Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PS BUSINESS PARKS, INC./MD | d149539dex991.htm |

| 8-K - 8-K - PS BUSINESS PARKS, INC./MD | d149539d8k.htm |

Exhibit 99.2

ANALYSIS OF OPERATING RESULTS AND FINANCIAL CONDITION FOR

THE THREE AND SIX MONTHS ENDED JUNE 30, 2021

| Page | ||

| Consolidated Balance Sheets |

3 | |

| Consolidated Statements of Income |

5 | |

| Portfolio Summary |

7 | |

| Second Quarter Fact Sheet |

8 | |

| Same Park Cash NOI by Region and Type |

9 | |

| Analysis of Capital Expenditures |

11 | |

| Funds from Operations (FFO), Core FFO and Funds Available for Distribution (FAD) |

12 | |

| Capital Structure and Financial Condition |

14 | |

| Portfolio Operating Analysis and Statistics |

15 | |

| Lease Expirations |

19 | |

| Quarter- and Year-to-Date Production Statistics |

22 | |

| Definitions and Non-GAAP Disclosures |

24 | |

Forward-Looking Statements

When used within this supplemental information package, the words “may,” “believes,” “anticipates,” “plans,” “expects,” “seeks,” “estimates,” “intends,” and similar expressions are intended to identify “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties, and other factors, which may cause the actual results and performance of the Company to be materially different from those expressed or implied in the forward-looking statements. Such factors include the duration and severity of the COVID-19 pandemic and its impact on our business and our customers; the impact of competition from new and existing commercial facilities which could impact rents and occupancy levels at the Company’s facilities; the Company’s ability to evaluate, finance, and integrate acquired and developed properties into the Company’s existing operations; the Company’s ability to effectively compete in the markets that it does business in; the impact of the regulatory environment as well as national, state, and local laws and regulations including, without limitation, those governing REITs; security breaches, including ransomware, or a failure of the Company’s networks, systems or technology, which could adversely impact the Company’s operations or its business, customer and employee relationships or result in fraudulent payments; the impact of general economic and business conditions, including as a result of the economic fallout of the COVID-19 pandemic; rental rates and occupancy levels at the Company’s facilities; and changes in these conditions as a result of the COVID-19 pandemic, the availability of permanent capital at attractive rates, the outlook and actions of rating agencies and risks detailed from time to time in the Company’s SEC reports, including quarterly reports on Form 10-Q, reports on Form 8-K, and annual reports on Form 10-K.

2

| June 30, 2021 | December 31, 2020 | |||||||||||

| ASSETS |

||||||||||||

| Cash and cash equivalents |

$ | 115,965 | $ | 69,083 | (a | ) | ||||||

| Real estate facilities, at cost |

||||||||||||

| Land |

865,081 | 864,092 | ||||||||||

| Buildings and improvements |

2,204,461 | 2,186,621 | ||||||||||

|

|

|

|

|

|

|

|||||||

| 3,069,542 | 3,050,713 | |||||||||||

| Accumulated depreciation |

(1,219,040 | ) | (1,181,402 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| 1,850,502 | 1,869,311 | (b | ) | |||||||||

| Properties held for sale, net |

12,871 | 26,273 | ||||||||||

| Land and building held for development, net |

52,529 | 40,397 | ||||||||||

|

|

|

|

|

|

|

|||||||

| 1,915,902 | 1,935,981 | |||||||||||

| Rent receivable |

1,903 | 1,519 | (c | ) | ||||||||

| Deferred rent receivable |

37,589 | 36,788 | ||||||||||

| Other assets |

15,165 | 14,334 | (d | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Total assets |

$ | 2,086,524 | $ | 2,057,705 | ||||||||

|

|

|

|

|

|

|

|||||||

| LIABILITIES AND EQUITY |

||||||||||||

| Accrued and other liabilities |

$ | 88,989 | $ | 82,065 | (e | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

88,989 | 82,065 | ||||||||||

| Equity |

||||||||||||

| PS Business Parks, Inc.’s stockholders’ equity: |

||||||||||||

| Preferred stock |

944,750 | 944,750 | ||||||||||

| Common stock |

275 | 274 | ||||||||||

| Paid-in capital |

739,336 | 738,022 | (f | ) | ||||||||

| Accumulated earnings |

89,800 | 73,631 | (g | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Total PS Business Parks, Inc.’s stockholders’ equity |

1,774,161 | 1,756,677 | ||||||||||

| Noncontrolling interests |

223,374 | 218,963 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Total equity |

1,997,535 | 1,975,640 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities and equity |

$ | 2,086,524 | $ | 2,057,705 | ||||||||

|

|

|

|

|

|

|

|||||||

See following page for additional detail related to the tickmarks shown in the table above.

3

| (a) |

Change in cash and cash equivalents | |||||||||||||

| Beginning cash balance at December 31, 2020 |

$ | 69,083 | ||||||||||||

| Net cash provided by operating activities |

148,107 | |||||||||||||

| Net cash used in investing activities |

(1,325 | ) | ||||||||||||

| Net cash used in financing activities |

(99,900 | ) | ||||||||||||

|

|

|

| ||||||||||||

| Ending cash balance at June 30, 2021 |

$ | 115,965 | ||||||||||||

|

|

|

| ||||||||||||

| (b) |

Change in real estate facilities, at cost | |||||||||||||

| Beginning balance at December 31, 2020 |

$ | 1,869,311 | ||||||||||||

| Recurring capital improvements |

4,436 | |||||||||||||

| Tenant improvements, gross |

7,065 | |||||||||||||

| Capitalized lease commissions |

3,404 | |||||||||||||

| Nonrecurring capital improvements |

843 | |||||||||||||

| Depreciation and amortization of real estate facilities |

(44,136 | ) | ||||||||||||

| Transfer from land and building held for development, net |

9,052 | |||||||||||||

| Transfer to properties held for sale, net |

527 | |||||||||||||

|

|

|

| ||||||||||||

| Ending balance at June 30, 2021 |

$ | 1,850,502 | ||||||||||||

|

|

|

| ||||||||||||

| Increase | ||||||||||||||

| (c) |

Change in rent receivable | June 30, 2021 | December 31, 2020 | (Decrease) | ||||||||||

|

|

|

|

|

|

|

| ||||||||

| Non-government customers |

$ | 1,093 | $ | 646 | $ | 447 | ||||||||

| U.S. Government customers |

810 | 873 | (63 | ) | ||||||||||

|

|

|

|

|

|

|

| ||||||||

| $ | 1,903 | $ | 1,519 | $ | 384 | |||||||||

|

|

|

|

|

|

|

| ||||||||

| Increase | ||||||||||||||

| (d) |

Change in other assets | June 30, 2021 | December 31, 2020 | (Decrease) | ||||||||||

|

|

|

|

|

|

|

| ||||||||

| Lease intangible assets, net |

$ | 7,051 | $ | 9,058 | $ | (2,007 | ) | |||||||

| Prepaid property taxes and insurance |

5,537 | 3,121 | 2,416 | |||||||||||

| Other |

2,577 | 2,155 | 422 | |||||||||||

|

|

|

|

|

|

|

| ||||||||

| $ | 15,165 | $ | 14,334 | $ | 831 | |||||||||

|

|

|

|

|

|

|

| ||||||||

| Increase | ||||||||||||||

| (e) |

Change in accrued and other liabilities | June 30, 2021 | December 31, 2020 | (Decrease) | ||||||||||

|

|

|

|

|

|

|

| ||||||||

| Customer security deposits |

$ | 39,769 | $ | 38,457 | $ | 1,312 | ||||||||

| Accrued property taxes |

15,348 | 12,513 | 2,835 | |||||||||||

| Customer prepaid rent |

13,047 | 12,518 | 529 | |||||||||||

| Lease intangible liabilities, net |

5,618 | 6,392 | (774 | ) | ||||||||||

| Other |

15,207 | 12,185 | 3,022 | |||||||||||

|

|

|

|

|

|

|

| ||||||||

| $ | 88,989 | $ | 82,065 | $ | 6,924 | |||||||||

|

|

|

|

|

|

|

| ||||||||

| (f) |

Change in paid-in capital | |||||||||||||

| Beginning paid-in capital at December 31, 2020 |

$ | 738,022 | ||||||||||||

| Issuance costs |

(105 | ) | ||||||||||||

| Exercise of stock options |

906 | |||||||||||||

| Stock compensation expense, net |

3,715 | |||||||||||||

| Cash paid for taxes in lieu of stock upon vesting of restricted stock units |

(3,202 | ) | ||||||||||||

|

|

|

| ||||||||||||

| Ending paid-in capital at June 30, 2021 |

$ | 739,336 | ||||||||||||

|

|

|

| ||||||||||||

| (g) |

Change in accumulated earnings | |||||||||||||

| Beginning accumulated earnings at December 31, 2020 |

$ | 73,631 | ||||||||||||

| Net income |

98,052 | |||||||||||||

| Distributions to preferred stockholders |

(24,093 | ) | ||||||||||||

| Distributions to common stockholders |

(57,790 | ) | ||||||||||||

|

|

|

| ||||||||||||

| Ending accumulated earnings at June 30, 2021 |

$ | 89,800 | ||||||||||||

|

|

|

| ||||||||||||

4

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||||||

| June 30, | June 30, | |||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||

| Rental income |

$ | 109,364 | $ | 100,559 | $ | 217,411 | $ | 206,775 | (a) | |||||||||||

| Expenses: |

||||||||||||||||||||

| Cost of operations |

31,849 | 30,131 | 65,067 | 61,394 | (b) | |||||||||||||||

| Depreciation and amortization |

22,514 | 22,963 | 45,499 | 49,582 | ||||||||||||||||

| General and administrative |

4,799 | 3,004 | 9,181 | 6,327 | (c) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

