Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | d8k.htm |

| EX-99.1 - PRESS RELEASE DATED AUGUST 11, 2011 - BROADRIDGE FINANCIAL SOLUTIONS, INC. | dex991.htm |

©

2011 Broadridge Financial Solutions, Inc.

Broadridge and the Broadridge logo are registered trademarks of Broadridge

Financial Solutions, Inc. August 11, 2011

Earnings Webcast & Conference Call

Fourth Quarter and Fiscal Year 2011

Broadridge Financial Solutions, Inc.

Exhibit 99.2 |

1

Forward-Looking Statements and Non-GAAP Measures

This

presentation

and

other

written

or

oral

statements

made

from

time

to

time

by

representatives

of

Broadridge

may

contain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995. Statements that are not historical in nature, and which may be

identified by the use of words like “expects,”

“assumes,”

“projects,”

“anticipates,”

“estimates,”

“we believe,”

“could be”

and other words of similar meaning, are

forward-looking

statements.

In

particular,

information

appearing

in

the

“Fiscal

Year

2012

Financial

Guidance”

section and statements about our fiscal years 2012 and 2013 performance are

forward-looking statements. These statements are based on

management’s expectations and assumptions and are subject to risks and uncertainties

that may cause actual results to differ materially from those expressed.

These risks and uncertainties include those

risk

factors

discussed

in

Part

I,

“Item

1A.

Risk

Factors”

of

our

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended June

30, 2011 (the “2011 Annual Report”), as they may be updated in any

future reports filed with the Securities and Exchange Commission. All

forward-looking statements speak only as of the date of this

presentation and are expressly qualified in their entirety by reference to the

factors discussed in the 2011 Annual Report.

These

risks

include:

the

success

of

Broadridge

in

retaining

and

selling

additional

services

to

its

existing

clients

and

in

obtaining

new

clients;

Broadridge’s reliance on a relatively small number of clients, the continued

financial

health

of

those

clients,

and

the

continued

use

by

such

clients

of

Broadridge’s

services

with

favorable

pricing

terms;

changes

in

laws

and

regulations

affecting

the

investor

communication

services

provided

by

Broadridge; declines in participation and activity in the securities markets;

overall market and economic conditions and

their

impact

on

the

securities

markets;

any

material

breach

of

Broadridge

security

affecting

its

clients’

customer

information;

the

failure

of Broadridge’s outsourced data center services provider to provide the

anticipated levels of service; any significant slowdown or failure of

Broadridge’s systems or error in the performance of Broadridge’s

services;

Broadridge’s

failure

to

keep

pace

with

changes

in

technology

and

demands

of

its

clients;

Broadridge’s

ability to

attract

and

retain key personnel; the impact of new acquisitions and divestitures; and

competitive conditions.

Broadridge

disclaims any obligation to update or revise forward-looking statements that

may be made to reflect events or circumstances that arise after the date

made or to reflect the occurrence of unanticipated events, other than as

required by law. This presentation may include certain Non-GAAP

(generally accepted accounting principles) financial measures in

describing

Broadridge’s

performance.

Management

believes

that

such

Non-GAAP

measures,

when

presented

in

conjunction with comparable GAAP measures provide investors a more complete

understanding of Broadridge’s underlying operational results.

These Non-GAAP measures are indicators that management uses to provide

additional meaningful comparisons between current results and prior reported

results, and as a basis for planning and forecasting for future periods.

These measures should be considered in addition to and not a substitute for the

measures of financial performance prepared in accordance with GAAP. The

reconciliations of such measures to the comparable GAAP figures are included

in this presentation. |

2

Today’s Agenda

Opening Remarks and Key Topics

Rich Daly, CEO

Fourth Quarter and Fiscal Year 2011

Dan Sheldon, CFO

Results and Fiscal Year 2012 Guidance

Summary

Rich Daly, CEO

Q&A

Rich Daly, CEO

Dan Sheldon, CFO

Rick Rodick, VP Investor Relations

Closing Remarks

Rich Daly, CEO |

3

Opening Remarks

Key Topics:

Financial Highlights

Fiscal Year 2012 Guidance

Closed Sales Performance

Acquisition Update |

4

Fiscal Year 2011 Financial Highlights

Financial performance for the quarter in line with expectations

Revenues for the year declined 2%

However

recurring

revenues

were

up

12%

($143M)

