Attached files

| file | filename |

|---|---|

| EX-5.1 - TIAA REAL ESTATE ACCOUNT | c60354_ex5-1.htm |

| EX-23.(D) - TIAA REAL ESTATE ACCOUNT | c60354_ex-23d.htm |

| EX-23.(C) - TIAA REAL ESTATE ACCOUNT | c60354_ex-23c.htm |

| EX-23.(B) - TIAA REAL ESTATE ACCOUNT | c60354_ex-23b.htm |

As filed with the Securities and Exchange Commission

on April 29, 2010

Registration No. 333-165286

|

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

Amendment No. 1 |

|

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933 |

|

|

|

|

TIAA REAL ESTATE ACCOUNT |

|

|

|

|

(Exact Name of Registrant as Specified in its Charter) |

||

|

|

|

|

New York |

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

||

|

|

|

|

(Not applicable) |

|

|

|

|

(Primary Standard Industrial Classification Code Number) |

||

|

|

|

|

(Not applicable) |

|

|

|

|

(I.R.S. Employer Identification No.) |

||

|

|

|

c/o Teachers Insurance and Annuity Association of America |

||

730 Third Avenue |

||

New York, New York 10017-3206 |

||

(212) 490-9000 |

||

|

|

|

(Address including zip code, and telephone number, |

||

including area code, of registrant’s principal executive offices) |

||

|

|

|

Keith F. Atkinson, Esquire |

||

Teachers Insurance and Annuity Association of America |

||

8500 Andrew Carnegie Blvd. |

||

Charlotte, North Carolina 28226 |

||

(704) 988-1000 |

||

|

|

|

(Name, address, including zip code, and telephone number, |

||

including area code, of agent for service) |

||

|

Copy to: |

Jeffrey S. Puretz, Esquire |

Dechert LLP |

1775 I Street, N.W. |

Washington, D.C. 20006 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of the registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer x Smaller Reporting Company o

Pursuant to Rule 429 under the Securities Act, the prospectus contained herein also relates to and constitutes a post-effective amendment to Securities Act registration statements 33-92990, 333-13477, 333-22809, 333-59778, 333-83964, 333-113602, 333-121493, 333-132580, 333-141513, 333-149862 and 333-158136 (collectively, the “Prior Registration Statements”).

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

Title of Each Class |

|

Amount to be |

|

Proposed Maximum Offering |

|

Proposed |

|

Amount |

|

|

|

|

|||||

Accumulation units in TIAA Real Estate Account |

|

* |

|

* |

|

$1,000,000,000** |

|

$71,300** |

|

|

* |

The securities are not issued in predetermined amounts or units, and the maximum aggregate offering price is estimated solely for purposes of determining the registration fee pursuant to Rule 457(o) under the Securities Act. |

|

|

** |

In addition to the $1,000,000,000 of accumulation units registered hereunder, the registrant is carrying forward securities which remain unsold but which were previously registered under the Prior Registration Statements for which filing fees were previously paid. |

|

|

(1) |

The Registrant paid filing fees in the amount of $279,000 in connection with the registration of accumulation units on its Registration Statement on Form S-1 (File No. 333-158136), which was initially filed with the Commission on March 20, 2009 and declared effective on May 1, 2009. The Registrant is not offsetting any filing fees previously paid in connection with any prior Registration Statement. |

|

|

(2) |

Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed.

We may not sell these securities until the registration statement filed with

the Securities and Exchange Commission is effective. This prospectus is not an

offer to sell these securities and we are not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

PROSPECTUS

TIAA REAL ESTATE ACCOUNT

A Tax-Deferred Variable Annuity Option Offered by Teachers Insurance and Annuity Association of America

This prospectus tells you about the TIAA Real Estate Account, an investment option offered through individual and group variable annuity contracts issued by TIAA. Please read it carefully before investing and keep it for future reference.

The Real Estate Account, which we refer to sometimes as “the Account” in this prospectus, invests primarily in real estate and real estate-related investments. TIAA, one of the largest and most experienced mortgage and real estate investors in the nation, manages the Account’s assets.

The value of your investment in the Real Estate Account will go up or down

depending on how the Account performs and you could lose money. The Account’s

performance depends mainly on the value of the Account’s real estate and other

real estate-related investments, the income generated by those investments and

the Account’s expenses. The Account’s returns could go down if, for example,

real estate values or rental and occupancy rates, or the value of real estate

related securities, decrease due to general economic conditions and/or a weak

market for real estate generally. Property operating costs, costs associated

with leverage on the Account’s properties, and government regulations, such as

zoning or environmental laws, could also affect a property’s profitability.

TIAA does not guarantee the investment performance of the Account, and you will

bear the entire investment risk. For a detailed discussion of the specific risks

of investing in the Account, see “Risk Factors” on page 12.

We take deductions daily from the

Account’s net assets for the Account’s operating and investment management

expenses. The Account also pays TIAA for bearing mortality and expense risks

and for providing a liquidity guarantee. The current estimated annual expense

deductions from the Account’s net assets over the next 12 months total 1.06%.

The Real Estate Account is designed as an option for retirement and

tax-deferred savings plans for employees of non-profit and governmental

institutions. TIAA currently offers the Real Estate Account under the following

annuity contracts:

|

|

|

|

§ |

RA and GRAs (Retirement Annuities and Group Retirement Annuities) |

|

|

|

|

§ |

SRAs (Supplemental Retirement Annuities) |

|

|

|

|

§ |

GSRAs (Group Supplemental Retirement Annuities) |

|

|

|

|

§ |

Retirement Choice and Retirement Choice Plus Annuity |

|

|

|

|

§ |

GAs (Group Annuities) and Institutionally-Owned GSRAs |

|

|

|

|

§ |

Classic and Roth IRAs (Individual Retirement Annuities) including SEP IRAs (Simplified Employee Pension Plans) |

|

|

|

|

§ |

Keoghs |

|

|

|

|

§ |

ATRAs (After-Tax Retirement Annuities) |

Note that state regulatory approval may be pending for certain of these

contracts and they may not currently be available in your state. TIAA may also

offer the Real Estate Account as an investment option under additional

contracts, both at the individual and plan sponsor level, in the future.

Neither the Securities and Exchange Commission (SEC) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy of the information in this prospectus. Any representation to the contrary is a criminal offense.

