Attached files

ICS

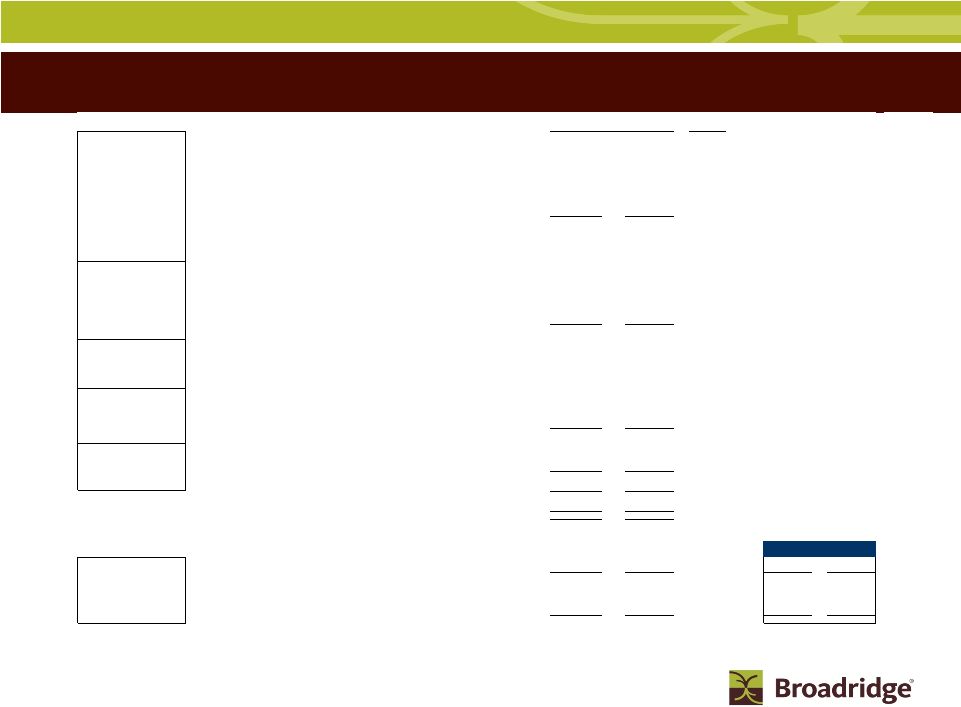

Key Segment Revenue Stats $ in millions

RC= Recurring

ED= Event-Driven

Exhibit 99.3

Fee Revenues

(1)

3Q09

3Q10

Type

Proxy

Equities

28.8

$

28.3

$

RC

Stock Record Position Growth

2%

-4%

Pieces

25.7

27.2

Mutual Funds

9.8

$

21.7

$

ED

Pieces

13.9

28.2

Contests/Specials

4.7

$

4.4

$

ED

Pieces

6.7

6.4

Total Proxy

43.3

$

54.4

$

Total Pieces

46.3

61.8

Notice and Access Opt-in %

63%

61%

Suppression %

49%

46%

Interims

Mutual Funds

(Annual/Semi-Annual Reports/Annual Prospectuses)

22.7

$

26.2

$

RC

Position Growth

1%

9%

Pieces

122.0

135.6

Mutual Funds

(Supplemental Prospectuses) & Other

20.2

$

16.0

$

ED

Pieces

127.0

96.4

Total Interims

42.9

$

42.2

$

Total Pieces

249.0

232.0

Transaction

Transaction Reporting

37.4

$

42.3

$

RC

Reporting

Fulfillment

Post-Sale Fulfillment

17.8

$

18.6

$

RC

Pre-Sale Fulfillment

8.7

$

9.0

$

ED

Total Fulfillment

26.5

$

27.6

$

Other

Other -

Recurring

-

$

3.0

$

RC

Communications

Other -

Event-Driven

(2)

11.2

$

12.0

$

ED

Total Other

11.2

$

15.0

$

Total Fee Revenues

161.3

$

181.5

$

Total Distribution Revenues

173.4

$

175.0

$

Total Revenues as reported -

GAAP

334.7

$

356.5

$

Total RC Fees

106.7

$

118.4

$

Total ED Fees

54.6

$

63.1

$

FY10 Ranges

Low

High

Sales

2%

4%

3%

3%

Losses

0%

-1%

-1%

-1%

Key

Net New Business

2%

3%

2%

2%

Revenue

Internal growth

0%

0%

0%

0%

Drivers

Event-Driven

0%

2%

5%

5%

Acquisitions

0%

1%

1%

1%

Distribution

-4%

1%

1%

2%

TOTAL

-2%

7%

9%

10%

(1) As of 3Q10, these items represent fee revenues only and exclude distribution revenues which are set

out separately. The historical numbers have been adjusted to exclude distribution revenues

