Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | d8k.htm |

Broadridge

Financial Solutions, Inc.

November 2010

J.P. Morgan Ultimate Services

Conference Presentation

Richard J. Daly

Chief Executive Officer

Exhibit 99.1 |

2

Forward-Looking Statements

This

presentation

and

other

written

or

oral

statements

made

from

time

to

time

by

representatives

of

Broadridge

may

contain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Statements

that

are

not

historical

in

nature,

such

as

our

fiscal

year

2011

financial

guidance,

and

which

may

be

identified

by

the

use

of

words

like

“expects,”

“assumes,”

“projects,”

“anticipates,”

“estimates,”

“we

believe,”

“could

be”

and

other

words

of

similar

meaning,

are

forward-looking

statements.

These

statements

are

based

on

management’s

expectations

and

assumptions

and

are

subject

to

risks

and

uncertainties

that

may

cause

actual

results

to

differ

materially

from

those

expressed.

These

risks

and

uncertainties

include

those

risk

factors

discussed

in

Part

I,

Item

1A.

“Risk

Factors”

of

our

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

June

30,

2010

(the

“2010

Annual

Report”),

as

they

may

be

updated

in

any

future

reports

filed

with

the

Securities

and

Exchange

Commission.

Any

forward-looking

statements

are

qualified

in

their

entirety

by

reference

to

the

factors

discussed

in

the

2010

Annual

Report.

These

risks

include:

the

success

of

Broadridge

in

retaining

and

selling

additional

services

to

its

existing

clients

and

in

obtaining

new

clients;

the

pricing

of

Broadridge’s

products

and

services;

changes

in

laws

and

regulations

affecting

the

investor

communication

services

provided

by

Broadridge;

declines

in

participation

and

activity

in

the

securities

markets;

overall

market

and

economic

conditions

and

their

impact

on

the

securities

markets;

any

material

breach

of

Broadridge

security

affecting

its

clients’

customer

information;

the

failure

of

Broadridge’s

outsourced

data

center

services

provider

to

provide

the

anticipated

levels

of

service;

any

significant

slowdown

or

failure

of

Broadridge’s

systems

or

error

in

the

performance

of

Broadridge’s

services;

Broadridge’s

failure

to

keep

pace

with

changes

in

technology

and

demands

of

its

clients;

Broadridge’s

ability

to

attract

and

retain

key

personnel;

the

impact

of

new

acquisitions

and

divestitures;

and

competitive

conditions.

Broadridge

disclaims

any

obligation

to

update

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

This

presentation

may

include

certain

Non-GAAP

(generally

accepted

accounting

principles)

financial

measures

in

describing

Broadridge’s

performance.

Management

believes

that

such

Non-GAAP

measures,

when

presented

in

conjunction

with

comparable

GAAP

measures

provide

investors

a

more

complete

understanding

of

Broadridge’s

underlying

operational

results.

These

Non-GAAP

measures

are

indicators

that

management

uses

to

provide

additional

meaningful

comparisons

between

current

results

and

prior

reported

results,

and

as

a

basis

for

planning

and

forecasting

for

future

periods.

These

measures

should

be

considered

in

addition

to

and

not

a

substitute

for

the

measures

of

financial

performance

prepared

in

accordance

with

GAAP.

The

reconciliations

of

such

measures

to

the

comparable

GAAP

figures

are

included

in

this

presentation. |

3

Use of Material Contained Herein

The information contained in this presentation is being provided

for your

convenience and information only. This information is accurate as of the date

of its initial presentation. If you plan to use this information for

any purpose, verification of its continued accuracy is your

responsibility. Broadridge assumes no duty to update or revise the

information contained in this

presentation. You may reproduce information contained in this presentation

provided you do not alter, edit, or delete any of the content and provided

you identify the source of the information as Broadridge Financial

Solutions, Inc., which owns the copyright.

