Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CENTERSPACE | centerspaceannouncesfirstq.htm |

| 8-K - 8-K - CENTERSPACE | iret-20210419.htm |

Investor Presentation April 2021

centerspacehomes.com 2 SAFE HARBOR STATEMENT AND LEGAL DISCLOSURE Certain statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from expected results. These statements may be identified by our use of words such as “expects,” “plans,” “estimates,” “anticipates,” “projects,” “intends,” “believes,” and similar expressions that do not relate to historical matters. Such risks, uncertainties, and other factors include, but are not limited to, changes in general and local economic and real estate market conditions, rental conditions in our markets, fluctuations in interest rates, the effect of government regulations, the availability and cost of capital and other financing risks, risks associated with our value-add and redevelopment opportunities, the failure of our property acquisitions and disposition activities to achieve expected results, competition in our markets, our ability to attract and retain skilled personnel, our ability to maintain our tax status as a real estate investment trust (REIT), and those risks and uncertainties detailed from time to time in our filings with the Securities and Exchange Commission, including the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” contained in our Form 10- K for the period ended December 31, 2020. We assume no obligation to update or supplement forward- looking statements that become untrue due to subsequent events.

centerspacehomes.com 3 Better Every Days IRET IS NOW CENTERSPACE A lot has changed since our business began, and our new name is a reflection of who we have become. The rebrand of the company reflects our mission to provide great homes for our residents, our teams, and our investors. It is about coming together for the benefit of everyone – something in which each and every member of our team believes. The new name and brand platform embody our desire to provide better every days for our residents and team as we work to create belonging, satisfaction, purpose, and growth. This is our way forward. We are proud of our previous 50 years and are excited for the future as Centerspace.” -Mark O. Decker, Jr, President and CEO “

centerspacehomes.com 4 Differentiated Markets Strong Midwest markets led by Minneapolis and Denver Nashville a new target market Internal Growth Opportunity Enhanced operating platform Value-Add Opportunity Deep value-add pipeline Balance Sheet Flexibility Strong balance sheet with sufficient liquidity to capitalize on future opportunities Experienced Leadership High caliber management and board executing a sound strategic plan COMPANY SNAPSHOT F o c u s e d o n G r o w t h i n M u l t i f a m i l y PORTFOLIO SUMMARY Founded in 1970, celebrating 50 Years Apartment owner/operator with 12,166 homes Publicly traded since 1997 Portfolio transformation from diversified to focused multifamily from 2017-2019 Total capitalization of $1.9 billion(1) Added to the S&P SmallCap 600 Index in 2020 0% 50% 100% 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 Multifamily and Other % of Gross Real Estate Assets Multifamily Other (1) See page 15 for breakdown

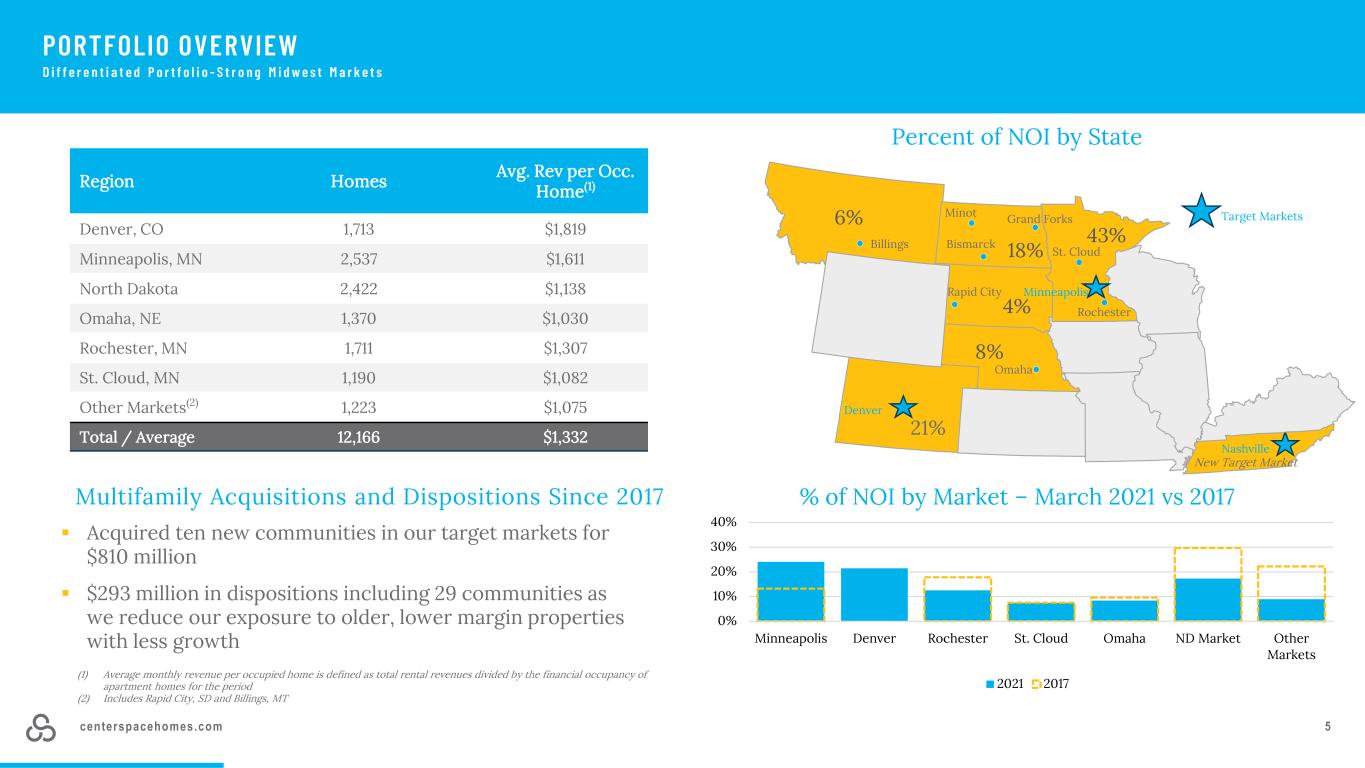

centerspacehomes.com 5 Multifamily Acquisitions and Dispositions Since 2017 % of NOI by Market – March 2021 vs 2017 Acquired ten new communities in our target markets for $810 million $293 million in dispositions including 29 communities as we reduce our exposure to older, lower margin properties with less growth Percent of NOI by State 6% 43% 4% 8% 21% 18% Denver Minneapolis St. Cloud Rochester Billings Bismarck Minot Rapid City Grand Forks Omaha Target Markets Nashville New Target Market PORTFOLIO OVERVIEW D i f f e r e n t i a t e d P o r t f o l i o - S t r o n g M i d w e s t M a r k e t s (1) Average monthly revenue per occupied home is defined as total rental revenues divided by the financial occupancy of apartment homes for the period (2) Includes Rapid City, SD and Billings, MT Region Homes Avg. Rev per Occ. Home(1) Denver, CO 1,713 $1,819 Minneapolis, MN 2,537 $1,611 North Dakota 2,422 $1,138 Omaha, NE 1,370 $1,030 Rochester, MN 1,711 $1,307 St. Cloud, MN 1,190 $1,082 Other Markets(2) 1,223 $1,075 Total / Average 12,166 $1,332 0% 10% 20% 30% 40% Minneapolis Denver Rochester St. Cloud Omaha ND Market Other Markets 2021 2017

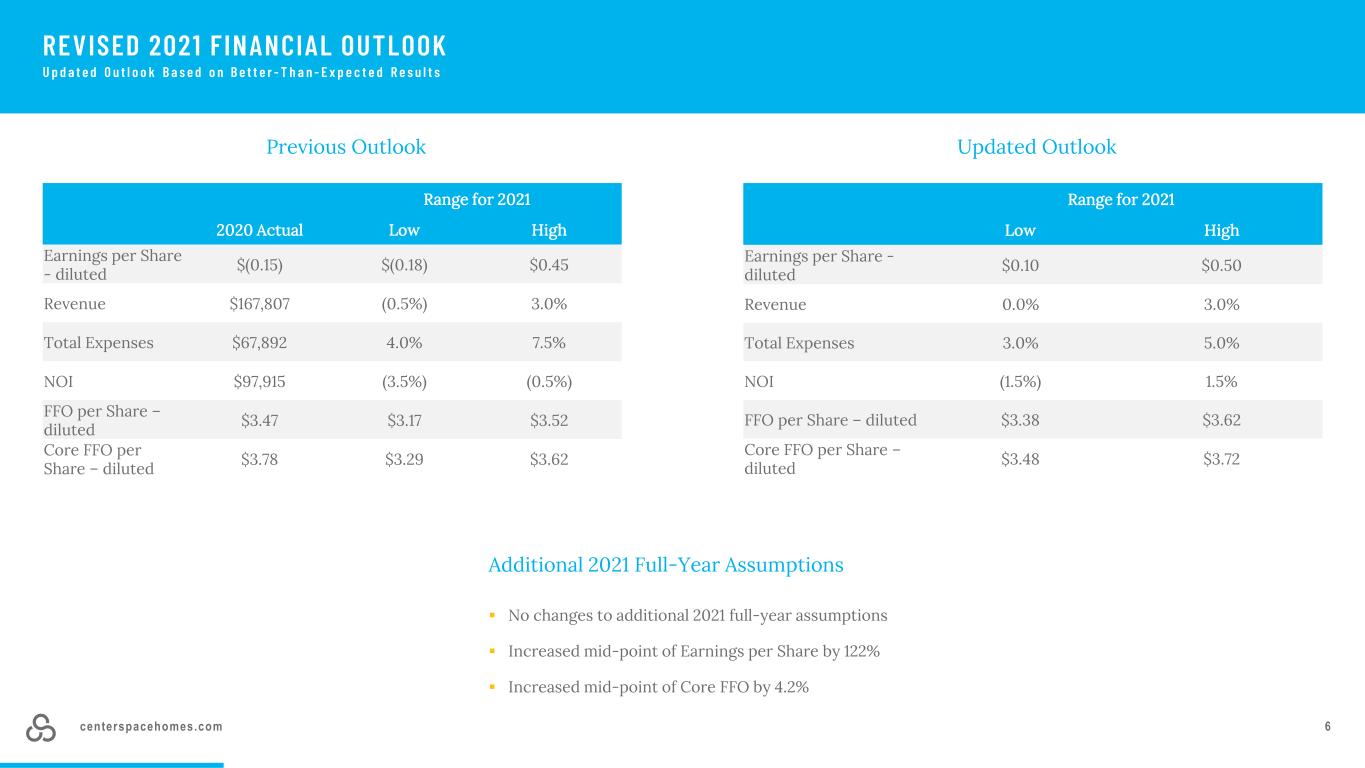

centerspacehomes.com 6 Range for 2021 Low High Earnings per Share - diluted $0.10 $0.50 Revenue 0.0% 3.0% Total Expenses 3.0% 5.0% NOI (1.5%) 1.5% FFO per Share – diluted $3.38 $3.62 Core FFO per Share – diluted $3.48 $3.72 REVISED 2021 FINANCIAL OUTLOOK U p d a t e d O u t l o o k B a s e d o n B e t t e r - T h a n - E x p e c t e d R e s u l t s Range for 2021 2020 Actual Low High Earnings per Share - diluted $(0.15) $(0.18) $0.45 Revenue $167,807 (0.5%) 3.0% Total Expenses $67,892 4.0% 7.5% NOI $97,915 (3.5%) (0.5%) FFO per Share – diluted $3.47 $3.17 $3.52 Core FFO per Share – diluted $3.78 $3.29 $3.62 Previous Outlook Additional 2021 Full-Year Assumptions Updated Outlook No changes to additional 2021 full-year assumptions Increased mid-point of Earnings per Share by 122% Increased mid-point of Core FFO by 4.2%

