Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - UNITED BANKSHARES INC/WV | d80596dex991.htm |

| 8-K - 8-K - UNITED BANKSHARES INC/WV | d80596d8k.htm |

United Bankshares, Inc. First Quarter 2021 Earnings Review April 23, 2021 Exhibit 99.2

Forward-Looking Statements This presentation and statements made by United Bankshares, Inc. (“United”) and its management contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about United’s plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts, and other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” or words of similar meaning generally intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations managements of United and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of United. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the effects of changing regional and national economic conditions, including the impact of the COVID-19 pandemic, and the negative impacts and disruptions on United’s customers, the communities it serves and the domestic and global economy; (2) current and future economic and market conditions, including the effects of high unemployment rates, United States fiscal debt, budget and tax matters and any slowdown in global economic growth; (3) legislative or regulatory changes, including changes in accounting standards, that may adversely affect the businesses in which United is engaged; (4) the interest rate environment may further compress margins and adversely affect net interest income; (5) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; (6) competition from other financial services companies in United's markets could adversely affect operations; and (7) the economic slowdown could continue to adversely affect credit quality and loan originations. Additional factors, that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed United’s reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available on the SEC's Internet site (http://www.sec.gov). United cautions that the foregoing list of factors is not exclusive. All subsequent written and oral forward-looking statements concerning United or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. United does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

1Q21 HIGHLIGHTS Achieved record quarterly Net Income of $106.9 million and record quarterly Diluted Earnings Per Share of $0.83 Generated Return on Average Assets of 1.64%, Return on Average Equity of 9.97%, and Return on Average Tangible Equity* of 17.20% Reported strong mortgage banking revenue, net income, and volume Continue to support our customers’ needs through new loan originations, loan deferrals, PPP loans, and other accommodations Quarterly dividend of $0.35 per share equates to a yield of 3.6% (based upon recent prices) Asset quality remains sound and Non Performing Assets decreased 12.8% linked-quarter Strong expense control with an efficiency ratio of 52.5% Capital position remains robust and liquidity remains sound *Non GAAP measure. Refer to appendix.

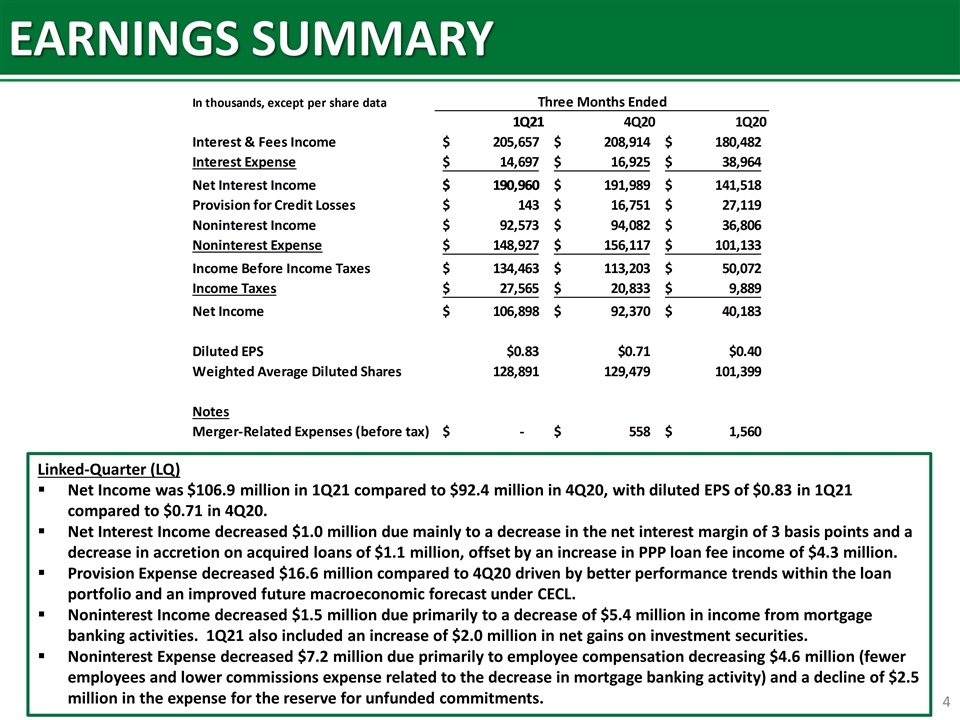

EARNINGS SUMMARY Linked-Quarter (LQ) Net Income was $106.9 million in 1Q21 compared to $92.4 million in 4Q20, with diluted EPS of $0.83 in 1Q21 compared to $0.71 in 4Q20. Net Interest Income decreased $1.0 million due mainly to a decrease in the net interest margin of 3 basis points and a decrease in accretion on acquired loans of $1.1 million, offset by an increase in PPP loan fee income of $4.3 million. Provision Expense decreased $16.6 million compared to 4Q20 driven by better performance trends within the loan portfolio and an improved future macroeconomic forecast under CECL. Noninterest Income decreased $1.5 million due primarily to a decrease of $5.4 million in income from mortgage banking activities. 1Q21 also included an increase of $2.0 million in net gains on investment securities. Noninterest Expense decreased $7.2 million due primarily to employee compensation decreasing $4.6 million (fewer employees and lower commissions expense related to the decrease in mortgage banking activity) and a decline of $2.5 million in the expense for the reserve for unfunded commitments.

