Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXCO RESOURCES INC | d8k.htm |

PPT-169 –

Barclay’s September 2010

Barclay’s Capital CEO Energy-Power Conference

September 15, 2010

Exhibit 99.1 |

EXCO

Resources, Inc. 2

PPT-169 –

Barclay’s September 2010

Key Investment Highlights

•

EXCO is positioned for growth

–

Targeting 30% growth for the next five years

•

Strong position in Haynesville/Bossier and Marcellus shale plays

–

8,800 potential drilling locations

•

Joint Ventures with BG Group

–

Accelerates

development

of

Haynesville/Bossier

and

Marcellus

and

infrastructure

•

Operational and technical expertise

–

Technical headcount has increased more than 200% since January 2008

•

Significant held-by-production acreage

–

Development pace driven by returns, not lease expirations

•

Strong balance sheet

–

Target funding drilling program within cash flow

•

EXCO is poised to thrive in low price environment

–

Focused in core shale areas where a 20% pre-tax IRR can be achieved at current

prices •

Experienced management team with successful track record and significant inside

ownership

–

Officers and directors represent 32.8% of shares outstanding

|

3

PPT-169 –

Barclay’s September 2010

Delivering What We Promise

Joint venture partner

–

Joint ventures with BG Group position EXCO for dramatic upstream

and midstream growth

–

Combined JV’s netted $1.8 billion of cash and $550 million carry on future

drilling through sale of 50% in all production, acreage and associated

midstream assets in JV areas Asset sales

–

Closed ~$1.1 billion in additional divestitures during 2009

Debt reduction

(1)

–

Reduced debt by approximately $2.1 billion or ~67%

–

Increased liquidity to ~$1.2 billion

Shifted strategy

–

Strategic

shift

from

acquisition

focus

to

organic

growth

through

development

of

existing assets

Focus on core areas of our shale plays

–

All drilling and acreage additions in specific areas of the plays

–

Since

late

2008,

we

have

spud

more

than

100

wells

and

produced

over

100

Bcf

of

gross

natural gas to sales in the Haynesville shale

–

Recently added 47,600 net acres (23,800 net to EXCO) in the Shelby Trough; we

believe a majority of the acreage is comparable to our DeSoto

Parish position

(1)

