Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Luther Burbank Corp | lbcer8kex991_2021q2.htm |

| 8-K - 8-K - Luther Burbank Corp | lbc-20210727.htm |

Investor Presentation June 30, 2021 Simone Lagomarsino President & Chief Executive Officer Laura Tarantino Executive Vice President & Chief Financial Officer EXHIBIT 99.2

2 Forward Looking Statement This communication contains a number of forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements reflect our current views with respect to, among other things, future events and our results of operations, financial condition and financial performance. All statements contained in this communication that are not clearly historical in nature are forward looking, and the words such as "anticipate," "believe," “continue,” "could," "estimate," "expect," “impact,” "intend," "seek," "may," "outlook," "plan," "potential," "predict," "project," "should," "will," "would" and similar terms and phrases are generally intended to identify forward looking statements. These forward looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward looking statements. Risk factors include, without limitation, the “Risk Factors” referenced in our Annual Report on Form 10 K for the year ended December 31, 2020 and other reports we file with the Securities and Exchange Commission (“SEC”). The risks and uncertainties listed from time to time in our reports and documents filed with the SEC include the following factors: challenges and uncertainties regarding the COVID 19 pandemic, business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic market areas; economic, market, operational, liquidity, credit and interest rate risks associated with our business; the occurrence of significant natural or man made disasters, including fires, earthquakes, and terrorist acts; public health crisis and pandemics, including the COVID 19 pandemic, and their effects on the economic and business environments in which we operate, including on our credit quality and business operations, as well as the impact on general economic and financial market conditions; our management of risks inherent in our real estate loan portfolio, and the risk of a prolonged downturn in the real estate market; our ability to achieve organic loan and deposit growth and the composition of such growth; the fiscal position of the U.S federal government and the soundness of other financial institutions; changes in consumer spending and savings habits; technological and social media changes; the laws and regulations applicable to our business; increased competition in the financial services industry; changes in the level of our nonperforming assets and charge offs; uncertainty regarding the future of LIBOR; our involvement from time to time in legal proceedings and examination and remedial actions by regulators; the composition of our management team and our ability to attract and retain key personnel; material weaknesses in our internal control over financial reporting; systems failures or interruptions involving our information technology and telecommunications systems; and potential exposure to fraud, negligence, computer theft and cyber crime. Luther Burbank Corporation ("LBC", the "Company", "we", "us", or "our") can give no assurance that any goal or expectation set forth in forward looking statements can be achieved and readers are cautioned not to place undue reliance on such statements. These forward looking statements are made as of the date of this communication, and the Company does not intend, and assumes no obligation, to update any forward looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by law.

3 Use of Non GAAP Financial Measures This investor presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore, are considered non GAAP financial measures. The Company’s management uses these non GAAP financial measures in their analysis of the Company’s performance, financial condition and the efficiency of its operations. Management believes that these non GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrate the effects of significant changes in the current period. The Company’s management also believes that investors find these non GAAP financial measures useful as they assist investors in understanding our underlying operating performance and the analysis of ongoing operating trends. However, the non GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which we calculate the non GAAP financial measures discussed herein may differ from that of other companies reporting measures with similar names. You should understand how such other banking organizations calculate their similar financial measures or with names similar to the non GAAP financial measures we have discussed herein when comparing such non GAAP financial measures. Below is a listing of the non GAAP financial measures used in this investor presentation. • Pro forma net income and efficiency ratio, for the year ended December 31, 2020, are provided to reverse the impact of a material non recurring cost incurred in connection with the prepayment of long term FHLB borrowings. • Pro forma items include provision for income taxes, net income, return on average assets, return on average equity and earnings per share. Prior to January 1, 2018, these pro forma amounts are calculated by adding back our franchise S Corporation tax to net income, and using a combined C Corporation effective tax rate for Federal and California income taxes of 42.0%. This calculation reflects only the changes in our status as a S Corporation and does not give effect to any other transaction. • Efficiency ratio is defined as noninterest expenses divided by operating revenue, which is equal to net interest income plus noninterest income. • Tangible book value and tangible stockholders’ equity to tangible assets are non GAAP measures that exclude the impact of goodwill and are used by the Company’s management to evaluate capital adequacy. Because intangible assets such as goodwill vary extensively from company to company, we believe that the presentation of these non GAAP financial measures allows investors to more easily compare the Company’s capital position to other companies. • Tangible book value per share is defined as tangible stockholders' equity divided by period end shares outstanding. A reconciliation to these non GAAP financial measures to the most directly comparable GAAP measures are provided in the appendix to this investor presentation.

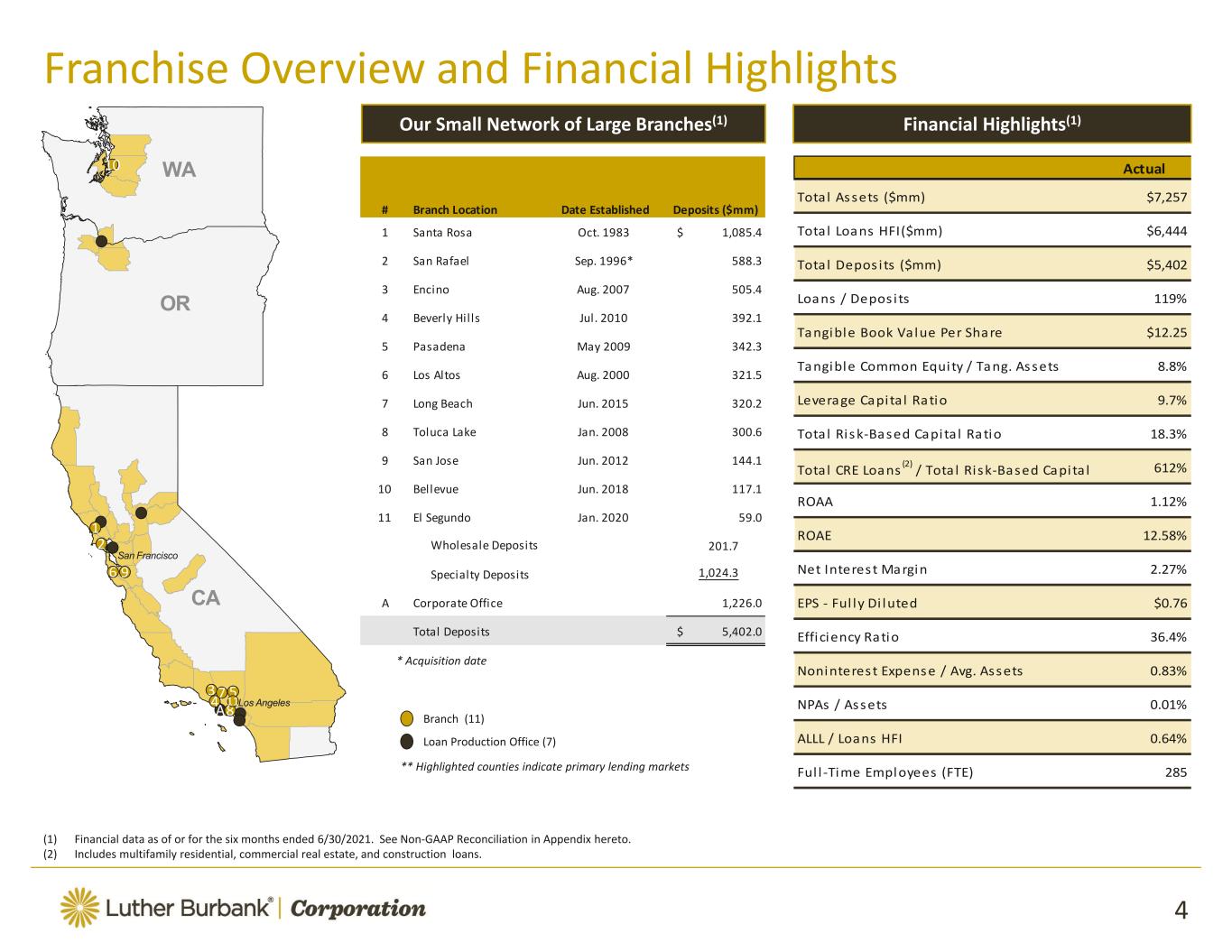

4 Franchise Overview and Financial Highlights Financial Highlights(1) Branch (11) Loan Production Office (7) ** Highlighted counties indicate primary lending markets Our Small Network of Large Branches(1) OR CA WA San Francisco Los Angeles 1 2 3 6 7 8 4 A 1 6 9 4 37 2 8 5 11 10 * Acquisition date (1) Financial data as of or for the six months ended 6/30/2021. See Non GAAP Reconciliation in Appendix hereto. (2) Includes multifamily residential, commercial real estate, and construction loans. # Branch Location Date Established 1 Santa Rosa Oct. 1983 $ 1,085.4 2 San Rafael Sep. 1996* 588.3 3 Encino Aug. 2007 505.4 4 Beverly Hills Jul. 2010 392.1 5 Pasadena May 2009 342.3 6 Los Altos Aug. 2000 321.5 7 Long Beach Jun. 2015 320.2 8 Toluca Lake Jan. 2008 300.6 9 San Jose Jun. 2012 144.1 10 Bellevue Jun. 2018 117.1 11 El Segundo Jan. 2020 59.0 201.7 Specialty Deposits 1,024.3 A Corporate Office 1,226.0 Total Deposits $ 5,402.0 Deposits ($mm) Wholesale Deposits Actual Total Assets ($mm) $7,257 Total Loans HFI($mm) $6,444 Total Depos i ts ($mm) $5,402 Loans / Depos i ts 119% Tangible Book Value Per Share $12.25 Tangible Common Equity / Tang. Assets 8.8% Leverage Capita l Ratio 9.7% Total Risk Based Capita l Ratio 18.3% Total CRE Loans (2) / Tota l Risk Based Capita l 612% ROAA 1.12% ROAE 12.58% Net Interest Margin 2.27% EPS Ful ly Di luted $0.76 Efficiency Ratio 36.4% Noninterest Expense / Avg. Assets 0.83% NPAs / Assets 0.01% ALLL / Loans HFI 0.64% Ful l Time Employees (FTE) 285