Full year Non-GAAP $1.37 and GAAP $1.34 diluted earnings per

share from continuing operations

Down

from

prior

year

primarily

due

to

the

decline

in

event-driven

revenues

from

last

year’s

unprecedented

high

levels

to

historical

low

levels

in

fiscal

year

2011

Repurchased 8.7M shares under its stock repurchase plans

during the fiscal year

Approximately

7.6M

shares

remain

available

under

the

Company’s

current

stock

repurchase

plan |

5

Fiscal Year 2012 Guidance

Fiscal year 2012 guidance

Revenue growth 8-10%

Non-GAAP fully diluted earnings per share from continuing

operations of $1.50-1.60, excluding IBM migration costs,

representing 9-17% growth

Free cash flow of $225M (mid-point of range), excluding IBM

migration costs

Increasing dividend by 7% to $0.64/share annualized

•

Increased the dividend amount 7% in FY11

•

Doubled the dividend amount in FY10

•

Increased the dividend amount 17% in FY09 |

6

Closed Sales Performance

Total closed sales for the year were $134M

Recurring revenue closed sales were $113M for the year

SPS full year closed sales of $50M were up 25% as

compared with the prior year primarily due to >$5M deals

ICS full year recurring revenue closed sales of $63M were

down ~$15M or 19%; however, last year’s results included

Morgan Stanley Smith Barney (MSSB) contract at ~$40M

While recurring revenue closed sales results are down from the

prior year, we are confident about our sales opportunities

especially in deals >$5M in both segments

Fiscal year 2012 recurring revenue closed sales guidance of

$110 -

$150M |

7

Acquisition Update

During

the

last

three

years

we

have

made

five

$15M+

acquisitions

in

which we spent approximately $370M

Three of the acquisitions occurred this year at a cost of approximately

$295M

The acquisitions contributed approximately $109M to revenue, $17M to

EBITDA and $3M to EBT in fiscal year 2011

We anticipate that the acquisitions will contribute approximately $182M to

revenue, $43M to EBITDA and $22M to EBT in fiscal year 2012

Our

recent

acquisitions

of

Matrix,

NewRiver

and

Forefield

are

exceeding their business cases, while Access Data and City Networks

are slightly behind

Our acquisition strategy

Accretive

to

growth,

margin

and

earnings

>20% IRR

Focused on “tuck-in”

sized businesses

Execution capacity |

8

IBM Data Center Migration –

Q4 FY11, FY12 & Beyond

Are in the final stages of planning with IBM

Still expecting ~$25M in average annual savings over the contract

service life which includes the impact of deferred cost amortization

Total BR migration costs currently estimated at ~$95M

BR cost of ~$30M being expensed in FY12

IBM Data Center Build-out costs of ~$55M being deferred and amortized

over 10-year service life of contract starting in FY13

IBM transition costs of ~$10M being “pulled forward”

and expensed in FY11

and FY12 instead of deferring and amortizing over 10-year service life of

contract

due

to

change

in

expected

accounting

treatment

–

no

impact

on

cash flow estimates

We expect to finalize the migration timing and cost estimates with IBM

sometime in Q1 FY12 |

9

Revenue Growth Drivers

Revenue from closed sales 60% carryover from FY10 and FY11. Conversions in process

Client revenue retention rate of 99% (no known large client losses)

Internal

growth

(Trades/Stock

Records)

–

Trade

volumes

primary

focus

–

flat

to

mid-high

single

digit

growth

Acquisitions represents base carryover only (new sales included in closed sales)

Slow recovery in event-driven. Although expecting growth, it’s not reflected in

guidance Distribution now includes pass-through 12b-1 fees from Matrix acquisition

Margin excluding IBM migration costs (Non-GAAP) higher due to operating scale

Historical CAGR

Actual

Forecast

(FY05-FY10)

FY11

FY12

6%

Total Revenue Growth

(2)%

8-10%

4%

Closed Sales

(Recurring)

3%

4-5%

(2)%

Client

Losses

(1)%

(1)%

2%

Net New Business

2%

3-4%

3%

Internal Growth

(a)

1%

0-1%

0%

Acquisitions

4%

~2%

5%

Total Recurring

7%

5-7%

1%

Event-Driven

(b)

(6)%

0%

0%

Distribution

(c)

(4)%

~3%

0%

FX/Other

1%

0%

EBIT Margin

(Non-GAAP IBM)

13.1%

13.8-14.4%

(a) Internal Growth includes SPS Equity & Fixed Income Trades, ICS Equity & Mutual Fund Stock

Record Growth, Transaction Reporting and Time & Materials (b) Event-Driven includes ICS

Proxy Contest/Specials, Mutual Fund Proxy and Marketing Communications Fulfillment (c)

