Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - E TRADE FINANCIAL CORP | d8k.htm |

Goldman, Sachs & Co.

2010 U.S. Financial Services Conference

Steven Freiberg

Chief Executive Officer

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

December 8, 2010

Exhibit 99.1 |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

2

Safe Harbor Statement

This presentation contains certain projections or other forward-

looking statements regarding future events or the future

performance of the Company. Various factors, including risks

and uncertainties referred to in the 10Ks, 10Qs and other

reports E*TRADE Financial Corporation periodically files with

the SEC, could cause our actual results to differ materially

from those indicated by our projections or other forward-

looking statements. This presentation also contains disclosure

of non-GAAP financial measures. A reconciliation of these

financial measures to the most directly comparable GAAP

financial measures can be found on the investor relations site

at https://investor.etrade.com.

©

2010 E*TRADE Financial Corp. All rights reserved. |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

3

Overview

Solid Retail Brokerage Franchise, Enhanced by

Corporate Services & Market Making Businesses

Optimizing Value of Customer Deposits

Strengthening Financial Position

Improving Legacy Loan Portfolio |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

4

Solid Retail Brokerage Franchise

***********************************************

***********************************************

***********************************************

***********************************************

***********************************************

***********************************************

*********************************************** |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

5

Solid Retail Brokerage Franchise

Achieving competitive DART levels, continuing

to gain market share versus traditional brokers

Growing net new brokerage assets

Improving brokerage account attrition,

account quality, and customer satisfaction

Introducing new products and enhancements

for both active traders and long-term investors

Maintaining disciplined expense management

Generating consistent profitability |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

175

203

180

158

155

170

127

145

0

25

50

75

100

125

150

175

200

225

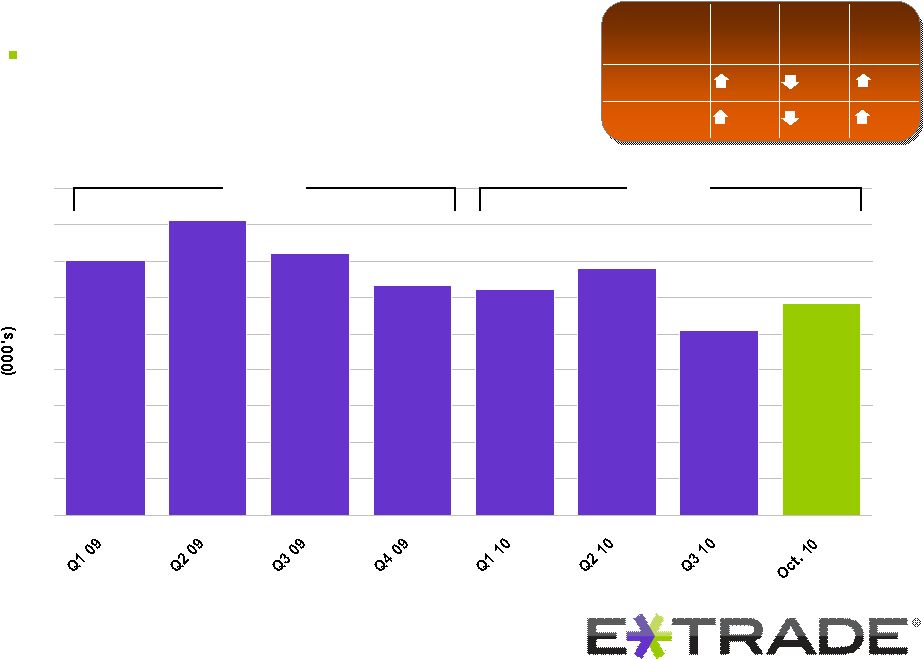

6

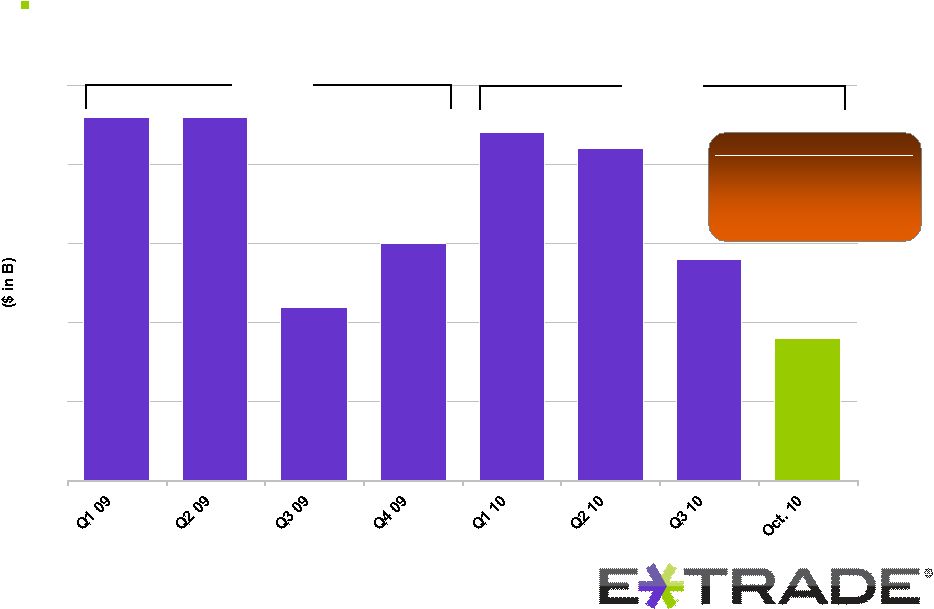

Solid Retail Brokerage Franchise

Competitive DART levels

179K

150K

YTD

2010

Oct /

Sep

Q3/

Q2

Q2/

Q1

E*TRADE

14%

26%

10%

Industry

10%

21%

7% |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

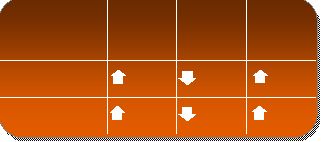

0

7

Solid Retail Brokerage Franchise

Growth in brokerage accounts & average assets per account

Brokerage accounts

Average brokerage assets per account

(1)