5 History of Profitability Well Positioned in Strategic Markets Demonstrated Organic Growth Engine Strong Management Team and Robust Infrastructure Strong Asset Quality Efficient Operations Key Highlights Note: Financial data as of or for the six months ended 6/30/2021. See Non GAAP Reconciliation in Appendix hereto. 4 3 2 1 6 5 Recorded consecutive quarterly profits since our second quarter of operations Survived and prospered through numerous economic cycles during our more than 37 year history West Coast gateway cities in supply constrained markets with strong job growth and limited affordable housing Achieve deeper penetration of our lending and deposit gathering operations in our attractive core markets Expand into other major metropolitan markets that share key demographic characteristics with our core markets Multifamily: professional real estate investors focused on investing in stable, cash flowing assets Single Family: primary residence, second home or investment property Retail Deposits: strong base built on a high level of service, competitive rates and our reputation for strength and security Led by President & CEO Simone Lagomarsino (30+ years of banking experience) Invested heavily in people and infrastructure over the last several years Our most important focus Strict, quality oriented underwriting and credit monitoring processes 0.01% NPAs / Total Assets Maintain a small network of large branches ($380 million avg. branch size) 36.4% efficiency ratio, 0.83% noninterest expense / average assets and 285 FTEs 1. History of Profitability 2. Well Positioned in Strategic Markets 3. Demonstrated Organic Growth Engine 4. Strong Management Team and Robust Infrastructure 5. Strong Asset Quality 6. Efficient Operations

6 Top Multifamily Lenders in the United States Source: S&P Global Market Intelligence (1) Represents delinquent multifamily loans as a percentage of total multifamily loans as March 31, 2021. Delinquent loans include 30+ days past due and nonaccrual loan. (2) Includes all U.S. commercial banks, savings banks and savings and loan associations. (3) Sterling Bancorp announced a merger of equals with Webster Financial Corp. on April 19, 2021. (4) Dime Community Bancshares Inc. completed a merger with Bridge Bancorp Inc. on February 1, 2021. Historical data is for Dime Community. Top 25 Banks and Thrifts by Multifamily Loans (Dollars in billions) AsofMarch 31, 2021 Multifamily LoansChange Since (%) Delinquency Total Multifamily December 31, March 31, % of Change Since (bps) Rank Institution Name Headquarters Assets Loans 2020 2020 Multifamily(1) March 31, 2020 1. JPMorgan Chase & Co. New York, NY 3,689.3 72.38 (1.3) (3.2) 0.39 21 2. New York Community Bancorp, Inc. Westbury, NY 57.7 32.22 (0.1) 3.0 0.03 1 3. Signature Bank New York, NY 85.4 15.62 3.0 5.1 0.05 (16) 4. Wel ls Fargo & Co. San Francisco, CA 1,959.5 15.26 0.2 2.0 0.69 55 5. Fi rs t Republ ic Bank San Francisco, CA 155.8 14.14 2.7 10.3 0.01 1 6. Capi ta l One Financia l Corporation McLean, VA 425.2 11.87 1.1 (8.3) 1.24 108 7. Santander Holdings USA, Inc. Boston, MA 146.6 8.13 (2.8) (4.6) 1.13 39 8. Citigroup Inc. New York, NY 2,314.3 7.88 (8.7) 4.3 1.04 (72) 9. Investors Bancorp Inc Short Hi l l s , NJ 25.8 7.24 1.5 (5.4) 0.54 (50) 10. MUFG Americas Holdings Corporation New York, NY 170.0 7.23 0.3 (3.4) 0.37 15 11. PNC Financia l Services Group, Inc. Pi ttsburgh, PA 474.5 6.78 (0.5) 3.1 0.26 9 12. Paci fi c Premier Bancorp, Inc. Irvine, CA 20.2 5.07 (2.0) 211.2 0.00 0 13. Val ley National Bancorp New York, NY 41.2 5.01 (2.6) (4.7) 0.24 21 14. Truis t Financia l Corp. Charlotte, NC 517.5 4.87 (13.6) (4.3) 0.06 (4) 15. TD Group US Holdings LLC Wilmington, DE 517.8 4.85 1.4 6.3 0.79 64 16. Bank of America Corp. Charlotte, NC 2,970.0 4.80 (0.2) (11.1) 0.08 (1) 17. M&T Bank Corporation Buffa lo, NY 150.5 4.44 (3.5) (4.4) 0.82 22 18. Sterl ing Bancorp (3) Pearl River, NY 29.9 4.39 (0.3) (7.3) 0.34 18 19. KeyCorp Cleveland, OH 176.3 4.21 2.2 (4.2) 0.66 54 20. Luther Burbank Corporation Santa Rosa, CA 7.1 4.11 0.2 1.3 0.05 2 21. U.S. Bancorp Minneapol is , MN 553.4 3.92 1.1 (0.8) 0.48 11 22. CIBC Bancorp USA Inc. Chicago, IL 57.3 3.72 0.4 (3.9) 0.00 0 23. Dime Community Bancshares Inc. (4) Hauppauge, NY 6.3 3.58 297.4 346.6 0.56 56 24. PacWest Bancorp Beverly Hi l l s , CA 32.9 3.51 (0.8) (2.6) 0.06 5 25. Umpqua Holdings Corporation Portland, OR 30.0 3.48 2.2 (1.1) 0.30 29 Banking Industry Aggregate(2) 481.26 0.3 2.7 0.42 10

7 Multifamily Loans Industry Trends Source: S&P Global Market Intelligence Analysis includes all U.S. commercial banks, savings banks and savings and loan associations. (1) Represents nonaccrual and past due multifamily loans as a percentage of total multifamily loans. (2) Represents nonaccrual and past due gross loans and leases as a percentage of gross loans and leases. Multifamily Loan Growth Multifamily Loan Delinquencies (1) (2)

8 Luther Burbank Peer Group Source: S&P Global Market Intelligence. GAAP data when available, otherwise FR Y 9C’s and bank call reports as of or for the three months ended 3/31/2021. Note that SNL earnings ratios may differ from Company as SNL annualizes one quarter rather than using data for 12 months. (1) Nonperforming assets (“NPA”) includes performing troubled debt restructurings. (2) Compound annual growth rate (“CAGR”) from 12/31/2017 to 3/31/2021 and reflects the impact from mergers and acquisitions. Includes all major exchange traded banks and thrifts nationwide as of and for the quarter ended March 31, 2021 with: Total assets > $1 billion Gross loans / assets > 65% Multifamily loans / total loans > 30% MFR + SFR + CRE / total loans > 75% General Information Profitability Capital & Balance Sheet Ratios Asset Quality(1) Bal. Sheet Growth(2) Total NPA / NCO / Gross Total Total Multifamily Yield on Cost of NIE / Avg. Eff. TCE / Leverage Capital Loans / LLR / Loans Avg. Loans Deposits Assets Loans ROAA ROAE NIM Loans Deposits Assets Ratio TA Ratio Ratio Deposits Loans + OREO Loans CAGR CAGR Institution Name Ticker State ($bn) ($bn) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) Luther Burbank Corporation LBC CA 7.1 4.1 1.05 11.82 2.26 3.51 0.89 0.88 39.3 8.8 9.7 18.6 115 0.70 0.13 0.00 6.9 10.0 Peer Group: 1. Dime Community Bancshares, Inc. DCOM NY 13.0 3.6 (0.79) (8.18) 3.10 3.70 0.36 3.11 NA 6.9 9.6 14.0 96 0.93 0.43 0.23 45.6 43.6 2. First Foundation Inc. FFWM TX 7.1 3.0 1.24 11.02 3.27 4.15 0.44 1.92 51.7 8.9 8.6 11.7 90 0.41 0.35 (0.01) 12.7 20.1 3. Flushing Financial Corporation FFIC NY 8.2 2.5 0.93 12.29 3.33 4.26 0.45 1.89 56.9 7.6 8.4 12.9 105 0.67 0.50 0.17 8.5 12.4 4. Investors Bancorp, Inc. ISBC NJ 25.8 7.2 1.11 10.56 2.87 NA 0.45 1.60 51.8 10.4 10.4 14.6 107 1.36 0.46 (0.03) 1.2 2.9 5. Kearny Financial Corp. KRNY NJ 7.4 2.1 0.90 6.07 2.91 4.17 0.55 1.63 55.6 11.9 12.1 20.2 88 1.33 1.65 0.06 12.3 19.2 6. Malaga Bank F.S.B. CA 1.3 1.0 1.46 11.44 2.97 3.86 0.44 0.93 31.2 12.7 12.9 22.4 136 0.31 0.00 0.00 7.3 4.6 7. Marquette Bank IL 1.9 0.6 0.64 6.66 3.08 3.94 0.18 2.88 73.7 7.6 7.9 13.4 76 1.14 1.51 0.14 3.3 7.0 8. New York Community Bancorp, Inc. NYCB NY 57.7 32.2 1.04 8.47 2.48 3.57 0.46 0.94 39.8 7.0 8.4 13.1 126 0.46 0.13 0.00 3.7 5.1 9. Northfield Bancorp, Inc. NFBK NJ 5.6 2.6 1.34 9.90 3.07 4.25 0.22 1.41 45.7 12.9 12.7 NA 94 1.10 0.37 0.25 7.2 12.3 10. Pacific Premier Bancorp, Inc PPBI CA 20.2 5.1 1.38 9.99 3.53 4.74 0.17 1.85 48.2 9.0 9.7 16.3 77 2.03 0.30 0.04 25.8 36.5 11. Provident Savings Bank, F.S.B. CA 1.2 0.5 0.58 5.88 2.67 3.81 0.19 2.32 77.7 9.9 10.0 20.0 89 0.98 2.10 0.00 4.6 0.9 12. Waterstone Financial, Inc. WSBF WI 2.2 0.6 3.94 20.21 2.95 4.11 0.57 7.72 NA 19.6 19.8 27.1 134 1.06 0.90 (0.01) 4.8 7.1 Average: 1.15 8.69 3.02 4.05 0.37 2.35 53.2 10.4 10.9 16.9 101 0.98 0.73 0.07 10.6 14.3 Median: 1.08 9.95 3.02 4.11 0.44 1.87 51.7 9.4 9.8 14.6 95 1.02 0.45 0.02 7.2 9.7