Distribution include pass-through fees from Matrix |

10

Segment Results & Forecast –

Investor Communication Solutions

FY11 revenue and margins in line with prior guidance

FY12 revenue approaches double digit growth despite dormant event-driven

activity environment Recurring

revenue

sales

of

$65-85M

and

the

carryover

effect

of

FY11

closed

sales

expected

to

contribute 2 to 3 points (50% carryover)

Matrix and other acquisitions projected to contribute 2 points

Exceptional client retention levels of 99%

Stock record growth driving 1 point

•

Mutual fund interim position growth planned at 9% consistent with FY11

•

Equity position growth flat to 1%

Event-Driven revenues -

virtually flat to FY11 and any upside or downside not in guidance. Expect

same experience as in FY02-04 where year after the significant downturn

almost no growth and then picked up significantly for years

thereafter Distribution revenues contribute 4 points due to recurring

interim growth and Matrix 12b-1 mutual fund shareholder services

fees Margins: Expect 120-160 bps of margin expansion from higher

fee revenue and cost containment efforts Revenue/Growth

EBIT/Growth

(Non-GAAP)

Margin/Growth

(Non-GAAP)

FY11:

$1,559M/ (7)%

$213M/ (22)%

13.7%/ (260) bps

FY12:

$1,707 to 1,718M / 9 to 10%

$254 to 263M / 19 to 23%

14.9

to

15.3%

/

120

to

160

bps |

11

11

Segment

Results

&

Forecast

–

Securities

Processing

Solutions

FY11 growth primarily due to on-boarding acquisition of City Networks and

Penson City Networks added $22M in revenues and hit its anniversary date in

Q4 Penson added $27M in revenues and conversion is running slower than

expected Sales contributed 4 points to growth but were offset by client

losses of 3 points (Bank of America Merrill Lynch client loss of $8M)

Margins

without

Penson

and

City

Networks

improved

to

20%,

up

from

19%

in

FY10

on

a

comparable

basis

FY12 growth primarily due to:

New sales adding approximately 6 points of growth (4-5 points

technology) Client

revenue

retention

rate

remaining

around

98%

-

no

known

large

client

losses

Penson

US

conversion

now

expected

to

be

completed

in

Q2

with

the

Outsourcing

business

expected

to be profitable as we exit FY12

Trade volume growth driving high and low end of revenue and margin guidance

Margins improving to an expected Q4 exit rate of around 21% including acquisitions

Revenue/Growth

EBIT/Growth

(Non-GAAP)

Margin/Growth

(Non-GAAP)

FY11:

$594M / +11%

$87M / (12)%

14.7% / (380) bps

FY12:

$631 to 647M / +6 to +9%

$99 to 115M / +13 to +31%

15.7 to 17.7% / +100 to +300 bps

Entered into non-binding letter of intent with Penson seeking to expand the

business relationship |

12

Broadridge -

FY12 Continuing Operations Financial Guidance Summary

Revenue growth in the range of 8-10%

Recurring closed sales forecast for the year at $110-150M

Earnings before interest and taxes (excluding IBM migration costs) growth of

13- 20% (Non-GAAP) and margin of 13.8-14.4% (Non-GAAP)

Diluted Earnings Per Share (excluding IBM migration costs) in the range of

$1.50- 1.60 (Non-GAAP). Diluted Earnings Per Share in the range of

$1.34-1.44 (GAAP) Diluted weighted-average outstanding shares of

~128M Free cash flow (Non-GAAP) mid-point excluding IBM migration

costs of approximately $225M

Revolving credit facility and term loan mature on March 29, 2012

and are

expected to be renewed in the first quarter of FY12

Dividend increased ~7% from $0.60 to $0.64 per share on annual basis

Guidance does not take into consideration the effect of any future acquisitions,

additional debt and/or share repurchases in excess of the repurchases needed

to be at our 128M diluted weighted-average outstanding shares

guidance |

13

Broadridge

–

Exiting FY12 and moving into FY13

FY12 Non-GAAP Diluted EPS guidance $1.50-1.60

Key initiatives expected to deliver on annualized basis:

IBM -

~$0.12

MSSB/Restructuring -

~$0.06

Assuming event-driven revenues begin to return to “historic normalized

levels”

