Attached files

| file | filename |

|---|---|

| 8-K - MTS SYSTEMS CORPORATION 8-K 12-28-2010 - MTS SYSTEMS CORP | form8k.htm |

MTS SYSTEMS CORPORATION 2010 ANNUAL REPORT

The MTS position is strong. Our assumptions and strategy served us well through the downturn, and our long-term focus has allowed us to stay consistent in our approach. Now we are forging ahead to capitalize on what’s next, applying our unique vision and capabilities to help MTS customers, employees and shareholders succeed. thinking ahead. MTS remains at the forefront of industries such as wind, rail and high-temperature materials science, with an established and expanding presence in both emerging and existing markets. moving ahead. We continue to capture new market share in Sensors through improved performance and reduced costs, and in Test by extending our application expertise to customers, with a growing presence in China. staying ahead. MTS 2010 financial performance exceeded our expectations in both Sensors and Test, and we feel positive about our potential in the months and years to come.

financial highlights (Expressed in thousands, except per share and percent data) Revenue $ 408,881 $ 374,053 Net income $ 17,394 $ 18,576 Earnings per share, diluted $ 1.03 $ 1.14 Cash provided by operating activities $ 43,838 $ 33,190 Return on sales 4.3% 5.0% Return on invested capital 7.9% 8.7% Dividends per share $ 0.60 $ 0.60 Weighted average shares outstanding, diluted 16,831 16,347 Orders $ 340,839 $ 423,525 Backlog of orders at year-end $ 167,726 $ 214,330 geographic revenue 2009 2010 SENSORS Americas 29% 30% Europe 49% 45% Asia 22% 25% TEST Americas 36% 33% Europe 28% 26% Asia 36% 41% Orders Revenue Net Income Debt Cash(3) 2008 2009 2010 Backlog Diluted EPS Return on Invested Capital $500M 400 300 200 100 0 $500M 400 300 200 100 0 $250M 200 150 100 0 $50M 40 30 20 10 0 $200M 150 100 50 0 $40M 30 20 10 0 $3.00 2.25 1.50 .75 0 25% 20 15 10 5 0 2008 2009 2010 2008 2009 2010 2008 2009 2010 2008 2009 2010 2008 2009 2010 2008 2009 2010 2008 2009 2010 (1) Includes severance impact of $8.0M in net income $0.48 earnings per share. (2) Includes legal settlement charge impact of $3.9M in net income & $0.24 earnings per share. (3) Cash, cash equivalents and short-term investments.

Less fuel, lower emissions. Even modest improvements in jet engine fuel-efficiency can save millions of dollars over time. We are currently helping the world’s leading aerospace companies develop new engines that operate reliably at higher temperatures, resulting in dramatically improved fuel and emissions performance.

to our shareholders MTS had a good year. With the first full year of recovery behind us, our 2010 performance was proof that our commitment to executing our strategy, in good times and in bad, pays off. Our work over the last several years, to further position MTS in high-opportunity geographies and applications, was instrumental in navigating this initial stretch of economic recovery. It also positions us well for the future. MTS employees saw us through the challenges of the recession and captured the opportunities of the recovery. By asking the best questions and listening carefully to the answers, MTS employees worked to deliver Best Total Value as defined by our customers. By better understanding their changing needs, we helped our customers improve manufacturing precision for advanced medical equipment, develop wind turbine blade and drivetrain test methods, and enable the next generation of gas turbine engines. Through our work with customers, we achieved nearly 25% year-over-year growth in orders. Our Sensors business is the lead story for 2010. Frankly, Sensors had an outstanding year. As our customers’ businesses improved, we responded quickly to demands for short delivery schedules and requests to quickly move development projects into production. As a result, order volume returned to 90 percent of the pre-recession peak. We worked through industry-wide supply issues to deliver a 17 percent increase in revenue with operating margin in excess of 20 percent. At the same time, we invested in market development to understand how we can better position ourselves for the future. Our Test business performance was very respectable considering a 30 percent lower beginning backlog. As customers increased R&D investment in key markets and geographies, we captured a considerable portion of the opportunity. Strong orders in 2010 helped to partially offset the backlog-driven revenue decline. We tightly managed costs while maintaining critical investments as we profitably worked through this difficult revenue trough. We delivered on our commitments. We have learned that the most difficult challenges push us to improve in ways we did not imagine were possible. It is clear today that there is more opportunity for us ahead. Visit www.MTS.com/AR10/CEO.HTML to watch brief videos of CEO Laura B. Hamilton discussing MTS.

