Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - NELNET INC | aex992_22521xsupplement.htm |

| EX-99.1 - EX-99.1 - NELNET INC | aex991_22521xearningsrelea.htm |

| 8-K - 8-K - NELNET INC | nni-20210225.htm |

2020 Letter to Shareholders | Page 1 Dear Shareholder: 2020 will be a pivotal year in peoples’ memory. Most certainly, people for generations to come will reflect upon the global pandemic that consumed the attention of the planet. During the pandemic came historic tension because of racial injustices, unprecedented climate-driven events, and a brutal national election process. In mid-December, USA Today ran a survey that asked the question “In a single word, how would you describe the year 2020?” Twenty-three percent of people responded “awful, terrible, or horrible.” Fifteen percent responded with “[expletive].” (Frankly, that would have been my response.) Eleven percent responded with “challenging or difficult.” Ten percent said “disaster, catastrophic, hell.” Eight percent responded with “crazy, wild, unpredictable.” Six percent said “tumultuous, turbulent, whirlwind, or chaotic,” five percent said “anxious, stressful, or depressing,” and five percent said “OK, wonderful, good.” Only five percent classified it as a good year. It made me think about how I would categorize Nelnet’s year in one word. Pretty quickly, it came to me: resilient. Our earnings came in at an all-time high of $9.02 per share, including resilient core earnings, but also large gains from our ALLO and Hudl investments. Because of the pandemic, we also incurred large expenses for increases in provision for loan losses and impairment charges on certain investments. Every one of our core businesses rose to the year’s challenges and navigated uncharted waters that made all of us extremely proud of our fellow associates. In 2019, we spent a lot of time rededicating our people to stay focused on our core values and our purpose to serve our customers, our associates, our communities, and our shareholders. It could not have been better timing coming into the insanity of the year 2020. When the pandemic came into full focus in early March, we moved approximately 6,000 associates from an office environment to working from home in one week – and we did it with virtually zero disruption to our customers. We stayed focused on the health and welfare of our customers, our associates and their families, and our communities. We never lost sight of the financial health and bottom line of the corporation. As a senior management team, we remain dedicated stewards of the capital we have been entrusted to manage. February 25, 2021 // Pandemic and Working From Home

2020 Letter to Shareholders | Page 2 In addition to managing through the pandemic and the work from home environment, the largest uncertainty for our company in the last year has been actions by the federal government surrounding the student loan servicing procurement called the Next Generation Financial Servicing Environment (NextGen). NextGen is made up of components including the core servicing system, or Enhanced Processing System (EPS), and the customer service and processing work, or Business Process Operations (BPO), that is performed for borrowers using those systems. The procurement process has been rife with challenges and changes over the last five years. At the start of the pandemic, the Department of Education (Department) eliminated two of the three bidders in the EPS component, including Nelnet, and subsequently cancelled that version of the system procurement. They later awarded BPO contracts to other entities, but to our knowledge those contracts have not been implemented. The federal government has since issued another procurement and has then put that version on hold during the transition to the new Administration. We remain hopeful that the most recent procurement will move forward, and we are optimistic that, as we are continually the top-rated servicer in the nation, we will play an important role in government-funded loan servicing in the future. // NextGen Federal Servicing Procurement In the lead-up to the presidential election and in the current budget cycle, there has been significant public discussion and debate around the forgiveness of student loans. As the largest unsecured consumer lender in the world, the federal government has taken on the huge burden of lending $1.7 trillion to students. There are many sides to the discussion and the potential impact on the cost of higher education, on existing borrowers, and on future borrowers, as the government lends $140 billion in new funding each year. We are hopeful and confident that thoughtful policies will be implemented that are best for the people truly in need. We are ready to help implement those policies however we can when the decisions are finalized. // Loan Forgiveness Diversity and inclusion have become an extremely important topic of discussion in companies across the country. To be crystal clear, Nelnet has always been committed to equality in all forms, including race, gender, ethnic background, and sexual orientation. Nelnet leadership believes equality to be a key component in its corporate culture and crucial to the health of any organization. We believe organizational culture is set by the tone at the top and by implementing processes to ensure the intended culture is represented throughout an organization. Following the murder of George Floyd last summer, Nelnet made an unwavering commitment to stand in support of the Black community and be a part of the long-term solution to systemic racism and inequality in the world - because Black lives matter. For the leadership at Nelnet, it is important not to just make a statement, but to put meaningful, sustained, and multi-faceted action behind our words by working to ensure equitable opportunity and treatment for all people of color. // Diversity and Inclusion