2,300

2,350

2,400

2,450

2,500

2,550

2,600

2,650

2,700

$0

$10

$20

$30

$40

$50

$60

$70 |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

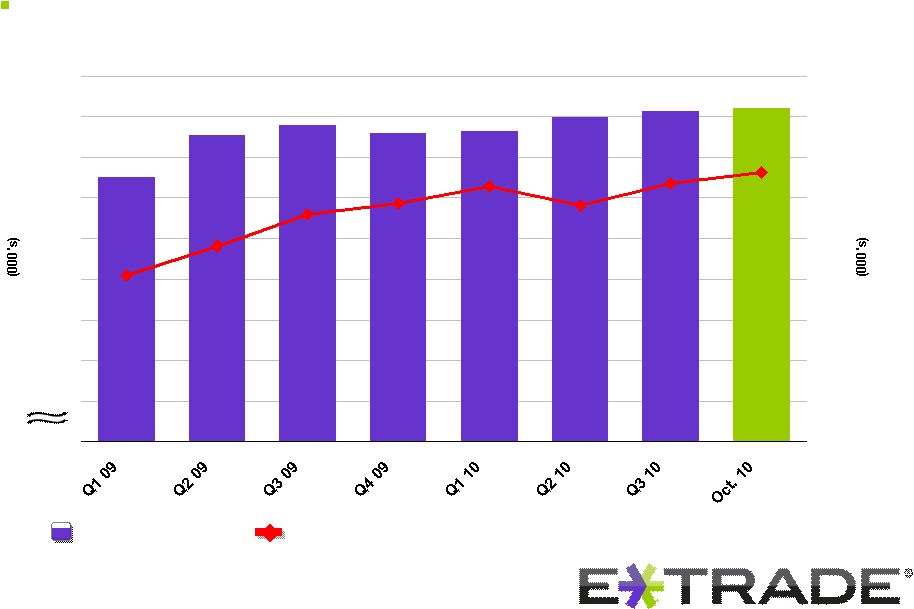

13.2%

12.4%

11.6%

14.3%

15.3%

13.0%

10.0%

10.3%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

8

Solid Retail Brokerage Franchise

Improved

brokerage

account

attrition

(2)

Goal: 10%

13.3%

12.6% |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

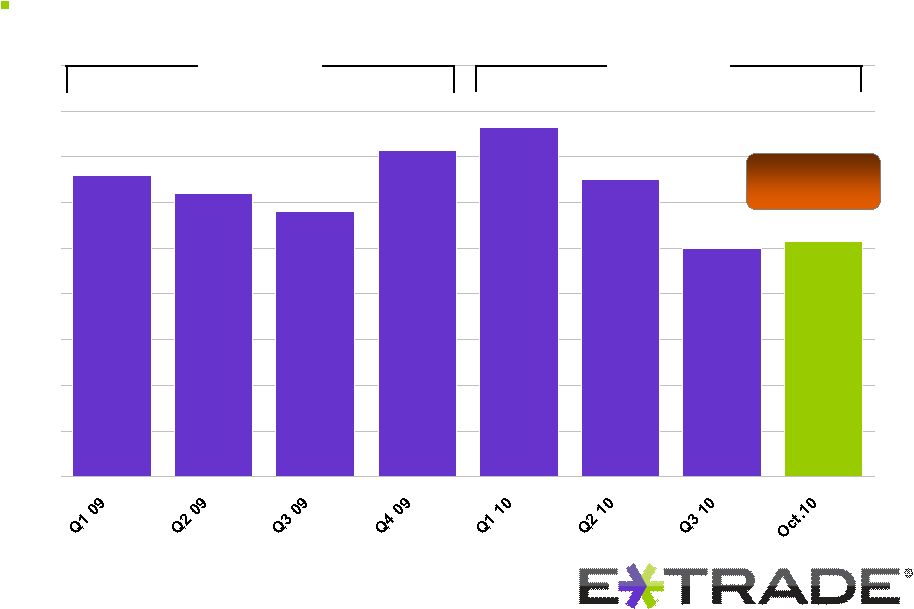

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

Solid Retail Brokerage Franchise

9

$7.2B

Consistent

growth

in

net

new

brokerage

assets

(3)

$6.6B

YTD

Brokerage asset flows

(4)

FY 2008: 3.6%

FY 2009: 8.6%

YTD 2010: 6.6% |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

$4.6

$4.8

$3.8

$3.7

$3.3

$3.0

$2.3

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

$4.5

$5.0

Solid Retail Brokerage Franchise

10

Growth in customer margin receivables |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

