Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - ENB Financial Corp | form8k-114620_enb.htm |

Exhibit 99.1

• Welcome

• Reading of the Minutes

• Certify Voting Activity

• Vote on Matters of the Proxy Statement

• Discussion of Condition of Company

Ø President’s Remarks

Ø Financial Review

Ø Lending Environment

• Questions & Answers

• Vote Results

• Adjournment

AGENDA

PRESENTERS

• Aaron L. Groff, Jr.

Ø President, CEO and Board Chairman - ENB Financial Corp

and Ephrata National Bank

and Ephrata National Bank

• Paul W. Wenger

Ø Vice President and Corporate Secretary - ENB Financial Corp

Ø Senior Vice President and Cashier - Ephrata National Bank

• Scott E. Lied

Ø Treasurer - ENB Financial Corp

Ø Senior Vice President and Chief Financial Officer -

Ephrata National Bank

Ephrata National Bank

• Dale G. Burkholder

Ø Senior Vice President and Senior Loan Officer - Ephrata National Bank

Presented by: Paul W. Wenger

Corporate Secretary - ENB Financial Corp

Corporate Secretary - ENB Financial Corp

ELECTION CERTIFICATION

• Elect three (3) Class C directors to serve a

three-year term

three-year term

MATTERS OF PROXY

CURRENT DIRECTORS

|

Class C Election (3 Year Term)

|

|

|

Susan Y. Nicholas

|

Paul W. Wenger

|

|

Mark C. Wagner

|

|

|

Continuing Directors - Class A

|

|

|

Aaron L. Groff, Jr.

J. Harold Summers

|

Paul M. Zimmerman, Jr.

Thomas H. Zinn

|

|

Continuing Directors - Class B

|

|

|

Willis R. Lefever

Donald Z. Musser

|

Bonnie R. Sharp

|

VOTING PROCESS

Presented by: Paul W. Wenger

Corporate Secretary - ENB Financial Corp

Corporate Secretary - ENB Financial Corp

Proxy Holders

• Janice S. Eaby

• John H. Shuey

Judges of Election

• Richard H. Binner

• Roger S. Kline

• William M. Rohrbach

VOTING PROCESS

Presented by: Aaron L. Groff, Jr.

President/CEO - ENB Financial Corp

PRESIDENT’S REMARKS

Ø To remain an independent community bank of

undisputed integrity, serving the communities of

Northern Lancaster County and beyond.

undisputed integrity, serving the communities of

Northern Lancaster County and beyond.

Ø To offer state-of-the-art financial products and

services of high quality and value at an affordable

price.

services of high quality and value at an affordable

price.

Ø To provide unsurpassed personal service, delivered

by a highly dedicated professional team.

by a highly dedicated professional team.

MISSION STATEMENT

• Courteous

• Accurate

• Responsive

• Empowered

WE CARE

• Growth

• Efficiency

• Leadership development

• Successfully navigate the new regulatory

environment

environment

• Stay true to our community banking core

values

values

STRATEGIC INITIATIVES

Presented by: Scott E. Lied

Treasurer - ENB Financial Corp

FINANCIAL CONDITION

• Unaudited Financial Information

Ø Some of the following slides do present financial

information that is unaudited. Therefore, this information is

subject to adjustments that could be necessary upon

completion of the annual audit.

information that is unaudited. Therefore, this information is

subject to adjustments that could be necessary upon

completion of the annual audit.

• Forward Looking Statements

Ø Some of the material and/or language used in this

presentation would be considered as a forward looking

statement. Management is not obligated to update these

forward looking statements.

presentation would be considered as a forward looking

statement. Management is not obligated to update these

forward looking statements.

