Attached files

SouthStar Energy Services

Mike Braswell

Chief Executive Officer

SouthStar Energy Services

Chief Executive Officer

SouthStar Energy Services

2

2010 Analyst Meeting

Forward-Looking Statements

Certain expectations and projections regarding our future performance referenced in this presentation, in other reports or statements we file with the SEC or otherwise release to the public,

and on our website, are forward-looking statements. Senior officers and other employees may also make verbal statements to analysts, investors, regulators, the media and others that are

forward-looking. Forward-looking statements involve matters that are not historical facts, such as statements regarding our future operations, prospects, strategies, financial condition,

economic performance (including growth and earnings), industry conditions and demand for our products and services. Because these statements involve anticipated events or conditions,

forward-looking statements often include words such as "anticipate," "assume," "believe," "can," "could," "estimate," "expect," "forecast," "future," "goal," "indicate," "intend," "may,"

"outlook," "plan," "potential," "predict," "project," "seek," "should," "target," "would," or similar expressions. Our expectations are not guarantees and are based on currently available

competitive, financial and economic data along with our operating plans. While we believe our expectations are reasonable in view of the currently available information, our expectations

are subject to future events, risks and uncertainties, and there are several factors - many beyond our control - that could cause results to differ significantly from our expectations.

and on our website, are forward-looking statements. Senior officers and other employees may also make verbal statements to analysts, investors, regulators, the media and others that are

forward-looking. Forward-looking statements involve matters that are not historical facts, such as statements regarding our future operations, prospects, strategies, financial condition,

economic performance (including growth and earnings), industry conditions and demand for our products and services. Because these statements involve anticipated events or conditions,

forward-looking statements often include words such as "anticipate," "assume," "believe," "can," "could," "estimate," "expect," "forecast," "future," "goal," "indicate," "intend," "may,"

"outlook," "plan," "potential," "predict," "project," "seek," "should," "target," "would," or similar expressions. Our expectations are not guarantees and are based on currently available

competitive, financial and economic data along with our operating plans. While we believe our expectations are reasonable in view of the currently available information, our expectations

are subject to future events, risks and uncertainties, and there are several factors - many beyond our control - that could cause results to differ significantly from our expectations.

Such events, risks and uncertainties include, but are not limited to, changes in price, supply and demand for natural gas and related products; the impact of changes in state and federal

legislation and regulation including changes related to climate change; actions taken by government agencies on rates and other matters; concentration of credit risk; utility and energy

industry consolidation; the impact on cost and timeliness of construction projects by government and other approvals, development project delays, adequacy of supply of diversified

vendors, unexpected change in project costs, including the cost of funds to finance these projects; the impact of acquisitions and divestitures; direct or indirect effects on our business,

financial condition or liquidity resulting from a change in our credit ratings or the credit ratings of our counterparties or competitors; interest rate fluctuations; financial market conditions,

including recent disruptions in the capital markets and lending environment and the current economic downturn; general economic conditions; uncertainties about environmental issues and

the related impact of such issues; the impact of changes in weather, including climate change, on the temperature-sensitive portions of our business; the impact of natural disasters such

as hurricanes on the supply and price of natural gas; acts of war or terrorism; and other factors which are provided in detail in our filings with the Securities and Exchange Commission.

Forward-looking statements are only as of the date they are made, and we do not undertake to update these statements to reflect subsequent changes.

legislation and regulation including changes related to climate change; actions taken by government agencies on rates and other matters; concentration of credit risk; utility and energy

industry consolidation; the impact on cost and timeliness of construction projects by government and other approvals, development project delays, adequacy of supply of diversified

vendors, unexpected change in project costs, including the cost of funds to finance these projects; the impact of acquisitions and divestitures; direct or indirect effects on our business,

financial condition or liquidity resulting from a change in our credit ratings or the credit ratings of our counterparties or competitors; interest rate fluctuations; financial market conditions,

including recent disruptions in the capital markets and lending environment and the current economic downturn; general economic conditions; uncertainties about environmental issues and

the related impact of such issues; the impact of changes in weather, including climate change, on the temperature-sensitive portions of our business; the impact of natural disasters such

as hurricanes on the supply and price of natural gas; acts of war or terrorism; and other factors which are provided in detail in our filings with the Securities and Exchange Commission.

Forward-looking statements are only as of the date they are made, and we do not undertake to update these statements to reflect subsequent changes.

