Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - ALBIREO PHARMA, INC. | tm216227d1_ex99-2.htm |

| 8-K - FORM 8-K - ALBIREO PHARMA, INC. | tm216227d1_8k.htm |

Exhibit 99.1

©2021 Albireo Pharma, Inc. All rights reserved Commercial Day: Road to $1 Billion February 11, 2021

2 ©2021 Albireo Pharma, Inc. All rights reserved Forward Looking Statements This presentation includes forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Forward - looking statements include statements, other than statements of historical fact, regarding , among other things : the timing to achieve revenues, and the amount of such revenues, from sales of odevixibat, should it receive FDA approval for on e or more indications; plans for, or progress, scope, cost, initiation, duration, enrollment, results or timing for availability of results of, development activities, nonclinical studi es and clinical trials of odevixibat or any other Albireo product candidate or program, such as the target indication(s) for development or approval, the size, design, population, location, conduct, cost, objective, enrollment, duratio n or endpoints of any clinical trial, or the timing for initiation or completion of or availability or reporting of results from any clinical trial, including the long - term open - label extension study for odevixibat in PFIC, the piv otal trial of odevixibat in biliary atresia or the pivotal trial of odevixibat in Alagille syndrome (ALGS), for submission of any regulatory filing, or for discussions with regulatory authorities; the timing of and our ability to obt ain and maintain regulatory approval of any of our product candidates, and any related restrictions, limitations, or warnings in the label of any approved product candidates; the potential approval and commercialization of ode vix ibat; the potential for odevixibat to become the first approved drug for PFIC patients; the size of the PFIC population, the biliary atresia population, the ALGS population or any other disease population for indications t hat may be targeted by Albireo; the potential benefits or competitive position of odevixibat or any other Albireo product candidate or program or the commercial opportunity in any target indication; the potential effects of odevixibat on the treatment of PFIC patients and its potential to improve the current standard of care; the potential issuance of a rare pediatric disease priority review voucher; Albireo’s plans, expectations or future operations, financial position, costs , expenses, uses of cash, capital requirements or our need for additional financing; or our strategies, prospects, beliefs, intentions, plans, expectations, forecasts or objectives . W ords such as “anticipates,” “believes,” “plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,” “should,” “could,” “estimates,” “predicts,” “potential,” “planned,” “continue,” “guidance,” and similar expressions sometimes identify forward - looking statements. Any forward - looking statement involves known and unknown risks, uncertainties and other factors that may cause our actual result s, levels of activity, performance or achievements to differ materially from those expressed or implied by such forward - looking statement, and, therefore, investors are cautioned not to place undue reliance on any forward - looking statement. These factors include, but are not limited to: negative impacts of the COVID - 19 pandemic, including on manufacturing, supply, conduct or initiation of clinical trials, or other aspects of our busines s; whether favorable findings from clinical trials of odevixibat to date, including findings in the completed Phase 3 clinical trial in PFIC and findings in indications other than PFIC, will be predictive of results from futu re clinical trials, including the pivotal trial of odevixibat in biliary atresia or the pivotal trial of odevixibat in ALGS; whether either or both of the United States Food and Drug Administration (FDA) and European Medicines Agency (EMA) will determine that the primary endpoint for their respective evaluations and treatment duration of the completed Phase 3 clinical trial in patients with PFIC are sufficient to support approval of odevixibat in the U nited States or the European Union, to treat PFIC, a symptom of PFIC, a specific PFIC subtype(s) or otherwise; whether the FDA or EMA will complete their respective reviews within the target timelines, including the FDA’s PDUFA goal dat e, as a potential result of the impact of the COVID - 19 pandemic or otherwise; the outcome and interpretation by regulatory authorities of the ongoing third - party study pooling and analyzing of long - term PFI C patient data; the timing for initiation or completion of, or for availability of data from, clinical trials of odevixibat, including the pivotal trial of odevixibat in biliary atresia or the pivotal trial of odevixibat in ALGS , a nd the outcomes of such trials; Albireo’s ability to obtain coverage, pricing or reimbursement for approved products in the United States or European Union; delays or other challenges in the recruitment of patients for the pivo tal trial of odevixibat in biliary atresia or the pivotal trial of odevixibat in ALGS ; whether odevixibat will meet the criteria to receive a rare pediatric disease priority review voucher from the FDA ; the competitive environment and commercial opportunity for a potential treatment for PFIC or other orphan pediatric cholestatic liver diseases; the medical benefit that may be derived from odevixibat, A3384 or any of the other product candidates; the significant control or influence that EA Pharma has over the commercialization of elobixibat in Japan and the development and commercialization of elobixibat in EA Pharma’s other licensed territories; our ab ili ty to protect and expand our intellectual property; the timing and success of submission, acceptance and approval of regulatory filings ; and our critical accounting policies . These and other risks and uncertainties that we face are described in our most recent Annual Report on Form 10 - K and in other filings that we make or have made with the Securities and Exchange Commission. In addition, market and industry statistics contained in th is presentation are based on information available to us that we believe to be reliable but have not independently verified. All forward - looking statements speak only as of the date this presentation is made and should not be relied upon as representing our views as of any date after this presentation is made. We specifically disclaim any obligation to update any forward - looking statement, except as required by applicable law. “Albireo” is a trademark of Albireo AB. All other trademarks, service marks, service marks, trade names, logos and brand names identified in this presentation are the properties of their respective owners.