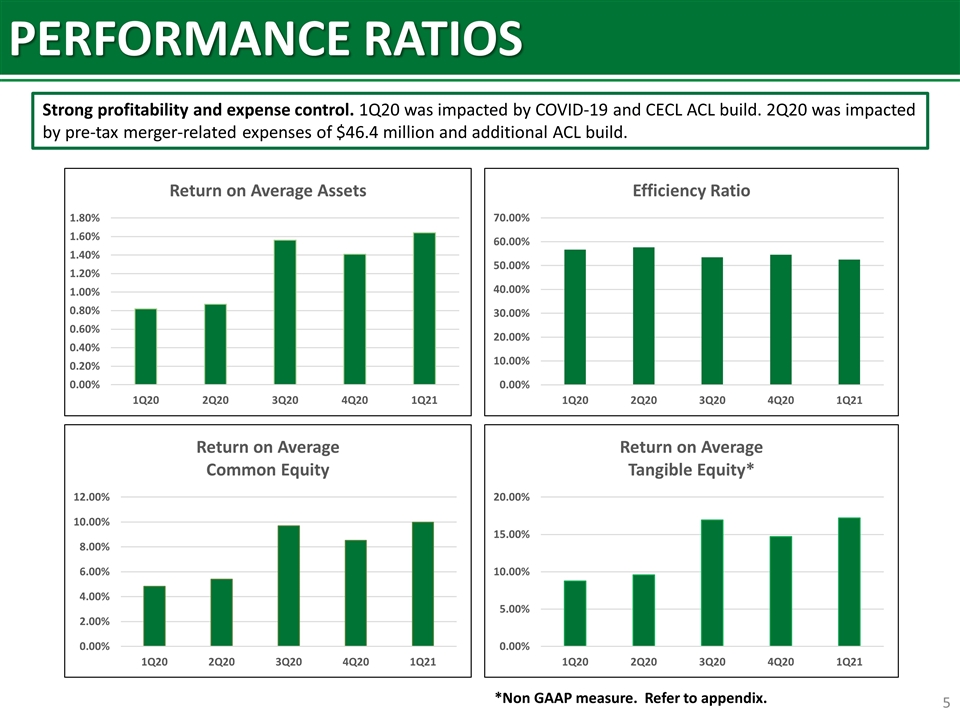

PERFORMANCE RATIOS Strong profitability and expense control. 1Q20 was impacted by COVID-19 and CECL ACL build. 2Q20 was impacted by pre-tax merger-related expenses of $46.4 million and additional ACL build. *Non GAAP measure. Refer to appendix.

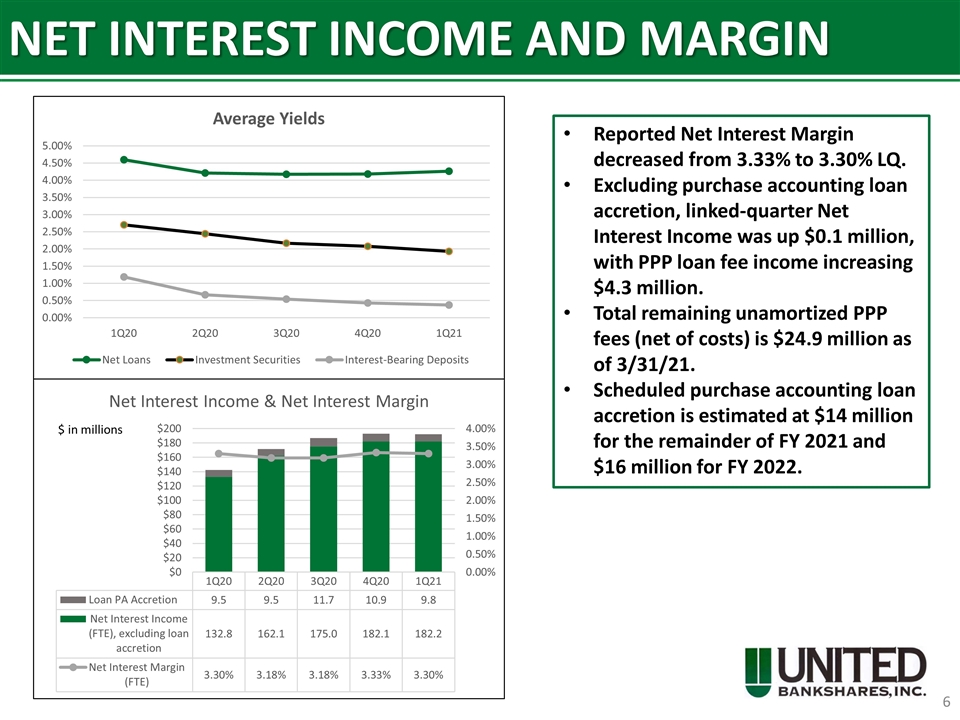

NET INTEREST INCOME AND MARGIN Reported Net Interest Margin decreased from 3.33% to 3.30% LQ. Excluding purchase accounting loan accretion, linked-quarter Net Interest Income was up $0.1 million, with PPP loan fee income increasing $4.3 million. Total remaining unamortized PPP fees (net of costs) is $24.9 million as of 3/31/21. Scheduled purchase accounting loan accretion is estimated at $14 million for the remainder of FY 2021 and $16 million for FY 2022. $ in millions