Broadridge and the Broadridge logo are registered trademarks of Broadridge

Financial Solutions, Inc. |

4

Agenda

Broadridge Overview and Summary

Business Overview

Business Expansion Strategy Overview

Financial Overview

Conclusion |

5

Broadridge Investment Thesis

Generate

very strong and

highly predictable

free cash flows

Strong core Investor

Communications business

which generates over 70% of

annual revenues and earnings

Market leader with high

client retention rates

driven by product innovation

Approximately 80%

in recurring annual revenues

Dependable mid-single-digit

revenue growth business

Highly experienced

management team

Scalable business model

with core business

generating margin expansion

Aim to invest in existing businesses and acquisitions to generate mid to

high- single-digit revenue growth and return excess cash to

shareholders |

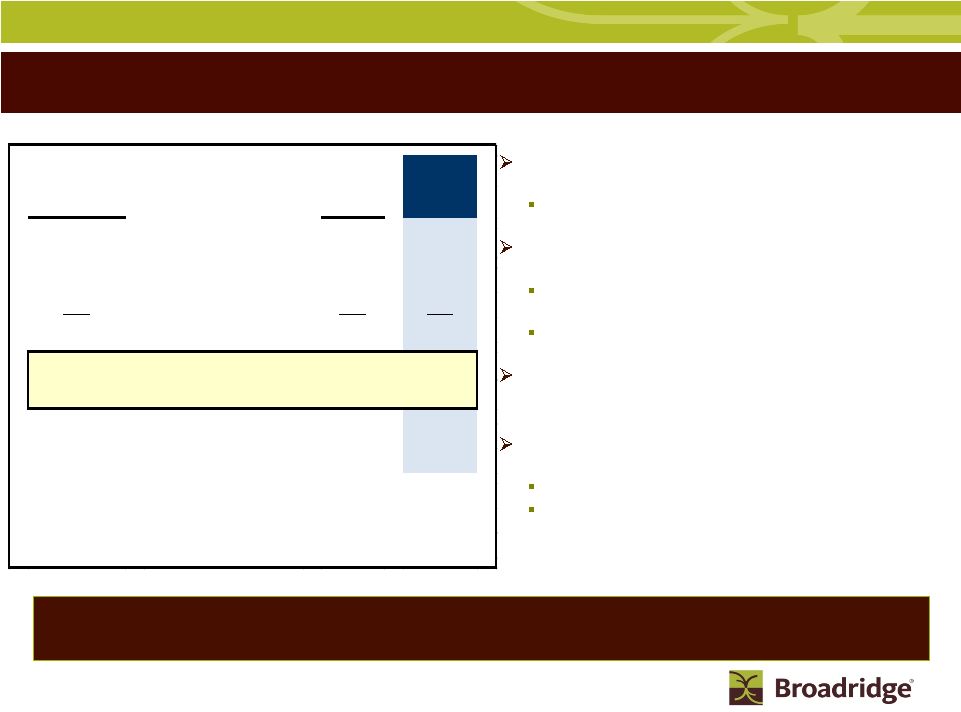

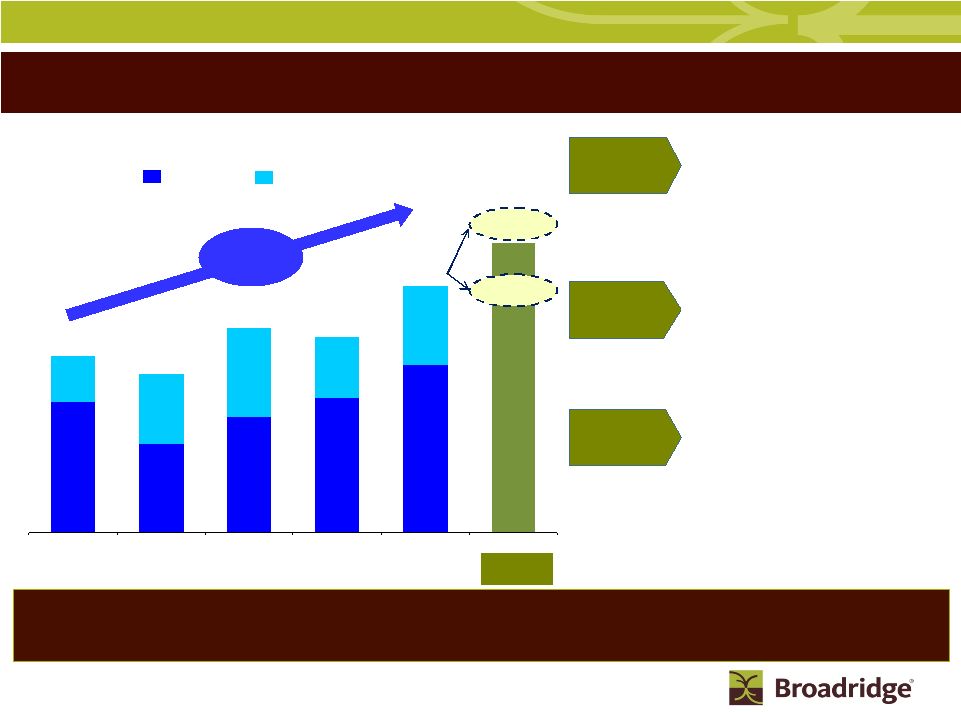

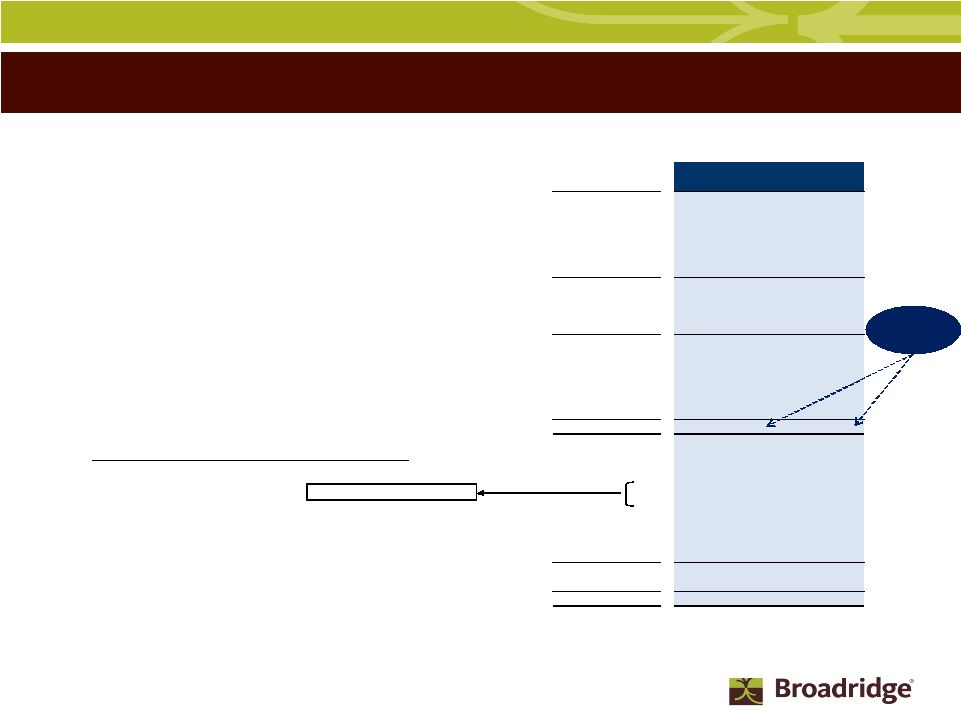

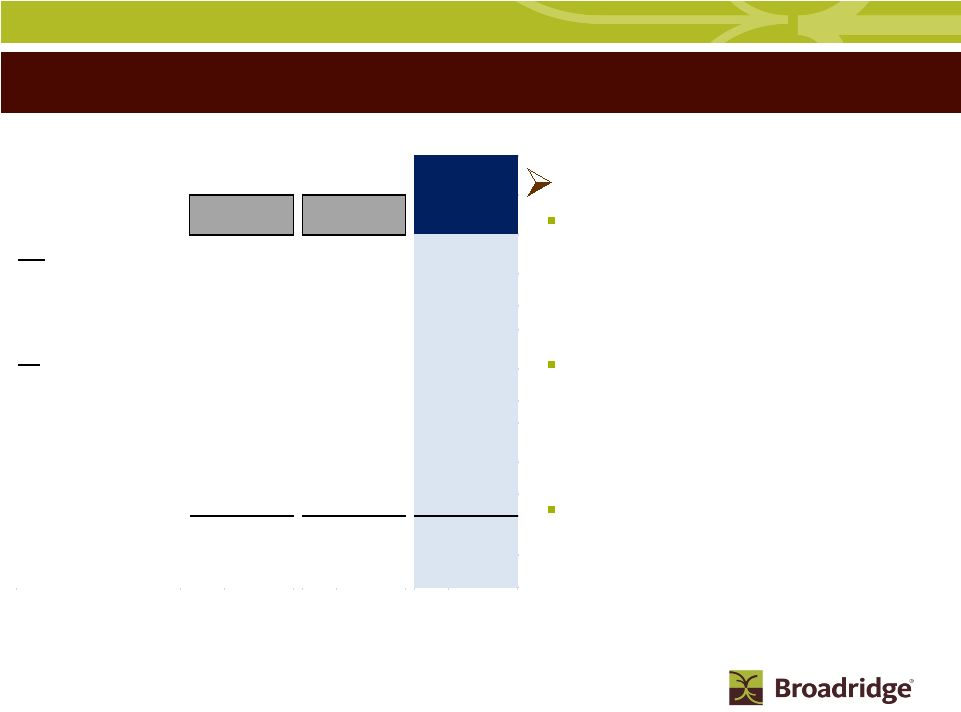

6

$290

$251

Broadridge

Free Cash Flow & Capital Allocation

Note: Free Cash Flow excludes financing activities in the Clearing and Outsourcing

Solutions segment Dividends

•Doubled annual dividend

amount from $0.28 to $0.56

per share for FY10, and

further increased annual

dividend amount 7% to

$0.60 per share for FY11

Stock

Repurchases

•Repurchased 20.2 million

shares pursuant to stock

repurchase plans since

spin-off with an additional

11.8 million authorization as

of September 30, 2010

Acquisitions

•Strategic acquisitions to

leverage the Broadridge

brand and distribution

channels

Strong predictable free cash flow allows for flexible capital allocation

options (1) Free cash flow is a Non-GAAP financial measure

and is defined as net cash flow provided by continuing operating activities, less capital expenditures and intangibles. A

reconciliation to the nearest GAAP numbers are provided in the

Appendix. $325

FY07

FY08

FY09

FY10

FY11

Free Cash Flow

(Non-GAAP)

(1)

($ in millions)

High: $222

Low: $166

$252

Forecast

Range |

7

Broadridge Mission

Partner with

Financial Institutions

to:

Reduce

Risk & Cost

Increase

Performance

•

Enable the financial services

industry to achieve higher levels

of performance by allowing firms

to focus on their core business

•

Help clients manage their

regulatory compliance risk by

improving clients’

processing,

communication accuracy and

data security

•

Deliver cost savings to financial

institutions through outsourcing

their non-differentiating back-

office processes

•

Develop long lasting relationships

with world class companies built

on mutual success

Our Mission is To Reduce Clients’

Risk While Lowering Their Total Cost of Ownership |

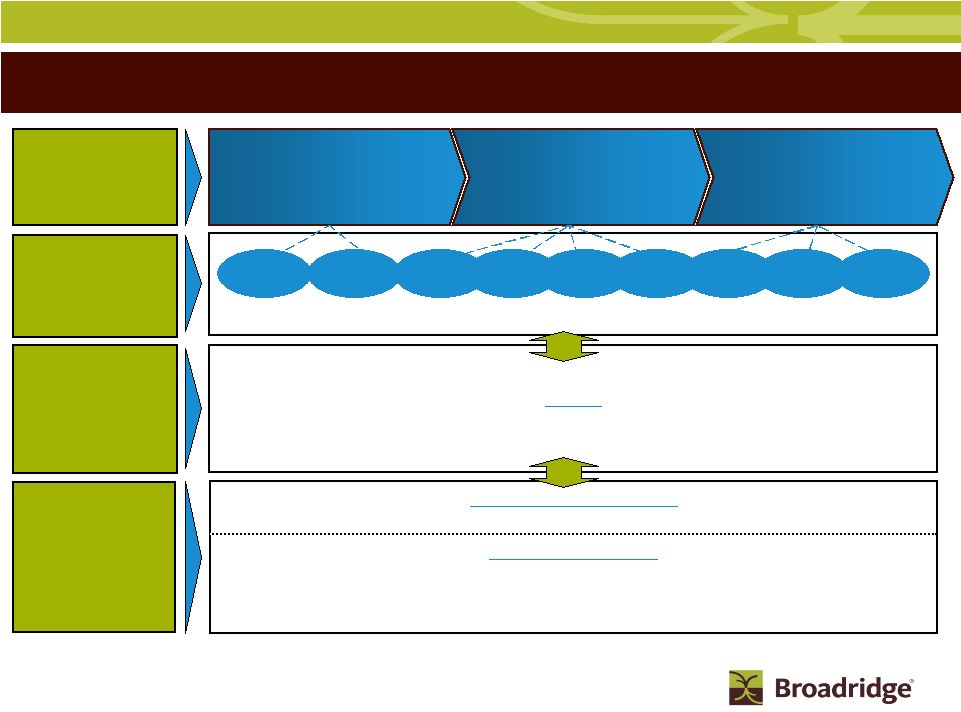

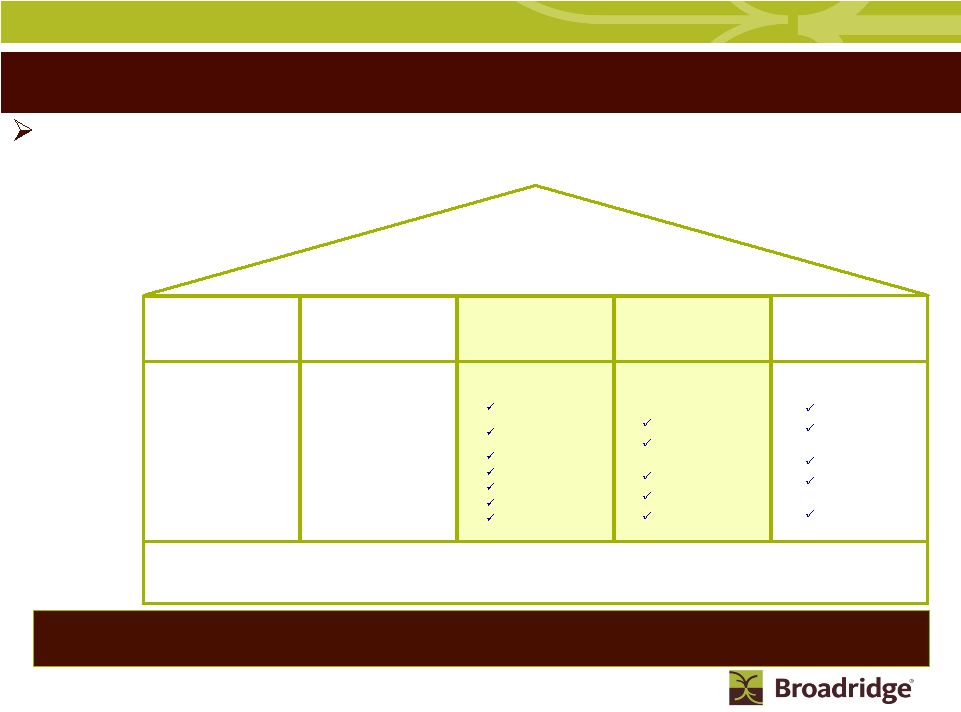

8

Individual (Retail) and Institutional

Clients

Broker-Dealers, Banks, Mutual Funds, Corporate Issuers

Integrated Solutions Spanning the Investment Lifecycle

Investment

Decision

(Pre-Trade)

Trade Processing

&

Books and Records

Asset

Servicing

(Post-Trade)

New Accounts

Welcome Kits

Proxy

Fulfillment

Archival

Confirms

Across the

investment

lifecycle...

...By partnering

with the world’s

leading financial

institutions...

