Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

■ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended

|

December 31, 2015

|

or

□ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from

|

to

|

|

Commission file number

|

000-13222

|

|

CITIZENS FINANCIAL SERVICES, INC.

|

||||||

|

(Exact name of registrant as specified in its charter)

|

||||||

|

Pennsylvania

|

23-2265045

|

|||||

|

State or other jurisdiction of

incorporation or organization

|

(I.R.S. Employer

Identification No.)

|

|||||

|

15 South Main Street, Mansfield, Pennsylvania

|

16933

|

|||||

|

(Address of principal executive offices)

|

(Zip Code)

|

|||||

|

Registrant’s telephone number, including area code

|

(570) 662-2121

|

|||||

|

Securities registered pursuant to Section 12(b) of the Act:

|

None

|

|||||

|

Securities registered pursuant to Section 12(g) of the Act:

|

||||||

|

Common Stock, par value $1.00 per share

|

||||||

|

(Title of class)

|

||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

□ Yes ■ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

□ Yes ■ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

■ Yes □ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

■ Yes □ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

■

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer ■

Non-accelerated filer o Smaller reporting company o

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

□ Yes ■ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $131,083,374 as of June 30, 2015.

As of February 23, 2016, there were 3,335,876 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part III is incorporated by reference to the Registrant’s Definitive Proxy Statement for the 2016 Annual Meeting of Shareholders.

|

Citizens Financial Services, Inc.

Form 10-K

INDEX

|

|

|

Page

|

|

|

PART I

|

|

|

ITEM 1 – BUSINESS

|

1 – 8

|

|

ITEM 1A – RISK FACTORS

|

8 – 14

|

|

ITEM 1B – UNRESOLVED STAFF COMMENTS

|

14

|

|

ITEM 2 – PROPERTIES

|

14

|

|

ITEM 3 – LEGAL PROCEEDINGS

|

14

|

|

ITEM 4 – MINE SAFETY DISCLOSURES

|

14

|

|

PART II

|

|

|

ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

15 – 16

|

|

ITEM 6 – SELECTED FINANCIAL DATA

|

17

|

|

ITEM 7 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

18 – 47

|

|

ITEM 7A – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

47

|

|

ITEM 8 – FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

48 – 100

|

|

ITEM 9 – CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

101

|

|

ITEM 9A – CONTROLS AND PROCEDURES

|

101

|

|

ITEM 9B– OTHER INFORMATION

|

101

|

|

PART III

|

|

|

ITEM 10 – DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

102

|

|

ITEM 11 – EXECUTIVE COMPENSATION

|

102

|

|

ITEM 12 – SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

102 – 103

|

|

ITEM 13 – CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

103

|

|

ITEM 14 – PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

103

|

|

PART IV

|

|

|

ITEM 15 – EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

104 – 105

|

|

SIGNATURES

|

106

|

PART I

ITEM 1 – BUSINESS.

CITIZENS FINANCIAL SERVICES, INC.

Citizens Financial Services, Inc. (the “Company”), a Pennsylvania corporation, was incorporated on April 30, 1984 to be the holding company for First Citizens Community Bank (the “Bank”), which until 2012, and in connection with its conversion from a national bank to a Pennsylvania-chartered bank and trust company, operated under the name First Citizens National Bank. The Company is primarily engaged in the ownership and management of the Bank and the Bank’s wholly-owned insurance agency subsidiary, First Citizens Insurance Agency, Inc. On December 11, 2015, the Company completed the acquisition of The First National Bank of Fredericksburg (“FNB”) by merging FNB into the Bank, with the Bank as the resulting institution.

AVAILABLE INFORMATION

A copy of the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current events reports on Form 8-K, and amendments to these reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are made available free of charge through the Company’s web site at www.firstcitizensbank.com as soon as reasonably practicable after such reports are filed with or furnished to the Securities and Exchange Commission. Information on our website shall not be considered as incorporated by reference into this Form 10-K.

FIRST CITIZENS COMMUNITY BANK

The Bank is a full-service bank engaged in a broad range of banking activities and services for individual, business, governmental and institutional customers. These activities and services principally include checking, savings, and time deposit accounts; residential, commercial and agricultural real estate, commercial and industrial, state and political subdivision and consumer loans; and a variety of other specialized financial services. The Trust and Investment division of the Bank offers a full range of client investment, estate, mineral management and retirement services.

The Bank’s main office is located at 15 South Main Street, Mansfield, (Tioga County) Pennsylvania. The Bank’s primary market area consists of the Pennsylvania Counties of Bradford, Clinton, Potter and Tioga in north central Pennsylvania. It also includes Allegany, Steuben, Chemung and Tioga Counties in Southern New York. With the completion of the FNB acquisition, the Bank has added seven additional banking offices in south central Pennsylvania; four offices in Lebanon Country, two offices in Schuylkill County, and one office in Berks County. The economy of the Bank’s market areas are diversified and include manufacturing industries, wholesale and retail trade, service industries, agricultural and the production of natural resources of gas and timber. We are dependent geographically upon the economic conditions in both north central and south central Pennsylvania, as well as the southern tier of New York. In addition to the main office in Mansfield and the additional seven offices acquired from FNB, the Bank has 16 other full service branch offices in its market areas.

As of December 31, 2015, the Bank had 229 full time employees and 51 part-time employees, resulting in 246 full time equivalent employees at our corporate offices and other banking locations.

COMPETITION

The banking industry in the Bank’s service area is intensely competitive, both among commercial banks and with financial service providers such as consumer finance companies, thrifts, investment firms, mutual funds, insurance companies, credit unions, mortgage banking firms, financial companies, financial affiliates of industrial companies, internet entities, and government sponsored agencies, such as Freddie Mac and Fannie Mae, provide additional competition for loans and other financial services. The overall economy, which continues to be sluggish, has also increased competitive pressures particularly for entities seeking loan growth. Additionally, north central Pennsylvania has benefited from additional wealth resulting from the exploration for natural gas in our primary market. This has resulted in increased competition from brokerage firms and retirement fund management firms. The Bank is generally competitive with all competing financial institutions in its service areas with respect to interest rates paid on time and savings deposits, service charges on deposit accounts and interest rates charged on loans.

1

Additional information related to our business and competition is included in Part II, Item 7, “Management's Discussion and Analysis of Financial Condition and Results of Operations”.

SUPERVISION AND REGULATION

GENERAL

The Bank is subject to extensive regulation, examination and supervision by the Pennsylvania Department of Banking (“PDB”) and, as a member of the Federal Reserve System, by the Board of Governors of the Federal Reserve System (the “FRB”). Federal and state banking laws and regulations govern, among other things, the scope of a bank’s business, the investments a bank may make, the reserves against deposits a bank must maintain, terms of deposit accounts, loans a bank makes, the interest rates a bank charges and collateral a bank takes, the activities of a bank with respect to mergers and consolidations and the establishment of branches. The Company is registered as a bank holding company and is subject to supervision and regulation by FRB under the Bank Holding Company Act of 1956, as amended (the “BHCA”).

PENNSYLVANIA BANKING LAWS

The Pennsylvania Banking Code (“Banking Code”) contains detailed provisions governing the organization, location of offices, rights and responsibilities of directors, officers, and employees, as well as corporate powers, savings and investment operations and other aspects of the Bank and its affairs. The Banking Code delegates extensive rule-making power and administrative discretion to the PDB so that the supervision and regulation of state chartered banks may be flexible and readily responsive to changes in economic conditions and in savings and lending practices.

