Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - CHINA GENGSHENG MINERALS, INC. | Financial_Report.xls |

| EX-32.2 - EXHIBIT 32.2 - CHINA GENGSHENG MINERALS, INC. | exhibit32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - CHINA GENGSHENG MINERALS, INC. | exhibit31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - CHINA GENGSHENG MINERALS, INC. | exhibit32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - CHINA GENGSHENG MINERALS, INC. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: March

31, 2012

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

_______________to ________________

Commission File Number: 001-34649

CHINA GENGSHENG MINERALS,

INC.

(Exact Name of Registrant as Specified in Its Charter)

| NEVADA | 91-0541437 |

| (State or Other jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| CHINA GENGSHENG MINERALS, INC. | |

| No. 88 Gengsheng Road, Dayugou Town, Gongyi, Henan Province P.R. China | 451271 |

| (Address of Principal Executive Offices) | (Zip Code) |

(86) 371-64059863

(Registrant’s Telephone Number,

Including Area Code)

N/A

(Former Name, Former Address and Former Fiscal

Year, if Changed Since Last Report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

As of May 15, 2012, there were 26,803,044 shares of Common Stock of the Company, $0.001 par value, outstanding.

Table of Contents

| Page | ||

| PART I - | FINANCIAL INFORMATION | |

| Item 1. | Financial Statements. | 1 |

| Condensed Consolidated Balance Sheets as of March 31, 2012 (Unaudited) and December 31, 2011 | 1 | |

| Condensed Consolidated Statements of Operations and Comprehensive Loss for the Three Months Ended March 31, 2012 (Unaudited) and 2011 (Unaudited) | 3 | |

| Condensed Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2012 (Unaudited) and 2011(Unaudited) | 5 | |

| Condensed Consolidated Statements of Equity for the Three Months Ended March 31, 2012 (Unaudited) | 7 | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | 8 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 23 |

| Item 3. | Quantitative and Qualitative Disclosure About Market Risk. | 36 |

| Item 4. | Controls and Procedures. | 36 |

| PART II - | OTHER INFORMATION | |

| Item 1. | Legal Proceedings. | 37 |

| Item 1A. | Risk Factors. | 37 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 37 |

| Item 3. | Defaults Upon Senior Securities. | 37 |

| Item 5. | Other Information. | 37 |

| Item 6. | Exhibits. | 37 |

| SIGNATURES | ||

China GengSheng Minerals, Inc.

Condensed

Consolidated Balance Sheets

| As of | As of | |||||

| March 31, | December 31, | |||||

| 2012 | 2011 | |||||

| (Unaudited) | (Audited) | |||||

|

ASSETS |

||||||

|

Current assets: |

||||||

|

Cash and cash equivalents |

$ | 2,696,810 | $ | 3,594,361 | ||

|

Restricted cash (Note 5) |

31,369,567 | 21,094,008 | ||||

|

Trade receivables, net (Note 6) |

48,017,132 | 49,167,748 | ||||

|

Bills receivable |

10,963,021 | 6,331,997 | ||||

|

Other receivables and prepayments, net (Note 7) |

10,490,196 | 8,451,185 | ||||

|

Advances to senior management (Note 7) |

- | 360,162 | ||||

|

Inventories, net (Note 8) |

21,278,336 | 16,956,582 | ||||

|

Deferred tax assets, net of valuation allowance |

- | - | ||||

|

|

||||||

|

Total current assets |

124,815,062 | 105,956,043 | ||||

|

|

||||||

|

Deposit for acquisition of a non-consolidated affiliate, net (Note 9) |

1,098,285 | 1,092,041 | ||||

|

Deposits for acquisition of land use right, property, plant and equipment |

622,431 | 618,892 | ||||

|

Goodwill, net (Note 10) |

- | - | ||||

|

Intangible assets, net (Note 10) |

- | - | ||||

|

Property, plant and equipment, net (Note 11) |

37,835,572 | 37,164,849 | ||||

|

Land use rights |

3,134,281 | 3,137,961 | ||||

|

|

||||||

|

TOTAL ASSETS |

$ | 167,505,631 | $ | 147,969,786 | ||

|

|

||||||

|

LIABILITIES AND EQUITY |

||||||

|

|

||||||

|

Current liabilities: |

||||||

|

Trade payables |

$ | 20,038,621 | $ | 18,671,086 | ||

|

Bills payable (Note 5) |

15,434,250 | 16,385,340 | ||||

|

Other payables and accrued expenses |

5,690,863 | 8,877,407 | ||||

|

Deferred revenue - Government grants |

461,999 | 443,632 | ||||

|

Provision for warranty |

167,698 | 184,778 | ||||

|

Income taxes payable |

72,091 | 218,038 | ||||

|

Non-interest-bearing loans (Note 12) |

3,635,263 | 3,318,472 | ||||

|

Collateralized short-term bank loans (Note 13) |

67,639,532 | 45,974,022 | ||||

|

Loan from a third party (Note 14) |

3,166,000 | - | ||||

|

Deferred tax liabilities |

125,397 | 112,625 | ||||

|

Warrant liabilities |

- | - | ||||

|

|

||||||

|

TOTAL LIABILITIES |

116,431,714 | 94,185,400 | ||||

|

|

||||||

|

COMMITMENTS AND CONTINGENCIES (Note 18) |

1

China GengSheng Minerals, Inc.

Condensed

Consolidated Balance Sheets (Cont’d)

| As of | As of | |||||

| March 31, | December 31, | |||||

| 2012 | 2011 | |||||

| (Unaudited) | (Audited) | |||||

|

STOCKHOLDERS’ EQUITY |

||||||

|

Preferred stock - $0.001 par value per share; authorized 50,000,000 shares in 2012 and 2011, none issued and outstanding |

$ | - | $ | - | ||

|

Common stock - $0.001 par value per share; authorized 100,000,000 shares in 2012 and 2011, issued and outstanding 26,803,044 shares in 2012 and 2011 |

26,803 | 26,803 | ||||

|

Additional paid-in capital |

28,197,310 | 28,197,310 | ||||

|

Statutory and other reserves |

8,110,972 | 8,110,972 | ||||

|

Accumulated other comprehensive income |

7,895,699 | 7,713,341 | ||||

|

Retained earnings |

6,628,728 | 9,541,560 | ||||

|

|

||||||

|

Total China GengSheng Minerals, Inc. stockholders’ equity |

50,859,512 | 53,589,986 | ||||

|

|

||||||

|

NONCONTROLLING INTEREST |

214,405 | 194,400 | ||||

|

|

||||||

|

TOTAL EQUITY |

51,073,917 | 53,784,386 | ||||

|

|

||||||

|

TOTAL LIABILITIES AND EQUITY |

$ | 167,505,631 | $ | 147,969,786 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

China GengSheng Minerals, Inc.

Condensed

Consolidated Statements of Operations and Comprehensive Loss

|

|

Three months ended | |||||

|

|

March 31, | |||||

|

|

(Unaudited) | |||||

|

|

2012 | 2011 | ||||

|

Sales revenue |

$ | 13,710,663 | $ | 16,183,829 | ||

|

Cost of goods sold |

10,994,309 | 11,896,194 | ||||

|

|

||||||

|

Gross profit |

2,716,354 | 4,287,635 | ||||

|

|

||||||

|

Operating expenses |

||||||

|

General and administrative expenses |

1,728,711 | 1,504,218 | ||||

|

Research and development expenses |

162,996 | 141,327 | ||||

|

Selling expenses |

2,480,591 | 1,971,935 | ||||

|

|

||||||

|

Total operating expenses |

4,372,298 | 3,617,480 | ||||

|

|

||||||

|

(Loss) income from operations |

(1,655,944 | ) | 670,155 | |||

|

|

||||||

|

Other (expenses) income |

||||||

|

Government grant income |

385,314 | 883 | ||||

|

Guarantee income |

153,554 | 87,296 | ||||

|

Guarantee expenses |

(129,178 | ) | (87,515 | ) | ||

|

Interest income |

52,574 | 119,488 | ||||

|

Change in fair value of warrant liabilities |

- | 260,000 | ||||

|

Other income (expenses) |

5,939 | (34,189 | ) | |||

|

Finance costs (Note 15) |

(1,750,192 | ) | (965,732 | ) | ||

|

|

||||||

|

Total other expenses |

(1,281,989 | ) | (619,769 | ) | ||

|

|

||||||

|

(Loss) income before income taxes and noncontrolling interest |

(2,937,933 | ) | 50,386 | |||

|

Income taxes (Note 16) |

(12,348 | ) | (136,171 | ) | ||

|

|

||||||

|

Net loss before noncontrolling interest |

(2,950,281 | ) | (85,785 | ) | ||

|

Net loss attributable to noncontrolling interest |

37,449 | 5,851 | ||||

|

|

||||||

|

Net loss attributable to Company’s common stockholders |

$ | (2,912,832 | ) | $ | (79,934 | ) |

|

|

||||||

|

Net loss before noncontrolling interest |

$ | (2,950,281 | ) | $ | (85,785 | ) |

|

Other comprehensive income |

||||||

|

Foreign currency translation adjustments |

239,812 | 204,844 | ||||

|

|

||||||

|

Comprehensive (loss) income |

(2,710,469 | ) | 119,059 | |||

|

Comprehensive (income) loss attributable to noncontrolling interest |

(20,005 | ) | 5,851 | |||

|

|

||||||

|

Comprehensive (loss) income attributable to Company’s common stockholders |

$ | (2,730,474 | ) | $ | 124,910 | |

3

China GengSheng Minerals, Inc.

