Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Federal Home Loan Bank of Cincinnati | regfdform8-k042821.htm |

©2021 FHLB Cincinnati. All rights reserved. Welcome 2021 FHLB Cincinnati Regional Stockholder Meeting April 28, 2021

©2021 FHLB Cincinnati. All rights reserved. Disclaimer This presentation may contain forward-looking statements that are subject to risks and uncertainties that could affect the FHLB’s financial condition and results of operations. These include, but are not limited to, the effects of economic and financial conditions, legislative or regulatory developments concerning the FHLB System, financial pressures affecting other FHLBanks, competitive forces, and other risks detailed from time to time in the FHLB’s annual report on Form 10-K and other filings with the Securities and Exchange Commission. The forward-looking statements speak as of the date made and are not guarantees of future performance. Actual results or developments may differ materially from the expectations expressed or implied in the forward-looking statements, and the FHLB undertakes no obligation to update any such statements. 1

©2021 FHLB Cincinnati. All rights reserved. Trusted Partners J. Lynn Anderson Chair, FHLB Cincinnati Board of Directors

©2021 FHLB Cincinnati. All rights reserved. Maintaining Consistent Operations Safely in 2020 3 The worldwide COVID-19 pandemic forced many companies, including many of our members, to fundamentally change the way they provided services. FHLB has always committed significant resources to ensure our ability to reliably and consistently provide service to members in the event of potential disruptions. Beginning in March 2020, nearly the entire FHLB staff began working remotely, with additional safety measures taken to protect staff working on-site.

©2021 FHLB Cincinnati. All rights reserved. Trusted Partners – Expanded Offerings and Continuous Improvements • We introduced the no-interest, short- term RISE Advances to help members with member liquidity needs • Expanded eligible collateral types to include Paycheck Protection Program (PPP) Loans • Updated other collateral qualifications • MPP mortgage payment accommodations • Improved member experience through expanded communications, DocuSign form approvals and account information management 4

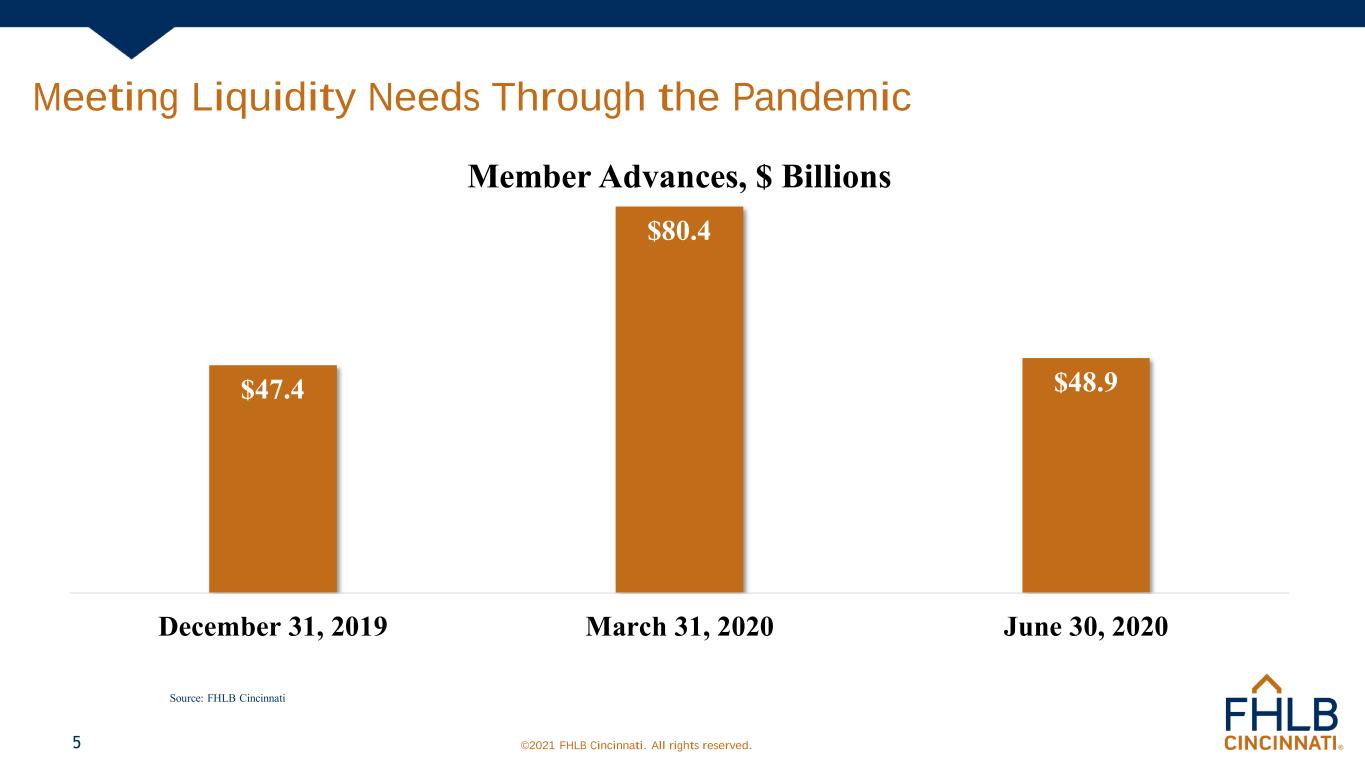

©2021 FHLB Cincinnati. All rights reserved. Meeting Liquidity Needs Through the Pandemic 5 $47.4 $80.4 $48.9 December 31, 2019 March 31, 2020 June 30, 2020 Member Advances, $ Billions Source: FHLB Cincinnati

©2021 FHLB Cincinnati. All rights reserved. Trusted Partners for Housing and Community Investment • During the year, over 250 members participated in one or more of our Housing programs • Through the FHLB’s Affordable Housing Program, approximately $40 million was awarded or disbursed in 2020 to members to help 4,579 households secure affordable housing • Since the program’s inception FHLB has awarded nearly $795 million to fund approximately 99,000 affordable housing units 6 Source: FHLB Cincinnati

©2021 FHLB Cincinnati. All rights reserved. Trusted Partners-Your Board of Directors • Disaster Reconstruction Program helped 378 households rebuild. • Carol M. Peterson Housing Fund helped 332 elderly and special needs householders with home repairs. • Council of FHLBanks addressed regulatory and legislative matters. • Fifth District engagement provides a seat at the table. • Director Elections - Nominate, Run, Vote. 7

©2021 FHLB Cincinnati. All rights reserved. Trusted Partners – Your 2021 Board of Directors 8 Member Directors Ohio Kentucky Brady Burt SVP & CFO Park National Bank, Newark Greg Caudill Director Farmers National Bank, Danville Mike Pell President & CEO First State Bank, Winchester David Sartore Executive VP and CFO Field & Main Bank, Henderson Bob Lameier President & CEO Miami Savings Bank, Miamitown Tennessee Kathy Rogers Executive Vice President U.S. Bank, Cincinnati Jim England - Vice Chair Chairman Decatur County Bank, Decaturville Jim Vance Senior VP and Co-Chief Investment Officer Western & Southern Financial Group, Cincinnati Sammy Stuard President and CEO F&M Bank, Clarksville Jonathan Welty President Ohio Capital Finance Corporation, Columbus * Public Interest Director Independent Directors J. Lynn Anderson – Chair * Retired Banking and Insurance Executive, Nationwide, Columbus, OH Board Member, National Church Residences, Columbus, OH Grady Appleton * Retired President & CEO East Akron Neighborhood Development Corp., Akron, OH April Miller Boise EVP and General Counsel Eaton Corporation, Cleveland, OH Kristin Darby Chief Information Officer Envision Healthcare, Nashville, TN Don Mullineaux Emeritus duPont Endowed Chair in Banking and Financial Services University of Kentucky, Lexington, KY Charlie Ruma President Davidson Phillips Inc., Columbus, OH Nancy Uridil Retired GCPG Executive, Avon Lake, OH

©2021 FHLB Cincinnati. All rights reserved. Looking Forward: The 2021 Director Election • The nominating and voting process will be conducted by email. • Following FHFA notification in June, the FHLB expects Member Director elections in Ohio and Kentucky and an Independent Public Interest Director election at-large. • On June 21, Survey & Ballot Systems (SBS) will email your designated Primary Contact with your unique credentials and a link to your online nominating ballot and election materials. • To ensure that you receive FHLB Election nominating and voting emails from SBS, please add the following address to your email contacts list as an approved sender (FHLBank Election Coordinator) noreply@directvote.net. • Director Elections electronic voting information will also be communicated through a Member NewsLine and to your Members Only inbox. • If you have questions, contact Melissa Dallas or Kevin Hanrahan at DirectorElection2021@fhlbcin.com. 9

