Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GLOBALSCAPE INC | d8k.htm |

Corporate Summary

Jim Morris, CEO

September 2010

Exhibit 99.1 |

2

Safe Harbor Statement

This presentation contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities

Exchange Act of 1934. The words “would,”

“exceed,”

“should,”

“anticipates,”

“believe,”

“steady,”

“dramatic,”

and variations of such words and similar

expressions identify forward-looking statements, but their absence does not

mean that a statement is not a forward-looking statement. These

forward- looking statements are based upon the Company’s current

expectations and are

subject

to

a

number

of

risks,

uncertainties

and

assumptions.

The

Company

undertakes no obligation to update any forward-looking statements, whether as

a result of new information, future events or otherwise. Among the important

factors that could cause actual results to differ significantly from those

expressed or implied by such forward-looking statements are risks that

are detailed in the Company’s Annual Report on Form 10-K for the

2009 calendar year, as filed with the Security Exchange Commission on March

30, 2010. |

3

35+ years of IT and information security experience (Commercial and

Government) Former VP, Information Assurance Strategy (General

Dynamics) Joined in 2008

Jim Morris

President & CEO

Proven Executive Team

20+ years of IT and information security experience (Commercial and

Government) Former VP, Worldwide Managed Security Services; VP,

Worldwide Product Marketing (Symantec) Joined in 2008

Craig Robinson

COO

Mendy Marsh

CFO

William Buie

EVP Sales

30+ years of executive, sales, and marketing leadership

Former SVP Alliances/Channel/System Integrators (Fujitsu); VP Global Strategic

Partner Sales (Symantec); President/COO ( Allure Fusion Media); VP Channel

Sales (IBM) Joined in 2010

8+ years of corporate financial experience

Former Audit Manager (Deloitte & Touche, LLP)

Joined in 2008

Doug Conyers

VP Engineering

10+ years of software engineering and security experience; author of two telecom

security patents Former Chief Architect, Dir. Systems Engineering, Sr.

Software Engineer (SecureLogix Corp) Joined in 2007

Mark Perry

VP Managed Services

25+ years IT and information security experience (Commercial and

Government) Former SVP (Fujitsu American); Global VP (Symantec); Partner

(KPMG, LLP) Joined in 2010 |

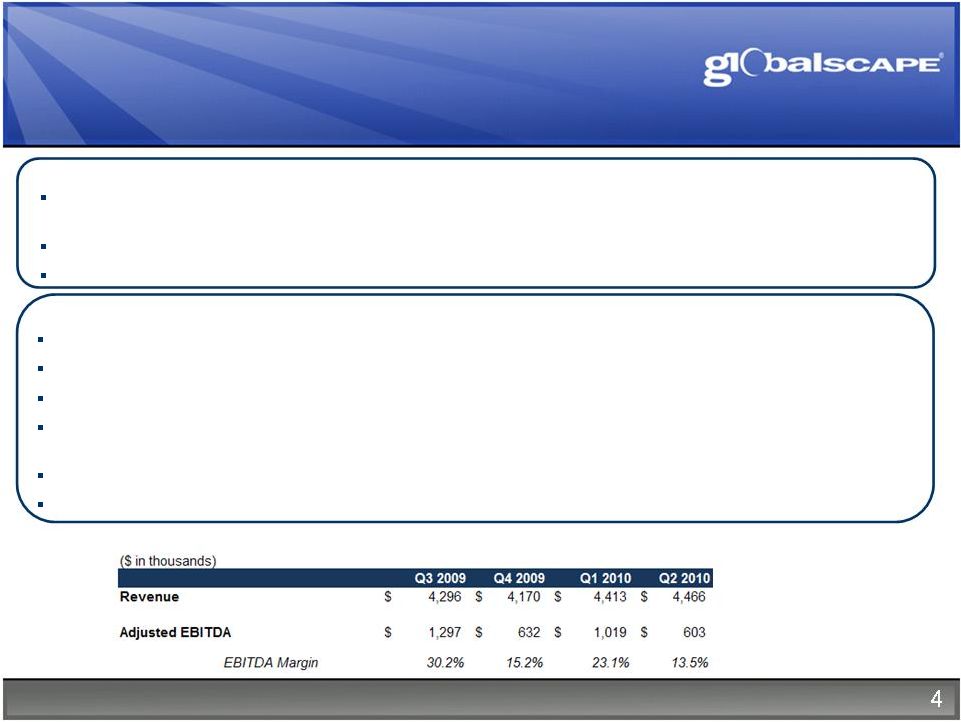

4

GlobalSCAPE

at a Glance

Overview

We provide secure information exchange solutions (software licenses, services, and

