Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXCO RESOURCES INC | d8k.htm |

PPT-136-DUG Conference – 03.31.10 Developing Unconventional Gas Conference & Exhibition Hal Hickey – Vice President and Chief Operating Officer Exhibit 99.1 |

EXCO

Resources, Inc. 2 PPT-138 – Howard Weil – March 2010 Forward Looking Statements This presentation contains forward-looking statements, as defined in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. These forward-looking statements relate to, among other things, the following: • our future financial and operating performance and results; • our business strategy; • market prices; • our future use of derivative financial instruments; and • our plans and forecasts. We have based these forward-looking statements on our current assumptions,

expectations and projections about future events. We use the words

"may," "expect," "anticipate," "estimate," "believe," "continue," "intend," "plan," "budget" and other similar words to identify forward-looking statements. You should read

statements that contain these words carefully because they discuss future

expectations, contain projections of results of operations or of our financial condition and/or state other "forward-looking" information. We do not undertake any obligation to update or revise publicly any forward-looking statements, except as required by law. These statements also involve risks and uncertainties that could cause our actual results or financial condition to materially differ from our expectations in this presentation,

including, but not limited to: • fluctuations in prices of oil and natural gas; • imports of foreign oil and natural gas, including liquefied natural gas; • future capital requirements and availability of financing; • continued disruption of credit and capital markets and the ability of financial institutions to honor their commitments, such as the events which occurred during the third quarter of 2008 and thereafter, for an extended period of time; • estimates of reserves and economic assumptions used in connection with our

acquisitions; • geological concentration of our reserves; • risks associated with drilling and operating wells; • exploratory risks, including our Marcellus and Huron shale plays in Appalachia and our Haynesville/Bossier shale play in East Texas/North Louisiana; • risks associated with operation of natural gas pipelines and gathering systems;

• discovery, acquisition, development and replacement of oil and natural gas

reserves; • cash flow and liquidity; • timing and amount of future production of oil and natural gas; • availability of drilling and production equipment; • marketing of oil and natural gas; • developments in oil-producing and natural gas-producing countries; • title to our properties; • competition; • litigation; • general economic conditions, including costs associated with drilling and operation of

our properties; • environmental or other governmental regulations, including legislation to reduce

emissions of greenhouse gases; • receipt and collectibility of amounts owed to us by purchasers of our production and

counterparties to our derivative financial instruments; • decisions whether or not to enter into derivative financial instruments; • potential acts of terrorism; • actions of third party co-owners of interests in properties in which we also own an

interest; • fluctuations in interest rates; and • our ability to effectively integrate companies and properties that we acquire.. |

EXCO

Resources, Inc. 3 PPT-138 – Howard Weil – March 2010 Forward Looking Statements (continued) We believe that it is important to communicate our expectations of future performance to

our investors. However, events may occur in the future that we are unable to accurately predict, or over which we have no control. You are cautioned not to place undue reliance on a forward-looking

statement. When considering our forward-looking statements, keep in mind the risk factors and other cautionary statements in this presentation, and the risk factors included in the Annual Reports on Form 10-K and

our Quarterly Reports on Form 10-Q. Our revenues, operating results, financial condition and ability to borrow funds or obtain additional capital depend substantially on prevailing prices for oil and natural gas, the availability of capital from our revolving credit facilities and liquidity from capital markets. Declines in oil or natural gas prices may materially adversely affect our financial condition, liquidity, ability to obtain financing and operating results. Lower oil or natural gas prices also may reduce the amount of oil or natural gas that we can produce

economically. A decline in oil and/or natural gas prices could have a material adverse effect on the estimated value and estimated quantities of our oil and natural gas reserves, our ability to fund our operations and our financial condition, cash flow, results of operations and access to capital. Historically, oil and natural gas prices and markets have been volatile, with prices fluctuating widely, and they are likely to