Pennsylvania law also provides Pennsylvania state chartered institutions elective parity with the power of national banks, federal thrifts, and state-chartered institutions in other states as authorized by the FDIC, subject to a required notice to the PDB. The Federal Deposit Insurance Corporation Act (“FDIA”), however, prohibits state chartered banks from making new investments, loans, or becoming involved in activities as principal and equity investments which are not permitted for national banks unless (1) the FDIC determines the activity or investment does not pose a significant risk of loss to the Deposit Insurance Fund and (2) the bank meets all applicable capital requirements. Accordingly, the additional operating authority provided to the Bank by the Banking Code is restricted by the FDIA.

In April 2008, banking regulators in the States of New Jersey, New York, and Pennsylvania entered into a Memorandum of Understanding (the “Interstate MOU”) to clarify their respective roles, as home and host state regulators, regarding interstate branching activity on a regional basis pursuant to the Riegle-Neal Amendments Act of 1997. The Interstate MOU establishes the regulatory responsibilities of the respective state banking regulators regarding bank regulatory examinations and is intended to reduce the regulatory burden on state chartered banks branching within the region by eliminating duplicative host state compliance exams. Under the Interstate MOU, the activities of branches we established in New York would be governed by Pennsylvania state law to the same extent that federal law governs the activities of the branch of an out-of-state national bank in such host states. Issues regarding whether a particular host state law is preempted are to be determined in the first instance by the PDB. In the event that the PDB and the applicable host state regulator disagree regarding whether a particular host state law is pre-empted, the PDB and the applicable host state regulator would use their reasonable best efforts to consider all points of view and to resolve the disagreement.

COMMUNITY REINVESTMENT ACT

The Community Reinvestment Act, (“CRA”), as implemented by FRB regulations, provides that the Bank has a continuing and affirmative obligation consistent with its safe and sound operation to help meet the credit needs of its entire community, including low and moderate income neighborhoods. The CRA does not establish specific lending requirements or programs for financial institutions nor does it limit an institution’s discretion to develop the types of products and services that it believes are best suited to its particular community, consistent with the CRA. The CRA requires the FRB, in connection with its examination of the Bank, to assess the institution’s record of meeting the credit needs of its community and to take such record into account in its evaluation of certain corporate applications by such institution, such as mergers and branching. The Bank’s most recent rating was “Satisfactory.” Various consumer laws and regulations also affect the operations of the Bank. In addition to the impact of regulation, commercial banks are affected significantly by the actions of the FRB as it attempts to control the money supply and credit availability in order to influence the economy.

2

THE DODD-FRANK ACT

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) has significantly changed the current bank regulatory structure and will affect it into the immediate future the lending and investment activities and general operations of depository institutions and their holding companies.

The Dodd-Frank Act requires the FRB to establish minimum consolidated capital requirements for bank holding companies that are as stringent as those required for insured depository institutions; the components of Tier 1 capital would be restricted to capital instruments that are currently considered to be Tier 1 capital for insured depository institutions. In addition, the proceeds of trust preferred securities are excluded from Tier 1 capital unless (i) such securities are issued by bank holding companies with assets of less than $500 million or (ii) such securities were issued prior to May 19, 2010 by bank or savings and loan holding companies with less than $15 billion of assets. The exclusion of such proceeds are phased in over a three year period beginning in 2013.

The Dodd-Frank Act also created a new Consumer Financial Protection Bureau with extensive powers to implement and enforce consumer protection laws. The Consumer Financial Protection Bureau has broad rulemaking authority for a wide range of consumer protection laws that apply to all banks, among other things, including the authority to prohibit “unfair, deceptive or abusive” acts and practices. However, institutions of less than $10 billion in assets, such as the Bank, will continue to be examined for compliance with consumer protection and fair lending laws and regulations by, and be subject to the enforcement authority of, their prudential regulators.

The Dodd-Frank Act created a new supervisory structure for oversight of the U.S. financial system, including the establishment of a new council of regulators, the Financial Stability Oversight Council, to monitor and address systemic risks to the financial system. Non-bank financial companies that are deemed to be significant to the stability of the U.S. financial system and all bank holding companies with $50 billion or more in total consolidated assets will be subject to heightened supervision and regulation. The FRB will implement prudential requirements and prompt corrective action procedures for such companies.

The Dodd-Frank Act made many other changes in banking regulation. Those include allowing depository institutions, for the first time, to pay interest on business checking accounts, requiring originators of securitized loans to retain a percentage of the risk for transferred loans, establishing regulatory rate-setting for certain debit card interchange fees and establishing a number of reforms for mortgage originations. Effective October 1, 2011, the debit-card interchange fee was capped at $0.21 per transaction, plus an additional 5 basis point charge to cover fraud losses. These fees are much lower than the current market rates. Although the regulation only impacts banks with assets above $10 billion, we believe that the provisions could result in a reduction in interchange revenue in the future.

The Dodd-Frank Act also broadened the base for FDIC insurance assessments. The FDIC was required to promulgate rules revising its assessment system so that it is based on the average consolidated total assets less tangible equity capital of an insured institution instead of deposits. That rule took effect April 1, 2011. The Dodd-Frank Act also permanently increased the maximum amount of deposit insurance for banks, savings institutions and credit unions to $250,000 per depositor, retroactive to January 1, 2008.

Under provisions of the Dodd-Frank Act referred to as the “Volcker Rule” certain limitations are placed on the ability of bank holding companies and their affiliates to engage in sponsoring, investing in and transacting with certain investment funds, including hedge funds and private equity funds (collectively “covered funds”). The Volcker Rule also places restrictions on proprietary trading, which could impact certain hedging activities. The Volcker Rule became fully effective in July 2015. We do not expect this rule to have a material impact on the Company.

3

The Dodd-Frank Act requires various federal agencies to promulgate numerous and extensive implementing regulations. Although the substance and scope of many of these regulations cannot be determined at this time, particularly those provisions relating to the new Consumer Financial Protection Bureau, the Dodd-Frank Act and implementing regulations may have a material impact on operations through, among other things, increased compliance costs, heightened regulatory supervision, and higher interest expense.

CURRENT CAPITAL REQUIREMENTS

Federal regulations require FDIC-insured depository institutions, including state-chartered, FRB-member banks, to meet several minimum capital standards. These capital standards were effective January 1, 2015, and result from a final rule implementing regulatory amendments based on recommendations of the Basel Committee on Banking Supervision and certain requirements of the Dodd-Frank Act.

The capital standards require the maintenance of common equity Tier 1 capital, Tier 1 capital and total capital to risk-weighted assets of at least 4.5%, 6.0% and 8.0%, respectively, and a leverage ratio of at least 4% of Tier 1 capital. Common equity Tier 1 capital is generally defined as common stockholders’ equity and retained earnings. Tier 1 capital is generally defined as common equity Tier 1 and Additional Tier 1 capital. Additional Tier 1 capital generally includes certain noncumulative perpetual preferred stock and related surplus and minority interests in equity accounts of consolidated subsidiaries. Total capital includes Tier 1 capital (common equity Tier 1 capital plus Additional Tier 1 capital) and Tier 2 capital. Tier 2 capital is comprised of capital instruments and related surplus meeting specified requirements, and may include cumulative preferred stock and long-term perpetual preferred stock, mandatory convertible securities, intermediate preferred stock and subordinated debt. Also included in Tier 2 capital is the allowance for loan and lease losses limited to a maximum of 1.25% of risk-weighted assets and, for institutions that have exercised an opt-out election regarding the treatment of Accumulated Other Comprehensive Income (“AOCI”), up to 45% of net unrealized gains on available-for-sale equity securities with readily determinable fair market values. The Company has exercised the AOCI opt-out option and therefore AOCI is not incorporated into common equity Tier 1 capital. Calculation of all types of regulatory capital is subject to deductions and adjustments specified in the regulations.