cloud-based solutions) to enterprise customers and over one million

individual consumers. Headquartered in San Antonio, Texas, with 80

full-time employees, supplemented by 5 offshore developers Founded

1996 Business Highlights

Provide license software and cloud-based subscription services for enterprises

and consumers As

of

August

31,

2010,

GlobalSCAPE

has

over

10,000

enterprise

customers

in

over

150

countries

Recognized as leader and innovator in the Security and Managed File Transfer

Sectors Profitable for 23 of the past 25 quarters; CAGR of 25+% over

the past 5 years (resulting in Deloitte Technology Fast 500

recognition). 90% Maintenance and Support (M&S) renewal rate

3 products

introduced

in

last

12

months

with

additional

products

to

be

introduced

over

next

6

months

Quarterly Financial Profile |

5

Globally Trusted Company and Brand

Outstanding Corporate Culture

Recognized as a top workplace by Computerworld, San Antonio Business Journal, and

San Antonio Express-News

Staff retention much higher than the overall IT industry

Innovative and results oriented

Globally Trusted Brand

Implemented by 95 of Fortune 100 Companies

Deployed by U.S. Army for worldwide logistics operations

Solution certifications include FIPS 140-2, U.S. Army Certificate of

Networthiness, and Drummond AS/2

Global

name

recognition

of

CuteFTP®

consumer

solution

Leader in Gartner’s Magic Quadrant for Managed File Transfer

|

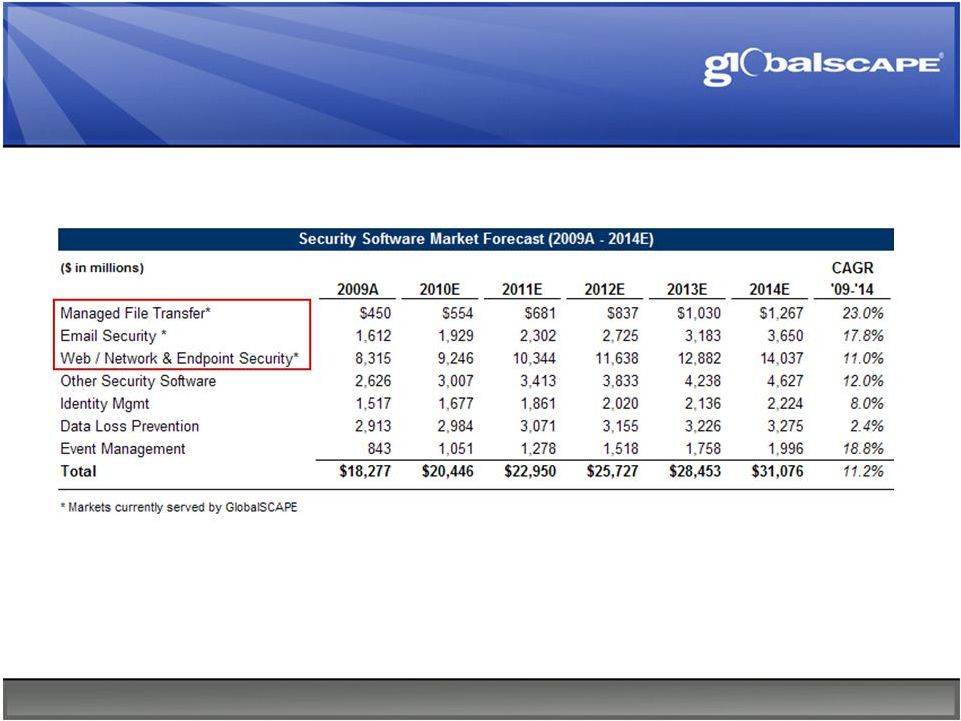

6

Market Opportunity

6 |

7

Budget Priorities (US)