Pro forma for $750 million bond issuance |

4

PPT-169 –

Barclay’s September 2010

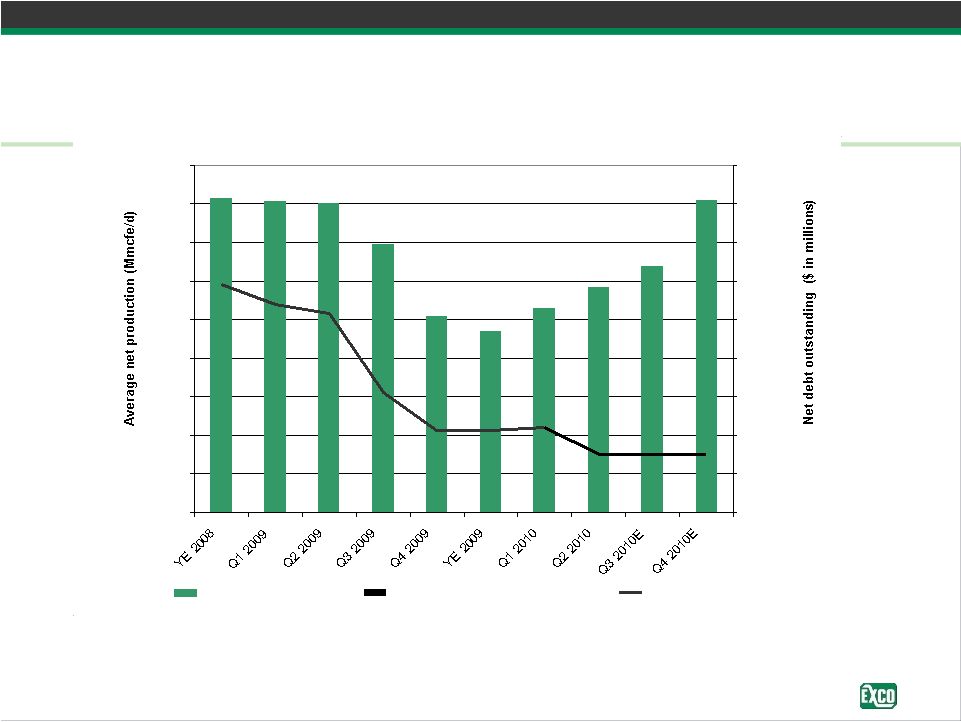

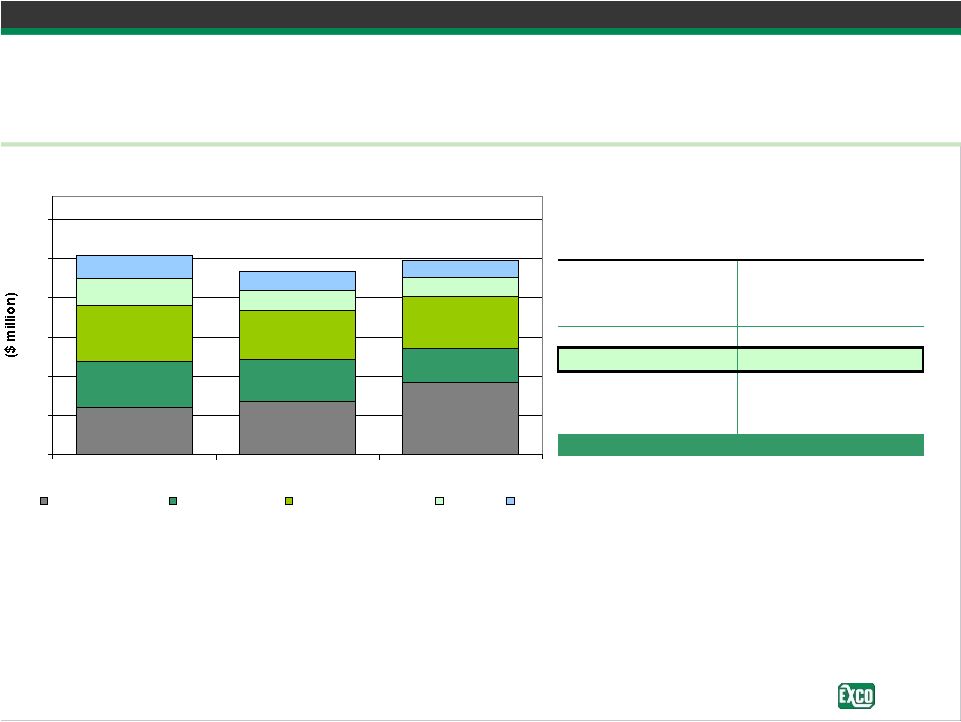

Production Profile

Positioned for growth while exceeding our economic hurdles in low price

environment •

Focused portfolio on Haynesville, Bossier and Marcellus shales

•

On track to deliver significant organic production growth in 2010 and beyond

-

50

100

150

200

250

300

350

400

450

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

Actual production

Production guidance midpoint

Net debt outstanding |

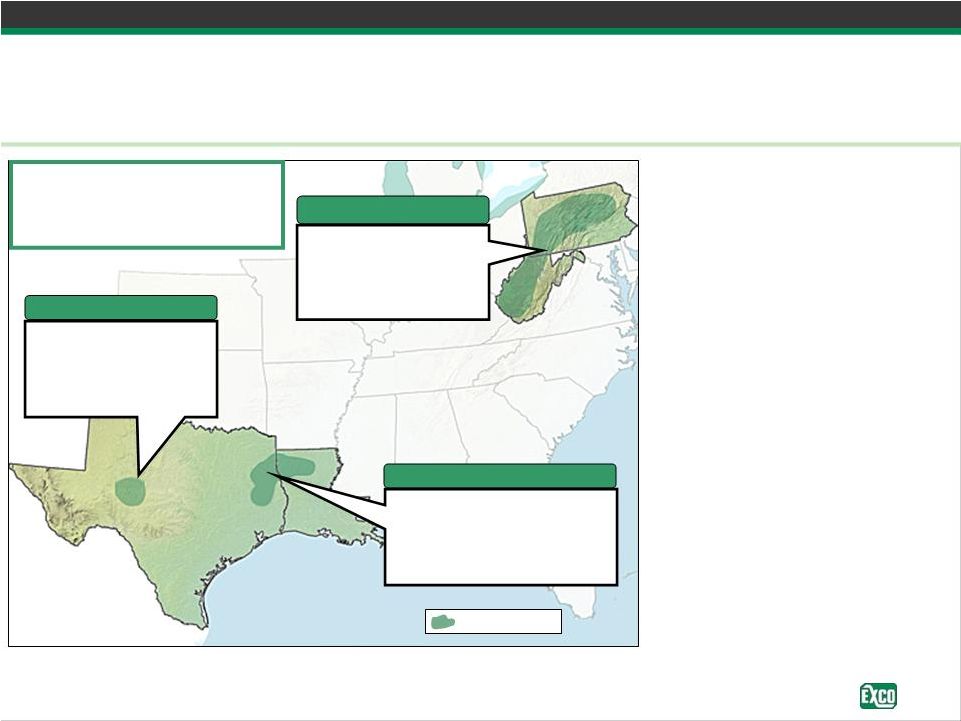

Company

Overview

and

Reserve

Base

(1)

High quality portfolio focused on shale resources

Texas

Texas

Louisiana

Louisiana

Pennsylvania

Pennsylvania

West

West

Virginia

Virginia

EXCO Operations Area

•

Reserve life of

10.3

years

and 62% Proved Developed

•

260 Bcf

of shale assets

booked as proved with

potential for significant

future reserve adds

•

Strong position in

Haynesville/Bossier and

Marcellus shale plays

–

8,800 potential drilling

locations

•

80,000

net

acres

in

the

Haynesville play and

pursuing additional leasing

opportunities

•

113,000

net

acres

in

the

Marcellus play and

pursuing additional leasing

opportunities

(1)

The reserve estimates provided throughout this document are pro forma for the Common

and Appalachia JV transactions and effective as of 3.31.10 with 3.31.10 NYMEX strip pricing, adjusted for differentials and excluding

hedge effects, unless otherwise noted

(2)

Haynesville

and

Marcellus

acreage

throughout

this

document

is

net

to

EXCO’s

interest

in

the

JVs;

assumes

BG

Group

exercises

their

option

to

purchase

50%

of

recently

acquired

acreage

Proved Reserves = 1.2 Tcfe

3P Reserves = 3.6 Tcfe

3P+ Reserves = 12.5 Tcfe

Current Net Production = 320 Mmcfe/d

Net

acreage

(2)

:

602,000

Proved Total: 0.1 Tcfe

3P Reserves = 0.1 Tcfe

3P+ Reserves = 0.3 Tcfe

Production: 20 Mmcfe/d

Net acreage: 98,000

Permian

Appalachia

Proved Total: 0.2 Tcfe

3P Reserves = 0.2 Tcfe

3P+ Reserves = 5.9 Tcfe

Production: 18 Mmcfe/d

Net acreage: 335,000

Proved Total: 0.9 Tcfe

3P Reserves = 3.3 Tcfe

3P+ Reserves = 6.3 Tcfe

Production: 262 Mmcfe/d

Net acreage: 169,000

East Texas / North Louisiana

PPT-169 –

Barclay’s September 2010

5 |

6

PPT-169 –

Barclay’s September 2010

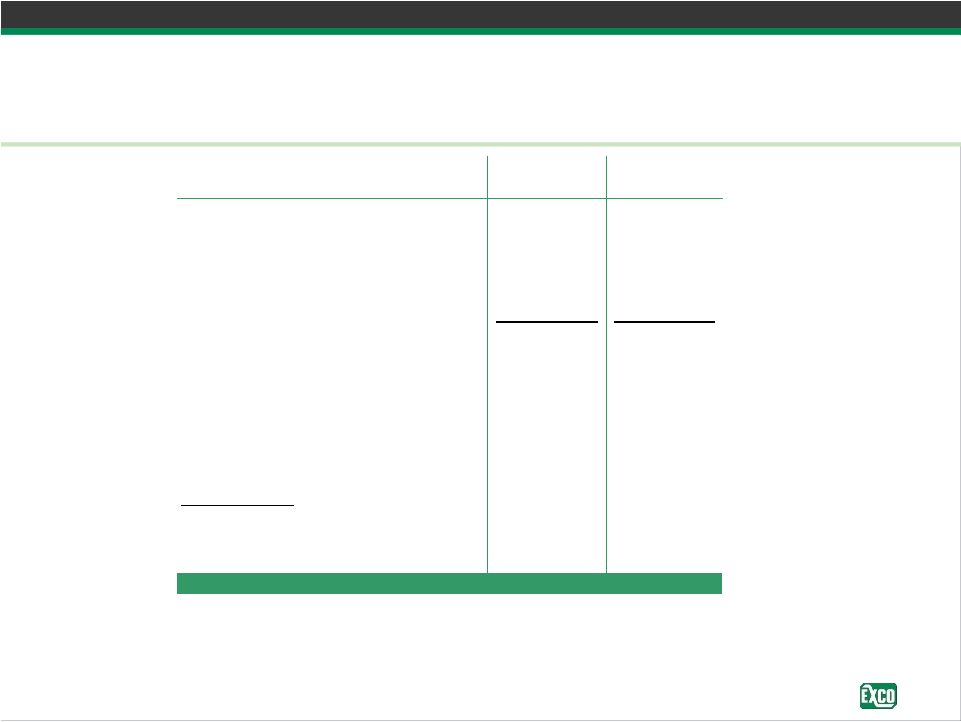

Liquidity and Financial Position

(1)

Includes $75.2

million of restricted cash at 6/30/10

(2)

Excludes bond premium or discount

(3)

Net of $15.2 million in letters of credit

(4)

LTM Adjusted EBITDA of $588.9 million pro forma for our joint venture transactions

with BG Group and 2009 divestitures as if each transaction occurred on June 30, 2009

•

Current liquidity of ~$1.2 billion pro forma for bond offering

Pro forma

Consolidated ($ in thousands)

June 30, 2010

June 30, 2010

Cash

(1)

173,273

$

173,273

$

Bank debt (L + 200 -

300bps)

477,500

197,870

7 1/4%

(2)

Senior notes due 2011

444,720

-

7 1/2%

(2)

Senior notes due 2018

-

750,000

Total debt

922,220

$

947,870

$

Net debt

748,947

$

774,597

$

Borrowing base

1,200,000

$

1,200,000

$

Unused borrowing base

(3)