continue to be volatile. Effective January 1, 2010, the United States

Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose not only "proved" reserves (i.e., quantities of oil and gas that are estimated to be recoverable with a high degree of confidence), but also "probable" reserves (i.e., quantities of oil and gas that are as likely as not to be recovered) as well as "possible" reserves (i.e., additional quantities of oil and gas that might be recovered, but with a lower probability than probable reserves). As noted above, statements of reserves are only estimates and may not correspond to the ultimate quantities of oil and gas recovered. Any reserve estimates provided in this

presentation that are not specifically designated as being estimates of proved reserves may include estimated reserves not necessarily calculated in accordance with, or contemplated by, the SEC's latest reserve reporting guidelines. Investors are urged to consider closely the disclosure in our Annual Report on Form 10-K for the fiscal year ended December 31, 2009, which is available on our website at www.excoresources.com under the Investor Relations tab or by calling us at 214-368-2084. |

EXCO

Resources, Inc. 4 PPT-138 – Howard Weil – March 2010 EXCO Resources, Inc. Well positioned to exploit significant shale resource base (1) Reserve estimates in this document based on year end SEC reserve report using 12/31/09 5 year NYMEX strip pricing averaging $6.43 per Mcf for natural gas and $87.44 per Bbl for crude oil adjusted for differentials and excluding hedge effects

(2) Includes development and exploration capital, excluding revisions • 1.2 Tcfe (1) of Proved Reserves • Significant Unproved Upside • ~1.0 million net acres • Current net production of ~265 Mmcfe/d • 800 employees • Successfully shifted focus from acquisitions to developing shale acreage • 2009 direct finding and development cost of $1.24 (2) per Mcfe; $0.71 per Mcf for Haynesville only |

EXCO

Resources, Inc. 5 PPT-136-DUG Conference – 03.31.10 Reserve Base Portfolio focused on shale resources Proved Reserves = 1.2 Tcfe 3P+ Reserves and Resources = 15.8 Tcfe Proved: 0.3 Tcfe 3P+: 11.6 Tcfe Production: 38 Mmcfe/d Net acreage: ~654,000 Permian Proved: 0.1 Tcfe 3P+: 0.3 Tcfe Production: 18 Mmcfe Net acreage: ~138,000 East Texas / North Louisiana Proved: 0.8 Tcfe 3P+: 3.9 Tcfe Production: 209 Mmcfe Net acreage: ~163,000 Appalachia |

EXCO

Resources, Inc. 6 PPT-136-DUG Conference – 03.31.10 Haynesville Assets and Efforts Implementing our growth strategy • ~53,900 net Haynesville acres – Actively working to acquire additional acreage • 23 Mmcf/d average IP in DeSoto Parish – PUD’s booked at an average of 6.6 Bcf – Average of 2.5 PUD locations booked per PDP well • Current Haynesville activity – 42 operated horizontal wells flowing to sales – 13 operated horizontal rigs – Current net production of ~110 Mmcf/d • 2010 Haynesville/Bossier plans – Drill 100+ operated wells – Initiating down spacing tests – Pad drilling in progress – Modifying completions to optimize performance and reduce costs EXCO / BG JV Area |

EXCO

Resources, Inc. 7 PPT-136-DUG Conference – 03.31.10 EXCO Gross Operated Haynesville Shale Production Current Gross Operated Production 360 Mmcf/d; project to exit 2010 at ~795 Mmcf/d gross 0 100 200 300 400 500 600 700 800 900 1,000 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Month 360 Mmcf/d Gross Production 12/4/08: XCO turns first horizontal well to sales 3/14/08: XCO TD’s first Haynesville vertical well 8/16/08: XCO spuds first horizontal well YE 2010: Midpoint projection at 795 Mmcf/d |

EXCO

Resources, Inc. 8 PPT-136-DUG Conference – 03.31.10 • Focus on Haynesville – Optimize DeSoto Parish • 36 wells drilled with similar completions to establish baseline performance • Now initiating 80 acre downspacing tests • Pad drilling in progress on certain areas in our Holly field • Using different proppants to evaluate performance and reduce costs – Testing Harrison County • Four horizontals by mid-year • Trading data with other operators • Test Bossier – Drill seven wells during 2010, primarily in DeSoto Parish • First completion April 2010 Haynesville and Bossier Development plans |