©2021 FHLB Cincinnati. All rights reserved. Navigating a Year of Change Andrew Howell President and CEO, FHLB Cincinnati

©2021 FHLB Cincinnati. All rights reserved. FHLB Cincinnati: Navigating a Year of Change • Maintaining Services in a Remote Operating Environment • Pandemic’s Impact on FHLB Products and Services • Financial Performance • Looking Forward 11

©2021 FHLB Cincinnati. All rights reserved. Maintaining Services During the Pandemic • The Bank’s long-term commitment to maintaining member service in the event of unexpected business disruptions was crucial to successfully operating in a remote environment for the past 14 months. • Our partnership with you was critically important. • The long-term impact of the Pandemic on the economy and business is still to be determined. • The immediate economic impact has also affected use of FHLB Cincinnati’s mission asset activities. 12

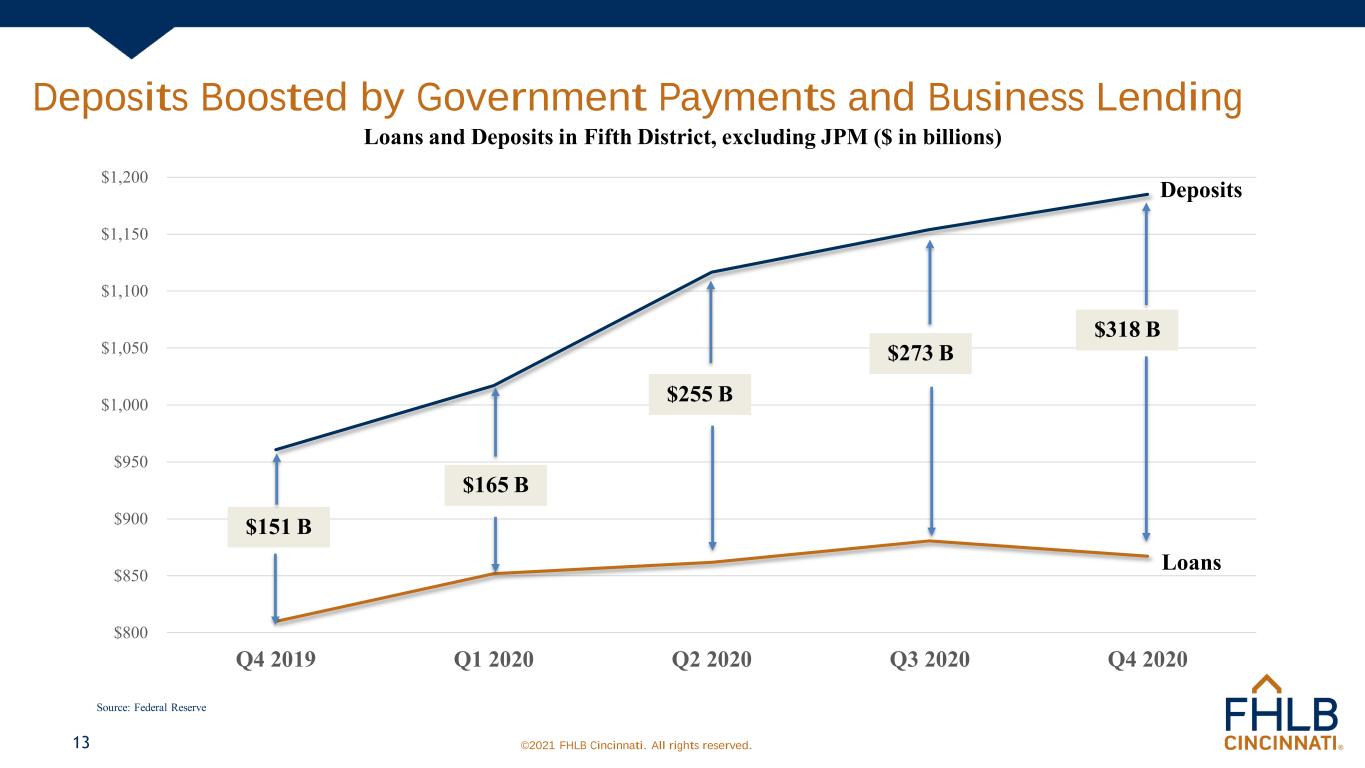

©2021 FHLB Cincinnati. All rights reserved. Deposits Boosted by Government Payments and Business Lending 13 $800 $850 $900 $950 $1,000 $1,050 $1,100 $1,150 $1,200 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Loans and Deposits in Fifth District, excluding JPM ($ in billions) $151 B $255 B $273 B $318 B $165 B Deposits Source: Federal Reserve Loans

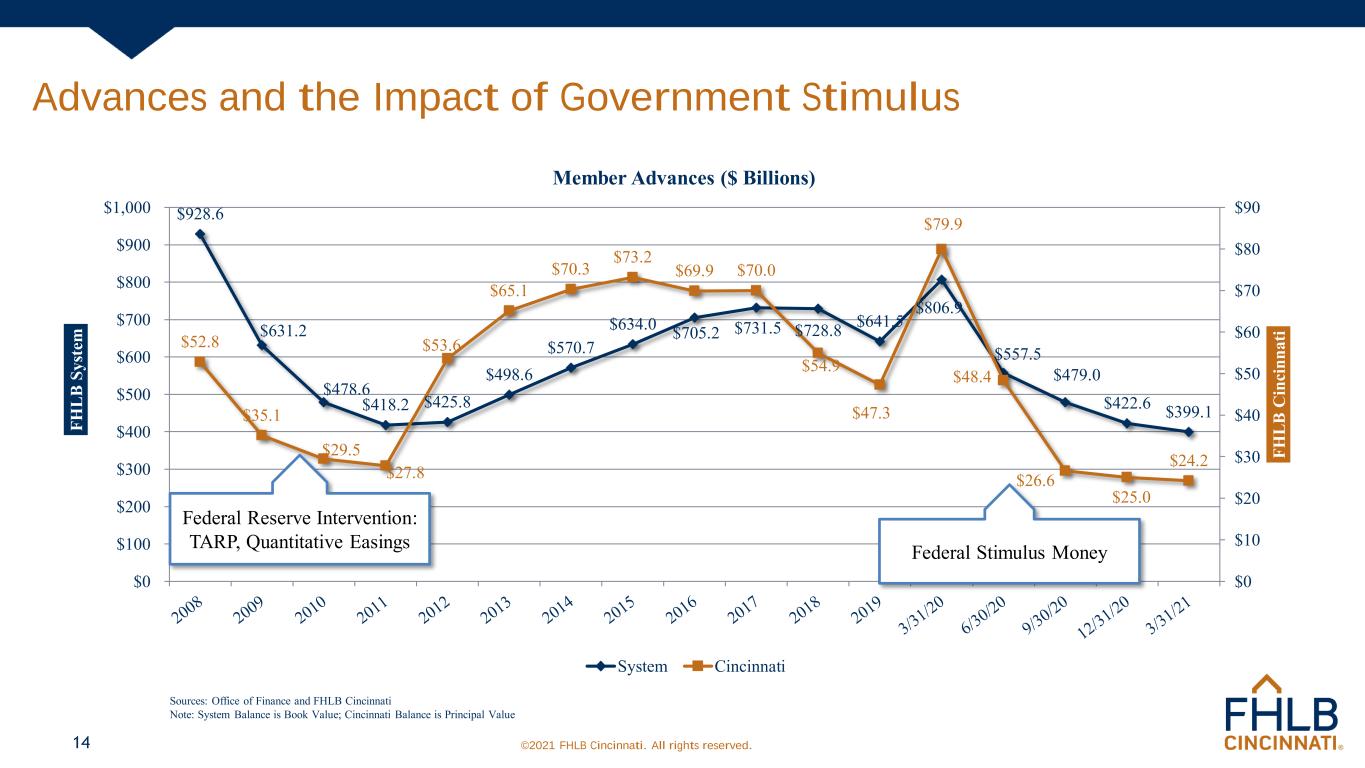

©2021 FHLB Cincinnati. All rights reserved. Advances and the Impact of Government Stimulus 14 Sources: Office of Finance and FHLB Cincinnati Note: System Balance is Book Value; Cincinnati Balance is Principal Value $928.6 $631.2 $478.6 $418.2 $425.8 $498.6 $570.7 $634.0 $705.2 $731.5 $728.8 $641.5 $806.9 $557.5 $479.0 $422.6 $399.1 $52.8 $35.1 $29.5 $27.8 $53.6 $65.1 $70.3 $73.2 $69.9 $70.0 $54.9 $47.3 $79.9 $48.4 $26.6 $25.0 $24.2 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 F H L B C in c in n a ti F H L B S y st e m Member Advances ($ Billions) System Cincinnati Federal Reserve Intervention: TARP, Quantitative Easings Federal Stimulus Money

