Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - CHINA GENGSHENG MINERALS, INC. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - CHINA GENGSHENG MINERALS, INC. | exhibit31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - CHINA GENGSHENG MINERALS, INC. | exhibit32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - CHINA GENGSHENG MINERALS, INC. | exhibit32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: March

31, 2010

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period

from _______________ to ________________

Commission File Number: 001-34649

CHINA GENGSHENG MINERALS,

INC.

(Exact Name of Registrant as Specified in Its Charter)

| NEVADA | 91-0541437 |

| (State or Other jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| CHINA GENGSHENG MINERALS, INC. | |

| No. 88 Gengsheng Road, Dayugou Town, Gongyi | |

| Henan Province, P.R. China | 451271 |

| (Address of Principal Executive Offices) | (Zip Code) |

(86) 371-64059818

(Registrant’s Telephone Number,

Including Area Code)

N/A

(Former Name, Former Address and Former Fiscal

Year, if Changed Since Last Report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [_]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [_ ] No [_]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer [_] | Accelerated filer [_] | Non-accelerated filer [_] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [_] No [X]

As of May 13, 2010, there were 24,294,386 shares of Common Stock of the Company, $0.001 par value, outstanding.

Table of Contents

| Page | |

| PART I - FINANCIAL INFORMATION | |

| Item 1. Financial Statements. | 2 |

|

Condensed Consolidated Balance Sheets as of March 31, 2010 (Unaudited) and December 31, 2009 |

2 |

|

Condensed Consolidated Statements of Income and Other Comprehensive Income (Unaudited) for the Three Months Ended March 31, 2010 (Unaudited) and March 31, 2009 (Unaudited) |

4 |

|

Condensed Consolidated Statements of Cash Flows (Unaudited) for the Three Months Ended March 31, 2010 and 2009 |

5 |

|

Notes to Condensed Consolidated Financial Statements (Unaudited) |

7 |

| Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations. | 21 |

| Item 3. Quantitative and Qualitative Disclosure About Market Risk. | 33 |

| Item 4. Controls and Procedures. | 33 |

| PART II - OTHER INFORMATION | |

| Item 1. Legal Proceedings. | 36 |

| Item 1A. Risks Factors. | 36 |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds. | 36 |

| Item 3. Defaults Upon Senior Securities. | 36 |

| Item 5. Other Information. | 36 |

| Item 6. Exhibits. | 37 |

| SIGNATURES | 38 |

1

PART I

ITEM 1. FINANCIAL STATEMENTS

China GengSheng Minerals, Inc.

Condensed Consolidated

Balance Sheets

| As of | As of | |||||

| March 31, | December 31, | |||||

| 2010 | 2009 | |||||

| (Unaudited) | (Audited) | |||||

| ASSETS | ||||||

| Current assets: | ||||||

| Cash and cash equivalents | $ | 520,927 | $ | 992,204 | ||

| Restricted cash - Note 5 | 14,523,300 | 15,990,300 | ||||

| Trade receivables, net | 38,194,039 | 36,909,518 | ||||

| Bills receivable | 1,413,437 | 1,953,496 | ||||

| Other receivables and prepayments | 8,069,160 | 7,627,968 | ||||

| Inventories - Note 6 | 10,871,351 | 9,924,413 | ||||

| Deferred tax assets | 77,281 | 56,787 | ||||

| Total current assets | 73,669,495 | 73,454,686 | ||||

| Deposits for acquisition of land use right, property, plant and equipment | 266,662 | 276,520 | ||||

| Goodwill - Note 7 | 441,089 | 441,089 | ||||

| Intangible asset, net - Note 7 | 940,214 | 953,550 | ||||

| Property, plant and equipment, net - Note 8 | 22,445,268 | 21,980,340 | ||||

| Land use rights, net | 928,991 | 934,981 | ||||

| TOTAL ASSETS | $ | 98,691,719 | $ | 98,041,166 | ||

| LIABILITIES AND EQUITY | ||||||

| Current liabilities: | ||||||

| Trade payables | $ | 11,674,599 | $ | 12,327,618 | ||

| Bills payable - Note 5 | - | 1,512,200 | ||||

| Other payables and accrued expenses | 5,955,510 | 4,294,606 | ||||

| Deferred revenue - Government grants | 381,420 | 381,420 | ||||

| Income taxes payable | 823,186 | 313,430 | ||||

| Non-interest-bearing loans - Note 9 | 3,700,936 | 1,520,160 | ||||

| Collateralized bank loans - Note 10 | 26,259,300 | 28,459,800 | ||||

| Deferred tax liabilities | 89,244 | 89,244 | ||||

| TOTAL LIABILITIES | 48,884,195 | 48,898,478 | ||||

| COMMITMENTS AND CONTINGENCIES - Note 16 |

2

PART I

ITEM 1. FINANCIAL STATEMENTS

China GengSheng Minerals, Inc.

Condensed Consolidated

Balance Sheets

| As of | As of | |||||

| March 31, | December 31, | |||||

| 2010 | 2009 | |||||

| (Unaudited) | (Audited) | |||||

| STOCKHOLDERS' EQUITY | ||||||

| Preferred stock - $0.001 par

value per share; authorized 50,000,000 shares in 2010

and 2009, none issued and outstanding |

$ | - |

$ | - |

||

| Common stock

- $0.001 par value per share; authorized 100,000,000 shares in 2010

and 2009, issued and outstanding 24,196,517 shares in 2010 and 24,038,183 in 2009 - Note 11 |

24,196 |

24,038 |

||||

| Additional paid-in capital | 19,869,086 | 19,608,044 | ||||

| Statutory and other reserves | 7,419,868 | 7,419,868 | ||||

| Accumulated other comprehensive income | 4,345,206 | 4,344,766 | ||||

| Retained earnings | 17,861,095 | 17,473,813 | ||||

| Total China GengSheng Minerals, Inc. (“the Company”) stockholders' equity | 49,519,451 | 48,870,529 | ||||

| NONCONTROLLING INTEREST | 288,073 | 272,159 | ||||

| TOTAL EQUITY | 49,807,524 | 49,142,688 | ||||

| TOTAL LIABILITIES AND EQUITY | $ | 98,691,719 | $ | 98,041,166 |

The accompanying notes are an integral part of these condensed consolidated financial statements

3

China GengSheng Minerals, Inc.

Condensed

Consolidated Statements of Income and Comprehensive Income

| Three months ended | ||||||

| March 31, | ||||||

| 2010 | 2009 | |||||

| (Unaudited) | (Unaudited) | |||||

| Revenue | ||||||

| Sales | $ | 11,861,352 | $ | 12,398,010 | ||

| Cost of goods sold | (7,888,058 | ) | (8,641,708 | ) | ||

| Gross profit | 3,973,294 | 3,756,302 | ||||

| Operating expenses | ||||||

| General and administrative expenses | 1,428,972 | 1,105,080 | ||||

| Research and development expenses | 184,233 | 4,392 | ||||

| Selling expenses | 1,494,949 | 1,529,468 | ||||

| Total operating expenses | 3,108,154 | 2,638,940 | ||||

| Net operating income | 865,140 | 1,117,362 | ||||

| Other income (expenses) | ||||||

| Government grant income | 71,032 | 36,891 | ||||

| Interest income | 34,726 | 8,664 | ||||

| Other income | 609 | 32,966 | ||||

| Finance costs - Note 12 | (405,196 | ) | (187,236 | ) | ||

| Total other expenses | (298,829 | ) | (108,715 | ) | ||

| Income before income taxes and noncontrolling interest | 566,311 | 1,008,647 | ||||

| Income taxes - Note 13 | (163,115 | ) | (46,126 | ) | ||

| Net income before noncontrolling interest | 403,196 | 962,521 | ||||

| Net income attributable to noncontrolling interest | (15,914 | ) | (8,903 | ) | ||

| Net income attributable to Company’s stockholders | $ | 387,282 | $ | 953,618 | ||

| Net income before noncontrolling interest | $ | 403,196 | $ | 962,521 | ||

| Other comprehensive income | ||||||

| Foreign currency translation adjustment | 440 | (55,933 | ) | |||

| Comprehensive income | 403,636 | 906,588 | ||||

| Comprehensive income attributable to noncontrolling interest | (15,914 | ) | (8,663 | ) | ||

| Comprehensive income attributable to the Company’s common stockholders | $ | 387,722 | $ | 897,925 | ||

| Earnings per share - Note 14 - Basic and diluted

attributable to the Company’s common stockholders |

$ 0.02 |

$ 0.04 |

||||

| Weighted average number of shares - Basic and diluted | 24,108,646 | 24,038,183 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements

4

China GengSheng Minerals, Inc.

