Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - SALON MEDIA GROUP INC | ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - SALON MEDIA GROUP INC | ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - SALON MEDIA GROUP INC | ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - SALON MEDIA GROUP INC | ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - SALON MEDIA GROUP INC | ex23-1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2016

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 0-26395

SALON MEDIA GROUP, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware |

94-3228750 |

|

(State of Incorporation) |

(IRS Employer Identification No.) |

870 Market Street

San Francisco, CA 94102

(Address of principal executive offices)

(415) 870-7566

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 Par Value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. [ ]

Indicate by check mark whether the registrant is an accelerated filer as defined in Rule 12b-2 of the Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☑

Indicate by check mark whether the registrant is a shell company (as defined by Exchange Act Rule 12b-2).Yes [ ] No [X]

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $3,055,000 based on the closing sale price of the registrant’s Common Stock on June 1, 2016. Shares of Common Stock held by each then current executive officer and director and by each person who is known by the registrant to own 5% or more of the outstanding Common Stock have been excluded from this computation in that such persons may be deemed to have been affiliates of Salon Media Group, Inc. This determination of affiliate status is not a conclusive determination for other purposes.

The number of outstanding shares of the Registrant's Common Stock, par value $0.001 per share, on June 1, 2016 was 76,245,442 shares.

FORM 10-K

SALON MEDIA GROUP, INC.

INDEX

| Page | |||

|

PART I |

Number | ||

|

ITEM 1. |

Business |

3 |

|

|

ITEM 1A. |

Risk Factors |

12 |

|

|

ITEM 1B. |

Unresolved Staff Comments |

21 |

|

|

ITEM 2. |

Properties |

21 |

|

|

ITEM 3. |

Legal Proceedings |

21 |

|

|

ITEM 4. |

Mine Safety Disclosures |

21 |

|

|

PART II |

|||

|

ITEM 5. |

Market for Registrant’s Common Equity and Related Stockholder Matters, and Issuer Purchases of Equity Securities |

21 |

|

|

ITEM 6. |

Selected Financial Data |

22 |

|

|

ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 |

|

|

ITEM 7A. |

Quantitative and Qualitative Disclosures about Market Risk |

31 |

|

|

ITEM 8. |

Financial Statements and Supplementary Data |

32 |

|

|

ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures |

52 |

|

|

ITEM 9A. |

Controls and Procedures |

52 |

|

|

ITEM 9B. |

Other Information |

53 |

|

|

PART III |

|||

|

ITEM 10. |

Directors, Executive Officers and Corporate Governance |

54 |

|

|

ITEM 11. |

Executive Compensation |

57 |

|

|

ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

64 |

|

|

ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

66 |

|

|

ITEM 14. |

Principal Accountant Fees and Services |

67 |

|

|

PART IV |

|||

|

ITEM 15. |

Exhibits, Financial Statement Schedules |

68 |

|

|

SIGNATURES |

70 | ||

PART I

This report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that involve risks and uncertainties, including but not limited to statements regarding our strategy, plans, objectives, expectations, intentions, financial performance, cash-flow breakeven timing, financing, economic conditions, Internet advertising market performance, subscription service plans, social media and other non-web opportunities and revenue sources. Although Salon Media Group, Inc. (“Salon”, the “Company”, “we”, “our” or “our”) believes its plans, intentions and expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such plans, intentions or expectations will be achieved. Salon’s actual results may differ significantly from those anticipated or implied in these forward-looking statements as a result of the factors set forth above and in Salon’s public filings. Salon assumes no obligation to update any forward-looking statements except as required by law.

Salon’s actual results may differ significantly from those anticipated or implied in these forward-looking statements as a result of the factors set forth in “Risk Factors.” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are elsewhere in this Annual Report. In this Annual Report, the words “anticipates,” “believes,” “expects,” “estimates,” “intends,” “future,” and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

ITEM 1. Business

OVERVIEW

Salon is an online news website committed to fearless journalism and to making the conversation smarter. Our award-winning journalism combines original investigative stories and provocative personal essays along with quick-take commentary and staff-written articles about politics, culture, entertainment, sustainability, innovation, technology and business.

Salon was originally incorporated in July 1995 in the State of California and reincorporated in Delaware in June 1999. In 1999, we had our initial public offering. In 2001, we adopted the name Salon Media Group, Inc. Our common stock is traded in the over-the-counter market and our stock symbol is SLNM.PK.

Highlights from Fiscal Year 2016

During the fiscal year ended March 31, 2016 (“fiscal year 2016”), we continued to execute our business strategy (see “Salon Strategy” below) to broaden our editorial coverage in order to attract a larger audience, which in turn should attract more advertising, and increase our revenues. Our focus on high quality editorial attracted a continued robust audience to our Website in fiscal year 2016, and we regularly reached new traffic milestones throughout the year. However, we faced increased competition from both new and larger websites for online advertising campaigns, while industry trends shifted toward increased use of agency and software-based approaches to buying online advertising. As a result, our direct ad sales have declined, and we have increasingly relied on third-party agencies to sell ads on our Website through programmatic advertising open marketplaces. The highlights of our fiscal year 2016 are listed below:

|

● |

Total revenue in the fiscal year 2016 increased 41% to $7.0 million. We have been working on strategies to better monetize our Website and increase advertising revenues. The digital advertising landscape has shifted considerably over the past year, and as advertisers have increasingly focused their attention on video and programmatic selling, we have increased our efforts in those areas. In fiscal year 2016, 67% of our advertising revenue was generated by programmatic selling, and 33% by our direct sales team which continues to focus mostly on high impact and higher cost-per-thousand-impression (“CPM”) video advertising. With the recent launch of Facebook’s ad sharing program, we will begin to monetize Salon content that is posted away from our website. We believe these strategies should help us to increase our revenues in fiscal year 2017. |

|

● |

Net loss for the fiscal year 2016 was $2.0 million, a 50% decrease from $3.9 million in the fiscal year ended March 31, 2015 (“fiscal year 2015”). The decrease in losses resulted from an increase in revenues and relatively stable operating expenses of $8.9 million for the corresponding periods. |

|

● |

The launch of our editorial video production department was a highlight of fiscal year 2016. In September 2015, we launched original video content focused on news, politics and entertainment. Our goal is to add high quality diversified content to our Website, and to attract premium video advertising that commands higher CPMs as compared to display advertising. More than 250 original videos were produced during the March quarter. A number of original videos went viral on Facebook: Patrice Waite’s story about Donald Trump contradicting himself about violence at his rallies garnered more than 14 million views on Facebook, Asha Parker’s mash up of Donald Trump and scenes from the Big Lebowski has been viewed more than 16 million times, and Janet Upadhye’s story about the political apathy of American youth got more than 40 million views. In total, more than 10 videos were viewed in excess of 1 million times, and many more were viewed more than 100,000 times. We will continue to assess and refine the video product based on user adoption. These videos complement Salon’s brand of fearless journalism that makes the conversation smarter, and are designed for maximum share-ability on social media sites. |