3 ©2021 Albireo Pharma, Inc. All rights reserved Agenda Albireo Leadership Here Today Ron Cooper President and CEO Former Bristol - Myers Squibb (President of Europe) Pamela Stephenson Chief Commercial Officer Former Vertex, Pfizer Pat Horn, MD, PhD Chief Medical Officer Former Orphan Technologies, Dyax, Tetraphase, Abbott Simon Harford Chief Financial Officer Former Parexel, GlaxoSmithKline, Eli Lilly Albireo Market Opportunity Attractive Business Model Cholestatic Liver Disease Patient Opportunity Rare Pricing & Access Launch Readiness Building Blocks for Commercial Success

4 ©2021 Albireo Pharma, Inc. All rights reserved Growing Albireo: Road to Reach $1 Billion Odevixibat Sales

5 ©2021 Albireo Pharma, Inc. All rights reserved Odevixibat Aspiration: Road to $1 Billion LARGE GLOBAL OPPORTUNITY PREPARED AND READY TO LAUNCH EXPANSION BEYOND PFIC HIGH CONFIDENCE IN ACCESS

6 ©2021 Albireo Pharma, Inc. All rights reserved Reaching $1 Billion Odevixibat Sales PRECLINICAL PHASE 3 PHASE 2 PHASE 1 APPROVED Chronic Constipation Approved in Japan/Partnered with EA Pharma Elobixibat Adult Liver Diseases A3907 Systemic ASBTi Viral & Cholestatic Diseases A2342 Oral NTCPi Bile Acid Modulators Undisclosed Odevixibat IBATi Pediatric Liver Diseases PFIC Biliary Atresia Alagille Syndrome Other Cholestatic Approval and launch expected H2 21 $1B 2 nd Half of the Decade IBATi = ileal bile acid transport inhibitor, ASBT = apical sodium - dependent bile acid transporter, NTCPi = sodium - taurocholate c o - transporting peptide inhibitor

7 ©2021 Albireo Pharma, Inc. All rights reserved Sustained Growth Through Multiple Catalysts A3907 Systemic ASBTi adult liver disease PEDFIC 2: PFIC rollover and expanded cohort BOLD: Biliary Atresia Phase 3 program ASSERT: Alagille Syndrome Phase 3 program PFIC approval, priority review voucher, launch A2342 Oral NTCP Inhibitor Novel bile acid modulators 2022 H2 21 H1 21 2023 Open label Full site activation Full site activation IND - enabling studies Ph1 Initiation 2024 Topline Data Topline Data Ph 1 Topline data Ph 2 Initiation Ph 1 Initiation Ph 2 Initiation Candidate identification

8 ©2021 Albireo Pharma, Inc. All rights reserved Global Market Opportunity Size: ~100,000 Patients with Pediatric Cholestatic Liver Disease in Top 25 Countries Excluding India and China