In determining the amount of risk-weighted assets for purposes of calculating risk-based capital ratios, assets, including certain off-balance sheet assets (e.g., recourse obligations, direct credit substitutes, residual interests) are multiplied by a risk weight factor assigned by the regulations based on the risks believed inherent in the type of asset. Higher levels of capital are required for asset categories believed to present greater risk. For example, a risk weight of 0% is assigned to cash and U.S. government securities, a risk weight of 50% is generally assigned to prudently underwritten first lien one- to four-family residential mortgages, a risk weight of 100% is assigned to commercial and consumer loans, a risk weight of 150% is assigned to certain past due loans and a risk weight of between 0% to 600% is assigned to permissible equity interests, depending on certain specified factors.

In addition to establishing the minimum regulatory capital requirements, the regulations limit capital distributions by the institution and certain discretionary bonus payments to management if an institution does not hold a “capital conservation buffer” consisting of 2.5% of common equity Tier 1 capital to risk-weighted assets above the amount necessary to meet its minimum risk-based capital requirements. The capital conservation buffer requirement is being phased in beginning January 1, 2016 at 0.625% of risk-weighted assets and increasing each year until fully implemented at 2.5% on January 1, 2019.

The FRB has authority to establish individual minimum capital requirements in appropriate cases upon a determination that an institution’s capital level is or may become inadequate in light of the particular risks or circumstances.

As of December 31, 2015, we met all applicable capital adequacy requirements.

PROMPT CORRECTIVE ACTION RULES

Federal law establishes a system of prompt corrective action to resolve the problems of undercapitalized institutions. The law requires that certain supervisory actions be taken against undercapitalized institutions, the severity of which depends on the degree of undercapitalization. The FRB has adopted regulations to implement the prompt corrective action legislation as to state member banks. The regulations were amended to incorporate the previously mentioned increased regulatory capital standards that were effective January 1, 2015. An institution is deemed to be “well capitalized” if it has a total risk-based capital ratio of 10.0% or greater, a Tier 1 risk-based capital ratio of 8.0% or greater, a leverage ratio of 5.0% or greater and a common equity Tier 1 ratio of 6.5% or greater. An institution is “adequately capitalized” if it has a total risk-based capital ratio of 8.0% or greater, a Tier 1 risk-based capital ratio of 6.0% or greater, a leverage ratio of 4.0% or greater and a common equity Tier 1 ratio of 4.5% or greater. An institution is “undercapitalized” if it has a total risk-based capital ratio of less than 8.0%, a Tier 1 risk-based capital ratio of less than 6.0%, a leverage ratio of less than 4.0% or a common equity Tier 1 ratio of less than 4.5%. An institution is deemed to be “significantly undercapitalized” if it has a total risk-based capital ratio of less than 6.0%, a Tier 1 risk-based capital ratio of less than 4.0%, a leverage ratio of less than 3.0% or a common equity Tier 1 ratio of less than 3.0%. An institution is considered to be “critically undercapitalized” if it has a ratio of tangible equity (as defined in the regulations) to total assets that is equal to or less than 2.0%.

4

Subject to a narrow exception, a receiver or conservator must be appointed for an institution that is “critically undercapitalized” within specified time frames. The regulations also provide that a capital restoration plan must be filed with the FRB within 45 days of the date an institution is deemed to have received notice that it is “undercapitalized,” “significantly undercapitalized” or “critically undercapitalized.” Compliance with the capital restoration plan must be guaranteed by any parent holding company up to the lesser of 5% of the depository institution’s total assets when it was deemed to be undercapitalized or the amount necessary to achieve compliance with applicable capital requirements. In addition, numerous mandatory supervisory actions become immediately applicable to an undercapitalized institution including, but not limited to, increased monitoring by regulators and restrictions on growth, capital distributions and expansion. The FRB could also take any one of a number of discretionary supervisory actions, including the issuance of a capital directive and the replacement of senior executive officers and directors. Significantly and critically undercapitalized institutions are subject to additional mandatory and discretionary measures.

STANDARDS FOR SAFETY AND SOUNDNESS

The federal banking agencies have adopted Interagency Guidelines prescribing Standards for Safety and Soundness in various areas such as internal controls and information systems, internal audit, loan documentation and credit underwriting, interest rate exposure, asset growth and quality, earnings and compensation, fees and benefits. The guidelines set forth the safety and soundness standards that the federal banking agencies use to identify and address problems at insured depository institutions before capital becomes impaired. If the FRB determines that a state member bank fails to meet any standard prescribed by the guidelines, the FRB may require the institution to submit an acceptable plan to achieve compliance with the standard.

ENFORCEMENT

The PDB maintains enforcement authority over the Bank, including the power to issue cease and desist orders and civil money penalties and remove directors, officers or employees. The PDB also has the power to appoint a conservator or receiver for a bank upon insolvency, imminent insolvency, unsafe or unsound condition or certain other situations. The FRB has primary federal enforcement responsibility over FRB-member state banks and has authority to bring actions against the institution and all institution-affiliated parties, including shareholders, who knowingly or recklessly participate in wrongful actions likely to have an adverse effect on the bank. Formal enforcement action may range from the issuance of a capital directive or a cease and desist order, to removal of officers and/or directors. Civil penalties cover a wide range of violations and can amount to $25,000 per day, or even $1 million per day in especially egregious cases. The FDIC, as deposit insurer, has the authority to recommend to the FRB that enforcement action be taken with respect to a member bank. If the FRB does not take action, the FDIC has authority to take such action under certain circumstances. In general, regulatory enforcement actions occur with respect to situations involving unsafe or unsound practices or conditions, violations of law or regulation or breaches of fiduciary duty. Federal and Pennsylvania law also establish criminal penalties for certain violations.

REGULATORY RESTRICTIONS ON BANK DIVIDENDS

The Bank may not declare a dividend without approval of the FRB, unless the dividend to be declared by the Bank's Board of Directors does not exceed the total of: (i) the Bank's net profits for the current year to date, plus (ii) its retained net profits for the preceding two years, less any required transfers to surplus.

5

Under Pennsylvania law, the Bank may only declare and pay dividends from its accumulated net earnings. In addition, the Bank may not declare and pay dividends from the surplus funds that Pennsylvania law requires that it maintain. Under these policies and subject to the restrictions applicable to the Bank, the Bank could have declared, during 2015, without prior regulatory approval, aggregate dividends of approximately $9.2 million, plus net profits earned to the date of such dividend declaration.

BANK SECRECY ACT

Under the Bank Secrecy Act (BSA), banks and other financial institutions are required to retain records to assure that the details of financial transactions can be traced if investigators need to do so. Banks are also required to report most cash transactions in amounts exceeding $10,000 made by or on behalf of their customers. Failure to meet BSA requirements may expose the Bank to statutory penalties, and a negative compliance record may affect the willingness of regulating authorities to approve certain actions by the Bank requiring regulatory approval, including new branches.

