Attached files

| file | filename |

|---|---|

| EX-99.5 - EX-99.5 - CVB FINANCIAL CORP | d173193dex995.htm |

| EX-2.1 - EX-2.1 - CVB FINANCIAL CORP | d173193dex21.htm |

| 8-K - 8-K - CVB FINANCIAL CORP | d173193d8k.htm |

Acquisition of Suncrest Bank July 27 2021 Exhibit 99.6

Forward Looking Statements Certain matters set forth in this presentation (including the accompanying oral presentation) constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including forward-looking statements relating to the Company’s pending acquisition of Suncrest Bank, business plans and expectations and future operating results. Words such as “will likely result”, “aims”, “anticipates”, “believes”, “could”, “estimates”, “expects”, “hopes”, “intends”, “may”, “plans”, “projects”, “seeks”, “should”, “will,” “strategy”, “possibility”, and variations of these words and similar expressions help to identify these forward-looking statements, which involve risks and uncertainties. These forward-looking statements are subject to risks and uncertainties that could cause actual results, performance and/or achievements to differ materially from those projected. The closing of the proposed Merger is subject to regulatory approvals, the approval of the shareholders of Suncrest, and other customary closing conditions. There is no assurance that such conditions will be met or that the proposed Merger will be consummated within the expected time frame, or at all. If the Merger is consummated, factors that may cause actual outcomes to differ from what is expressed or forecasted in these forward-looking statements include, among things: difficulties and delays in integrating Citizens and Suncrest and achieving anticipated synergies, cost savings and other benefits from the transaction; higher than anticipated transaction costs; deposit attrition, operating costs, customer loss and business disruption following the Merger, including difficulties in maintaining relationships with employees, may be greater than expected; local, regional, national and international economic and market conditions, political events and public health developments and the impact they may have on Citizens, its customers and its assets and liabilities; Citizens’ ability to attract deposits and other sources of funding or liquidity; supply and demand for commercial or residential real estate and periodic deterioration in real estate prices and/or values in California or other states where Citizens lends; a sharp or prolonged slowdown or decline in real estate construction, sales or leasing activities; changes in the financial performance and/or condition of Citizens’ borrowers, depositors, key vendors or counterparties; changes in Citizens’ levels of delinquent loans, nonperforming assets, allowance for credit losses and charge-offs; the costs or effects of mergers, acquisitions or dispositions CVBF may make, whether CVBF is able to obtain any required governmental approvals in connection with any such mergers, acquisitions or dispositions, and/or Citizens’ ability to realize the contemplated financial or business benefits associated with any such mergers, acquisitions or dispositions; the effects of new laws, regulations and/or government programs, including those laws, regulations and programs enacted by federal, state or local governments in the geographic jurisdictions in which Citizens does business in response to the current national emergency declared in connection with the COVID-19 pandemic; the impact of the federal CARES Act and the significant additional lending activities undertaken by the Company in connection with the Small Business Administration’s Paycheck Protection Program enacted thereunder, including risks to the Company with respect to the uncertain application by the Small Business Administration of new borrower and loan eligibility, forgiveness and audit criteria; the effects of the Company’s participation in one or more of the new lending programs recently established by the Federal Reserve, including the Main Street New Loan Facility, the Main Street Priority Loan Facility and the Nonprofit Organization New Loan Facility, and the impact of any related actions or decisions by the Federal Reserve Bank of Boston and its special purpose vehicle established pursuant to such lending programs; the effect of changes in other pertinent laws, regulations and applicable judicial decisions (including laws, regulations and judicial decisions concerning financial reforms, taxes, bank capital levels, allowance for credit losses, consumer, commercial or secured lending, securities and securities trading and hedging, bank operations, compliance, fair lending, the Community Reinvestment Act, employment, executive compensation, insurance, cybersecurity, vendor management and information security technology) with which CVBF and its subsidiaries must comply or believe the Company should comply or which may otherwise impact the CVBF; changes in estimates of future reserve requirements and minimum capital requirements, based upon the periodic review thereof under relevant regulatory and accounting standards, including changes in the Basel Committee framework establishing capital standards for bank credit, operations and market risks; the accuracy of the assumptions and estimates and the absence of technical error in implementation or calibration of models used to estimate the fair value of financial instruments or currently expected credit losses or delinquencies; inflation, changes in market interest rates, securities market and monetary fluctuations; changes in government-established interest rates, reference rates or monetary policies, including the possible imposition of negative interest rates on bank reserves; the impact of the anticipated phase-out of the London Interbank Offered Rate (LIBOR) on interest rate indexes specified in certain of our customer loan agreements and in Citizens’ interest rate swap arrangements, including any economic and compliance effects related to the expected change from LIBOR to an alternative reference rate; changes in the amount, cost and availability of deposit insurance; disruptions in the infrastructure that supports CVBF’s business and the communities where CVBF is located, which are concentrated in California, involving or related to public health, physical site access and/or communication facilities; cyber incidents, attacks, infiltrations, exfiltrations, or theft or loss of CVBF, customer or employee data or money; political developments, uncertainties