Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - SPLASH BEVERAGE GROUP, INC. | e2408_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - SPLASH BEVERAGE GROUP, INC. | e2408_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - SPLASH BEVERAGE GROUP, INC. | e2408_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - SPLASH BEVERAGE GROUP, INC. | e2408_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - SPLASH BEVERAGE GROUP, INC. | e2408_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - SPLASH BEVERAGE GROUP, INC. | e2408_ex21-1.htm |

| EX-4.1 - EXHIBIT 4.1 - SPLASH BEVERAGE GROUP, INC. | e2408_ex4-1.htm |

| EX-3.3 - EXHIBIT 3.3 - SPLASH BEVERAGE GROUP, INC. | e2408_ex3-3.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________to _________

Commission File Number 000-55114

SPLASH BEVERAGE GROUP, INC.

(Exact name of registrant as specified in its charter)

| Colorado | 34-1720075 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1314 E Las Olas Blvd. Suite 221

Fort Lauderdale, FL 33301

(Address of principal executive offices) (Zip code)

(954) 745-5815

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| N/A | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, No Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (i) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by checkmark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company,” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the Registrant’s common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the Registrant’s most recently completed second fiscal quarter was $24,013,945.

On March 8, 2021, there were 76,093,546 shares of Common Stock issued and outstanding.

SPLASH BEVERAGE GROUP, INC.

FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2020

TABLE OF CONTENTS

i

Overview

Canfield Medical Supply, Inc. (“CMS”) was incorporated in the State of Ohio on September 3, 1992, and changed domicile to Colorado on April 18, 2012. CMS was in the business of home health services, primarily the selling of durable medical equipment and medical supplies to the public, nursing homes, hospitals and other end users.

On December 31, 2019, Canfield entered into an Agreement and Plan of Merger (the “Merger Agreement”) with SBG Acquisition Inc. (“Merger Sub”), a Nevada Corporation wholly-owned by Canfield, and Splash Beverage Group, Inc. a Nevada corporation (“Splash” or “SBG“) pursuant to which Merger Sub merged with and into Splash (the “Merger”) with Splash as the surviving company and a wholly-owned subsidiary of Canfield. The Merger was consummated on March 31, 2020.

As the owners and management of Splash had voting and operating control of CMS following the Merger, the Merger transaction was accounted for as a reverse acquisition (that is with Splash as the acquiring entity), followed by a recapitalization.

On July 31, 2020, CMS changed its name to Splash Beverage Group, Inc. (“SBG”).

On December 24, 2020, SBG consummated an Asset Purchase Agreement(the “APA”) with Copa di Vino Corporation (“CdV”), to purchase certain assets and assume certain liabilities that comprise the Copa di Vino business for a total purchase price of $5,980,000, payable in the combination of $2,000,000 in cash (“Cash Consideration”), $2,000,000 convertible promissory note (the “Convertible Note”) to Seller and a variable number of shares of the Company’s common stock based on a attainment of revenue hurdles. CdV is one of the leading producers of premium wine by the glass in the United States with its primary offices and facilities in The Dalles, Oregon.

The Company’s common stock is quoted on the OTCQB under the symbol SBEV.

1

Company Overview and History

Splash was incorporated in the State of Nevada under the name TapouT Beverages, Inc. for the purpose of acquiring the rights under a license agreement with TapouT, LLC (Authentic Brands Group and now the WWE) for the right to use the TapouT brand in connection with manufacturing and selling certain beverages. Robert Nistico was hired as CEO and the name was changed to Splash Beverage Group, Inc. (SBG) to reflect the revised business plan of being a manufacturer and distributor of several brands of beverages including both non-alcoholic and spirits brands.

Robert Nistico has over 28 years of experience in all levels of the three-tier distribution system used in the beverage industry. Prior to joining the Company, he led the Marley Beverage Company from startup to over $47 million in annual revenues and ultimately profitability in three and one-half years. Before that he was the 5th employee at Red Bull North America, Inc. and served as General Manager, VP of Field Marketing and Sr. Vice President & General Manager during his 11 years there. He was instrumental in building the Red Bull brand in North and Central America and the Caribbean from $0 revenue to $1.6 billion in annual revenues. Nistico began his career with the Gallo Winery, quickly ascending within that system between winery and senior positions in distribution with Premier Beverage and RNDC Texas.

Mr. Nistico has assembled a team of experienced beverage industry professionals with the goal of replicating the business model of companies like Diageo of owning some brands and managing others where there are synergies among a distribution standpoint. SBG however, has an additional strategic advantage of “brand incubation” with its own ecommerce platform.

SBG has license rights to the TapouT brand for the United States and several other countries and we have joint venture with SALT Flavored Tequila. Mr. Nistico and SBG understand the proven strategy of infusing beverage brands with strong pop culture and lifestyle elements which drives trial, belief and most importantly repeat purchase.

Our Strategy

Our strategy is to combine the traditional approach of manufacturing, distributing, and marketing of beverages, but with brands that have a reasonable level of pre-existing brand awareness (market presence) or have attributes that we believe to be purely innovative. These are SBG’s core values. We believe this allows SBG to break through the clutter of numerous brand introductions and dilute risk. This philosophy is applied regardless as to whether the brand is to be 100% owned or a joint venture.

For acquisition or joint venture consideration, we prefer to work with brands that already have one or more of the following in place:

| ● | Some level of preexisting brand awareness |

| ● | Regional presence that can be expanded |

| ● | Licensing an existing brand name (TapouT for example) |

| ● | Add to an underdeveloped and growing category |

| ● | Innovation to an existing attractive category (Flavored Tequila) |

We believe offering brand founders access to our shared services model, provides us with two paths to success: one, developing our wholly owned core brands and two the ability to tap into high growth early stage brands ready to scale. By managing joint venture brands, we can significantly reduce their development expense while simultaneously increasing efficiencies for all brands in the SBG portfolio.

Most new single beverage brands have limited access to distribution and thus find it extremely difficult to obtain meaningful retail shelf presence. With decades of successful brand introductions (Gallo, Red Bull, Bacardi, DIAGEO, Sparkling Ice, Jones Soda, FUZE Beverage, NOS Energy, SoBe Beverages, Muscle Milk, Marley Beverages) our ability to break through the distribution and retail bottlenecks makes us an attractive joint venture partner to many new brand owners.

Our business ventures are typically structured with a revenue split, a marketing spend commitment from the brand founder and an earned equity position that constitutes control. Most are happy to award an equity position in their brand in exchange for distribution, sales and marketing management within the distribution network which eliminates their need to invest in infrastructure. Our partners only need to manage a small base of corporate operations.

2

We benefit by avoiding the development costs for new products. This model spreads our risk over several brands, contributes to our economies of scale, and it improves our relationship with distribution because we can provide them with a broader line of proven beverage products.