59,162 | 56,098 | 119,747 | 117,303 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

| Interest and other income |

923 | 225 | 1,179 | 782 | (d) | |||||||||||||||

| Interest and other expense |

(268 | ) | (203 | ) | (479 | ) | (364 | ) | (e) | |||||||||||

| Gain on sale of real estate facility |

19,193 | — | 19,193 | 19,621 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

70,050 | 44,483 | 117,557 | 109,511 | ||||||||||||||||

| Allocation to noncontrolling interests |

(12,094 | ) | (6,795 | ) | (19,505 | ) | (17,887 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

| Net income allocable to PS Business Parks, Inc. |

57,956 | 37,688 | 98,052 | 91,624 | ||||||||||||||||

| Allocation to preferred stockholders |

(12,047 | ) | (12,047 | ) | (24,093 | ) | (24,093 | ) | ||||||||||||

| Allocation to restricted stock unit holders |

(314 | ) | (119 | ) | (478 | ) | (394 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

| Net income allocable to common stockholders |

$ | 45,595 | $ | 25,522 | $ | 73,481 | $ | 67,137 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per share of common stock |

||||||||||||||||||||

| Basic |

$ | 1.66 | $ | 0.93 | $ | 2.67 | $ | 2.44 | ||||||||||||

| Diluted |

$ | 1.65 | $ | 0.93 | $ | 2.66 | $ | 2.44 | ||||||||||||

| Weighted average common stock outstanding |

||||||||||||||||||||

| Basic |

27,531 | 27,479 | 27,513 | 27,464 | ||||||||||||||||

| Diluted |

27,632 | 27,560 | 27,611 | 27,557 | ||||||||||||||||

See following page for additional detail related to the tickmarks shown in the table above.

5

| For The Three Months Ended | Increase | For the Six Months Ended | Increase | |||||||||||||||||||||||

| (a) | Rental income: | June 30, 2021 | June 30, 2020 | (Decrease) | June 30, 2021 | June 30, 2020 | (Decrease) | |||||||||||||||||||

| Same Park (1) (2) |

$ | 101,471 | $ | 91,638 | $ | 9,833 | $ | 201,029 | $ | 190,015 | $ | 11,014 | ||||||||||||||

| Same Park non-cash rental income (1) (3) |

30 | 2,440 | (2,410) | 467 | 3,193 | (2,726) | ||||||||||||||||||||

| Non-Same Park (1) (2) |

3,706 | 1,911 | 1,795 | 6,605 | 4,189 | 2,416 | ||||||||||||||||||||

| Non-Same Park non-cash rental income (1) (3) |

220 | 156 | 64 | 1,090 | 299 | 791 | ||||||||||||||||||||

| Multifamily |

2,248 | 2,488 | (240) | 4,575 | 5,048 | (473) | ||||||||||||||||||||

| Rental income from assets sold or held for sale (4) |

1,689 | 1,926 | (237) | 3,645 | 4,031 | (386) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| $ | 109,364 | $ | 100,559 | $ | 8,805 | $ | 217,411 | $ | 206,775 | $ | 10,636 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| For The Three Months Ended | Increase | For the Six Months Ended | Increase | |||||||||||||||||||||||

| (b) | Cost of operations: | June 30, 2021 | June 30, 2020 | (Decrease) | June 30, 2021 | June 30, 2020 | (Decrease) | |||||||||||||||||||

| Same Park (1) |

$ | 28,330 | $ | 27,181 | $ | 1,149 | $ | 58,014 | $ | 55,561 | $ | 2,453 | ||||||||||||||

| Same Park non-cash expense (1) (5) |

461 | 256 | 205 | 896 | 519 | 377 | ||||||||||||||||||||

| Non-Same Park (1) |

1,187 | 878 | 309 | 2,340 | 1,707 | 633 | ||||||||||||||||||||

| Non-Same Park non-cash expense (1) (5) |

13 | 6 | 7 | 26 | 12 | 14 | ||||||||||||||||||||

| Multifamily |

1,177 | 1,002 | 175 | 2,244 | 2,018 | 226 | ||||||||||||||||||||

| Operating expenses from assets sold or held for sale (4) |

681 | 808 | (127) | 1,547 | 1,577 | (30) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| $ | 31,849 | $ | 30,131 | $ | 1,718 | $ | 65,067 | $ | 61,394 | $ | 3,673 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| For The Three Months Ended | Increase | For the Six Months Ended | Increase | |||||||||||||||||||||||

| (c) | General and administrative expenses: | June 30, 2021 | June 30, 2020 | (Decrease) | June 30, 2021 | June 30, 2020 | (Decrease) | |||||||||||||||||||

| Compensation expense |

$ | 1,610 | $ | 1,424 | $ | 186 | $ | 3,253 | $ | 3,177 | $ | 76 | ||||||||||||||

| Stock compensation expense |

1,820 | 665 | 1,155 | 3,144 | 1,333 | 1,811 | ||||||||||||||||||||

| Professional fees and other |

1,369 | 915 | 454 | 2,784 | 1,817 | 967 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| $ | 4,799 | $ | 3,004 | $ | 1,795 | $ | 9,181 | $ | 6,327 | $ | 2,854 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| For The Three Months Ended | Increase | For the Six Months Ended | Increase | |||||||||||||||||||||||

| (d) | Interest and other income: | June 30, 2021 | June 30, 2020 | (Decrease) | June 30, 2021 | June 30, 2020 | (Decrease) | |||||||||||||||||||

| Management fee income |

$ | 65 | $ | 63 | $ | 2 | $ | 133 | $ | 133 | $ | - | ||||||||||||||

| Interest income |

4 | 42 | (38) | 8 | 345 | (337) | ||||||||||||||||||||

| Other income |

854 | 120 | 734 | 1,038 | 304 | 734 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| $ | 923 | $ | 225 | $ | 698 | $ | 1,179 | $ | 782 | $ | 397 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| For The Three Months Ended | Increase | For the Six Months Ended | Increase | |||||||||||||||||||||||

| (e) | Interest and other expense: | June 30, 2021 | June 30, 2020 | (Decrease) | June 30, 2021 | June 30, 2020 | (Decrease) | |||||||||||||||||||

| Interest expense |

$ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||

| Credit facilities fees & other charges |

(268) | (203) | (65) | (479) | (364) | (115) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| $ | (268) | $ | (203) | $ | (65) | $ | (479) | $ | (364) | $ | (115) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Refer to page 24, Definitions and Non-GAAP Disclosures, for the definitions of Same Park and Non-Same Park. |

| (2) | Same Park rental income is presented net of (a) accounts receivable write-offs of $0.0 and $1.1 million for the three months ended June 30, 2021 and 2020, respectively, and $0.0 and $1.2 million for the six months ended June 30, 2021 and 2020, respectively, and (b) rent deferrals and abatements of $0.2 million and $4.5 million for the three months ended June 30, 2021 and 2020, respectively, and $0.5 million and $4.5 million for the six months ended June 30, 2021 and 2020, respectively. Non-Same Park rental income is presented net of (a) accounts receivable write-offs of $0.0 for the three and six months ended June 30, 2021 and 2020, and (b) rent deferrals and abatements of $0.0 for the three and six months ended June 30, 2021 and 2020. |

| (3) | Non-cash rental income represents amortization of deferred rent receivable (net of write-offs), in-place intangibles, tenant improvement reimbursements, and lease incentive. Same Park non-cash rental income is presented net of deferred rent receivable write-offs of $0.1 million and $2.4 million for the three months ended June 30, 2021 and 2020, respectively, and $0.2 million and $2.4 million for the six months ended June 30, 2021 and 2020, respectively. Non-Same Park non-cash rental income is presented net of deferred rent receivable write-offs of $0.0 for the three and six months ended June 30, 2021 and 2020. |

| (4) | Amounts shown for the three and six months ended June 30, 2021 include operating results attributable to assets held for sale comprising 244,000 square feet and an asset sold in June 2021 comprising 198,000 square feet. Amounts shown for the three months ended June 30, 2020 include operating results attributable to assets held for sale comprising 244,000 square feet, the asset sold in June 2021 comprising 198,000 square feet, and an asset sold in September 2020 comprising 40,000 square feet. Amounts shown for the six months ended June 30, 2020 include operating results attributable to assets held for sale comprising 244,000 square feet, the asset sold in June 2021 comprising 198,000 square feet, the asset sold in September 2020 comprising 40,000 square feet, and an asset sold in January 2020 comprising 113,000 square feet. |

| (5) | Non-cash expense represents stock compensation expense attributable to employees whose compensation expense is recorded in costs of operations. |

6

| PROPERTY INFORMATION | ||||||||||||||||||||||||

| For The Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | |||||||||||||||||||

| Total Portfolio (1) |

||||||||||||||||||||||||

| Total rentable square footage at period end |

27,369,000 | 27,040,000 | 1.2% | 27,369,000 | 27,040,000 | 1.2% | ||||||||||||||||||