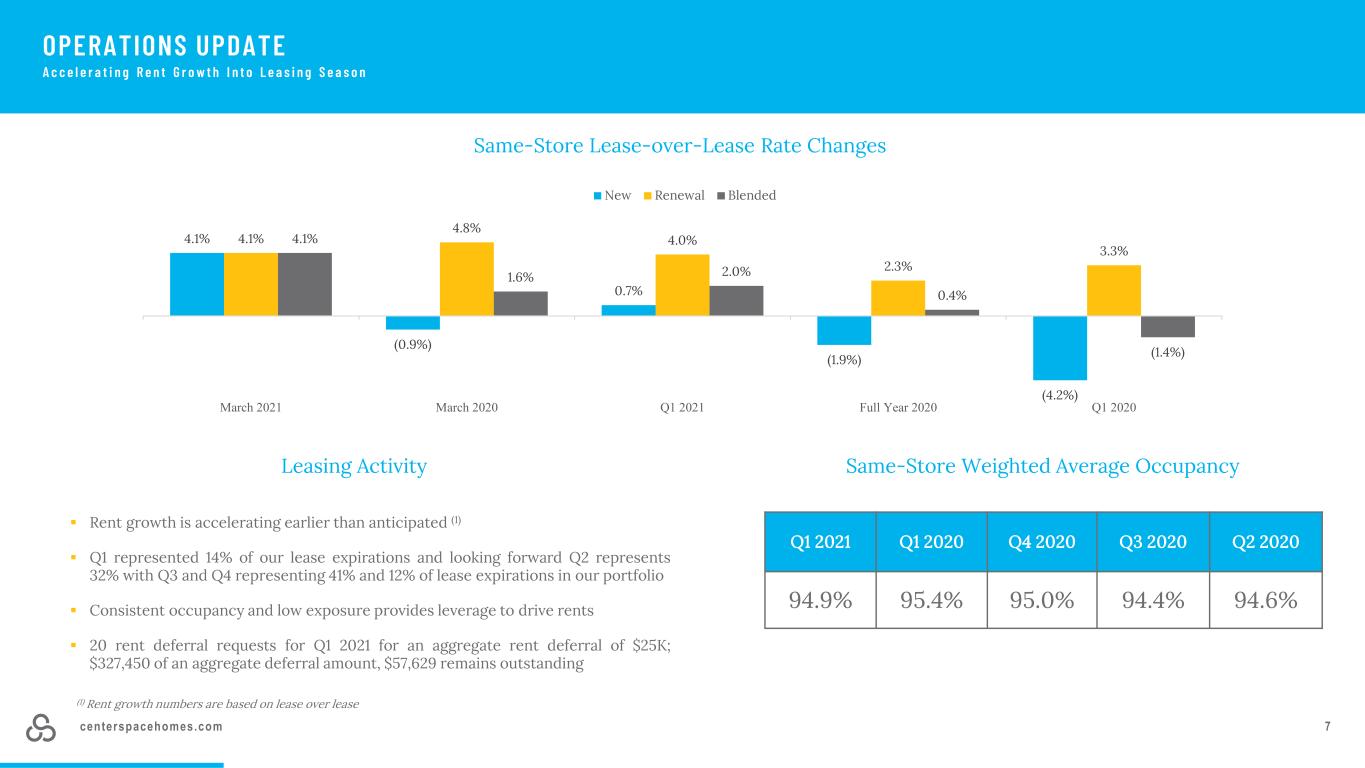

centerspacehomes.com 7 OPERATIONS UPDATE A c c e l e r a t i n g R e n t G r o w t h I n t o L e a s i n g S e a s o n Same-Store Lease-over-Lease Rate Changes Same-Store Weighted Average OccupancyLeasing Activity Rent growth is accelerating earlier than anticipated (1) Q1 represented 14% of our lease expirations and looking forward Q2 represents 32% with Q3 and Q4 representing 41% and 12% of lease expirations in our portfolio Consistent occupancy and low exposure provides leverage to drive rents 20 rent deferral requests for Q1 2021 for an aggregate rent deferral of $25K; $327,450 of an aggregate deferral amount, $57,629 remains outstanding Q1 2021 Q1 2020 Q4 2020 Q3 2020 Q2 2020 94.9% 95.4% 95.0% 94.4% 94.6% 4.1% (0.9%) 0.7% (1.9%) (4.2%) 4.1% 4.8% 4.0% 2.3% 3.3% 4.1% 1.6% 2.0% 0.4% (1.4%) March 2021 March 2020 Q1 2021 Full Year 2020 Q1 2020 New Renewal Blended (1) Rent growth numbers are based on lease over lease

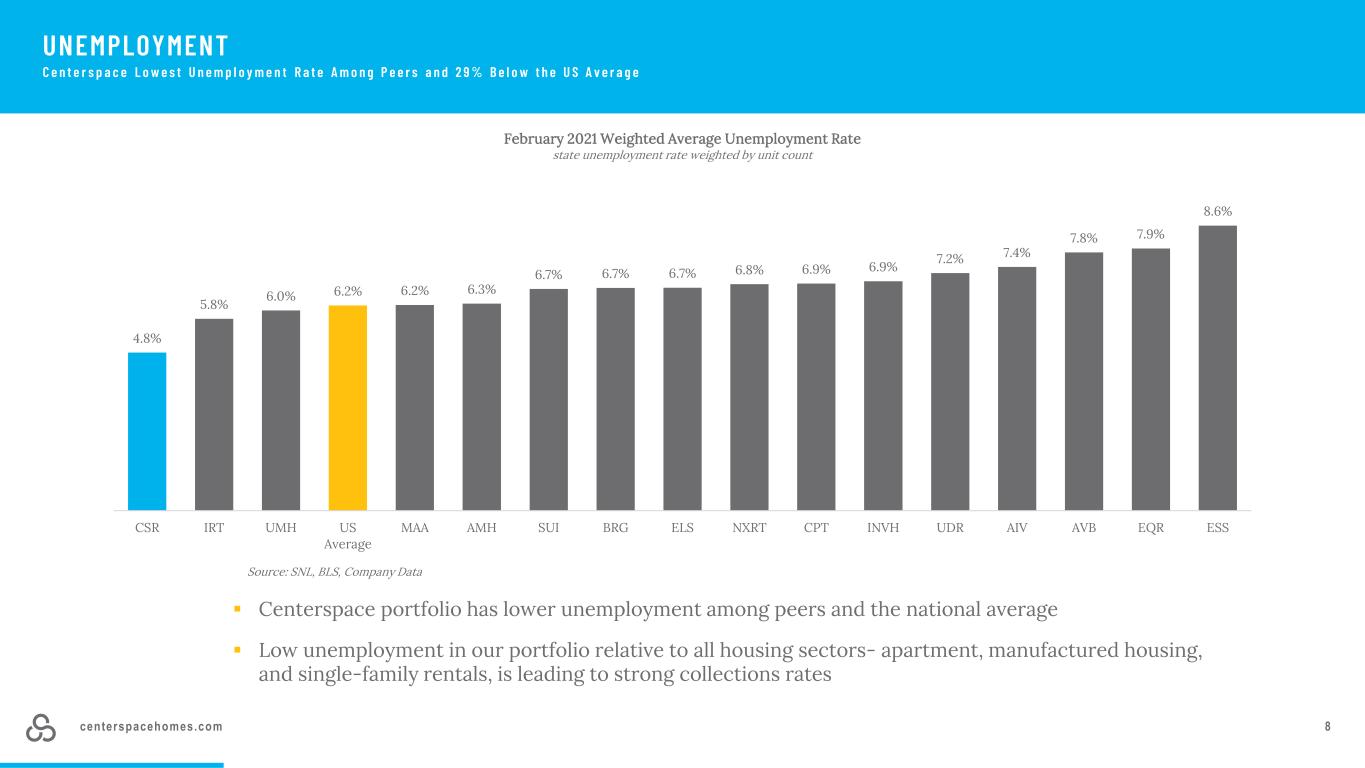

centerspacehomes.com 8 UNEMPLOYMENT C e n t e r s p a c e L o w e s t U n e m p l o y m e n t R a t e A m o n g P e e r s a n d 2 9 % B e l o w t h e U S A v e r a g e Centerspace portfolio has lower unemployment among peers and the national average Low unemployment in our portfolio relative to all housing sectors- apartment, manufactured housing, and single-family rentals, is leading to strong collections rates Source: SNL, BLS, Company Data 4.8% 5.8% 6.0% 6.2% 6.2% 6.3% 6.7% 6.7% 6.7% 6.8% 6.9% 6.9% 7.2% 7.4% 7.8% 7.9% 8.6% CSR IRT UMH US Average MAA AMH SUI BRG ELS NXRT CPT INVH UDR AIV AVB EQR ESS February 2021 Weighted Average Unemployment Rate state unemployment rate weighted by unit count