-80%

-60%

-40%

-20%

0%

20%

40%

60%

80%

Server consolidation/virtualization

Improving Information and Network Security

Application or Business Intelligence Software deployment

Reducing the number of external IT vendors

Cloud Computing

Moving to work to lower cost locations

IT Outsourcing

PC Upgrade

Transition to Windows Vista or Windows 7

Custom software development

Human resources outsourcing

Call Center Outsourcing

Business Process Outsourcing

2Q2010

1Q2010

4Q2009

3Q2009

Market Opportunity |

8

Cloud Services Market Opportunity

Source: Gartner, Citigroup Global Markets, IDC

2010/2011 Outlook

Estimated worldwide cloud services revenue is forecast to reach $68.3 billion in

2010, a 16.6% increase from 2009.

55% of US CIOs plan to implement cloud technologies over the next 12 months.

Market Upside (2012 and beyond)

Industry poised for strong growth, at least through 2014, when worldwide cloud

services revenue is forecasted to reach $148.8 billion.

Cloud services is expected to capture 25% of total IT spending growth by 2012 and

nearly 33% of growth of the following year. |

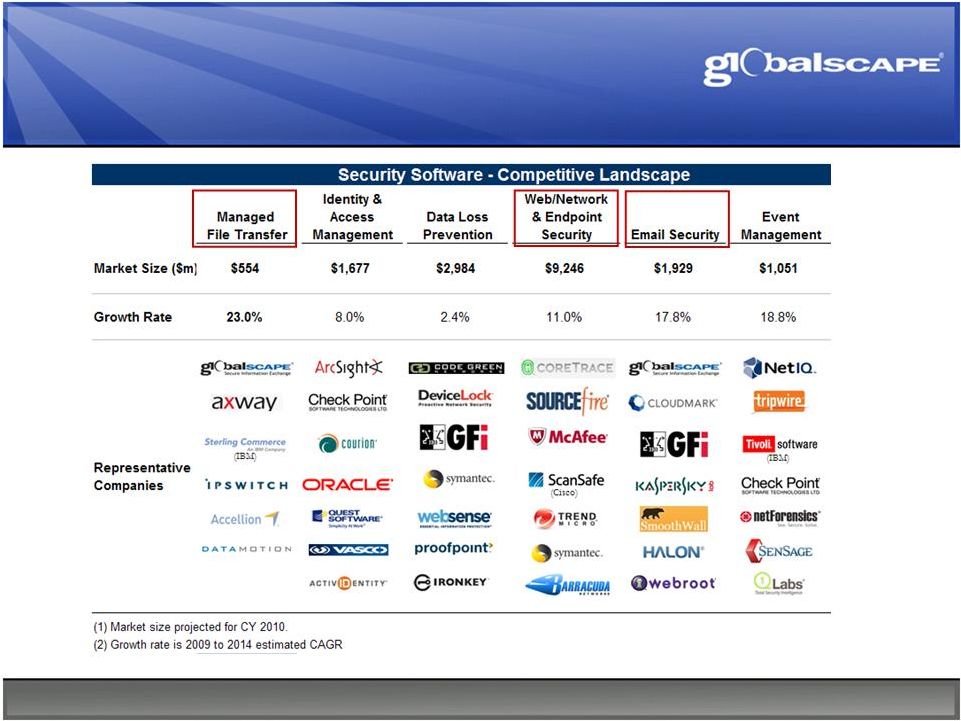

Competitive Landscape

9 |

10

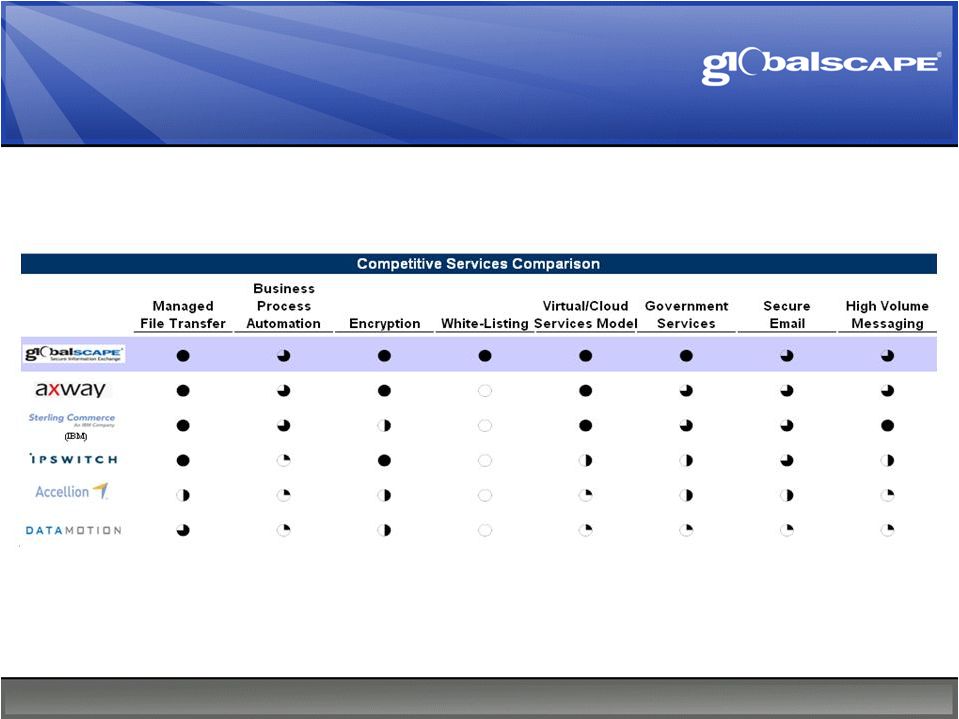

Competitive Landscape (continued)

|

11

Unequalled Solution Certifications

US

Army

Certificate

of

Networthiness

Signifies successful completion of a stringent assessment to ensure Army

Automated Information Systems are secure, supportable, sustainable, and

compatible with Army standards.

FIPS-140-2

Certified

The Federal Information Processing Standard (FIPS) Pub 140-2 specifies

the security requirements of cryptographic modules. The certification verifies

that a vendors product has met or exceeded the requirement.

AS/2

Drummond

Certified

Drummond certification is vendor-neutral operability testing and

certification that a vendor meets or exceeds the Applicability Statement

2 (AS/2) standard with their product.

These certifications represent a considerable barrier to entry that significantly

differentiates GlobalSCAPE from its competitors.

|

12

Current Product Offerings

Professional Services

Broad Range of Services

Customization, implementation,

process, training

Resell

Endpoint Security

Business Process

Automation

BOUNCER by CoreTrace

AutoMate and BPA Server by

Network Automation

Manage and automate business

processes and workflows

Protect against viruses and malware

through innovative whitelisting

technology

Cloud Offering

Cloud Services

Managed Information Xchange (MIX)

Securely exchange business data

in the cloud

E-mail Security

Mail Express

Easily and securely email large files

License

Secure File Transfer

(Encryption, Access

Controls, Auditing,

Reporting,

Management)

Enhanced File Transfer Server

Wide Area File Services (WAFS)