9 Our Lending Business Note: Data as of 6/30/2021. Multifamily Residential Loans Markets: High barrier to entry for new development; little land to develop Limited supply of new housing High variance between cost to own and rent Deals: Stabilized and seasoned assets Older, smaller properties with rents at/below market levels, catering to lower and middle income renters Sponsors: Experienced real estate professionals who desire regular income/cash flow streams and are focused on building wealth steadily over time Single Family Residential Loans Occupancy Types: Both owner occupied and investor owned Broker Network: Primarily third party mortgage brokers Originations: Portfolio lender Purchase and refinance transactions Underwriting Focus: Debt ratios Loan to value Credit scores Borrower’s liquidity and cash reserves 0.01% NPAs / Assets 0.01% NPLs / Loans Multifamily Portfolio Highlights $1.6 million average loan balance 14.5 average units 57% average loan to value ratio 1.52x average debt service coverage ratio Single Family Portfolio Highlights $835 thousand average loan balance 62% average loan to value ratio 757 average credit score

10 First Mortgages Hybrid Structures • 25 or 30 year amortization • 10 , 25 or 30 year maturities • 3 , 5 , 7 or 10 year fixed rate periods Interest Only Option • Lower loan to value ratios • Underwrite at amortizing payment Investor Owner Purchase or Refinance Lines of Credit • Real estate secured only/specific business purpose/fully adjustable/short term Our Lending Products Multifamily / Commercial Real Estate Lending Single Family Residential Lending First Mortgages Hybrid Structures • 30 or 40 year amortization • 30 or 40 year maturities • 3 , 5 , 7 or 10 year fixed rate periods Full Documentation Interest Only Purchase or Refinance Transactions Primary Residence, Second Home or Investor programs Low and Moderate income lending program • 30 year fixed mortgages and forgivable second mortgages

11 Loan Portfolio (1) As of or for the six months ended 6/30/2021. Historical Loan Growth 3.46% yield on loans; 3.78% weighted average coupon Loan Portfolio Composition (1) Multifamily Loans by Lending Area (1) Single Family Loans by Lending Area (1) SoCal (LA / OC) 48% SoCal (Other) 14% NorCal 33% Washington 5% Oregon 0% SoCal (LA / OC) 54% SoCal (Other) 10% NorCal 23% Washington 11% Oregon 2% Construction & Land Development 0% Single Family Residential 30% Multifamily Residential 67% Commercial Real Estate 3% Other Loans 0%

12 Commercial Real Estate Loan Detail (1) As of 6/30/2021. (2) Construction and land development LTV is calculated based on an “as completed” property value. Loan Portfolio Composition (1) Construction & Land Development 0% Single Family Residential 30% Multifamily Residential 67% Commercial Real Estate 3% Other Loans 0% ($ in 000's) Count Balance Weighted Avg. LTV (2) % of Total Loans Multifamily Real Estate 2,655 4,281,698$ 56.6% 66.5% Single Family Real Estate 2,330 1,945,099 62.4% 30.2% Commercial Real Estate Type: Strip Retail 23 48,313 50.6% 0.7% Mid Rise Office 7 38,875 64.4% 0.6% Low Rise Office 13 24,191 54.6% 0.4% Medical Office 6 19,540 60.2% 0.3% Anchored Retail 3 12,103 52.7% 0.2% Multi-Tenant Industrial 7 10,792 47.9% 0.2% More than 50% commercial 11 10,696 46.7% 0.2% Shopping Center 4 8,690 50.0% 0.1% Unanchored Retail 7 8,408 43.9% 0.1% Shadow Retail 4 6,916 60.3% 0.1% Flex Industrial 2 2,462 63.5% 0.0% Warehouse 3 2,444 45.8% 0.0% Restaurant 2 1,512 33.9% 0.0% Light Manufacturing 1 1,320 48.7% 0.0% Other 1 85 16.3% 0.0% Commercial Real Estate 94 196,347 54.5% 3.0% Construction & Land Development 9 20,496 58.6% 0.3% Total 5,088 6,443,640$ 58.3% 100.0%

13 Asset Quality Risk management is a core competency of our business Extensive expertise among our lending and credit administration staff and executive officers Credit decisions are made efficiently and consistent with our underwriting standards Continuous evaluation of risk and return Strict separation between business development and credit decisions Vigilant response to adverse economic conditions and specific problem credits Strict, quality oriented underwriting and credit monitoring processes 6/30/2021 NPAs / Total Assets of 0.01%; NPLs / Total Loans of 0.01% NPAs and loans 90+ days past due to total assets have been at low levels since 2014 No foreclosures since 2015 Culture Approach Results Nonperforming Assets / Total Assets $6.9 $2.0 $6.3 $6.3 $6.7 $0.7 0.12% 0.03% 0.09% 0.09% 0.09% 0.01% 0.00% 0.50% 1.00% $0.0 $5.0 $10.0 $15.0 December 31, 2017 December 31, 2018 December 31, 2019 December 31, 2020 March 31, 2021 June 30, 2021 ($ in millions) Nonperforming Assets (excluding performing troubled debt restructuings) Nonperforming Assets / Total Assets

14 Loan Origination Volume and WAC (1) Total loan pipeline at June 30, 2021 is $471.8 million ($309.8 million CRE at 3.609% weighted average coupon (“WAC”) and $162.0 million SFR at 3.228% WAC). A portion of our pipeline will ultimately not fund and loans without rate locks are subject to ongoing rate adjustments. (2) Q1 2021 originations include a $287.8 million SFR fixed rate loan pool purchase with a WAC of 2.31%. Excluding the loan pool purchase, Q1 2021 originations would have been $391.0 million with a WAC of 3.35%. $2,140.3 $2,047.8 $1,564.1 $333.1 $678.8 $487.9 $729.4 $235.2 $385.2 4.00% 4.63% 4.35% 3.70% 3.13% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 December 31, 2017 December 31, 2018 December 31, 2019 December 31, 2020 June 30, 2021 ($ in millions) $1,408.2 2.91% (1) (2) $1,441.4 3.98% 3.78% 3.66% 3.39% Q1 Q1 Q2 Q3 Q4 Q2 3.34%

15 $1,366.8 $1,218.3 $972.9 $217.5 $253.0 $269.1 $478.5 $166.7 $293.4 4.02% 4.60% 4.40% 3.67% 3.40% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% $0 $250 $500 $750 $1,000 $1,250 $1,500 December 31, 2017 December 31, 2018 December 31, 2019 December 31, 2020 June 30, 2021 ($ in millions) $731.5 Q2 CRE Loan Origination Volume and WAC $946.7 3.36% 3.65% 3.78% 3.95% Q1 3.38% Q4 Q3 Q2 Q1 3.40%

16 $756.1 $828.8 $591.2 $115.6 $425.8$218.8 $250.9 $68.6 $91.8 3.94% 4.67% 4.29% 3.77% 2.85% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% $0 $200 $400 $600 $800 $1,000 December 31, 2017 December 31, 2018 December 31, 2019 December 31, 2020 June 30, 2021 ($ in millions) 3.22% SFR Loan Origination Volume and WAC 5.15% (1) Q1 2021 originations include a $287.8 million SFR fixed rate loan pool purchase with a WAC of 2.31%. Excluding the loan pool purchase, Q1 2021 SFR originations would have been $138.1 million with a WAC of 3.30%. $494.8 3.49% 3.69% 3.78% 4.02% Q4 Q3 Q2 Q1 Q1 2.63% (1) $676.7 Q2

17 Loan Portfolio WAC • At June 30, 2021, loans representing 73% of the loan portfolio, or $4.7 billion in aggregate outstanding principal balance, are at their floors. • February 2021 originations include a $287.8 million SFR fixed rate loan pool purchase with a WAC of 2.31%. Excluding the impact of the loan pool purchase, the WAC for originations would have been 3.43% in February 2021. 2.000% 2.500% 3.000% 3.500% 4.000% 4.500% 5.000% 5.500% Ja n M ar M ay Ju l Se p No v Ja n M ar M ay Ju l Se p No v Ja n M ar M ay Ju l Se p No v Ja n M ar M ay Ju l Se p No v Ja n M ar M ay 2017 2018 2019 2020 2021 WAC on Originations/Purchases WAC on Principal Reductions/Sales WAC on Loan Portfolio

18 Loan Prepayment Speeds 3.00% 8.00% 13.00% 18.00% 23.00% 28.00% 33.00% 38.00% 43.00% Ja n Fe b M ar Ap r M ay Ju n Ju l Au g Se p Oc t No v De c Ja n Fe b M ar Ap r M ay Ju n Ju l Au g Se p Oc t No v De c Ja n Fe b M ar Ap r M ay Ju n Ju l Au g Se p Oc t No v De c Ja n Fe b M ar Ap r M ay Ju n Ju l Au g Se p Oc t No v De c Ja n Fe b M ar Ap r M ay Ju n 2017 2018 2019 2020 2021 CP R Total Loans SFR Loans CRE Loans Conditional prepayment rate ("CPR") based on 12 month rolling average of monthly prepayment rates (SMM)