|

● |

We reached several new traffic milestones. Our peak monthly users for Salon.com (or, the “Website”) traffic in fiscal year 2016 was in June 2015 when we recorded 19.6 million users, as measured by Google Analytics. In total, the average number of monthly users in fiscal year 2016 was 16.6 million, compared to 16.9 million in fiscal year 2015, a decrease of 2%. Unique visitors as measured by comScore (U.S. desktop) reached a high of 5.2 million in June 2015 and for the fiscal year ended March 2016 averaged 4.1 million, a decrease of 8% compared to 4.5 million average in fiscal year 2015. The difference between the two sources is that comScore uses a panel-centric method for counting unique visitors in the U.S. market rather than the tagging technology used by Google to measure global users. |

|

● |

In August, Salon recognized the Writers Guild of America, East, Inc. (“WGAE”) as the collective bargaining representative of our non-supervisory editorial staff. We commenced collective bargaining with the WGAE in November 2015. |

|

● |

We were proud to be honored for our excellence in journalism during the fiscal year. Salon was an honoree for the 2016 Webby Awards for its Online Film & Video, Video Remixes and Mashups category, for our Donald Trump/Big Lebowski mashup. Lindsay Abrams was honored by the Audubon Society as one of its "Women Greening Journalism" at their annual Women in Conservation luncheon. Columnist Brittney Cooper was identified as part of the "emerging black intelligentsia" by The New Republic in September. Damon Tweedy's "Being Black Can Be Bad for Your Health" named as part of "The 13 Biggest Health Stories of 2015" by Healthline. We were also proud that Chauncey DeVega's piece on race, terrorism and the Planned Parenthood shooting was named among most essential writing by a person of color in 2015 by the HuffingtonPost. |

|

● |

Mobile users accounted for 61.8% of all users in March 2016, which is up slightly from 59.4% in December 2015 and 58.7% in March 2015. We continue to have a company-wide focus on our users’ mobile needs, especially quick and easy access to fast-loading content optimized for better readability on smaller screens. In the 2015 fiscal year, we redesigned our mobile applications (“apps”) and iteratively integrated native advertising solutions to better monetize them. |

|

● |

Social media continues to be a major source of referral traffic, at approximately 38.5% of Website visitors as of March 31, 2016, and a significant focus across the Company. We make regular updates to the Website to optimize content to be shared on social media with a special focus on our mobile platforms. In March 2016, we had approximately 881,000 Facebook “likes,” and 576,000 Twitter followers. |

|

● |

Our direct advertising team continued to focus on high value campaigns that incorporated custom creative applications, pre-roll video advertising and seamless video integrations. More than 75% of our advertising campaigns fell in two categories: branded consumer and entertainment. Major advertising clients in fiscal year 2016 included Amazon, Panera, Ally Bank, Cadillac, PBS, Audible, and Hulu, for which we created an interactive crossword and advent calendar to promote “Seinfeld.” which won an OMMA award for best integrated entertainment online campaign. |

|

● |

We continually work toward leaner, more efficient technological systems through automation, improved architecture and adoption of emerging best practices. Throughout the year, we made technological updates to our browser, tablet, mobile, app and watch platforms with a focus on video, mobile and advertising and ad blocking. |

Salon Strategy

In May 2016, we adopted a new strategy alongside the appointment of Jordan Hoffner as Chief Executive Officer. Our strategy focuses on improving monetization of our user base by innovating our ad technology in order to better match our highly educated and affluent users with advertisers. In the past few years, we have successfully grown our user base, which in fiscal year 2016 averaged 16.6 million users per month, and reached an all-time high of 19.6 million unique users in June 2015. Our number of users translates to our number of viewer impressions that can be sold to our advertisers, and offers opportunities to develop business relationships with companies that want access to our attractive user base. We currently sell our impressions to advertisers programmatically based on Run of Site private marketplaces, or at times, based on editorial content that falls in a particular vertical such as “Movies” or “Innovation.” The CPM is driven by market demand for our content, and the general demographics of our audience. Going forward, the CPM that we can charge our advertisers will increasingly be based on our ability to deliver highly targeted and defined users to our advertiser, and we expect to achieve higher CPMs as we can deliver more detailed information about our users.

Our strategy is predicated on the following core principles: (1) create high quality diversified content that meets our users’ and advertisers’ interests; (2) hire the best possible talent to create centers of excellence and (3) innovate to bring great products to our users and advertisers. Our focus on these core principals underpins our goal to continue to grow our user base, and to develop new strategies around Website monetization that will provide opportunity for future growth.

In fiscal year 2017, our goal is to continue our mission of creating fearless journalism and making the conversation smarter, while anticipating continued shifts in the online advertising market to better monetize our Website. To reach our goals, and to achieve profitability, we will push ahead in the following areas:

|

● |

Develop a broader mix of provocative content in addition to the core areas of news and politics, building off the original definition of a “salon” as a center of intellectual discussion |

|

● |

Deepen our editorial coverage by adopting a broader array of story telling methods, such as expanding our video content, and adding audio and other visual products, with a unwavering commitment to high quality content and fearless journalism |

|

● |

Integrate into our advertising approach a deeper focus on new advertising products that match our high quality user with appropriate advertisers using data and innovative ad products |

Develop a Broader Mix of Provocative Content

We target an educated, culturally engaged audience interested in original thinking and smart commentary. We pursue that audience by featuring a diverse array of voices and perspectives, and covering a wide range of topics including News, Politics, Business, Technology, Life, Entertainment, Sustainability and Innovation. Twenty-four hours a day, 365 days per year, Salon invites users to immerse themselves in thought-provoking content that impassions and empowers them to be the intellectual and cultural leaders of our time.

In fiscal year 2016, we continued to expand our breaking news coverage with a focus on politics ahead of the 2016 Presidential Election. Using data analytics in real-time, we can assess where our users’ interests are shifting, and respond by determining content, site layout and structure to best suit their needs in the moment. In fiscal year 2017, we intend to respond to users’ interests by hosting more dynamic content, such as video, slideshows and images, as well as by expanding into content areas such as business and lifestyle. We will expand into new content areas by reallocating internal resources, as well as continue to have content partnerships to diversify our content offerings across various verticals.

As we continue to focus our editorial to our users’ needs, we seek to grow unique visitors to our Website since the resulting page views serve as a platform for advertising impressions, a key driver of our revenue growth.

Develop Innovative, User-Oriented Products

We continually need fresh content and new ideas to attract readers to our Website. We plan to continue to focus on developing our audience through a combination of editorial enhancements, increased dynamic content and new user-focused functionalities and products. We are continually evaluating the needs of our users and trying to adjust and create new solutions to meet their needs.

Video is popular with our users, and as a result in fiscal year 2016 we launched Salon branded video content. The success of this launch has led us to explore ways to offer more video and integrate it more seamlessly into our Website. In fiscal year 2017, in order to achieve widespread video integration, we are expanding our video editorial team, exploring additional partnerships to gain access to premium video content, and implementing new technology to improve viewability. Video is in high demand with our advertisers. In fiscal year 2016, 85% of our direct advertisers incorporated video into their campaigns. We plan to monetize video through sale of advertising pre-roll via direct and programmatic advertising partnerships, and through syndication of our video content.