$0

$5

$10

$15

$20

$25

$30

$35

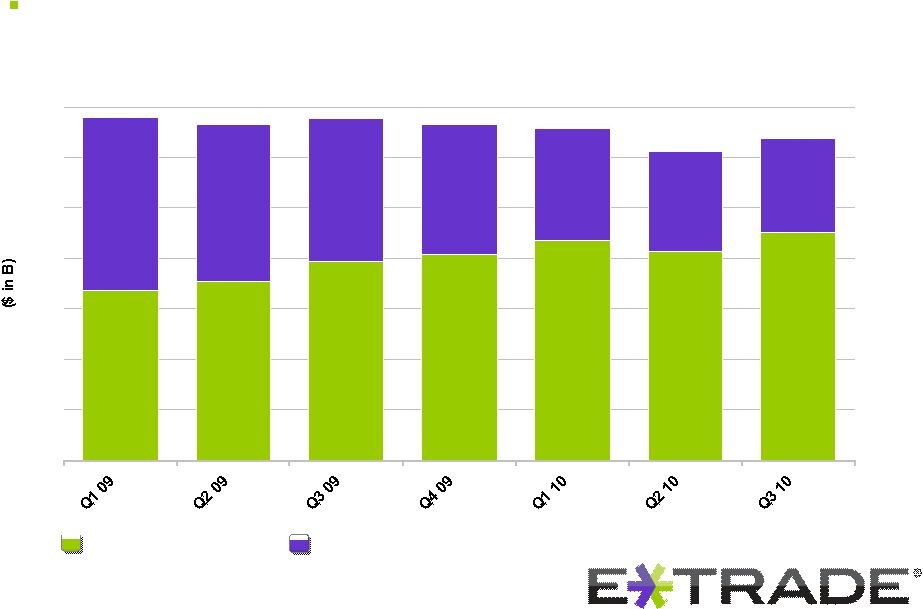

Solid Retail Brokerage Franchise

11

Improved strategic mix of customer cash,

providing longer duration and lower cost funding

Brokerage related cash

Bank related cash

29%

71%

32%

68%

34%

66%

39%

61%

42%

58%

47%

53%

51%

49% |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

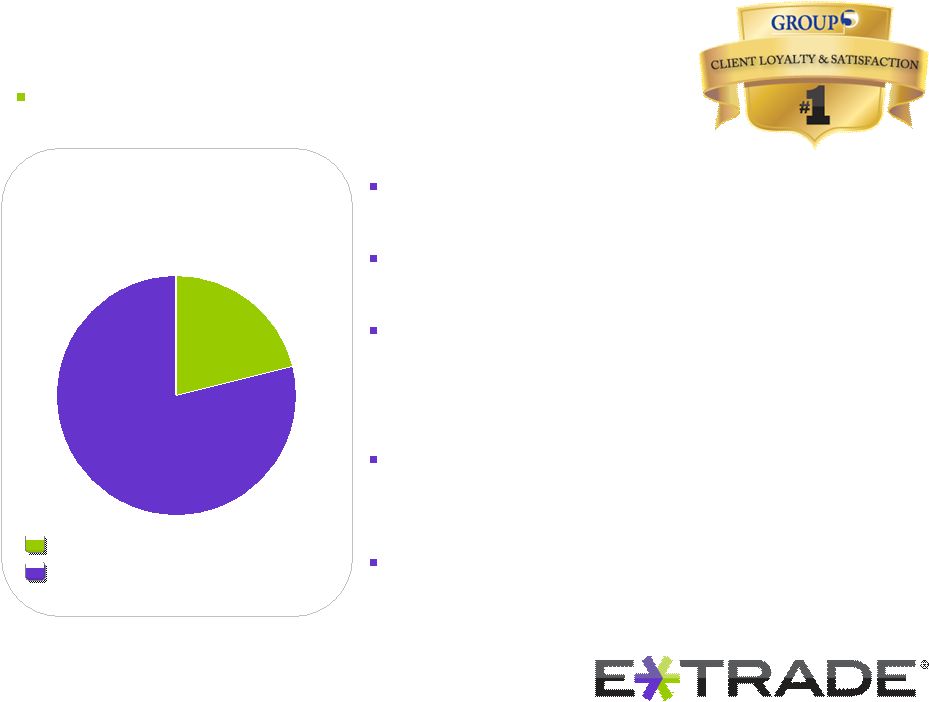

Solid Retail Brokerage Franchise

12

21%

79%

Enhanced by Corporate Services Group

Market leader in

administering stock plans

for public companies

More than 8 other providers

E*TRADE Corporate Services

Build on position as market leader:

Corporate clients comprise +20% of the S&P 500

Leverage best in class platform:

Equity Edge Online

Foster strategically important channel for

brokerage accounts:

Generating 25-30% of gross new brokerage

accounts

Cultivate retail relationships with corporate

employees:

Increasing dedicated relationship managers

Pursue strategic partnerships for growth:

Leveraging complementary capabilities

*GROUP FIVE rating for overall satisfaction and loyalty among broker plan

administrators for full and partial outsourced stock plan administration. |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

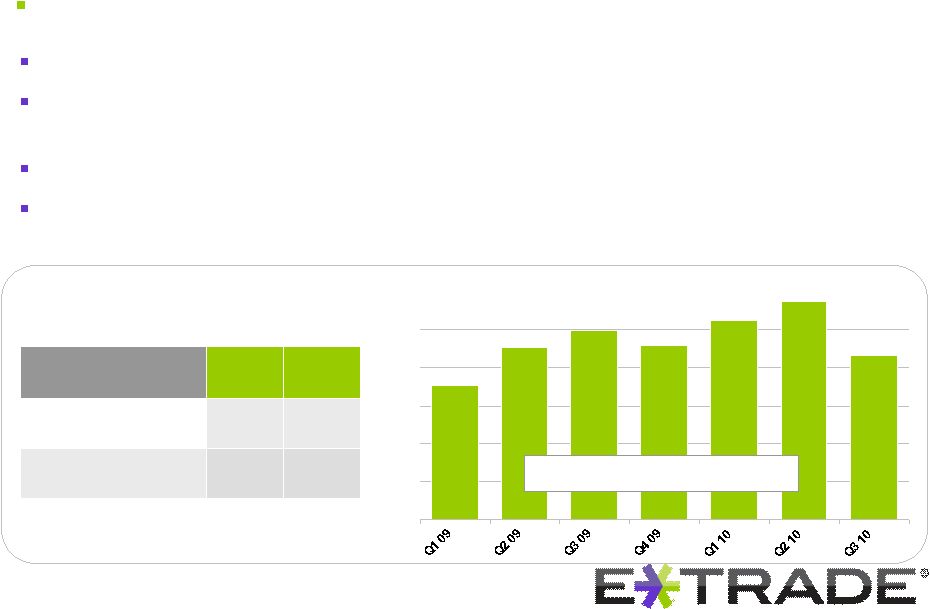

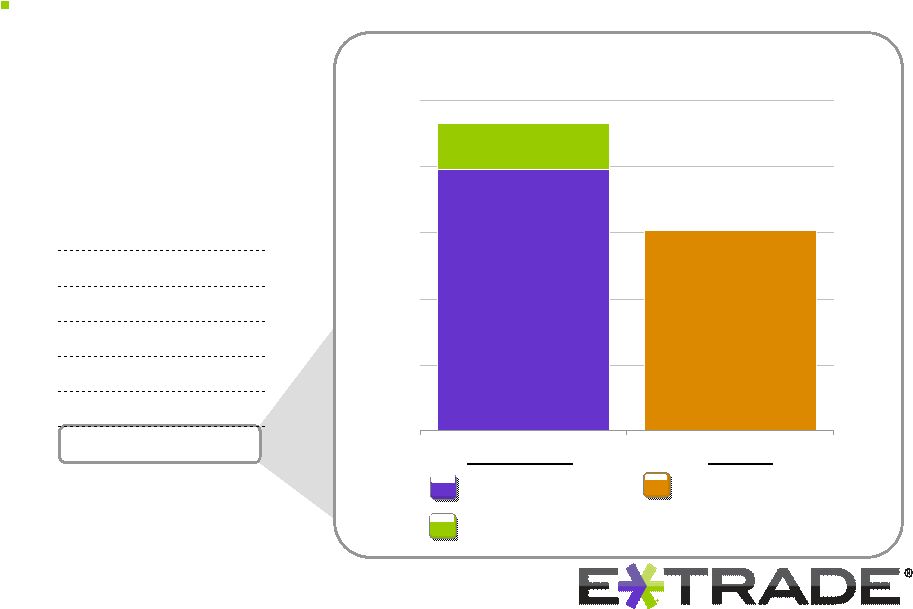

Solid Retail Brokerage Franchise

Enhanced by Market Making operations

Leveraging world class technologies and superior execution capabilities

Leading market share in OTC, foreign securities /

ADRs;

growing market share in National Market Securities

Capitalizing on strategically important internal order flow

Growing base of external customers, comprising 165+ broker/dealers,

up 15%+ y/y

($ in MM)