CuteFTP

Securely move files over the Internet

Access files real-time across offices

Manage data exchange among

worldwide offices, clients, and partners

Product Category

Products & Services

Product Descriptions |

13

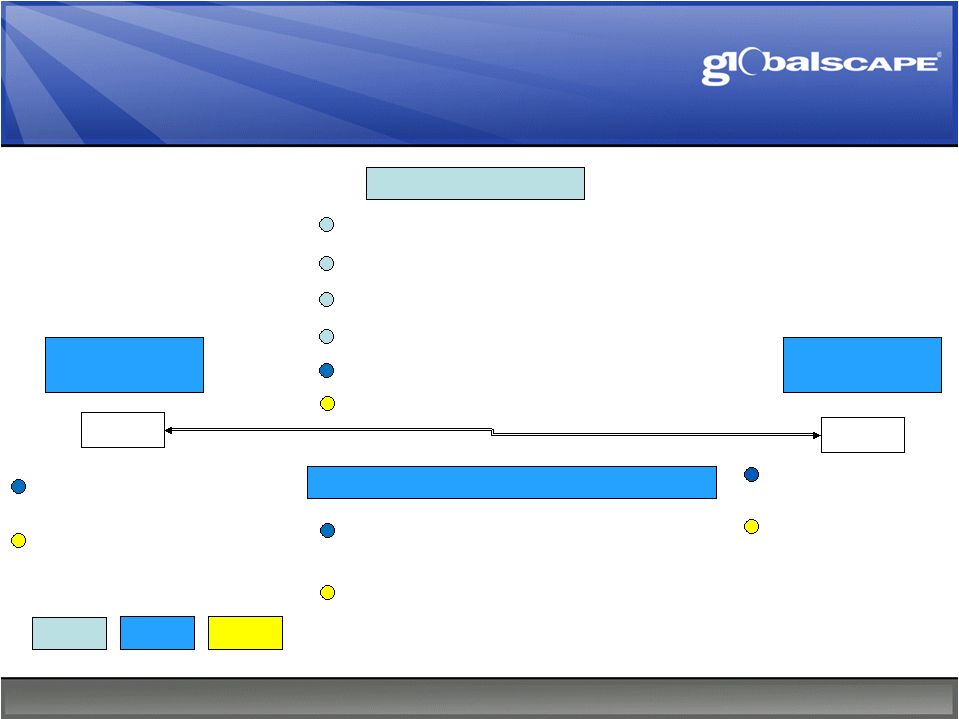

Technology and Product Roadmap

Personal File Transfer (CuteFTP™)

Managed File Transfer (EFT Server™)

Wide Area File Services

2008

File Transfer

SaaS File Transfer (CuteSendIt™)

A

B

2010

Managed E-mail Attachments (Mail Express™)

Endpoint

Operations

Advanced Workflow Engine –

(Network Automation)

Managed Information Xchange (MIX) –

through

Rackspace Hosting Infrastructure

Cloud-based Managed Services

Endpoint

Security

Application Whitelisting

–

Enterprise

2011+

Other Solutions

Other Solutions

Other Solutions

Other Solutions |

Product Road Map

New modules

Additional certifications

Continued management and performance enhancements

Additional integration and partnerships

International offerings (e.g. support for additional languages, localizations,

etc.) Expand collaboration capabilities

Additional products and services

Additional integration and partnerships

Larger engagements to support increasing deal size

Additional

collaboration

with

3

rd

party

consulting

entities

License

Secure File Transfer

(Encryption, Access

Controls, Auditing,

Reporting,

Management)

E-mail Security

Cloud Offering

Cloud Services

Professional Services

Product Category

Potential Products & Services Offerings

14 |

Product Differentiation and Advantages

License

Solutions

-

Managed

file

transfer

market

Best-value offering (feature coverage for TCO) for enterprises

Flexible

“add-on”

modules

for

core

products

to

meet

specific

customer

needs

Advanced security and automation capabilities

Easy to use, rollout, manage, and update

Certifications and validations

Cloud and Managed Services Solutions

Robust

“enterprise-grade”

security

measures

Fully scalable for large and global capacity demands

Built upon market leading products and providers

15 |

16

16

Select Customers |

Sales and Marketing Strategy

Direct Sales

We have 15 direct sales people led by William Buie, EVP Sales.

Our direct sales team, focused on enterprise solutions and M&S renewals,

accounts for 70% of our bookings. The

direct

sales

team

engages

with

key,

named

accounts

mostly

in

the

U.S.,

Canada,

and

the

UK.

We

have

long-standing

relationships

with

DoD

customers

and

within

the

finance,

health

care,

manufacturing,

engineering,

and other commercial verticals.

Indirect Sales

We

have

3

indirect

sales

people,

including

a

solution

architect,

who

focus

on

channel

development

and

enablement.

Our indirect sales team works with an international network of 150 distributors and

resellers who account for approximately 20% of our bookings.

We are leveraging select partners, including Lifeboat Distribution, to drive

channel sales growth (Target: >30% of bookings).