2020 Letter to Shareholders | Page 3 Our leaders chose to focus on distinct initiatives where we believe we can use the company’s resources, influence, and data to create real change. As part of Nelnet’s commitment to deepen its support of organizations advancing racial and socioeconomic equality and social justice, we created the Service, Not Silence fundraising and volunteer campaign. Through this fundraiser, Nelnet associates could donate to local and national organizations advancing these issues. The money raised was matched by the Nelnet Foundation 3:1. The company created an aggressive goal of $1 million to give to these organizations and Nelnet hit that goal in a short period of time. To further Nelnet’s objective of creating an awesome work environment and furthering associate development, Better Together, Nelnet’s Diversity, Equity, and Inclusion Program, launched a robust mentoring program. The program is available to all associates, prioritizing mentorships for associates from underrepresented racial and ethnic groups. Having opportunities to build meaningful relationships with leadership is always a motivator to keep associates engaged. Associates participating in this program are partnered with tenured Nelnet leaders for guidance, support, and coaching. Better Together has also provided training sessions for all associates on cultural competence and unconscious bias. We also revised our scholarship program for the children of Nelnet associates to better recognize minority and low-income students. We have changed new hire recruiting methods, tactics, and strategies in order to increase pools of minority, female, veteran, and disabled candidates, in addition to creating specific programs to increase diversity throughout the company focused on race and gender. The company is making progress in the number of women working in leadership positions across the organization. Nelnet’s Board of Directors has an equal number of women and men, excluding our Executive Chairman Mike Dunlap. The company has acknowledged that people of color are underrepresented in leadership positions at Nelnet, and this needs to change. We are committed to have our workforce reflect the diversity in our communities. We know that we are not alone in corporate America in facing or tackling this challenge, and we are committed to the work. Pay equity is equal pay for work and experience of equal value. By paying associates fairly and consistently based on the role they perform, working conditions, and market data, companies can ensure that associates are not paid based on factors like gender, race, or ethnicity. We know that subjective factors can play a role in compensation, to the associate’s disadvantage or to their advantage. Nelnet launched a supplier diversity program to help us develop relationships with minority and women-owned companies to meet our business needs. In fact, we are committing to significantly increase our IT infrastructure spending with minority-owned suppliers. The Nelnet leadership team has committed to bringing analytical rigor to measuring and maintaining our progress in order to hold ourselves accountable for creating real change on all these fronts.

2020 Letter to Shareholders | Page 4 // Nelnet Renewable Energy I mentioned our funding of solar energy projects via tax equity financing in last year’s letter, and I’m proud to say that Nelnet continues to make a positive, indirect impact on the environment. We have now funded or committed to fund $149 million for the development and operations of over 214 megawatts of power at 86 community solar sites across the country. We continue to be encouraged by the financial yields offered by these investments and believe the federal tax incentives and operational cash flows are a great fit within our capital deployment strategy. Though it is counterintuitive, the accounting for these investments requires a significant write-down of these investments in the initial couple of years followed by a corresponding write-up in the latter years of investment. Meanwhile, the cash flow of these investments is front-loaded such that the next capital outlay at any given time is not significant. Though these investments may create unusual impacts to our earnings each year, we like the cash flows they generate. By the end of the hold period, the economic gain realized will also be realized in our earnings. As we’ve previously discussed, Nelnet continues to be innovative and provide value in current and new markets with existing and new services. In this regard, during 2020 we have expanded our footprint within renewable energy to be more than simply an investor but rather look to diversify and grow our service offering within the industry. Based on customer feedback, we determined there was a need in the market that we were well positioned to solve. We leveraged our loan servicing infrastructure and expertise to launch a solar subscription acquisition and management business for solar projects that are selling power to commercial and residential off-takers. In addition, we are utilizing our tax equity underwriting, market relationships, and asset management proficiency to bring other tax equity co-investors into the financing of solar projects. The renewable energy team is focused on continued innovation to diversify the services we offer and grow the margin earned within this space. We remain optimistic about the growth of this business and our ability to provide value within it, especially with the direction of the new Administration, corporate America, the momentum toward socially responsible management, and the need to combat climate change. // Nelnet Diversified Services It was anything but a dull year within our loan servicing operation. The division showed its resiliency amid a significant amount of volatility which is demonstrated in its revenue for the year of over $497 million. The earnings for the year were a bit choppy due to multiple events tied to the federal government and the pandemic. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which was passed by Congress and signed into law by President Trump on March 27, 2020, effectively put all direct student loans into a zero-interest forbearance status. In response, the Department of Education’s office of Federal Student Aid lowered the rates that it pays student loan servicers per borrower due to the unique status of all loans going into forbearance. As you can imagine, the COVID forbearance took away a significant portion of NDS’s workload. We knew we had an opportunity to find new things for our associates in these roles to do so we could retain these hard-working associates. This was especially important when keeping in mind that at some point all the loans will exit the forbearance status and millions of borrowers will need trained and experienced people to help them navigate back into repayment. Further complicating the process was the unknown date of when the CARES Act forbearance would end – as of the publication of this letter, President Biden has extended it through September 30, 2021.

