Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NORFOLK SOUTHERN CORP | d8k.htm |

| EX-99.1 - CONFERENCE CALL TRANSCRIPT DATED JULY 27, 2010 - NORFOLK SOUTHERN CORP | dex991.htm |

Second Quarter 2010 Results

Donald W. Seale

Executive Vice President

and Chief Marketing Officer

Exhibit 99.2 |

Railway Operating Revenue

Second Quarter 2010 vs. 2009

Total -

$2.4 Billion

Up $573 million, 31% vs. 2Q 2009

Volume

$404

Revenue Per Unit

$169

Total Change

$573

Merchandise

$1,283

+31%

Coal

$696

+36%

Intermodal

$451

+23% |

Revenue Per Unit

Second Quarter 2010 vs. 2009

Automotive -

legacy contract

renegotiation & extended hauls

Coal –

Improved export and

utility yield

Agriculture -

decline due to

shorter haul business

Paper –

lower RPU due to truck

competition and increased

shorter haul traffic

2Q 2010

vs. 2Q 2009

Rev/Unit

Abs.

% Chg.

Agriculture

$2,103

($22)

(1%)

MetCon

$1,586

$126

9%

Chemicals

$3,158

$111

4%

Paper

$2,142

($97)

(4%)

Automotive

$2,277

$479

27%

Merchandise

$2,166

$73

3%

Intermodal

$616

$16

3%

Coal

$1,765

$227

15%

Total

$1,413

$98

7% |

Railway Volume

Second Quarter 2010 vs. 2009

•

Improving economy & weak

comparisons

to

2

nd

quarter

2009

•

Strong project growth

•

Metals/Construction, Paper,

Chemicals & Intermodal

produce 52 week high

loadings

2Q 2010

Units

Abs.

% Chg.