An investment in the Real Estate Account is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

32 |

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

|

43 |

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

56 |

|

|

|

|

|

|

|

58 |

|

|

|

|

|

|

|

59 |

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

61 |

|

|

|

|

|

|

Management’s Discussion and Analysis of the Account’s Financial Condition and Results of Operations |

|

62 |

|

|

|

|

|

|

99 |

|

|

|

|

|

|

101 |

|

|

|

|

|

|

|

107 |

|

|

|

|

|

|

|

113 |

|

|

|

|

|

|

|

117 |

|

|

|

|

|

|

|

119 |

|

|

|

|

|

|

|

125 |

|

|

|

|

|

|

|

127 |

|

|

|

|

|

|

|

127 |

|

|

|

|

|

|

|

127 |

|

|

|

|

|

|

|

127 |

|

|

|

|

|

|

|

128 |

|

|

|

|

|

|

|

128 |

|

|

|

|

|

|

|

129 |

|

|

|

|

|

|

|

175 |

|

|

|

|

|

|

|

178 |

|

|

|

|

|

|

|

184 |

|

|

|

|

|

|

|

|

Please see Appendix C for definitions of certain special terms used in this prospectus. |

|

|

|

|

|

The Real Estate Account securities offered by this prospectus are only being offered in those jurisdictions where it is legal to do so. No person may make any representation to you or give you any information about the offering that is not in the prospectus. If anyone provides you with information about the offering that is not in the prospectus, you shouldn’t rely on it. |

|

|

|

|

|

|

|

|

|

TIAA REAL ESTATE ACCOUNT |

You should read

this summary together with the more detailed information regarding the Account,

including the Account’s financial statements and related notes, appearing

elsewhere in this prospectus. More information about the Account may be

obtained by writing us at 730 Third Avenue, New York, NY 10017-3206, calling us

at 877 518-9161 or visiting our website at www.tiaa-cref.org. Information

contained on this website is expressly not incorporated into this prospectus.

ABOUT THE TIAA REAL ESTATE ACCOUNT

The TIAA Real Estate Account was established in February 1995 as a separate account of Teachers Insurance and Annuity Association of America (TIAA) and interests in the Account were first offered to eligible participants on October 2, 1995. The Account offers individual and group accumulating annuity contracts (with contributions made on a pre-tax or after-tax basis), as well as individual lifetime and term-certain variable payout annuity contracts (including the payment of death benefits to beneficiaries). Investors are entitled to transfer funds to or from the Account under certain circumstances. Funds invested in the Account for each category of contract are expressed in terms of units, and unit values will fluctuate depending on the Account’s performance.

INVESTMENT OBJECTIVE

The Account seeks favorable long-term returns primarily through rental income and appreciation of real estate investments owned by the Account. The Account will also invest in publicly traded securities and short-term higher quality liquid investments that are easily converted to cash to enable the Account to meet participant redemption requests, purchase or improve properties or cover other expense needs.

INVESTMENT STRATEGY

Real Estate-Related Investments. The Account intends

to have between 75% and 85% of its net assets invested directly in real estate

or real estate-related investments with the goal of producing favorable

long-term returns primarily through rental income and appreciation. The

Account’s principal strategy is to purchase direct ownership interests in

income-producing real estate, primarily office, industrial, retail, and

multi-family residential properties. The Account can also invest in real estate

or real estate-related investments through joint ventures, real estate

partnerships or common or preferred stock or other equity securities

TIAA Real Estate Account § Prospectus 3

of companies whose operations involve real estate (i.e., that primarily

own or manage real estate), including real estate investment trusts (REITs).

To a limited extent, the Account can also invest in conventional mortgage loans, participating mortgage loans, and collateralized mortgage obligations, including commercial mortgage-backed securities (CMBS) and other similar investments. Under the Account’s current investment guidelines, the Account is authorized to hold up to 10% of its invested assets in commercial mortgage loans (of all types), and up to 10% of its invested assets in CMBS. The Account from time to time will also make foreign real estate investments, which, together with foreign real estate related and foreign liquid investments, are expected to comprise no more than 25% of the Account’s total assets.

Non Real Estate-Related Investments. The Account will invest the remaining portion of its assets (intended to be between 15% and 25% of its net assets) in liquid investments; namely, securities issued by U.S. government agencies or U.S. government sponsored entities, corporate debt securities, money market instruments and, at times, stock of companies that do not primarily own or manage real estate. There will be periods of time (including since late 2008) during which the Account’s liquid investments will comprise less than 15% (and possibly less than 10%) of its assets (on a net basis and/or a gross basis), especially during and immediately following periods of significant net participant outflows. Alternatively, in some circumstances, the portion of the Account’s net assets invested in liquid investments may exceed 25%. This could happen, for example, if the Account receives a large inflow of money in a short period of time, there is a lack of attractive real estate investments available on the market, and/or the Account anticipates more near-term cash needs.

At December 31, 2009, the Account held a total of 101 real estate property investments (including its interests in 12 real estate-related joint ventures), representing 90.27% of the Account’s total investment portfolio (“Total Investments”). As of that date, the Account also held investments in a mortgage loan receivable (representing 0.73% of Total Investments), real estate limited partnerships (representing 2.07% of Total Investments), U.S. Treasury Bills (representing 2.13% of Total Investments) and government agency notes (representing 4.80% of Total Investments).

Leverage. The Account is authorized to borrow money in accordance with its investment guidelines. Under the Account’s current investment guidelines, which were modified as to borrowing in 2009, management intends to maintain the Account’s loan to value ratio (as defined below) at or below 30%. However, through December 31, 2011:

|

|

|

|

|

|

• |

the Account will maintain outstanding debt in an aggregate principal amount not to exceed the principal amount of debt outstanding as of the date of adoption of such guidelines (approximately $4.0 billion); and |

|

|

|

|

|

|

• |

subject to this $4.0 billion limitation, the Account is permitted under its investment guidelines to incur and/or maintain debt on its properties (including refinancing outstanding debt, assuming debt on the Account’s properties, extending the maturity date of outstanding debt and/or incurring |

|

|

|

|

4 Prospectus § TIAA Real Estate Account

|

|

|

|

|

|

|

new debt on its properties) based on the ratio of the outstanding principal amount of the Account’s debt to the Account’s total gross asset value (a “loan to value ratio”). |

In addition, the Account may borrow up to 70% of the then-current value of a particular property. Non-construction mortgage loans on a property will be non-recourse to the Account. See “General Investment and Operating Policies — Other Real Estate-Related Policies — Borrowing” on page 34.

Management intends to attain a loan to value ratio of 30% or less by December 31, 2011 and thereafter intends to maintain it at or below 30% (measured at the time of incurrence and after giving effect thereto).

As of December 31, 2009, the Account’s loan to value ratio was approximately 33.1%.

SUMMARY OF EXPENSE DEDUCTIONS

Expense deductions are made each Valuation Day from the net assets of the Account for various services to manage investments, administer the Account and the contracts, distribute the contracts and to cover certain risks borne by TIAA. Services are provided “at cost” by TIAA and TIAA-CREF Individual & Institutional Services, LLC (“Services”), a registered broker-dealer and wholly owned subsidiary of TIAA. Currently, TIAA provides investment management services and administration services for the Account, and Services provides distribution services for the Account. TIAA guarantees that in the aggregate, the expense charges will never be more than 2.50% of average net assets per year.

The estimated

annual expense deduction rate that appears in the expense table below reflects

an estimate of the amount we currently expect to deduct to approximate the

costs that the Account will incur from May 1, 2010 through April 30, 2011.