2020 Letter to Shareholders | Page 5 // Nelnet Financial Services There are many products and services we offer within our Nelnet Financial Services division, but the primary revenue and net income driver is our student loan asset management business, which is driven by loan volume and how we finance those loans in the capital markets. As you are all acutely aware, 2020 saw many highs and lows in the capital markets. We went into the pandemic-induced downturn well-positioned to take advantage of market turmoil – and emerged stronger nine months later. This is another shining example of the resiliency of our business. From a macro perspective, the sudden drop in interest rates was very beneficial to our fixed rate loan portfolio that was only partially hedged. Moreover, during the depth of the crisis, we spent $33 million to acquire student loan residuals with 15% to 20% expected returns. Those residuals effectively correlate to approximately $550 million in loans and complement the $1.6 billion in whole loans we acquired during the year. Lastly, the disruption in fixed income trading caused spreads to widen to levels not seen since the credit crisis. We were buyers throughout 2020 and capitalized on the lower prices to add over $400 million to our assets under management at Whitetail Rock, our SEC-registered investment advisor. We were able to leverage hundreds of our associates for different opportunities that were presenting themselves as a part of the pandemic, such as for the states of Nebraska and Wisconsin to help process record levels of unemployment claims and to perform contact tracing. Although these activities did not fully offset the lost revenue due to the CARES Act, they did help mitigate the severity and helped us retain people to be able to serve borrowers once it expires. Another excellent opportunity presented itself toward the end of the year when Wells Fargo launched a process to sell its $10 billion private student loan portfolio and the accompanying servicing business. We have always prided ourselves on opportunistic acquisitions of loan portfolios. Taking on that level of servicing in one fell swoop is definitely within the ordinary course of business given our level of expertise and experience. However, the approximately $1 billion dollars of capital to fund the 10 times leverage one can put on a private loan portfolio was a bit larger than our appetite for capital investment in a single transaction. We were fortunate enough to join with some large entities who funded the vast majority of equity in the transaction and we will assume all of the servicing, growing our number of private loan servicing borrowers by over 70%. We are looking forward to executing this transaction during the first half of 2021 and putting up to $100 million of additional capital to work as a partial owner of the assets. With these successes and the continued deployment of the Velocity loan servicing system we remain optimistic about the future of our servicing business.

2020 Letter to Shareholders | Page 6 // Nelnet Bank More great news came in 2020 with the launch of Nelnet Bank. After years of hard work, we felt very fortunate to be granted approval by the FDIC and Utah Department of Financial Institutions for federal deposit insurance and an Industrial Bank Charter, respectively. After the charter was granted, our bank team worked tirelessly to stand up the entity and we launched Nelnet Bank on November 2. It was the first new industrial bank launched since 2008. A true virtual bank with one physical location in Salt Lake City, Nelnet Bank is now receiving institutional deposits and making loans every day. We are elated at this accomplishment and confident we can add value to our customers, our communities, and our shareholders with state-of-the-art systems and loan products. We believe the bank will be a key part of our asset replacement strategy as our FFELP program continues to run off. We are originating refinance loans and will be launching an in-school private student loan product in 2021. We could not be more excited about innovation at Nelnet in the form of a new bank launch. // Nelnet Business Services Nelnet Business Services (NBS) is a diversified international business that specializes in facilitating education commerce. Our diversified revenue streams are resilient in challenging times because most of our revenue streams are recurring in nature. In fact, resilience is the perfect way to describe Nelnet Business Services’ performance in 2020. Our ability to increase earnings 6% over 2019 was the financial measure of resilience. The year could have been much different under COVID-19 than what we experienced. The effort to achieve consistent earnings was the direct result of a solid business model, loyal customers, and the adaptability of the Nelnet Business Services team members. We could not be prouder of the way our team members responded to pandemic impacts. Once at home, our team members continued to perform at high levels, efficiency did not decline, calls were answered, chats were completed, and emails sent – all because of a resilient team of people dedicated to the mission of our clients. I also want to give a special thanks to our Australian team members. Australia, and our office in Melbourne, was effectively shut down for the longest period of any of our locations. The team in Australia exhibited resolve and resilience in dealing with the most significant restrictions anywhere in our company. NBS produced more net income in 2020 than in 2019. We begin 2021 with anticipation that vaccine deployment will return both K-12 education and higher education to normalcy in the fall of 2021. Our team members stand ready to support our clients, our families, and our students no matter what the future brings.