Condensed

Consolidated Statements of Operations and Comprehensive Loss (Cont’d)

| Three months ended | ||||||

| March 31, | ||||||

| (Unaudited) | ||||||

|

|

2012 | 2011 | ||||

|

Loss per share (Note 17) - Basic and diluted attributable to Company’s common stockholders |

$ | (0.11 | ) | $ | (0.003 | ) |

|

|

||||||

|

Weighted average number of shares - Basic and diluted |

26,803,044 | 26,627,719 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

China GengSheng Minerals, Inc.

Condensed

Consolidated Statements of Cash Flows

|

|

Three months ended March 31, | |||||

|

|

(Unaudited) | |||||

|

|

2012 | 2011 | ||||

|

Cash flows from operating activities |

||||||

|

Net loss before noncontrolling interest |

$ | (2,950,281 | ) | $ | (85,785 | ) |

|

Adjustments to reconcile net loss before noncontrolling interest to net cash flows used in operating activities: |

||||||

|

Depreciation |

725,675 | 500,644 | ||||

|

Amortization of land use rights |

21,649 | 5,514 | ||||

|

Amortization of intangible assets |

- | 19,025 | ||||

|

Deferred taxes |

12,348 | 162,168 | ||||

|

Loss on disposal of property, plant and equipment |

447 | - | ||||

|

Guarantee expenses |

129,178 | - | ||||

|

Guarantee income |

(153,554 | ) | - | |||

|

Allowance for doubtful accounts |

304,678 | 250,783 | ||||

|

Deferred revenue amortized |

- | (45,660 | ) | |||

|

Change in fair value of warrant liabilities |

- | (260,000 | ) | |||

|

Exchange gain |

(55,660 | ) | - | |||

|

Changes in operating assets and liabilities: |

||||||

|

Restricted cash |

(118,875 | ) | (6,810,950 | ) | ||

|

Trade receivables |

1,445,883 | 3,242,541 | ||||

|

Bills receivable |

(4,622,703 | ) | (273,579 | ) | ||

|

Other receivables and prepayments |

(2,437,411 | ) | (4,509,546 | ) | ||

|

Advances to senior management |

362,678 | - | ||||

|

Inventories |

(4,230,052 | ) | (2,435,941 | ) | ||

|

Other payables and accrued expenses |

(3,217,498 | ) | 946,972 | |||

|

Trade payables |

1,273,464 | 2,164,614 | ||||

|

Bills payable |

(1,024,020 | ) | 6,810,950 | |||

|

Provision for warranty |

(18,160 | ) | - | |||

|

Income taxes payable |

(147,063 | ) | (141,148 | ) | ||

|

|

||||||

|

Net cash flows used in operating activities |

(14,699,277 | ) | (459,398 | ) | ||

|

Cash flows from investing activities |

||||||

|

Payments for deposits of acquisition of land use right, property, plant and equipment |

- | (1,508,148 | ) | |||

|

Payments for acquisition of property, plant and equipment |

(1,196,013 | ) | (1,849,334 | ) | ||

|

|

||||||

|

Net cash flows used in investing activities |

(1,196,013 | ) | (3,357,482 | ) | ||

|

|

||||||

|

Cash flows from financing activities |

||||||

|

Net proceeds from issuance of shares |

- | 9,258,466 | ||||

|

Restricted cash |

(10,048,900 | ) | (7,193,779 | ) | ||

|

Proceeds from bank loans |

24,361,925 | 19,299,987 | ||||

|

Repayment of bank loans |

(2,932,250 | ) | (6,544,600 | ) | ||

|

Proceeds from non-interest-bearing loans |

642,137 | - | ||||

|

Repayment of non-interest-bearing loans |

(375,884 | ) | (478,016 | ) | ||

|

Loan from a third party |

3,170,000 | - | ||||

|

Government grant received |

171,180 | - | ||||

|

Net cash flows provided by financing activities |

14,988,208 | 14,342,058 | ||||

5

| Three months ended March 31, | ||||||

| (Unaudited) | ||||||

| 2012 | 2011 | |||||

|

Effect of foreign currency translation on cash and cash equivalents |

9,531 | 21,819 | ||||

|

|

||||||

|

Net (decrease) increase in cash and cash equivalents |

(897,551 | ) | 10,546,997 | |||

|

Cash and cash equivalents - beginning of period |

3,594,361 | 925,052 | ||||

|

|

||||||

|

Cash and cash equivalents - end of period |

$ | 2,696,810 | $ | 11,472,049 | ||

|

|

||||||

|

Supplemental disclosure of cash flow information: |

||||||

|

Cash paid for: |

||||||

|

Interest |

$ | 688,791 | $ | 965,732 | ||

|

Income taxes |

$ | 158,232 | $ | 114,639 | ||

|

|

||||||

|

Non-cash operating and investing activities:- |

||||||

|

Proceeds from disposal of property, plant and equipment settled by offsetting trade payables |

$ | 11,095 | $ | - | ||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

China GengSheng Minerals, Inc.

Condensed Consolidated Statements

of Equity

| China GengSheng Minerals, Inc. stockholders | ||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||

| Common stock | other | |||||||||||||||||||||||

|

|

Number of | Additional | Statutory and | comprehensive | Retained | Noncontrolling | ||||||||||||||||||

| shares | Amount | paid-in capital | other reserves | income | earnings | interest | Total | |||||||||||||||||

|

Balance, December 31, 2011 |

26,803,044 | $ | 26,803 | $ | 28,197,310 | $ | 8,110,972 | $ | 7,713,341 | $ | 9,541,560 | $ | 194,400 | $ | 53,784,386 | |||||||||

|

Net loss |

- | - | - | - | - | (2,912,832 | ) | (37,449 | ) | (2,950,281 | ) | |||||||||||||

|

Foreign currency translation adjustments |

- | - | - | - | 182,358 | - | 57,454 | 239,812 | ||||||||||||||||

|

|

||||||||||||||||||||||||

|

Balance, March 31, 2012 |

26,803,044 | $ | 26,803 | $ | 28,197,310 | $ | 8,110,972 | $ | 7,895,699 | $ | 6,628,728 | $ | 214,405 | 51,073,917 | ||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