Since our inception we have seen very good deal flow having been offered over 20 brands. SBG is only engaging with brands that fit comfortably within the above guidelines and are in some way complementary to each other categorically or from a distribution standpoint.

We also believe the distribution landscape in the beverage category is changing rapidly and see that tech-enabled business models are thriving. Direct to consumer, office or home solutions are projected to continue to gain traction in the future. A core strategy for SBG is to build onto the early success we’re seeing with the Qplash online platform.

Products

We produce, distribute and market two beverages brands, “TapouT Performance”, a hydration & recovery isotonic sport drink and SALT Naturally Flavored Tequila, a 100% agave 80 proof line of flavored tequilas. The following is a description of these products.

SALT Flavored Tequila

We produce, distribute, and market the following flavors under the brand name SALT Naturally Flavored Tequila:

| ● | Citrus flavor |

| ● | Berry flavor |

| ● | Chocolate flavor |

SALT Tequila is the first line of 100% agave 80-proof flavored tequilas. Tequila, vodka, rum, and now even brown spirits have experienced significant growth when flavors were introduced, and we expect significant growth as the tequila category is already growing at double digits.

SALT is currently being launched and distributed by RNDC, Youngs Market and Major Brands to Walmart and Total Wine to date in 6 U.S. states and is for sale in Mexico. Several South American countries will also launch SALT during spring 2021.

3

SALT is a business venture between SBG and SALT USA, LLC. All aspects of manufacturing, logistics, distribution and marketing are the responsibility of SBG.

TapouT Isotonic Sports Drinks

SBG will produce, market, sell and distribute the following sports beverages under the brand name TapouT in the coming two years:

| ● | TapouT Performance: Flavors completed |

| Flavor | Cherry Lemonade | Orange | Citrus Kick | |||

| Some Sugar / 120 Calories | 2021 | 2021 | In Production | |||

| Zero Sugar / 10 Calories | In Production | In Production | 2021 |

| ● | TapouT Elite: In development for 2022 |

| ● | TapouT Energy: Under consideration also for 2022 |

TapouT Performance is a unique advanced performance functional beverage that has recuperative and cell regeneration capabilities that increase hydration and cellular recovery. It is formulated with all GRAS (FDA Designation “Generally Regarded As Safe) ingredients versus controversial ingredients used in many competitive products. It can be taken before, during or after activity to enhance activation, hydration, and recovery. TapouT Performance is all natural and is perfectly balanced with a proprietary blend of 5 electrolytes, amino acids and a proprietary specialized ingredient blend of minerals and nutrients.

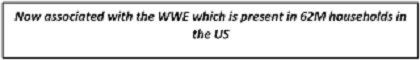

TapouT, formally associated with the UFC and mixed martial arts (MMA) has been producing branded clothing and light equipment for over 23 years and has a very high level of aided and unaided brand awareness.

4

Now associated with the WWE, Authentic Brands Group, LLC (“ABG TapouT”), the original owner of the TapouT brand IP, represents the biggest WWE stars, produces reality TV shows, Pod Casts, and other media and TapouT is the official training partner of the WWE.

TapouT License Agreement

We have the rights under a License Agreement to North, Central and South America, US military bases, Australia, South Africa and the EU. The beverages covered by the License Agreement include sports drinks, energy drinks, energy shots, water, protein, teas, etc.

We pay a 6% royalty of net sales or a guaranteed minimum royalty of $540,000 whichever is greater. This agreement goes through December 31, 2022.

We have the right to use the TapouT brand to market, advertise and promote for sale our TapouT beverages, and TapouT agrees to provide us with certain materials which we can use in connection with our advertising and promotion. We are required to spend 2% of our net sales on marketing expenditures such as expenses attributable to trade shows, catalogs and websites, point-of-sale advertising featuring TapouT products and other retail advertising. TapouT has certain relationships with certain celebrity and athletic talent and, if requested, it agrees to use its reasonable efforts to request the celebrities and/or athletes to be present at autograph signings, tradeshows and other similar events.

Manufacturing and Distribution

SBG is responsible for the manufacturing of the TapouT Performance Beverage and SALT Naturally Flavored Tequila.

Although we are responsible for manufacturing TapouT and SALT, we do not directly manufacture these products, but instead we outsource such manufacturing to third party bottlers and contract packers.

5

We purchase concentrates, flavors, dietary ingredients, cans, bottles, caps, labels, and other ingredients for our beverage products from our suppliers, which are delivered to our various third-party bottlers and co-packers. In some cases, certain common supplies may be purchased by our various third-party bottlers and co-packers. Depending on the product, the third-party bottlers or packers add filtered water and/or other ingredients (including dietary ingredients) for the manufacture and packaging of the finished products into our approved containers in accordance with our formulas.

The Copa di Vino and Pulpoloco brands are manufactured at our manufacturing facility in The Dalles, Oregon.

Co-Packing Arrangements

Our TapouT products are manufactured by various third-party bottlers and co-packers situated throughout the United States under separate arrangements with each party. Our co-packaging arrangements are generally on a month-to-month basis or are terminable upon request and do not typically obligate us to produce any minimum quantities of products within specified periods.

In some instances, subject to agreement, certain equipment may be purchased by us and installed at the facilities of our co-packers to enable them to produce certain of our products. In general, such equipment remains our property and is returned to us upon termination of the packing arrangements with such co-packers, unless we are reimbursed by the co-packer via a per-case credit over a predetermined number of cases that are produced at the facilities concerned.

We are generally responsible for arranging for the purchase and delivery to our third-party bottlers and co-packers the containers in which our beverage products are packaged.

We pack some of our products in multiple locations to enable us to produce finished goods closer to the markets where they are sold, with the objective of reducing freight costs as well as transportation-related product damages. As distribution volumes increase, we will continue to source additional packing arrangements closer to such markets to further reduce logistics costs. Our ability to estimate demand for our products is imprecise, particularly with new products, and may be less precise during periods of rapid growth, particularly in new markets. If we materially underestimate demand for our products and/or are unable to secure sufficient ingredients or raw materials including, but not limited to aluminum cans, PET plastic bottles, labels, flavors, juice concentrates, dietary ingredients, and other ingredients, and/or procure adequate packing arrangements and/or obtain adequate or timely shipment of our products, we might not be able to satisfy demand on a short-term basis.

Our production arrangements are generally of short duration or are terminable upon our request. For some of our products, there may be limited co-packing facilities in our domestic market with adequate capacity and/or suitable equipment to package our products. We believe a short disruption or delay in production would not significantly affect our revenues; however, as alternative co-packing facilities in our domestic market with adequate long-term capacity may not be available for such products, either at commercially reasonable rates and/or within a reasonably short time period, if at all, a lengthy disruption or delay in production of any of such products could significantly affect our revenues.