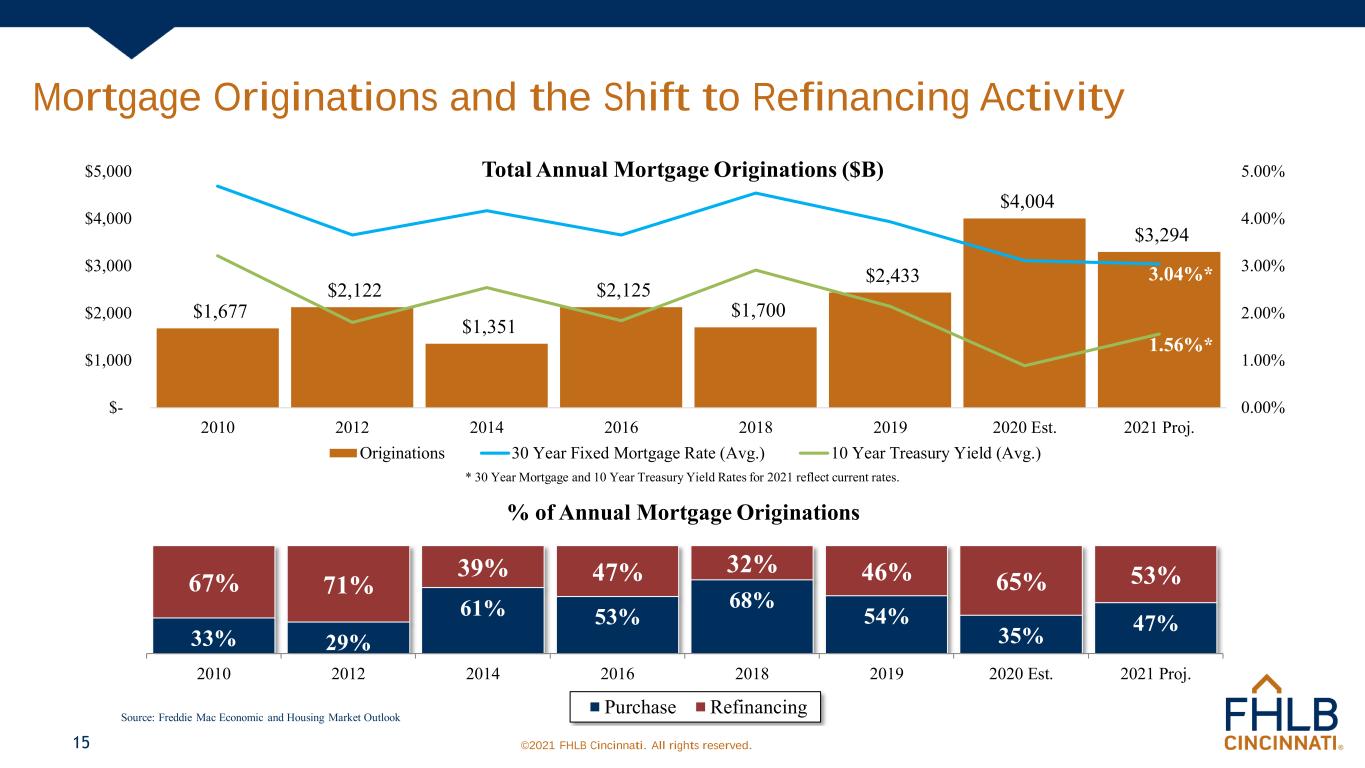

©2021 FHLB Cincinnati. All rights reserved. Mortgage Originations and the Shift to Refinancing Activity 15 33% 29% 61% 53% 68% 54% 35% 47% 67% 71% 39% 47% 32% 46% 65% 53% 2010 2012 2014 2016 2018 2019 2020 Est. 2021 Proj. % of Annual Mortgage Originations Purchase Refinancing Source: Freddie Mac Economic and Housing Market Outlook $1,677 $2,122 $1,351 $2,125 $1,700 $2,433 $4,004 $3,294 3.04%* 1.56%* 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% $- $1,000 $2,000 $3,000 $4,000 $5,000 2010 2012 2014 2016 2018 2019 2020 Est. 2021 Proj. Total Annual Mortgage Originations ($B) Originations 30 Year Fixed Mortgage Rate (Avg.) 10 Year Treasury Yield (Avg.) * 30 Year Mortgage and 10 Year Treasury Yield Rates for 2021 reflect current rates.

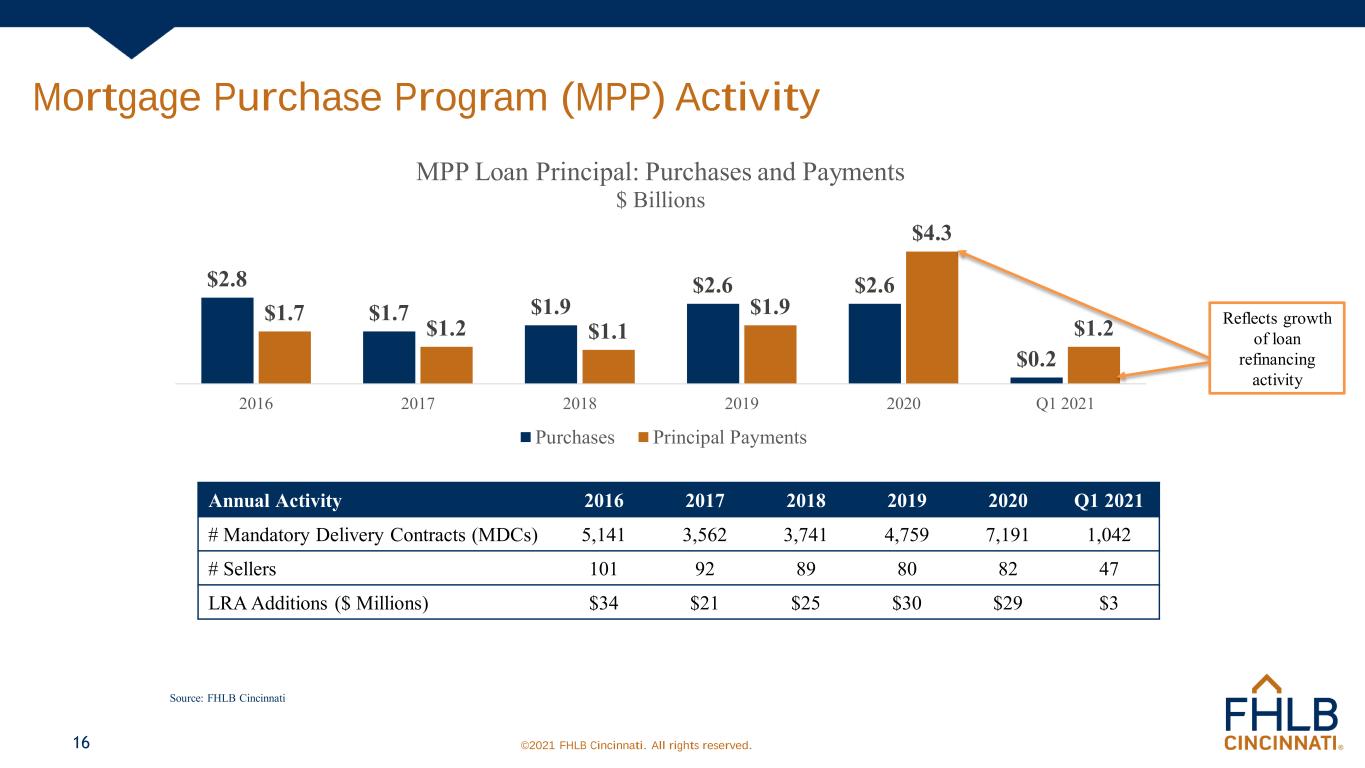

©2021 FHLB Cincinnati. All rights reserved. Mortgage Purchase Program (MPP) Activity 16 Annual Activity 2016 2017 2018 2019 2020 Q1 2021 # Mandatory Delivery Contracts (MDCs) 5,141 3,562 3,741 4,759 7,191 1,042 # Sellers 101 92 89 80 82 47 LRA Additions ($ Millions) $34 $21 $25 $30 $29 $3 $2.8 $1.7 $1.9 $2.6 $2.6 $0.2 $1.7 $1.2 $1.1 $1.9 $4.3 $1.2 2016 2017 2018 2019 2020 Q1 2021 MPP Loan Principal: Purchases and Payments $ Billions Purchases Principal Payments Reflects growth of loan refinancing activity Source: FHLB Cincinnati