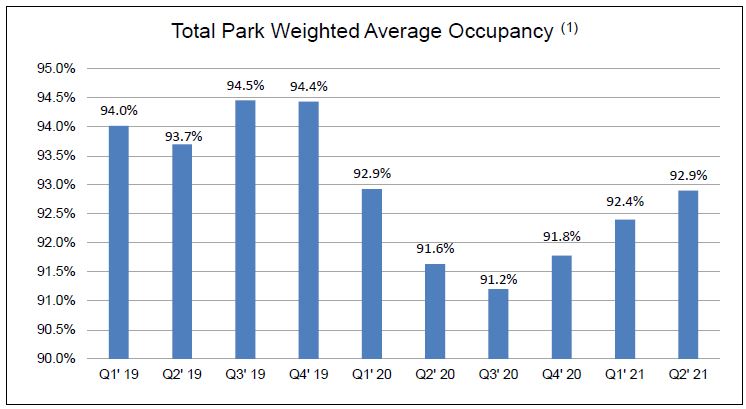

| Weighted average occupancy |

92.9% | 91.6% | 1.4% | 92.6% | 92.3% | 0.3% | ||||||||||||||||||

| Period end occupancy |

93.5% | 91.8% | 1.9% | 93.5% | 91.8% | 1.9% | ||||||||||||||||||

| Cash rental income per occupied square foot (2) (3) |

||||||||||||||||||||||||

| Industrial |

$ | 14.26 | $ | 12.61 | 13.1% | $ | 14.05 | $ | 13.04 | 7.7% | ||||||||||||||

| Flex |

$ | 20.30 | $ | 18.36 | 10.6% | $ | 20.06 | $ | 18.87 | 6.3% | ||||||||||||||

| Office |

$ | 24.67 | $ | 23.95 | 3.0% | $ | 24.86 | $ | 24.60 | 1.1% | ||||||||||||||

| Total cash rental income per occupied square foot |

$ | 16.55 | $ | 15.10 | 9.6% | $ | 16.39 | $ | 15.56 | 5.3% | ||||||||||||||

| Cash rental income per available foot (2) (3) |

||||||||||||||||||||||||

| Industrial |

$ | 13.56 | $ | 11.54 | 17.5% | $ | 13.29 | $ | 12.04 | 10.4% | ||||||||||||||

| Flex |

$ | 18.10 | $ | 16.83 | 7.5% | $ | 17.97 | $ | 17.43 | 3.1% | ||||||||||||||

| Office |

$ | 21.34 | $ | 22.08 | (3.4%) | $ | 21.55 | $ | 22.64 | (4.8%) | ||||||||||||||

| Total cash rental income per available foot |

$ | 15.37 | $ | 13.84 | 11.1% | $ | 15.19 | $ | 14.37 | 5.7% | ||||||||||||||

| Same Park Portfolio (2) |

||||||||||||||||||||||||

| Total rentable square footage at period end |

26,271,000 | 26,271,000 | — | 26,271,000 | 26,271,000 | — | ||||||||||||||||||

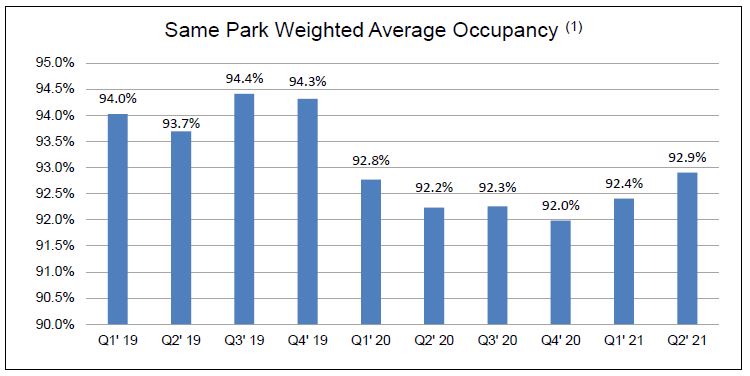

| Weighted average occupancy |

92.9% | 92.2% | 0.8% | 92.7% | 92.5% | 0.2% | ||||||||||||||||||

| Period end occupancy |

93.5% | 92.8% | 0.8% | 93.5% | 92.8% | 0.8% | ||||||||||||||||||

| Cash rental income per occupied square foot (2) (4) |

||||||||||||||||||||||||

| Industrial |

$ | 14.27 | $ | 12.60 | 13.3% | $ | 14.13 | $ | 13.09 | 7.9% | ||||||||||||||

| Flex |

$ | 20.28 | $ | 18.33 | 10.6% | $ | 20.03 | $ | 18.84 | 6.3% | ||||||||||||||

| Office |

$ | 24.67 | $ | 23.95 | 3.0% | $ | 24.86 | $ | 24.60 | 1.1% | ||||||||||||||

| Total cash rental income per occupied square foot |

$ | 16.63 | $ | 15.13 | 9.9% | $ | 16.52 | $ | 15.64 | 5.6% | ||||||||||||||

| Cash rental income per available foot (2) (4) |

||||||||||||||||||||||||

| Industrial |

$ | 13.59 | $ | 11.64 | 16.8% | $ | 13.38 | $ | 12.12 | 10.4% | ||||||||||||||

| Flex |

$ | 18.07 | $ | 16.82 | 7.4% | $ | 17.94 | $ | 17.41 | 3.0% | ||||||||||||||

| Office |

$ | 21.34 | $ | 22.08 | (3.4%) | $ | 21.55 | $ | 22.64 | (4.8%) | ||||||||||||||

| Total cash rental income per available foot |

$ | 15.45 | $ | 13.95 | 10.8% | $ | 15.30 | $ | 14.47 | 5.7% | ||||||||||||||

| Non-Same Park Portfolio (2) |

||||||||||||||||||||||||

| Total rentable square footage at period end |

1,098,000 | 769,000 | 42.8% | 1,098,000 | 769,000 | 42.8% | ||||||||||||||||||

| Weighted average occupancy |

92.0% | 71.4% | 28.9% | 92.3% | 84.9% | 8.7% | ||||||||||||||||||

| Period end occupancy |

93.0% | 55.2% | 68.5% | 93.0% | 55.2% | 68.5% | ||||||||||||||||||

| Cash rental income per occupied square foot (2) (5) |

||||||||||||||||||||||||

| Industrial |

$ | 14.09 | $ | 12.93 | 9.0% | $ | 12.63 | $ | 11.86 | 6.5% | ||||||||||||||

| Flex |

$ | 21.84 | $ | 20.87 | 4.6% | $ | 22.27 | $ | 21.10 | 5.5% | ||||||||||||||

| Office |

$ | — | $ | — | — | $ | — | $ | — | — | ||||||||||||||

| Total cash rental income per occupied square foot |

$ | 14.65 | $ | 13.92 | 5.2% | $ | 13.34 | $ | 12.87 | 3.7% | ||||||||||||||

| Cash rental income per available foot (2) (5) |

||||||||||||||||||||||||

| Industrial |

$ | 12.95 | $ | 8.98 | 44.2% | $ | 11.66 | $ | 10.01 | 16.5% | ||||||||||||||

| Flex |

$ | 20.46 | $ | 18.23 | 12.2% | $ | 20.58 | $ | 18.96 | 8.5% | ||||||||||||||

| Office |

$ | — | $ | — | — | $ | — | $ | — | — | ||||||||||||||

| Total cash rental income per available foot |

$ | 13.49 | $ | 9.93 | 35.9% | $ | 12.32 | $ | 10.94 | 12.6% | ||||||||||||||

| Multifamily Portfolio |

||||||||||||||||||||||||

| Number of units |

395 | 395 | — | 395 | 395 | — | ||||||||||||||||||

| Weighted average occupancy |

94.6% | 91.7% | 3.1% | 94.4% | 93.3% | 1.2% | ||||||||||||||||||

| Period end occupancy |

94.9% | 90.6% | 4.8% | 94.9% | 90.6% | 4.8% | ||||||||||||||||||

| (1) | Excludes multifamily assets, assets held for sale comprising 244,000 square feet, an asset sold in June 2021 comprising 198,000 square feet, and assets sold in 2020 comprising 153,000 square feet for the periods shown. |

| (2) | Refer to page 24, Definitions and Non-GAAP Disclosures, for the definitions of Cash Rental Income per Available Foot, Cash Rental Income per Occupied Square Foot, Same Park, and Non-Same Park. |

| (3) | Included in the calculation of Total Park Cash Rental Income per Occupied Square Feet and Cash Rental Income per Available foot is (a) lease buyout income of $0.3 million for both of the three months ended June 30, 2021 and 2020, and $0.7 million and $0.5 million for the six months ended June 30, 2021 and 2020, respectively, (b) accounts receivable write-offs of $0.0 and $1.1 million for the three months ended June 30, 2021 and 2020, respectively, and $0.0 and $1.2 million for the six months ended June 30, 2021 and 2020, respectively, and (c) rent deferrals and abatements of $0.2 million and $4.5 million for the three months ended June 30, 2021 and 2020, respectively, and $0.5 million and $4.5 million for the six months ended June 30, 2021 and 2020, respectively. |

| (4) | Included in the calculation of Same Park Cash Rental Income per Occupied Square Feet and Cash Rental Income per Available foot is (a) lease buyout income of $0.3 million for both of the three months ended June 30, 2021 and 2020, and $0.7 million and $0.5 million for the six months ended June 30, 2021 and 2020, respectively, (b) accounts receivable write-offs of $0.0 and $1.1 million for the three months ended June 30, 2021 and 2020, respectively, and $0.0 and $1.2 million for the six months ended June 30, 2021 and 2020, respectively, and (c) rent deferrals and abatements of $0.2 million and $4.5 million for the three months ended June 30, 2021 and 2020, respectively, and $0.5 million and $4.5 million for the six months ended June 30, 2021 and 2020, respectively. |

| (5) | Included in the calculation of Non-Same Park Cash Rental Income per Occupied Square Feet and Cash Rental Income per Available foot is (a) lease buyout income of $0.0 for both of the three and six months ended June 30, 2021 and 2020, (b) accounts receivable write-offs of $0.0 for both of the three and six months ended June 30, 2021 and 2020, and (c) rent deferrals and abatements of $0.0 for both of the three and six months ended June 30, 2021 and 2020. |