or instability, catastrophic events, acts of war or terrorism, or natural disasters, such as earthquakes, drought, the effects of pandemic diseases, climate change or extreme weather events, that may affect electrical, environmental and communications or other services, computer services or facilities CVBF may use, or that may affect CVBF’s assets, customers, employees or third parties with whom CVBF conducts business; CVBF’s timely development and implementation of new banking products and services and the perceived overall value of these products and services by customers and potential customers; CVBF’s relationships with and reliance upon outside vendors with respect to certain of CVBF’s key internal and external systems, applications and controls; changes in commercial or consumer spending, borrowing and savings patterns, preferences or behaviors; technological changes and the expanding use of technology in banking and financial services (including the adoption of mobile banking, funds transfer applications, electronic marketplaces for loans, block-chain technology and other financial products, systems or services); CVBF’s ability to retain and increase market share, to retain and grow customers and to control expenses; changes in the competitive environment among banks and other financial services and technology providers; competition and innovation with respect to financial products and services by banks, financial institutions and non-traditional providers including retail businesses and technology companies; volatility in the credit and equity markets and its effect on the general economy or local or regional business conditions or on CVBF’s capital, deposits, assets or customers; fluctuations in the price of CVBF’s common stock or other securities, and the resulting impact on CVBF’s ability to raise capital or to make acquisitions; the effect of changes in accounting policies and practices, as may be adopted from time-to-time by the principal regulatory agencies with jurisdiction over CVBF, as well as by the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard-setters; changes in CVBF’s organization, management, compensation and benefit plans, and CVBF’s ability to recruit and retain or expand or contract its workforce, management team, key executive positions and/or CVBF’s board of directors; CVBF’s ability to identify suitable and qualified replacements for any executive officers who may leave their employment, including CVBF’s Chief Executive Officer; the costs and effects of legal, compliance and regulatory actions, changes and developments, including the initiation and resolution of legal proceedings (including any securities, lender liability, bank operations, check or wire fraud, financial product or service, data privacy, health and safety, consumer or employee class action litigation); regulatory or other governmental inquiries or investigations, and/or the results of regulatory examinations or reviews; ongoing relations with various federal and state regulators, including, but not limited to, the SEC, Federal Reserve Board, FDIC and California DFPI; success at managing the risks involved in the foregoing items and all other factors set forth in CVBF's public reports, including its Annual Report on Form 10-K for the year ended December 31, 2020, and particularly the discussion of risk factors within that document. Among other risks, the ongoing COVID-19 pandemic may significantly affect the banking industry, the health and safety of Suncrest and Citizens’ employees, and their business prospects. The ultimate impact of the COVID-19 pandemic on Suncrest and Citizens’ business and financial results will depend on future developments, which are highly uncertain and cannot be predicted, including the scope and duration of the pandemic, the impact on the economy, customers, employees and business partners, the safety, effectiveness, distribution and acceptance of vaccines developed to mitigate the pandemic, and actions taken by governmental authorities in response to the pandemic. The Company does not undertake, and specifically disclaims any obligation, to update any forward-looking statements to reflect occurrences or unanticipated events or circumstances after the date of such statements, except as required by law. Any statements about future operating results, such as those concerning accretion and dilution to the Company’s earnings or shareholders, are for illustrative purposes only, are not forecasts, and actual results may differ. Additional Information About the Proposed Merger and Where to Find It In connection with the proposed merger, CVBF will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of Suncrest and a Prospectus of CVBF, as well as other relevant documents concerning the proposed transaction. The final proxy statement/prospectus will be distributed to the shareholders of Suncrest in connection with their vote on the proposed transaction. SHAREHOLDERS OF SUNCREST ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Proxy Statement/Prospectus and other relevant materials (when they become available), and any other documents CVBF filed with the SEC may be obtained free of charge at the SEC’s website, http://www.sec.gov, at the investor relations portion of CVBF’s website, https://www.cbbank.com, by contacting Myrna DiSanto, Investor Relations, CVB Financial Corp., 701 N Haven Avenue, Ontario, CA 91764 or by telephone at (909) 980-4030 or by contacting Ciaran McMullan, President and Chief Executive Officer, Suncrest Bank, 501 West Main Street, Visalia, CA 93291 or by telephone at (559) 802-1000. CVBF, Suncrest, their respective directors, executive officers and certain other persons may be deemed to be participants in the solicitation of proxies from Suncrest’s shareholders in favor of the approval of the merger. Information about the directors and executive officers of Suncrest and their ownership of Suncrest common stock will be set forth in the definitive proxy statement for Suncrest’s special meeting to vote on the merger. Information about the directors and executive officers of CVBF and their ownership of CVBF common stock is set forth in the proxy statement for the CVBF’s 2021 annual meeting of shareholders, as previously filed with the SEC on April 5, 2021. Shareholders may obtain additional information regarding the interests of Suncrest’s directors and executive officers by reading the registration statement and the proxy statement/prospectus when they become available.