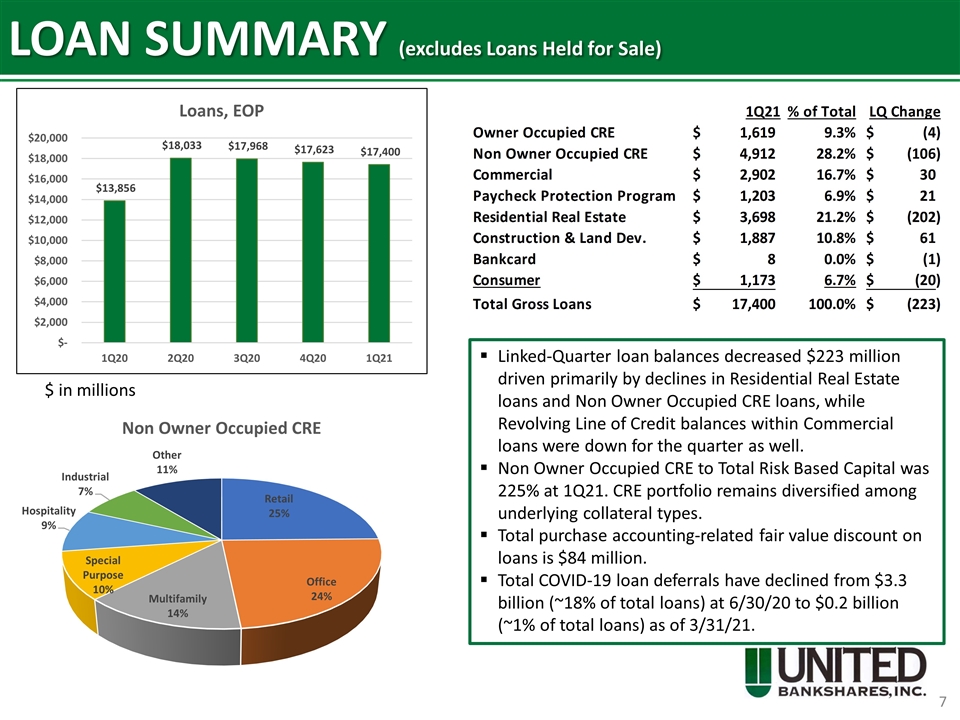

LOAN SUMMARY (excludes Loans Held for Sale) Linked-Quarter loan balances decreased $223 million driven primarily by declines in Residential Real Estate loans and Non Owner Occupied CRE loans, while Revolving Line of Credit balances within Commercial loans were down for the quarter as well. Non Owner Occupied CRE to Total Risk Based Capital was 225% at 1Q21. CRE portfolio remains diversified among underlying collateral types. Total purchase accounting-related fair value discount on loans is $84 million. Total COVID-19 loan deferrals have declined from $3.3 billion (~18% of total loans) at 6/30/20 to $0.2 billion (~1% of total loans) as of 3/31/21. $ in millions

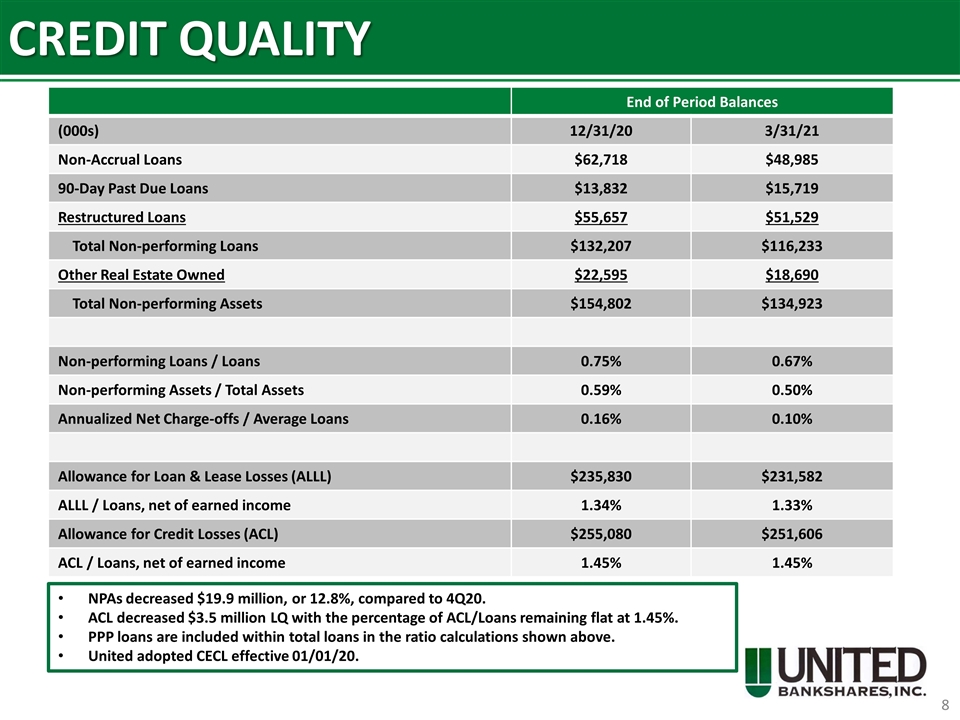

CREDIT QUALITY End of Period Balances (000s) 12/31/20 3/31/21 Non-Accrual Loans $62,718 $48,985 90-Day Past Due Loans $13,832 $15,719 Restructured Loans $55,657 $51,529 Total Non-performing Loans $132,207 $116,233 Other Real Estate Owned $22,595 $18,690 Total Non-performing Assets $154,802 $134,923 Non-performing Loans / Loans 0.75% 0.67% Non-performing Assets / Total Assets 0.59% 0.50% Annualized Net Charge-offs / Average Loans 0.16% 0.10% Allowance for Loan & Lease Losses (ALLL) $235,830 $231,582 ALLL / Loans, net of earned income 1.34% 1.33% Allowance for Credit Losses (ACL) $255,080 $251,606 ACL / Loans, net of earned income 1.45% 1.45% NPAs decreased $19.9 million, or 12.8%, compared to 4Q20. ACL decreased $3.5 million LQ with the percentage of ACL/Loans remaining flat at 1.45%. PPP loans are included within total loans in the ratio calculations shown above. United adopted CECL effective 01/01/20.

