Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23 - CHINA GENGSHENG MINERALS, INC. | exhibit23.htm |

| EX-32.1 - EXHIBIT 32.1 - CHINA GENGSHENG MINERALS, INC. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - CHINA GENGSHENG MINERALS, INC. | exhibit31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - CHINA GENGSHENG MINERALS, INC. | exhibit32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - CHINA GENGSHENG MINERALS, INC. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[X] Annual Report Pursuant To Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the fiscal year ended: December 31,

2010

[_] Transition Report Under Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the transition period from ______ to

_______

Commission file number: 000-51527

CHINA GENGSHENG MINERALS, INC.

(Exact name of small business issuer as specified in its charter)

| NEVADA | 91-0541437 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

No. 88 Gengsheng Road

Dayugou Town, Gongyi, Henan

People’s Republic of China, 451271

(Address of Principal Executive

Offices and Zip Code)

(86) 371-64059863

(Registrant’s Telephone Number,

Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | NYSE Amex Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [_] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [_] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [_]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [_] No [_]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [_]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition for “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer [_] Non-Accelerated Filer [_] Accelerated Filer [_] Smaller Reporting Company [X]

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [_] No [X]

The number of shares outstanding of our common stock as of June 30, 2010, was 24,294,386 shares. The aggregate market value of the common stock held by non-affiliates (9,042,638 shares), based on the closing market price ($1.34 per share) of the common stock as of June 30, 2010 was $12,117,135.

There were a total of 26,794,386 shares of the registrant’s common stock outstanding as of March 31, 2011.

Documents Incorporated by Reference: None

TABLE OF CONTENTS

| PART I | ||

| ITEM 1. BUSINESS | 2 | |

| ITEM 1A. RISK FACTORS | 11 | |

| ITEM 1B. UNRESOLVED STAFF COMMENTS | 20 | |

| ITEM 2. PROPERTIES | 20 | |

| ITEM 3. LEGAL PROCEEDINGS | 21 | |

| PART II | ||

| ITEM 5. MARKET FOR OUR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. | 21 | |

| ITEM 6. SELECTED FINANCIAL DATA | 22 | |

| ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 22 | |

| ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 30 | |

| ITEM 8. FINANCIAL STATEMENT AND SUPPLEMENTARY DATA | 30 | |

| ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 31 | |

| ITEM 9A. CONTROLS AND PROCEDURES. | 31 | |

| ITEM 9B. OTHER INFORMATION | 32 | |

| PART III | ||

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 32 | |

| ITEM 11. EXECUTIVE COMPENSATION | 34 | |

| ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 35 | |

| ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | 36 | |

| ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES | 36 | |

| PART IV | ||

| ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 37 | |

Special Note Regarding Forward Looking Statements

The following discussion of the financial condition and results of operations should be read in conjunction with the consolidated financial statements and related notes thereto. The following discussion contains forward-looking statements. China GengSheng Minerals, Inc. is referred to herein as “we”, “us”, “our”, the “Registrant” or the “Company.” The words or phrases “would be,” “will allow,” “expect to,” “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” or similar expressions are intended to identify forward-looking statements. Such statements include those concerning our expected financial performance, our corporate strategy and operational plans. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties, including: (a) those risks and uncertainties related to general economic conditions in China, including regulatory factors that may affect such economic conditions; (b) whether we are able to manage our planned growth efficiently and operate profitable operations, including whether our management will be able to identify, hire, train, retain, motivate and manage required personnel or that management will be able to successfully manage and exploit existing and potential market opportunities; (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations; and (d) whether we are able to successfully fulfill our primary requirements for cash which are explained below under “Liquidity and Capital Resources.” Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim any obligation, to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

1

Use of Certain Defined Terms

In this Form 10-K, unless indicated otherwise, references to:

-

“Powersmart” or “GengSheng International” refers to GengSheng International Corporation, a BVI company (formerly, Powersmart Holdings Limited) that is wholly owned by China GengSheng Minerals, Inc.;

-

“Securities Act” refers to the Securities Act of 1933, as amended, and “Exchange Act” refer to Securities Exchange Act of 1934, as amended;

-

“China” and “PRC” refer to the People's Republic of China, and “BVI” refers to the British Virgin Islands;

-

“RMB” refers to Renminbi, the legal currency of China; and

-

“U.S. dollar,” “$” and “US$” refers to the legal currency of the United States. For all U.S. dollar amounts reported, the dollar amount has been calculated on the basis that RMB=$0.1517 for its audited balance sheet at December 31, 2010, and RMB1=$0.1467 for its audited balance sheet at December 31, 2009, which were determined based on the currency conversion rate at the end of each respective period. The conversion rates of RMB1=$0.148 is used for the consolidated statement of income and comprehensive income and consolidated statement of cash flows for its December 31, 2010, and RMB1=$0.1466 is used for that ended December 31, 2009, which were based on the average currency conversion rate for each respective period.

PART I

ITEM 1. BUSINESS

Overview

We are a Nevada holding company operating in the materials technology industry through our direct and indirect subsidiaries in China. We develop, manufacture and sell a broad range of mineral-based, heat-resistant products capable of withstanding high temperatures, saving energy and boosting productivity, primarily in the steel and oil industries. We manufacture products across four business segments: refractory products, industrial ceramics, fracture proppants and fine precision abrasives.

We sell our products to over 200 customers in the iron, steel, oil, glass, cement, aluminum and chemical businesses located in China and other countries in Asia, Europe and North America. Our largest customers, measured by percentage of our revenue, mainly operate in the steel industry. The majority of our revenues are derived from the sale of our monolithic refractory products to customers in China.

Currently, we conduct our operations in China through our wholly owned subsidiaries, Henan GengSheng Refractories Co., Ltd. (“Refractories”), ZhengZhou Duesail Fracture Proppant Co., Ltd. (“Duesail”), Henan GengSheng Micronized Powder Materials Co., Ltd. (“Micronized”), and Guizhou Southeast Prefecture GengSheng New Materials Co., Ltd. (“Prefecture”), and through our majority owned subsidiary, Henan GengSheng High-Temperature Materials Co., Ltd. (“High-Temperature”). We manufacture:

-

Refractory products through our wholly owned BVI subsidiary, GengSheng International, and its direct and wholly owned Chinese subsidiary, Refractories, which has an annual production capacity of approximately 127,000 tons. Our refractory customers are companies in the steel, iron, petroleum, chemical, coal, glass and mining industries.

-

Fracture proppant products through our wholly owned subsidiary Duesail, which has an annual production capacity of approximately 60,000 tons. Our fracture proppant products are sold to oil and gas companies.

-

Fine precision abrasives products through our wholly owned subsidiary Micronized, which has an annual production capacity of approximately 22,000 tons. Our fine precision abrasives are marketed to solar companies and optical equipment manufacturers.

-

Industrial and functional ceramic products through our majority owned subsidiary High-Temperature, which has an annual production capacity of approximately 150,000 units. Our industrial ceramics are used in the utilities and petrochemical industries.

Our principal executive offices are located at No. 88 Gengsheng Road, Dayugou Town, Gongyi, Henan, People’s Republic of China 451271 and our telephone number is (86) 371-6405-9818.