707,300

$

986,930

Unused borrowing base plus cash

(3)

880,573

$

1,160,203

$

Credit statistics

Debt / PD reserves

1.27

$

Debt / proved reserves

0.79

$

Debt / Adjusted EBITDA (LTM)

(4)

1.6x |

7

PPT-169 –

Barclay’s September 2010

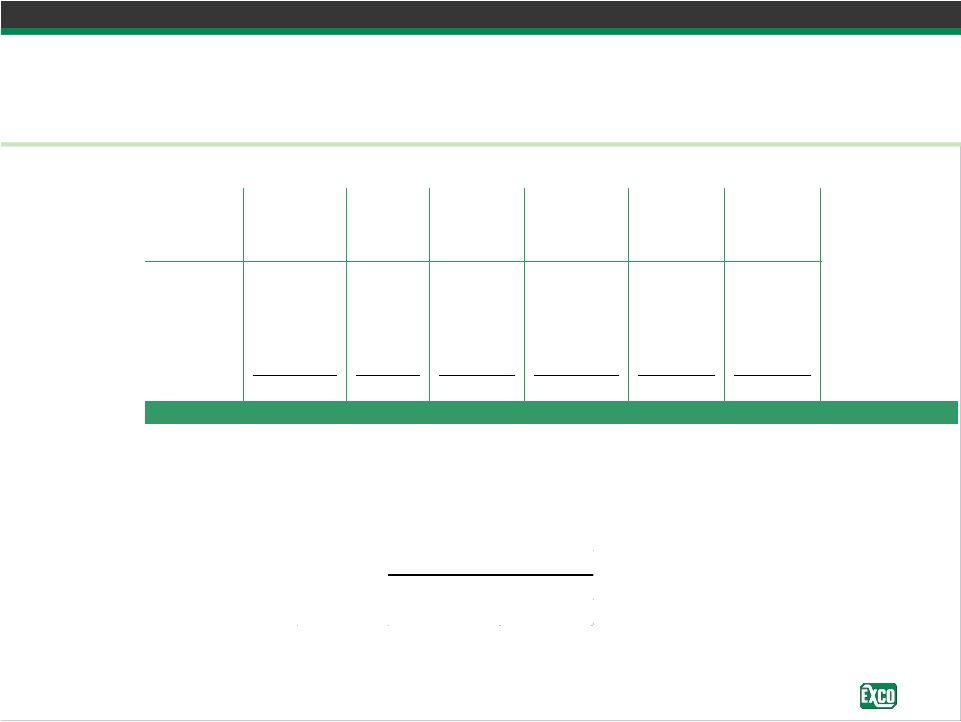

Derivatives Position

As of June 30, 2010

•

Cash settlements for Q2 2010 totaled $46.5 million

•

Hedges added in Q2:

NG

Oil

2011

30 Mmcf/d

2012

20 Mmcf/d

250 Bbls/d

NYMEX

Contract

Contract

Contract

natural gas

price per

NYMEX oil

price per

Equivalent

price per

Mmcf

Mcf

Mbls

Bbl

Mmcfe

Equivalent

Q3 2010

13,940

7.16

$

113

114.96

$

14,616

7.72

$

Q4 2010

13,940

7.21

113

114.96

14,616

7.76

2011

31,025

6.54

548

111.32

34,310

7.69

2012

16,470

6.05

92

109.30

17,019

6.44

2013

5,475

5.99

-

-

5,475

5.99

Total

94,653

6.70

$

976

112.39

$

100,508

7.41

$ |

8

PPT-169 –

Barclay’s September 2010

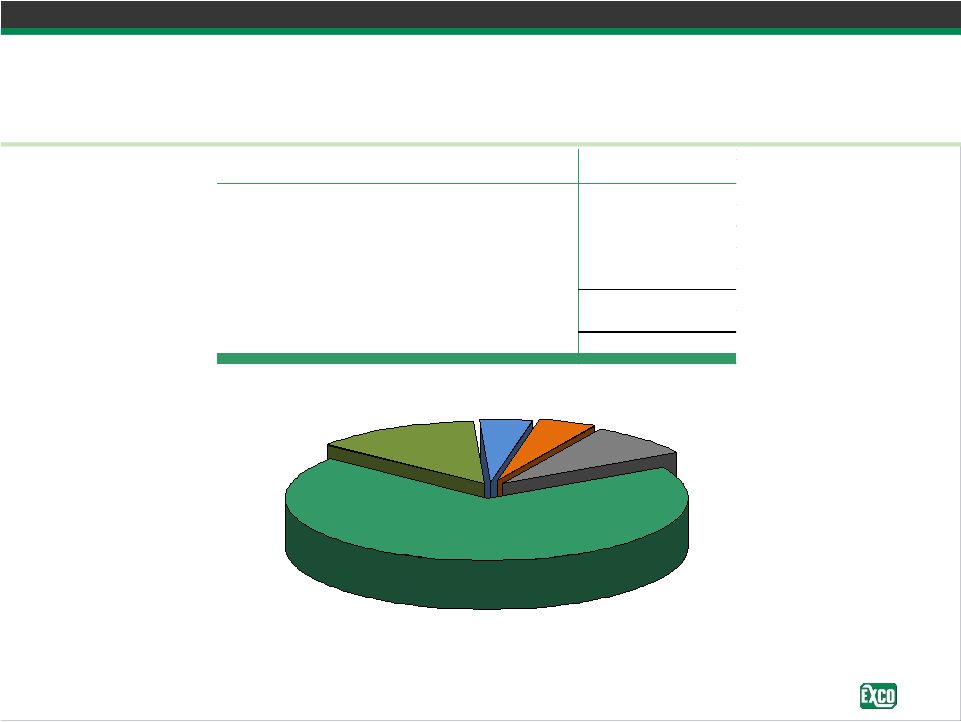

Capital Spending Summary

Approximately 75% of 2010 spending focused on shales

(1)

2010 budget excludes acquisitions. Leasing net of BG Group acreage

reimbursements. (2)

Related to acquisitions closed prior to June 30, 2010, of which $91 million has been

received as of June 30, 2010 •

Closed on $454 million of acquisitions

•

Expect to receive $131 million

(2)

of acquisition reimbursements from BG Group during 2010

$ in millions

Total 2010 Budget

(1)