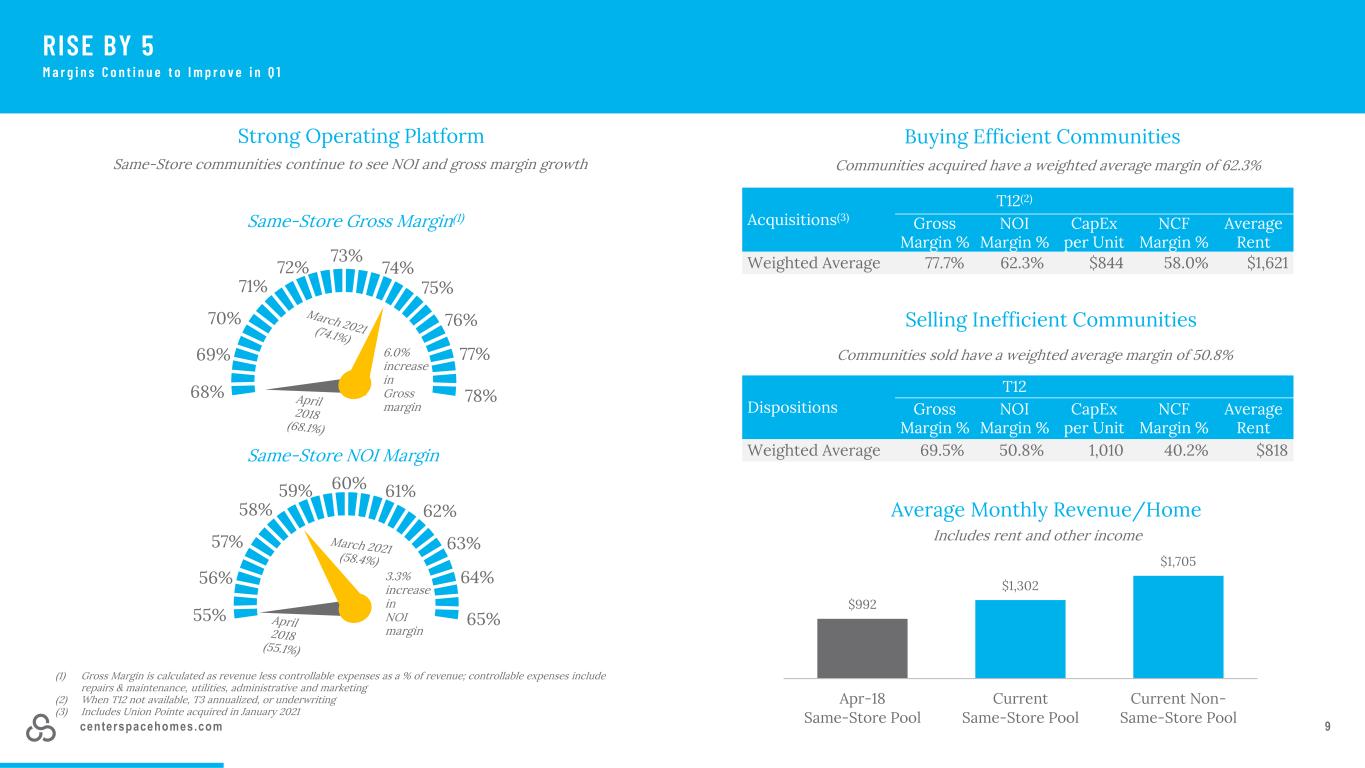

centerspacehomes.com 9 68% 69% 70% 71% 72% 73% 74% 75% 76% 77% 78% Strong Operating Platform RISE BY 5 M a r g i n s C o n t i n u e t o I m p r o v e i n Q 1 Same-Store communities continue to see NOI and gross margin growth Buying Efficient Communities Communities acquired have a weighted average margin of 62.3% Acquisitions(3) T12(2) Gross Margin % NOI Margin % CapEx per Unit NCF Margin % Average Rent Weighted Average 77.7% 62.3% $844 58.0% $1,621 Selling Inefficient Communities Communities sold have a weighted average margin of 50.8% Dispositions T12 Gross Margin % NOI Margin % CapEx per Unit NCF Margin % Average Rent Weighted Average 69.5% 50.8% 1,010 40.2% $818 Average Monthly Revenue/Home Includes rent and other income $992 $1,302 $1,705 Apr-18 Same-Store Pool Current Same-Store Pool Current Non- Same-Store Pool Same-Store Gross Margin(1) 55% 56% 57% 58% 59% 60% 61% 62% 63% 64% 65% (1) Gross Margin is calculated as revenue less controllable expenses as a % of revenue; controllable expenses include repairs & maintenance, utilities, administrative and marketing (2) When T12 not available, T3 annualized, or underwriting (3) Includes Union Pointe acquired in January 2021 Same-Store NOI Margin 3.3% increase in NOI margin 6.0% increase in Gross margin

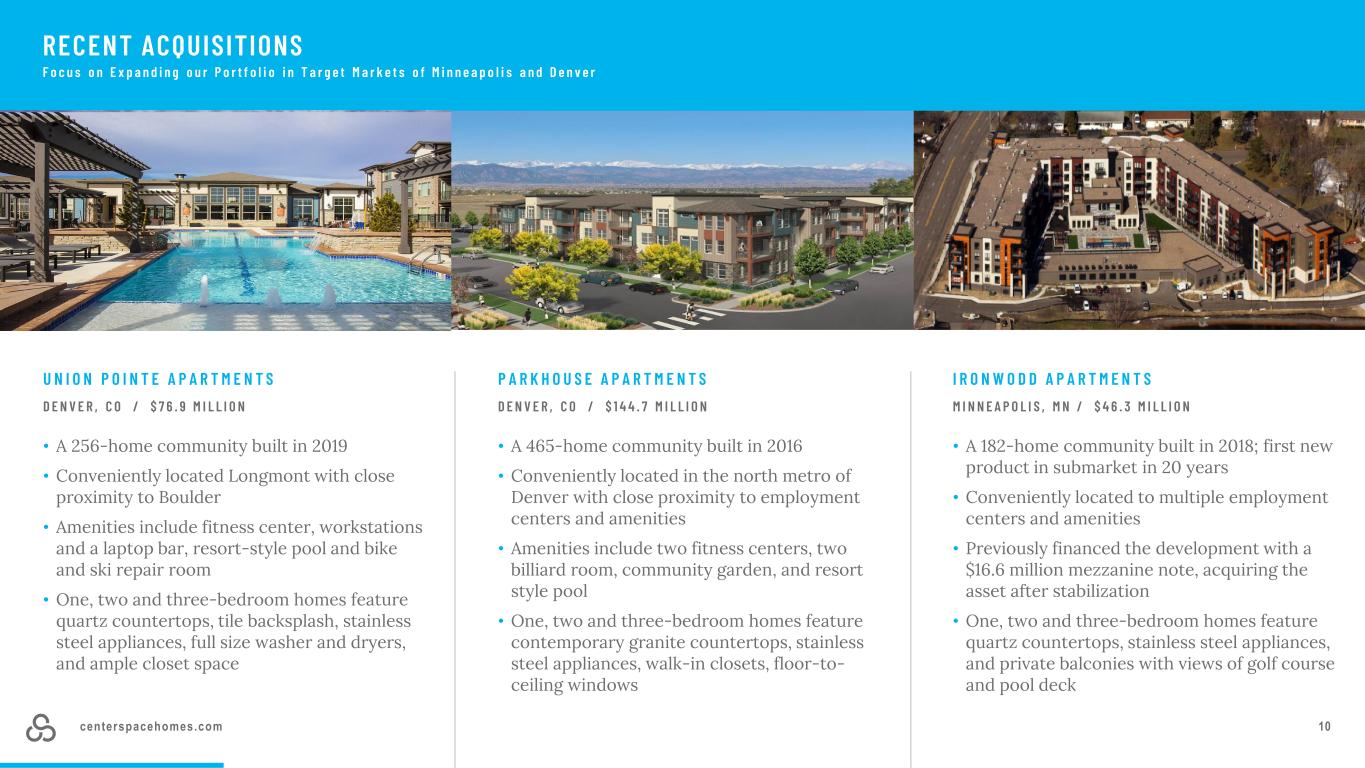

centerspacehomes.com 10 RECENT ACQUISITIONS F o c u s o n E x p a n d i n g o u r P o r t f o l i o i n T a r g e t M a r k e t s o f M i n n e a p o l i s a n d D e n v e r • A 256-home community built in 2019 • Conveniently located Longmont with close proximity to Boulder • Amenities include fitness center, workstations and a laptop bar, resort-style pool and bike and ski repair room • One, two and three-bedroom homes feature quartz countertops, tile backsplash, stainless steel appliances, full size washer and dryers, and ample closet space U N I O N P O I N T E A P A R T M E N T S D E N V E R , C O / $ 1 4 4 . 7 M I L L I O N I R O N W O D D A P A R T M E N T S M I N N E A P O L I S , M N / $ 4 6 . 3 M I L L I O N • A 465-home community built in 2016 • Conveniently located in the north metro of Denver with close proximity to employment centers and amenities • Amenities include two fitness centers, two billiard room, community garden, and resort style pool • One, two and three-bedroom homes feature contemporary granite countertops, stainless steel appliances, walk-in closets, floor-to- ceiling windows P A R K H O U S E A P A R T M E N T S D E N V E R , C O / $ 7 6 . 9 M I L L I O N • A 182‐home community built in 2018; first new product in submarket in 20 years • Conveniently located to multiple employment centers and amenities • Previously financed the development with a $16.6 million mezzanine note, acquiring the asset after stabilization • One, two and three-bedroom homes feature quartz countertops, stainless steel appliances, and private balconies with views of golf course and pool deck