Available Information

We are required to file annual, quarterly and current reports, proxy statements and other information required by the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with the Securities and Exchange Commission (the “SEC”). You may read and copy any document we file with the SEC at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. Our SEC filings are also accessible electronically on the SEC website at http://www.sec.gov.

2

Our SEC filings are also available free of charge through our corporate website at http://www.gengsheng.com. Filings available include our annual reports on Form 10-K; quarterly reports on Form 10-Q; current reports on Form 8-K; proxy statements, if any, Forms 3, 4 and 5 filed by or on behalf of directors, executive officers and certain large stockholders; and any amendments to those documents filed or furnished pursuant to the Exchange Act. These filings will become available as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC.

In addition, the following information is available on the Investor Relations page of our website: (i) Corporate Governance and (ii) Quarterly Results. These documents will also be available in print without charge to any person who requests them by writing or telephoning our principal executive offices: China Gengsheng Minerals Co.,Ltd, No.88 Gengsheng Road, Dayugou Town, Gongyi, Henan, 451271, P.R. China, Tel:86+371-6405-9818, Fax:86+371-6405-9846. The information posted on our web site is not incorporated into this annual report on Form 10-K.

Corporate History & Background

We were originally incorporated under the laws of the State of Washington, on November 13, 1947, under the name Silver Mountain Mining Company. From our inception until 2001, we operated various unpatented mining claims and deeded mineral rights in the State of Washington, but we abandoned these operations entirely by 2001. On August 15, 2006, we changed our domicile from Washington to Nevada when we merged with and into Point Acquisition Corporation, a Nevada corporation. On April 25, 2007, we completed a reverse acquisition transaction through a share exchange with Gengsheng International whereby we issued to the sole shareholder of Gengsheng International, Shunqing Zhang, 16,887,815 shares of China GengSheng Minerals, Inc. common stock, in exchange for all of the issued and outstanding capital stock of Gengsheng International. By this transaction, Gengsheng International became our wholly owned subsidiary and Mr. Zhang became our controlling stockholder. From about 2001 until our reverse acquisition of GengSheng International we were a blank check company and had no active business operations. On June 11, 2007, we changed our corporate name from "Point Acquisition Corporation" to "China Minerals Technologies, Inc." and subsequently changed our name again to "China GengSheng Minerals, Inc." on July 26, 2007 as we found a Delaware company with a similar corporate name.

Corporate Structure

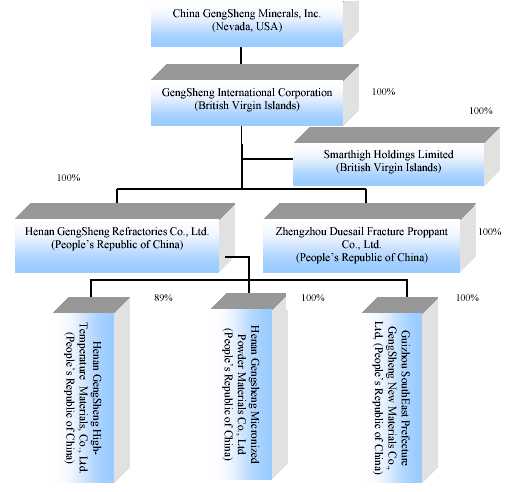

We conduct our operations in China through our wholly owned subsidiaries Refractories, Duesail, Micronized and Prefecture and through our majority owned subsidiary, High-Temperature. The following chart reflects our organizational structure as of the date of this report.

3

Segmental Information

Our operating segments are functioned by our manufacturing facilities and include four reportable segments: refractories, industrial ceramics, fracture proppants and fine precision abrasives.

For financial information relating to our business segments, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 22 to the consolidated financial statements appearing elsewhere in this annual report. For a discussion of the risks attendant to our foreign operations and of any dependence on one or more of the Company’s segments upon such foreign operations, please see Item 1A, “Risk Factors” .

Our Products and Markets

The following table set forth sales information about our product mix in each of the last two years.

(All amounts, other than percentage, in thousands of U.S. dollars)

| Year Ended December 31, | ||||||||||||

| 2010 | 2009 | |||||||||||

| Revenue | percentage of | Revenue | percentage of | |||||||||

| net revenues | net revenues | |||||||||||

| Refractories | 45,758 | 73.6% | 47,818 | 84.0% | ||||||||

| Industrial Ceramics | 1,246 | 2.0% | 1,098 | 1.9% | ||||||||

| Fracture Proppants | 14,320 | 23.0% | 8,039 | 14.1% | ||||||||

| Fine Precision Abrasives | 865 | 1.4% | 0 | 0% | ||||||||

| 62,189 | 100% | 56,955 | 100% | |||||||||

4

Refractories

Our largest product segment is the refractories segment, which accounted for approximately 73.6% of our total revenue in 2010. Our refractory products have high-temperature resistant qualities and can function under thermal stress that is common in many heavy industrial production environments. Because of their unique high-temperature resistant qualities, the refractory products are used as linings and key components in many industrial furnaces, such as steel production furnaces, ladles, vessels, and other high-temperature processing machines that must operate at high temperatures for a long period of time without interruption. The majority of our customers are in the iron, steel, cement, chemical, coal, glass, petro-chemical and nonferrous industries.

We provide a customized solution for each order of our monolithic refractory materials based on the customer’s uniquely requested formula. Upon delivery to customers, the monolithic materials are applied to the inner surfaces of our customers’ furnaces, ladles or other vessels to improve the productivity of that equipment. The product is beneficial because it lowers the overall cost of production and improves financial performance for our customers. The reasons that the monolithic materials can help our customers improve productivity, lower production costs and achieve stronger financial performance include the following: (i) monolithic refractory castables can be cast into complex shapes which are unavailable or difficult to achieve by alternative products such as shaped bricks; (ii) monolithic refractory linings can be repaired, and in some cases, even reinstalled, without furnace cool-down periods or steel-production interruptions, and therefore improve the steel makers’ productivity; (iii) monolithic refractories can form an integral surface without joints, enhancing resistance to penetration, impact and erosion, and thereby improving the equipment’s operational safety and extending their useful service lives; (iv) monolithic refractories can be installed by specialty equipment either automatically or manually, thus saving construction and maintenance time as well as costs; and (v) monolithic refractories can be customized to specific requirements by adjusting individual formulas without the need to change batches of shaped bricks, which is a costly procedure. Our refractory products and a description of their features are as follows:

-

Castable, coating, and dry mix materials. Offerings within this product line are used as linings in containers such as a tundish used for pouring molten metal into a mold. The primary advantages of these products are speed and ease of installation for heat treatment.

-

Low-cement and non-cement castables. Our low-cement and non-cement castable products are typically used in reheating furnaces for producing steel. These castable products are highly durable and can last up to five years.

-

Pre-cast roofs. These products are usually used as a component of electric arc furnaces. They are highly durable, and in the case of our corundum-based, pre-cast roof, products, can endure approximately 160 to 220 complete operations of furnace heating.