2009

2010

YTD

Revenue

$88

$76

Revenue from

external customers

36%

44%

Principal Transactions Revenue

13

$0

$5

$10

$15

$20

$25

20% growth since 2008

(5) |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

$0

$50

$100

$150

$200

$250

$300

$350

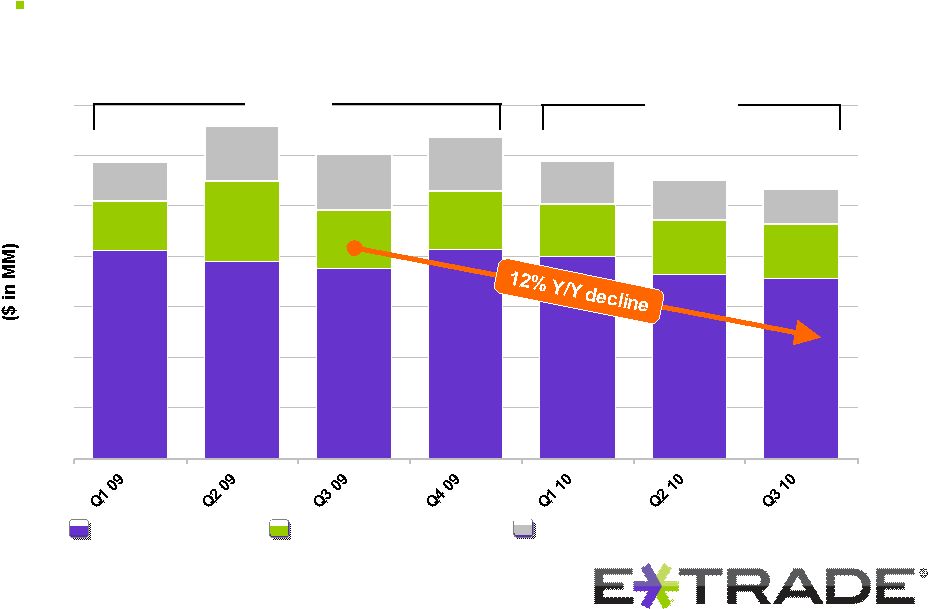

Solid Retail Brokerage Franchise

14

Disciplined expense management

Trading and Investing

$1.2B

Balance Sheet Management

Corporate

$0.8B

YTD |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

$0

$50

$100

$150

$200

$250

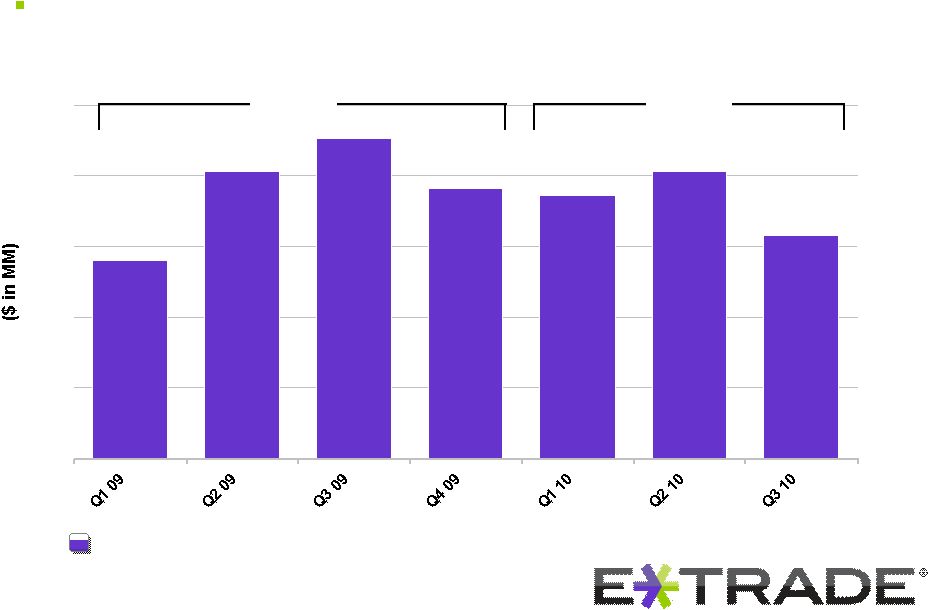

Solid Retail Brokerage Franchise

15

Consistently profitable trading and investing segment

Segment income

$760M

$547M

YTD |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

16

Solid Retail Brokerage Franchise

Strategies for growth

Increasing partner network

Rolling out developer kit

Application

Programming

Interface (API)

Evolving Products & Platform

Personalized

investor portal

A unique, customizable

investor experience

E*TRADE

Mobile Pro

Superior mobile platform,

accessing our most powerful

desktop tools

Platform for Android

Enhanced

capabilities in

options, futures

and FX

3-4 legged spreads

Portfolio margining

Communities

Connecting customers for

education, investing ideas |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

17

Solid Retail Brokerage Franchise

Strategies for growth

Turbocharging

Sales & Enhancing Service

Significantly

increasing sales

impact

Increase sales network +35% in 2011; incremental to +17% in 2010

Implementing performance management plan that clearly measures,

targets, and rewards performance

Improving lead generation, maximizing asset gathering

Segmentation and targeting of long-term investors for outreach

Expanding

annuitized

revenue product

sales

Greater focus on mutual funds and Managed Investment Portfolios

Launching unified managed and separately managed accounts

Continuous improvements in awareness/packaging of diversified

investment products

Continuously

improving the

customer

experience

Improved first call resolution from 30% to 60%; raised customer

satisfaction 24% over 2 years. Net promoter score 33% in 2010, up

from 16% in 2009.