2020 Letter to Shareholders | Page 7 // FACTS Management We serve over 11,000 private faith-based K-12 schools in the United States and in over 50 countries worldwide. Our revenue streams from these schools are derived from licensing fees for software used to manage schools, transaction- based fees for creating and presenting bills, processing payments, and offering deferred payment plans to help families afford tuition. Of particular importance this year was our capability to process financial aid applications. Traditionally, we supported our school clients in processing applications from families and evaluating whether they qualify for need-based aid, and then allocating limited funds in the form of need-based scholarships. Because of the design of our flexible systems and service capability, we were able to help states allocate CARES Act funding to families struggling with COVID-19 financial impacts to keep their children in a school of their choice. Throughout the last half of the year, our Nelnet Business Services division was working on two strategic acquisitions that eventually closed at year-end: Catholic Faith Technologies (CFT), based in Overland Park, Kan. and Higher School Instructional Services (Higher School), based in New York City. CFT was formed in 2010 and has a powerful and customizable learning and content management platform for churches and non-education corporate customers – two markets where we are looking to expand our NBS products and services. Their platform is branded as CFT in the faith-based market and as CD2 Learning (CD2) in the public and private business sector. The expansion into online learning management technologies for church and faith-based communities complements our Aware3 church member engagement platform. Like our FACTS Management business, CFT has a relationship with over 35 Archdioceses and ministries in the U.S., as well as internationally. This acquisition allows us to continue to advance our mission to “Make Educational Dreams Possible with Service and Technology.” Additionally, CD2 will meet one of our primary initiatives to diversify and grow in new vertical markets. There are lots of students falling behind despite the efforts of our public and private school systems. We are committed to helping students catch up through FACTS Education Solutions. FACTS Education Solutions helps students catch up through focused tutoring services paid for by the Department’s Title I Program. We also help teachers with professional development through the Title II program. Both programs were in great demand as teachers needed to learn how to teach virtually and help kids that had a difficult time with the transition. The acquisition of Higher School as of December 31, 2020 complements FACTS Education Solutions’ existing business. Founded in 2004, Higher School has an outstanding reputation in the academic services market and is dedicated to improving outcomes for their students and educators. Over the past nine years, Higher School has developed a strong partnership with approximately 50 Yeshiva schools in New York City, one of the fastest growing faith-based markets in the country. Higher School's experience and deep knowledge of the largest K-12 system in the U.S. will support FACTS Education Solutions’ continued growth.

2020 Letter to Shareholders | Page 8 // Nelnet Campus Commerce In the United States and Australia, Nelnet Campus Commerce serves over 1,200 higher education institutions. In 2020, higher education saw a significant decrease in enrollment, with many students taking gap years when faced with the prospect of losing an in-person higher education learning experience. Our business was resilient to lower enrollment, because of the recurring nature of our revenue streams, and because of the high retention rate and loyalty we achieve with our higher education clients. However, most of the services we offer remain enrollment dependent – for example, the creation and presentation of a bill to a student, helping a student or family with a deferred payment plan, or a payment or refund processed for a student. The loyalty we have to our clients and they have to us has been built up over many years. This was reflected in the high retention rates we maintained with our clients and, in almost every case, we were able to maintain or grow these service relationships. We look forward to seeing expanded enrollment in higher education with vaccine deployment and the return of more students to campus in the fall of 2021. // Nelnet Communication Services Another shining beacon in the Nelnet portfolio of companies in 2020 was the validation of the business model and our investment in ALLO Communications. As the pandemic unfolded, it became absolutely clear to everyone that high speed broadband is critical in a work from home, school from home, teach from home environment – not to mention the impact of social distancing on gaming and remote social activities. In my household, everyone put massive simultaneous stress on our ALLO internet. I am like tens of thousands of our customers; I can’t even imagine living without it. As I have previously stated publicly, if my family had to choose between me and their ALLO service, I don’t think it would be a very difficult decision. The demand from mid-sized cities and rural areas for ALLO’s service is insatiable. With the growing demand for fiber becoming greater and greater throughout the year, we decided to enter into a transaction in the fourth quarter to restructure ALLO’s balance sheet and provide additional funding for ALLO’s growth. SDC Capital Partners invested $197 million for an approximate 48% equity interest in ALLO. Nelnet retained just over 45%. The investment, combined with ALLO’s $230 million debt facility structured in January of 2021, will position ALLO for accelerated growth not solely reliant upon Nelnet. As a result of these transactions, ALLO paid Nelnet $260 million to redeem preferred interests held by Nelnet. Currently, Nelnet holds approximately $130 million of additional preferred ALLO interests earning 6.25%. Overall, Nelnet recognized a pretax gain of $259 million in the fourth quarter, or more than $5.00 per share in 2020. As a result, ALLO is now treated as an equity-method investment and no longer consolidated as part of Nelnet’s financial statements.