EXCO

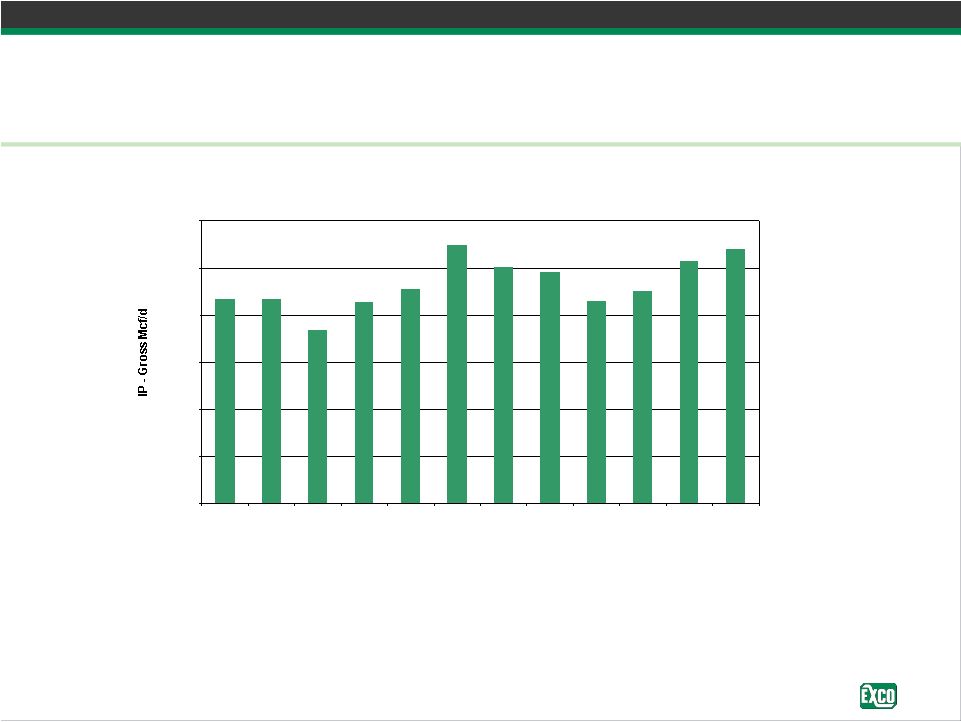

Resources, Inc. 9 PPT-136-DUG Conference – 03.31.10 Haynesville IP Rate Consistency 23 Mmcf/d average IP in DeSoto Parish • EXCO IP’s defined as highest 24 hour average flow rate to sales • First 36 wells in DeSoto Parish have averaged 23 Mmcf/d IP’s; excludes 2 being tested on restricted chokes • Consistent flow back procedure and choke management program on 36 of 38 wells • Completion procedure optimization studies currently underway 2010 EXCO Operated Haynesville IP's DeSoto Parish, LA 0 5,000 10,000 15,000 20,000 25,000 30,000 Well 25 Well 26 Well 27 Well 28 Well 29 Well 30 Well 31 Well 32 Well 33 Well 34 Well 35 Well 36 |

EXCO

Resources, Inc. 10 PPT-136-DUG Conference – 03.31.10 Choke Management Consistently restricted drawdowns, beginning with our first well • First 30 day plot on our first horizontal well • Increase choke size to a max 26/64 • Reduce to 20/64 and hold • Maximum drawdown 3,000 psi Oden Heirs 30 H-6 First 30 days to sales 0 2000 4000 6000 8000 10000 12000 14000 16000 18000 20000 22000 24000 12/3/08 12/5/08 12/7/08 12/9/08 12/11/08 12/13/08 12/15/08 12/17/08 12/19/08 12/21/08 12/23/08 12/25/08 12/27/08 12/29/08 12/31/08 1/2/09 0 20 40 60 80 100 120 CASING PRESS (psi) GAS (mcfd) CHOKE SIZE (64ths) WATER (bbls/hr) th th |