Agriculture

152,951

17,914

13%

MetCon

175,389

58,190

50%

Paper

85,250

11,173

15%

Chemicals

105,933

25,432

32%

Automotive

72,547

11,695

19%

Merchandise

592,070

124,404

27%

Intermodal

733,324

120,559

20%

Coal

394,415

62,504

19%

Total

1,719,809

307,467

22%

vs. 2Q 2009 |

Merchandise Volume

Second Quarter 2010 vs. 2009

•

Total Merchandise volume up

27%

•

Metals/Construction volume driven

by increased steel demand, new

business, and energy related

construction materials

•

Chemicals markets growth from

increased production of basic

chemicals & project growth

•

Automotive volume growth led by

increased vehicle production &

new Northeast business

Chemicals

105,933

+32%

Automotive

72,547

+19%

Paper

85,250

+15%

Agriculture

152,951

+13%

Metals/Construction

175,389

+50% |

Merchandise Volume

Second Quarter 2010 vs. 2009

•

Agriculture growth driven by

increased corn, ethanol and

fertilizer shipments

•

Paper & Forest volume increase in

pulpboard and lumber

Chemicals

105,933

+32%

Automotive

72,547

+19%

Paper

85,250

+15%

Agriculture

152,951

+13%

Metals/Construction

175,389

+50% |

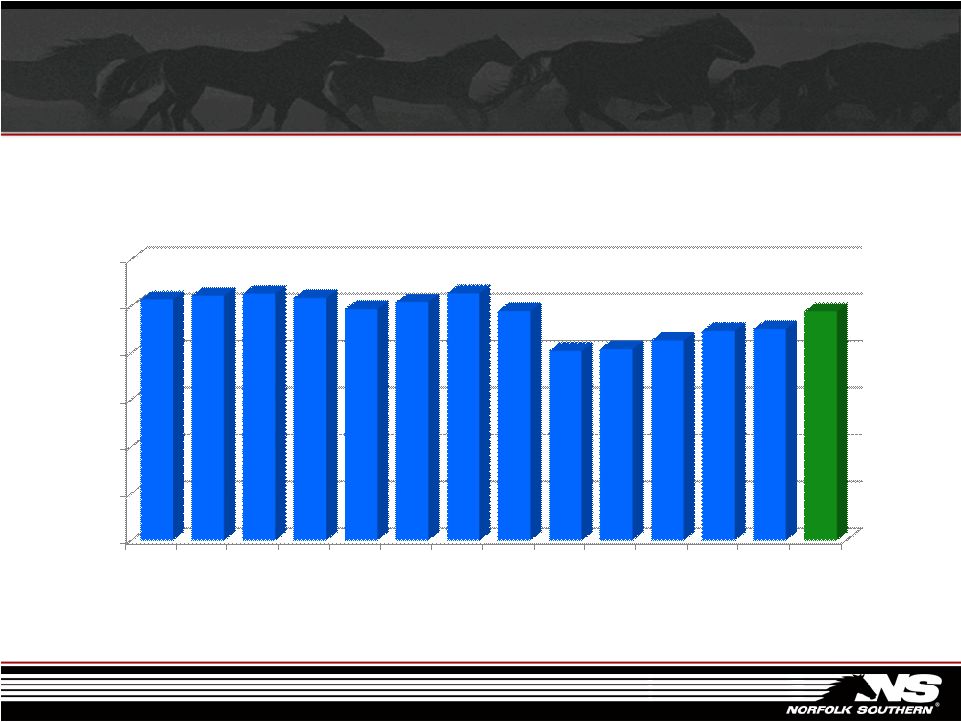

Merchandise Volume

First Quarter 2007 –

Second Quarter 2010

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

1Q

2007

2Q

2007

3Q

2007

4Q

2007

1Q

2008

2Q

2008

3Q

2008

4Q

2008

1Q

2009

2Q

2009

3Q

2009

4Q

2009

1Q

2010

2Q

2010

Merchandise Carloads

+27% |

Intermodal Volume

Second Quarter 2010 vs. 2009

•

Total Intermodal volume up 20%

•

Domestic volume up 32%, led by

truckload diversions

•

International volume up 10%,

driven by improving global

demand

•

Premium volume up 19%, driven

by new LTL and truckload

services

Premium

57,140

+19%

Triple Crown

74,051

+7%

Domestic

335,900

+32%

International

266,233

+10% |

Intermodal Volume

First Quarter 2007 –

Second Quarter 2010

0

150,000

300,000

450,000

600,000

750,000

900,000

1Q

2007

2Q

2007

3Q

2007

4Q

2007

1Q

2008

2Q

2008

3Q

2008

4Q

2008

1Q

2009

2Q

2009

3Q

2009

4Q

2009

1Q

2010

2Q

2010

Intermodal Units

+20% |

Chicago

Cincinnati

Columbus

Pritchard

Roanoke

Norfolk

Detroit

Heartland Corridor

Existing Terminals

New Terminals

•

First Double Stack Train in September, 2010

•

Saves up to 233 miles off current routes

•

Early

2

nd

Morning

service

from

Norfolk

to

Columbus

•

Late

2

nd

Morning

service

from

Norfolk

to

Chicago |

Coal

Volume Second Quarter 2010 vs. 2009

•

Total Coal volume up 19%

•

Strong growth in met coal to

export and domestic markets

•

Growth in northern utility volume

offset by weakness in the south

•

Recovery in industrial coal

shipments

Utility

257,349

(4%)

