Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 10-K

______________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2016

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-32743

______________________________

EXCO RESOURCES, INC.

(Exact name of registrant as specified in its charter)

______________________________

Texas | 74-1492779 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

12377 Merit Drive Suite 1700 Dallas, Texas | 75251 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (214) 368-2084

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Shares, $0.001 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

______________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. YES o NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant is required to submit and post such files). YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | o | Accelerated filer | x | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO x

As of March 10, 2017, the registrant had 282,821,519 outstanding common shares, par value $0.001 per share, which is its only class of common shares. As of the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the registrant's common shares held by non-affiliates was approximately $181,081,000.

______________________________

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Definitive Proxy Statement on Schedule 14A to be furnished to shareholders in connection with its 2017 Annual Meeting of Shareholders are incorporated by reference in Part III, Items 10-14 of this Annual Report on Form 10-K.

EXCO RESOURCES, INC.

TABLE OF CONTENTS

1

EXCO RESOURCES, INC.

PART I

Item 1. Business

General

Unless the context requires otherwise, references in this Annual Report on Form 10-K to “EXCO,” “EXCO Resources,” “Company,” “we,” “us,” and “our” are to EXCO Resources, Inc. and its consolidated subsidiaries.

We have provided definitions of terms commonly used in the oil and natural gas industry in the “Glossary of selected oil and natural gas terms” section of this Annual Report on Form 10-K.

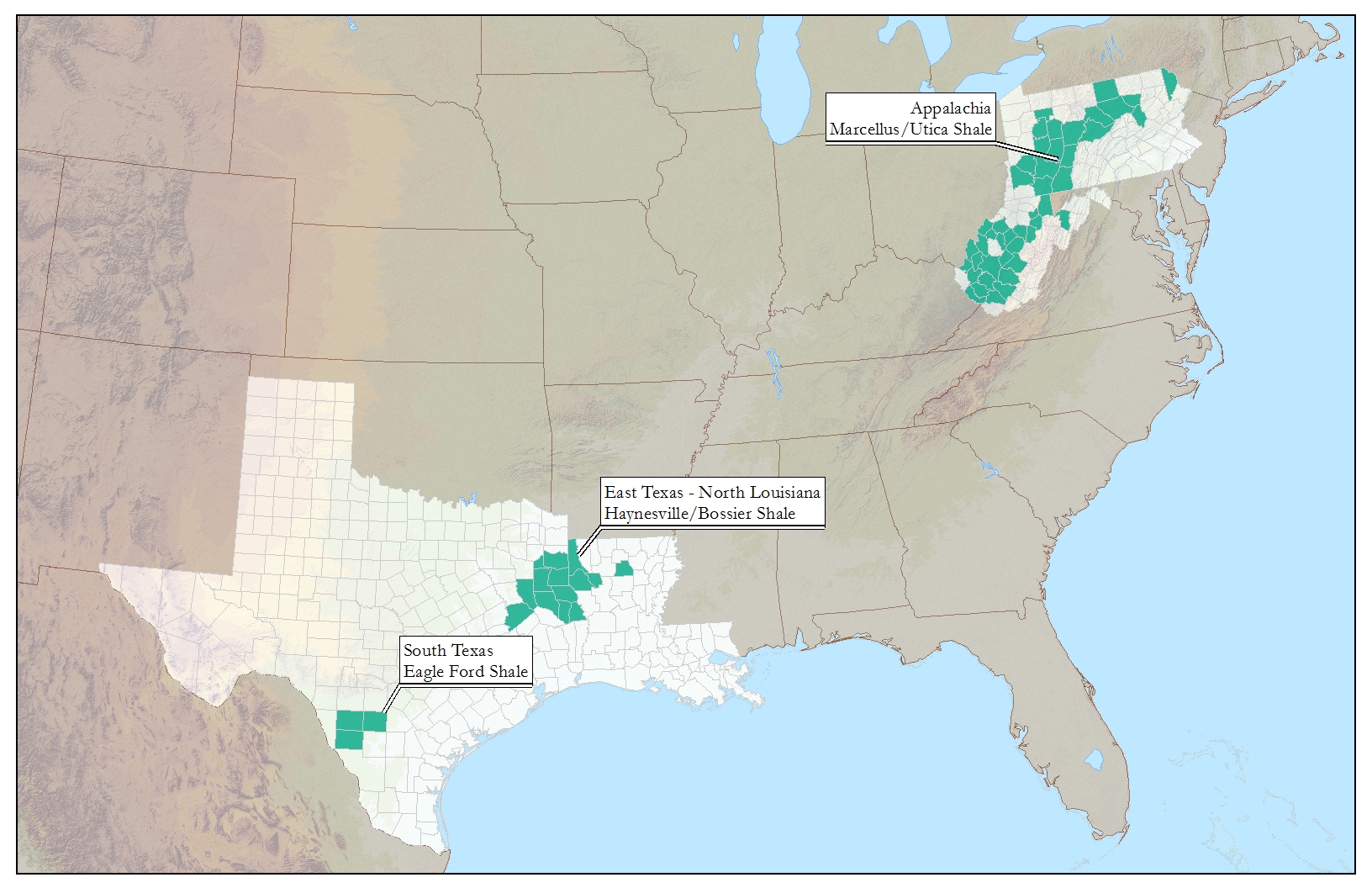

We are an independent oil and natural gas company engaged in the exploration, exploitation, acquisition, development and production of onshore U.S. oil and natural gas properties with a focus on shale resource plays. Our principal operations are conducted in certain key U.S. oil and natural gas areas including Texas, Louisiana and the Appalachia region.

Our business strategy

Our primary strategy focuses on the exploitation and development of our shale resource plays and the pursuit of leasing and acquisition opportunities. We plan to carry out this strategy by executing on a strategic plan that incorporates the following three core objectives: (i) restructuring the balance sheet to enhance our capital structure and extend structural liquidity; (ii) transforming ourselves into the lowest cost producer; and (iii) optimizing and repositioning our portfolio. We believe this strategy will allow us to create long-term value for our shareholders. The three core objectives and the Company's recent accomplishments are detailed below:

Restructuring the balance sheet to enhance our capital structure and extend structural liquidity

We remain committed to improving our financial flexibility and enhancing our capital structure. In March 2017, we closed a series of transactions intended to improved our capital structure and liquidity, including the issuance of $300.0 million in aggregate principal amount of senior secured 1.5 lien notes due March 20, 2022 ("1.5 Lien Notes"), exchange of $682.8 million in aggregate principal amount of our existing senior secured second lien term loans due October 26, 2020 ("Second Lien Term Loans") for a like amount of senior 1.75 lien term loans due October 26, 2020 ("1.75 Lien Term Loans"), and the issuance of warrants to purchase our common shares. The 1.5 Lien Notes and 1.75 Lien Term Loans provide us the option, subject to certain limitations, to pay interest in cash, common shares, or additional indebtedness. The 1.5 Lien Notes were issued to affiliates of Fairfax Financial Holdings Limited ("Fairfax"), Energy Strategic Advisory Services, LLC ("ESAS") and Oaktree Capital Management, LP ("Oaktree"), as well as an unaffiliated lender.

The proceeds from the issuance of the 1.5 Lien Notes were primarily utilized to repay the outstanding indebtedness under our credit agreement ("EXCO Resources Credit Agreement"). The EXCO Resources Credit Agreement was amended to reduce the borrowing base to $150.0 million, permit the issuance of the 1.5 Lien Notes and the exchange of Second Lien Term Loans, and modify certain financial covenants. As a result of these transactions, our cash and restricted cash plus the unused borrowing base under the EXCO Resources Credit Agreement ("Liquidity"), improved from $66.4 million as of December 31, 2016 to $181.4 million on a pro forma basis after incorporating the impact of the transactions as of December 31, 2016. The optionality for the method of interest payments on the 1.5 Lien Notes and 1.75 Lien Term Loans has the potential to reduce annual cash interest payments by approximately $109.3 million if we elect to pay interest through the issuance of common shares, subject to certain restrictions. See further discussion of these transactions as part of "Item 7. Management's Discussion and Analysis of Financial Results" and "Note 18. Subsequent Events" to the Notes to our Consolidated Financial Statements.

