Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION CFO - SALON MEDIA GROUP INC | ex31-2.htm |

| EX-32.2 - CERTIFICATION CFO - SALON MEDIA GROUP INC | ex32-2.htm |

| EX-31.1 - CERTIFICATION CEO - SALON MEDIA GROUP INC | ex31-1.htm |

| EX-32.1 - CERTIFICATION CEO - SALON MEDIA GROUP INC | ex32-1.htm |

| EX-23.1 - CONSENT OF ACCOUNTING FIRM - SALON MEDIA GROUP INC | ex23-1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2011

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 0-26395

SALON MEDIA GROUP, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

94-3228750

|

|

(State of Incorporation)

|

(IRS Employer Identification No.)

|

101 Spear Street, Suite 203

San Francisco, CA 94105

(Address of principal executive offices)

(415) 645-9200

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 Par Value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [x]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. [ ]

Indicate by check mark whether the registrant is an accelerated filer as defined in Rule 12b-2 of the Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined by Exchange Act Rule 12b-2).Yes [X] No

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $81,000 based on the closing sale price of the registrant’s common stock on June 1, 2011. Shares of common stock held by each then current executive officer and director and by each person who is known by the registrant to own 5% or more of the outstanding common stock have been excluded from this computation in that such persons may be deemed to have been affiliates of Salon Media Group, Inc. This determination of affiliate status is not a conclusive determination for other purposes.

The number of outstanding shares of the Registrant's Common Stock, par value $0.001 per share, on June 1, 2011 was 3,282,576 shares.

1

FORM 10-K

SALON MEDIA GROUP, INC.

INDEX

| Page

Number

|

||

|

PART I

|

||

|

ITEM 1.

|

Business

|

3

|

|

ITEM 1A.

|

Risk Factors

|

10

|

|

ITEM 1B.

|

Unresolved Staff Comments

|

19

|

|

ITEM 2.

|

Properties

|

19

|

|

ITEM 3.

|

Legal Proceedings

|

19

|

|

PART II

|

||

|

ITEM 5.

|

Market for Registrant’s Common Equity and Related Stockholder Matters, and Issuer Purchases of Equity Securities

|

19

|

|

ITEM 6.

|

Selected Consolidated Financial Data

|

22

|

|

ITEM 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

23

|

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

31

|

|

ITEM 8.

|

Financial Statements and Supplementary Data

|

32

|

|

ITEM 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures

|

56

|

|

ITEM 9A.

|

Controls and Procedures

|

56

|

|

ITEM 9B.

|

Other Information

|

57

|

|

PART III

|

||

|

ITEM 10.

|

Directors, Executive Officers and Corporate Governance

|

57

|

|

ITEM 11.

|

Executive Compensation

|

61

|

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

69

|

|

ITEM 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

75

|

|

ITEM 14.

|

Principal Accountant Fees and Services

|

77

|

| PART IV | ||

| ITEM 15. | Exhibits, Financial Statement Schedules | 78 |

| SIGNATURES | 88 |

2

PART I

This report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that involve risks and uncertainties, including but not limited to statements regarding our strategy, plans, objectives, expectations, intentions, financial performance, cash-flow breakeven timing, financing, economic conditions, Internet advertising market performance, subscription service plans, non-web opportunities and revenue sources. Although Salon Media Group, Inc. (“Salon” or the “Company”) believes its plans, intentions and expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such plans, intentions or expectations will be achieved. Salon’s actual results may differ significantly from those anticipated or implied in these forward-looking statements as a result of the factors set forth above and in Salon’s public filings. Salon assumes no obligation to update any forward-looking statements as circumstances change.

Salon’s actual results may differ significantly from those anticipated or implied in these forward-looking statements as a result of the factors set forth below and in "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Factors That May Affect Salon’s Future Results and Market Price of Stock." In this report, the words “anticipates,” “believes,” “expects,” “estimates,” “intends,” “future,” and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

ITEM 1. Business

Overview

Salon was originally incorporated in July 1995 in the State of California and reincorporated in Delaware in June 1999. On June 22, 1999, Salon had its initial public offering, with its common stock quoted on the NASDAQ National Market under the symbol SALN. Effective May 16, 2001, Salon adopted the name Salon Media Group, Inc. Due to Salon’s inability to meet the continued listing requirements of the NASDAQ Market, on November 21, 2002, Salon’s common stock began trading in the OTC (Over-The-Counter) Bulletin Board marketplace under the symbol SALN.OB. Following a 20:1 reverse split on November 15, 2006, the Company’s stock ticker symbol became SLNM.OB. The stock symbol for the Company has since been updated to SLNM.PK.

Salon is an online news and social networking company and an Internet publishing pioneer providing high quality journalism and a forum for discussing current events and contemporary social political issues. Salon’s award-winning content combines breaking news, original investigative stories and provocative personal essays along with quick-take commentary and staff-written blogs about politics, technology, culture and entertainment. Committed to interactivity, the Website also hosts two online communities, The Well, and Open Salon, an innovative blogging social network. Among its many quality offerings, Salon sponsors daily blogs by well-known staff and freelance writers, plus an evolving group of new voices who are regular contributors to the site. In its editorial product, Salon balances two crucial missions: (1) providing original and provocative content on topics that the mainstream media overlook, and (2) filtering through the media chatter and clutter to help readers find the stories that matter.

3

The main entry and navigation point to Salon's primary subject-specific sections is Salon's home page at www.salon.com. Built around multiple daily features such as War Room, Since You Asked, How the World Works, Ask the Pilot and daily blogs by Glenn Greenwald and Joan Walsh, Salon provides a constantly updated array of news, features, interviews, columnists and blogs, which is increasingly being grouped and expanded into five key content areas.

|

News

|

Smartly aggregated posts on the big news of the day for the well-read, savvy audience. Heavily formatted for easy access – Starting Point (big story of the morning); Morning Clip (the hot video from late-night); Big Question (the answer to the big question raised by the day’s news). Staffed by three news bloggers, seven days a week.

|

|

Politics

|

Anchored by our War Room politics blog, we offer rolling commentary on the big political stories of the day by brand-name writers and TV mainstays, such as Joan Walsh, Glenn Greenwald, Alex Pareene, Steve Kornacki and David Sirota.

|

|

Arts & Entertainment

|

Exhaustive, enthusiast coverage of entertainment, with special emphasis on breaking pop culture stories with deep cultural relevance, and obsessive coverage of the best in TV, film and books. Headline writers include Matt Zoller Seitz (TV), Mary Beth Williams and Drew Grant (pop culture), Andrew O’Hehir (film), and Laura Miller (books).

|

|

Life

|

Gripping personal essays from famous writers (such as Jennifer Egan, David Rakoff, Walter Kirn, Anne Lamott) and Salon readers alike, exploring the most complicated issues of modern life – family, relationships, work and spirituality. Also includes advice columnists: Tracy Clark-Flory (love/sex); Cary Tennis (all-purpose); and Rahul Parikh, MD (health and medicine).

|

|

Food

|

Salon's evolving food section includes recipes, cultural studies and the increasing political movement around food and sustainability issues. An adjunct to our Life content, it is currently all freelance.

|

|

Open Salon

|

Open Salon provides a smart home for reader’s work where they can publish and share their work, generate advertising revenue, and potentially have their works be published on Salon.com.

|

Salon also operates The Well, a subscription member-only discussion community in which members use their real names to post and only members can view the postings. It had approximately 1,905 paying subscribers as of March 31, 2011.