7

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 1. |

Basis of presentation |

|

Basis of presentation | |

|

These unaudited condensed consolidated financial statements of the Company and its subsidiaries have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (the “SEC”) including the instructions to Form 10-Q and Regulation S-X. Certain information and note disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (the “US GAAP”) have been condensed or omitted from these statements pursuant to such rules and regulations and, accordingly, they do not include all the information and notes necessary for comprehensive consolidated financial statements and should be read in conjunction with our audited consolidated financial statements for the year ended December 31, 2011, included in our Annual Report on Form 10-K for the year ended December 31, 2011 as filed with the Securities and Exchange Commission on April 16, 2012. | |

|

In the opinion of the management of the Company, all adjustments, which are of a normal recurring nature, necessary for a fair statement of the results for the three-month period have been made. Results for the interim period presented are not necessarily indicative of the results that might be expected for the entire fiscal year. | |

| 2. |

Corporate information |

|

The Company was originally incorporated on November 13, 1947, in accordance with the laws of the State of Washington as Silver Mountain Mining Company. On August 20, 1979, the Articles of Incorporation were amended to change the corporate name of the Company to Leadpoint Consolidated Mines Company. On August 15, 2006, the Company changed its state of incorporation from Washington to Nevada by means of a merger with and into a Nevada corporation formed on May 23, 2006, solely for the purpose of effecting the reincorporation and changed its name to Point Acquisition Corporation. On June 11, 2007, the Company changed its name to China Minerals Technologies, Inc. and on July 26, 2007, the Company changed its name to China GengSheng Minerals, Inc. On March 4, 2010, the Company’s common stock began trading on the NYSE Amex Stock Exchange (formerly the American Stock Exchange) under the symbol “CHGS.” Prior to March 4, 2010, the Company’s common stock traded Over-the-Counter Bulletin Board under the symbol CHGS.OB. | |

|

Currently the Company has the following eight subsidiaries: |

| Company name | Place/date of

incorporation or establishment |

The Company’s

effective ownership interest |

Common stock/

registered capital |

Principal

activities | |||||

| GengSheng

International Corporation ( “GengSheng International” ) |

The

British Virgin Islands (the “BVI”)/ November 3, 2004 |

100% | Ordinary shares :- Authorized: 50,000 shares of $1 each Paid up: 100 shares of $1 each | Investment holding | |||||

| Henan GengSheng

Refractories Co., Ltd. ( “Refractories” ) |

The

People’s Republic of China (the “PRC”)/ December 20, 1996 |

100% | Registered capital of $12,089,879 fully paid up | Manufacturing and selling of refractory products | |||||

| Henan GengSheng

High-Temperature Materials Co., Ltd. ( “High-Temperature” ) |

PRC/

September 4, 2002 |

89.33% | Registered capital of $1,246,300 fully paid up | Manufacturing and selling of functional ceramic products | |||||

| Smarthigh Holdings

Limited ( “Smarthigh” ) |

BVI/

November 5, 2004 |

100% | Ordinary shares :- Authorized: 50,000 shares of $1 each Paid up: 100 shares of $1 each | Investment holding |

8

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 2. |

Corporate information (Cont’d) |

| Zhengzhou Duesail Fracture Proppant Co., Ltd. ( “Duesail” ) |

PRC/ August 14, 2006 |

100% | Registered capital of $2,800,000 fully paid up | Manufacturing and selling of fracture proppant products | |||||

| Henan GengSheng Micronized Powder Materials Co., Ltd. ( “Micronized” ) |

PRC/ March 31, 2008 |

100% | Registered capital of $5,823,000 fully paid up | Manufacturing and selling of fine precision abrasives | |||||

| Guizhou Southeast Prefecture GengSheng New Materials Co., Ltd. ( “Prefecture” ) |

PRC/ April 13, 2004 |

100% | Registered capital of $141,840 fully paid up | Manufacturing and selling of corundum materials | |||||

| Henan Yuxing Proppant Co., Ltd. (“Yuxing”) |

PRC/ June 3, 2011 |

100% | Registered capital of $3,086,000 fully paid up | Manufacturing and selling of fracture proppant products |

| 3. |

Description of business |

|

The Company is a holding company whose primary business operations are conducted through its subsidiaries located in the PRC’s Henan Province. Prefecture is located in Guizhou Province and is manufacturing corundum materials, a major raw material for monolithic refractory. Through its operating subsidiaries, the Company produces and markets a broad range of monolithic refractory, functional ceramics, fracture proppants, fine precision abrasives, and corundum materials. | |

|

The principal raw materials used in the products are several forms of aluminum oxide, including bauxite, processed AI2 O3 and calcium aluminates cement, and other materials, such as corundum, magnesia, resin and silica, which are primarily sourced from suppliers located in the PRC. The production facilities of the Company, other than the Prefecture’s sub-processing factory located in Guizhou, are also located in Henan Province. | |

|

Refractories products allow steel makers and other customers to improve the productivity and longevity of their equipment and machinery. Functional ceramic products mainly include abrasive balls and tiles, valves, electronic ceramics and structural ceramics. Fracture proppant products are used to reach trapped pockets of oil and natural gas deposits, which lead to higher productivities of oil and natural gas wells. Due to their heat-resistant qualities and ability to function under thermal stress, refractories serve as components in industrial furnaces and other heavy industrial machinery. Corundum materials are major raw material for producing monolithic refractory. Fine precision abrasive is the Company’s new product that was commercially launched in the fourth quarter of 2009, and is used for slicing the solar-silicon bar and polishing the equipment surface. The Company’s customers include some of the largest steel and iron producers located in 25 provinces in the PRC, as well as in the United States and other countries in Asia, and Europe. |

9

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 4. |

Summary of significant accounting policies |

|

Basis of consolidation | |

|

The condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All significant inter-company accounts and transactions have been eliminated in consolidation. | |

|

Concentrations of credit risk | |

|

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and cash equivalents, restricted cash, trade, bills and other receivables. As of March 31, 2012 and December 31, 2011, substantially all of the Company’s cash and cash equivalents and restricted cash were held by major financial institutions located in the PRC and Hong Kong, which management believes are of high credit quality. With respect to trade and other receivables, the Company extends credit based on an evaluation of the customer’s financial condition. The Company generally does not require collateral for trade and other receivables and maintains an allowance for doubtful accounts of trade and other receivables. | |

|

Regarding bills receivable, they are undertaken by the banks to honor the payments at maturity and the customers are required to place deposits with the banks equivalent to a certain percentage of the bills amount as collateral. These bills receivable can be sold to any third party at a discount before maturity. The Company does not maintain allowance for bills receivable in the absence of bad debt experience and the payments are undertaken by the banks. | |

|

During the reporting periods, customers represented 10% or more of the Company’s condensed consolidated sales are: |

| Three months ended | |||||||

| March 31, | |||||||

| (Unaudited) | |||||||

|

|

2012 | 2011 | |||||

|

|

|||||||

|

Shangdong Steel Co., Ltd. Rizhao Subsidiary |

$ | 2,144,544 | $ | 1,795,952 | |||

|

Trina Solar |

2,038,554 | 272,594 | |||||

|

Fushun New Steel Co., Ltd. |

1,530,790 | 179,274 | |||||

|

AMSAT International Limited |

- | 2,671,222 | |||||

|

|

|||||||

|

|

$ | 5,713,888 | $ | 4,919,042 | |||

Fair value of financial instruments

ASC 820 requires the disclosure of the estimated fair value of financial instruments including those financial instruments for which fair value option was not elected. The fair value of collateralized borrowings are estimated using discounted cash flow analysis, based on the Company’s current incremental borrowing rates for similar types of borrowing arrangement. The carrying amount of financial assets and liabilities approximate their fair value due to short maturities.

Recently issued accounting pronouncements

In September 2011, the FASB issued ASU 2011-08, “Intangibles - Goodwill and Other (Topic 350)”. The amendments in this update will allow an entity to first assess qualitative factors to determine whether it is necessary to perform the two-step quantitative goodwill impairment test. Under these amendments, an entity would not be required to calculate the fair value of a reporting unit unless the entity determines, based on a qualitative assessment, that it is more likely than not that its fair value is less than its carrying amount. The amendments include a number of events and circumstances for an entity to consider in conducting the qualitative assessment. The amendments in this ASU are effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. Early adoption is permitted. The adoption of this ASU has no material impact on the Company’s condensed consolidated financial statements.

