Attached files

| file | filename |

|---|---|

| EX-21 - SUBSIDIARIES OF THE REGISTRANT - MTS SYSTEMS CORP | mts154085_ex21.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - MTS SYSTEMS CORP | mts154085_ex31-1.htm |

| EX-32.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 906 - MTS SYSTEMS CORP | mts154085_ex32-1.htm |

| EX-32.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 906 - MTS SYSTEMS CORP | mts154085_ex32-2.htm |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - MTS SYSTEMS CORP | mts154085_ex31-2.htm |

| EX-10.16 - UNIFORM TERMS AND CONDITIONS - MTS SYSTEMS CORP | mts154085_ex10-16.htm |

| EX-10.17 - FORM OF NOTICE OF GRANT PERFORMANCE - MTS SYSTEMS CORP | mts154085_ex10-17.htm |

| EX-23 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - MTS SYSTEMS CORP | mts154085_ex23.htm |

MTS Systems Corporation

Annual Report on Form 10-K

For the Fiscal Year Ended October 3, 2015

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended October 3, 2015

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from _____________ to ______________

Commission File No. 0-2382

MTS SYSTEMS CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| Minnesota | 41-0908057 |

|

(State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification No.) |

|

14000 Technology Drive Eden Prairie, Minnesota |

55344 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (952) 937-4000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, $0.25 par value |

The NASDAQ Stock Market LLC (NASDAQ Global Select Market)

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of March 28, 2015 was approximately $1.1 billion based on the closing price of $74.30 as reported on the NASDAQ.

As of November 30, 2015, there were 14,835,161 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of MTS System Corporation’s definitive Proxy Statement (to be filed pursuant to Regulations 14A within 120 days after the end of the fiscal year ended October 3, 2015) for its annual shareholders’ meeting to be held February 9, 2016 are incorporated by reference into Part III of this Form 10-K to the extent described in such Part.

Annual Report on Form 10-K

For the Year Ended October 3, 2015

Business Overview

MTS Systems Corporation (the Company or MTS) is a leading global supplier of high-performance test systems and position sensors that was incorporated under Minnesota law in 1966. Our operations are organized and managed in two reportable segments, Test and Sensors, based upon global similarities within their markets, products, operations and distribution. The Test and Sensors segments represented approximately 82% and 18% of our revenue, respectively, for the fiscal year ended October 3, 2015.

Terms

When we use the terms “we,” “us,” the “Company” or “our” in this report, unless the context otherwise requires, we are referring to MTS Systems Corporation.

Fiscal year 2015 refers to the fiscal year ended October 3, 2015; fiscal year 2014 refers to the fiscal year ended September 27, 2014; and fiscal year 2013 refers to the fiscal year ended September 28, 2013. Fiscal years 2015, 2014 and 2013 include 53, 52 and 52 weeks, respectively. All dollar amounts are in thousands (unless otherwise noted).

Products and Markets by Business Segment

Test Segment

Our Test segment (Test) provides testing solutions including hardware, software and services. The testing solutions are used by customers in the development of products to characterize the product’s mechanical properties. Our solutions simulate forces and motions that customers expect their products to encounter in use. Mechanical simulation testing in a lab setting is an accepted method to accelerate product development compared to reliance on full physical prototypes in real-world settings, proving ground testing and virtual testing because it provides more controlled simulation and accurate measurement. The need for mechanical simulation increases in proportion to the cost of a product, the range and complexity of the physical environment in which the product will be used, expected warranty or recall risk and expense, governmental regulation and potential legal liability. A significant portion of the products in Test are considered by our customers to be capital expenditures. We believe the timing of purchases may be impacted by interest rates, general economic conditions, product development cycles and new product initiatives.

A typical Test system includes a reaction frame to hold the prototype specimen, a hydraulic pump or electro-mechanical power source, piston actuators to create the force or motion and a computer controller with specialized software to coordinate the actuator movement and record and manipulate results. Lower force and less dynamic testing can usually be accomplished with electro-mechanical power sources, which are generally less expensive than hydraulic systems. In addition to these basic components, we sell a variety of accessories and spare parts. We also provide a number of service offerings, including installation, calibration, maintenance, training and consulting.

Test has a diverse set of customers by industry and geography. Regionally, the Americas, Europe and Asia represented 25%, 21% and 54% of orders for fiscal year 2015, respectively, based upon customer location.

| 1 |

Products, service and customers are grouped into the following three global markets:

| · | Ground Vehicles (approximately 55% of Test orders for fiscal year 2015) |

This market consists of automobile, truck, motorcycle, motorsports vehicles, construction equipment, agricultural equipment, rail, and off-road vehicle manufacturers and their suppliers. Our products are used to measure and simulate solutions to assess durability, vehicle dynamics and aerodynamics of vehicles, sub-systems and components. Our products include:

| o | Road simulators for durability simulation; |

| o | Tire performance and rolling resistance measurement systems; |

| o | Moving road-plane systems and balances for aerodynamic measurements in wind tunnels; and |

| o | Service to maintain the equipment and maximize the life of the product. |

| · | Materials (approximately 30% of Test orders for fiscal year 2015) |

This market covers diverse industries such as power generation, aerospace, vehicles and bio-medical. Our products and services support customers in the research and development of products through the physical characterization of material properties, such as ceramics, composites and steel. Bio-medical applications include systems to test durability and performance of implants, prostheses and other medical and dental materials and devices.

| · | Structures (approximately 15% of Test orders for fiscal year 2015) |

This market serves the structural testing needs and service in the fields of aerospace, wind energy, oil and gas, and structural engineering, among others. The aerospace structural testing market consists of manufacturers of commercial, military, and private aircraft and their suppliers that use our products, systems and software to perform static and fatigue testing of aircraft and space vehicles. The wind energy market consists of wind turbine manufacturers and their component suppliers that use our products to reduce the cost and improve the reliability of blades, bearings and entire wind turbines. Systems for structural engineering include high force static and dynamic testing, as well as seismic simulation tables used around the world to test the design of structures, such as bridges and buildings, and to help governments establish building codes. Structural engineering customers include construction companies, government agencies, universities and the manufacturers of building materials.

Sensors Segment

Our Sensors segment (Sensors) products are used by industrial machinery and mobile equipment manufacturers to automate the operation of their products for improved safety and end-user productivity. Examples of customer industries include manufacturers of plastic injection molding machines, steel mills, fluid power, oil and gas, medical, wood product processing equipment, mobile equipment and energy. Our products are also used to measure fluid displacement, such as liquid levels for customers in the process industries.

Sensors manufactures products utilizing magnetostriction technology. We have developed a unique implementation of the technology known as Temposonics®. This technology offers high speed and precise non-contact position sensing and is ideal for use in harsh operating environments.

Sensors customers are also diverse by industry and geography. Regionally, the Americas, Europe and Asia represented 32%, 47% and 21% of orders for fiscal year 2015, respectively, based upon customer location.

| 2 |

Products and customers are grouped into the following three global markets:

| · | Industrial Machinery (approximately 80% of Sensors orders for fiscal year 2015) |

This market consists of a wide range of industrial machinery original equipment manufacturers (OEM’s) and their end use customers with applications in all areas of manufacturing, including plastics, steel, wood and other forms of factory automation. Temposonics sensors provide position feedback for motion control systems, improving productivity by enabling high levels of automation, as well as driving improved quality of manufactured parts. Temposonics technology is known for ruggedness in harsh manufacturing environments, which maximizes machine up-time and lowers overall manufacturing costs of our customers.

| · | Mobile Hydraulics (approximately 15% of Sensors orders for fiscal year 2015) |

This market consists of mobile equipment OEM’s with applications in construction, agriculture, material handling, mining and other heavy vehicle markets. Our sensors provide feedback for motion control and implement positioning, enabling improved productivity while also enhancing safe operation of the machines. The overall ruggedness and reliability of our technology in high shock and vibration applications makes it especially suitable to the market.

| · | Liquid Level (approximately 5% of Sensors orders for fiscal year 2015) |

This market encompasses a wide range of liquid level storage tank applications in oil and gas, chemical processing, food and beverage and pharmaceutical companies. Our technology provides precise measurements over long distances (tanks up to seventy feet long). Our sensors provide value by incorporating the measurement of the target liquid, a second measurement and temperature, all in a single package.