9 ©2021 Albireo Pharma, Inc. All rights reserved Large Ex - US Sales for Rare Disease Analogs 1 Source: Simon - Kucher & Partners 2019 - p roprietary research by Albireo and information from the manufacturers’ websites . 2 Source: Simon - Kucher & Partners 2019. aHUS: atypical Hemolytic Uremic Syndrome - p roprietary research by Albireo and information from the manufacturers’ websites . Global launch analogs Global revenue (USD) US Ex - US Spinraza $1,725M 1 ~ 50 % Y2 post - launch Soliris $ 259 M 2 ~56 % Y2 post - launch

10 ©2021 Albireo Pharma, Inc. All rights reserved Robust Pricing and Reimbursement Plans PEDFIC RCT Phase 3 Data Natural History Data Burden of Disease Study Extensive Payor Research RCT = Randomized Control Trial

11 ©2021 Albireo Pharma, Inc. All rights reserved Strong Candidate for Approval & Successful Launch Attractive Orphan Commercial Model • Once - Daily Dosing • Oral Capsule or Sprinkles, No Refrigeration Required • Minimal Systemic Exposure • Generally Well Tolerated • PEDFIC 1 RCT • PEDFIC 2 • NAPPED Natural History • Burden of Disease Study Drug Profile Strong Data • ~100 US KOLs/ 60 Centers • 10 US Sales Representatives • US/EU Leaders Hired • Medical & Access on the Ground

12 ©2021 Albireo Pharma, Inc. All rights reserved Expansion Beyond PFIC: Anticipated First to Market in Most Regions Current assumption: ASSERT Topline data anticipated in 2022; BOLD Topline data anticipated in 2024 1st PFIC 1st Biliary Atresia 1st ALGS ROW 1 st PFIC 1 st Biliary Atresia Fast Follower ALGS US 1st PFIC 1st Biliary Atresia 1st ALGS Europe After modest PFIC build, marginal additional costs Unencumbered global rights, no royalties/milestone payments Expansion into rare adult liver diseases

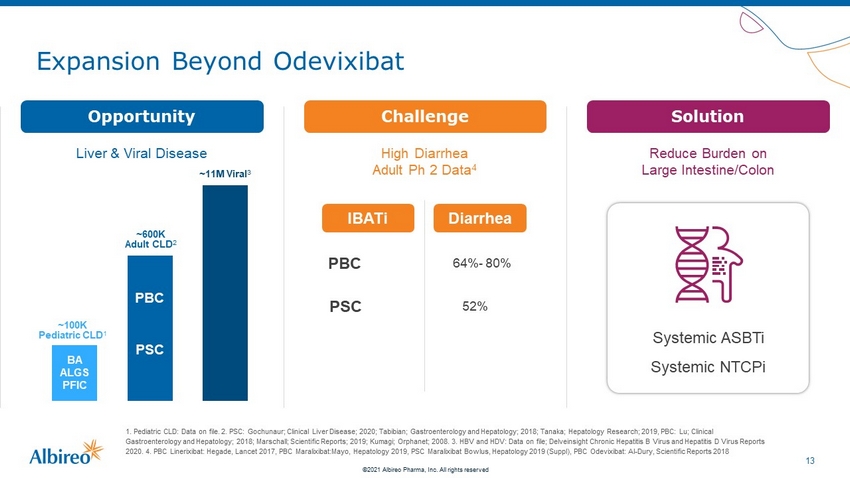

13 ©2021 Albireo Pharma, Inc. All rights reserved Expansion Beyond Odevixibat 1. Pediatric CLD: Data on file. 2. PSC: Gochunaur; Clinical Liver Disease; 2020; Tabibian; Gastroenterology and Hepatology; 2 018 ; Tanaka; Hepatology Research; 2019, PBC: Lu; Clinical Gastroenterology and Hepatology; 2018; Marschall; Scientific Reports; 2019; Kumagi; Orphanet; 2008 . 3. HBV and HDV: Data on file; Delveinsight Chronic Hepatitis B Virus and Hepatitis D Virus Reports 2020. 4. PBC Linerixibat: Hegade, Lancet 2017, PBC Maralixibat:Mayo, Hepatology 2019, PSC Maralixibat Bowlus, Hepatology 2019 (Supp l) , PBC Odevixibat: Al - Dury, Scientific Reports 2018 ~100K Pediatric CLD 1 ~600K Adult CLD 2 PBC PSC ~11M Viral 3 BA ALGS PFIC High Diarrhea Adult Ph 2 Data 4 IBATi Diarrhea PBC 64% - 80% PSC 52% Reduce Burden on Large Intestine/Colon Challenge Opportunity Solution Liver & Viral Disease Systemic ASBTi Systemic NTCPi

