.3 |

|

42.7 |

|

50° |

|

-55° |

|

214844 |

|

2833831 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDX-008** |

|

0.055 |

|

2.0 |

|

0.094 |

|

65.6 |

|

101.7 |

|

50° |

|

-45° |

|

214791 |

|

2833940 |

|

Including |

|

0.091 |

|

3.2 |

|

0.156 |

|

30.5 |

|

112.5 |

|

|

|

|

|

|

|

|

* Gold:Silver ratio = 1:50

**SDX-001 includes 9.8 ft of open stope, SDX-002 includes 9.8 ft of open stope, SDX-003 includes 9.8 ft of open stop and SDX-004 includes 6.6 ft of open stope