(2) Other includes 4.7M pieces for 3Q09 and 3.3M pieces for 3Q10 primarily related to corporate actions

30 |

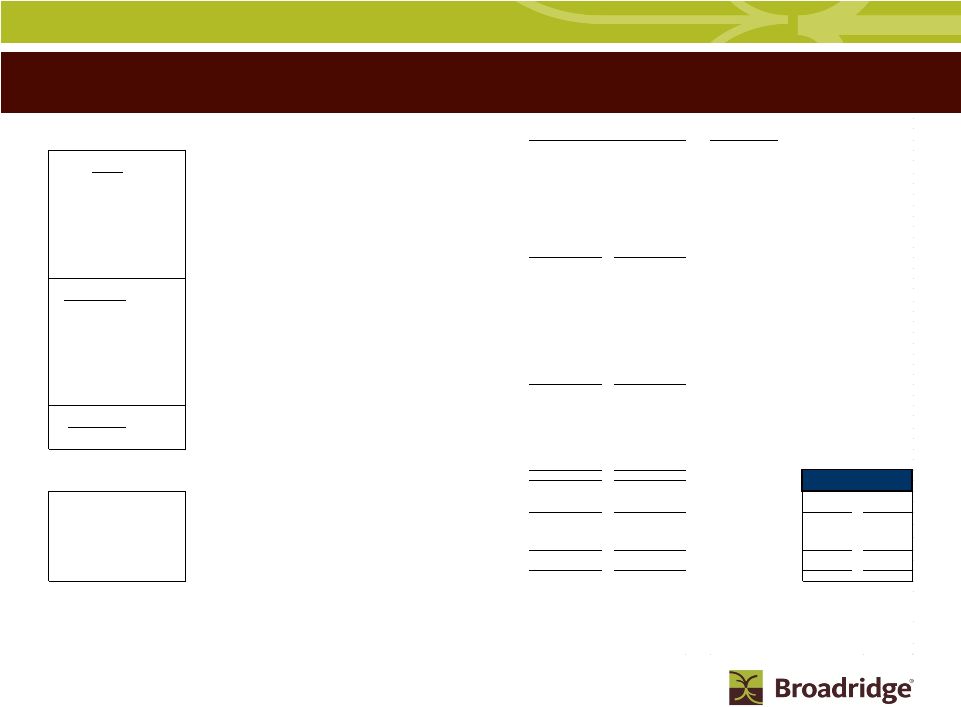

SPS

and

Outsourcing

Key

Segment

Revenue

Stats

$ in millions

RC= Recurring

ED= Event-Driven

vv

3Q09

3Q10

Type

Equity

Transaction-Based

Equity Trades

60.6

$

57.6

$

RC

Internal Trade Volume

(1)

1,512

1,516

Internal Trade Growth

2%

0%

Trade Volume (Average Trades per Day in '000)

(2) (3)

1,555

1,556

Non-Transaction

Other Equity Services

50.3

$

51.5

$

RC

Total Equity

110.9

$

109.1

$

Fixed Income

Transaction-Based

Fixed Income Trades

12.0

$

11.9

$

RC

Internal Trade Volume

(1)

296

277

Internal Trade Growth

2%

-7%

Trade Volume (Average Trades per Day in '000)

(3)

296

279

Non-Transaction

Other Fixed Income Services

7.2

$

6.5

$

RC

Total Fixed Income

19.2

$

18.3

$

Outsourcing

Outsourcing

6.2

$

6.2

$

RC

# of Clients

6

7

Total Net Revenue as reported -

GAAP

136.3

$

133.6

$

FY10 Ranges

Low

High

Sales

7%

6%

5%

6%

Losses

-5%

-4%

-4%

-4%

Key

Net New Business

2%

2%

1%

2%

Revenue

Transaction & Non-transaction

4%

-2%

-3%

-3%

Drivers

Concessions

-5%

-2%

-4%

-4%

Internal growth

-1%

-4%

-7%

-7%

Acquisitions

1%

0%

1%

0%

TOTAL

2%

-2%

-5%

-5%

(1) 3Q09 Internal Trade Volume previously was reported as 1,470 and 249 for Equities and Fixed Income,

respectively. These numbers were adjusted to reflect Losses and Sales in order to present

consistent business for the purpose of calculating internal trade growth (2) Equity Trade

volume adjusted to exclude trades processed under fixed priced contracts. Management believes excluding this trade volume presents a stronger correlation between

trade volume and Equity Trade revenue

(3) Prior Year's trade volume was re-stated for comparability

31 |