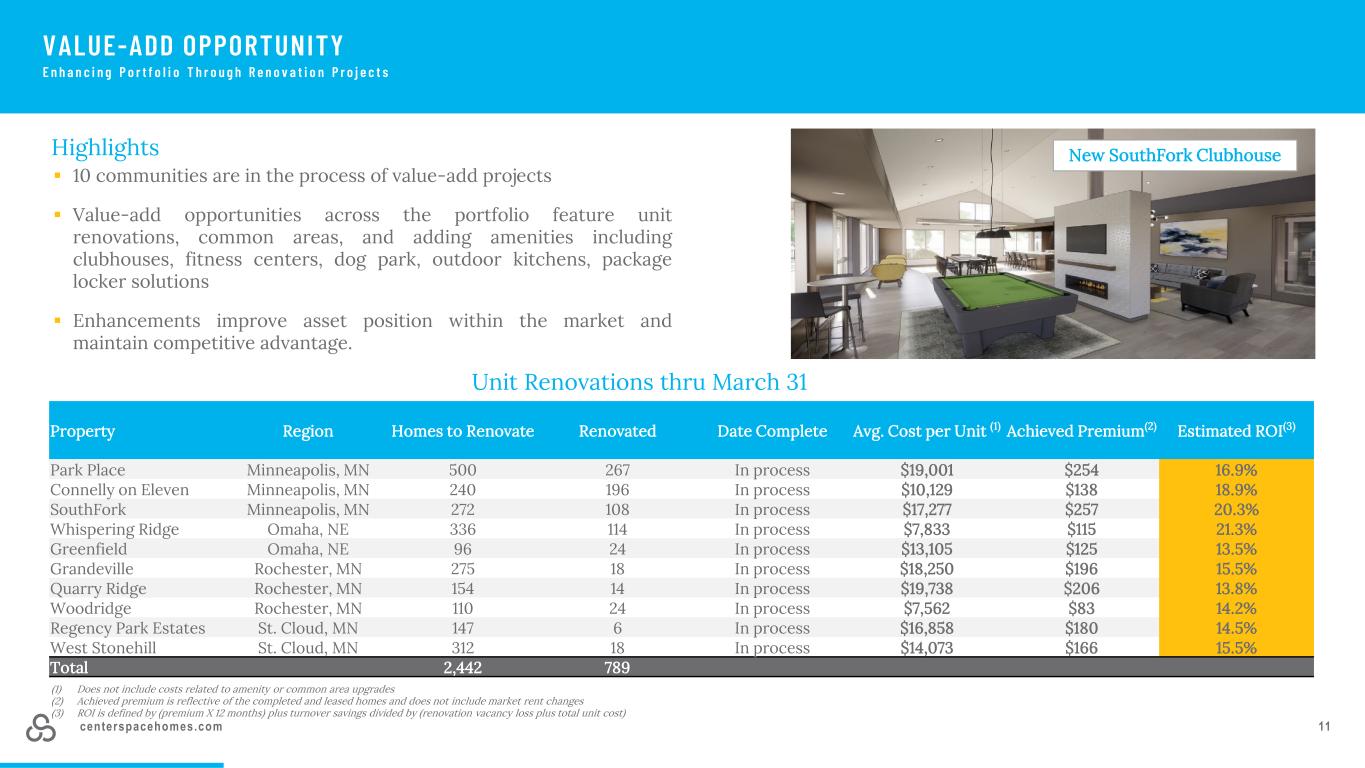

centerspacehomes.com 11 Property Region Homes to Renovate Renovated Date Complete Avg. Cost per Unit (1) Achieved Premium(2) Estimated ROI(3) Park Place Minneapolis, MN 500 267 In process $19,001 $254 16.9% Connelly on Eleven Minneapolis, MN 240 196 In process $10,129 $138 18.9% SouthFork Minneapolis, MN 272 108 In process $17,277 $257 20.3% Whispering Ridge Omaha, NE 336 114 In process $7,833 $115 21.3% Greenfield Omaha, NE 96 24 In process $13,105 $125 13.5% Grandeville Rochester, MN 275 18 In process $18,250 $196 15.5% Quarry Ridge Rochester, MN 154 14 In process $19,738 $206 13.8% Woodridge Rochester, MN 110 24 In process $7,562 $83 14.2% Regency Park Estates St. Cloud, MN 147 6 In process $16,858 $180 14.5% West Stonehill St. Cloud, MN 312 18 In process $14,073 $166 15.5% Total 2,442 789 Highlights VALUE-ADD OPPORTUNITY E n h a n c i n g P o r t f o l i o T h r o u g h R e n o v a t i o n P r o j e c t s 10 communities are in the process of value-add projects Value-add opportunities across the portfolio feature unit renovations, common areas, and adding amenities including clubhouses, fitness centers, dog park, outdoor kitchens, package locker solutions Enhancements improve asset position within the market and maintain competitive advantage. New SouthFork Clubhouse Unit Renovations thru March 31 (1) Does not include costs related to amenity or common area upgrades (2) Achieved premium is reflective of the completed and leased homes and does not include market rent changes (3) ROI is defined by (premium X 12 months) plus turnover savings divided by (renovation vacancy loss plus total unit cost)

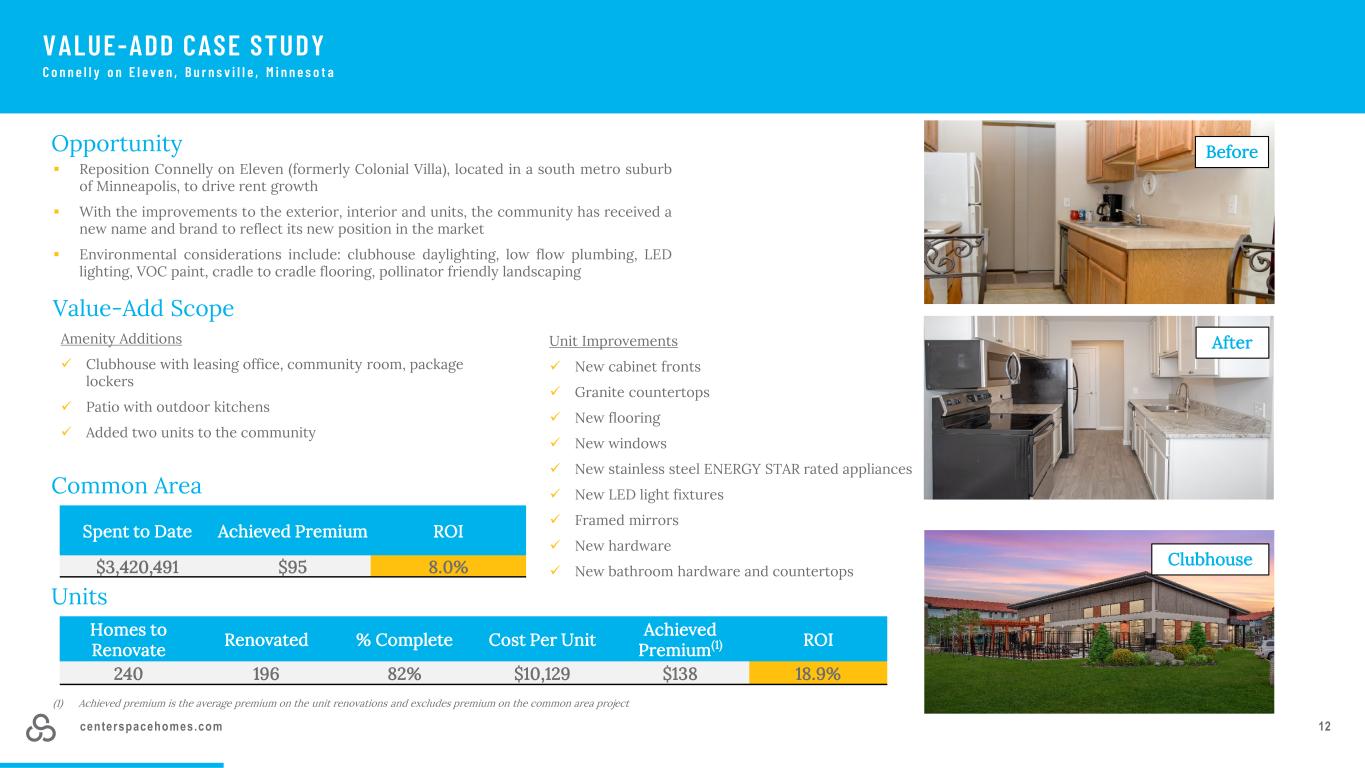

centerspacehomes.com 12 Homes to Renovate Renovated % Complete Cost Per Unit Achieved Premium(1) ROI 240 196 82% $10,129 $138 18.9% Spent to Date Achieved Premium ROI $3,420,491 $95 8.0% After BeforeOpportunity VALUE-ADD CASE STUDY C o n n e l l y o n E l e v e n , B u r n s v i l l e , M i n n e s o t a Reposition Connelly on Eleven (formerly Colonial Villa), located in a south metro suburb of Minneapolis, to drive rent growth With the improvements to the exterior, interior and units, the community has received a new name and brand to reflect its new position in the market Environmental considerations include: clubhouse daylighting, low flow plumbing, LED lighting, VOC paint, cradle to cradle flooring, pollinator friendly landscaping (1) Achieved premium is the average premium on the unit renovations and excludes premium on the common area project Value-Add Scope Common Area Units Amenity Additions Clubhouse with leasing office, community room, package lockers Patio with outdoor kitchens Added two units to the community Unit Improvements New cabinet fronts Granite countertops New flooring New windows New stainless steel ENERGY STAR rated appliances New LED light fixtures Framed mirrors New hardware New bathroom hardware and countertops Clubhouse

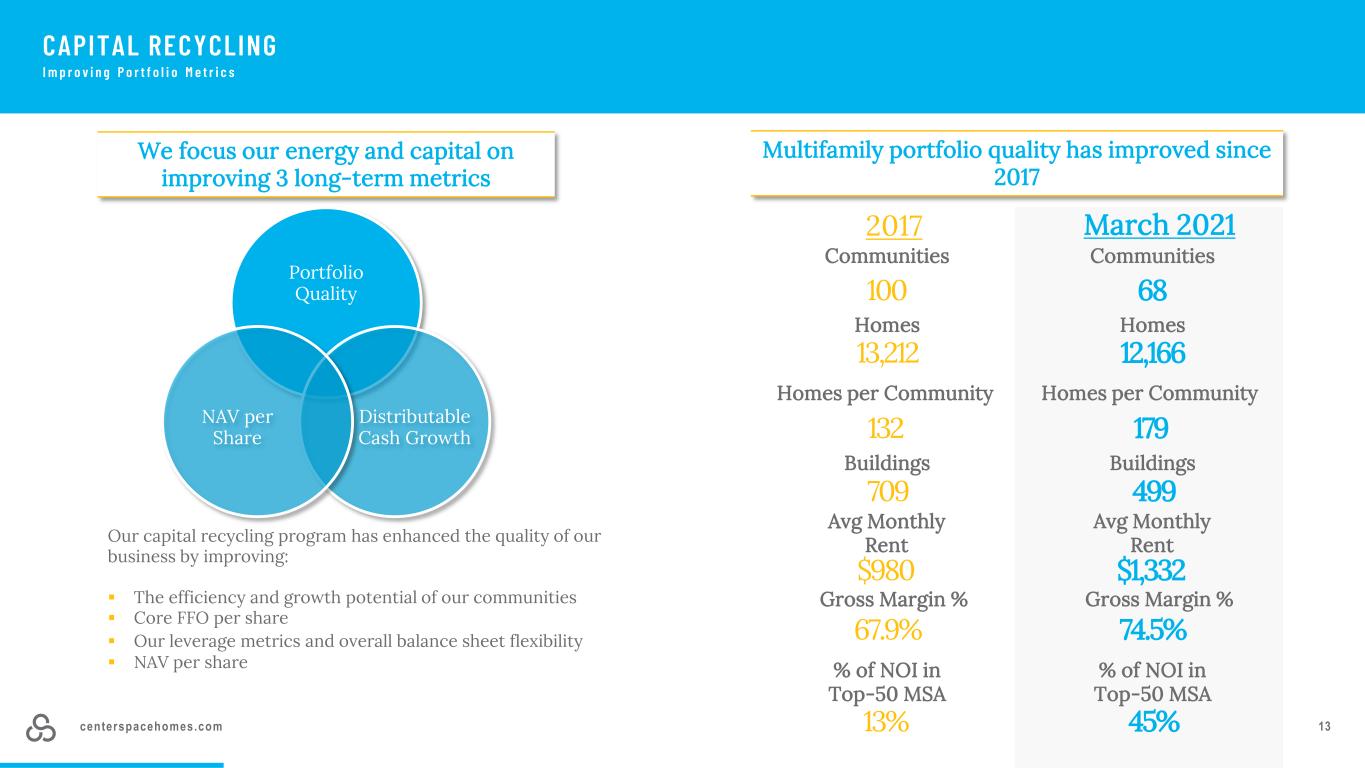

centerspacehomes.com 13 Multifamily portfolio quality has improved since 2017 We focus our energy and capital on improving 3 long-term metrics CAPITAL RECYCLING I m p r o v i n g P o r t f o l i o M e t r i c s Portfolio Quality Distributable Cash Growth NAV per Share Our capital recycling program has enhanced the quality of our business by improving: The efficiency and growth potential of our communities Core FFO per share Our leverage metrics and overall balance sheet flexibility NAV per share Homes per Community Buildings 132 709 Avg Monthly Rent $980 Communities 100 % of NOI in Top-50 MSA 13% 2017 Homes 13,212 Gross Margin % 67.9% Homes per Community Buildings 179 499 Avg Monthly Rent $1,332 Communities 68 % of NOI in Top-50 MSA 45% March 2021 Homes 12,166 Gross Margin % 74.5%