-

Fee revenues FY12-13 increase by $30-60M delivering

~$0.10-0.20

Recurring revenues expected to continue to grow at mid-high single

digits (Recurring revenue closed sales > $110M per year, retention rate

of 99%, benefit from market driven trade volumes and stock record

growth as well as acquisitions) |

14

Transfer Agency

Volly

Global & Emerging products

Outsourcing for BPO

Matrix

Fixed Income

Access Data

SPS Large Global Deals

Summary

Fiscal year 2011 results are not reflective of the value-creation foundation

that has been grown and expanded during the year

Due to the decline in event-driven revenues

However recurring revenues continued to grow

Strong recurring revenue closed sales, second highest in our history

Strong client revenue retention rate of 99%

We have never had better recognition by NYSE and SEC of the value we

provide

We made three very successful acquisitions

Matrix, NewRiver and Forefield

We made excellent progress on our key strategic initiatives

Tangible opportunities make us confident about the future

|

15

Q&A

There are no slides during this portion of the

presentation |

16

Closing Comments

There are no slides during this portion of the

presentation |

17

Appendix

Appendix |

18

Segment Results & Forecast –

Other & Foreign Exchange (FX)

Mmx

FY12 Range

4Q11

FY11

Low

High

Other Fees Revenue

$0M

$0M

$0M

$0M

Other Fees Margin

$0M

$0M

$0M

$0M

Interest Expense, net

$(2)M

$(8)M

$(17)M

$(17)M

Corp. Expenses & Investments including IBM

$(14)M

$(31)M

$(69)M

$(76)M

FX

- P&L

- Revenue

$7M

$14M

$9M

$12M

- EBIT

$4M

$10M

$7M

$9M

- Transaction Activity

$(1)M

$(2)M

$(1)M

$(1)M

Full year run rate in the

$15-20M range, consisting of corporate expenses, excluding M&A activity, IBM migration costs,

and associate related one-time charges

Interest, net: FY11 reflects lower average debt balance, FY12

reflects higher average debt balance and

refinancing of our credit facilities Forward Rates remain consistent through FY12 FX:

Corporate Expenses and Investments excluding IBM migration costs:

FY11 IBM migration expenses “pulled forward” were $6M.

FY12 IBM migration expenses are expected to be ~$33M (includes the remaining ~$4M of

IBM transition costs “pulled forward”)

|

19

Broadridge 4Q and FY11 from Continuing Operations

(a)

FY11 excludes the IBM migration costs of $6M, after-tax $4M, or $0.03 EPS impact.

(b)

Includes impacts of FX P&L Margins and FX Transaction Activity

(c)

FY10 excludes the release of a valuation allowance on a deferred tax asset relating to tax loss

carryforwards of approximately $8M. Including the 1-Time Tax Credit, the FY10 effective tax rate was 34.2%.

(d)

FY10 Full Year Diluted EPS Before 1-Times (Non-GAAP) excludes the release of a valuation

allowance on a deferred tax asset relating to tax loss carryforwards of approximately $8M (gain reflected in Income Taxes) $0.06 impact to EPS. |

20

Broadridge FY12 Guidance from Continuing Operations

(a)

FY11 excludes the IBM migration costs of $6M, after-tax $4M, or $0.03 EPS impact. FY12 Range

Low & High excludes the estimated IBM migration costs of $33M, after-tax $21M, or $0.16 EPS impact.

(b)

Includes impact of FX P&L Margin and FX Transaction Activity |

21

Cash Flow –

FY11 Results and FY12 Forecast

(In millions)

Year Ended

June 2011

Low

High

Free Cash Flow

(Non-GAAP)

:

Net earnings from continuing operations per GAAP

172

$

172

$

184

$

Depreciation and amortization (includes other LT assets)

72

95

100

Stock-based compensation expense

30

31

31

Other

5

(5)

5

Subtotal

279

293

320

Working capital changes

(51)

(30)

-

Long-term assets & liabilities changes

Includes IBM Migration costs of $(6) and ~$(33) for FY11 and FY12,

respectively (38)

(55)

(45)

Net cash flow (used in) provided by continuing operating activities

190

208

275

Cash Flows From Investing Activities

IBM / ITO data center investment

(7)

(15)

(10)

Penson

-

(20)

(15)

Capital expenditures & software purchases

(40)

(65)

(55)

Free cash flow

(b)

143

$

108

$

195

$

Cash Flows From Other Investing and Financing Activities

Acquisitions

(294)

-

-

Stock repurchases net of options proceeds

(174)

-

-

Proceeds from Short-term borrowing, net

200

-

-

Dividends paid

(75)

(78)

(78)

Other (includes Disc Ops)

28

(5)

5

Net change in cash and cash equivalents

(172)

25

122

Cash and cash equivalents, at the beginning of year

413

242

242

Cash and cash equivalents, at the end of period

241

$

267

$

364

$

FY12 Range

(a)

(a)

Guidance does not take into consideration the effect of any future

acquisitions, additional debt and/or share repurchases in excess of the

repurchases needed to achieve our 128 million diluted weighted-average

outstanding shares guidance. (b)

FY12 ranges includes an impact of ~$(73) million due to IBM migration

costs. When added back to the FY12 ranges, free cash flow would

be ~$225 million at the mid-point of its expected range.