Actual expenses may be higher or lower.

|

|

|

|

|

|

|

Type of Expense Deduction |

|

Estimated |

|

Services Performed |

|

Investment Management |

|

0.54% |

|

For investment advisory, investment management, portfolio accounting, custodial and similar services, including independent fiduciary and appraisal fees |

|

|

|

|

|

|

|

Administration |

|

0.25% |

|

For administration and operations of the Account and the contracts, including administrative services such as receiving and allocating premiums and calculating and making annuity payments |

|

|

|

|

|

|

|

Distribution |

|

0.07% |

|

For services and expenses associated with distributing the annuity contracts |

|

|

|

|

|

|

|

Mortality and Expense Risk |

|

0.05% |

|

For TIAA’s bearing certain mortality and expense risks |

|

|

|

|

|

|

|

Liquidity Guarantee |

|

0.15% |

|

For TIAA’s liquidity guarantee |

|

|

|

|

|

|

|

Total Annual Expense Deduction1,2,3 |

|

1.06% |

|

For total services to the Account |

|

|

|

|

|

|

|

|

|

|

1 |

TIAA guarantees that the total annual expense deduction will not exceed an annual rate of 2.50% of average net assets. |

|

|

|

|

2 |

TIAA currently does not impose a fee on transfers from the Account, but reserves the right to impose a fee on transfers from the Account in the future. |

|

|

|

|

3 |

Property-level expenses, including property management fees and transfer taxes, are not reflected in the table above; instead these expenses are charged directly to the Account’s properties. |

Please see “Expense Deductions” on page 56 and “Selected Financial Data” on

page 60 for additional information.

TIAA Real Estate Account § Prospectus 5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

|

3 Year |

|

5 Year |

|

10 Year |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIAA Real Estate Account |

|

|

$ 109 |

|

|

$ 339 |

|

|

$ 587 |

|

|

$ 1,299 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Acquiring and Owning Real Estate: The risks associated with acquiring and owning real property, including general economic and real estate market conditions, the availability of, and economic cost associated with, financing the Account’s properties, the risk that the Account’s properties become too concentrated (whether by geography, sector or by tenant mix), competition for acquiring real estate properties, leasing risk (including tenant defaults) and the risk of uninsured losses at properties (including due to terrorism and acts of violence); |

|

|

|

|

|

|

• |

Selling Real Estate: The risk that the sales price of a property might differ, perhaps significantly, from its estimated or appraised value, leading to losses or reduced profits to the Account, the risk that the Account might not be able to sell a property at a particular time for a price which management believes represents its fair or full value, the lack of availability of financing (for potential purchasers of the Account’s properties), disruptions in the credit and capital markets, and the risk that the Account may be required to make significant expenditures before the Account is able to market and/or sell a property; |

|

|

|

|

|

|

• |

Valuation: The risks associated with property valuations, including the fact that appraisals can be subjective in a number of respects, the fact that the Account’s appraisals are generally obtained on a quarterly basis and there may be periods in between appraisals of a property during which the value attributed to the property for purposes of the Account’s daily accumulation unit value may be more or less than the actual realizable value of the property; |

|

|

|

|

|

|

• |

Borrowing: Risks associated with financing the Account’s properties, including the risk of default on loans secured by the Account’s properties (which could lead to foreclosure), the risk associated with high loan to value ratios on the Account’s properties (including the fact that the Account may have limited, or no net value in such a property), the risk that significant |

6 Prospectus § TIAA Real Estate Account

|

|

|

|

|

|

|

sums of cash could be required to make principal and interest payments on the loans and the risk that the Account may not have the ability to obtain financing or refinancing on favorable terms (or at all), which may be aggravated by general disruptions in credit and capital markets; |

|

|

|

|

|

|

• |

Participant Transactions: Investment risk associated with participant transactions, including the fact that significant net participant transfers out of the Account may impair its ability to pursue or consummate new investment opportunities that are otherwise attractive to the Account or that significant net participant transfers into the Account may take time to invest in attractive investment opportunities; |

|

|

|

|

|

|

• |

Joint Venture Investments: The risks associated with joint venture partnerships, including the risk that a co-venturer may have interests or goals inconsistent with that of the Account, that a co-venturer may have financial difficulties, and the risk that the Account may have limited rights with respect to operation of the property and transfer of the Account’s interest; |

|

|

|

|

|

|

• |

Regulatory Matters: Uncertainties associated with environmental and other regulatory matters; |

|

|

|

|

|

|

• |

Foreign Investments: The risks associated with purchasing, owning and disposing foreign investments (primarily real estate properties), including political risk and the risk associated with currency fluctuations; |

|

|

|

|

|

|

• |

Conflicts of Interests: Conflicts of interest associated with TIAA serving as investment manager of the Account and provider of the liquidity guarantee at the same time as TIAA and its affiliates are serving as an investment manager to other real estate accounts or funds, including conflicts associated with satisfying its fiduciary duties to all such accounts and funds associated with purchasing, selling and leasing of properties; |

|

|

|

|

|

|

• |

Required Property Sales: The risk that, if TIAA were to own too large a percentage of the Account’s accumulation units through funding the liquidity guarantee, the independent fiduciary could require the sales of properties to reduce TIAA’s ownership interest, which sales could occur at times and at prices that depress the sale proceeds to the Account; and |

|

|

|

|

|

|

• |

Liquid Assets and Securities: Risks associated with investments in liquid assets or investment securities (which could include, from time to time, corporate bonds, REIT securities and CMBS), including financial/credit risk, market volatility risk, interest rate volatility risk and deposit/money market risk. |

VALUING THE ACCOUNT’S ASSETS

The assets of the Account are valued at the close of each Valuation Day and the Account calculates and publishes a unit value, which is available on TIAA-CREF’s website (www.tiaa-cref.org), for each Valuation Day. The values of the Account’s

TIAA Real Estate Account § Prospectus 7

With respect to the Account’s real property investments, following the initial purchase of a property or the making of a mortgage loan on a property by the Account (at which time the Account normally receives an independent appraisal on such property), each of the Account’s real properties are appraised, and mortgage loans are valued, at least once every calendar quarter. Each of the Account’s real estate properties are appraised each quarter by an independent external state-certified (or its foreign equivalent) appraiser (which we refer to in this prospectus as an “independent appraiser”) who is a member of a professional appraisal organization. In addition, TIAA’s internal appraisal staff performs a review of each quarterly appraisal, in conjunction with the Account’s independent fiduciary, and TIAA’s internal appraisal staff or the independent fiduciary may request an additional appraisal or valuation outside of this quarterly cycle. Any differences in the conclusions of TIAA’s internal appraisal staff and the independent appraiser will be reviewed by the independent fiduciary, which will make a final determination on the matter (which may include ordering a subsequent independent appraisal).