Exciting new applications for MTS sensors. We are currently supporting the Italian government with its launch of the Venice Tide Barrier Project, scheduled for completion in 2014. To protect the historic city of Venice from flooding, gates will automatically dam the main outlet to the Adriatic Sea whenever water levels reach a certain threshold.

Looking ahead We expect the global economic recovery to continue to be long and somewhat inconsistent, and we intend to stay flexible, responsive and long-sighted in response. The macro trends of globalization, energy and the environment, together with the recession’s impact on business competitiveness, continue to inform our strategy and growth opportunities. Today, our customers are driving better automation and faster product development in response to these trends. We see opportunity to help our customers successfully move ahead. Our plans for the future start with our two business strategies. In Sensors, we continue to aggressively improve performance while reducing cost, which enables us to access an ever-greater portion of the market. Through our applications strength, machine builders around the world can enhance the efficiency of their equipment and reduce total cost of ownership for their customers. In Test, our industry-leading applications knowledge and real-life simulation expertise, combined with a more competitive cost position, enables us to serve a diverse set of customers globally. As our customers push higher-performing products, from higher-temperature materials to faster trains, we help them build their confidence. To accelerate our growth beyond our core strategies, we focus on a few key opportunities with China being the near-term priority. Our success in China over the last several years positions us well as we aggressively expand our capabilities to meet the needs of this rapidly growing and changing market. We are also well positioned in the emerging areas of wind and mobile hydraulics — two great examples of market development opportunities for MTS. And finally, we are building service delivery capabilities, laying the foundation for the lifecycle opportunity we see ahead. Our intent to secure the next 40 years guides us to great performance as measured by customers, employees and shareholders. We strive to maintain our market leadership position, to attract and retain outstanding employees and to achieve top-quartile financial performance over 10 years. This is no small task in today’s business environment, but we move confidently ahead. Laura B. Hamilton Chief Executive Officer and Chair MTS 2010 Highlights SENSORS » Ramped up capacity to meet increased demand » Overcame industry-wide supply issues » Redesigned Temposonics® E-Series™ sensors family to serve a broader range of customers » Increased China coverage, directly and through distribution » Restored mobile hydraulics and industrial new-customer acquisitions to pre-recession levels TEST » Developed wind turbine blade, drivetrain and bearing offerings » Continued rail market development, especially in China » Implemented new cost-reduction initiatives to ensure cost competitiveness » Enhanced automotive tire testing capabilities » Launched expanded MTS TestSuite™ software platform and MTS Criterion™ test systems