Condensed Consolidated

Statements of Cash Flows

| Three months ended March 31, | ||||||

| 2010 | 2009 | |||||

| (Unaudited) | (Unaudited) | |||||

| Cash flows from operating activities | ||||||

| Net income before noncontrolling interest | $ | 403,196 | $ | 962,521 | ||

| Adjustments to reconcile net

income before noncontrolling interest to net cash used in operating activities: |

||||||

| Depreciation | 357,883 | 230,101 | ||||

| Amortization of land use right | 5,990 | 6,115 | ||||

| Amortization of intangible assets | 13,336 | - | ||||

| Deferred taxes | (20,494 | ) | 23,110 | |||

| Provision for doubtful debts | (4,251 | ) | - | |||

| Share-based compensation | 261,200 | - | ||||

| Changes in operating assets and liabilities: | ||||||

| Restricted cash | 733,500 | (2,490,670 | ) | |||

| Trade receivables | (1,280,270 | ) | 523,995 | |||

| Bills receivables | 540,059 | (656,628 | ) | |||

| Other receivables and prepayments | (210,350 | ) | (1,085,158 | ) | ||

| Inventories | (946,938 | ) | (729,885 | ) | ||

| Other payables and accrued expenses | 1,251,547 | (738,865 | ) | |||

| Trade payables | (653,019 | ) | 430,516 | |||

| Bills payables | (1,512,200 | ) | 2,783,690 | |||

| Income tax payable | 509,756 | 22,169 | ||||

| Net cash flows used in operating activities | (551,055 | ) | (718,989 | ) | ||

| Cash flows from investing activities | ||||||

| Payments for deposits of acquisition of land use right, property, plant and equipment | - | (1,425,328 | ) | |||

| Payments for acquisition of property, plant and equipment | (812,953 | ) | - | |||

| Net cash flows used in investing activities | (812,953 | ) | (1,425,328 | ) | ||

| Cash flows from financing activities | ||||||

| Restricted cash | 733,500 | - | ||||

| Proceeds from bank loans | 6,601,500 | 6,592,950 | ||||

| Repayment of bank loans | (8,802,000 | ) | - | |||

| Repayment to a director | - | (1,356,952 | ) | |||

| Proceed from non-interest-bearing loans | 2,204,167 | - | ||||

| Repayment of non-interest-bearing loans | (23,391 | ) | (219,765 | ) | ||

| Government grant received | 178,974 | - | ||||

| Net cash flows provided by financing activities | 892,750 | 5,016,233 | ||||

| Effect of foreign currency translation on cash and cash equivalents | (19 | ) | (415 | ) | ||

| Net (decrease) increase in cash and cash equivalents | (471,277 | ) | 2,871,501 | |||

| Cash and cash equivalents - beginning of period | 992,204 | 955,732 | ||||

| Cash and cash equivalents - end of period | $ | 520,927 | $ | 3,827,233 | ||

| Supplemental disclosure of cash flow information: | ||||||

| Cash paid for: | ||||||

| Interest | $ | 239,514 | $ | 76,214 | ||

| Income taxes | $ | - | $ | - |

5

China GengSheng Minerals, Inc.

Consolidated Statements of Equity

| China GengSheng Minerals, Inc. stockholders | ||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||

| Common stock | other | |||||||||||||||||||||||

| Number of | Additional | Statutory and | comprehensive | Retained | Noncontrolling | |||||||||||||||||||

| Shares | Amount | paid-in capital | other reserves | income | earnings | interest | Total | |||||||||||||||||

| Balance, December 31, 2009 | 24,038,183 | $ | 24,038 | $ | 19,608,044 | $ | 7,419,868 | $ | 4,344,766 | $ | 17,473,813 | $ | 272,159 | $ | 49,142,688 | |||||||||

| Share-based compensation expenses | - | - | 261,200 | - | - | - | - | 261,200 | ||||||||||||||||

| Common stock issued and

allotted upon share-based payment at fair value |

50,000 |

50 |

(50 |

) | - |

- |

- |

- |

- |

|||||||||||||||

| Common stock issued and allotted

upon exercise of warrants |

108,334 |

108 |

(108 |

) | - |

- |

- |

- |

- |

|||||||||||||||

| Net income | - | - | - | - | - | 387,282 | 15,914 | 403,196 | ||||||||||||||||

| Foreign currency translation adjustments | - | - | - | - | 440 | - | - | 440 | ||||||||||||||||

| Balance, March 31, 2010 | 24,196,517 | $ | 24,196 | $ | 19,869,086 | $ | 7,419,868 | $ | 4,345,206 | $ | 17,861,095 | $ | 288,073 | $ | 49,807,524 | |||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 1. |

Basis of presentation |

|

These unaudited condensed consolidated financial statements of the Company and its subsidiaries have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (the “SEC”) including the instructions to Form 10-Q and Regulation S-X. Certain information and note disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (the “US GAAP”) have been condensed or omitted from these statements pursuant to such rules and regulation and, accordingly, they do not include all the information and notes necessary for comprehensive consolidated financial statements and should be read in conjunction with our audited consolidated financial statements for the year ended December 31, 2009, included in our Annual Report on Form 10-K for the year ended December 31, 2009. | |

|

In the opinion of the management of the Company, all adjustments, which are of a normal recurring nature, necessary for a fair statement of the results for the three-month periods have been made. Results for the interim period presented are not necessarily indicative of the results that might be expected for the entire fiscal year. | |

| 2. |

Corporate information |

|

The Company was originally incorporated on November 13, 1947, in accordance with the laws of the State of Washington as Silver Mountain Mining Company. On August 20, 1979, the Articles of Incorporation were amended to change the corporate name of the Company to Leadpoint Consolidated Mines Company. On August 15, 2006, the Company changed its state of incorporation from Washington to Nevada by means of a merger with and into a Nevada corporation formed on May 23, 2006, solely for the purpose of effecting the reincorporation and changed its name to Point Acquisition Corporation. On June 11, 2007, the Company changed its name to China Minerals Technologies, Inc. and on July 26, 2007, the Company changed its name to China GengSheng Minerals, Inc. On March 4, 2010, the Company’s common stock began trading on the NYSE Amex stock exchange (formerly the American Stock Exchange) under the symbol “CHGS.” Prior to March 4, 2010, the Company’s common stock traded over-the-counter bulletin board under the symbol CHGS.OB. | |

|

Currently the Company has seven subsidiaries |

| Company name |

Place/date of incorporation or establishment |

The Company's effective ownership interest |

Common stock/ registered capital |

Principal activities | |

| GengSheng International Corporation ( “GengSheng International” ) | The British Virgin Islands (the “BVI”)/ November 3, 2004 | 100% | Ordinary shares :- Authorized: 50,000 shares of $1 each Paid up: 100 shares of $1 each | Investment holding | |

| Henan GengSheng Refractories Co., Ltd. ( “Refractories” ) | The People's Republic of China (the “PRC”)/ December 20, 1996 | 100% | Registered capital of $12,089,879 fully paid up | Manufacturing and selling of refractories products | |

| Henan GengSheng High-Temperature Materials Co., Ltd. ( “High-Temperature” ) | PRC/ September 4, 2002 | 89.33% | Registered capital of $1,246,300 fully paid up | Manufacturing and selling of functional ceramic products | |

| Smarthigh Holdings Limited ( “Smarthigh” ) | BVI/ November 5, 2004 | 100% | Ordinary shares :- Authorized: 50,000 shares of $1 each Paid up: 100 shares of $1 each | Investment holding |