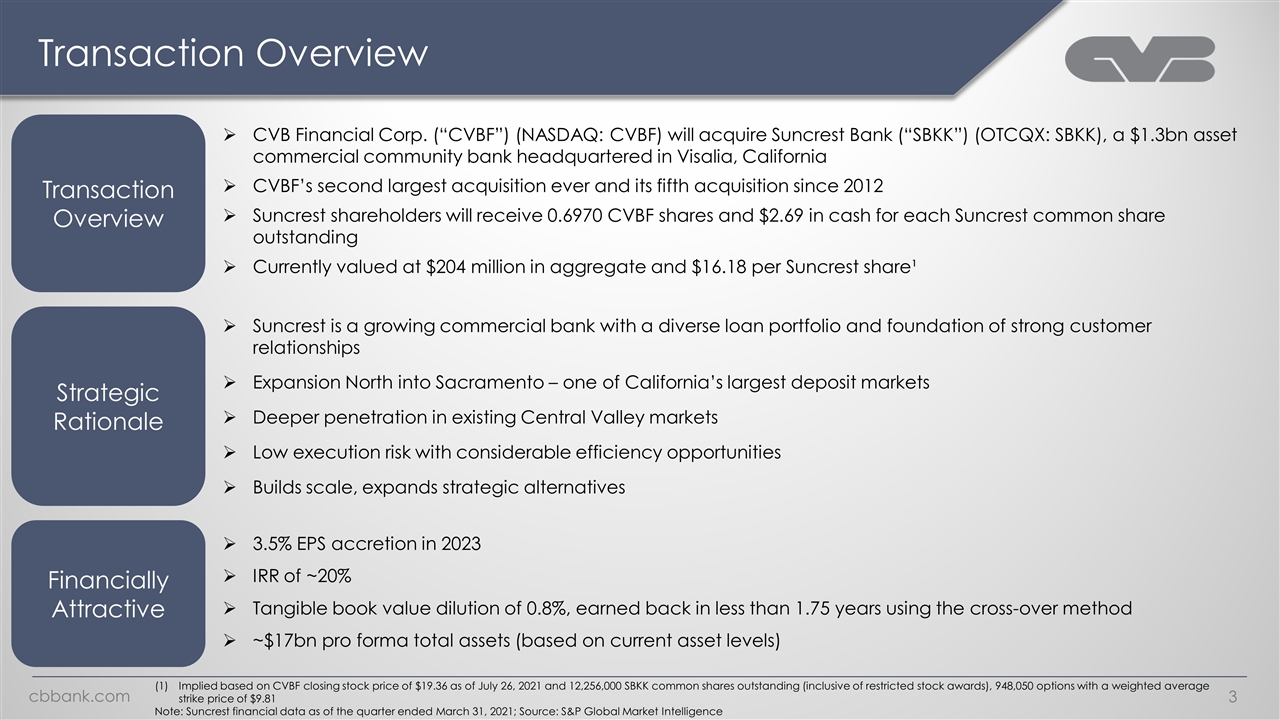

Transaction Overview Suncrest is a growing commercial bank with a diverse loan portfolio and foundation of strong customer relationships Expansion North into Sacramento – one of California’s largest deposit markets Deeper penetration in existing Central Valley markets Low execution risk with considerable efficiency opportunities Builds scale, expands strategic alternatives Strategic Rationale Transaction Overview CVB Financial Corp. (“CVBF”) (NASDAQ: CVBF) will acquire Suncrest Bank (“SBKK”) (OTCQX: SBKK), a $1.3bn asset commercial community bank headquartered in Visalia, California CVBF’s second largest acquisition ever and its fifth acquisition since 2012 Suncrest shareholders will receive 0.6970 CVBF shares and $2.69 in cash for each Suncrest common share outstanding Currently valued at $204 million in aggregate and $16.18 per Suncrest share¹ Financially Attractive 3.5% EPS accretion in 2023 IRR of ~20% Tangible book value dilution of 0.8%, earned back in less than 1.75 years using the cross-over method ~$17bn pro forma total assets (based on current asset levels) Implied based on CVBF closing stock price of $19.36 as of July 26, 2021 and 12,256,000 SBKK common shares outstanding (inclusive of restricted stock awards), 948,050 options with a weighted average strike price of $9.81 Note: Suncrest financial data as of the quarter ended March 31, 2021; Source: S&P Global Market Intelligence