Development capital expenditures

327

$

Leasing

62

Seismic

20

Gas gathering and water pipelines

23

Corporate and other

40

Capital expenditures before acquisitions

472

Investment in TGGT Holdings, LLC

75

Total investing activities before acquisitions

547

$

Corporate and other

8%

Gas gathering &

water pipelines

5%

Seismic

4%

Leasing

13%

Development capital

expenditures

70% |

9

PPT-169 –

Barclay’s September 2010

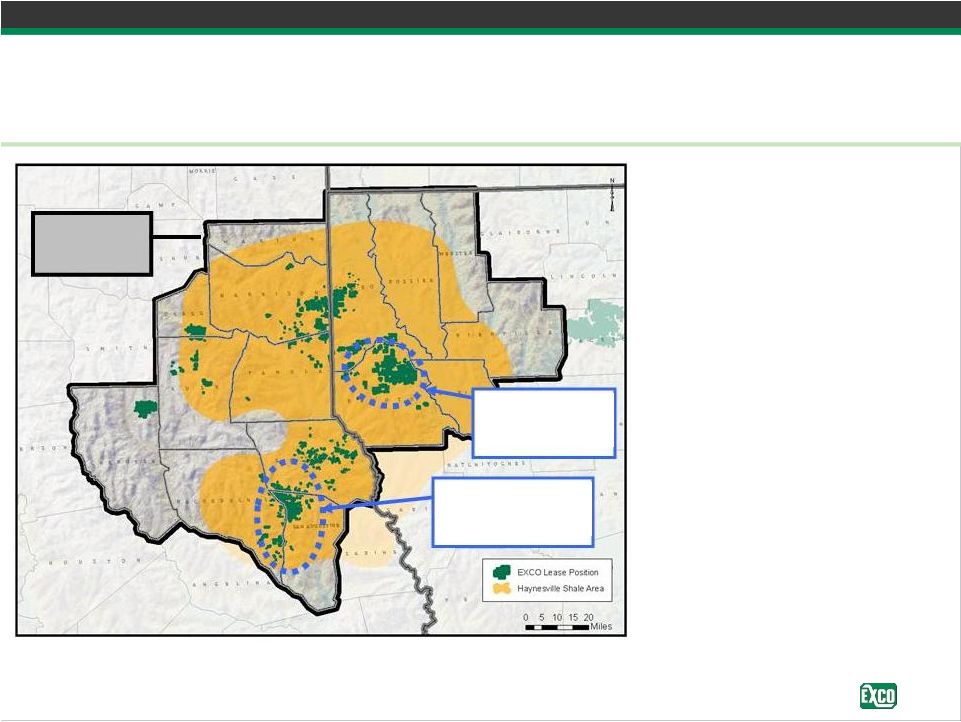

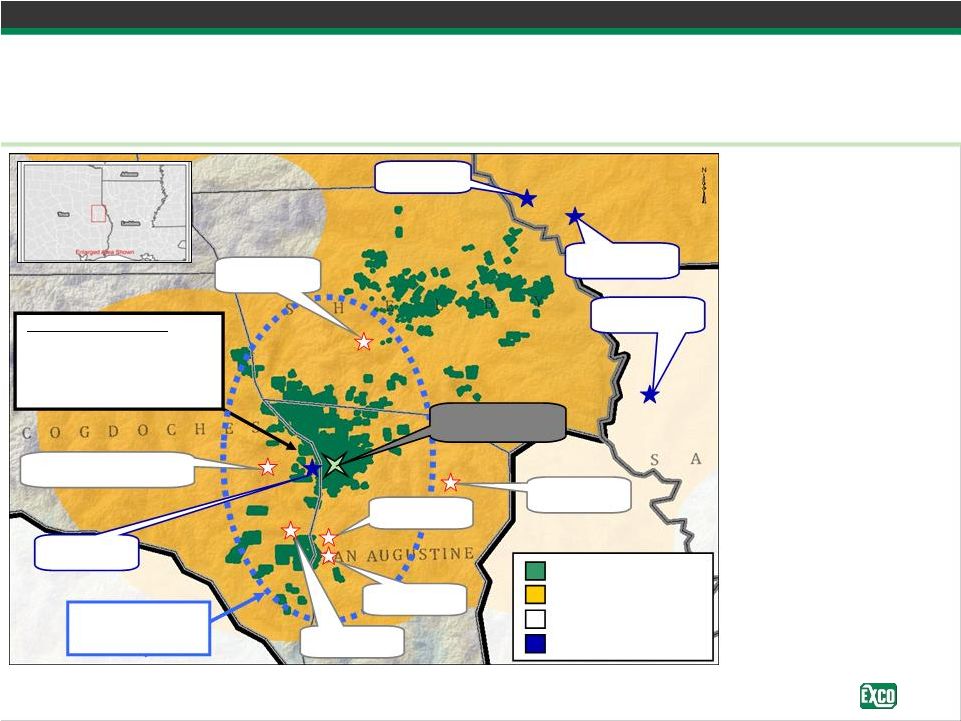

Haynesville Overview

•

80,000 net Haynesville acres

with significant held by

production position

•

Optimizing drilling and

completion methods to improve

recoveries and reduce costs

•

Average IP rate from our

operated Haynesville horizontal

wells

in

our

core

DeSoto

Parish

area

continues

to

be

~23

Mmcf/d

•

Full scale development will

focus drilling in our core areas

with >20 Mmcf/d

IP’s

EXCO / BG

JV Area

Holly Field

Focus Area

Shelby Trough

Focus Area |

Shelby

Trough

Focus

Area

Haynesville and Middle Bossier assets

•

Located in Shelby Trough

in Shelby, San Augustine

& Nacogdoches Counties,

TX

•

10

operated horizontal

shale wells flowing to

sales (9 Haynesville, 1

Bossier)

•

Large acreage holdings in

three areas totaling

approximately 60,800

gross & 47,600 net acres

(JV interest)

•

3 operated rigs currently

running

•

First EXCO operated

completion IP’d

at 22

Mmcf/d

EXCO Lease Position

Haynesville Shale Area

Haynesville Shale Well

Bossier Shale Well

10

PPT-169 –

Barclay’s September 2010

Prior Operator Results

•

Last 3 Haynesville wells:

–

21, 18 and 22 IP’s

•

First Middle Bossier well:

–

11 Mmcf/d

IP

Haynesville

3 wells > 15 Mmcf/d

IP

Bossier

21 Mmcf/d

IP

Shelby

Focus Area

Haynesville

32 Mmcf/d

IP

Haynesville

32 Mmcf/d

IP

Haynesville

30 Mmcf/d

IP

Haynesville

31 Mmcf/d

IP

EXCO’s

1

well

22 Mmcf/d

IP

Bossier

20 Mmcf/d

IP

Bossier

12 Mmcf/d

IP

Bossier

9 Mmcf/d

IP

Haynesville

12 Mmcf/d

IP

st |

11

PPT-169 –

Barclay’s September 2010

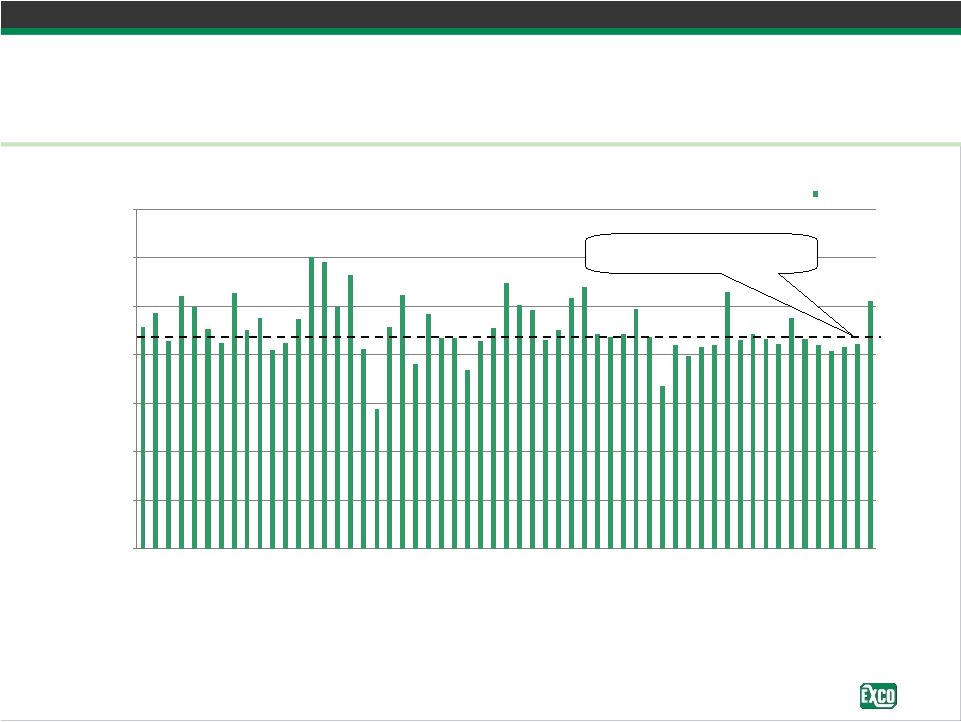

EXCO Operated Haynesville IP's

DeSoto Parish, LA

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

IP, Mcf/d

Haynesville IP Rate Consistency

23 Mmcf/d average IP in DeSoto Parish

(1)