7

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 2. |

Corporate information (Cont’d) |

| ZhengZhou Duesail Fracture Proppant Co., Ltd. ( “Duesail” ) | PRC/ August 14, 2006 | 100% | Registered capital of $2,800,000 fully paid up | Manufacturing and selling of fracture proppant products | |

| Henan GengSheng Micronized Powder Materials Co., Ltd. ( “Micronized” ) | PRC/ March 31, 2008 | 100% | Registered capital of $5,823,000 fully paid up | Manufacturing and selling of fine precision abrasives | |

| Guizhou Southeast Prefecture GengSheng Shunda New Materials Co., Ltd ( “Prefecture” ) | PRC/ April 13, 2004 | 100% | Registered capital of $141,840 fully paid up | Manufacturing and selling of corundum materials |

| 3. |

Description of business |

|

The Company is a holding company whose primary business operations are conducted through its subsidiaries located in the PRC’s Henan Province. Prefecture is located in Guizhou Province and is manufacturing corundum materials, a major raw material for monolithic refractory. Through its operating subsidiaries, the Company produces and markets a broad range of monolithic refractory, functional ceramics, fracture proppants, fine precision abrasives, and corundum materials. | |

|

The principal raw materials used in the products are several forms of aluminum oxide, including bauxite, processed AI2 O3 and calcium aluminates cement, and other materials, such as corundum, magnesia, resin and silica, which are primarily sourced from suppliers located in the PRC. The production facilities of the Company, other than the Prefecture’s sub-processing factory located in Guizhou, are also located in Henan Province. | |

|

Refractories products allow steel makers and other customers to improve the productivity and longevity of their equipment and machinery. Functional ceramic products mainly include abrasive balls and tiles, valves, electronic ceramics and structural ceramics. Fracture proppant products are used to reach trapped pockets of oil and natural gas deposits, which lead to higher productivities of oil and natural gas wells. Due to their heat-resistant qualities and ability to function under thermal stress, refractories serve as components in industrial furnaces and other heavy industrial machinery. Corundum materials are major raw material for producing monolithic refractory. Fine precision abrasive is the Company’s new product that was commercially launched in the fourth quarter of 2009, and is used for slicing the solar-silicon bar and polishing the equipment surface. The Company’s customers include some of the largest steel and iron producers located in 25 provinces in the PRC, as well as in the United States and other countries in Asia, and Europe. | |

| 4. |

Summary of significant accounting policies |

|

Basis of consolidation | |

|

The condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All significant inter-company accounts and transactions have been eliminated in consolidation. | |

|

Concentrations of credit risk | |

|

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and cash equivalents, trade, bills and other receivables, and financial guarantee issued to third parties. As of March 31, 2010 and December 31, 2009, substantially all of the Company’s cash and cash equivalents and restricted cash were held by major financial institutions located in the PRC, which management believes are of high credit quality. With respect to trade and bills receivables, the Company extends credit based on an evaluation of the customer’s financial condition. The Company generally does not require collateral for trade and other receivables and maintains an allowance for doubtful accounts of trade and other receivables. |

8

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 4. |

Summary of significant accounting policies (Cont’d) |

|

Concentrations of credit risk (Cont’d) | |

|

Bills receivable in China are undertaken by the banks to honor the payments at maturity and the customers are required to place deposits with the banks equivalent to a certain percentage of the bills amount as collateral. These bills receivable can be sold to any third party at a discount before maturity. The Company does not maintain allowance for bills receivable in the absence of bad debt experience and the payments are undertaken by the banks. | |

|

The financial guarantees issued to third parties are located in the PRC. The management believes GengSheng’s operating subsidiaries have high credit ratings and good reputation in their respective industries. | |

|

During the three months ended March 31, 2010 and 2009, we had only one customer, Shandong Steel Co., Ltd Rizhao Subsidiary (formerly, “Rizhao Steel”), representing 10% or more of the Company’s consolidated sales. Our sales to Shandong Steel amounted to $1,850,313 or 15.60%, $2,412,053 or 19.46% of our sales for the three months ended March 31, 2010 and 2009, respectively. | |

|

Fair value of financial instruments | |

|

The Company adopted ASC 820 (previously Statement of Financial Accounting Standards (“SFAS”) No. 157 on January 1, 2009. The adoption of ASC 820 did not materially impact the Company’s financial position, results of operations or cash flows. | |

|

ASC 825 requires the disclosure of the estimated fair value of financial instruments including those financial instruments for which fair value option was not elected. Except for collateralized borrowings disclosed as below, the carrying amounts of other financial assets and liabilities approximate their fair value due to short maturities: |

| As of March 31, 2010 | As of December 31, 2009 | ||||||||||||

| (Unaudited) | (Audited) | ||||||||||||

| Carrying | Carrying | Fair | |||||||||||

| amount | Fair value | amount | value | ||||||||||

| Collateralized bank loans | $ | 26,259,300 | $ | 26,630,665 | $ | 28,459,800 | $ | 29,339,460 | |||||

The fair values of collateralized borrowings are based on the Company’s current incremental borrowing rates for similar types of borrowing arrangements.

Recently issued accounting pronouncements

Accounting for Transfers of Financial Assets (Included in amended Topic ASC 860 “Transfers and Servicing”, previously SFAS No. 166, “Accounting for Transfers of Financial Assets - an Amendment of Financial Accounting Standard Board (“FASB”) Statement No. 140.”). The amended topic addresses information a reporting entity provides in its financial statements about the transfer of financial assets; the effects of a transfer on its financial position, financial performance, and cash flows; and a transferor’s continuing involvement in transferred financial assets. Also, the amended topic removes the concept of a qualifying special purpose entity, limits the circumstances in which a transferor derecognizes a portion or component of a financial asset, defines participating interest and enhances the information provided to financial statement users to provide greater transparency. The amended topic is effective for the first annual reporting period beginning after November 15, 2009 and was effective for us as of January 1, 2010. The adoption of this amended topic has no material impact on the Company’s financial statements.

9

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 4. |

Summary of significant accounting policies (Cont’d) |

|

Recently issued accounting pronouncements (Cont’d) | |

|

Consolidation of Variable Interest Entities - Amended (Included in amended Topic ASC 810 “Consolidation”, previously SFAS 167 “Amendments to FASB Interpretation No. 46(R)”). The amended topic requires an enterprise to perform an analysis to determine the primary beneficiary of a variable interest entity; to require ongoing reassessments of whether an enterprise is the primary beneficiary of a variable interest entity and to eliminate the quantitative approach previously required for determining the primary beneficiary of a variable interest entity. The amended topic also requires enhanced disclosures that will provide users of financial statements with more transparent information about an enterprise’s involvement in a variable interest entity. The amended topic is effective for the first annual reporting period beginning after November 15, 2009 and was effective for us as of January 1, 2010. The adoption of this amended topic has no material impact on the Company’s financial statements. | |

|

The FASB issued Accounting Standards Update (ASU) No. 2009-13, Revenue Recognition (Topic 605): Multiple Deliverable Revenue Arrangements - A Consensus of the FASB Emerging Issues Task Force.” This update provides application guidance on whether multiple deliverables exist, how the deliverables should be separated and how the consideration should be allocated to one or more units of accounting. This update establishes a selling price hierarchy for determining the selling price of a deliverable. The selling price used for each deliverable will be based on vendor-specific objective evidence, if available, third-party evidence if vendor-specific objective evidence is not available, or estimated selling price if neither vendor-specific or third-party evidence is available. The Company will be required to apply this guidance prospectively for revenue arrangements entered into or materially modified after January 1, 2011; however, earlier application is permitted. The management is in the process of evaluating the impact of adopting this ASU update on the Company’s financial statements. | |

|

The FASB issued ASU 2010-06, Improving Disclosures about Fair Value Measurements. ASU 2010-06 amends ASC Topic 820 to require the following additional disclosures regarding fair value measurements: (i) the amounts of transfers between Level 1 and Level 2 of the fair value hierarchy; (ii) reasons for any transfers in or out of Level 3 of the fair value hierarchy and (iii) the inclusion of information about purchases, sales, issuances and settlements in the reconciliation of recurring Level 3 measurements. ASU 2010-06 also amends ASC Topic 820 to clarify existing disclosure requirements, requiring fair value disclosures by class of assets and liabilities rather than by major category and the disclosure of valuation techniques and inputs used to determine the fair value of Level 2 and Level 3 assets and liabilities. With the exception of disclosures relating to purchases, sales, issuances and settlements of recurring Level 3 measurements, ASU 2010-06 was effective for interim and annual reporting periods beginning after December 15, 2009. The disclosure requirements related to purchases, sales, issuances and settlements of recurring Level 3 measurements are effective for financial statements for annual reporting periods beginning after December 15, 2010. The Company does not expect the adoption of these new Level 3 disclosures to have a material impact on the Company’s financial statements. | |

|

The FASB issued ASU No. 2010-02, “Consolidation (Topic 810) Accounting and Reporting for Decreases in Ownership of a Subsidiary - a Scope Clarification”. This amendment affects entities that have previously adopted Topic 810-10 (formally SFAS 160). It clarifies the decrease in ownership provisions of Subtopic 810-10 and removes the potential conflict between guidance in that Subtopic and asset derecognition and gain or loss recognition guidance that may exist in other US GAAP. An entity will be required to follow the amended guidance beginning in the period that it first adopts FAS 160 (now included in Subtopic 810-10). For those entities that have already adopted FAS 160, the amendments was effective at the beginning of the first interim or annual reporting period ending on or after December 15, 2009. The amendments should be applied retrospectively to the first period that an entity adopted FAS 160. The adoption of this ASU update has no material impact on the Company’s financial statements. |