10

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 4. |

Summary of significant accounting policies (Cont’d) |

|

Recently issued accounting pronouncements (cont’d) | |

|

In September 2011, the FASB issued ASU 2011-09, “Compensation - Retirement Benefits - Multiemployer Plans (Subtopic 715 - 80)”. The amendments in this update require additional disclosures about an employer’s participation in a multiemployer plan. ASU 2011-09 is effective for annual periods for fiscal years ending after December 15, 2011, and early adoption is permitted. ASU 2011-09 should be applied retrospectively for all prior periods presented. The adoption of this ASU has no material impact on the Company’s condensed consolidated financial statements. | |

|

In December 2011, the FASB issued ASU 2011-11, “Balance Sheet (Topic 210)”. The objective of this update is to provide enhanced disclosures that will enable users of its financial statements to evaluate the effect or potential effect of netting arrangements on an entity’s financial position. This includes the effect or potential effect of rights of setoff associated with an entity’s recognized assets and recognized liabilities within the scope of this update. The amendments require enhanced disclosures by requiring improved information about financial instruments and derivative instruments that are either (1) offset in accordance with either Section 210-20-45 or Section 815-10-45 or (2) subject to an enforceable master netting arrangement or similar agreement, irrespective of whether they are offset in accordance with either Section 210-20-45 or Section 815-10-45. An entity is required to apply the amendments retrospectively for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. The adoption of this ASU has no material impact on the Company’s condensed consolidated financial statements. | |

|

In December 2011, the FASB issued ASU 2011-12, “Comprehensive Income (Topic 220)”. The amendments in this update supersede certain pending paragraphs in Accounting Standards Update No. 2011-05, “Comprehensive Income (Topic 220): Presentation of Comprehensive Income”, to effectively defer only those changes in ASU 2011-05 that relate to the presentation of reclassification adjustments out of accumulated other comprehensive income. The amendments will be temporary to allow the Board time to redeliberate the presentation requirements for reclassifications out of accumulated other comprehensive income for annual and interim financial statements for public, private, and non-profit entities. The amendments are effective for fiscal years, and interim periods within those years, beginning after December 15, 2011. Early application is permitted. The adoption of this ASU has no material impact on the Company’s condensed consolidated financial statements. | |

| 5. |

Restricted cash and bills payable |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2012 | 2011 | ||||||

|

|

(Unaudited) | (Audited) | |||||

|

|

|||||||

|

Bank deposits held as collateral for bills payable (Note 5a) |

$ | 12,743,150 | $ | 12,552,650 | |||

|

Bank deposits held as collateral for bank loans (Note 13) |

18,584,420 | 8,499,600 | |||||

|

Other (Note 5b) |

41,997 | 41,758 | |||||

|

|

|||||||

|

|

$ | 31,369,567 | $ | 21,094,008 |

Notes :-

| a) |

The Company is requested by certain suppliers to settle amounts owed to such suppliers by the issuance of bills through banks for which the banks undertake to guarantee the Company’s settlement of these amounts at maturity. These bills are interest free and would be usually matured within six months from the date of issuance. As collateral security for the banks’ undertakings, the Company is required to pay the bank charges as well as maintaining deposits with such banks amounts equal to 50% or 100% of the bills’ amounts issued. | |

| b) |

The amount was held by a third party due to the dispute with one supplier at Prefecture. |

11

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 6. |

Trade receivables, net |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2012 | 2011 | ||||||

| (Unaudited) | (Audited) | ||||||

| Trade receivables | $ | 50,063,349 | $ | 51,214,568 | |||

| Allowance for doubtful accounts | (2,046,217 | ) | (2,046,820 | ) | |||

| $ | 48,017,132 | $ | 49,167,748 |

An analysis of the allowance for doubtful accounts for the three months ended March 31, 2012 and 2011 is as follows:

| Three months ended | |||||||

| March 31, | |||||||

| (Unaudited) | |||||||

| 2012 | 2011 | ||||||

|

|

|||||||

|

Balance at beginning of period |

$ | 2,046,820 | $ | 1,020,741 | |||

|

(Reversal) addition of doubtful debt expenses, net |

(12,322 | ) | 250,783 | ||||

|

Translation adjustments |

11,719 | 3,364 | |||||

|

|

|||||||

|

Balance at end of period |

$ | 2,046,217 | $ | 1,274,888 | |||

| 7. |

Other receivables and prepayments, net and advances to senior management |

|

|

As of | As of | |||||

|

|

March 31, | December 31, | |||||

|

|

2012 | 2011 | |||||

|

|

(Unaudited) | (Audited) | |||||

|

|

|||||||

|

Government grant receivables (Note 7a) |

$ | 398,409 | $ | 550,396 | |||

|

Loans to third parties (Note 7b) |

2,347,328 | 1,314,359 | |||||

|

Value added tax and other tax recoverable |

491,100 | 662,151 | |||||

|

Deposits for purchase of raw materials |

975,919 | 1,430,517 | |||||

|

Other deposit |

105,305 | 198,988 | |||||

|

Prepayment |

1,398,467 | 1,817,126 | |||||

|

Other receivables |

326,732 | 248,731 | |||||

|

Advances to staff (Note 7c) |

5,525,083 | 2,986,134 | |||||

|

|

|||||||

|

|

11,568,343 | 9,208,402 | |||||

|

Allowance for doubtful accounts |

(1,078,147 | ) | (757,217 | ) | |||

|

|

|||||||

|

|

$ | 10,490,196 | $ | 8,451,185 | |||

|

|

|||||||

|

Advances to senior management (Note 7b) |

$ | - | $ | 360,162 |

12

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 7. |

Other receivables and prepayments, net and advances to senior management (Cont’d) |

|

An analysis of the allowance for doubtful accounts for the three months ended March 31, 2012 and 2011 is as follows: |

| Three months ended | |||||||

| March 31, | |||||||

| (Unaudited) | |||||||

|

|

2012 | 2011 | |||||

|

|

|||||||

|

Balance at beginning of period |

$ | 757,217 | $ | 374,590 | |||

|

Addition of doubtful debt expenses, net |

317,000 | - | |||||

|

Translation adjustments |

3,930 | 1,234 | |||||

|

|

|||||||

|

Balance at end of period |

$ | 1,078,147 | $ | 375,824 | |||

Notes :-

| a) |

As of March 31, 2012, government grant receivables represented incentive bonus of $398,409 from the local government for successful back-door listing and good performance by Refractories. | |

| b) |

The loans to third parties mainly represent the loans to companies and government entity which have business connections with the Company. The amounts are interest-free, unsecured and repayable on demand. | |

|

The advances to senior management are mainly for handling sourcing activities and for travel and other expenses in the ordinary course of business. | ||

| c) |

The amounts mainly represent staff drawings for handling sourcing and logistic activities, and those normal operations for the Company in the ordinary course of business. |

| 8. |

Inventories, net |

|

|

As of | As of | |||||

|

|

March 31, | December 31, | |||||

|

|

2012 | 2011 | |||||

|

|

(Unaudited) | (Audited) | |||||

|

|

|||||||

|

Raw materials |

$ | 6,780,059 | $ | 5,542,691 | |||

|

Work-in-progress |

3,242,420 | 619,773 | |||||

|

Finished goods |

11,282,441 | 10,820,551 | |||||

|

|

|||||||

|

|

21,304,920 | 16,983,015 | |||||

|

Allowance for obsolete inventories |

(26,584 | ) | (26,433 | ) | |||

|

|

|||||||

|

|

$ | 21,278,336 | $ | 16,956,582 |

No allowance for obsolete inventories was recognized in the cost of goods sold during the three months ended March 31, 2012 and 2011.

13

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 9. | Deposit for acquisition of a non-consolidated affiliate, net |

The Company paid RMB 15 million (equivalent to $2.37 million) in August 2010 to acquire 24.5% equity interest in Yili YiQiang Silicon Limited ("Yili"), a company established in the PRC and engaged in manufacturing and trading of silicon carbide. Due to some unexpected administrative difficulties in the completion of the acquisition, the aforesaid investment amount paid was only recognized as deposit as the ownership, risks and rewards of 24.5% equity interest in Yili had not been transferred to the Company as of March 31, 2012 and December 31, 2011. However, the management is committed to the completion of this acquisition and expects that it will be completed by May 2012.

The management opined that there was an indication of impairment as the financial position of Yili deteriorated subsequent to the payment of deposit. Based on the impairment review performed by the management with reference to the financial position of Yili as of December 31, 2011, an impairment loss of $1,248,804 was recognized in the consolidated statements of operations and comprehensive loss for the year ended December 31, 2011 as the management assessed the probability of recovering the whole carrying value of the deposit was unlikely. Based on further impairment review performed by the management with reference to the financial position of Yili as of March 31, 2012, the management assessed and concluded that there was no material impairment charge to be recognized for the three-month period ended March 31, 2012.