19 $3,951.3 $5,001.0 $5,234.7 $5,264.3 $5,391.9 $5,402.0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 December 31, 2017 December 31, 2018 December 31, 2019 December 31, 2020 March 31, 2021 June 30, 2021 ($ in millions) Deposit Composition (1) As of or for the six months ended 6/30/2021. Historical Deposit Growth & Portfolio Composition 0.82% cost of interest bearing deposits (1) Deposit Breakdown by Branch ($ in millions) (1) Branch Location Consumer Specialty/ Business Wholesale Total Deposits Santa Rosa $ 1,023.7 $ 61.7 $ 0.0 $ 1,085.4 San Rafael 525.8 62.5 0.0 588.3 Encino 499.0 6.4 0.0 505.4 Beverly Hills 381.2 10.9 0.0 392.1 Pasadena 339.7 2.6 0.0 342.3 Los Altos 314.1 7.4 0.0 321.5 Long Beach 315.5 4.7 0.0 320.2 Toluca Lake 287.5 13.1 0.0 300.6 San Jose 143.7 0.4 0.0 144.1 Bellevue 116.5 0.6 0.0 117.1 El Segundo 53.7 5.3 0.0 59.0 Corporate Office 56.8 967.5 201.7 1,226.0 Total Deposits $ 4,057.2 $ 1,143.1 $ 201.7 $ 5,402.0 Noninterest bearing Deposits 2% MMDAs & Other Savings Deposits 44% Interest Checking Deposits 3% Time Deposits 51%

20 $3,418.0 $3,852.6 $3,845.5 $4,101.2 $4,159.4 $4,057.2 $253.9 $440.1 $416.0 $50.0 $50.0 $201.7$279.4 $708.3 $973.2 $1,113.1 $1,182.5 $1,143.1 $ $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 December 31, 2017 December 31, 2018 December 31, 2019 December 31, 2020 March 31, 2021 June 30, 2021 ($ in millions) Retail Consumer Wholesale Retail Specialty & Business Deposit Growth/Balance Growth Trend $1,049.7 $233.7 $29.6 $127.6 $10.1

21 Specialty & Business Deposit Composition By Vertical December 31, 2020 June 30, 2021 Total Specialty & Business Deposits of $1.1 billion Total Specialty & Business Deposits of $1.1 billion HOA 6% 1031 Exchange 6% Fiduciary 58% Union Accounts 8% Zero Interest 5% Other 17% HOA 5% 1031 Exchange 10% Fiduciary 53% Union Accounts 7% Zero Interest 7% Other 18%

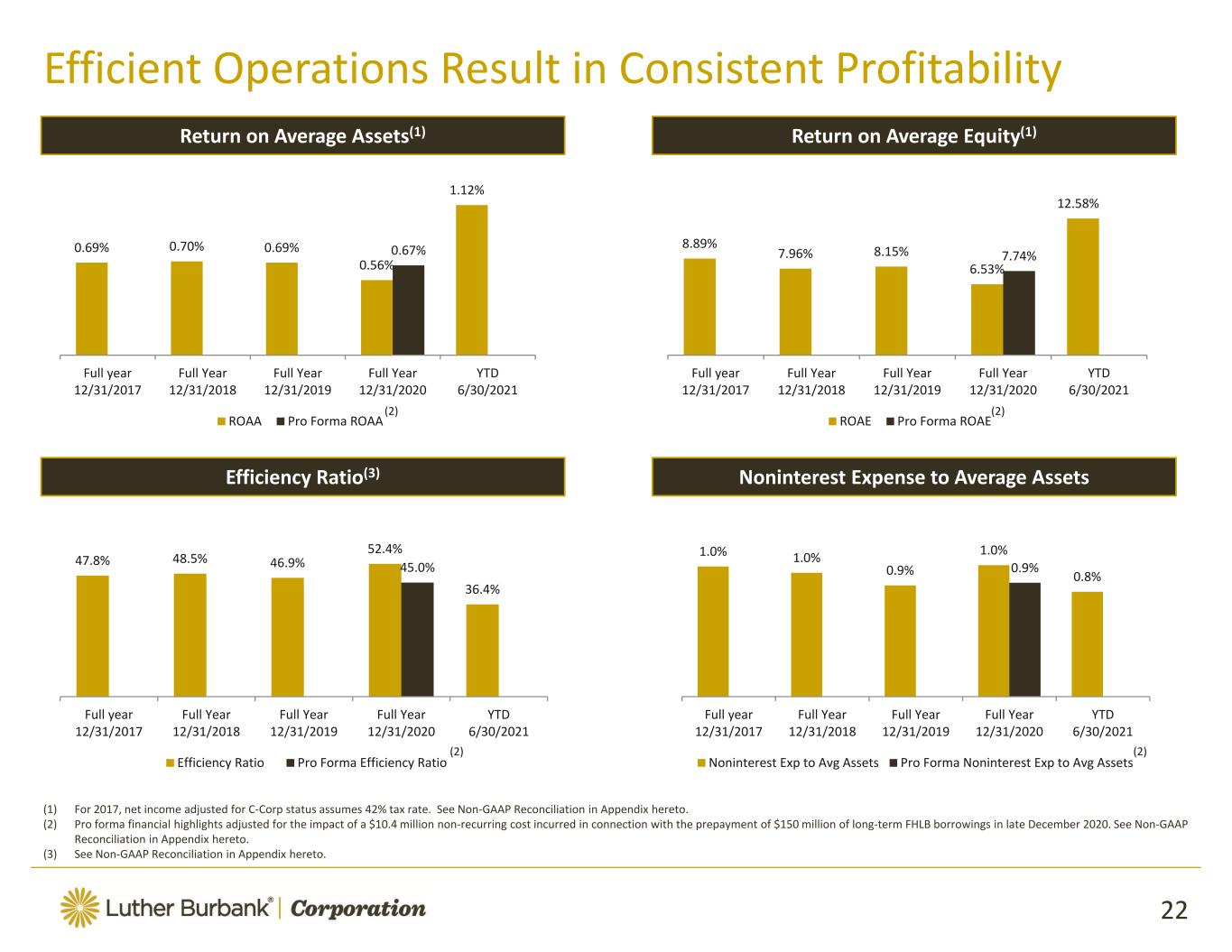

22 47.8% 48.5% 46.9% 52.4% 36.4% 45.0% Full year 12/31/2017 Full Year 12/31/2018 Full Year 12/31/2019 Full Year 12/31/2020 YTD 6/30/2021 Efficiency Ratio Pro Forma Efficiency Ratio 8.89% 7.96% 8.15% 6.53% 12.58% 7.74% Full year 12/31/2017 Full Year 12/31/2018 Full Year 12/31/2019 Full Year 12/31/2020 YTD 6/30/2021 ROAE Pro Forma ROAE 0.69% 0.70% 0.69% 0.56% 1.12% 0.67% Full year 12/31/2017 Full Year 12/31/2018 Full Year 12/31/2019 Full Year 12/31/2020 YTD 6/30/2021 ROAA Pro Forma ROAA Efficient Operations Result in Consistent Profitability (1) For 2017, net income adjusted for C Corp status assumes 42% tax rate. See Non GAAP Reconciliation in Appendix hereto. (2) Pro forma financial highlights adjusted for the impact of a $10.4 million non recurring cost incurred in connection with the prepayment of $150 million of long term FHLB borrowings in late December 2020. See Non GAAP Reconciliation in Appendix hereto. (3) See Non GAAP Reconciliation in Appendix hereto. Return on Average Assets(1) Return on Average Equity(1) Efficiency Ratio(3) Noninterest Expense to Average Assets (2) (2) (2) (2) 1.0% 1.0% 0.9% 1.0% 0.8%0.9% Full year 12/31/2017 Full Year 12/31/2018 Full Year 12/31/2019 Full Year 12/31/2020 YTD 6/30/2021 Noninterest Exp to Avg Assets Pro Forma Noninterest Exp to Avg Assets

23 Net Interest Margin Quarterly Net Interest Margin Net Interest Margin 1.84% 1.89% 1.84% 1.88% 2.03% 2.13% 2.23% 2.31% Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 2.05% 1.98% 1.84% 1.97% 2.27% Full year 12/31/2017 Full Year 12/31/2018 Full Year 12/31/2019 Full Year 12/31/2020 YTD 6/30/2021

24 Interest Rate Risk Analysis On a quarterly basis, the Company measures and reports Net Interest Income at Risk (“NII”) and the Economic Value of Equity (“EVE”) to isolate the change in income and equity related solely to interest earning assets and interest bearing liabilities. Both models measure instantaneous parallel shifts in market interest rates, implied by the forward yield curve. NII Impact ($ in millions) EVE Impact ($ in millions)

25 35% 30% 25% 20% 15% 10% 5% 0% +200bp Shock +100bp Shock Economic Value of Equity Trend (1) For Luther Burbank Savings (2) The increase in EVE at June 30, 2021 is due to loan portfolio growth along with a steepening of the yield curve during the quarter and a change in model assumptions. (1) (1) (2) (2)

26 Deposits Cost of Funds Comparison (1) Beta is calculated using an average Fed Funds Rate. 0.000 0.500 1.000 1.500 2.000 2.500 3.000 Av e. M on th ly Ra te % Deposit Portfolio Cost of Funds Fed Funds Deposit Portfolio Beta 55% Aug. 2019 – Jun. 2021 (1) Deposit Portfolio Beta 66% Jan. 2017 – Jul. 2019 (1)