Export

61,557

+177%

Metallurgical

55,852

+125%

Industrial

17,780

+11% |

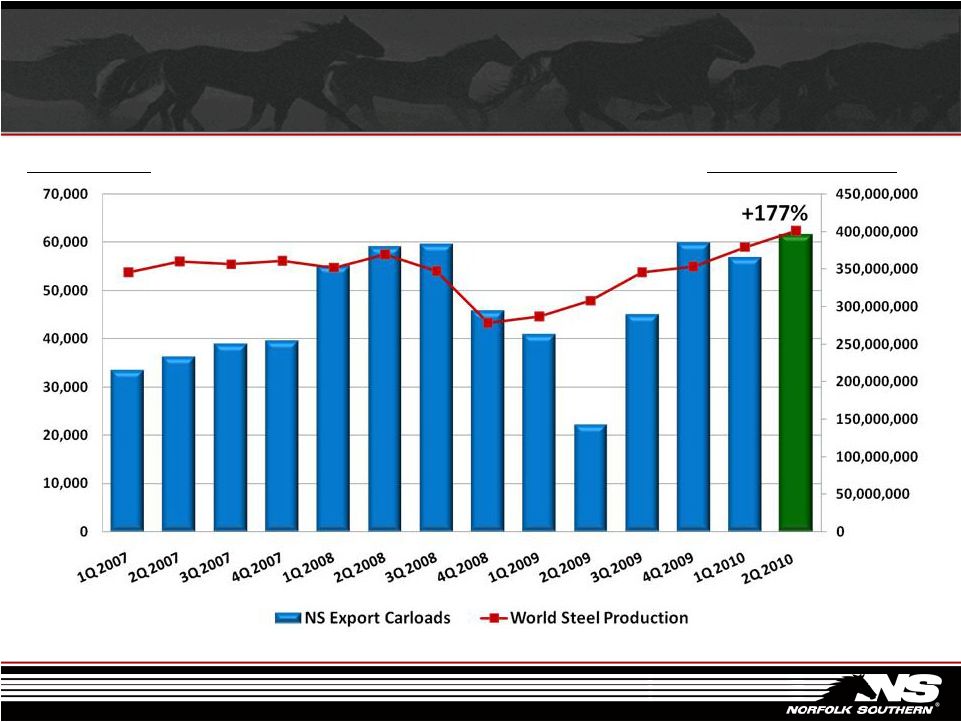

Source: World Steel Association Crude Steel Production Statistics, NS Comparison

Report Export Coal Volume & World Steel Production

First Quarter 2007 –

Second Quarter 2010

NS Export Carloads

World

Steel

Production

-

Tons |

Source: World Steel Association Crude Steel Production Statistics, NS Comparison

Report Domestic Metallurgical Coal Volume & Domestic

Steel Production –

First Quarter 2007 –

Second Quarter 2010

NS Domestic Met Carloads

Domestic

Steel

Production

-

Tons

+125% |

Utility Coal Volume & Coal Stockpiles

2007 -

2010

Sources: EVA, EEI

Utility Carloads (000) & Coal Stocks (MMT)