•

Since operations have commenced in Q3 2008, we have spud in excess of 100

Haynesville operated horizontal wells

•

Monitor and control pressure drawdown on every well

•

Initiated pad drilling operations; simultaneously completed first 4 wells on a

single pad in June 2010 with total IP of 92 Mmcf/d

(1)

EXCO IP’s defined as highest 24 hour average flow rate to sales

Average Core DeSoto Parish Area

IP rate of 23 Mmcf/d |

12

PPT-169 –

Barclay’s September 2010

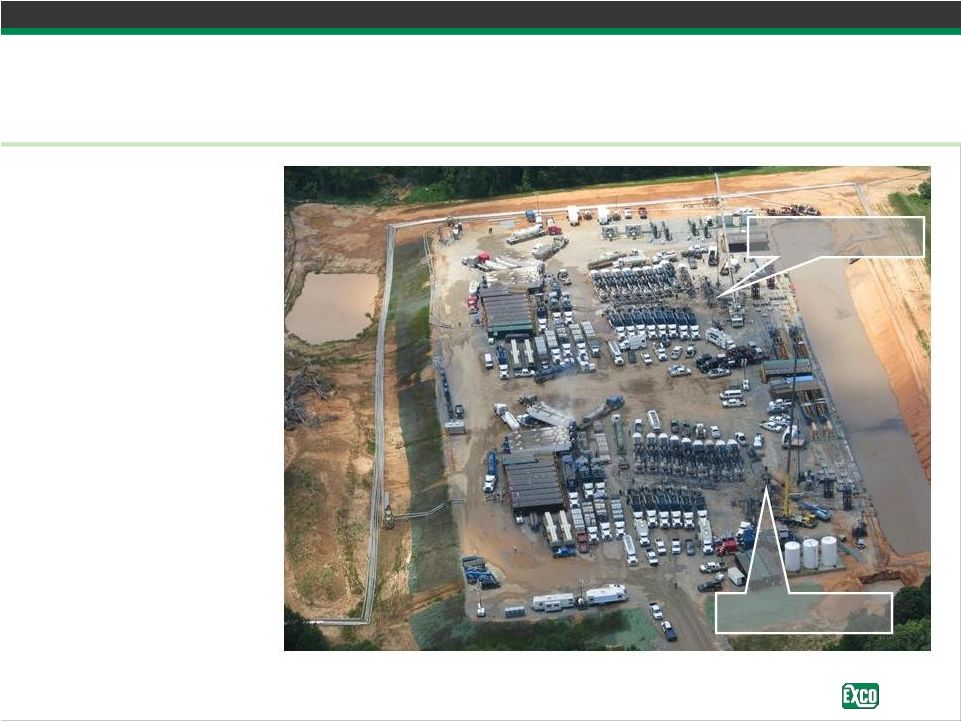

Pad Drilling

EXCO’s

first 4 well, 80 acre spacing super pad -

IP rate of 92 Mmcf/d

•

4 wells drilled with 2 rigs on a

9 acre pad in DeSoto

Parish

•

Completed with 2 frac

fleets

•

20 million pounds of proppant

–

400 truckloads or 100

railroad cars

•

23 million gallons of water

–

35 Olympic size pools

•

Currently utilizing surface

water; constructing pipeline

project for water sourced from

nearby industrial plant

•

Monitoring performance with

microseismic

and pressure

observation

2 well heads

2 well heads |

13

PPT-169 –

Barclay’s September 2010

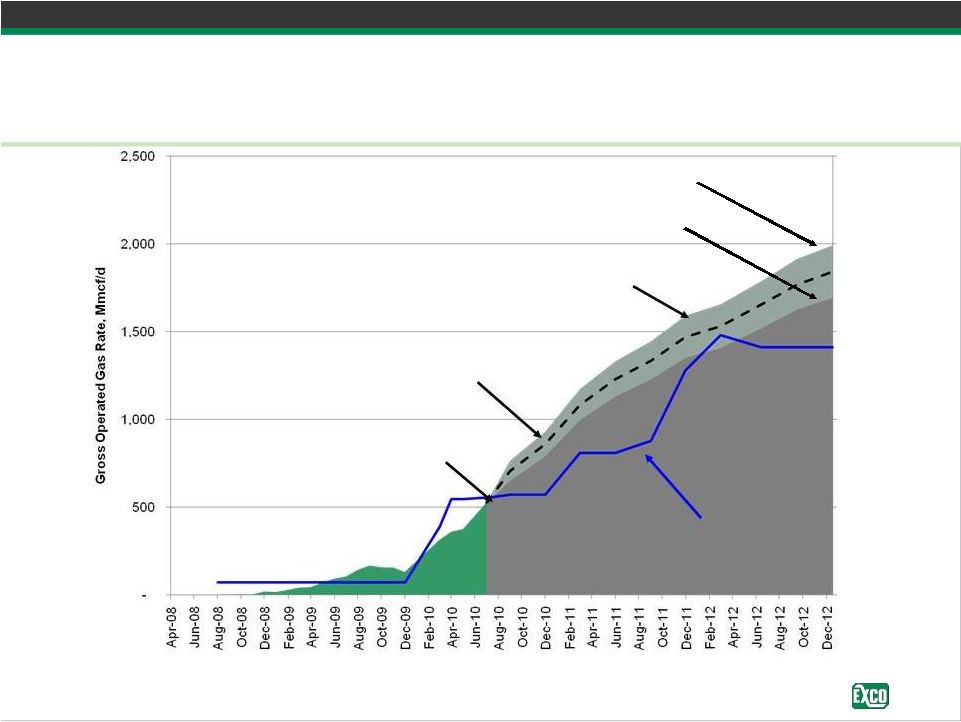

EXCO

Gross

Operated

Haynesville

Shale

Forecast

(1)

Poised to deliver significant growth in Haynesville production

~2,000 Mmcf/d

Production (High Case)

Currently ~

500 Mmcf/d

Gross

~ 939 Mmcf/d

Production

~1,600 Mmcf/d

Production

•

Have secured firm transportation to ensure takeaway; continuing to evaluate

additional takeaway opportunities as needed

Firm Transportation

~1,700 Mmcf/d

Production (Low Case)

(1)