10

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 4. |

Summary of significant accounting policies (Cont’d) |

|

Recently issued accounting pronouncements (Cont’d) | |

|

In February 2010, the FASB issued ASU 2010-09, Subsequent Events: Amendments to Certain Recognition and Disclosure Requirements, which amends FASB ASC Topic 855, Subsequent Events. The update provides that SEC filers, as defined in ASU 2010-09, are no longer required to disclose the date through which subsequent events have been evaluated in originally issued and revised financial statements. The update also requires SEC filers to evaluate subsequent events through the date the financial statements are issued rather than the date the financial statements are available to be issued. The Company adopted ASU 2010-09 upon issuance. This update had no material impact on the financial position, results of operations or cash flows of the Company. | |

| 5. |

Restricted cash and bills payable |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2010 | 2009 | ||||||

| (Unaudited) | (Audited) | ||||||

| Bank deposits held as collateral for bills payable | $ | - | $ | 733,500 | |||

| Bank deposits held as collateral for bank loans | 14,523,300 | 15,256,800 | |||||

| $ | 14,523,300 | $ | 15,990,300 |

|

The Company is requested by certain of its suppliers to settle amounts owed to such suppliers by the issuance of bills through banks for which the banks undertake to guarantee the Company’s settlement of these amounts at maturity. These bills are interest free and would be matured within six months from the date of issuance. As collateral security for the banks’ undertakings, the Company is required to pay the bank charges as well as maintaining deposits with such banks amounts equal to 50% to 100% of the bills’ amounts issued. | |

| 6. |

Inventories |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2010 | 2009 | ||||||

| (Unaudited) | (Audited) | ||||||

| Raw materials | $ | 4,395,077 | $ | 4,893,114 | |||

| Work-in-progress | 585,589 | 407,063 | |||||

| Finished goods | 5,915,321 | 4,648,872 | |||||

| 10,895,987 | 9,949,049 | ||||||

| Provision for obsolete inventories | (24,636 | ) | (24,636 | ) | |||

| $ | 10,871,351 | $ | 9,924,413 |

No provision for obsolete inventories was recognized in the cost of goods sold during the three months ended March 31, 2010.

11

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 7. |

Goodwill and intangible assets, net |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2010 | 2009 | ||||||

| (Unaudited) | (Audited) | ||||||

| Costs: | |||||||

| Unpatented technology - Note a | $ | 366,750 | $ | 366,750 | |||

| Patented technology - Note b | 586,800 | 586,800 | |||||

| 953,550 | 953,550 | ||||||

| Accumulated amortization | (13,336 | ) | - | ||||

| Net | $ | 940,214 | $ | 953,550 | |||

| Goodwill - Note c | $ | 441,089 | $ | 441,089 |

Note a: In 2007, Refractories entered into a contract with an independent third party to purchase technical unpatented technology in relation to the production of mortar, at a cash consideration of $342,750 (translated at historical rate). This consideration was mutually agreed between Refractories and such third party and this unpatented technology can be used for an unlimited period of time. Since its acquisition, annual impairment review was performed by management and no impairment was identified and accordingly, it is stated at cost as at March 31, 2008.

Note b: In late 2008, GengSheng International, entered into a contract with an individual third party (licensor) for a patented technology license for use up to 2021. This patented technology represents “know-how” on methods and installation for removal particles from the powder for Abrasive. Amortization started from January 1, 2010 when the production commenced.

Note c: The goodwill was identified upon the acquisition of 100% equity interest in Prefecture, which represented the excess of the purchase price of $875,400 over the fair value of acquired identified net assets of Prefecture of $434,311 at the time of acquisition on June 12, 2008. Since its acquisition, an annual impairment review was performed by management and no impairment has been identified.

12

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 8. |

Property, plant and equipment, net |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2010 | 2009 | ||||||

| (Unaudited) | (Audited) | ||||||

| Costs: | |||||||

| Buildings | $ | 14,226,969 | $ | 14,011,187 | |||

| Plant and machinery | 6,675,618 | 6,135,012 | |||||

| Furniture, fixture and equipment | 508,677 | 490,654 | |||||

| Motor vehicles | 1,560,127 | 1,525,936 | |||||

| 22,971,391 | 22,162,789 | ||||||

| Accumulated depreciation | (4,443,798 | ) | (4,085,915 | ) | |||

| Construction in progress | 3,917,675 | 3,903,466 | |||||

| Net | $ | 22,445,268 | $ | 21,980,340 |

Note:

| (i) |

Construction in progress | |

|

Construction in progress mainly comprises capital expenditure for construction of the Company’s new office and factories. For the year ended December 31, 2009, the Company capitalized interest of $247,392 to the cost of construction in progress. No interest was capitalized during the period ended March 31, 2010. |

| 9. |

Non-interest-bearing loans |

|

The loans represent interest-free and unsecured loans from third parties and government authority and are repayable on demand. | |

| 10. |

Collateralized bank loans |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2010 | 2009 | ||||||

| (Unaudited) | (Audited) | ||||||

| Bank loans repayable within 1 year | $ | 26,259,300 | $ | 28,459,800 |

The above bank loans are denominated in RMB and carry average interest rates at 6.47% per annum with maturity dates ranging from four months to eight months.

The bank loans as of March 31, 2010

were secured by the followings: -

(a) Guarantee executed by Mr. Shunqing

Zhang (“Mr. Zhang”), a director and a shareholder of the Company;

(b)

Guarantee executed by business associates (Note 15(b));

(c) Land use rights

with a carrying value of $897,941; and

(d) Bank deposits of $14,523,300

(Note 5).

During the reporting periods, there was no covenant requirement under the banking facilities granted to the Company.

13

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 11. |

Common stock |

|

50,000 and 108,334 addition common stocks were issued and allotted on January 1, 2010 and March 10, 2010, respectively. The number of common stock outstanding was increased from 24,038,183 to 24,196,517. Apart from as disclosed, no common stock was issued and there were 24,196,517 shares of common stock outstanding as at March 31, 2010. | |

| 12. |

Finance costs |

| Three months ended | |||||||

| March 31, | |||||||

| (Unaudited) | |||||||

| 2010 | 2009 | ||||||

| Interest expenses | $ | 230,690 | $ | 105,516 | |||

| Bills discounting charges | 170,560 | 48,372 | |||||

| Bank charges | 3,946 | 33,348 | |||||

| $ | 405,196 | $ | 187,236 | ||||

| 13. |

Income taxes |

|

UNITED STATES | |

|

The Company is incorporated in the United States of America (“U.S.”) and is subject to U.S. tax law. No provisions for income taxes have been made as the Company has no U.S. taxable income for reporting periods. The applicable income tax rate for the reporting periods is 34%. The Company has not provided deferred tax on undistributed earnings of its non-U.S. subsidiaries as of March 31, 2010, as it is the Company's current policy to reinvest these earnings in non-U.S. operations. | |

|

BVI | |

|

GengSheng International and Smarthigh were incorporated in the BVI and are not subject to income taxes under the current laws of the BVI. |