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2012 | 2011 | ||||||

| (Unaudited) | (Audited) | ||||||

|

Initial cost |

$ | 2,374,500 | $ | 2,361,000 | |||

|

Less: Impairment charge |

(1,248,804 | ) | (1,248,804 | ) | |||

|

Translation adjustments |

(27,411 | ) | (20,155 | ) | |||

|

|

|||||||

|

Net |

$ | 1,098,285 | $ | 1,092,041 |

| 10. |

Intangible assets, net and goodwill, net |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2012 | 2011 | ||||||

| (Unaudited) | (Audited) | ||||||

|

Unpatented technology (Note 10a) |

$ | 395,750 | $ | 393,500 | |||

|

Accumulated amortization |

(77,450 | ) | (77,450 | ) | |||

|

Translation adjustments |

(1,700 | ) | (6,250 | ) | |||

|

|

|||||||

|

Net book value |

316,600 | 309,800 | |||||

|

Less: Impairment charge |

(316,600 | ) | (309,800 | ) | |||

|

|

|||||||

|

Net |

$ | - | $ | - |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2012 | 2011 | ||||||

| (Unaudited) | (Audited) | ||||||

|

|

|||||||

|

Goodwill (Note 10b) |

$ | 441,089 | $ | 441,089 | |||

|

Less: Impairment charge |

(441,089 | ) | (441,089 | ) | |||

|

|

|||||||

|

Net |

$ | - | $ | - |

14

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

Notes :-

| a) |

During 2007, Refractories entered into a contract with an independent third party to purchase unpatented technology in relation to the production of mortar, at a cash consideration of $342,750. This consideration was mutually agreed between Refractories and such third party and this unpatented technology can be used for an unlimited period of time. Since its acquisition, an annual impairment review was performed by management and it was stated at cost less any impairment losses. In 2011, the expected useful life of the unpatented technology was reviewed and can be used up to 2015. Unpatented technology is stated at cost less any accumulated amortization and any identified impairment losses. Based on the result of the impairment review performed by the management at the end of 2011, the management assessed the probability of recovering the carrying value of the unpatented technology was unlikely and the intangible asset was considered fully impaired. | |

|

During the three months ended March 31, 2012 and 2011, the amortization charge was nil and $19,025 respectively. | ||

| b) |

The goodwill was identified upon the acquisition of 100% equity interest in Prefecture, which represented the excess of the purchase price of $875,400 over the fair value of acquired identified net assets of Prefecture of $434,311 at the time of acquisition on June 12, 2008. Since its acquisition, annual impairment reviews have been performed by management. Based on the result of the impairment review performed by the management at the end of 2011, the management assessed the probability of recovering the carrying value of the goodwill was unlikely and the goodwill was considered fully impaired. |

| 11. |

Property, plant and equipment, net |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2012 | 2011 | ||||||

| (Unaudited) | (Audited) | ||||||

| Costs: | |||||||

| Buildings | $ | 25,124,101 | $ | 24,950,339 | |||

| Plant and machinery | 14,346,015 | 13,712,330 | |||||

| Furniture, fixture and equipment | 1,443,506 | 1,411,826 | |||||

| Motor vehicles | 2,188,481 | 2,157,474 | |||||

| 43,102,103 | 42,231,969 | ||||||

| Accumulated depreciation | (8,631,335 | ) | (7,862,270 | ) | |||

| Construction in progress | 3,364,804 | 2,795,150 | |||||

| Net | $ | 37,835,572 | $ | 37,164,849 |

| (i) |

During the reporting periods, depreciation is included in: |

| Three months ended | |||||||

| March 31, | |||||||

| (Unaudited) | |||||||

| 2012 | 2011 | ||||||

| Cost of goods sold and overhead of inventories | $ | 542,685 | $ | 351,108 | |||

| General and administrative expenses | 182,990 | 149,536 | |||||

| $ | 725,675 | $ | 500,644 | ||||

|

During the three months ended March 31, 2012, property, plant and equipment with carrying amounts of $11,542 was disposed of at a consideration of $11,095 to offset trade payable balance, resulting in a loss of $447. No property, plant and equipment was disposed of during the three months ended March 31, 2011. | ||

|

Capitalized interest for the three months ended March 31, 2012 and 2011 was immaterial. | ||

| (ii) |

Construction in progress | |

|

Construction in progress mainly comprises capital expenditure for construction of the Company’s new offices and factories. |

15

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 12. |

Non-interest-bearing loans |

|

The loans represent interest-free and unsecured loans from the Company’s business associates and a government entity and are repayable on demand. | |

| 13. |

Collateralized short-term bank loans |

| As of | As of | ||||||

|

|

March 31, | December 31, | |||||

|

|

2012 | 2011 | |||||

|

|

(Unaudited) | (Audited) | |||||

|

|

|||||||

|

Bank loans wholly repayable within 1 year |

$ | 67,639,532 | $ | 45,974,022 |

The above bank loans are denominated in RMB and carry average interest rates at 8.14% (2011 : 9.57%) per annum with maturity dates ranging from one months to eleven months.

The bank loans as of March 31, 2012 were secured by the followings:-

| (a) |

Guarantee executed by Mr. Shunqing Zhang, the Chairman and CEO of the Company and a shareholder; | |

| (b) |

Guarantee executed by business associates (Note 18b) up to the amount of $33,401,300; | |

| (c) |

Land use rights with carrying amount of $3,134,281; | |

| (d) |

Bank deposits of $18,584,420 (Note 5); and | |

| (e) |

Bills receivable of $6,202,511. |

| 14. |

Loan from a third party |

|

The loan is interest-bearing at 24% per annum, guaranteed by a business associate and repayable no later than August 31, 2012. | |

| 15. |

Finance costs |

| Three months ended | |||||||

| March 31, | |||||||

| (Unaudited) | |||||||

| 2012 | 2011 | ||||||

| Interest expenses | $ | 889,601 | $ | 813,726 | |||

| Bills discounting charges | 860,591 | 152,006 | |||||

| $ | 1,750,192 | $ | 965,732 | ||||

| 16. |

Income taxes |

|

UNITED STATES | |

|

The Company is incorporated in the United States of America (“U.S.”) and is subject to U.S. tax law. No provisions for income taxes have been made as the Company has no U.S. taxable income for reporting periods. The applicable income tax rate for the reporting periods is 34%. The Company has not provided deferred tax on undistributed earnings of its non-U.S. subsidiaries as of March 31, 2012, as it is the Company’s current policy to reinvest these earnings in non-U.S. operations. |

16

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 16. |

Income taxes (Cont’d) |

|

BVI | |

|

GengSheng International and Smarthigh were incorporated in the BVI and are not subject to income taxes under the current laws of the BVI. | |

|

PRC | |

|

The PRC’s legislative body, the National People’s Congress, adopted the unified Corporate Income Tax Law (“CIT Law”) on March 16, 2007. This new tax law replaces the then separate income tax laws for domestic enterprises and foreign-invested enterprises and became effective on January 1, 2008. Under the new tax law, a unified income tax rate is set at 25% for both domestic enterprises and foreign-invested enterprises. However, there will be a transition period for enterprises, whether foreign-invested or domestic, that are currently receiving preferential tax treatments granted by relevant tax authorities. Enterprises that are subject to an enterprise income tax rate lower than 25% may continue to enjoy the lower rate and will transit into the new tax rate over a five year period beginning on the effective date of the CIT Law. Enterprises that are currently entitled to exemptions for a fixed term will continue to enjoy such treatment until the exemption term expires. Preferential tax treatment will continue to be granted to industries and projects that qualify for such preferential treatments under the new tax law. | |

|

Pursuant to the income tax rules and regulations of the PRC, provision for PRC income tax of the PRC subsidiaries is calculated based on the following rates : - |

| Period ended March 31, | ||||||||||

| Note | 2012 | 2011 | ||||||||

| Refractories | (a) | 15% | 15% | |||||||

| High-Temperature | (a) | 15% | 25% | |||||||

| Duesail | (a) | 12.5% | 12.5% | |||||||

| Prefecture | 25% | 25% | ||||||||

| Micronized | 25% | 25% | ||||||||

| Yuxing | 25% | N/A | ||||||||

Note :-

| (a) |

Entities entitled to a tax holiday in which they are fully exempted from the PRC enterprise income tax for 2 years starting from their first profit-making year after netting off accumulated tax losses, followed by a 50% reduction in the PRC enterprise income tax for the next 3 years (“tax holidays”). Any unutilised tax holidays will continue until expiry while tax holidays were deemed to start from January 1, 2008, even if the entity was not yet making profit after netting off its accumulated tax losses. Duesail is in the fifth year of tax holidays in 2012. Refractories was in the fifth year of tax holidays in 2009 and starting from the fiscal year 2010, Refractories is subject to enterprise income tax at unified rate of 15% for three years due to its engagement in an advanced technology industry and has passed the inspection of the provincial high-tech item. The relevant authority granted it a certificate during 2008 and renewed it during 2011. Starting from the fiscal year 2011, High-Temperature is subject to enterprise income tax at unified rate of 15% for three years due to its engagement in an advanced technology industry. The relevant authority granted it a certificate during 2011. |