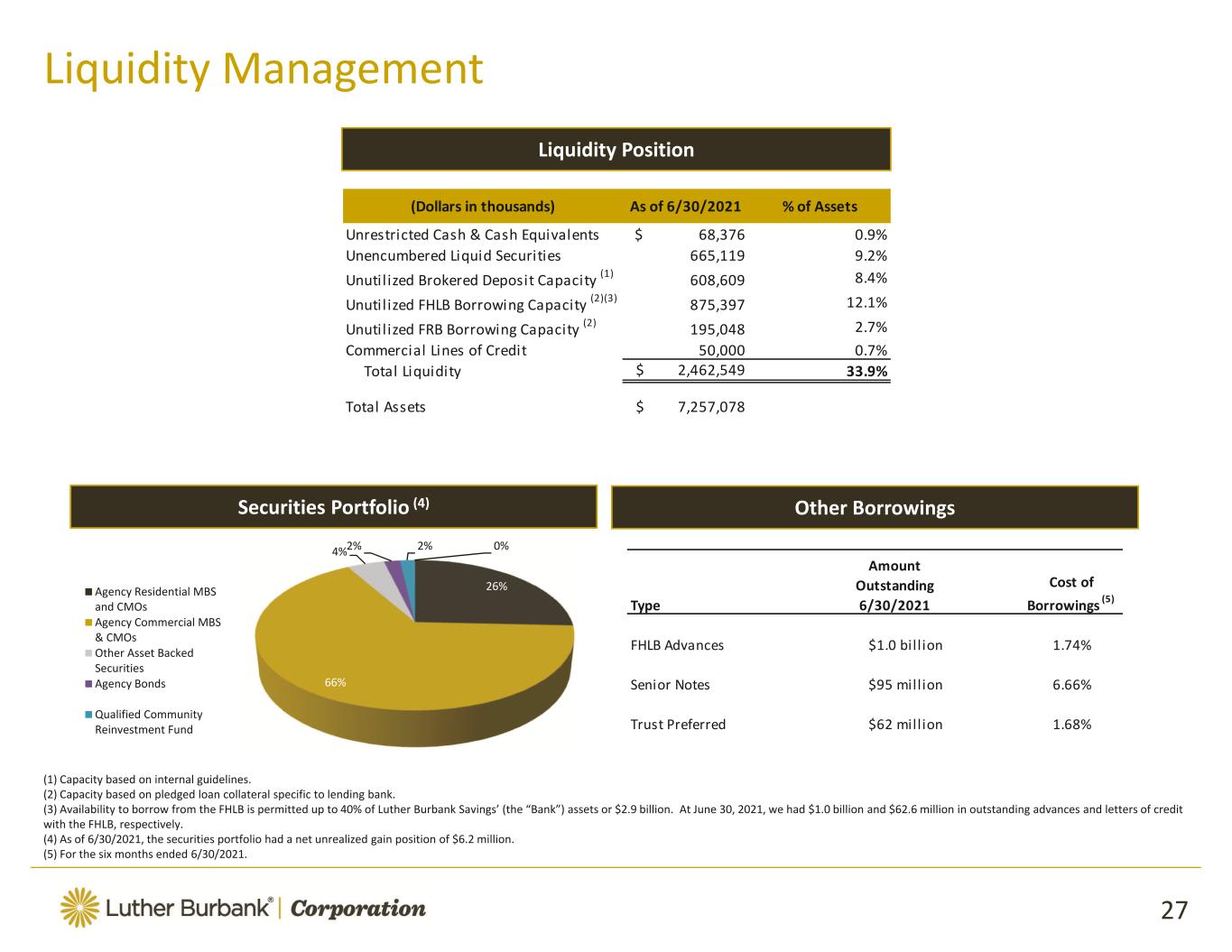

27 Liquidity Management (1) Capacity based on internal guidelines. (2) Capacity based on pledged loan collateral specific to lending bank. (3) Availability to borrow from the FHLB is permitted up to 40% of Luther Burbank Savings’ (the “Bank”) assets or $2.9 billion. At June 30, 2021, we had $1.0 billion and $62.6 million in outstanding advances and letters of credit with the FHLB, respectively. (4) As of 6/30/2021, the securities portfolio had a net unrealized gain position of $6.2 million. (5) For the six months ended 6/30/2021. Other BorrowingsSecurities Portfolio (4) Liquidity Position 26% 66% 4%2% 2% 0% Agency Residential MBS and CMOs Agency Commercial MBS & CMOs Other Asset Backed Securities Agency Bonds Qualified Community Reinvestment Fund (Dollars in thousands) As of 6/30/2021 % of Assets Unrestricted Cash & Cash Equivalents $ 68,376 0.9% Unencumbered Liquid Securities 665,119 9.2% Unutil ized Brokered Deposit Capacity (1) 608,609 8.4% Unutil ized FHLB Borrowing Capacity (2)(3) 875,397 12.1% Unutil ized FRB Borrowing Capacity (2) 195,048 2.7% Commercial Lines of Credit 50,000 0.7% Total Liquidity $ 2,462,549 33.9% Total Assets $ 7,257,078 Type Amount Outstanding 6/30/2021 Cost of Borrowings (5) FHLB Advances $1.0 bill ion 1.74% Senior Notes $95 mill ion 6.66% Trust Preferred $62 mill ion 1.68%

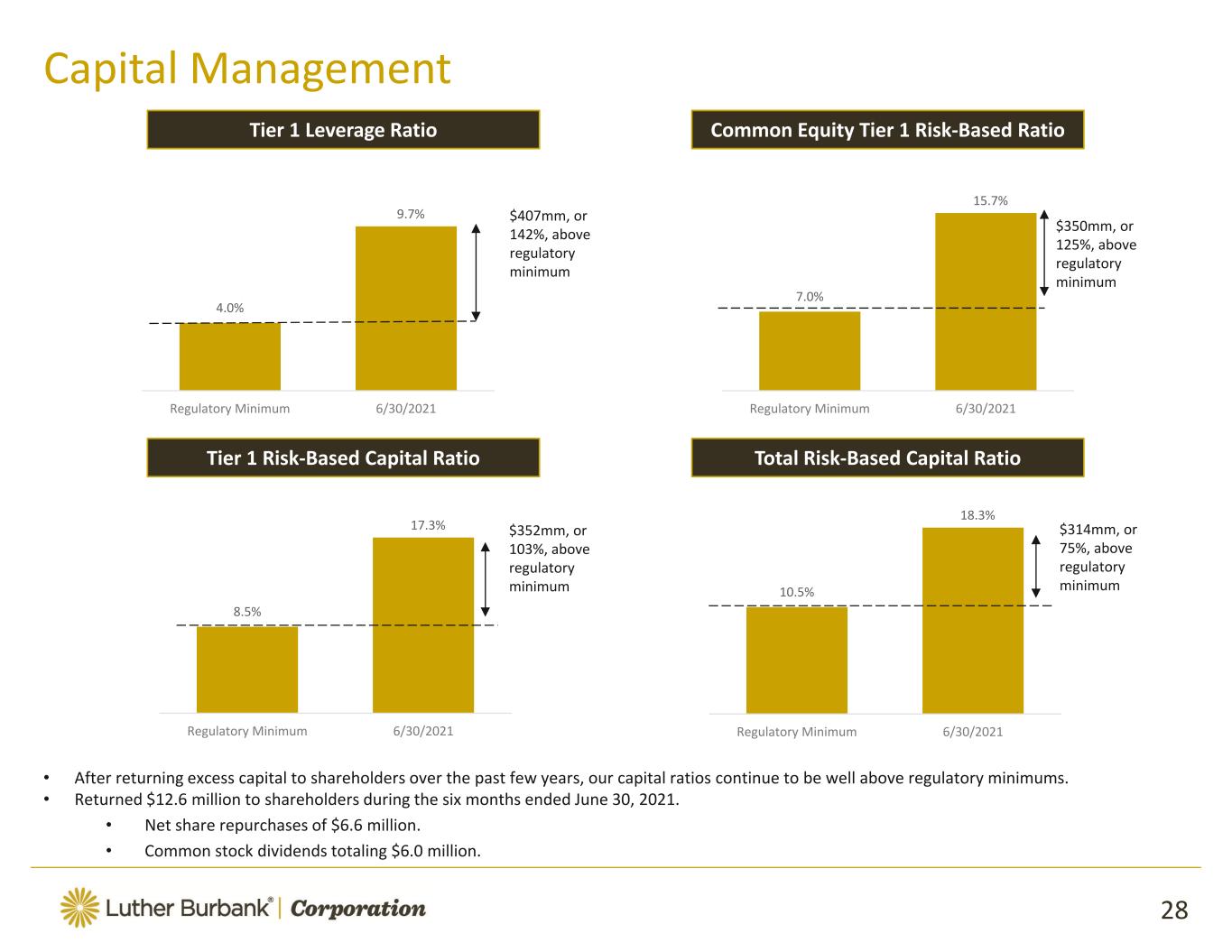

28 10.5% 18.3% Regulatory Minimum 6/30/2021 8.5% 17.3% Regulatory Minimum 6/30/2021 7.0% 15.7% Regulatory Minimum 6/30/2021 4.0% 9.7% Regulatory Minimum 6/30/2021 Capital Management • After returning excess capital to shareholders over the past few years, our capital ratios continue to be well above regulatory minimums. • Returned $12.6 million to shareholders during the six months ended June 30, 2021. • Net share repurchases of $6.6 million. • Common stock dividends totaling $6.0 million. Common Equity Tier 1 Risk Based RatioTier 1 Leverage Ratio Tier 1 Risk Based Capital Ratio Total Risk Based Capital Ratio $407mm, or 142%, above regulatory minimum $350mm, or 125%, above regulatory minimum $352mm, or 103%, above regulatory minimum $314mm, or 75%, above regulatory minimum

29 Executive Management Simone Lagomarsino. Ms. Lagomarsino serves as President and Chief Executive Officer (“CEO”) of the Company and the Bank. Ms. Lagomarsino has served on our Board of Directors since November 30, 2018. Prior to joining the Company, Ms. Lagomarsino was President and CEO of the Western Bankers Association and a director of Pacific Premier Bancorp. (NASDAQ: PPBI). From 2011 to 2017, she served as CEO of Heritage Oaks Bank, and President and CEO and a director of Heritage Oaks Bancorp. Ms. Lagomarsino also previously held executive positions with Hawthorne Financial Corporation, Ventura County National Bank, and Kinecta Federal Credit Union. In addition to her role at the Company, Ms. Lagomarsino serves on the board of directors of the Federal Home Loan Bank of San Francisco and Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE: HASI). Laura Tarantino.Ms. Tarantino serves as Chief Financial Officer of the Company and Bank, a position she has held since 2006. In this role, she oversees all aspects of financial reporting including strategic planning, asset/liability management, taxation and regulatory filings. She also serves on the Company's Executive Committee. Ms. Tarantino has over 28 years of experience with the Bank, having joined as Controller in 1992. She previously served as Audit Manager for KPMG LLP, San Francisco, specializing in the financial services industry. In addition to her role at the Company, Ms. Tarantino has served as an audit committee member for the Santa Rosa Council on Aging since 2012. Ms. Tarantino is a CPA (inactive) and holds a B.S. in Business Administration Finance & Accounting with summa cum laude honors from San Francisco State University. Bill Fanter. Mr. Fanter serves the Company as Head of Retail Banking. In this role he is responsible for expanding the Bank’s deposit offerings and creating greater access to its products and services, including consumer deposit generation across traditional branch and online banking platforms. He is also a member of the Company's Executive Committee. Prior to joining the Company in 2020, Mr. Fanter served as Executive Vice President, Head of Retail Banking at Opus Bank from 2019 and previous to that, as Senior Vice President, Consumer and Business Banking Market Executive at U.S. Bank from 2003 2019. His background also includes positions as Director of Automation Services at Kirchman Corporation and several roles culminating with Senior Vice President, Chief Operating Officer at GreatBanc, Inc.