7

| NET OPERATING INCOME | ||||||||||||||||||||||||

| For The Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | |||||||||||||||||||

| Rental income |

||||||||||||||||||||||||

| Same Park (1) (2) (3) |

$ | 101,501 | $ | 94,078 | 7.9% | $ | 201,496 | $ | 193,208 | 4.3% | ||||||||||||||

| Non-Same Park (1) |

3,926 | 2,067 | 89.9% | 7,695 | 4,488 | 71.5% | ||||||||||||||||||

| Multifamily |

2,248 | 2,488 | (9.6%) | 4,575 | 5,048 | (9.4%) | ||||||||||||||||||

| Assets sold or held for sale |

1,689 | 1,926 | (12.3%) | 3,645 | 4,031 | (9.6%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total rental income |

109,364 | 100,559 | 8.8% | 217,411 | 206,775 | 5.1% | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Adjusted cost of operations (1) (5) |

||||||||||||||||||||||||

| Same Park (1) (6) |

28,330 | 27,181 | 4.2% | 58,014 | 55,561 | 4.4% | ||||||||||||||||||

| Non-Same Park (1) |

1,187 | 878 | 35.2% | 2,340 | 1,707 | 37.1% | ||||||||||||||||||

| Multifamily |

1,177 | 1,002 | 17.5% | 2,244 | 2,018 | 11.2% | ||||||||||||||||||

| Assets sold or held for sale |

674 | 804 | (16.2%) | 1,532 | 1,568 | (2.3%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

31,368 | 29,865 | 5.0% | 64,130 | 60,854 | 5.4% | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net operating income |

||||||||||||||||||||||||

| Same Park (1) |

73,171 | 66,897 | 9.4% | 143,482 | 137,647 | 4.2% | ||||||||||||||||||

| Non-Same Park (1) |

2,739 | 1,189 | 130.4% | 5,355 | 2,781 | 92.6% | ||||||||||||||||||

| Multifamily |

1,071 | 1,486 | (27.9%) | 2,331 | 3,030 | (23.1%) | ||||||||||||||||||

| Assets sold or held for sale |

1,015 | 1,122 | (9.5%) | 2,113 | 2,463 | (14.2%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total net operating income |

$ | 77,996 | $ | 70,694 | 10.3% | $ | 153,281 | $ | 145,921 | 5.0% | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| CASH NET OPERATING INCOME | ||||||||||||||||||||||||

| For The Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | |||||||||||||||||||

| Cash rental income (1) (5) |

||||||||||||||||||||||||

| Same Park (1) (2) (4) |

$ | 101,471 | $ | 91,638 | 10.7% | $ | 201,029 | $ | 190,015 | 5.8% | ||||||||||||||

| Non-Same Park (1) |

3,706 | 1,911 | 93.9% | 6,605 | 4,189 | 57.7% | ||||||||||||||||||

| Multifamily |

2,248 | 2,487 | (9.6%) | 4,575 | 5,046 | (9.3%) | ||||||||||||||||||

| Assets sold or held for sale |

1,756 | 1,777 | (1.2%) | 3,712 | 3,715 | (0.1%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total cash rental income |

109,181 | 97,813 | 11.6% | 215,921 | 202,965 | 6.4% | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Adjusted cost of operations (1) (5) |

||||||||||||||||||||||||

| Same Park (1) (6) |

28,330 | 27,181 | 4.2% | 58,014 | 55,561 | 4.4% | ||||||||||||||||||

| Non-Same Park (1) |

1,187 | 878 | 35.2% | 2,340 | 1,707 | 37.1% | ||||||||||||||||||

| Multifamily |

1,177 | 1,002 | 17.5% | 2,244 | 2,018 | 11.2% | ||||||||||||||||||

| Assets sold or held for sale |

674 | 804 | (16.2%) | 1,532 | 1,568 | (2.3%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total adjusted cost of operations |

31,368 | 29,865 | 5.0% | 64,130 | 60,854 | 5.4% | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Cash net operating income |

||||||||||||||||||||||||

| Same Park (1) |

73,141 | 64,457 | 13.5% | 143,015 | 134,454 | 6.4% | ||||||||||||||||||

| Non-Same Park (1) |

2,519 | 1,033 | 143.9% | 4,265 | 2,482 | 71.8% | ||||||||||||||||||

| Multifamily |

1,071 | 1,485 | (27.9%) | 2,331 | 3,028 | (23.0%) | ||||||||||||||||||

| Assets sold or held for sale |

1,082 | 973 | 11.2% | 2,180 | 2,147 | 1.5% | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total cash net operating income |

$ | 77,813 | $ | 67,948 | 14.5% | $ | 151,791 | $ | 142,111 | 6.8% | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION FOR REAL ESTATE (EBITDAre) (1) | ||||||||||||||||||||||||

| For The Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | |||||||||||||||||||

| Net income | $ | 70,050 | $ | 44,483 | 57.5% | $ | 117,557 | $ | 109,511 | 7.3% | ||||||||||||||

| Net interest (income) expense | 132 | 94 | 40.4% | 264 | (72) | 466.7% | ||||||||||||||||||

| Depreciation and amortization | 22,514 | 22,963 | (2.0%) | 45,499 | 49,582 | (8.2%) | ||||||||||||||||||

| Gain on sale of real estate facilities and development rights | (19,193) | — | (100.0%) | (19,193) | (19,621) | (2.2%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| EBITDAre | $ | 73,503 | $ | 67,540 | 8.8% | $ | 144,127 | $ | 139,400 | 3.4% | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Refer to page 24, Definition and Non-GAAP Disclosures, for the definitions of Same Park, Non-Same Park, Cash Rental Income, Adjusted Cost of Operations, and EBITDAre. |

| (2) | Same Park rental income and cash rental income include lease buyout income of $0.3 million for both of the three months ended June 30, 2021 and 2020, and $0.7 million and $0.5 million for the six months ended June 30, 2021 and 2020, respectively. |

| (3) | Same Park rental income is presented net of (a) accounts receivable write-offs of $0.0 and $1.1 million for the three months ended June 30, 2021 and 2020, respectively, and $0.0 and $1.2 million for the six months ended June 30, 2021 and 2020, respectively, and (b) deferred rent receivable write-offs of $0.1 million and $2.4 million for the three months ended June 30, 2021 and 2020, respectively, and $0.2 million and $2.4 million for the six months ended June 30, 2021 and 2020, respectively. |

| (4) | Same Park cash rental income is presented net of (a) accounts receivable write-offs of $0.0 and $1.1 million for the three months ended June 30, 2021 and 2020, respectively, and $0.0 and $1.2 million for the six months ended June 30, 2021 and 2020, respectively, and (b) rent deferrals and abatements of $0.2 million and $4.5 million for the three months ended June 30, 2021 and 2020, respectively, and $0.5 million and $4.5 million for the six months ended June 30, 2021 and 2020, respectively. |

| (5) | Refer to page 6 for a reconciliation of cash rental income to rental income and adjusted cost of operations to cost of operations as reported on our GAAP statements of income. |

| (6) | The table below details Same Park Adjusted Cost of Operations: |

| For The Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | |||||||||||||||||||

| Cost of operations |

||||||||||||||||||||||||

| Property taxes |

$ | 11,155 | $ | 11,102 | 0.5% | $ | 22,579 | $ | 22,158 | 1.9% | ||||||||||||||

| Utilities |

4,323 | 4,027 | 7.4% | 8,960 | 8,999 | (0.4%) | ||||||||||||||||||

| Repairs and maintenance |

5,805 | 5,586 | 3.9% | 11,274 | 10,950 | 3.0% | ||||||||||||||||||

| Compensation |

4,114 | 3,886 | 5.9% | 8,394 | 8,156 | 2.9% | ||||||||||||||||||

| Snow removal |

9 | — | 100.0% | 1,028 | 71 | 1,347.9% | ||||||||||||||||||

| Property insurance |

1,171 | 856 | 36.8% | 2,349 | 1,735 | 35.4% | ||||||||||||||||||

| Other expenses |

1,753 | 1,724 | 1.7% | 3,430 | 3,492 | (1.8%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total cost of operations |

$ | 28,330 | $ | 27,181 | 4.2% | $ | 58,014 | $ | 55,561 | 4.4% | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

8

| For the Three Months Ended | ||||||||||||||||||||||||||||||||||||

| June 30, 2021 | June 30, 2020 | Total | ||||||||||||||||||||||||||||||||||

| Industrial | Flex | Office | Total | Industrial | Flex | Office | Total | % Change | ||||||||||||||||||||||||||||

| Cash rental income (1) |

||||||||||||||||||||||||||||||||||||

| Northern California |

$ | 23,469 | $ | 2,433 | $ | 2,691 | $ | 28,593 | $ | 20,304 | $ | 2,097 | $ | 3,053 | $ | 25,454 | 12.3% | |||||||||||||||||||

| Southern California |

9,780 | 5,214 | 208 | 15,202 | 7,711 | 4,346 | 201 | 12,258 | 24.0% | |||||||||||||||||||||||||||

| Dallas |

3,154 | 4,823 | — | 7,977 | 2,694 | 5,253 | — | 7,947 | 0.4% | |||||||||||||||||||||||||||

| Austin |

2,260 | 6,392 | — | 8,652 | 1,801 | 5,941 | — | 7,742 | 11.8% | |||||||||||||||||||||||||||

| Northern Virginia |

4,987 | 5,565 | 8,543 | 19,095 | 4,808 | 5,105 | 8,576 | 18,489 | 3.3% | |||||||||||||||||||||||||||

| South Florida |

11,494 | 485 | 41 | 12,020 | 9,779 | 445 | 25 | 10,249 | 17.3% | |||||||||||||||||||||||||||

| Seattle |

3,207 | 1,738 | 136 | 5,081 | 2,816 | 1,616 | 161 | 4,593 | 10.6% | |||||||||||||||||||||||||||

| Suburban Maryland |

1,064 | — | 3,787 | 4,851 | 983 | — | 3,923 | 4,906 | (1.1%) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Total |