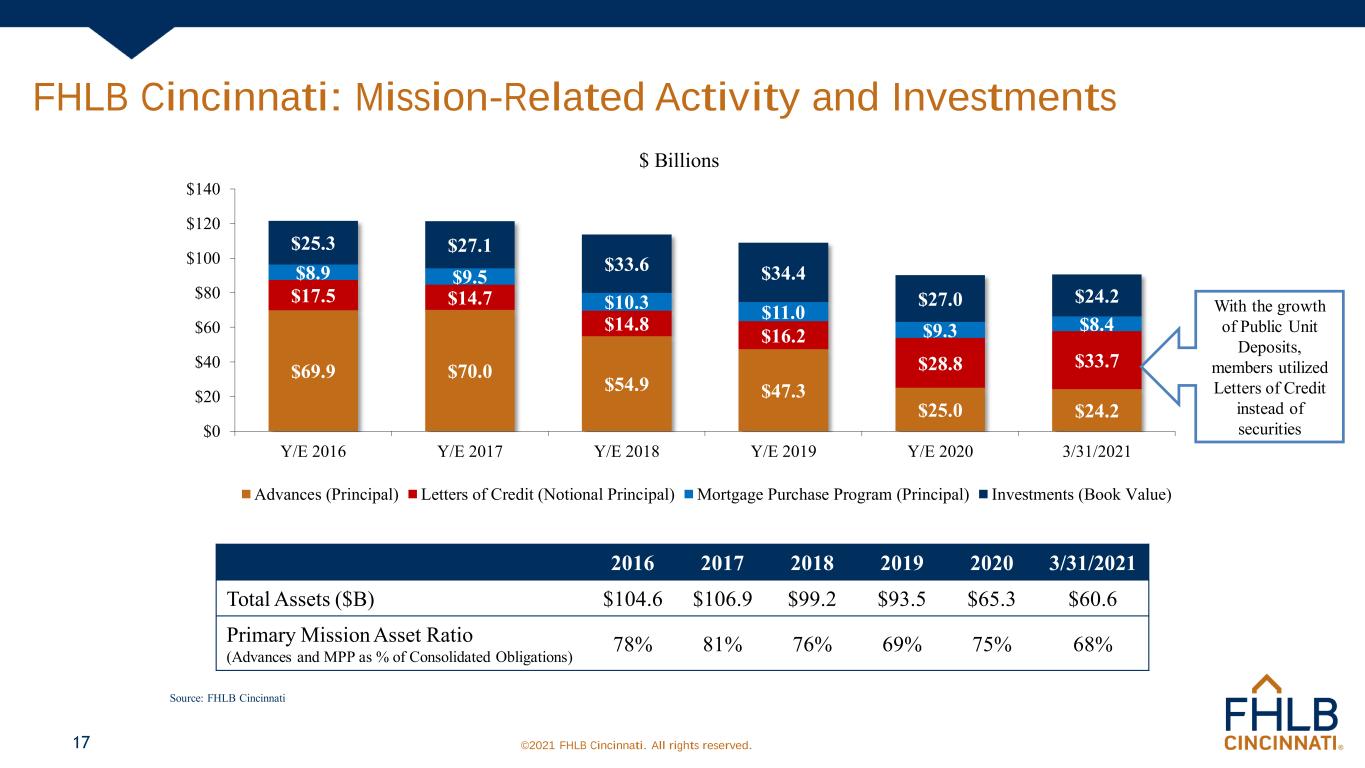

©2021 FHLB Cincinnati. All rights reserved.17 FHLB Cincinnati: Mission-Related Activity and Investments $69.9 $70.0 $54.9 $47.3 $25.0 $24.2 $17.5 $14.7 $14.8 $16.2 $28.8 $33.7 $8.9 $9.5 $10.3 $11.0 $9.3 $8.4 $25.3 $27.1 $33.6 $34.4 $27.0 $24.2 $0 $20 $40 $60 $80 $100 $120 $140 Y/E 2016 Y/E 2017 Y/E 2018 Y/E 2019 Y/E 2020 3/31/2021 $ Billions Advances (Principal) Letters of Credit (Notional Principal) Mortgage Purchase Program (Principal) Investments (Book Value) 2016 2017 2018 2019 2020 3/31/2021 Total Assets ($B) $104.6 $106.9 $99.2 $93.5 $65.3 $60.6 Primary Mission Asset Ratio (Advances and MPP as % of Consolidated Obligations) 78% 81% 76% 69% 75% 68% With the growth of Public Unit Deposits, members utilized Letters of Credit instead of securities Source: FHLB Cincinnati

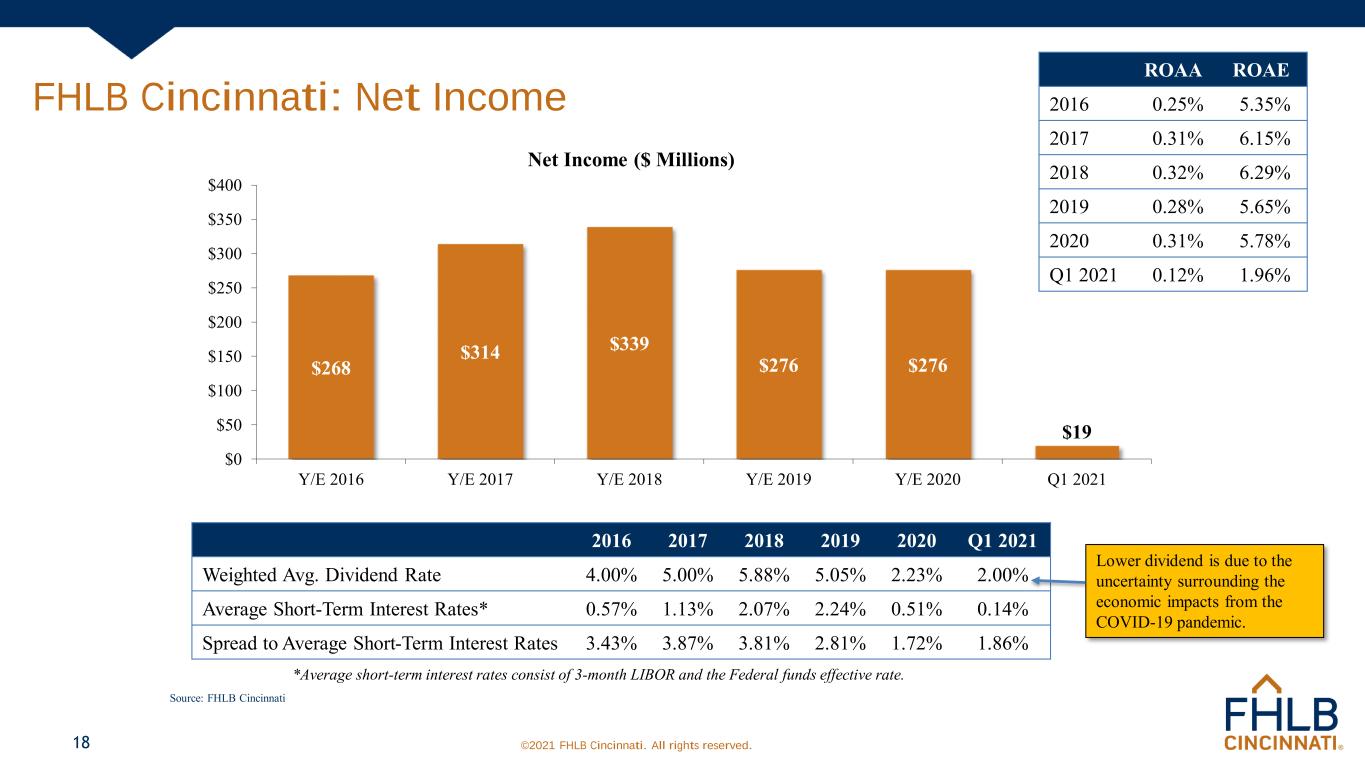

©2021 FHLB Cincinnati. All rights reserved. FHLB Cincinnati: Net Income 18 $268 $314 $339 $276 $276 $19 $0 $50 $100 $150 $200 $250 $300 $350 $400 Y/E 2016 Y/E 2017 Y/E 2018 Y/E 2019 Y/E 2020 Q1 2021 Net Income ($ Millions) 2016 2017 2018 2019 2020 Q1 2021 Weighted Avg. Dividend Rate 4.00% 5.00% 5.88% 5.05% 2.23% 2.00% Average Short-Term Interest Rates* 0.57% 1.13% 2.07% 2.24% 0.51% 0.14% Spread to Average Short-Term Interest Rates 3.43% 3.87% 3.81% 2.81% 1.72% 1.86% Lower dividend is due to the uncertainty surrounding the economic impacts from the COVID-19 pandemic. ROAA ROAE 2016 0.25% 5.35% 2017 0.31% 6.15% 2018 0.32% 6.29% 2019 0.28% 5.65% 2020 0.31% 5.78% Q1 2021 0.12% 1.96% *Average short-term interest rates consist of 3-month LIBOR and the Federal funds effective rate. Source: FHLB Cincinnati