We continue to actively seek alternative and/or additional advantageously located co-packing facilities with adequate capacity and capability for the production of our various products to minimize transportation costs and transportation-related damages as well as to create redundancies to mitigate the risk of a disruption in production and/or importation.

Distribution

In the United States we operate within what is referred to as the “Three Tier Distribution System” where manufacturers do not typically sell directly to retailers, but instead contract for local and regional distribution with independent distributors. These distributors typically have geographic rights to distribute major beverage brands such as Budweiser, Pepsi, and Red Bull and call on every store in a given area such as major cities or regions. However, due to increasing costs over the last 20 years for these distributors to call on every store (sometimes referred to in the industry as “DSD” or direct store delivery), there has been a great deal of consolidation which has limited the options for new brands to gain distribution and retail shelf presence. Our management team believes that their history of success and experience working within this channel will allow SBG to be successful in building a strong network of these distributors.

In addition to working with these independent distributors, we also have distribution arrangements with national retail accounts to distribute some of our products directly through their warehouse operations.

6

E-commerce

“Qplash” is the consumer-packaged goods retail division of Splash Beverage Group and our first entry point into the growing e-commerce channel. The division sells beverages & groceries online through qplash.com, and third-party storefronts such as Amazon.com and Walmart.com. Inside of the division, there are two primary customer groups, B-to-B retail businesses, which in turn offer the products to their customers, and B-to-C, selling direct to end users.

Qplash sells to retailers through www.qplash.com. These retailers, generally in the high-end apparel space, are working to enhance their customers in store shopping experience. They offer high end beverages to for customers to enjoy while shopping or to take on the go. This program allows businesses to control inventory, order with payment terms, and the convenience of delivery directly to each store.

To the end user, we ship orders from our warehouses direct to their home or office. We offer competitive pricing, an easy & convenient transactional process, and a wide selection of products. Consumers can order from qplash.com, from our storefront on Amazon, or other third-party platforms. Amazon is a valuable revenue source as it allows us to access their loyal customer base and a high conversion rate as they are comfortable navigating and checking out.

Currently we offer over 350 listings and ship from Ontario, California. Later this year, we plan to activate additional warehouse partnerships, thus reducing shipping costs and the transit times while gaining access to several thousand additional items. Our objective is to offer 1,500 items by the spring of 2021.

Additionally, this vertically integrated platform affords SBG a unique opportunity to incubate, accelerate and ultimately migrate brands to traditional distribution.

Canfield Medical Supply, Inc.

Canfield Medical Supply, Inc. is a provider of home medical equipment, supplies and services (which relate to the equipment sales) in Ohio’s Mahoning Valley, Western Pennsylvania and Northern West Virginia, with an emphasis on providing for patients with mobility-related limitations who have had strokes, hip or knee replacements, and other surgeries after they are discharged from a hospital or rehab center.

7

Copa di Vino Wine Group, Inc. Products:

Copa Di Vino is the leading producer of premium wine by the glass in the United States. Founder and owner, James Martin discovered the concept on a bullet train adventure through the south of France. A year later he brought the technology to his hometown of The Dalles, Oregon located in the majestic Columbia River Gorge. His passion for wine led to Copa Di Vino – wine in a glass – a ready to drink wine glass that could go anywhere without the need for a bottle, corkscrew or glass. Just open and enjoy! Wine is no longer trapped in the bottle!

We currently have seven varietals of wine: Pinot Grigio, Riesling, Merlot, Chardonnay, White Zinfandel, Moscato, and Cabernet Sauvignon.

Pulpoloco is a sangria which is encased in a 100% biodegradable can made from paper.

You should carefully consider the risks described below as well as other information provided to you in this document, including information in the section of this document entitled “Information Regarding Forward Looking Statements.” If any of the following risks actually occur, the Company’s business, financial condition or results of operations could be materially adversely affected, the value of the Company’s Common Stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

An occurrence of an uncontrollable event such as the COVID-19 pandemic may negatively affect our operations and our ability to raise capital.

The occurrence of an uncontrollable event such as the COVID-19 pandemic may negatively affect our operations. A pandemic typically results in social distancing, travel bans and quarantine, and this may limit access to our facilities, customers, management, support staff and professional advisors. This event may also limit our ability to raise capital which as noted above could trigger certain rescission rights which could result in the Company’s incurring additional debt and preferred holders who may take preference over other common holders. These factors, in turn, may not only impact our operations, financial condition and demand for our products but our overall ability to react timely to mitigate the impact of this event. Also, it may hamper our efforts to comply with our filing obligations with the Commission.

If we are unable to continue as a going concern, our securities will have little or no value.

Although our audited financial statements for the year ended December 31, 2020 were prepared under the assumption that we would continue our operations as a going concern, the report of our independent registered public accounting firm that accompanies our financial statements for the year ended December 31, 2020 contains a going concern qualification in which such firm expressed substantial doubt about our ability to continue as a going concern, based on the financial statements at that time. Specifically, we have sustained recurring losses and we have had a working capital and stockholders’ equity deficits. These prior losses and expected future losses have had, and will continue to have, an adverse effect on our financial condition. In addition, continued operations and our ability to continue as a going concern may be dependent on our ability to obtain additional financing in the near future and thereafter, and there are no assurances that such financing will be available to us at all or will be available in sufficient amounts or on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we are unable to generate additional funds in the future through sales of our products, financings or from other sources or transactions, we will exhaust our resources and will be unable to continue operations. If we cannot continue as a going concern, our shareholders would likely lose most or all of their investment in us.

8

We have experienced recurring losses from operations and negative cash flows from operating activities and anticipate that we will continue to incur significant operating losses in the future.

We have experienced recurring losses from operations and negative cash flows from operating activities. We expect to continue to incur significant expenses related to our ongoing operations and generate operating losses for the foreseeable future. The size of our losses will depend, in part, on the rate of future expenditures and our ability to generate revenues. We incurred a net loss of $28.7 million for the year ended December 31, 2020. Our accumulated deficit increased to $61.6 million as of December 31, 2020 compared to the prior year’s deficit of $35.6 million.

We may encounter unforeseen expenses, difficulties, complications, delays, and other unknown factors that may adversely affect our financial condition. Our prior losses and expected future losses have had, and will continue to have, an adverse effect on our financial condition. If our products do not achieve sufficient market acceptance and our revenues do not increase significantly, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Our failure to become and remain profitable would decrease the value of our company and could impair our ability to raise capital, expand our business, diversify our product offerings or continue our operations. A decline in the value of our company could cause you to lose all or part of your investment.

9

If we are not able to successfully execute on our future operating plans, our financial condition and results of operation may be materially adversely affected, and we may not be able to continue as a going concern.

It is important that we meet our sales goals and increase sales going forward as our operating plan already reflects prior significant cost containment measures and may make it difficult to achieve top-line growth if further significant reductions become necessary. If we do not meet our sales goals, our available cash and working capital will decrease and our financial condition will be negatively impacted.