59,415 | 26,650 | 15,406 | 101,471 | 50,896 | 24,803 | 15,939 | 91,638 | 10.7% | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Adjusted cost of operations (1) |

||||||||||||||||||||||||||||||||||||

| Northern California |

4,812 | 680 | 754 | 6,246 | 4,599 | 690 | 763 | 6,052 | 3.2% | |||||||||||||||||||||||||||

| Southern California |

2,376 | 1,209 | 81 | 3,666 | 2,098 | 1,169 | 82 | 3,349 | 9.5% | |||||||||||||||||||||||||||

| Dallas |

1,104 | 2,101 | — | 3,205 | 978 | 2,218 | — | 3,196 | 0.3% | |||||||||||||||||||||||||||

| Austin |

769 | 2,372 | — | 3,141 | 736 | 2,227 | — | 2,963 | 6.0% | |||||||||||||||||||||||||||

| Northern Virginia |

1,446 | 1,586 | 2,946 | 5,978 | 1,447 | 1,462 | 3,022 | 5,931 | 0.8% | |||||||||||||||||||||||||||

| South Florida |

3,005 | 151 | 19 | 3,175 | 2,819 | 124 | 17 | 2,960 | 7.3% | |||||||||||||||||||||||||||

| Seattle |

801 | 410 | 60 | 1,271 | 741 | 381 | 49 | 1,171 | 8.5% | |||||||||||||||||||||||||||

| Suburban Maryland |

355 | — | 1,293 | 1,648 | 318 | — | 1,241 | 1,559 | 5.7% | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Total |

14,668 | 8,509 | 5,153 | 28,330 | 13,736 | 8,271 | 5,174 | 27,181 | 4.2% | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Cash NOI (1) |

||||||||||||||||||||||||||||||||||||

| Northern California |

18,657 | 1,753 | 1,937 | 22,347 | 15,705 | 1,407 | 2,290 | 19,402 | 15.2% | |||||||||||||||||||||||||||

| Southern California |

7,404 | 4,005 | 127 | 11,536 | 5,613 | 3,177 | 119 | 8,909 | 29.5% | |||||||||||||||||||||||||||

| Dallas |

2,050 | 2,722 | — | 4,772 | 1,716 | 3,035 | — | 4,751 | 0.4% | |||||||||||||||||||||||||||

| Austin |

1,491 | 4,020 | — | 5,511 | 1,065 | 3,714 | — | 4,779 | 15.3% | |||||||||||||||||||||||||||

| Northern Virginia |

3,541 | 3,979 | 5,597 | 13,117 | 3,361 | 3,643 | 5,554 | 12,558 | 4.5% | |||||||||||||||||||||||||||

| South Florida |

8,489 | 334 | 22 | 8,845 | 6,960 | 321 | 8 | 7,289 | 21.3% | |||||||||||||||||||||||||||

| Seattle |

2,406 | 1,328 | 76 | 3,810 | 2,075 | 1,235 | 112 | 3,422 | 11.3% | |||||||||||||||||||||||||||

| Suburban Maryland |

709 | — | 2,494 | 3,203 | 665 | — | 2,682 | 3,347 | (4.3%) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Total |

$ | 44,747 | $ | 18,141 | $ | 10,253 | $ | 73,141 | $ | 37,160 | $ | 16,532 | $ | 10,765 | $ | 64,457 | 13.5% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| (1) | Refer to page 24, Definitions and Non-GAAP Disclosures, for the definitions of Same Park, Cash Rental Income, Adjusted Cost of Operations, and Cash NOI. |

9

| For the Six Months Ended | ||||||||||||||||||||||||||||||||||||

| June 30, 2021 | June 30, 2020 | Total | ||||||||||||||||||||||||||||||||||

| Industrial | Flex | Office | Total | Industrial | Flex | Office | Total | % Change | ||||||||||||||||||||||||||||

| Cash rental income (1) |

||||||||||||||||||||||||||||||||||||

| Northern California |

$ | 45,845 | $ | 4,834 | $ | 5,296 | $ | 55,975 | $ | 41,344 | $ | 4,676 | $ | 6,180 | $ | 52,200 | 7.2% | |||||||||||||||||||

| Southern California |

19,210 | 10,155 | 400 | 29,765 | 16,714 | 9,244 | 388 | 26,346 | 13.0% | |||||||||||||||||||||||||||

| Dallas |

6,220 | 9,647 | — | 15,867 | 5,862 | 10,683 | — | 16,545 | (4.1%) | |||||||||||||||||||||||||||

| Austin |

4,465 | 12,820 | — | 17,285 | 3,985 | 12,041 | — | 16,026 | 7.9% | |||||||||||||||||||||||||||

| Northern Virginia |

10,050 | 10,996 | 17,533 | 38,579 | 9,823 | 10,422 | 17,665 | 37,910 | 1.8% | |||||||||||||||||||||||||||

| South Florida |

22,751 | 972 | 83 | 23,806 | 20,387 | 947 | 57 | 21,391 | 11.3% | |||||||||||||||||||||||||||

| Seattle |

6,238 | 3,492 | 271 | 10,001 | 5,820 | 3,351 | 347 | 9,518 | 5.1% | |||||||||||||||||||||||||||

| Suburban Maryland |

2,212 | — | 7,539 | 9,751 | 2,025 | — | 8,054 | 10,079 | (3.3%) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Total |

116,991 | 52,916 | 31,122 | 201,029 | 105,960 | 51,364 | 32,691 | 190,015 | 5.8% | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Adjusted cost of operations (1) |

||||||||||||||||||||||||||||||||||||

| Northern California |

9,740 | 1,354 | 1,496 | 12,590 | 9,336 | 1,338 | 1,544 | 12,218 | 3.0% | |||||||||||||||||||||||||||

| Southern California |

4,693 | 2,509 | 156 | 7,358 | 4,397 | 2,522 | 155 | 7,074 | 4.0% | |||||||||||||||||||||||||||

| Dallas |

2,207 | 4,107 | — | 6,314 | 1,989 | 4,252 | — | 6,241 | 1.2% | |||||||||||||||||||||||||||

| Austin |

1,568 | 4,788 | — | 6,356 | 1,481 | 4,441 | — | 5,922 | 7.3% | |||||||||||||||||||||||||||

| Northern Virginia |

3,093 | 3,386 | 6,538 | 13,017 | 2,930 | 2,968 | 6,496 | 12,394 | 5.0% | |||||||||||||||||||||||||||

| South Florida |

6,029 | 291 | 39 | 6,359 | 5,663 | 258 | 31 | 5,952 | 6.8% | |||||||||||||||||||||||||||

| Seattle |

1,613 | 820 | 130 | 2,563 | 1,544 | 801 | 103 | 2,448 | 4.7% | |||||||||||||||||||||||||||

| Suburban Maryland |

760 | — | 2,697 | 3,457 | 669 | — | 2,643 | 3,312 | 4.4% | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Total |

29,703 | 17,255 | 11,056 | 58,014 | 28,009 | 16,580 | 10,972 | 55,561 | 4.4% | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Cash NOI (1) |

||||||||||||||||||||||||||||||||||||

| Northern California |

36,105 | 3,480 | 3,800 | 43,385 | 32,008 | 3,338 | 4,636 | 39,982 | 8.5% | |||||||||||||||||||||||||||

| Southern California |

14,517 | 7,646 | 244 | 22,407 | 12,317 | 6,722 | 233 | 19,272 | 16.3% | |||||||||||||||||||||||||||

| Dallas |

4,013 | 5,540 | — | 9,553 | 3,873 | 6,431 | — | 10,304 | (7.3%) | |||||||||||||||||||||||||||

| Austin |

2,897 | 8,032 | — | 10,929 | 2,504 | 7,600 | — | 10,104 | 8.2% | |||||||||||||||||||||||||||

| Northern Virginia |

6,957 | 7,610 | 10,995 | 25,562 | 6,893 | 7,454 | 11,169 | 25,516 | 0.2% | |||||||||||||||||||||||||||

| South Florida |

16,722 | 681 | 44 | 17,447 | 14,724 | 689 | 26 | 15,439 | 13.0% | |||||||||||||||||||||||||||

| Seattle |

4,625 | 2,672 | 141 | 7,438 | 4,276 | 2,550 | 244 | 7,070 | 5.2% | |||||||||||||||||||||||||||

| Suburban Maryland |

1,452 | — | 4,842 | 6,294 | 1,356 | — | 5,411 | 6,767 | (7.0%) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Total |

$ | 87,288 | $ | 35,661 | $ | 20,066 | $ | 143,015 | $ | 77,951 | $ | 34,784 | $ | 21,719 | $ | 134,454 | 6.4% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| (1) | Refer to page 24, Definitions and Non-GAAP Disclosures, for the definitions of Same Park, Cash Rental Income, Adjusted Cost of Operations, and Cash NOI. |

10

| For the Six Months Ended June 30, | ||||||||

| 2021 | 2020 | |||||||

| Commercial recurring capital expenditures (1) |

||||||||

| Same Park |

||||||||

| Capital improvements |

$ | 4,376 | $ | 4,249 | ||||

| Tenant improvements |

6,682 | 7,380 | ||||||

| Lease commissions |

3,208 | 3,027 | ||||||

|

|

|

|

|

|||||

| Total Same Park recurring capital expenditures |

14,266 | 14,656 | ||||||

| Non-Same Park recurring capital expenditures |

481 | 26 | ||||||

|

|

|

|

|

|||||

| Total recurring capital expenditures |

14,747 | 14,682 | ||||||

| Assets sold or held for sale recurring capital expenditures |

110 | 1,143 | ||||||

|

|

|

|

|

|||||

| Total commercial recurring capital expenditures |

14,857 | 15,825 | ||||||

| Non-recurring property renovations (1) |

843 | 213 | ||||||

| Multifamily capital expenditures |

7 | — | ||||||

|

|

|

|

|

|||||

| Total capital expenditures |

$ | 15,707 | $ | 16,038 | ||||

|

|

|

|

|

|||||

| Same Park recurring capital expenditures as a percentage of NOI |

9.9% | 10.6% | ||||||

| (1) | Refer to page 24, Definitions and Non-GAAP Disclosures, for the definitions of Recurring Capital Expenditures and Non-recurring Property Renovations. |