We also sell our consumer products and certain enterprise solutions over the

Internet (approximately 10% of bookings). Marketing

We have transformed from a managed file transfer (MFT) company into a market leader

in secure information exchange. We will continue to develop our brand through

marketing communications and investor relations activities. Our sales,

marketing, and engineering activities are integrated to deliver on the considerable market potential in current,

emerging, and projected markets.

17 |

18

Select Partners

18 |

19

Growth Strategy

Acquisitions and Partnerships

Capitalize on opportunities by making build/buy/partner decisions to increase

market share and enter adjacent markets with shorter

time-to-market. Goal: Retain leadership in current markets. Become

competitive in synergistic adjacent markets. Typically target specific

technologies (e.g., whitelisting) and market presence (high-growth adjacencies, such as cloud

solutions).

Sound financials and public stock (potentially part of the transaction currency)

increase range of viable possibilities. Targeted profile for

acquisitions: Similar or smaller-size companies; accretive (immediately or within short time period).

Organic Growth

Expand our solution portfolio with products and services in current and adjacent

markets (e.g., cloud and endpoint security).

Continue to enhance and develop our existing solutions for enterprise customers and

individual consumers. Aggressively grow cloud-based subscription

services that complement our existing software license (on premises)

business.

Build

upon

current

recurring

revenue

base

(40%)

from

maintenance

and

support

contracts.

Develop our global sales capability, including direct and channel sales.

Increase government sales (larger deal size but longer sales cycles); recent

Defense AT&L article. Penetrate deeper into organizations (tackle the

last mile) and increase exposure to CXO-level decision makers (through

new solutions and more business-oriented marketing).

19 |

20

Partner Case Study: CoreTrace

Austin-based Application Whitelisting Startup; VC-funded in 2007

Revenue generating; increasing market traction

Have known the leadership team for 20 years (founders of Wheel Group)

Innovative technology in projected high-growth market

Why Partner?

Possibly disruptive Endpoint Security solution with or without AntiVirus

McAfee Acquired SolidCore for $33M and $14M earn out in 2009

Resell into our 10,000 enterprise customers

Resell through our worldwide distribution channels

Possible integration into our product line or rebranded (OEM)

GlobalSCAPE invested $2.3 million in Series B in December 2009

Access to technology

Minority equity position

Board seat |

21

Partner Case Study: Rackspace

San Antonio-based web hosting and cloud infrastructure company (NYSE: RAX)

$629M revenue (2009); 120,000 customers worldwide; Fanatical Support®

Top 100 Performing Technology Company by Bloomberg Businessweek

Leader’s Quadrant of the Gartner Magic Quadrant for Web Hosting and Hosted

Cloud System Infrastructure Services

GlobalSCAPE

Managed Solutions

Initially: Hosted and Hosted/Managed File Transfer

Later Phases: Integrate additional products and services

Why cloud services and Rackspace?

Enter attractive and growing adjacent Cloud Services market

Shorter sales cycle; CXO as economic buyer; attractive value proposition

Helps customers operate within tighter budgets and address elasticity demands

Establish

strong

positioning

and

global

reach

with

global

“Tier

1”