...And delivering

broad and

innovative

global solutions

Investor Communications

Proxy management, corporate governance, and stockholder

communications Securities Processing

Global trade processing for equities, options,

mutual funds, and fixed income securities

and operations outsourcing solutions

Processing

Reporting

Statements

...Broadridge

touches

investors... |

9

Resilient and Predictable Business Model

Business is resilient and largely independent of the stock market being at its highs

or lows……….predictable revenue stream drives predictable free

cash flow Recurring

Revenue

(~80%)

Event-

Driven

Revenue

(~20%)

Shareholder Positions

Images and Pieces

Processed

Revenue Drivers

A Market Leader

with

High Retention Rates

Recurring Revenue

Complex Proprietary

Processing Platforms

High Client Satisfaction

and Highly Engaged

Associates

Investor Communication

Solutions

Securities Processing

Solutions

Indispensable Provider for

Mission Critical Processing

Processing Fees

(Trades Per Day)

# of Accounts |

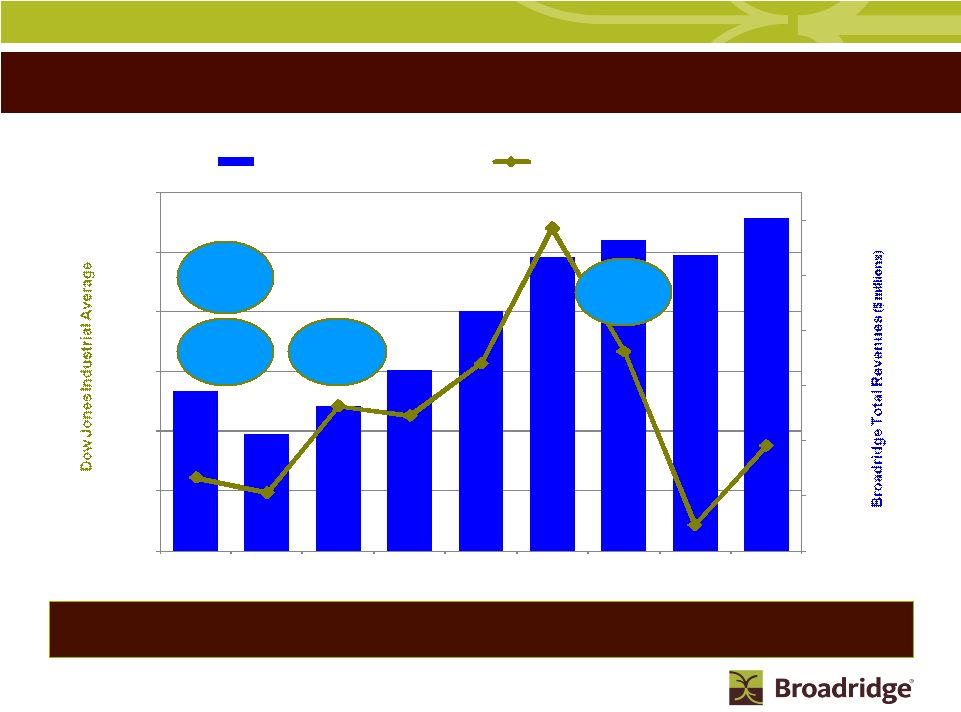

10

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

$2,200

8,000

9,000

10,000

11,000

12,000

13,000

14,000

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

Broadridge Total Revenues

Dow Jones Industrial Average

Business is Resilient in Changing Markets

Our revenue growth has been resilient through various economic and

market cycles

Stock Market

Rebounds

Decimalization

of Trades

Internet Bubble

Impact

Financial

Crisis

Note:

Fiscal

year

is

based

on

June

30

th

year

end |

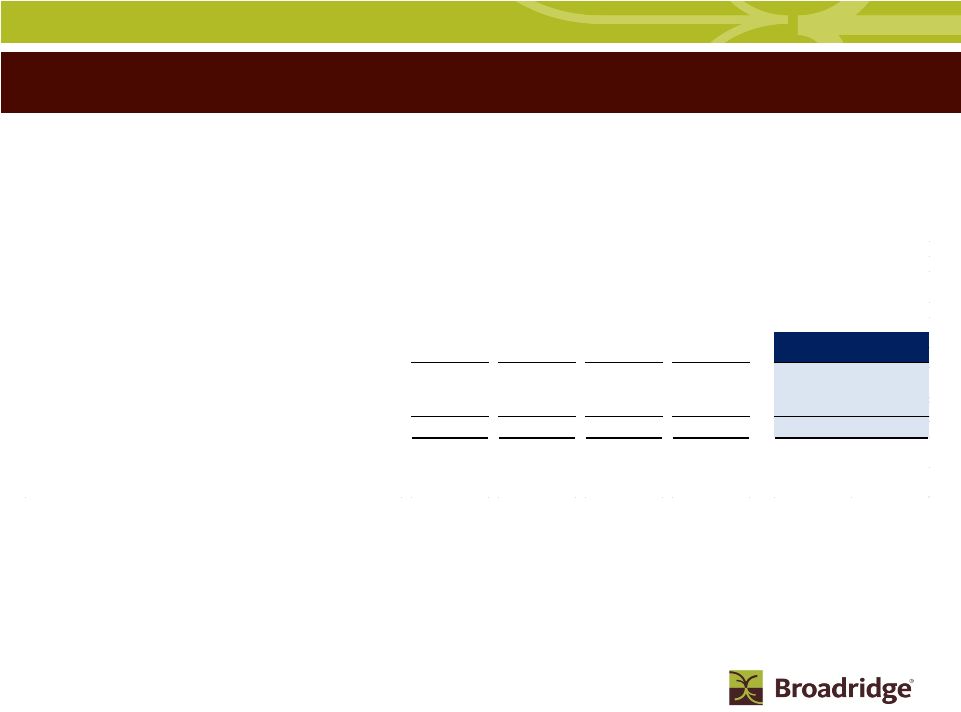

11

Revenue Growth Drivers

Low double-digit revenue growth in robust markets and flat to slightly negative growth in severe

down markets. Historically, growth from Sales is consistent in all markets cycles

Average historical growth of 6%, including a severe down

market cycle

In high growth economic cycles revenue growth averages

10-12% and 0-(3)% in severe down markets

Historical sales growth component consistent in all market

cycles

ICS sales expected to be driven by market share gains in

transaction reporting and registered proxy

SPS sales expected to be driven by our Operations

Outsourcing offering

ICS internal growth is driven by stock record growth for

equities and mutual funds and SPS is driven by trades per

day (TPD), which is somewhat offset by price concessions

Event-driven revenue activity declines in severe down

markets and rebounds to new highs in robust markets

Last trough to peak cycle had 20% CAGR (FY03-07)

Mutual Fund Proxy is the most volatile component of

event-driven revenue activity

Historical (FY05-FY10)

Actual

Forecast

CAGR

FY10

FY11

6%

Total Revenue Growth

7%

1-4%

4%

Sales

(Recurring).

4%

3-4%

(2)%

Client Losses

(2)%

(1)%

2%

Net New Business

2%

2-3%

3%

Internal Growth

(a)

(2)%

0-1%

1%

Event-Driven

(b)

4%

(5)-(4)%

0%

Distribution

1%

0%

0%

Acq/FX/Other

2%

4%

(a) Internal Growth includes SPS Equity & Fixed Income Trades, ICS Equity

& Mutual Fund Stock Record Growth, Transaction Reporting and Time &

Materials

(b) Event-Driven includes ICS Proxy Contest/Specials, Mutual Fund Proxy

and Marketing Communications Fulfillment |

12

Business Expansion Focus

Closed

Sales

Long-Term

Growth

Challenges

Broadridge

is well-positioned and on the high ground as a result of our recurring revenue

base, great value propositions, new initiatives, free cash flow and solid

balance sheet •

Strong

and

growing

pipeline

with

large

opportunities in all segments

•

Winning

a

meaningful

percentage

of

each year’s market-driven sales activity

•

Growth

in

recurring

closed

sales

>25%

in FY10, representing the second

consecutive year of record sales

•

Leverage

our

core

capabilities

and

unique

communications network

•

Investments

in

the

business

have

started

to introduce new and exciting opportunities

•

Meaningful

growth

opportunities

in

the

mutual fund area via data hub strategy

•

SPS

business,

despite

retaining

its

market

leadership position, faces challenges of

price compression and how to monetize its

unique opportunities for growth

•

Overcoming

conversion

decision

hurdles

for large clients and industry consolidation

$92

$63

$82

$95

$119

$33

$49

$63

$43

$56

FY06

FY07

FY08

FY09

FY10

FY11

Forecast

Range

High: $215

Low: $160

Closed Sales

(Fee Only, $ in millions)

Recurring (RC) Event-Driven (ED)