Salon believes that its original, award-winning content allows Salon to attract and retain users who are more affluent, better educated and more likely to make online purchases than typical Internet users. Salon believes its user profile makes its Website a valuable media property for advertisers and retailers who are allocating marketing resources to target consumers online.

During fiscal year 2009, Salon launched Open Salon.com, a social network for bloggers, with content curated by Salon staff. Open Salon functions like a real-time magazine cover, where the best content is spotlighted. Blogs from Open Salon may be posted on the Salon.com website. Open Salon’s audience has grown consistently since its launch, and has become a reliable source of content and audience traffic.

4

Revenue Sources

One customer accounted for over 10% of total revenue for the year ended March 31, 2011. No customer accounted for over 10% of total revenue for the years ended March 31, 2010 and 2009, which were as follows (in thousands):

|

Year Ended March 31,

|

||||||||||||||||||||||||

|

2011

|

2010

|

2009

|

||||||||||||||||||||||

|

Amount

|

%

|

Amount

|

%

|

Amount

|

%

|

|||||||||||||||||||

|

Advertising

|

$ | 3,584 | 78 | % | $ | 2,967 | 69 | % | $ | 5,195 | 76 | % | ||||||||||||

|

Salon Premium

|

472 | 10 | % | 701 | 16 | % | 994 | 14 | % | |||||||||||||||

|

All Other

|

517 | 12 | % | 623 | 15 | % | 685 | 10 | % | |||||||||||||||

|

Total

|

$ | 4,573 | 100 | % | $ | 4,291 | 100 | % | $ | 6,874 | 100 | % | ||||||||||||

Salon has generated Internet advertising revenues since its inception in 1995. The Company launched Salon Premium, a subscription service, in April 2001. It acquired The Well, its primary source of other revenue, in 1999. Online advertising, which accounts for the bulk of Salon’s revenue, is subject to broader economic fluctuations, like other forms of advertising, but with a consistent upward bias. According to the Interactive Advertising Bureau, United States online advertising revenues have grown from $9.6 billion in 2004 to $26.0 billion in 2010, with further double digit gains anticipated in 2011. Central to Salon’s strategy is to capitalize on the expected continued shift in spending of advertising budgets to the Web in response to increased online usage. According to the eMarketer, online advertising surpassed newspaper advertising for the first time in 2010.

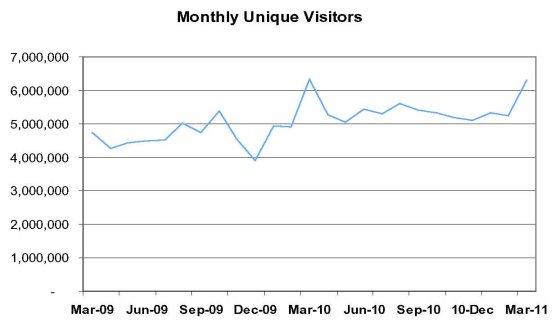

An important factor in increasing advertising revenues in future periods is growth in Salon’s audience. Attracting more unique Website visitors is important to Salon as they generate page views, and each page view becomes a potential platform for serving advertisements. Ultimately, Salon charges advertisers for a set number of ad impressions viewed by a Website visitor. During fiscal 2010, management launched a new strategy to increase traffic, including a fresh new site design, more aggressive and timely news coverage, and expanded lifestyle coverage in areas such as food, film and books. The strategy began to bear fruit in the fourth quarter ending March 31, 2010, as unique monthly visitors averaged 5.4 million, a 22% increase over the same quarter in the prior fiscal year. In the fourth quarter ending March 31, 2011, further gains brought average unique monthly visitors to 5.6 million, a 4% increase over the same quarter in the prior fiscal year. In 2011, full year average monthly unique visitors grew by 12% compared to fiscal 2010. Additionally, monthly unique visitors have grown by a cumulative 43% over the past four years. Aiding the continued growth in unique visitors to Salon’s Website is the general migration of readers to the Internet from print newspapers. The table in the following page reflects unique monthly visitors to Salon’s Website.

5

Advertising is Salon’s primary source of revenue. Most advertising campaigns are of short duration, generally less than ninety days. Salon’s obligations may include a guaranteed minimum number of impressions, or views by Website visitors of an advertisement, a set number of “Site Pass” advertisements viewed by Website visitors or a set number of days that a Site Pass advertisement is to run. To the extent the minimum guaranteed amounts are not achieved, Salon defers recognition of the corresponding revenue until the remaining guaranteed amounts are provided, if mutually agreeable with an advertiser. If these “make good” amounts are not agreeable with an advertiser, no further revenue is recognized. Salon has also successfully made greater use of ad networks to better monetize unsold ad inventory.

Subscriptions have been de-emphasized and are a secondary source of revenue. Generally, subscriptions to Salon Premium cost between $29 and $45 annually, depending on any associated bundles of promotional items offered. Benefits of Salon Premium include unrestricted access to Salon’s content with no banners, pop-ups or site pass advertisements, free magazine subscriptions, or other premiums, and the ability to download content in text or PDF format.

Salon Premium revenue is recognized ratably over the period that services are provided. For the year ended March 31, 2011, Salon received $0.4 million in cash and recognized $0.5 million of revenue for this service primarily from approximately 7,700 paid new and renewed one year subscriptions and from approximately 9,900 monthly subscriptions. For the year ended March 31, 2010, Salon received $0.6 million in cash and recognized $0.7 million of revenue for this service primarily from approximately 12,000 paid new and renewed one year subscriptions and from approximately 10,600 monthly subscriptions. For the year ended March 31, 2009, Salon received $0.8 million in cash and recognized $1.0 million of revenue for this service primarily from approximately 17,600 paid new and renewed one year subscriptions and from approximately 7,000 monthly subscriptions. Since peaking at 89,100 subscribers in December 2004, paid subscriptions have continued to decline to 15,800 as of March 31, 2010 and approximately 10,900 as of March 31, 2011. The drop is expected to continue during the next year, following longstanding industry trends away from paid Web content.

6

The other sources of revenue are primarily membership and data storage fees from The Well, an on-line discussion forum. Revenue is recognized ratably over the subscription period. The revenues recognized were approximately $0.3 million for the year ended March 31, 2011, and approximately $0.4 million for each of the years ended March 31, 2010 and March 31, 2009. Salon generates nominal revenue from the licensing of content that previously appeared in Salon, for providing links to a third party’s Website offering personals/dating services, and from its limited e-commerce activities.

Sales and Marketing

Salon has sales offices in New York City and Los Angeles, with seven advertising sales and operations employees as of March 31, 2011, of which four actively solicit orders. As of March 31, 2011, Salon has one employee associated with Salon Premium membership activities.

Salon incurred advertising expenses of $0.0 million, $1.2 million and $0.9 million for the years ended March 31, 2011, 2010, and 2009, respectively. These advertising expenses primarily represent non-cash expenses from the utilization of advertising credits which Salon acquired in January 2000 from the sale of common stock to Rainbow Media Holdings (“Rainbow”). During the year ended March 31, 2003, Rainbow transferred a portion of its obligation to provide Salon with advertising credits to NBC’s Bravo channel, while still retaining a portion of the overall obligation. The transfer occurred due to the sale by Cablevision, which owns Rainbow Media Holdings, of its Bravo channel to NBC. As of December 31, 2009, Salon has fully utilized the ad credits with NBC and Rainbow.