30 Executive Management Continued Tammy Mahoney. Ms. Mahoney joined the Company in 2016 and serves as the Chief Risk Officer. In her role, Ms. Mahoney oversees the Company's compliance, internal audit and risk management functions; she is also a member of its Executive Committee. Prior to joining the Bank, Ms. Mahoney served as Senior Vice President of Enterprise Risk and Compliance at Opus Bank from 2011 through 2015; as Director, Risk Advisory Services at KPMG LLP from 1995 to 2004; and as Associate National Bank Examiner with the Office of the Comptroller of the Currency. A Certified Enterprise Risk Professional, Certified Regulatory Compliance Manager and Certified Internal Auditor, Ms. Mahoney holds a B.S. in Business Administration Finance from San Diego State University. Parham Medhat. Mr. Medhat serves the Company as Chief Operations and Technology Officer. In this role he is responsible for deposit operations, information technology, project management and marketing; he is also a member of the Company’s Executive Committee. Prior to joining the Bank in 2019, Mr. Medhat served as Executive Vice President, Chief Operating Officer at CTBC from 2014 to 2019; previous to that as Senior Vice President, Director of Bank Operations at Opus Bank; and in several roles over thirteen years at CapitalSource Bank. Mr. Medhat holds a M.A. in Educational–Instructional Technology from California State University, Dominguez Hills and a B.A. in Industrial/Organizational Psychology from California State University, Long Beach. Liana Prieto. Ms. Prieto serves as General Counsel and Corporate Secretary of the Company and Bank. In this role she is responsible for leading a team of legal, human resources, Bank Secrecy Act, fair and responsible banking and third party risk management professionals. She is also a member of the Company's Executive Committee. Prior to joining the Bank in 2014, Ms. Prieto served as Associate and then Counsel at Buckley LLP from 2009 to 2014, and as a trial attorney in the Enforcement & Compliance Division of the Office of the Comptroller of the Currency. In addition to her role at the Company, Ms. Prieto has served in leadership and advisory roles on the Banking Law Committee of the American Bar Association's Business Law Section and the American Association of Bank Directors. She also serves on the Board of Directors of Long Beach Local, a non profit that supports sustainable urban agriculture. Ms. Prieto holds a J.D. from Fordham University School of Law and a B.A. from Georgetown University. Alex Stefani. Mr. Stefani serves the Company as Chief Credit Officer. In this role, he oversees Luther Burbank’s appraisal, underwriting, credit administration and special assets activities; he is also a member of the Company’s Executive Committee. Mr. Stefani joined the Bank in 2004 and has held several positions including loan underwriter, loan officer, and underwriting manager before being promoted to Director of Income Property Lending in 2017, a position he held until accepting his current role in 2021. Mr. Stefani holds a M.A. in Political Science from San Francisco State University and a B.A. in Political Science from Sonoma State University.

31 Board of Directors Victor S. Trione. Mr. Trione serves as Chair of the Board of Directors of the Company and the Bank, a position he has held since founding the Bank in 1983. In addition to serving as our Chair, Mr. Trione is President of Vimark, Inc., a real estate development and vineyard management company, and co proprietor of Trione Winery. Mr. Trione also serves in the following roles: Director and Chair of the Executive Committee of Empire College; Advisory Board member of the Stanford Institute for Economic Policy Research; Board of Overseers of Stanford University's Hoover Institution; and, trustee of the U.S. Navy Memorial Foundation. Renu Agrawal. Ms. Agrawal joined the Board of Directors in December 2020 and serves on the Audit and Risk Committee. Ms. Agrawal most recently served as Executive Vice President and Chief Operating Officer for Wells Fargo’s Financial Institutions Group. Prior to that, she oversaw Well’s Fargo International Treasury Management business and played a leadership role in the Wells Fargo Wachovia merger. Earlier, Ms. Agrawal was Chief Operating Officer at ValleyCrest Companies and Quisic Corporation. She began her career as a scientist at Polaroid and also worked at McKinsey & Company. Ms. Agrawal is a founding member of Neythri, a global community of South Asian professional women committed to helping each other succeed. In 2018, she received the National Asian Pacific American Corporate Achievement Award. Ms. Agrawal holds a M.B.A. from MIT Sloan School of Management and a Ph.D. in Materials Science and Engineering from MIT. She graduated with a B.Tech in Metallurgy from IIT, Kanpur. John C. Erickson. Mr. Erickson serves on the Audit and Risk Committee and on the Compensation Committee. Mr. Erickson has served on our Board of Directors since 2017. Mr. Erickson has more than 35 years of financial services experience, including over 30 years at Union Bank N.A. He served in many executive roles across that institution, culminating in two vice chairman positions (Chief Risk Officer and Chief Corporate Banking Officer) between 2007 and 2014. As Chief Corporate Banking Officer, he oversaw commercial banking, real estate, global treasury management, wealth management and global capital markets. He was a director of Zions Bancorporation (NASDAQ: ZION) from 2014 to 2016, and chair of that board's Risk Committee, as well as a member of the Audit Committee. He also served as President, Consumer Banking and President, California, for CIT Group, Inc. (NYSE: CIT) in 2016. He joined the board of directors of Bank of Hawaii Corporation (NYSE: BOH) in January 2019, and serves as a member of its Audit and Risk Committee and Nominating and Governance Committee. Mr. Erickson qualifies as an "audit committee financial expert" as defined in SEC rules. Jack Krouskup.Mr. Krouskup serves on the Audit and Risk Committee and on the Governance and Nominating Committee. Mr. Krouskup has served on our Board of Directors since 2012. He is a certified public accountant (inactive) with more than 35 years of experience serving customers in a variety of industries. At Deloitte, he served as partner in charge of the company's Northern California Financial Services practice and also served on Deloitte's Financial Services Advisory Committee. Mr. Krouskup has years of boardroom experience representing Deloitte with numerous global and highly complex organizations. Consequently, he has an extensive corporate governance background and deep familiarity with board and audit committee best practices. Mr. Krouskup retired from Deloitte in 2011. He currently serves on the Board of Trustees of the University of California, Santa Barbara, Alumni Association. Mr. Krouskup qualifies as an "audit committee financial expert" as defined in SEC rules.

32 Board of Directors Continued Anita Gentle Newcomb. Mrs. Newcomb serves as Chair of the Audit and Risk Committee. Ms. Newcomb has served on our Board of Directors since 2014. Her experience spans over three decades in the financial services industry as a commercial banker, investment banker, and strategic consultant. She has advised numerous banks and financial services companies on a wide range of corporate development initiatives, from strategic planning, consumer and business banking strategy, and corporate governance best practices, to mutual conversions and valuing and structuring acquisitions. Most recently, Ms. Newcomb was president of A.G. Newcomb & Co., a financial services consultancy, she founded and managed from 1999 to 2019. She also served on the board of the Federal Reserve Bank of Richmond Baltimore Branch from 2010 through 2015. She is also a certified public accountant (inactive). Ms. Newcomb qualifies as an "audit committee financial expert" as defined in SEC rules. Bradley M. Shuster. Mr. Shuster serves as Chair of the Compensation Committee and also serves on the Governance and Nominating Committee. Mr. Shuster has served on our Board of Directors since 1999. Mr. Shuster has served as Executive Chairman and Chairman of the Board of NMI Holdings, Inc. (NASDAQ: NMIH) since January 2019. Mr. Shuster founded National MI and served as Chairman and Chief Executive Officer of the company from 2012 to 2018. Prior to founding National MI, he was a senior executive of The PMI Group, Inc. (NYSE: PMI), where he served as Chief Executive Officer of PMI Capital Corporation. Before joining PMI in 1995, Mr. Shuster was a partner at Deloitte, where he served as partner in charge of Deloitte's Northern California Insurance and Mortgage Banking practices. Mr. Shuster has received both CPA and CFA certifications. He is a member of the board of directors of McGrath Rentcorp (NASDAQ: MGRC), and serves as a member of its Audit and Governance Committees. Thomas C. Wajnert. Mr. Wajnert serves as our Lead Independent Director, Chair of the Governance and Nominating Committee, and a member of the Compensation Committee. Mr. Wajnert has served on our Board of Directors since 2013. He launched his career in 1968 with US Leasing, a NYSE listed company. For over 40 years, Mr. Wajnert has navigated the changing currents of the equipment leasing industry and built an impressive list of accomplishments, including serving as Chief Executive Officer and Chair of AT&T Capital Corporation, an international, full service equipment leasing and commercial finance company, from 1984 to 1996. Mr. Wajnert also has extensive public company board experience at Reynolds American as Chair, and at Solera, UDR, Inc., NYFIX, and JLG Industries as a director. Mr. Wajnert also serves on the board of International Finance Group, one of the largest privately owned P&C insurance companies in the U.S., and for many years served as a Trustee of Wharton's Center for Financial Institutions.