INSURANCE OF DEPOSIT ACCOUNTS

The Bank’s deposits are insured up to applicable limits by the Deposit Insurance Fund (DIF) of the FDIC. Under the FDIC’s risk-based assessment system, insured institutions are assigned to one of four risk categories based on supervisory evaluations, regulatory capital levels and certain other factors, with less risky institutions paying lower assessments. An institution’s assessment rate depends upon the category to which it is assigned, and certain adjustments specified by FDIC regulations. Until recently, assessment rates ranged from seven to 77.5 basis points of assessable deposits.

As required by the Dodd-Frank Act, the FDIC has issued final rules implementing changes to the assessment rules. The rules change the assessment base used for calculating deposit insurance assessments from deposits to total assets less tangible (Tier 1) capital. Since the new base is larger than the previous base, the FDIC also lowered assessment rates so that the rule would not significantly alter the total amount of revenue collected from the industry. The range of adjusted assessment rates is now 2.5 to 45 basis points of the new assessment base. The rule is expected to benefit smaller financial institutions, which typically rely more on deposits for funding, and shift more of the burden for supporting the insurance fund to larger institutions, which are thought to have greater access to nondeposit funding. No institution may pay a dividend if it is in default of its assessments. As a result of the Dodd-Frank Act, deposit insurance per account owner is $250,000 for all types of accounts.

The Dodd-Frank Act increased the minimum target DIF ratio from 1.15% of estimated insured deposits to 1.35% of estimated insured deposits. The FDIC must seek to achieve the 1.35% ratio by September 30, 2020. Insured institutions with assets of $10 billion or more are supposed to fund the increase. The Dodd-Frank Act eliminated the 1.5% maximum fund ratio, instead leaving it to the discretion of the FDIC. The FDIC has recently exercised that discretion by establishing a long range fund ratio of 2%.

The FDIC has authority to increase insurance assessments. A significant increase in insurance premiums would likely have an adverse effect on the operating expenses and results of operations of the Bank. Management cannot predict what insurance assessment rates will be in the future.

Insurance of deposits may be terminated by the FDIC upon a finding that the institution has engaged in unsafe or unsound practices, is in an unsafe or unsound condition to continue operations or has violated any applicable law, regulation, rule, order or regulatory condition imposed in writing. The management of the Bank does not know of any practice, condition or violation that might lead to termination of deposit insurance.

FEDERAL RESERVE SYSTEM

Under FRB regulations, the Bank is required to maintain reserves against its transaction accounts (primarily NOW and regular checking accounts). For 2016, the Bank is required to maintain average daily reserves equal to 3% on aggregate transaction accounts of up to $110.0 million, plus 10% on the remainder, and the first $15.2 million of otherwise reservable balances will be exempt. These reserve requirements are subject to annual adjustment by the FRB. The Bank is in compliance with the foregoing requirements.

6

ACQUISITION OF THE HOLDING COMPANY

Under the Federal Change in Bank Control Act (the “CIBCA”), a notice must be submitted to the FRB if any person (including a company), or group acting in concert, seeks to acquire 10% or more of the Company’s shares of outstanding common stock, unless the FRB has found that the acquisition will not result in a change in control of the Company. Under the CIBCA, the FRB generally has 60 days within which to act on such notices, taking into consideration certain factors, including the financial and managerial resources of the acquirer, the convenience and needs of the communities served by the Company and the Bank, and the anti-trust effects of the acquisition. Under the BHCA, any company would be required to obtain prior approval from the FRB before it may obtain “control” of the Company within the meaning of the BHCA. Control generally is defined to mean the ownership or power to vote 25% or more of any class of voting securities of the Company or the ability to control in any manner the election of a majority of the Company’s directors. An existing bank holding company would be required to obtain the FRB’s prior approval under the BHCA before acquiring more than 5% of the Company’s voting stock.

HOLDING COMPANY REGULATION

The Company, as a bank holding company, is subject to examination, supervision, regulation, and periodic reporting under the BHCA, as administered by the FRB. The Company is required to obtain the prior approval of the FRB to acquire all, or substantially all, of the assets of any bank or bank holding company. Prior FRB approval would be required for the Company to acquire direct or indirect ownership or control of any voting securities of any bank or bank holding company if it would, directly or indirectly, own or control more than 5% of any class of voting shares of the bank or bank holding company.

A bank holding company is generally prohibited from engaging in, or acquiring, direct or indirect control of more than 5% of the voting securities of any company engaged in nonbanking activities. One of the principal exceptions to this prohibition is for activities found by the FRB to be so closely related to banking or managing or controlling banks as to be a proper incident thereto. Some of the principal activities that the FRB has determined by regulation to be closely related to banking are: (i) making or servicing loans; (ii) performing certain data processing services; (iii) providing securities brokerage services; (iv) acting as fiduciary, investment or financial advisor; (v) leasing personal or real property under certain conditions; (vi) making investments in corporations or projects designed primarily to promote community welfare; and (vii) acquiring a savings association.

A bank holding company that meets specified conditions, including that its depository institutions subsidiaries are “well capitalized” and “well managed,” can opt to become a “financial holding company.” A “financial holding company” may engage in a broader array of financial activities than permitted a typical bank holding company. Such activities can include insurance underwriting and investment banking. The Company does not anticipate opting for “financial holding company” status at this time.

The Company is subject to the FRB’s consolidated capital adequacy guidelines for bank holding companies. Traditionally, those guidelines have been structured similarly to the regulatory capital requirements for the subsidiary depository institutions, but were somewhat more lenient. For example, the holding company capital requirements allowed inclusion of certain instruments in Tier 1 capital that are not includable at the institution level. As previously noted, the Dodd-Frank Act requires that the guidelines be amended so that they are at least as stringent as those required for the subsidiary depository institutions. See “—The Dodd-Frank Act.”

A bank holding company is generally required to give the FRB prior written notice of any purchase or redemption of then outstanding equity securities if the gross consideration for the purchase or redemption, when combined with the net consideration paid for all such purchases or redemptions during the preceding 12 months, is equal to 10% or more of the Company’s consolidated net worth. The FRB may disapprove such a purchase or redemption if it determines that the proposal would constitute an unsafe and unsound practice, or would violate any law, regulation, FRB order or directive, or any condition imposed by, or written agreement with, the FRB. The FRB has adopted an exception to that approval requirement for well-capitalized bank holding companies that meet certain other conditions.

The FRB has issued a policy statement regarding the payment of dividends by bank holding companies. In general, the FRB’s policies provide that dividends should be paid only out of current earnings and only if the prospective rate of earnings retention by the bank holding company appears consistent with the organization’s capital needs, asset quality and overall financial condition. The FRB’s policies also require that a bank holding company serve as a source of financial strength to its subsidiary banks by using available resources to provide capital funds during periods of financial stress or adversity and by maintaining the financial flexibility and capital-raising capacity to obtain additional resources for assisting its subsidiary banks where necessary. The Dodd-Frank Act codified the source of strength policy and requires the promulgation of implementing regulations. Under the prompt corrective action laws, the ability of a bank holding company to pay dividends may be restricted if a subsidiary bank becomes undercapitalized. These regulatory policies could affect the ability of the Company to pay dividends or otherwise engage in capital distributions.