During 2016, we completed a cash tender offer for our outstanding unsecured notes ("Tender Offer") that resulted in the repurchase of an aggregate of $101.3 million in principal amount of the senior unsecured notes due April 15, 2022 (“2022 Notes”) for an aggregate purchase price of $40.0 million. In addition, we repurchased an aggregate of $26.4 million and $51.4 million in principal amount of our senior unsecured notes due September 15, 2018 (“2018 Notes”) and 2022 Notes, respectively, with an aggregate of $13.3 million in cash through open market repurchases during 2016.

We renegotiated certain commercial contracts including a sales contract in North Louisiana, effective January 1, 2016, that improved the rate per Mcf of natural gas and extended the term of the contracts. In South Texas, we renegotiated a sales

2

contract that improved our realized price on oil production. We remain committed to continuing our efforts to restructure certain of our gathering and transportation contracts that were not successfully renegotiated during 2016.

Transforming ourselves into the lowest cost producer

We continue to exercise fiscal discipline to transform ourselves into the lowest cost producer. Lease operating expenses decreased by 36% in 2016 compared to 2015 primarily due to the renegotiation of saltwater disposal contracts, modifications to chemical programs, enhanced use of well site automation, optimization of work schedules and less workover activity. In the Appalachia region, we divested our conventional assets, which had the highest lease operating expenses per Mcfe in our portfolio. The divestitures contributed to reduction in field employee headcount in the region of approximately 85% since December 31, 2015. Our cost reduction efforts have resulted in a decrease in total employee headcount across the portfolio of approximately 40% since December 31, 2015 and approximately 70% since December 31, 2014. The reductions in headcount and other initiatives have resulted in significant decreases in general and administrative expenses compared to prior years.

Our operational team is dedicated to the continuous improvement and innovation of well designs in order to maximize our return on capital. We reduced our drilling and completion costs through modifications to well designs, renegotiated contracts with vendors, and other efficiencies. In addition, we improved our well performance through the use of extended laterals and increased use of proppant while reducing both capital and operating costs.

Our drilling program in North Louisiana achieved strong results, further confirming that our enhanced completion methods have proven to be effective and increase the potential for higher rates of return on our undeveloped locations. We drilled three gross wells in North Louisiana with lateral lengths of approximately 4,300 feet during 2016 featuring completion methods that included the use of approximately 2,700 lbs of proppant per lateral foot for an average cost of $5.9 million, representing a 13% decrease compared to wells drilled in this region with similar lateral lengths in prior year despite increased proppant use. We also drilled three gross wells in North Louisiana during 2016 with lateral lengths of approximately 7,600 feet featuring completion methods that included the use of approximately 2,650 lbs of proppant per lateral foot for an average cost of approximately $8.8 million. Our development plans for 2017 include increased proppant levels and we are evaluating plans to further extend our lateral lengths.

The average drilling and completion costs for the wells we turned-to-sales in East Texas during 2016 were approximately $9.3 million, a decrease of approximately 20% compared to the wells drilled in this region in 2015. Our two most recent wells turned-to-sales in the southern area of our East Texas region continue to exceed expectations and resulted in a 73% increase to an average EUR of 2.6 Bcf per 1,000 lateral feet as compared to December 31, 2015.

Optimizing and repositioning the portfolio

We have implemented a disciplined capital allocation approach to ensure the highest and best use of capital, including the completion of a series of asset divestitures as part of our portfolio optimization initiative. Our use of capital is allocated based on the highest risk adjusted rates of return, including both the development of our oil and natural gas properties and liability management initiatives.

In May 2016, we closed a sale of certain non-core undeveloped acreage in South Texas. In July 2016, we closed a sale of our interests in shallow conventional assets located in Pennsylvania and retained an overriding royalty interest. In October 2016, we closed a sale of our interests in shallow conventional assets located primarily in West Virginia. EXCO retained all rights to other formations below the conventional depths in the Appalachia region including the Marcellus and Utica shales. We are evaluating other divestitures of assets, including our assets in South Texas, to generate capital that can be deployed to projects with high rates of return. Our technical team is performing an evaluation of prospective locations in our portfolio, including the dry gas window of the Utica shale in Pennsylvania and the Bossier shale in North Louisiana. We believe that significant upside exists to apply advanced completion techniques that have been effective in other formations based on our technical analysis and the recent success of nearby operators.

We continue to evaluate opportunities to add undeveloped locations in core areas that meet our strategic objectives at a low cost. We are able to leverage our technical expertise and economies of scale to maximize our returns in these areas.

Our strengths

High quality asset base in attractive regions

3

Our core areas have an extensive inventory of drilling opportunities that provide us the option to allocate capital to enhance our returns in various commodity price environments. In addition, a significant portion of our acreage is held-by-production, which allows us to develop these properties within an optimum time frame. We hold significant acreage positions in three prominent oil and natural gas regions in the United States:

• | East Texas and North Louisiana - we currently hold approximately 82,100 net acres in the Haynesville and Bossier shales; |

• | South Texas - we currently hold approximately 49,300 net acres in the Eagle Ford shale; and |

• | Appalachia - we currently hold approximately 127,000 net acres prospective for the Marcellus shale and approximately 40,000 net acres prospective for the Utica shale predominantly located in the dry gas window. |

Our properties are generally characterized by:

• | multi-year inventory of development drilling and exploitation projects; |

• | high drilling success rates; |

• | significant unproved reserves and resources; and |

• | long reserve lives. |

We have extensive amounts of technical and operational expertise within the Haynesville and Bossier shales. We have accumulated significant amounts of contiguous acreage and are one of the largest operators within this region. Our economies of scale and operational expertise have allowed us to efficiently develop our assets and minimize our costs through greater utilization of multi-well pads and existing infrastructure and facilities.

We have applied our technical and operational expertise from other shale plays to our development of the Eagle Ford shale. We have realized significant improvements in our drilling performance, and the optimization of our well design has yielded strong results.

Our position in the Marcellus and Utica shales requires low maintenance capital as a substantial portion of our acreage is held-by-production, which gives us flexibility to control the timing of our development activities in the region.

Operational control

We operate a significant portion of our properties, which allows us to manage our operating costs and better control capital expenditures as well as the timing of development and exploitation activities. Therefore, we are able to allocate our capital to the most attractive projects based on commodity prices, rates of return and industry trends. As of December 31, 2016, we operated 868 of our 1,155 gross wells, or wells representing approximately 95% of our proved developed producing reserves. We have continued to demonstrate improved drilling and completion results in our operated areas while maintaining low capital and operating costs.

Skilled technical personnel and experienced team

We have developed a workforce of highly skilled technical and operational personnel who have been successful in developing our shale resources. We leverage our technical expertise to exploit our asset base in an efficient and cost-effective manner. We believe our technical expertise gives us a competitive advantage in our key operating areas.

Our management team has extensive industry experience in acquiring, exploring, exploiting and developing oil and natural gas properties. In addition, we have a services and investment agreement with ESAS to assist in the development and execution of our business plan. ESAS is owned by Bluescape Energy Recapitalization and Restructuring Fund III LP, which is directed by its general partner, Bluescape Energy Partners III GP LLC ("Bluescape").

Plans for 2017

Our plans for the first quarter of 2017 focus primarily on the appraisal, exploitation and development of projects with the highest rates of return in our portfolio, including the Haynesville and Bossier shales in North Louisiana. The wells included as part of our first quarter 2017 plans will feature a modified well design that builds on the success of the results from our 2016 development program in the North Louisiana and East Texas regions, including the use of extended laterals and more proppant. The completion methods will include extended laterals of up to 7,500 feet and an average of 3,500 lbs of proppant per lateral foot. We will continue to focus on operational initiatives to enhance our well designs, optimize our base production and

4

maximize the recoveries from our properties. In addition, we plan to participate in non-operated wells in the Haynesville and Bossier shales in North Louisiana and East Texas, and the Utica shale in Appalachia during 2017. We are currently incorporating the impact of the recent financing transactions into our development plans for the remainder of 2017. Furthermore, we will continue to evaluate and pursue accretive leasing and acquisition opportunities to increase our drilling inventory.