We also have a production line for pressed bricks, which is a type of “shaped” refractory, for steel production. The annual designed production capacity of our shaped refractory products is approximately 15,000 metric tons.

Finally, we provide a full-service option to our steel customers, which includes refractory product installation, testing, maintenance, repair and replacement. Our on-site installation and technical support personnel services often serve as an add on tour refractory product sales which provide an additional revenue source with attractive margins. Our installation services include applying refractory materials to the walls of steel-making furnaces and other high temperature vessels to maintain and extend their lives. Our technical service staff provides assurances that our customers will achieve their desired productivity objectives. They also measure the refractory wear at our customer sites to improve the quality of maintenance and overall performance of our customers’ equipment. Full-service customers contributed approximately 46.6% of our total sales in 2010, compared with 47.9% in 2009. We believe that these services together with our refractory products provide us with a strategic advantage to secure our profits.

Industrial Ceramics

Our industrial ceramic products, including abrasive balls and tiles, valves, electronic ceramics and structural ceramics, are components for a variety of end products such as fuses, vacuum interrupters, electrical components, mud slurry pumps, and high-pressure pumps. Such end use products are used in the electric power, electronic component, industrial pump, and metallurgy industries. We install and maintain some of these products.

Some examples and description of our products and their benefits are introduced as follows:

-

Ceramic plates, tubes, elbows, and rollers. These products are used in heavy machines for steel production, power generation, and mining. They are highly resistant to heat, erosion, abrasion, and impact.

-

Ceramic cylinders and plugs. Our ceramic cylinders and plugs are often used in plug pumps for drilling crude oil. They are highly resistant to pressure.

-

Wearable ceramic valves. Our wearable ceramic valves are used for transferring gas and liquid products. They are highly resistant to wash out, erosion, abrasion, and impact.

In 2008, we signed a five-year collaboration agreement with the Ceramics Research Institute of Zhengzhou University (the "CRI") in Henan province of China, to research and develop innovative ways of improving the manufacturing process and functionality of an array of bauxite-based materials. Specifically, under this agreement we work with CRI to optimize and reduce costs for the production of fine precision abrasives, which are bauxite-based, ultra-fine, grain-like materials used to polish fine-metal or optical equipment surfaces, including solar panels. Under this agreement CRI will also help us develop next-generation industrial ceramics that can reduce energy use and pollution. We will jointly apply for government grants for bauxite-based materials research.

5

Fracture Proppants

Our fracture proppants are very fine ball-like pellets, used to reach pockets of oil and natural gas deposits that are trapped in the fractures under the ground. Oil drillers inject the pellets into those fractures, squeezing out the trapped oil or natural gas, which leads to higher yield. Our fracture proppant products are available in several different particle sizes (measured in millimeters). They are typically used to extract crude oil and natural gas, which increases the productivity of crude oil and natural gas wells. These products are highly resistant to pressure. In October 2007, our fracture proppant products were recognized by China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation (the “Sinopec”) and the China National Offshore Oil Corporation (the “CNOOC”) as their supplier of fracture proppants for their oil and gas-drilling operations.

On April 27, 2009, Duesail finished construction of its second production line for fracture proppants, and successfully doubled its capacity for fracture proppants, from 33,000 tons per year to 66,000 tons per year. The newly completed production line ("Phase II") adopts a so-called Revolving Kiln technology which cuts down production time and costs by up to 10%. The Phase II improvements also include the ability to produce a wider range of proppants catering to oil wells with different underground pressures.

Fine precision abrasives

Fine precision abrasives are used for producing a super-fine, super-consistent finish on certain products. A high-strength polyester backing provides a uniform base for a coating of micron-graded mineral particles that are uniformly dispersed for greater finishing efficiency. Our fine precision abrasives are made from silicon carbide (“SiC”). They are ultra-fine, high-strength pellets with uniform shape, and they are used for surface-polishing and slicing of precision instrument such as solar panels. Currently, the type of abrasives that we produce is in high demand among solar-energy companies. Solar energy companies use fine precision abrasives to cut silicon bars and to polish equipment surfaces so that they can be smooth and shining. Our products can be utilized in a broad range of areas including machinery manufacturing, electronics industry, optical glass, architecture industry development, semiconductor, silicon chip, plastic and lens. Our fine precision abrasives product was launched in 2009 and we began selling this product in the third quarter of 2010. Our ultrafine precision abrasives is a fine alumina or silicon carbide powder whose size is in microns. This product has characteristics suitable for wire slicing and specific polishing.

Our Competition Strength and Challenges

With over 1,500 manufacturers, the refractory market in which we compete is highly fragmented and highly competitive. In each of our product segments, there is at least one major competitor. Many of our products are made to industry specifications and may be interchangeable with our competitors’ products. Some of our competitors are large and well-established companies, such as Puyang Refractories Co., Ltd., Wuhan Ruisheng Specialty Refractory Materials Co., Ltd., and Beijing Lirr Refractories Co., Ltd., and their financial resources and ability to gain market share may be greater than ours, which limits our pricing power in the market. However, due to the diversity of our product offering, we believe that we enjoy a competitive advantage because most of our competitors do not offer the entire spectrum of our product line.

Refractories and Industrial Ceramics

Through our wholly-owned Chinese subsidiary Henan GengSheng and its direct majority-owned Chinese subsidiary, Refractories, and its majority-owned Chinese subsidiary High-Temperature, we manufacture refractory products and industrial ceramic products respectively in China. We are well positioned to compete in the refractories segment and the industrial ceramics segment, because of our long-standing business relationships with the major steel companies, the quality and diversity of our products and our price differential. In 2004 our line of furnace products won awards in Henan Province. Furthermore, our patented integral casting technology for mixer furnaces has been licensed by more than twenty steel plants since 2000. In addition, we took the lead in developing small and medium-sized aluminum-magnesium spinel castables which were recognized in May 1995 by the Henan Science and Technology Committee as “key new products” of the State. Refractories was awarded the AAA credit rating by the Zhengzhou Enterprise Creditworthiness Evaluation Committee ("the Committee") in Henan Province in December of 2008.

We have distinguished ourselves through our excellent customer service team that provides a full-range of refractory services, including refractory construction and on-site maintenance and technical support. Our national registered laboratory with its excellent research team is available to meet our customer’s diverse product requirements in a timely manner based on the differences of construction sites. Our products are largely marketed based on our comparatively more efficient operations, our price differential and our quality of service. We have also made ourselves more competitive through competitive pricing.

Our largest customers, measured by percentage of our revenue, operate in the steel industry. The steel industry is characterized by intense price competition, which results in a continuing emphasis on our need to increase product productivity and performance. We are generally able to keep our prices lower than many of our competitors because we have contracted a supplier who provides high quality products at relatively lower prices. Our strategy has been to fulfill the steel industry’s need by developing technologically advanced refractory products to help our customers increase their productivity. We believe that the trend towards even greater productivity in the highly competitive steel industry will continue to provide a growth opportunity for our products, especially monolithic refractories.

We believe our strategy based on diverse product offerings, comprehensive maintenance services and competitive pricing affords us a competitive advantage compared with competing companies.