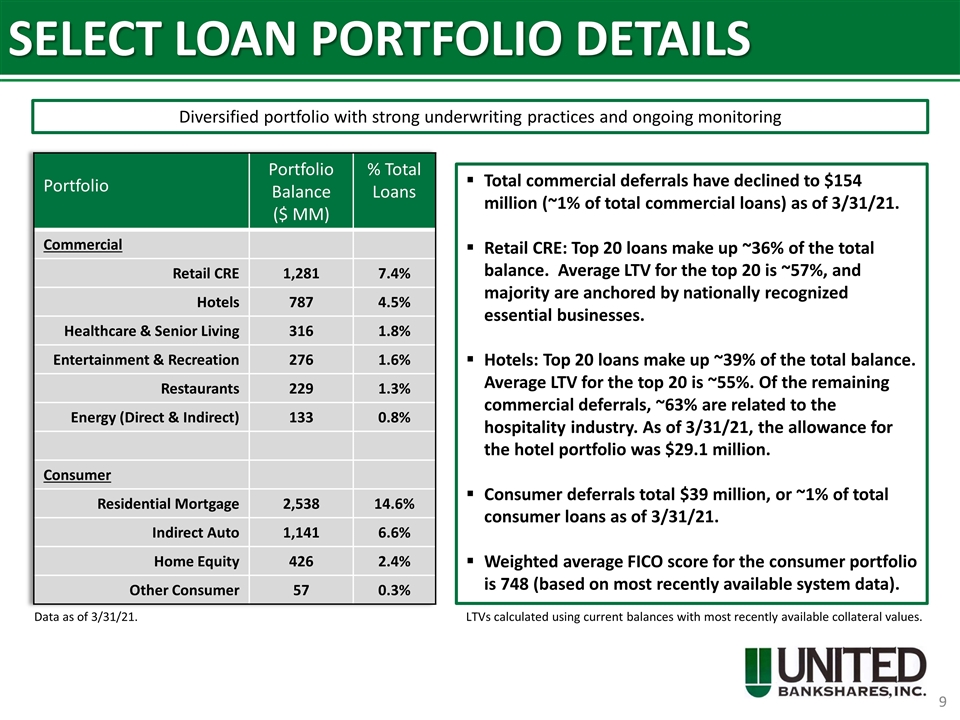

SELECT LOAN PORTFOLIO DETAILS Diversified portfolio with strong underwriting practices and ongoing monitoring Portfolio Portfolio Balance ($ MM) % Total Loans Commercial Retail CRE 1,281 7.4% Hotels 787 4.5% Healthcare & Senior Living 316 1.8% Entertainment & Recreation 276 1.6% Restaurants 229 1.3% Energy (Direct & Indirect) 133 0.8% Consumer Residential Mortgage 2,538 14.6% Indirect Auto 1,141 6.6% Home Equity 426 2.4% Other Consumer 57 0.3% Total commercial deferrals have declined to $154 million (~1% of total commercial loans) as of 3/31/21. Retail CRE: Top 20 loans make up ~36% of the total balance. Average LTV for the top 20 is ~57%, and majority are anchored by nationally recognized essential businesses. Hotels: Top 20 loans make up ~39% of the total balance. Average LTV for the top 20 is ~55%. Of the remaining commercial deferrals, ~63% are related to the hospitality industry. As of 3/31/21, the allowance for the hotel portfolio was $29.1 million. Consumer deferrals total $39 million, or ~1% of total consumer loans as of 3/31/21. Weighted average FICO score for the consumer portfolio is 748 (based on most recently available system data). Data as of 3/31/21. LTVs calculated using current balances with most recently available collateral values.

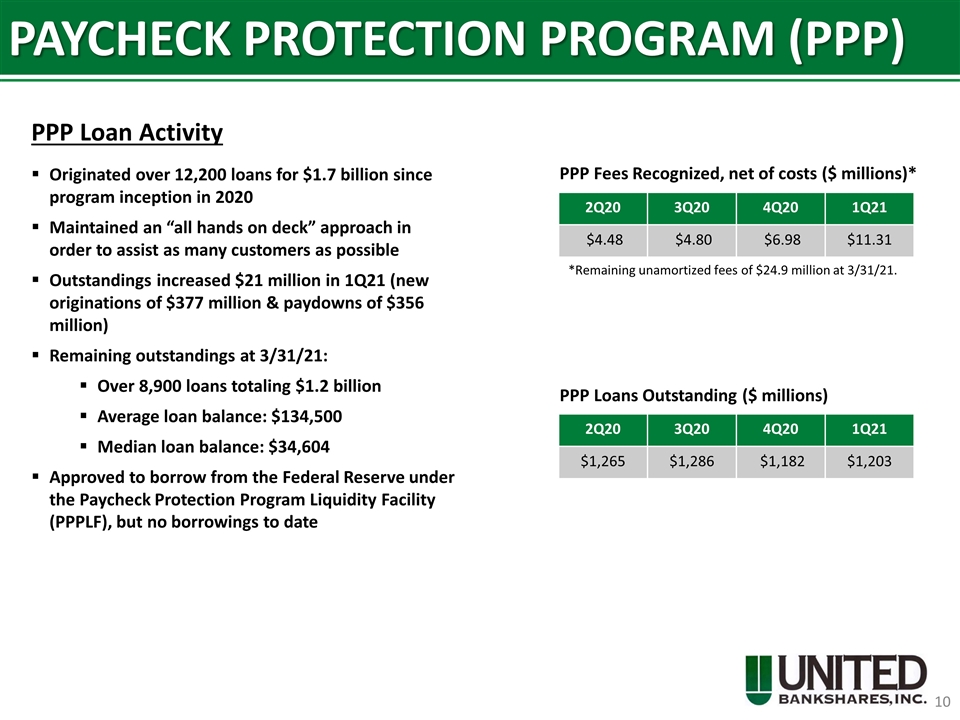

PAYCHECK PROTECTION PROGRAM (PPP) Originated over 12,200 loans for $1.7 billion since program inception in 2020 Maintained an “all hands on deck” approach in order to assist as many customers as possible Outstandings increased $21 million in 1Q21 (new originations of $377 million & paydowns of $356 million) Remaining outstandings at 3/31/21: Over 8,900 loans totaling $1.2 billion Average loan balance: $134,500 Median loan balance: $34,604 Approved to borrow from the Federal Reserve under the Paycheck Protection Program Liquidity Facility (PPPLF), but no borrowings to date PPP Loan Activity 2Q20 3Q20 4Q20 1Q21 $4.48 $4.80 $6.98 $11.31 PPP Fees Recognized, net of costs ($ millions)* *Remaining unamortized fees of $24.9 million at 3/31/21. PPP Loans Outstanding ($ millions) 2Q20 3Q20 4Q20 1Q21 $1,265 $1,286 $1,182 $1,203