14 ©2021 Albireo Pharma, Inc. All rights reserved Expansion Beyond Odevixibat: Novel Compounds High bioavailability Highly selective Bile acid excreted in stools and urine Improved liver histology in NASH model A3907 Novel Systemic ASBT Inhibitor A2342 Novel Oral NTCP Inhibitor Blocks entry into the liver Potential in viral and cholestatic diseases SubQ Hepcludex Œ proof of concept Gilead purchased €1.15B +.3B CVR

15 ©2021 Albireo Pharma, Inc. All rights reserved Odevixibat Aspiration: Road to $1 Billion LARGE GLOBAL OPPORTUNITY PREPARED AND READY TO LAUNCH EXPANSION BEYOND PFIC HIGH CONFIDENCE IN ACCESS

©2021 Albireo Pharma, Inc. All rights reserved Building Blocks for Commercial Success

17 ©2021 Albireo Pharma, Inc. All rights reserved Building Blocks for Commercial Success Patient OPPORTUNITY CONFIDENCE IN ACCESS READY TO LAUNCH

18 ©2021 Albireo Pharma, Inc. All rights reserved Building Blocks for Commercial Success Patient OPPORTUNITY CONFIDENCE IN ACCESS READY TO LAUNCH

19 ©2021 Albireo Pharma, Inc. All rights reserved Overview: Rare Pediatric Cholestatic Liver Diseases 1 Pawlikowska 2010 2 Data on file; Lykavieris et al. Hepatology , 2005 Progressive Familial Intrahepatic Cholestasis (PFIC) 1 Age ~1 - 2 years, cholestatic, pruritic Multiple genes, similar symptoms Inflammation, fibrosis, cirrhosis, death Almost no patients survive beyond age 20 without surgical diversion or liver transplant 1 Alagille Syndrome (ALGS) Age ~4 - 12 Months, multiple symptoms Autosomal dominant, multiple organ impact Paucity of bile ducts Many patients may need a liver transplant Disease can stabilize Biliary Atresia 2 Age ~2 wk - 3 Months, failure to thrive, acholic stools, jaundice Absence of/blocked bile ducts Potential need for liver transplant Disease can stabilize Kasai (HPE) surgery may restore bile flow ~50% of patients have liver transplant in first 2 years 2 Transplant is definitive treatment Presentation Cause or Genetic Disorder Disease Progression Treatment & Survival

20 ©2021 Albireo Pharma, Inc. All rights reserved Extensive Research Informs Global Market Opportunity U.S. and European Account Mapping HCP & Caregiver Qualitative Study Pediatric Hepatologist Study Adult Hepatologist Study Post - Phase 3 Caregiver and HCP Studies Genetic Testing Data Electronic Health Record Data Review Systematic Literature Review

21 ©2021 Albireo Pharma, Inc. All rights reserved PFIC Methodology: Prevalent Patient Opportunity 1 Jacquemin E; Progressive Familial Intrahepatic Cholestasis; Clin Res Hepatol Gastroenterol. 2012 Sep;36 Suppl 1:S26 - 35; Pawli kowska L, et al. Differences in presentation and progression between severe FIC1 and BSEP deficiencies. Journal of Hepatology. 2010;53(1):170 - 178; Jain A, et al. Long - Term Survival After Liver Tra nsplantation in 4,000 Consecutive Patients at a Single Center. Annals of Surgery. 2000; Vol. 232, No. 4, 490 - 500; LIVE BIRTHS PER YEAR PREVALENCE 4.1 Million U.S. 4.2 Million EU ROW 8.4 Million 3,500 U.S. 3,500 EU 8,000 ROW Includes Patients Under Survival Curve Primary references: literature reviews and market research, NAPPED 1 SURVIVAL CURVE Informed by incidence, age, liver transplant INCIDENCE RATE OF PFIC ESTIMATED PFIC BIRTHS PER YEAR 55 56 1 in 75,000 1 in 75,000 1 in 75,000 112