Enhanced

self-help

tools

–

online

service

center

Re-engineered

customer

routing

–

50%

interactive

voice

response |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

18

Funds account

Completes application…

Starts application process…

Prospect visits site…

Opportunities to drive greater

conversion

New advertising campaign

Homepage optimization

w/dynamic content

New online application

Updated on-boarding

Opportunities for greater conversion of prospects

Solid Retail Brokerage Franchise

•Print

•Other

•TV

•Online

Marketing

Sales Channels

•Local branches

•National centers

Every 10k gross new accounts

~$200MM in assets / $3MM in revenue |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

19

Solid Retail Brokerage Franchise

Strategies for growth

Refining Brand & Marketing

Prospect site & homepage

optimization

8 BETA versions of site, increasing

prospect conversions +5%

Overhauled online application

Targeted and aggressive

offers and direct marketing

Testing multiple offers; focused on

greater assets and account quality

Dynamic communication in online

ads; audience targeting

Balancing campaign mix

between renowned “baby”

and new “passion”

advertisements

“Passion”

campaign focused on

mature, wealthy prospects

Expanding brand recognition

beyond trading |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

20

Solid Retail Brokerage Franchise

Expanding offerings for long-term investors

Broaden and strengthen revenue drivers through disruptive

innovation, expanding beyond current business

model (customer base, wallet share, other

revenue drivers) Complementing organic growth

strategies

Developing innovative product and service offerings based on significant

unmet consumer needs and large opportunity spaces

Creating opportunities to grow revenue with new, larger population

segments

Focusing on concepts with disruptive & scale potential; leveraging brand,

business model, and customer base

Formed an experienced and focused group to lead disruptive innovation;

currently in research to identify, understand, test, and prioritize approach

to: |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

21

Optimizing Value of

Customer Deposits

***********************************************

***********************************************

***********************************************

***********************************************

***********************************************

***********************************************

*********************************************** |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

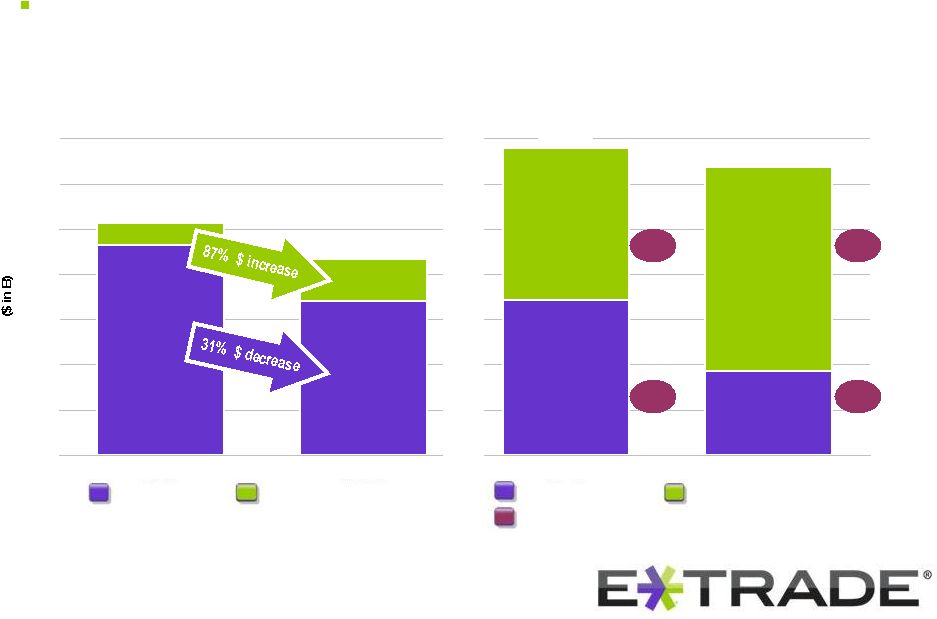

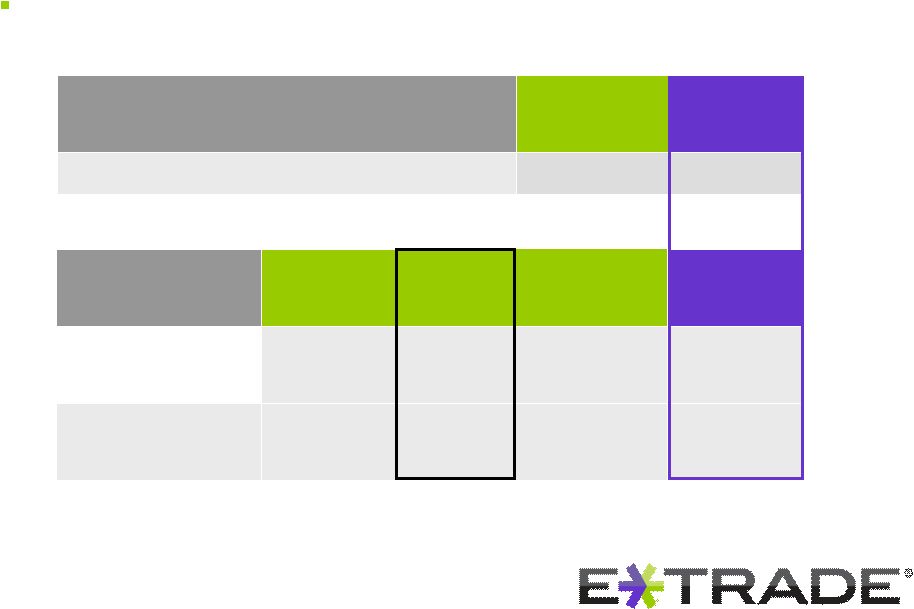

Optimizing Value of Customer Deposits

22

Improving mix of loans and customer deposits

$0

$5

$10

$15

$20

$25

$30

$35

Q1 09

Q3 10

Q1 09

Q3 10

91%

78%

51%

29%

$34B

$32B

22%

49%

71%

$26B

9%

Loans, net

Margin receivables

Bank related cash

Brokerage related cash

$21B

Loans

Customer Deposits

Average customer yield

(6)