Web browsers and applications on mobile platforms are a significant area of audience growth and ad revenue in the online news industry, in particular as social media users have increasingly adopted usage on their mobile phones. Our users continue to move to mobile at record rates, and as of March 2016, mobile browsers accounted for 61.8%, of our unique visitors. Social media has also become a key driver of users for us, consistent with trends for other online news sites. Traffic from Facebook alone grew by over 32% since March 2014. The increase in Website traffic from social media was underpinned by the significant increases in the number of Facebook “likes” to more than 881,000, and monthly reach of more than 80 million (defined as a user who viewed or interacted with our content) on the Facebook platform in March 2016. In fiscal year 2017, we plan to continue our efforts to build our audience on social media, and place more emphasis on other emerging platforms, through a continuation of the strategies we have employed in the past two years.

In fiscal year 2017, we are working on a Website and advertising architecture redesign aimed at improving the user experience. As part of this effort, we will continue exploring new products that meet the immediate needs of our mobile users, building out new advertising products for video and mobile and improving our security and scaling capabilities.

A Deeper Focus on New Advertising Products that Match our User with Appropriate Advertisers

In order to expand our base of advertisers and increase our advertising revenues, we plan to integrate into our advertising approach a deeper focus on new advertising products that match our high quality user with appropriate advertisers using data and innovative ad products. This includes adding software and data capabilities to better understand our users and match their interests with advertisers more closely.

Path to Profitability

Although we reduced our losses in fiscal year 2016 compared to fiscal year 2015, we did not achieve our goal of profitability so will continue to make adjustments to our revenue model in order to increase advertising revenues. We have taken advantage of the shift in online advertising to programmatic marketplaces that are driven by software to purchase digital advertising space. In fiscal year 2016, our programmatic advertising revenues increased 59% compared to fiscal year 2015, and accounted for 67% of our advertising revenues as compared to 56% in fiscal year 2015. We will be re-architecting our programmatic platform to improve the match between advertisers and users, and will invest greater resources into this business area to optimize further our advertising capabilities. We believe the adjustments we are making to our advertising sales approach will allow further growth in programmatic advertising revenues in fiscal year 2017.

We continue to believe that our focus on excellence in our core editorial product can attract a high demographic audience and deliver value to our advertising clients. Our users consist of a global community that is demanding and engaged. They are considered influencers in public policy, culture, art, technology and fashion. Advertisers evaluate a website based on its scale (number of impressions), and the type of ads that are offered (high impact, such as video, sponsored content and content that may be otherwise tied to nearby ads, versus display only.) Advertisers typically seek to attract a specified demographic age, gender, socio-economic background, and education. We believe that improved information and targeting of our user profile will make our Website a more valuable media property for advertisers and retailers who are allocating marketing resources to target consumers online who have our demographic profile.

We work with our advertising clients to reach this attractive audience and tailor advertising to their needs. Through our direct sales team, we have increasingly focused our ad implementations on customized editorial content, mostly in a combination of written editorial, video and slideshows, that promote an advertiser’s brand and are shown on our Website as “sponsored.” As a result, nearly 90% of our advertising campaigns in fiscal year 2016 included high-impact rich media and sponsored content. In fiscal year 2017, we plan to continue to expand our custom ad integration, and broaden our sponsored content offerings, with a special focus on video and mobile products.

Due to an industry shift in advertising dollars toward programmatic and video advertising, our direct advertising declined 2% and programmatic advertising increased 59% leading to total advertising revenues increasing 33% in fiscal year 2016. At the same time, our production costs remained constant from a year ago, leading to decreased losses. To maintain this trend, we will continue to drive revenue growth as described above, while closely monitoring our operating expenses, and re-evaluate costs where we do not see clear productivity gains. As a result, we have discontinued spending in marketing that we felt was not generating sufficient revenue opportunity, streamlined our editorial workforce and made changes to the structure of our sales team. Given these changes, we anticipate that fiscal year 2017 will better align production costs with our revenue potential in an effort to reach profitability.

OUR BUSINESS

We target an educated, culturally engaged audience interested in original thinking and reporting on the day’s big stories. We pursue that audience by featuring a diverse array of voices and perspectives, and covering a wide range of topics including politics, race, religion, culture, entertainment, sustainability, innovation, technology and business.

Salon.com Website

|

News |

Breaking news fast – and what it means. Whether it's Charlie Hebdo, Ferguson, the Josh Duggar and Bill Cosby scandals, or debates over important foreign policy issues, we surround stories people want to talk about as they happen– with dedicated bloggers, extensive videos, and smart columnists who put important news into immediate context. | |

|

Politics |

Fearless, independent and sophisticated coverage of the most important stories from Washington and around the world, delivered by big-name veterans like Amanda Marcotte and Andrew O’Hehir, and the brightest new analysts on the Web (Heather Digby Parton, Simon Maloy, Ben Norton and more). Our political coverage starts early in the morning with our Opening Shot columns, and is updated all day with new pieces, all designed to drive the conversation – and keep our readers ahead of it. | |

|

Arts & Culture |

Our writers and critics are just as obsessed with "The Americans," "Girls,” “Game of Thrones," and the coolest and hottest new books and movies as our readers are. Our entertainment coverage is edgy, exhaustive and fast, and we are just as determined to get to the latest viral video first as we are to mine the intersections between culture and politics. Our writers include Andrew O’Hehir (film), Sonia Saraiya (TV), and Mary Beth Williams, Scott Timberg (pop culture). | |

|

Life |

Our popular life essays go in-depth on the most complicated and deeply personal topics – sex, parenting, family, relationships, religion, work and so many more – and are written both by famous writers like Anne Lamott and Jennifer Egan, as well as daring and interesting new voices. | |

|

Sustainability and Innovation |

We launched these verticals in 2013 and it immediately became one of our most well-read sections. Our sustainability and innovation verticals combine the personal and the political – issues of climate change, the future of energy, organic food, and the politicization of science all receive authoritative. The section also includes the “Dream City” column, about how we design cities of the future to meet the values of today, written by Henry Grabar. | |

|

Tech |

Salon Tech goes beyond just gadgets and gee-whiz stories to get at how technology is changing our lives and workplaces – in increasingly complicated ways. In addition to the staff writers and book excerpts from the hottest and newest titles, the section includes content from sites like The Daily Dot, staff aggregation and AP wires. | |

|

Business |

Combines coverage of labor and income inequality issues from our politics writers with high-quality regular contributors (Robert Reich, Jared Bernstein) and book excerpts, content partners (International Business Times, NewDeal 2.0), staff aggregation and AP wires. |

Revenue Sources

Advertising is our primary source of revenue. Internet advertising revenues accounted for 86% of revenues in fiscal year 2016. From June 2001 until June 2012, our other main source of revenue was from subscriptions. Due to a tepid response from users, new subscriptions and renewals were no longer accepted as of June 2012, and the wind down of our subscription service was completed in fiscal year 2015. Revenue from referring users to third party websites primarily accounted for the remainder 14% of revenues in fiscal year 2016.