In general, the Account obtains appraisals of its real estate properties spread out throughout the quarter, which is intended to result in appraisal adjustments and thus adjustments to the valuations of its holdings (to the extent adjustments are made) that happen regularly throughout each quarter and not on one specific day in each period. In addition, an estimated daily equivalent of net operating income is taken into consideration and is adjusted for actual transactional activity. The remaining assets in the Account are primarily marketable securities that are priced on a daily basis and are included in the Account’s daily unit value.

As of December 31, 2009, the Account’s net assets totaled approximately $7.9 billion. See “Valuing the Account’s Assets” on page 50 for more information on how each class of the Account’s investments are valued.

PAST PERFORMANCE

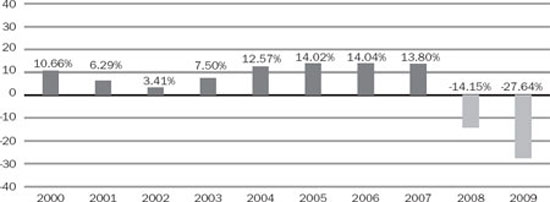

The bar chart and performance table below illustrate how investment performance during the accumulation period has varied. The bar chart shows the Account’s total return (which includes all expenses) during the accumulation period over each of the last ten calendar years and the performance table shows the Account’s returns during the accumulation period for the one-, three-, five- and ten-year periods through December 31, 2009. These returns represent the total return during each such year and are calculated as a function of both the Account’s investment income and capital appreciation from the Account’s total investments during each such year. How the Account has performed in the past is not necessarily an indication of how it will perform in the future. Please see “Risk Factors” beginning on page 12.

8 Prospectus § TIAA Real Estate Account

Worst quarter: -9.96%, for the quarter ended June 30, 2009.

AVERAGE ANNUAL TOTAL RETURNS (AS OF DECEMBER 31, 2009)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

|

|

3 Year |

|

|

5 Year |

|

|

10 Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIAA Real Estate Account |

|

|

-27.64% |

|

|

-10.92% |

|

|

-1.67% |

|

|

3.07% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABOUT TIAA AND TIAA’S ROLE WITH THE ACCOUNT

TIAA is the companion organization of the College Retirement Equities Fund (CREF), the first company in the United States to issue a variable annuity. CREF is a nonprofit membership corporation established in New York State in 1952. Together, TIAA and CREF, serving approximately 3.6 million people and approximately 15,000 institutions as of December 31, 2009, form the principal retirement system for the nation’s education and research communities and form one of the largest pension systems in the U.S., based on assets under management. As of December 31, 2009, TIAA’s total statutory admitted assets were approximately $201.7 billion; the combined assets under management for TIAA, CREF and other entities within the TIAA-CREF organization (including TIAA-sponsored mutual funds) totaled approximately $414.6 billion. CREF does not stand behind TIAA’s guarantees and TIAA does not guarantee CREF products.

The Account does not have officers, directors or employees. TIAA employees, under the direction and control of TIAA’s Board of Trustees and its Investment Committee, manage the investment of the Account’s assets, following investment management procedures TIAA has adopted for the Account. In addition, TIAA performs administration functions for the Account (which include receiving and allocating premiums, calculating and making annuity payments and providing recordkeeping and other services). Distribution services for the Account (which include, without limitation, distribution of the annuity contracts, advising existing annuity contract owners in connection with their accumulations and helping employers implement and manage retirement plans) are performed by Services. TIAA and Services provide administration and distribution services, as applicable, on an “at-cost” basis.

TIAA Real Estate Account § Prospectus 9

Liquidity Guarantee. In the event that the Account’s level of liquidity is not sufficient to guarantee that Account participants may redeem their accumulation units, the TIAA General Account will purchase accumulation units issued by the Account (sometimes called “liquidity units”) in accordance with its liquidity guarantee. The cost of this guarantee is embedded in the overall expense charge of the Account. This liquidity guarantee is not a guarantee of either investment performance or the value of units in the Account.

This liquidity guarantee was first exercised in December 2008. As of the date of this prospectus, TIAA owns 4.7 million liquidity units, representing approximately 12% of the Account’s outstanding accumulation units as of such date. The Account’s independent fiduciary is vested with oversight of the liquidity guarantee, including overseeing the timing of any redemption of liquidity units held by TIAA. See “Establishing and Managing the Account – The Role of TIAA – Liquidity Guarantee” on page 37 and “—Role of the Independent Fiduciary” on page 39.

THE CONTRACTS

TIAA offers the Account as a variable option for the annuity contracts listed on the cover page of this prospectus, although some employer plans may not offer the Account as an option for certain contracts. Each payment to the Account buys a number of accumulation units. Similarly, any transfer or withdrawal from the Account results in the redemption of a number of accumulation units. The price you pay for an accumulation unit, and the price you receive for an accumulation unit when you redeem accumulation units, is the accumulation unit value (which we sometimes call the “AUV”) calculated for the business day on which we receive your purchase, redemption or transfer request in good order (unless you ask for a later date for a redemption or transfer).

The Right To Cancel Your Contract. Generally, you may cancel any RA, SRA, GSRA, Classic IRA Roth IRA, ATRA or Keogh contract in accordance with the contract’s Right to Examine provision (unless we have begun making annuity payments from it) and subject to the time period regulated by the state in which the contract is issued. Although the contract terms and state law provisions differ, you will generally have between 10 and 60 days to exercise this cancellation right.

Transfers and Withdrawals. Subject to the terms of the contracts and your employer’s plan, you can move your money to and from the Account in the following ways:

|

|

|

|

|

|

• |

from the Account to a CREF investment account, a TIAA Access variable account (if available), TIAA’s traditional annuity or a mutual fund (including TIAA-CREF affiliated mutual funds) or other option available under your plan; |

10 Prospectus § TIAA Real Estate Account

|

|

|

|

|

|

• |

to the Account from a CREF investment account, a TIAA Access variable account (if available), TIAA’s traditional annuity (transfers from TIAA’s traditional annuity under RA, GRA or Retirement Choice contracts are subject to restrictions), a TIAA-CREF affiliated mutual fund or from other companies/plans; |

|

|

|

|

|

|

• |

by withdrawing cash; and/or |

|

|

|

|

|

|

• |

by setting up a program of automatic withdrawals or transfers. |

Importantly, cash withdrawals and transfers out of the Account to a TIAA or CREF account or into another investment option can be executed on any business day but are limited to once per calendar quarter, although some plans may allow systematic transfers and withdrawals that result in more than one transfer or withdrawal per calendar quarter. Other limited exceptions may apply. Also, transfers to CREF accounts or to certain other options may be restricted by your employer’s plan, current tax law or by the terms of your contract.

The Annuity Period. Your income payments may be paid out of the Account through a variety of income options. Ordinarily, your annuity payments begin on the date you designate as your annuity starting date, subject to the terms of your employer’s plan. Your initial income payments are based on the value of your accumulation on the last valuation day before the annuity starting date and annuity payments can change after the initial payment based on the Account’s investment experience, the income option you choose and the income change method you choose. Important tax considerations may also apply. See “Receiving Annuity Income” beginning on page 113.