12bps

39bps

22bps

222bps |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

23

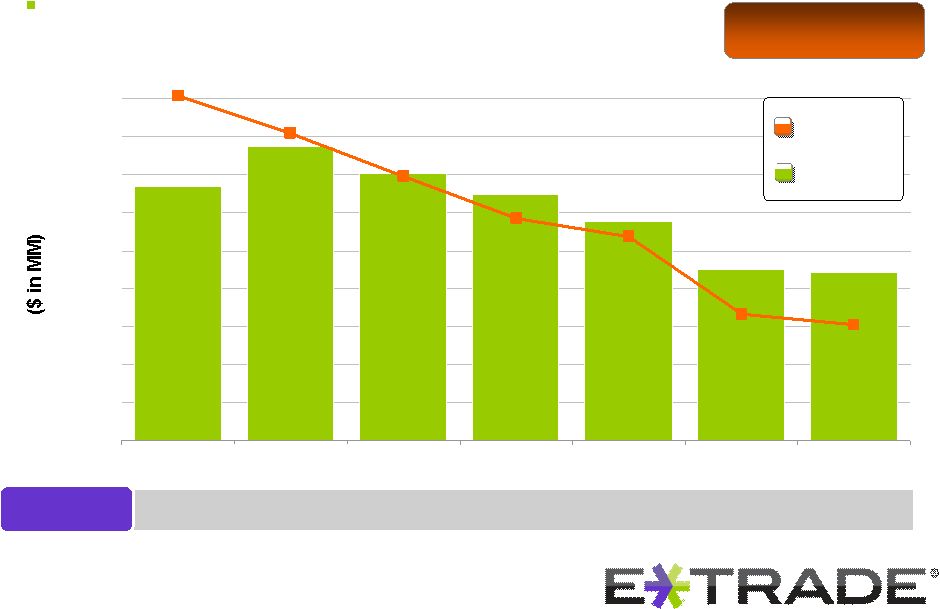

Optimizing Value of Customer Deposits

Customer deposit franchise driving balance sheet size and mix

Target interest earning assets: ~ $40B

Balance Sheet Reinvestment Strategies

Continue to increase brokerage deposits

Focus on growing customer margin receivables

Segmentation of legacy loan portfolio

Invest in agencies and other high quality assets

Manage challenges of interest rate environment |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

24

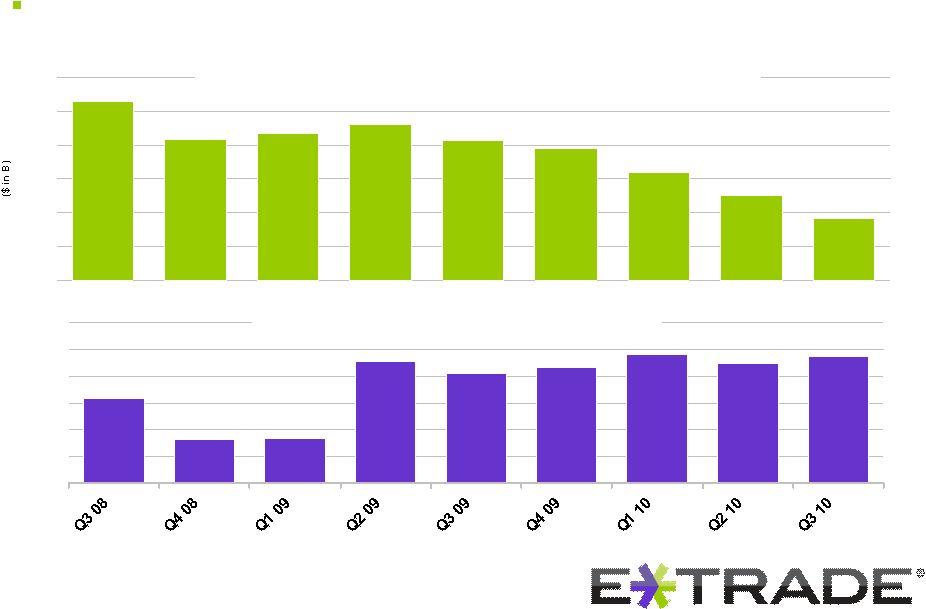

Optimizing Value of Customer Deposits

Customer deposit franchise driving balance sheet size and mix

$46.6

$44.3

$44.7

$45.2

$44.3

$43.8

$42.4

$41.0

$39.7

$36

$38

$40

$42

$44

$46

$48

2.63%

2.32%

2.34%

2.91%

2.82%

2.86%

2.96%

2.89%

2.95%

2.00%

2.20%

2.40%

2.60%

2.80%

3.00%

3.20%

Average enterprise interest earning assets

Enterprise net interest spread |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

25

Improving Legacy Loan Portfolio

***********************************************

***********************************************

***********************************************

***********************************************

***********************************************

***********************************************

*********************************************** |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

26

Improving Legacy Loan Portfolio

($ in B)

Loan

Balance

9/30/07

(7)

Paydowns

(8)

Charge-offs

Loan

Balance

9/30/10

(7)

1-4 Family loans

$16.9

($7.4)

($0.8)

$8.7

Home equity

$12.4

($3.3)

($2.3)

$6.8

Consumer

$3.0

($1.2)

($0.2)

$1.6

TOTAL

$32.3

($11.9)

($3.3)

$17.1

Loan portfolio continues to run off |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