Financial and geographical information about our segments is included in Item 7 and Note 4 of the Notes to Consolidated Financial Statements under Item 8 of this Annual Report on Form 10-K.

Sales and Service

Test Segment

Test products are sold worldwide through a direct field sales and service organization, independent representatives and distributors and to a much lesser extent, through other means (e.g. catalogs, internet, etc.) for standard products and accessories. Direct field sales and service personnel are compensated through salary and order incentive programs. Independent representatives and distributors are either compensated through commissions based upon orders or discounts off list prices.

In addition to direct field sales and service personnel throughout the United States and China, we have sales and service subsidiaries in Toronto, Canada; Berlin, Germany; Paris, France; Guildford, United Kingdom; Turin, Italy; Gothenburg and Gislaved, Sweden; Chinchon, Spain; Tokyo and Nagoya, Japan; Seoul, South Korea; Moscow, Russia and Shanghai and Shenzhen, China.

In fiscal year 2015, Test product orders ranged in value from less than $1 to approximately $21,000 on a United States dollar-equivalent basis. The average order size was approximately $77. We also market services to customers on a per-call and contract basis, accounting for virtually all of our service revenue in the Consolidated Statements of Income for the fiscal years 2015, 2014 and 2013. Service orders in fiscal year 2015 ranged from less than $1 to over $1,275 on a United States dollar-equivalent basis.

| 3 |

The timing and volume of large orders valued at $5,000 or greater on a United States dollar-equivalent basis may produce volatility in orders, backlog and quarterly operating results. Most customer orders are based on fixed-price quotations and typically have an average sales cycle of three to nine months due to the technical nature of the test systems and customer capital expenditure approval processes. The sales cycle for larger, more complex test systems may be two years or longer.

Sensors Segment

Sensors products are sold worldwide through a direct sales organization as well as through independent distributors. The direct sales organization is compensated through salary and commissions based upon revenue. The independent distributors pay us a wholesale price and re-sell the product to their customers. Our products are sold at unit prices ranging from a few dollars to $15, with an average sales price of approximately $600 (in actual dollars) on a United States dollar-equivalent basis. While the average sales cycle for Sensors is approximately one week to one month for existing customers purchasing standard products, the sales cycle for a new account can range from three months to two years depending on customer testing and specification requirements.

Manufacturing and Engineering

Test Segment

Test systems are largely built to order and primarily engineered and assembled at our headquarters in Eden Prairie, Minnesota. We also operate manufacturing facilities in Shenzhen and Shanghai, China, which manufacture test systems serving the materials market, and our facility in Lexington, North Carolina manufactures test systems serving the ground vehicles market. We perform some smaller system assembly at our locations in Berlin, Germany and Seoul, South Korea. Installation of systems, training, service and consulting services are primarily delivered at customer sites. The engineering and assembly cycle for a typical Test system ranges from one to twelve months, depending on the complexity of the system and the availability of components. The engineering and assembly cycle for larger, more complex systems may be up to three years.

Sensors Segment

Sensors are primarily built to order, engineered and assembled regionally at facilities located in Cary, North Carolina; Lüdenscheid, Germany; and Machida, Japan. Assembly cycles generally vary from several days to several weeks, depending on the degree of product customization, the size of the order and manufacturing capacity.

Sources and Availability of Raw Materials and Components

A significant portion of Test systems and Sensors products consist of materials and component parts purchased from independent vendors. We are dependent, in certain situations, on a limited number of vendors to provide raw materials and components, such as mechanical and electronic components. However, we have not experienced any recent issues in procuring materials, parts or components needed in our engineering or production processes.

As Test generally sells products and services based on fixed-price contracts, fluctuations in the cost of materials and components between the date of the order and the delivery date may impact the expected profitability. The material and component cost variability is considered in the estimation and customer negotiation process. We believe fluctuations in the cost of raw materials and components did not have a significant impact on our operating results for fiscal years 2015, 2014 and 2013.

| 4 |

Patents and Trademarks

We rely on a combination of patents, copyrights, trademarks and proprietary trade secrets to protect our proprietary technology, some of which are material to our segments. We have obtained numerous patents and trademarks worldwide and actively file and renew patents and trademarks on a global basis to establish and protect our proprietary technology. We are also party to exclusive and non-exclusive license and confidentiality agreements relating to our own and third-party technologies. We aggressively protect certain of our processes, products and strategies as proprietary trade secrets. Our efforts to protect intellectual property and avoid disputes over proprietary rights include ongoing review of third-party patents and patent applications.

Seasonality

There is no significant seasonality in Test or Sensors.

Working Capital

Neither Test nor Sensors segments have significant finished product inventory, but each maintains inventories of materials and components to facilitate on-time product delivery. Test may have varying levels of work-in-process projects that are classified as inventory or unbilled receivables, depending upon the manufacturing cycle, timing of orders, project revenue recognition and shipments to customers.

In Test, payments are often received from customers upon order or at milestones during the fulfillment of the order, depending upon the size and customization of the system. These are recorded as advance payments from customers on our Consolidated Balance Sheets and reduced as revenue is recognized. Conversely, if revenue is recognized on a project prior to customer billing, an unbilled accounts receivable is recorded on our Consolidated Balance Sheets until the customer is billed. Upon billing, it is recorded as accounts receivable. Changes in the average size, payment terms and revenue recognition for orders in Test may have a significant impact on accounts receivable, unbilled accounts receivable, advance payments from customers and inventory. It has not been our practice to provide rights of return for our products. Payment terms vary and are subject to negotiation.

Customers

We do not have a significant concentration of sales with any individual customer within Test or Sensors. Therefore, the loss of any one customer would not have a material impact on our results.

Order Backlog

Most of our products are built to order. Our backlog of orders, defined as firm orders from customers that remain unfulfilled, totaled approximately $353,013, $326,473 and $290,151 at October 3, 2015, September 27, 2014 and September 28, 2013, respectively. The majority of this backlog is related to Test. Based on anticipated manufacturing schedules, we estimate that approximately $267,000 of the backlog at October 3, 2015 will be converted to revenue during fiscal year 2016. Delays may occur in the conversion of backlog into revenue as a result of export licensing compliance, technical difficulties, specification changes, manufacturing capacity, supplier issues or access to the customer site for installation. While the backlog is subject to order cancellations, we have not historically experienced a significant number of order cancellations. Refer to Item 7 of this Annual Report on Form 10-K for further discussion of order cancellations.

| 5 |

Government Contracts

Revenue from U.S. Government contracts varies by year. A portion of our government business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of the U.S. Government. In addition to contract terms, we must comply with procurement laws and regulations relating to the formation, administration and performance of U.S. Government contracts. Failure to comply with these laws and regulations could lead to the termination of contracts at the election of the U.S. Government or the suspension or debarment from U.S. Government contracting or subcontracting. U.S. Government revenue as a percentage of our total revenue was approximately 3%, 5% and 5% for fiscal years 2015, 2014 and 2013, respectively.

Competition

Test Segment

For relatively simple and inexpensive mechanical testing applications, customers may satisfy their needs internally by building their own test systems or using competitors who compete on price, performance, quality and service. For larger and more complex mechanical test systems, we compete directly with several companies throughout the world based upon customer value including application knowledge, engineering capabilities, technical features, price, quality and service.