Death Benefits. Subject to the terms of your employer’s plan, TIAA may pay death benefits if you or your annuity partner dies. When you purchase your annuity contract, you name one or more beneficiaries to receive the death benefit if you die. You can change your beneficiaries anytime before you die, and, unless you instruct otherwise, your annuity partner can do the same after your death. Your choice of beneficiary for death benefits may, in some cases, be subject to the consent of your spouse and federal and state law may impose additional restrictions. If you die during the accumulation period, the death benefit is the amount of your accumulation. If you and your annuity partner die during the annuity period while payments are still due under a fixed-period annuity or for the remainder of a guaranteed period, the death benefit is the present value, based on interest at the effective annual rate of 4%, of the unit annuity payments due for the remainder of the period. Death benefits may be paid out during the accumulation period (currently under one of five available methods) or during the annuity period. Ordinarily, death benefits are subject to federal estate tax. Generally, if taken as a lump sum, death benefits would be taxed like complete withdrawals. If taken as annuity benefits, death benefits would be taxed like annuity payments. See “Death Benefits” on page 117.

TIAA Real Estate Account § Prospectus 11

The value of your investment in the Account will fluctuate based on the value of the Account’s assets, the income the assets generate and the Account’s expenses. You can lose money by investing in the Account. There is risk associated with an investor attempting to “time” an investment in the Account’s units, or effecting a redemption of an investor’s units. The Account’s assets and income can be affected by many factors, and you should consider the specific risks presented below before investing in the Account. In particular, for a discussion of how forward-looking statements contained in this prospectus are subject to uncertainties that are difficult to predict, which may be beyond management’s control and which could cause actual results to differ materially from historical experience or management’s present expectations, please refer to the subsection entitled “Forward-Looking Statements,” which is contained in the section entitled “Management’s Discussion and Analysis of the Account’s Financial Condition and Results of Operations.”

RISKS ASSOCIATED WITH REAL ESTATE INVESTING

General Risks of Acquiring and Owning Real Property: As referenced elsewhere in this prospectus, the substantial majority of the Account’s net assets are comprised of direct ownership interests in real estate. As such, the Account is particularly subject to the risks inherent in acquiring and owning real property, including in particular the following:

|

|

|

|

|

|

|

• |

Adverse Global and Domestic Economic Conditions. The economic conditions in the markets where the Account’s properties are located may be adversely impacted by factors which include: |

|

|

|

|

|

|

|

|

|

• |

adverse domestic or global economic conditions, particularly in the event of a deep recession which results in significant employment losses across many sectors of the economy and reduced levels of consumer spending; |

|

|

|

|

|

|

|

|

• |

a weak market for real estate generally and/or in specific locations where the Account may own property; |

|

|

|

|

|

|

|

|||

|

|

|

• |

the availability of financing (both for the Account and potential purchasers of the Account’s properties); |

|

|

|||

|

|

|

|

|

|

|

|

• |

an oversupply of, or a reduced demand for, certain types of real estate properties; |

|

|

|

|

|

|

|

|

• |

business closings, industry or sector slowdowns, employment losses and related factors; |

|

|

|

|

|

|

|

|

• |

natural disasters, flooding and other significant and severe weather-related events, including those caused by global climate change; |

|

|

|

|

|

|

|

|

• |

terrorist attacks and/or other man-made events; and |

|

|

|

|

|

|

|

|

• |

decline in population or shifting demographics. |

The incidence of some or all of these factors could reduce occupancy, rental rates and the market value of the Account’s real properties or interests in

12 Prospectus § TIAA Real Estate Account

investment vehicles (such as limited partnerships) which directly hold real properties.

|

|

|

|

|

|

|

• |

Concentration Risk. The Account may experience periods in which its investments are geographically concentrated, either regionally or in certain markets with similar demographics. Further, while the Account seeks diversification across its four primary property types: office, industrial, retail and multi-family residential properties, the Account may experience periods where it has concentration in one property type, increasing the potential exposure if there were to be an oversupply of, or a reduced demand for, certain types of real estate properties in the markets in which the Account operates. Also, the Account may experience periods in which its tenant base is concentrated within a particular industry sector. If any or all of these events occur, the Account’s income and performance may be adversely impacted disproportionately by deteriorating economic conditions in those areas or industry sectors in which the Account’s investments are concentrated. Also, the Account could experience a more rapid negative change in the value of its real estate investments than would be the case if its real estate investments were more diversified. |

|

|

|

|

|

|

|

|

• |

Leasing Risk. A number of factors could cause the Account’s rental income, a key source of the Account’s revenue and investment return, to decline, which would adversely impact the Account’s results and investment returns. These factors include: |

|

|

|

|

|

|

|

|

|

• |

A property may be unable to attract new tenants or retain existing tenants. This situation could be exacerbated if a concentration of lease expirations occurred during any one time period or multiple tenants exercise early termination at the same time. |

|

|

|

|

|

|

|

|

• |

The financial condition of our tenants may be adversely impacted, particularly in a prolonged economic downturn. The Account could lose revenue if tenants do not pay rent when contractually obligated, request some form of rent relief and/or default under a lease at one of the Account’s properties. Such a default could occur if a tenant declared bankruptcy, suffered from a lack of liquidity, failed to continue to operate its business or for other reasons. In the event of any such default, we may experience a delay in, or an inability to effect, the enforcement of our rights against that tenant, particularly if that tenant filed for bankruptcy protection. Further, any disputes with tenants could involve costly and time consuming litigation. |

|

|

|

|

|

|

|

|

• |

In the event a tenant vacates its space at one of the Account’s properties, whether as a result of a default, the expiration of the lease term, rejection of the lease in bankruptcy or otherwise, given current market conditions, we may not be able to re-lease the vacant space either (i) for as much as the rent payable under the previous lease or (ii) at all. Also, we may not be able to re-lease such space without incurring substantial expenditures for tenant improvements and other lease-up related costs, while still being obligated |