14

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 13. |

Income taxes (Cont’d) |

|

PRC | |

|

On March 16, 2007, the National People's Congress approved the Corporate Income Tax Law of the People's Republic of China (the “New CIT Law”). The New CIT Law reduces the corporate income tax rate from 33% to 25% with effect from January 1, 2008. | |

|

In the fiscal year 2004, Refractories was a domestic enterprise in the PRC and subject to the enterprise income tax at 33%, of which 30% was national tax and 3% was local tax, of the assessable profits as reported in the statutory financial statements prepared under China Accounting regulations. Following the change of the legal form of Refractories from a domestic enterprise to a wholly foreign owned enterprise (“WFOE”) (after its entire equity interest was acquired by GengSheng International), Refractories became subject to a preferential enterprise income tax rate at 30%. Further, according to the PRC tax laws and regulations, Refractories being a WFOE is entitled to, starting from the first profitable year, a two-year exemption from enterprise income tax followed by a three-year 50% reduction in its enterprise income tax rate (“Tax Holiday”). As such, after the application by Refractories and approval by the relevant tax authority, Refractories was exempted from the enterprise income tax for the fiscal years 2005 and 2006 and was subject to the enterprises income tax at a rate of 15% for the fiscal year 2007. However, as a result of the new unified tax law mentioned above, for the fiscal years 2008 and 2009, Refractories was subject to enterprise income tax at a rate of 12.5% and starting from the fiscal year 2010, Refractories will be subject to enterprise income tax at unified rate of 15% for three years due to its engagement in advance technology industry and passed the inspection of provincial high-tech item. The relevant authority granted it a certificate at end of 2008. | |

|

High-Temperature engages in an advanced technology industry and has passed the inspection of the provincial high-tech item, so it was granted a preferential enterprise income tax rate of 15% for two years upon the issuance of certificate by the relevant government authority. High-Temperature received such certificates in 2004 and 2006. Accordingly, High-Temperature was subject to a preferential tax rate of 15% for fiscal years 2004 to 2007. Pursuant to the notices issued by the State Administration Taxation dated January 30, 2008 and April 14, 2008, High-Temperature can continue to enjoy the preferential tax rate of 15% in 2008. As its high technology industry status has not been re-registered and approved by the relevant PRC authority, High-Temperature is subject to enterprise income tax at the unified rate of 25% after 2008. | |

|

Duesail, being a WFOE, is subject to a preferential enterprise income tax rate at 30% and is entitled to the Tax Holiday upon application. In fiscal year 2007, Duesail did not apply for such Tax Holiday as no assessable profit was generated by Duesail since its establishment on August 25, 2006. Under the New CIT Law, the Tax Holiday will be deemed to commence in 2008 and therefore Duesail will be exempted from the enterprise income tax for the fiscal years 2008 and 2009. Duesail will be subject to the enterprise income tax at a rate of 12.5% for fiscal years from 2010 to 2012 and a rate of 25% thereafter. | |

|

Prefecture, being a domestic enterprise established in the PRC was subject to enterprise income tax at 33%. Prefecture is located in Guizhou, in accordance with the Guizhou Province of Western Development Scheme and the City Investment Policy issued by the central government of the PRC, and was entitled to a three-year exemption from the enterprise income tax followed by a two-year 50% reduction in its enterprise income tax, starting from 2005. As such, Prefecture was exempted from the enterprise income tax for fiscal years 2005 to 2007 and under the New CIT Law mentioned above, Prefecture is subject to enterprise income tax at a rate of 12.5% for fiscal years 2008 and 2009. Starting from the fiscal year 2010, Prefecture is subject to the enterprises income tax at the unified rate of 25%. | |

|

Micronized, being a domestic enterprise established in the PRC, was subject to enterprise income tax at 25% upon its incorporation. |

15

China GengSheng Minerals, Inc.

Notes to Consolidated

Financial Statements

| 13. |

Income taxes (Cont’d) |

|

PRC | |

|

In July 2006, the FASB issued ASC 740-10-25 (previously Interpretation No. 48, “Accounting for Uncertainty in Income Taxes”). This interpretation requires recognition and measurement of uncertain income tax positions using a “more-likely-than-not” approach. The Company adopted this ASC 740-10-25 on January 1, 2007. Under the new CIT Law which became effective on January 1, 2008, the Company may be deemed to be a resident enterprise by the PRC tax authorities. If the Company was deemed to be resident enterprise, the Company may be subject to the CIT at 25% on the worldwide taxable income and dividends paid from the PRC subsidiaries to their overseas holding companies may be exempted from 10% PRC withholding tax. Except for certain immaterial interest income from bank deposits placed with financial institutions outside the PRC, all of the Company’s income is generated from the PRC operation. Given the immaterial amount of income generated from outside the PRC and the PRC subsidiaries do not intend to pay dividends for the foreseeable future, the management considers that the impact arising from resident enterprise on the Company’s financial position is not significant. The management evaluated the Company's tax positions and considered that no additional provision for uncertainty in income taxes is necessary as of March 31, 2010. | |

| 14. |

Earnings per share |

|

During the reporting periods, certain share-based awards were not included in the computation of diluted earnings per share because they were anti-dilutive. Accordingly, the basic and diluted earnings per share are the same. | |

| 15. |

Commitments and contingencies |

| (a) |

The Company’s operations are subject to the laws and regulations in the PRC relating to the generation, storage, handling, emission, transportation and discharge of certain materials, substances and waste into the environment, and various other health and safety matters. Governmental authorities have the power to enforce compliance with their regulations, and violators may be subject to fines, injunctions or both. The Company must devote substantial financial resources to ensure compliance and believes that it is in substantial compliance with all the applicable laws and regulations. | |

|

The Company is currently not involved in any environmental remediation and has not accrued any amounts for environmental remediation relating to its operations. Under existing legislation, management believes that there are no probable liabilities that will have a material adverse effect on the financial position, operating results or cash flows of the Company. | ||

| (b) |

The Company guaranteed the following debts of third parties, which is summarized as follows: |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2010 | 2009 | ||||||

| (Unaudited) | (Audited) | ||||||

| Guaranteed amount | $ | 41,846,175 | $ | 41,736,150 |

16

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 15. |

Commitments and contingencies (Cont’d) |

Guarantees as of March 31, 2010 are further analyzed as below:

| Outstanding | Outstanding | |||||||||||||||||||||||

| Term loan | Interest | Principal repaid | as of | interest as of | ||||||||||||||||||||

| draw down | Expiry | rate (per | Loan | up to March ,31 | March 31, | March 31, | Estimated | |||||||||||||||||

| Guarantee | date | date | annum) | principal | 2010 | 2010 | 2010 | exposure | ||||||||||||||||

| A supplier (Note i) | 11/30/2009 | 11/29/2010 | 7.6% | $ | 1,467,000 | $ | - | $ | 1,467,000 | $ | 74,148 | $ | 1,541,148 | |||||||||||

| Local government authorities and its controlled entity (Note ii) |

6/26/2009 to 1/23/2010 |

1/22/2011 to 12/29/2012 |

6.8% |

11,222,550 |

- |

11,222,550 |

611,900 |

11,834,450 |

||||||||||||||||

| Business associates (Note iii) |

3/26/2009 to 12/17/2009 |

3/25/2011 to 6/30/2011 |

6.8% | 26,406,000 | - | 26,406,000 | 1,080,368 | 27,486,368 | ||||||||||||||||

| $ | 39,095,550 | $ | - | $ | 39,095,550 | $ | 1,766,416 | $ | 40,861,966 | |||||||||||||||

| Maximum exposure | $ | 41,846,175 |

| Notes: | ||

| i. | In order to ensure normal operation of a major supplier of Duesail, the Company agreed to act as the guarantor for bank loans granted to it. | |

| ii. | To maintain a good relationship with the local government of Gongyi City, the Company has been so requested to act as guarantor for bank loans granted to certain local authorities and its controlled entity. | |

| iii. | During the period ended of March 31, 2010, the Company has acted as guarantor for bank loans granted to certain business associates. Certain of these associates also provided guarantees for bank loans to the Company. (Note 10(b)). None of our directors, director nominees or executive officers is involved in normal operation or investing in the business of the guaranteed business associates. All the business associates have a healthy financial position as at March 31, 2010. | |

| (c) |

As of March 31, 2010, the Company had capital commitments in respect of the acquisition of property, plant and equipment amounting to $359,357, which was contracted for but not provided in these financial statements. | |

| (d) |

As of March 31, 2010, the Company had capital commitments in respect of the acquisition of land use right amounting to $954,432, which was not contracted and provided in these financial statements. |