6

Fracture Proppants

We first produced fracture proppant products in December 2006, through our direct, wholly-owned BVI subsidiary, GengSheng International, and its wholly-owned Chinese subsidiary, Duesail. Our products have passed the testing conducted by the China Petroleum and Chemical Industry Association (CPCIA), which strengthens our competitive market position. We were recognized as the fracture proppant supplier by China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation (Sinopec) and China National Offshore Oil Corp. (CNOOC), who monopolize the oil and gas drilling business in China, and we are the sole signed provider for China National Offshore Oil Corp. (CNOOC). Our main competitors for the production of fracture proppants are Carbo Ceramics Inc. and Saint-Gobain Proppants (Guanghan) Co., Ltd, while the two companies are both subsidiaries of international magnates, which focus on international sales. In addition, we doubled our production capacity in April 2009, to enlarge the production capacity to 66,000 tons from 33,000 tons, and the new Revolving Kiln technology in the second production line is designed to increase efficiency by shortening the production cycle and saving energy costs. After completion of the second production line, we are able to provide a wide range of products, with sizing from 52M Pa 69M Pa to 86M Pa and 102M Pa.

Fine Precision Abrasives

We finished construction of facility and started trial production for fine precision abrasives in July 2009, and commercially launched the abrasives products through our direct, wholly-owned BVI subsidiary, Gengsheng International Corporation, and its wholly-owned Chinese subsidiary Micronized. Our fine precision abrasives facility is designed to have capacity of 22,000 tons per year. From the trial use feedback we got from potential customers, our products are qualified for used in wire slicing of solar ingots for solar cell makers to make wafers and polishing surface of solar panels or high-precision instruments. Currently the fine precision abrasives market in China is dominated by two Japanese companies, namely Nanxing and FUJIMI. We source our key raw material, green silicon carbide (SiC) from a mine in Xinjiang to ensure the supply of highly purified material to produce high quality products. Because the production costs of precision abrasives remained high with the patented technology that we licensed, we terminated the agreement with the owner of the patent on December 30, 2010. Meanwhile the Company recruited a new director of technology, a senior engineer with 12 years of experience in the fine precision abrasive industry, to redesign our production technologies and processes so as to improve productivity and margin. We are now applying a different technology developed by ourselves and have started commercial production.

Overall, we believe that our competitive strengths include the following:

-

Market Position. We believe that we hold a competitive position in the monolithic refractory marketplace. According to a Chinese steel industry publication, during 2010, total national sales were approximately $36 billion, 70% of which were from refractories applied in steel making, of which 73% were monolithic refractories. Based on our sales of monolithic refractories during fiscal 2010, which was approximately $27.6 million, we believe that our market share for monolithic refractories applied in steel making is approximately 0.1% . Our industry is highly competitive and consists of more than 2,000 manufacturers. However, we believe that our market share of 0.1%, as well as our well recognized “GengSheng” brand and leading position in research and development place us in a strong competitive position in the monolithic refractory marketplace. Our position affords us a broad customer base, superior recognition of the “GengSheng” brand, procurement leverage and pricing advantages with our suppliers, flexible manufacturing capabilities and easily accessed distribution channels. These capabilities and distribution channels enable us to introduce new refractory products and product categories to our customer base efficiently and cost effectively.

-

Broad Product Offering. Our refractory product segment offers over 25 product categories that can be tailored to a wide range of customers’ specifications for use in the iron and steel manufacturing industries, in industrial furnaces, and in other heavy machinery. Our broad product offerings allow us to offer our customers a single source for many of their refractory product requirements.

-

Diversified End Markets/Customer Base. We sell our refractory products in over 25 provinces in China and 11 overseas countries. In the 2010 fiscal year, for the refractories segment, we had 200 customers, none of which accounted for more than 20% of 2010 net sales. One customer, Shandong Steel Co., Ltd, Rizhao Subsidiary accounted for 14.5% of 2010 net sales. We believe that our broad product line and diverse target markets and customer base have contributed to greater stability in our sales and operating profit margin. We have long term relationships with significant steel and iron industry leaders in China, such as Bao Steel, Anshan Steel and Shandong Steel.

-

Experienced Management Team. Our senior management team has, on average, over 20 years of experience in the refractory industry and with the company.

-

Access to Raw Materials. We are located in Gongyi, Henan Province, an area of China which has an abundant reserve of bauxite and other key raw materials used in refractory manufacturing. We have diversified our access to raw materials by acquiring the Guizhou, a subsidiary of our wholly own subsidiary Refractories to secure and stabilize the supply and the prices of raw materials.. We also entered into a supply agreement with a raw material-green silicon carbide provider, Ehe Silicon Carbide Co., Ltd., located in Xinjiang, Currently, we are in the process of negotiating with Ehe Silicon Carbide Co., Ltd regarding establishing a joint venture, a new SiC producing company, in which we will have priority to obtain our raw materials-green SiC.

7

-

Research and Development Capabilities. We utilize our research and development capabilities to supply our customers with cutting edge refractory products designed to meet their specific demands. To ensure the highest quality product developments, we established a modern, state-of-the-art laboratory in China dedicated to quality control and testing.

-

Maintenance Service Capabilities. The sale price of our refractory products also includes installation and ongoing maintenance services, which we believe can be developed into a high margin business if our products continue to be reliable and do not require extraordinary servicing other than ordinary maintenance. We dedicate over 300 employees to the installation and service of our products. We believe that this service offering solidifies a positive business relationship with our customers and makes our products more attractive to them.

Our Customers

We have over 200 customers in 25 Chinese provinces, as well as in greater Asia, North America and Europe. Our customers include some of the largest steel and iron producers and petroleum & chemical producers in China and elsewhere. During each of fiscal years 2010 and 2009, only two of our customers, Shandong Steel Co., Ltd, Rizhao Subsidiary and AMSAT International Co., represented 10% or more of our consolidated sales. Our sales to Shandong Steel Co., Ltd, Rizhao Subsidiary amounted to 14.5% or $9 million of our revenues for 2010 and 14.2%, or $8.1 million of our revenues for 2009. Our sales to AMSAT International Co., Ltd amounted to 10.4% or $6.5 million of our revenues for 2010 and 14.2%, or $2.7 million of our revenues for 2009.

During the fiscal year of 2010, our top ten customers among our segmental lines, which are listed below, accounted for approximately 55.5% of our consolidated revenues.