% Change in GWh

vs. Previous Year |

Outlook –

Business Portfolio |

Outlook Summary

Continued growth in core

markets

Strong project growth and

new business

Continued revenue per

unit improvement

1Q 2009 –

2Q 2010 Units

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

1,455,567

1,412,342

1,522,215

1,567,133

1,582,861

1,719,809 |

Second Quarter 2010 Results

Mark Manion

Executive Vice President

and Chief Operating Officer |

Rail

Industry Safety 6 Months 2010 Preliminary

(Injury Ratio per 200,000 Employee-Hours) |

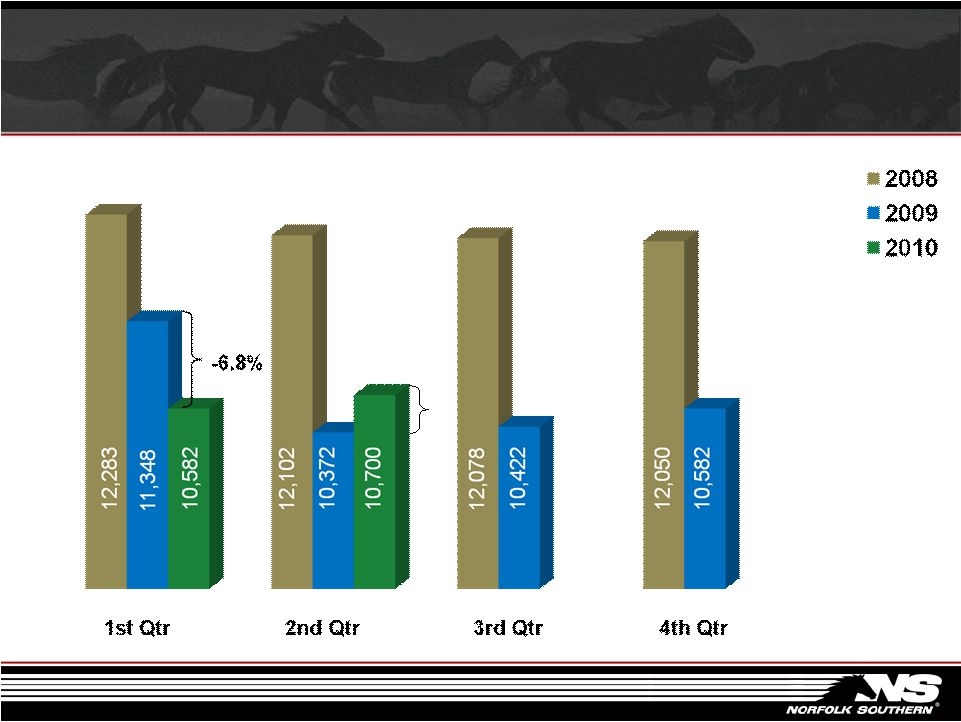

Road

& Yard Crew Starts By Quarters 2008 -

2010

-1.1% |

Train

& Engine Employees By Quarters 2008 -

2010

3.2% |

Composite Service Performance

By Quarters 2008 -

2010

Change from Prior Year: |

Productivity Scorecard

2Q 2010 vs. 2Q 2009

•

Carload Volume

22%

•

Crew Starts

10%

•

Railroad Employees

0%

•

GTMs per Employee

24%

•

GTMs per Gallon

5%

•

GTMs per Train Hour

3%

•

Car Hire Days per Carload

4% |

Second Quarter 2010 Results

James A. Squires

Executive Vice President Finance

and Chief Financial Officer |

Operating Results

Second Quarter 2010 vs. 2009 ($ Millions)

2

Second Qtr

Second Qtr

Favorable

(Unfavorable)

2010

2009

$

%

Railway Operating Revenues

$

2,430

$

1,857

$

573

31% |

Operating Results

Second Quarter 2010 vs. 2009 ($ Millions)

3

Second Qtr

Second Qtr

Favorable

(Unfavorable)

2010

2009

$

%

Railway Operating Revenues

$

2,430

$

1,857

$

573

31%

Railway Operating Expenses

1,697

1,389

(308)

(22%)

Income from Railway Operations

$

733

$

468

$

265

57%

Railway Operating Ratio

69.8

74.8

5.0

7% |

Railway Operating Expense Analysis

Second Quarter 2010 vs. 2009 ($ Millions)

4

Net Increase

$308 Million / 22%

-

$3

+ $105

+ $119

Depreciation

+ $40

+ $47

Materials

and Other

Purchased

Services

and Rents

Fuel

Compensation

and Benefits |

Compensation and Benefits Analysis

Second Quarter 2010 vs. 2009 ($ Millions)

5

Increase

Incentive and Stock-Based Compensation

$

41

Volume-Related Payroll

29

Wage Rates

20

Medical Benefits (Active and Retiree)

18

Other

11

Total Increase

$

119 |

Railway Operating Expense Analysis

Second Quarter 2010 vs. 2009 ($ Millions)

6

Net Increase

$308 Million / 22%

-

$3

+ $105

+ $119

Depreciation

+ $40

+ $47

Materials

and Other

Purchased

Services

and Rents

Fuel

Compensation

and Benefits |

Fuel

Expense Analysis Second Quarter 2010 vs. 2009 ($ Millions)

7

$258

+ $25

+ $80

$153 |

Railway Operating Expense Analysis

Second Quarter 2010 vs. 2009 ($ Millions)

8

Net Increase

$308 Million / 22%

-

$3

+ $105

+ $119

Depreciation

+ $40

+ $47

Materials

and Other

Purchased

Services

and Rents

Fuel

Compensation

and Benefits |

Railway Operating Expense Analysis

Second Quarter 2010 vs. 2009 ($ Millions)

