Attached files

Exhibit 99.6

Exhibit

Acquisition of AmeriCredit

GM

GM Confidential

GM Forward Looking Statements

GM and AmeriCredit Corp. advise that in this press release and in related comments by our management, our use of the words “expect,” “anticipate,” “possible,” “potential,” “target,” “believe,” “commit,” “intend,” “continue,” “may,” “would,” “could,” “should,” “project,” “projected,” “positioned” or similar expressions is intended to identify forward-looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors might include for GM: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our ability to maintain adequate liquidity and financing sources and an appropriate level of debt, including as required to fund our planning significant investment in new technology; our ability to realize successful vehicle applications of new technology and our ability to comply with the continuing requirements related to U.S. and other government support. For AmeriCredit these factors include our ability to successfully operate in variable economic conditions, including fluctuating interest rate environment, changes in competitive, regulatory and legal environment, volatile wholesale vehicle values; our ability to service adverse changes in portfolio performance, our reliance on warehouse financing and capital markets; our ability to continue to securitize loans; our ability to obtain credit enhancement for securitization transactions on acceptable terms; our ability to manage the high degree of risk associated with subprime borrowers, and our exposure to litigation.

Our most recent annual reports on Form 10-K and quarterly reports on Form 10-Q provide information about these and other factors, which we may revise or supplement in future reports to the SEC.

GM Confidential

| 1 |

|

GM

Pre-Proxy Filing

Important additional information regarding the merger will be filed with the SEC:

In connection with the proposed merger, AmeriCredit plans to file a proxy statement with the Securities and Exchange Commission (the “SEC”). INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE PROXY

STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER AND THE PARTIES TO THE MERGER. Investors and security holders may obtain a free copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s web site at http://www.sec.gov. Investors and security holders and other interested parties will also be able to obtain, free of charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to Investor Relations, AmeriCredit Corp., 801 Cherry Street, Suite 3500, Fort Worth, Texas 76102, telephone (800) 644-2297, or from AmeriCredit’s web site at www.AmeriCredit.com.

AmeriCredit and its directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from AmeriCredit’s shareholders with respect to the merger. Information about AmeriCredit’s directors and executive officers and their ownership of AmeriCredit’s common stock is set forth in AmeriCredit’s Proxy Statement on Schedule 14A filed on September 16, 2009. Shareholders and investors may obtain additional information regarding the interests of AmeriCredit and its directors and executive officers in the merger, which may be different than those of AmeriCredit’s shareholders generally, by reading the proxy statement and other relevant documents regarding the merger, which will be filed with the SEC.

GM and its directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from AmeriCredit’s shareholders with respect to the merger. Information about GM’s directors and executive officers is set forth in GM’s Form 10-K filed on April 7, 2010 and GM’s Form 10 Amendment No.1 filed May 17, 2010. These documents are available free of charge from the SEC’s web site at http://www.sec.gov, and by directing a request by mail or telephone to Investor Relations, General Motors Company, 303 Renaissance Center, Detroit, Michigan 48265-3000, telephone (313) 667-1669, or from GM’s web site at www.GM.com.

GM Confidential

| 2 |

|

GM Summary

• General Motors has agreed to purchase AmeriCredit for

$24.50/share, total consideration of approximately $3.5B

• Acquiring AmeriCredit will improve competition and choice in the non-prime and lease financing markets for U.S. consumers, resulting in stronger GM sales

• AmeriCredit is a successful standalone business, and will form the core of GM’s captive financing strategy

– Will result in increased availability of leasing and non-prime financing for GM customers throughout all economic cycles

– GM branding and targeted customer marketing initiatives will improve penetration levels

• Clearly supports our vision to design, build and sell the world’s best vehicles by establishing a strategic financing capability