Our Top 10 Customers

(As of December 31,

2010)

| Customers | Sales | Percentage | Locations | ||||||

| (in US dollars) | of our net sales | of Customers | |||||||

| Shandong Steel Co., Ltd., Rizhao Subsidiary | 8,991,759 | 14.5% | Rizhao City | ||||||

| AMSAT International | 6,451,116 | 10.4% | USA | ||||||

| Zibo Hongda Steel LLC. | 3,578,568 | 5.8% | Zibo City | ||||||

| Nanchang Changli Iron & Steel Co., Ltd. | 2,992,841 | 4.8% | Nanchang City | ||||||

| Heilongjiang Jianlong Iron & Steel LLC. | 2,680,449 | 4.3% | Shuangyashan City | ||||||

| Anhui Yangtze Steel LLC. | 2,190,150 | 3.5% | Maanshan City | ||||||

| Anshan Baode Iron & Steel Ltd. | 2,071,022 | 3.3% | Anshan City | ||||||

| Gansu Jiu Steel Group Hongxing Iron &Steel Co,Ltd. | 1,858,349 | 3.0% | Jiayu City | ||||||

| CNPC Bohai Drilling Engineering Company Limited | 1,875,010 | 3.0% | Handan City | ||||||

| Beijing Shenwu Thermal Energy Technology Co., Ltd. | 1,836,227 | 3.0% | Beijing City | ||||||

| Total | 34,525,491 | 55.5% |

Our Suppliers of Raw Materials

The principal raw materials used in our refractory products and fracture proppants are various forms of aluminum oxide, including bauxite, corundum, processed AI203, magnesia, calcium aluminates cement, resin, and silica. Bauxite is used in the production of refractory materials, fracture proppants and some industrial ceramic products. Bauxite is abundantly available from mines nearby our manufacturing facilities. We purchase a significant portion of our magnesia requirements from sources in Liaoning province. We strive to source raw materials from geographically proximate suppliers as higher shipping costs increase the cost of raw materials when they are bought from other regions. If we experience supply interruptions of our refractory raw material requirements, we believe that we could obtain adequate supplies from alternate sources in local areas or elsewhere in China at reasonable costs. The costs of some of our raw materials from 2009 to 2010 are as follows:

(State in US dollar)

| 2010 | 2009 | % Change | |||||||

| Ordinary bauxite | 73.57 | 61.15 | 20.3% | ||||||

| Refined bauxite | 250.20 | 249.79 | 0.2% | ||||||

| Middle class magnesia | 191.42 | 176.18 | 8.6% |

8

| 2010 | 2009 | % Change | |||||||

| High class magnesia | 219.40 | 213.52 | 2.8% | ||||||

| Silica | 317.09 | 308.21 | 2.9% | ||||||

| Calcium aluminates cement | 756.14 | 799.48 | -5.4% | ||||||

| Processed aluminum oxide | 675.95 | 626.10 | 8.0% | ||||||

| Brown fused corundum | 496.57 | 506.85 | -2.0% | ||||||

| White fused corundum | 545.62 | 676.58 | -19.4% |

We typically have supply agreements with terms of one to two years that do not impose minimum purchase requirements. The cost of raw materials purchased during the term of a supply agreement usually is the market price for the raw materials at the time of purchase. Our centralized procurement department makes an ongoing effort to maintain and reduce raw material costs. We generally are not engaged in speculative raw material commodity contracts and attempt to reflect raw material price changes in the sale price of our products. Our ability to achieve anticipated operating results depends in part on having an adequate supply of raw materials for our manufacturing operations. We typically pass through a portion of the cost of any increase in the price of raw materials to our customers if and when such prices increase. Because of our strategy to maintain multiple suppliers for each material we source, we do not rely on one single supplier

Our Sales and Marketing

Our sales and marketing group is comprised of over 100 employees who focus on managing specific product lines across several distribution channels. Our marketing process involves an integrated process of screening sales leads, preparing bid documents (in response to customer requests for a proposal, or RFP), making competitive bids and negotiating and executing definitive sales agreements.

To maximize the accessibility of our product offerings to a diverse group of end users, we market our products through a variety of distribution channels. We have separate sales and marketing groups that work directly with our customers in each of our target markets. Marketing and sales are accomplished through the mailing of brochures, industry trade advertising, trade show exhibitions, website applications and sales presentations.

Our Growth Strategy

We are committed to growing our business in the coming years. The key elements of our growth strategy are summarized below:

-

Adjust Cost Structure Through Operating Efficiency and Productivity Improvements. We regularly evaluate our operating productivity and efficiency and focus on decreasing our manufacturing and distribution costs. We have planned to advance internal capacity for new refractory products and new product development while continuing to enhance our order completing capabilities throughout our supply chain. We believe that these initiatives will provide significant costs savings and improve operating profits.

-

Expand Product Lines and Specialty Product Lines. We are actively seeking to identify, develop and commercialize new products that use our core technology and manufacturing competencies. In particular, we intend to develop a variety of specialty, higher margin mineral-based products, including fracture proppant and fine precision abrasive products.

-

Pursue Sales Opportunities in Existing and New Markets. We believe that we have significant opportunities to grow our business by increasing our penetration within our existing customer base, adding new customers, expanding our already broad refractory product offering, and pursuing additional marketing channels for other segmental line products. In addition to continuing to target leading steel and iron manufacturers and become their major source provider of refractory products, we have been awarded contracts with major oil & chemical manufacturers in China.

-

Selectively Pursue Strategic Acquisitions. As a strong competitor in our core refractory manufacturing market, we believe that we are well-positioned to benefit from the consolidation of manufacturers in these markets. We also believe that our management has the ability to identify and integrate strategic acquisitions. We will continue to selectively consider acquisitions that will improve our market position within our existing target markets, expand our product offerings or end markets, or increase our manufacturing efficiency.

-

Expand International Operations. We have expanded the operations to address our new potential overseas markets to leverage resources from our existing operations, increase our geographic presence and our sales efforts in countries outside of China. We have received initial supply contracts from 11 other countries in Asia, Europe and North America and expect this contract volume to continue to increase.

Regulation

Because our operations are based in China, we are regulated by the national and local laws of the People’s Republic of China. The refractory materials industry is generally subject to state, local laws and regulations relating to the environment, health, and safety. The operation of refractory materials involves the release of powder and dust which are classified as environmental pollutants under applicable government laws and regulations. We regularly monitor and review our operations, procedures, and policies for compliance with these laws and regulations. We have made substantial capital investments in our facilities to ensure compliance with environmental and regulatory laws. We believe that our operations are in substantial compliance with the laws and regulations and that there are no violations that would have a material effect on us. The cost of compliance with these laws and regulations is not expected to have a large financial impact on our operations.

9

There is no private ownership of land in China. All land ownership is held by the government of the PRC, its agencies and collectives. Land use rights can be obtained from the government for a period up to 50 years, and are typically renewable. Land use rights can be transferred upon approval by the land administrative authorities of the Chinese State Land Administration Bureau upon payment of the required land transfer fee. We have received the necessary land use right certificates for our primary operating facility which are located at No. 88 Gengsheng Road, Dayugou Town, Gongyi, Henan Province.

In addition, we are also subject to PRC’s foreign currency regulations. The PRC government has control over Renminbi reserves through, among other things, direct regulation of the conversion or Renminbi into other foreign currencies. Although foreign currencies which are required for “current account” transactions can be bought freely at authorized Chinese banks, the proper procedural requirements prescribed by Chinese law must be met. At the same time, Chinese companies are also required to sell their foreign exchange earnings to authorized Chinese banks and the purchase of foreign currencies for capital account transactions still requires prior approval of the Chinese government.

We do not face any significant government regulation of in connection with the production of our products. We do not require any special government permits to produce our products other than those permits that are required of all corporations in China.