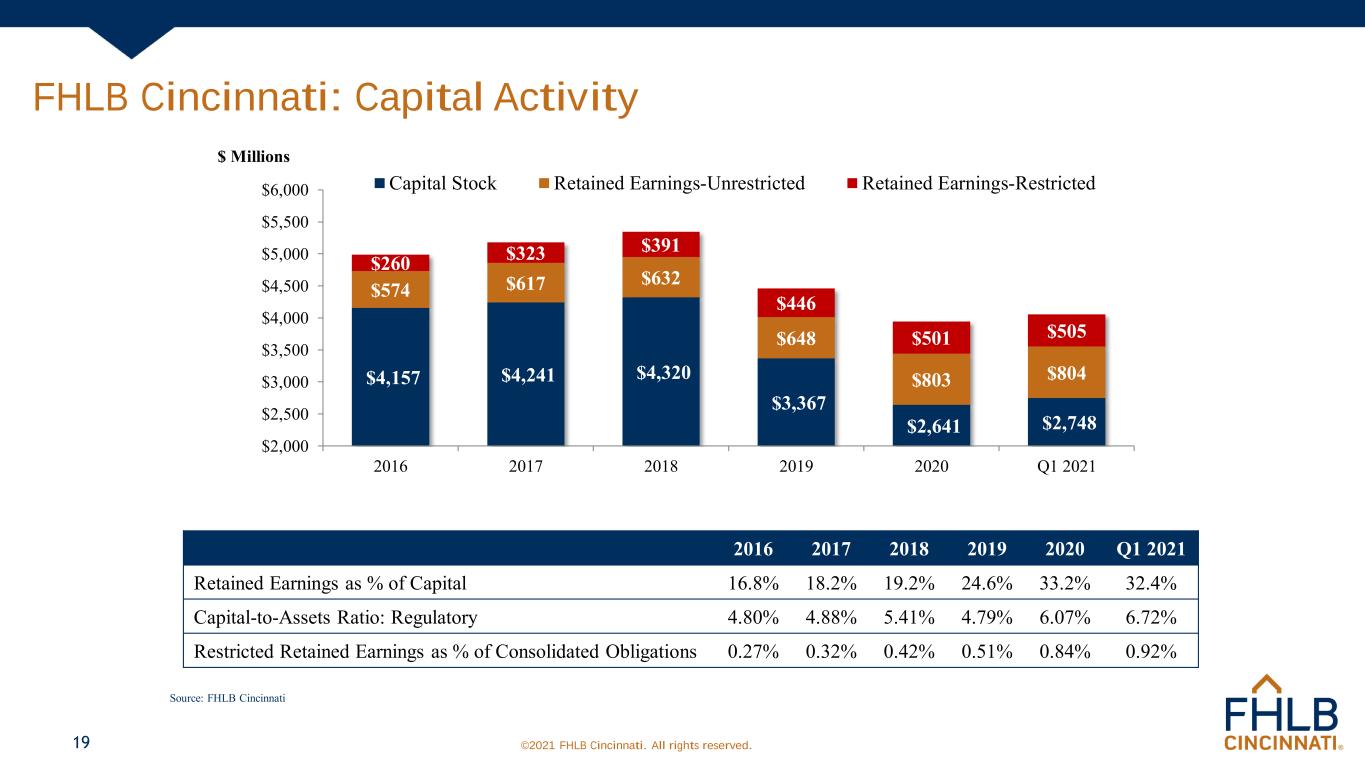

©2021 FHLB Cincinnati. All rights reserved. FHLB Cincinnati: Capital Activity 19 $4,157 $4,241 $4,320 $3,367 $2,641 $2,748 $574 $617 $632 $648 $803 $804 $260 $323 $391 $446 $501 $505 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 $6,000 2016 2017 2018 2019 2020 Q1 2021 $ Millions Capital Stock Retained Earnings-Unrestricted Retained Earnings-Restricted 2016 2017 2018 2019 2020 Q1 2021 Retained Earnings as % of Capital 16.8% 18.2% 19.2% 24.6% 33.2% 32.4% Capital-to-Assets Ratio: Regulatory 4.80% 4.88% 5.41% 4.79% 6.07% 6.72% Restricted Retained Earnings as % of Consolidated Obligations 0.27% 0.32% 0.42% 0.51% 0.84% 0.92% Source: FHLB Cincinnati

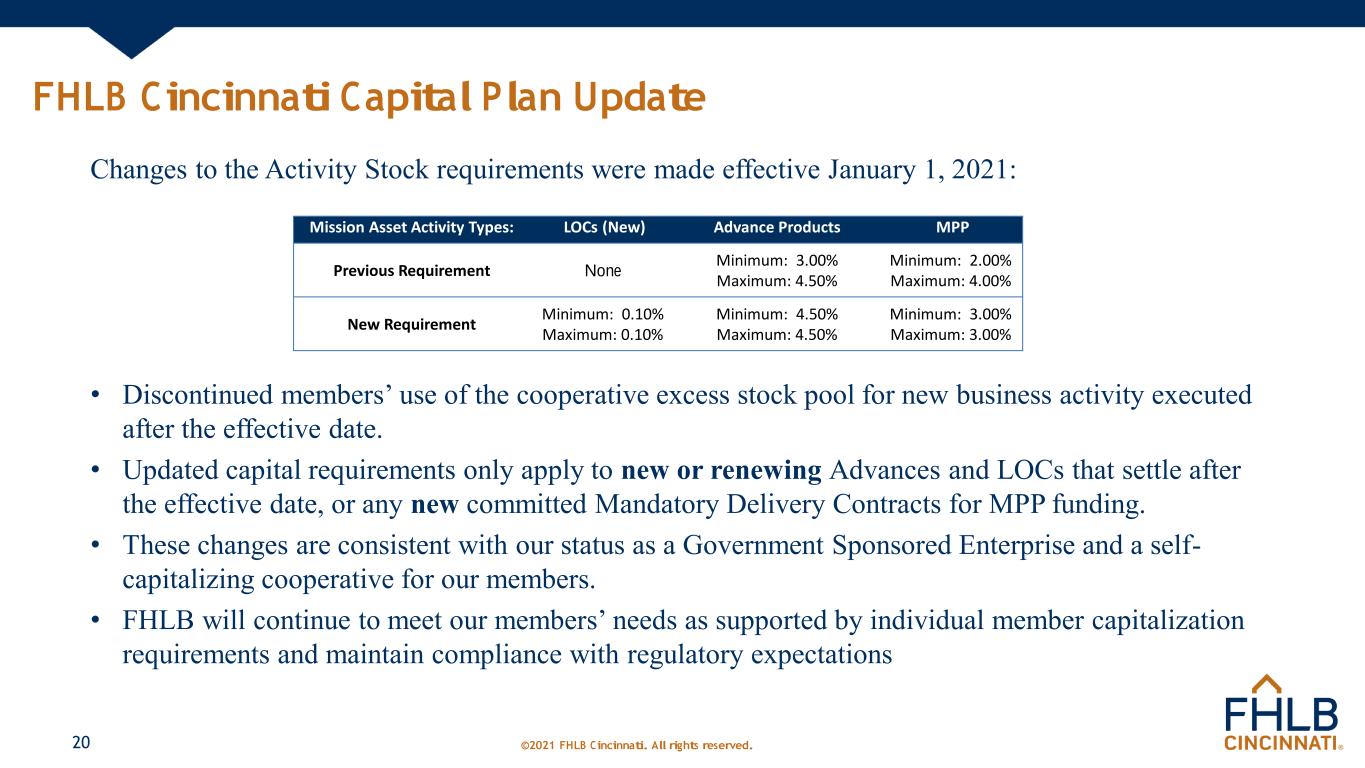

©2021 FHLB Cincinnati. All rights reserved. FHLB Cincinnati Capital Plan Update Changes to the Activity Stock requirements were made effective January 1, 2021: • Discontinued members’ use of the cooperative excess stock pool for new business activity executed after the effective date. • Updated capital requirements only apply to new or renewing Advances and LOCs that settle after the effective date, or any new committed Mandatory Delivery Contracts for MPP funding. • These changes are consistent with our status as a Government Sponsored Enterprise and a self- capitalizing cooperative for our members. • FHLB will continue to meet our members’ needs as supported by individual member capitalization requirements and maintain compliance with regulatory expectations 20 Mission Asset Activity Types: LOCs (New) Advance Products MPP Previous Requirement None Minimum: 3.00% Maximum: 4.50% Minimum: 2.00% Maximum: 4.00% New Requirement Minimum: 0.10% Maximum: 0.10% Minimum: 4.50% Maximum: 4.50% Minimum: 3.00% Maximum: 3.00%

©2021 FHLB Cincinnati. All rights reserved. Looking Forward: “Member Centric” Strategic Initiatives • Member Advisory Panel (MAP) • Modernize Member Experience (MME) • LIBOR Transition • Data and Analytics 21

©2021 FHLB Cincinnati. All rights reserved. Looking Forward: The Legislative Landscape 22 • Senate Banking, Housing and Urban Affairs Committee will focus on COVID-19 relief, rental assistance, eviction moratoriums, infrastructure investment, consumer protections, Minority Depository Institutions (MDI), CDFI, and community banking support, low-cost access to banking services and active industry hearings. • House Financial Services Committee will focus GSE status quo, MDI/CDFI support, housing affordability, D&I progress and a new Climate Change task force.