Competition

Salon competes for advertising revenues with numerous Websites, with the 50 largest companies attracting an estimated 91% of all the internet advertising dollars according to a recent study by PricewaterhouseCoopers LLC and sponsored by the Interactive Advertising Bureau. These companies have Websites that include major portals such as Yahoo, major search engines such as Google, major social networks such as Facebook and MySpace, and major online media publications such as CNN.com.

Salon also competes with many news–oriented Websites. In addition to traditional news-oriented Websites such as CNN, NBC, ABC and CBS, Salon also competes with sites such as the Huffington Post, Slate, Mother Jones, Daily Beast and Politico for staff, audience and ad sales.

Salon’s Strategy

Continued focus on growing Salon’s audience

Increasing unique visitors to Salon’s Website and the resulting page views that serve as a platform for advertising impressions is key to Salon’s revenue growth. In addition to the revenue generated from advertising, an increase in unique visitors could increase revenue from subscriptions as each new visitor to Salon’s Website is a potential new subscriber to Salon Premium. As a result, audience growth will continue to be a primary business goal for Salon.

During fiscal 2010, Salon launched a re-designed architecture and Website in an effort to accelerate its growth and gave increased attention to search engine optimization and referral traffic. Salon plans to continue to focus on developing its audience growth through a combination of editorial enhancements, new products, and more effective use of technology. Salon has broadened its content by reclassifying its content in five key contents areas. These are: News, Politics, Arts & Entertainment, Life and Food. Through these five key content areas, Salon continues to enhance or create new content and features for its readers. Further changes are in the process of being implemented.

7

Salon launched a new social networking service in August 2008 for its users, “Open Salon,” which allows them to post user profiles; contribute blogs and other content; and collect all their contributions to Salon, including Letters to the Editor, in one place. Management believes Open Salon will attract and retain unique users, increase advertising inventory and lower its incremental editorial costs. Salon’s strategy to continue to grow its audience also encompasses partnership formation to deliver Salon’s content to a broader audience, a search engine optimization plan, and an integrated marketing plan that includes mostly online advertising. In the last several years Salon has not allocated, and does not currently contemplate in its next fiscal year allocating any significant cash resources towards such efforts; however, Salon has formed and continues to form partnerships and alliances to deliver Salon’s award-winning, unique, and compelling content to a broader audience.

Focus on advertising revenue opportunity while Premium subscriber base declines

Salon generates most of its revenue from advertising on its Website, as well as through subscribers who pay to read its content without ads. However, as Salon increased its number of readers to its Website, Salon has determined that if its advertising sales team can sell most of its inventory, it will be far more profitable for Salon to drive its readers to its advertising supported Website rather than to a subscription, without-ads Website. Salon recognizes that its subscription model will continue to be preferred by a minority of its readers, and will therefore continue the subscription program, with emphasis on “Premium with ads” as a means of increasing potential ad impressions. Additionally, Salon will continue efforts to increase the average value per subscriber by bundling third-party services with subscriptions, and intends to offer other products and services to current subscribers.

Since the end of fiscal year 2007, Salon has increased emphasis on advertising revenues. In fiscal year 2012, Salon plans to continue to provide more creative advertising offerings, improve the technological orientation of the site to attract more non-standard advertising and expand into additional advertising categories. It will also expand and better optimize the use of ad networks to fully monetize any unsold remnant inventory.

Enhanced Website Design

In fiscal 2010, Salon launched a re-designed architecture and Website to improve the presentation of timely and relevant content through a compelling and dynamically tuned interface. Salon expects this redesign to result in greater user satisfaction, and therefore, higher utilization, higher search rankings that will drive new users to the site and a higher proportion of repeat engagement, as users return throughout the day to obtain timely news and information. The site has been dynamic and interactive, and its new modular architecture has allowed editors to manage a real time flow of content presented in a graphically compelling fashion, while also servicing multiple platforms and devices, and dynamic usability experiments.

Expanding Gross Margins

Salon has made substantial strides in the past fiscal year to better realign its production costs with its revenue potential in an effort to reach profitability. Among other measures, the company reduced full-time headcount from 53 in March 2009, to 45 in March 2010, to 41 in March 2011 and is continually aiming to match personnel resources to overall business need given the prevailing advertising market. Additionally, Salon is evaluating opportunities to reduce the expense of its high-quality content by focusing on reducing cost per page and seeking less costly sources of content, including greater content aggregation and the use of popular articles and blogs from Open Salon.

8

Develop Content Partnerships

Salon believes it needs fresh content and new ideas to continue to attract readers to its Website. To this end, Salon has made efforts to initiate partnerships to create content particularly in areas where Salon does not have facilities or experience, such as video content, and various content verticals. Additionally, Salon has made efforts to identify bloggers who might have a strong affinity with its readers, and who might be interested in moving their sites to Salon in order to gain a greater reach of readership, and to gain infrastructure support.

Infrastructure and Operations

Salon has created a flexible publishing structure that enables it to develop its content while responding quickly to news events and take advantage of the ease of distribution provided by the Internet. Salon content is deployed on its proprietary software platform and captured in a database for reuse in Web and other formats. The content on Salon’s Website has been structured to facilitate being found by search engines, a key driver in increasing traffic to Salon’s Website. During the last three years, Salon has improved the look and feel of its Website to increase appeal to its audience and contemplates continued changes to its Website. In fiscal year 2010, Salon made significant investments in this area with a re-designed architecture and website to help drive traffic to its site.

Salon’s Website is supported by a variety of servers using the Solaris and Linux operating systems. Salon’s top technical priority is the fast delivery of pages to its users. Salon’s systems are designed to handle traffic growth by balancing the amount of traffic among multiple servers. Salon relies on server redundancy to help achieve its goal of 24 hours, seven-days-a-week Website availability. Regular automated backups protect the integrity of Salon’s data. Salon servers are maintained at a third-party facility in Sacramento, in a building capable of withstanding a major earthquake. The third-party facility provides continuous monitoring of the servers. In fiscal 2011, Salon has decided to explore a possible move to a cloud-based infrastructure.

Software to maintain and manage Salon Premium was created in-house and upgraded in 2003, again during fiscal year 2007, and a major reprogramming effort was conducted in fiscal year 2010. A full migration to an open source content management system is planned for fiscal 2012.

Proprietary Rights

Salon’s success and ability to compete is dependent in part on the goodwill associated with its trademarks, trade names, service marks and other proprietary rights and on its ability to use U.S. laws to protect its intellectual property, including its original content, content provided by third parties, and content provided by columnists. Salon has a registered trademark on its name and its logo.

Salon owns the Internet address www.salon.com. Because www.salon.com is the address of the main home page to Salon’s Website and incorporates Salon’s company name, it is a vital part of Salon’s intellectual property assets. Salon does not have a registered trademark on the address, and therefore it may be difficult for Salon to prevent a third party from infringing its intellectual property rights to the address.

9

Employees

As of March 31, 2011, Salon has 41 full-time employees. Salon believes its employee relations are good. No employees of Salon are represented by a labor union or are subject to a collective bargaining agreement. Salon’s future success is highly dependent on the ability to attract, hire, retain and motivate qualified personnel.

ITEM 1A. Risk Factors

Factors That May Affect Salon’s Future Results and Market Price of Stock

Salon’s business faces significant risks. The risks described below may not be the only risks Salon faces. Additional risks that are not yet known or that are currently immaterial may also impair its business operations or have a negative impact on its stock price. If any of the events or circumstances described in the following risks actually occurs, its business, financial condition or results of operations could suffer, and the trading price of its common stock could decline.