Sensors Segment

We primarily compete on factors that include technical performance, price and service in new applications or in situations in which other position sensing technologies have been used. Sensors’ competitors are typically either larger companies that carry multiple sensor product lines or smaller, privately held companies throughout the world.

Research and Development

We invest in significant product, system, and software application development. Occasionally, we also contract with our customers to advance the state of technology and increase product functionality. Costs associated with research and development (R&D) are expensed as incurred, totaling $23,705, $23,844 and $22,812 for fiscal years 2015, 2014 and 2013, respectively. During fiscal year 2015 and 2014, we allocated certain resources to capitalized software development activities. Total internal software development costs capitalized during fiscal years 2015 and 2014 were $1,966 and $494, respectively.

Environmental Compliance

We believe our operations are in compliance with all applicable material environmental regulations within the jurisdictions in which we operate. Capital expenditures for environmental compliance were not material in fiscal year 2015, and we do not expect such expenditures will be material in fiscal year 2016.

Employees

We had 2,400 employees as of October 3, 2015, including 1,240 employees located outside the United States.

Available Information

The Securities and Exchange Commission (SEC) maintains a website that contains reports, proxy and information statements and other information regarding issuers, including the Company, that file electronically with the SEC. The public can obtain any documents that we file with the SEC at http://www.sec.gov. We file annual reports, quarterly reports, proxy statements and other documents with the SEC under the Securities Exchange Act of 1934 (Exchange Act). The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

| 6 |

We also make available free of charge on or through the “Investor Relations” pages of our corporate website (www.mts.com) our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnishes it to, the SEC. Our Code of Conduct (the “Code”), any waivers from and amendments to the Code and our Corporate Governance Guidelines, Articles of Incorporation and Bylaws, as well as the Charters for the Audit, Compensation and Governance and Nominating Committees of our Board of Directors are also available free of charge on the “Investor Relations” pages of our corporate website (www.mts.com).

Our business involves risks. The following summarizes what we believe to be the most important risks facing us that could adversely impact our business, financial condition or operating results. The information about these risks should be considered carefully together with the other information contained in this Annual Report on Form 10-K. Additional risks not currently known to us or that we currently deem to be immaterial may also adversely affect our business, financial condition or results of operations in future periods.

Market Risks

Our business is significantly international in scope.

We have manufacturing facilities in North America, Europe and Asia. Sales outside of the United States, including export sales from U.S. business locations, accounted for approximately 75% of our revenue in fiscal year 2015. Accordingly, our business is subject to the political, economic and other risks that are inherent in operating in foreign countries. These risks include, but are not limited to:

| · | exposure to the risk of currency value fluctuations, where payment for products is denominated in a currency other than U.S. dollars; |

| · | variability in the U.S. dollar value of foreign currency-denominated assets, earnings and cash flows; |

| · | difficulty enforcing agreements, including patent and trademarks, and collecting receivables through foreign legal systems; |

| · | trade protection measures and import or export licensing requirements; |

| · | tax rates in certain foreign countries that exceed those in the U.S. and the imposition of withholding requirements on foreign earnings; |

| · | higher danger of terrorist activity, war or civil unrest, compared to domestic operations; |

| · | imposition of tariffs, exchange controls or other restrictions; |

| · | difficulty in staffing and managing global operations; |

| · | required compliance with a variety of foreign laws and regulations and U.S. laws and regulations, such as the Foreign Corrupt Practices Act applicable to our international operations and significant compliance costs and penalties for failure to comply with any of these laws and regulations; and |

| · | changes in general economic and political conditions in countries where we operate, particularly in emerging markets. |

| 7 |

Volatility in the global economy could adversely affect results.

Long-term disruptions in the capital and credit markets would likely adversely affect our customers’ operations and financing of both our international and U.S. customers and could therefore result in a decrease in orders. In addition, during periods of economic uncertainty, our customers’ spending patterns and financing availability could be negatively impacted, reducing demand for our products and services.

Fluctuations in foreign currency exchange rates could affect our financial results.

Although our financial results are reported in U.S. dollars, a large portion of our sales and operating costs are realized in Euros, the Japanese Yen, the Chinese Yuan and other foreign currencies. Our profitability is affected by movements of the U.S. dollar against these currencies in which we generate revenues and incur expenses. To the extent that we are unable to match revenues received in foreign currencies with costs paid in the same currency, exchange rate fluctuations in any such currency could have an adverse effect on financial results. During times of a strengthening U.S. dollar, our reported sales and earnings from our international operations will be lower because the applicable local currency will translate into fewer U.S. dollars. Significant long-term fluctuations in relative currency values, in particular a significant change in the relative values of the U.S. dollar, Euro or Japanese Yen, could have an adverse effect on our results of operations and financial condition given that approximately 75% of our revenue has historically been derived from customers outside of the United States. As further described below, our fiscal year 2015 results were negatively impacted by currency translation.

Our business is subject to strong competition.

Our products are sold in competitive markets throughout the world. Competition is based on application knowledge, product features and design, brand recognition, reliability, technology, breadth of product offerings, price, delivery, customer relationships and after-market support. If we are not perceived as competitive in overall value as measured by these criteria, our customers would likely choose solutions offered by our competitors or developed internally.

Our business is subject to customer demand cycles.

For many of our products, orders are subject to customers’ procurement cycles and their willingness and ability to invest in capital, especially in the cyclical automotive, aircraft and machine tool industries. Any event that adversely impacts those customers’ new product development activities may reduce their demand for our products.

We may experience difficulty obtaining materials or components for our products, or the cost of materials or components may increase.

We purchase materials and components from third-party suppliers, some of whom may be competitors. Other materials and components may be provided by a limited number of suppliers or by sole sources and could only be replaced with difficulty or at significant added cost. Additionally, some materials or components may become scarce or difficult to obtain in the market or they may increase in price. This could adversely affect the lead-time within which we receive the materials or components, and in turn affect our commitments to our customers, or could adversely affect the material cost or quality.

| 8 |

Interest rate fluctuations could adversely affect results.

Significant changes in interest rates may affect our business in several ways, depending on our financial position and short-term financing needs. We may, at times, use debt to purchase shares of our common stock, finance working capital needs or finance the growth of the business through acquisitions. Fluctuations in interest rates can increase borrowing costs. We have not elected to mitigate this risk since our borrowings are typically outstanding for a short period of time. Increases in short-term interest rates may directly impact the amount of interest we are required to pay and reduce earnings accordingly. Conversely, lower interest rates will adversely impact the interest we earn on cash and short-term investments.

Operational Risks

We have identified material weaknesses in our internal control over financial reporting. If our remedial measures are insufficient to address the material weaknesses, or if additional material weaknesses or significant deficiencies in our internal control over financial reporting are discovered or occur in the future, our consolidated financial statements may contain material misstatements, which could adversely affect our stock price and could negatively impact our results of operations.

As of October 3, 2015, we concluded that there were material weaknesses in our internal control over financial reporting. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. The material weaknesses related to our risk assessment, information and communications and monitoring processes with respect to revenue, identification of deliverables contained in multiple element revenue arrangements and timely closure of revenue projects and release of residual accrued costs have been identified and included in management’s assessment. See Item 9A in Part II of this Annual Report on Form 10-K for further details.

While we are committed to remediating the control deficiencies that gave rise to the material weaknesses, there can be no assurances that our remediation efforts will be successful or that we will be able to prevent future control deficiencies (including material weaknesses) from happening that could cause us to incur unforeseen costs, negatively impact our results of operations, cause our consolidated financial results to contain material misstatements, cause the market price of our common stock to decline, damage our reputation or have other potential material adverse consequences.

The changes we are making in Test processes and operating systems may not deliver the results we require for growth of the business.

We continue to invest in our Test operating model and modify our business processes and systems. We have restructured the business to make it a more scalable business model. Successful implementation of these initiatives is critical to our growth.