7

The Federal Deposit Insurance Act makes depository institutions liable to the Federal Deposit Insurance Corporation for losses suffered or anticipated by the insurance fund in connection with the default of a commonly controlled depository institution or any assistance provided by the Federal Deposit Insurance Corporation to such an institution in danger of default. That law would have potential applicability if the Company ever held as a separate subsidiary a depository institution in addition to the Bank.

The status of the Company as a registered bank holding company under the Bank Holding Company Act will not exempt it from certain federal and state laws and regulations applicable to corporations generally, including, without limitation, certain provisions of the federal securities laws.

EFFECT OF GOVERNMENT MONETARY POLICIES

The earnings and growth of the banking industry are affected by the credit policies of monetary authorities, including the Federal Reserve System. An important function of the Federal Reserve System is to regulate the national supply of bank credit in order to control recessionary and inflationary pressures. Among the instruments of monetary policy used by the Federal Reserve to implement these objectives are open market activities in U.S. government securities, changes in the discount rate on member bank borrowings and changes in reserve requirements against member bank deposits. These operations are used in varying combinations to influence overall economic growth and indirectly, bank loans, securities, and deposits. These variables may also affect interest rates charged on loans or paid on deposits. The monetary policies of the Federal Reserve authorities have had a significant effect on the operating results of commercial banks in the past and are expected to continue to have such an effect in the future.

In view of the changing conditions in the national economy and in the money markets, as well as the effect of actions by monetary and fiscal authorities including the Federal Reserve System, no prediction can be made as to possible changes in interest rates, deposit levels, loan demand or their effect on the business and earnings of the Company and the Bank. Additional information is included under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing in this Annual Report on Form 10-K.

ITEM 1A – RISK FACTORS.

Changing interest rates may decrease our earnings and asset values.

Our net interest income is the interest we earn on loans and investments less the interest we pay on our deposits and borrowings. Our net interest margin is the difference between the yield we earn on our assets and the interest rate we pay for deposits and our other sources of funding. Changes in interest rates—up or down—could adversely affect our net interest margin and, as a result, our net interest income. Although the yield we earn on our assets and our funding costs tend to move in the same direction in response to changes in interest rates, one can rise or fall faster than the other, causing our net interest margin to expand or contract. Our liabilities tend to be shorter in duration than our assets, so they may adjust faster in response to changes in interest rates. As a result, when interest rates rise, our funding costs may rise faster than the yield we earn on our assets, causing our net interest margin to contract until the asset yields catch up. Changes in the slope of the “yield curve”—or the spread between short-term and long-term interest rates—could also reduce our net interest margin. Normally, the yield curve is upward sloping, meaning short-term rates are lower than long-term rates. Because our liabilities tend to be shorter in duration than our assets, when the yield curve flattens or even inverts, we could experience pressure on our net interest margin as our cost of funds increases relative to the yield we can earn on our assets.

8

Changes in interest rates also affect the value of the Bank’s interest-earning assets, and in particular the Bank’s securities portfolio. Generally, the value of fixed-rate securities fluctuates inversely with changes in interest rates. Unrealized gains and losses on securities available for sale are reported as a separate component of shareholder equity, net of tax. Decreases in the fair value of securities available for sale resulting from increases in interest rates could have an adverse effect on shareholders’ equity.

Local economic conditions are impacted by the exploration and drilling activities for natural gas in the in the Marcellus and Utica Shale formations.

Our market area is predominately centered in the Marcellus and Utica Shale natural gas exploration and drilling area, and as a result, the economy in north central Pennsylvania has become increasingly influenced by the natural gas industry. Loan demand, deposit levels and the market value of local real estate have been impacted by this activity. While the Company does not lend to the various entities directly engaged in exploration, drilling or production activities, many of our customers provide transportation and other services and products that support natural gas exploration and production activities. Therefore, our customers could be negatively impacted by the market price for natural gas as a significant downturn in this industry could impact the ability of our borrowers to repay their loans in accordance with their terms. Additionally, exploration and drilling activities may be affected by federal, state and local laws and regulations such as restrictions on production, permitting, changes in taxes and environmental protection. Regulatory and market pricing of natural gas could also impact and/or reduce demand for loans and deposit levels. These factors could have a material adverse effect on our business, prospects, financial condition and results of operations.

Higher loan losses could require us to increase our allowance for loan losses through a charge to earnings.

When we loan money we incur the risk that our borrowers do not repay their loans. We reserve for loan losses by establishing an allowance through a charge to earnings. The amount of this allowance is based on our assessment of loan losses inherent in our loan portfolio. The process for determining the amount of the allowance is critical to our financial results and condition. It requires subjective and complex judgments about the future, including forecasts of economic or market conditions that might impair the ability of our borrowers to repay their loans. We might underestimate the loan losses inherent in our loan portfolio and have loan losses in excess of the amount reserved. We might increase the allowance because of changing economic conditions. For example, in a rising interest rate environment, borrowers with adjustable-rate loans could see their payments increase. There may be a significant increase in the number of borrowers who are unable or unwilling to repay their loans, resulting in our charging off more loans and increasing our allowance. In addition, when real estate values decline, the potential severity of loss on a real estate-secured loan can increase significantly, especially in the case of loans with high combined loan-to-value ratios. A decline in the national economy and the local economies of the areas in which the loans are concentrated could result in an increase in loan delinquencies, foreclosures or repossessions resulting in increased charge-off amounts and the need for additional loan loss allowances in future periods. In addition, bank regulators may require us to make a provision for loan losses or otherwise recognize further loan charge-offs following their periodic review of our loan portfolio, our underwriting procedures, and our loan loss allowance. Any increase in our allowance for loan losses or loan charge-offs as required by such regulatory authorities could have a material adverse effect on our financial condition and results of operations.

Our allowance for loan losses amounted to $7.1 million, or 1.02% of total loans outstanding and 99.3% of nonperforming loans, at December 31, 2015. Our allowance for loan losses at December 31, 2015 may not be sufficient to cover future loan losses. A large loss could deplete the allowance and require increased provisions to replenish the allowance, which would decrease our earnings. In addition, at December 31, 2015, we had a total of 29 loan relationships with outstanding balances that exceeded $3.0 million, 28 of which were performing according to their original terms. However, the deterioration of one or more of these loans could result in a significant increase in our nonperforming loans and our provision for loan losses, which would negatively impact our results of operations.

Our emphasis on commercial real estate, agricultural, construction and municipal lending may expose us to increased lending risks.

At December 31, 2015, we had $237.5 million in loans secured by commercial real estate, $57.8 million in agricultural loans, $15.0 million in construction loans and $98.5 million in municipal loans. Commercial real estate loans, agricultural, construction and municipal loans represented 34.2%, 8.3%, 2.2% and 14.1%, respectively, of our loan portfolio. At December 31, 2015, we had $4.4 million of reserves specifically allocated to these loan types. While commercial real estate, agricultural, construction and municipal loans are generally more interest rate sensitive and carry higher yields than do residential mortgage loans, these types of loans generally expose a lender to greater risk of non-payment and loss than single-family residential mortgage loans because repayment of the loans often depends on the successful operation of the property, the income stream of the borrowers and, for construction loans, the accuracy of the estimate of the property’s value at completion of construction and the estimated cost of construction. Such loans typically involve larger loan balances to single borrowers or groups of related borrowers compared to single-family residential mortgage loans.