Appendix

34 Balance Sheet ($ in 000’s) (1) Unaudited June 30, 2021 (1) December 31, 2020 ASSETS Cash, cash equivalents and restricted cash $ 70,296 $ 178,861 Available for sale investment securities, at fair value 653,260 593,734 Held to maturity investment securities, at amortized cost (fair value of $4,527 and $7,870 at June 30, 2021 and December 31, 2020, respectively) 4,324 7,467 Equity securities, at fair value 11,859 12,037 Loans receivable, net of allowance for loan losses of $41,335 and $46,214 at June 30, 2021 and December 31, 2020, respectively 6,402,305 6,003,602 Accrued interest receivable 18,909 18,795 Federal Home Loan Bank ("FHLB") stock, at cost 29,135 25,122 Premises and equipment, net 17,039 18,226 Goodwill 3,297 3,297 Prepaid expenses and other assets 46,654 44,963 Total assets $ 7,257,078 $ 6,906,104 LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities: Deposits $ 5,401,972 $ 5,264,329 Federal Home Loan Bank advances 1,005,147 806,747 Junior subordinated deferrable interest debentures 61,857 61,857 Senior debt $95,000 face amount, 6.5% interest rate, due September 30, 2024 (less debt issuance costs of $399 and $461 at June 30, 2021 and December 31, 2020, respectively) 94,601 94,539 Accrued interest payable 527 1,388 Other liabil ities and accrued expenses 54,275 63,553 Total liabilities 6,618,379 6,292,413 Stockholders' equity: Common stock, no par value; 100,000,000 shares authorized; 51,861,704 and 52,220,266 shares issued and outstanding at June 30, 2021 and December 31, 2020, respectively 407,860 414,120 Retained earnings 226,446 192,834 Accumulated other comprehensive income, net of taxes 4,393 6,737 Total stockholders' equity 638,699 613,691 Total liabilities and stockholders' equity $ 7,257,078 $ 6,906,104 As of

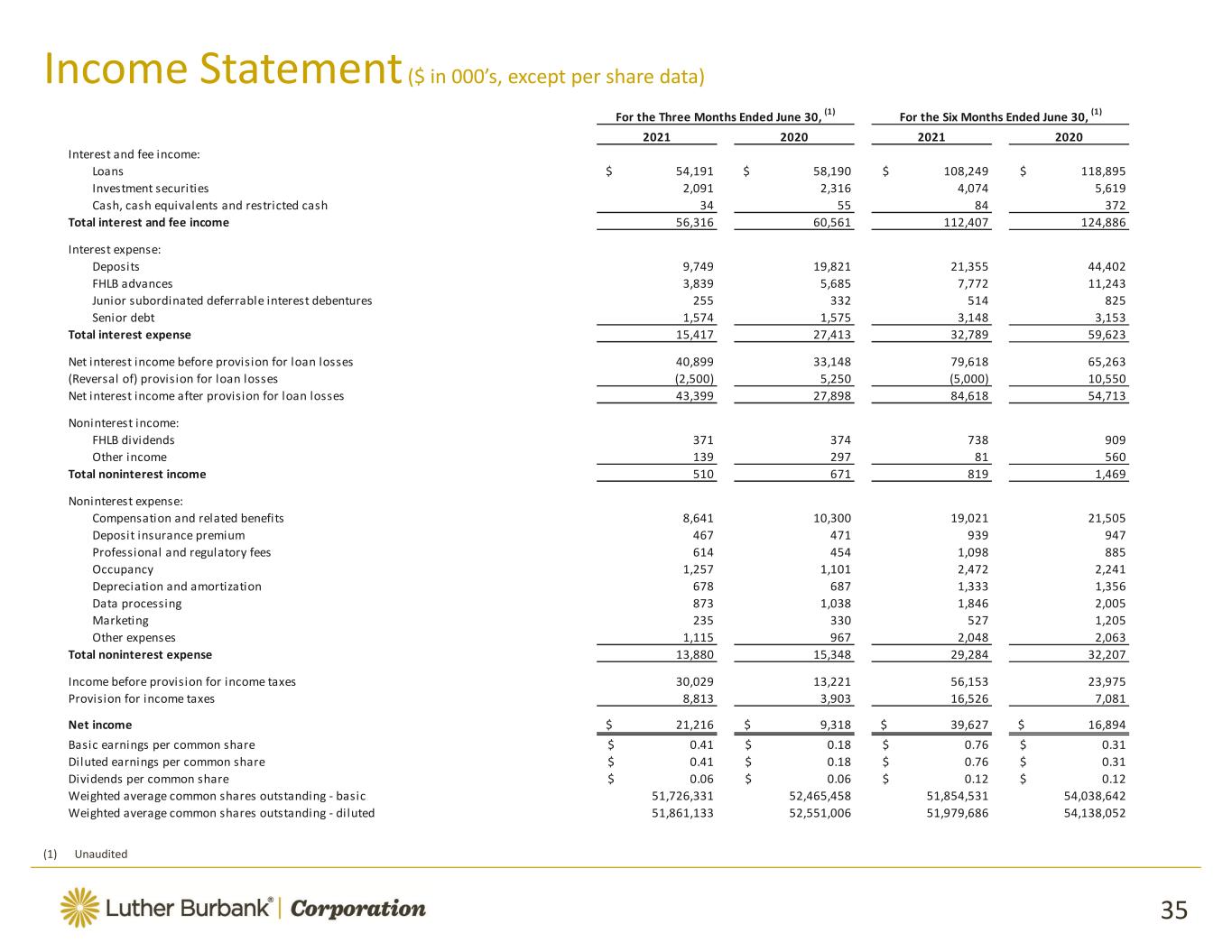

35 Income Statement ($ in 000’s, except per share data) (1) Unaudited 2021 2020 2021 2020 Interest and fee income: Loans $ 54,191 $ 58,190 $ 108,249 $ 118,895 Investment securities 2,091 2,316 4,074 5,619 Cash, cash equivalents and restricted cash 34 55 84 372 Total interest and fee income 56,316 60,561 112,407 124,886 Interest expense: Deposits 9,749 19,821 21,355 44,402 FHLB advances 3,839 5,685 7,772 11,243 Junior subordinated deferrable interest debentures 255 332 514 825 Senior debt 1,574 1,575 3,148 3,153 Total interest expense 15,417 27,413 32,789 59,623 Net interest income before provision for loan losses 40,899 33,148 79,618 65,263 (Reversal of) provision for loan losses (2,500) 5,250 (5,000) 10,550 Net interest income after provision for loan losses 43,399 27,898 84,618 54,713 Noninterest income: FHLB dividends 371 374 738 909 Other income 139 297 81 560 Total noninterest income 510 671 819 1,469 Noninterest expense: Compensation and related benefits 8,641 10,300 19,021 21,505 Deposit insurance premium 467 471 939 947 Professional and regulatory fees 614 454 1,098 885 Occupancy 1,257 1,101 2,472 2,241 Depreciation and amortization 678 687 1,333 1,356 Data processing 873 1,038 1,846 2,005 Marketing 235 330 527 1,205 Other expenses 1,115 967 2,048 2,063 Total noninterest expense 13,880 15,348 29,284 32,207 Income before provision for income taxes 30,029 13,221 56,153 23,975 Provision for income taxes 8,813 3,903 16,526 7,081 Net income $ 21,216 $ 9,318 $ 39,627 $ 16,894 Basic earnings per common share $ 0.41 $ 0.18 $ 0.76 $ 0.31 Diluted earnings per common share $ 0.41 $ 0.18 $ 0.76 $ 0.31 Dividends per common share $ 0.06 $ 0.06 $ 0.12 $ 0.12 Weighted average common shares outstanding basic 51,726,331 52,465,458 51,854,531 54,038,642 Weighted average common shares outstanding diluted 51,861,133 52,551,006 51,979,686 54,138,052 For the Three Months Ended June 30, (1) For the Six Months Ended June 30, (1)