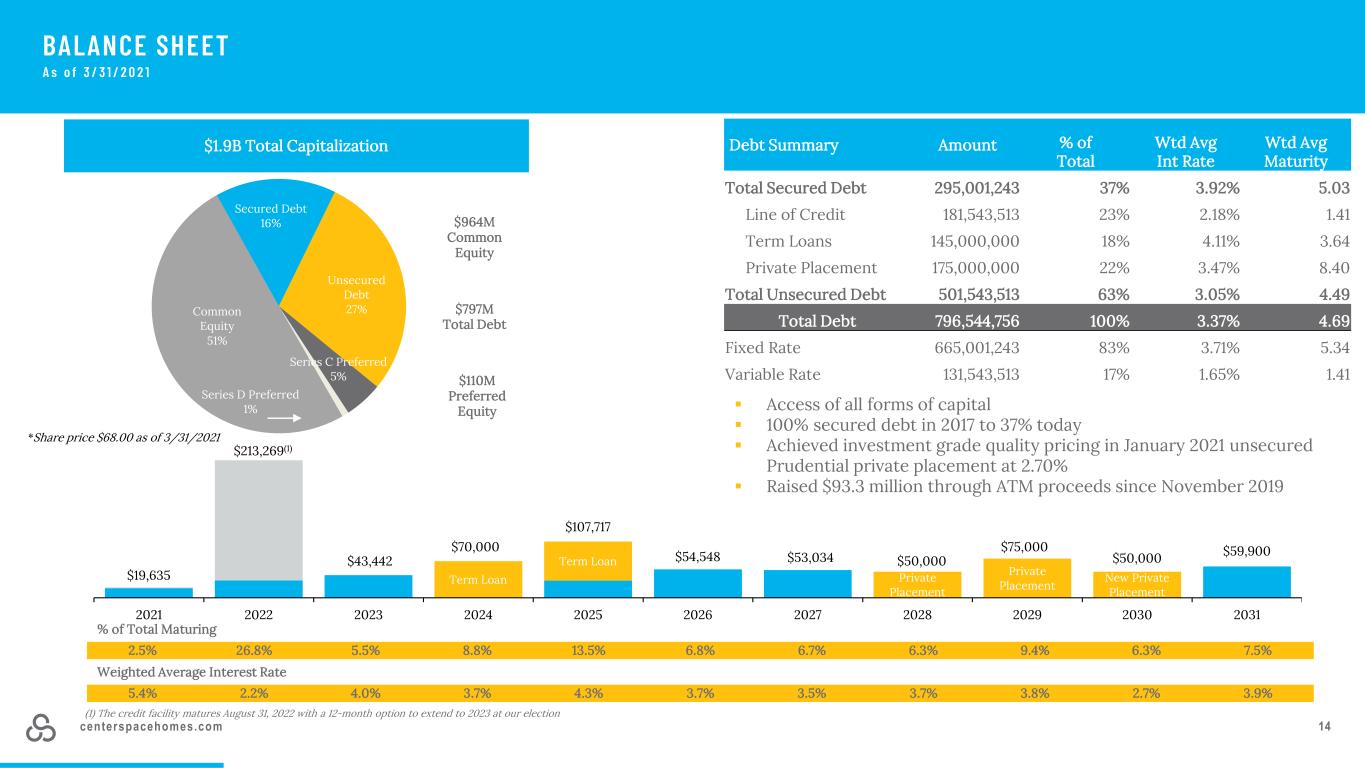

centerspacehomes.com 14 Common Equity 51% Secured Debt 16% Unsecured Debt 27% Series C Preferred 5% Series D Preferred 1% Debt Summary Amount % of Total Wtd Avg Int Rate Wtd Avg Maturity Total Secured Debt 295,001,243 37% 3.92% 5.03 Line of Credit 181,543,513 23% 2.18% 1.41 Term Loans 145,000,000 18% 4.11% 3.64 Private Placement 175,000,000 22% 3.47% 8.40 Total Unsecured Debt 501,543,513 63% 3.05% 4.49 Total Debt 796,544,756 100% 3.37% 4.69 Fixed Rate 665,001,243 83% 3.71% 5.34 Variable Rate 131,543,513 17% 1.65% 1.41 *Share price $68.00 as of 3/31/2021 BALANCE SHEET A s o f 3 / 3 1 / 2 0 2 1 $1.9B Total Capitalization Access of all forms of capital 100% secured debt in 2017 to 37% today Achieved investment grade quality pricing in January 2021 unsecured Prudential private placement at 2.70% Raised $93.3 million through ATM proceeds since November 2019 $797M Total Debt $964M Common Equity $110M Preferred Equity Private Placement % of Total Maturing 2.5% 26.8% 5.5% 8.8% 13.5% 6.8% 6.7% 6.3% 9.4% 6.3% 7.5% Weighted Average Interest Rate 5.4% 2.2% 4.0% 3.7% 4.3% 3.7% 3.5% 3.7% 3.8% 2.7% 3.9% $19,635 $213,269(1) $43,442 $70,000 $107,717 $54,548 $53,034 $50,000 $75,000 $50,000 $59,900 Term Loan Term Loan Private Placement Private Placement New Private Placement 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 (1) The credit facility matures August 31, 2022 with a 12-month option to extend to 2023 at our election

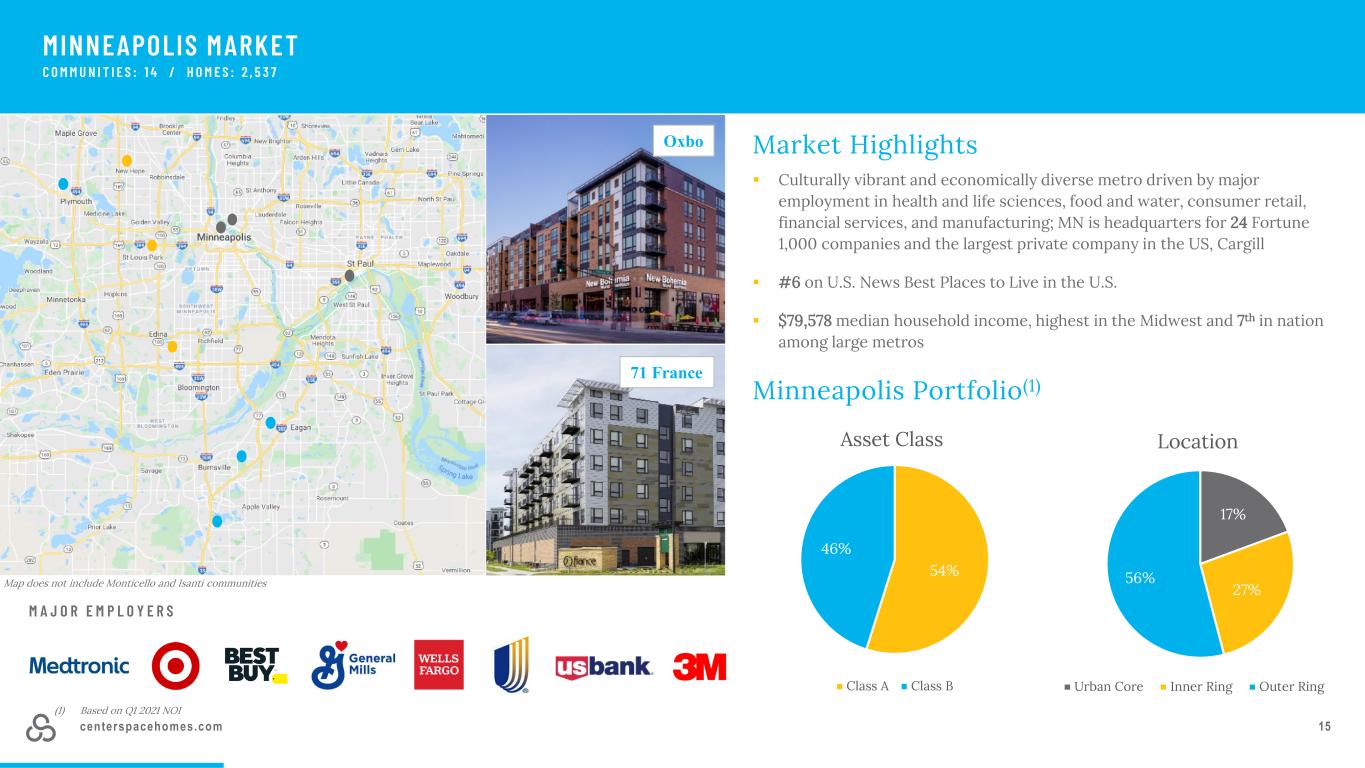

centerspacehomes.com 15 MINNEAPOLIS MARKET C O M M U N I T I E S : 1 4 / H O M E S : 2 , 5 3 7 M A J O R E M P L O Y E R S Culturally vibrant and economically diverse metro driven by major employment in health and life sciences, food and water, consumer retail, financial services, and manufacturing; MN is headquarters for 24 Fortune 1,000 companies and the largest private company in the US, Cargill #6 on U.S. News Best Places to Live in the U.S. $79,578 median household income, highest in the Midwest and 7th in nation among large metros Market Highlights Minneapolis Portfolio(1) 54% 46% Asset Class Class A Class B Oxbo 71 France 17% 27% 56% Location Urban Core Inner Ring Outer Ring (1) Based on Q1 2021 NOI Map does not include Monticello and Isanti communities