TIAA Real Estate Account § Prospectus 13

|

|

|

|

|

|

|

|

|

for any mortgage payments, real estate taxes and other expenditures related to the property. |

|

|

|

|

|

|

|

|

• |

In some instances, our properties may be specifically suited to and/or outfitted for the particular needs of a certain tenant based on the type of business the tenant operates. For example, many companies desire space with an open floor plan. We may have difficulty obtaining a new tenant for any vacant space in our properties, particularly if the floor plan limits the types of businesses that can use the space without major renovation, which may require us to incur substantial expense in re-planning the space. |

|

|

|

|

|

|

|

|

• |

The Account owns and operates retail properties, which, in addition to the risks listed above, are subject to specific risks, including variations in rental revenues due to customary “percentage rent” clauses which may be in place for retail tenants and the insolvency and/or closing of an anchor tenant. Many times, anchor tenants will be “big box” stores and other large retailers that can be particularly adversely impacted by a global recession and reduced consumer spending generally. Factors that can impact the level of consumer spending include increases in fuel and energy costs, residential and commercial real estate and mortgage conditions, labor and healthcare costs, access to credit, consumer confidence and other macroeconomic factors. Under certain circumstances, the leases may allow other tenants in a retail property to terminate their leases, reduce or withhold rental payments. The insolvency and/or closing of an anchor tenant may also cause such tenants to fail to renew their leases at expiration. |

|

|

|

|

|

|

|

• |

Competition. The Account may face competition for real estate investments from multiple sources, including individuals, corporations, insurance companies or other insurance company separate accounts, as well as real estate limited partnerships, real estate investment funds, commercial developers, pension plans, other institutional and foreign investors and other entities engaged in real estate investment activities. Some of these competitors may have similar financial and other resources as the Account, and/or they may have investment strategies and policies (including the ability to incur significantly more leverage than the Account) that allow them to compete more aggressively for real estate investment opportunities, which could result in the Account paying higher prices for investments, experiencing delays in acquiring investments or failing to consummate such purchases. Any resulting delays in the acquisition of investments, or the failure to consummate acquisitions the Account deems desirable, may increase the Account’s costs or otherwise adversely affect the Account’s investment results. |

|

|

|

|

|

|

|

|

|

In addition, the Account’s properties may be located close to properties that are owned by other real estate investors and that compete with the Account for tenants. These competing properties may be better located, more suitable for tenants than our properties or have owners who may compete more aggressively for tenants, resulting in a competitive advantage for these other |

|

14 Prospectus § TIAA Real Estate Account

|

|

|

|

|

|

|

properties. We may also face similar competition from other properties that may be developed in the future. This competition may limit the Account’s ability to lease space, increase its costs of securing tenants, limit our ability to maximize our rents and/or require the Account to make capital improvements it otherwise would not, in order to make its properties more attractive to prospective tenants. |

|

|

|

|

|

|

||

|

|

• |

Operating Costs. A property’s cash flow could decrease if operating costs, such as property taxes, utilities, litigation expenses associated with a property, maintenance and insurance costs that are not reimbursed by tenants increase in relation to gross rental income, or if the property needs unanticipated repairs and renovations. |

|

|

|

|

|

|

• |

Condemnation. A governmental agency may condemn and convert for a public use (i.e., through eminent domain) all or a portion of a property owned by the Account. While the Account would receive compensation in connection with any such condemnation, such compensation may not be in an amount the Account believes represents equivalent value for the condemned property. Further, a partial condemnation could impair the ability of the Account to maximize the value of the property during its operation, including making it more difficult to find new tenants or retain existing tenants. Finally, a property which has been subject to a partial condemnation may be more difficult to sell at a price the Account believes is appropriate. |

|

|

||

|

|

|

|

|

|

• |

Terrorism and Acts of War and Violence. Terrorist attacks may harm our property investments. The Account cannot assure you that there will not be further terrorist attacks against the United States, U.S. businesses or elsewhere in the world. These attacks or armed conflicts may directly or indirectly impact the value of the property we own or that secure our loans. Losses resulting from these types of events may be uninsurable or not insurable to the full extent of the loss suffered. Moreover, any of these events could cause consumer confidence and spending to decrease or result in increased volatility in the United States and worldwide financial markets and economy. Such events could also result in economic uncertainty in the United States or abroad. Adverse economic conditions resulting from terrorist activities could reduce demand for space in the Account’s properties and thereby reduce the value of the Account’s properties and therefore your investment return. |

General Risks of Selling Real Estate Investments: Among the risks of selling real estate investments are:

|

|

|

|

|

|

• |

The sale price of an Account property might differ, perhaps significantly, from its estimated or appraised value, leading to losses or reduced profits to the Account. |

|

|

|

|

|

|

||

|

|

• |

The Account might not be able to sell a property at a particular time for a price which management believes represents its fair or full value. This illiquidity may result from the cyclical nature of real estate, general economic |

|

|

||

TIAA Real Estate Account § Prospectus 15

|

|

|

|

|

|

||

|

|

|

conditions impacting the location of the property, disruption in the credit markets or the availability of financing on favorable terms or at all, and the supply of and demand for available tenant space, among other reasons. This might make it difficult to raise cash quickly which could impair the Account’s liquidity position (particularly during any period of sustained significant net participant outflows) and also could lead to Account losses. Further, the liquidity guarantee does not serve as a working capital facility or credit line to enhance the Account’s liquidity levels generally, as its purpose is tied to participants having the ability to redeem their accumulation units upon demand (thus, alleviating the Account’s need to dispose of properties solely to increase liquidity levels in what management deems a suboptimal sales environment). |

|

|

|

|

|

|

• |

The Account may need to provide financing to a purchaser if no cash buyers are available, or if buyers are unable to receive financing on terms enabling them to consummate the purchase. |

|

|

||

|

|

|

|

|

|

• |

For any particular property, the Account may be required to make expenditures for improvements to, or to correct defects in, the property before the Account is able to market and/or sell the property. |

Further, as the Account generally obtains appraisals on a quarterly basis, there may be circumstances in the period between appraisals or interim valuation adjustments in which the true realizable value of a property is not reflected in the Account’s daily net asset value calculation or in the Account’s periodic financial statements. This disparity may be more apparent when the commercial and/or residential real estate markets experience an overall and possibly dramatic decline (or increase) in property values in a relatively short period of time between appraisals.

16 Prospectus § TIAA Real Estate Account

If the appraised values of the Account’s properties as a whole are too high, those participants who purchased accumulation units prior to (i) a downward valuation adjustment of a property or multiple properties or (ii) a property or properties being sold for a lower price than the appraised value will be credited with less of an interest than if the value had previously been adjusted downward. Also, those participants who redeem during any such period will have received more than their pro rata share of the value of the Account’s assets, to the detriment of other non-redeeming participants. In particular, appraised property values may prove to be too high (as a whole) in a rapidly declining commercial real estate market. Further, implicit in the Account’s definition of fair value is a principal assumption that there will be a reasonable time to market a given property and that the property will be exchanged between a willing buyer and willing seller in a non-distressed scenario. However, an appraised value may not reflect the actual realizable value that would be obtained in a rush sale where time was of the essence. Also, appraised values may lag actual realizable values to the extent there is significant and rapid economic deterioration in a particular geographic market or a particular sector within a geographic market.

Finally, the Account recognizes items of income (such as net operating income from real estate investments, distributions from real estate limited partnerships or joint ventures, or dividends from REIT stocks) and expense in many cases on an intermittent basis, where the Account cannot predict with certainty the magnitude or the timing of such item. As such, even as the Account estimates items of net operating income on a daily basis, the AUV for the Account may fluctuate, perhaps significantly, from day to day, as a result of adjusting these estimates for the actual recognized item of income or expense.