DISCLOSURES

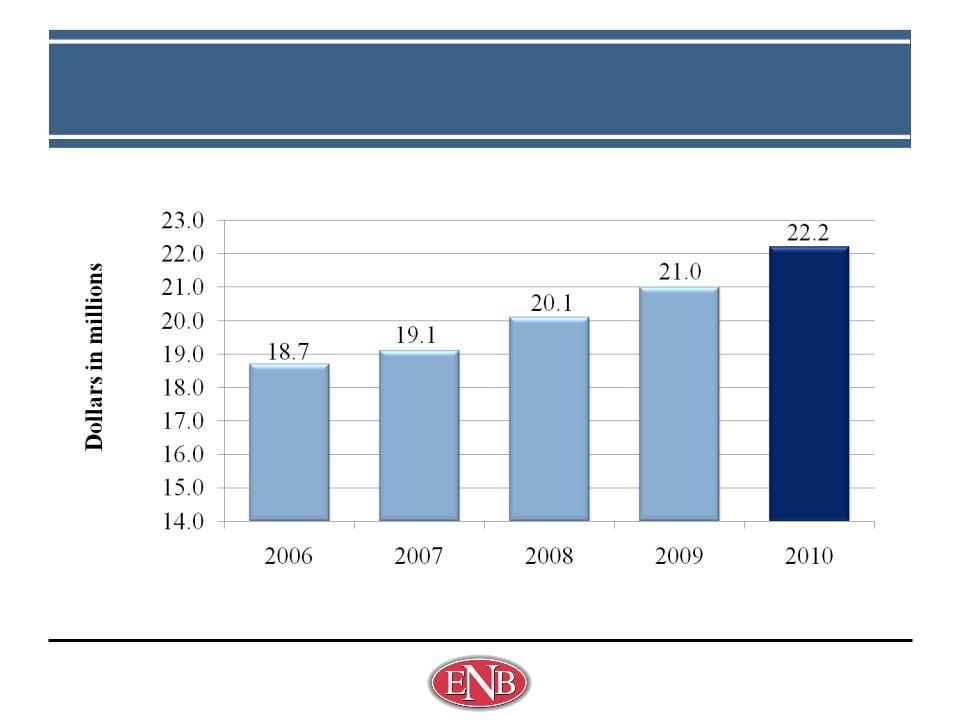

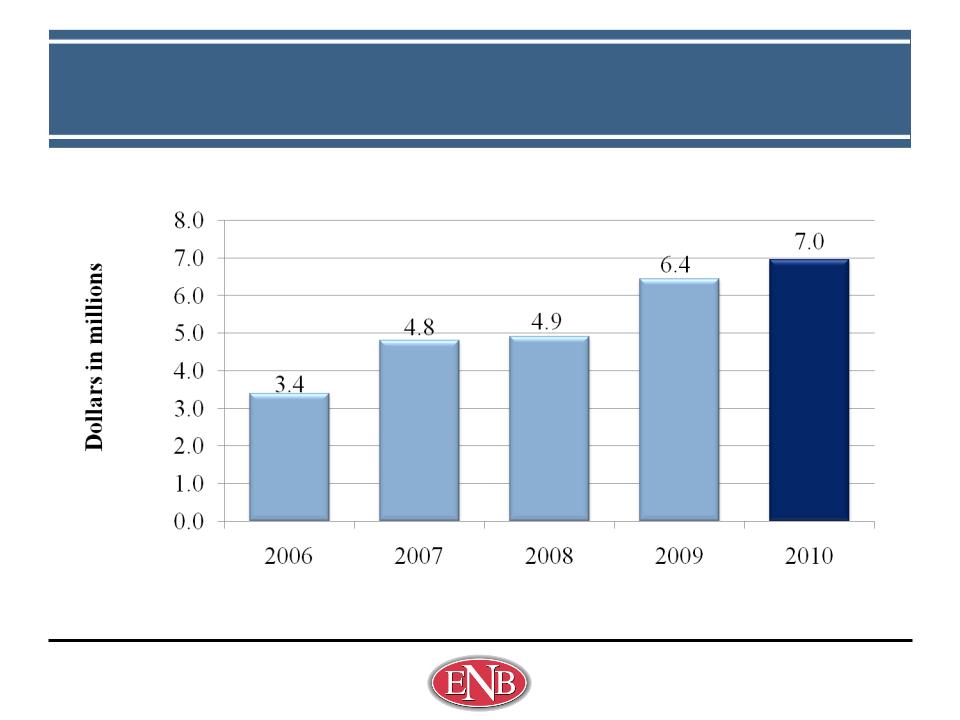

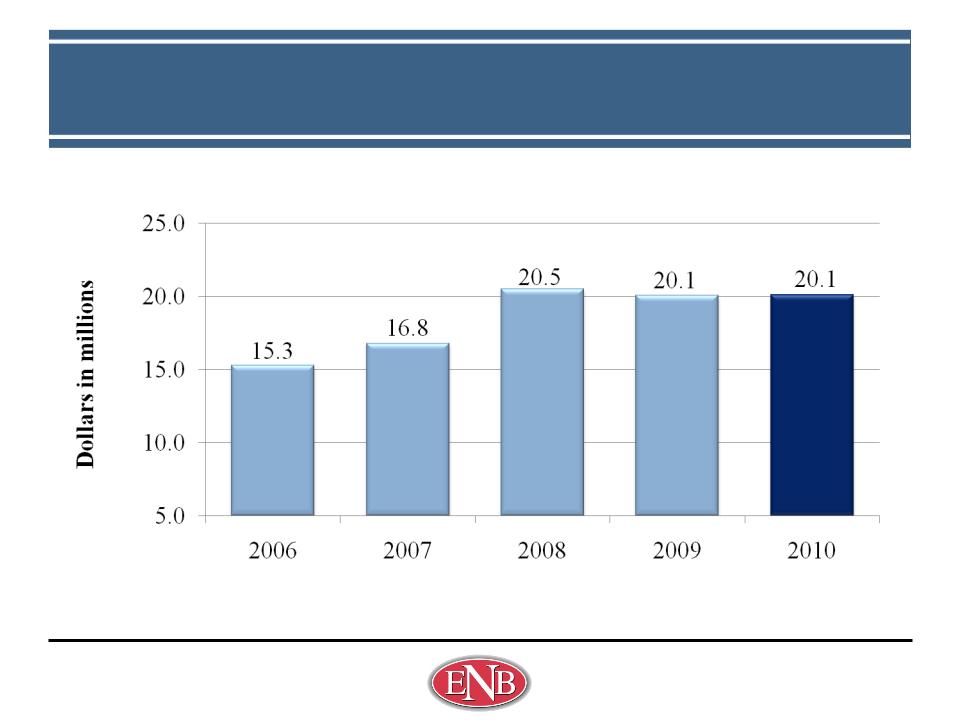

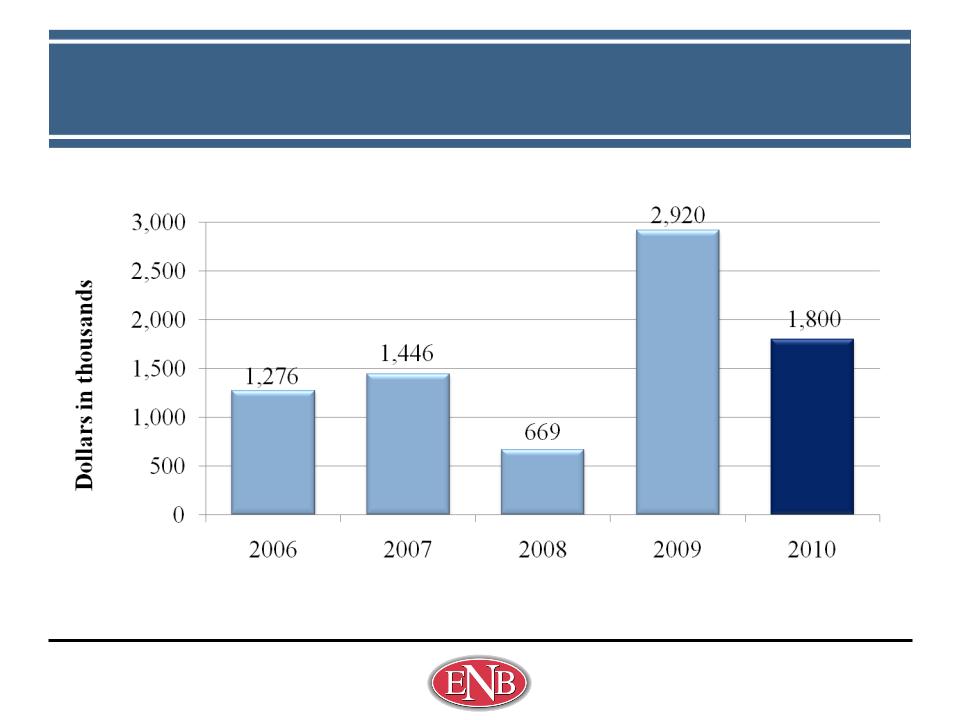

NET INCOME

SIGNIFICANT ITEMS

|

Net Interest Income

|

$

|

1,222,000

|

increase

|

|

Other Income

|

$

|

520,000

|

increase

|

|

Operating Expenses

|

$

|

12,000