9

Net Increase

$308 Million / 22%

-

$3

+ $105

+ $119

Depreciation

+ $40

+ $47

Materials

and Other

Purchased

Services

and Rents

Fuel

Compensation

and Benefits |

Other

Income - Net

Second Quarter 2010 vs. 2009 ($ Millions)

10

Second Qtr

Second Qtr

Favorable

(Unfavorable)

2010

2009

$

%

Corporate-Owned Life Insurance

$

(5)

$

7

$

(12)

(171%)

Interest on Tax Deficiencies

(2)

5

(7)

(140%)

All Other

24

24

--

--%

Other Income -

Net

$

17

$

36

$

(19)

(53%)

Interest Expense on Debt

$

115

$

113

$

(2)

(2%) |

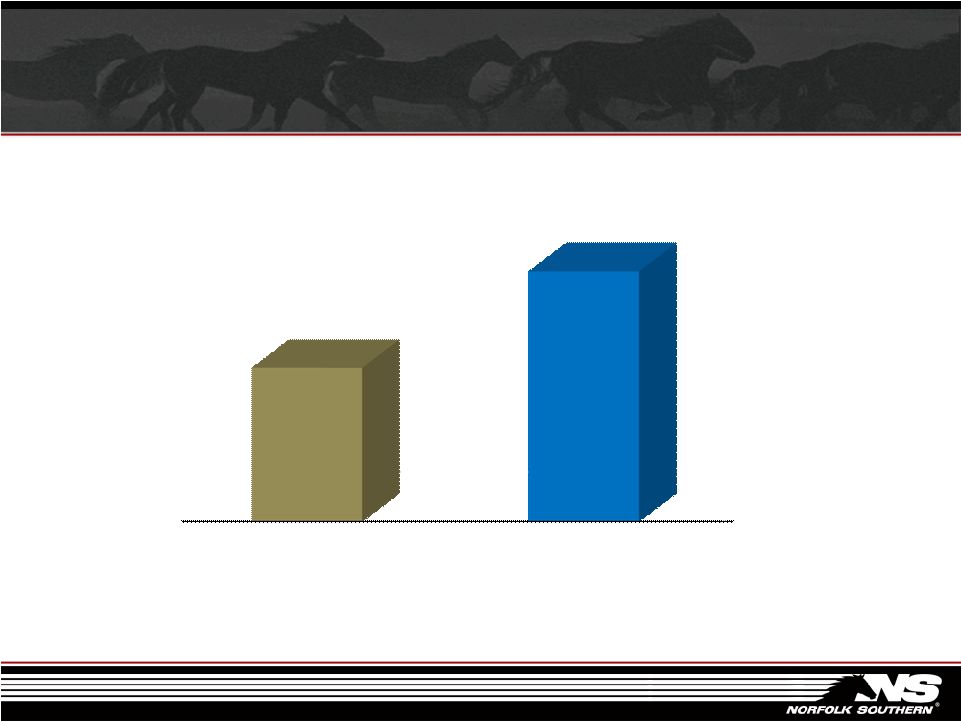

Income Before Income Taxes

Second Quarter ($ Millions)

11

Change vs.

Prior Period: + 62%

$391

$635

2009

2010 |

Income Taxes

Second Quarter ($ Millions)

12

Change vs.

Prior Period: + 69%

$144

$243

2009

2010 |

Net

Income and Diluted Earnings per Share Second Quarter ($ Millions except per

share) Net Income

13

$247

Diluted Earnings per Share

$392

$1.04

$0.66

Change vs. Prior Period:

+ 59%

Change vs. Prior Period:

+ 58%

2009

2010

2009

2010 |

Cash

Flows First Six Months 2010 vs. 2009 ($ Millions)

14

*Please see reconciliation to GAAP posted on our web site.

2010

2009

Cash Provided by Operating Activities

$

1,382

$

643

Capital Expenditures

(569)

(566)

*Free Cash Flow

$

813

$

77

Dividends

$

252

$

250

Share Repurchases

$

114

$

--

Cash and Cash Equivalents at June 30

$

855

$

722 |