Our business operations may be affected by government contracting risks.

Government business is important to us. Revenue from U.S. Government contracts varies by year. Such revenue as a percent of our total revenue was approximately 3%, 5% and 5% for fiscal years 2015, 2014 and 2013, respectively.

| 9 |

We must comply with procurement laws and regulations relating to the formation, administration and performance of U.S. Government contracts. Failure to comply with these laws and regulations could lead to suspension or debarment from U.S. Government contracting or subcontracting and result in administrative, civil or criminal penalties. Failure to comply could also have a material adverse effect on our reputation, our ability to secure future U.S. Government contracts and export control licenses and our results of operations and financial condition. These laws and regulations also create compliance risks and affect how we do business with federal agency clients. U.S. Government contracts, as well as contracts with certain foreign governments with which we do business, are also subject to modification or termination by the government, either for the convenience of the government or for default as a result of our failure to perform under the applicable contract. Further, any investigation relating to, or suspension or debarment from, U.S. Government contracting could have a material impact on our results of operations as, during the duration of any suspension or debarment, we would be prohibited or otherwise limited in our ability to enter into prime contracts or subcontracts with U.S. Government agencies, certain entities that receive U.S. Government funds or that are otherwise subject to the Federal Acquisition Regulations (FAR), and certain state government or commercial customers who decline to contract with suspended or debarred entities. A federal suspension could also impact our ability to obtain export control licenses, which have material importance to our business.

We are subject to risks because we design and manufacture first-of-a-kind products.

We design and build systems that are unique and innovative and, in some cases, the first created to address complex and unresolved issues. The design, manufacture and support of these systems may involve higher than planned costs. If we are unable to meet our customers’ expectations, our reputation and ability to utilize our expertise will likely be damaged.

The backlog, sales, delivery and acceptance cycle for many of our products is irregular and may not develop as anticipated.

Many of our products have long sales, delivery and acceptance cycles. In addition, our backlog is subject to order cancellations and our sales arrangements typically do not include specific cancellation provisions. If an order is cancelled, we typically would only be entitled to receive reimbursement from the customer for actual costs incurred under the arrangement plus a reasonable margin. Events may cause recognition of orders, backlog and results of operations to be aberrant over shorter periods of time. These factors include the timing of individual large orders which may be impacted by interest rates, customer capital spending and product development cycles, design and manufacturing problems, capacity constraints, delays in product readiness, damage or delays in transit, problems in achieving technical performance requirements and various customer-initiated delays. Any such delay may cause fluctuation in our reported periodic financial results.

The business could be adversely affected by product liability and commercial litigation.

Our products or services may be claimed to cause or contribute to personal injury or property damage to our customers’ facilities. Additionally, we are, at times, involved in commercial disputes with third parties, such as customers, vendors and others. The ensuing claims may arise singularly, in groups of related claims or in class actions involving multiple claimants. Such claims and litigation are frequently expensive and time-consuming to resolve, may result in substantial liability to us, which liability and related costs and expenses may not be recoverable through insurance or other forms of reimbursement.

| 10 |

We may experience difficulties obtaining and retaining the services of skilled employees.

We rely on knowledgeable, experienced and skilled technical personnel, particularly engineers, sales management and service personnel, to design, assemble, sell and service our products. We may be unable to attract, retain and motivate a sufficient number of such people, which could adversely affect our business. The inability to transfer knowledge and transition between roles within these teams could also adversely affect our business.

We may fail to protect our intellectual property effectively or may infringe upon the intellectual property of others.

We have developed significant proprietary technology and other rights that are used in our businesses. We rely on trade secret, copyright, trademark and patent laws and contractual provisions to protect our intellectual property. While we take enforcement of these rights seriously, other companies such as competitors or others in markets in which we do not participate, may attempt to copy or use our intellectual property for their own benefit.

In addition, the intellectual property of others also has an impact on our ability to offer some of our products and services for specific uses or at competitive prices. Competitors’ patents or other intellectual property may limit our ability to offer products and services to our customers. Any infringement on the intellectual property rights of others could result in litigation and adversely affect our ability to continue to provide, or could increase the cost of providing, products and services.

Intellectual property litigation is very costly and could result in substantial expense and diversions of our resources, both of which could adversely affect our businesses, financial condition and results. In addition, there may be no effective legal recourse against infringement of our intellectual property by third parties, whether due to limitations on enforcement of rights in foreign jurisdictions or as a result of other factors.

If we are unable to protect our information systems against misappropriation of data or breaches of security, our business operations and financial results could be adversely impacted.

Information security risks have generally increased in recent years because of the proliferation of new technologies and the increased sophistication and activities of cyber attacks. Although we strive to have appropriate security controls in place, prevention of security breaches cannot be assured, particularly as cyber threats continue to evolve. We may be required to expend additional resources to continue to enhance our security measures or to investigate and remediate any security vulnerabilities. The consequences of these risks could adversely impact our business operations and financial results.

| 11 |

Government regulation imposes costs and other constraints.

Our manufacturing operations and past and present ownership and operations of real property are subject to extensive and changing federal, state, local and foreign laws and regulations, including laws and regulations pertaining to health and safety matters, as well as the handling or discharge of hazardous materials into the environment. We expect to continue to incur costs to comply with these laws, and may incur penalties for any failure to do so. We may also be identified as a responsible party and be subject to liability relating to any investigation and clean-up of properties used for industrial purposes or the generation or disposal of hazardous substances. Some of our export sales require approval from the U.S. government. Changes in political relations between the U.S. and foreign countries and/or specific potential customers for which export licenses may be required, may cause a license application to be delayed or denied, or a previously issued license withdrawn, rendering us unable to complete a sale, or vulnerable to competitors who do not operate under such restrictions. Capital expenditures for environmental compliance were not material in fiscal year 2015, and we do not expect such expenditures will be material in fiscal year 2016 but the factors described above may cause our estimates to differ from our expectations.

We have been required to conduct a good faith reasonable country of origin analysis on our use of “conflict minerals,” which has imposed and may impose additional costs on us and could raise reputational and other risks.

The SEC has promulgated final rules in connection with the Dodd-Frank Wall Street Reform and Consumer Protection Act regarding disclosure of the use of certain minerals, known as conflict minerals, mined from the Democratic Republic of the Congo and adjoining countries. While there is pending litigation challenging these rules, we have incurred and will continue to incur costs associated with complying with these disclosure requirements, including costs to determine the source of any conflict minerals used in our products. We have adopted a policy relating to conflict minerals, incorporating the standards set forth in the Organisation for Economic Co-Operation and Development Due Diligence Guidance, which affect the sourcing, supply, and pricing of materials used in our products. As we continue our due diligence, we may face reputational challenges if we are unable to verify the origins for all metals used in our products through the procedures we have and may continue to implement. We may also encounter challenges in our efforts to satisfy customers that may require all of the components of products purchased to be certified as conflict free. If we are not able to meet customer requirements, customers may choose to disqualify us as a supplier.

We may not achieve our growth plans for the expansion of the business.

In addition to market penetration, our long-term success depends on our ability to expand our business through (a) new product development and service offerings; (b) mergers and acquisitions; and/or (c) geographic expansion.

New product development and service offerings require that we maintain our ability to improve existing products, continue to bring innovative products and services to market in a timely fashion and adapt products and services to the needs and standards of current and potential customers. Our products and services may become less competitive or eclipsed by technologies to which we do not have access or which render our solutions obsolete.

| 12 |

Mergers and acquisitions will be accompanied by risks that may include:

| · | suitable candidates may not exist or may not be available at acceptable costs; |

| · | failure to achieve the financial and strategic goals for the acquired and combined businesses; |

| · | difficulty integrating the operations and personnel of the acquired businesses; |

| · | disruption of ongoing business and distraction of management from the ongoing business; |

| · | dilution of existing stockholders and earnings per share; |

| · | unanticipated, undisclosed or inaccurately assessed liabilities, legal risks and costs; and |

| · | difficulties retaining the key vendors, customers or employees of the acquired business. |

Acquisitions of businesses having a significant presence outside the U.S. will increase our exposure to the risks of international operations discussed in the operational risk factors.