Supplemental Information

Company management evaluates segment financial performance based on earnings before interest and taxes (EBIT), which includes the effects of corporate expense allocations and on

operating margin. EBIT is a non-GAAP (accounting principles generally accepted in the United States of America) financial measure that includes operating income, other income and

expenses. Items that are not included in EBIT are financing costs, including debt and interest expense and income taxes. The company evaluates each of these items on a consolidated

level and believes EBIT is a useful measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational

perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those operations.

operating margin. EBIT is a non-GAAP (accounting principles generally accepted in the United States of America) financial measure that includes operating income, other income and

expenses. Items that are not included in EBIT are financing costs, including debt and interest expense and income taxes. The company evaluates each of these items on a consolidated

level and believes EBIT is a useful measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational

perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those operations.

Operating margin is a non-GAAP measure calculated as operating revenues minus cost of gas, excluding operation and maintenance expense, depreciation and amortization, and taxes

other than income taxes. These items are included in the company's calculation of operating income. The company believes operating margin is a better indicator than operating revenues

of the contribution resulting from customer growth, since cost of gas is generally passed directly through to customers.

other than income taxes. These items are included in the company's calculation of operating income. The company believes operating margin is a better indicator than operating revenues

of the contribution resulting from customer growth, since cost of gas is generally passed directly through to customers.

EBIT and operating margin should not be considered as alternatives to, or more meaningful indicators of, the company's operating performance than operating income or net income

attributable to AGL Resources Inc. as determined in accordance with GAAP. In addition, the company's EBIT and operating margin may not be comparable to similarly titled measures of

another company.

attributable to AGL Resources Inc. as determined in accordance with GAAP. In addition, the company's EBIT and operating margin may not be comparable to similarly titled measures of

another company.

Reconciliations of non-GAAP financial measures referenced in this presentation are available on the company’s Web site at www.aglresources.com.

Cautionary Statements and Supplemental Information

3

2010 Analyst Meeting

2009 Key Achievements

• Achieved full year 2009 earnings (EBT) of $108 million*

• Launched successful integrated marketing campaign in GA

resulting in customer growth and market share gains in 1Q

2010

resulting in customer growth and market share gains in 1Q

2010

– Leveraged exclusive landfill

gas deal to create “recycled

gas” ad campaign

gas deal to create “recycled

gas” ad campaign

– Developed new billing

functionality to broaden

price offerings

functionality to broaden

price offerings

– Continued to leverage new sales

team at call center

team at call center

• Completed meter-to-cash BPO vendor transition reducing

year-over-year operating expenses by $3 million

year-over-year operating expenses by $3 million

* Results represent 100% of SouthStar earnings. See slide 4 for further detail.

4

2010 Analyst Meeting

2009 Key Achievements

• Capitalized on commercial opportunities in 2009

– Leveraged storage and transportation assets in Georgia and Ohio

to capture incremental earnings

to capture incremental earnings

• Generated strong margin contribution from Southeastern large

commercial and industrial (C&I) markets

commercial and industrial (C&I) markets

• Continued successful growth in expanded markets (Ohio and

Florida), resulting in a $4 million increase in 2009 margin

contribution as compared to 2008

Florida), resulting in a $4 million increase in 2009 margin

contribution as compared to 2008

5

2010 Analyst Meeting

• Earnings before tax. SouthStar’s EBT is equal to net income as it does not record income taxes because of its partnership

structure. Results represent 100% of SouthStar earnings, which effective January 1, 2010 are split 85% to AGL Resources and

15% to Piedmont Natural Gas. Lower-of-cost-or-market (LCM) inventory adjustments are +$6MM in 2006; -$6MM in 2007;

+$17MM in 2008; and -$11MM in 2009. No LCM adjustment is included in the 2010P.

structure. Results represent 100% of SouthStar earnings, which effective January 1, 2010 are split 85% to AGL Resources and

15% to Piedmont Natural Gas. Lower-of-cost-or-market (LCM) inventory adjustments are +$6MM in 2006; -$6MM in 2007;

+$17MM in 2008; and -$11MM in 2009. No LCM adjustment is included in the 2010P.