2020 Letter to Shareholders | Page 9 // Hudl Resilience was also a key theme for Hudl in 2020. When sports paused globally in March, the company quickly worked to strengthen its capital position and launch a number of new initiatives. This ensured the company could stay true to its mission and serve coaches, athletes, and analysts in the best way possible. Hudl launched its Return to Play initiative, allowing schools to sign a multi-year agreement to upgrade to a school-wide package. These deals provided both short-term budget relief for the school and long-term account growth for the company. Most importantly, these school-wide packages promote equity across sports and genders by providing the same tools for all athletes and coaches. In total, around 4,000 schools participated in Hudl’s Return to Play program. Last year, we discussed Hudl’s acquisition of the Italy-based company Wyscout. Wyscout boasts the largest soccer video archive in the world, with more than 210,000 full matches analyzed across 90 countries, and more than 550,000 players profiled on the platform. Since the acquisition, Hudl has worked to integrate Wyscout into Hudl’s family of products and expand distribution through the company’s global sales reach. That work couldn’t have proven more timely as travel restrictions shut down global talent scouting and recruiting efforts, pushing everyone to video scouting and leading to significant increases in platform utilization. Two years ago, we talked about Hudl’s acquisition of the Netherlands-based company Incatec and the subsequent launch of Hudl Focus, the company’s automatic capture, upload, and livestream solution. Hudl Focus played a huge role this year to help teams make every moment count. With fan restrictions in most of the country, schools relied even more on the company’s livestream offering to keep fans and athletes connected. In 2020, the company roughly tripled the number of Hudl Focus cameras installed. Not to be left behind, the company’s media division – focused on highlights, athletes, fans, and brands – saw significant brand partnership growth in 2020. More brands turned to the platform for unique ways to connect with both athletes and the company’s highly-coveted demographic of fans. As we’ve shared before, Hudl completed a significant financing round in May 2020. In addition to Nelnet’s approximately $26 million participation in the round and further funding from other current investors, Hudl also added Bain Capital’s expertise to the mix. As part of the round, all investors have the opportunity to participate in a follow-on investment in May 2021, and Nelnet expects to fully participate in the second tranche. // Mike Dunlap's Thoughts on the Market It is our goal for each Nelnet shareholder to record a gain or loss in market value proportional to the gain or loss in per-share fundamental value recorded by the company. To achieve this goal, we strive to maintain a one-to-one relationship between the company’s fundamental value and market price. As that implies, we would rather see Nelnet’s stock price at a fair level than at an artificial level. Our fair value approach may not be preferred by all investors, but we believe it aligns with Nelnet’s long-term approach to both our business model and market value. However, from time to time Mrs./Mr. Market can be irrational and will materially overvalue or undervalue the investment style they currently love.

2020 Letter to Shareholders | Page 10 Here’s an excerpt from an article I wrote in February 2000: “’Internet/NASDAQ,’ ‘Biotech,’ ‘Nifty Fifty,’ ‘1929.’ What do all of these things have in common? They are all speculative bubbles. Today, there are warning signs we may be in a speculative bubble. Many believe it is different this time, that we are in a new paradigm. However, fear and greed still run the market. Currently we are in the greed phase. People are buying stock, not based on the discounted cash flow the stock will pay out to shareholders, but with a hope and prayer a greater fool will buy it from them in the near future for a far higher price.” Today, we are once again living in wild and crazy times. How do you know you are in a bubble? My dad’s 84-year-old close friend asked me to explain Bitcoin and whether or not he should buy some. Some other friends are asking me about GameStop and AMC Theaters. What happens when the government increases liquidity exponentially, maybe infinitely, and pours trillions of dollars of cash into the economy? When there is more money than investable assets? The magic about the market is it will create new options. Many companies with negative earnings, suspect business plans, and questionable long-term prospects are entering the public markets through IPOs, direct listings, and Special Purpose Acquisition Companies (SPACs) for billions and billions of dollars. In May 1999, I went to a Young Presidents’ Organization Technology University in San Francisco. I have many interesting, funny, and informative memories from this meeting, but I am going to share the top three. Number 3. In the 20 years from 1979 to 1999, there was more wealth created within a twenty-mile radius of downtown San Francisco than in all of Europe since World War II. I would guess if you did the same analysis again from 1999-2021 it may be true again. Number 2. e.Schwab was set up as a distinct separate company with its own offices across town. In 18 months, the new e.Schwab took over the original Charles Schwab. Number 1. I was in a small breakout session with about 20 c-suite executives with several new dot.com companies and the likes of Yahoo, Palm, Amazon, and CNET. The CEO of Williams-Sonoma was presenting. Howard Lester was 67 years old and had worked decades of blood, sweat, and tears to build Williams-Sonoma into a household brand. At the time, the company had roughly a $2 billion market value and around $100 million in earnings. One interesting fact that he shared was that wherever they had a store location their mail order sales increased tenfold. But the funniest and truest thing he said was, “Someday all of you dot.com companies are going to have to make real money and you can take your Yahoo money and shove it up your a$#.” What does any of this have to do with Nelnet? I am now the 57-year-old version of Howard. I am not sure how funny I think it is when all of these companies that lose money, but are master marketers at selling hype, are going public quickly while the market is hot through SPACs (giving up to 20% dilution in exchange for speed and ease) for multiples of Nelnet’s market value. The magic question I ask myself is how many will be here 22 years from now? Our goal at Nelnet is to be here decades into the future and for our stock to trade for a fair value. When we make investments and buy businesses, we look at the discounted cash we will create over time and then look for ways to reinvest that cash into the future. As you read in Jeff’s letter, we have a decent track record. We are owner shareholders and treat our shareholders’ cash like it is our own – because it is.