Internet advertising is affected by broad economic conditions, like other forms of advertising, but overall it has continued its upward trend even through the Great Recession. According to the 2015 IAB Internet Advertising Revenue Report (the “IAB Study”) conducted by PricewaterhouseCoopers, the compound annual growth rate (“CAGR”) over the past ten years for Internet advertising in the United States was 17%, which has significantly outpaced the U.S. current dollar GDP growth of 3% over the same period. Furthermore, since 2010, Internet advertising growth was fueled by a 100% CAGR in mobile, compared to a 9% growth in non-mobile revenues. Internet advertising revenue in the United States totaled $59.6 billion in 2015, a 20.4% increase from $49.5 billion 2014. In the quarter ended December 2015, the sources for advertising revenues were non-mobile search (32%), mobile (including search, display and video formats) (40%), non-mobile display advertising (22%), classifieds (4%) and lead generation (2%). Notably, mobile advertising grew 77% in 2015, jumping to the largest ad format. Within the non-mobile display advertising segment, which accounts for a significant part of our revenues, banner ads accounted for 12%, digital video for 7%, rich media for 2% and sponsorship for 1% of advertising revenues.

The bulk of online advertising remains concentrated in a relatively small number of dominant Internet companies, with the top ten companies accounting for 75% of online advertising in the December 2015 quarter, and another 9% captured by the next tier of companies ranked 11th through 25th. Therefore, we believe our market opportunity falls roughly at 16% of the online advertising market, or $9.5 billion.

The primary factor in our ability to increase our advertising revenues in future periods is growth in our audience. Attracting more unique visitors to our Website is important because these users generate additional page views, and each page view becomes a potential platform for advertisements. Advertising comprises video, banners, rich media, and other interactive ads across our desktop, tablet, mobile browser and apps platforms. Advertisers pay for advertising based on a cost-per-thousand-impression (“CPM”), and different platforms attract different CPMs. CPMs for mobile have been less than for desktop. Videos and sponsored content on mobile devices continue to grow in popularity and can demand a higher CPM. We believe that continuing to add videos and sponsored content to our mobile platform and improving and optimizing the platform’s design will help increase revenues from our mobile platform.

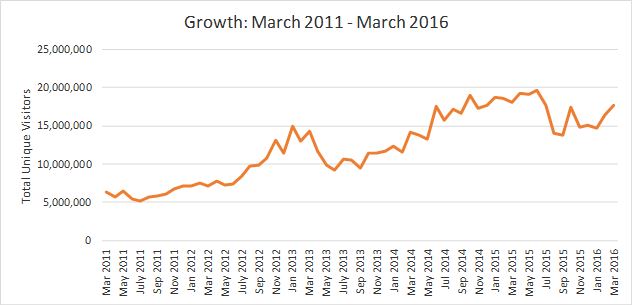

Overall, monthly unique visitors to our Website have grown from 6.3 million in March 31, 2011, to 17.7 million in March 31, 2016, a cumulative growth rate of 181% over the past six fiscal years. Our full year average monthly unique visitors was 5.4 million, 6.4 million, 10.6 million, 11.2 million, 16.9 million and 16.6 million in fiscal years 2011, 2012, 2013, 2014, 2015 and 2016, respectively. This growth reflects an increase in content areas on our Website over the same period, as well as improved search engine optimization and social media outreach. The table below reflects unique monthly visitors to our Website from fiscal year 2011 through fiscal year 2016. Unique visitors in the period from March 2011 to May 2013 included traffic to an affiliated website that has since been shut down.

|

Source: Google Analytics

Sales and Marketing

As a media Website that competes against much larger websites, we have sought to distinguish ourselves in the marketplace by offering customized, innovative and integrated advertising products that appeal to users and seamlessly and organically incorporate our advertising clients and their objectives into our Website. Our content rich environment offers advertisers the opportunity to develop custom content programs, including video-rich implementations. Using a dedicated team of content producers, we collaborate closely with the advertiser to create original series, slideshows, infographics and more to bring brand content to users in an organic way. To ensure engagement, all content is available cross-platform and supported by our promotional platforms and social profiles.

We have also built a suite of ad products that includes, among others: our “homepage spotlight” that features custom content in-stream in our editorial news feed, advertiser-sponsored articles and content verticals, custom Website “skins” that can overlay an advertisement onto the background of our Website, “pushdowns” that temporarily move the editorial content below an ad while it is being served, video overlays and in-stream video modules, a multi-media content module and a social feed module. This variety of products has given our advertisers multiple options to speak to and engage with our influential audience.

Our sales office is located in New York, with six advertising sales and operations employees as of March 31, 2016, of which four actively solicit orders.

Product Development

We recognize that users come to the site for online news, reporting, opinion and an engaging, active community of writers, users and commenters. Users engage with the site through desktop computers, mobile phones and social networking platforms and other referral partners. To meet users’ rapidly evolving online media needs, we are continually innovating and developing our Website, mobile Website and social media presence – by adding new features, design updates and technologies that improve the user experience, speed and search engine optimization. We have developed an internal culture of innovation where the Edit, Technology and Sales teams collaborate on product development. In fiscal year 2013, Salon implemented its mobile application strategy with the launch of its responsive mobile browser site and release of Apple and Android mobile applications. In fiscal year 2014, we continued to optimize the mobile browser experience, deploying updates to improve load time, design and layout for small screens.

In fiscal year 2015 we continued to make technological updates to our browser, tablet and mobile platforms with a focus on video presentation, mobile, advertising technologies and analytics integrations. We continued to make updates to our site recirculation and integrated with messaging app platforms such as Whatsapp and Tango. We optimized the site content for social media platforms, mobile and search engine optimization. We increased our site security and stability, by adding internal tools that provide powerful new techniques for site management, troubleshooting, and internal analytics. We began the process of shifting our browser site to utilize an API that provides comprehensive data source for all platforms. For the debut of the Salon App for Apple Watch, we launched a user notification system that allows editors to send breaking news alerts to users on our Apple Watch, iPhone and Android apps, and other emerging platforms.

In fiscal year 2016, we worked on a Website redesign aimed at improving our users’ experience. As part of this effort, we continued building out new advertising products for video and mobile, expanding our social media integration, improving our security and scaling capabilities, and exploring new products that meet the immediate needs of our mobile users.

Competition

The bulk of online advertising remains concentrated in a relatively small number of dominant Internet companies, with the top ten companies accounting for 75% of online advertising in the December 2015 quarter, and another 9% captured by the next tier of companies ranked 11th through 25th. Therefore, we believe our market opportunity falls roughly at 16% of the online advertising market, or $9.5 billion. We compete for advertising revenues with numerous websites, including major portals such as Yahoo and AOL, major search engines such as Google and Bing, major social networks such as Facebook and Twitter, and other online large media publications such as Buzzfeed, The Huffington Post, New York Times, Washington Post, MSNBC and CNN.com. We also compete with many smaller news and politics-oriented Websites, such as Slate, Gawker, The Daily Beast, The Atlantic, Talking Points Memo, Politico and Mother Jones for staff, audience and advertising sales.

Infrastructure and Operations

We have created a flexible publishing structure that enables us to develop our content while responding quickly to news events and to take advantage of the ease of distribution provided by the Internet. Our content is deployed on our proprietary software platform and captured in a database for reuse in Web and other formats. The content on our Website has been structured to facilitate being found by search engines, a key driver in increasing traffic to our Website, and optimized for sharing on social networks. During the past three years, we have improved the look and feel of our Website to increase appeal to our audience and we will continue to ongoing changes to our Website.