Summary of geographic areas of operations

The following tables set forth summary operating information attributable to our principal geographic areas of operation as of December 31, 2016:

Areas | Total Proved Reserves (Bcfe) (1) | PV-10 (in millions) (1) (2) | Average daily net production (Mmcfe) (3) | |||||||

North Louisiana | 222,143 | $ | 87.1 | 140 | ||||||

East Texas | 77,639 | 70.4 | 57 | |||||||

South Texas | 68,019 | 123.4 | 24 | |||||||

Appalachia and other | 108,926 | 30.0 | 33 | |||||||

Total | 476,727 | $ | 310.9 | 254 | ||||||

Areas | Total gross acreage | Total net acreage | ||||

North Louisiana | 102,200 | 50,800 | ||||

East Texas | 120,000 | 45,500 | ||||

South Texas | 101,600 | 49,300 | ||||

Appalachia and other | 410,000 | 184,100 | ||||

Total | 733,800 | 329,700 | ||||

(1) | The total Proved Reserves and PV-10 as of December 31, 2016 were prepared in accordance with the rules and regulations of the Securities and Exchange Commission ("SEC"). The estimated future plugging and abandonment costs necessary to compute PV-10 were computed internally. |

(2) | The PV-10 data used in this table was based on reference prices using the simple average of the spot prices for the trailing 12 month period using the first day of each month beginning on January 1, 2016 and ending on December 1, 2016, of $2.48 per Mmbtu for natural gas and $42.75 per Bbl for oil, in each case adjusted for geographical and historical differentials. Market prices for oil and natural gas are volatile (see “Item 1A. Risk Factors - Risks Relating to Our Business”). We believe that PV-10, while not a financial measure in accordance with generally accepted accounting principles in the United States ("GAAP"), is an important financial measure used by investors and independent oil and natural gas producers for evaluating the relative significance of oil and natural gas properties and acquisitions due to tax characteristics which can differ significantly among comparable companies. The total Standardized Measure, a measure recognized under GAAP, as of December 31, 2016 was $310.9 million. The Standardized Measure represents the PV-10 after giving effect to income taxes, and is calculated in accordance with the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 932, Extractive Activities, Oil and Gas ("ASC 932"). Our tax basis in the associated properties exceeded the pre-tax cash inflows and, as a result, there is no difference in Standardized Measure and PV-10 for all years presented. The amount of estimated future plugging and abandonment costs, the PV-10 of these costs and the Standardized Measure were determined by us. We do not designate our derivative financial instruments as hedges and accordingly, do not include the impact of derivative financial instruments when computing the Standardized Measure. |

(3) | The average daily net production rate was calculated based on the average daily rate during the final month of the year ended December 31, 2016. |

5

Our development and exploitation project areas

East Texas and North Louisiana

Our operations in East Texas and North Louisiana are focused on the Haynesville and Bossier shales, which are primarily located in Shelby, Harrison, Panola, San Augustine and Nacogdoches Counties in Texas and DeSoto and Caddo Parishes in Louisiana. Our acreage in this region is predominantly held-by-production. The Haynesville shale is located at depths of 12,000 to 14,500 feet and is being developed with horizontal wells that typically have 4,500 to 7,500 foot laterals. Recent operators in the region have been developing the Haynesville and Bossier shales using enhanced completion methods including longer laterals of up to 10,000 feet. The lateral lengths of future wells to be drilled in this region are dependent on factors including our acreage position and nearby existing wells. These enhanced completion methods have proven to be effective and have resulted in improved recoveries in the region. The Bossier shale lies just above certain portions of the Haynesville shale and also contains rich deposits of natural gas. The geographic position of our properties in the Haynesville and Bossier shales provides us access to nearby markets with favorable natural gas price indices compared to the rest of the country.

North Louisiana

Our position in the Holly area of North Louisiana consists of 29,100 net acres in DeSoto Parish and 8,500 net acres in Caddo Parish, which are all held-by-production. At December 31, 2016, we had a total of 416 gross (208.7 net) operated horizontal wells flowing to sales. Our development activities in North Louisiana during 2016 featured a modified Haynesville shale well design, which featured enhanced completion methods including the use of more proppant and longer laterals. We drilled and turned-to-sales 6 gross (5.2 net) operated wells in the Haynesville shale during 2016 including 3 gross (2.7 net) cross-unit wells with lateral lengths of approximately 7,600 feet and an average of 2,650 lbs of proppant per lateral foot. Including non-operated volumes, our average natural gas production was approximately 140 net Mmcfe per day during December 2016. The improved performance of the Haynesville shale wells turned-to-sales during 2016 in our Holly area of North Louisiana resulted in a 13% increase in the EUR to an average of 2.3 Bcf per 1,000 lateral feet compared to prior year.

In the North Louisiana region, average drilling and completion costs per well during 2016 were approximately $5.9 million for standard lateral wells and approximately $8.8 million for extended lateral wells, achieving a significant decrease in drilling and completion costs on a per foot basis from prior year, despite larger completion designs. Our extended lateral wells

6

drilled in 2016 had average lateral lengths of approximately 7,600 feet and represent some of our longest laterals drilled-to-date in the region.

We plan to drill 5 gross (3.9 net) wells during the first quarter of 2017 that will be completed and turned-to-sales in the second and third quarters of 2017. This includes 4 gross (3.0 net) wells in the Haynesville shale with lateral lengths ranging from 4,500 feet to 7,500 feet and 1 gross (0.8 net) well in the Bossier shale with a lateral length of 7,500 feet. The completion design of these wells will include 3,500 lbs of proppant per lateral foot. The cost per well for the wells drilled during the first quarter 2017 is expected to be $6.8 million to $9.3 million in the Haynesville shale based on the lateral length and $11.2 million in the Bossier shale. We will evaluate the results of the Bossier shale well featuring enhanced completion methods to assess the potential for future development of our inventory of Bossier shale locations in North Louisiana. Our development plans in this region subsequent to the first quarter 2017 may feature drilling extended lateral length wells up to 10,000 feet.

East Texas

Our operations in East Texas are focused on the Haynesville and Bossier shales. Our acreage is primarily located in Harrison, Panola, Shelby, San Augustine and Nacogdoches Counties in Texas and is predominantly held-by-production. The Haynesville and Bossier shales in East Texas are being developed with horizontal wells that typically have 6,000 to 7,500 foot laterals. Our position in the Shelby area of East Texas primarily consists of 31,400 net acres and includes approximately 10,000 net acres subject to continuous drilling obligations. We plan to drill, or participate with another operator in drilling, on the acreage subject to the continuous drilling obligation in the future to hold the acreage. Excluding the acreage subject to the continuous drilling obligation, approximately 91% of our net acres are held-by-production in the Shelby area.

As of December 31, 2016, we had a total of 105 gross (47.3 net) operated horizontal wells flowing to sales. We completed and turned-to-sales 8 gross (3.6 net) wells in the area during 2016, which included 5 gross (2.2 net) operated wells in the Haynesville shale and 3 gross (1.4 net) operated wells in the Bossier shale. Including non-operated volumes, our average natural gas production was approximately 57 net Mmcfe per day during December 2016. Our average drilling and completion costs decreased from $11.6 million in 2015 to $9.3 million in 2016 despite larger completion designs.

Our development activities in the East Texas region during the first quarter of 2017 will primarily include the participation in wells operated by others. This includes the development of a well by a third-party that will satisfy our continuous drilling obligation on certain acreage in the southern portion of the region. The most recent two wells drilled on our acreage in the southern portion of the region continue to exhibit strong performance and resulted in an average EUR of 2.6 Bcf per 1,000 lateral feet, which represents a 73% increase from the prior year.

South Texas

Our position in this region includes 49,300 net acres, of which approximately 95% is held-by-production, that cover portions of Zavala, Dimmit and Frio Counties in Texas. Our acreage in the Eagle Ford shale is in the oil window and averages 375 feet in gross thickness at true vertical depths ranging from 5,400 to 6,800 feet. Our lateral lengths range from 5,000 to 9,000 feet and the total measured depth averages 14,600 feet. Our acreage in the area also includes additional upside in formations such as the Austin Chalk, Buda, Georgetown and Pearsall formations.