Demand for our products may be adversely affected by changes in consumer preferences or any inability on our part to innovate, market or distribute our products effectively, and any significant reduction in demand could adversely affect our business, financial condition or results of operations.

Our beverage portfolio is comprised of a number of unique brands with reputations and consumer imagery that have been built over time. Our investments in marketing as well as our strong commitment to product quality are intended to have a favorable impact on brand image and consumer preferences. Unfavorable publicity, or allegations of quality issues, even if false or unfounded, could tarnish our reputation and brand image and may cause consumers to choose other products. In addition, if we do not adequately anticipate and react to changing demographics, consumer and economic trends, health concerns and product preferences, our financial results could be adversely affected.

Volatility in the price or availability of the inputs we depend on, including raw materials, packaging, energy and labor, could adversely impact our financial results.

Our financial results could be adversely impacted by changes in the cost or availability of raw materials and packaging. Continued growth would require us to hire, retain and develop a highly skilled workforce and talented management team. Any unplanned turnover or our failure to develop an adequate succession plan for current positions could erode our competitiveness. In addition, our financial results could be adversely affected by increased costs due to increased competition for employees, higher employee turnover or increased employee benefit costs.

Changes in government regulation or failure to comply with existing regulations could adversely affect our business, financial condition and results of operations.

Our business and properties are subject to various federal, state and local laws and regulations, including those governing the production, packaging, quality, labeling and distribution of beverage products. In addition, various governmental agencies have enacted or are considering additional taxes on soft drinks and other sweetened beverages. Changes in existing laws or regulations could require material expenses and negatively affect our financial results through lower sales or higher costs.

We compete in an industry that is brand-conscious, so brand name recognition and acceptance of our products are critical to our success.

Our business is dependent upon awareness and market acceptance of our products and brands by our target market, trendy, young consumers looking for a distinctive tonality in their beverage choices. In addition, our business depends on acceptance by our independent distributors and retailers of our brands as beverage brands that have the potential to provide incremental sales growth. If we are not successful in the revitalization and growth of our brand and product offerings, we may not achieve and maintain satisfactory levels of acceptance by independent distributors and retail consumers. In addition, we may not be able to effectively execute our marketing strategies in light of the various closures and event cancellations caused by the COVID-19 outbreak. Any failure of our brand to maintain or increase acceptance or market penetration would likely have a material adverse effect on our revenues and financial results.

10

Our brands and brand images are keys to our business and any inability to maintain a positive brand image could have a material adverse effect on our results of operations.

Our success depends on our ability to maintain brand image for our existing products and effectively build up brand image for new products and brand extensions. We cannot predict whether our advertising, marketing and promotional programs will have the desired impact on our products’ branding and on consumer preferences. In addition, negative public relations and product quality issues, whether real or imagined, could tarnish our reputation and image of the affected brands and could cause consumers to choose other products. Our brand image can also be adversely affected by unfavorable reports, studies and articles, litigation, or regulatory or other governmental action, whether involving our products or those of our competitors.

Competition from traditional and large, well-financed non-alcoholic and alcoholic beverage manufacturers may adversely affect our distribution relationships and may hinder development of our existing markets, as well as prevent us from expanding our markets.

The beverage industry is highly competitive. We compete with other beverage companies not only for consumer acceptance but also for shelf space in retail outlets and for marketing focus by our distributors, all of whom also distribute other beverage brands. Our products compete with all non-alcoholic beverages and alcoholic, most of which are marketed by companies with substantially greater financial resources than ours. Some of these competitors are placing severe pressure on independent distributors not to carry competitive brands such as ours. We also compete with regional beverage producers and “private label” hydration suppliers.

Increased competitor consolidations, market-place competition, particularly among branded beverage products, and competitive product and pricing pressures could impact our earnings, market share and volume growth. If, due to such pressure or other competitive threats, we are unable to sufficiently maintain or develop our distribution channels, we may be unable to achieve our current revenue and financial targets. Competition, particularly from companies with greater financial and marketing resources than ours, could have a material adverse effect on our existing markets, as well as on our ability to expand the market for our products.

We compete in an industry characterized by rapid changes in consumer preferences and public perception, so our ability to continue developing new products to satisfy our consumers’ changing preferences will determine our long-term success.

Failure to introduce new brands, products or product extensions into the marketplace as current ones mature and to meet our consumers’ changing preferences could prevent us from gaining market share and achieving long-term profitability. Product lifecycles can vary and consumers’ preferences and loyalties change over time. Although we try to anticipate these shifts and innovate new products to introduce to our consumers, we may not succeed. Customer preferences also are affected by factors other than taste, such as health and nutrition considerations and obesity concerns, shifting consumer needs, changes in consumer lifestyles, increased consumer information and competitive product and pricing pressures. Sales of our products may be adversely affected by the negative publicity associated with these issues. In addition, there may be a decreased demand for our product as a result of the COVID-19 outbreak. If we do not adequately anticipate or adjust to respond to these and other changes in customer preferences, we may not be able to maintain and grow our brand image and our sales may be adversely affected.

Legislative or regulatory changes that affect our products, including new taxes, could reduce demand for products or increase our costs.

Taxes imposed on the sale of certain of our products by federal, state and local governments in the United States, or other countries in which we operate could cause consumers to shift away from purchasing our beverages. Several municipalities in the United States have implemented or are considering implementing taxes on the sale of certain “sugared” beverages, including non-diet soft drinks, fruit drinks, teas and flavored waters to help fund various initiatives. These taxes could materially affect our business and financial results.

11

Our reliance on distributors, retailers and brokers could affect our ability to efficiently and profitably distribute and market our products, maintain our existing markets and expand our business into other geographic markets.

Our ability to maintain and expand our existing markets for our products, and to establish markets in new geographic distribution areas, is dependent on our ability to establish and maintain successful relationships with reliable distributors, retailers and brokers strategically positioned to serve those areas. Most of our distributors, retailers and brokers sell and distribute competing products, including non-alcoholic and alcoholic beverages, and our products may represent a small portion of their businesses. The success of this network will depend on the performance of the distributors, retailers and brokers of this network. There is a risk that the mentioned entities may not adequately perform their functions within the network by, without limitation, failing to distribute to sufficient retailers or positioning our products in localities that may not be receptive to our product. Our ability to incentivize and motivate distributors to manage and sell our products is affected by competition from other beverage companies who have greater resources than we do. To the extent that our distributors, retailers and brokers are distracted from selling our products or do not employ sufficient efforts in managing and selling our products, including re-stocking the retail shelves with our products, our sales and results of operations could be adversely affected. Furthermore, such third-parties’ financial position or market share may deteriorate, which could adversely affect our distribution, marketing and sales activities.