Our Website is hosted on cloud-based virtual servers running open-source Linux operating systems and various open-source web and network software packages. Our top technical priority is the fast and reliable delivery of pages to our users. Our systems are designed to handle traffic growth and network failures by balancing the requests among several pools of servers across the globe that automatically scale to match traffic demands. We rely on multiple tiers of redundancy/failover and third-party Content Delivery Network to achieve our goal of 24 hours, seven-days-a-week Website uptime. Regular automated backups protect the integrity of our data. Our servers are continuously monitored by numerous third-party and open-source monitoring and alerting tools.

Proprietary Rights

Our success and ability to compete is dependent in part on the goodwill associated with our trademarks, trade names, service marks and other proprietary rights and on our ability to use U.S. laws to protect our intellectual property, including our original content, content provided by third parties, and content provided by columnists. We have a registered trademark on our Salon name and logo.

Employees

As of March 31, 2016, Salon has 50 full-time employees, and 3 part-time employees. We believe our relations with our employees are good. We started collective bargaining with our non-supervisory editorial employees in November 2015, and the results of this process are uncertain. Our future success is highly dependent on our ability to attract, hire, retain and motivate talented personnel.

ITEM 1A. Risk Factors

Salon’s business faces significant risks. The risks described below may not be the only risks Salon faces. Additional risks that are not yet known or that are currently immaterial may also impair its business operations or have a negative impact on its stock price. If any of the events or circumstances described in the following risks actually occurs, its business, financial condition or results of operations could suffer, and the trading price of its Common Stock could decline. The Risk Factors set forth below have not materially changed from those included in our Fiscal 2015 Annual Report.

Salon has historically lacked significant revenues and has a history of losses

We have a history of significant losses and expect to incur a loss from operations, based on accounting principles generally accepted in the United States of America, for our fiscal year ending March 31, 2017 and to be determined in future years. Even if we attain profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. If revenues grow more slowly than we anticipate or operating expenses exceed expectations, financial results will most likely be severely harmed and our ability to continue operations will be seriously jeopardized.

Burr Pilger Mayer, Inc., Salon’s independent registered public accounting firm for the fiscal years ended March 31, 2012 through 2016 included a “going-concern” audit opinion on the financial statements for each of those years. The audit opinions report substantial doubt about our ability to continue as a going concern, citing issues such as the history of losses and absence of current profitability. As a result of the “going-concern” opinions, our stock price and investment prospects have been and will continue to be adversely affected, thus limiting financing choices and raising concerns about the realization of value on assets and operations.

The Company has operated principally with the assistance of interest free advances from related parties. The financial statements do not include any adjustments relating to the recoverability and classification of asset amounts or the amounts and classification of liabilities that might be necessary should we be unable to continue as a going concern.

Salon’s projected cash flows may not meet expectations

We rely on cash projections to run our business and change such projections as new information is made available or events occur. The most significant component of our cash projections is cash to be generated from advertising sales. Forecasting advertising revenues and resulting cash receipts for an extended period of time is problematic due to the short duration of most advertising sales contracts. If projected cash inflows and outflows do not meet expectations, our ability to continue as a going concern may be adversely affected.

If we forecast or experience periods of limited, or diminishing cash resources, we may need to sell additional securities or borrow additional funds. There is no guarantee that we will be able to issue additional securities in future periods or borrow additional funds on commercially reasonable terms to meet our cash needs. Our ability to continue as a going concern will be adversely affected if we are unable to raise additional cash from sources we have relied upon in the past or new sources.

We have relied on related parties for significant investment capital

We have relied on cash infusions from related parties to fund operations for many years. The related parties are primarily John Warnock, Chairman of the Board of Salon, and William Hambrecht. William Hambrecht is a Director and the father of our former CEO and current Chief Financial Officer, Elizabeth Hambrecht. During the fiscal year ended March 31, 2016, Mr. Warnock made approximately $2.2 million in cash advances to fund our operations. Subsequent to March 31, 2016, Mr. Warnock provided an additional $350,000 to meet our working capital requirements.

Curtailment of cash investments and borrowing guarantees by related parties would detrimentally impact our cash availability and our ability to fund our operations.

We started collective bargaining with our non-supervisory editorial employees, and the results of this process are uncertain

On August 3, 2015, the Writers Guild of America, East, Inc. (“WGAE”) became the collective bargaining representative of Salon’s non-supervisory editorial employees. We commenced collective bargaining with the WGAE in November 2015. Should this collective bargaining process result in an agreement that would not permit us to obtain additional funding, there can be no assurance that we will be able to continue our current business.

Our principal stockholders exercise a controlling influence over our business affairs and may make business decisions with which non-principal stockholders disagree, which may affect the value of non-principal stockholders’ investments

Approximately 45% of our voting securities are controlled, directly or indirectly by our Chairman, John Warnock, and approximately 36% is controlled directly or indirectly by William Hambrecht, a Director and the father of our Chief Financial Officer. We remain dependent upon Mr. Warnock and Mr. Hambrecht for continued financial support while we seek external financing from potential investors in the form of additional indebtedness or through the sale of equity securities in a private placement. While all outstanding, unsecured, interest-free cash advances from Mr. Warnock and Mr. Hambrecht at February 28, 2013 were exchanged for Common Stock in the Company’s Recapitalization, details of which were described in Note 4 to the financial statements included in the 2015 Annual Report, Mr. Warnock has continued to make unsecured, interest-free, cash advances to cover our operating expenses. These advances are payable on demand, and are exchangeable into securities on the same terms as those to be issued in our next financing from non-related parties. We were advised by Mr. Warnock and Mr. Hambrecht that they executed a stock transaction that has the effect of equalizing their stock ownership. The corresponding Forms 4 and Form 8-K were filed with the SEC on November 24 and November 25, 2015, respectively.

Future sales of significant number of shares of our Common Stock by principal stockholders could cause our stock price to decline

Our directors and officers own approximately 65 million shares, or 83% in the aggregate, of our Common Stock. As our Common Stock is normally thinly traded, if our principal stockholders were to sell their shares of Common Stock, the per share price of our Common Stock could be adversely affected.

Our stock has been, and will likely continue to be, subjected to substantial price and volume fluctuations due to a number of factors, many of which will be beyond our control and which may prevent our stockholders from reselling Common Stock at a profit

The securities markets have recently experienced significant price and volume fluctuations. This market volatility, as well as general economic, market or political conditions, has reduced and may continue to reduce the market price of our Common Stock, regardless of our operating performance. In addition, our stock is thinly traded. Even a few transactions, whether in response to disappointment in our expected operating results or any other reason, could cause the market price of our Common Stock to decrease significantly.

Holders of our Series C Preferred Stock are entitled to potentially significant liquidation preferences of Salon’s assets over holders of our Common Stock in the event of a liquidation event

Holders of our Series C Preferred Stock (“Preferred Stock”) have liquidation preferences over holders of Common Stock of the first approximately $2.6 million in potential sales proceeds as of March 31, 2016, which includes the effect of undeclared dividends, if granted, of about $0.8 million. If a liquidation event were to occur, and Preferred Stock dividends were declared, the holders of Preferred Stock would be entitled to the first $2.6 million of cash distributions. If a liquidation event were to occur in excess of $2.6 million and if Preferred Stock dividends were to be declared, the holders of Preferred Stock would be entitled to receive a relatively larger distribution than the holders of Common Stock would be entitled to receive.