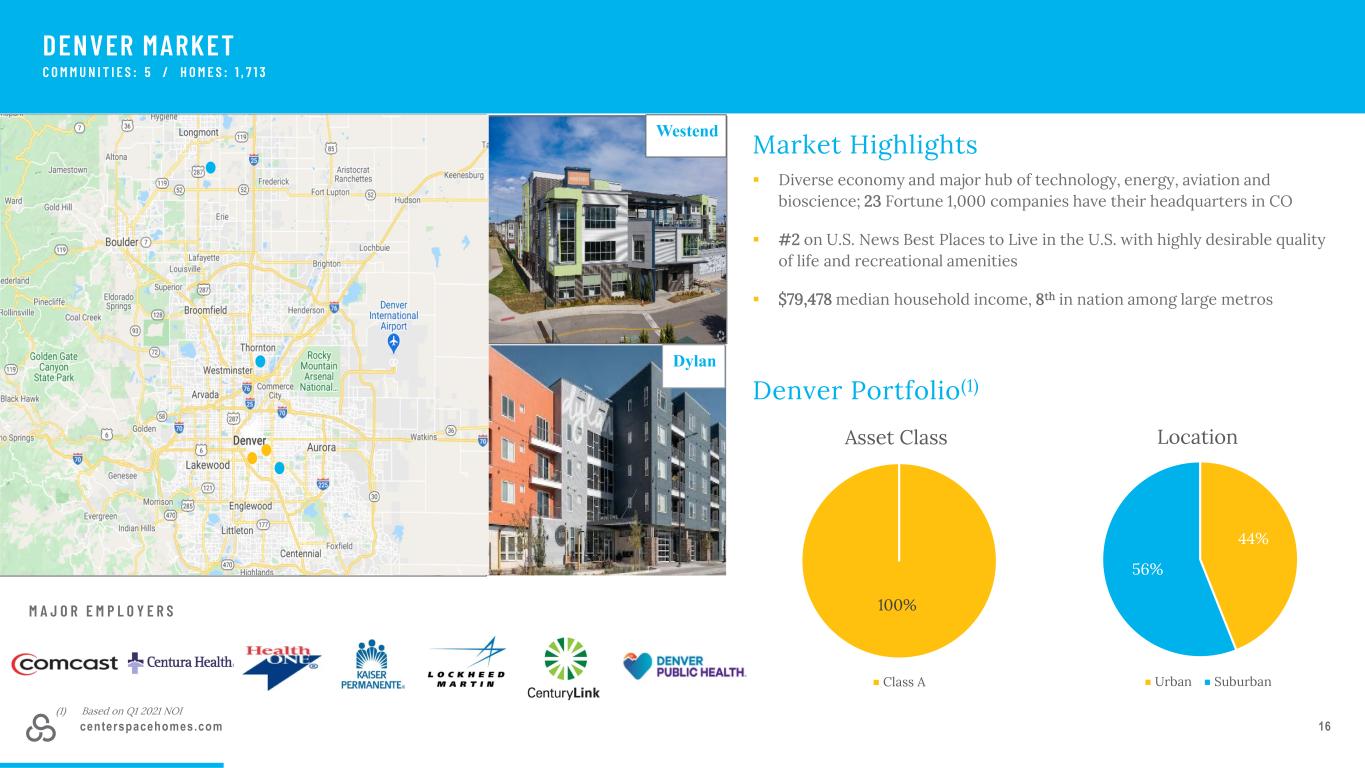

centerspacehomes.com 16 100% Asset Class Class A 44% 56% Location Urban Suburban DENVER MARKET C O M M U N I T I E S : 5 / H O M E S : 1 , 7 1 3 M A J O R E M P L O Y E R S Diverse economy and major hub of technology, energy, aviation and bioscience; 23 Fortune 1,000 companies have their headquarters in CO #2 on U.S. News Best Places to Live in the U.S. with highly desirable quality of life and recreational amenities $79,478 median household income, 8th in nation among large metros Market Highlights Denver Portfolio(1) Westend Dylan (1) Based on Q1 2021 NOI

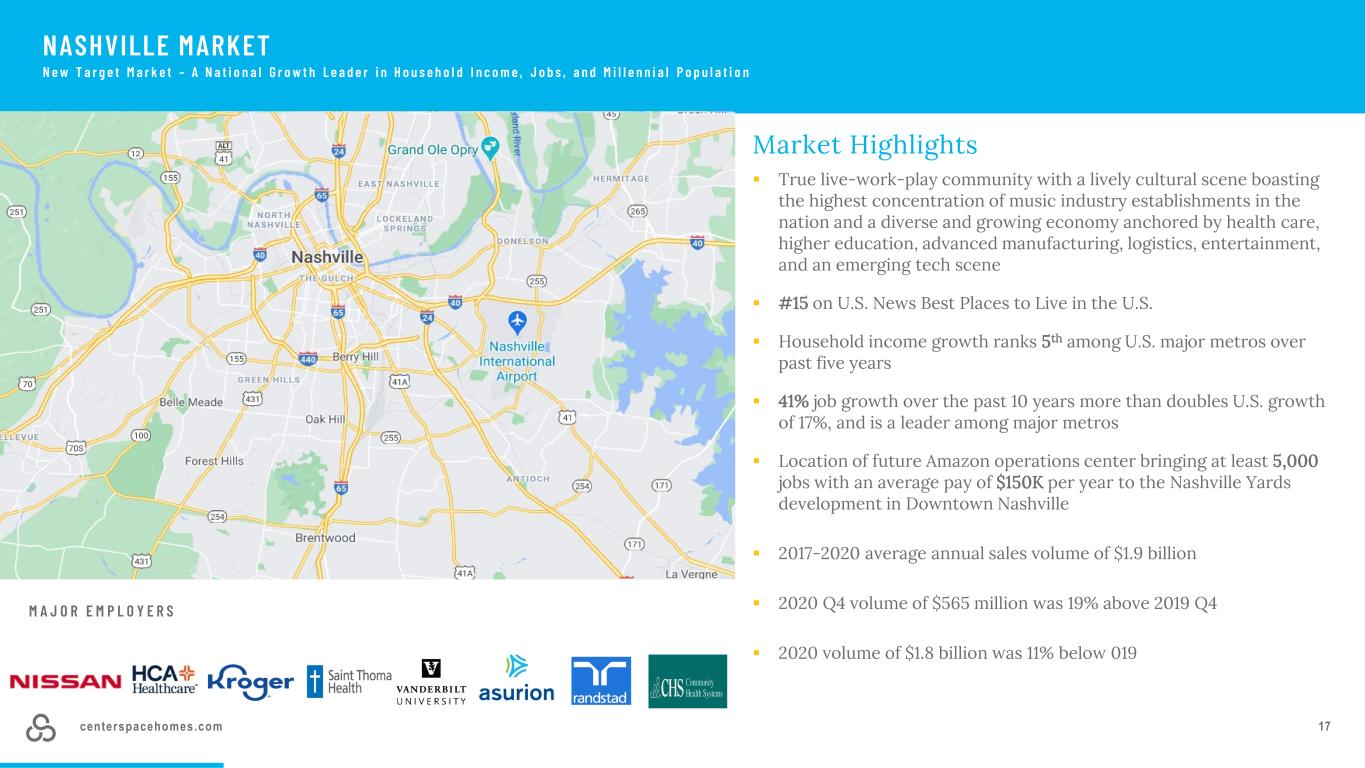

centerspacehomes.com 17 NASHVILLE MARKET N e w T a r g e t M a r k e t – A N a t i o n a l G r o w t h L e a d e r i n H o u s e h o l d I n c o m e , J o b s , a n d M i l l e n n i a l P o p u l a t i o n M A J O R E M P L O Y E R S True live-work-play community with a lively cultural scene boasting the highest concentration of music industry establishments in the nation and a diverse and growing economy anchored by health care, higher education, advanced manufacturing, logistics, entertainment, and an emerging tech scene #15 on U.S. News Best Places to Live in the U.S. Household income growth ranks 5th among U.S. major metros over past five years 41% job growth over the past 10 years more than doubles U.S. growth of 17%, and is a leader among major metros Location of future Amazon operations center bringing at least 5,000 jobs with an average pay of $150K per year to the Nashville Yards development in Downtown Nashville 2017-2020 average annual sales volume of $1.9 billion 2020 Q4 volume of $565 million was 19% above 2019 Q4 2020 volume of $1.8 billion was 11% below 019 Market Highlights