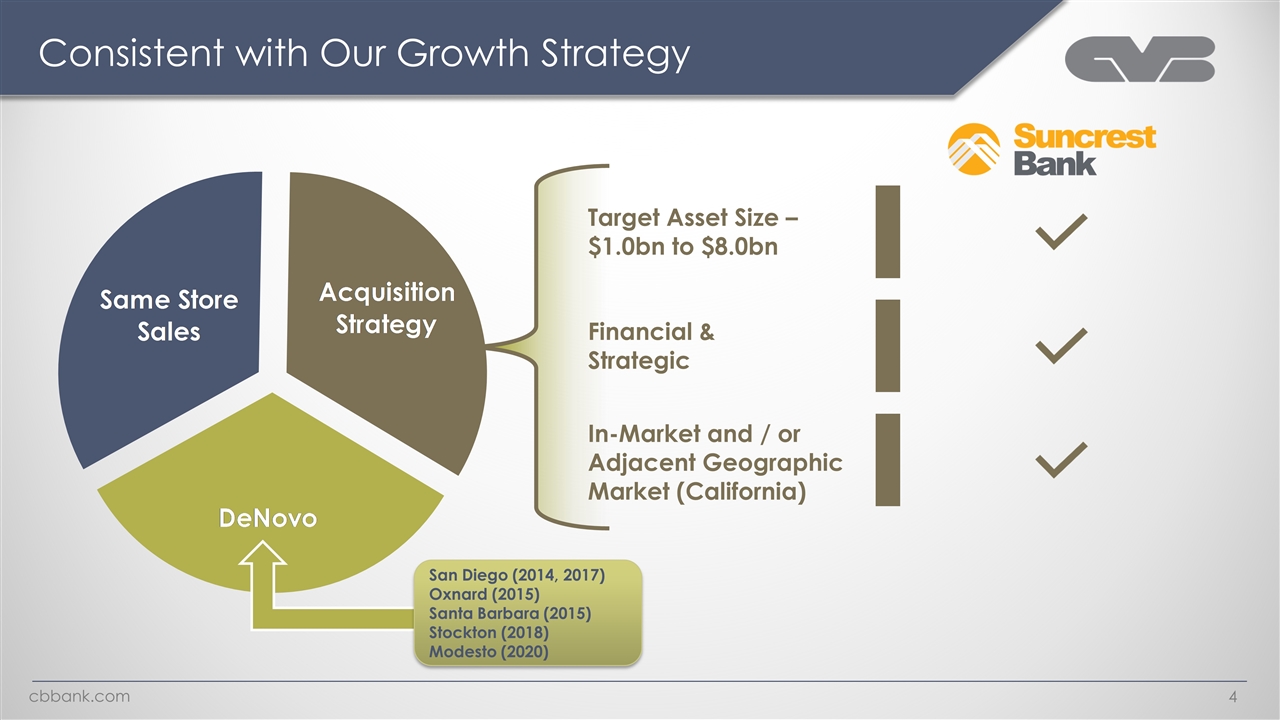

Consistent with Our Growth Strategy In-Market and / or Adjacent Geographic Market (California) Financial & Strategic Target Asset Size – $1.0bn to $8.0bn San Diego (2014, 2017) Oxnard (2015) Santa Barbara (2015) Stockton (2018) Modesto (2020)

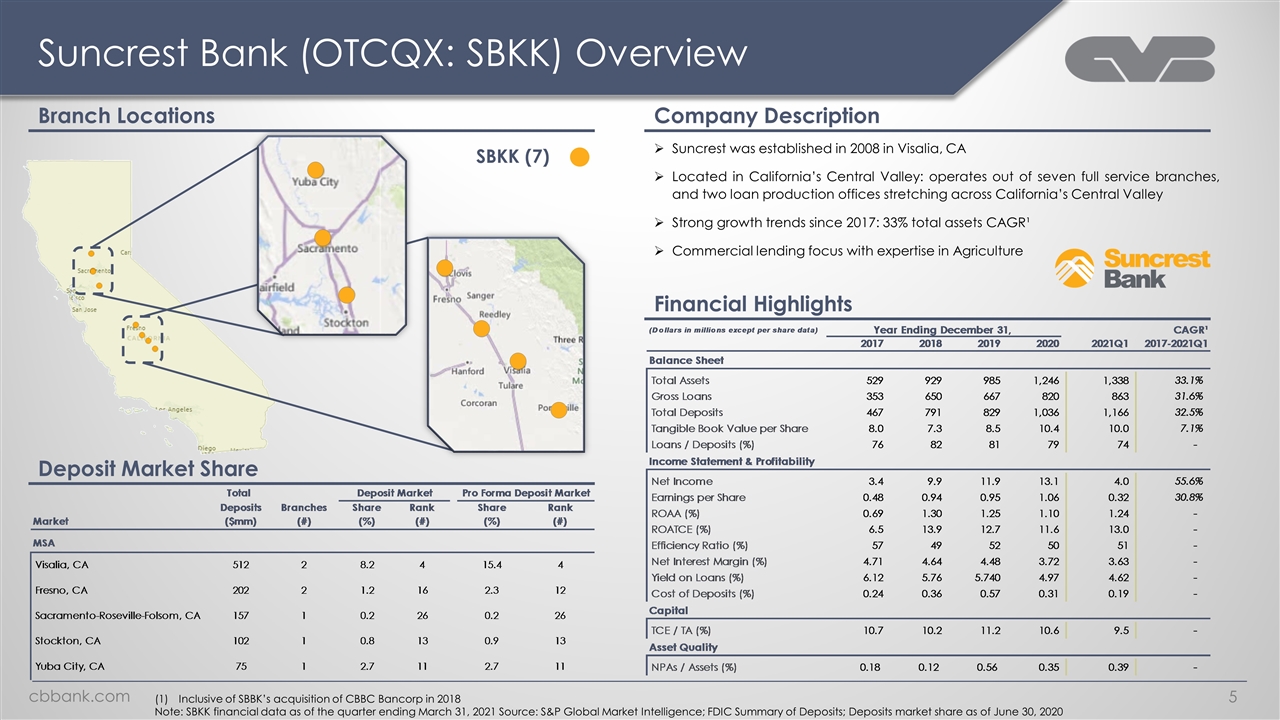

Suncrest Bank (OTCQX: SBKK) Overview Branch Locations Company Description Financial Highlights Deposit Market Share Suncrest was established in 2008 in Visalia, CA Located in California’s Central Valley: operates out of seven full service branches, and two loan production offices stretching across California’s Central Valley Strong growth trends since 2017: 33% total assets CAGR¹ Commercial lending focus with expertise in Agriculture SBKK (7) Inclusive of SBBK’s acquisition of CBBC Bancorp in 2018 Note: SBKK financial data as of the quarter ending March 31, 2021 Source: S&P Global Market Intelligence; FDIC Summary of Deposits; Deposits market share as of June 30, 2020