©2021 FHLB Cincinnati. All rights reserved. FHLB Fifth District Leadership and Key Congressional Committees • Former Rep. Marcia Fudge (OH-11), Secretary of Housing & Urban Development • Sen. Mitch McConnell (R-KY) Minority Leader • Sen. Sherrod Brown (D-OH) Chair, Banking, Housing & Urban Affairs Committee • Sen. Bill Hagerty (R-TN) Raking Member, National Security and International Trade and Finance Subcommittee • Rep. Joyce Beatty (OH-3), House Financial Services Committee (HFSC) Chair, Diversity & Inclusion Subcommittee; Chair, Congressional Black Caucus • Rep. Steve Stivers (OH-15) HFSC, Ranking Member, Housing, Community Development & Insurance Subcommittee • Rep. Andy Barr (KY-6) HFSC, Ranking Member, Oversight & Investigations • Rep. Anthony Gonzalez (OH-16) HFSC, Vice-Ranking Member, Diversity & Inclusion Subcommittee • Reps. Davidson (OH-8), Kustoff (TN-8) & Rose (TN-6), HFSC Members 23

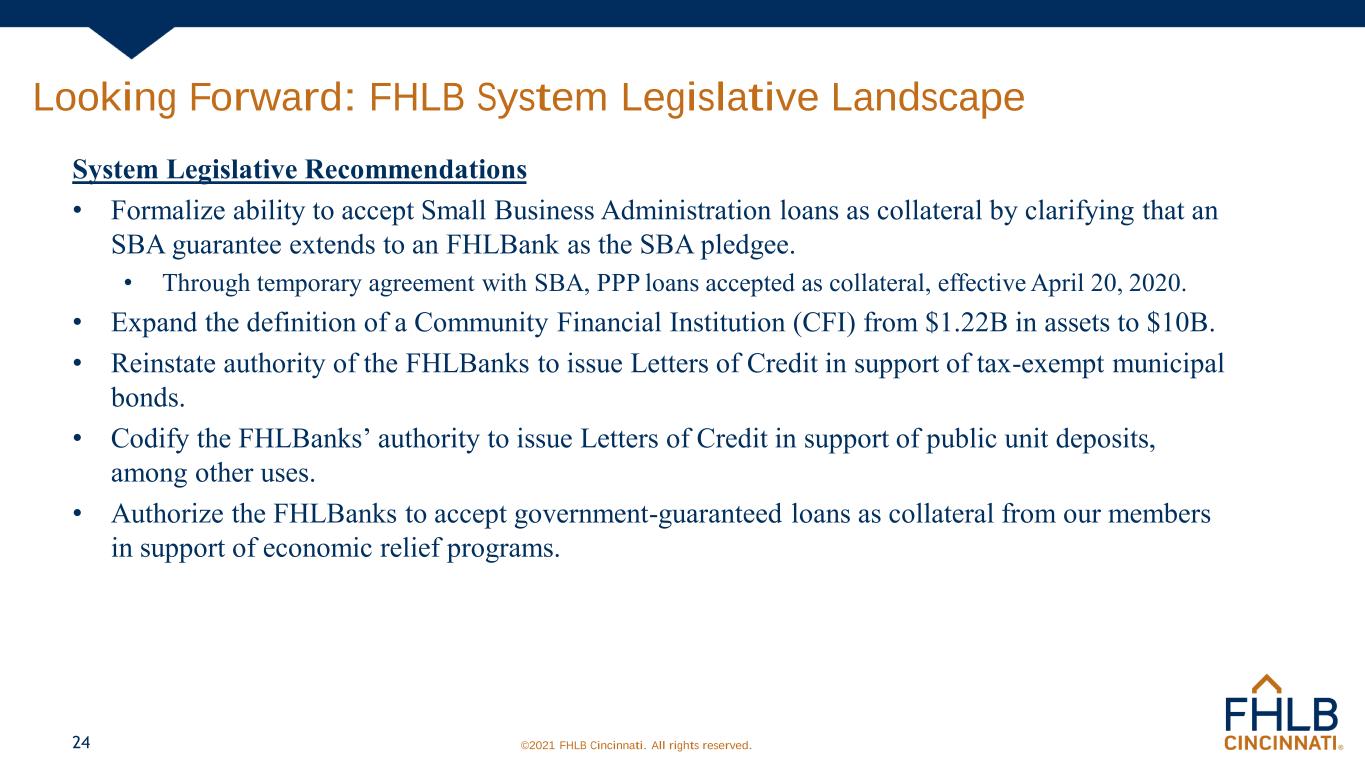

©2021 FHLB Cincinnati. All rights reserved. Looking Forward: FHLB System Legislative Landscape System Legislative Recommendations • Formalize ability to accept Small Business Administration loans as collateral by clarifying that an SBA guarantee extends to an FHLBank as the SBA pledgee. • Through temporary agreement with SBA, PPP loans accepted as collateral, effective April 20, 2020. • Expand the definition of a Community Financial Institution (CFI) from $1.22B in assets to $10B. • Reinstate authority of the FHLBanks to issue Letters of Credit in support of tax-exempt municipal bonds. • Codify the FHLBanks’ authority to issue Letters of Credit in support of public unit deposits, among other uses. • Authorize the FHLBanks to accept government-guaranteed loans as collateral from our members in support of economic relief programs. 24

©2021 FHLB Cincinnati. All rights reserved. Looking Forward: Our Highest Priorities • Ensuring the health and safety of our staff • Remaining a reliable partner for our members • Readily available liquidity provider • Assistance programs • Support programs for communities we serve • Maintaining an open communication 25

©2021 FHLB Cincinnati. All rights reserved. Partners Through Change R. Kyle Lawler Executive VP and Chief Business Officer, FHLB Cincinnati