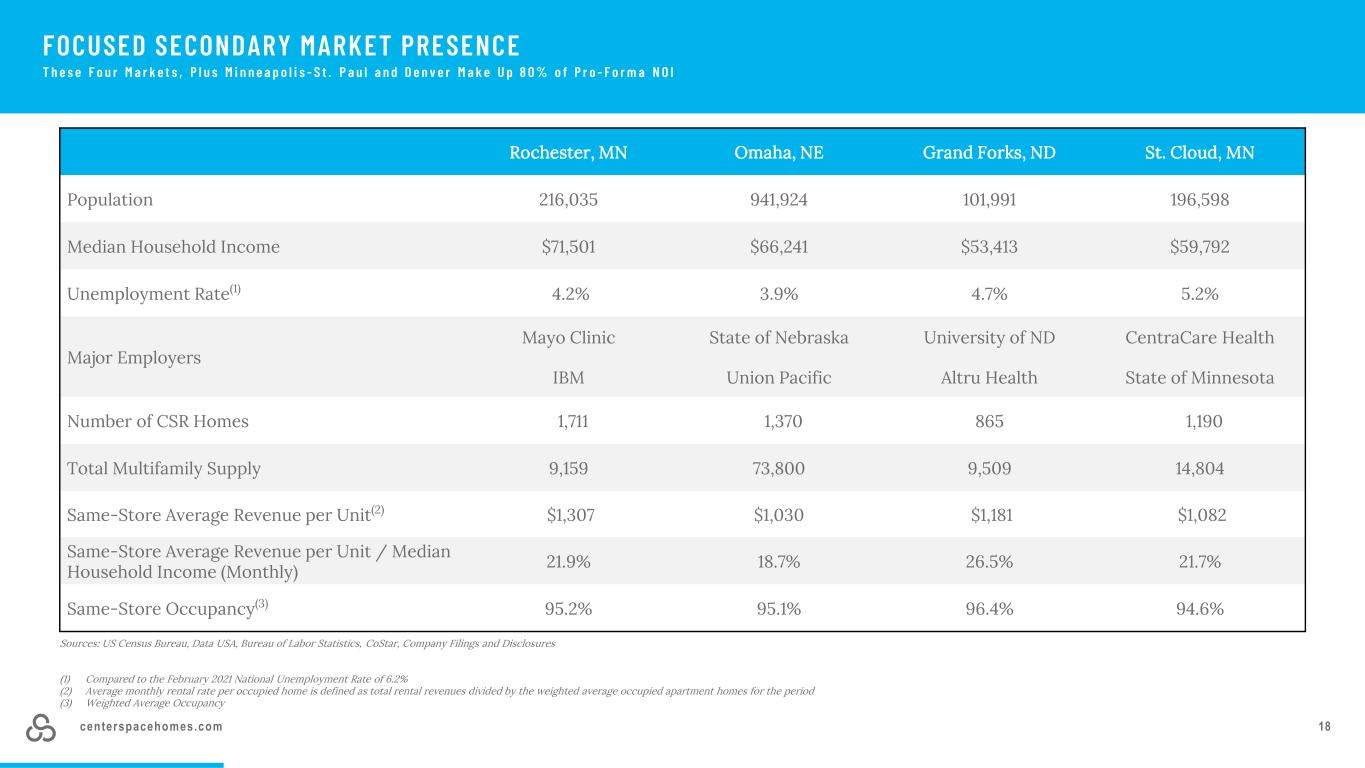

centerspacehomes.com 18 FOCUSED SECONDARY MARKET PRESENCE T h e s e F o u r M a r k e t s , P l u s M i n n e a p o l i s - S t . P a u l a n d D e n v e r M a k e U p 8 0 % o f P r o - F o r m a N O I Rochester, MN Omaha, NE Grand Forks, ND St. Cloud, MN Population 216,035 941,924 101,991 196,598 Median Household Income $71,501 $66,241 $53,413 $59,792 Unemployment Rate(1) 4.2% 3.9% 4.7% 5.2% Major Employers Mayo Clinic State of Nebraska University of ND CentraCare Health IBM Union Pacific Altru Health State of Minnesota Number of CSR Homes 1,711 1,370 865 1,190 Total Multifamily Supply 9,159 73,800 9,509 14,804 Same-Store Average Revenue per Unit(2) $1,307 $1,030 $1,181 $1,082 Same-Store Average Revenue per Unit / Median Household Income (Monthly) 21.9% 18.7% 26.5% 21.7% Same-Store Occupancy(3) 95.2% 95.1% 96.4% 94.6% Sources: US Census Bureau, Data USA, Bureau of Labor Statistics, CoStar, Company Filings and Disclosures (1) Compared to the February 2021 National Unemployment Rate of 6.2% (2) Average monthly rental rate per occupied home is defined as total rental revenues divided by the weighted average occupied apartment homes for the period (3) Weighted Average Occupancy

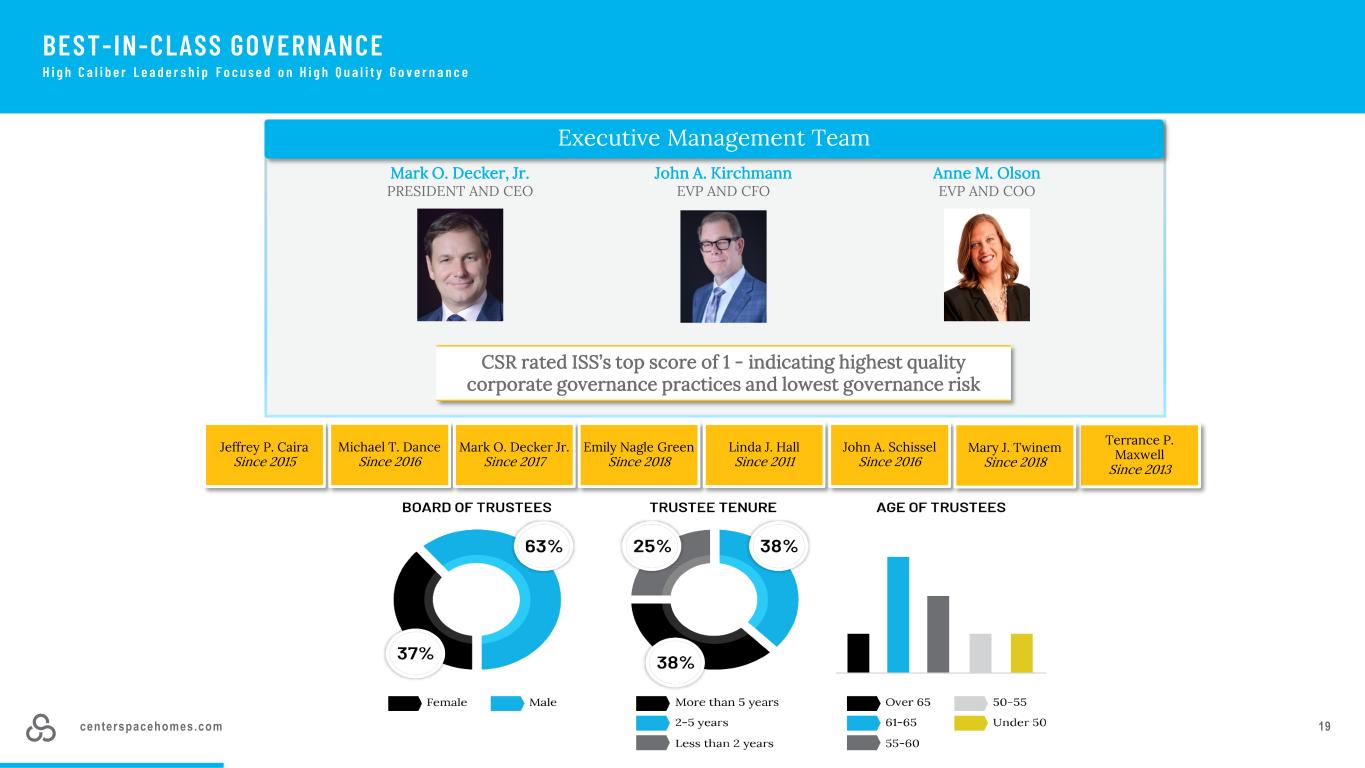

centerspacehomes.com 19 BEST-IN-CLASS GOVERNANCE H i g h C a l i b e r L e a d e r s h i p F o c u s e d o n H i g h Q u a l i t y G o v e r n a n c e Executive Management Team Mark O. Decker, Jr. PRESIDENT AND CEO John A. Kirchmann EVP AND CFO Anne M. Olson EVP AND COO CSR rated ISS’s top score of 1 - indicating highest quality corporate governance practices and lowest governance risk Jeffrey P. Caira Since 2015 Michael T. Dance Since 2016 Mark O. Decker Jr. Since 2017 Emily Nagle Green Since 2018 Linda J. Hall Since 2011 Terrance P. Maxwell Since 2013 John A. Schissel Since 2016 Mary J. Twinem Since 2018

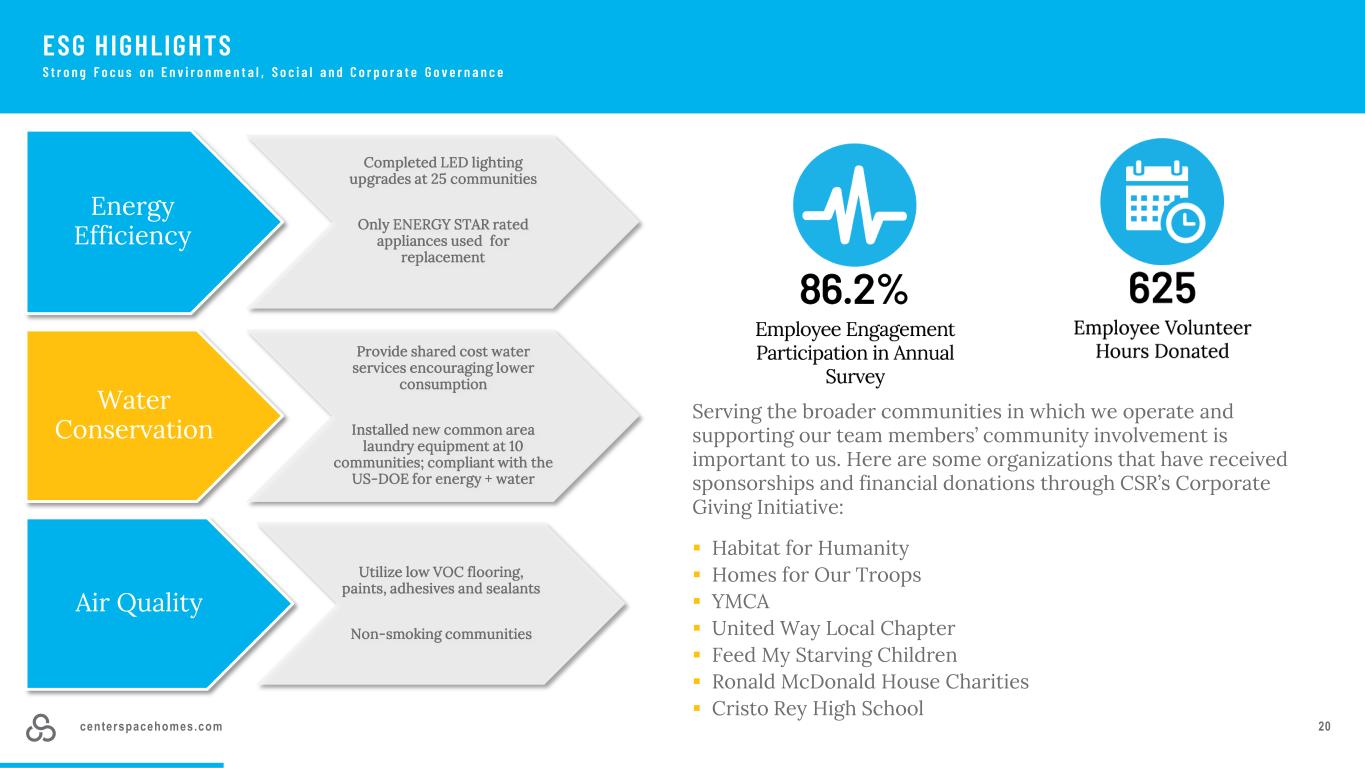

centerspacehomes.com 20 ESG HIGHLIGHTS S t r o n g F o c u s o n E n v i r o n m e n t a l , S o c i a l a n d C o r p o r a t e G o v e r n a n c e Energy Efficiency Completed LED lighting upgrades at 25 communities Only ENERGY STAR rated appliances used for replacement Water Conservation Provide shared cost water services encouraging lower consumption Installed new common area laundry equipment at 10 communities; compliant with the US-DOE for energy + water Air Quality Utilize low VOC flooring, paints, adhesives and sealants Non-smoking communities Serving the broader communities in which we operate and supporting our team members’ community involvement is important to us. Here are some organizations that have received sponsorships and financial donations through CSR’s Corporate Giving Initiative: Habitat for Humanity Homes for Our Troops YMCA United Way Local Chapter Feed My Starving Children Ronald McDonald House Charities Cristo Rey High School