$0

$100

$200

$300

$400

$500

$600

$700

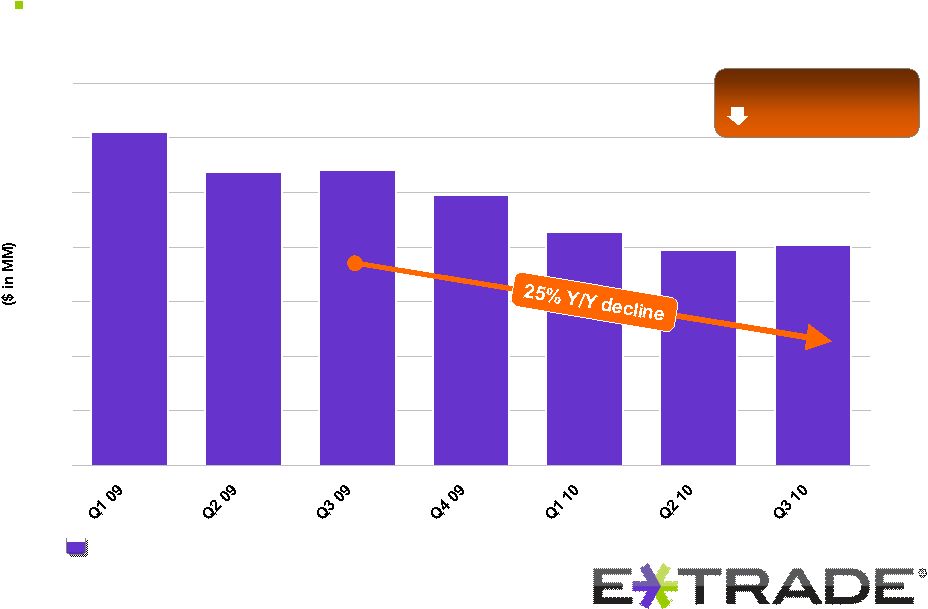

27

Improving Legacy Loan Portfolio

Improvement in 1-4 family delinquencies

30-89 Days delinquent

Portfolio size: $8.7B

48% from 2007 peak |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

$0

$50

$100

$150

$200

$250

$300

$350

28

Improving Legacy Loan Portfolio

Improvement in home equity delinquencies

30-89 Days delinquent

Portfolio size: $6.8B

48% from 2007 peak |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

$0

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

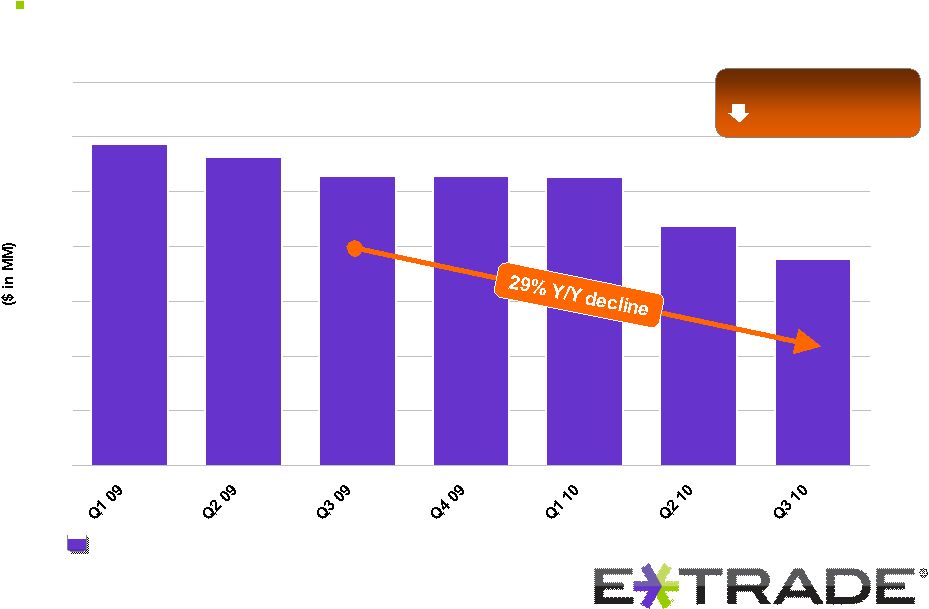

Q3 10

29

Improving Legacy Loan Portfolio

Allowance

Provision for

loan losses

Charge-offs

Continued decline in provision and charge-offs

$1,201

$1,219

$1,215

$1,183

$1,162

$1,103

$1,033

8 quarters of

declining provision |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

30

Strengthening Financial Position

***********************************************

***********************************************

***********************************************

***********************************************

***********************************************

***********************************************

*********************************************** |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

31

Strengthening Financial Position

Generating regulatory risk-based capital ($ in MM)

Q1 09

($271)

Q2 09

($33)

Q3 09

($26)

Q4 09

($86)

Q1 10

$47

Q2 10

$63

Q3 10

$81

Capital generation

(usage)

(9)

$35

$152

$198

$0

$50

$100

$150

$200

$250

Sources

Uses

Q3 2010 capital generation

(9)

of $81MM

Bank earnings

(10)

Loan loss provision

Portfolio changes and other

(11) |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

32

Strengthening Financial Position

Generating capital in excess of regulatory and management targets

Bank capital

(12)

as of 9/30/10 ($ in millions)

Well-

capitalized

threshold

Ratio

Excess to

well-capitalized

threshold

Excess to

management

target

Total capital to

risk-weighted

assets

10.0%

15.0%

$1,090

$590

Tier I Capital to

total adjusted

assets

5.0%

7.4%

$976

$569

9/30/10

Excess to

management

target

Corporate cash

($ in millions)

$490

$158 |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

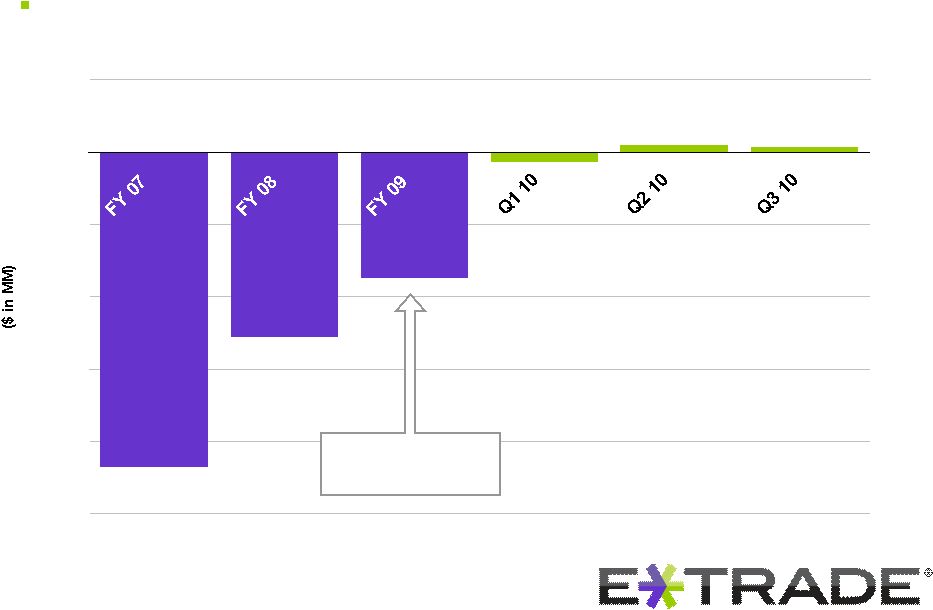

33

Strengthening Financial Position

Continued improvement in pre-tax income (loss)

($867)

($1,279)

($2,175)

-$2,500

-$2,000

-$1,500

-$1,000

-$500

$0

$500

Excludes impact

of Debt Exchange

(13) |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

34

Overview

Solid Retail Brokerage Franchise, Enhanced by

Corporate Services & Market Making Businesses

Optimizing Value of Customer Deposits

Strengthening Financial Position

Improving Legacy Loan Portfolio |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

35 |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

36

Appendix

Explanation of Non-GAAP Measures and Certain Metrics

Management believes that bank earnings before taxes and before credit losses

is an appropriate measure for evaluating the operating and liquidity

performance of the Company. Management believes that the elimination of certain

items from the related GAAP measures is helpful to investors and analysts who may wish to use some or all

of this information to analyze our current performance, prospects and valuation.