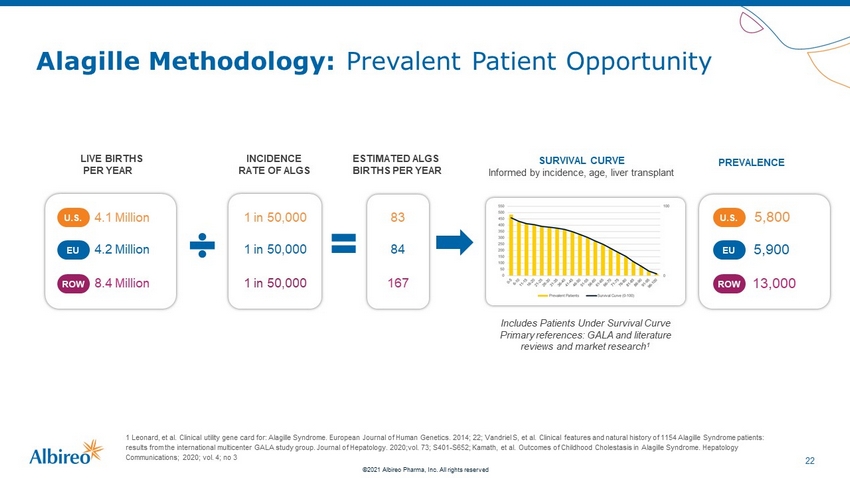

22 ©2021 Albireo Pharma, Inc. All rights reserved Alagille Methodology: Prevalent Patient Opportunity 1 Leonard, et al. Clinical utility gene card for: Alagille Syndrome. European Journal of Human Genetics. 2014; 22; Vandriel S , e t al. Clinical features and natural history of 1154 Alagille Syndrome patients: results from the international multicenter GALA study group. Journal of Hepatology. 2020;vol. 73; S401 - S652; Kamath, et al. Outc omes of Childhood Cholestasis in Alagille Syndrome. Hepatology Communications; 2020; vol. 4; no 3 LIVE BIRTHS PER YEAR 4.1 Million U.S. 4.2 Million EU ROW 8.4 Million INCIDENCE RATE OF ALGS ESTIMATED ALGS BIRTHS PER YEAR 83 84 167 PREVALENCE SURVIVAL CURVE Informed by incidence, age, liver transplant Includes Patients Under Survival Curve Primary references: GALA and literature reviews and market research 1 1 in 50,000 1 in 50,000 1 in 50,000 5,800 U.S. 5,900 EU 13,000 ROW

23 ©2021 Albireo Pharma, Inc. All rights reserved Biliary Atresia Methodology: Prevalent Patient Opportunity 1 Hopkins PC et al. Incidence of Biliary Atresia and Timing of Hepatoportoenterostomy in the United States. J Pediatr. 2017 A ug; 187:253 - 257; Verkade H et al. Biliary atresia and other cholestatic childhood diseases: Advances and future challenges. J. of Hepatology 2016;65:631 - 642 LIVE BIRTHS PER YEAR 4.1 Million U.S. 4.2 Million EU ROW 8.4 Million INCIDENCE RATE OF BA 7 in 100,000 6 in 100,000 10 in 100,000 ESTIMATED BA BIRTHS PER YEAR 290 252 840 PREVALENCE SURVIVAL CURVE Informed by incidence, age, liver transplant Includes Patients Under Survival Curve Primary references: literature reviews and market research 1 9,700 U.S. 8,400 EU 27,000 ROW

24 ©2021 Albireo Pharma, Inc. All rights reserved Addressable Patient Market Opportunity* *Top 25 Markets excluding China and India PFIC ALGS BA 600 (500 - 700) 1,500 ( 1400 - 1600 ) 2,400 (2200 - 2700 ) 1,900 (1700 - 2100) 3,500 (3100 - 3800) 8,600 (7800 - 9400 ) U.S. Ex - U.S. Addressable patient numbers based on: Diagnosis Liver Transplant Medical Eligibility