Geographic expansion may be outside of the U.S., and hence will be disproportionately subject to the risks of international operations discussed in the operational risk factors.

We may be required to recognize impairment charges for long-lived assets.

As of October 3, 2015, the net carrying value of long-lived assets (property and equipment, goodwill and other intangible assets) totaled approximately $127,837. We periodically assess the value of these assets for impairment in accordance with generally accepted accounting principles. Significant negative industry or economic trends, disruptions to our businesses, significant unexpected or planned changes in use of the assets, divestitures and market capitalization declines may result in impairments to goodwill and other long-lived assets. No impairment was identified in fiscal year 2015. Future impairment charges could significantly affect results of operations in the periods for which any such impairment charges are recognized.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| 13 |

| ITEM 2. | PROPERTIES |

Shown below is a breakdown of the approximate square footage of our primary owned and leased facilities as of October 3, 2015. We consider our current facilities adequate to support our operations during fiscal year 2016.

Owned Property

| Location | Use of Facility | Approximate Square Footage |

||||

| Eden Prairie, Minnesota (USA) | Corporate headquarters and primary Test manufacturing and research | 420,000 | ||||

| Cary, North Carolina (USA) | Sensors manufacturing, research and North American sales and service administration | 65,000 | ||||

| Berlin, Germany | Test manufacturing and European sales and service administration | 72,000 | ||||

| Shenzhen, China | Test manufacturing, research and sales and service administration | 75,000 | ||||

| Shanghai, China | Test manufacturing and sales and service administration | 129,000 | ||||

| Total | 761,000 |

| 14 |

Leased Property

| Location | Use of Facility | Lease Expires |

Approximate Square Footage | |||

| Lexington, North Carolina (USA) | Test manufacturing | 2019 | 12,000 | |||

| Ludenscheid, Germany | Sensors manufacturing, research and European | 2017 | 55,000 | |||

| Sensors sales and service administration | 2016 | 10,000 | ||||

| Sensors manufacturing | 2016 | 10,000 | ||||

| Creteil, France | Test sales and service administration | 2018 | 16,000 | |||

| Guildford, UK | Test sales, service and manufacturing | 2025 | 8,000 | |||

| Tokyo, Japan | Test sales and service administration | 2018 | 7,000 | |||

| Sensors manufacturing and Asia sales and service administration | 2025 | 5,000 | ||||

| Swatz Creek, Michigan (USA) | Test manufacturing and research | 2017 | 8,000 | |||

| Sungnam, South Korea | Test sales, service administration and assembly | 2019 | 8,000 | |||

| Cary, North Carolina (USA) | Sensors manufacturing | 2020 | 8,000 | |||

| Beijing, China | Test sales, service | 2017 | 6,000 | |||

| Shanghai, China | Test sales, service administration and assembly | 2018 | 13,000 | |||

| Test sales and service | 2016 | 7,000 | ||||

| Shenzhen, China | Test manufacturing and warehouse | 2016 | 13,000 | |||

| Test manufacturing and warehouse | 2016 | 16,000 | ||||

| Berlin, Germany | Test land under Berlin facility | 2052 | 97,000 | |||

| Shenzhen, China | Test land under Shenzhen facility | 2047 | 155,000 | |||

| Shanghai, China | Test land under Shanghai facility | 2056 | 161,000 | |||

| Other Locations1 | Test and Sensors other sales and services | 70,000 | ||||

| Total | 685,000 |

| 1 | We also lease space in the United States, Europe and Asia for Test sales and service administration, including locations in Germany, Sweden, Italy, Spain, Russia, China, Japan and various other locations in the United States. Neither the amount of leased space nor the rental obligations in these locations is significant individually or in aggregate. |

Additional information relative to lease obligations is included in Management’s Discussion and Analysis of Financial Condition and Results of Operations, appearing under Item 7 of this Annual Report on Form 10-K.

| 15 |

| ITEM 3. | LEGAL PROCEEDINGS |

Discussion of legal matters is incorporated by reference from Note 13, “Commitments and Contingencies,” included in Item 8, “Notes to Consolidated Financial Statements,” under Part II of this Annual Report on Form 10-K, and should be considered an integral part of Part I, Item 3, “Legal Proceedings.”

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Shares of our common stock are traded on the NASDAQ Global Select MarketSM under the trading symbol MTSC. The table below sets forth the quarterly high and low common stock prices for each quarter in fiscal years 2015 and 2014 as quoted on NASDAQ OnlineSM (www.nasdaq.net).

| Market Price | ||||||||

| (per share data) | High | Low | ||||||

| Fiscal Year 2015 | ||||||||

| First Quarter | $ | 76.17 | $ | 62.20 | ||||

| Second Quarter | $ | 77.39 | $ | 67.86 | ||||

| Third Quarter | $ | 76.68 | $ | 63.94 | ||||

| Fourth Quarter | $ | 70.66 | $ | 54.35 | ||||

| Fiscal Year 2014 | ||||||||

| First Quarter | $ | 72.62 | $ | 62.01 | ||||

| Second Quarter | $ | 78.90 | $ | 65.00 | ||||

| Third Quarter | $ | 71.20 | $ | 56.87 | ||||

| Fourth Quarter | $ | 72.97 | $ | 59.97 | ||||

The number of record holders of our common stock as at November 30, 2015 was 733. This number does not reflect shareholders who hold their shares in the name of broker-dealers or other nominees.

| 16 |

Issuer Purchases of Equity Securities

| (in thousands, except shares) | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs | ||||||||||||

| June 28, 2015 - August 1, 2015 | - | $ | - | - | 731,162 | |||||||||||

| August 2, 2015 - August 29, 2015 | - | $ | - | - | 731,162 | |||||||||||

| August 30, 2015 - October 3, 2015 | - | $ | - | - | 731,162 | |||||||||||

We purchase common stock to mitigate dilution related to new shares issued as employee equity compensation such as stock option, restricted stock, and employee stock purchase plan awards, as well as to return to shareholders capital not immediately required to fund ongoing operations.

Our Board of Directors approved, and on February 11, 2011 announced, a 2,000,000 share purchase authorization. Authority over pricing and timing under this authorization has been delegated to management. The share purchase authorization has no expiration date. At October 3, 2015, there were 731,162 shares available for purchase under the existing authorization.

Dividends

Our dividend policy is to maintain a payout ratio that allows dividends to increase with the long-term growth of earnings per share, while sustaining dividends through economic cycles. Our dividend practice is to target, over time, a payout ratio of approximately 25% of net earnings per share. We have historically paid dividends to holders of our common stock on a quarterly basis. The declaration and payment of future dividends will depend on many factors, including, but not limited to, our earnings, financial condition, business developments needs and regulatory consideration and are at the discretion of our Board of Directors. During fiscal years 2015 and 2014, we declared quarterly cash dividends of $0.30 per share to holders of our common stock, which resulted in a payout ratio of approximately 40% and 44% of net earnings per share, respectively. Cash outlay for dividends paid was higher in fiscal year 2015 compared to fiscal year 2014 due to a fifth dividend payment occurring during the 53rd week of the fiscal year.