GM Confidential

| 3 |

|

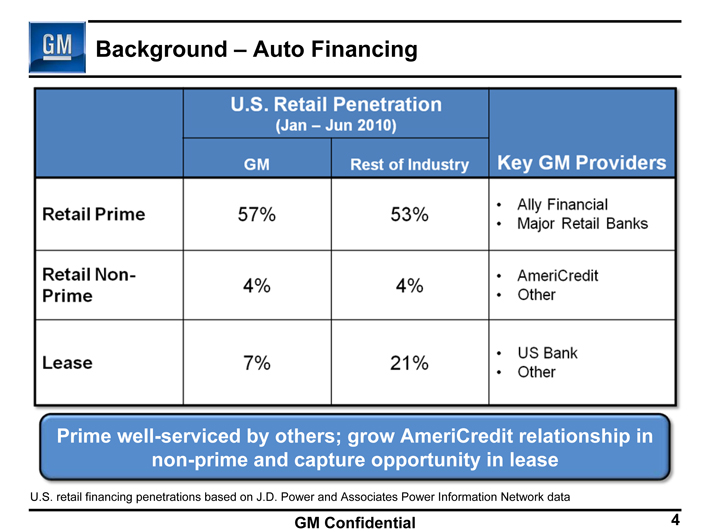

GM Background – Auto Financing

RETAIL PRIME 57% 53% ALLY FINANCIAL MAJOR RETAIL BANKS

RETAIL NON-PRIME 4% 4% AMERICREDIT OTHER

LEASE 7% 21% US BANK OTHER

Prime well-serviced by others; grow AmeriCredit relationship in

non-prime and capture opportunity in lease

U.S. retail financing penetrations based on J.D. Power and Associates Power Information Network data

GM Confidential 4

GM AmeriCredit Profile

• Independent, non-prime auto finance company

– ~$9 billion in managed auto receivables

– ~800,000 retail customers

– ~11,000 dealer relationships (~4,000 are GM)

• Primarily funded through on-balance sheet securitizations

• Scalable business model/infrastructure

• Strong, prudent management team led company successfully through 2008-2009 crisis

GM Confidential

| 5 |

|

GM Approach

• AmeriCredit will form core of GM’s captive finance strategy

• Strong AmeriCredit management team will remain in place – and strengthen overall GM team

• Focus will be on developing GM solutions in non-prime and leasing segments

• Strong track record of non-prime program with GM; will re-enter leasing business

• Under GM ownership, AmeriCredit will maintain its own direct access to the capital markets for its financing requirements

• GM will maintain relationships with third party providers, especially Ally Financial focusing on retail prime and wholesale financing

GM Confidential

| 6 |

|

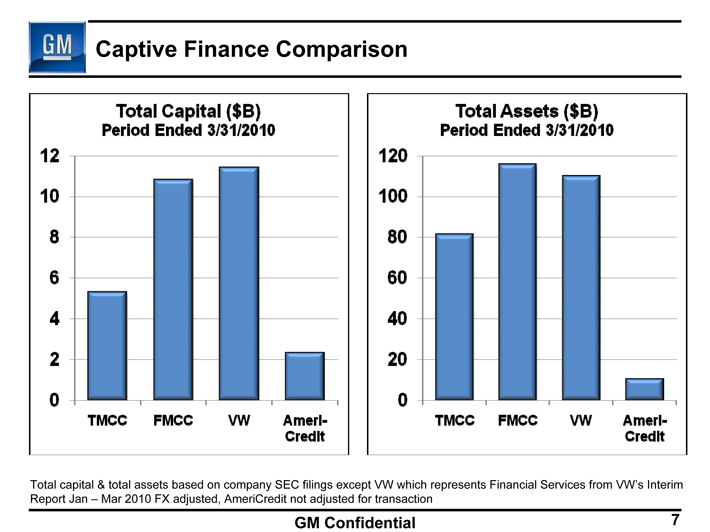

GM Captive Finance Comparison

TOTAL CAPITAL ($B) PERIOD ENDED 3/31/2010

12 10 8 6 4 2 0 TMCC FMCC VW AMERI-CREDIT

TOTAL ASSETS ($B) 120 100 80 60 40 20 0 TMCC FMCC VW AMERI-CREDIT

Total capital & total assets based on company SEC filings except VW which represents Financial Services from VW’s Interim Report Jan – Mar 2010 FX adjusted, AmeriCredit not adjusted for transaction

GM Confidential

| 7 |

|

GM Transaction Details

• Price of $24.50/share

• Total consideration of approximately $3.5B

• Certain closing conditions, including approval of AmeriCredit shareholders

• 1.5x tangible book value

• 16x 2011E net income*, before benefit of:

– Profitability from incremental GM vehicle sales

– Profitability from incremental AmeriCredit financing volume

– Utilization of GM NOLs

| * |

|

Based on Institutional Brokers’ Estimate System Consensus |

GM Confidential

| 8 |

|

GM Summary

• Good for customers, dealers, GM and AmeriCredit

• Will allow GM to provide a full range of financing alternatives for its customers through economic cycles

• New GM will continue to be aggressive in its pursuit of designing, building and selling the world’s best vehicles

GM Confidential

9