17

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 16. |

Defined contribution plan |

|

The Company has a defined contribution plan for all qualified employees in the PRC. The employer and its employees are each required to make contributions to the plan at the rates specified in the plan. The only obligation of the Company with respect to the retirement plan is to make the required contributions under the plan. No forfeited contribution is available to reduce the contribution payable in the future years. The defined contribution plan contributions were charged to the condensed consolidated statements of income and comprehensive income. The Company contributed $59,303 and $43,711 for the two period ended March 31, 2010 and 2009, respectively. | |

| 17. |

Segment information |

|

The Company uses the “management approach” in determining reportable operating segments. The management approach considers the internal organization and reporting used by the Company's chief operating decision maker for making operating decisions and assessing performance as the source for determining the Company's reportable segments. Management, including the chief operating decision maker, reviews operating results solely by the revenue of monolithic refractory products, functional ceramic products, fracture proppant products, fine precision abrasives and operating results of the Company. As such, the Company has determined that it has four operating segments as defined by ASC 280, “Segment Reporting” (previously SFAS 131): refractories, functional ceramic, fracture proppant and fine precision abrasives. However, since the Company has not yet commenced production of fine precision abrasives, there is not yet any revenue from this new product line. | |

|

Adjustments and eliminations of inter-company transactions were not included in determining segment profit (loss), as they are not used by the chief operating decision maker. | |

|

Three months ended March 31 (Unaudited) |

| Refractories | Industrial ceramic | Fracture proppant | Fine precision abrasives | Total | ||||||||||||||||||||||||||

| 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | |||||||||||||||||||||

| Revenue from external customers |

$ |

10,383,562 |

$ |

9,794,375 |

$ |

276,097 |

$ |

150,108 |

$ |

1,201,693 |

$ |

2,453,527 |

$ |

- |

$ |

- |

$ |

11,861,352 |

$ |

12,398,010 |

||||||||||

| Segment profit (loss) |

$ |

654,865 |

$ |

291,053 |

$ |

190,646 |

$ |

83,438 |

$ |

204,375 |

$ |

688,049 |

$ |

(221,445 |

) |

$ |

(51,393 |

) |

$ |

828,441 |

$ |

1,011,147 |

||||||||

| March | December | March | December | March | December | March | December | March | December | |||||||||||||||||||||

| 31, | 31, | 31, | 31, | 31, | 31, | 31, | 31, | 31, | 31, | |||||||||||||||||||||

| 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | |||||||||||||||||||||

| (Unaudited) | (Audited) | (Unaudited) | (Audited) | (Unaudited) | (Audited) | (Unaudited) | (Audited) | (Unaudited) | (Audited) | |||||||||||||||||||||

| Segment assets | $ | 50,519,549 | $ | 50,393,011 | $ | 3,840,369 | $ | 3,808,548 | $ | 29,594,349 | $ | 29,437,474 | $ | 14,702,711 | $ | 14,374,938 | $ | 98,656,978 | $ | 98,013,971 | ||||||||||

18

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 17. |

Segment information (Cont'd) |

|

Segment information by products for the three months ended March 31, 2010 and 2009 |

| Wearable | |||||||||||||||||||||||||

| Monolithic | Pre-cast | Ceramic | Ceramic | ceramic | Fracture | ||||||||||||||||||||

| materials1 | Mortar | roofs | tubes2 | cylinders3 | valves | proppant | Total | ||||||||||||||||||

| Three months ended March 31, 2010 (Unaudited) | |||||||||||||||||||||||||

| Revenue | $ | 6,403,944 | $ | 80,628 | $ | 3,898,990 | $ | 25,507 | $ | 242,089 | $ | 8,500 | $ | 1,201,694 | $ | 11,861,352 | |||||||||

| Three months ended March 31, 2009 (Unaudited) | |||||||||||||||||||||||||

| Revenue | $ | 5,802,418 | $ | 75,883 | $ | 3,916,074 | $ | 140,576 | $ | - | $ | 9,532 | $ | 2,453,527 | $ | 12,398,010 | |||||||||

1 Castable, coating, and dry

mix materials & low-cement and non-cement castables general refer as

Monolithic materials. |

2 Ceramic plates, tubes, elbows, and

rollers generally refer as Ceramic tubes.

3 Ceramic cylinders and

plugs comprehensively refer to Ceramic cylinders.

Reconciliation is provided for unallocated amounts relating to corporate operations which are not included in the segment information.

| Three months ended March 31, | |||||||

| 2010 | 2009 | ||||||

| (Unaudited) | (Unaudited) | ||||||

| Total profit for reportable segments | $ | 828,441 | $ | 1,011,147 | |||

| Unallocated amounts relating to operations: | |||||||

| General and administrative expenses | (262,130 | ) | (2,500 | ) | |||

| Income before income taxes and noncontrolling interest | $ | 566,311 | $ | 1,008,647 | |||

19

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 17. |

Segment information (Cont'd) |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2010 | 2009 | ||||||

| (Unaudited) | (Audited) | ||||||

| Assets | |||||||

| Total assets for reportable segments | $ | 98,656,978 | $ | 98,013,971 | |||

| Cash and cash equivalents | 27,174 | 27,195 | |||||

| Other receivables | 7,567 | - | |||||

| $ | 98,691,719 | $ | 98,041,166 |

All of the Company's long-lived assets are located in the PRC. Geographic information about the revenues, which are classified based on customers, is set out as follows:

| Three months ended March 31, | |||||||

| 2010 | 2009 | ||||||

| (Unaudited) | (Unaudited) | ||||||

| PRC | $ | 11,445,970 | $ | 9,927,380 | |||

| United States of America | 23,930 | 2,373,149 | |||||

| Others - Note | 391,452 | 97,481 | |||||

| Total | $ | 11,861,352 | $ | 12,398,010 | |||

|

Note: They include Asia and Europe and are not further analyzed as none of them contributed more than 10% of the total revenue. | |

| 18. |

Related party transactions |

|

Apart from the guarantee given by Mr. Shunqing Zhang as disclosed in note 10, the Company had no material transactions carried out with related parties during the reporting periods. | |

| 19. |

Subsequent events |

|

The Company evaluated all events or transactions that occurred after March 31, 2010 and has determined that there is no material recognizable nor subsequent events or transactions which require recognition or disclosure in the financial statements, other than noted herein. |

20

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Forward-Looking Statements:

The following discussion of the financial condition and results of operations should be read in conjunction with the consolidated financial statements and related notes thereto. The following discussion contains forward-looking statements. China GengSheng Minerals, Inc. is referred to herein as “we” or “our.” The words or phrases “would be,” “will allow,” “expect to”, “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” or similar expressions are intended to identify forward-looking statements. Such statements include those concerning our expected financial performance, our corporate strategy and operational plans. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties, including: (a) those risks and uncertainties related to general economic conditions in China, including regulatory factors that may affect such economic conditions; (b) whether we are able to manage our planned growth efficiently and operate profitable operations, including whether our management will be able to identify, hire, train, retain, motivate and manage required personnel or that management will be able to successfully manage and exploit existing and potential market opportunities; (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations; and (d) whether we are able to successfully fulfill our primary requirements for cash which are explained below under “Liquidity and Capital Resources. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim any obligation, to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

Conventions

In this Form 10-Q, unless indicated otherwise, references to:

-

“China GengSheng Minerals”, “we”, “us”, “our”, the “Registrant” or the “Company” refer to the combined business of China GengSheng Minerals, Inc., a Nevada corporation (formerly, China Minerals Technologies, Inc.) and its direct, wholly-owned BVI subsidiary, GengSheng International Corporation, or International, and International 's direct and wholly-owned Chinese subsidiary, ZhengZhou Duesail Fracture Proppant Co. Ltd., or Duesail, and its wholly-owned Chinese subsidiary Henan GengSheng Refractories Co., Ltd., or Refractories, and Refractories’s direct majority-owned subsidiary, Henan GengSheng High-Temperature Materials Co., Ltd., or High Temperature and Refractories’s direct and wholly-owned subsidiary, Henan GengSheng Micronized Powder Materials Co., Ltd., or Micronized and Henan GengSheng's direct and wholly-owned subsidiary, GengSheng Shunda New Materials Co., Ltd, SouthEast Prefecture, Guizhou or Shunda;