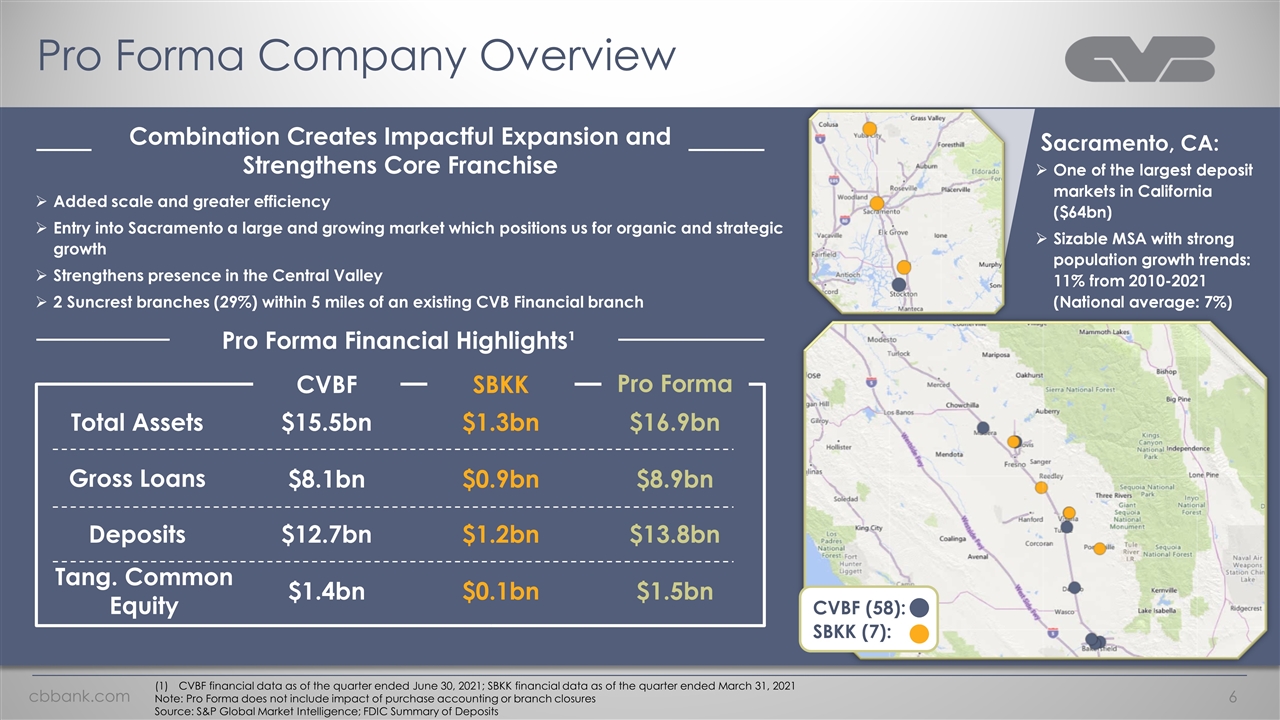

Added scale and greater efficiency Entry into Sacramento a large and growing market which positions us for organic and strategic growth Strengthens presence in the Central Valley 2 Suncrest branches (29%) within 5 miles of an existing CVB Financial branch Pro Forma Company Overview Combination Creates Impactful Expansion and Strengthens Core Franchise CVBF financial data as of the quarter ended June 30, 2021; SBKK financial data as of the quarter ended March 31, 2021 Note: Pro Forma does not include impact of purchase accounting or branch closures Source: S&P Global Market Intelligence; FDIC Summary of Deposits Pro Forma Financial Highlights¹ Total Assets Gross Loans Deposits Tang. Common Equity CVBF $15.5bn $8.1bn $12.7bn $1.4bn SBKK $1.3bn $0.9bn $1.2bn $0.1bn Pro Forma $16.9bn $8.9bn $13.8bn $1.5bn CVBF (58): SBKK (7): Sacramento, CA:

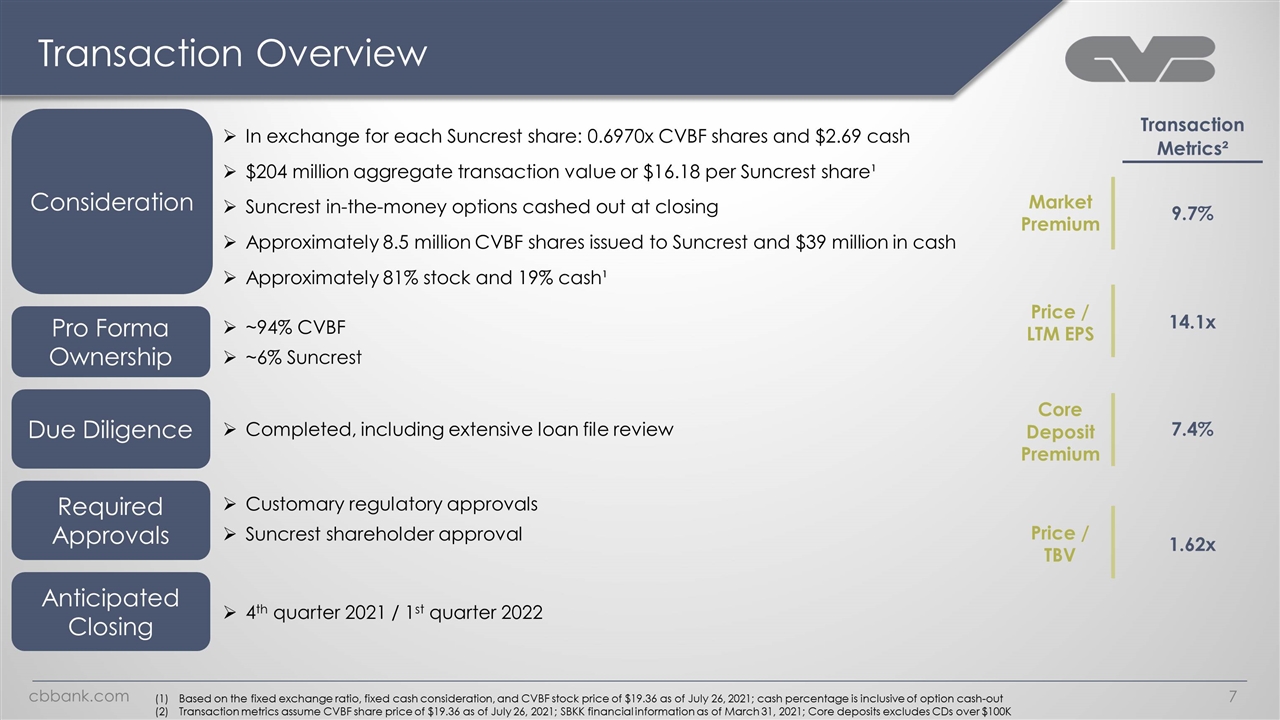

Transaction Overview Consideration Pro Forma Ownership Due Diligence Required Approvals Anticipated Closing 4th quarter 2021 / 1st quarter 2022 In exchange for each Suncrest share: 0.6970x CVBF shares and $2.69 cash $204 million aggregate transaction value or $16.18 per Suncrest share¹ Suncrest in-the-money options cashed out at closing Approximately 8.5 million CVBF shares issued to Suncrest and $39 million in cash Approximately 81% stock and 19% cash¹ ~94% CVBF ~6% Suncrest Transaction Metrics² Customary regulatory approvals Suncrest shareholder approval Completed, including extensive loan file review Price / TBV 1.62x Price / LTM EPS 14.1x Core Deposit Premium 7.4% Market Premium 9.7% Based on the fixed exchange ratio, fixed cash consideration, and CVBF stock price of $19.36 as of July 26, 2021; cash percentage is inclusive of option cash-out Transaction metrics assume CVBF share price of $19.36 as of July 26, 2021; SBKK financial information as of March 31, 2021; Core deposits excludes CDs over $100K