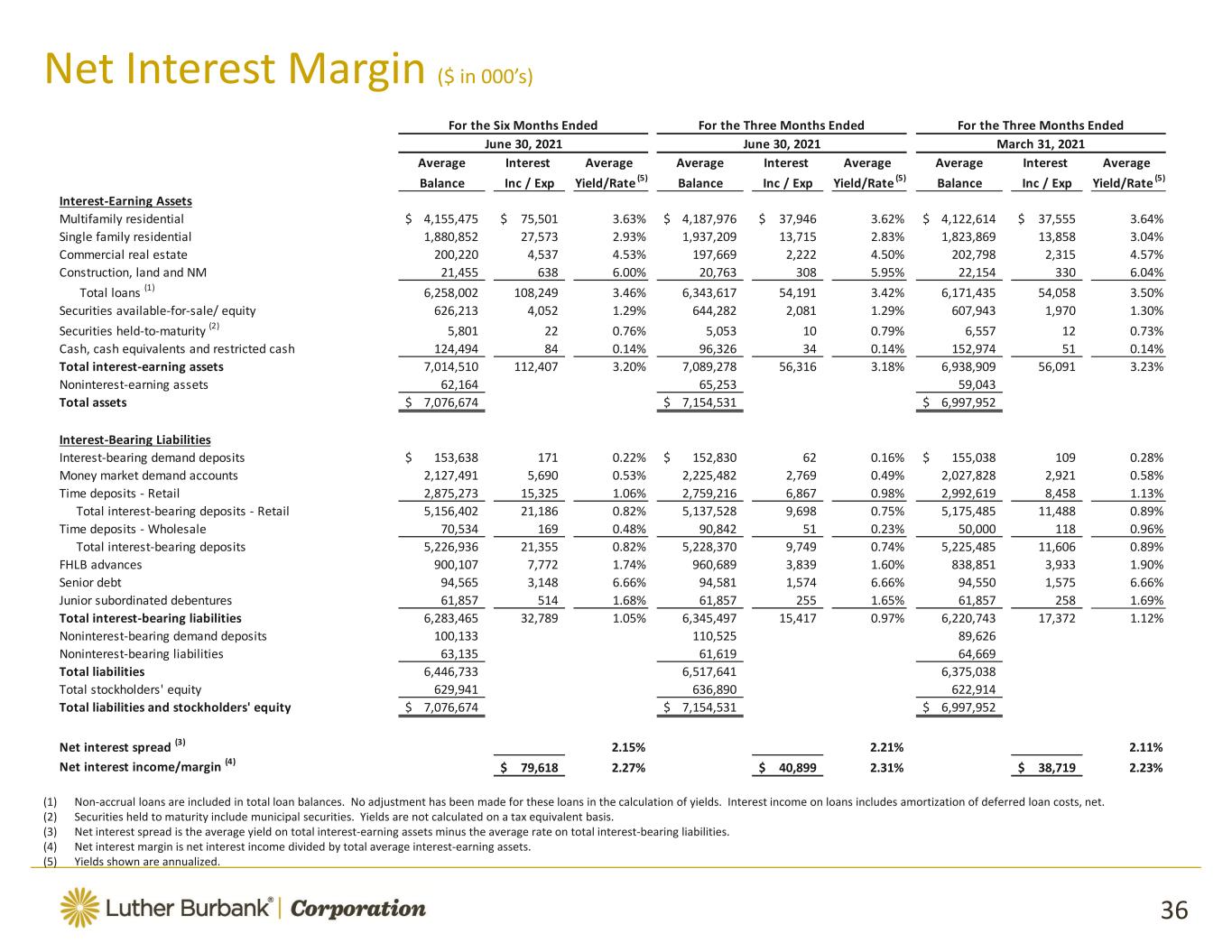

36 Average Interest Average Average Interest Average Average Interest Average Balance Inc / Exp Yield/Rate (5) Balance Inc / Exp Yield/Rate (5) Balance Inc / Exp Yield/Rate (5) Interest Earning Assets Multifamily residential 4,155,475$ 75,501$ 3.63% 4,187,976$ 37,946$ 3.62% 4,122,614$ 37,555$ 3.64% Single family residential 1,880,852 27,573 2.93% 1,937,209 13,715 2.83% 1,823,869 13,858 3.04% Commercial real estate 200,220 4,537 4.53% 197,669 2,222 4.50% 202,798 2,315 4.57% Construction, land and NM 21,455 638 6.00% 20,763 308 5.95% 22,154 330 6.04% Total loans (1) 6,258,002 108,249 3.46% 6,343,617 54,191 3.42% 6,171,435 54,058 3.50% Securities available for sale/ equity 626,213 4,052 1.29% 644,282 2,081 1.29% 607,943 1,970 1.30% Securities held to maturity (2) 5,801 22 0.76% 5,053 10 0.79% 6,557 12 0.73% Cash, cash equivalents and restricted cash 124,494 84 0.14% 96,326 34 0.14% 152,974 51 0.14% Total interest earning assets 7,014,510 112,407 3.20% 7,089,278 56,316 3.18% 6,938,909 56,091 3.23% Noninterest earning assets 62,164 65,253 59,043 Total assets 7,076,674$ 7,154,531$ 6,997,952$ Interest Bearing Liabilities Interest bearing demand deposits 153,638$ 171 0.22% 152,830$ 62 0.16% 155,038$ 109 0.28% Money market demand accounts 2,127,491 5,690 0.53% 2,225,482 2,769 0.49% 2,027,828 2,921 0.58% Time deposits Retail 2,875,273 15,325 1.06% 2,759,216 6,867 0.98% 2,992,619 8,458 1.13% Total interest bearing deposits Retail 5,156,402 21,186 0.82% 5,137,528 9,698 0.75% 5,175,485 11,488 0.89% Time deposits Wholesale 70,534 169 0.48% 90,842 51 0.23% 50,000 118 0.96% Total interest bearing deposits 5,226,936 21,355 0.82% 5,228,370 9,749 0.74% 5,225,485 11,606 0.89% FHLB advances 900,107 7,772 1.74% 960,689 3,839 1.60% 838,851 3,933 1.90% Senior debt 94,565 3,148 6.66% 94,581 1,574 6.66% 94,550 1,575 6.66% Junior subordinated debentures 61,857 514 1.68% 61,857 255 1.65% 61,857 258 1.69% Total interest bearing liabilities 6,283,465 32,789 1.05% 6,345,497 15,417 0.97% 6,220,743 17,372 1.12% Noninterest bearing demand deposits 100,133 110,525 89,626 Noninterest bearing liabilities 63,135 61,619 64,669 Total liabilities 6,446,733 6,517,641 6,375,038 Total stockholders' equity 629,941 636,890 622,914 Total liabilities and stockholders' equity 7,076,674$ 7,154,531$ 6,997,952$ Net interest spread (3) 2.15% 2.21% 2.11% Net interest income/margin (4) 79,618$ 2.27% 40,899$ 2.31% 38,719$ 2.23% For the Six Months Ended For the Three Months Ended For the Three Months Ended June 30, 2021 June 30, 2021 March 31, 2021 Net Interest Margin ($ in 000’s) (1) Non accrual loans are included in total loan balances. No adjustment has been made for these loans in the calculation of yields. Interest income on loans includes amortization of deferred loan costs, net. (2) Securities held to maturity include municipal securities. Yields are not calculated on a tax equivalent basis. (3) Net interest spread is the average yield on total interest earning assets minus the average rate on total interest bearing liabilities. (4) Net interest margin is net interest income divided by total average interest earning assets. (5) Yields shown are annualized.

37 Non GAAP Reconciliation ($ in 000’s, except per share data) (1) For 2017, we calculate our pro forma net income, earnings per share, return on average assets, return on average equity and return on average tangible equity by adding back our franchise S Corporation tax to net income, and using a combined C Corporation effective tax rate for Federal and California income taxes of 42%. This calculation reflects only the change in our status as an S Corporation and does not give effect to any other transaction. June 30, 2021 2020 2019 2018 2017 Tangible stockholders' equity Total assets $ 7,257,078 $ 6,906,104 $ 7,045,828 $ 6,937,212 $ 5,704,380 Less: Goodwill (3,297) (3,297) (3,297) (3,297) (3,297) Less: Total liabilities (6,618,379) (6,292,413) (6,431,364) (6,356,067) (5,154,635) Tangible stockholders' equity $ 635,402 $ 610,394 $ 611,167 $ 577,848 $ 546,448 Tangible assets Total assets $ 7,257,078 $ 6,906,104 $ 7,045,828 $ 6,937,212 $ 5,704,380 Less: Goodwill (3,297) (3,297) (3,297) (3,297) (3,297) Tangible assets $ 7,253,781 $ 6,902,807 $ 7,042,531 $ 6,933,915 $ 5,701,083 Tangible stockholders' equity to tangible assets Tangible book value (numerator) $ 635,402 $ 610,394 $ 611,167 $ 577,848 $ 546,448 Tangible assets (denominator) 7,253,781 6,902,807 7,042,531 6,933,915 5,701,083 Tangible stockholders' equity to tangible assets 8.8% 8.8% 8.7% 8.3% 9.6% Efficiency ratio Noninterest expense (numerator) $ 29,284 $ 73,934 $ 62,386 $ 62,687 $ 56,544 Net interest income $ 79,618 $ 138,623 $ 128,407 $ 125,087 $ 110,895 Noninterest income 819 2,520 4,675 4,131 7,508 Operating revenue (denominator) $ 80,437 $ 141,143 $ 133,082 $ 129,218 $ 118,403 Efficiency ratio 36.4% 52.4% 46.9% 48.5% 47.8% Tangible book value per share Tangible stockholders' equity (numerator) $ 635,402 Period end shares outstanding (denominator) 51,861,704 Tangible book value per share $ 12.25 Pro forma items (1) Net income before income taxes $ 65,231 Effective tax rate 42% Pro forma provision for income taxes $ 27,397 Net income before income taxes $ 65,231 Pro forma provision for income taxes 27,397 Pro forma net income $ 37,834 Pro forma net income (numerator) $ 37,834 Average assets (denominator) 5,485,832 Pro forma return on average assets 0.69% Average stockholders' equity (denominator) $ 425,698 Pro forma return on average stockholders' equity 8.89% As of or For the Six Months Ended As of or For the Years Ended December 31,

38 Non GAAP Reconciliation ($ in 000’s, except per share data) (1) For the year ended December 31, 2020, our pro forma amounts above are adjusted to reverse the impact of a non recurring cost incurred in connection with the early paydown of $150 million of long term FHLB borrowings in late December 2020. As of or For the Year Ended December 31, 2020 Pro forma items continued (1) Net income $ 39,912 Add: Non recurring noninterest expense item, net taxes 7,352 Pro forma net income $ 47,264 Pro forma net income (numerator) $ 47,264 Average assets (denominator) 7,092,407 Pro forma return on average assets 0.67% Pro forma net income (numerator) $ 47,264 Average stockholders' equity (denominator) 610,770 Pro forma return on average stockholders' equity 7.74% Pro forma net income (numerator) $ 47,264 Fully dilutive shares (denominator) 53,146,298 Pro forma earnings per share $ 0.89 Noninterest expense $ 73,934 Less: Non recurring noninterest expense item, before income taxes (10,443) Pro forma noninterest expense (numerator) $ 63,491 Operating revenue (denominator) $ 141,143 Pro forma efficiency ratio 45.0% Pro forma noninterest expense (numerator) $ 63,491 Average assets (denominator) 7,092,407 Pro forma noninterest expense to average assets 0.90%