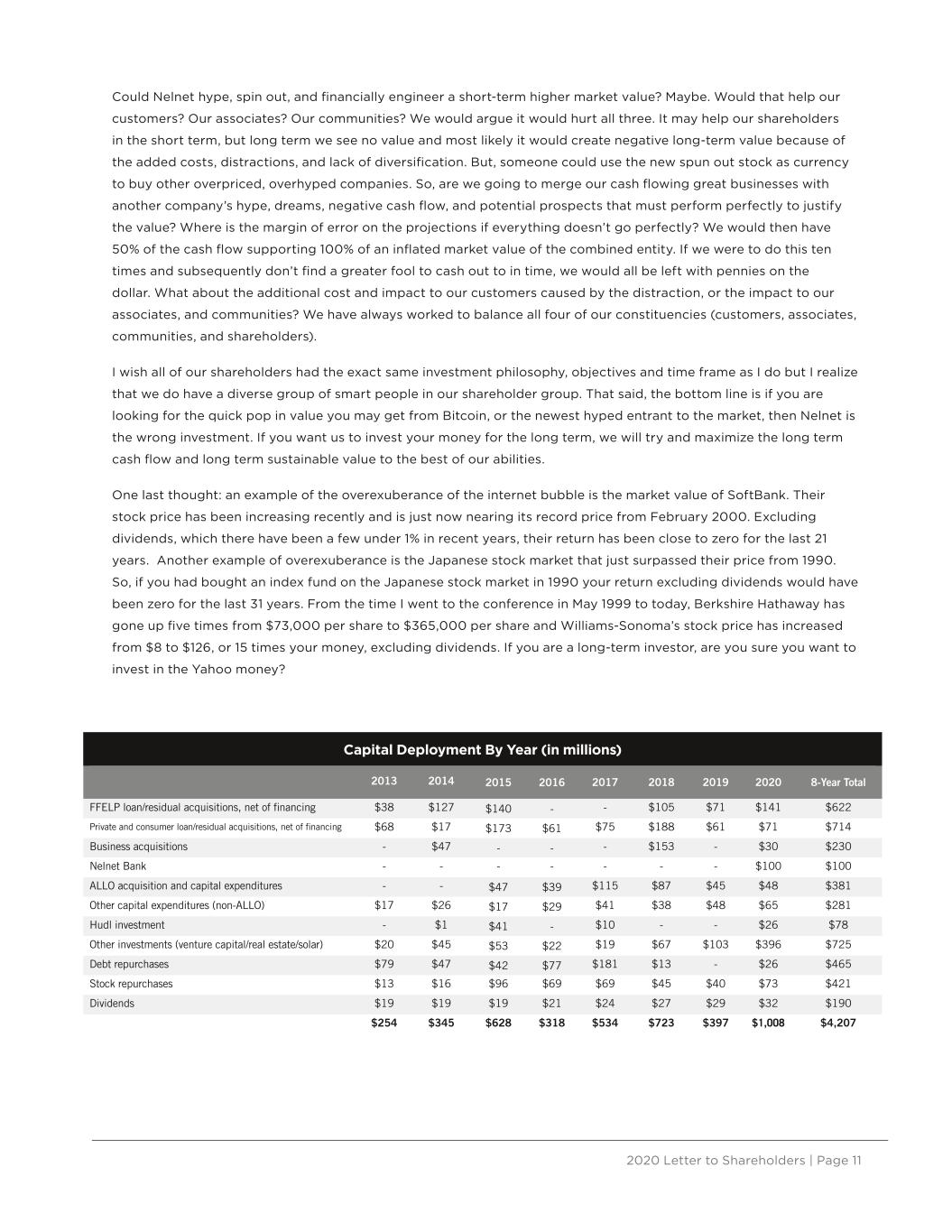

2020 Letter to Shareholders | Page 11 Could Nelnet hype, spin out, and financially engineer a short-term higher market value? Maybe. Would that help our customers? Our associates? Our communities? We would argue it would hurt all three. It may help our shareholders in the short term, but long term we see no value and most likely it would create negative long-term value because of the added costs, distractions, and lack of diversification. But, someone could use the new spun out stock as currency to buy other overpriced, overhyped companies. So, are we going to merge our cash flowing great businesses with another company’s hype, dreams, negative cash flow, and potential prospects that must perform perfectly to justify the value? Where is the margin of error on the projections if everything doesn’t go perfectly? We would then have 50% of the cash flow supporting 100% of an inflated market value of the combined entity. If we were to do this ten times and subsequently don’t find a greater fool to cash out to in time, we would all be left with pennies on the dollar. What about the additional cost and impact to our customers caused by the distraction, or the impact to our associates, and communities? We have always worked to balance all four of our constituencies (customers, associates, communities, and shareholders). I wish all of our shareholders had the exact same investment philosophy, objectives and time frame as I do but I realize that we do have a diverse group of smart people in our shareholder group. That said, the bottom line is if you are looking for the quick pop in value you may get from Bitcoin, or the newest hyped entrant to the market, then Nelnet is the wrong investment. If you want us to invest your money for the long term, we will try and maximize the long term cash flow and long term sustainable value to the best of our abilities. One last thought: an example of the overexuberance of the internet bubble is the market value of SoftBank. Their stock price has been increasing recently and is just now nearing its record price from February 2000. Excluding dividends, which there have been a few under 1% in recent years, their return has been close to zero for the last 21 years. Another example of overexuberance is the Japanese stock market that just surpassed their price from 1990. So, if you had bought an index fund on the Japanese stock market in 1990 your