Debt Covenants

Our unsecured credit facility includes certain financial covenants, including the ratio of consolidated total indebtedness to consolidated EBITDA, as well as the ratio of consolidated EBITDA to consolidated interest expense. These financial covenants may restrict our ability to pay dividends and purchase outstanding shares of our common stock. At October 3, 2015 and September 27, 2014, we were in compliance with these financial covenants. Information on our debt agreements is included in Item 7 of this Annual Report on Form 10-K.

| 17 |

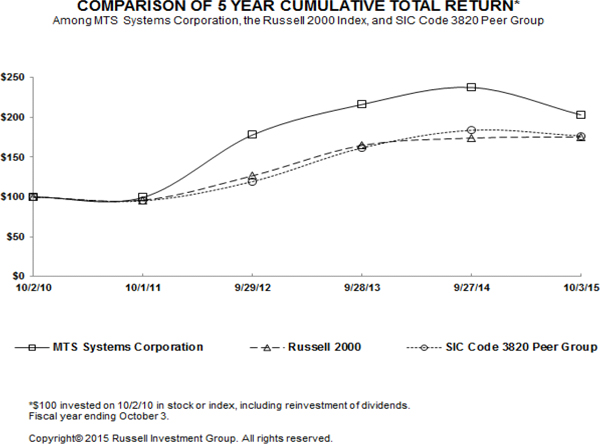

Shareholder Performance Graph

The following graph compares the cumulative total shareholder return of our common stock over the last five fiscal years with the cumulative total shareholder return on the Russell 2000 Index and a peer group of companies in the Laboratory Apparatus and Analytical, Optical, Measuring, and Controlling Instruments Standard Industrial Code (SIC Code 3820) that are traded on the NASDAQ, NYSE and NYSE MKT exchanges. The graph assumes that $100 (in actual dollars) was invested at market close on October 2, 2010 in our common stock, the Russell 2000 Index and the SIC Code 3820 Peer Group and that all dividends were reinvested. The graph is not necessarily indicative of future investment performance.

| Fiscal Year | ||||||||||||||||||||||||

| (in actual dollars) | 20101 | 20111 | 20121 | 2013 | 2014 | 2015 | ||||||||||||||||||

| MTS Systems Corporation | $ | 100.00 | $ | 99.43 | $ | 177.94 | $ | 216.15 | $ | 237.57 | $ | 203.12 | ||||||||||||

| Russell 2000 Index | 100.00 | 96.02 | 126.66 | 164.79 | 173.93 | 175.48 | ||||||||||||||||||

| SIC Code 3820 Peer Group2 | 100.00 | 95.13 | 119.36 | 161.72 | 183.81 | 176.68 | ||||||||||||||||||

| 1 | Fiscal year 2012 refers to the fiscal year ended September 29, 2012, fiscal year 2011 refers to the fiscal year ended October 1, 2011 and fiscal year 2010 refers to the fiscal year ended October 2, 2010. |

| 2 | Modified to remove non-exchange traded companies. |

| 18 |

| ITEM 6. | SELECTED FINANCIAL DATA |

The following selected financial data should be read in conjunction with Item 7 and Item 8 of this Annual Report on Form 10-K.

| Fiscal Year1 | |||||||||||||||

| (in thousands, except per share data) | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||

| Operating Results | |||||||||||||||

| Revenue | $ | 563,934 | $ | 564,328 | $ | 569,439 | $ | 542,256 | $ | 467,368 | |||||

| Gross profit | 219,613 | 223,643 | 231,939 | 236,192 | 201,990 | ||||||||||

| Gross margin % | 38.9 | % | 39.6 | % | 40.7 | % | 43.6 | % | 43.2 | % | |||||

| Research and development expense | $ | 23,705 | $ | 23,844 | $ | 22,812 | $ | 21,893 | $ | 14,785 | |||||

| Research and development expense as a % of revenue | 4.2 | % | 4.2 | % | 4.0 | % | 4.0 | % | 3.2 | % | |||||

| Effective income tax rate | 23.2 | % | 28.1 | % | 27.1 | % | 35.4 | % | 30.5 | % | |||||

| Net income | $ | 45,462 | $ | 42,009 | $ | 57,806 | $ | 51,556 | $ | 50,942 | |||||

| Net income as a % of revenue | 8.1 | % | 7.4 | % | 10.2 | % | 9.5 | % | 10.9 | % | |||||

| Earnings per share | |||||||||||||||

| Basic | $ | 3.03 | $ | 2.76 | $ | 3.69 | $ | 3.24 | $ | 3.29 | |||||

| Diluted | $ | 3.00 | $ | 2.73 | $ | 3.64 | $ | 3.21 | $ | 3.24 | |||||

| Weighted average shares outstanding2 | |||||||||||||||

| Basic | 14,984 | 15,218 | 15,664 | 15,913 | 15,487 | ||||||||||

| Diluted | 15,142 | 15,397 | 15,861 | 16,077 | 15,739 | ||||||||||

| Depreciation and amortization | 21,106 | 19,279 | 16,589 | 13,782 | 12,894 | ||||||||||

| Financial Position | |||||||||||||||

| Total assets | $ | 460,831 | $ | 487,408 | $ | 451,277 | $ | 409,438 | $ | 427,859 | |||||

| Interest-bearing debt3 | 21,183 | 60,000 | 35,000 | - | 40,000 | ||||||||||

| Total shareholders’ equity | 258,142 | 258,127 | 256,537 | 226,719 | 210,848 | ||||||||||

| Interest-bearing debt as a % of shareholders’ equity | 8.2 | % | 23.2 | % | 13.6 | % | 0.0 | % | 19.0 | % | |||||

| Return on equity4 | 17.6 | % | 16.4 | % | 25.5 | % | 24.5 | % | 30.7 | % | |||||

| Return on invested capital5 | 15.5 | % | 15.4 | % | 22.5 | % | 25.1 | % | 22.6 | % | |||||

| Other Statistics | |||||||||||||||

| Orders | $ | 618,296 | $ | 615,586 | $ | 567,418 | $ | 565,327 | $ | 540,023 | |||||

| Backlog of orders at year-end | 353,013 | 326,473 | 290,151 | 298,363 | 287,916 | ||||||||||

| Dividends declared per share | 1.20 | 1.20 | 1.20 | 1.05 | 0.85 | ||||||||||

| Capital Expenditures | 18,445 | 20,038 | 29,690 | 15,625 | 10,145 | ||||||||||

| 1 | Fiscal years 2015, 2014, 2013, 2012 and 2011 include 53, 52, 52, 52 and 52 weeks, respectively. |

| 2 | Assumes the conversion of potential common shares using the treasury stock method. |

| 3 | Consists of short-term borrowings. |

| 4 | Calculated by dividing net income by beginning shareholders’ equity. |

| 19 |

| 5 | The measure “Return on Invested Capital” (ROIC) is not a measure of performance presented in accordance with U.S. Generally Accepted Accounting Principles (GAAP). ROIC is calculated by dividing adjusted net income by average invested capital. Adjusted net income is calculated by excluding after-tax interest expense from reported net income. In addition, for fiscal year 2012, adjusted net income also excludes the cost related to the settlement of the U.S. Government investigation. Average invested capital is defined as the aggregate of average interest-bearing debt and average shareholders’ equity and is calculated as the sum of current and prior year ending amounts divided by two. Because the ratio is not prescribed or authorized by GAAP, the ROIC percentage is a non-GAAP financial measure. We believe ROIC is useful to investors as a measure of operating performance and of the effectiveness of the use of capital in our operations. We use ROIC as a measure to monitor and evaluate operating performance relative to our invested capital. This measure should not be construed as an alternative to return on equity or any other measure determined in accordance with GAAP. |

| Presented below is the reconciliation of the non-GAAP financial measure to the nearest GAAP measure: |

| Fiscal Year | ||||||||||||||||||||

| (in thousands) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Net income | $ | 45,462 | $ | 42,009 | $ | 57,806 | $ | 51,556 | $ | 50,942 | ||||||||||

| Expense to settle U.S. Government investigation | - | - | - | 7,750 | - | |||||||||||||||