CAGR* = 9%

RC = 7%

ED = 14%

$175

$145

$125

$112

$139

* CAGR from FY06-10 |

13

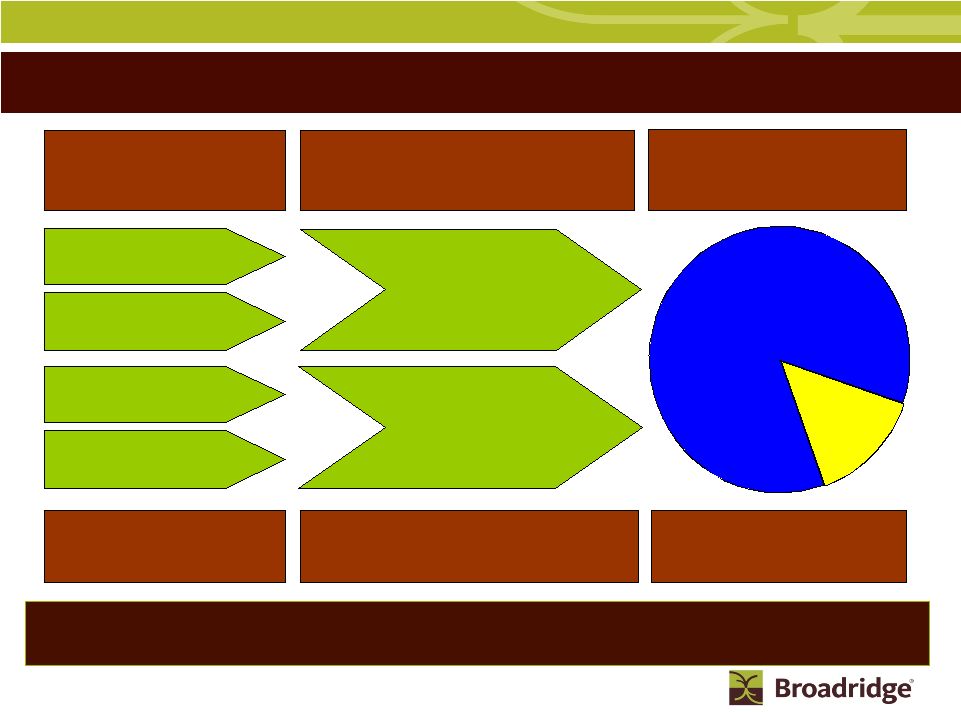

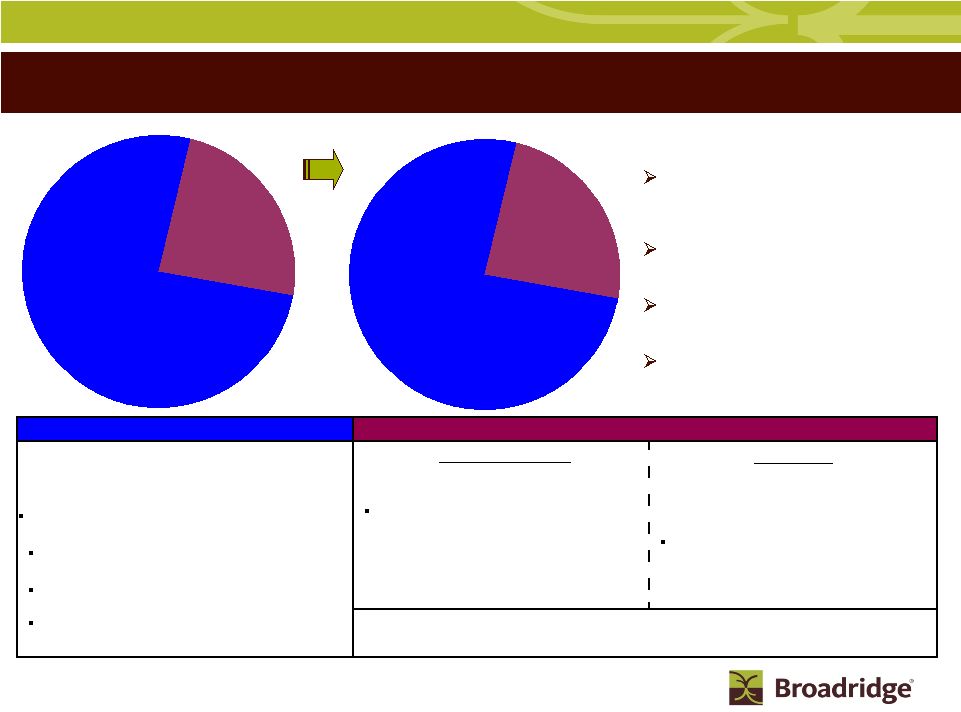

This is Broadridge

We are a market leader in processing and

distributing shareholder communications,

and provider of choice for mission-critical

securities processing solutions

Over 40 years of experience and a solid

customer base with long standing

relationships

Our core business is resilient and largely

independent of the stock market being at its

highs or lows

Strong and predictable Free Cash Flow

averaging >$275M over last 4 fiscal years

FY10 Segment Revenues

FY10 Segment Margins

Investor

Communications

$1,670M (76%)

Securities

Processing

$536M

(24%)

Investor

Communications

EBIT $273M

Margin 16.3%

Securities

Processing

EBIT $99M

Margin 18.5%

Outsourcing

Innovative industry service provider of

outsourcing of critical back-office labor

functions that are integrated with our

processing technology platform:

Operations

Outsourcing

offering

-

growth opportunity to expand existing

relationships and add new clients

•

Outsourcing

(~5%)

Investor Communications

(1)

Securities Processing

Leading global back-office service provider for

both equity and fixed income processing:

Hosted

applications

for

self-clearing

firms

using Broadridge’s

service bureau for:

•

Equity

(~80%)

•

Fixed

Income

(~15%)

World’s largest processor and provider of investor

communications with over one billion

communications processed annually:

Primary

business

unit

is

a

clear

market

leader

with

over

70%

of

Broadridge

revenues

and

pre-tax

earnings

Proxy

communications

and

vote

processing

and

interim

communications

(~65%)

Transaction

reporting

and

fulfillment

services

(~30%)

Other

(~5%)

Securities Processing

(1)

Only service provider offering service bureau and operations outsourcing

on a single multi-entity and multi-currency

platform (1 Percentages represent revenue contribution within

each reporting segment |

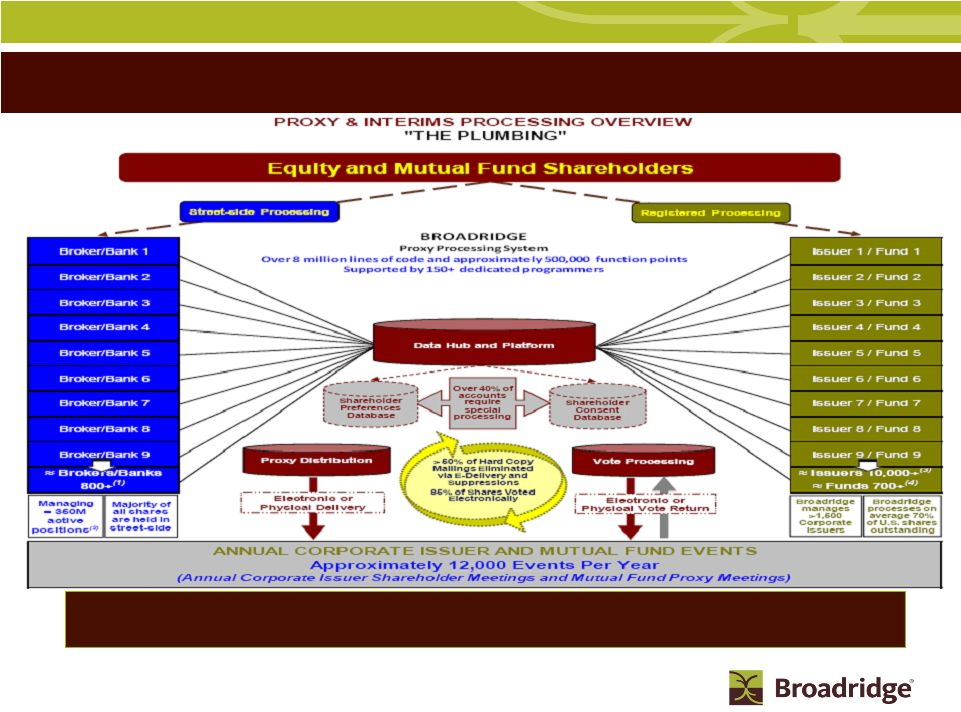

14

ICS Unique Business Systems Processing Model

(1)

Represents Broadridge’s

estimated total number of brokerage firms and banks in the U.S.

and international markets

(2)

Represents Broadridge’s

estimated total number of positions managed by U.S. brokers and

banks

(3)

Represents Broadridge’s

estimated total number of corporate issuers in the U.S.

(4)

Represents total number of Fund Sponsors in the U.S. who manage over

16,000 funds including Mutual Funds, Closed-end Funds,

ETFs

and UITs, according to the Investment Company Institute’s 2009

Investment Company Year Book Proxy

and

Interim

processing

system

is

the

“plumbing”

supporting

the

voting

process for corporate governance |

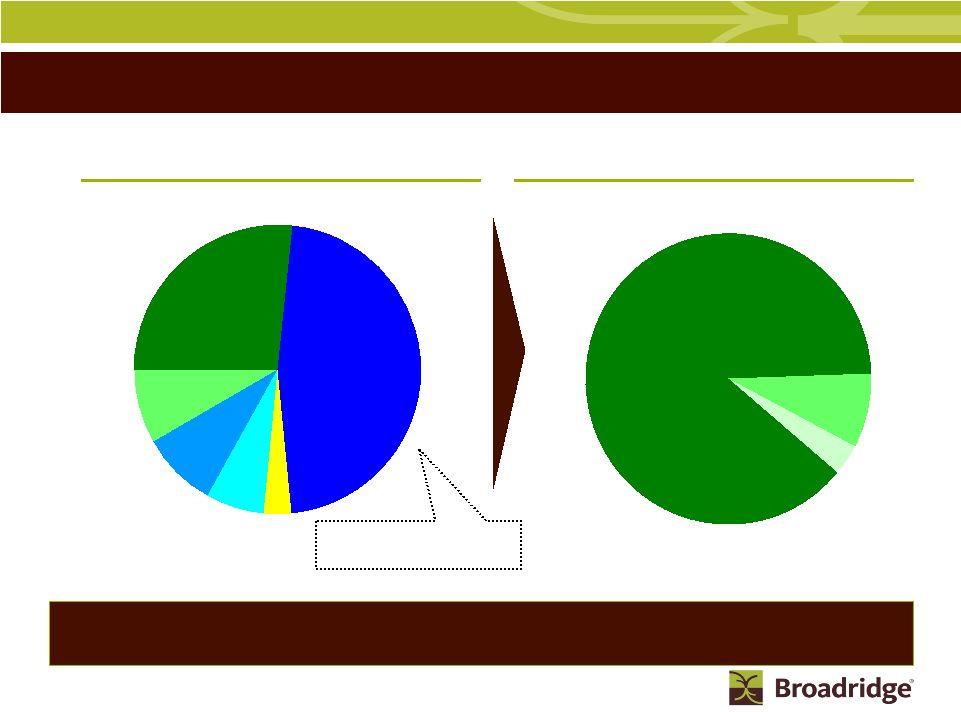

15

Bank/Broker-

Dealer

$1,474M (88%)

Mutual Fund

$138M (8%)

Corporate

Issuer

$58M (4%)

Distribution

$781M (47%)

Other

$53M (3%)

Fulfillment

$110M (7%)

Transaction

Reporting

$143M (9%)

Interims

$137M (8%)

Proxy

$447M (27%)

ICS Product and Client Revenue Overview:

We have a strong and diverse product

offering…

ICS is highly resilient due to our deep customer relationships with our

Bank/Broker-Dealer clients

Primarily

Postage

…and we have deep and longstanding

client relationships

Increase in electronic

distribution reduces postage

revenue and increases profits

FY10 Product Revenues

FY10 Client Revenues |

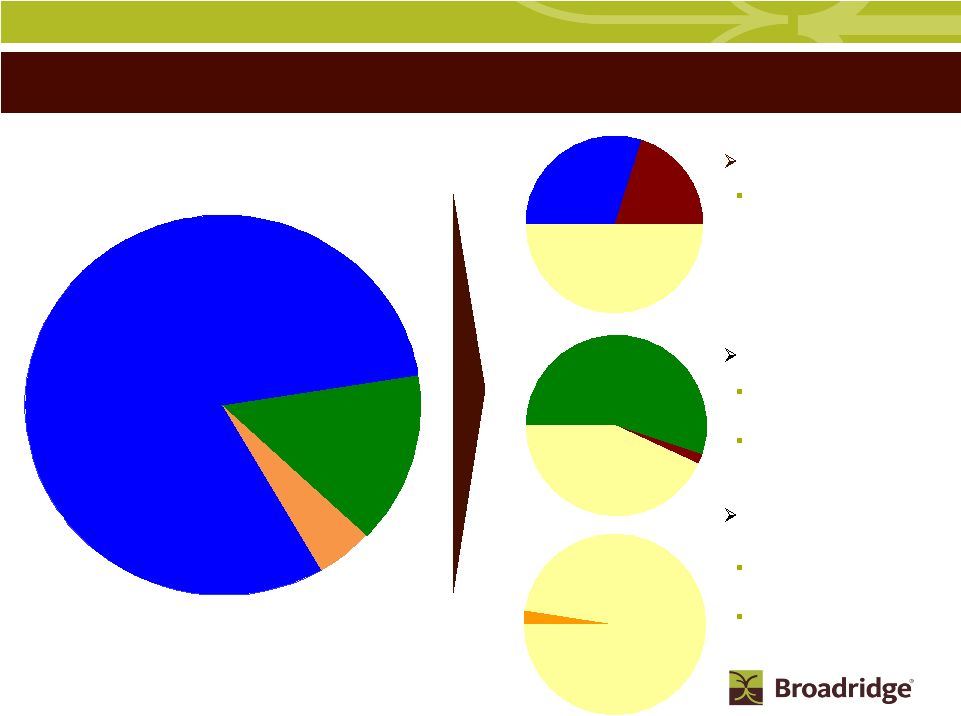

16

ICS Market Share Overview by Products and Markets

Product depth and relationships with Bank/Broker-Dealers provide high client

retention with large potential upside

We have deep penetration in our core business and clients, yet

large potential to grow market share |

17

M

A

R

K

E

T

S

H

A

R

E

Equity

(~80%)

Transactions, $238M

Non-transactions, $195M

Fixed Income

(~15%)

Transactions, $50M

Non-transactions, $28M

Outsourcing

(~5%)

$25M

FY10 Product Revenues

Securities Processing North America Market Share Overview(1)

Equity Processing Client Volume

Broadridge

~30%

Competitors

~20%

In-house

~50%

(1)

All market share information is based on management’s 2010

estimates and is part of much larger market. No attempt has been

made to size such market Broadridge

~2%

Untapped

Market

~98%

(>$1 Billion)

In-house

~43%

Competitors

~2%

Broadridge

~55%

Fixed Income (US$ only) Client Volume

High client retention rates

(~98%) with growth opportunity

During recent market turmoil,

BR continued to close sales

with major clients

Fixed Income platform is the

industry standard

BR processes for 11 of the 18

primary dealers of fixed income

securities

In FY10, BR processed on

average approximately $3.5

trillion in trades daily

BR is the only provider of

Operations Outsourcing for

self-clearing firms

>$1 Billion market potential is

based on clearing firms in North

America

Expected to exit FY11 with run-

rate of ~$90M annualized

revenue

Operations Outsourcing |

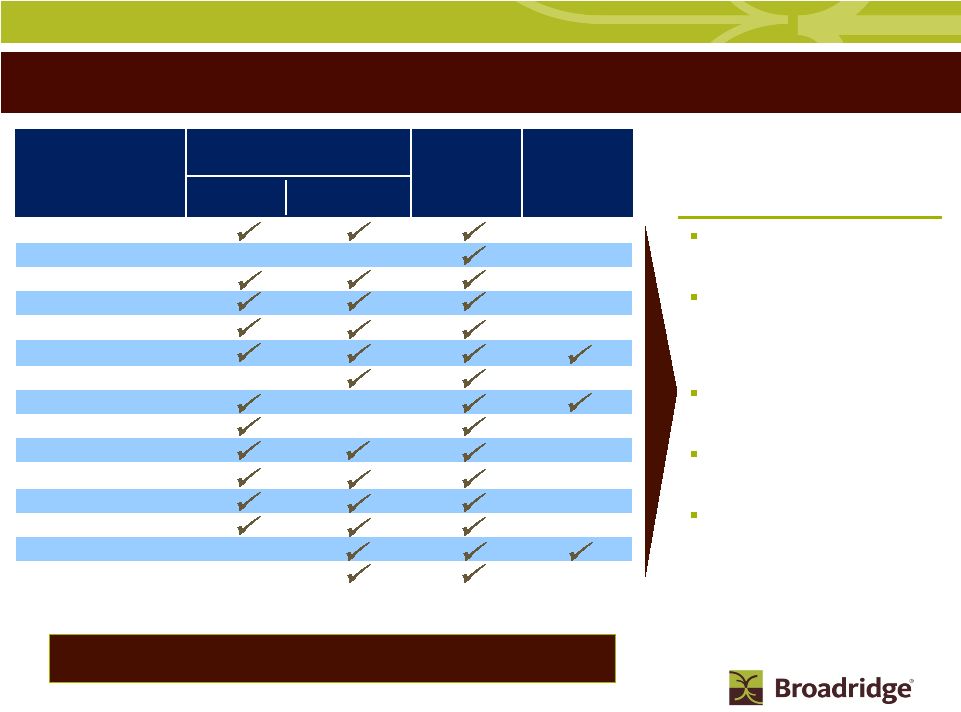

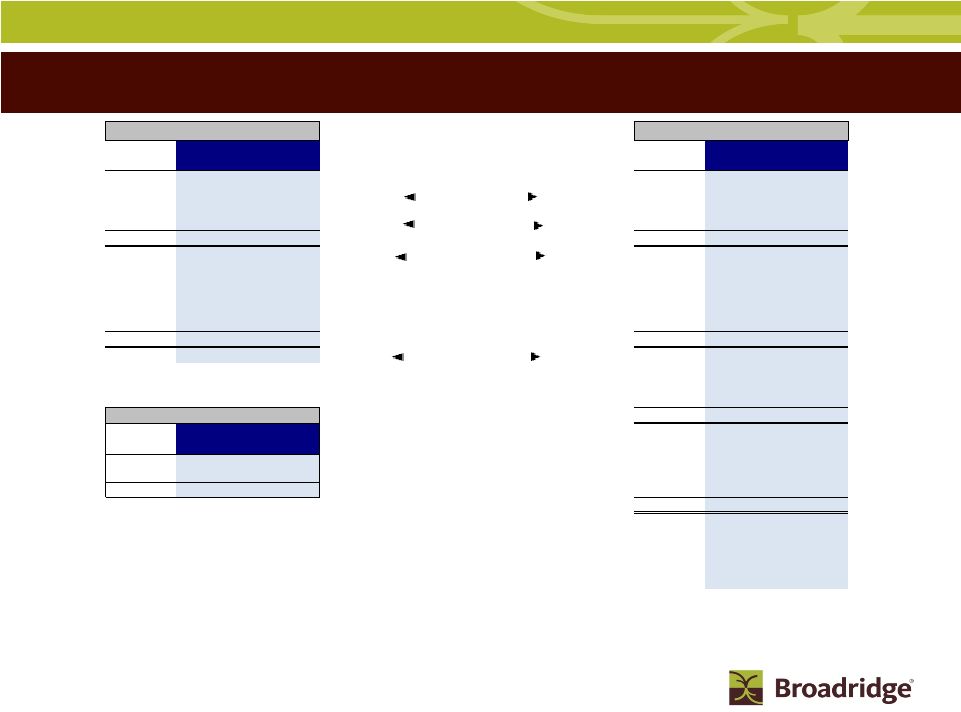

18

Securities Processing Solutions Top 15 Clients for FY10

Broadridge

has fared well

during the recent industry

consolidations and financial

crisis

The top 15 SPS clients generate

approximately 70% of the SPS

segment’s revenues

13 of 15 top clients have multi-

years remaining under their

existing agreements; contract

extensions for additional clients

are in progress

Closed contract with Barclays to

handle new trade volume as

result of Lehman

Closed contract with JP Morgan

for Bear Stearns fixed income

processing

Bank of America/Merrill Lynch

transaction resulted in loss of

equity processing business and

win of fixed income processing

business

SPS client relationships are stable in volatile market

Alliance Bernstein

Bank of America/Merrill Lynch*

Barclays Capital Services

BMO Nesbitt Burns

BNP Paribas

CIBC World Markets

Deutsche Bank

E*Trade Group

Edward Jones

J.P. Morgan Chase

Jefferies & Company

Royal Bank of Canada

Scotia Capital

State Street

UBS Securities

Note: The above schedule is an alphabetical listing of the top 15 SPS clients as of

June 30, 2010 based on FY10 revenues * Bank of America/Merrill Lynch includes

loss of equity processing business as previously disclosed Equity

Processing Fixed

Income

Processing

Retail

Institutional

Top

Clients

Outsourcing |

19

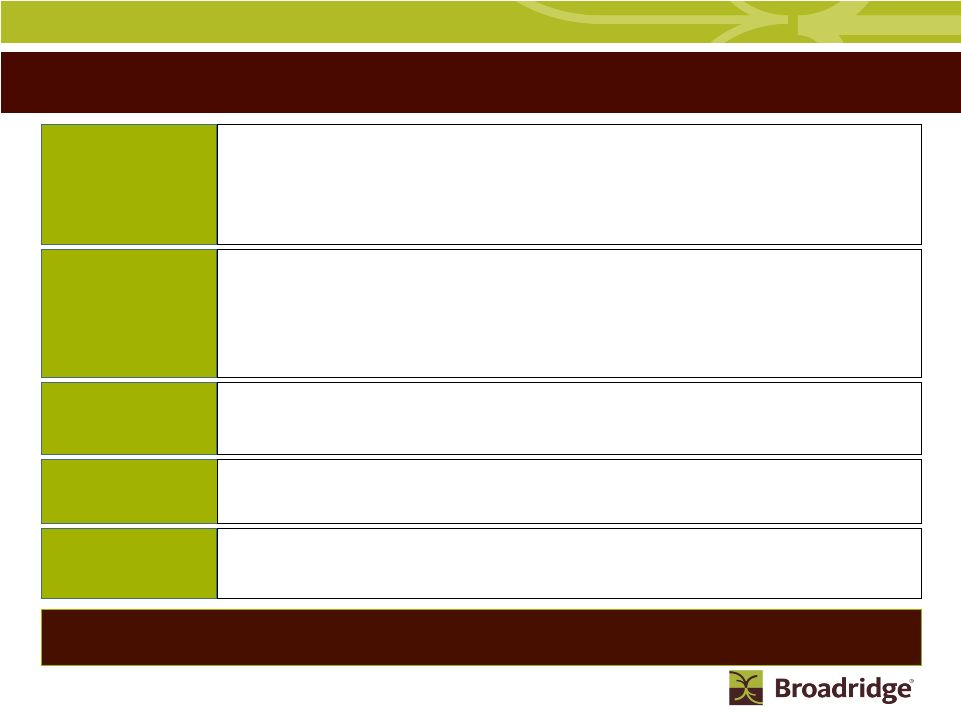

Business Expansion Strategy

Focused on core processing and communication businesses and making

investments in business that leverage these strong industry positions

Offer New

Solutions

Leverage

Industry

Position

Margin

Improvement

Foundation

Five Pillars

•

Improve world class

service scores for

every product every

year

•

Zero losses to

competition

•

Be “indispensable”

•

Increase total

sales year-over-

year

•

Increase existing

client penetration

•

Value

propositions with

“teeth”

•

Improve margins in all

products every year

Data center

Leverage

technology

Smart/Off-shoring

Strict financial

controls

Challenge the status

quo

•

Create (build or buy)

unique solutions enabled

by our heritage

Global outsourcing

Electronic delivery

solutions

Global proxy

Mutual Funds

Global Processing

Expansion

CULTURE

Trusting / Engaging / Accountable / Client-Centric / Committed /

Caring / Passionate/ Ethical “A Great Place to

Work” Vision

Be Indispensable!