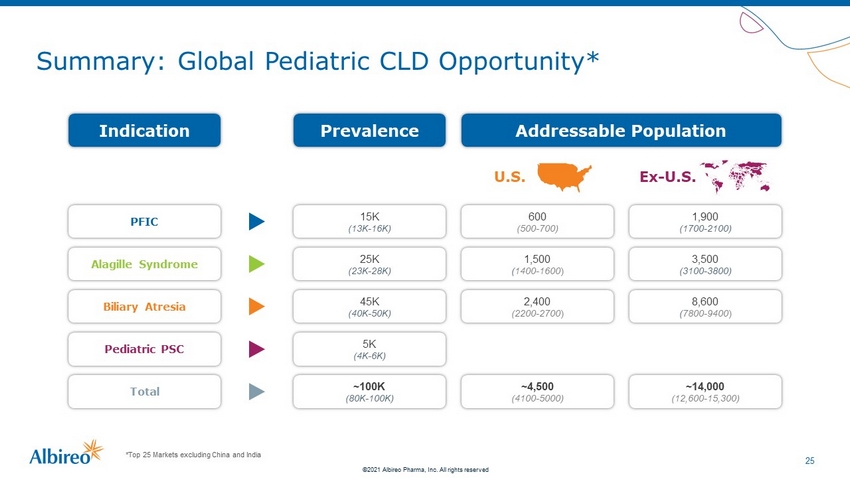

25 ©2021 Albireo Pharma, Inc. All rights reserved Summary: Global Pediatric CLD Opportunity* *Top 25 Markets excluding China and India Prevalence Indication Addressable Population 15K (13K - 16K) PFIC 600 (500 - 700) 1,900 (1700 - 2100) 25K (23K - 28K) Alagille Syndrome 1,500 ( 1400 - 1600 ) 3,500 (3100 - 3800) 45K (40K - 50K) Biliary Atresia 2,400 (2200 - 2700 ) 8,600 ( 7800 - 9400 ) 5K (4K - 6K) Pediatric PSC ~100K (80K - 100K) Total ~4,500 (4100 - 5000) ~14,000 (12,600 - 15,300) U.S. Ex - U.S.

26 ©2021 Albireo Pharma, Inc. All rights reserved Rare Therapies with ~50% of Revenue from Ex - US Markets Strong performers saw ~50% of global revenue come from ex - US markets two years after commercial launch Spinraza Biogen Launch Prices 1 : US: $750K (Y1) GER: €450K (Y1) Launch Prices 1 : US: $300K GER: €210K Kalydeco Vertex Launch Prices 1 : US: $410K (Y1) GER: €340K (Y1) Soliris Alexion 1. Spinraza, Kalydeco, Soliris Data Source: Simon - Kucher & Partners 2019. aHUS: atypical Hemolytic Uremic Syndrome - p roprietary research by Albireo and information from the manufacturers’ websites . Soliris

27 ©2021 Albireo Pharma, Inc. All rights reserved Building Blocks for Commercial Success Patient OPPORTUNITY CONFIDENCE IN ACCESS READY TO LAUNCH

28 ©2021 Albireo Pharma, Inc. All rights reserved Robust Pricing and Reimbursement Plans PEDFIC RCT Phase 3 Data Natural History Data Burden of Disease Study Extensive Payor Research RCT = Randomized Control Trial