Our ability to maintain and expand our distribution network and attract additional distributors, retailers and brokers will depend on a number of factors, some of which are outside our control. Some of these factors include:

| ● | the level of demand for our brands and products in a particular distribution area; | |

| ● | our ability to price our products at levels competitive with those of competing products; and | |

| ● | our ability to deliver products in the quantity and at the time ordered by distributors, retailers and brokers. |

We may not be able to successfully manage all or any of these factors in any of our current or prospective geographic areas of distribution. Our inability to achieve success with regards to any of these factors in a geographic distribution area will have a material adverse effect on our relationships in that particular geographic area, thus limiting our ability to maintain or expand our market, which will likely adversely affect our revenues and financial results.

It is difficult to predict the timing and amount of our sales because our distributors are not required to place minimum orders with us.

Our independent distributors and national accounts are not required to place minimum monthly or annual orders for our products. In order to reduce their inventory costs, independent distributors typically order products from us on a “just in time” basis in quantities and at such times based on the demand for the products in a particular distribution area. Accordingly, we cannot predict the timing or quantity of purchases by any of our independent distributors or whether any of our distributors will continue to purchase products from us in the same frequencies and volumes as they may have done in the past. Additionally, our larger distributors and national partners may make orders that are larger than we have historically been required to fill. Shortages in inventory levels, supply of raw materials or other key supplies could negatively affect us.

12

If we do not adequately manage our inventory levels, our operating results could be adversely affected.

We need to maintain adequate inventory levels to be able to deliver products to distributors on a timely basis. Our inventory supply depends on our ability to correctly estimate demand for our products. Our ability to estimate demand for our products is imprecise, particularly for new products, seasonal promotions and new markets. If we materially underestimate demand for our products or are unable to maintain sufficient inventory of raw materials, we might not be able to satisfy demand on a short-term basis. If we overestimate distributor or retailer demand for our products, we may end up with too much inventory, resulting in higher storage costs, increased trade spend and the risk of inventory spoilage. If we fail to manage our inventory to meet demand, we could damage our relationships with our distributors and retailers and could delay or lose sales opportunities, which would unfavorably impact our future sales and adversely affect our operating results. In addition, if the inventory of our products held by our distributors and retailers is too high, they will not place orders for additional products, which would also unfavorably impact our sales and adversely affect our operating results.

If we fail to maintain relationships with our independent contract manufacturers, our business could be harmed.

We do not manufacture our products but instead outsource the manufacturing process to third-party bottlers and independent contract manufacturers (co-packers). We do not own the plants or the majority of the equipment required to manufacture and package our beverage products, and we do not anticipate bringing the manufacturing process in-house in the future. Our ability to maintain effective relationships with contract manufacturers and other third parties for the production and delivery of our beverage products in a particular geographic distribution area is important to the success of our operations within each distribution area. We may not be able to maintain our relationships with current contract manufacturers or establish satisfactory relationships with new or replacement contract manufacturers, whether in existing or new geographic distribution areas. The failure to establish and maintain effective relationships with contract manufacturers for a distribution area could increase our manufacturing costs and thereby materially reduce gross profits from the sale of our products in that area. Poor relations with any of our contract manufacturers could adversely affect the amount and timing of product delivered to our distributors for resale, which would in turn adversely affect our revenues and financial condition. In addition, our agreements with our contract manufacturers are terminable at any time, and any such termination could disrupt our ability to deliver products to our customers.

Increases in costs or shortages of raw materials could harm our business and financial results.

The principal raw materials we use include glass bottles, aluminum cans, labels and cardboard cartons, aluminum closures, flavorings, sucrose/inverted pure cane sugar and sucralose. In addition, certain of our contract manufacturing arrangements allow such contract manufacturers to increase their charges to us based on their own cost increases. These manufacturing and ingredient costs are subject to fluctuation. Substantial increases in the prices of our ingredients, raw materials and packaging materials, to the extent that they cannot be recouped through increases in the prices of finished beverage products, would increase our operating costs and could reduce our profitability. If our supply of these raw materials is impaired or if prices increase significantly, it could affect the affordability of our products and reduce sales.

If we are unable to secure sufficient ingredients or raw materials including glass, sugar, and other key supplies, we might not be able to satisfy demand on a short-term basis. Moreover, in the past there have been industry-wide shortages of certain concentrates, supplements and sweeteners and these shortages could occur again from time to time in the future, which could interfere with and delay production of our products and could have a material adverse effect on our business and financial results.

13

In addition, suppliers could fail to provide ingredients or raw materials on a timely basis, or fail to meet our performance expectations, for a number of reasons, including, for example, disruption to the global supply chain as a result of the COVID-19 outbreak, which could cause a serious disruption to our business, increase our costs, decrease our operating efficiencies and have a material adverse effect on our business, results of operations and financial condition.

The volatility of energy and increased regulations may have an adverse impact on our gross margin.

Over the past few years, volatility in the global oil markets has resulted in variable fuel prices, which many shipping companies have passed on to their customers by way of higher base pricing and increased fuel surcharges. If fuel prices increase, we expect to experience higher shipping rates and fuel surcharges, as well as energy surcharges on our raw materials. It is hard to predict what will happen in the fuel markets in 2021 and beyond. Due to the price sensitivity of our products, we may not be able to pass such increases on to our customers.

Disruption within our supply chain, contract manufacturing or distribution channels could have an adverse effect on our business, financial condition and results of operations.

Our ability, through our suppliers, business partners, contract manufacturers, independent distributors and retailers, to make, move and sell products is critical to our success. Damage or disruption to our suppliers or to manufacturing or distribution capabilities due to weather, natural disaster, fire or explosion, terrorism, pandemics such as influenza and the novel coronavirus (COVID-19), labor strikes or other reasons, could impair the manufacture, distribution and sale of our products. Many of these events are outside of our control. Failure to take adequate steps to protect against or mitigate the likelihood or potential impact of such events, or to effectively manage such events if they occur, could adversely affect our business, financial condition and results of operations.

We rely upon our ongoing relationships with our key flavor suppliers. If we are unable to source our flavors on acceptable terms from our key suppliers, we could suffer disruptions in our business.

We currently purchase our flavor concentrate from various flavor concentrate suppliers, and continually develop other sources of flavor concentrate for each of our products. Generally, flavor suppliers hold the proprietary rights to their flavor specific ingredients. Although we have the exclusive rights to flavor concentrates developed with our current flavor concentrate suppliers, while we have the rights to the ingredients for our products, we do not have the list of ingredients for our flavor extracts and concentrates. Consequently, we may be unable to obtain these exact flavors or concentrates from alternative suppliers on short notice. If we have to replace a flavor supplier, we could experience disruptions in our ability to deliver products to our customers, which could have a material adverse effect on our results of operations.

If we are unable to attract and retain key personnel, our efficiency and operations would be adversely affected; in addition, management turnover causes uncertainties and could harm our business.