In July 2006, the FASB issued ASC 740-10-25. This interpretation requires recognition and measurement of uncertain income tax positions using a “more-likely-than-not” approach. The Company adopted this ASC 740-10-25 on January 1, 2007. Under the new CIT Law which became effective on January 1, 2008, the Company may be deemed to be a resident enterprise by the PRC tax authorities. If the Company was deemed to be resident enterprise, the Company may be subject to the CIT at 25% on the worldwide taxable income and dividends paid from the PRC subsidiaries to their overseas holding companies may be exempted from 10% PRC withholding tax. Except for certain immaterial interest income from bank deposits placed with financial institutions outside the PRC, all of the Company’s income is generated from the PRC operations. Given the immaterial amount of income generated from outside the PRC and the PRC subsidiaries do not intend to pay dividends for the foreseeable future, the management considers that the impact arising from resident enterprise on the Company’s financial position is not significant. The management evaluated the Company’s tax positions and considered no provision for uncertainty in income taxes is necessary as of March 31, 2012 and December 31, 2011.

17

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 17. |

Loss per share | |

|

During the reporting periods, all the potential dilutive shares were not included in the computation of diluted loss per share because they were anti-dilutive. Accordingly, the basic and diluted loss per share are the same. | ||

| 18. |

Commitments and contingencies | |

| (a) |

The Company’s operations are subject to the laws and regulations in the PRC relating to the generation, storage, handling, emission, transportation and discharge of certain materials, substances and waste into the environment, and various other health and safety matters. Governmental authorities have the power to enforce compliance with their regulations, and violators may be subject to fines, injunctions or both. The Company must devote substantial financial resources to ensure compliance and believes that it is in substantial compliance with all the applicable laws and regulations. | |

|

The Company is currently not involved in any environmental remediation and has not accrued any amounts for environmental remediation relating to its operations. Under existing legislation, management believes that there are no probable liabilities that will have a material adverse effect on the financial position, operating results or cash flows of the Company. | ||

| (b) |

The Company guaranteed the following debts of third parties, which is summarized as follows:- | |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2012 | 2011 | ||||||

| (Unaudited) | (Audited) | ||||||

| Guaranteed amount | $ | 44,719,750 | $ | 41,317,500 |

In 2010, the Company, in accordance with ASC 460, commenced to recognize the liability arising from guarantees given for the debts granted to third parties by financial institutions.

An analysis of the guarantee liability is as follows:

| Three months | Year | ||||||

| ended | ended | ||||||

| March 31, | December 31, | ||||||

| 2012 | 2011 | ||||||

| (Unaudited) | (Audited) | ||||||

|

|

|||||||

|

Balance at beginning of period/year |

$ | 309,858 | $ | 392,978 | |||

|

Recognized as expenses for the period/year |

129,178 | 518,141 | |||||

|

Recognized as income for the period/year |

(153,554 | ) | (614,472 | ) | |||

|

Translation adjustments |

1,802 | 13,211 | |||||

|

|

|||||||

|

Balance at end of period/year |

$ | 287,284 | $ | 309,858 |

The fair value of such guarantees is determined by reference to fees charged in an arm’s length transaction for similar services.

18

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 18. |

Commitments and contingencies (Cont’d) |

Guarantees as of March 31, 2012 are further analyzed as below:-

| Principal | Outstanding | Outstanding | |||||||||||||||||||||||

| Term loan | Interest | repaid up to | as of | interest as of | Estimated | ||||||||||||||||||||

|

|

draw down | rate (per | March 31, | March 31, | March 31, | Maximum | |||||||||||||||||||

|

Guarantee |

date | Expiry date | annum) | Loan principal | 2012 | 2012 | 2012 | exposure | |||||||||||||||||

|

|

|||||||||||||||||||||||||

|

Local government authorities and their controlled entity (Note i) |

12/30/2009 | 12/29/2012 | 7.56% | $ | 7,915,000 | $ | - | $ | 7,915,000 | $ | 463,945 | $ | 8,378,945 | ||||||||||||

|

|

|||||||||||||||||||||||||

|

Business associates (Note ii) |

6/3/2011 | 6/2/2012 | 7.216% | 3,166,000 | - | 3,166,000 | 45,692 | 3,211,692 | |||||||||||||||||

|

|

6/28/2011 | 6/25/2012 | 12.492% | 474,900 | - | 474,900 | 15,603 | 490,503 | |||||||||||||||||

|

|

7/18/2011 | 7/17/2012 | 7.216% | 1,583,000 | - | 1,583,000 | 36,929 | 1,619,929 | |||||||||||||||||

|

|

8/22/2011 | 8/21/2012 | 8.528% | 712,350 | - | 712,350 | 25,631 | 737,981 | |||||||||||||||||

|

|

9/2/2011 | 8/31/2012 | 6.559% | 316,600 | - | 316,600 | 9,274 | 325,874 | |||||||||||||||||

|

|

9/7/2011 | 4/6/2012 | 7.930% | 3,166,000 | - | 3,166,000 | 11,693 | 3,177,693 | |||||||||||||||||

|

|

9/19/2011 | 9/18/2012 | 6.560% | 3,166,000 | - | 3,166,000 | 102,991 | 3,268,991 | |||||||||||||||||

|

|

9/20/2011 | 9/19/2012 | 7.216% | 3,166,000 | - | 3,166,000 | 113,916 | 3,279,916 | |||||||||||||||||

|

|

10/8/2011 | 10/7/2012 | 8.420% | 791,500 | - | 791,500 | 36,517 | 828,017 | |||||||||||||||||

|

|

10/27/2011 | 10/26/2012 | 6.560% | 3,166,000 | - | 3,166,000 | 124,614 | 3,290,614 | |||||||||||||||||

|

|

11/25/2011 | 11/24/2012 | 6.560% | 3,166,000 | - | 3,166,000 | 140,546 | 3,306,546 | |||||||||||||||||

|

|

12/22/2011 | 12/21/2012 | 6.560% | 3,166,000 | - | 3,166,000 | 156,478 | 3,322,478 | |||||||||||||||||

|

|

1/12/2012 | 1/11/2013 | 6.588% | 7,915,000 | - | 7,915,000 | 422,867 | 8,337,867 | |||||||||||||||||

|

|

2/29/2012 | 8/9/2012 | 0% | 791,500 | - | 791,500 | - | 791,500 | |||||||||||||||||

|

|

3/6/2012 | 3/5/2013 | 7.216% | 2,057,900 | - | 2,057,900 | 142,395 | 2,200,295 | |||||||||||||||||

|

|

$ | 44,719,750 | $ | - | $ | 44,719,750 | $ | 1,849,091 | $ | 46,568,841 |

Notes:-

| i) |

To maintain a good relationship with the local government of Gongyi City, the Company has been so requested to act as guarantor for bank loans granted to certain local government authorities and their controlled entity. | |

| ii) |

During the period, the Company has acted as guarantor for bank loans and bank acceptance bill granted to certain business associates. Certain of these associates also provided guarantees for bank loans to the Company (Note 13). None of our directors, director nominees or executive officers is involved in normal operation or investing in the business of the guaranteed business associates. All the business associates have a healthy record to pay back loans and bank acceptance bill on a timely manner, in the People’s Bank of China’s (Central Bank of China) credit rating system. |

|

All the above guarantees have no recourse provision that would enable the Company to recover from third parties of any amounts paid under the guarantees and any assets held either as collateral or by third parties that the Company can obtain or liquidate to recover all or a portion of the amounts paid under the guarantees. | ||

|

If the third parties fail to perform under their contractual obligation, the Company will make future payments including the contractual principal amounts, related interest and penalties. | ||

| (c) |

As of March 31, 2012, the Company had capital commitments of $1,160,627 in respect of the acquisition of land use right; $1,221,424 in respect of the construction of new office buildings and workshops; and $551,014 in respect of the purchase of machinery, which were not contracted for and provided in these financial statements. |