Unaudited |

22

Closed Sales to Revenue Contribution

Recurring Closed Sales to Revenue

(A)

($ in millions)

Forecast

Recurring

FY09

(C)

FY10

FY11

(D)

FY12

ICS

$55

$80

$65

$65-85

~ Revenue Contribution Year 1-3

55%

35%

10%

50%

50%

0%

45%

45%

10%

40%

35%

25%

SPS

(B)

$30

$40

$50

$45-65

~ Revenue Contribution Year 1-3

30%

70%

0%

15%

25%

40%

10%

20%

55%

15%

35%

35%

Total RC Closed Sales

(B)

$85

$120

$115

$110-150

~ Revenue Contribution Year 1-3

45%

45%

10%

40%

40%

15%

30%

35%

30%

30%

35%

30%

(B)

SPS Recurring Closed Sales are expected to contribute revenue over a four year

period. (C)

Recurring

Closed

Sales

were

adjusted

down

to

$85M

from

$95M.

The

$10M

difference

relates

to

the

Penson

Canada

deal

that

is

now being reflected as an acquisition.

(D)

ICS Recurring Closed Sales includes approximately $11M related to acquisitions and

$15M classified as internal growth/other. (A)

For

presentation

purposes,

certain

amounts

have

been

rounded

up

to

the

nearest

whole

number. |

23

Revenues and Closed Sales FY05-FY12

(1) Includes reclassification of Pre-sale Fulfillment from

event-driven revenues to recurring revenues. (2)

Includes reclassification of Pre-sale Fulfillment related distribution revenues and Matrix pass-through administrative services from event-driven revenues to recurring revenues.

($ in millions)

FY05-10

Forecast

FY11-12

Recurring Fee Revenues

FY05

FY06

FY07

FY08

FY09

FY10

CAGR

FY11

FY12

Growth Rates

ICS

444

$

513

$

519

$

558

$

583

$

610

$

7%

650

$

$706-715

9-10%

Growth

16%

1%

8%

4%

5%

7%

SPS

459

$

458

$

509

$

515

$

537

$

513

$

2%

522

$

$543-556

4-6%

Growth

0%

11%

1%

4%

-4%

2%

Segment Recurring Fee Revenues

903

$

971

$

1,028

$

1,073

$

1,120

$

1,123

$

4%

1,172

$

$1,249-1,271

7-8%

Growth

7%

6%

4%

4%

0%

4%

Acquisitions

0

$

18

$

28

$

28

$

33

$

45

$

NM*

141

$

~$188

~33%

Total Recurring Fee Revenues

903

$

988

$

1,056

$

1,101

$

1,153

$

1,168

$

5%

1,313

$

$1,435-1,461

9-11%

9%

7%

4%

5%

1%

12%

Event-Driven

128

$

153

$

203

$

200

$

180

$

257

$

15%

135

$

~$140

~4%

Growth

20%

33%

-1%

-10%

43%

-47%

Distribution

649

$

730

$

821

$

808

$

757

$

781

$

4%

704

$

~$765

~9%

Growth

12%

12%

-2%

-6%

3%

-10%

Other/FX

(25)

$

(19)

$

(12)

$

22

$

(17)

$

4

$

NM*

14

$

~$10

NM*

Total BR Revenues

1,656

$

1,853

$

2,068

$

2,131

$

2,072

$

2,209

$

6%

2,166

$

$2,347-2,377

8-10%

Growth

12%

12%

3%

-3%

7%

-2%

Recurring Closed Sales

77

$

92

$

63

$

82

$

95

$

119

$

9%

113

$

$110-150

Growth

19%

-32%

30%

16%

25%

-4%

*NM= Not Meaningful

($ in millions)

FY05-10

Forecast

Event-Driven Fee Revenues

(1)

FY05

FY06

FY07

FY08

FY09

FY10

CAGR

FY11

FY12

Mutual Fund Proxy

51

$

61

$

79

$

92

$

55

$

150

$

24%

39

$

42

$

Mutual Fund Supplemental

39

$

43

$

51

$

49

$

58

$

48

$

4%

44

$

47

$

Contest/ Specials/ Other Communications

38

$

49

$

73

$

59

$

67

$

59

$

9%

52

$

51

$

Total Event-Driven Fee Revenues

128

$

153

$

203

$

200

$

180

$

257

$

15%

135

$

140

$

Growth

20%

33%

-1%

-10%

43%

-47%

Recurring Distribution Revenues

(2)