Management uses non-GAAP information internally to evaluate our operating performance in formulating our

budget for future periods.

(1)

Average

brokerage

assets

per

account

is

calculated

as

the

sum

of

security

holdings

and

brokerage

related

cash

divided

by

end

of

period

brokerage

accounts.

(2)

The

attrition

rate

is

calculated

by

dividing

attriting

(a)

brokerage

accounts,

by

total

brokerage

accounts,

for

the

previous

period

end.

This

measure

is

presented

annually

and

on

an

annualized

basis (where it appears quarterly).

(a) Attriting

brokerage accounts: Gross new brokerage accounts, less net new brokerage

accounts. (3) The net new brokerage assets metrics treat asset flows between

E*TRADE entities in the same manner as unrelated third party accounts.

(4)

Brokerage

asset

flows

are

calculated

by

dividing

the

total

amount

of

net

new

brokerage

assets

for

the

period,

by

the

total

amount

of

brokerage

assets

(a)

for

the

previous

period

end.

(a) Brokerage assets: Sum of security holdings and brokerage related cash.

(5) Growth rate is calculated using annualized revenue for 2010 based on the nine

months ended September 30, 2010. (6) Average customer yield includes customer

cash balances held by third parties. (7) Represents unpaid principal

balances. (8) Net paydowns

includes paydowns

on loans as well as limited origination activity, home equity advances, repurchase

activity, limited sale and securitization activities and transfers to real

estate owned assets.

(9) Capital generation (usage) represents the increase (decrease) in excess

risk-based capital at E*TRADE Bank excluding any capital downstreams. Q3

2010 Q2 2010

Q1 2010

Q4 2009

Q3 2009

Q2 2009

Q1 2009

Income (loss) before income tax benefit

35,544

$

52,259

$

(65,929)

$

(128,530)

$

(1,151,349)$

$

(211,496)

(344,056)

$

Add back:

Non-bank loss before income tax benefit (b)

49,775

49,860

58,016

80,286

1,032,910

71,731

84,525

Provision for loan losses

151,983

165,666

267,979

292,402

347,222

404,525

453,963

Gains on loans and securities, net

(46,904)

(48,908)

(29,046)

(18,667)

(41,979)

(73,170)

(35,290)

Net impairment

7,301

12,158

8,652

21,412

19,229

29,671

18,783

Losses on early extinguishment of FHLB advances

-

-

-

-

37,239

10,356

2,999

Bank earnings before taxes and before credit losses

197,699

$

231,035

$

239,672

$

246,903

$

243,272

$

231,617

$

180,924

$

(10) Bank earnings before taxes and before credit losses represents the pre-tax

earnings of E*TRADE Bank Holding Company (“Bank”) provision for loan losses, gains (losses) on loans and

securities, net, net impairment and losses on early extinguishment of FHLB

advances. This metric shows the amount of earnings that the Bank, after accruing for the interest expense on its

trust

preferred

securities,

generates

each

quarter

prior

to

credit

related

losses,

primarily

provision

and

losses

on

securities.

Management

believes

this

non-GAAP

measure

is

useful

to

investors

and

analysts

as

it

is

an

indicator

of

the

level

of

credit

related

losses

the

Bank

can

absorb

without

causing

a

decline

in

E*TRADE

Bank’s

excess

risk-based

capita

l(a).

Below

is

a

reconciliation of Bank earnings before taxes and before credit losses from loss

before income taxes: (a)

Excess risk-based capital is the excess capital that E*TRADE Bank has compared

to the regulatory minimum well-capitalized threshold.

(b)

Non-bank loss represents all of the Company’s subsidiaries, including

Corporate, but excluding the Bank. |

©

2010 E*TRADE Financial Corp. All rights reserved.

This presentation contains confidential information and may not be disclosed

without E*TRADE Financial Corporation’s written permission.

37

(11) Portfolio

changes

and

other

includes

the

decrease

in

risk

based

capital

required

for

our

one-

to

four-family,

home

equity

and

consumer

loan

portfolios,

the

decrease

(increase)

in

margin,

capital downstreams

or upstreams

and other capital changes.

Q3 2010

Q2 2010

Q1 2010

Q4 2009

Q3 2009

Q2 2009

Q1 2009

Beginning E*TRADE Bank excess risk-based capital ($MM)

1,008

$

946

$

899

$

985

$

911

$

444

$

715

$

Bank earnings before taxes and before credit losses

198

231

240

247

243

232

181

Provision for loan losses

(152)

(166)

(268)

(292)

(347)

(405)

(454)

Loan portfolio run-off

(a)

72

71

85

81

131

101

84

Margin decrease (increase)

22

(90)

(17)

(37)

(30)

(69)

36

Capital downstream (upstream)

(b)

(34)

(25)

(39)

(28)

100

500

-

Other capital changes

(c)

(24)

41

46

(57)

(23)

108

(118)

Ending E*TRADE Bank excess risk-based capital ($MM)

1,090

$

1,008

$

946

$

899

$

985

$

911

$

444

$

(a)

The

capital

release

from

loan

portfolio

run-off

includes

the

decrease

in

risk-based

capital

required

for

our

one-

to

four-family,

home

equity

and

consumer

loan

portfolios.

(b)

Represents cash flows to and from the parent company.

(c)

Represents the capital impact related to changes in other risk-weighted assets.

Appendix

FY 2009

Pre-tax net loss

(1,835,431)

$

Add back: pre-tax non-cash charge on Debt Exchange

968,254

Adjusted pre-tax net loss

(867,177)

$

(12) Capital ratios, thresholds and excess capital amounts are at the E*TRADE Bank

level. (13) In the third quarter of 2009, the Company exchanged $1.7 billion

aggregate principal amount of interest-bearing corporate debt for an equal principal amount of newly-issued non-interest-

bearing

convertible

debentures.

This

Debt

Exchange

resulted

in

a

pre-tax

non-cash

charge

of

$968

million.

The

following

table

provides

a

reconciliation

of

GAAP

pre-tax

net

loss

to

non-GAAP

pre-tax net loss for FY2009: |