Forecasted production growth through 2012 is primarily based on our current drilling program of 22 rigs

running at year end 2010 (18 rigs running as of June 30, 2010), 22 rigs running during 2011 and 27 rigs

running during 2012, our year end Haynesville type curve of 6.6 Bcfe EUR, and current drilling and

completion timing |

14

PPT-169 –

Barclay’s September 2010

•

Further efficiencies expected to reduce average well cost by ~$0.5 million

•

Current fracture stimulation costs have remained at Q2 2010 levels

•

Drilling costs have decreased since 2H ’09; expect to increase as a result of

deeper targets in the Shelby Trough area and certain directional drilling

Haynesville Well Costs and Rate of Return

Haynesville Well Cost Break-Down

2.4

2.1

1.8

2.5

1.4

1.0

1.0

1.2

1.0

2.7

2.4

3.6

2.8

2.6

0.9

$9.9

$9.3

$10.2

0

2

4

6

8

10

12

2H '09 Avg. Cost

Q1 Avg. Cost

Q2 Avg. Cost

Fracture Stimulation

Completion Other

Drilling Special Services

Rig Costs

OCTG

(1)

XCO Core Desoto / Shelby Asset locations

(2)

Industry average of 800+ Haynesville wells

IP

(Mmcf/d)

Gas price required to

achieve 20% pre-tax IRR

(per Mcf)

XCO Core

(1)

20

$4.00 -

$4.25

Industry Avg

(2)

13

$6.00 -

$6.25

@ $10mm Well D&C Costs |

PPT-169 –

Barclay’s September 2010

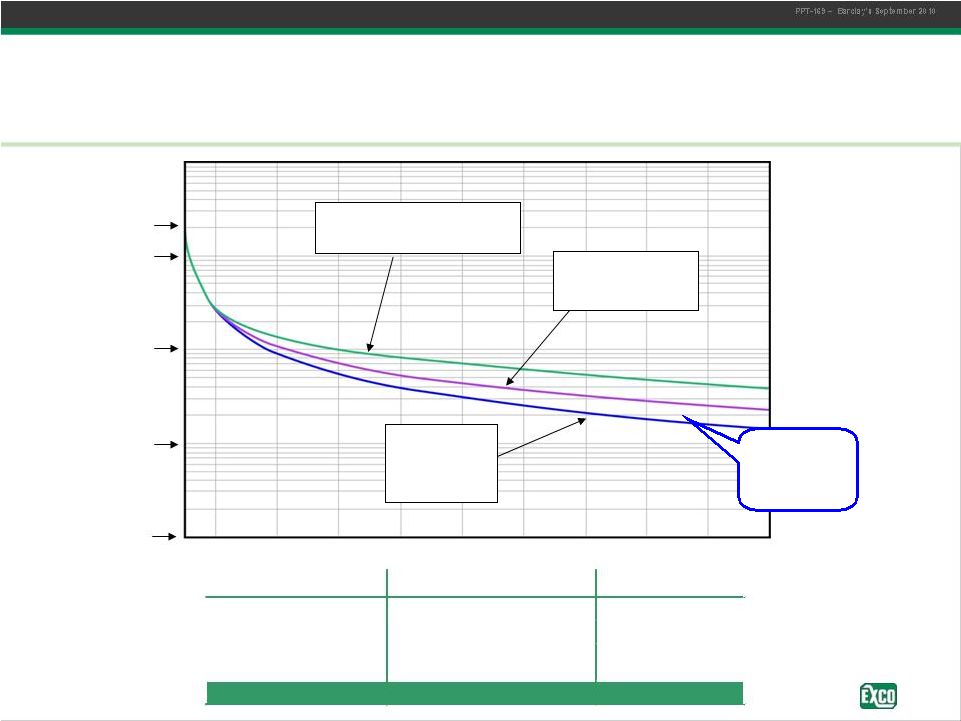

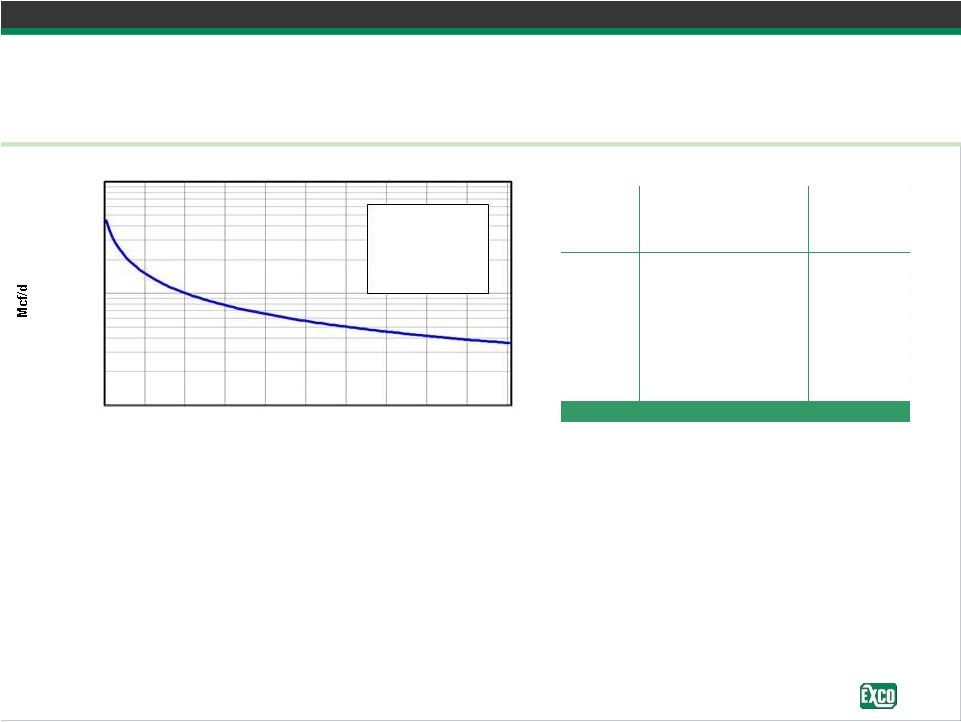

Haynesville Type Curve

Significant upside from potential shallower decline rates

EXCO’s

current

proved type

curve

b = 1.75

EUR = 9.6 Bcfe

b = 1.25

EUR = 7.6 Bcfe

b = 1.00

EUR = 6.6

Bcfe

Year:

1 2

3 4

5

6 7

8

9

20 Mmcf/d

10 Mmcf/d

1 Mmcf/d

100 Mcf/d

10 Mcf/d

Avg

Haynesville IP

EUR Booked

EXCO Resources

23 Mmcf/d

6.7

Competitor A

17 Mmcf/d

7.5

Competitor B

15 Mmcf/d

7.5

15 |

PPT-169 –

Barclay’s September 2010

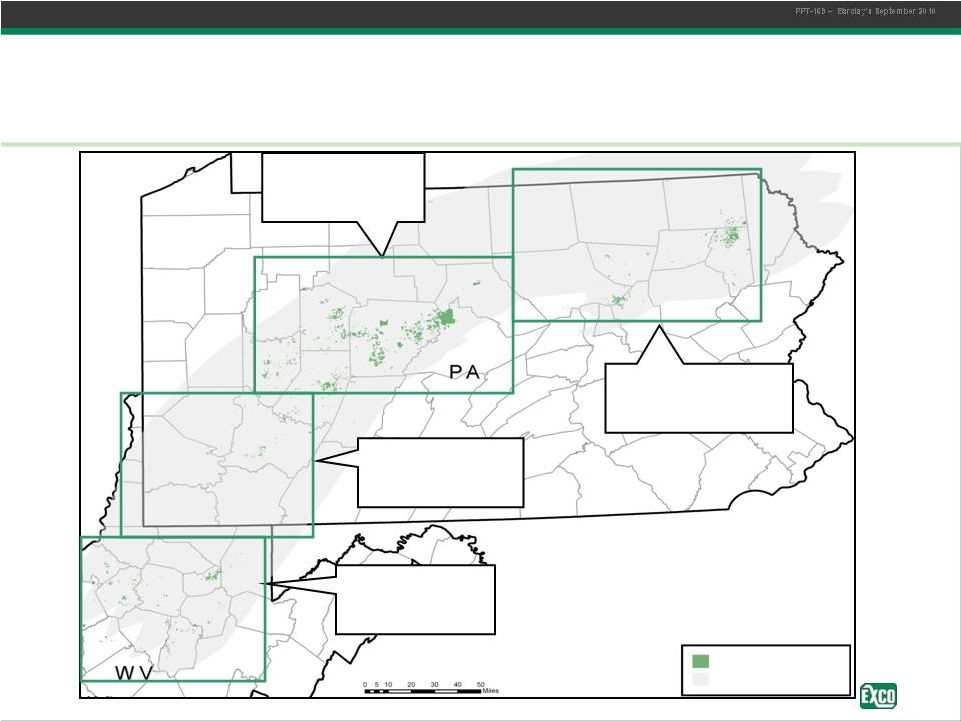

Marcellus Overview

Well positioned acreage

Northeast PA Area

Avg

IP’s 6-12 Mmcf/d

Major Operators:

Talisman, Cabot, Chesapeake, East

Central PA Area

Avg

IP’s 4-7 Mmcf/d

Major Operators:

EXCO, Anadarko, Rex, EOG

Southwest PA Area

Avg

IP’s 4-10 Mmcf/d

Major Operators:

Range, Atlas, Consol

Northern WV Area

Avg

IP’s 4-7 Mmcf/d

Major Operators:

Chesapeake, EQT, Antero

EXCO Marcellus Acreage

Marcellus Fairway

16 |

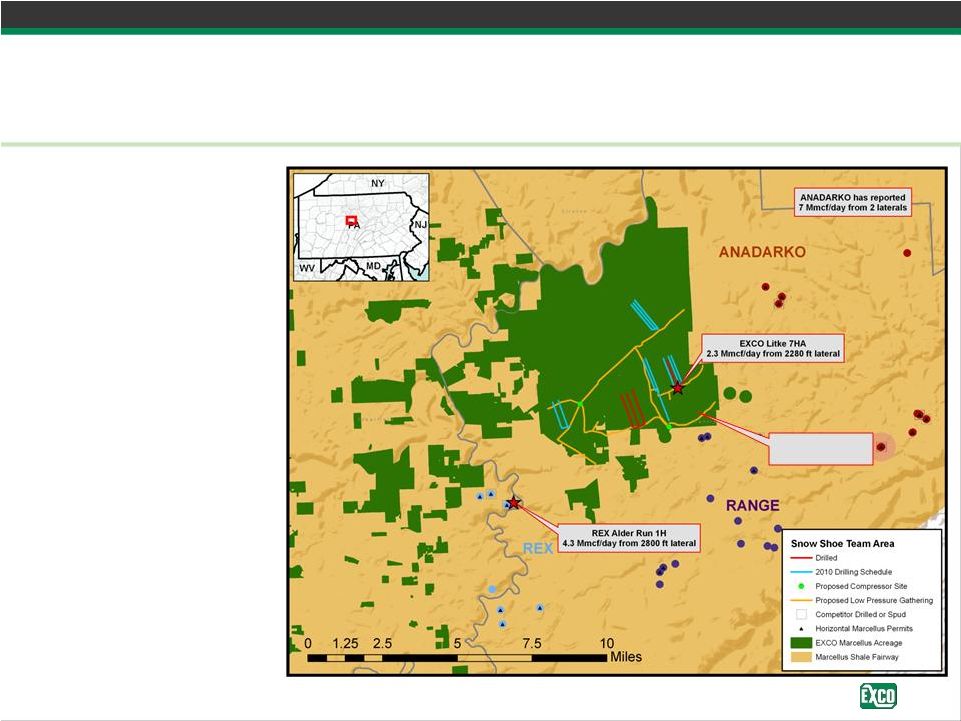

PPT-169 –

Barclay’s September 2010

•

2010 Drilling program

–

12 horizontal wells in

2010

–

Exit year with 3 rigs

running

•

Completion activity

–

Last well IP’d

at 4.0

Mmcf/d

from a 4,500’

lateral

•

Current and 30 day

average production

rates of 3.9 Mmcf/d

–

Currently completing

three 5,000’+ horizontal

laterals

•

Solidifying land position

–

Hold 113,000 net

Marcellus acres

–

Continuing to block up

acreage

Central Pennsylvania Area

Current Marcellus activity

Planned Q3 Pad

Completions

17 |

18

PPT-169 –

Barclay’s September 2010

Marcellus Type Curve and Economics

Year: 1

2 3 4 5

6

7 8 9 10

•

Expect

average

well

cost

to

decrease

from

current

costs

of

~$6.5

million

to

~$5.0

million

by

year end 2011 with further expected reductions as development continues

•

Expected

well

cost

reductions

from

improved

drilling,

completion

and

logistical

efficiencies

resulting from multi rig program

(1)

Based on forward natural gas strip prices of $4.50, $5.25, $5.50, $5.75 and $6.00 for

2011, 2012, 2013, 2014 and beyond 10 Mmcf/d

1 Mmcf/d

100 Mcf/d

Well Cost

($MM)

Gas price required to

achieve 20% pre tax

IRR (per Mcf)

IRR at

NYMEX strip

pricing

(1)

4.5

$

$3.75 -

$4.00

40%

5.5

$

$4.25 -

$4.50

25%

6.5

$

$5.00 -

$5.25

20%

Lateral = 4,500’