496

$

562

$

593

$

580

$

567

$

564

$

3%

573

$

~$615

Growth

13%

6%

-2%

-2%

-1%

2%

ED Distribution Revenues

(2)

153

$

169

$

228

$

228

$

190

$

217

$

7%

131

$

~$150

Growth

10%

35%

0%

-17%

14%

-39%

Total Distribution Revenues

649

$

730

$

821

$

808

$

757

$

781

$

4%

704

$

~$765

Growth

12%

12%

-2%

-6%

3%

-10% |

24

Reconciliation of Non-GAAP to GAAP Measures

(a)

Includes impact of FX Transaction Activity

(b)

4Q11 & FY11 excludes the IBM migration costs of $6M, after-tax $4M, or $0.03 EPS impact.

FY12 Range Low & High excludes the IBM migration costs of ~$33M, after-tax ~$21M, or ~$0.16 EPS impact.

(c)

FY10 excludes the 1-Time Tax Credit of $8M, or $0.06 EPS impact.

(a)

Guidance does not take into consideration the effect of any future acquisitions, additional debt

and/or share repurchases in excess of the repurchases needed to achieve our 128 million diluted

weighted-average outstanding shares guidance. (b)

FY12 ranges includes an impact of ~$(73) million due to IBM migration costs. When added

back to the FY12 guidance ranges, free cash flow would be ~$225 million at the mid-point of

its expected range. Unaudited

(In millions)

Free Cash Flow Reconciliation

Year Ended

June 2011

Low

High

Free Cash Flow (Non-GAAP)

:

Net earnings from continuing operations (GAAP)

172

$

172

$

184

$

Depreciation and amortization (includes other LT assets)

72

95

100

Stock-based compensation expense

30

31

31

Other

5

(5)

5

Subtotal

279

293

320

Working capital changes

(51)

(30)

-

Long-term assets & liabilities changes

Includes IBM Migration costs of $(6) and ~$(33) for FY11 and FY12,

respectively (38)

(55)

(45)

Net cash flow (used in) provided by continuing operating activities

190

208

275

Cash Flows From Investing Activities

IBM / ITO data center investment

(7)

(15)

(10)

Penson

-

(20)

(15)

Capital expenditures & software purchases

(40)

(65)

(55)

Free cash flow (b)

143

$

108

$

195

$

FY12 Range

(a)

EBIT Reconciliation

4Q10

4Q11

FY10

FY11

FY12 Range

($ in millions)

Actual

Actual

Actual

Actual

Low

High

EBIT (Non-GAAP / excluding IBM migration costs)

(a) & (b)

$185

$190

$352

$285

$323

$343

Margin %

24.6%

24.4%

15.9%

13.1%

13.8%

14.4%

Interest & Other

($2)

($2)

($10)

($8)

($17)

($17)

Total EBT (Non-GAAP / excluding IBM migration costs)

$183

$188

$342

$276

$306

$326

Margin %

24.3%

24.2%

15.5%

12.7%

13.0%

13.7%

IBM migration costs

-

($6)

-

($6)

($33)

($33)

Total EBT (GAAP)

$183

$181

$342

$270

$273

$293

Margin %

24.3%

23.3%

15.5%

12.4%

11.6%

12.3%

EPS Reconciliation

4Q10

4Q11

FY10

FY11

FY12 Range

Actual

Actual

Actual

Actual

Low

High

Diluted EPS from continuing operations (GAAP)

$0.84

$0.91

$1.62

$1.34

$1.34

$1.44

One-time

recognition

of

a

deferred

tax

asset

-

FY10

-

-

($0.06)

-

IBM migration costs -

FY11 and FY12

-

$0.03

-

$0.03

$0.16

$0.16

Diluted EPS before One-Times (Non-GAAP)

$0.84

$0.94

$1.56

$1.37

$1.50

$1.60

(a)

(b)