Our Intellectual Property

While we consider our patents and trademarks to be valuable assets, we do not consider any single patent or trademark to be of such material importance that its absence would harm or cause a material disruption of our business. We also consider the production of our refractories to involve proprietary know-how, and we adjust and test the specific composition formulas to ensure optimal product performance.

Patents

We own nine Chinese patents which are approved by and registered with the China State Intellectual Property Office. The following table lists our patents:

| Patent Name | Patent Number | Application Date | Patent Term | Country |

| Integral casting technology in mixer furnaces | ZL00137106.1 | December 29, 2000 | 20 years | PRC |

| Light-slag heat-retaining refractory castables in high-furnaces clinders | ZL200510107341.X | December 27, 2005 | 20 years | PRC |

| Ceramic sealing double-gate valve | ZL200520029858.7 | January 24, 2005 | 10 years | PRC |

| Direct-fired gas generator | ZL200520030706.9 | May 23, 2005 | 10 years | PRC |

| Ceramic plunger in pumps | ZL200520029859.1 | January 24, 2005 | 10 years | PRC |

| Ceramic cylinder in slurry pumps | ZL200820148214.3 | July 25, 2008 | 10 years | PRC |

| Ceramic plunger pump | ZL200820148089.6 | July 21, 2008 | 10 years | PRC |

| Ceramic lining in abrasion-resistance tubes | ZL20082014090.9 | July 21, 2008 | 10 years | PRC |

| Oversized particles removal method | ZL01127585.5 | October 30, 2001 | 20 years | PRC |

In addition, we have pending patent applications with the China State Intellectual Property Office.

Trademarks

We also own the following registered trademarks associated with the brand “GengSheng” that were issued by the State Industrial and Commercial Administration Bureau of the PRC.

| Trademark | Registered Number | Termination Date | Use |

|

|

560614 | August 9, 2011 | Used for products with high-carbon black lead catalogued as class number 1 |

|

|

561260 | August 9, 2011 | Used for refractories catalogued as class number 19 |

10

Our Research and Development

We believe that the development of new products and new technology is critical to our success. We are continuously working to improve the quality, efficiency and cost-effectiveness of our existing products and develop technology to expand the range of specifications of our products.

We have spent $817,179 and $478,422 on Company-sponsored research and development activities in fiscal years 2010 and 2009 respectively. The expenses on research and development include salary, cost of raw material consumed, testing expenses and other costs incurred for research and development of potential new products. We have not spent any money on customer-sponsored research and development activities.

Litigation

From time to time, we may become involved in various lawsuits and legal proceedings that arise in the ordinary course of business. We are currently not a party to any legal proceeding and are not aware of any legal claims that we believe will have a material adverse affect on our business, financial condition or operating results.

Our Employees

As of December 31, 2010, we had approximately 1,400 employees, all of whom are all salaried employees and members of a labor union. Over 25% of our employees hold a bachelor’s degree, and approximately 1% of our employees hold a master’s degree. We actively recruit our employees from the local market and expect to focus our recruiting efforts on bachelor degree candidates in the fields of material science, refractory materials and marketing as we implement our expansion plans. We have implemented a comprehensive training program for our employees that focus not just on skills and knowledge training for their specific duties, but also on our corporate philosophy and our product concepts.

Our employees participate in a mandated state pension scheme and social insurance programs organized by Chinese municipal and provincial governments which cover pensions, unemployment and injury insurance. We are required to contribute to the scheme at a rate of 20% of the average monthly salary for employee pensions, 2% of the average monthly salary for the state unemployment fund and 1% of the monthly average salary for injury insurance. Our compensation expenses related to this scheme were $324,810 and $356,076 for the years ended December 31, 2010 and 2009, respectively.

Our Chinese subsidiaries have trade unions which protect employees’ rights, aim to assist in the fulfillment of our economic objectives, encourage employee participation in management decisions and assist in mediating disputes between us and union members. We believe that we maintain a satisfactory working relationship with our employees and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations.

China enacted a new Labor Contract Law, which became effective on January 1, 2008. We have updated our employment contracts and employee handbook and been in compliance with the new law. We will work with the employees and the labor union to ensure that the employees obtain the full benefit of the law. We do not anticipate that changes in the law will materially impact the Company balance sheet.

ITEM 1A. RISK FACTORS

The market price of our common stock could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock.

RISKS RELATED TO OUR BUSINESS

The slow recovery of the global economic crisis could affect the overall availability and cost of external financing for our operation.

The slow recovery of the global financial markets from the global economic crisis and turmoil may adversely impact our business, the business and financial condition of our customers and the business of potential investors from whom we expect to generate our potential sources of capital financing. Presently it is unclear to what extent the economic stimulus measures and other actions taken or contemplated by the Chinese governments and other governments throughout the world will mitigate the effects of the negative impact caused by the economic turmoil on our industry and other industries that affect our business. Although these conditions have not presently impaired our ability to access credit markets and finance our operations, the impact of the current crisis on our ability to obtain capital financing in the future, and the cost and terms of same, is unclear.

11

A downturn or negative changes in the highly volatile steel and iron industry will harm our business and profitability.

The iron and steel industries accounted for approximately 60%-70% of the consumption in the Chinese refractory industry according to the industry association statistics. Because our largest customers are in the steel industry, our business performance is closely tied to the performance of the steel industry. The sector as a whole is cyclical and its profitability can be volatile as a result of general economic conditions, labor costs, competition, import duties, tariffs and currency exchange rates. These macroeconomic factors have historically resulted in wide fluctuations in the Chinese and the global economies in which steel companies sell their products. In our case, future economic downturns, stagnant economies or currency fluctuations in China or globally could decrease the demand for steel products both in China and overseas and, in turn, could negatively impact our sales, margins and profits.

Industry growth rate for refractory products may decelerate and may affect our future revenue growth.

In China, the production of refractory materials has experienced fast growth in recent years driven largely by growth in China’s steel production. China has become the largest country for producing and consuming refractories, among which 60%-70% were demanded by companies in the steel industry. Our industry’s growth has been primarily driven by the growth in the Chinese steel industry. According to figures provided by the National Statistics Bureau of China, the Chinese steel output grew from an annual output of 157 million tons in 2001 to 627 million tons in 2010, representing a compounded average growth rate of 9.3% . Going forward, however, the forecast provided by the China International Capital Corporation suggests that the annual output of steel in China will not maintain this growth rate.

If the steel industry experiences such a slowdown, our growth prospects will likewise be curtailed. Additionally, the market for monolithic refractories in China is still in the developmental stage, and successful market penetration of the monolithic refractories depends heavily on two factors. First, successful market penetration depends on technological progress that results in products that provide better performance by our customers, new varieties of products that meet our customer’s future requirements, and more efficient and effective installation and maintenance methods. Second, successful market penetration also depends on our marketing strategy and our ability to execute that strategy while maintaining a high quality of service to our customers. Our future revenue growth—without acquisitions—may maintain growth, but nevertheless, we may not match our past growth rate.

Our inability to overcome fierce competition in the highly fragmented and highly competitive Chinese refractory market could reduce our revenue and net income.