9

Loan participations have been a significant source of loan originations in recent periods and a decline in loan participation volume could hurt profits and slow loan growth.

We have actively engaged in loan participations in recent periods whereby we are invited to participate in loans, primarily commercial real estate and municipal loans, originated by another financial institution known as the lead lender. We have participated with other financial institutions in both our primary markets and out of market areas. Loan participations accounted for approximately $14.3 million, $14.4 million and $13.1 million, or 37.6%, 100% and 50.4% of the Company’s net organic loan growth during 2013, 2014 and 2015, respectively. Our profits and loan growth could be significantly and adversely affected if the volume of loan participations would materially decrease, whether because loan demand declines, loan payoffs, lead lenders may come to perceive us as a potential competitor in their respective market areas, or otherwise.

If we conclude that the decline in value of any of our investment securities is other than temporary, we are required to write down the value of that security through a charge to earnings.

We review our investment securities portfolio monthly and at each quarter-end reporting period to determine whether the fair value is below the current carrying value. When the fair value of any of our investment securities has declined below its carrying value, we are required to assess whether the decline is other than temporary. If we conclude that the decline is other than temporary, we are required to write down the value of that security through a charge to earnings. As of December 31, 2015, our investment portfolio included available for sale investment securities with an amortized cost of $356.4 million and a fair value of $359.7 million, which included unrealized losses on 91 securities totaling $801,000. Changes in the expected cash flows of these securities and/or prolonged price declines may result in our concluding in future periods that the impairment of these securities is other than temporary, which would require a charge to earnings to write down these securities to their fair value. Any charges for other-than-temporary impairment would not impact cash flow, tangible capital or liquidity.

Failure to resolve the Pennsylvania state budget impasse could hurt our profits, asset values and liquidity.

The Company makes loans to, invests in securities issued by, and maintains deposit accounts of Pennsylvania municipalities, primarily school districts. Until funding was distributed in January 2016, the state budget impasse resulted in the non-receipt by municipalities of state subsidies, which is a significant source of cash flow needed to meet their financial obligations. If the budget impasse remains unresolved, we may incur losses on loans granted to municipalities as well as incur losses, including impairment losses as a result of credit rating downgrades or otherwise, on municipal securities in which we invest. The continuing budget impasse may also reduce municipal funds on deposit with the Company, which could hurt our liquidity and our earnings if we would have to resort to higher cost funding sources to meet our liquidity needs.

Income from secondary mortgage market operations is volatile, and we may incur losses or charges with respect to our secondary mortgage market operations which would negatively affect our earnings.

We generally sell in the secondary market the longer term fixed-rate residential mortgage loans that we originate, earning non-interest income in the form of gains on sale. When interest rates rise, the demand for mortgage loans tends to fall and may reduce the number of loans available for sale. Furthermore, the prolonged low interest rate environment has reduced the demand for loans available for sale. In addition to interest rate levels, weak or deteriorating economic conditions also tend to reduce loan demand. Although we sell loans in the secondary market without recourse, we are required to give customary representations and warranties to the buyers. If we breach those representations and warranties, the buyers can require us to repurchase the loans and we may incur a loss on the repurchase. Because we generally retain the servicing rights on the loans we sell in the secondary market, we are required to record a mortgage servicing right asset, which we test annually for impairment. The value of mortgage servicing rights tends to increase with rising interest rates and to decrease with falling interest rates. If we are required to take an impairment charge on our mortgage servicing rights our earnings would be adversely affected.

10

As a result of the acquisition of FNB, the Bank acquired a portfolio of loans sold to the FHLB, which were sold under the Mortgage Partnership Finance Program ("MPF"). The Bank is no longer an active participant in the MPF program. The MPF portfolio balance was $40,437,000 at December 31, 2015, respectively. The FHLB maintains a first-loss position for the MPF portfolio that totals $104,000. Should the FHLB exhaust its first-loss position, recourse to the Bank's credit enhancement would be up to the next $4,345,000 of losses. The Bank has not experienced any losses for the MPF portfolio.

The Company’s financial condition and results of operations are dependent on the economy in the Bank’s market area.

The Bank’s primary market area consists of the Pennsylvania Counties of Bradford, Clinton, Potter, and Tioga in north central Pennsylvania and Allegany, Steuben, Chemung and Tioga Counties in southern New York. With the acquisition of FNB, south central Pennsylvania counties of Lebanon, Schuylkill and Berks represents a new market area. As of December 31, 2015, management estimates that approximately 92.1% of deposits and 77.0% of loans came from households whose primary address is located in the Bank’s primary market area. Because of the Bank’s concentration of business activities in its market area, the Company’s financial condition and results of operations depend upon economic conditions in its market area. Adverse economic conditions in our market areas could reduce our growth rate, affect the ability of our customers to repay their loans and generally affect our financial condition and results of operations. Conditions such as inflation, recession, unemployment, high interest rates and short money supply and other factors beyond our control may adversely affect our profitability. We are less able than a larger institution to spread the risks of unfavorable local economic conditions across a large number of diversified economies. Any sustained period of increased payment delinquencies, foreclosures or losses caused by adverse market or economic conditions in the States of Pennsylvania and New York could adversely affect the value of our assets, revenues, results of operations and financial condition. Moreover, we cannot give any assurance we will benefit from any market growth or favorable economic conditions in our primary market areas if they do occur.

A return of recessionary conditions could result in increases in our level of nonperforming loans and/or reduce demand for our products and services, which could have an adverse effect on our results of operations.

Although the U.S. economy is not currently in a recession, economic growth has been slow and uneven, and the percentage of people out of the workforce or uemployed remains elevated. A return to prolonged deteriorating economic conditions and/or continued negative developments in the domestic and international credit markets could significantly affect the markets in which we do business, the value of our loans and investments, and our ongoing operations, costs and profitability. These events may cause us to incur losses and may adversely affect our financial condition and results of operations.

We may fail to realize all of the anticipated benefits of the acquisition of FNB.

With the FNB acquisition, the Company entered into a new banking market area. The success of the FNB acquisition will depend upon, in part, the Company’s ability to realize the anticipated benefits and cost savings from combining the businesses of the Company and FNB. To realize these anticipated benefits and cost savings, the businesses must be successfully combined and operated. If the Company is not able to achieve these objectives, the anticipated benefits, including growth and cost savings related to the combined businesses, may not be realized at all or may take longer to realize than expected. If the Company fails to realize the anticipated benefits of the acquisition, the Company’s results of operations could be adversely affected.

Regulation of the financial services industry is undergoing major changes, and future legislation could increaseour cost of doing business or harm our competitive position.

We are subject to extensive regulation, supervision and examination by the FRB and the PDB, our primary regulators, and by the FDIC, as insurer of our deposits. Such regulation and supervision governs the activities in which an institution and its holding company may engage and are intended primarily for the protection of the insurance fund and the depositors and borrowers of the Bank rather than for holders of our common stock. Regulatory authorities have extensive discretion in their supervisory and enforcement activities, including the imposition of restrictions on our operations, the classification of our assets and determination of the level of our allowance for loan losses. Any change in such regulation and oversight, whether in the form of regulatory policy, regulations, legislation or supervisory action, may have a material impact on our profitability and operations. Future legislative changes could require changes to business practices or force us to discontinue businesses and potentially expose us to additional costs, liabilities, enforcement action and reputational risk.