(c) |

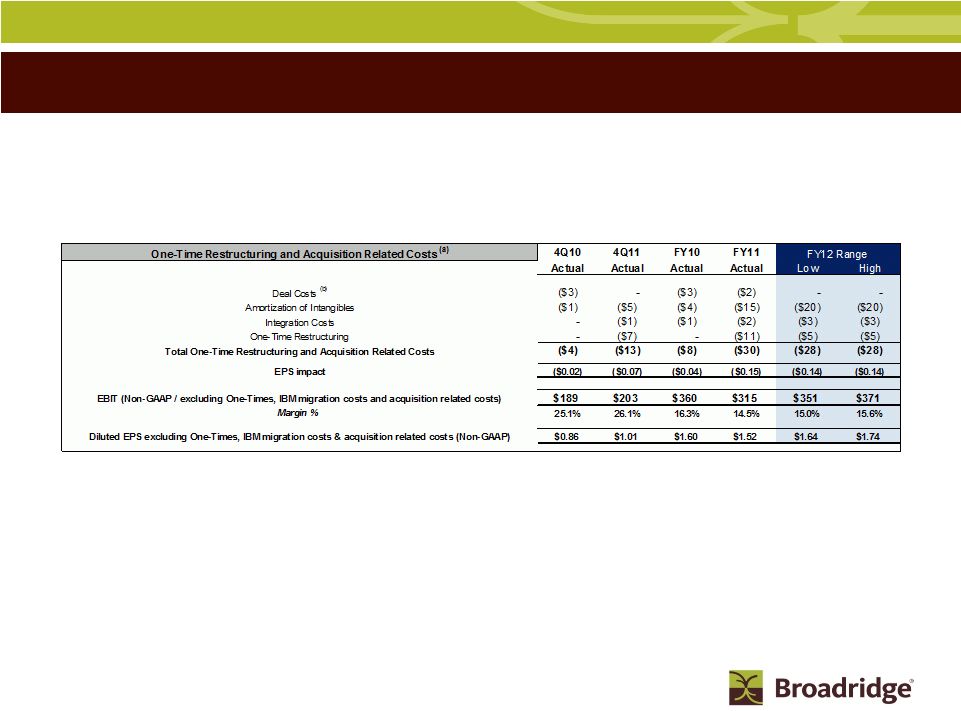

25

One-time

Items

(For

Informational

Purposes

Only)

(a)

(b)

Estimated for Informational Purposes Only. Included are other items that management believes

should be excluded from the GAAP financials when assessing the overall business performance.

Deal Costs include only costs related to closed transactions. |

26

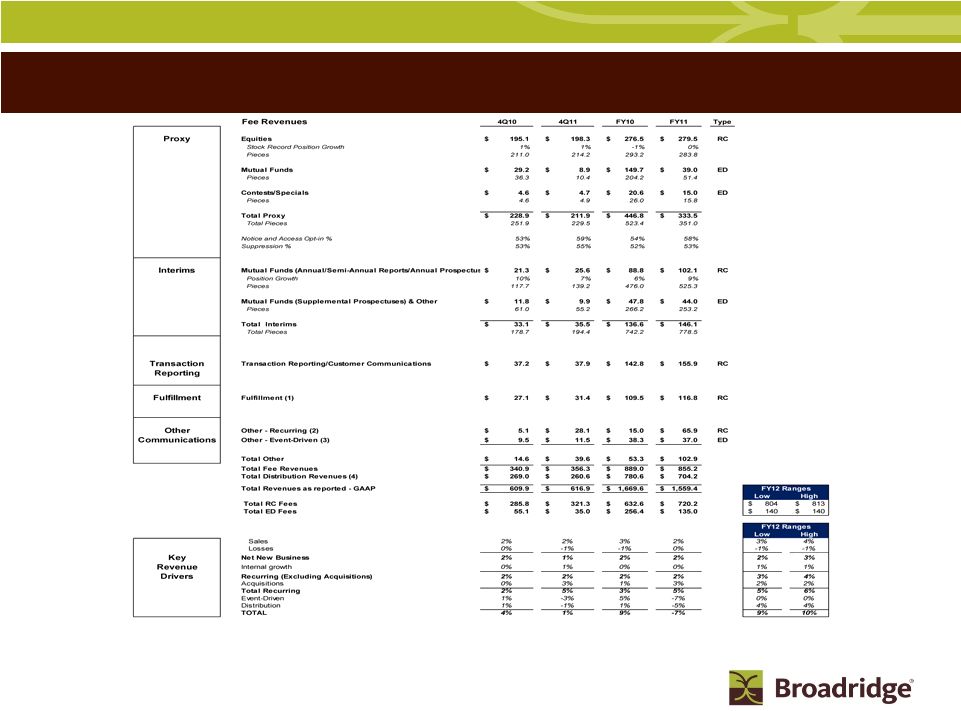

(1) Consolidated Pre-sale and Post-sale Fulfillment and reclassified Pre-sale from

event-driven to recurring revenues. (2) Other Recurring Fee Revenue includes Matrix,

NewRiver, StockTrans, Access Data, Forefield and Tax Reporting. (3) Other

event-driven includes 1.8M pieces for 4Q10 and 1.5M for 4Q11, primarily related to corporate actions. Total other pieces for FY10 were 10.5M and for FY11 were 8.3M.