We enable the financial services industry

to achieve superior levels of performance through our passion to

deliver extraordinary

value to our clients, shareholders, and associates

Accelerate

Sales

•

More than 2 dozen new

products introduced since

spin-off

Virtual Shareholder

meeting

The Investor Network/

Shareholder Forum

Know-On-Pay

12b-1/ 22c-2 reporting

Compliance

Client On-boarding

Data aggregation/

analytics

Client

Retention

Successful

execution

of

strategy

is

expected

to

accelerate

average

revenue

growth

forecast

from

mid-single digits to high single-digits |

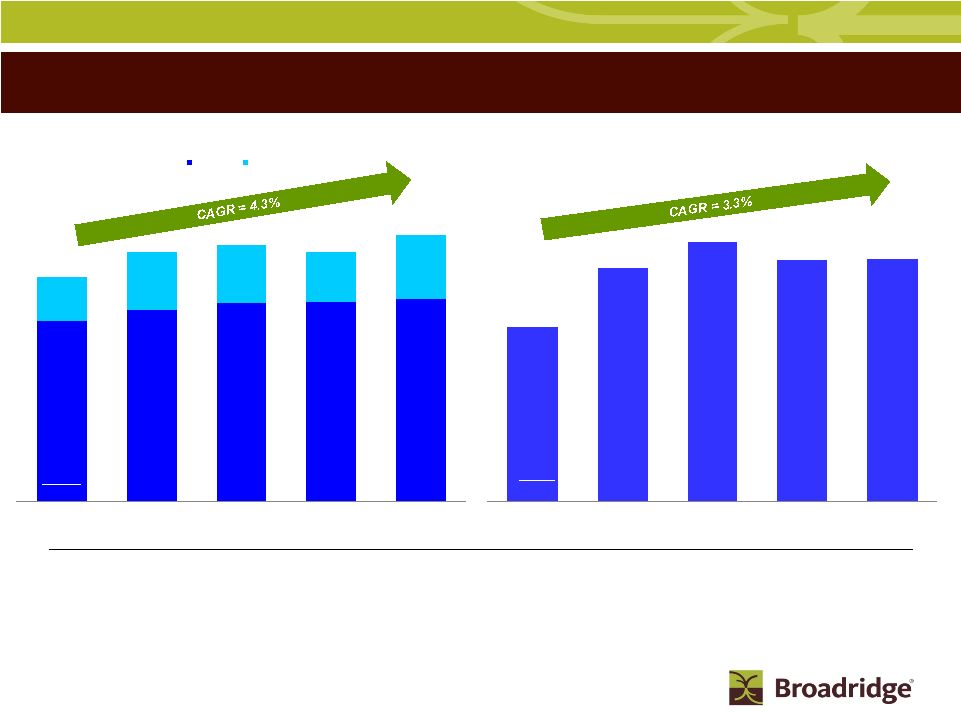

20

$352

$352

$364

$347

$310

FY10

FY09

FY08

FY07

FY06

Earnings Before Interest & Taxes (1)

($ in millions)

$1,688

$1,655

$1,652

$1,584

$1,504

$521

$418

$479

$483

$365

FY10

FY09

FY08

FY07

FY06

Net Revenues

($ in millions)

Recurring

Event-Driven

Financial Performance is Driven by Recurring Revenues

(1)

Earnings before provision for interest and income taxes is a Non-GAAP financial

measure. In fiscal 2010, it excludes approximately $10 million in interest

expense and impact of F/X. In fiscal 2009, it excludes approximately $14

million in interest expense and impact of F/X and one-time gain of approximately $8

million on purchase of senior notes. In fiscal 2008, it excludes

approximately $30 million in interest expense and impact of F/X

and one-time transition

expenses of approximately $14 million. In fiscal 2007, it excludes approximately

$12 million in interest expense and impact of F/X and one-time transition

expenses of approximately $14 million. In fiscal 2006, it excludes approximately $1

million in interest expense and impact of F/X. We believe that this measure

is useful to investors because it excludes the impact of certain

transactions or events that we expect to occur infrequently in order to provide

meaningful comparisons between current results and previously reported

results. Management, therefore, believes such Non-GAAP measure provides a useful means for

evaluating Broadridge's

comparative operating performance

%

Revenue

81%

77% 78%

80%

76% %

Margins

16.6%

16.8% 17.1%

17.0% 15.9%

$1,869

$2,209 |

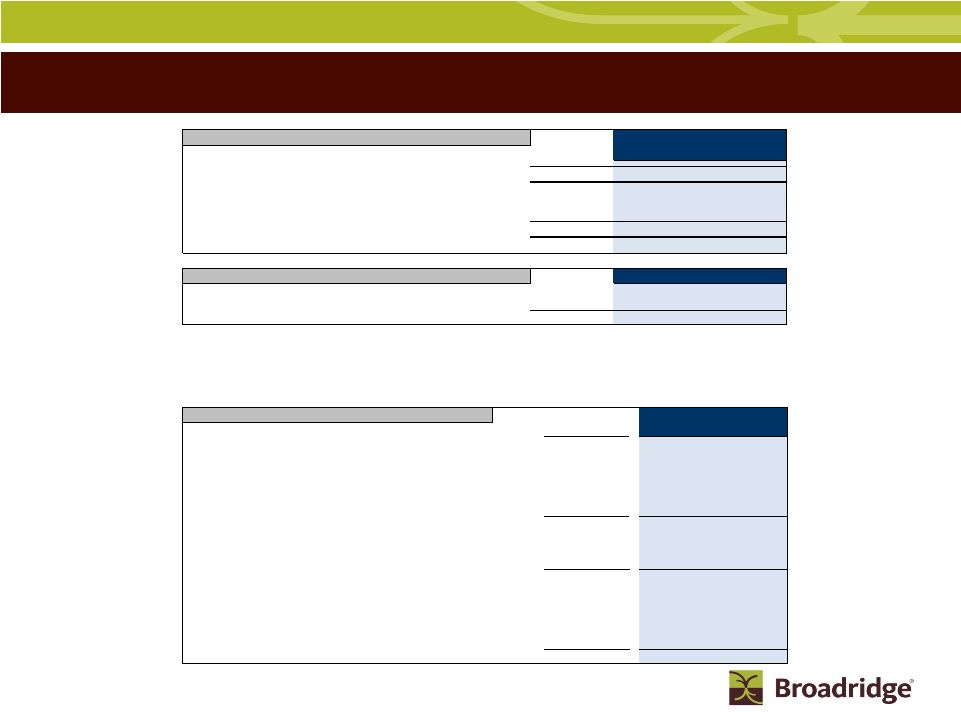

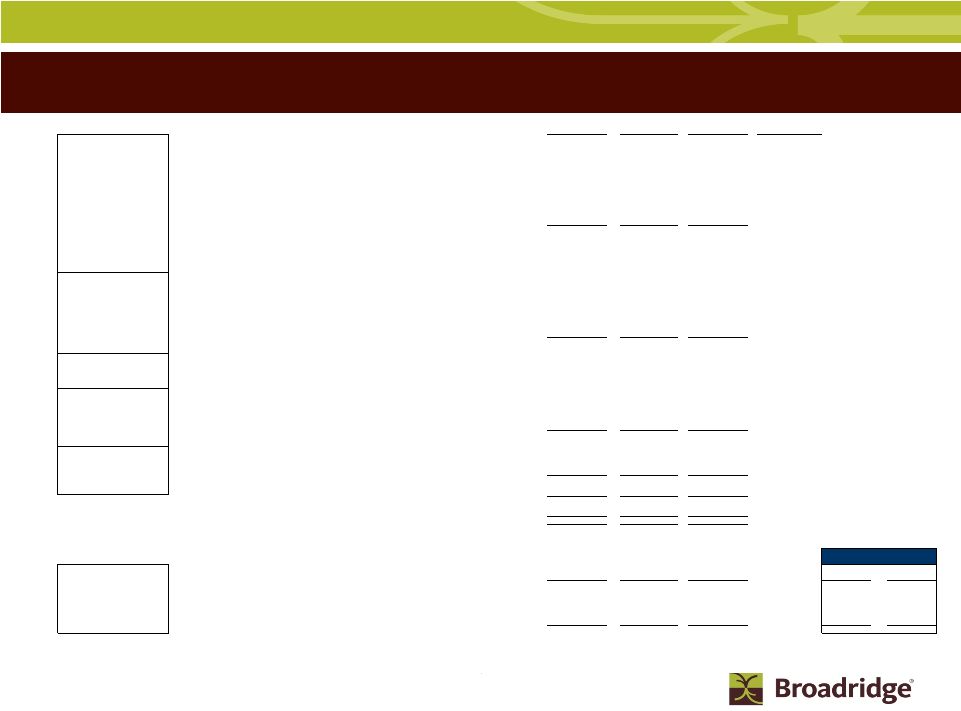

21

Broadridge

FY11 Guidance from Continuing Operations as of November 4,

2010 Guidance does not take into consideration the effect of any

future acquisitions, additional debt and/or share repurchases in excess of the repurchases

needed to be within our 128 million to 130 million diluted weighted-average

outstanding shares guidance. Revenue

($ in millions)