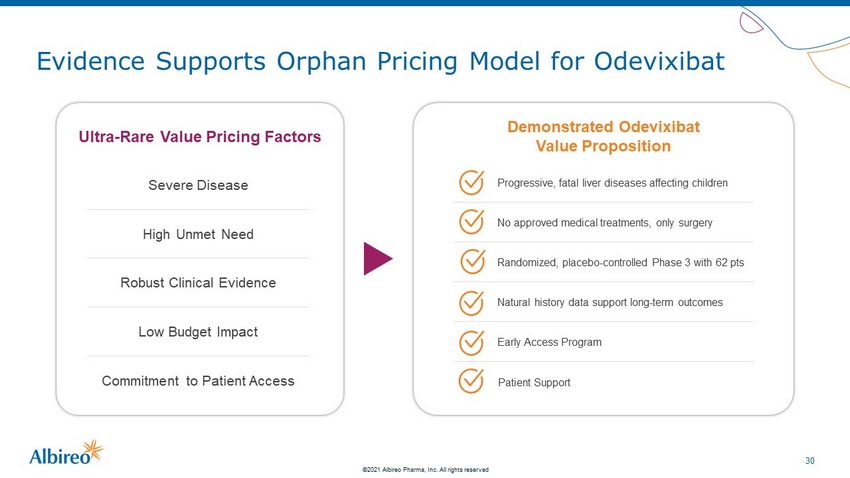

29 ©2021 Albireo Pharma, Inc. All rights reserved Evidence Supports Orphan Pricing Model for Odevixibat Ultra - Rare Value Pricing Factors Severe Disease High Unmet Need Robust Clinical Evidence Low Budget Impact Commitment to Patient Access

30 ©2021 Albireo Pharma, Inc. All rights reserved Evidence Supports Orphan Pricing Model for Odevixibat Ultra - Rare Value Pricing Factors Demonstrated Odevixibat Value Proposition Severe Disease High Unmet Need Robust Clinical Evidence Low Budget Impact Commitment to Patient Access No approved medical treatments, only surgery Progressive, fatal liver diseases affecting children Natural history data support long - term outcomes Randomized, placebo - controlled Phase 3 with 62 pts Early Access Program Patient Support

31 ©2021 Albireo Pharma, Inc. All rights reserved Payor Research Reinforces Odevixibat Rare Disease Pricing US payors confirm attributes supporting rare disease pricing Odevixibat mirrors product attributes

32 ©2021 Albireo Pharma, Inc. All rights reserved Payors Expect Rare Disease Pricing for Odevixibat

33 ©2021 Albireo Pharma, Inc. All rights reserved Robust Evidence Generation to Support Value of Odevixibat Clinical Clinical benefit as demonstrated through robust placebo - controlled Phase 3 study Economic Cost off - sets (E.g. Liver transplant PEBD surgery) Humanistic Burden on caregiver, family and society (E.g. worker productivity, missed school days)

34 ©2021 Albireo Pharma, Inc. All rights reserved Building Blocks for Commercial Success Patient OPPORTUNITY CONFIDENCE IN ACCESS READY TO LAUNCH

35 ©2021 Albireo Pharma, Inc. All rights reserved Building Blocks for Commercial Success Commercial Build - up Early Access Programs Patient Assistance Programs Distribution Network Regional Partnerships Customer Insight

36 ©2021 Albireo Pharma, Inc. All rights reserved Building an Experienced Leadership Team U.S. ~60 Key Centers TOP KOLs Pediatric Hepatologists ~100 A Other KOLs & Prescribers with patients with cholestatic liver disease ~400 B Hospital - affiliated • Hepatologists • Gastroenterologists (no colonoscopies) • Prescribe meds for cholestatic liver disease ~600 C Total universe of hepatologists and gastroenterologists = ~14,000 Global Leadership Kevin Springman President of the Americas • Joined Sept 2020 • Sobi, AstraZeneca • Key Launches: Synagis, Gamifant, AZ brands Steve Arnold President of International • Joining March 1 • Intercept, UCB, Gilead • Key Launches: Atripla, Viread, Ocaliva U.S. Team: • Area Sales Directors • Payor Account Leads • MSLs • Sales Reps International Team: • Regional VPs • Country Managers • Medical Directors • MSLs

37 ©2021 Albireo Pharma, Inc. All rights reserved Odevixibat Positioned for Competitive Advantage at Launch Favorable Profile Once - Daily Dosing Oral Capsule or Sprinkles No Refrigeration Required Generally Favorable Tolerability Profile Minimal Systemic Exposure Market Leading Approach Global launches planned for U.S., EU, ROW Accelerated reviews in U.S. and EU Potential to be first drug therapy in PFIC Quality Design & Data Gold standard randomized, placebo - controlled trials PFIC types 1, 2, 3 Largest database provides confidence for ASSERT, BOLD studies Data strength supports value proposition with payors

©2021 Albireo Pharma, Inc. All rights reserved Attractive Business Model

39 ©2021 Albireo Pharma, Inc. All rights reserved Global Opportunity Key to $1 Billion and Beyond PFIC Odevixibat 2021 ALGS Odevixibat 2022 BILIARY ATRESIA Odevixibat 2024