|

decrease

|

|

Provision Expense

|

$

|

1,120,000

|

decrease

|

NET INTEREST INCOME

OTHER INCOME

OPERATING EXPENSES

PROVISION EXPENSE

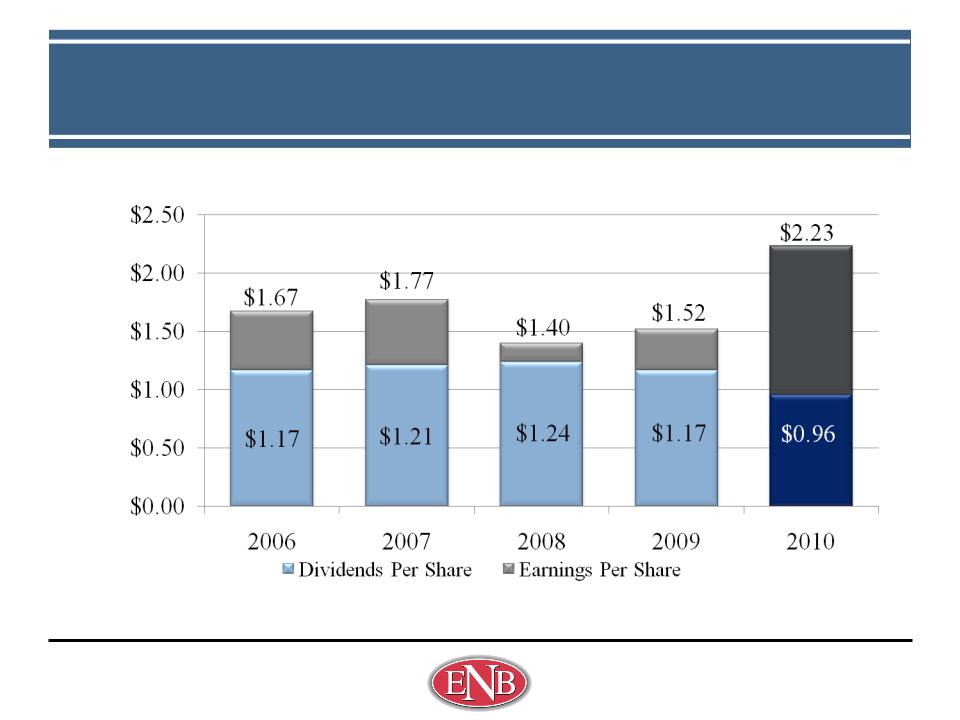

EARNINGS AND DIVIDENDS PER SHARE

DIVIDEND COMPARISON

|

Corporate Name

|

Current

Dividend |

Change from Dividend

High (2006 - 2008) |

|

ENB Financial Corp

|

$0.24

|

-22.58%

|

|

VIST Financial Corp

|

$0.05

|

-75.00%

|

|

Fulton Financial Corp

|

$0.04

|

-77.78%

|

|

National Penn Bancshares

|

$0.01

|

-94.12%

|

|

Susquehanna Bancshares

|

$0.02

|

-91.30%

|

|

Union National

Financial Corp |

$0.00

|

-100.00%

|

SHAREHOLDER VALUE

*Average derived from first quarter 2011 daily close prices.