Earnings

FY10

FY11 Range

FY10

FY11 Range

Actual

Low

High

Actual

Low

High

$1,670

$1,641

$1,682

ICS

$273

$271

$284

9%

-2%

1%

Growth % / Margin %

16.3%

16.5%

16.9%

$536

$589

$615

SPS

$99

$80

$96

-4%

10%

15%

Growth % / Margin %

18.5%

13.5%

15.6%

$2,205

$2,230

$2,297

Total Segments

$372

$351

$380

6%

1%

4%

Growth % / Margin %

16.9%

15.7%

16.5%

$2

$0

$0

Other

($25)

($28)

($35)

$1

$7

$11

FX

*

$5

$3

$6

$2,209

$2,237

$2,308

Total Broadridge

$352

$327

$350

7%

1%

4%

Growth % / Margin %

15.9%

14.6%

15.2%

Interest & Other

($10)

($11)

($11)

Total EBT

$342

$316

$339

FY11 Range

Margin %

15.5%

14.1%

14.7%

Segments

Low

High

ICS

$85

$115

Income Taxes

($117)

($114)

($127)

SPS

$75

$100

Tax Rate (a)

34.2%

36.2%

37.5%

Total

$160

$215

Total Net Earnings

$225

$201

$212

Margin %

10.2%

9.0%

9.2%

Diluted Shares

139

130

128

Diluted EPS (GAAP)

$1.62

$1.55

$1.65

Diluted EPS Before 1-Times (Non-GAAP)

(b)

$1.56

$1.55

$1.65

* Includes impact of FX P&L Margin and FX Transaction Activity

(a)

FY10

Full

Year

Tax

Rate

of

34.2%

is

attributable

to

the

release

of

a

valuation

allowance

on

a

deferred

tax

asset

relating

to

tax

loss

carryforwards

of

approximately

$8M.

Excluding the year-to-date benefit the FY10 Full Year tax rate would be

36.5% (b) FY10 Full Year Diluted EPS Before 1-Times (Non-GAAP)

excludes the release of a valuation allowance on a deferred tax asset relating to tax loss carryforwards

of

approximately

$8M

(gain

reflected

in

Income

Taxes).

$0.06

impact

to

EPS.

Closed Sales |

22

Focused on Capital Stewardship and Long-Term Shareholder Value

Cash Level on

Balance Sheet

•

We expect to keep approximately $100M of cash on hand

Strong Predictable

FCF Allows for

Flexible Capital

Allocation

Options

•

Investing for organic growth

•

Tuck-in acquisitions to sustain organic growth expand product offering

•

Continue to grow dividend payout

•

Pursue stock repurchases to offset any dilution from equity compensation plan

and opportunistic repurchases versus scheduled steady repurchases

Manage to a

Debt to EBITDA

Ratio 1:1

Debt

•

Maintain

investment

grade

rating

with

rating

agencies

as

this

is

important

to

our

large clients and prospects

Mid-single-digit

organic revenue

growth

•

Capitalize on fundamentals driving long-term market growth

•

Invest in and drive new sales of existing solutions

•

Rollout new solutions to enable client efficiencies and facilitate client

growth •

Capture the global securities processing opportunity

Improve Margins

•

Initiatives to sustain and drive continued efficiencies and enhance our

scalability Aim to invest through existing businesses and acquisitions to

generate mid to high single-digit revenue growth and return excess cash

to shareholders |

23

Summary

Broadridge is a dependable mid-single-digit revenue grower

with a scalable business model providing opportunity for margin

expansion

We expect to continue to invest in our existing businesses and

execute strategic acquisitions to generate mid to high single-

digit average revenue growth

We expect to generate strong free cash flows and aim to return

cash to shareholders through dividends, repurchasing shares to

offset dilution and to opportunistically repurchase shares

|

24

Appendix

Appendix |

25

Regulatory Update

(1)

For

our

complete

comments,

see

http://sec.gov/comments/s7-14-10/s71410.shtml

or

http://www.broadridge.com/comment_letters/

The Securities and Exchange Commission (“SEC”) issued its Concept Release

on the U.S. Proxy System on July 14, 2010

Broadridge

submitted comments on the following topics (1):

Vote accuracy

•

Accuracy is critical to the U.S. proxy system

•

Vote

accuracy,

process

integrity

and

transparency

goals

have

been

achieved

through

Broadridge’s

leadership

and

technology investments

Process efficiency

•

The U.S. proxy system supports the needs of the most efficient and liquid markets

in the world •

Broadridge’s

systems and technologies, which support the street clearance and settlement

environment, create significant efficiencies for all constituencies

involved in the proxy distribution process Voting participation

•

Effective

participation

requires

the

provision

of

communications

and

voting

in

ways

that

reflect

beneficial

shareholder

preferences and choices

•

Broadridge’s

system, in which we have invested >$1 billion, accurately and consistently

tracks and applies shareholder delivery preferences to all investments in

investor accounts creating a consistent scalable process across all issuers

•

Broadridge

has pioneered the client-directed voting solution being considered by the SEC

in the Concept Release – another

tangible

example

of

how

Broadridge’s

innovations

raise

investor

participation

Broadridge

has developed a social network solution that we believe would increase levels

of participation, transparency and efficiency beyond what is viewed as

attainable today Broadridge

has consistently identified ways to improve the proxy system’s accuracy and

efficiency

First we invest and then we execute |

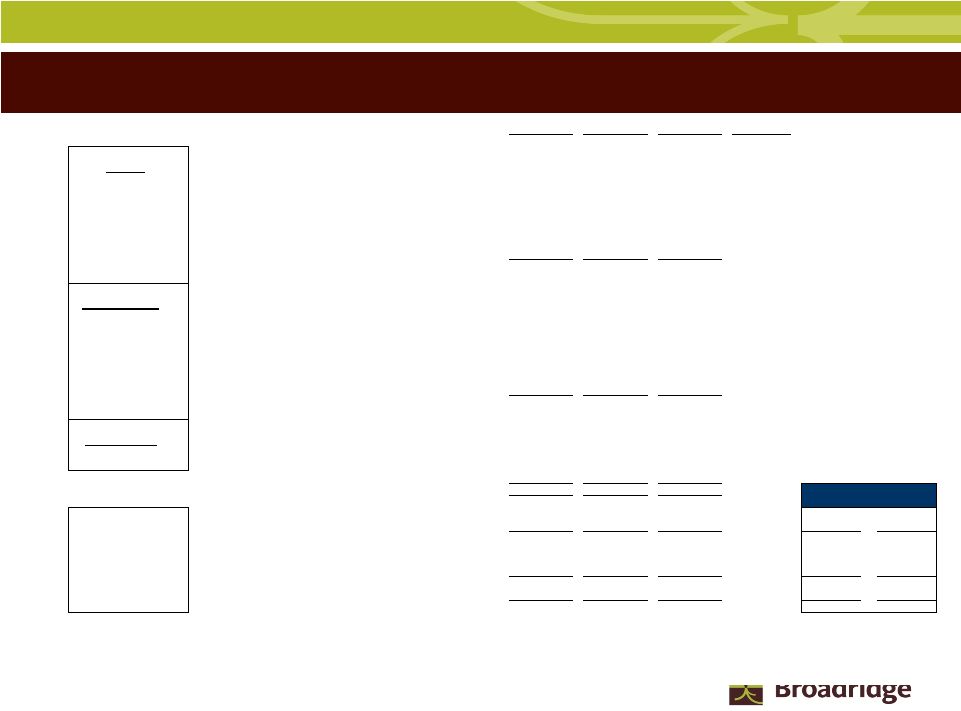

26

Free Cash Flow (Non-GAAP) –

FY10 Actual and FY11 Forecast as of November 4, 2010

Unaudited

(In millions)

FY10

Low

High

Free Cash Flow

(Non-GAAP)

:

Net earnings from continuing operations per GAAP

225

$

201

$

212

$

Depreciation and amortization (includes other LT assets)

57

65

75

Stock-based compensation expense

27

30

30

Other

4

(5)

5

Subtotal

313

291

322

Working capital changes

59

(30)

(25)

Long-term assets & liabilities changes

6

(30)

(20)

Net cash flow provided by continuing operating activities

378

231

277

Cash Flows From Investing Activities

IBM / ITO data center investment

-

(20)

(15)

Capital expenditures & purchased of intangibles

(53)

(45)

(40)

Free cash flow

325

$

166

$

222

$

Cash Flows From Other Investing and Financing Activities

Acquisitions

(35)

(77)

(77)

Clearing capital freed-up

75

-

-

Clearing capital to be freed-up

165

-

-

Stock repurchases net of options proceeds

(212)

(111)

(176)

Long-term debt repayment

-

-

-

Dividends paid

(67)

(76)

(76)

Other (FY10 Disc Ops)

(11)

9

9

Net change in cash and cash equivalents

240

(89)

(98)

Cash and cash equivalents, at the beginning of year

173

413

413

Cash and cash equivalents, at the end of period

413

$

324

$

315

$

(a) Guidance does not take into consideration the effect of any future

acquisitions, additional debt and/or share repurchases in excess

of the repurchases needed to be within our 128 million to 130 million diluted

weighted-average outstanding shares guidance. FY11 Range

(a)

Freed

-up Capital $240M

Free Cash Flow

$166-222M |

27

Historical Free Cash Flow Non-GAAP to GAAP Reconciliation

Reconciliation of Non-GAAP to GAAP Measures

Free Cash Flow (Non-GAAP)

($ in millions)

(Unaudited)

FY07

FY08

FY09

FY10

Actual

Actual

Actual

Actual

Low

High

Net cash flow provided by continuing operating activities (GAAP)

306

308

277

378

(b)

231

277

Capital expenditures & Intangibles

(a)

(38)

(46)

(30)

(53)

(65)

(55)

Free cash flow (Non-GAAP)

268

$

262

$

247

$

325

$

166

$

222

$

(a) Includes IBM/ITO data center investment

(b) Adjusted for certain non-recurring items in the amount of

approximately $18M due to loss on disposal of discontinued operations

FY11 Range |

28

Reconciliation of Non-GAAP to GAAP Measures

Free Cash Flow Reconciliation

($ in millions)

FY10

Low

High

Net earnings from continuing operations (GAAP)

225

$

201

$

212

$

Depreciation and amortization (includes other LT assets)

57

65

75

Stock-based compensation expense

27

30

30

Other

4

(5)