centerspacehomes.com 21 INVESTMENT HIGHLIGHTS Best-In-Class Governance

centerspacehomes.com 22 APPENDIX

centerspacehomes.com 23 RECONCILIATION TO NON-GAAP MEASURES Reconciliation of Net Income (Loss) Available to Common Shareholders to Funds From Operations and Core Funds From Operations We use the definition of FFO adopted by the National Association of Real Estate Investment Trusts, Inc. (“Nareit”). Nareit defines FFO as net income or loss calculated in accordance with GAAP, excluding: depreciation and amortization related to real estate; gains and losses from the sale of certain real estate assets; and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. Due to the limitations of the Nareit FFO definition, we have made certain interpretations in applying this definition. We believe that all such interpretations not specifically identified in the Nareit definition are consistent with this definition. Nareit's FFO White Paper 2018 Restatement clarified that impairment write-downs of land related to a REIT's main business are excluded from FFO and a REIT has the option to exclude impairment write-downs of assets that are incidental to its main business. We believe that FFO, which is a standard supplemental measure for equity real estate investment trusts, is helpful to investors in understanding our operating performance, primarily because its calculation excludes depreciation and amortization expense on real estate assets, thereby providing an additional perspective on our operating results. We believe that GAAP historical cost depreciation of real estate assets is not correlated with changes in the value of those assets, whose value does not diminish predictably over time, as historical cost depreciation implies. The exclusion in Nareit’s definition of FFO of impairment write-downs and gains and losses from the sale of real estate assets helps to identify the operating results of the long-term assets that form the base of our investments, and assists management and investors in comparing those operating results between periods. While FFO is widely used by us as a primary performance metric, not all real estate companies use the same definition of FFO or calculate FFO in the same way. Accordingly, FFO presented here is not necessarily comparable to FFO presented by other real estate companies. FFO should not be considered as an alternative to net income or any other GAAP measurement of performance, but rather should be considered as an additional, supplemental measure. FFO also does not represent cash generated from operating activities in accordance with GAAP and is not necessarily indicative of sufficient cash flow to fund all of our needs or our ability to service indebtedness or make distributions. Core Funds from Operations ("Core FFO") is FFO as adjusted for non-routine items or items not considered core to our business operations. By further adjusting for items that are not considered part of our core business operations, we believe that Core FFO provides investors with additional information to compare our core operating and financial performance between periods. Core FFO should not be considered as an alternative to net income as an indication of financial performance, or as an alternative to cash flows from operations as a measure of liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to make distributions to shareholders. Core FFO is a non-GAAP and non-standardized measure that may be calculated differently by other REITs and should not be considered a substitute for operating results determined in accordance with GAAP.

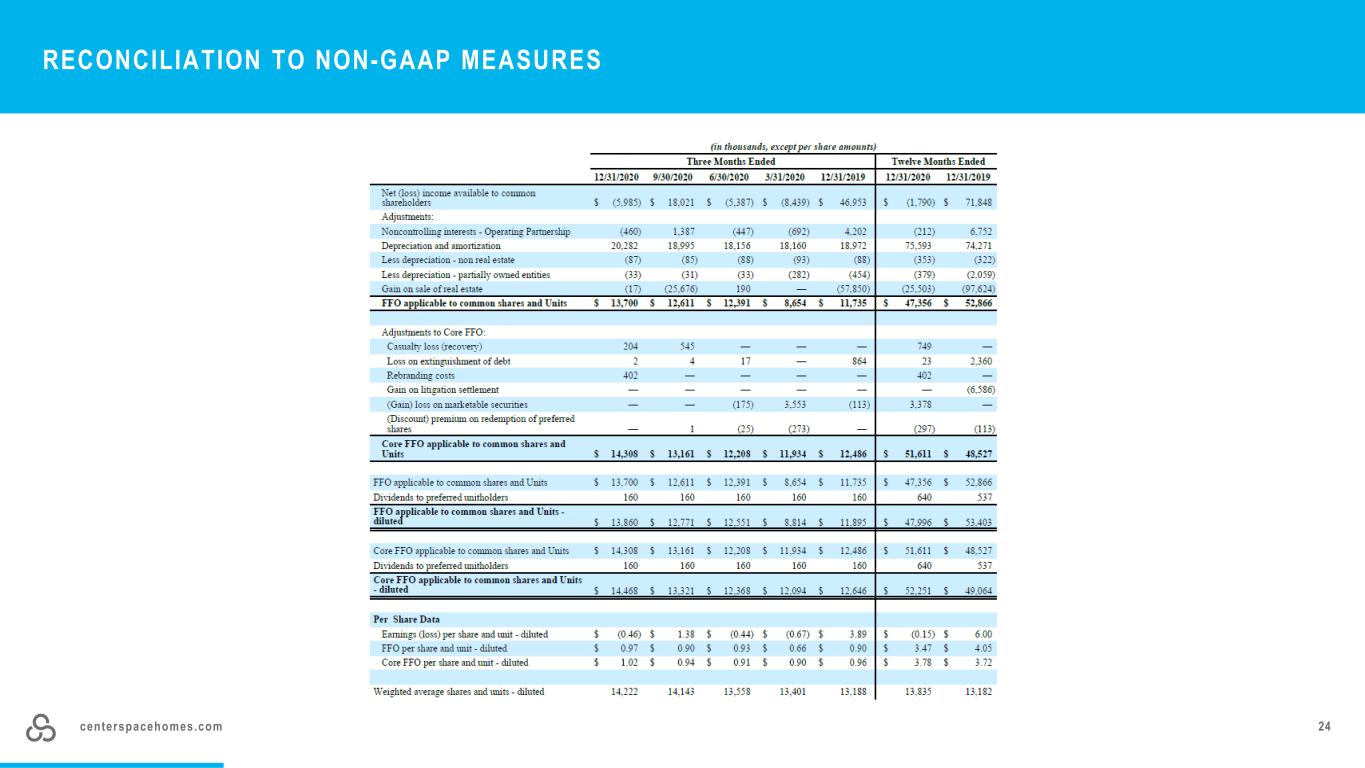

centerspacehomes.com 24 RECONCILIATION TO NON-GAAP MEASURES

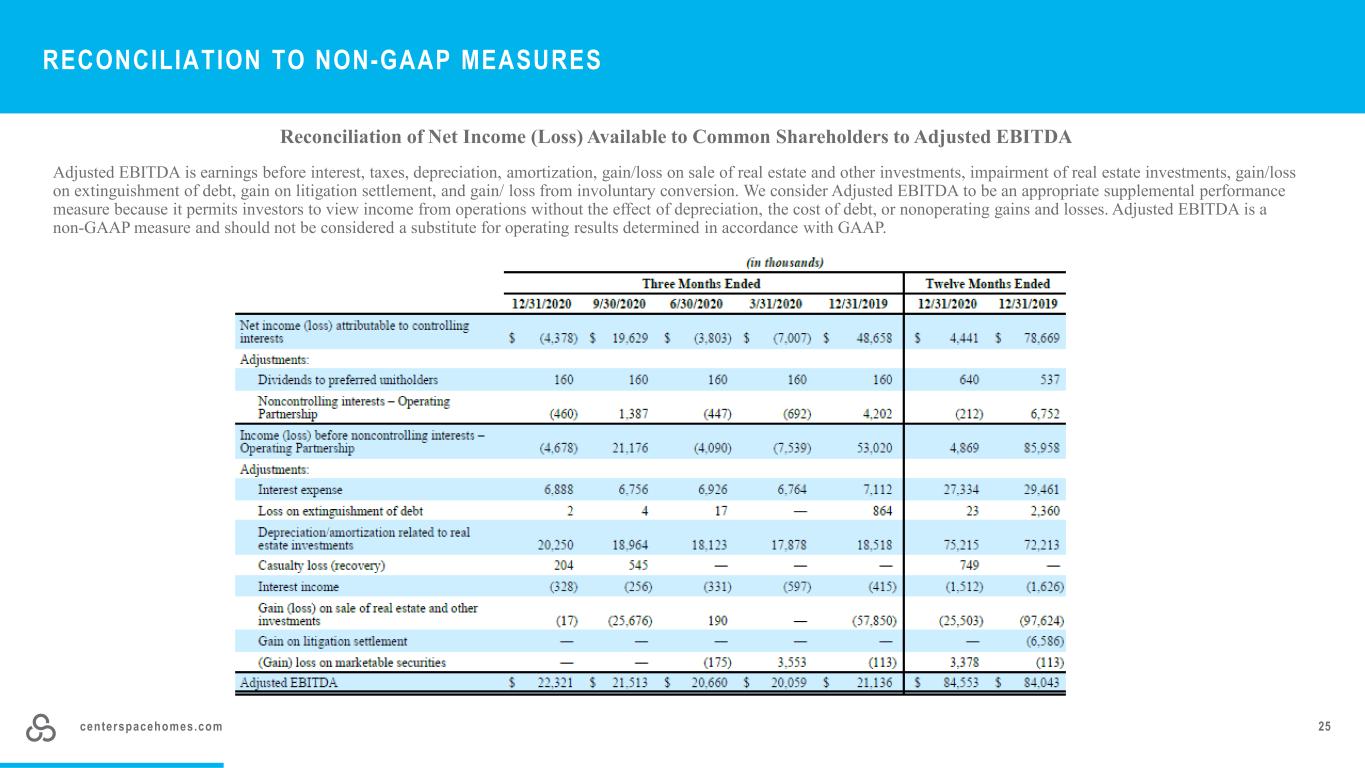

centerspacehomes.com 25 RECONCILIATION TO NON-GAAP MEASURES Reconciliation of Net Income (Loss) Available to Common Shareholders to Adjusted EBITDA Adjusted EBITDA is earnings before interest, taxes, depreciation, amortization, gain/loss on sale of real estate and other investments, impairment of real estate investments, gain/loss on extinguishment of debt, gain on litigation settlement, and gain/ loss from involuntary conversion. We consider Adjusted EBITDA to be an appropriate supplemental performance measure because it permits investors to view income from operations without the effect of depreciation, the cost of debt, or nonoperating gains and losses. Adjusted EBITDA is a non-GAAP measure and should not be considered a substitute for operating results determined in accordance with GAAP.