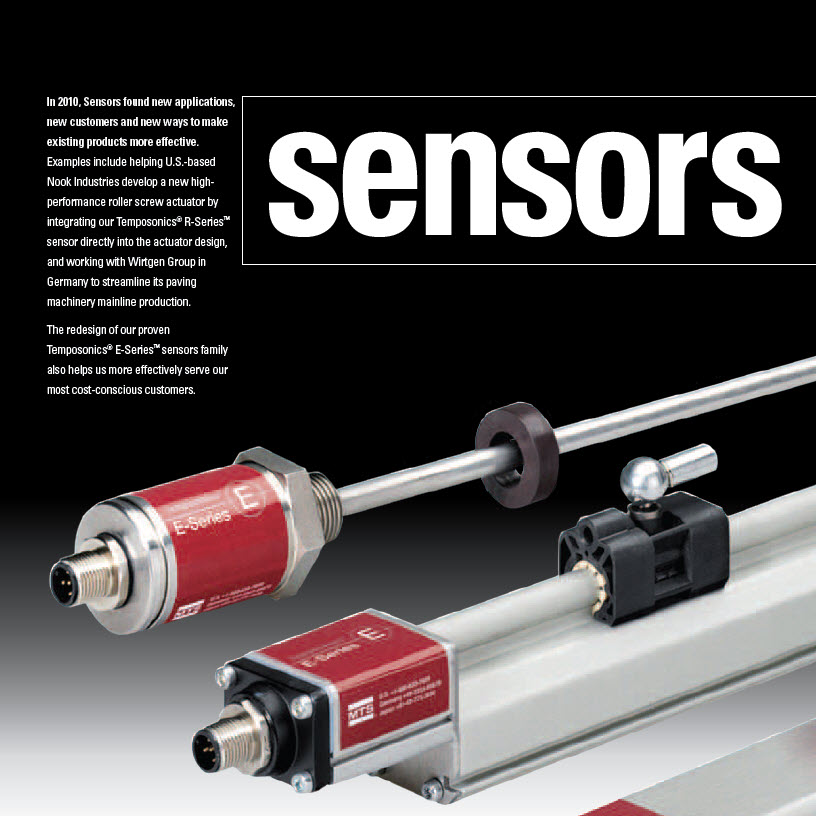

In 2010, Sensors found new applications, new customers and new ways to make existing products more effective. Examples include helping U.S.-based Nook Industries develop a new high-performance roller screw actuator by integrating our Temposonics® R-Series™ sensor directly into the actuator design, and working with Wirtgen Group in Germany to streamline its paving machinery mainline production. The redesign of our proven Temposonics® E-Series™ sensors family also helps us more effectively serve our most cost-conscious customers.

Highly precise and durable MTS position sensors allow fixed and mobile equipment manufacturers to automate their machine functions. Leveraging exclusive magnetostrictive technology, our sensors facilitate high levels of manufacturing speed, safety and efficiency. MTS sensors are also valued for their affordable cost. Together with our applications support, we help machine builders around the world in steel, plastics and energy production improve the productivity of their machines and reduce total cost of ownership for their customers. $20M 15 10 5 0 2008 2009 2010 INCOME FROM OPERATIONS $ millions $100M 75 50 25 0 2008 2009 2010 REVENUE $ millions $100M 75 50 25 0 2008 2009 2010 ORDERS $ millions 25% 20 15 10 5 0 2008 2009 2010 INCOME FROM OPERATIONS as percent of revenue KEY CuSTOMERS Industrial: Bosch Rexroth, Parker Hannifin, Festo, Eaton, Siemens, GE Automation, Husky Injection Molding Systems, Stryker, Krones Mobile Hydraulics: Caterpillar, Wirtgen Group, John Deere, CNH, Claas, AGCO Company, Hiab, Harsco Rail INDuSTRIES » Fluid power » Fuel storage » Medical products » Metals » Mobile equipment » Plastics » Wind and clean energy » Wood processing MTS ADVANTAGES » Exclusive technologies in magnetostriction sensing » unrivaled application expertise » Worldwide service and consultation

We’re investing to meet new material testing needs driven by the macro trends of energy, the environment and globalization. During 2010, we leveraged our unique position and history to expand the MTS TestSuite™ software portfolio, enabling our customers to enhance productivity and support new applications. We also applied our success in China and our strengths in controls and software to create the MTS Criterion™ test systems line, helping us to capture more business in China and in emerging markets. With these introductions, MTS is well equipped to support a broad array of material testing needs, including continuing to support the ever-expanding quest for knowledge in global materials research and development.

Test and product development professionals rely on MTS expertise and technology to optimize their designs, improve productivity and reduce time to market. Our integrated solutions are globally recognized for enabling the efficient characterization of materials, components, subsystems, full-scale prototypes and finished goods. The comprehensive MTS offering of testing hardware, software and global support includes both standard tools and custom solutions, which are used worldwide by customers ranging from suppliers and researchers to large-scale and high-volume manufacturers. 12% 9 6 3 0 2008 2009 2010 INCOME FROM OPERATIONS as percent of revenue $40M 30 20 10 0 2008 2009 2010 INCOME FROM OPERATIONS $ millions $400M 300 200 100 0 2008 2009 2010 REVENUE $ millions $400M 300 200 100 0 2008 2009 2010 ORDERS $ millions KEY CuSTOMERS STRuCTuRES: Airbus, Boeing, Embraer, Honda Aircraft, IMA, Lockheed Martin, NREL, Sandia National Labs, Sikorsky Helicopter, Taiwan National Center of Research for Earthquake Engineering, uCSD, Vestas MATERIALS: Bell Helicopters, Boston Scientific, CEAT, DePuy, GE Engines, Japan National Research Institute, Medtronic, NASA, Pratt & Whitney, Rolls-Royce Aero Engines, Raytheon, Stryker, Synthes, Zimmer GROuND VEHICLES: Arvin-Meritor, Audi, BMW, Bridgestone, China Academy of Railway Sciences, Chery, CSR Sifang Locomotive, Daimler, Delphi, Ferrari, Ford, General Motors, Goodyear, Honda, Hyundai, Nissan, Renault, Toyota, TRW, Volkswagen, Volvo INDuSTRIES » Aerospace » Automotive » Biomedical » Geomechanical, civil and seismic engineering » Materials sciences » Rail » Renewable energy MTS ADVANTAGES » Application knowledge » Technology leadership » Comprehensive offerings » Worldwide service and consultation