6

2010 Analyst Meeting

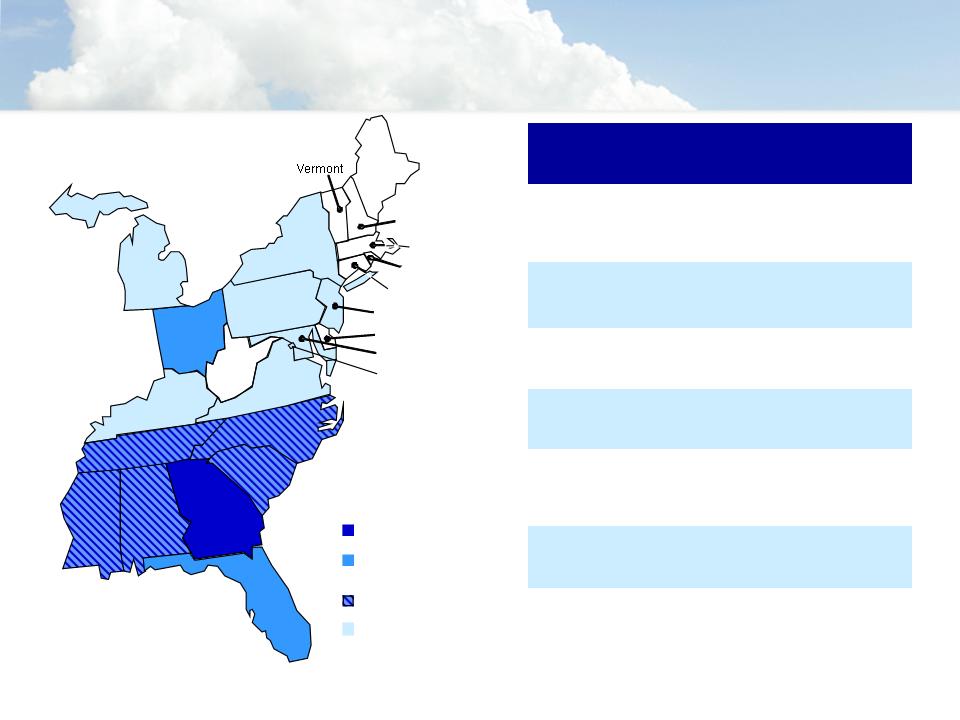

Markets, Customers and Volumes

* Customer counts known as of May 2010

** Projected FY10 throughput

|

Customer and Throughput Information

|

||

|

|

Customers & Customer

Equivalents* (000s) |

Annual

Throughput** (Bcf) |

|

Georgia (Mass)

|

506

|

45

|

|

Ohio

|

30

40 |

4

6 |

|

Florida

|

1

8 |

1

0.3 |

|

SE Large C&I

Markets (including Georgia) |

0.3

|

18

|

|

Total

|

585

|

74

|

Customers

Cust. Equiv.

TECO Cust.

CFG Cust.

Mississippi

Alabama

Georgia

Tennessee

Kentucky

Virginia

West

Virginia

Ohio

Pennsylvania

New York

Maine

Connecticut

Rhode Island

Massachusetts

New Hampshire

North Carolina

South

Carolina

Florida

New Jersey

Maryland

Delaware

District of Columbia

Michigan

Core Retail Market

Expanded Retail

Markets

C&I Markets

Emerging Markets

7

2010 Analyst Meeting

|

Current Environment

|

Business Impact

|

|

Moderate wholesale prices:

• Generally robust supply outlook and dampened

demand • Many analysts expect natural gas prices to stay in a

range around $4-6/DT, which is consistent with the current NYMEX curve |

Low to moderate prices generally improve customer

usage and lower bad debt. Lower prices could offset some of the effects of colder weather and poor economic conditions on consumer interest |

|

Relatively tight seasonal spreads:

• Reasonable ending season inventory levels (1.65

Tcf). Incremental 100+ Bcf of storage capacity 2010 vs. 2009. Risk of “storage box” less in 2010 vs. 2009 partly due to increased storage • Demand reductions are forecast due to reduced fuel

switching from coal slightly offset by higher industrial demand and reduced availability of hydro power in the west • Mixed views on the strength of domestic production

are influencing price and seasonal spreads (forecasts of beginning inventory levels range from 3.65 Tcf to 4.1 Tcf) |

Currently, seasonal spreads are tighter than those

experienced in 2009 and there is a moderate likelihood of a “storage box”. These factors reduce the expected value of SouthStar’s storage contribution in 2010 versus 2009 |

|

Reduced transportation / basis values:

• Increased infrastructure development

• Shale gas development in the East

|

Basis differentials are contracting, reducing

SouthStar’s value from transportation in 2010 as compared to 2009 |

Macroeconomic / Market Update

8

2010 Analyst Meeting

|

Current Environment

|

Business Impact

|

|

Impact of 2008 NYMEX volatility persists on select

Georgia (Atlanta Gas Light) assets: • Dramatic run-up in gas prices during storage

injection season in 2008, followed by subsequent collapse in 2009, resulting in higher-priced Atlanta Gas Light-owned storage assets

|

Atlanta Gas Light Company-managed inventory: A

significant overhang persists for SouthStar and other marketers Atlanta Gas Light Company and marketers have

begun discussions to address this issue in the 2010 Capacity Supply Plan |

|

Retail competition and customer shopping remain

high: • Retail markets of all industries are being impacted

by unprecedented value-seeking shoppers • This behavior has been exacerbated by a poor

economy and an extremely cold winter in Georgia |

There is increased pressure on retail prices and

price plan mix creating greater required investment in marketing necessary for customer acquisition and retention |

|

Economic Challenges Continue:

• Struggling economy and high unemployment persist,

but some signs of moderation exist

|

There are more credit-challenged customers in the

marketplace. Utility systems have experienced slower growth or, in some cases, contraction |

|

Focus on Environmental Responsibility:

• Increased interest in individual and societal impacts

on the environment |

Favorably positions natural gas as an energy source.