40 ©2021 Albireo Pharma, Inc. All rights reserved Key Revenue Modeling Considerations at Annual $1 Billion 2021 Addressable Patients 2,500 5,000 11,000 18,500 Future Addressable Patients 3,400 5,300 11,700 20,400 PFIC ALGS Biliary Artesia Total Key Items to Bridge from Addressable Patients to $ Net Sales Annual US$ Net Sales (by Indication) Annual US$ Net Sales (by Region) ~30% ~60% ~25% ~40% ~45% >$1B >$1B Total U.S. Ex - U.S. iBATi Market share % Compliance Price changes Gross to net discounts Reimbursed price

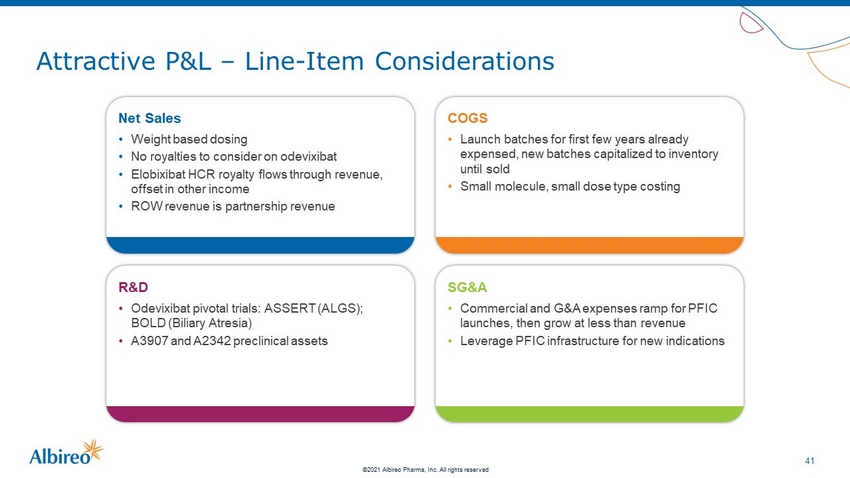

41 ©2021 Albireo Pharma, Inc. All rights reserved Attractive P&L – Line - Item Considerations Net Sales • Weight based dosing • No royalties to consider on odevixibat • Elobixibat HCR royalty flows through revenue, offset in other income • ROW revenue is partnership revenue COGS • Launch batches for first few years already expensed, new batches capitalized to inventory until sold • Small molecule, small dose type costing R&D • Odevixibat pivotal trials: ASSERT (ALGS); BOLD (Biliary Atresia) • A3907 and A2342 preclinical assets SG&A • Commercial and G&A expenses ramp for PFIC launches, then grow at less than revenue • Leverage PFIC infrastructure for new indications

42 ©2021 Albireo Pharma, Inc. All rights reserved Revenue Uptake Builds Over Time to Profitable Long - Term Revenue • 2021 – low single - digit $ millions • 2 nd Half of Decade >$1B annual revenue aspiration Cash • Cash runway into 2023 based on budgeted net sales and expenses • Priority Review Voucher (PRV) eligible upon approval; plan to monetize • 2020 op. cash burn $101M and 12/31/20 cash of $251M (unaudited) • 2021 op. cash burn $120 - $130M

43 ©2021 Albireo Pharma, Inc. All rights reserved Sustained Growth Through Multiple Catalysts A3907 Systemic ASBTi adult liver disease PEDFIC 2: PFIC rollover and expanded cohort BOLD: Biliary Atresia Phase 3 program ASSERT: Alagille Syndrome Phase 3 program PFIC approval, priority review voucher, launch A2342 Oral NTCP Inhibitor Novel bile acid modulators 2022 H2 21 H1 21 2023 Open label Full site activation Full site activation IND - enabling studies Ph1 Initiation 2024 Topline Data Topline Data Ph 1 Topline data Ph 2 Initiation Ph 1 Initiation Ph 2 Initiation Candidate identification

44 ©2021 Albireo Pharma, Inc. All rights reserved Growing Albireo: Road to Reach $1 Billion Odevixibat Sales

©2021 Albireo Pharma, Inc. All rights reserved Q&A

©2021 Albireo Pharma, Inc. All rights reserved Commercial Day: Road to $1 Billion