-

“Powersmart” or “GengSheng International” refer to GengSheng International Corporation, a BVI company (formerly, Powersmart Holdings Limited) that is wholly-owned by China GengSheng Minerals;

-

“Securities Act” refers to the Securities Act of 1933, as amended, and “Exchange Act” refer to Securities Exchange Act of 1934, as amended;

-

“China” and “PRC” refer to the People's Republic of China, and “BVI” refers to the British Virgin Islands;

-

“RMB” refers to Renminbi, the legal currency of China; and

-

“U.S. dollar,” “$” and “US$” refers to the legal currency of the United States. For all U.S. dollar amounts reported, the dollar amount has been calculated on the basis that $1 = RMB6.8166 for its December 31, 2009 audited balance sheet, and $1 = RMB6.8166 for its March 31, 2010 unaudited balance sheet, which were determined based on the currency conversion rate at the end of each respective period. The conversion rates of $1 = RMB6.8166 is used for the condensed consolidated statement of income and comprehensive income and consolidated statement of cash flows for the first fiscal quarter of 2010, and $1= RMB6.8255 is used for the condensed consolidated statement of income and comprehensive income and consolidated statement of cash flows for the first fiscal quarter of 2009; both of which were based on the average currency conversion rate for each respective quarter.

Overview of Company

We are a Nevada holding company operating in the materials technology industry through our direct and indirect subsidiaries in China. We develop, manufacture and sell a broad range of mineral-based, heat-resistant products capable of withstanding high temperatures, saving energy and boosting productivity in industries such as steel and oil. Our products include refractory products, industrial ceramics, fracture proppants and fine precision abrasives.

Currently, we conduct our operations in China through our wholly owned subsidiaries, Henan GengSheng Refractories Co., Ltd. (“Refractories”), ZhengZhou Duesail Fracture Proppant Co., Ltd. (“Duesail”), Henan GengSheng Micronized Powder Materials Co., Ltd. (“Micronized”), and Guizhou Southeast Prefecture GengSheng New Materials Co., Ltd. (“Prefecture”), and through our majority owned subsidiary, Henan GengSheng High-Temperature Materials Co., Ltd. (“High-Temperature”). Through our direct, wholly owned BVI subsidiary, GengSheng International, and its direct and wholly owned Chinese subsidiary, Refractories, which has an annual production capacity of approximately 127,000 tons, we manufacture refractories products. We manufacture fracture proppant products through Duesail, which has an annual production capacity of approximately 66,000 tons. We manufacture fine precision abrasives products through Micronized, which has designed annual production capacity of approximately 22,000 tons. Through our majority owned subsidiary, High-Temperature, which has an annual production capacity of approximately 150,000 units, we manufacture industrial and functional ceramic products.

21

We sell our products to over 200 customers in the iron, steel, oil, glass, cement, aluminum and chemical businesses located in China and other countries in Asia, Europe and North America. Our refractory customers are companies in the steel, iron, petroleum, chemical, coal, glass and mining industries. Our fracture proppant products are sold to oil and gas companies. Our industrial ceramics are used in the utilities and petrochemical industries. Our fine precision abrasives are marketed to solar companies and optical equipment manufacturers. Our largest customers, measured by percentage of our revenue, mainly operate in the steel industry. Currently, most of our revenues are derived from the sale of our monolithic refractory products to customers in China.

Our principal executive offices are located at No. 88 Gengsheng Road, Dayugou Town, Gongyi, Henan, People’s Republic of China 451271 and our telephone number is (86) 371-6405-9818.

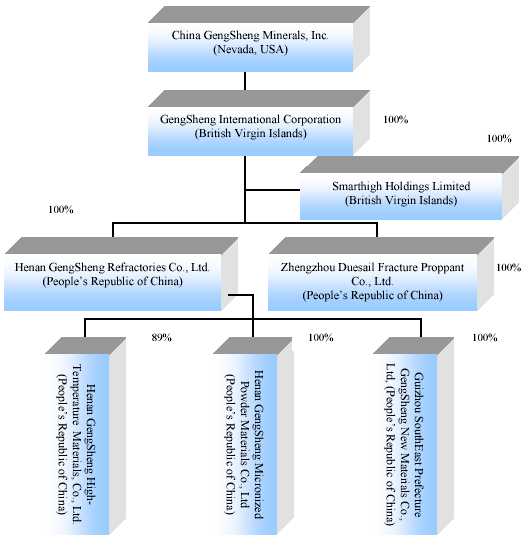

Corporate Structure

We conduct our operations in China through our wholly owned subsidiaries Refractories, Duesail, Micronized and Prefecture and through our majority owned subsidiary, High-Temperature.

The following chart reflects our organizational structure as of the date of this report.

Corporate Background

We were originally incorporated under the laws of the State of Washington, on November 13, 1947, under the name Silver Mountain Mining Company. From our inception until 2001, we operated various unpatented mining claims and deeded mineral rights in the State of Washington, but we abandoned these operations entirely by 2001. On August 15, 2006, we changed our domicile from Washington to Nevada when we merged with and into Point Acquisition Corporation, a Nevada corporation. From about 2001 until our reverse acquisition of Powersmart on April 25, 2007, which is discussed in the next section entitled "Acquisition of Powersmart and Related Financing," we were a blank check company and had no active business operations. On June 11, 2007, we changed our corporate name from "Point Acquisition Corporation" to "China Minerals Technologies, Inc." and subsequently changed our name again to "China GengSheng Minerals, Inc." on July 26, 2007 as we found a Delaware company with a similar corporate name.

22

Acquisition of Powersmart and Related Financing

On April 25, 2007, we completed a reverse acquisition transaction through a share exchange with Powersmart Holdings Limited whereby we issued to the sole shareholder of Powersmart Holdings Limited, Shunqing Zhang, 16,887,815 shares of China GengSheng Minerals, Inc. common stock, in exchange for all of the issued and outstanding capital stock of Powersmart Holdings Limited. By this transaction, Powersmart Holdings Limited became our wholly owned subsidiary and Mr. Zhang became our controlling stockholder.

On April 25, 2007, we also completed a private placement financing transaction pursuant to which we issued and sold 5,347,594 shares of our common stock to certain accredited investors for $10 million in gross proceeds. In connection with this private placement, we paid a fee of $683,618 to Brean Murray Carret & Co., LL, or Brean Murray, and Civilian Capital, Inc. for services as placement agents for the private placement. We also issued to Brean Murray Carret & Co., LLC and Civilian Capital, Inc. warrants for the purchase of 374,331 shares of our common stock in the aggregate. The warrants are immediately exercisable, have piggyback registration rights and have a three-year term, expiring on April 26, 2010. On March 10, 2010, Brean Murray Carret & Co., LLC exercised the warrant cashlessly, which was converted to 108,334 shares of the Corporation’s common stock, and on April 21, 2010, Civilian Capital, Inc. exercised the warrant cashlessly, which was converted to 27,869 shares of the Corporation’s common stock.

Also, on April 25, 2007, our majority stockholder, Shunqing Zhang, entered into an escrow agreement with the private placement investors, pursuant to which, Mr. Zhang agreed to deposit in an escrow account a total of 2,673,796 shares of the Company's common stock owned by him, to be held for the benefit of the investors. Mr. Zhang agreed that if the Company does not attain a minimum after-tax net income threshold of $8,200,000 for the fiscal year ended December 31, 2007 and $13,500,000 for the fiscal year ending December 31, 2008, the escrow agent may deliver his escrowed shares to the investors, based upon a pre-defined formula agreed to between the investors and Mr. Zhang. However, if the after-tax net income threshold is met, the shares in escrow will be returned to Mr. Zhang. In addition, on April 25, 2007, Mr. Zhang entered into a similar escrow agreement with HFG International, Limited. Under such agreement, Mr. Zhang placed into escrow a total of 638,338 shares of the Company's common stock to cover the same minimum net income thresholds as described above with respect to the investor make-good. Similarly, if the thresholds are not achieved in either year, the escrow agent must release certain amounts of the make-good shares that were put into escrow. As a result, we met the after-tax net income threshold of $8,200,000 for the fiscal year ended December 31, 2007 and the pro rata shares in escrow were returned to Mr. Zhang, while we did not meet the after-tax net income threshold of $13,500,000 for the fiscal year ended December 31, 2008, and the pro rata shares in escrow were transferred to the investors on March 8, 2010.