** Dividend yield calculated as of 03/31/2011.

|

|

ENBP

|

SUSQ

|

FULT

|

|

Average Stock Price - Oct 2008

|

$25.69

|

$17.12

|

$11.62

|

|

Average Stock Price - Jul 2009

Jul 2009 Price as % of Oct 2008 Price

|

$24.83

97%

|

$4.80

28%

|

$6.05

52%

|

|

Average Stock Price* - Q1 2011

Q1 2011 Price as % of Oct 2008 Price

|

$22.54

88%

|

$9.52

56%

|

$10.69

92%

|

|

Current Dividend Yield on Investment**

|

4.26%

|

0.42%

|

1.50%

|

|

Measurement

|

ENB

|

Peer**

|

|

Return on Assets (ROA)

|

0.86%

|

0.50%

|

|

Return on Equity (ROE)

|

8.88%

|

4.60%

|

|

Efficiency Ratio

|

65.55%

|

68.18%

|

|

Tier 1 Leverage Capital

|

9.63%

|

9.08%

|

PEER ANALYSIS*

* As of December 31, 2010

** Peer Group is defined as all banks nationwide with assets between $300 million and

$1 billion.

$1 billion.

• Q1 2011

Ø Earnings: $1,697,000 versus $1,468,000 (Q1 2010)

• 15.6% increase over Q1 2010

Ø Assets: $756 million versus $748 million (Q4 2010)

• 1.0% increase over year-end 2010

FIRST QUARTER RESULTS

LENDING ENVIRONMENT

Presented by: Dale G. Burkholder

Sr. Vice President and Sr. Lending Officer -

Ephrata National Bank

Ephrata National Bank

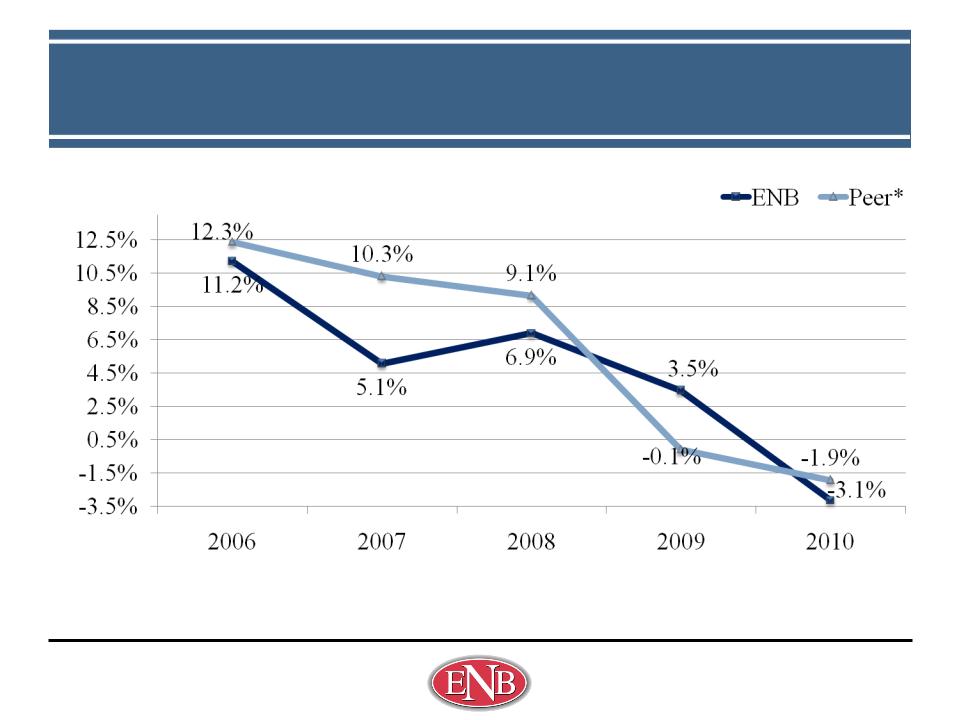

LOAN GROWTH RATES

* Peer Group is defined as all banks nationwide with assets between $300 million and

$1 billion.

$1 billion.