The refractory market in China is highly fragmented with over 2,000 producers of refractory products, according to the Chairman of the Association of China Refractory Industry. Our competitors manufacture products that are similar to and directly compete with the products that we manufacture and market. We compete with many other refractory manufacturers in China, on a region-by-region basis, and with international competitors on a world-wide basis. Our main competitors are located in China and include Puyang Punai High-temperature Materials Co., Ltd., Wuhan Ruisheng Specialty Refractory Materials Co., Ltd., Beijing Lirr Refractories Co., Ltd. and others. Currently, our primary international competitor is Mineral Technologies, Inc. in the United States.

As a market leader in the monolithic refractory marketplace in China, we can buy raw materials in large quantities allowing us to negotiate volume pricing that result in lower prices than what is offered to our smaller competitors. As our smaller competitors consolidate and grow larger, they may be able to negotiate similar volume pricing from raw material suppliers. Under that scenario, any cost advantage that we currently enjoy may be reduced or eliminated altogether. Although our smaller competitors may pay higher materials costs relative to our material costs, their operating and administrative costs may be lower than ours, which may allow our competitors to quote very competitive prices for their products and services. Their competitive prices may force us to lower our prices, and to sell products and services at a loss in order to maintain our market share. Currently, we have a policy for setting a pricing floor so that we do not sell products at a loss; however, we cannot assure that we can maintain this policy indefinitely. Thus, increased competition in our industry could reduce our revenue and net income.

Any decrease in the availability, or increase in the cost, of raw materials and energy could materially increase our costs and jeopardize our current profit margins and profitability.

The principal raw materials used in our refractory products are several forms of the minerals SiO2, Al203, and MgO, including bauxite, mullite, corundum, processed Al203, Spinel, magnesia, calcium aluminates cement, and silica. We primarily use bauxite in the production of refractory materials, fracture proppants and some industrial ceramic products. The availability of these raw materials and energy resources may decrease and their prices can become volatile as a result of, among other things, changes in overall supply and demand levels and new laws or regulations. Our ability to achieve our sales target depends on our ability to maintain what we believe to be adequate inventories of raw materials to meet reasonably anticipated orders from our customers. In 2010, raw material costs accounted for 82.9% of the production cost for refractory products, 44.0% for fracture proppant products and 72.0% for industrial ceramics products 74% for Micropowder products.

Our production facilities are located in Gongyi, Henan Province, where there is currently an abundant reserve of bauxite and corundum for refractory manufacturing. Although our proximity to bauxite allows us to benefit from a relatively short delivery time and lower shipping costs, we may experience supply shortages or price increases or both due to sharp increases in overall industry demand for bauxite. Besides purchasing bauxite from local suppliers, we also purchase bauxite, mullite, magnesia, calcium aluminates cement and other raw materials from suppliers in Shanxi Province, Shandong Province, Liaoning Province and Gansu Province. All of these locations are outside of Henan Province. Any increase in shipping costs will increase our cost of raw materials from these sources and will decrease our revenues and profitability.

12

Further, if our existing suppliers are unable or unwilling to deliver our raw materials requirements on time to meet our production schedules, we may be unable to produce certain products, which could result in a decrease in revenues and profitability, a loss of good will with our customers, and could tarnish our reputation as a reliable supplier in our industry. In the event that our raw material and energy costs increase, we may not be able to pass these higher costs on to our customers in full or at all due to contractual agreements or pricing pressures in the refractory market. Any increase in the prices for raw materials or energy resources could materially increase our costs and therefore lower our earnings and profitability.

Actions by the Chinese government could drive up our material costs and could have a negative impact on our profitability.

In the past years, the Chinese government has shut down some outdated mineral mines in China. These shutdowns have decreased the overall supply of raw materials needed to produce refractory products. As a result, the materials costs for our products have increased. If the Chinese government shuts down more mineral mines, we could experience further supply shortages and price increases that could have a negative impact on our profitability.

We may not be able to implement our business plan because we may be unable to both fund the substantial ongoing capital and maintenance expenditures that our operations require and invest in new projects at the same time.

Our operations are capital intensive and the nature of our business and our business strategy will require substantial additional working capital investment. We require capital for building new production lines, acquiring new equipment, maintaining the condition of our existing equipment and maintaining compliance with environmental laws and regulations, and to pursue new market opportunities. We may not be able to fund our capital expenditures from operating cash flow and from the proceeds of borrowings available for capital expenditures under our credit facilities, and we may require additional debt or equity financing. We cannot assure that this type of financing will be available or, if available, it may result in increased interest expenses, increased leverage and decreased income available to fund further expansion. In addition, future debt financings may limit our ability to withstand competitive pressures and render us more vulnerable to economic downtowns. If we are unable to fund our capital requirements, we may be unable to implement our business plan and our financial performance may be adversely impacted.

Approximately 55.5% of our sales revenues were derived from our ten largest customers, and any reduction in revenues from any of these customers would reduce our revenues and net income.

While we have over 200 active customers, approximately 55.5% of our sales revenue came from our top ten customers in 2010, with Shandong Steel Co., Ltd, Rizhao Subsidiary alone accounting for approximately 14.5% of our sales revenue in the same period. If we cease to do business at or above current levels with Shandong Steel Co., Ltd, Rizhao Subsidiary or any one of our other largest customers which contribute significantly to our sales revenues, and we are unable to generate additional sales revenues with new and existing customers that purchase a similar amount of our products, then our revenues and net income would decline considerably.

A significant interruption or casualty loss at any of our facilities could increase our production costs and reduce our sales and earnings.

Our manufacturing process requires large industrial facilities for crushing, smashing, batching, molding and baking raw materials. After the refractory products come off the production line, we need additional facilities to inspect, package, and store the finished goods. Our facilities may experience interruptions or major accidents and may be subject to unplanned events such as explosions, fires, inclement weather, acts of God, terrorism, accidents and transportation interruptions. Any shutdown or interruption of any facility would reduce the output from that facility, which could substantially impair our ability to meet sales targets. Interruptions in production capabilities will inevitably increase production costs and reduce our sales and earnings. In addition to the revenue losses, longer-term business disruption could result in the loss of goodwill with our customers. To the extent these events are not covered by insurance, our revenues, margins and cash flows may be adversely impacted by events of this type.

Environmental regulations impose substantial costs and limitations on our operations.

Our products are not considered environmentally hazardous materials, however, the dust produced during our production process is considered hazardous to the environment. We have environmental liability risks and limitations on operations brought about by the requirements of environmental laws and regulations. We are subject to various national and local environmental laws and regulations concerning issues such as air emissions, wastewater discharges, and solid and hazardous waste management and disposal. These laws and regulations are becoming increasingly stringent. While we believe that our facilities are in material compliance with all applicable environmental laws and regulations, the risks of substantial unanticipated costs and liabilities related to compliance with these laws and regulations are an inherent part of our business. It is possible that future conditions may develop, arise or be discovered that create new environmental compliance or remediation liabilities and costs. While we believe that we can comply with environmental legislation and regulatory requirements and that the costs of compliance have been included within budgeted cost estimates, compliance may prove to be more limiting and costly than anticipated.