11

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| Net income allocable to common stockholders |

$ | 45,595 | $ | 25,522 | $ | 73,481 | $ | 67,137 | ||||||||

| Adjustments |

||||||||||||||||

| Gain on sale of real estate facility |

(19,193 | ) | — | (19,193 | ) | (19,621 | ) | |||||||||

| Depreciation and amortization |

22,514 | 22,963 | 45,499 | 49,582 | ||||||||||||

| Net income allocable to noncontrolling interests |

12,094 | 6,795 | 19,505 | 17,887 | ||||||||||||

| Net income allocable to restricted stock unit holders |

314 | 119 | 478 | 394 | ||||||||||||

| FFO allocated to joint venture partner |

(18 | ) | (38 | ) | (45 | ) | (81 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

| FFO allocable to diluted common stock and units (1) |

61,306 | 55,361 | 119,725 | 115,298 | ||||||||||||

| Maryland reincorporation costs |

510 | — | 510 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

| Core FFO allocable to diluted common stock and units (1) |

61,816 | 55,361 | 120,235 | 115,298 | ||||||||||||

| Adjustments |

||||||||||||||||

| Recurring capital improvements |

(3,761 | ) | (3,133 | ) | (4,407 | ) | (4,298 | ) | ||||||||

| Tenant improvements |

(4,100 | ) | (3,938 | ) | (6,956 | ) | (7,343 | ) | ||||||||

| Capitalized lease commissions |

(1,544 | ) | (1,212 | ) | (3,384 | ) | (3,041 | ) | ||||||||

| Total recurring capital expenditures for assets sold or held for sale |

(47 | ) | (691 | ) | (110 | ) | (1,143 | ) | ||||||||

| Total multifamily capital expenditures |

(7 | ) | — | (7 | ) | — | ||||||||||

| Non-cash rental income (2) |

(183 | ) | (2,746 | ) | (1,490 | ) | (3,810 | ) | ||||||||

| Non-cash stock compensation expense |

2,301 | 931 | 4,081 | 1,873 | ||||||||||||

| Cash paid for taxes in lieu of stock upon vesting of restricted stock units |

(5 | ) | (5 | ) | (3,202 | ) | (3,660 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

| FAD allocable to diluted common stock and units (1) |

54,470 | 44,567 | 104,760 | 93,876 | ||||||||||||

| Distributions to common stockholders |

(28,918 | ) | (28,856 | ) | (57,790 | ) | (57,673 | ) | ||||||||

| Distributions to noncontrolling interests - common units |

(7,670 | ) | (7,670 | ) | (15,341 | ) | (15,341 | ) | ||||||||

| Distributions to restricted stock unit holders |

(202 | ) | (147 | ) | (366 | ) | (329 | ) | ||||||||

| Distributions to noncontrolling interests - joint venture |

(23 | ) | (25 | ) | (40 | ) | (63 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

| Free cash available after fixed charges |

17,657 | 7,869 | 31,223 | 20,470 | ||||||||||||

| Non-recurring property renovations (1) |

(432 | ) | (120 | ) | (843 | ) | (213 | ) | ||||||||

| Investment in multifamily development |

(7,539 | ) | (1,248 | ) | (17,024 | ) | (2,123 | ) | ||||||||

| Investment in industrial development |

(93 | ) | (2,435 | ) | (1,216 | ) | (2,872 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

| Retained cash (1) |

$ | 9,593 | $ | 4,066 | $ | 12,140 | $ | 15,262 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

| Weighted average outstanding |

||||||||||||||||

| Common stock |

27,531 | 27,479 | 27,513 | 27,464 | ||||||||||||

| Operating partnership units |

7,305 | 7,305 | 7,305 | 7,305 | ||||||||||||

| Restricted stock units |

32 | 43 | 35 | 65 | ||||||||||||

| Common stock equivalents |

101 | 81 | 98 | 93 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

| Total diluted common stock and units |

34,969 | 34,908 | 34,951 | 34,927 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

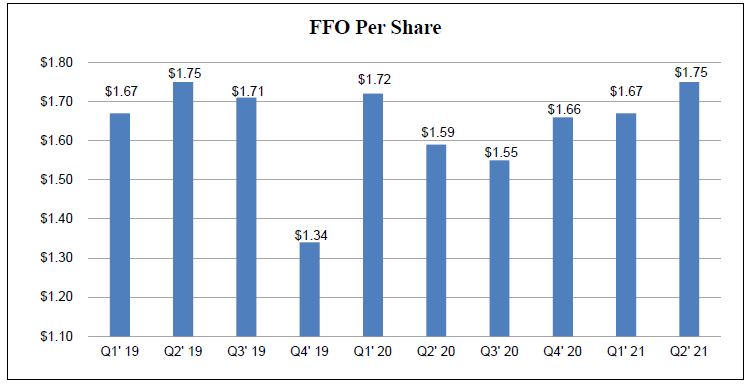

| FFO per share |

$ | 1.75 | $ | 1.59 | $ | 3.43 | $ | 3.30 | ||||||||

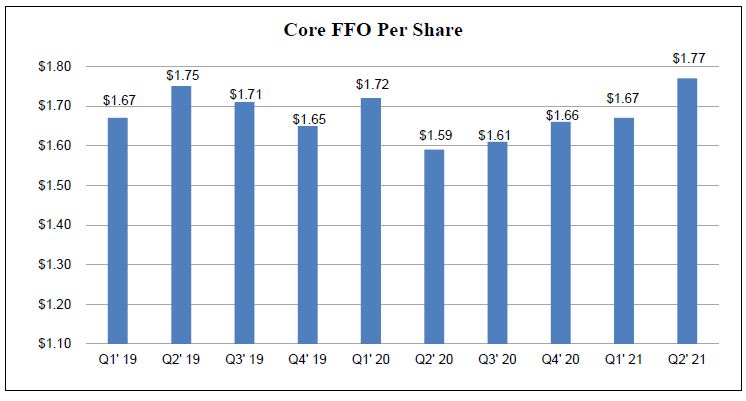

| Core FFO per share |

$ | 1.77 | $ | 1.59 | $ | 3.44 | $ | 3.30 | ||||||||

| FAD distribution payout ratio (3) |

67.6% | 82.3% | 70.2% | 78.2% | ||||||||||||

| (1) | Refer to page 24, Definitions and Non-GAAP Disclosures, for the definition of FFO, Core FFO, FAD, Non-Recurring Property Renovations and Retained Cash. |

| (2) | Non-cash rental income includes amortization of deferred rent receivable (net of write-offs), in-place lease intangible, tenant improvement reimbursements, and lease incentives. |

| (3) | FAD distribution payout ratio is equal to total distributions to common stockholders, unit holders, restricted stock unit holders and our joint venture partner divided by FAD during the same reporting period. |

12

13

| As of June 30, 2021 | As of December 31, 2020 | |||||||||||||||||||||||

| Total | % of Total Market Capitalization |

Wtd Avg Rate |

Total | % of Total Market |

Wtd Avg Rate |

|||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Unsecured Debt: |

||||||||||||||||||||||||

| Credit facility borrowing ($250.0 million at LIBOR + 0.825%) |

$ | - | - | - | $ | - | - | - | ||||||||||||||||

| Unrestricted cash |

(115,965 | ) | (69,083 | ) | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Net debt |

$ | (115,965 | ) | - | - | $ | (69,083 | ) | - | - | ||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Preferred Equity: |

||||||||||||||||||||||||

| 5.200% Series W preferred stock (7,590,000 depositary shares outstanding) callable 10/20/21 |

$ | 189,750 | 3.2% | $ | 189,750 | 3.5% | ||||||||||||||||||

| 5.250% Series X preferred stock (9,200,000 depositary shares outstanding) callable 9/21/22 |

230,000 | 3.8% | 230,000 | 4.2% | ||||||||||||||||||||

| 5.200% Series Y preferred stock (8,000,000 depositary shares outstanding) callable 12/7/22 |

200,000 | 3.3% | 200,000 | 3.6% | ||||||||||||||||||||

| 4.875% Series Z preferred stock (13,000,000 depositary shares outstanding) callable 11/4/24 |

325,000 | 5.4% | 325,000 | 5.9% | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total preferred equity |

$ | 944,750 | 15.7% | 5.10% | $ | 944,750 | 17.2% | 5.10% | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total net debt and preferred equity |

$ | 828,785 | 13.8% | 5.10% | $ | 875,667 | 15.9% | 5.10% | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Common stock (27,541,464 and 27,488,547 shares outstanding as of June 30, 2021 and December 31, 2020, respectively) (1) |

$ | 4,078,340 | 68.1% | $ | 3,652,403 | 66.4% | ||||||||||||||||||

| Common operating partnership units (7,305,355 units outstanding as of June 30, 2021 and December 31, 2020) (1) |

1,081,777 | 18.1% | 970,663 | 17.7% | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total common equity and operating partnership units (1) |

$ | 5,160,117 | 86.2% | $ | 4,623,066 | 84.1% | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total implied market capitalization |