19

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 18. |

Commitments and contingencies (Cont’d) | |

| (d) |

In accordance with the PRC tax regulations, the Company’s sales are subject to value added tax (“VAT”) at 17% upon the issuance of VAT invoices to its customers. When preparing these condensed consolidated financial statements, the Company recognized revenue when the significant risks and rewards of ownership have been transferred to the buyer at the time when the products are delivered to and accepted by customers, and made full tax provision in accordance with relevant national and local laws and regulations of the PRC. | |

|

The Company follows the practice of reporting its revenue for PRC tax purposes when invoices are issued. In the local statutory financial statements prepared under PRC GAAP, the Company recognized revenue on an “invoice basis” instead of when the significant risks and rewards of ownership have been transferred to the buyer at the time when the products are delivered to and accepted by customers. Accordingly, despite the fact that the Company has made full tax provision in the condensed consolidated financial statements, the Company may be subject to a penalty for the deferred reporting of tax obligations. The exact amount of penalty cannot be estimated with any reasonable degree of certainty. The management considers it is very unlikely that the tax penalty will be imposed. | ||

| 19. |

Defined contribution plan | |

|

The Company has a defined contribution plan for all qualified employees in the PRC. The employer and its employees are each required to make contributions to the plan at the rates specified in the plan. The only obligation of the Company with respect to the retirement plan is to make the required contributions under the plan. No forfeited contribution is available to reduce the contribution payable in the future years. The defined contribution plan contributions were charged to the condensed consolidated statements of operations and comprehensive loss. The Company contributed $124,491 and $94,997 for the three months ended March 31, 2012 and 2011, respectively. | ||

| 20. |

Segment information | |

|

The Company uses the “management approach” in determining reportable operating segments. The management approach considers the internal organization and reporting used by the Company’s chief operating decision maker for making operating decisions and assessing performance as the source for determining the Company’s reportable segments. Management, including the chief operating decision maker, reviews operating results solely by the revenue of monolithic refractory products, industrial ceramic products, fracture proppant products, fine precision abrasives and operating results of the Company. As such, the Company has determined that it has four operating segments as defined by ASC 280, “Segment Reporting”: refractories, industrial ceramic, fracture proppant and fine precision abrasives. | ||

|

Adjustments and eliminations of inter-company transactions were not included in determining segment (loss) profit, as they are not used by the chief operating decision maker. | ||

|

Three months ended March 31, (Unaudited) | ||

| Refractories | Industrial ceramic | Fracture proppant | Fine precision abrasives | Total | |||||||||||||||||||||||||||

| 2012 | 2011 | 2012 | 2011 | 2012 | 2011 | 2012 | 2011 | 2012 | 2011 | ||||||||||||||||||||||

|

Revenue from external customers |

$ | 9,941,627 | $ | 9,934,926 | $ | 331,279 | $ | 229,602 | $ | 998,345 | $ | 5,199,855 | $ | 2,439,412 | $ | 819,446 | $ | 13,710,663 | $ | 16,183,829 | |||||||||||

|

|

|||||||||||||||||||||||||||||||

|

Segment (loss) profit |

$ | (1,065,528 | ) | $ | (553,787 | ) | $ | (350,970 | ) | $ | (54,839 | ) | $ | (529,074 | ) | $ | 560,268 | $ | (839,560 | ) | $ | (157,209 | ) | $ | (2,785,132 | ) | $ | (205,567 | ) | ||

|

|

As of | As of | As of | As of | As of | As of | As of | As of | As of | As of | |||||||||||||||||||||

|

|

March 31, | December | March 31, | December | March 31, | December | March 31, | December | March 31, | December | |||||||||||||||||||||

|

|

2012 | 31, 2011 | 2012 | 31, 2011 | 2012 | 31, 2011 | 2012 | 31, 2011 | 2012 | 31, 2011 | |||||||||||||||||||||

|

|

(Unaudited) | (Audited) | (Unaudited) | (Audited) | (Unaudited) | (Audited) | (Unaudited) | (Audited) | (Unaudited) | (Audited) | |||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

Segment assets |

$ | 88,496,600 | $ | 82,480,900 | $ | 3,423,962 | $ | 3,677,127 | $ | 39,680,944 | $ | 32,048,852 | $ | 33,044,145 | $ | 26,954,762 | $ | 164,645,651 | $ | 145,161,641 |

20

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 20. |

Segment information (Cont’d) |

|

Segment information by products for the three months ended March 31, 2012 and 2011 |

| Fine | ||||||||||||||||||||||||||||

| Monolithic | Pre-cast | Ceramic | Ceramic | Wearable | Fracture | precision | ||||||||||||||||||||||

| materials1 | Mortar | roofs | tubes2 | cylinders3 | ceramic valves | proppant | abrasives | Total | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Three months ended March 31, 2012 (Unaudited) |

||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Revenue |

$ | 5,813,991 | $ | 26,790 | $ | 4,100,846 | $ | 316,635 | $ | 8,620 | $ | 6,024 | $ | 998,345 | $ | 2,439,412 | $ | 13,710,663 | ||||||||||

|

|

||||||||||||||||||||||||||||

|

Three months ended March 31, 2011 (Unaudited) |

||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Revenue |

$ | 5,296,790 | $ | - | $ | 4,638,135 | $ | - | $ | 224,856 | $ | 4,747 | $ | 5,199,855 | $ | 819,446 | $ | 16,183,829 | ||||||||||

1 Castable, coating, and dry

mix materials & low-cement and non-cement castables generally refer as

Monolithic materials.

2 Ceramic plates, tubes, elbows, and

rollers generally refer as Ceramic tubes.

3 Ceramic cylindsers and

plugs comprehensively refer to Ceramic cylinders.

Reconciliation is provided for unallocated amounts relating to corporate operations which are not included in the segment information.

| Three months ended March 31, | |||||||

| (Unaudited) | |||||||

|

|

2012 | 2011 | |||||

|

|

|||||||

|

Total consolidated revenue |

$ | 13,710,663 | $ | 16,183,829 | |||

|

|

|||||||

|

Total loss for reportable segments |

$ | (2,785,132 | ) | $ | (205,567 | ) | |

|

Unallocated amounts relating to operations: |

|||||||

|

General and administrative expenses |

(152,963 | ) | (4,047 | ) | |||

|

Other income |

162 | 260,000 | |||||

|

|

|||||||

|

(Loss) income before income taxes and noncontrolling interest |

$ | (2,937,933 | ) | $ | 50,386 | ||

21

China GengSheng Minerals, Inc.

Notes to Condensed

Consolidated Financial Statements

| 20. |

Segment information (Cont’d) |

| As of | As of | ||||||

| March 31, | December 31, | ||||||

| 2012 | 2011 | ||||||

| (Unaudited) | (Audited) | ||||||

|

Assets |

|||||||

|

|

|||||||

|

Total assets for reportable segments |

$ | 164,645,651 | $ | 145,161,641 | |||

|

Other receivables |

1,339,345 | 430,558 | |||||

|

Cash and cash equivalents |

1,520,635 | 2,377,587 | |||||

|

|

|||||||

|

|

$ | 167,505,631 | $ | 147,969,786 |

All of the Company’s long-lived assets are located in the PRC. Geographic information about the revenues, which are classified based on customers, is set out as follows:

| Three months ended March 31, | |||||||

| (Unaudited) | |||||||

| 2012 | 2011 | ||||||

| PRC | $ | 13,434,453 | $ | 13,250,099 | |||

| United States | 24,523 | 2,729,101 | |||||

| Others | 251,687 | 204,629 | |||||

| Total | $ | 13,710,663 | $ | 16,183,829 | |||

| 21. |

Related party transactions |

|

Apart from the information as disclosed in elsewhere in the condensed consolidated financial statements, the Company had no material transactions carried out with related parties during the reporting periods. | |

| 22. |

2011 Stock Incentive Plan (the “2011 Plan”) |

|

At the annual meeting of stockholders of the Company held on September 28, 2011, the Company’s stockholders approved the 2011 Plan. The 2011 Plan authorized the Company to grant equity awards to directors, employees (including executive officers), consultants and other service providers, as more fully described and summarized in the Company’s Proxy Statement, which was included in the Schedule 14A filed with the Securities and Exchange Commission on August 15, 2011. | |

| 23. |

Subsequent events |

|

The Company evaluated all events or transactions that occurred through the date the condensed consolidated financial statements were issued and determined that, except for the transactions described below, there were no material recognizable or subsequent events or transactions which would require recognition or disclosure in the condensed consolidated financial statements. | |

|

As of April 5, 2012, Yili YiQiang Silicon Limited ("Yili") held a shareholders’ meeting to approve the transfer of 24.5% equity interest in Yili. Yili is applying for the revision of registration documents from the local government entity and the acquisition of Yili is expected to be completed by May 2012 upon the government entity’s approval. Other details of the acquisition of Yili is set out in note 9 to the condensed consolidated financial statement. |