As of December 31, 2016, we had a total of 228 gross (99.4 net) operated horizontal wells flowing to sales. Including non-operated volumes, our average oil production in South Texas was approximately 4,100 net barrels of oil equivalent per day during December 2016. We were able to significantly reduce our operating costs in the region during 2016 through the execution of several initiatives such as reductions in service costs with certain key vendors, including saltwater disposal costs and chemical treating programs. In addition, we successfully renegotiated a sales contract in this region during 2016 that improved our net realized price for the related oil production. We are evaluating the potential divestiture of our properties in South Texas and do not anticipate allocating development capital to this region during 2017.

7

Appalachia

Our operations in the Appalachia region have primarily included testing and selectively developing the Marcellus shale with horizontal drilling. We currently hold approximately 181,100 net acres in the Appalachia region, with approximately 127,000 of these net acres prospective for the Marcellus shale. Our acreage in the region includes 40,000 net acres prospective for the dry gas window of the Utica shale in Pennsylvania and we are currently assessing its potential. Drilling, completion and production activities in Pennsylvania target the Marcellus shale as well as deeper formations including the Utica shale at depths ranging from 5,000 to more than 12,000 feet. Approximately 90% of our acreage is held-by-production, which allows us to control the timing of the development of this region.

As of December 31, 2016, we operated a total of 116 gross (41.4 net) horizontal wells in the Marcellus shale. During 2016, we divested our shallow conventional assets in the region and retained all rights to other formations below the conventional depths including the Marcellus and Utica shales. Including non-operated volumes, our production in the Appalachia region was approximately 33 net Mmcfe per day during December 2016. We turned-to-sales 1 gross (0.4 net) operated Marcellus shale well in Lycoming County, Pennsylvania during 2016. In recent years, we have limited our development of the Marcellus shale due to wide regional natural gas price differentials. These differentials began to narrow in late 2016 and have the potential to be favorably impacted by the expansion of infrastructure and other sources of demand for natural gas in the Northeast region as early as 2018. We have an extensive inventory of undeveloped locations prospective for the Marcellus and Utica shales that have potential to provide attractive rates of return in an improved commodity price environment. We plan to participate in certain appraisal wells with other operators in the Utica shale during 2017.

We have effectively managed our base production declines as a result of increased automation and surveillance equipment to reduce downtime as well as artificial lift installations. During 2016, we divested our conventional assets in the Appalachia region, which had the highest lease operating expenses per Mcfe in our portfolio. As a result of these divestitures and other reductions in our workforce, our field employee count in the area decreased by 85% from 87 employees as of December 31, 2015 to 13 employees as of December 31, 2016.

Our hydraulic fracturing activities

Oil and natural gas may be recovered from our properties through the use of sophisticated drilling and hydraulic fracturing techniques. Hydraulic fracturing involves the injection of water, sand, gel and chemicals under pressure into formations to fracture the surrounding rock and stimulate production. Our hydraulic fracturing activities are primarily focused in the Eagle Ford shale in South Texas, Haynesville and Bossier shales in East Texas and North Louisiana and Marcellus shale in the Appalachia region. Predominantly all of our Proved Reserves are associated with shale assets in these areas.

Although the cost of each well will vary, the costs associated with hydraulic fracturing activities on average represent the following portions of the total costs of drilling and completing a well: 35-40% in the Haynesville and Bossier shale formation; 30-40% in the Eagle Ford shale formation; and 25-35% in the Marcellus shale formation. These costs may increase in future periods as a result of higher levels of proppant utilized in the completion of our shale wells.

We review best practices and industry standards to comply with regulatory requirements in the protection of potable water sources when drilling and completing our wells. Protective practices include, but are not limited to, setting multiple strings of protection pipe across potable water sources and cementing these pipe strings to surface, continuously monitoring the hydraulic fracturing process in real time and disposing of non-recycled produced fluids in authorized disposal wells at depths below the potable water sources. In addition, we actively seek methods to minimize the environmental impact of our hydraulic fracturing operations in all of our operating areas. For example, we use discharge water from a local paper plant as a key water source for our fracture stimulation operations in North Louisiana. We recycle flowback fluids when economically feasible.

For more information on the risks of hydraulic fracturing, see “Item 1A. Risk Factors - Our business exposes us to liability and extensive regulation on environmental matters, which could result in substantial expenditures” and “Item 1A. Risk Factors - Federal, state and local legislation and regulatory initiatives relating to hydraulic fracturing could result in increased costs and additional operating restrictions or delays.”

Our oil and natural gas reserves

Our Proved Reserves as of December 31, 2016 were approximately 476.7 Bcfe, of which approximately 63% were located in the Haynesville/Bossier shales, 23% in the Marcellus shale and 14% in the Eagle Ford shale.

8

The following table summarizes Proved Reserves as of December 31, 2016, 2015 and 2014. This information was prepared in accordance with the rules and regulations of the SEC. The comparability of our reserves is impacted by commodity prices, purchases and sales of reserves in place, production, revisions of previous estimates, changes in our development plans, and discoveries and extensions. See "Management's discussion and analysis of oil and natural gas reserves" for a summary of the changes in our Proved Reserves.

As of December 31, | ||||||||||||

2016 (3) | 2015 | 2014 | ||||||||||

Oil (Mbbls) | ||||||||||||

Developed | 10,168 | 12,056 | 14,429 | |||||||||

Undeveloped | — | 8,383 | 3,258 | |||||||||

Total | 10,168 | 20,439 | 17,687 | |||||||||

Natural gas (Mmcf) | ||||||||||||

Developed | 415,719 | 364,932 | 504,636 | |||||||||

Undeveloped | — | 419,742 | 653,038 | |||||||||

Total | 415,719 | 784,674 | 1,157,674 | |||||||||

Equivalent reserves (Mmcfe) | ||||||||||||

Developed | 476,727 | 437,268 | 591,210 | |||||||||

Undeveloped | — | 470,040 | 672,586 | |||||||||

Total | 476,727 | 907,308 | 1,263,796 | |||||||||

PV-10 (in millions) (1) | ||||||||||||

Developed | $ | 310.9 | $ | 359.4 | $ | 1,117.6 | ||||||

Undeveloped | — | 42.7 | 425.0 | |||||||||

Total | $ | 310.9 | $ | 402.1 | $ | 1,542.6 | ||||||

Standardized Measure (in millions) (2) | $ | 310.9 | $ | 402.1 | $ | 1,542.6 | ||||||

(1) | The PV-10 is based on the following average spot prices, in each case adjusted for historical differentials. Prices presented on the table below are the trailing 12 month simple average spot price at the first of the month for natural gas at Henry Hub and West Texas Intermediate ("WTI") crude oil at Cushing, Oklahoma. |

Average spot prices | ||||||||

Oil (per Bbl) | Natural gas (per Mmbtu) | |||||||

December 31, 2016 | $ | 42.75 | $ | 2.48 | ||||

December 31, 2015 | 50.28 | 2.59 | ||||||

December 31, 2014 | 94.99 | 4.35 | ||||||

(2) | There is no difference in Standardized Measure and PV-10 for all years presented as our tax basis in the associated properties exceeded the pre-tax cash inflows. We believe that PV-10, while not a financial measure in accordance with GAAP, is an important financial measure used by investors and independent oil and natural gas producers for evaluating the relative significance of oil and natural gas properties and acquisitions due to tax characteristics, which can differ significantly among comparable companies. The Standardized Measure represents the PV-10 after giving effect to income taxes, and is calculated in accordance with ASC 932. |

(3) | All of our Proved Undeveloped Reserves were reclassified to unproved during the first quarter of 2016 due to the uncertainty regarding the financing required to develop these reserves that existed on March 31, 2016. These reserves remained classified as unproved due to our inability to meet the Reasonable Certainty criteria for recording Proved Undeveloped Reserves, as prescribed under the SEC requirements, as the uncertainty regarding our availability of capital required to develop these reserves still existed at December 31, 2016. A significant amount of our Proved Undeveloped |

9

Reserves that were reclassified to unproved remain economic at current prices, and we may report Proved Undeveloped Reserves in future filings if we determine we have the financial capability to execute a development plan.