EXCO

Resources, Inc. 11 PPT-136-DUG Conference – 03.31.10 Choke Management First well with more restricted choke • Recent tests on two wells to further restrict rate and minimize drawdown • Increase choke size to a max 20/64 • Hold on 20/64 • Maximum drawdown 1,800 psi Waldron 7-5 First 30 days to sales 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 22,000 24,000 2/19/10 2/21/10 2/23/10 2/25/10 2/27/10 3/1/10 3/3/10 3/5/10 3/7/10 3/9/10 3/11/10 3/13/10 3/15/10 3/17/10 3/19/10 0 10 20 30 40 50 60 70 80 90 100 110 120 CASING PRESS (psi) GAS (mcfd) CHOKE SIZE (64ths) WATER (bbls/hr) th th |

EXCO

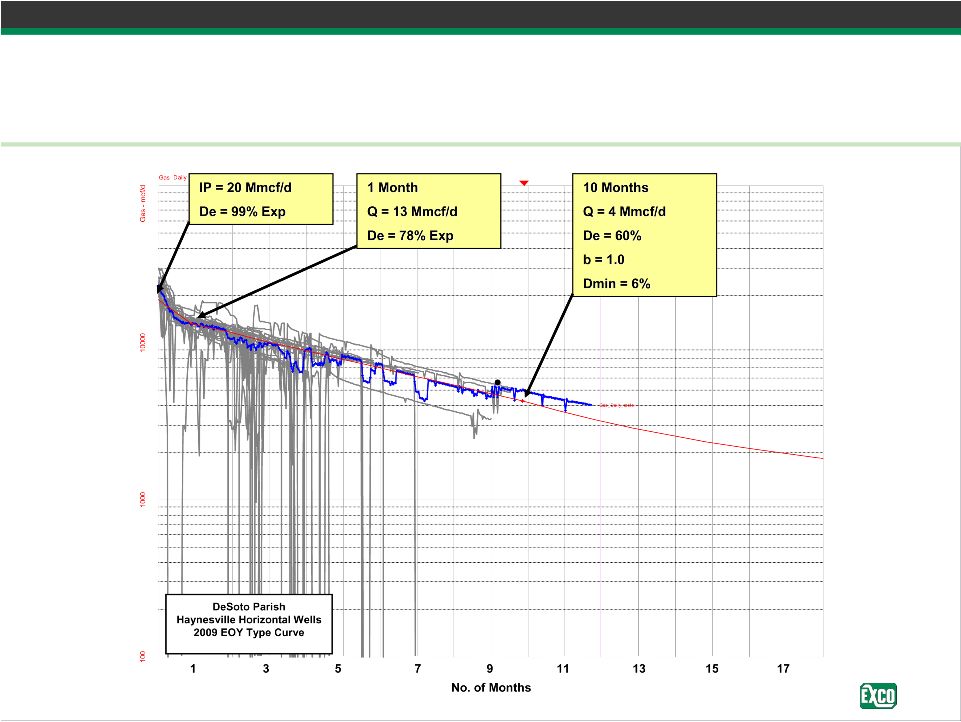

Resources, Inc. 12 PPT-136-DUG Conference – 03.31.10 2009 EOY Reserves Type Curve DeSoto Parish Haynesville PUD (EUR ~ 6.6 Bcf) |