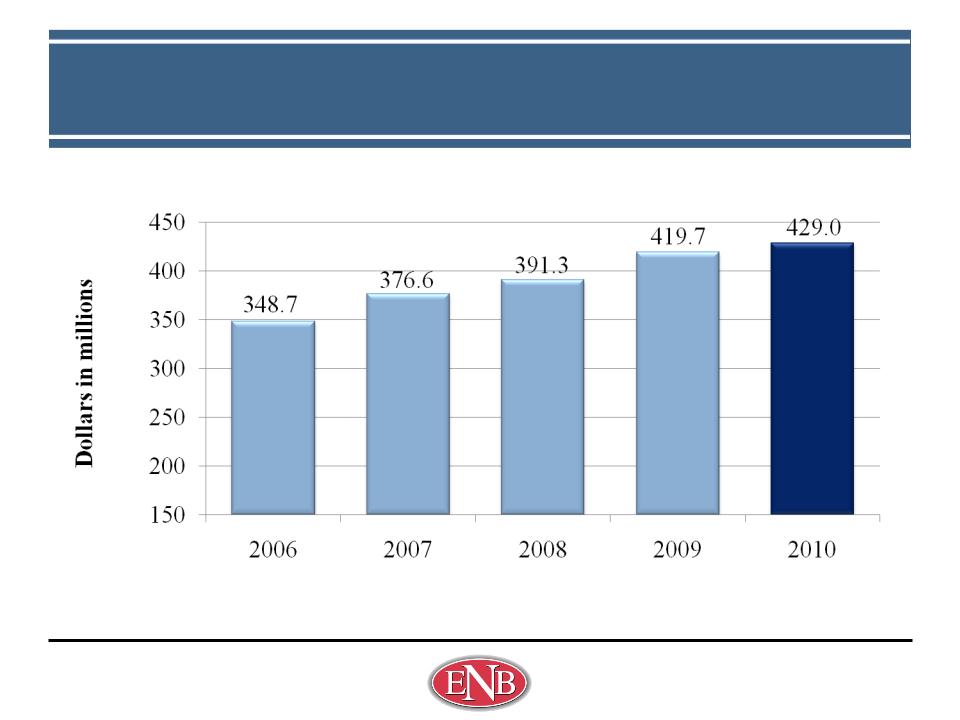

AVERAGE LOAN GROWTH

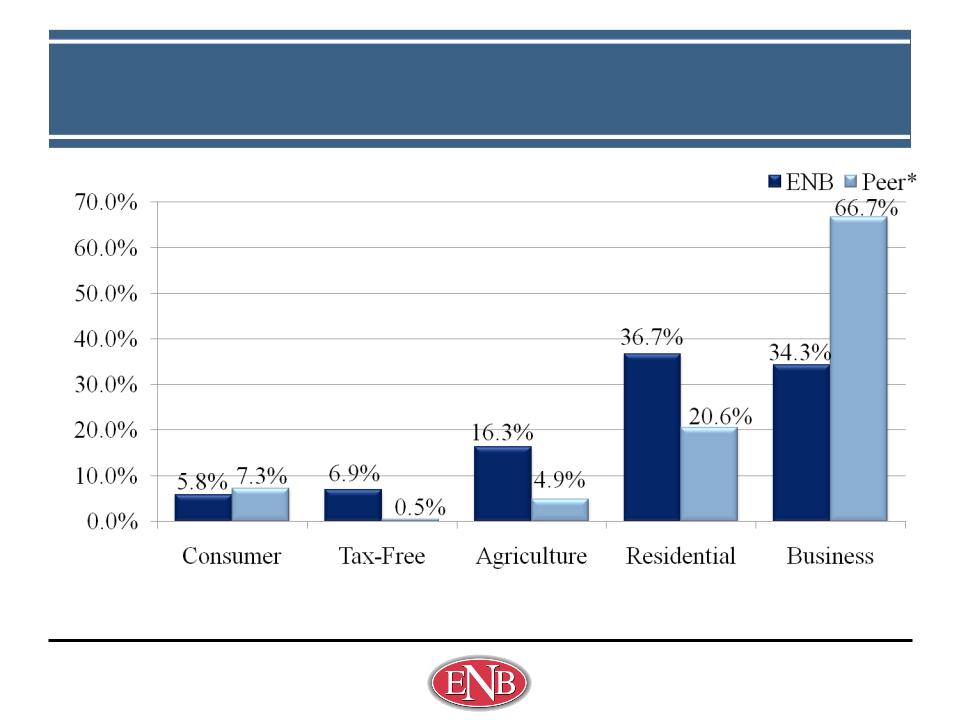

MIX OF LOAN PORTFOLIO

* Peer Group is defined as all banks nationwide with assets between $300 million and

$1 billion.