Management has established, and is responsible for, internal controls designed to provide reasonable assurance that the estimates of Proved Reserves are computed and reported in accordance with rules and regulations promulgated by the SEC as well as established industry practices used by independent engineering firms and our peers. These internal controls include documented process workflows, qualified professional engineering and geological personnel with specific reservoir experience. Our internal audit function routinely tests our processes and controls. We also retain outside independent engineering firms to prepare estimates of our Proved Reserves. Senior management reviews and approves our reserve estimates, whether prepared internally or by third parties. Our Strategic Development and Reserves Director oversaw our outside independent engineering firms, Netherland, Sewell & Associates, Inc. ("NSAI"), and Ryder Scott Company, L.P. ("Ryder Scott") in connection with the preparation of their estimates of our Proved Reserves as of December 31, 2016. We also regularly communicate with our outside independent engineering firms throughout the year regarding technical and operational matters critical to our reserve estimations. Our Strategic Development and Reserves Director has over 12 years of experience in the oil and natural gas industry with a focus on reserves valuation. He is a graduate of the University of Oklahoma with dual degrees in Energy Management and Finance. In addition, he is an active participant in industry reserves seminars and professional industry groups. Our Chief Operating Officer and our Strategic Development and Reserves Director, with input from other members of senior management, are responsible for the selection of our third-party engineering firms and review the reports generated by such firms. Our Chief Operating Officer has over 25 years of experience in the oil and natural gas industry and is a graduate of Texas Tech University with a degree in Petroleum Engineering. During his career, he has had multiple responsibilities in technical or leadership roles including asset management, drilling and completions, production engineering, reservoir engineering and reserves management, economic evaluations and field development in U.S. onshore and international projects. The third-party engineering reports are also provided to our audit committee.

Our estimated Proved Reserves and future net cash flows for our shale properties in all regions except South Texas were prepared by NSAI as of December 31, 2016, 2015 and 2014. Our estimated Proved Reserves and future net cash flows for our shale properties in the South Texas region were prepared by Ryder Scott as of December 31, 2016, 2015 and 2014. During 2016, we sold substantially all of our remaining non-shale properties. The estimates of Proved Reserves and future net cash flows for our non-shale properties as of December 31, 2015 and 2014 were prepared by Lee Keeling and Associates, Inc. ("Lee Keeling").

NSAI, Ryder Scott and Lee Keeling are independent petroleum engineering firms that perform a variety of reserve engineering and valuation assessments for public and private companies, financial institutions and institutional investors. NSAI, Ryder Scott and Lee Keeling have performed these services for over 50 years. Our internal technical employees responsible for reserve estimates and interaction with our independent engineers include employees and corporate officers with petroleum and other engineering degrees and relevant industry experience.

Estimates of oil and natural gas reserves are projections based on a process involving an independent third party engineering firm's communication with EXCO's engineers and geologists, the collection of any and all required geological, geophysical, engineering and economic data, and such firm's complete external preparation of all required estimates and are forward-looking in nature. These reports rely on various assumptions, including definitions and economic assumptions required by the SEC, including the use of constant oil and natural gas pricing, use of current and constant operating costs and capital costs. We also make assumptions relating to availability of funds and timing of capital expenditures for development of our Proved Undeveloped Reserves. These reports should not be construed as the current market value of our Proved Reserves. The process of estimating oil and natural gas reserves is also dependent on geological, engineering and economic data for each reservoir. Because of the uncertainties inherent in the interpretation of this data, we cannot ensure that the Proved Reserves will ultimately be realized. Our actual results could differ materially. See “Note 17. Supplemental information relating to oil and natural gas producing activities (unaudited)” in the Notes to our Consolidated Financial Statements for additional information regarding our oil and natural gas reserves and the Standardized Measure.

NSAI, Ryder Scott and Lee Keeling also examined our estimates with respect to reserve categorization, using the definitions for Proved Reserves set forth in SEC Regulation S-X Rule 4-10(a) and SEC staff interpretations and guidance. In preparing an estimate of our Proved Reserves and future net cash flows attributable to our interests, NSAI, Ryder Scott and Lee Keeling did not independently verify the accuracy and completeness of information and data furnished by us with respect to ownership interests, oil and natural gas production, well test data, historical costs of operation and development, product prices, or any agreements relating to current and future operations of the properties and sales of production. However, if in the course of the examination anything came to the attention of NSAI, Ryder Scott or Lee Keeling, which brought into question the validity or sufficiency of any such information or data, NSAI, Ryder Scott or Lee Keeling did not rely on such information or

10

data until they had satisfactorily resolved their questions relating thereto or had independently verified such information or data. NSAI, Ryder Scott and Lee Keeling determined that their estimates of Proved Reserves conform to the guidelines of the SEC, including the criteria of Reasonable Certainty, as it pertains to expectations about the recoverability of Proved Reserves in future years, under existing economic and operating conditions, consistent with the definition in Rule 4-10(a)(24) of SEC Regulation S-X.

Management's discussion and analysis of oil and natural gas reserves

The following discussion and analysis of our proved oil and natural gas reserves and changes in our Proved Reserves is intended to provide additional guidance on the operational activities, transactions, economic and other factors which significantly impacted our estimate of Proved Reserves as of December 31, 2016 and changes in our Proved Reserves during 2016. This discussion and analysis should be read in conjunction with “Note 17. Supplemental information relating to oil and natural gas producing activities (unaudited)” and in “Item 1A. Risk Factors” addressing the uncertainties inherent in the estimation of oil and natural gas reserves elsewhere in this Annual Report on Form 10-K. The following table summarizes the changes in our Proved Reserves from January 1, 2016 to December 31, 2016.

Oil (Mbbls) | Natural gas (Mmcf) | Equivalent natural gas (Mmcfe) | |||||||

Proved Developed Reserves | 10,168 | 415,719 | 476,727 | ||||||

Proved Undeveloped Reserves | — | — | — | ||||||

Total Proved Reserves | 10,168 | 415,719 | 476,727 | ||||||

The changes in reserves for the year are as follows: | |||||||||

January 1, 2016 | 20,439 | 784,674 | 907,308 | ||||||

Purchases of reserves in place | — | 552 | 552 | ||||||

Discoveries and extensions | — | 16,381 | 16,381 | ||||||

Revisions of previous estimates (1): | |||||||||

Changes in price | (2,061 | ) | (55,748 | ) | (68,114 | ) | |||

Other factors | (5,165 | ) | (208,714 | ) | (239,704 | ) | |||

Sales of reserves in place | (1,276 | ) | (27,597 | ) | (35,253 | ) | |||

Production | (1,769 | ) | (93,829 | ) | (104,443 | ) | |||

December 31, 2016 | 10,168 | 415,719 | 476,727 | ||||||

(1) | Revisions of previous estimates include both reserves in place at the beginning of the year and acquisitions and divestitures, if any, during the year. We reclassified 427.6 Bcfe of Proved Undeveloped Reserves to unproved due to the uncertainty regarding the financing required to develop these reserves. As a result of our inability to meet the Reasonable Certainty criteria for recording Proved Undeveloped Reserves as prescribed under the SEC requirements, we did not record any Proved Undeveloped Reserves at December 31, 2016. This decrease was partially offset by approximately 187.9 Bcfe of upward revisions due to performance and other factors. |

Discoveries and extensions

Proved Reserve additions from discoveries and extensions in 2016 were 16.4 Bcfe, primarily due to 14.9 Bcfe of discoveries and extensions from our East Texas region. The discoveries and extensions in the East Texas region were due to the development of our Shelby area and consist of both the Haynesville and Bossier shales.

Revisions of previous estimates

Our revisions of previous estimates included downward revisions to our Proved Reserve quantities of 239.7 Bcfe. These downward revisions were primarily the result of 427.6 Bcfe of our Proved Undeveloped Reserves that were reclassified to unproved during the first quarter of 2016 due to the uncertainty regarding the financing required to develop these reserves that existed on March 31, 2016. These reserves remained classified as unproved since the uncertainty regarding our availability of capital required to develop these reserves still existed at December 31, 2016.

The decrease in commodity prices contributed to 68.1 Bcfe of the downward revisions, which shortened the economic life of certain producing properties when using prices prescribed by the SEC. This change in price was primarily driven by the decrease in the trailing 12 month average of oil and natural gas prices. The trailing 12 month average oil price decreased from

11

$50.28 per Bbl for the year ended December 31, 2015 to $42.75 per Bbl for the year ended December 31, 2016 and the trailing 12 month average natural gas price decreased from $2.59 per Mmbtu for the year ended December 31, 2015 to $2.48 per Mmbtu for the year ended December 31, 2016.