We depend on advertising sales for substantially all of our revenues, and our inability to maintain or increase advertising revenues would harm our business

Our ability to maintain or increase our advertising revenues depends upon many factors, including whether we will be able to:

|

● |

attract and maintain additional visitors to our Website and increase brand awareness; |

|

● |

sell and market our Website or other rich media advertisements; |

|

● |

maintain a significant number of sellable impressions generated from Website visitors available to advertisers; |

|

● |

increase the dollar amount of our advertising orders; |

|

● |

improve our Website’s technology for serving advertising; |

|

● |

handle temporary high volume traffic spikes to our Website; |

|

● |

measure accurately the number and demographic characteristics of our users; and |

|

● |

attract and retain key sales personnel. |

As more of our users access our Website using mobile devices rather than PCs, if we do not continue to grow our mobile users and revenue, our business will be adversely impacted.

Internet users increasingly use mobile devices rather than PCs to access the Internet. Over 50% of our monthly users are now visiting our Website on mobile devices. As mobile platforms encompass a larger share of our readers, our ability to grow advertising revenue is increasingly dependent on our ability to generate revenue from ads displayed on mobile devices. While we plan to continue to devote technology resources to support our mobile browser product, apps and advertising products, if our mobile browser product, apps, and advertising products for mobile devices do not attract and retain users and advertisers to generate mobile revenue, our operating and financial results will be adversely impacted. We are dependent upon our products operating on mobile operating systems we do not control. The mobile phone manufacturer and its operating systems might block access to our Website or make it hard for users to find our Website through their devices, or block certain ads or charge us for delivery of ads, all of which would harm our operations and suppress revenue potential.

Technologies and software applications could block our advertisements, which could harm our operating results.

Technologies and software applications have been developed for PC and mobile devices that can block or allow users to opt out of display advertising, delete or block cookies used to deliver advertising, or move advertising to less optimal placements to suppress view-ability. Most of our advertising revenue is derived from display or video advertisements on our Website. As a result, ad-blocking technologies or software could reduce the number of display or video advertisements

If we cannot increase referrals from social media platforms, our ability to attract new unique visitors and maintain the engagement of existing unique visitors could be adversely affected.

As the behavior of internet consumers continues to change, distribution of our content, products and services via traditional methods may become less effective, and new distribution strategies may need to be developed. Consumers are increasingly using social networking sites such as Facebook and Twitter, to communicate and to acquire and disseminate information. As consumers migrate towards social networks, we continue to build social elements into our content, products and services in order to make them available on social networks and to attract and engage consumers on our Website and mobile platforms. There is no guarantee that we will be able to successfully integrate our content with such social networking or other new consumer trends. Even if we are able to distribute our content, products and services effectively through social networking or other new or developing distribution channels, this does not assure that we will be able to attract new unique visitors.

Hackers may attempt to penetrate our security system and online security breaches could harm our business

Consumer and supplier confidence in our Website depends on maintaining strong security features. Experienced programmers or “hackers” have penetrated sectors of our systems, and we expect that these attempts will continue to occur from time to time. To our knowledge, there has been no outward harm to us or our users as a result of hacking attempts. Furthermore, Salon has engaged the services of a third-party web application security-testing company, which conducts regular comprehensive searches for any vulnerabilities that may exist, allowing us to address and fix any issues before they can be exploited. This minimizes the risk of damage; however, because a hacker who is able to penetrate network security could misappropriate proprietary information or cause interruptions in our products and services, we may have to expend significant capital and resources to protect against or to alleviate problems caused by hackers. Additionally, we may not have a timely remedy against a hacker who is able to penetrate our network security. Such security breaches could materially affect our operations, damage our reputation and expose us to risk of loss or litigation. In addition, the transmission of computer viruses resulting from hackers or otherwise could expose us to significant liability. Our insurance policies may not be adequate to reimburse us for losses caused by security breaches. We also face risks associated with security breaches affecting third parties with whom we have relationships.

We must promote the Salon brand to attract and retain users, advertisers and strategic partners

The success of the Salon brand depends largely on our ability to provide high quality content and services. If Internet users do not perceive our existing content and services to be of high quality, or if we introduce new content and services or enter into new business ventures that are not favorably perceived by users, we may not be successful in promoting and maintaining the Salon brand. Any change in the focus of our operations creates a risk of diluting our brand, confusing consumers and decreasing the value of our user base to advertisers. If we are unable to maintain or grow the Salon brand, our business would be severely harmed.

We must hire, integrate and/or retain qualified personnel to support our business plans

Our success significantly depends on key personnel. In addition, because our users must perceive the content of our Website as having been created by credible and notable sources, our success also depends on the name recognition and reputation of our editorial staff. Due to our history of losses, we may experience difficulty in hiring and retaining highly skilled employees with appropriate qualifications. We may be unable to retain our current key employees or attract, integrate or retain other qualified employees in the future. If we do not succeed in attracting new personnel or retaining and motivating our current personnel, our business would be harmed.

Our success depends on our key personnel, including our executive officers, and the loss of key personnel, including our Chief Executive Officer, could disrupt our business

Our success greatly depends on the continued contributions of our senior management and other key sales, marketing and operations personnel. While we have employment agreements with some key management, these employees may voluntarily terminate their employment at any time. We may not be able to successfully retain existing personnel or identify, hire and integrate new personnel. We do not have key person insurance policies in place for these employees.

We may expend significant resources to protect our intellectual property rights or to defend claims of infringement by third parties, and if we are not successful we may lose rights to use significant material or be required to pay significant fees

Our success and ability to compete are dependent on our proprietary content. We rely exclusively on copyright law to protect our content. While we actively take steps to protect our proprietary rights, these steps may not be adequate to prevent the infringement or misappropriation of our content, which could severely harm our business. We also license content from various freelance providers and other third-party content providers. While we attempt to ensure that such content may be freely licensed to us, other parties may assert claims of infringement against us relating to such content.

We may need to obtain licenses from others to refine, develop, market and deliver new services. We may not be able to obtain any such licenses on commercially reasonable terms or at all or rights granted pursuant to any licenses may not be valid and enforceable.

In April 1999, we acquired the Internet address www.salon.com. Because www.salon.com is the address of the main home page to our Website and incorporates Salon’s name, it is a vital part of our intellectual property assets. We do not have a registered trademark on the address, and therefore it may be difficult for us to prevent a third party from infringing on our intellectual property rights to the address. If we fail to adequately protect our rights to the Website address, or if a third party infringes our rights to the address, or otherwise dilutes the value of www.salon.com, our business could be harmed.

Our technology development efforts may not be successful in improving the functionality of our network, which could result in reduced traffic on our Website or reduced advertising revenues

We are constantly upgrading our technology to manage our Website. We create new products that we expect to launch on an ongoing basis. If these systems do not work as intended, or if we are unable to continue to develop these systems to keep up with the rapid evolution of technology for content delivery, our Website may not operate properly, which could harm our business. Additionally, software product design, development and enhancement involve creativity, expense and the use of new development tools and learning processes. Delays in software development processes are common, as are project failures, and either factor could harm our business. Moreover, complex software products such as our online publishing platform frequently contain undetected errors or shortcomings, and may fail to perform or scale as expected. Although we have tested and will continue to test our systems, errors or deficiencies may be found in these systems that could adversely impact our business.