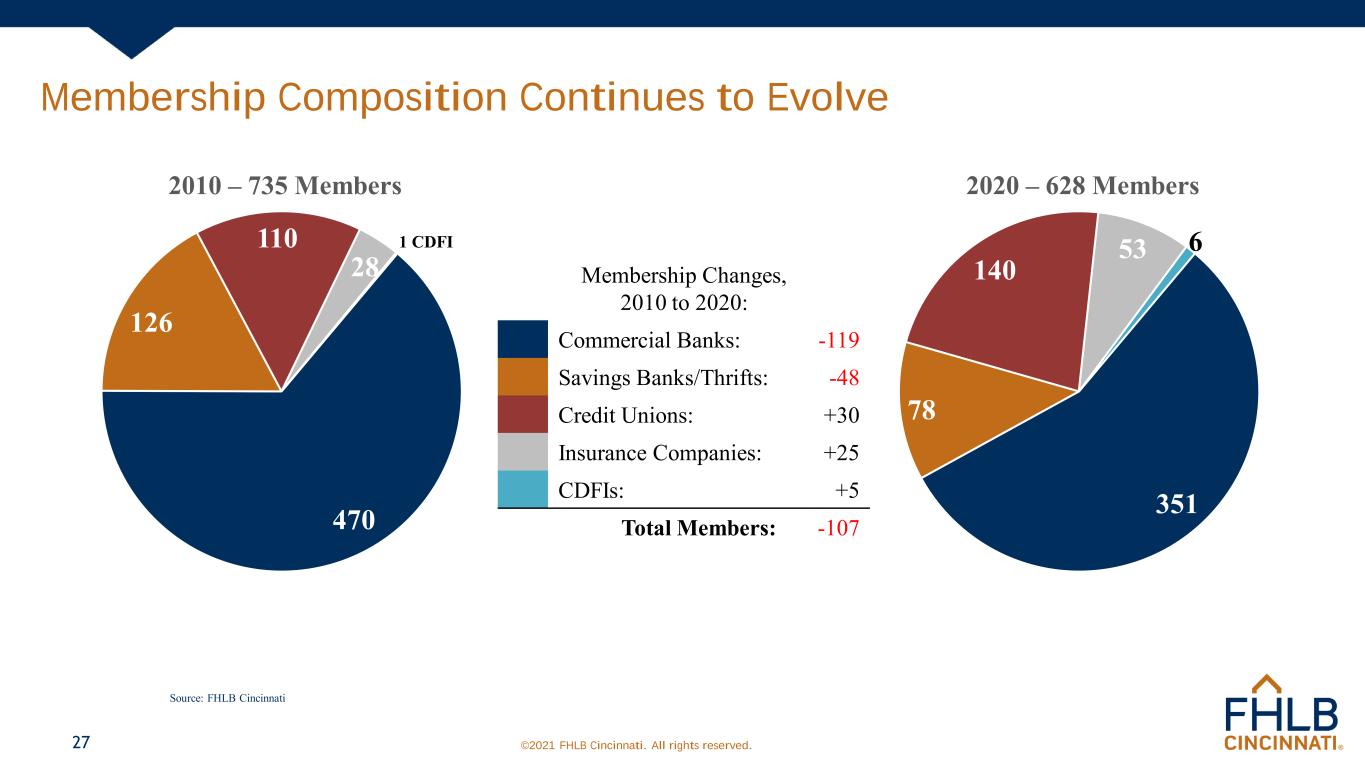

©2021 FHLB Cincinnati. All rights reserved. Membership Composition Continues to Evolve 27 351 78 140 53 6 2020 – 628 Members Membership Changes, 2010 to 2020: Commercial Banks: -119 Savings Banks/Thrifts: -48 Credit Unions: +30 Insurance Companies: +25 CDFIs: +5 Total Members: -107470 126 110 28 1 CDFI 2010 – 735 Members Source: FHLB Cincinnati

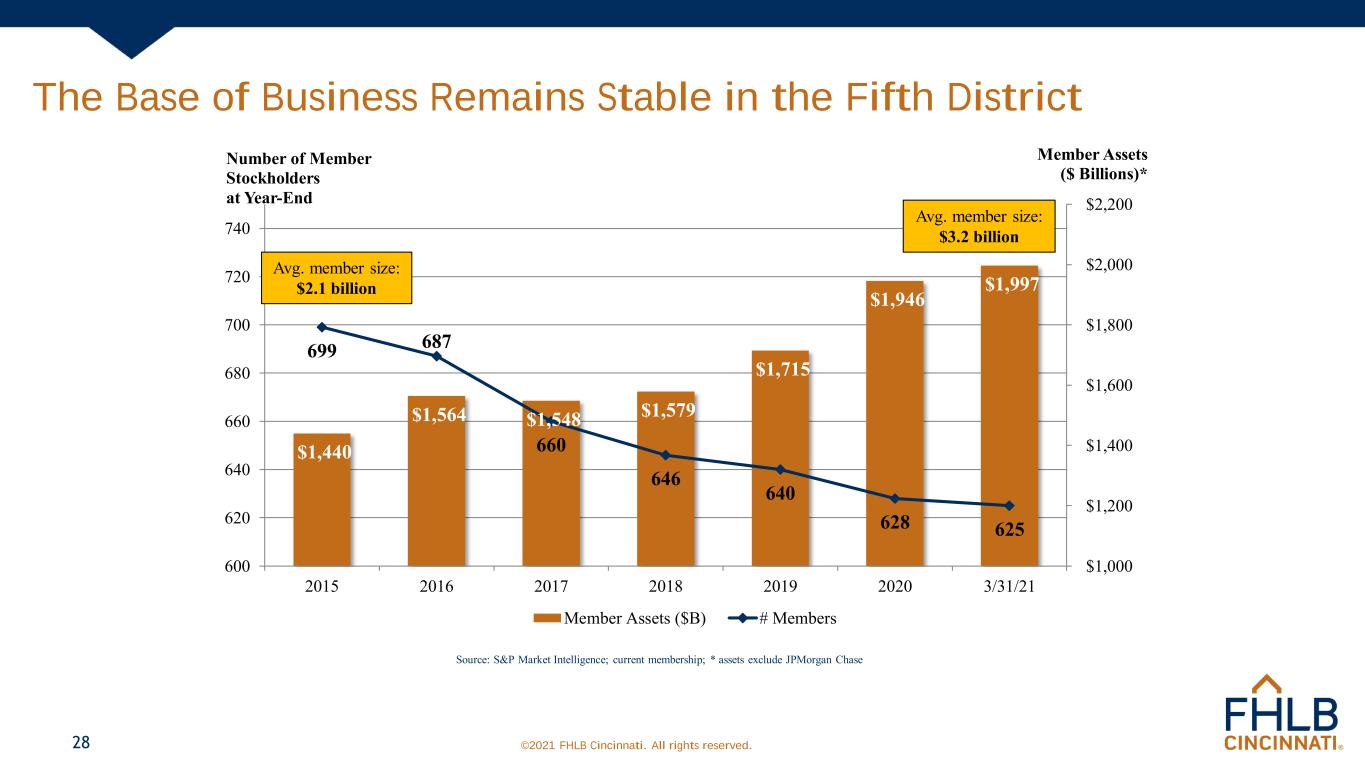

©2021 FHLB Cincinnati. All rights reserved. The Base of Business Remains Stable in the Fifth District 28 $1,440 $1,564 $1,548 $1,579 $1,715 $1,946 $1,997 699 687 660 646 640 628 625 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 600 620 640 660 680 700 720 740 2015 2016 2017 2018 2019 2020 3/31/21 Member Assets ($ Billions)* Number of Member Stockholders at Year-End Member Assets ($B) # Members Source: S&P Market Intelligence; current membership; * assets exclude JPMorgan Chase Avg. member size: $2.1 billion Avg. member size: $3.2 billion

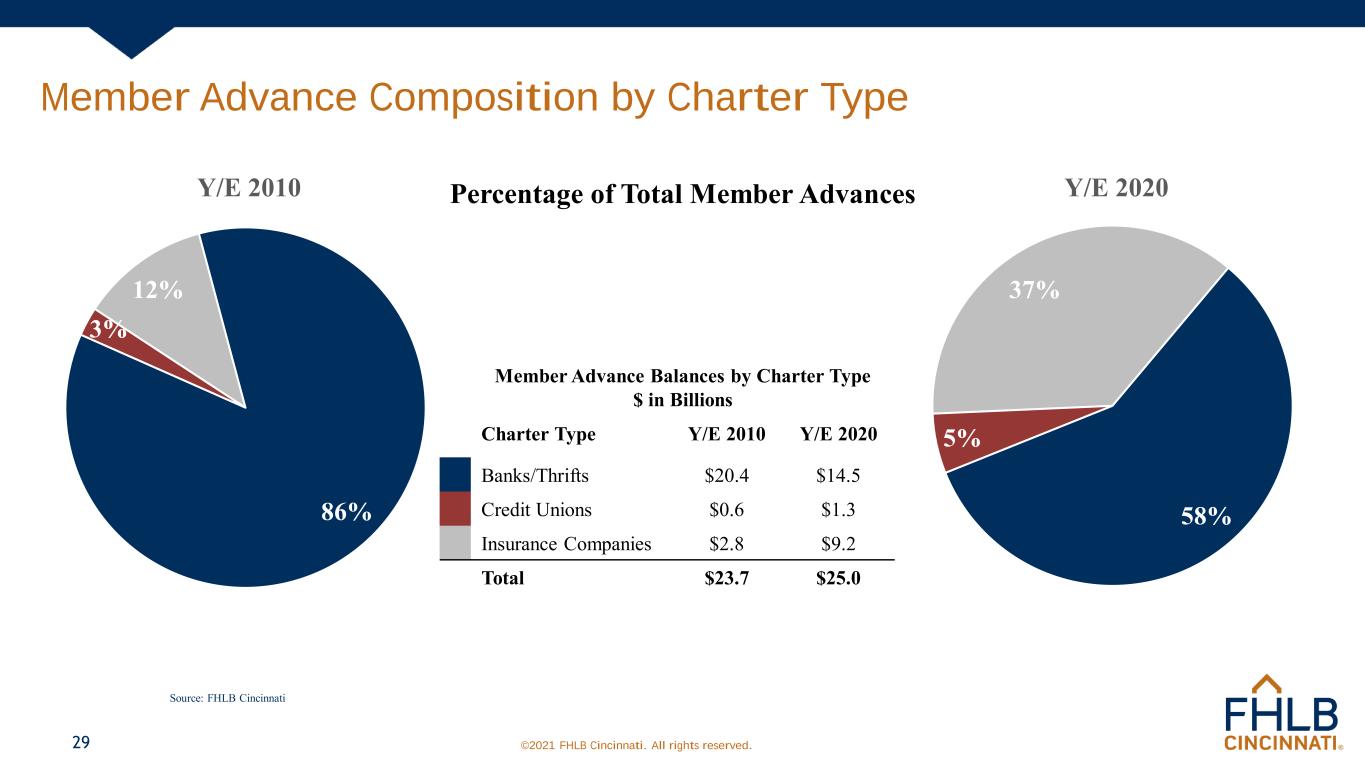

©2021 FHLB Cincinnati. All rights reserved. 86% 3% 12% Y/E 2010 Member Advance Composition by Charter Type 29 58% 5% 37% Y/E 2020 Member Advance Balances by Charter Type $ in Billions Charter Type Y/E 2010 Y/E 2020 Banks/Thrifts $20.4 $14.5 Credit Unions $0.6 $1.3 Insurance Companies $2.8 $9.2 Total $23.7 $25.0 Percentage of Total Member Advances Source: FHLB Cincinnati