13

Climate change and related regulatory responses may impact our business.

Climate change as a result of emissions of greenhouse gases is a significant topic of discussion and may generate U.S. federal and other regulatory responses in the near future, including the imposition of a so-called “cap and trade” system. It is impracticable to predict with any certainty the impact of climate change on our business or the regulatory responses to it, although we recognize that they could be significant. The most direct impact is likely to be an increase in energy costs, which would increase slightly our operating costs, primarily through increased utility and transportations costs. In addition, many of our customers operate in the manufacturing industry. Any restrictions or penalties imposed under a cap and trade system might significantly impact their operations, which in turn, would adversely affect their demand for our products. However, it is too soon for us to predict with any certainty the ultimate impact, either directionally or quantitatively, of climate change and related regulatory responses.

If our customers and/or the ultimate consumers of products which use our products successfully assert product liability claims against us due to defects in our products, our operating results may suffer and our reputation may be harmed.

Our products are widely used as protective linings in industrial furnaces operating in highly hazardous environments because those furnaces must operate under extremely high temperatures in order to produce iron, steel and other industrial products. Significant property damage, personal injuries and even death can result from the malfunctioning of high temperature furnaces as a result of defects in our refractory products. The costs and resources needed to defend product liability claims could be substantial. We could be responsible for paying some or all of the damages if found liable. We do not have product liability insurance. The publicity surrounding these sorts of claims is also likely damage our reputation, regardless of whether such claims are successful. Any of these consequences resulting from defects in our products would hurt our operating results and stockholder value.

If we are not able to adequately secure and protect our patent, trademark and other proprietary rights our business may be materially affected.

We hold patents for (a) an integral casting technology in mixer furnaces (which expires on December 29, 2020), (b) a light-slag heat-retaining refractory castables in high-furnaces clinders (which expires on December 27, 2025), (c) a ceramic sealing double-gate valve (which expires on January 24, 2015), (d) a direct-fired gas generator (which expires on May 23, 2015) (e) a Ceramic plunger in pumps (which expires on January 24, 2015), (f) a ceramic cylinder in slurry pumps (which expires on July 25, 2018) , (g) a Ceramic plunger pump(which expires on July 21, 2018) , (h) a ceramic lining in abrasion-resistance tubes(which expires on July 21, 2018) and (i) an oversized particles removal method (which expires on October 30, 2021). We also rely on non-disclosure agreements and other confidentiality procedures to protect our intellectual property rights in various jurisdictions. These technologies are very important to our business and it may be possible for unauthorized third parties to copy or reverse engineer our products, or otherwise obtain and use information that we regard as proprietary. Furthermore, third parties could challenge the scope or enforceability of our patents. In certain foreign countries, including China where we operate, the laws do not protect our proprietary rights to the same extent as the laws of the United States. Decided court cases in China’s civil law system do not have binding legal effect on future decisions and even where adequate law exists in China, enforcement based on existing law may be uncertain and sporadic and it may be difficult to obtain enforcement of a judgment by a court of another jurisdiction. In addition, the relative inexperience of China’s judiciary in many cases creates additional uncertainty as to the outcome of any litigation, and interpretation of statutes and regulations may be subject to government policies reflecting domestic political changes. Any misappropriation of our intellectual property could have a material adverse effect on our business and results of operations, and we cannot assure you that the measures we take to protect our proprietary rights are adequate.

Expansion of our business may pull our management and operational infrastructure and impede our ability to meet any increased demand for our products.

Our business plan is to significantly grow our operations by meeting the anticipated growth in demand for existing products and by introducing new product offerings. Growth in our business may place a significant strain on our personnel, management, financial systems and other resources. Our business growth also presents numerous risks and challenges, including:

-

Our ability to successfully and rapidly expand sales to potential customers in response to potentially increasing demand;

-

The costs associated with such growth, which are difficult to quantify, but could be significant; and

-

The costs associated with developing new products to keep pace with rapid technological changes.

To accommodate this growth and compete effectively, we may need to obtain additional funding to improve information systems, procedures and controls and expand, train, motivate and manage existing and additional employees. Funding may not be available in a sufficient amount or on favorable terms, if at all. If we are not able to manage these activities and implement these strategies successfully to expand to meet any increased demand, our operating results could suffer.

Improvements in the quality and lifespan of refractory products may decrease product turnover and our sales revenues.

Technological and manufacturing improvements have made refractory products more durable and more efficient. While making products more durable and more efficient is generally a positive development, the increased quality and durability of refractory products could lead to declining consumption and turnover of refractory products. With the growth rate in the steel industry decelerating and with the consumption rate of refractory products per metric ton of steel produced decreasing, the refractory industry’s future growth rate may decelerate. We can increase our prices to offset a decrease in product consumption, but we cannot assure that price increases will be acceptable to our customers.

14

Our new products are complex and may contain defects that are detected only after their release to our customers, which may cause us to incur significant unexpected expenses and lost sales.

Our products are highly complex and must operate at high temperatures for a long period of time. Although our new products are tested prior to release, they can only be fully tested when they are used by our customers. Consequently, our customers may discover defects after new products have been released. Although we have test procedures and quality control standards in place designed to minimize the number of defects in our products, we cannot guarantee that our new products will be completely free of defects when released. If we are unable to quickly and successfully correct the defects identified after their release, we could experience significant costs associated with compensating our customers for damages caused by our products, costs associated with correcting the defects, costs associated with design modifications, and costs associated with service or warranty claims or both. Additionally, we could lose customers, lose market share and suffer damage to our reputation.

Our holding company structure may limit the payment of dividends.

We have no direct business operations, other than our ownership of our subsidiaries. While we have no current intention of paying dividends, should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries and other holdings and investments. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions as discussed below. If future dividends are paid in RMB, fluctuations in the exchange rate for the conversion of RMB into U.S. dollars may reduce the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars.

Chinese regulations currently permit the payment of dividends only out of accumulated profits as determined in accordance with Chinese accounting standards and regulations. Our subsidiaries in China are also required to set aside a portion of their after-tax profits according to Chinese accounting standards and regulations to fund certain reserve funds. Currently, our subsidiaries in China are the only sources of revenues or investment holdings for the payment of dividends. If they do not accumulate sufficient profits under Chinese accounting standards and regulations to first fund certain reserve funds as required by Chinese accounting standards, we will be unable to pay any dividends.

We completed our new fine precisions production line in 2009 and we have earned revenue in 2010 but we cannot guarantee that we will earn the estimated revenues in the future or that it ultimately will be profitable.

We initiated the construction of our fine precisions line in 2008 and completed it in 2009. We entered into trial production in July 2009 and after making various technological adjustments and remolding, we shipped some test products for trial use by potential customers in November 2009 and received positive feedback from these potential customers. We initiated sales in August 2010, and as of December 31, 2010 the company sold approximately 260 ton abrasive.

We may incur significant costs to ensure compliance with United States corporate governance and accounting requirements.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley Act”) and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Currently we do not maintain an effective system of internal controls and may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market price of our stock may be adversely impacted.