EXCO

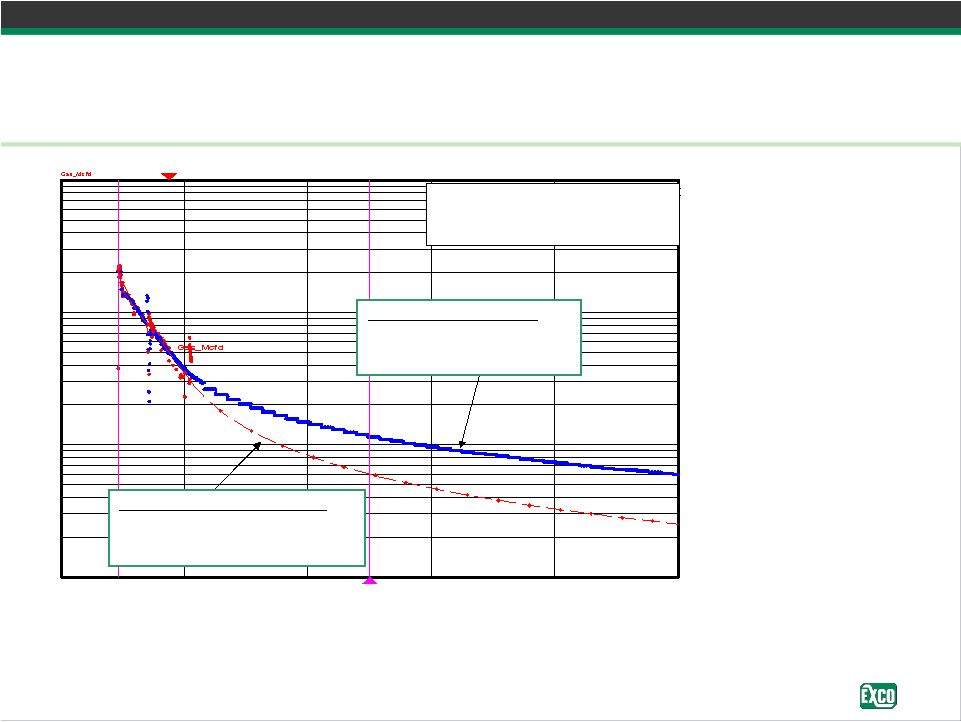

Resources, Inc. 13 PPT-136-DUG Conference – 03.31.10 First Haynesville Well - Oden 30 H-6 EUR projections – large 3P potential EXCO Resources, Inc. Oden 30 H-6 DeSoto Parish, Louisiana Current Type Curve PUD Reserves EUR = 6.6 Bcf in 30 years B factor = 1.0 10,000 1,000 100 Current Reservoir Simulation EUR = 9.5 Bcf in 30 years B factor = 1.75 • EXCO’s first operated horizontal Haynesville well • IP of 22.9 Mmcf/d December 2008 • 3.5 Bcf cumulative production to date • Currently producing 3.3 Mmcf/d • Flowing tubing pressure 1,700 psi • 20/64 choke 2010 2012 2014 2016 Year th |

