Attached files

| file | filename |

|---|---|

| 8-K - 2021 ANNUAL MEETING RESULTS - CITIZENS FINANCIAL SERVICES INC | annualmeetingresults2021.htm |

| EX-99.2 - PRESS RELEASE - CITIZENS FINANCIAL SERVICES INC | pressrelease.htm |

| EX-3.1 - ARTICLES OF AMENDMENT - CITIZENS FINANCIAL SERVICES INC | restatedarticles.htm |

Exhibit 99.1

192165 5974150 0113186 838484 24815756 Navigating The Storm 2020

2020 Financial Performance

Efficiency Ratio History Finished in the 100th percentile compared to the CZFS peer group for 2020

Return on Equity History Finished in the 100th percentile compared to the CZFS peer group for 2020

Return on Assets History Finished in the 100th percentile compared to the CZFS peer group for 2020

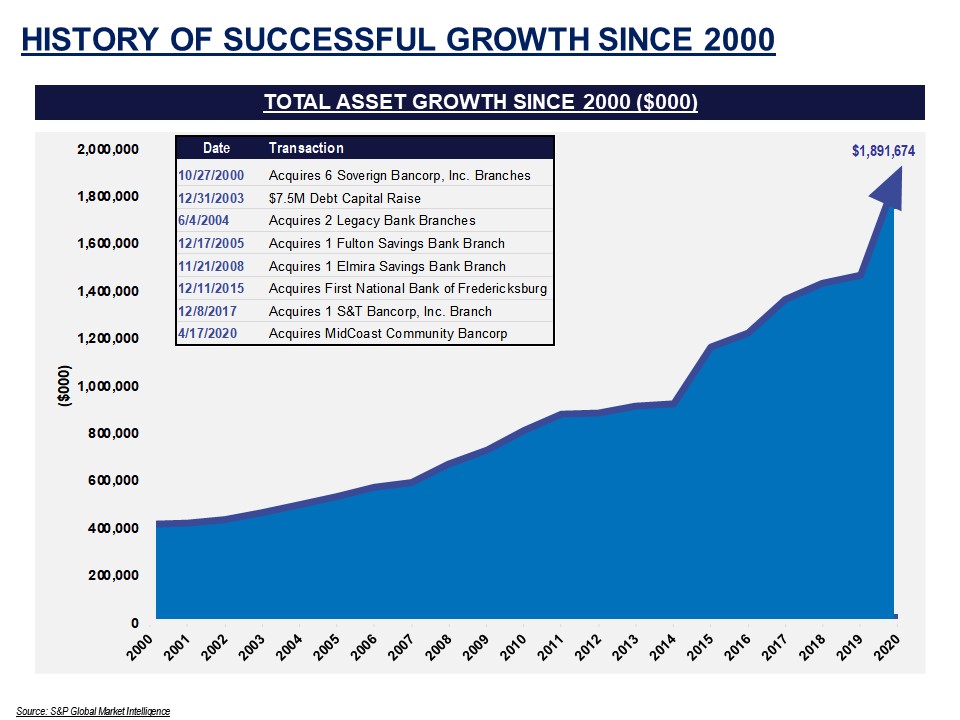

Source: S&P Global Market Intelligence Total Asset Growth Since 2000 ($000) History of

Successful Growth Since 2000

Cash Dividends Paid History 1% stock dividend paid in 2016, 2018, 2019 & 2020, and a 5% stock dividend

paid in 2017

Track Record of Value Creation Note: Pre-COVID time period determined as prior to March 1, 2020Note:

Market data as of market close on March 28, 2021Source: S&P Global Market Intelligence Under Current Management.. Randy & Mick Took Leadership Roles 1H’2004 Total Return Under Current Leadership: 487% 5-Year Stock Performance 5

Year Total Return: 57%

Source: S&P Global Market Intelligence TBV/Share & EPS Growth Dividend History Annual

Dividend/Share Stock Dividend 1.0% 1.0% 5.0% 1.0% 1.0% 5.0% (1) 1.0%

Current Company Snapshot (12/31/2020) Overview & Trading Information Financial Highlights About

Citizens Financial Services, Inc. Assets: $1,891M Deposits: $1,588M Loans: $1,405M Consolidated TCE/TA: 8.7% Bank Leverage Ratio: 8.8% Loan Loss Reserves / Loans: 1.1% MRQ LTM Net Income: $7.2 million $25.1

million Net Interest Margin: 3.84% 3.92% ROAA: 1.55% 1.46% ROAE: 15.20% 14.21% Core ROAE: 14.89% 15.16% Headquarters: Mansfield, PA Offices: 31 branches FTEs: ~300 full time employees Exchange/Listing: OTC Pink:

CZFS Pre-Pandemic(3/1/2020) Post-Pandemic(3/29/2021) Market Cap: $223 million $232.6 million Closing Price: $63.25 $59.45 Annualized Dividend Yield: 2.8% 3.13% Average Daily Volume (3Mo): 425 shares 2,103 shares 52 Week

Range: $43.00 - $60.00 P/TBV: 170% 144% P/E: 11.4x 9.0x Note: As of market close on March 29, 2021Source: S&P Global Market Intelligence Strong Capital Ratios (12/31/2020) Profitability (12/31/2020)

2020 Strategic Initiatives

COVID Task Force Designed to:Protect our EMPLOYEES.Protect our CUSTOMERS.Keep our COMPANY strong.

2021 and Beyond

19 4 Strategic Tenets Community – actively supporting the well-being of communities Customer

Expectations – exceeding them at every point of contact Financial Performance – to produce exceptional shareholder value Growth – achieved throughrelationship and geographic expansion

Thank you