Investment Risk Associated with Participant Transactions: The amount we have available to invest in new properties and other real estate related assets will depend, in large part, on the level of net participant transfers into or out of the Account as well as participant premiums into the Account. As noted elsewhere in this prospectus, the Account intends to hold between 15% and 25% of its net assets in investments other than real estate and real estate-related investments, primarily comprised of highly liquid investments. These liquid assets are intended to be available to purchase real estate-related investments in accordance with the Account’s investment objective and strategy and are also available to meet the participant redemption requests and the Account’s expense needs (including, from time to time, obligations on maturing debt). During 2008 (and in particular, the second half of 2008), the Account experienced significant net participant transfers

TIAA Real Estate Account § Prospectus 17

If the amount of net participant transfers out of the Account were to continue, particularly at an increased rate similar to that experienced in late 2008, we may not have enough available liquid assets to pursue, or consummate, new investment opportunities presented to us that are otherwise attractive to the Account. This, in turn, could harm the Account’s returns. Management cannot predict with precision whether net participant transfers will cease in the near term (i.e., during 2010). Additionally, even if net transfers out of the Account ceased for a period of time, there is no guarantee that redemption activity would not increase again, perhaps in a significant and rapid manner.

Risks of Borrowing: The Account acquires some of its properties subject to existing financing and from time to time borrows new funds at the time of purchase. Also, the Account may from time to time place new leverage on, increase the leverage already placed on, or refinance maturing debt on, existing properties the Account owns. Under the Account’s current investment guidelines, the Account is permitted to maintain indebtedness, in the aggregate, either directly or through its joint venture investments, in an amount up to approximately $4.0 billion, and following December 31, 2011, the Account intends to maintain a loan to value ratio at or below 30% (measured at the time of incurrence and after giving effect thereto). Also, the Account may borrow up to 70% of the then-current value of a particular property. Non-construction mortgage loans on a property will be non-recourse to the Account.

Among the risks of borrowing money or otherwise investing in a property subject to a mortgage are:

|

|

|

|

|

|

• |

General Economic Conditions. General economic conditions, dislocations in the capital or credit markets generally or the market conditions then in effect in the real estate finance industry, may hinder the Account’s ability to obtain financing or refinancing for its property investments on favorable terms or at all, regardless of the quality of the Account’s property for which financing or refinancing is sought. Such unfavorable terms might include high interest rates, increased fees and costs and restrictive covenants applicable to the Account’s operation of the property. Longer term disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions could adversely affect our access to financing necessary to make profitable real estate investments. Our failure to obtain financing or refinancing on |

18 Prospectus § TIAA Real Estate Account

|

|

|

|

|

|

|

favorable terms due to the current state of the credit markets or otherwise could have an adverse impact on the returns of the Account. |

|

|

|

|

|

|

||

|

|

• |

Default Risk. The property may not generate sufficient cash flow to support the debt service on the loan, the property may fail to meet certain financial or operating covenants contained in the loan documents and/or the property may have negative equity (i.e., the loan balance exceeds the value of the property). In any of these circumstances, we may default on the loan, including due to the failure to make required debt service payments when due. If a loan is in default, the Account may determine that it is not economically desirable and/or in the best interests of the Account to continue to make payments on the loan (including accessing other sources of funds to support debt service on the loan), and/or the Account may not be able to otherwise remedy such default on commercially reasonable terms or at all. In either case, the lender then could accelerate the outstanding amount due on the loan and/or foreclose on the underlying property, in which case the Account could lose the value of its investment in the foreclosed property. Further, any such default or acceleration could trigger a default under loan agreements in respect of other Account properties pledged as security for the defaulted loan. Finally, any such default could increase the Account’s borrowing costs, or result in less favorable terms, with respect to financing future properties. |

|

|

|

|

|

|

• |

Balloon Maturities. If the Account obtains a mortgage loan that involves a balloon payment, there is a risk that the Account may not be able to make the lump sum principal payment due under the loan at the end of the loan term, or otherwise obtain adequate refinancing on terms commercially acceptable to the Account or at all. The Account then may be forced to sell the property or other properties under unfavorable market conditions or default on its mortgage, resulting in the lender exercising its remedies, which may include repossession of the property, and the Account could lose the value of its investment in that property. |

|

|

|

|

|

|

• |

Variable Interest Rate Risk. If the Account obtains variable-rate loans, the Account’s returns may be volatile when interest rates are volatile. Further, to the extent that the Account takes out fixed-rate loans and interest rates subsequently decline, this may cause the Account to pay interest at above-market rates for a significant period of time. Any hedging activities the Account engages in to mitigate this risk may not fully protect the Account from the impact of interest rate volatility. |

|

|

|

|

|

|

• |

Valuation Risk. The market valuation of mortgage loans payable could have an adverse impact on the Account’s performance. Valuations of mortgage loans payable are generally based on the amount at which the liability could be transferred in a current transaction, exclusive of transaction costs, and such valuations are subject to a number of assumptions and factors with respect to the loan and the underlying property, a change in any of which could cause the value of a mortgage loan to fluctuate. |

|

|

||

TIAA Real Estate Account § Prospectus 19

A general disruption in the credit markets, such as the credit markets have been recently experiencing, may aggravate some or all of these risks. For a discussion of the recent credit market disruptions, please see “Management’s Discussion and Analysis of the Account’s Financial Condition and Results of Operations.”

Regulatory Risks: Government regulation at the federal, state and local levels, including, without limitation, zoning laws, rent control or rent stabilization laws, laws regulating housing on the Account’s multifamily residential properties, the Americans with Disabilities Act, property taxes and fiscal, accounting, environmental or other government policies, could operate or change in a way that adversely affects the Account and its properties. For example, these regulations could raise the cost of owning, improving or maintaining properties, present barriers to otherwise desirable investment opportunities or make it harder to sell, rent, finance, or refinance properties either on economically desirable terms, or at all, due to the increased costs associated with regulatory compliance.

Uninsurable Losses: Certain catastrophic losses (e.g., from earthquakes, wars, terrorist acts, nuclear accidents, wind, floods or environmental or industrial hazards or accidents) may be uninsurable or so expensive to insure against that it is economically disadvantageous to buy insurance for them. Further, the terms and conditions of the insurance coverage the Account has on its properties, in conjunction with the type of loss actually suffered at a property, may subject the property, or the Account as a whole, to a cap on insurance proceeds that is less than the loss or losses suffered. If a disaster that we have not insured against occurs, if the insurance contains a high deductible, and/or if the aggregate

20 Prospectus § TIAA Real Estate Account

insurance proceeds for a particular type of casualty are capped, the Account could lose some of its original investment and any future profits from the property. Further, the Account may not have sufficient access to external sources of funding to repair or reconstruct a damaged property to the extent insurance proceeds do not cover the full loss. In addition, some leases may permit a tenant to terminate its obligations in certain situations, regardless of whether those events are fully covered by insurance. In that case, the Account would not receive rental income from the property while that tenant’s space is vacant.