return excluding dividends would have been zero for the last 31 years. From the time I went to the conference in May 1999 to today, Berkshire Hathaway has gone up five times from $73,000 per share to $365,000 per share and Williams-Sonoma’s stock price has increased from $8 to $126, or 15 times your money, excluding dividends. If you are a long-term investor, are you sure you want to invest in the Yahoo money? Capital Deployment By Year (in millions) 2013 2014 2015 2016 2017 2018 2019 2020 8-Year Total FFELP loan/residual acquisitions, net of financing $38 $127 $140 - - $105 $71 $141 $622 Private and consumer loan/residual acquisitions, net of financing $68 $17 $173 $61 $75 $188 $61 $71 $714 Business acquisitions - $47 - - - $153 - $30 $230 Nelnet Bank - - - - - - - $100 $100 ALLO acquisition and capital expenditures - - $47 $39 $115 $87 $45 $48 $381 Other capital expenditures (non-ALLO) $17 $26 $17 $29 $41 $38 $48 $65 $281 Hudl investment - $1 $41 - $10 - - $26 $78 Other investments (venture capital/real estate/solar) $20 $45 $53 $22 $19 $67 $103 $396 $725 Debt repurchases $79 $47 $42 $77 $181 $13 - $26 $465 Stock repurchases $13 $16 $96 $69 $69 $45 $40 $73 $421 Dividends $19 $19 $19 $21 $24 $27 $29 $32 $190 $254 $345 $628 $318 $534 $723 $397 $1,008 $4,207

2020 Letter to Shareholders | Page 12 Nelnet’s Corporate Performance (Annual Percentage Change) Nelnet Per Share Book Value With Dividends Included Nelnet Per Share Market Value With Dividends Included S&P 500 With Dividends Included Net Income Reinvested1 (in millions) 2004 49.2% 20.2% 10.9% $149 2005 41.5% 51.1% 4.9% $181 2006 6.3% (32.7%) 15.8% $6 2007 (1.6%) (52.5%) 5.5% ($63) 2008 6.6% 13.3% (37.0%) $24 2009 21.0% 20.7% 26.5% $135 2010 23.7% 41.6% 15.1% $115 2011 22.6% 4.9% 2.1% $160 2012 16.7% 27.5% 16.0% $89 2013 26.1% 42.8% 32.4% $271 2014 21.1% 10.9% 13.7% $273 2015 16.0% (26.6%) 1.4% $153 2016 15.4% 52.7% 12.0% $166 2017 8.8% 9.1% 21.8% $80 2018 9.9% (3.2%) (4.4%) $156 2019 6.2% 12.7% 31.5% $72 2020 15.6% 23.7% 18.4% $247 CAGR/Total 17.3% 8.4% 9.6% $2,214 1We believe well-managed companies do not distribute to the shareholders all their earnings. Instead, they retain a part of their earnings and reinvest the capital to grow the business. Since going public in late 2003, the company has recognized $3.2 billion in cumulative net income and, of that amount, has reinvested $2.2 billion – or 69% of our earnings over time – back into the business.