Our success depends on our ability to attract and retain highly qualified employees in such areas as finance, sales, marketing and product development. We compete to hire new employees, and, in some cases, must train them and develop their skills and competencies. We may not be able to provide our employees with competitive salaries, and our operating results could be adversely affected by increased costs due to increased competition for employees, higher employee turnover or increased employee benefit costs.

Recently, we have experienced significant changes in our key personnel, especially on our finance team, and more could occur in the future. Changes to operations, policies and procedures, which can often occur with the appointment of new personnel, can create uncertainty, may negatively impact our ability to execute quickly and effectively, and may ultimately be unsuccessful. In addition, management transition periods are often difficult as the new employees gain detailed knowledge of our operations, and friction can result from changes in strategy and management style. Management turnover inherently causes some loss of institutional knowledge, which can negatively affect strategy and execution. Until we integrate new personnel, and unless they are able to succeed in their positions, we may be unable to successfully manage and grow our business, and our financial condition and profitability may suffer.

14

Further, to the extent we experience additional management turnover, our operations, financial condition and employee morale could be negatively impacted. In addition, competition for top management is high and it may take months to find a candidate that meets our requirements. If we are unable to attract and retain qualified management personnel, our business could suffer. Moreover, our operations could be negatively affected if employees are quarantined as the result of exposure to a contagious illness such as COVID-19.

If we lose the services of our Chief Executive Officer, our operations could be disrupted and our business could be harmed.

Our business plan relies significantly on the continued services of Robert Nistico, our Chief Executive Officer. If we were to lose the services of Mr. Nistico, our ability to execute our business plan could be materially impaired. We are not aware of any facts or circumstances that suggest he might leave us.

If we fail to protect our trademarks and trade secrets, we may be unable to successfully market our products and compete effectively.

We rely on a combination of trademark and trade secrecy laws, confidentiality procedures and contractual provisions to protect our intellectual property rights. Failure to protect our intellectual property could harm our brand and our reputation, and adversely affect our ability to compete effectively. Further, enforcing or defending our intellectual property rights, including our trademarks, copyrights, licenses and trade secrets, could result in the expenditure of significant financial and managerial resources. We regard our intellectual property, particularly our trademarks and trade secrets to be of considerable value and importance to our business and our success, and we actively pursue the registration of our trademarks in the United States and internationally. However, the steps taken by us to protect these proprietary rights may not be adequate and may not prevent third parties from infringing or misappropriating our trademarks, trade secrets or similar proprietary rights. In addition, other parties may seek to assert infringement claims against us, and we may have to pursue litigation against other parties to assert our rights. Any such claim or litigation could be costly. In addition, any event that would jeopardize our proprietary rights or any claims of infringement by third parties could have a material adverse effect on our ability to market or sell our brands, profitably exploit our products or recoup our associated research and development costs.

As part of the licensing strategy of our brands, we enter into licensing agreements under which we grant our licensing partners certain rights to use our trademarks and other designs. Although our agreements require that the use of our trademarks and designs is subject to our control and approval, any breach of these provisions, or any other action by any of our licensing partners that is harmful to our brands, goodwill and overall image, could have a material adverse impact on our business.

If we encounter product recalls or other product quality issues, our business may suffer.

Product quality issues, real or imagined, or allegations of product contamination, even when false or unfounded, could tarnish our image and could cause consumers to choose other products. In addition, because of changing government regulations or implementation thereof, or allegations of product contamination, we may be required from time to time to recall products entirely or from specific markets. Product recalls could affect our profitability and could negatively affect brand image.

15

Our business is subject to many regulations and noncompliance is costly.

The production, marketing and sale of our beverages, including contents, labels, caps and containers, are subject to the rules and regulations of various federal, provincial, state and local health agencies. If a regulatory authority finds that a current or future product or production batch or “run” is not in compliance with any of these regulations, we may be fined, or production may be stopped, which would adversely affect our financial condition and results of operations. Similarly, any adverse publicity associated with any noncompliance may damage our reputation and our ability to successfully market our products. Furthermore, the rules and regulations are subject to change from time to time and while we closely monitor developments in this area, we cannot anticipate whether changes in these rules and regulations will impact our business adversely. Additional or revised regulatory requirements, whether labeling, environmental, tax or otherwise, could have a material adverse effect on our financial condition and results of operations.

Litigation or legal proceedings could expose us to significant liabilities and damage our reputation.

We may become party to litigation claims and legal proceedings. Litigation involves significant risks, uncertainties and costs, including distraction of management attention away from our business operations. We evaluate litigation claims and legal proceedings to assess the likelihood of unfavorable outcomes and to estimate, if possible, the amount of potential losses. Based on these assessments and estimates, we establish reserves and disclose the relevant litigation claims or legal proceedings, as appropriate. These assessments and estimates are based on the information available to management at the time and involve a significant amount of management judgment. Actual outcomes or losses may differ materially from those envisioned by our current assessments and estimates. Our policies and procedures require strict compliance by our employees and agents with all U.S. and local laws and regulations applicable to our business operations, including those prohibiting improper payments to government officials. Nonetheless, our policies and procedures may not ensure full compliance by our employees and agents with all applicable legal requirements. Improper conduct by our employees or agents could damage our reputation or lead to litigation or legal proceedings that could result in civil or criminal penalties, including substantial monetary fines, as well as disgorgement of profits.

We are subject to risks inherent in sales of products in international markets.

Our operations outside of the United States, contribute to our revenue and profitability, and we believe that developing and emerging markets could present future growth opportunities for us. However, there can be no assurance that existing or new products that we manufacture, distribute or sell will be accepted or be successful in any particular foreign market, due to local or global competition, product price, cultural differences, consumer preferences or otherwise. There are many factors that could adversely affect demand for our products in foreign markets, including our inability to attract and maintain key distributors in these markets; volatility in the economic growth of certain of these markets; changes in economic, political or social conditions, the status and renegotiations of the North American Free Trade Agreement, imposition of new or increased labeling, product or production requirements, or other legal restrictions; restrictions on the import or export of our products or ingredients or substances used in our products; inflationary currency, devaluation or fluctuation; increased costs of doing business due to compliance with complex foreign and U.S. laws and regulations. If we are unable to effectively operate or manage the risks associated with operating in international markets, our business, financial condition or results of operations could be adversely affected.

Climate change may negatively affect our business.

There is growing concern that a gradual increase in global average temperatures may cause an adverse change in weather patterns around the globe resulting in an increase in the frequency and severity of natural disasters. While warmer weather has historically been associated with increased sales of our products similar to ours, changing weather patterns could have a negative impact on agricultural productivity, which may limit availability or increase the cost of certain key ingredients. Also, increased frequency or duration of extreme weather conditions may disrupt the productivity of our facilities, the operation of our supply chain or impact demand for our products. In addition, the increasing concern over climate change may result in more regional, federal and global legal and regulatory requirements and could result in increased production, transportation and raw material costs. As a result, the effects of climate change could have a long-term adverse impact on our business and results of operations.