11

We are periodically subject to examination and scrutiny by a number of banking agencies and, depending upon the findings and determinations of these agencies, we may be required to make adjustments to our business that could adversely affect us.

Federal and state banking agencies periodically conduct examinations of our business, including compliance with applicable laws and regulations. If, as a result of an examination, a banking agency was to determine that the financial condition, capital resources, asset quality, asset concentration, earnings prospects, management, liquidity, sensitivity to market risk or other aspects of any of our operations has become unsatisfactory, or that we or our management is in violation of any law or regulation, it could take a number of different remedial actions as it deems appropriate. These actions include the power to enjoin “unsafe or unsound” practices, to require affirmative actions to correct any conditions resulting from any violation or practice, to issue an administrative order that can be judicially enforced, to direct an increase in our capital, to restrict our growth, to change the asset composition of our portfolio or balance sheet, to assess civil monetary penalties against our officers or directors, to remove officers and directors and, if it is concluded that such conditions cannot be corrected or there is an imminent risk of loss to depositors, to terminate our deposit insurance. If we become subject to such regulatory actions, our business, results of operations and reputation may be negatively impacted.

Strong competition within the Bank’s market areas could hurt profits and slow growth.

The Bank faces intense competition both in making loans and attracting deposits. This competition has made it more difficult for the Bank to make new loans and at times has forced the Bank to offer higher deposit rates. Price competition for loans and deposits might result in the Bank earning less on loans and paying more on deposits, which would reduce net interest income. Competition also makes it more difficult to increase the volume of our loan and deposit portfolios. As of June 30, 2015, which is the most recent date for which information is available, we held 35.5% of the FDIC insured deposits in Bradford, Potter and Tioga Counties, Pennsylvania, which was the largest share of deposits out of eight financial institutions with offices in the area, and 6.1% of the FDIC insured deposits in Allegany County, New York, which was the fourth largest share of deposits out of five financial institutions with offices in this area. As of June 30, 2015, which is prior to the acquisition by the Company, FNB held 6.9% of the deposits in Lebanon County, Pennsylvania. This data does not include deposits held by credit unions. Competition also makes it more difficult to hire and retain experienced employees. Some of the institutions with which the Bank competes have substantially greater resources and lending limits than the Bank has and may offer services that the Bank does not provide. Management expects competition to increase in the future as a result of legislative, regulatory and technological changes and the continuing trend of consolidation in the financial services industry. The Bank’s profitability depends upon its continued ability to compete successfully in its market area.

We rely on our management and other key personnel, and the loss of any of them may adversely affect our operations.

We are and will continue to be dependent upon the services of our executive management team. In addition, we will continue to depend on our ability to retain and recruit key commercial loan officers. The unexpected loss of services of any key management personnel or commercial loan officers could have an adverse effect on our business and financial condition because of their skills, knowledge of our market, years of industry experience and the difficulty of promptly finding qualified replacement personnel.

Environmental liability associated with lending activities could result in losses.

In the course of our business, we may foreclose on and take title to properties securing our loans. If hazardous substances were discovered on any of these properties, we could be liable to governmental entities or third parties for the costs of remediation of the hazard, as well as for personal injury and property damage. Many environmental laws can impose liability regardless of whether we knew of, or were responsible for, the contamination. In addition, if we arrange for the disposal of hazardous or toxic substances at another site, we may be liable for the costs of cleaning up and removing those substances from the site even if we neither own nor operate the disposal site. Environmental laws may require us to incur substantial expenses and may materially limit use of properties we acquire through foreclosure, reduce their value or limit our ability to sell them in the event of a default on the loans they secure. In addition, future laws or more stringent interpretations or enforcement policies with respect to existing laws may increase our exposure to environmental liability.

12

Our ability to pay dividends is limited by law.

Our ability to pay dividends to our shareholders largely depends on our receipt of dividends from the Bank. The amount of dividends that the Bank may pay to us is limited by federal and state laws and regulations. We also may decide to limit the payment of dividends even when we have the legal ability to pay them in order to retain earnings for use in our business.

Federal and state banking laws, our articles of incorporation and our by-laws may have an anti-takeover effect.

Federal law imposes restrictions, including regulatory approval requirements, on persons seeking to acquire control over us. Pennsylvania law also has provisions that may have an anti-takeover effect. These provisions may serve to entrench management or discourage a takeover attempt that shareholders consider to be in their best interest or in which they would receive a substantial premium over the current market price.

We are subject to certain risks in connection with our use of technology

Communications and information systems are essential to the conduct of our business, as we use such systems to manage our customer relationships, our general ledger, our deposits, our loans, and to deliver on-line and electronic banking services. Our operations rely on the secure processing, storage, and transmission of confidential and other information in our computer systems and networks. Although we take protective measures and endeavor to modify them as circumstances warrant, the security of our computer systems, software, and networks may be vulnerable to breaches, unauthorized access, misuse, computer viruses, or other malicious code and cyber attacks that could have a security impact.

In addition, breaches of security may occur through intentional or unintentional acts by those having authorized or unauthorized access to our confidential or other information or the confidential or other information of our customers, clients, or counterparties. If one or more of such events were to occur, the confidential and other information processed and stored in, and transmitted through, our computer systems and networks could potentially be jeopardized, or could otherwise cause interruptions or malfunctions in our operations or the operations of our customers, clients, or counterparties. This could cause us significant reputational damage or result in our experiencing significant losses from fraud or otherwise.

Furthermore, we may be required to expend significant additional resources to modify our protective measures or to investigate and remediate vulnerabilities or other exposures arising from operational and security risks. Also, we may be subject to litigation and financial losses that are either not insured against or not fully covered through any insurance we maintain.

In addition, we routinely transmit and receive personal, confidential, and proprietary information by e-mail and other electronic means. We have discussed and worked with our customers, clients, and counterparties to develop secure transmission capabilities, but we do not have, and may be unable to put in place, secure capabilities with all of these constituents, and we may not be able to ensure that these third parties have appropriate controls in place to protect the confidentiality of such information. Any interception, misuse, or mishandling of personal, confidential, or proprietary information being sent to or received from a customer, client, or counterparty could result in legal liability, regulatory action, and reputational harm, and could have a significant adverse effect on our competitive position, financial condition, and results of operations.

Our risk management framework may not be effective in mitigating risks and/or losses to us.

We have implemented a risk management framework to manage our risk exposure. This framework is comprised of various processes, systems and strategies, and is designed to manage the types of risk to which we are subject, including, among others, credit, market, liquidity, interest rate and compliance. Our framework also includes financial or other modeling methodologies which involve management assumptions and judgment. There is no assurance that our risk management framework will be effective under all circumstances or that it will adequately mitigate any risk or loss to us. If our framework is not effective, we could suffer unexpected losses and our business, financial condition, results of operations or prospects could be materially and adversely affected. We may also be subject to potentially adverse regulatory consequences.

13

ITEM 1B – UNRESOLVED STAFF COMMENTS.

Not applicable.

ITEM 2 – PROPERTIES.

The headquarters of the Company and Bank are located at 15 South Main Street, Mansfield, Pennsylvania. The building contains the central offices of the Company and Bank. Our bank owns twenty one banking facilities and leases four other facilities. All buildings owned by the Bank are free of any liens or encumbrances.

The net book value of owned banking facilities and leasehold improvements totaled $16,317,000 as of December 31, 2015. The properties are adequate to meet the needs of the employees and customers. We have equipped all of our facilities with current technological improvements for data processing.