2020 Letter to Shareholders | Page 13 Without a doubt we have some strong opinions about the debt and equity markets and our focus on running Nelnet for the long term. When we look ahead, we often say it is hard to plan too many years out as the speed of change in the world is inspiring. As we grow and navigate uncharted waters in the post-pandemic era, our goal is to be able to adapt, innovate, and implement change quickly within our company. If we were to summarize in one word what we believe will describe 2021, it would be optimism. We believe in the resiliency of humankind and specifically in the resiliency of America and the American Dream. Although it may be cautious optimism, we are still very excited about all of the businesses we are in as we have extreme faith in our people and the culture we have built to empower them to provide our customers with exceptional service and ensure we are good stewards of the capital you have entrusted us to invest. Dream. Learn. Grow. Jeff Noordhoek, Chief Executive Officer // Closing Nelnet Board of Directors Michael S. Dunlap James P. Abel Preeta Bansal William R. Cintani Kathleen A. Farrell Ph.D. David Graff Thomas E. Henning Joann Martin Kimberly Rath Nelnet Bank Board of Directors Michael S. Dunlap Tim Tewes Carine Strom Clark Connie Edmond Anthony Goins Crawford Cragun Jaime Pack Andrea Moss

2020 Letter to Shareholders | Page 14 Forward-Looking and Cautionary Statements This letter to shareholders contains forward-looking statements within the meaning of federal securities laws. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “would,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements. These statements are based on management's current expectations as of the date of this letter and are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to: risks and uncertainties related to the severity, magnitude, and duration of the Coronavirus Disease 2019 ("COVID-19") pandemic, including changes in the macroeconomic environment and consumer behavior, restrictions on business, educational, individual, or travel activities intended to slow the spread of the pandemic, and volatility in market conditions resulting from the pandemic; risks related to the ability to successfully maintain and increase allocated volumes of student loans serviced by the company under existing and any future servicing contracts with the Department, which current contracts accounted for 27 percent of the company's revenue in 2020; risks to the company related to the Department's initiatives to procure new contracts for federal student loan servicing and awards of contracts to other parties, including the pending and uncertain nature of the Department's procurement process, the possibility that awards or other evaluations of proposals may be challenged by various interested parties and may not be finalized or implemented for an extended period of time or at all, risks that the company may not be successful in obtaining any of such potential new contracts, and risks related to the company's ability to comply with agreements with third-party customers for the servicing of loans; risks related to the company's loan portfolio, such as interest rate basis and repricing risk and changes in levels of loan repayment or default rates; the use of derivatives to manage exposure to interest rate fluctuations; the uncertain nature of expected benefits from FFEL Program, private education, and consumer loan purchases and initiatives to purchase additional FFEL Program, private education, and consumer loans; financing and liquidity risks, including risks of changes in the securitization and other financing markets for loans; risks and uncertainties from changes in terms of education loans and in the educational credit and services marketplace resulting from changes in applicable laws, regulations, and government programs and budgets, such as changes resulting from the Coronavirus Aid, Relief, and Economic Security Act and the expected decline over time in FFEL Program loan interest income due to the discontinuation of new FFEL Program loan originations in 2010 and the resulting initiatives by the company to adjust to a post-FFEL Program environment; risks and uncertainties of the expected benefits from the November 2020 launch of Nelnet Bank operations, including the ability to successfully conduct banking operations and achieve expected market penetration; risks related to the expected benefits to the company and to ALLO from the recapitalization and additional funding for ALLO and the company’s continuing investment in ALLO, and risks related to investments in solar projects, including risks of not being able to realize tax credits which remain subject to recapture by taxing authorities; risks and uncertainties related to other initiatives to pursue additional strategic investments, acquisitions, and other activities, such as the planned transactions associated with the sale by Wells Fargo of its private education loan portfolio, including activities that are intended to diversify the company both within and outside of its historical core education-related businesses; risks from changes in economic conditions and consumer behavior; cybersecurity risks, including potential disruptions to systems, disclosure of confidential information, and/or damage to reputation resulting from cyber-breaches; and changes in the general interest rate environment, including the availability of any relevant money-market index rate such as LIBOR or the relationship between the relevant money-market index rate and the rate at which the company's assets and liabilities are priced. For more information, see the "Risk Factors" sections and other cautionary discussions of risks and uncertainties included in documents filed or furnished by the company with the Securities and Exchange Commission (SEC), including the most recent form 10-K filed by the company with the SEC. All forward- looking statements in this letter are as of the date of this letter. Although the company may voluntarily update or revise its forward-looking statements from time to time to reflect actual results or changes in the company's expectations, the company disclaims any commitment to do so except as required by law.