16

Our business and operations would be adversely impacted in the event of a failure or interruption of our information technology infrastructure or as a result of a cybersecurity attack.

The proper functioning of our own information technology (IT) infrastructure is critical to the efficient operation and management of our business. We may not have the necessary financial resources to update and maintain our IT infrastructure, and any failure or interruption of our IT system could adversely impact our operations. In addition, our IT is vulnerable to cyberattacks, computer viruses, worms and other malicious software programs, physical and electronic break-ins, sabotage and similar disruptions from unauthorized tampering with our computer systems. We believe that we have adopted appropriate measures to mitigate potential risks to our technology infrastructure and our operations from these IT-related and other potential disruptions. However, given the unpredictability of the timing, nature and scope of any such IT failures or disruptions, we could potentially be subject to downtimes, transactional errors, processing inefficiencies, operational delays, other detrimental impacts on our operations or ability to provide products to our customers, the compromising of confidential or personal information, destruction or corruption of data, security breaches, other manipulation or improper use of our systems and networks, financial losses from remedial actions, loss of business or potential liability, and/or damage to our reputation, any of which could have a material adverse effect on our cash flows, competitive position, financial condition or results of operations.

Our results of operations may fluctuate from quarter to quarter for many reasons, including seasonality.

Our sales are seasonal and we experience fluctuations in quarterly results as a result of many factors. companies similar to ours have historically generated a greater percentage of our revenues during the warm weather months of April through September. Timing of customer purchases will vary each year and sales can be expected to shift from one quarter to another. As a result, management believes that period-to-period comparisons of results of operations are not necessarily meaningful and should not be relied upon as any indication of future performance or results expected for the fiscal year.

Changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters could significantly affect our financial results.

The United States generally accepted accounting principles and related pronouncements, implementation guidelines and interpretations with regard to a wide variety of matters that are relevant to our business, such as, but not limited to, stock-based compensation, trade spend and promotions, and income taxes are highly complex and involve many subjective assumptions, estimates and judgments by our management. Changes to these rules or their interpretation or changes in underlying assumptions, estimates or judgments by our management could significantly change our reported results.

If we are unable to maintain effective disclosure controls and procedures and internal control over financial reporting, our stock price and investor confidence could be materially and adversely affected.

We are required to maintain both disclosure controls and procedures and internal control over financial reporting that are effective. Because of their inherent limitations, internal control over financial reporting, however well designed and operated, can only provide reasonable, and not absolute, assurance that the controls will prevent or detect misstatements. Because of these and other inherent limitations of control systems, there is only the reasonable assurance that our controls will succeed in achieving their goals under all potential future conditions. The failure of controls by design deficiencies or absence of adequate controls could result in a material adverse effect on our business and financial results, which could also negatively impact our stock price and investor confidence.

Due to the size of the Company, we have an inherent material weakness relating to Internal Controls over Financial Reporting.

17

We are dependent on a distiller in Mexico, to provide us with our finished SALT tequila product. Failure to obtain satisfactory performance from them or a loss of their services could cause us to lose sales, incur additional costs, and lose credibility in the marketplace.

We depend on a distiller in Mexico, a company in Jalisco, for the production, bottling, labeling, capping and packaging of our finished tequila product. We do not have a written agreement with our distiller in Mexico obligating it to produce our product. The termination of our relationship with our distiller in Mexico distiller or an adverse change in the terms of its services could have a negative impact on our business. If our distiller in Mexico increases its prices, we may not have alternative sources of supply at comparable prices and may not be able to raise the prices of our products to cover all, or even a portion, of the increased costs. In addition, if our distiller in Mexico fails to perform satisfactorily, fails to handle increased orders, or the loss of the services of our distiller in Mexico, along with delays in shipments of products, could cause us to fail to meet orders, lose sales, incur additional costs, and/or expose us to product quality issues. In turn, this could cause us to lose credibility in the marketplace and damage our relationships with our customers and consumers, ultimately leading to a decline in our business and results of operations.

Regulatory decisions and changes in the legal, regulatory and tax environment where our tequila is produced and where we operate could limit our business activities or increase our operating costs and reduce our margins.

Our business is subject to extensive regulation regarding production, distribution, marketing, advertising and labeling of beverage alcohol products in the U.S. and in Mexico, where our tequila is produced. We are required to comply with these regulations and maintain various permits and licenses. We are also required to conduct business only with holders of licenses to import, warehouse, transport, distribute, and sell spirits. We cannot assure you that these and other governmental regulations, applicable to our industry, will not change or become more stringent. Moreover, because these laws and regulations are subject to interpretation, we may not be able to predict when, and to what extent, liability may arise. Additionally, due to increasing public concern over alcohol-related societal problems, including driving while intoxicated, underage drinking, alcoholism and health consequences from the abuse of alcohol, various levels of government may seek to impose additional restrictions or limits on advertising or other marketing activities promoting beverage alcohol products. Failure to comply with any of the current or future regulations and requirements relating to our industry and products, could result in monetary penalties, suspension or even revocation of our licenses and permits. Costs of compliance with changes in regulations could be significant and could harm our business, as we may find it necessary to raise our prices in order to maintain profit margins, which could lower the demand for our products and reduce our sales and profit potential.

In addition, the distribution of beverage alcohol products is subject to extensive taxation both in the United States and internationally (and, in the United States, at both the federal and state government levels), and beverage alcohol products themselves are the subject of national import and excise duties in most countries around the world. An increase in taxation or in import or excise duties could also significantly harm our sales revenue and margins, both through the reduction of overall consumption and by encouraging consumers to switch to lower-taxed categories of beverage alcohol.

We face substantial competition in the alcoholic beverage industry and we may not be able to effectively compete.

Consolidation among spirits producers, distributors, wholesalers, or retailers could create a more challenging competitive landscape for our products. Consolidation at any level could hinder the distribution and sale of our products as a result of reduced attention and resources allocated to our brands, both during and after transition periods, because our brands might represent a smaller portion of the new business portfolio. Expansion into new product categories by other suppliers, or innovation by new entrants into the market, could increase competition in our product categories. Changes to our route-to-consumer models or partners in important markets could result in temporary or longer-term sales disruption, higher implementation-related or fixed costs, and could negatively affect other business relationships we might have with that partner. Distribution network disruption or fluctuations in our product inventory levels with distributors, wholesalers, or retailers could negatively affect our results for a particular period.

18

Our competitors may respond to industry and economic conditions more rapidly or effectively than we do. Our competitors offer products that compete directly with ours for shelf space, promotional displays, and consumer purchases. Pricing, (including price promotions, discounting, couponing, and free goods), marketing, new product introductions, entry into our distribution networks, and other competitive behavior by our competitors could adversely affect our sales margins, and profitability.