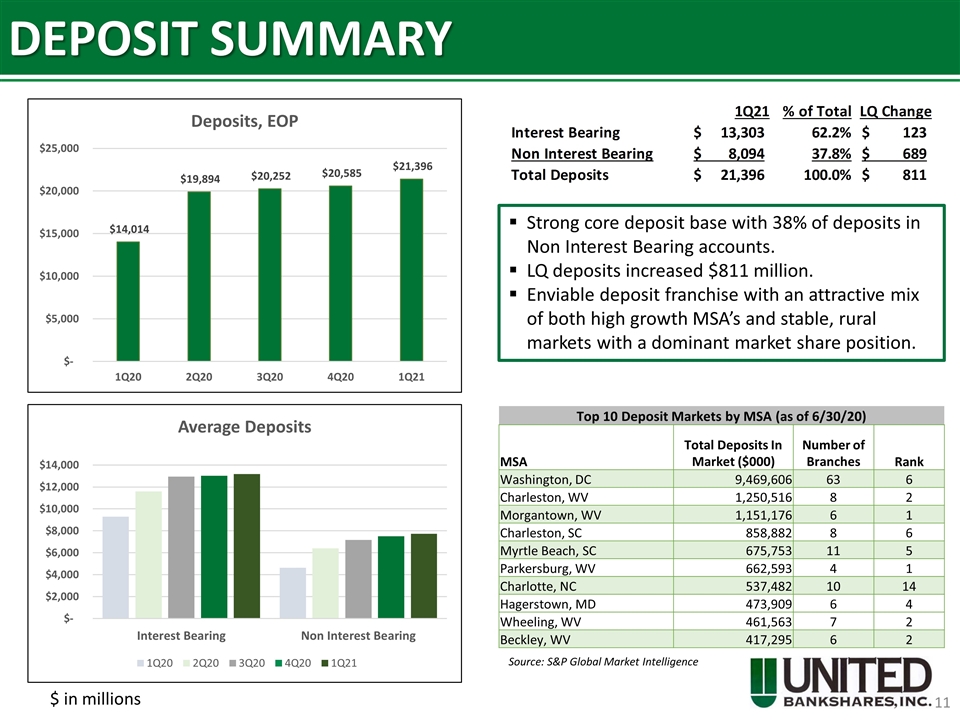

DEPOSIT SUMMARY Strong core deposit base with 38% of deposits in Non Interest Bearing accounts. LQ deposits increased $811 million. Enviable deposit franchise with an attractive mix of both high growth MSA’s and stable, rural markets with a dominant market share position. $ in millions Source: S&P Global Market Intelligence Top 10 Deposit Markets by MSA (as of 6/30/20) MSA Total Deposits In Market ($000) Number of Branches Rank Washington, DC 9,469,606 63 6 Charleston, WV 1,250,516 8 2 Morgantown, WV 1,151,176 6 1 Charleston, SC 858,882 8 6 Myrtle Beach, SC 675,753 11 5 Parkersburg, WV 662,593 4 1 Charlotte, NC 537,482 10 14 Hagerstown, MD 473,909 6 4 Wheeling, WV 461,563 7 2 Beckley, WV 417,295 6 2

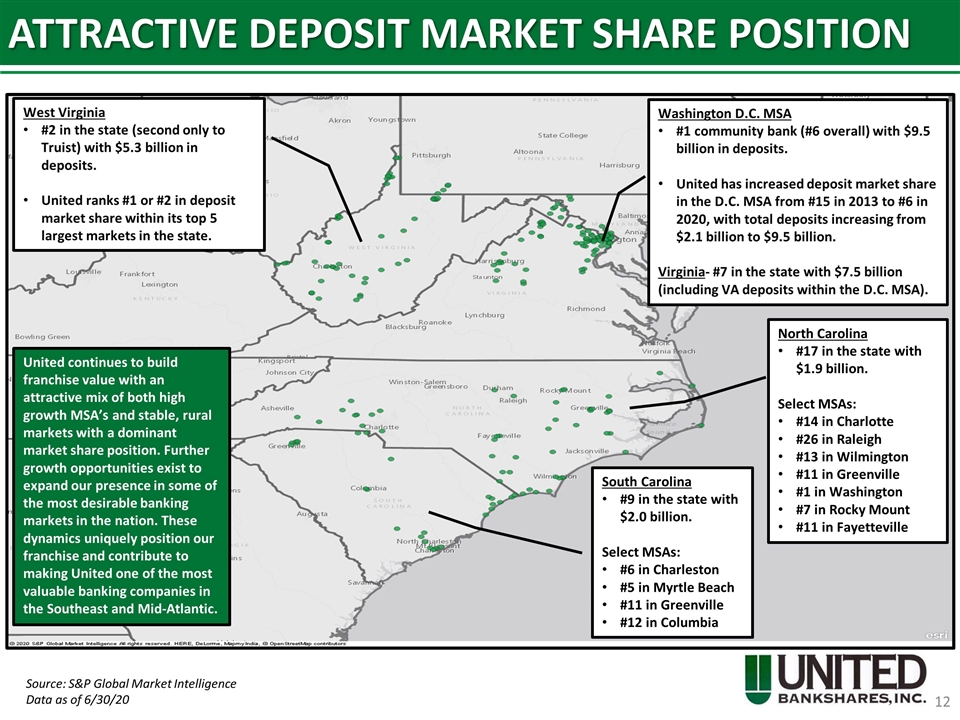

ATTRACTIVE DEPOSIT MARKET SHARE POSITION West Virginia #2 in the state (second only to Truist) with $5.3 billion in deposits. United ranks #1 or #2 in deposit market share within its top 5 largest markets in the state. North Carolina #17 in the state with $1.9 billion. Select MSAs: #14 in Charlotte #26 in Raleigh #13 in Wilmington #11 in Greenville #1 in Washington #7 in Rocky Mount #11 in Fayetteville Washington D.C. MSA #1 community bank (#6 overall) with $9.5 billion in deposits. United has increased deposit market share in the D.C. MSA from #15 in 2013 to #6 in 2020, with total deposits increasing from $2.1 billion to $9.5 billion. Virginia- #7 in the state with $7.5 billion (including VA deposits within the D.C. MSA). South Carolina #9 in the state with $2.0 billion. Select MSAs: #6 in Charleston #5 in Myrtle Beach #11 in Greenville #12 in Columbia United continues to build franchise value with an attractive mix of both high growth MSA’s and stable, rural markets with a dominant market share position. Further growth opportunities exist to expand our presence in some of the most desirable banking markets in the nation. These dynamics uniquely position our franchise and contribute to making United one of the most valuable banking companies in the Southeast and Mid-Atlantic. Source: S&P Global Market Intelligence Data as of 6/30/20