We rely on third parties to provide the technologies necessary to deliver content, advertising and services to our users, and any change in the licensing terms, costs, availability, or acceptance of these formats and technologies could adversely affect our business

We rely on third parties to provide the technologies that we use to deliver content, advertising, and services to our users. There can be no assurance that these providers will continue to license their technologies or intellectual property to us on reasonable terms, or at all. Providers may change the fees they charge users or otherwise change their business models in a manner that slows the widespread acceptance of their technologies. In order for our services to be successful, there must be a large base of users of the technologies to deliver our content, advertising, and services. We have limited or no control over the availability or acceptance of those technologies, and any change in licensing terms, costs, availability, or user acceptance of these technologies could adversely affect our business.

We may be held liable for content or third party links on our Website or content distributed to third parties

As a publisher and distributor of content over the Internet, including links to third-party websites that may be accessible through our Website, or content that includes links or references to a third-party’s website, we face potential liability for defamation, negligence, copyright, patent or trademark infringement and other claims based on the nature, content or ownership of the material that is published on or distributed from our Website. These types of claims have been brought, sometimes successfully, against online services, websites and print publications in the past. Other claims may be based on errors or false or misleading information provided on linked websites, including information deemed to constitute professional advice such as legal, medical, financial or investment advice. Other claims may be based on links to sexually explicit websites. Although we carry general liability and media insurance, our insurance may not be adequate to indemnify us for all liabilities imposed. Any liability that is not covered by our insurance or is in excess of our insurance coverage could severely harm our financial condition and business. Implementing measures to reduce our exposure to these forms of liability may require us to spend substantial resources and limit the attractiveness of our service to users.

Our systems may fail due to natural disasters, telecommunications failures and other events, any of which would limit user traffic

Our Website “salon.com”, and content management system run on cloud computing hosted by Amazon Web Services, which are in a facility in Herndon, Virginia. Any disruption of Amazon’s cloud computing platform could result in a service outage. Fire, floods, earthquakes, power loss, telecommunications failures, break-ins, supplier failure to meet commitments, and similar events could damage these systems and cause interruptions in our services. Computer viruses, electronic break-ins or other similar disruptive problems could cause users to stop visiting our Website and could cause advertisers to terminate any agreements with us. In addition, we could lose advertising revenues during these interruptions and user satisfaction could be negatively impacted if the service is slow or unavailable. If any of these circumstances occurred, our business could be harmed. Our insurance policies may not adequately compensate us for losses that may occur due to any failures of or interruptions in our systems. We do not presently have a formal disaster recovery plan.

Our Website must accommodate a high volume of traffic and deliver frequently updated information. It is possible that we will experience systems failures in the future and that such failures could harm our business. In addition, our users depend on Internet service providers, online service providers and other website operators for access to our Website. Many of these providers and operators have experienced significant outages in the past, and could experience outages, delays and other difficulties due to system failures unrelated to our systems. Any of these system failures could harm our business.

Privacy concerns could impair our business

We have a policy against using personally identifiable information obtained from users of our Website and services without the user’s permission. In the past, the Federal Trade Commission has investigated companies that have used personally identifiable information without permission or in violation of a stated privacy policy. If we use personal information without permission or in violation of our policy, we may face potential liability for invasion of privacy for compiling and providing information to our corporate customers and electronic commerce merchants. In addition, legislative or regulatory requirements may heighten these concerns if businesses must notify Internet users that the data may be used by marketing entities to direct product promotion and advertising to the user. Other countries and political entities, such as the European Union, have adopted such legislation or regulatory requirements. The United States may adopt similar legislation or regulatory requirements in the future. If consumer privacy concerns are not adequately addressed, our business, financial condition and results of operations could be materially harmed.

Due to the volatility of the price of our Common Stock, we may be the target of securities litigation, which is costly and time-consuming to defend

The price of our Common Stock has experienced volatility in the past, and may continue to do so in the future. In the past, following volatility in the price of a company’s securities, securities holders have instituted class action litigation against such company. Many companies have been subjected to this type of litigation. If the market value of our Common Stock experiences adverse fluctuations and we become involved in this type of litigation, regardless of the merits or outcome, we could incur substantial legal costs and our management’s attention could be diverted, causing our business, financial condition and operating results to suffer. To date, we have not been subject to such litigation.

Our quarterly operating results are volatile and may adversely affect the price of our Common Stock

Our future revenues and operating results are likely to fluctuate significantly from quarter to quarter due to a number of factors, many of which are outside our control, and any of which could severely harm our business. These factors include:

|

● |

Our ability to attract and retain advertisers; |

|

● |

Our ability to attract and retain a large number of users; |

|

● |

Our ability to increase referrals from our social media presence; |

|

● |

The introduction of new websites, services or products by us or by our competitors; |

|

● |

Our ability to maximize our mobile presence; |

|

● |

The timing and uncertainty of our advertising sales cycles; |

|

● |

The mix of advertisements sold by us or our competitors; |

|

● |

Economic and business cycles; |

|

● |

Our ability to attract, integrate and retain qualified personnel; |

|

● |

Technical difficulties or system downtime affecting the Internet generally or the operation of our Website; and |

|

● |

The amount and timing of operating costs. |

Due to the factors noted above and the other risks discussed in this section and throughout this Annual Report, one should not rely on quarter-to-quarter comparisons of our results of operations as an indication of future performance. It is possible that some future periods’ results of operations may be below the expectations of public market analysts and investors. If this occurs, the price of our Common Stock may decline.

Provisions in Delaware law and our charter, stock option agreements and offer letters to executive officers may prevent or delay a change of control

We are subject to the Delaware anti-takeover laws regulating corporate takeovers. These anti-takeover laws prevent a Delaware corporation from engaging in a merger or sale of more than 10% of its assets with any stockholder, including all affiliates and associates of the stockholder, who owns 15% or more of the corporation’s outstanding voting stock, for three years following the date that the stockholder acquired 15% or more of the corporation’s assets unless:

|

● |

the board of directors approved the transaction in which the stockholder acquired 15% or more of the corporation’s assets; |

|

● |

after the transaction in which the stockholder acquired 15% or more of the corporation’s assets, the stockholder owned at least 85% of the corporation’s outstanding voting stock, excluding shares owned by directors, officers and employee stock plans in which employee participants do not have the right to determine confidentially whether shares held under the plan will be tendered in a tender or exchange offer; or |

|

● |

on or after such date, the merger or sale is approved by the board of directors and the holders of at least two-thirds of the outstanding voting stock that is not owned by the stockholder. |

A Delaware corporation may opt out of the Delaware anti-takeover laws if its certificate of incorporation or bylaws so provide. We have not opted out of the provisions of the anti-takeover laws. As such, these laws could prohibit or delay mergers or other takeovers or changes of control of Salon and may discourage attempts by other companies to acquire us.

Our certificate of incorporation and bylaws include a provision relating to special meetings of our shareholders that may deter or impede hostile takeovers or changes of control or management. Special meetings of stockholders may be called only by our board of directors pursuant to a resolution adopted by a majority of the total number of authorized directors (whether or not there exist any vacancies in previously authorized directorships at the time any such resolution is presented to the Board for adoption) or by the holders of not less than 10% of all of the shares entitled to cast votes at the meeting. This provision may have the effect of delaying or preventing a change of control.