Our Products

The following table set forth sales information about our product mix in each of the first quarter of 2010 and 2009.

(All amounts, other than percentages, in thousands of U.S. dollars)

| Three Months Ended March 31, | ||||||||||||

| 2010 | 2009 | |||||||||||

| Revenue | percentage of | Revenue | percentage of | |||||||||

| net revenues | net revenues | |||||||||||

| Refractories | $ | 10,383 | 87.5% | $ | 9,794 | 79.0% | ||||||

| Industrial Ceramics | 276 | 2.4% | 150 | 1.2% | ||||||||

| Fracture Proppants | 1,202 | 10.1% | 2,454 | 19.8% | ||||||||

| Fine Precision Abrasives | 0 | 0% | 0 | 0% | ||||||||

| $ | 11,861 | 100% | $ | 12,398 | 100% | |||||||

Refractories

Our largest product segment is the refractories segment, which accounted for approximately 87.5% of the total revenue in the first quarter of 2010. Our refractory products have high-temperature resistant qualities and can function under thermal stress that is common in many heavy industrial production environments. Because of their unique high-temperature resistant qualities, the refractory products are used as linings and key components in many industrial furnaces, such as steel production furnaces, ladles, vessels, and other high-temperature processing machines that must operate at high temperatures for a long period of time without interruption. The majority of our customers are in the iron, steel, cement, chemical, coal, glass, petro-chemical and nonferrous industries.

23

We provide a customized solution for each order of our monolithic refractory materials based on customer-specific formulas. Upon delivery to customers, the monolithic materials are applied to the inner surfaces of our customers’ furnaces, ladles or other vessels to improve the productivity of that equipment. The product is beneficial because it lowers the overall cost of production and improves financial performance for our customers. The reasons that the monolithic materials can help our customers improve productivity, lower production costs and achieve stronger financial performance include the following: (i) monolithic refractory castables can be cast into complex shapes which are unavailable or difficult to achieve by alternative products such as shaped bricks; (ii) monolithic refractory linings can be repaired, and in some cases, even reinstalled, without furnace cool-down periods or steel-production interruptions, and therefore improve the steel makers’ productivity; (iii) monolithic refractories can form an integral surface without joints, enhancing resistance to penetration, impact and erosion, and thereby improving the equipment’s operational safety and extending their useful service lives; (iv) monolithic refractories can be installed by specialty equipment either automatically or manually, thus saving construction and maintenance time as well as costs; and (v) monolithic refractories can be customized to specific requirements by adjusting individual formulas without the need to change batches of shaped bricks, which is a costly procedure. Our refractory products and a description of their features are as follows:

- Castable, coating, and dry mix materials. Offerings within this product line are used as linings in containers such as a tundish used for pouring molten metal into a mold. The primary advantages of these products are speed and ease of installation for heat treatment.

- Low-cement and non-cement castables. Our low-cement and non-cement castable products are typically used in reheating furnaces for producing steel. These castable products are highly durable and can last up to five years.

- Pre-cast roofs. These products are usually used as a component of electric arc furnaces. They are highly durable, and in the case of our corundum-based, pre-cast roof, products, can endure approximately 160 to 220 complete operations of furnace heating.

We also have a production line for pressed bricks, which is a type of “shaped” refractory, for steel production. The annual designed production capacity of our shaped refractory products is approximately 15,000 metric tons. Finally, we provide a full-service option to our steel customers, which includes refractory product installation, testing, maintenance, repair and replacement. Refractory product sales are often enhanced by our on-site installation and technical support personnel. Our installation services include applying refractory materials to the walls of steel-making furnaces and other high temperature vessels to maintain and extend their lives. Our technical service staff provides assurances that our customers will achieve their desired productivity objectives. They also measure the refractory wear at our customer sites to improve the quality of maintenance and overall performance of our customers’ equipment. Full-service customers contributed approximately 46.1% of the Company’s total sales in the first quarter of 2010, compared with 38.9% in the same period of 2009. We believe that these services together with our refractory products provide us with a strategic advantage to secure our profits.

Industrial Ceramics

Industrial Ceramics accounted for approximately 2.4% of the total revenue in the first quarter of 2010. Our industrial ceramic products, including abrasive balls and tiles, valves, electronic ceramics and structural ceramics, are components for a variety of end products such as fuses, vacuum interrupters, electrical components, mud slurry pumps, and high-pressure pumps. Such end use products are used in the electric power, electronic component, industrial pump, and metallurgy industries. We install and maintain some of these products.

Some examples and description of our products and their benefits are introduced as follows:

- Ceramic plates, tubes, elbows, and rollers. These products are used in heavy machines for steel production, power generation, and mining. They are highly resistant to heat, erosion, abrasion, and impact.

- Ceramic cylinders and plugs. Our ceramic cylinders and plugs are often used in plug pumps for drilling crude oil. They are highly resistant to pressure.

- Wearable ceramic valves. Our wearable ceramic valves are used for transferring gas and liquid products. They are highly resistant to wash out, erosion, abrasion, and impact.

We signed a five-year collaboration agreement with the Ceramics Research Institute of Zhengzhou University (the "CRI") in Henan province of China in 2008, to research and develop innovative ways of improving the manufacturing process and functionality of an array of bauxite-based materials. Specifically, we will work with CRI to optimize and reduce costs for the production of fine precision abrasives, which are bauxite-based, ultra-fine, grain-like materials used to polish fine-metal or optical equipment surfaces, including solar panels. CRI will also help us develop next-generation industrial ceramics that can reduce energy use and pollution. In addition, we and CRI will jointly apply for government grants for bauxite-based materials research.

Fracture Proppants

Fracture Proppants accounted for approximately 10.1% of the total revenue in the first quarter of 2010. Our fracture proppants are very fine ball-like pellets, used to reach pockets of oil and natural gas deposits that are trapped in the fractures under the ground. Oil drillers inject the pellets into those fractures, squeezing out the trapped oil or natural gas, which leads to higher yield. Our fracture proppant products are available in several different particle sizes (measured in millimeters). They are typically used to extract crude oil and natural gas, which increases the productivity of crude oil and natural gas wells. These products are highly resistant to pressure. In October 2007, our fracture proppant products were certified by PetroChina Company Limited (the “PetroChina”), China Petroleum & Chemical Corporation (the “Sinopec”) and the China National Offshore Oil Corporation (the “CNOOC”) as we became a first-tier supplier of fracture proppants for their oil and gas-drilling operations.

24

On April 27th, 2009, Duesail finished construction of its second production line for fracture proppants, and successfully doubled its capacity for fracture proppants, from 33,000 tons per year to 66,000 tons per year. The newly completed production line ("Phase II") adopts a so-called Revolving Kiln technology which cuts down production time and costs by up to 10%. The Phase II improvements also include the ability to produce a wider range of proppants catering to oil wells with different underground pressures. With more efficient production technology and higher capacity, we are well positioned to enlarge our sales both in China and internationally.

Fine precision abrasives

Fine precision abrasives are used for producing a super-fine, super-consistent finish on certain products. A high-strength polyester backing provides a uniform base for a coating of micron-graded mineral particles that are uniformly dispersed for greater finishing efficiency. Our fine precision abrasives are made from silicon carbide (“SiC”). They are ultra-fine, high-strength pellets with uniform shape, and they are used for surface-polishing and slicing of precision instruments such as solar panels. Currently, the type of abrasives that we produce is in high demand among solar-energy companies. Solar energy companies use fine precision abrasives to cut silicon bars and to polish equipment surfaces so that they can be smooth and reflective. Our products can be utilized in a broad range of areas including machinery manufacturing, electronics, optical glass, architecture industry development, semiconductor, silicon chip, plastic and lens. We launched the fine precision abrasive segment in the fourth quarter of 2009, and had shipped out trial products to potential customers. A description of its features is as follows:

Ultrafine precision abrasives. This product is a fine alumina or silicon carbide powder whose size is measured in microns. This product has characteristics suitable for wire slicing and specific polishing.

Highlights of the First Quarter of 2010