Salon’s projected cash flows may not meet expectations

Salon relies on cash projections to run its business and changes such projections as new information is made available or events occur. The most significant component of Salon’s cash projections is cash to be generated from advertising sales and, to a lesser extent, cash to be generated from Salon Premium. Forecasting advertising revenues and resulting cash receipts for an extended period of time is problematic due to the short duration of most advertising sales. If projected cash inflows and outflows do not meet expectations, Salon’s ability to continue as a going concern may be adversely affected.

If Salon forecasts or experiences periods of limited, or diminishing cash resources, Salon may need to issue additional securities or borrow additional funds. These newly issued securities could be highly dilutive to existing common stockholders. However, there is no guarantee that Salon will be able to issue additional securities in future periods or borrow additional funds on commercially reasonable terms to meet its cash needs . Salon’s ability to continue as a going concern will be adversely affected if it is unable to raise additional cash from sources it had relied upon in the past or new sources.

Salon has relied on related parties for significant investment capital

Salon has been relying on cash infusions primarily from related parties to fund operations. The related parties are generally John Warnock, Chairman of the Board of Salon, and William Hambrecht. William Hambrecht is the father of Salon’s former President and Chief Executive Officer, Elizabeth Hambrecht, a Director of the Company. During the year ended March 31, 2011, related parties provided approximately $2.2 million in cash advances to fund Salon’s operations.

Curtailment of cash investments and borrowing guarantees by related parties could detrimentally impact Salon’s cash availability and its ability to fund its operations.

10

Salon’s principal stockholders can exercise a controlling influence over Salon’s business affairs and may make business decisions with which non-principal stockholders disagree and may affect the value of their investment

Based on information available to Salon, the holders of Salon’s Series A, B, C and D preferred stock collectively own approximately 95% of all voting securities. These stockholders therefore own a controlling interest in Salon. Of this amount, approximately 20% is controlled directly or indirectly by William Hambrecht and approximately 37% by Chairman and Director John Warnock. Therefore, related parties by themselves own a controlling interest in Salon.

If these stockholders were to act together, they would be able to exercise control over all matters requiring approval by other stockholders, including the election of Directors and approval of significant corporate transactions. This concentration of ownership could also have the effect of accelerating, delaying or preventing a change in control of Salon, which could cause Salon’s stock price to decline.

Future sales of significant number of shares of Salon’s common stock by principal stockholders could cause its stock price to decline

Salon’s preferred stockholders can convert their 9,404 shares of preferred stock to approximately 10.0 million shares of common stock at any time. As Salon’s common stock is normally thinly traded, if these stockholders were to convert their shares of preferred stock to common stock and sell the resulting shares, the per share price of Salon’s common stock may be adversely affected.

Salon’s stock has been and will likely continue to be subjected to substantial price and volume fluctuations due to a number of factors, many of which will be beyond its control and may prevent its stockholders from reselling its common stock at a profit

The securities markets have experienced significant price and volume fluctuations. This market volatility, as well as general economic, market or political conditions, have and may continue to reduce the market price of its common stock, regardless of its operating performance. In addition, Salon’s stock is thinly traded and operating results could be below the expectations of public market analysts and investors, and in response, the market price of its common stock could decrease significantly.

Salon’s preferred stockholders are entitled to potentially significant liquidation preferences of Salon’s assets over common stockholders in the event of such an occurrence

Salon’s Series A, B, C and D preferred stockholders have liquidation preferences over common stockholders of the first approximately $25.4 million in potential sales proceeds as of March 31, 2011, which includes the effect of undeclared dividends of $6.4 million. If a liquidation event were to occur, and preferred stock dividends were declared, the holders of preferred stock would be entitled to the first $25.4 million of cash distributions, while the holders of common stock would receive none of this amount. If a liquidation event were to occur in excess of $25.4 million and if preferred stock dividends were to be declared, the holders of preferred stock would be entitled to receive a relatively larger distribution than the holders of common stock would be entitled to receive.

Salon has historically lacked significant revenues and has a history of losses

Salon has a history of significant losses and expects to incur an operating loss, based on generally accepted accounting principles, for its fiscal year ending March 31, 2012. Salon expects to turn cash flow positive during FY 2012. Once Salon attains profitability, it may not be able to sustain or increase profitability on a quarterly or annual basis in the future. If revenues grow slower than Salon anticipates or operating expenses exceed expectations, financial results will most likely be severely harmed and the ability of Salon to continue its operations will be seriously jeopardized.

11

Burr, Pilger Mayer, Inc., Salon’s independent registered public accounting firm for the years ended March 31, 2009, March 31, 2010, and March 31, 2011, included a “going-concern” audit opinion on the consolidated financial statements for those years. The audit opinions report substantial doubt about Salon’s ability to continue as a going concern, citing issues such as the history of losses and absence of current profitability. As a result of the “going-concern” opinions, Salon’s stock price and investment prospects have been and will continue to be adversely affected, thus limiting financing choices and raising concerns about the realization of value on assets and operations.

Salon Premium memberships have been declining and will most likely continue to decline, adversely affecting revenues and available cash

Salon has been relying on the revenues and cash generated from Salon Premium subscriptions since its implementation in April 2002. Salon Premium subscriptions grew from nothing to a high of approximately 89,100 as of December 31, 2004. However, since that time, subscriptions have been declining to approximately 10,900 as of March 31, 2011. Salon forecasts that these memberships will continue to decline to approximately 7,000 as of March 31, 2012. If the decline were to be in excess of anticipated amounts, Salon’s operations and available cash could be adversely affected.

Salon has depended on advertising sales for much of its revenues, and its inability to maintain or increase advertising revenues could harm its business

Maintaining or increasing Salon’s advertising revenues depends upon many factors, including whether it will be able to:

|

·

|

successfully sell and market its Website auto start Site Pass or other rich media advertisements;

|

|

·

|

entice non-Salon Premium Website visitors to view and advertisers to sell new ad units and formats;

|

|

·

|

maintain a significant number of unique Website visitors and corresponding significant reach of Internet users;

|

|

·

|

maintain a significant number of sellable impressions generated from Website visitors available to advertisers;

|

|

·

|

successfully sell and market its network to advertisers;

|

|

·

|

increase the dollar amount of the advertising orders it receives;

|

|

·

|

maintain pricing levels of the advertising it sells;

|

|

·

|

increase awareness of the Salon brand;

|

|

·

|

improve the technology for serving advertising on its Website;

|

12

|

·

|

handle temporary high volume traffic spikes to its Website;

|

|

·

|

accurately measure the number and demographic characteristics of its users; and

|

|

·

|

attract and retain key sales personnel.

|

Legislative action and potential new accounting pronouncements are likely to cause its general and administrative expenses and other operating expenses to increase

To comply with the Sarbanes-Oxley Act of 2002 and proposed accounting changes by the Securities and Exchange Commission, Salon ultimately may be required to hire additional personnel and utilize additional outside legal, accounting and advisory services, all of which will cause its general and administrative costs to increase.