| Restructuring expense, net of tax | - | 4,376 | - | - | - | |||||||||||||||

| After-tax interest expense | 767 | 637 | 372 | 535 | 808 | |||||||||||||||

| Adjusted net income* | $ | 46,229 | $ | 47,022 | $ | 58,178 | $ | 59,841 | $ | 51,750 | ||||||||||

| Total beginning shareholders’ equity | $ | 258,127 | $ | 256,537 | $ | 226,719 | $ | 210,848 | $ | 166,106 | ||||||||||

| Total ending shareholders’ equity | 258,142 | 258,127 | 256,537 | 226,719 | 210,848 | |||||||||||||||

| Total beginning interest bearing debt | 60,000 | 35,000 | - | 40,000 | 40,000 | |||||||||||||||

| Total ending interest bearing debt | 21,183 | 60,000 | 35,000 | - | 40,000 | |||||||||||||||

| Sum of invested capital | $ | 597,452 | $ | 609,664 | $ | 518,256 | $ | 477,567 | $ | 456,954 | ||||||||||

| Average invested capital* | $ | 298,726 | $ | 304,832 | $ | 259,128 | $ | 238,784 | $ | 228,477 | ||||||||||

| Return on invested capital* | 15.5 | % | 15.4 | % | 22.5 | % | 25.1 | % | 22.6 | % | ||||||||||

| * Denotes Non-GAAP financial measure | ||||||||||||||||||||

| 20 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is designed to provide a reader of our financial statements with a narrative from the perspective of management on our financial condition, results of operations, liquidity and certain other factors that may affect our future results. Our MD&A is presented in nine sections:

| · | Overview |

| · | Financial Results |

| · | Cash Flow Comparison |

| · | Liquidity and Capital Resources |

| · | Off-Balance Sheet Arrangements |

| · | Critical Accounting Policies |

| · | Recently Issued Accounting Pronouncements |

| · | Quarterly Financial Information |

| · | Forward Looking Statements |

Our MD&A should be read in conjunction with the Consolidated Financial Statements and related Notes included in Item 8 of this Annual Report on Form 10-K. All dollar amounts are in thousands (unless otherwise noted).

Overview

MTS Systems Corporation is a leading global supplier of high-performance test systems and position sensors. Our testing hardware and software solutions help customers accelerate and improve design, development and manufacturing processes and are used for determining the mechanical behavior of materials, products and structures. Our high-performance position sensors provide controls for a variety of industrial and vehicular applications.

Our goal is to grow profitably, generate strong cash flow and deliver a strong return on invested capital to our shareholders by leveraging our leadership position in the research and development and industrial and mobile equipment global end markets. Our desire is to be the innovation leader in creating test and measurement solutions to support our customers. Through innovation, we believe we can create value for our customers that will drive our growth. There are four global macro-trends that will help enable this growth: energy scarcity; environmental concerns; globalization, including development of the emerging markets; and global demographics. These macro-trends have significant implications for our customers, such as increasing the demand for new and more innovative products and increasing our customers’ organizational complexity. We believe we have an excellent geographic footprint and are well positioned in both Test and Sensors markets to take advantage of these macro-trends and deliver profitable growth in the years ahead.

| 21 |

We are working toward our goals of sustained double digit growth in annual revenue, margin expansion and mid-to-upper teens for Return on Invested Capital (ROIC). Our plan is to grow at twice the market rate with merger and acquisitions filling the gap to sustain our double-digit growth goals. Economic conditions and the competitive environment may impact the timing of when the goals are achieved. There are four primary opportunities we are pursuing which will support these goals:

| · | Expanding service offerings in our Test business; |

| · | Growth in composite materials which drives new testing requirements and technologies in the Test materials market; |

| · | Development of intelligent machines which provides opportunity in the Sensors mobile hydraulics market; and |

| · | Opportunistic mergers and acquisitions. |

We believe that our business model supports achieving our double digit growth milestone assuming we continue to move aggressively to build our infrastructure, expand our offerings and execute on opportunities with our key customers around the world. In order to accelerate our revenue growth over the next few years, investments in infrastructure, sales support and field service capacity and capability are essential. We invested significantly in fiscal years 2014 and 2013, moderately in fiscal year 2015 and will continue to moderately invest in future years.

Fiscal Year

We have a 5-4-4 week accounting cycle with the fiscal year ending on the Saturday closest to September 30. Fiscal years 2015, 2014 and 2013 ended October 3, 2015, September 27, 2014 and September 28, 2013, respectively. Fiscal year 2015 included 53 weeks, while fiscal years 2014 and 2013 both included 52 weeks.

Foreign Currency

Approximately 75% of our revenue has historically been derived from customers outside of the United States. Our financial results are principally exposed to changes in exchange rates between the U.S. dollar and the Euro, the Japanese Yen and the Chinese Yuan. A change in foreign exchange rates could positively or negatively affect our reported financial results. The discussion below quantifies the impact of foreign currency translation on our financial results for the periods discussed.

| 22 |

Financial Results

Fiscal Year 2015 Compared to Fiscal Year 2014

Total Company

Results of Operations

The following table compares results of operations in fiscal years 2015 and 2014, separately identifying the estimated impact of currency translation and the acquisition of Roehrig Engineering, Inc. (REI) in fiscal year 2014.

| Estimated | ||||||||||||||||

| Business | REI | Currency | ||||||||||||||

| (in thousands) | 2015 | Change | Acquisition | Translation | 2014 | |||||||||||

| Revenue | $ | 563,934 | $ | 27,292 | $ | 5,432 | $ | (33,118 | ) | $ | 564,328 | |||||

| Cost of sales | 344,321 | 22,295 | 3,740 | (22,399 | ) | 340,685 | ||||||||||

| Gross profit | 219,613 | 4,997 | 1,692 | (10,719 | ) | 223,643 | ||||||||||

| Gross margin | 38.9 | % | 39.6 | % | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Selling and marketing | 82,974 | (227 | ) | 117 | (5,052 | ) | 88,136 | |||||||||

| General administrative | 51,438 | 1,284 | 921 | (2,174 | ) | 51,407 | ||||||||||

| Research and development | 23,705 | 384 | - | (523 | ) | 23,844 | ||||||||||

| Total operating expenses | 158,117 | 1,441 | 1,038 | (7,749 | ) | 163,387 | ||||||||||

| Income from operations | $ | 61,496 | $ | 3,556 | $ | 654 | $ | (2,970 | ) | $ | 60,256 | |||||

Severance and Related Costs

We initiated workforce reductions and other cost reduction actions during fiscal year 2014. As a result of these actions, we incurred severance and related costs of $6,336 in fiscal year 2014, of which $3,507, $1,805, and $1,024 were reported in cost of sales, selling and marketing, and general and administrative expense, respectively. No severance and related costs were recognized in fiscal year 2015.

Revenue

| Increased / (Decreased) | |||||||||

| (in thousands) | 2015 | 2014 | $ | % | |||||

| Revenue | $ | 563,934 | $ | 564,328 | $ | (394) | (0.1%) | ||

Revenue was essentially flat. Increases in revenue from higher sales volumes, the impact of the 53rd week in fiscal year 2015 and $5,432 from the acquisition of REI which was completed in fiscal year 2014 were more than offset by the negative impact of currency translation. Excluding the impact of currency translation, revenue increased 5.8%. Test revenue increased $4,727 due to higher sales volumes, the impact of the 53rd week in fiscal year 2015 and the acquisition of REI which was completed in fiscal year 2014, partially offset by a 4.6% unfavorable currency translation. Sensors revenue declined $5,121 driven by an 11.3% unfavorable impact of currency translation.

| 23 |

The following table compares revenue in fiscal years 2015 and 2014 by geography.

| Increased / (Decreased) | ||||||||||

| (in thousands) | 2015 | 2014 | $ | % | ||||||

| Americas | $ | 173,523 | $ | 176,133 | $ | (2,610) | (1.5%) | |||

| Europe | 149,308 | 179,043 | (29,735) | (16.6%) | ||||||

| Asia | 241,103 | 209,152 | 31,951 | 15.3% | ||||||

| Total Revenue | $ | 563,934 | $ | 564,328 | $ | (394) | (0.1%) | |||

Although selective product price changes were implemented during each of these fiscal years, the overall impact of pricing changes did not have a material effect on revenue.