These decreases were partially offset by 187.9 Bcfe of upward revisions due to performance and other factors. This included 99.0 Bcfe of upward revisions in the Marcellus shale primarily due to narrower regional differentials, reductions in our operating expenses, and improved performance as wells have exhibited shallower declines than previously forecasted. The upward revision also reflects a reduction in operating expenses in other areas, primarily North Louisiana and South Texas, which increased our reserves by 51.4 Bcfe and 23.9 Bcfe, respectively. Lower operating costs were primarily the result of various cost reduction efforts, including significant reductions in labor costs, chemical treatment costs and saltwater disposal costs. Reductions in our operating costs extended the economic life of certain properties and resulted in upward revisions to our reserve quantities. In addition, the improved performance of certain Haynesville shale wells turned-to-sales in North Louisiana during 2016 resulted in upward revisions. These wells featured enhanced completion methods including more proppant per lateral foot.

Sales of reserves in place

Sales of reserves in place consisted primarily of divestitures of our shallow conventional assets in Appalachia and the transfer of a portion of our interests in certain producing wells to a joint venture partner in South Texas. See "Note 3. Acquisitions, divestitures and other significant events" in the Notes to our Consolidated Financial Statements for additional information. The reserve quantities attributable to sales of reserves in place were calculated based on our estimates and assumptions as of the respective divestiture dates.

Oil and natural gas production

Total oil and natural gas production in 2016 was 104.4 Bcfe, which included approximately 3.4 Bcfe in production from extensions and discoveries that were not reflected in our Proved Reserves at January 1, 2016.

Proved Undeveloped Reserves

The following table summarizes the changes in our Proved Undeveloped Reserves for the year ended December 31, 2016:

Mmcfe | ||

Proved Undeveloped Reserves at January 1, 2016 | 470,040 | |

Proved Undeveloped Reserves transferred to developed (1) | (42,393 | ) |

Proved Undeveloped Reserves transferred to unproved (2) | (427,647 | ) |

Proved Undeveloped Reserves at December 31, 2016 | — | |

(1) | Approximately 61% and 39% of the Proved Undeveloped Reserves transferred to Proved Developed Reserves were in the North Louisiana and East Texas regions, respectively. Capital costs incurred to convert Proved Undeveloped Reserves to Proved Developed Reserves were $47.6 million during 2016. The Proved Undeveloped Reserves transferred to Proved Developed Reserves in the East Texas region primarily relate to wells drilled in this region in 2015 that were completed in early 2016. The transfers to Proved Developed Reserves presented in this table were based on the Proved Undeveloped Reserves at the beginning of the year prior to any revisions. |

(2) | All of our Proved Undeveloped Reserves were reclassified to unproved during the first quarter of 2016 due to the uncertainty regarding the financing required to develop these reserves that existed on March 31, 2016. These reserves remained classified as unproved due to our inability to meet the Reasonable Certainty criteria for recording Proved Undeveloped Reserves, as prescribed under the SEC requirements, as the uncertainty regarding our availability of capital required to develop these reserves still existed at December 31, 2016. A significant amount of our Proved Undeveloped Reserves that were reclassified to unproved remain economic at current prices, and we may report Proved Undeveloped Reserves in future filings if we determine we have the financial capability to execute a development plan. The transfers to unproved presented in this table were based on Proved Undeveloped Reserves at the beginning of the year prior to any revisions. |

12

Impacts of changes in reserves on depletion rate and statements of operations in 2016

Our depletion rate decreased to $0.71 per Mcfe in 2016 from $1.72 per Mcfe in 2015. The decrease was primarily due to the impairments of our oil and natural gas properties during 2016 and 2015, which lowered our depletable base.

Our production, prices and expenses

The following table summarizes revenues, net production, average sales price per unit and costs and expenses associated with the production of oil and natural gas. Certain reclassifications have been made to prior period information to conform to current period presentation.

Year Ended December 31, | ||||||||||||

(in thousands, except production and per unit amounts) | 2016 | 2015 | 2014 | |||||||||

Revenues, production and prices: | ||||||||||||

Oil: | ||||||||||||

Revenue | $ | 67,317 | $ | 102,787 | $ | 196,316 | ||||||

Production sold (Mbbls) | 1,769 | 2,342 | 2,236 | |||||||||

Average sales price per Bbl | $ | 38.05 | $ | 43.89 | $ | 87.80 | ||||||

Natural gas: | ||||||||||||

Revenue | $ | 181,332 | $ | 226,471 | $ | 464,668 | ||||||

Production sold (Mmcf) | 93,829 | 109,926 | 122,324 | |||||||||

Average sales price per Mcf | $ | 1.93 | $ | 2.06 | $ | 3.80 | ||||||

Costs and expenses: | ||||||||||||

Oil and natural gas operating costs per Mcfe | $ | 0.33 | $ | 0.43 | $ | 0.47 | ||||||

We had three fields that exceeded 15% of our total Proved Reserves as of December 31, 2016. The Holly field in North Louisiana, Marcellus shale in Appalachia and Shelby field in East Texas represented approximately 47%, 23% and 16% of our total Proved Reserves, respectively. The following table provides additional information related to our Holly, Shelby and Marcellus shale fields:

Year Ended December 31, | |||||||||||

2016 | 2015 | 2014 | |||||||||

Holly field: | |||||||||||

Natural gas production sold (Mmcf) | 55,290 | 73,863 | 82,299 | ||||||||

Average price per Mcf | $ | 2.00 | $ | 2.18 | $ | 4.03 | |||||

Oil and natural gas operating costs per Mcf | 0.23 | 0.22 | 0.22 | ||||||||

Marcellus shale: | |||||||||||

Natural gas production sold (Mmcf) | 10,851 | 12,133 | 16,374 | ||||||||

Average price per Mcf | $ | 1.50 | $ | 1.39 | $ | 2.86 | |||||

Oil and natural gas operating costs per Mcf | 0.12 | 0.22 | 0.19 | ||||||||

Shelby field: | |||||||||||

Natural gas production sold (Mmcf) | 24,278 | 18,047 | 10,314 | ||||||||

Average price per Mcf | $ | 2.25 | $ | 2.50 | $ | 3.90 | |||||

Oil and natural gas operating costs per Mcf | 0.22 | 0.30 | 0.33 | ||||||||

Our interest in productive wells

The following table quantifies information regarding productive wells (wells that are currently producing oil or natural gas or are capable of production), including temporarily shut-in wells. The number of total gross oil and natural gas wells excludes any multiple completions. Gross wells refer to the total number of physical wells in which we hold a working interest, regardless of our percentage interest. A net well is not a physical well, but is a concept that reflects the actual total working interests we hold in all wells. We compute the number of net wells by totaling the percentage interests we hold in all our gross wells.

13

At December 31, 2016 | ||||||||||||||||||

Gross wells (1) | Net wells | |||||||||||||||||

Oil | Natural gas | Total | Oil | Natural gas | Total | |||||||||||||

Producing region: | ||||||||||||||||||

North Louisiana | — | 616 | 616 | — | 220.4 | 220.4 | ||||||||||||

East Texas | — | 147 | 147 | — | 51.0 | 51.0 | ||||||||||||

South Texas | 246 | 1 | 247 | 102.2 | 0.1 | 102.3 | ||||||||||||

Appalachia and other | 1 | 144 | 145 | — | 43.1 | 43.1 | ||||||||||||

Total | 247 | 908 | 1,155 | 102.2 | 314.6 | 416.8 | ||||||||||||

(1) | As of December 31, 2016, we did not hold any interests in well with multiple completions. |

As of December 31, 2016, we operated 868 gross (398.1 net) wells, which represented approximately 95% of our proved developed producing reserves.

Our drilling activities

Our drilling activities are primarily focused on horizontal drilling in shale plays, particularly in the Haynesville, Bossier, Eagle Ford and Marcellus shales. The following tables summarize our approximate gross and net interests in the operated wells we drilled during the periods indicated and refer to the number of wells completed during the period, regardless of when drilling was initiated.