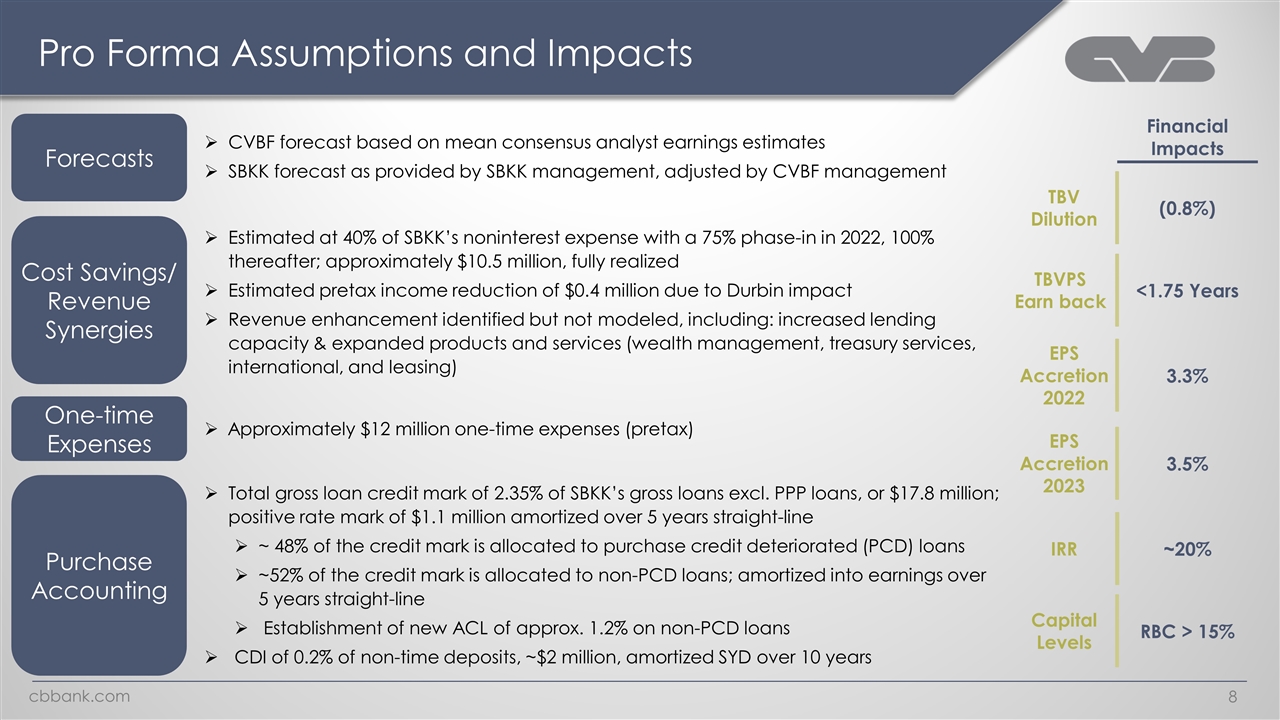

Pro Forma Assumptions and Impacts Financial Impacts TBV Dilution (0.8%) TBVPS Earn back <1.75 Years EPS Accretion 2022 3.3% EPS Accretion 2023 3.5% Capital Levels RBC > 15% Forecasts CVBF forecast based on mean consensus analyst earnings estimates SBKK forecast as provided by SBKK management, adjusted by CVBF management Purchase Accounting Total gross loan credit mark of 2.35% of SBKK’s gross loans excl. PPP loans, or $17.8 million; positive rate mark of $1.1 million amortized over 5 years straight-line ~ 48% of the credit mark is allocated to purchase credit deteriorated (PCD) loans ~52% of the credit mark is allocated to non-PCD loans; amortized into earnings over 5 years straight-line Establishment of new ACL of approx. 1.2% on non-PCD loans CDI of 0.2% of non-time deposits, ~$2 million, amortized SYD over 10 years One-time Expenses Approximately $12 million one-time expenses (pretax) Cost Savings/ Revenue Synergies Estimated at 40% of SBKK’s noninterest expense with a 75% phase-in in 2022, 100% thereafter; approximately $10.5 million, fully realized Estimated pretax income reduction of $0.4 million due to Durbin impact Revenue enhancement identified but not modeled, including: increased lending capacity & expanded products and services (wealth management, treasury services, international, and leasing) IRR ~20%