Increases consumer interest in corporate environmental responsibility. As a result, SouthStar has created a strong environmental attribute associated with its Georgia Natural Gas brand |

Macroeconomic / Market Update

9

2010 Analyst Meeting

|

Business Opportunity / Risk

|

Description

|

Actions / Mitigations

|

|

Increase Georgia addressable market and

deepen GNG’s brand appeal |

Introduce Pre-pay plan and continue marketing

campaign to emphasize GNG’s corporate responsibility |

Pre-pay plan rollout scheduled for summer

2010 Marketing initiatives underway

|

|

Increase retail customer base in Ohio

|

Build brand and leverage market presence with

consumers in Ohio |

Execute direct marketing campaign to grow

customer count in Ohio |

|

Capture earnings from emerging market

opportunities |

Several state gas choice programs may represent

potential future markets and earnings sources for SouthStar |

Analyze market structure and earnings

potential to assess viability and timing of adding new markets |

|

Continue to develop SouthStar’s operating

model to enable new market growth in scalable and cost effective manner |

Develop processes and improve technology to

reduce costs and improve service delivery while maintaining flexibility to add new markets |

Continue to improve, integrate and

standardize processes and technology to capture cost efficiencies and create a scalable operating model for expansion |

|

Georgia Retail Environment

• Increased competitor activity

• Increased consumer shopping

|

Increased competition and high consumer interest

with heavy promotion of fixed price |

Execute integrated plan that leverages

marketing, customer service, billing and new product offerings |

|

Higher-priced Georgia assets (storage

inventory) owned by Atlanta Gas Light |

Increased storage costs and limited value capture

from storage spreads |

Active participation in 2010 Atlanta Gas Light

Company Capacity Supply Plan |

|

Weather

|

• Mild summer reduces commercial opportunities

• Warmer than normal weather in 4Q2010

|

• Increasing emphasis on term deals

• Weather hedge for 4Q2010

|

|

Commodity / Basis Risk

|

Price effectuation, swing, high wholesale prices,

fixed price offerings, etc. |

Commodity and basis hedging

|

|

Bad Debt

|

Uncollectible revenue

|

Robust credit policies, procedures and

controls |

Key Opportunities and Risks

10

2010 Analyst Meeting

Business

Area

Area

Objective

Business Plan

Continue integrated marketing campaign including advertising.

Introduce a variable price pre-pay plan to increase addressable

market and bolster mix

Introduce a variable price pre-pay plan to increase addressable

market and bolster mix

Core

Retail

Market

Retail

Market

Maintain GA market share and

mitigate degradation of portfolio

mix in a mature market and

difficult economy

mitigate degradation of portfolio

mix in a mature market and

difficult economy

Execute marketing campaign including direct mail and telemarketing.

Develop formal retention programs for customers behind each LDC.

Plan to continue participating in auctions behind the major Ohio

LDCs.

Develop formal retention programs for customers behind each LDC.

Plan to continue participating in auctions behind the major Ohio

LDCs.

Expanded

Retail

Markets

Retail

Markets

Grow retail customer base in

Ohio and Florida while continuing

participation in LDC auctions and

open enrollments

Ohio and Florida while continuing

participation in LDC auctions and

open enrollments

Develop a prioritization of market opportunities to begin market

entry and business planning

entry and business planning

Emerging

Markets

Markets

Assess opportunities available to

SouthStar in emerging markets

SouthStar in emerging markets

Actively work with Atlanta Gas Light and other marketers to achieve

a favorable outcome in 2010 Atlanta Gas Light Company Capacity

Supply Plan to improve ability to optimize Georgia assets. Continue

commercial focus on aggressively managing assets and risks in the

business

a favorable outcome in 2010 Atlanta Gas Light Company Capacity

Supply Plan to improve ability to optimize Georgia assets. Continue

commercial focus on aggressively managing assets and risks in the

business

Commercial

Operations

Operations

Position commercial business to

create incremental value from

asset management and manage

risks inherent in retail business

create incremental value from

asset management and manage

risks inherent in retail business

Leverage retail market position to strategically grow large customer

portfolio

portfolio

Large C&I

Markets

Markets

Continue to increase contribution

from large customer segment

from large customer segment

Distributed 100% of 2009 earnings (EBT) to member companies

Projected 2010 earnings (EBT) of $95 - 105 million

Financial

Achieve short term earnings

targets while maintaining

investment in business to create

long-term value

targets while maintaining

investment in business to create

long-term value

2010 Areas of Focus