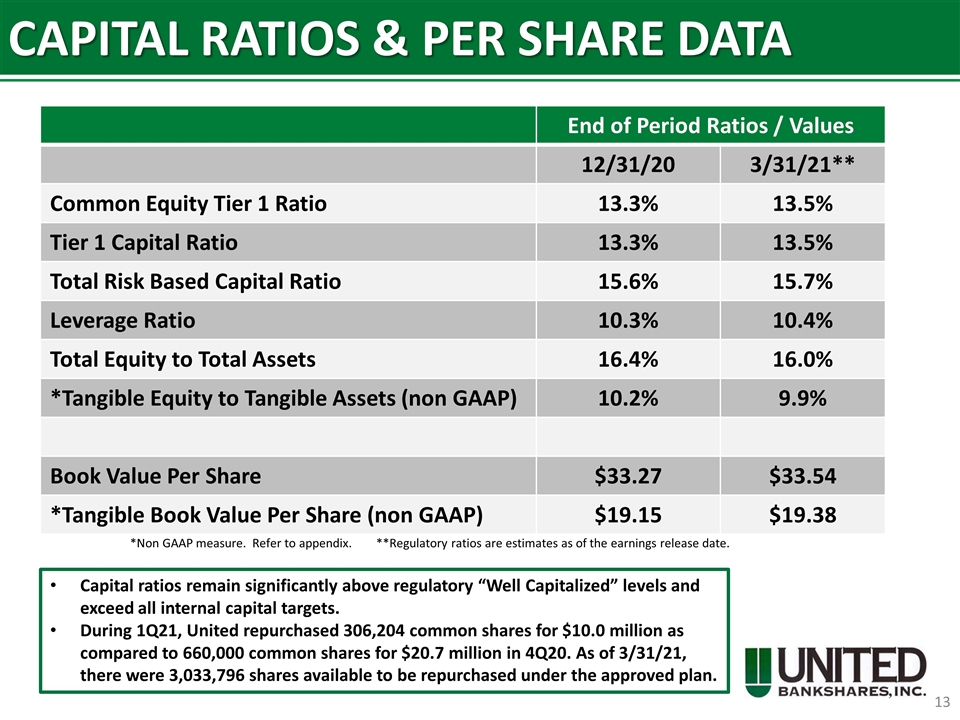

CAPITAL RATIOS & PER SHARE DATA End of Period Ratios / Values 12/31/20 3/31/21** Common Equity Tier 1 Ratio 13.3% 13.5% Tier 1 Capital Ratio 13.3% 13.5% Total Risk Based Capital Ratio 15.6% 15.7% Leverage Ratio 10.3% 10.4% Total Equity to Total Assets 16.4% 16.0% *Tangible Equity to Tangible Assets (non GAAP) 10.2% 9.9% Book Value Per Share $33.27 $33.54 *Tangible Book Value Per Share (non GAAP) $19.15 $19.38 Capital ratios remain significantly above regulatory “Well Capitalized” levels and exceed all internal capital targets. During 1Q21, United repurchased 306,204 common shares for $10.0 million as compared to 660,000 common shares for $20.7 million in 4Q20. As of 3/31/21, there were 3,033,796 shares available to be repurchased under the approved plan. *Non GAAP measure. Refer to appendix. **Regulatory ratios are estimates as of the earnings release date.

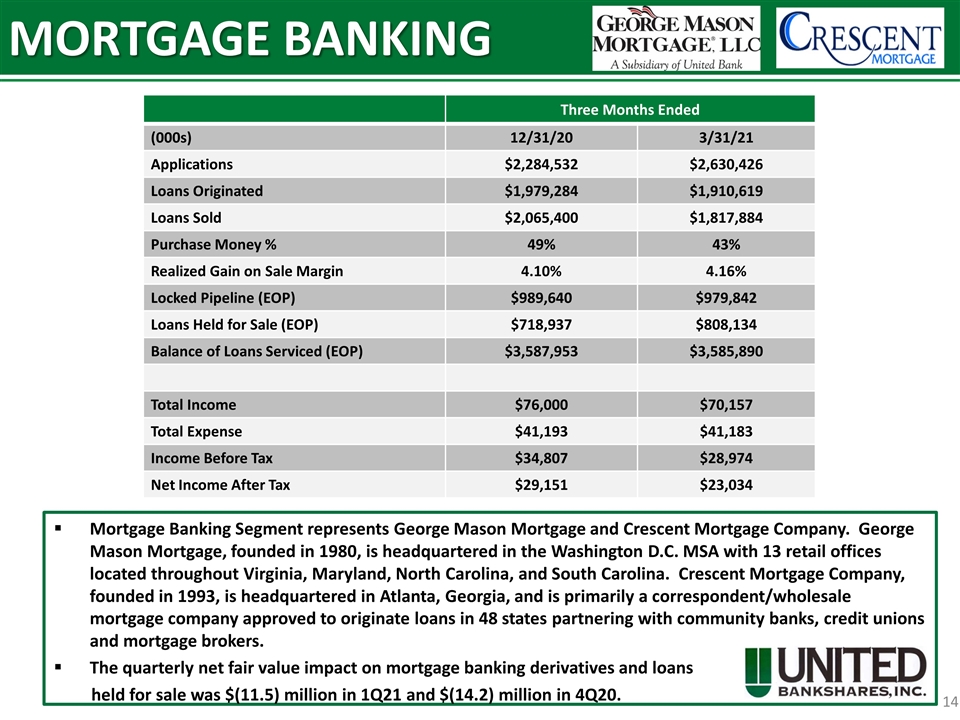

MORTGAGE BANKING Mortgage Banking Segment represents George Mason Mortgage and Crescent Mortgage Company. George Mason Mortgage, founded in 1980, is headquartered in the Washington D.C. MSA with 13 retail offices located throughout Virginia, Maryland, North Carolina, and South Carolina. Crescent Mortgage Company, founded in 1993, is headquartered in Atlanta, Georgia, and is primarily a correspondent/wholesale mortgage company approved to originate loans in 48 states partnering with community banks, credit unions and mortgage brokers. The quarterly net fair value impact on mortgage banking derivatives and loans held for sale was $(11.5) million in 1Q21 and $(14.2) million in 4Q20. Three Months Ended (000s) 12/31/20 3/31/21 Applications $2,284,532 $2,630,426 Loans Originated $1,979,284 $1,910,619 Loans Sold $2,065,400 $1,817,884 Purchase Money % 49% 43% Realized Gain on Sale Margin 4.10% 4.16% Locked Pipeline (EOP) $989,640 $979,842 Loans Held for Sale (EOP) $718,937 $808,134 Balance of Loans Serviced (EOP) $3,587,953 $3,585,890 Total Income $76,000 $70,157 Total Expense $41,193 $41,183 Income Before Tax $34,807 $28,974 Net Income After Tax $29,151 $23,034