Hackers may attempt to penetrate Salon’s security system; online security breaches could harm its business

Consumer and supplier confidence in Salon’s Website depends on maintaining relevant security features. Security breaches also could damage its reputation and expose it to a risk of loss or litigation. Experienced programmers or “hackers” have successfully penetrated sectors of its systems and Salon expects that these attempts will continue to occur from time to time. Because a hacker who is able to penetrate network security could misappropriate proprietary information or cause interruptions in its products and services, Salon may have to expend significant capital and resources to protect against or to alleviate problems caused by these hackers. Additionally, Salon may not have a timely remedy against a hacker who is able to penetrate its network security. Such security breaches could materially affect Salon. In addition, the transmission of computer viruses resulting from hackers or otherwise could expose it to significant liability. Salon’s insurance policies may not be adequate to reimburse it for losses caused by security breaches. Salon also faces risks associated with security breaches affecting third parties with whom it has relationships.

With a volatile share price, Salon may be the target of securities litigation, which is costly and time-consuming to defend

In the past, following periods of market volatility in the price of a company’s securities, security holders have instituted class action litigation. Salon’s share price has in the past experienced price volatility, and may continue to do so in the future. Many companies have been subjected to this type of litigation. If the market value of its common stock experiences adverse fluctuations and it becomes involved in this type of litigation, regardless of the merits or outcome, Salon could incur substantial legal costs and its management’s attention could be diverted, causing its business, financial condition and operating results to suffer. To date, Salon has not been subjected to such litigation.

Salon’s quarterly operating results are volatile and may adversely affect its common stock price

Salon’s future revenues and operating results, both Generally Accepted Accounting Principles in the United States (“GAAP”) and non-GAAP, are likely to vary significantly from quarter to quarter due to a number of factors, many of which are outside Salon’s control, and any of which could severely harm Salon’s business. These factors include:

|

·

|

Salon’s ability to attract and retain advertisers and subscribers;

|

13

|

·

|

Salon’s ability to attract and retain a large number of users;

|

|

·

|

the introduction of new Websites, services or products by Salon or by its competitors;

|

|

·

|

the timing and uncertainty of Salon’s advertising sales cycles;

|

|

·

|

the mix of advertisements sold by Salon or its competitors;

|

|

·

|

the economic and business cycle;

|

|

·

|

Salon’s ability to attract, integrate and retain qualified personnel;

|

|

·

|

technical difficulties or system downtime affecting the Internet generally or the operation of Salon’s Website; and

|

|

·

|

the amount and timing of operating costs.

|

Due to the factors noted above and the other risks discussed in this section, one should not rely on quarter-to-quarter comparisons of Salon’s results of operations as an indication of future performance. It is possible that some future periods’ results of operations may be below the expectations of public market analysts and investors. If this occurs, the price of its common stock may decline.

The controversial content of Salon’s Website may limit its revenues

Salon’s Website contains, and will continue to contain, content that is politically and culturally controversial. As a result of this content, current and potential advertisers, potential Salon Premium subscribers, or third parties who contemplate aggregating content, may refuse to do business with Salon. Salon’s outspoken stance on political issues has and may continue to result in negative reactions from some users, commentators and other media outlets. From time to time, certain advocacy groups have successfully targeted Salon’s advertisers in an attempt to persuade such advertisers to cease doing business with Salon. These efforts may be a material impediment to Salon’s ability to grow and maintain advertising revenue.

Salon’s promotion of the Salon brand must be successful to attract and retain users as well as advertisers and strategic partners

The success of the Salon brand depends largely on its ability to provide high quality content and services. If Internet users do not perceive Salon’s existing content and services to be of high quality, or if Salon introduces new content and services or enters into new business ventures that are not favorably perceived by users, Salon may not be successful in promoting and maintaining the Salon brand. Any change in the focus of its operations creates a risk of diluting its brand, confusing consumers and decreasing the value of its user base to advertisers. If Salon is unable to maintain or grow the Salon brand, its business could be severely harmed.

Salon needs to hire, integrate and/or retain qualified personnel because these individuals are important to its growth

Salon’s success significantly depends on key personnel. In addition, because Salon’s users must perceive the content of Salon’s Website as having been created by credible and notable sources, Salon’s success also depends on the name recognition and reputation of its editorial staff. Due to Salon’s history of losses, Salon may experience difficulty in hiring and retaining highly skilled employees with appropriate qualifications. Salon may be unable to retain its current key employees or attract, integrate or retain other qualified employees in the future. If Salon does not succeed in attracting new personnel or retaining and motivating its current personnel, its business could be harmed.

14

Salon may expend significant resources to protect its intellectual property rights or to defend claims of infringement by third parties, and if Salon is not successful it may lose rights to use significant material or be required to pay significant fees

Salon’s success and ability to compete are significantly dependent on its proprietary content. Salon relies exclusively on copyright law to protect its content. While Salon actively takes steps to protect its proprietary rights, these steps may not be adequate to prevent the infringement or misappropriation of its content, which could severely harm its business. Salon also licenses content from various freelance providers and other third-party content providers. While Salon attempts to ensure that such content may be freely licensed to it, other parties may assert claims of infringement against it relating to such content.

Salon may need to obtain licenses from others to refine, develop, market and deliver new services. Salon may not be able to obtain any such licenses on commercially reasonable terms or at all or rights granted pursuant to any licenses may not be valid and enforceable.

In April 1999 Salon acquired the Internet address www.salon.com. Because www.salon.com is the address of the main home page to its Website and incorporates its company name, it is a vital part of its intellectual property assets. Salon does not have a registered trademark on the address, and therefore it may be difficult for it to prevent a third party from infringing on its intellectual property rights to the address. If Salon fails to adequately protect its rights to the Website address, or if a third party infringes its rights to the address, or otherwise dilutes the value of www.salon.com, its business could be harmed.

Salon’s technology development efforts may not be successful in improving the functionality of its network, which could result in reduced traffic on its Website, reduced advertising revenues, or a loss of Salon Premium subscribers

Salon is constantly upgrading its technology to manage its Website and its Salon Premium program, and during the last year redesigned its Website homepage and vertical sections. In addition, it is creating technology for new products that Salon expects to launch during its next fiscal year. If these systems do not work as intended, or if Salon is unable to continue to develop these systems to keep up with the rapid evolution of technology for content delivery and subscription management, its Website or subscription management systems may not operate properly, which could harm Salon’s business. Additionally, software product design, development and enhancement involve creativity, expense and the use of new development tools and learning processes. Delays in software development processes are common, as are project failures, and either factor could harm Salon’s business. Moreover, complex software products such as its online publishing and subscription management systems frequently contain undetected errors or shortcomings, and may fail to perform or scale as expected. Although Salon has tested and will continue to test its systems, errors or deficiencies may be found in these systems that may adversely impact its business.

15

Salon relies on software, purchased from an independent supplier, to deliver and report some of its advertising, the failure of which could impair its business

Salon uses software, purchased from an independent supplier, to manage and measure the delivery of advertising on its Website. The software is essential to Salon whenever an advertiser does not stipulate ad serving from a third party such as Doubleclick. This type of software may fail to perform as expected. If this software malfunctions, advertisements may not be served correctly on its Website, or if the software does not accurately capture impression information, then Salon’s advertising revenues could be reduced, and its business could be harmed.