Risks of Developing Real Estate or Buying Recently Constructed Properties: If the Account chooses to develop a property or buys a recently constructed property, it may face the following risks:

|

|

|

|

|

|

• |

In developing real estate, there may be delays or unexpected increases in the cost of property development and construction due to strikes, bad weather, material shortages, increases in material and labor costs or other events. |

|

|

|

|

|

|

• |

Because external factors may have changed from when the project was originally conceived (e.g., slower growth in the local economy, higher interest rates, or overbuilding in the area), the property may not operate at the income and expense levels first projected or may not be developed in the way originally planned or at all. |

|

|

|

|

|

|

|

• |

The co-venturer may have interests or goals inconsistent with those of the Account, including during times when a co-venturer may be experiencing financial difficulty. For example: |

|

|

|

|

|

|

|

|

|

• |

a co-venturer may desire a higher current income return on a particular investment than does the Account (which may be motivated by a longer-term investment horizon or exit strategy), or vice versa, which could cause difficulty in managing a particular asset; |

|

|

|

|

|

|

|

|

• |

a co-venturer may desire to maximize or minimize leverage in the venture, which may be at odds with the Account’s strategy; |

|

|

|

|

|

|

|

|

• |

a co-venturer may be more or less likely than the Account to agree to modify the terms of significant agreements (including loan agreements) binding the venture, or may significantly delay in reaching a determination whether to do so, each of which may frustrate the business objectives of the Account; and |

|

|

|

|

|

|

|

|

• |

for reasons related to its own business strategy, a co-venturer may have different concentration standards as to its investments (geographically, by sector, or by tenant), which might frustrate the execution of the business plan for the joint venture. |

|

|

|||

|

|

|

|

|

|

|

• |

The co-venturer may be unable to fulfill its obligations (such as to fund its pro rata share of committed capital, expenditures or guarantee obligations of the |

|

TIAA Real Estate Account § Prospectus 21

|

|

|

|

|

|

|

venture) during the term of such agreement or may become insolvent or bankrupt, any of which could expose the Account to greater liabilities than expected and frustrate the investment objective of the venture. |

|

|

|

|

|

|

• |

If a co-venturer doesn’t follow the Account’s instructions or adhere to the Account’s policies, the jointly owned properties, and consequently the Account, might be exposed to greater liabilities than expected. |

|

|

|

|

|

|

• |

The Account may have limited rights with respect to the underlying property pursuant to the terms of the joint venture, including the right to operate, manage or dispose of a property, and a co-venturer could have approval rights over the sale of the underlying property. |

|

|

|

|

|

|

• |

A co-venturer can make it harder for the Account to transfer its equity interest in the venture to a third party, which could adversely impact the valuation of the Account’s interest in the venture. |

Risks with Purchase-Leaseback Transactions: To the extent the Account invested in a purchase leaseback transaction, the major risk is that the third party lessee will be unable to make required payments to the Account. If the leaseback interest is subordinate to other interests in the real property, such as a first mortgage or other lien, the risk to the Account increases because the lessee may have to pay the senior lienholder to prevent foreclosure before it pays the Account. If the lessee defaults or the leaseback is terminated prematurely, the Account might not recover its investment unless the property is sold or leased on favorable terms.

The Account’s investment strategy includes, to a limited extent, investments in mortgage loans (i.e., the Account serving as lender).

|

|

|

|

|

|

|

• |

General Risks of Mortgage Loans: The Account will be subject to the risks inherent in making mortgage loans, including: |

|

|

|

|

|

|

|

|

|

• |

The borrower may default on the loan, requiring that the Account foreclose on the underlying property to protect the value of its mortgage loan. Since its mortgage loans are usually non-recourse, the Account must rely solely on the value of a property for its security. |

|

|

|

|

|

|

|

|||

|

|

|

• |

The larger the mortgage loan compared to the value of the property securing it, the greater the loan’s risk. Upon default, the Account may not be able to sell the property for its estimated or appraised value. Also, certain liens on the property, such as mechanics or tax liens, may have priority over the Account’s security interest. |

|

|

|||

|

|

|

|

|

|

|

|

• |

A deterioration in the financial condition of tenants, which could be caused by general or local economic conditions or other factors beyond the control of the Account, or the bankruptcy or insolvency of a major tenant, may adversely affect the income of a property, which could increase the likelihood that the borrower will default under its obligations. |

22 Prospectus § TIAA Real Estate Account

|

|

|

|

|

|

|

|

• |

The borrower may be unable to make a lump sum principal payment due under a mortgage loan at the end of the loan term, unless it can refinance the mortgage loan with another lender. |

|

|

|

|

|

|

|

|

• |

If interest rates are volatile during the loan period, the Account’s variable-rate mortgage loans could have volatile yields. Further, to the extent the Account makes mortgage loans with fixed interest rates, it may receive lower yields than that which is then available in the market if interest rates rise generally. |

|

|

|

|

|

|

|

• |

Prepayment Risks: The Account’s mortgage loan investments will usually be subject to the risk that the borrower repays a loan early. Also, we may be unable to reinvest the proceeds at as high an interest rate as the original mortgage loan rate. |

|

|

|

|

|

|

|

|

• |

Interest Limitations: The interest rate we charge on mortgage loans may inadvertently violate state usury laws that limit rates, if, for example, state law changes during the loan term. If this happens, we could incur penalties or may be unable to enforce payment of the loan. |

|

|

|

|

|

|

|

|

• |

Risks of Participations: To the extent the Account invested in a participating mortgage, the following additional risks would apply: |

|

|

|

|

|

|

|

|

|

• |

The participation feature, in tying the Account’s returns to the performance of the underlying asset, might generate insufficient returns to make up for the higher interest rate the loan would have obtained without the participation feature. |

|

|

|

|

|

|

|

|

• |

In very limited circumstances, a court may characterize the Account’s participation interest as a partnership or joint venture with the borrower and the Account could lose the priority of its security interest or become liable for the borrower’s debts. |

The Account from time to time has invested in REIT securities and may in the future invest in such securities. Investments in REIT securities are subject to many of the same general risks associated with direct real property ownership. In particular, equity REITs may be affected by changes in the value of the underlying properties owned by the entity, while mortgage REITs may be affected by the quality of any credit extended. In addition to these risks, because REIT investments are securities, they may be exposed to market risk and potentially significant price volatility due to changing conditions in the financial markets and, in particular, changes in overall interest rates, regardless of the value of the underlying real estate such REIT may own.

In addition, REITs are tax-regulated entities established to invest in real estate-related assets. REITs do not pay federal income taxes if they distribute most of their earnings to their shareholders and meet other tax requirements. As a result, REITs are subject to tax risk in continuing to qualify as a REIT.

TIAA Real Estate Account § Prospectus 23

RISKS OF MORTGAGE-BACKED SECURITIES

The

Account from time to time has invested in mortgage-backed securities and may in