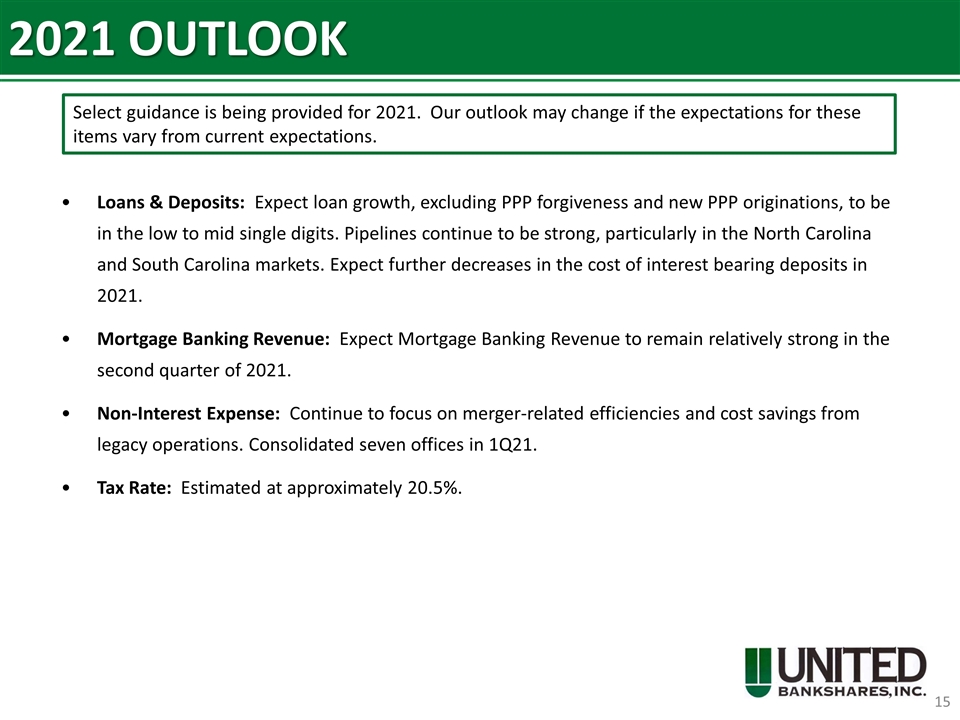

2021 OUTLOOK Loans & Deposits: Expect loan growth, excluding PPP forgiveness and new PPP originations, to be in the low to mid single digits. Pipelines continue to be strong, particularly in the North Carolina and South Carolina markets. Expect further decreases in the cost of interest bearing deposits in 2021. Mortgage Banking Revenue: Expect Mortgage Banking Revenue to remain relatively strong in the second quarter of 2021. Non-Interest Expense: Continue to focus on merger-related efficiencies and cost savings from legacy operations. Consolidated seven offices in 1Q21. Tax Rate: Estimated at approximately 20.5%. Select guidance is being provided for 2021. Our outlook may change if the expectations for these items vary from current expectations.

INVESTMENT THESIS Excellent franchise with long-term growth prospects Current income opportunity with a dividend yield of 3.6% (based upon recent prices) High-performance bank with a low-risk profile Experienced management team with a proven track record of execution High level of insider ownership 47 consecutive years of dividend increases evidences United’s strong profitability, solid asset quality, and sound capital management over a very long period of time Attractive valuation with a current Price-to-Earnings Ratio of 15.9x (based upon median 2021 street consensus estimate of $2.43 per Bloomberg)

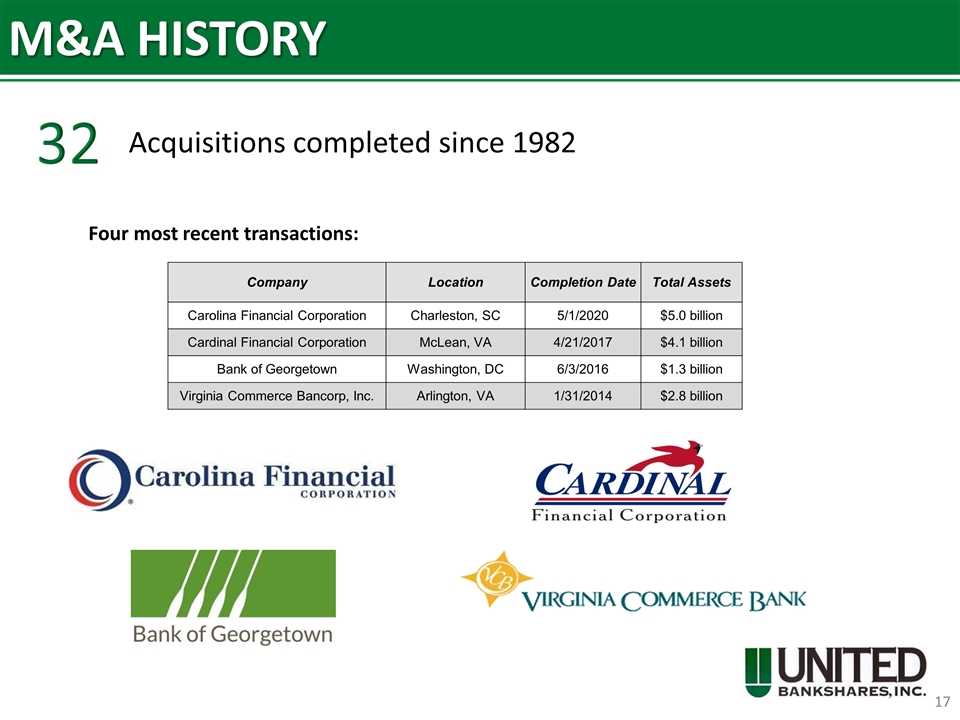

M&A HISTORY Four most recent transactions: Company Location Completion Date Total Assets Carolina Financial Corporation Charleston, SC 5/1/2020 $5.0 billion Cardinal Financial Corporation McLean, VA 4/21/2017 $4.1 billion Bank of Georgetown Washington, DC 6/3/2016 $1.3 billion Virginia Commerce Bancorp, Inc. Arlington, VA 1/31/2014 $2.8 billion 32 Acquisitions completed since 1982