IP = 4,500 Mcf/d

b = 1.49

EUR = 4.5 Bcfe |

PPT-169 –

Barclay’s September 2010

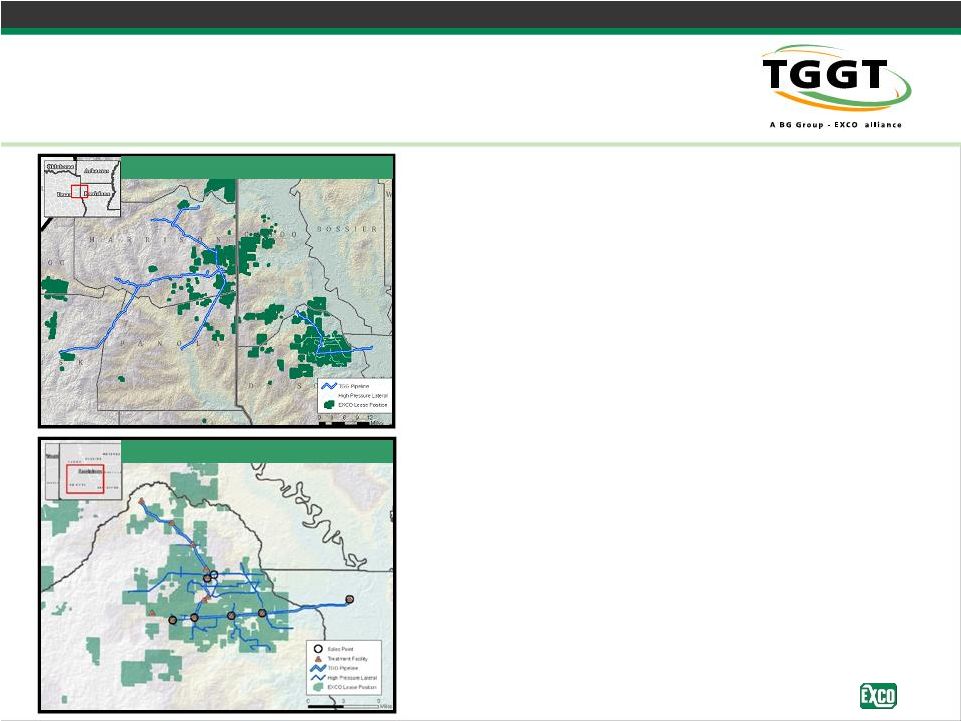

TGGT Midstream Operations

Additional expansion projects in Shelby Trough

•

TGGT throughput currently totals more than 1.1 Bcf/d

•

Throughput capacity growing to 2.0 Bcf/d

•

Will have amine and glycol facilities with capacity to

treat 1 Bcf/d

of natural gas to meet pipeline quality

requirements during 2010; evaluating additional

treating opportunities

•

Interconnects in Holly area to several major pipelines

with access to multiple markets

–

Regency

–

Crosstex

–

Centerpoint

–

Gulf South

–

ETC Tiger (Q1 2011)

–

Enterprise Acadian (Q3 2011)

•

Building midstream infrastructure in Shelby County

similar to TGG Holly system; multiple interconnects

available

–

Tenaska

–

ETC

–

NGPL

–

Enbridge

–

TETCO (now in service)

19

TGGT East TX / North LA System

TGGT Holly System |

20

PPT-169 –

Barclay’s September 2010

Forward Looking Statements

This

presentation

contains

forward-looking

statements,

as

defined

in

Section

27A

of

the

Securities

Act

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

or

the

Exchange

Act.

These

forward-looking

statements relate to, among other things, the following:

•

our future financial and operating performance and results;

•

our business strategy;

•

market prices;

•

our future use of derivative financial instruments; and

•

our plans and forecasts.

We have based these forward-looking statements on our current assumptions,

expectations and projections about future events. We use the words

"may," "expect," "anticipate," "estimate," "believe," "continue," "intend," "plan," "budget" and other similar words to identify forward-looking statements. You should read

statements that contain these words carefully because they discuss future

expectations, contain projections of results of operations or of our financial condition and/or state other "forward-looking" information. We do not

undertake

any

obligation

to

update

or

revise

publicly

any

forward-looking

statements,

except

as

required

by

law.

These

statements

also

involve

risks

and

uncertainties

that

could

cause

our

actual

results

or

financial condition to materially differ from our expectations in this presentation,

including, but not limited to: •

fluctuations in prices of oil and natural gas;

•

imports of foreign oil and natural gas, including liquefied natural gas;

•

future capital requirements and availability of financing;

•

continued disruption of credit and capital markets;

•

estimates of reserves and economic assumptions;

•

geological concentration of our reserves;

•

risks associated with drilling and operating wells;

•

exploratory risks, including our Marcellus shale play in Appalachia and our

Haynesville and Bossier shale plays in East Texas/North Louisiana;

•

risks associated with operation of natural gas pipelines and gathering

systems; •

discovery, acquisition, development and replacement of oil and natural gas

reserves; •

cash flow and liquidity;

•

timing and amount of future production of oil and natural gas;

•

availability of drilling and production equipment;

•

marketing of oil and natural gas;

•

developments in oil-producing and natural gas-producing countries;

•

title to our properties;

•

competition;

•

litigation;

•

general economic conditions, including costs associated with drilling and operation

of our properties; •

environmental or other governmental regulations, including legislation to reduce

emissions of greenhouse gases, legislation of derivative financial instruments, regulation of hydraulic fracture

stimulation and elimination of income tax incentives available to our

industry; •

receipt and collectibility

of amounts owed to us by purchasers of our production and counterparties to our

derivative financial instruments; •

decisions whether or not to enter into derivative financial instruments;

•

potential acts of terrorism;

•

actions of third party co-owners of interests in properties in which we also

own an interest; •

fluctuations in interest rates; and

•

our ability to effectively integrate companies and properties that we

acquire.. |

21

PPT-169 –

Barclay’s September 2010

Forward Looking Statements (continued)

We believe that it is important to communicate our expectations of future

performance to our investors. However, events may occur in the future that we are unable to accurately predict, or over which we have no

control. You are cautioned not to place undue reliance on a

forward-looking statement. When considering our forward-looking statements, keep in mind the risk factors and other cautionary statements in this

presentation, and the risk factors included in our Registration Statement on form

S-3 with respect to the senior notes, our Annual Reports on Form 10-K and our Quarterly Reports on Form 10-Q.

Our

revenues,

operating

results,

financial

condition

and

ability

to

borrow

funds

or

obtain

additional

capital

depend

substantially

on

prevailing

prices

for

oil

and

natural

gas,

the

availability

of

capital

from

our

revolving

credit

facilities

and

liquidity

from

capital

markets.

Declines

in

oil

or

natural

gas

prices

may

materially

adversely

affect

our

financial

condition,

liquidity,

ability

to

obtain

financing

and

operating

results.

Lower

oil

or

natural gas prices also may reduce the amount of oil or natural gas that we can

produce economically. A decline in oil and/or natural gas prices could have a material adverse effect on the estimated value and

estimated

quantities

of

our

oil

and

natural

gas

reserves,

our

ability

to

fund

our

operations

and

our

financial

condition,

cash

flow,

results

of

operations

and

access

to

capital.

Historically,

oil

and

natural

gas

prices

and markets have been volatile, with prices fluctuating widely, and they are likely

to continue to be volatile. Effective January 1, 2010, the United States

Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose not only "proved" reserves (i.e., quantities of oil

and

gas

that

are

estimated

to

be

recoverable

with

a

high

degree

of

confidence),

but

also

"probable"

reserves

(i.e.,

quantities

of

oil

and

gas

that

are

as

likely

as

not

to

be

recovered)

as

well

as

"possible"

reserves

(i.e.,

additional

quantities

of

oil

and

gas

that

might

be

recovered,

but

with

a

lower

probability

than

probable

reserves).

As

noted

above,

statements

of

reserves

are

only

estimates

and

may

not

correspond

to

the

ultimate quantities of oil and gas recovered. Any reserve estimates provided in this

presentation that are not specifically designated as being estimates of proved reserves may include estimated reserves not

necessarily

calculated

in

accordance

with,

or

contemplated

by,

the

SEC's

latest

reserve

reporting

guidelines.

Investors

are

urged

to

consider

closely

the

disclosure

in

our

Registration

Statement

on

form

S-3

with

respect

to

the

senior

notes,

our

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

December

31,

2009,

and

our

Quarterly

Reports

on

Form

10-Q

which

are

available

on

our

website

at

www.excoresources.com

under the Investor Relations tab or by calling us at 214-368-2084.

|