22

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Forward-Looking Statements:

The following discussion of the financial condition and results of operations should be read in conjunction with the consolidated financial statements and related notes thereto. The following discussion contains forward-looking statements. Unless the context requires otherwise, references to “we”, “us”, “our”, “the Registrant”, or the “Company” refer to China GengSheng Minerals, Inc. and its subsidiaries. The words or phrases “would be,” “will allow,” “expect to,” “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” or similar expressions are intended to identify forward-looking statements. Such statements include those concerning our expected financial performance, our corporate strategy and operational plans. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties, including: (a) those risks and uncertainties related to general economic conditions in China, including regulatory factors that may affect such economic conditions; (b) whether we are able to manage our planned growth efficiently and operate profitable operations, including whether our management will be able to identify, hire, train, retain, motivate and manage required personnel or that management will be able to successfully manage and exploit existing and potential market opportunities; (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations; and (d) whether we are able to successfully fulfill our primary requirements for cash which are explained below under “Liquidity and Capital Resources.” Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim any obligation, to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

Conventions

In this Form 10-Q, unless indicated otherwise, references to:

-

“China GengSheng Minerals”, “we”, “us”, “our”, the “Registrant” or the “Company” refer to the combined business of China GengSheng Minerals, Inc., a Nevada corporation (formerly, China Minerals Technologies, Inc.) and its wholly-owned BVI subsidiary, GengSheng International Corporation, or GengSheng International, and GengSheng International’s wholly-owned Chinese subsidiary, Zhengzhou Duesail Fracture Proppant Co. Ltd., or Duesail, and Duesail’s wholly-owned subsidiary, Henan Yuxing Proppant Co., Ltd., or Yuxing and GengSheng International’s wholly-owned Chinese subsidiary, Henan GengSheng Refractories Co., Ltd., or Refractories, and Refractories’s majority-owned subsidiary, Henan GengSheng High-Temperature Materials Co., Ltd., or High Temperature, and Refractories’s wholly-owned subsidiary, Henan GengSheng Micronized Powder Materials Co., Ltd., or Micronized, and Henan GengSheng’s wholly-owned subsidiary, GengSheng Shunda New Materials Co., Ltd, Southeast Prefecture, Guizhou or Shunda;

-

“Powersmart” or “GengSheng International” refer to GengSheng International Corporation, a BVI company (formerly, Powersmart Holdings Limited) that is wholly-owned by China GengSheng Minerals;

-

“Securities Act” refers to the Securities Act of 1933, as amended, and “Exchange Act” refer to Securities Exchange Act of 1934, as amended;

-

“China” and “PRC” refer to the People’s Republic of China, and “BVI” refers to the British Virgin Islands;

-

“RMB” refers to Renminbi, the legal currency of China; and

-

“U.S. dollar,” “$” and “US$” refers to the legal currency of the United States. For all U.S. dollar amounts reported, the dollar amount has been calculated on the basis that RMB1 = $0.1574 for its December 31, 2011 audited balance sheet, and RMB1 = $0.1583 for its March 31, 2012 unaudited balance sheet, which were determined based on the currency conversion rate at the end of each respective period. The conversion rates of RMB1 = $0.1585 is used for the condensed consolidated statement of income and comprehensive income and consolidated statement of cash flows for the first quarter of 2012, and RMB1 = $0.1522 is used for the condensed consolidated statement of income and comprehensive income and consolidated statement of cash flows for the first quarter of 2011; both of which were based on the average currency conversion rate for each respective quarter.

Overview of Company

We are a Nevada holding company operating in the materials technology industry through our subsidiaries in China. We develop, manufacture and sell a broad range of mineral-based, heat-resistant products capable of withstanding high temperatures, saving energy and boosting productivity in industries such as steel and oil. Our products include refractory products, industrial ceramics, fracture proppants and fine precision abrasives.

Currently, we conduct our operations in China through our wholly owned subsidiaries, Henan GengSheng Refractories Co., Ltd. (“Refractories”), Zhengzhou Duesail Fracture Proppant Co., Ltd. (“Duesail”), Henan GengSheng Micronized Powder Materials Co., Ltd. (“Micronized”), Guizhou Southeast Prefecture GengSheng New Materials Co., Ltd. (“Prefecture”) and Henan Yuxing Proppant Co., Ltd., (“Yuxing”), and through our majority owned subsidiary, Henan GengSheng High-Temperature Materials Co., Ltd. (“High-Temperature”).

23

Through our wholly owned BVI subsidiary, GengSheng International, and its wholly owned Chinese subsidiary, Refractories, which has an annual production capacity of approximately 127,000 tons, we manufacture refractories products. We manufacture fracture proppant products through Duesail, which has an annual production capacity of approximately 66,000 tons, and Yuxing, which has designed annual production capacity of approximately 60,000 tons. We manufacture fine precision abrasives products through Micronized, which has designed annual production capacity of approximately 22,000 tons. Through our majority owned subsidiary, High-Temperature, which has an annual production capacity of approximately 150,000 units, we manufacture industrial and functional ceramic products.

We sell our products to over 170 customers in the iron, steel, oil, glass, cement, aluminum, chemical and solar industries located in China and other countries in Asia, Europe and North America. Our refractory customers are companies in the steel, iron, petroleum, chemical, coal, glass and mining industries. Our fracture proppant products are sold to oil and gas companies. Our industrial ceramics are used in the utilities and petrochemical industries. Our fine precision abrasives are marketed to solar companies and optical equipment manufacturers. Our largest customers, measured by percentage of our revenue, mainly operate in the steel industry and oil industry. Currently, most of our revenues are derived from the sale of our monolithic refractory products and fracture proppants products to customers in China and in the United States.

Our principal executive offices are located at No. 88 Gengsheng Road, Dayugou Town, Gongyi, Henan, People’s Republic of China 451271 and our telephone number is (86) 371-6405-9818.

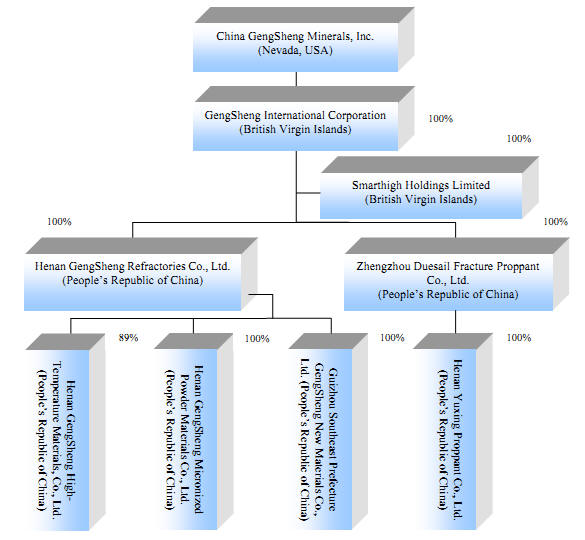

Corporate Structure

We conduct our operations in China through our wholly owned subsidiaries Refractories, Duesail, Yuxing, Micronized and Prefecture and through our majority owned subsidiary, High-Temperature.

The following chart reflects our organizational structure as of the date of this report.

24

Corporate History

We were originally incorporated under the laws of the State of Washington, on November 13, 1947, under the name Silver Mountain Mining Company. From our inception until 2001, we operated various unpatented mining claims and deeded mineral rights in the State of Washington, but we abandoned these operations entirely by 2001. On August 15, 2006, we changed our domicile from Washington to Nevada when we merged with and into Point Acquisition Corporation, a Nevada corporation. From about 2001 until our reverse acquisition of Powersmart on April 25, 2007, which is discussed in the next section entitled "Acquisition of Powersmart and Related Financing", we were a blank check company and had no active business operations. On June 11, 2007, we changed our corporate name from "Point Acquisition Corporation" to "China Minerals Technologies, Inc." and subsequently changed our name again to "China GengSheng Minerals, Inc." on July 26, 2007.

Acquisition of Powersmart and Related Financing