EXCO

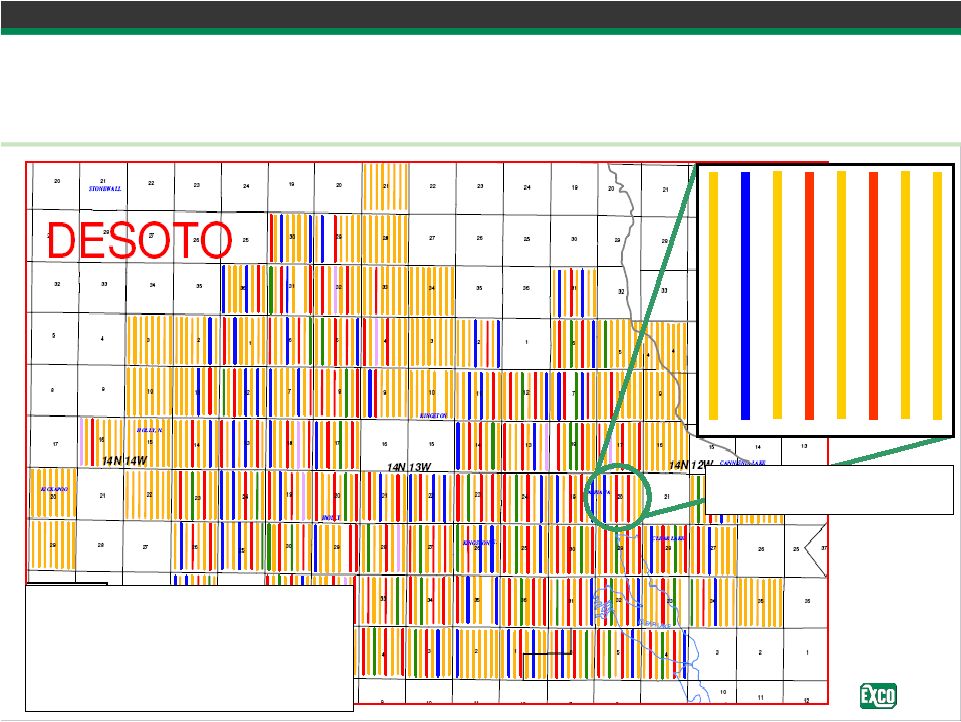

Resources, Inc. 14 PPT-136-DUG Conference – 03.31.10 Down Spacing Tests 89 contiguous sections We may soon set record for the largest capital investment per section End of Year Reserves Classification Green – Proved Developed Producing Pink_Proved Not Producing Red – Proved Undeveloped Blue – Probable Gold - Possible 1 Locations 6 and 8 Cased Locations 1, 5 and 7 Drilling Slots 1 2 3 4 5 6 7 8

|

EXCO

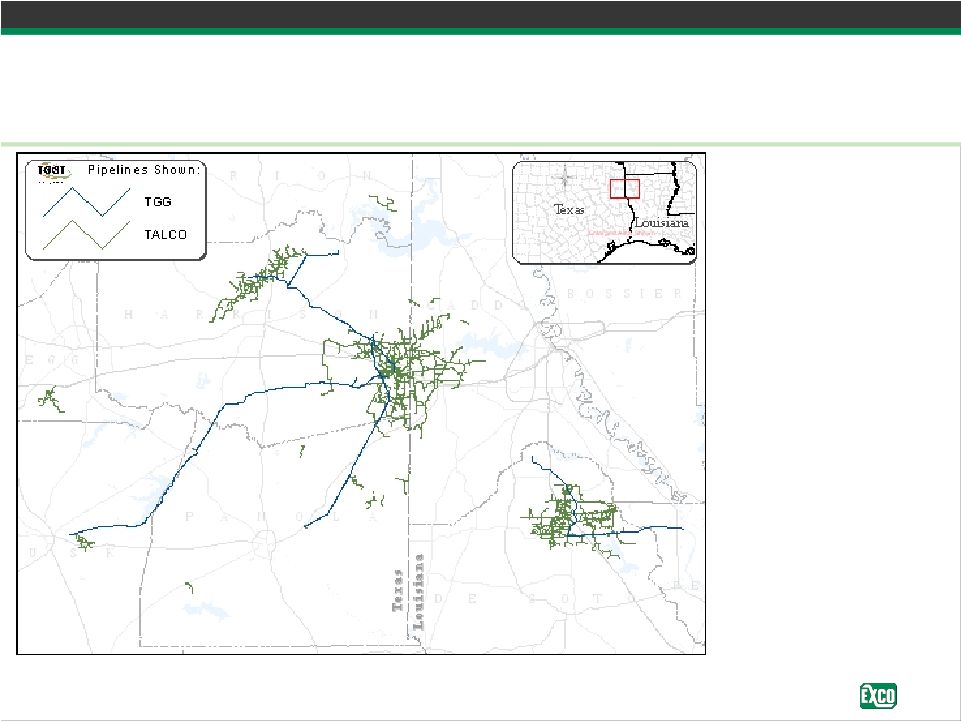

Resources, Inc. 15 PPT-136-DUG Conference – 03.31.10 EXCO Midstream Operations East Texas / North Louisiana – Positioned for growth • Completed 36 inch, 29 mile Haynesville header system • Throughput capacity in excess of 1.5 Bcf/d • Constructing 1 Bcf/d of treating capacity |