Our business operations may be adversely affected by social, political and economic conditions affecting market risks and the demand for and pricing of our tequila products. These risks include:

| ● | Unfavorable economic conditions and related low consumer confidence, high unemployment, weak credit or capital markets, sovereign debt defaults, sequestrations, austerity measures, higher interest rates, political instability, higher inflation, deflation, lower returns on pension assets, or lower discount rates for pension obligations; |

| ● | Changes in laws, regulations, or policies – especially those that affect the production, importation, marketing, sale, or consumption of our beverage alcohol products; |

| ● | Tax rate changes (including excise, sales, tariffs, duties, corporate, individual income, dividends, capital gains), or changes in related reserves, changes in tax rules or accounting standards, and the unpredictability and suddenness with which they can occur; |

| ● | Dependence upon the continued growth of brand names; |

| ● | Changes in consumer preferences, consumption, or purchase patterns – particularly away from tequila, and our ability to anticipate and react to them; bar, restaurant, travel, or other on premise declines; |

| ● | Unfavorable consumer reaction to our products, package changes, product reformulations, or other product innovation; |

| ● | Decline in the social acceptability of beverage alcohol products in our markets; |

| ● | Production facility or supply chain disruption; |

| ● | Imprecision in supply/demand forecasting; |

| ● | Higher costs, lower quality, or unavailability of energy, input materials, labor, or finished goods; |

| ● | Route-to-consumer changes that affect the timing of our sales, temporarily disrupt the marketing or sale of our products, or result in higher implementation-related or fixed costs; |

| ● | Inventory fluctuations in our products by distributors, wholesalers,

or retailers; Competitors’ consolidation or other competitive activities, such as pricing actions (including price reductions, promotions, discounting, couponing, or free goods), marketing, category expansion, product introductions, or entry or expansion in our geographic markets; |

| ● | Insufficient protection of our intellectual property rights; |

| ● | Product recalls or other product liability claims; product counterfeiting, tampering, or product quality issues; |

| ● | Significant legal disputes and proceedings; government investigations (particularly of industry or company business, trade or marketing practices); |

| ● | Failure or breach of key information technology systems; |

| ● | Negative publicity related to our company, brands, marketing, personnel, operations, business performance or prospects; and |

| ● | Business disruption, decline, or costs related to organizational changes, reductions in workforce, or other cost-cutting measures, or our failure to attract or retain key executive or employee talent. |

19

Uncertainty in the financial markets and other adverse changes in general economic or political conditions in any of the major countries in which we do business could adversely affect our industry, business and results of operations.

Global economic uncertainties, including foreign currency exchange rates, affect businesses such as ours in a number of ways, making it difficult to accurately forecast and plan our future business activities. There can be no assurance that economic improvements will occur, or that they would be sustainable, or that they would enhance conditions in markets relevant to us.

Our limited operating history makes it difficult to forecast our future results, making any investment in us highly speculative.

We have a limited operating history, and our historical financial and operating information is of limited value in predicting our future operating results. We may not accurately forecast customer behavior and recognize or respond to emerging trends, changing preferences or competitive factors facing us, and, therefore, we may fail to make accurate financial forecasts. Our current and future expense levels are based largely on our investment plans and estimates of future revenue. As a result, we may be unable to adjust our spending in a timely manner to compensate for any unexpected revenue shortfall, which could then force us to curtail or cease our business operations.

An investment in the Securities is speculative and there can be no assurance of any return on any such investment.

An investment in the Securities is speculative and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in the Company, including the risk of losing their entire investment.

Future sales of common stock, or the perception of such future sales, by some of our existing stockholders could cause our stock price to decline.

The market price of our common stock could decline as a result of sales of a large number of shares of our common stock in the market or the perception that these sales may occur. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell shares in the future at a time and at a price that we deem appropriate.

There is currently a limited liquid trading market for the Company’s Common Stock.

Our common stock is quoted on the OTCQB tier under the symbol “SBEV.” Trading in stocks quoted on the OTCQB is often thin and is characterized by wide fluctuations in trading prices due to many factors that may be unrelated to a company’s operations or business prospects. We cannot assure you that there will be a market in the future for our common stock.

OTCQB securities are not listed or traded on the floor of an organized national or regional stock exchange. Instead, OTCQB securities transactions are conducted through a telephone and computer network connecting dealers in stocks. OTCQB issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

20

Our Board of Directors may issue and fix the terms of shares of our Preferred Stock without stockholder approval, which could adversely affect the voting power of holders of our Common Stock or any change in control of our Company.

Our Articles of Incorporation authorize the issuance of up to 5,000,000 shares of “blank check” preferred stock, with no par value per share, with such designation rights and preferences as may be determined from time to time by the Board of Directors. Our Board of Directors is empowered, without shareholder approval, to issue shares of preferred stock with dividend, liquidation, conversion, voting or other rights which could adversely affect the voting power or other rights of the holders of our Common Stock. In the event of such issuances, the preferred stock could be used, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of our company.

Because certain principal stockholders own a large percentage of our voting stock, other stockholders’ voting power may be limited.

As of December 31, 2020 our ten (10) largest shareholders own or controlled approximately 52% of our outstanding common stock. If those stockholders act together, they would have the ability to have a substantial influence on matters submitted to our stockholders for approval, including the election and removal of directors and the approval of any merger, consolidation or sale of all or substantially all of our assets. As a result, our other stockholders may have little or no influence over matters submitted for shareholder approval. In addition, the ownership of such stockholders could preclude any unsolicited acquisition of us, and consequently, adversely affect the price of our common stock. These stockholders may make decisions that are adverse to your interests.

We do not expect to pay dividends and investors should not buy our Common Stock expecting to receive dividends.

We do not anticipate that we will declare or pay any dividends in the foreseeable future. Consequently, you will only realize an economic gain on your investment in our common stock if the price appreciates. You should not purchase our common stock expecting to receive cash dividends. Since we do not pay dividends, and if we are not successful in establishing an orderly trading market for our shares, then you may not have any manner to liquidate or receive any payment on your investment. Therefore, our failure to pay dividends may cause you to not see any return on your investment even if we are successful in our business operations. In addition, because we do not pay dividends we may have trouble raising additional funds which could affect our ability to expand our business operations.

Our common stock may be considered a “penny stock”, and thereby be subject to additional sale and trading regulations that may make it more difficult to sell.

Our common stock may be considered to be a “penny stock” if it does not qualify for one of the exemptions from the definition of “penny stock” under Section 3a51-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our common stock may be a “penny stock” if it meets one or more of the following conditions: (i) the stock trades at a price less than $5 per share; (ii) it is not traded on a “recognized” national exchange; or (iii) is issued by a company that has been in business less than three years with net tangible assets less than $5 million.

Our common stock could be further diluted as the result of the issuance of additional Common Shares, convertible securities, warrants or options.