$1 billion.

|

Measurement

|

ENB

|

Peer*

|

|

Delinquent Loans as a % of Total Loans

|

1.38%

|

4.51%

|

|

Non-performing Loans as a % of Total Loans

|

0.97%

|

3.22%

|

|

ALLL as a % of Total Loans

|

1.72%

|

1.96%

|

|

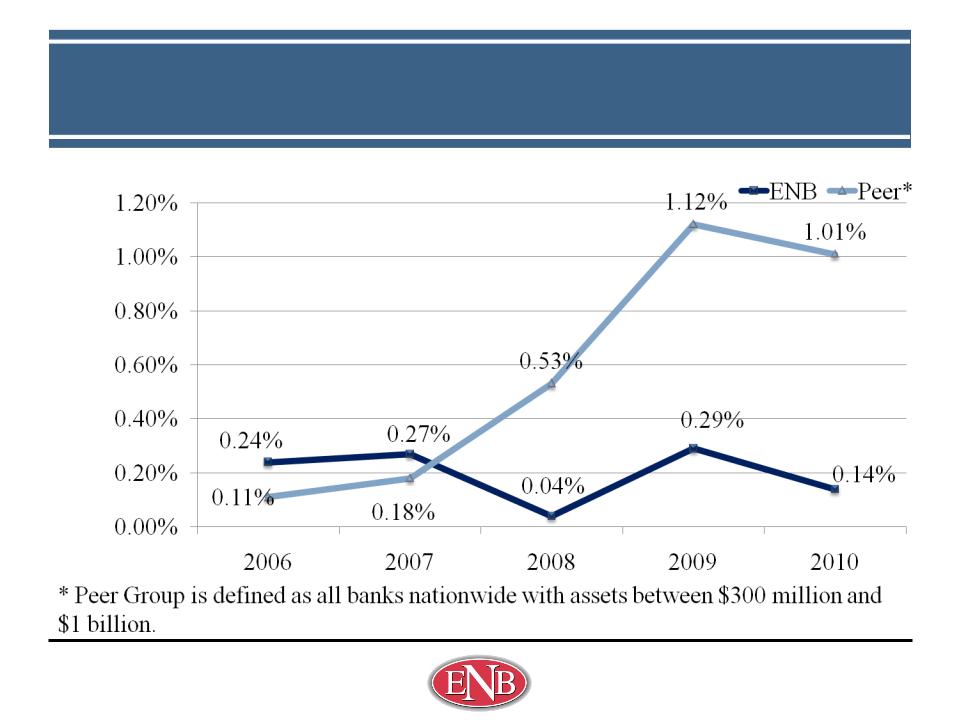

Charge-offs as a % of Average Loans

|

0.14%

|

1.01%

|

ASSET QUALITY

* Peer Group is defined as all banks nationwide with assets between $300 million and

$1 billion.

$1 billion.

HISTORICAL LOAN LOSSES

QUESTIONS & ANSWERS

Presented by: Paul W. Wenger

Corporate Secretary - ENB Financial Corp

Corporate Secretary - ENB Financial Corp

VOTING RESULTS

• Mission Statement:

Ø To remain an independent community bank of

undisputed integrity, serving the communities of

Northern Lancaster County and beyond.

undisputed integrity, serving the communities of

Northern Lancaster County and beyond.

Ø To offer state-of-the-art financial products and

services of high quality and value at an affordable

price.

services of high quality and value at an affordable

price.

Ø To provide unsurpassed personal service, delivered

by a highly dedicated professional team.

by a highly dedicated professional team.

ADJOURNMENT