Appendix

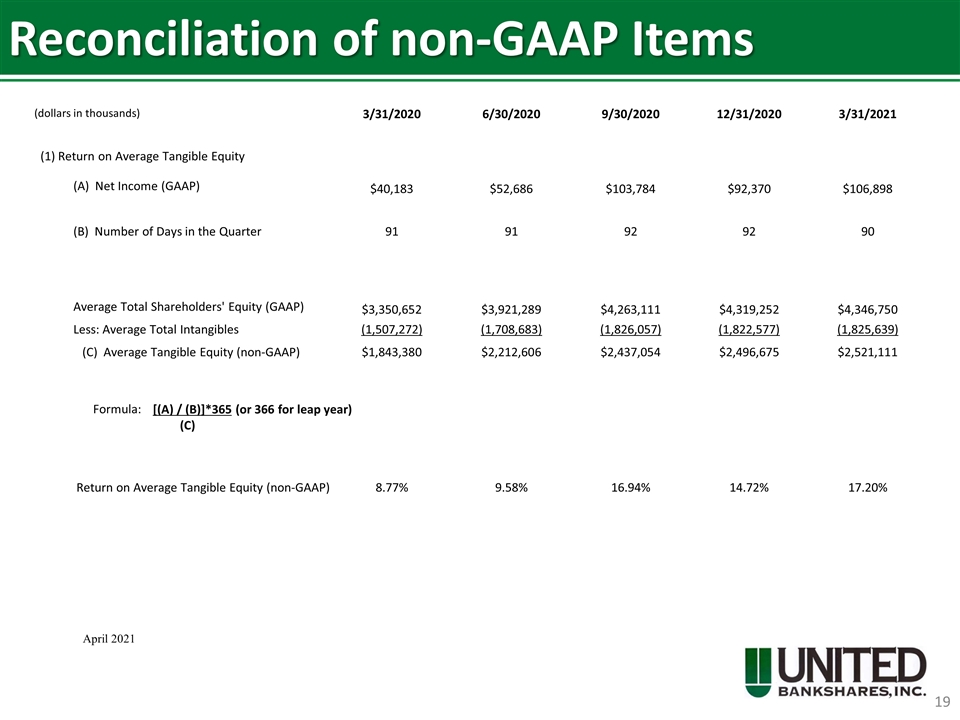

Reconciliation of non-GAAP Items April 2021 (dollars in thousands) 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 (1) Return on Average Tangible Equity (A) Net Income (GAAP) $40,183 $52,686 $103,784 $92,370 $106,898 (B) Number of Days in the Quarter 91 91 92 92 90 Average Total Shareholders' Equity (GAAP) $3,350,652 $3,921,289 $4,263,111 $4,319,252 $4,346,750 Less: Average Total Intangibles (1,507,272) (1,708,683) (1,826,057) (1,822,577) (1,825,639) (C) Average Tangible Equity (non-GAAP) $1,843,380 $2,212,606 $2,437,054 $2,496,675 $2,521,111 Formula: [(A) / (B)]*365 (or 366 for leap year) (C) Return on Average Tangible Equity (non-GAAP) 8.77% 9.58% 16.94% 14.72% 17.20%

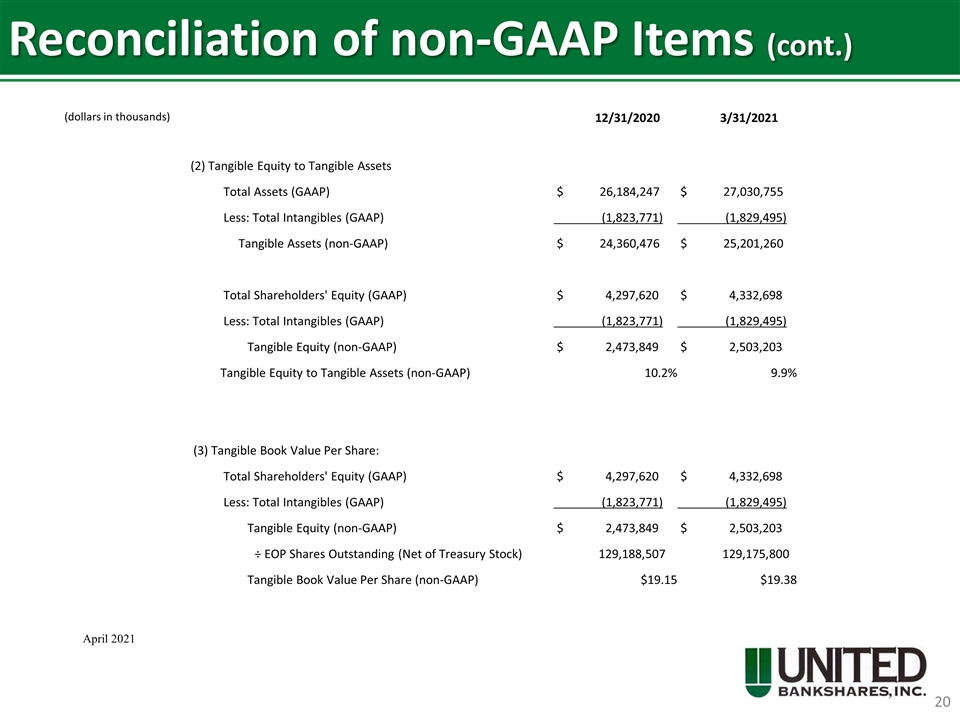

Reconciliation of non-GAAP Items (cont.) April 2021 (dollars in thousands) 12/31/2020 3/31/2021 (2) Tangible Equity to Tangible Assets Total Assets (GAAP) $ 26,184,247 $ 27,030,755 Less: Total Intangibles (GAAP) (1,823,771) (1,829,495) Tangible Assets (non-GAAP) $ 24,360,476 $ 25,201,260 Total Shareholders' Equity (GAAP) $ 4,297,620 $ 4,332,698 Less: Total Intangibles (GAAP) (1,823,771) (1,829,495) Tangible Equity (non-GAAP) $ 2,473,849 $ 2,503,203 Tangible Equity to Tangible Assets (non-GAAP) 10.2% 9.9% (3) Tangible Book Value Per Share: Total Shareholders' Equity (GAAP) $ 4,297,620 $ 4,332,698 Less: Total Intangibles (GAAP) (1,823,771) (1,829,495) Tangible Equity (non-GAAP) $ 2,473,849 $ 2,503,203 ÷ EOP Shares Outstanding (Net of Treasury Stock) 129,188,507 129,175,800 Tangible Book Value Per Share (non-GAAP) $19.15 $19.38