Board of Directors Laura B. Hamilton Chief Executive Officer and Chair MTS Systems Corporation David J. Anderson Retired Former President and CEO Executive Director and Co-Vice Chair Sauer-Danfoss Inc. Jean-Lou Chameau President California Institute of Technology Brendan C. Hegarty Retired Former Chief Executive Officer NanoMagnetics Emily M. Liggett President and Chief Executive Officer NovaTorque William V. Murray Consultant Former President and Chief Executive Officer ReShape Medical, Inc. Barb J. Samardzich Vice President Global Products Programs Ford Motor Company Gail P. Steinel President and Owner Executive Advisors Notice of Annual Meeting The annual meeting of shareholders will be held at 3:00 p.m. (Central Standard Time) on Wednesday, February 9, 2011, at the Company’s headquarters in Eden Prairie, Minnesota. Shareholders who cannot attend the meeting are urged to exercise their right to vote by proxy via the mail, phone or internet. Executive Management Laura B. Hamilton Chief Executive Officer and Chair Joachim Hellwig Vice President Sensors Susan E. Knight Vice President Chief Financial Officer Kathleen M. Staby Vice President Human Resources and Strategy Corporate Officers Bruce W. Mooty Corporate Secretary Shareholder, Gray Plant Mooty Mooty & Bennett, PA Michael J. Hoff Assistant Corporate Secretary Andrew J. Cebulla Treasurer and Corporate Controller Investor Relations Susan E. Knight Chief Financial Officer MTS Systems Corporation 14000 Technology Drive Eden Prairie, Minnesota 55344-2290 Telephone: 952-937-4005 Email: sue.knight@mts.com Stock Transfer Wells Fargo Shareowner Services Phone: 800.401.1957 www.shareowneronline.com Dividend Reinvestment Plan Shareholders may invest MTS dividends and purchase additional shares of MTS common stock. Shareholders may obtain further details by calling Wells Fargo Shareowner Services at 800-468-9716. Trademarks MTS and MTS logo are registered trademarks of MTS Systems Corporation. Common Stock MTS’ common stock publicly trades on the NASDAq Global Select MarketSM under the symbol MTSC. Corporate Headquarters MTS Systems Corporation 14000 Technology Drive Eden Prairie, Minnesota 55344-2290 Telephone: 952-937-4000 info@mts.com www.mts.com North American Subsidiaries MTS Testing Systems (Canada) Ltd. European Subsidiaries MTS Automotive Sensors GmbH MTS Holdings France, SARL MTS Sensor Technologie und Verwaltungs - GmbH MTS Sensor Technologie GmbH and Co. KG MTS Systems SAS MTS Systems GmbH MTS Systems Ltd. MTS Systems Norden AB MTS Systems srl MTS System Switzerland GmbH Asian Subsidiaries MTS Japan Ltd. MTS Korea, Inc. MTS Sensors Technology K.K. MTS Systems (China), Inc. MTS Systems (Hong Kong), Inc. MTS Systems (China) Co., Ltd. corporate information Visit www.mts.com/AR10/CEO.html to watch a brief video of CEO Laura B. Hamilton discussing MTS and its opportunities. 100-236-225 PRINTED IN THE u.S.A. 12 10 ©2010 MTS SYSTEMS CORPORATION