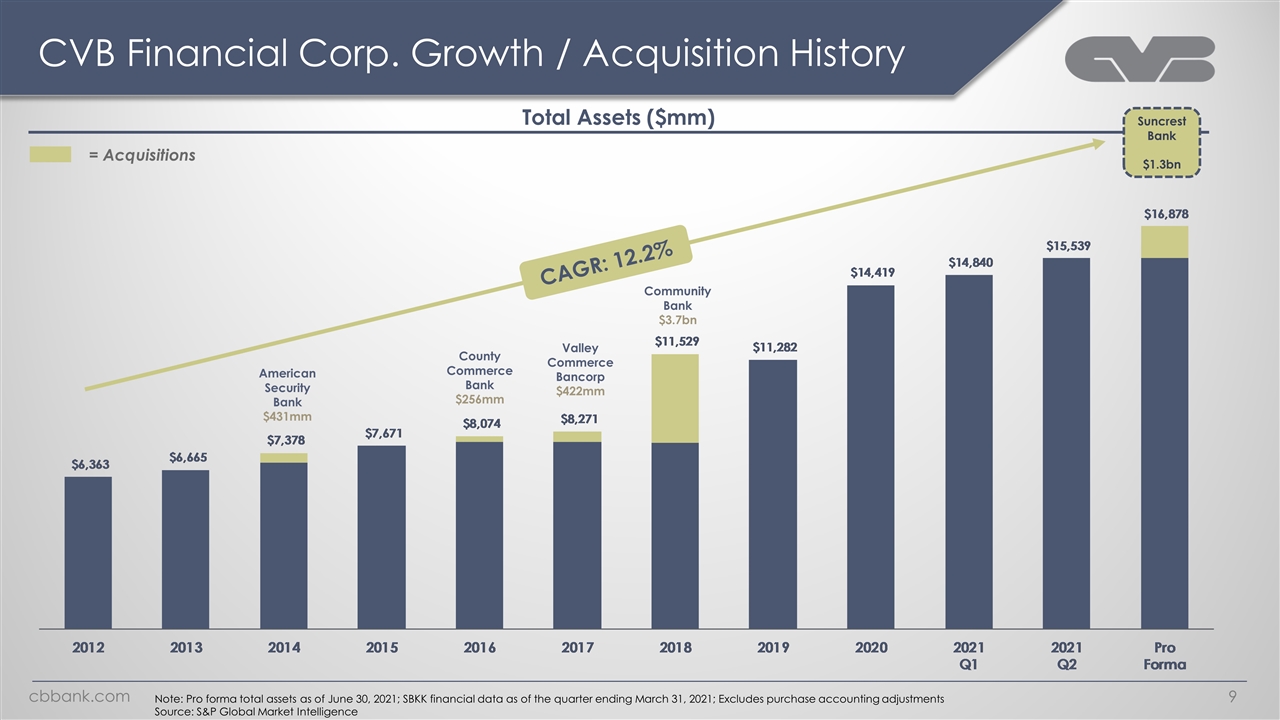

CVB Financial Corp. Growth / Acquisition History Total Assets ($mm) Note: Pro forma total assets as of June 30, 2021; SBKK financial data as of the quarter ending March 31, 2021; Excludes purchase accounting adjustments Source: S&P Global Market Intelligence = Acquisitions Community Bank $3.7bn American Security Bank $431mm Valley Commerce Bancorp $422mm County Commerce Bank $256mm Suncrest Bank $1.3bn CAGR: 12.2%

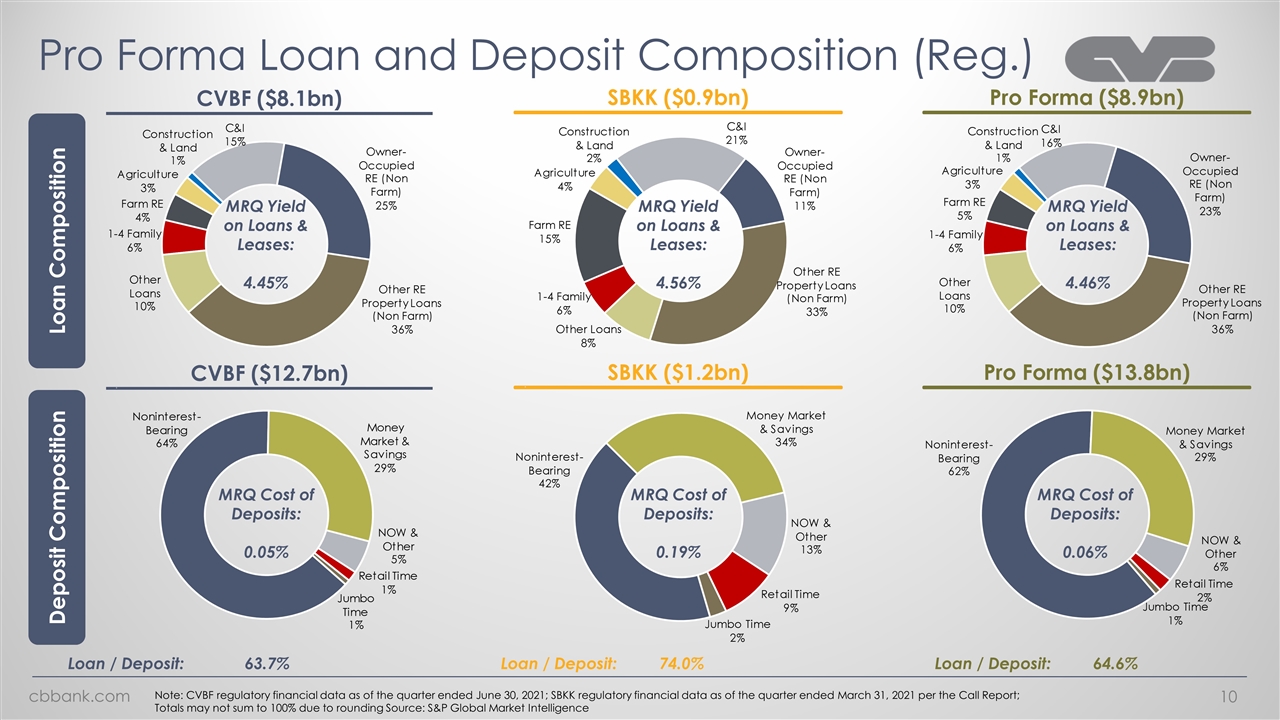

Pro Forma Loan and Deposit Composition (Reg.) Deposit Composition Loan Composition CVBF ($8.1bn) SBKK ($0.9bn) Pro Forma ($8.9bn) ( MRQ Yield on Loans & Leases: 4.45% CVBF ($12.7bn) ($ SBKK ($1.2bn) ($ Pro Forma ($13.8bn) ( MRQ Cost of Deposits: 0.05% MRQ Cost of Deposits: 0.19% MRQ Cost of Deposits: 0.06% Note: CVBF regulatory financial data as of the quarter ended June 30, 2021; SBKK regulatory financial data as of the quarter ended March 31, 2021 per the Call Report; Totals may not sum to 100% due to rounding Source: S&P Global Market Intelligence MRQ Yield on Loans & Leases: 4.56% MRQ Yield on Loans & Leases: 4.46% Loan / Deposit: 63.7% 74.0% Loan / Deposit: 64.6% Loan / Deposit:

Executive Summary $204 million stock and cash acquisition is second largest acquisition in CVBF history and fifth acquisition since 2012 Suncrest is a growing commercial bank with a diverse loan portfolio and quality customer relationships Entry into Sacramento – one of California’s largest deposit markets, expands organic and strategic growth opportunities Added penetration in existing Central Valley markets Increased scale will improve competitive position and operating efficiency CVBF is a proven integrator and acquisitions continue to be an important component of our growth strategy