(4) Total Distribution revenues primarily include pass-through revenues related to the

physical mailing of Proxy and Interims, as well as Matrix administrative services. Note:

Certain prior period amounts have been reclassified to conform with current period presentation

$ in millions

RC= Recurring

ED= Event-Driven

ICS Key Segment Revenue Stats |

27

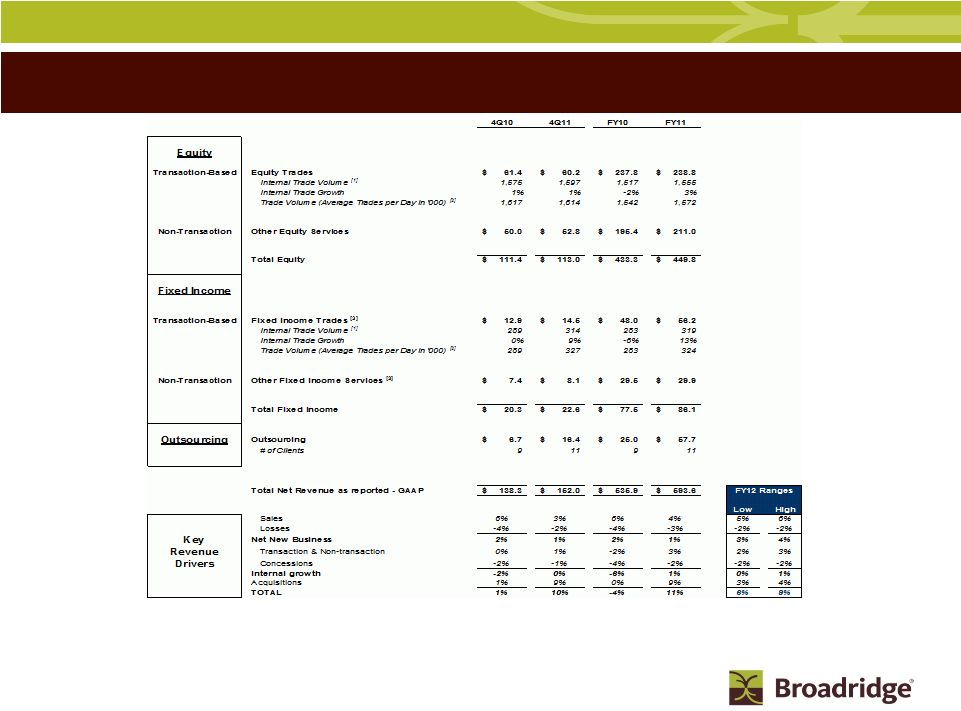

SPS and Outsourcing Key Segment Revenue Stats

All Revenues are Recurring

$ in millions

[1] 4Q10 Internal Trade Volume was previously reported as 1,581 and 287 for Equities and Fixed Income,

respectively. FY10 Internal Trade Volume was previously reported as 1,507 and 269 for

Equities and Fixed Income, respectively. These numbers were adjusted to reflect Losses and

Sales in order to present consistent business for the purpose of calculating internal trade growth.

[2] Equity trade volume adjusted to exclude trades processed under fixed priced contracts.

Management believes excluding this trade volume presents a stronger correlation between trade

volume and Equity trade revenue. [3] Fixed Income FY10 trade revenue reclassified $0.6M

mortgage product revenue to other fixed income services, $1.8M full year. |

28

Broadridge ICS Definitions |

29

Use of Material Contained Herein

The information contained in this presentation is being provided

for your convenience and

information only. This information is accurate as of the date of its initial

presentation. If you plan to use this information for any purpose,

verification of its continued accuracy is your responsibility.

Broadridge assumes no duty to update or revise the information

contained in this presentation. You may reproduce information contained in

this presentation provided you do not alter, edit, or delete any of the

content and provided you identify the source of the information as

Broadridge Financial Solutions, Inc., which owns the copyright.

Financial information presented for periods prior to the March 30, 2007

spin-off of Broadridge from Automatic Data Processing, Inc.

(“ADP”) represents the operations of the brokerage services

business which were operated as part of ADP. Broadridge’s

financial results for periods before the spin-off from ADP may not be

indicative of our future performance and do not necessarily reflect what our

results would have been had Broadridge operated as a separate,

stand-alone entity during the periods presented, including changes in

our operations and capitalization as a result of the spin-off from

ADP.

Broadridge and the Broadridge logo are registered trademarks of Broadridge

Financial Solutions, Inc. |