Development wells | ||||||||||||||||||

Gross | Net | |||||||||||||||||

Productive | Dry | Total | Productive | Dry | Total | |||||||||||||

Year ended December 31, 2016 (1) | 15 | — | 15 | 9.2 | — | 9.2 | ||||||||||||

Year ended December 31, 2015 (2) | 63 | — | 63 | 25.3 | — | 25.3 | ||||||||||||

Year ended December 31, 2014 | 98 | — | 98 | 29.6 | — | 29.6 | ||||||||||||

Exploratory wells | ||||||||||||||||||

Gross | Net | |||||||||||||||||

Productive | Dry | Total | Productive | Dry | Total | |||||||||||||

Year ended December 31, 2016 | — | — | — | — | — | — | ||||||||||||

Year ended December 31, 2015 (2) | 5 | — | 5 | 3.9 | — | 3.9 | ||||||||||||

Year ended December 31, 2014 | — | — | — | — | — | — | ||||||||||||

(1) | Our development wells in 2016 primarily included the Haynesville and Bossier shales in the Shelby area of East Texas and the Haynesville shale in the Holly area of North Louisiana. |

(2) | Our development wells in 2015 included the Haynesville and Bossier shales in the Shelby area of East Texas and the Holly area of North Louisiana. Our development wells also included the Eagle Ford shale in our core area in Zavala and Frio Counties, Texas. We completed one gross exploratory well in the Bossier shale in the North Louisiana region and four gross exploratory wells in the Buda formation in the South Texas region. |

14

Our developed and undeveloped acreage

Developed acreage includes those acres spaced or assignable to producing wells or wells capable of producing. Undeveloped acreage represents those acres that do not currently have completed wells capable of producing commercial quantities of oil or natural gas, regardless of whether the acreage contains Proved Reserves. The definitions of gross acres and net acres conform to how we determine gross wells and net wells. The following table sets forth our developed and undeveloped acreage:

At December 31, 2016 | ||||||||||||

Developed | Undeveloped | |||||||||||

Area | Gross | Net | Gross | Net | ||||||||

North Louisiana | 82,900 | 35,900 | 19,300 | 14,900 | ||||||||

East Texas | 48,600 | 21,900 | 71,400 | 23,600 | ||||||||

South Texas | 95,500 | 46,400 | 6,100 | 2,900 | ||||||||

Appalachia and other | 42,000 | 15,900 | 368,000 | 168,200 | ||||||||

Total | 269,000 | 120,100 | 464,800 | 209,600 | ||||||||

The primary terms of our oil and natural gas leases expire at various dates. Most of our undeveloped acreage is held-by-production, which means that these leases are active as long as we produce oil or natural gas from the acreage or comply with certain lease terms. Upon ceasing production, these leases will expire. We have approximately 4,600, 8,800 and 480 net acres with lease expirations in 2017, 2018 and 2019, respectively. The majority of this acreage with lease expirations is located in the Appalachia region. In addition, we have approximately 10,000 net acres located in the Shelby area of East Texas that are subject to continuous drilling obligations, and we plan to drill on the acreage in the future to hold the acreage. Predominantly all of our expiring acreage is located within our shale resource plays.

The held-by-production acreage in many cases represents potential additional drilling opportunities through down-spacing and drilling of proved undeveloped and unproved locations in the same formation(s) already producing, as well as other non-producing formations, in a given oil or natural gas field without the necessity of purchasing additional leases or producing properties.

Our significant customers

In 2016, sales to BG Energy Merchants LLC, and subsequently to Shell Energy North America US, LP, and Chesapeake Energy Marketing Inc. accounted for approximately 24% and 32%, respectively, of our total consolidated revenues. BG Energy Merchants LLC was a subsidiary of BG Group, plc ("BG Group") until the acquisition of BG Group by Royal Dutch Shell, plc ("Shell") in February 2016. Chesapeake Energy Marketing Inc. is a subsidiary of Chesapeake Energy Corporation ("Chesapeake"). We are managing our credit risk as a result of the current commodity price environment through the attainment of financial assurances from certain customers. The loss of any significant customer may cause a temporary interruption in sales of, or lower price for, our oil and natural gas production.

Competition

The oil and natural gas industry is highly competitive, particularly with respect to acquiring prospective oil and natural gas properties and oil and natural gas reserves. We encounter strong competition from other independent operators and from major oil companies in acquiring properties, contracting for drilling equipment and securing trained personnel. Many of these competitors have substantially greater financial, managerial, technological and other resources than we do. Many of these companies not only engage in the acquisition, exploration, development, and production of oil and natural gas, but also have refining operations, market refined products and their own drilling rigs and oilfield services.

The oil and natural gas industry has periodically experienced shortages of drilling rigs, equipment, pipe and personnel, which have delayed development drilling and other exploitation activities and have caused significant price increases and operational delays. We may experience difficulties in obtaining drilling rigs and other services in certain areas as well as an increase in the cost for these services and related material and equipment. We are unable to predict when, or if, supply or demand imbalances may occur or how these market-driven factors impact prices, which affects our development and exploitation programs. Competition also exists for hiring experienced personnel, particularly in petroleum engineering, geoscience, accounting and financial reporting, tax and land professions. In addition, the market for oil and natural gas properties is competitive. We are often outbid by competitors in our attempts to lease or acquire properties. The oil and natural

15

gas industry also faces competition from alternative fuel sources, including other fossil fuels such as coal and renewable energy sources such as wind and solar power. Competitive conditions may be affected by future legislation and regulations as the U.S. develops new energy and climate-related policies. All of these challenges could make it more difficult to execute our growth strategy or result in an increase in our costs.

Applicable laws and regulations

General

The oil and natural gas industry is extensively regulated by numerous federal, state and local authorities. Laws, orders and regulations affecting the oil and natural gas industry are under constant review for amendment or expansion, which could increase the regulatory burden and financial sanctions for noncompliance. Although the regulatory burden on the oil and natural gas industry increases our cost of doing business and, consequently, affects our profitability, we believe these burdens do not affect us any differently or to any greater or lesser extent than they affect others in our industry with similar types, quantities and locations of production.

The following is a summary of the more significant existing environmental, safety and other laws and regulations to which our business operations are subject and with which compliance may have a material adverse effect on our capital expenditures, earnings or competitive position.

Production regulation

Our operations are subject to a number of regulations at the federal, state and local levels. These regulations require, among other things, permits for the drilling of wells, drilling bonds and reports concerning operations. Many states, counties and municipalities in which we operate also regulate one or more of the following:

• | the location of wells; |

• | the method of drilling, completing and operating wells; |

• | the surface use and restoration of properties upon which wells are drilled; |

• | the plugging and abandoning of wells; |

• | notice to surface owners and other third parties; and |

• | produced water and waste disposal. |

State laws regulate the size and shape of drilling and spacing units or proration units governing the pooling of oil and natural gas properties. Horizontal wells drilled in shale formations, as distinguished from vertical wells, utilize multilateral wells and stacked laterals, all of which are also subject to well spacing, density and proration requirements of the Texas Railroad Commission that could adversely impact our ability to maximize the efficiency of our horizontal wells related to reservoir drainage over time. Some states, including Louisiana and Texas, allow forced pooling or integration of tracts to facilitate exploration while other states rely on voluntary pooling of lands and leases. In some instances, forced pooling or unitization may be implemented by third parties and may reduce our interest in the unitized properties. In addition, state conservation laws establish maximum rates of production from oil and natural gas wells and generally prohibit the venting or flaring of natural gas and require that oil and natural gas be produced in a prorated, equitable system. These laws and regulations may limit the amount of oil and natural gas we can produce from our wells or limit the number of wells or the locations at which we can drill. Moreover, most states generally impose a production, ad valorem or severance tax with respect to the production and sale of oil and natural gas within its jurisdiction. Many local authorities also impose an ad valorem tax on the minerals in place. States do not generally regulate wellhead prices or engage in other, similar direct economic regulation, but there can be no assurance they will not do so in the future.

Our operations are subject to numerous stringent federal and state statutes and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection, some of which carry substantial administrative, civil and criminal penalties, as well as potential injunctive relief, for failure to comply. These laws and regulations may require the acquisition of a permit before drilling commences, restrict the types, quantities and concentrations of various substances that can be released into the environment in connection with drilling, production and transportation of oil and natural gas, govern the sourcing, storage and disposal of water used or produced in the drilling and completion process, restrict or prohibit drilling activities in certain areas and on certain lands lying within wetlands and other protected areas, require closing earthen impoundments and impose liabilities for pollution resulting from operations or failure to comply with regulatory filings.