ITEM 3 - LEGAL PROCEEDINGS.

The Company is not involved in any pending legal proceedings other than routine legal proceedings occurring in the ordinary course of business. Such routine legal proceedings in the aggregate are believed by management to be immaterial to the Company's financial condition or results of operations.

ITEM 4 – MINE SAFETY DISCLOSURES

Not applicable.

14

PART II

ITEM 5 - MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

The Company's stock is not listed on any stock exchange, but it is quoted on the OTC Pink Market under the trading symbol CZFS. Prices presented in the table below are bid prices between broker-dealers published by the OTC Pink Market and the Pink Sheets Electronic Quotation Service. The prices do not include retail markups or markdowns or any commission to the broker-dealer. The bid prices do not necessarily reflect prices in actual transactions. Cash dividends are declared on a quarterly basis and are summarized in the table below

|

Dividends

|

Dividends

|

|||||

|

2015

|

declared

|

2014

|

declared

|

|||

|

|

High

|

Low

|

per share

|

High

|

Low

|

per share

|

|

First quarter

|

$ 53.63

|

$ 49.39

|

$ 0.405

|

$ 52.56

|

$ 47.00

|

$ 0.385

|

|

Second quarter

|

50.14

|

48.00

|

0.405

|

53.56

|

50.02

|

0.385

|

|

Third quarter

|

49.89

|

45.50

|

0.510

|

52.59

|

50.86

|

1.000

|

|

Fourth quarter

|

49.22

|

45.50

|

0.410

|

53.34

|

51.51

|

0.400

|

The Company has paid dividends since April 30, 1984, the effective date of our formation as a bank holding company. The Company's Board of Directors expects that comparable cash dividends will continue to be paid by the Company in the future; however, future dividends necessarily depend upon earnings, financial condition, appropriate legal restrictions and other factors in existence at the time the Board of Directors considers a dividend policy. Cash available for dividend distributions to stockholders of the Company comes primarily from dividends paid to the Company by the Bank. Therefore, restrictions on the ability of the Bank to make dividend payments are directly applicable to the Company. Under the Pennsylvania Business Corporation Law of 1988, the Company may pay dividends only if, after payment, the Company would be able to pay debts as they become due in the usual course of our business and total assets will be greater than the sum of total liabilities. These regulatory policies could affect the ability of the Company to pay dividends or otherwise engage in capital distributions. Also see “Supervision and Regulation – Regulatory Restrictions on Bank Dividends,” “Supervision and Regulation – Holding Company Regulation,” and “Note 14 – Regulatory Matter” to the consolidated financial statements.

As of February 23, 2016, the Company had approximately 1,738 stockholders of record. The computation of stockholders of record excludes investors whose shares were held for them by a bank or broker at that date. The following table presents information regarding the Company’s stock repurchases during the three months ended December 31, 2015:

|

Period

|

Total Number of

Shares (or units

Purchased)

|

Average Price

Paid per

Share (or

Unit)

|

Total Number of Shares (or

Units) Purchased as Part of

Publicly Announced Plans of

Programs

|

Maximum Number (or

Approximate Dollar Value) of

Shares (or Units) that May Yet Be

Purchased Under the Plans or

Programs (1)

|

|

10/1/15 to 10/31/15

|

1

|

$48.15

|

1

|

176,746

|

|

11/1/15 to 11/31/15

|

3,147

|

$46.00

|

3,147

|

173,599

|

|

12/1/15 to 12/31/15

|

63

|

$46.00

|

63

|

173,536

|

|

Total

|

3,211

|

$46.00

|

3,211

|

173,536

|

|

(1)

|

On January 17, 2012, the Company announced that the Board of Directors authorized the Company to repurchase up to 140,000 shares. The repurchases will be conducted through open-market purchases or privately negotiated transactions and will be made from time to time depending on market conditions and other factors. No time limit was placed on the duration of the share repurchase program. Any repurchased shares will be held as treasury stock and will be available for general corporate purposes.

|

|

(2)

|

On October 20, 2015, the Company announced that the Board of Directors authorized the Company to repurchase up to an additional 150,000 shares. The repurchases will be conducted through open-market purchases or privately negotiated transactions and will be made from time to time depending on market conditions and other factors. No time limit was placed on the duration of the share repurchase program. Any repurchased shares will be held as treasury stock and will be available for general corporate purposes.

|

15

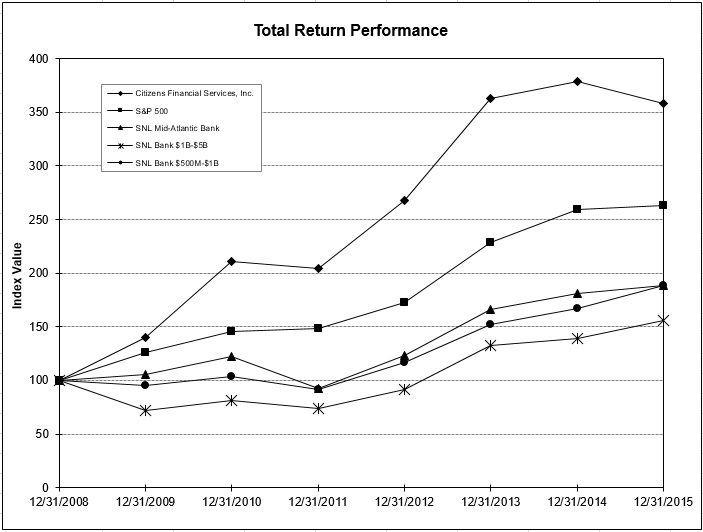

Set forth below is a line graph comparing the yearly dollar changes in the cumulative shareholder return on the Company’s common stock against the cumulative total return of the S&P 500 Stock index, SNL Mid-Atlantic Bank Index and SNL Bank $500 Million to $1 Billion index for the period of seven fiscal years assuming the investment of $100.00 on December 31, 2008 and assuming the reinvestment of dividends. The $1 Billion to $5 Billion Index was added to the chart in 2015 due to the Company exceeding $1.0 billion in assets in December as a result of the FNB acquisition. The shareholder return shown on the graph below is not necessarily indicative of future performance and was obtained from SNL Financial LC, Charlottesville, VA.

|

Period Ending

|

||||||||

|

Index

|

12/31/08

|

12/31/09

|

12/31/10

|

12/31/11

|

12/31/12

|

12/31/13

|

12/31/14

|

12/31/15

|

|

Citizens Financial Services, Inc.

|

100.00

|

139.87

|

210.87

|

204.87

|

268.13

|

362.46

|

378.63

|

358.26

|

|

S&P 500

|

100.00

|

126.46

|

145.51

|

148.59

|

172.37

|

228.19

|

259.43

|

263.02

|

|

SNL Mid-Atlantic Bank

|

100.00

|

105.27

|

122.81

|

92.26

|

123.59

|

166.59

|

181.49

|

188.30

|

| SNL Bank $1B-$5B | 100.00 | 71.68 | 81.25 | 74.10 | 91.37 | 132.87 | 138.93 | 155.51 |

|

SNL Bank $500M-$1B

|

100.00

|

95.24

|

103.96

|

91.46

|

117.25

|

152.05

|

166.81

|

188.27

|

16

ITEM 6 - SELECTED FINANCIAL DATA.