$ | 5,988,902 | 100.0% | $ | 5,498,733 | 100.0% | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| For the Six Months Ended | For the year ended | |||||||||||||||||||||||

| June 30, 2021 | December 31, 2020 | |||||||||||||||||||||||

| Interest expense and related expenses (2) |

$ | 272 | $ | 548 | ||||||||||||||||||||

| Preferred distributions |

24,093 | 48,186 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total fixed charges and preferred distributions |

$ | 24,365 | $ | 48,734 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Ratio of EBITDAre to fixed charges and preferred distributions |

5.9x | 5.7x | ||||||||||||||||||||||

| Ratio of FFO to total fixed charges and preferred distributions (3) |

5.9x | 5.7x | ||||||||||||||||||||||

| Ratio of net debt and preferred equity to EBITDAre (4) |

2.9x | 3.2x | ||||||||||||||||||||||

| (1) | Total common equity is calculated as the total number of shares of common stock and operating partnership units outstanding multiplied by the Company’s closing stock price at the end of each respective period shown. Closing stock prices on June 30, 2021 and December 31, 2020 were $148.08 and $132.87, respectively. |

| (2) | Interest expense and related expenses includes facility fees associated with our unsecured credit facility. |

| (3) | Ratio of FFO to total fixed charges and preferred distributions is calculated by dividing FFO excluding fixed charges and preferred distributions by total fixed charges and preferred distributions. |

| (4) | Ratio of net debt and preferred equity to EBITDAre is calculated as total net debt and preferred equity divided by EBITDAre. Ratio of net debt and preferred equity to EBITDAre as of June 30, 2021 is calculated using annualized EBITDAre for the six months ended June 30, 2021. |

14

| Industry Concentration as of June 30, 2021 (1) (2) | ||||||||||||

| Percentage of Total Rental Income |

||||||||||||

| Business services |

21.3% | |||||||||||

| Logistics |

13.3% | |||||||||||

| Technology |

10.3% | |||||||||||

| Retail, food, and automotive |

9.1% | |||||||||||

| Construction and engineering |

8.1% | |||||||||||

| Health services |

7.2% | |||||||||||

| Government |

6.3% | |||||||||||

| Electronics |

3.1% | |||||||||||

| Home furnishings |

2.5% | |||||||||||

| Insurance and financial services |

2.4% | |||||||||||

| Communications |

1.8% | |||||||||||

| Aerospace/defense |

1.8% | |||||||||||

| Education |

1.0% | |||||||||||

| Other |

11.8% | |||||||||||

|

|

|

|||||||||||

| Total |

100.0% | |||||||||||

|

|

|

|||||||||||

| Top 10 Customers by Total Annual Rental Income as of June 30, 2021 (2) | ||||||||||||

| Customer |

Square Footage |

Annualized Rental Income (3) |

Percentage of Total Annualized Rental Income |

|||||||||

| US Government |

602,000 | $ | 13,637 | 3.1% | ||||||||

| Amazon Inc. |

543,000 | 6,709 | 1.5% | |||||||||

| KZ Kitchen Cabinet & Stone |

370,000 | 5,385 | 1.2% | |||||||||

| Luminex Corporation |

199,000 | 4,508 | 1.0% | |||||||||

| ECS Federal, LLC |

133,000 | 2,895 | 0.7% | |||||||||

| Lockheed Martin Corporation |

124,000 | 2,703 | 0.6% | |||||||||

| CentralColo, LLC |

96,000 | 2,431 | 0.6% | |||||||||

| Applied Materials, Inc. |

162,000 | 2,431 | 0.6% | |||||||||

| Carbel, LLC |

236,000 | 2,270 | 0.5% | |||||||||

| Great Way Trading & Transportation, Inc. |

176,000 | 2,038 | 0.5% | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

2,641,000 | $ | 45,007 | 10.3% | ||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Industry concentration is categorized based on customers’ Standard Industrial Classification Code. |

| (2) | Excludes assets held for sale as of June 30, 2021. |

| (3) | For leases expiring within one year, annualized rental income includes only the income to be received under the existing lease from July 1, 2021 through the respective date of expiration. |

15

| Rentable Square Footage of Same Park Properties by Product Type as of June 30, 2021 (1) | ||||||||||||||||||||

| Markets |

Industrial | Flex | Office | Total | % of Total | |||||||||||||||

| Northern Virginia |

1,564 | 1,242 | 1,726 | 4,532 | 17.1% | |||||||||||||||

| South Florida |

3,728 | 126 | 12 | 3,866 | 14.7% | |||||||||||||||

| Silicon Valley |

3,094 | 367 | - | 3,461 | 13.2% | |||||||||||||||

| East Bay |

3,297 | 53 | - | 3,350 | 12.8% | |||||||||||||||

| Dallas |

1,300 | 1,587 | - | 2,887 | 11.0% | |||||||||||||||

| Austin |

755 | 1,208 | - | 1,963 | 7.5% | |||||||||||||||

| Los Angeles County |

1,256 | 317 | 31 | 1,604 | 6.1% | |||||||||||||||

| Seattle |

1,052 | 270 | 28 | 1,350 | 5.1% | |||||||||||||||

| Suburban Maryland |

394 | - | 751 | 1,145 | 4.4% | |||||||||||||||

| Orange County |

810 | 101 | - | 911 | 3.5% | |||||||||||||||

| San Diego County |

233 | 535 | - | 768 | 2.9% | |||||||||||||||

| Mid-Peninsula |

- | 94 | 340 | 434 | 1.7% | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

17,483 | 5,900 | 2,888 | 26,271 | 100.0% | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Percentage by Product Type |

66.5% | 22.5% | 11.0% | 100.0% | ||||||||||||||||

| Same Park Weighted Average Occupancy Rates by Product Type for the Three Months Ended June 30, 2021 (1) | ||||||||||||||||||||

|

Markets |

Industrial | Flex | Office | Total | ||||||||||||||||

| Northern Virginia |

93.9% | 97.3% | 86.8% | 92.1% | ||||||||||||||||

| South Florida |

97.4% | 81.6% | 100.0% | 96.9% | ||||||||||||||||

| Silicon Valley |

96.9% | 87.7% | - | 95.9% | ||||||||||||||||

| East Bay |

93.6% | 95.0% | - | 93.6% | ||||||||||||||||

| Dallas |

89.7% | 76.8% | - | 82.6% | ||||||||||||||||

| Austin |

97.5% | 93.4% | - | 95.0% | ||||||||||||||||

| Los Angeles County |

98.5% | 94.8% | 93.9% | 97.7% | ||||||||||||||||

| Seattle |

94.5% | 94.5% | 69.3% | 94.0% | ||||||||||||||||

| Suburban Maryland |

86.0% | - | 88.9% | 87.9% | ||||||||||||||||

| Orange County |

94.5% | 93.9% | - | 94.4% | ||||||||||||||||

| San Diego County |

99.3% | 92.6% | - | 94.6% | ||||||||||||||||

| Mid-Peninsula |

- | 85.9% | 78.5% | 80.1% | ||||||||||||||||

| Total |

95.3% | 89.1% | 86.3% | 92.9% | ||||||||||||||||

| Same Park Weighted Average Occupancy Rates by Product Type for the Six Months Ended June 30, 2021 (1) | ||||||||||||||||||||

|

Markets |

Industrial | Flex | Office | Total | ||||||||||||||||

| Northern Virginia |

93.8% | 96.7% | 86.7% | 91.9% | ||||||||||||||||

| South Florida |

96.7% | 82.3% | 100.0% | 96.2% | ||||||||||||||||

| Silicon Valley |

96.4% | 87.7% | - | 95.5% | ||||||||||||||||

| East Bay |

93.1% | 94.8% | - | 93.1% | ||||||||||||||||

| Dallas |

88.6% | 78.3% | - | 83.0% | ||||||||||||||||

| Austin |

96.5% | 94.1% | - | 95.0% | ||||||||||||||||

| Los Angeles County |

98.4% | 94.2% | 94.5% | 97.5% | ||||||||||||||||

| Seattle |

94.0% | 94.9% | 67.0% | 93.6% | ||||||||||||||||

| Suburban Maryland |

86.0% | - | 89.2% | 88.1% | ||||||||||||||||

| Orange County |

93.9% | 95.3% | - | 94.1% | ||||||||||||||||

| San Diego County |

98.8% | 92.5% | - | 94.4% | ||||||||||||||||

| Mid-Peninsula |

- | 85.0% | 80.3% | 81.3% | ||||||||||||||||

| Total |

94.7% | 89.5% | 86.6% | 92.7% | ||||||||||||||||

| (1) | Excludes assets held for sale as of June 30, 2021. |

16

| Rentable Square Footage of Properties by Product Type as of June 30, 2021 (1) | ||||||||||||||||||||

| Markets |

Industrial | Flex | Office | Total | % of Total | |||||||||||||||

| Northern Virginia |

1,810 | 1,242 | 1,726 | 4,778 | 17.5% | |||||||||||||||

| South Florida |

3,728 | 126 | 12 | 3,866 | 14.1% | |||||||||||||||

| Silicon Valley |

3,094 | 446 | - | 3,540 | 12.9% | |||||||||||||||

| East Bay |

3,297 | 53 | - | 3,350 | 12.2% | |||||||||||||||

| Dallas |

1,383 | 1,587 | - | 2,970 | 10.9% | |||||||||||||||

| Los Angeles County |

1,946 | 317 | 31 | 2,294 | 8.4% | |||||||||||||||

| Austin |

755 | 1,208 | - | 1,963 | 7.2% | |||||||||||||||

| Seattle |

1,052 | 270 | 28 | 1,350 | 4.9% | |||||||||||||||

| Suburban Maryland |

394 | - | 751 | 1,145 | 4.2% | |||||||||||||||

| Orange County |

810 | 101 | - | 911 | 3.3% | |||||||||||||||

| San Diego County |

233 | 535 | - | 768 | 2.8% | |||||||||||||||

| Mid-Peninsula |

- | 94 | 340 | 434 | 1.6% | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

18,502 | 5,979 | 2,888 | 27,369 | 100.0% | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Percentage by Product Type |