16

Statutes, rules and regulations that apply to the exploration and production of oil and natural gas are often reviewed, amended, expanded and reinterpreted, making the prediction of future costs or the impact of regulatory compliance to new laws and statutes difficult. The regulatory burden on the oil and natural gas industry increases its cost of doing business and, consequently, adversely affects its (and our) profitability.

FERC and CFTC matters

The availability, terms and cost of downstream transportation significantly affect sales of natural gas and oil. The interstate transportation of natural gas, including regulation of the terms, conditions and rates for interstate transportation and storage of natural gas, is subject to federal regulation by the Federal Energy Regulatory Commission (“FERC”) under the Natural Gas Act (“NGA”). Transportation rates under the NGA must be just and reasonable. Since 1985, FERC has implemented regulations intended to increase competition within the natural gas industry by requiring that interstate natural gas transportation be made available on an open-access, not unduly discriminatory basis. FERC’s jurisdiction under the NGA excludes gathering and distribution of natural gas, therefore, gathering and distribution of natural gas are subject to regulation by individual state laws. State regulations also govern the rates and terms for access to, and transportation of natural gas on, intrastate pipeline facilities (while intrastate pipelines may from time to time provide specific services that are subject to limited regulation by FERC). The interstate transportation of oil, including regulation of the rates, terms and conditions of service, is subject to federal regulation by FERC under the Interstate Commerce Act. Rates for such oil transportation must be just and reasonable and not unduly discriminatory. Oil transportation that is not federally regulated is left to state regulation.

The federal government recently ended its decades-old prohibition of exports of crude oil produced in the lower 48 states of the U.S. It is too recent an event to determine the impact this regulatory change may have on our operations or our sales of oil. The general perception in the industry is that ending the prohibition on exports of oil produced in the U.S. may have a positive impact on U.S. producers.

Wholesale prices for natural gas and oil are not currently regulated and are determined by the market. We cannot predict, however, whether new legislation to regulate the price of energy commodities might be proposed, what proposals, if any, might actually be enacted by Congress or the various state legislatures, and what effect, if any, the proposals might have on the operations of the underlying properties.

Under the Energy Policy Act of 2005, FERC possesses regulatory oversight over natural gas markets, including the purchase, sale and transportation activities of natural gas market participants other than intrastate pipelines. The Commodity Futures Trading Commission (“CFTC”) also holds authority to monitor markets and enforce anti-market manipulation regulations with respect to the physical and financial (futures, options and swaps) energy commodities market pursuant to the Commodity Exchange Act and the Dodd Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd Frank Act”). With regard to our physical sales of natural gas and oil, our gathering of any of these energy commodities, and any related hedging activities that we undertake, we are required to observe these anti-market manipulation laws and related regulations enforced by FERC and/or the CFTC. These agencies hold substantial enforcement authority, including the ability to assess civil penalties of up to $1 million per day per violation, to order disgorgement of profits and to recommend criminal penalties. Should we violate the anti-market manipulation laws and regulations, we could also be subject to related third party damage claims by, among others, sellers, royalty owners and taxing authorities.

Federal, state or tribal oil and natural gas leases

In the event we conduct operations on federal, state or tribal oil and natural gas leases, these operations must comply with numerous regulatory restrictions, including various nondiscrimination statutes, royalty and related valuation requirements, and certain of these operations must be conducted pursuant to certain on-site security regulations and other appropriate permits issued by the Bureau of Land Management, Bureau of Ocean Energy Management, Bureau of Safety and Environmental Enforcement or other appropriate federal, state or tribal agencies.

Surface Damage Acts

In addition, a number of states and some tribal nations have enacted surface damage statutes (“SDAs”). These laws are designed to compensate for damage caused by mineral development. Most SDAs contain entry notification and negotiation requirements to facilitate contact between operators and surface owners/users. Most also contain binding requirements for payments by the operator to surface owners/users in connection with exploration and operating activities in addition to bonding requirements to compensate for damages to the surface as a result of such activities. Costs and delays associated with SDAs could impair operational effectiveness and increase development costs.

17

Other regulatory matters relating to our pipeline and gathering system assets and rail transportation

The pipelines we use to gather and transport our oil and natural gas are subject to regulation by the U.S. Department of Transportation (“DOT”) under the Hazardous Liquid Pipeline Safety Act of 1979, as amended (“HLPSA”) with respect to oil, and the Natural Gas Pipeline Safety Act of 1968, as amended (“NGPSA”) with respect to natural gas. The HLPSA and NGPSA govern the design, installation, testing, construction, operation, replacement and management of natural gas and hazardous liquids pipeline facilities, including pipelines transporting crude oil. Where applicable, the HLPSA and NGPSA also require us and other pipeline operators to comply with regulations issued pursuant to these acts that are designed to permit access to and allow copying of records and to make certain reports available and provide information as required by the Secretary of Transportation.

The Pipeline Safety Act of 1992, as reauthorized and amended (“Pipeline Safety Act”) mandates requirements in the way that the energy industry ensures the safety and integrity of its pipelines. The law applies to natural gas and hazardous liquids pipelines, including some gathering pipelines. Central to the law are the requirements it places on each pipeline operator to prepare and implement an “integrity management program.” The Pipeline Safety Act mandates a number of other requirements, including increased penalties for violations of safety standards and qualification programs for employees who perform sensitive tasks. The DOT has established a number of rules carrying out the provisions of this act. The DOT Pipeline and Hazardous Materials Safety Administration (“PHMSA”) has established a new risk-based approach to determine which gathering pipelines are subject to regulation, and what safety standards regulated pipelines must meet. We could incur significant expenses as a result of these laws and regulations.

The Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011 was signed into law on January 3, 2012. This law includes a number of provisions affecting pipeline owners and operators that became effective upon approval, including increased civil penalties for violators of pipeline regulations and additional reporting requirements. Most of the changes do not impact gathering lines. The legislation requires the PHMSA to issue or revise certain regulations and to conduct various reviews, studies and evaluations. In addition, the PHMSA in August 2011 issued an Advance Notice of Proposed Rulemaking (“ANPR”) regarding pipeline safety. As described in the ANPR, PHMSA is considering regulations regarding, among other things, the designation of additional high consequence areas along pipelines, minimum requirements for leak detection systems, installation of emergency flow restricting devices, and revision of valve spacing requirements. If revisions to gathering line regulations are enacted by PHMSA as a result of such ANPR, we could incur significant expenses. In October 2015, the PHMSA issued proposed new safety regulations for hazardous liquid pipelines, including a requirement that all hazardous liquid pipelines have a system for detecting leaks and that operators establish a timeline for inspections of affected pipelines following extreme weather events or natural disasters.

Any transportation of the Company’s crude oil or natural gas liquids by rail is also subject to regulation by the DOT’s PHMSA and the DOT’s Federal Railroad Administration (“FRA”) under the Hazardous Materials Regulations at 49 CFR Parts 171-180 (“HMR”), including Emergency Orders by the FRA and new regulations being proposed by the PHMSA, arising due to the consequences of train accidents and the increase in the rail transportation of flammable liquids.

In September 2013, the PHMSA issued a final rule updating its regulations to increase the maximum civil penalty from $100,000 to $200,000 for each violation for each day the violation continues, and to increase from $1,000,000 to $2,000,000 the limitation that the maximum administrative civil penalty may not exceed for any related series of violations.

U.S. federal taxation

Federal income tax laws significantly affect our operations. The principal provisions that affect us are those that permit us, subject to certain limitations, to deduct as incurred, rather than to capitalize and amortize, our share of the domestic “intangible drilling and development costs” and to claim depletion on a portion of our domestic oil and natural gas properties (up to an aggregate of 1,000 Bbls per day of domestic crude oil and/or equivalent units of domestic natural gas). Further, the federal government may adopt tax laws and/or regulations that will possibly materially adversely affect us. Some possible measures that have been proposed in the past include the repeal or elimination of percentage depletion and the immediate deduction or write-offs of intangible drilling costs. Because of the speculative nature of such measures at this time, we are unable to determine what effect, if any, future proposals would have on product demand or our results of operations.

U.S. environmental regulations