Salon may be held liable for content or third party links on its Website or content distributed to third parties

As a publisher and distributor of content over the Internet, including user-generated content, links to third party Websites that may be accessible through Salon.com, or content that includes links or references to a third party’s Website, Salon faces potential liability for defamation, negligence, copyright, patent or trademark infringement and other claims based on the nature, content or ownership of the material that is published on or distributed from its Website. These types of claims have been brought, sometimes successfully, against online services, Websites and print publications in the past. Other claims may be based on errors or false or misleading information provided on linked Websites, including information deemed to constitute professional advice such as legal, medical, financial or investment advice. Other claims may be based on links to sexually explicit Websites. Although Salon carries general liability and media insurance, its insurance may not be adequate to indemnify Salon for all liabilities imposed. Any liability that is not covered by its insurance or is in excess of its insurance coverage could severely harm its financial condition and business. Implementing measures to reduce its exposure to these forms of liability may require Salon to spend substantial resources and limit the attractiveness of Salon’s service to users.

Concerns about transactional security may hinder electronic commerce on Salon’s Website and may expose Salon to potential liability

A significant barrier to sale of subscriptions and electronic commerce is the secure transmission of confidential information over public networks. Any breach in Salon’s security could expose it to a risk of loss or litigation and possible liability. Salon relies on encryption and authentication technology licensed from third parties to provide secure transmission of confidential information. As a result of advances in the capabilities of Internet hackers, or other developments, a compromise or breach of the algorithms Salon uses to protect customer transaction data may occur. A compromise of Salon’s security could severely harm its business. A party who is able to circumvent Salon’s security measures could misappropriate proprietary information, including customer credit card information, or cause interruptions in the operation of its Website.

Salon may be required to expend significant capital and other resources to protect against the threat of security breaches or to alleviate problems caused by these breaches. Protection may not be available at a reasonable price or at all.

Salon’s internally developed software and software platforms provided by a third party to manage Salon’s subscription business might fail resulting in lost subscription income

Salon’s software to manage its subscription business was developed internally to interface with the software provided by a third party. The third party’s software provides a gateway to authenticate credit card transactions. Even though Salon’s system to manage its Salon Premium program is Payment Card Industry (PCI) compliant, if this system were to fail or not function as intended, credit card transactions might not be processed and Salon’s cash resources and revenues would therefore be harmed.

16

Salon’s systems may fail due to natural disasters, telecommunications failures and other events, any of which would limit user traffic

Substantially all of Salon’s communications hardware and computer hardware operations for its Website are in a facility in Sacramento, California that has been extensively retrofitted to withstand a major earthquake. Fire, floods, earthquakes, power loss, telecommunications failures, break-ins, supplier failure to meet commitments, and similar events could damage these systems and cause interruptions in its services. Computer viruses, electronic break-ins or other similar disruptive problems could cause users to stop visiting Salon’s Website and could cause advertisers to terminate any agreements with Salon. In addition, Salon could lose advertising revenues during these interruptions and user satisfaction could be negatively impacted if the service is slow or unavailable. If any of these circumstances occurred, Salon’s business could be harmed. Salon’s insurance policies may not adequately compensate it for losses that may occur due to any failures of or interruptions in its systems. Salon does not presently have a formal disaster recovery plan.

Salon’s Website must accommodate a high volume of traffic and deliver frequently updated information. It is possible that Salon will experience systems failures in the future and that such failures could harm its business. In addition, its users depend on Internet service providers, online service providers and other Website operators for access to its Website. Many of these providers and operators have experienced significant outages in the past, and could experience outages, delays and other difficulties due to system failures unrelated to its systems. Any of these system failures could harm its business.

Privacy concerns could impair Salon’s business

Salon has a policy against using personally identifiable information obtained from users of its Website and services without the user’s permission. In the past, the Federal Trade Commission has investigated companies that have used personally identifiable information without permission or in violation of a stated privacy policy. If Salon uses personal information without permission or in violation of its policy, Salon may face potential liability for invasion of privacy for compiling and providing information to its corporate customers and electronic commerce merchants. In addition, legislative or regulatory requirements may heighten these concerns if businesses must notify Internet users that the data may be used by marketing entities to direct product promotion and advertising to the user. Other countries and political entities, such as the European Union, have adopted such legislation or regulatory requirements. The United States may adopt similar legislation or regulatory requirements. If consumer privacy concerns are not adequately addressed, its business, financial condition and results of operations could be materially harmed.

Possible state sales and other taxes could adversely affect Salon’s results of operations

Salon does not collect sales or other taxes from individuals who sign up for Salon subscriptions. During the year ended March 31, 2003, the State of California audited Salon’s sales tax returns and found Salon in compliance with its filings and did not object to the fact that it did not collect sales tax on subscriptions. However, one or more other states may seek to impose sales tax collection obligations on out-of-state companies, including Salon, which engage in or facilitate electronic commerce. State and local governments have discussed and made proposals imposing taxes on the sale of goods and services through the Internet. Such proposals, if adopted, could substantially impair the growth of electronic commerce and could reduce Salon’s ability to derive revenue from electronic commerce. Moreover, if any state or foreign country were to assert successfully that Salon should collect sales or other taxes on the exchange of merchandise on its network or to tax revenue generated from Salon subscriptions, its financial results could be harmed.

17

Provisions in Delaware law and Salon’s charter, stock option agreements and offer letters to executive officers may prevent or delay a change of control

Salon is subject to the Delaware anti-takeover laws regulating corporate takeovers. These anti-takeover laws prevent Delaware corporations from engaging in a merger or sale of more than 10% of its assets with any stockholder, including all affiliates and associates of the stockholder, who owns 15% or more of the corporation’s outstanding voting stock, for three years following the date that the stockholder acquired 15% or more of the corporation’s assets unless:

|

·

|

the Board of Directors approved the transaction in which the stockholder acquired 15% or more of the corporation’s assets;

|

|

·

|

after the transaction in which the stockholder acquired 15% or more of the corporation’s assets, the stockholder owned at least 85% of the corporation’s outstanding voting stock, excluding shares owned by directors, officers and employee stock plans in which employee participants do not have the right to determine confidentially whether shares held under the plan will be tendered in a tender or exchange offer; or

|

|

·

|

on or after this date, the merger or sale is approved by the Board of Directors and the holders of at least two-thirds of the outstanding voting stock that is not owned by the stockholder.

|

A Delaware corporation may opt out of the Delaware anti-takeover laws if its certificate of incorporation or bylaws so provide. Salon has not opted out of the provisions of the anti-takeover laws. As such, these laws could prohibit or delay mergers or other takeover or change of control of Salon and may discourage attempts by other companies to acquire Salon.

Salon’s certificate of incorporation and bylaws include a number of provisions that may deter or impede hostile takeovers or changes of control or management. These provisions include:

|

·

|

Salon’s Board is classified into three classes of Directors as nearly equal in size as possible with staggered three year-terms; and

|

|

·

|

special meetings of the stockholders may be called only by the Chairman of the Board, the Chief Executive Officer or the Board of Directors.

|

These provisions may have the effect of delaying or preventing a change of control.

Salon’s Certificate of Incorporation and Bylaws provide that it will indemnify officers and Directors against losses that they may incur in investigations and legal proceedings resulting from their services to Salon, which may include services in connection with takeover defense measures. These provisions may have the effect of preventing changes in Salon’s management.

In addition, employment agreements with certain executive officers provide for the payment of severance and acceleration of the vesting of options and restricted stock in the event of termination of the executive officer following a change of control of Salon. These provisions could have the effect of discouraging potential takeover attempts.