5

Subtotal

313

291

322

Working capital changes

59

(30)

(25)

Long-term assets & liabilities changes

6

(30)

(20)

Net cash flow provided by continuing operating activities

378

231

277

Cash Flows From Investing Activities

IBM / ITO data center investment

-

(20)

(15)

Capital expenditures & purchased of intangibles

(53)

(45)

(40)

Free cash flow (Non-GAAP)

325

$

166

$

222

$

FY11 Range

(a)

Guidance

does

not

take

into

consideration

the

effect

of

any

future

acquisitions,

additional

debt

and/or

share

repurchases

in

excess

of

the

repurchases needed to be within our 128 million to 130 million diluted

weighted-average outstanding shares guidance. EBIT Reconciliation

FY10

FY11 Range (a)

($ in millions)

Actual

Low

High

EBIT (Non-GAAP)*

$352

$327

$350

Margin %

17.0%

14.6%

15.2%

Interest & Other

($0)

($11)

($11)

Total EBT (GAAP)

$342

$316

$339

Margin %

15.5%

14.1%

14.7%

EPS Reconciliation

Low

High

Diluted EPS from continuing operations (GAAP)

$1.62

$1.55

$1.65

One-time recognition of a deferred tax asset

($0.06)

-

-

Diluted EPS before One-Times (Non-GAAP)

$1.56

$1.55

$1.65

* Includes impact of FX Transaction Activity

|

29

Closed Sales to Revenue Contribution

Closed Sales Stats:

Recurring

•

Both ICS and SPS trending toward

longer revenue recognition cycle

•

Larger strategic deals could take 12-

24 months to convert

Event-Driven

•

Majority usually recognized during

the year the deal closed

•

Sales are less predictable

dependent on size of the client

Revenue contribution could be +/-5%

each year depending on the

complexity of the conversion

($ in millions)

Forecast

Recurring

FY09

FY10

FY11

ICS

$55

$80

$35-50

~ Revenue Contribution Year 1-3

55%

35%

10%

50%

40%

10%

35%

40%

25%

SPS

$40

$40

$75-100

~ Revenue Contribution Year 1-3

25%

50%

25%

10%

50%

40%

5%

45%

50%

Event-Driven

$45

$55

$50-65

~ Revenue Contribution Year 1-3

70%

10%

20%

80%

10%

10%

60%

20%

20%

Total Closed Sales

$140

$175

$160-215

~ Revenue Contribution Year 1-3

50%

30%

20%

50%

30%

20%

30%

40%

30% |

30

Broadridge

ICS Key Statistics

$ in millions

RC= Recurring

ED= Event-Driven

Fee Revenues

(1)

FY08

FY09

FY10

Type

Proxy

Equities

(2)

259.8

$

272.5

$

276.5

$

RC

Stock Record Position Growth

2%

-2%

-1%

Pieces

297.8

288.0

293.2

Mutual Funds

92.1

$

55.0

$

149.7

$

ED

Pieces

176.6

73.5

204.2

Contests/Specials

19.7

$

26.9

$

20.6

$

ED

Pieces

21.2

30.8

26.0

Total Proxy

371.6

$

354.4

$

446.8

$

Total Pieces

495.6

392.3

523.4

Notice and Access Opt-in %

28%

50%

54%

Suppression %

49%

50%

52%

Interims

Mutual Funds

(Annual/Semi-Annual Reports/Annual Prospectuses)

73.9

$

78.1

$

88.8

$

RC

Position Growth

9%

3%

6%

Pieces

401.1

440.5

476.0

Mutual Funds

(Supplemental Prospectuses) & Other

48.9

$

58.0

$

47.8

$

ED

Pieces

301.3

349.6

266.2

Total Interims

122.8

$

136.1

$

136.6

$

Total Pieces

702.4

790.1

742.2

Transaction

Transaction Reporting

124.6

$

132.0

$

142.8

$

RC

Reporting

Fulfillment

Post-Sale Fulfillment

70.4

$

72.9

$

74.0

$

RC

Pre-Sale Fulfillment

37.5

$

36.6

$

35.5

$

ED

Total Fulfillment

107.9

$

109.5

$

109.5

$

Other

Other -

Recurring

0.6

$

0.9

$

12.1

$

RC

Communications

Other -

Event-Driven

(2), (3)

39.9

$

41.3

$

41.2

$

ED

Total Other

40.5

$

42.2

$

53.3

$

Total Fee Revenues

767.4

$

774.2

$

889.0

$

Total Distribution Revenues

807.8

$

756.8

$

780.6

$

Total Revenues as reported -

GAAP

1,575.2

$

1,531.0

$

1,669.6

$

Total RC Fees

529.3

$

556.4

$

594.2

$

Total ED Fees

238.1

$

217.8

$

294.8

$

FY11 Ranges

Low

High

Sales

1%

1%

3%

3%

3%

Losses

-1%

0%

-1%

0%

0%

Key

Net New Business

0%

1%

2%

3%

3%

Revenue

Internal growth

3%

0%

0%

0%

1%

Drivers

Event-Driven

0%

-1%

5%

-5%

-4%

Acquisitions

0%

0%

1%

1%

1%

Distribution

-1%

-3%

1%

-1%

0%

TOTAL

2%

-3%

9%

-2%

1%

(1) As of 4Q09, these items represent fee revenues only and exclude distribution

revenues which are set out separately. The historical numbers have been adjusted to exclude distribution revenues.

(2) For comparability purposes, Other Proxy related fee revenue has been

reclassified from Other Event-Driven to Annual Equity Proxy (FY08: $3.8M, FY09: $4.1M & FY10: $4.5M).

(3) Other includes 12.6M pieces for FY08, 14.4M pieces for FY09 and 10.5M pieces for

FY10 primarily related to corporate actions. |

31

Broadridge

SPS Key Statistics

$ in millions

RC= Recurring

ED= Event-Driven

FY08

(3)

FY09

FY10

Type

Equity

Transaction-Based

Equity Trades

259.8

$

258.5

$

237.8

$

RC

Internal Trade Growth

12%

6%

-2%

Trade Volume (Average Trades per Day in '000)

(1) (2)

1,559

1,602

1,542

Non-Transaction

Other Equity Services

178.9

$

193.6

$

195.4

$

RC

Total Equity

438.7

$

452.1

$

433.3

$

Fixed Income

Transaction-Based

Fixed Income Trades

51.0

$

52.3

$

49.9

$

RC

Internal Trade Growth

19%

11%

-6%

Trade Volume (Average Trades per Day in '000)

(2)

237

287

283

Non-Transaction

Other Fixed Income Services

24.6

$

29.4

$

27.7

$

RC

Total Fixed Income

75.6

$

81.7

$

77.5

$

Outsourcing

Outsourcing

19.2

$

25.1

$

25.0

$

# of Clients

5

6

9

Total Net Revenue as reported -

GAAP

533.5

$

558.9

$

535.9

$

FY11 Ranges

Low

High

Sales

4%

6%

5%

5%

6%

Losses

-8%

-4%

-4%

-4%

-4%

Key

Net New Business

-4%

2%

2%

1%

2%

Revenue

Transaction & Non-transaction

8%

5%

-2%

0%

4%

Drivers

Concessions

-3%

-3%

-4%

-2%

-2%

Internal growth

5%

2%

-6%

-2%

2%

Acquisitions

0%

1%

0%

11%

11%

TOTAL

1%

5%

-4%

10%

15%

(1) Equity Trade volume adjusted to exclude trades processed under fixed priced

contracts. Management believes excluding this trade volume presents a

stronger correlation between trade volume and Equity Trade revenue. (2) Prior

Year's trade volume re-stated for comparability. (3) FY 2009 trade volumes

re-stated for step-pricing clients; FY 2008 has not been re-stated. |

32

Broadridge

ICS Definitions

Proxy

Equities - Refers to the proxy

services we provide in connection with annual stockholder meetings for publicly traded

corporate issuers. Annual meetings of public companies include shares held in "street

name" (meaning that they are held of record by brokers or banks, which in turn hold the

shares on behalf of their clients, the ultimate beneficial owners) and shares held in

"registered name" (shares registered directly in the names of their owners). Mutual Funds - Refers to the proxy

services we provide for funds, classes or trusts of an investment company. Open-ended mutual funds are not required

to have annual meetings. As a result, mutual fund proxy services provided to open-ended

mutual funds are driven by a "triggering event." These triggering events can be a change

in directors, fee structures, investment restrictions, or mergers of funds.

Contests - Refers to the proxy

services we provide when a separate agenda is put forth by one or more stockholders that is in

opposition to the proposals presented by management of the company which is separately distributed and

tabulated from the company’s proxy materials.

Specials - Refers to the proxy

services we provide in connection with stockholder meetings held outside of the normal annual

meeting cycle and are primarily driven by special events (e.g., mergers and acquisitions in which the

company being acquired is a public company and needs to solicit the approval of its

stockholders). Interims

Mutual Funds (Annual/Semi-Annual Reports/Annual Prospectuses) – Refers to the services we provide investment

companies in connection with information they are required by regulation to distribute periodically to

their investors. These reports contain pertinent information such as holdings, fund

performance, and other required disclosure. Mutual Funds (Supplemental Prospectuses) – Refers primarily to information required to be provided by mutual funds to

supplement information previously provided in an annual mutual fund prospectus (e.g., change in

portfolio managers, closing funds or class of shares to investors, or restating or clarifying

items in the original prospectus). The events could occur at any time throughout the

year. Other – Refers to communications

provided by corporate issuers

and investment companies to

investors including

newsletters, notices, tax information, marketing materials and other information not required to be

distributed by regulation. Transaction Reporting

Transaction Reporting– Refers

primarily to the printing and distribution of account statements, trade confirmations and tax

reporting documents to account holders, including electronic delivery and archival services.

Fulfillment

Post-Sale Fulfillment – Refers

primarily to the distribution of prospectuses, offering documents, and required regulatory

disclosure information to investors in connection with purchases of securities.

Pre-Sale Fulfillment – Refers

to the distribution of marketing literature, welcome kits, enrollment kits, and investor information

to prospective investors, existing stockholders and other targeted recipients on behalf of

broker-dealers, mutual fund companies and 401(k) administrators.

Other Communications

Other – Refers to the services we

provide in connection with the distribution of communications material not included in the

above definitions such as non-objecting beneficial owner (NOBO) lists, and corporate

actions such as mergers, acquisitions, and tender offer transactions.

|