Gross Profit

| Increased / (Decreased) | |||||||||

| (in thousands) | 2015 | 2014 | $ | % | |||||

| Gross profit | $ | 219,613 | $ | 223,643 | $ | (4,030) | (1.8%) | ||

| Gross margin | 38.9 | % | 39.6 | % | (0.7) | ppts | |||

Gross profit declined due to the negative impact of currency translation, unfavorable product mix and an investment in labor and systems to improve utilization in the upcoming fiscal year. Due to a higher concentration of manufacturing performed in the U.S., currency had a 0.3 percentage point positive impact on the gross margin rate. Excluding the impact of currency translation, the gross margin rate decreased by 1.0 percentage point primarily driven by unfavorable product mix resulting from a higher number of custom projects which generally have lower margins and an investment in labor and systems to improve utilization in the upcoming fiscal year. The decrease was partially offset by severance and related costs of $3,507 recognized in fiscal year 2014 and nine months of profit totaling $1,692 from the acquisition of REI in fiscal year 2014.

Selling and Marketing Expense

| Increased / (Decreased) | |||||||||

| (in thousands) | 2015 | 2014 | $ | % | |||||

| Selling and marketing | $ | 82,974 | $ | 88,136 | $ | (5,162) | (5.9%) | ||

| % of Revenue | 14.7 | % | 15.6 | % | |||||

Selling and marketing expenses decreased due to a favorable impact of currency translation, severance and related costs of $1,805 during fiscal year 2014 and lower external commissions as a result of revenue timing, partially offset by merit increases and the timing of selling activities to drive future revenue growth.

General and Administrative Expense

| Increased / (Decreased) | |||||||||

| (in thousands) | 2015 | 2014 | $ | % | |||||

| General administrative | $ | 51,438 | $ | 51,407 | $ | 31 | 0.1% | ||

| % of Revenue | 9.1 | % | 9.1 | % | |||||

The general and administrative expense increase was driven by an estimated favorable impact of currency translation and $1,024 of severance and related costs incurred in fiscal year 2014 that did not recur in fiscal year 2015, offset by increased professional fees and nine months of expenses totaling $921 related to the acquisition of REI completed in fiscal year 2014.

| 24 |

Research and Development Expense

| Increased / (Decreased) | |||||||||

| (in thousands) | 2015 | 2014 | $ | % | |||||

| Research and development | $ | 23,705 | $ | 23,844 | $ | (139) | (0.6%) | ||

| % of Revenue | 4.2 | % | 4.2 | % | |||||

Research and development expense declined primarily due to an increase in the capitalization of internally developed software labor of $1,472 as headcount was reallocated to internally developed software activities and a favorable impact of currency translation, partially offset by higher compensation and benefits related to increased headcount.

Income from Operations

| Increased / (Decreased) | |||||||||

| (in thousands) | 2015 | 2014 | $ | % | |||||

| Income from operations | $ | 61,496 | $ | 60,256 | $ | 1,240 | 2.1% | ||

| % of Revenue | 10.9 | % | 10.7 | % | |||||

Income from operations increased primarily due to lower operating expenses.

Interest Expense, net

| Increased / (Decreased) | |||||||||

| (in thousands) | 2015 | 2014 | $ | % | |||||

| Interest expense, net | $ | 795 | $ | 692 | $ | 103 | 14.9% | ||

Interest expense, net was higher due to higher average borrowings on our credit facility.

Other (Expense) Income, net

| Increased / (Decreased) | |||||||||

| (in thousands) | 2015 | 2014 | $ | % | |||||

| Other expense, net | $ | 1,529 | $ | 1,121 | $ | 408 | 36.4% | ||

The increase in other expense, net was primarily driven by increased net losses on foreign currency transactions.

| 25 |

Provision for Income Taxes

| Increased / (Decreased) | ||||||||||||||||

| (in thousands) | 2015 | 2014 | $ | % | ||||||||||||

| Provision for income taxes | $ | 13,710 | $ | 16,434 | $ | (2,724 | ) | (16.6 | %) | |||||||

| Effective Rate | 23.2% | 28.1% | (4.9 | ) | ppts | |||||||||||

The decreased provision for income taxes during fiscal year 2015 was primarily due to a decrease in the effective tax rate. The decrease in the effective tax rate was primarily driven by the enactment of tax legislation during the three months ended December 27, 2014 that retroactively extended the United States research and development tax credit and resulted in a tax benefit of $2,098 in the first quarter of fiscal year 2015. In addition, we recognized a tax benefit of $1,836 associated with the favorable resolution in 2015 of audit matters in connection with the Internal Revenue Service examination of tax years ending October 1, 2011 and September 29, 2012. The 2015 rate was also favorably impacted by our geographic mix of earnings, with foreign income generally taxed at lower rates than domestic income. The 2014 effective tax rate includes a one-time benefit due to the recognition of additional federal and state research and development credit benefits of $2,563 which related to prior years.

Net Income

| Increased / (Decreased) | ||||||||||||||||

| (in thousands, except per share data) | 2015 | 2014 | $ | % | ||||||||||||

| Net income | $ | 45,462 | $ | 42,009 | $ | 3,453 | 8.2 | % | ||||||||

| Diluted earnings per share | 3.00 | 2.73 | 0.27 | 9.9 | % | |||||||||||

A $6,336 charge for severance and related costs negatively impacted fiscal year 2014 earnings per diluted share by $0.28. Excluding the severance and related costs, diluted earnings per share in fiscal year 2014 would have been essentially flat year-over-year.

Orders and Backlog

The following table compares orders in fiscal years 2015 and 2014, separately identifying the estimated impact of currency translation and the acquisition of REI in fiscal year 2014.

| Estimated | ||||||||||||||||||||

| (in thousands) | 2015 | Business Change | REI Acquisition | Currency Translation | 2014 | |||||||||||||||

| Orders | $ | 618,296 | $ | 35,159 | $ | 6,392 | $ | (38,841 | ) | $ | 615,586 | |||||||||

Orders were up 0.4% driven by strong orders in Asia, partially offset by the unfavorable impact of currency translations. Excluding the impact of currency translation, orders increased 6.7%. Orders for fiscal year 2015 included six large orders in Asia totaling $67,696 and one large order in the Americas totaling $5,150. Orders for fiscal year 2014 included six large orders in Asia totaling $42,249 and two large Americas orders totaling $19,028.

| 26 |

The following table compares orders in fiscal years 2015 and 2014 by geography.

| Increased / (Decreased) | ||||||||||

| (in thousands) | 2015 | 2014 | $ | % | ||||||

| Americas | $ | 158,735 | $ | 188,738 | $ | (30,003) | (15.9%) | |||

| Europe | 157,383 | 170,563 | (13,180) | (7.7%) | ||||||

| Asia | 302,178 | 256,285 | 45,893 | 17.9% | ||||||

| Total Orders | $ | 618,296 | $ | 615,586 | $ | 2,710 | 0.4% | |||

Backlog of undelivered orders at October 3, 2015 was $353,013, an increase of $26,540 or 8.1%, compared to backlog of $326,473 at September 27, 2014. The majority of this backlog is related to Test. Based on anticipated manufacturing schedules, we estimate that approximately $267,000 of the backlog at October 3, 2015 will be converted into revenue during fiscal year 2016 (76% conversion). The conversion rate is slightly down from the prior year rate of 77% due to a shift from short cycle, quicker turning orders to larger custom orders in fiscal year 2015.