18

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

Salon leases 8,623 square feet of office space at 101 Spear Street, San Francisco, California, where it is headquartered. The lease for the San Francisco office will terminate in February 2014. Salon also leases 4,200 square feet of office space at 15 West 37th Street, 8th Floor, New York, NY and a smaller office at 300 Manhattan Beach Blvd., Manhattan Beach, CA, through August 2011. Salon also rents minimal space to host its servers in Sacramento, California.

Salon believes that its existing properties are in good condition and are suitable for the conduct of its business.

ITEM 3. Legal Proceedings

Salon is not a party to any pending legal proceedings that it believes will materially affect its financial condition or results of operations.

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Information with respect to the quarterly high and low sales prices for Salon’s common stock, ticker symbol SLNM.PK, for its fiscal years 2011 and 2010, based on sales transactions reported by the OTC (Over-The-Counter) Bulletin Board is provided below:

|

Fiscal Year Ended

|

Fiscal Year Ended

|

||||||||

|

March 31, 2011

|

March 31, 2010

|

||||||||

|

For the quarter ended

|

High

|

Low

|

High

|

Low

|

|||||

|

June 30

|

0.34

|

0.03

|

0.40

|

0.11

|

|||||

|

September 30

|

0.80

|

0.03

|

0.20

|

0.11

|

|||||

|

December 31

|

0.79

|

0.10

|

0.65

|

0.11

|

|||||

|

March 31

|

0.50

|

0.10

|

0.35

|

0.06

|

|||||

There were 43 active holders of record of Salon common stock as of June 1, 2011. This number was derived from Salon’s stockholder records, and does not include beneficial owners of Salon’s voting common stock whose shares are held in the names of various dealers, clearing agencies, banks, brokers, and other fiduciaries. The closing price of Salon’s common stock on June 1, 2011 was $0.12 per share.

Salon has never declared or paid any cash dividends on its capital stock and does not expect to pay any cash dividends in the foreseeable future.

Salon has never repurchased any of its equity securities.

19

Equity Compensation Plan Information

The following table provides information about Salon’s common stock that may be issued upon the exercise of options and rights under all of Salon’s existing equity compensation plans as of March 31, 2011, including the Salon Internet, Inc. 1995 Stock Option Plan, the Salon Media Group, Inc. 2004 Stock Plan, the Salon Media Group, Inc. Non-Plan Stock Agreement and the 1999 Employee Stock Purchase Plan.

|

Plan category

|

Number of securities to

|

Weighted-average

|

Number of securities

|

|

be issued upon exercise

|

exercise price of

|

remaining available for

|

|

|

of outstanding options

|

outstanding options

|

future issuance under

|

|

|

and rights

|

and rights

|

equity compensation

|

|

|

plans, excluding

|

|||

|

securities reflected in

|

|||

|

column (a)

|

|||

|

(a)

|

(b)

|

(c)

|

|

|

Equity compensation plans

|

|

||

|

approved by security

|

|||

|

holders

|

5,321,728 | $0.23 | 866,098 |

|

Equity compensation plans

|

|

|

|

|

not approved by security

|

|||

|

holders

|

50,000 | $0.35 | None |

|

Total

|

5,371,728

|

N/A

|

866,098

|

Equity Compensation Plans Not Approved by Security Holders

In February 2005, Salon entered into a Non-Plan Stock Agreement with its then Chairman, pursuant to which Salon granted such person non-qualified options to purchase 50,000 shares of common stock at an exercise price of $2.80 per share. Such option grant did not receive stockholder approval. 50% of the shares subject to the option vested on the date of grant and 50% of the shares subject to the option vested in February 2006. On December 4, 2008, these and substantially all other options then outstanding were repriced to $0.35, the fair market value of the Company’s common stock on that date.

In June 2006, Salon entered into a Non-Plan Stock Agreement with its then Senior Vice President – Publisher, pursuant to which Salon granted such person non-qualified options to purchase 50,000 shares of common stock at an exercise price of $3.20 per share. Such option grant did not receive stockholder approval. 25% of the shares subject to the option vested after one year and 1/48th vests per month thereafter. In December 2006, Salon entered into another Non-Plan Stock Agreement with its then Senior Vice President – Publisher, pursuant to which Salon granted such person non-qualified options to purchase 25,000 shares of common stock at an exercise price of $1.05 per share. Such option grant did not receive stockholder approval. 25% of the shares subject to the option vested after one year and 1/48th vests per month thereafter. These options have been forfeited following the departure of the executive.

20

Stock Performance Graph

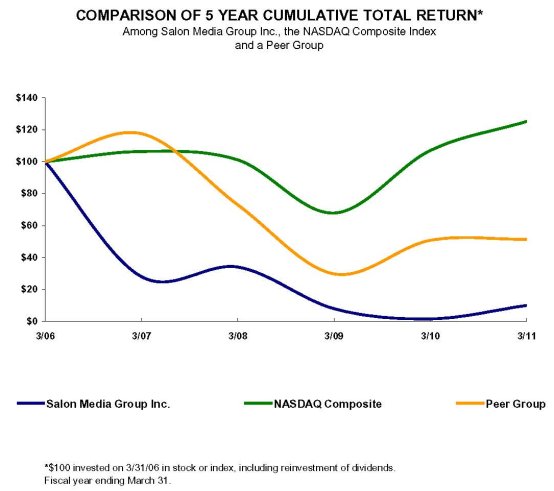

The graph below matches Salon Media Group Inc.'s cumulative 5-year total stockholder return on common stock with the cumulative total returns of the NASDAQ Composite index, and a customized peer group of five companies that includes: Answers Corp., Quepasa Corp., Thestreet.com Inc., Tucows Inc. and Edgar Online Inc. The graph tracks the performance of a $100 investment in our common stock, in the peer group, and the index (with the reinvestment of all dividends) from March 31, 2006 to March 31, 2011.

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

21

ITEM 6. Selected Consolidated Financial Data

|

Dollar amounts in thousands, except per share

|

||||||||||||||||||||

|

Year Ended March 31,

|

2011

|

2010

|

2009

|

2008

|

2007

|

|||||||||||||||

|

Net revenues

|

$ | 4,573 | $ | 4,291 | $ | 6,874 | $ | 7,513 | $ | 7,748 | ||||||||||

|

Net loss

|

$ | (2,584 | ) | $ | (4,861 | ) | $ | (4,699 | ) | $ | (3,409 | ) | $ | (1,566 | ) | |||||

|

Net loss attributable to common

|

||||||||||||||||||||

|

stockholders (1)

|

$ | (2,584 | ) | $ | (4,861 | ) | $ | (4,699 | ) | $ | (3,463 | ) | $ | (1,861 | ) | |||||

|

Basic and diluted net loss per share

|

||||||||||||||||||||

|

attributable to common

|

||||||||||||||||||||

|

stockholders (2)

|

$ | (0.84 | ) | $ | (2.30 | ) | $ | (2.34 | ) | $ | (1.79 | ) | $ | (1.10 | ) | |||||

|

Weighted average common shares

|

||||||||||||||||||||

|

outstanding used in computing

|

||||||||||||||||||||

|

per share amounts (thousands)(2)

|

3,086 | 2,116 | 2,008 | 1,940 | 1,692 | |||||||||||||||

|

Cash and cash equivalents

|

$ | 386 | $ | 216 | $ | 371 | $ | 818 | $ | 829 | ||||||||||

|

Prepaid advertising rights

|

$ | - | $ | - | $ | 1,225 | $ | 2,131 | $ | 3,267 | ||||||||||

|

Total assets

|

$ | 1,636 | $ | 1,627 | $ | 3,330 | $ | 4,616 | $ | 5,605 | ||||||||||

|

Total long-term liabilities

|

$ | 1,380 | $ | 3,030 | $ | 2,706 | $ | 600 | $ | 85 | ||||||||||

|

(1)