cloud

provider

Mutually beneficial sales relationship leveraging two San Antonio-based

firms |

22

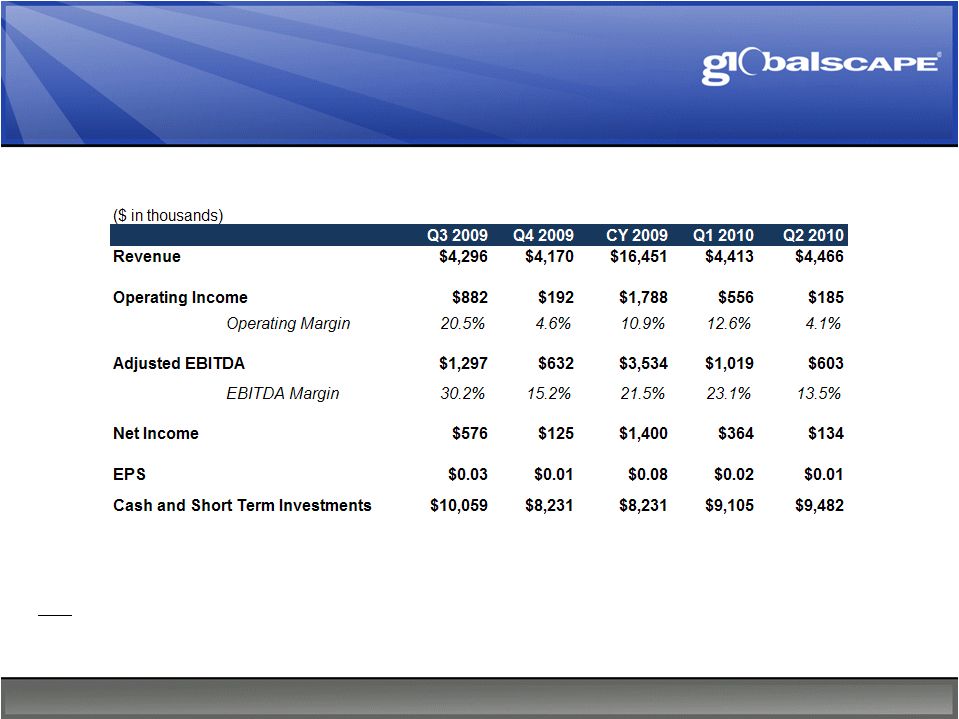

Select Financial Highlights

Notes

1.

During fiscal year 2009, maintenance & support revenue represented

approximately 40% of total revenue. 2.

M&S renewal rate for 2009 was over 90% for enterprise products.

3.

17.9M fully diluted shares as of June 30, 2010.

4.

Adjusted EBITDA equals standard EBITDA plus stock compensation expense.

|

23

Recent Financial Highlights

Q2 2010 (ended June 30, 2010)

Revenue of $4.5M vs. $4.4M in Q1 10 (both exceeding prior guidance)

Software product revenue of $2.6M

Maintenance and support revenue of $1.9M

Other second quarter highlights

YTD revenue of $8.9M exceeds YTD 2009 by 11% (even with large $2.7M Army order in

FY 09) Free cash flow of $1.3M, up from $900,000 in Q1 FY 10

Cash balances increased to $9.5M from $8.2M at end of FY 09

|

24

Summary and Outlook (Market, Customers, Sales)

Large and Growing Market Footprint

Transformed

from

managed

file

transfer

vendor

to

secure

information

exchange

solution

provider

Security and cloud markets are much larger than MFT market and represent an IT

budget priority Established Base of Customers

95

of

the

Fortune

100

are

GlobalSCAPE

customers

10,000 enterprise customers

One million+ consumer customers (large target audience for potential future

solutions) New Product and Partnership Introductions

Enhancements of existing solutions

New solutions to be announced in next two quarters

Potential acquisitions to augment our offerings

Strong Sales of Existing Solutions

Revenue up 11% YTD; >90% Maintenance & Support (M&S) renewal

rates Quarterly growth in sales (exceeds revenue growth as subscription

sales increase) |

25

Summary and Outlook (Financials)

Solid Financial Position

Consistent cash generation, with no long term debt

Customer Retention greater than 90% and growing base of recurring revenues

Strong position for potential acquisitions

Increased ability to see additional, future revenue

Financial Projections

FY 2010 organic revenues projected to be > $18.5M (new high water

mark) 12%

increase

from

FY

09

(including

single

large

Army

order

in

FY

09)

27%

increase

in

core

revenue

(excluding

the

Army

order

in

FY

09)

FY 2011 organic revenue in $21M to $25M range

Software licenses

Increased

recurring

revenue

(Managed

Information

Xchange

and

Maintenance

&

Support

contracts)

Sales Growth even greater than Revenue Growth (due to subscription sales)

Company has been and will remain fiscally disciplined

Clear focus on revenue growth into 2011

Manage to positive EPS |

Contact Us

Corporate Headquarters

4500 Lockhill-Selma, Suite 150

San Antonio, TX 78249

800-290-5054 (US & Canada)

210-308-8267 (International)

www.GlobalSCAPE.com

NYSE Amex: GSB

26 |