67.6% | 21.8% | 10.6% | 100.0% | ||||||||||||||||

|

|

||||||||||||||||||||

| Weighted Average Occupancy Rates by Product Type for the Three Months Ended June 30, 2021 (1) | ||||||||||||||||||||

|

Markets |

Industrial | Flex | Office | Total | ||||||||||||||||

| Northern Virginia |

93.7% | 97.3% | 86.8% | 92.1% | ||||||||||||||||

| South Florida |

97.4% | 81.6% | 100.0% | 96.9% | ||||||||||||||||

| Silicon Valley |

96.9% | 88.6% | - | 95.9% | ||||||||||||||||

| East Bay |

93.6% | 95.0% | - | 93.6% | ||||||||||||||||

| Dallas |

86.1% | 76.8% | - | 81.1% | ||||||||||||||||

| Los Angeles County |

98.9% | 94.8% | 93.9% | 98.2% | ||||||||||||||||

| Austin |

97.5% | 93.4% | - | 95.0% | ||||||||||||||||

| Seattle |

94.5% | 94.5% | 69.3% | 94.0% | ||||||||||||||||

| Suburban Maryland |

86.0% | - | 88.9% | 87.9% | ||||||||||||||||

| Orange County |

94.5% | 93.9% | - | 94.4% | ||||||||||||||||

| San Diego County |

99.3% | 92.6% | - | 94.6% | ||||||||||||||||

| Mid-Peninsula |

- | 85.9% | 78.5% | 80.1% | ||||||||||||||||

| Total |

95.1% | 89.2% | 86.3% | 92.9% | ||||||||||||||||

| Weighted Average Occupancy Rates by Product Type for the Six Months Ended June 30, 2021 (1) | ||||||||||||||||||||

|

Markets |

Industrial | Flex | Office | Total | ||||||||||||||||

| Northern Virginia |

93.6% | 96.7% | 86.7% | 91.9% | ||||||||||||||||

| South Florida |

96.7% | 82.3% | 100.0% | 96.2% | ||||||||||||||||

| Silicon Valley |

96.4% | 88.4% | - | 95.4% | ||||||||||||||||

| East Bay |

93.1% | 94.8% | - | 93.1% | ||||||||||||||||

| Dallas |

86.0% | 78.3% | - | 81.9% | ||||||||||||||||

| Los Angeles County |

98.2% | 94.2% | 94.5% | 97.6% | ||||||||||||||||

| Austin |

96.5% | 94.1% | - | 95.0% | ||||||||||||||||

| Seattle |

94.0% | 94.9% | 67.0% | 93.6% | ||||||||||||||||

| Suburban Maryland |

86.0% | - | 89.2% | 88.1% | ||||||||||||||||

| Orange County |

93.9% | 95.3% | - | 94.1% | ||||||||||||||||

| San Diego County |

98.8% | 92.5% | - | 94.4% | ||||||||||||||||

| Mid-Peninsula |

- | 85.0% | 80.3% | 81.3% | ||||||||||||||||

| Total |

94.6% | 89.6% | 86.6% | 92.6% | ||||||||||||||||

| (1) | Excludes assets held for sale as of June 30, 2021. |

17

| (1) | Excludes assets sold or held for sale as of June 30, 2021. |

18

| Lease Expirations - Total Portfolio (1) | ||||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Annualized Rental Income (2) |

% Total | % of Total Annualized Rental Income |

||||||||||||

|

2021 |

2,454 | $ | 43,790 | 9.7% | 9.7% | |||||||||||

|

2022 |

5,967 | 105,739 | 23.5% | 23.5% | ||||||||||||

|

2023 |

5,719 | 97,076 | 21.5% | 21.5% | ||||||||||||

|

2024 |

4,235 | 75,245 | 16.7% | 16.7% | ||||||||||||

|

2025 |

3,008 | 52,237 | 11.6% | 11.6% | ||||||||||||

| Thereafter |

4,268 | 76,922 | 17.0% | 17.0% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Total |

25,651 | $ | 451,009 | 100.0% | 100.0% | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

| Lease Expirations - Industrial | ||||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Annualized Rental Income (2) |

% of Industrial |

% of Total Annualized Rental Income |

||||||||||||

|

2021 |

1,526 | $ | 22,291 | 8.3% | 5.0% | |||||||||||

|

2022 |

3,830 | 56,591 | 21.0% | 12.6% | ||||||||||||

|

2023 |

3,984 | 58,375 | 21.7% | 12.9% | ||||||||||||

|

2024 |

2,939 | 46,160 | 17.1% | 10.2% | ||||||||||||

|

2025 |

1,989 | 28,772 | 10.7% | 6.4% | ||||||||||||

| Thereafter |

3,458 | 57,068 | 21.2% | 12.6% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Total |

17,726 | $ | 269,257 | 100.0% | 59.7% | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

| Lease Expirations - Flex | ||||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Annualized Rental Income (2) |

% of Flex |

% of Total Annualized Rental Income |

||||||||||||

|

2021 |

632 | $ | 13,194 | 11.7% | 2.9% | |||||||||||

|

2022 |

1,439 | 29,822 | 26.5% | 6.6% | ||||||||||||

|

2023 |

1,144 | 23,142 | 20.6% | 5.1% | ||||||||||||

|

2024 |

872 | 17,989 | 16.0% | 4.0% | ||||||||||||

|

2025 |

801 | 17,798 | 15.8% | 3.9% | ||||||||||||

| Thereafter |

500 | 10,547 | 9.4% | 2.3% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Total |

5,388 | $ | 112,492 | 100.0% | 24.8% | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

| Lease Expirations - Office (1) | ||||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Annualized Rental Income (2) |

% of Office |

% of Total Annualized Rental Income |

||||||||||||

|

2021 |

296 | $ | 8,305 | 12.0% | 1.8% | |||||||||||

|

2022 |

698 | 19,326 | 27.9% | 4.3% | ||||||||||||

|

2023 |

591 | 15,559 | 22.5% | 3.5% | ||||||||||||

|

2024 |

424 | 11,096 | 16.0% | 2.5% | ||||||||||||

|

2025 |

218 | 5,667 | 8.2% | 1.3% | ||||||||||||

| Thereafter |

310 | 9,307 | 13.4% | 2.1% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Total |

2,537 | $ | 69,260 | 100.0% | 15.5% | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

| (1) | Excludes assets held for sale as of June 30, 2021. |

| (2) | Annualized rental income represents annualized outgoing rents inclusive of related estimated expense recoveries. Actual rental income amounts may vary depending upon re-leasing of expiring spaces. |

19

| Lease Expirations - Northern California | ||||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Annualized Rental Income (1) |

% of No. CA |

% of Total Annualized Rental Income |

||||||||||||

|

2021 |

509 | $ | 11,828 | 9.3% | 2.6% | |||||||||||

|

2022 |

1,180 | 21,852 | 17.2% | 4.9% | ||||||||||||

|

2023 |

1,344 | 24,658 | 19.5% | 5.5% | ||||||||||||

|

2024 |

1,094 | 19,449 | 15.4% | 4.3% | ||||||||||||

|

2025 |

755 | 11,125 | 8.8% | 2.5% | ||||||||||||

| Thereafter |

2,051 | 37,810 | 29.8% | 8.4% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Total |

6,933 | $ | 126,722 | 100.0% | 28.2% | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

| Lease Expirations - Southern California | ||||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Annualized Rental Income (1) |

% of So. CA |

% of Total Annualized Rental Income |

||||||||||||

|

2021 |

356 | $ | 7,181 | 9.8% | 1.6% | |||||||||||

|

2022 |

1,205 | 22,207 | 30.3% | 4.9% | ||||||||||||

|

2023 |

890 | 17,095 | 23.3% | 3.8% | ||||||||||||

|

2024 |

556 | 11,620 | 15.8% | 2.6% | ||||||||||||

|

2025 |

328 | 5,860 | 8.0% | 1.3% | ||||||||||||

| Thereafter |

531 | 9,373 | 12.8% | 2.1% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Total |

3,866 | $ | 73,336 | 100.0% | 16.3% | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

| Lease Expirations - Dallas | ||||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Annualized Rental Income (1) |

% of Dallas |

% of Total Annualized Rental Income |

||||||||||||

|

2021 |

273 | $ | 3,408 | 10.3% | 0.8% | |||||||||||

|

2022 |

562 | 6,416 | 19.4% | 1.4% | ||||||||||||

|

2023 |

692 | 9,032 | 27.3% | 2.0% | ||||||||||||

|

2024 |

376 | 5,655 | 17.1% | 1.2% | ||||||||||||

|

2025 |

267 | 5,208 | 15.8% | 1.2% | ||||||||||||

| Thereafter |

281 | 3,328 | 10.1% | 0.7% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Total |

2,451 | $ | 33,047 | 100.0% | 7.3% | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

| Lease Expirations - Austin | ||||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Annualized Rental Income (1) |

% of Austin |

% of Total Annualized Rental Income |

||||||||||||

|

2021 |

252 | $ | 4,614 | 12.5% | 1.0% | |||||||||||

|

2022 |

331 | 7,138 | 19.4% | 1.6% | ||||||||||||

|

2023 |

291 | 5,444 | 14.8% | 1.2% | ||||||||||||

|

2024 |

308 | 6,664 | 18.1% | 1.5% | ||||||||||||

|

2025 |

401 | 8,520 | 23.2% | 1.9% | ||||||||||||

| Thereafter |

293 | 4,426 | 12.0% | 0.9% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Total |