|

The net losses attributable to common stockholders for the years ended March 31, 2011, 2010 and 2009 do not include a preferred deemed dividend as there were no deemed dividend changes. The net loss attributable to common stockholders for the year ended March 31, 2008 includes a preferred deemed dividend charge of $54 from the issuance of Series D preferred stock. The charge represents the difference between the offering price of Salon’s Series D preferred stock and the fair value of Salon’s common stock into which the preferred stock was convertible on the date of the transaction and the value of the warrants issued in the transaction. The net loss attributable to common stockholders for the year ended March 31, 2007 includes a preferred deemed dividend charge of $295 from the issuance of Series D preferred stock. The charge represents the difference between the offering price of Salon’s Series D preferred stock and the fair value of Salon’s common stock into which the preferred stock was convertible on the date of the transaction and the value of the warrants issued in the transaction.

|

|

(2)

|

The share and per share results for the year ended prior to March 31, 2007 reflects a reverse stock split effective as of November 15, 2006. In the reverse stock split, each 20 outstanding shares common stock (“old common stock”) was automatically reduced into one share of new common stock |

22

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

Salon is an online news and social networking company and an Internet publishing pioneer. Salon’s award-winning journalism combines original investigative stories and provocative personal essays along with quick-take commentary and staff-written Weblogs about politics, technology, culture and entertainment. Committed to interactivity, the Website also hosts two online communities, The Well, and Open Salon, a social network for bloggers. In its editorial product Salon balances two crucial missions: (1) providing original and provocative content on topics that the mainstream media overlook, and (2) filtering through the media chatter and clutter to help readers find the stories that matter.

Sources of Revenue

The most significant portion of Salon’s revenues is derived from advertising from the sale of promotional space on its Website. The sale of promotional space is generally less than ninety days in duration. Advertising units sold include “rich media” streaming advertisements, as well as traditional banner and pop-up advertisements.

Salon also derives a significant portion of its revenues from its Salon Premium subscription program. This source of revenue has been decreasing since Salon’s quarter ended December 31, 2004 when paid subscriptions peaked at approximately 89,100 and have since decreased to approximately 10,900 as of March 31, 2011. Salon expects this downward trend to continue, as it is placing greater emphasis on its advertising sales to generate revenue. Revenue from membership to the online discussion forum The Well has been recognized ratably over the subscription period. Salon also generates nominal revenue from the licensing of content that previously appeared in Salon’s Website, for hosting links to a third party’s personals/dating Websites, and operating its emerging e-commerce activities.

Operating Expenses

Production and content expenses consist primarily of salaries and related expenses for Salon’s editorial, artistic, and production staff, online communities’ staff, payments to freelance writers and artists, bandwidth costs associated with serving pages and hosting our online communities on our Website, credit card transaction costs and ad serving costs.

Sales and marketing expenses consist primarily of salaries, commissions and related personnel costs, travel, and other costs associated with Salon’s sales force, business development efforts and its subscription service. It also includes advertising, promotions and the amortization of prepaid advertising rights.

Information technology support expenses consist primarily of salaries and related personnel costs associated with the development, testing and enhancement of Salon’s software to manage its Website, and to maintain and enhance the software utilized in managing Salon Premium, as well as supporting marketing and sales efforts.

General and administrative expenses consist primarily of salaries and related personnel costs, accounting and legal fees, and other fees associated with operating a publicly traded company. Certain shared overhead expenses are allocated to other departments.

23

Critical Accounting Policies

The preparation of financial statements in conformity with generally accepted accounting principles requires Salon to utilize accounting policies and make estimates and assumptions that affect our reported amounts. Salon’s significant accounting policies are described in Note 2 to the Consolidated Financial Statements. Salon believes accounting policies and estimates related to revenue recognition and accounting for debt and equity are the most critical to Salon’s financial statements. Future results may differ from current estimates if different assumptions or conditions were to prevail.

Share Based Compensation

Salon accounts for share-based compensation under ASC 718 and recognizes the fair value of stock awards on a straight-line basis over the requisite service period of the award, which is the standard vesting term of four years.

Salon recognized share-based compensation expense of $295,000 and $379,000 during the twelve months ended March 31, 2011 and March 31, 2010, respectively. As of March 31, 2011, Salon had an aggregate of $335,000 of share-based compensation remaining to be amortized to expense over the remaining requisite service period of the underlying awards. Salon currently expects this share-based compensation balance to be amortized as follows: $198,000 during fiscal 2012; $111,000 during fiscal 2013; $24,000 during fiscal 2014 and $2,000 during fiscal 2015. The expected amortization reflects only outstanding stock option awards as of March 31, 2011. Salon expects to continue to issue share-based awards to its employees in future periods.

The full impact of share-based compensation in the future is dependent upon, among other things, the timing of when Salon hires additional employees, the effect of new long-term incentive strategies involving share-based awards in order to continue to attract and retain employees, the total number of share-based awards granted, the fair value of the stock awards at the time of grant and the tax benefit that Salon may or may not receive from stock-based expenses. Additionally, share-based compensation requires the use of an option-pricing model to determine the fair value of stock option awards. This determination of fair value is affected by Salon’s stock price as well as assumptions regarding a number of highly complex and subjective variables. These variables include, but are not limited to, Salon’s expected stock price volatility over the term of the awards.

Liquidity

Salon has incurred significant net losses and negative cash flows from operations since its inception. As of March 31, 2011, Salon had an accumulated deficit of $108.4 million. These losses have been funded primarily through the issuance of common stock from Salon’s initial public offering in June 1999, issuances of preferred stock, bank debt, from the issuance of convertible notes payable and other advances from related parties.

Burr Pilger Mayer, Inc., Salon’s independent accountants for the years ended March 31, 2011, March 31, 2010 and March 31, 2009 have included a paragraph in their report indicating that substantial doubt exists as to Salon’s ability to continue as a going concern because of Salon’s recurring operating losses, negative cash flow and accumulated deficit.

24

Income Taxes

Salon has not recorded a provision for federal or state income taxes since inception due to recurring operating losses. At March 31, 2011, Salon had net operating loss carryforwards of $79.7 million for federal income tax purposes that begin to expire in March 2016, and $25.2 million for California income tax purposes. As Salon has been incurring tax losses, $7.1 million of California net operating loss carryforwards expired as of March 31, 2011, and if Salon were to incur a tax loss for the year ending March 31, 2012, an additional $2.1 million operating loss carryforward will expire. Utilization of Salon’s net operating loss carryforwards may be subject to a substantial annual limitation due to ownership change limitations provided by the Internal Revenue Code and similar California State provisions. Such an annual limitation could result in the expiration of the net operating loss carryforwards before utilization. A valuation allowance has been established and, accordingly, no benefit has been recognized for such operating losses and other deferred tax assets. The net valuation allowance decreased $0.5 million during the year ended March 31, 2011 to $29.1 million. Salon believes that, based on a number of factors, the availability of objective evidence creates sufficient uncertainty regarding the realization of the deferred tax assets such that a full valuation allowance has been recorded. These factors include Salon’s history of net losses since inception and expected near-term future losses.

Revenue Recognition