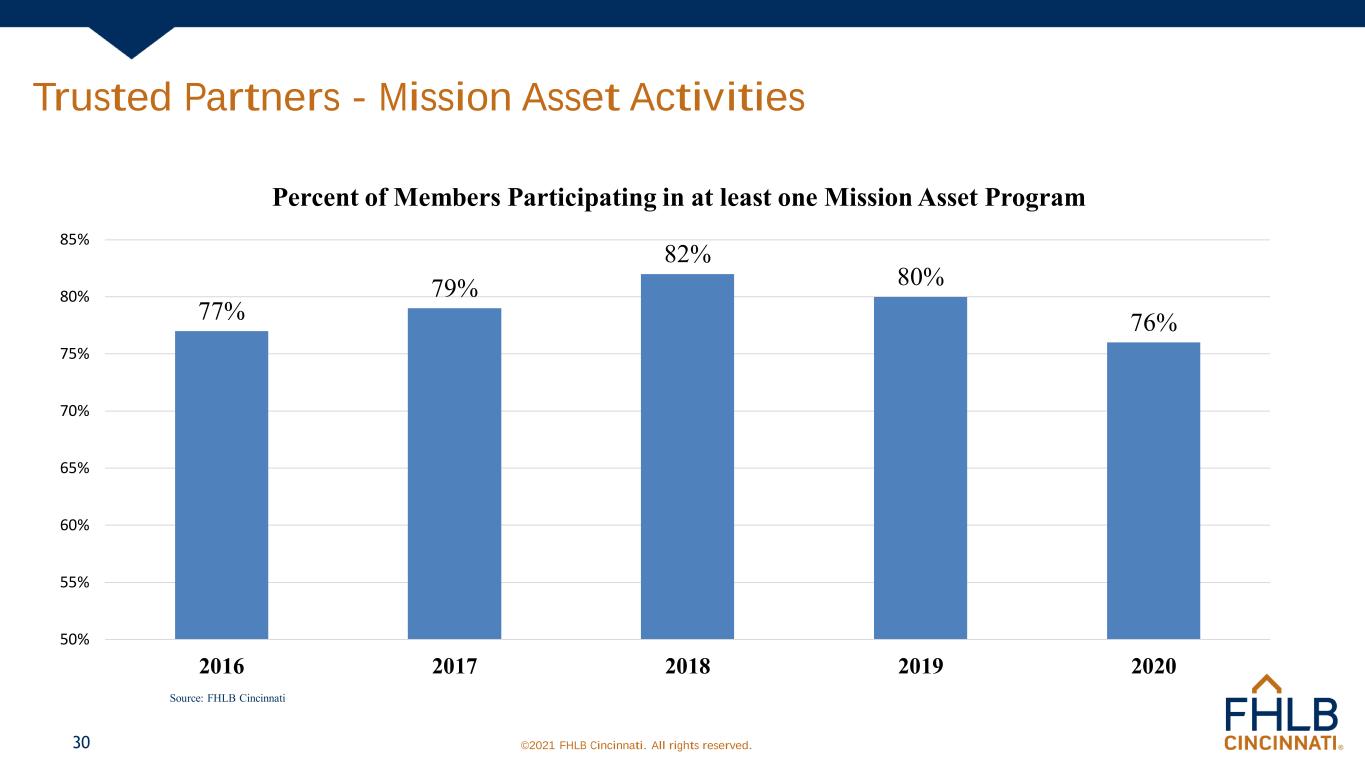

©2021 FHLB Cincinnati. All rights reserved. Trusted Partners - Mission Asset Activities 30 77% 79% 82% 80% 76% 50% 55% 60% 65% 70% 75% 80% 85% 2016 2017 2018 2019 2020 Percent of Members Participating in at least one Mission Asset Program Source: FHLB Cincinnati

©2021 FHLB Cincinnati. All rights reserved. An Update on LIBOR Transition • The FHLB continues to make efforts to transition away from LIBOR and is committed to continuing to educate and support our Members in their transition process • The Financial Conduct Authority announced the cessation dates for various LIBOR tenors: • December 31, 2021 for 1 week and 2 month LIBOR • June 30, 2023 for all other tenors • This announcement was deemed a fallback trigger event, fixing the fallback spread for all Euro, Sterling, US Dollar, Swiss Franc, and Yen LIBOR settings • The FHLB is continuing to evaluate additional indices (such as Ameribor, Ice Bank Yield Index, and Bloomberg Short-Term Bank Yield Index) for potential product offerings in addition to SOFR • The FHLB will strive to offer variable rate funding that meets the current and anticipated needs of our Members 31

©2021 FHLB Cincinnati. All rights reserved. New Products – Discount Note Floating Rate Advance • As part of the FHLB’s focus on meeting members’ funding needs we are evaluating our product portfolio in this ever changing environment to ensure we offer products that suit our Membership. • This focus, in conjunction with our LIBOR Transition efforts, led to the development of the Discount Note Floating Rate Advance product. This new variable rate Advance will assist our Members in their LIBOR transition efforts while offering some of the key attributes of this legacy Advance. • The key features of this Advance are: • Monthly or Quarterly variable rate, referencing the FHLB’s own Discount Note Auctions • Rates reset every 1 or 3 months (fixed spread similar to the outgoing LIBOR Advance) • A pre-payment option (with 2 business days-notice at resets) • Maturities from 1 through 5 years (shorter maturities available dependent upon market conditions) • This Advance has been available since April 5th 32

©2021 FHLB Cincinnati. All rights reserved. Continuous Improvement in Providing Member Services • Accepting various forms of Advance and Letter of Credit application authorization when physical signatures aren’t possible • Email (instead of regular mail): • Reminder notifications for upcoming CMA/REPO line expirations • Delivery of Letters of Credit • Notifications by email or text regarding upcoming Letter of Credit expirations • Members enable this notification on Members Only 33

©2021 FHLB Cincinnati. All rights reserved. Collateral –Related COVID-19 Accommodations • Expanded eligible collateral to include: • Payroll Protection Program Loans • Contractually delinquent loans in forbearance • Loans modified electronically • Extended maximum allowable maturity for eligible loans by one year to 31 years from the original note date • Extended the maximum allowable timeframe for recordation of mortgages or deeds of trust securing eligible loans to six months from origination 34

©2021 FHLB Cincinnati. All rights reserved. eNotes Acceptance • In late 2020, we rolled out acceptance criteria for 1-4 Family and Home Equity Installment Loans in “eNote” form when executed in compliance with our Guide standards. • To receive borrowing capacity from this form of collateral requires an application process (detailed in the Guide) and execution of a pledge addendum. • Requires use of an FHLB-approved eVault and use of the MERS® eRegistry. • We are working to expand our acceptance of eSigned note modifications where the original promissory note is wet-signed. • Continue to work with industry participants and trade associations to expand to other collateral types (CRE, multi-family, etc.) but this is a ways off. • Still early industry adoption, mostly large regional banks; not seen as large segment at any FHLB at this point. 35

©2021 FHLB Cincinnati. All rights reserved. The MPP Program Responds to COVID Mortgage Market Impact 36 • In line with secondary market actions, verbal verification of employment flexibilities are offered through April 30, 2021, and appraisal flexibilities are offered through May 31, 2021 • Suspend foreclosure sales and evictions through June 30th, 2021 • Report loans in forbearance or repayment plans as current to credit bureaus • Waive late fees for borrowers under COVID-19 loss mitigation arrangements • Authorize extended forbearance plans • Offer alternative modification options

©2021 FHLB Cincinnati. All rights reserved. FHLB Member Meetings and Facilitations in a Virtual World During 2020, we provided educational opportunities for members through facilitations, webinars and meetings: In-Person Sessions (January-early March 2020): • “LIBOR Transition Symposium” (with TD Securities) • “Balance Sheet Optimization: Driving Profitability” (with Taylor Advisors) • “Balance Sheet Strategies in the Current Environment” (with Darling Consultants) Remote Meetings and Webinars: • Regional Shareholder Meeting • Financial Management Conference • MPP User Group Meeting • Four Webinar Facilitation Sessions with Market Insights, Darling Consultants and Abrigo 37

©2021 FHLB Cincinnati. All rights reserved. The 2021 Financial Management Conference 38 • August 4-5, 2021 • Nashville, TN • Subjects Will Include: o Economic Update o Asset Liability Management Strategies o Technology Trends o Future Business Strategies