In addition, employment agreements with certain executive officers provide for the payment of severance and acceleration of the vesting of options and restricted stock in the event of termination of the executive officer following a change of control of Salon. These provisions could have the effect of discouraging potential takeover attempts.

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

Salon leases 2,405 square feet of office space at 870 Market Street, San Francisco, California, where it has been headquartered since November 2012. The San Francisco office lease will expire in November 2017. Salon also leases 6,523 square feet of office space for its New York office at 132 West 31st Street, New York, New York through September 2019. Salon believes that its existing properties are in good condition and are suitable for the conduct of its business.

ITEM 3. Legal Proceedings

Salon is not a party to any pending legal proceedings that it believes will materially affect its financial condition or results of operations.

ITEM 4. Mine Safety Disclosures

Not applicable.

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Information with respect to the quarterly high and low sales prices for Salon’s Common Stock, ticker symbol SLNM.PK, for its fiscal years 2016 and 2015, based on sales transactions reported by the OTC (Over-The-Counter) Bulletin Board is provided below:

|

Fiscal Year Ended |

Fiscal Year Ended |

|||||||||||||||

|

March 31, 2016 |

March 31, 2015 |

|||||||||||||||

|

For the quarter ended |

High |

Low |

High |

Low |

||||||||||||

|

June 30 |

$ | 0.16 | $ | 0.13 | $ | 0.25 | $ | 0.16 | ||||||||

|

September 30 |

0.20 | 0.13 | 0.40 | 0.16 | ||||||||||||

|

December 31 |

0.19 | 0.10 | 0.45 | 0.13 | ||||||||||||

|

March 31 |

$ | 0.16 | $ | 0.10 | $ | 0.20 | $ | 0.13 | ||||||||

Such over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

There were 76 top stockholders of record of Salon Common Stock as of June 1, 2016. This number was derived from Salon’s stockholder records, and does not include beneficial owners of Salon’s voting Common Stock whose shares are held in the names of various dealers, clearing agencies, banks, brokers and other fiduciaries. The closing price of Salon’s Common Stock on June 1, 2016 was $0.24 per share.

Salon has never declared or paid any cash dividends on its capital stock and does not expect to pay any cash dividends in the foreseeable future.

Salon has never repurchased any of its equity securities.

Equity Compensation Plan Information

The following table provides information about Salon’s Common Stock that may be issued upon the exercise of options and rights under all of Salon’s existing equity compensation plans as of March 31, 2016, including the Salon Media Group, Inc. 2004 Stock Plan and the Salon Media Group, Inc. 2014 Stock Incentive Plan.

|

Plan category |

Number of securities to |

Weighted-average |

Number of securities |

|||||||||

|

be issued upon exercise |

exercise price of |

remaining available for |

||||||||||

|

of outstanding options |

outstanding options |

future issuance under |

||||||||||

|

and rights |

and rights |

equity compensation |

||||||||||

|

plans, excluding |

||||||||||||

|

securities reflected in |

||||||||||||

|

column (a) |

||||||||||||

|

(a) |

(b) |

(c) |

||||||||||

|

Equity compensation plans approved by security holders |

7,241,623 | $ | 0.15 | 8,446,840 | ||||||||

|

Equity compensation plans not approved by security holders |

None |

N/A |

None |

|||||||||

|

Total |

7,241,623 | $ | 0.15 | 8,446,840 | ||||||||

Equity Compensation Plans Not Approved by Security Holders

None.

ITEM 6. Selected Financial Data

|

Amounts in thousands, except per share amounts |

||||||||||||||||||||

|

Year Ended March 31, |

2016 |

2015 |

2014 |

2013 |

2012 |

|||||||||||||||

|

Net revenues |

$ | 6,959 | $ | 4,946 | $ | 6,004 | $ | 3,641 | $ | 3,477 | ||||||||||

|

Gain from discontinued operations |

$ | - | $ | - | $ | - | $ | 233 | $ | 60 | ||||||||||

|

Net loss |

$ | (1,960 | ) | $ | (3,940 | ) | $ | (2,186 | ) | $ | (3,936 | ) | $ | (4,098 | ) | |||||

|

Basic and diluted net loss per share |

$ | (0.03 | ) | $ | (0.05 | ) | $ | (0.03 | ) | $ | (0.72 | ) | $ | (1.25 | ) | |||||

|

Weighted average common shares outstanding used in computing per share amounts (thousands) |

76,245 | 76,245 | 73,923 | 5,443 | 3,283 | |||||||||||||||

|

Cash and cash equivalents |

$ | 189 | $ | 229 | $ | 119 | $ | 96 | $ | 130 | ||||||||||

|

Total assets |

$ | 2,034 | $ | 1,605 | $ | 2,033 | $ | 1,299 | $ | 1,557 | ||||||||||

|

Total long-term liabilities |

$ | 69 | $ | 73 | $ | 2 | $ | 12 | $ | 123 | ||||||||||

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

Salon is an online media company and a unique voice in the Internet landscape. Our award-winning journalism combines original investigative stories and provocative personal essays along with quick-take commentary and staff-written articles about politics, technology, culture and entertainment. In our editorial product we balance two crucial missions: (1) providing original and provocative content on topics that the mainstream media overlook, and (2) filtering through the media chatter and clutter to help readers find the stories that matter.

Sources of Revenue

Most of Salon’s net revenues are derived from advertising from the sale of promotional space on its Website. The sale of promotional space is generally for less than ninety days in duration. The primary factor in our ability to increase our advertising revenues in future periods is growth in our audience. Attracting more unique visitors to our Website is important because these returning users generate additional page views, and each page view becomes a potential platform for advertisements. Advertising comprises banners, video, rich media and other interactive ads. Advertisers pay for advertising based on a cost-per-thousand-impression (“CPM”). CPM varies by platform and CPMs for mobile have been less than for desktop, however in the recent quarter they have been increasing. Videos and sponsored content on mobile devices continue to grow in popularity and can demand a higher CPM. We believe that continuing to add videos and sponsored content to our mobile platform and improving and optimizing the platform’s design will help increase revenues from our mobile platform.

In addition, Salon generates revenue from referring users to third party websites. For fiscal year 2016, referral fees totaled $0.94 million, a 141% increase from $0.39 million in fiscal year 2015. We also generated nominal revenue from the licensing of content that previously appeared in Salon.

Our total net revenue and the sources thereof for the years ended March 31, 2016, 2015 and 2014 were as follows (in thousands):

|

Year Ended March 31, |

|||||||||||||||||||||||||

|

2016 |

2015 |

2014 |

|||||||||||||||||||||||

|

Amount |

% |

Amount |

% |

Amount |

% |

||||||||||||||||||||

|

Advertising |

$ | 5,988 | 86 | % | $ | 4,518 | 91 | % | $ | 5,534 | 92 | % | |||||||||||||

|

Subscription Program |

7 |

<1% |

12 |

<1% |

27 |

<1% |

|||||||||||||||||||

|

All Other |

964 | 13 | % | 416 | 8 | % | 443 | 7 | % | ||||||||||||||||

|

Total |

$ | 6,959 | 100 | % | $ | 4,946 | 100 | % | $ | 6,004 | 100 | % | |||||||||||||